A Captive Audience for DPCs

Medical stop-loss captives seen as a promising way to elevate the value of direct primary care and help stabilize claim costs

At the heart of expecting the unexpected

Leverage captive insurance to self-fund your healthcare.

As your business grows, so will your healthcare expenses. Customized captive insurance from QBE creates strength to self-fund your employee healthcare coverage, allowing you to increase transparency and reduce the cost of risk. The QBE Captive Curve® solution model removes barriers to entry and allows you to move easily to new strategies.

Take advantage of QBE’s Captive Curve solutions:

• Fronted policy that is “AA-” rated by S&P for single-parent and group captive programs.

• Reinsurance placement covering direct writing captive insurers assuming Medical Stop Loss (MSL) risk.

• Agora, an open MSL group captive that makes it more efficient to participate in a group program.

Together, we’ll find a solution so no matter what happens next, you can stay focused on your future.

Written By Bruce Shutan

Written By Dominic Hagger

Written By Laura Carabello

Written By John W. Sbrocco

Written By Bruce Shutan

The Self-Insurer (ISSN 10913815) is published monthly by Self-Insurers’ Publishing Corp. (SIPC). Postmaster: Send address changes to The Self-Insurer Editorial and Advertising Office, P.O. Box 1237, Simpsonville, SC 29681, (888) 394-5688

PUBLISHING DIRECTOR Bryan Irland, SENIOR WRITER Bruce Shutan, CONTRIBUTING EDITORS Mike Ferguson, Jennifer Ivy, PRESIDENT/CEO Erica M. Massey, CFO Grace Chen

A Captive Audience for DPCs

Medical stop-loss captives seen as a promising way to elevate the value of direct primary care and help stabilize claim costs

Written By Bruce Shutan

FewFwould argue that direct primary care (DPC) provides better access to healthcare, but there’s a dearth of credible data on the merits of this emerging approach. One potential obstacle is that there several different iterations of this solution, notes Dale Sagen, vice president and business development leader of QBE North America.

For example, some go by advanced primary care, others are virtual-based or have extremely low total patient panel counts and do house calls. “The question is, which ones are impacting the risk at a greater level?” he asks.

Some self-insured employers are using group captive insurance to segregate risk in order to identify if it’s working over the long run, which Sagen says QBE’s producer partners find intriguing. DPC is one of several newer applications for the medical stop-loss captive model. He says a group captive can serve as a rallying point for likeminded employers with a strong belief that DPC will reduce the risk they share and propensity for incurring catastrophic claims that often are a problem in the medical stop-loss space. On the surface, DPC appears to be a good fit conceptually for a medical stop-loss group captive. “From our perspective, the philosophy of the employer that sponsors direct primary care aligns with the stop-loss group captive because they’re already thinking about risk mitigation,” notes Don McCully, president of Medical Captive Underwriters. “Someone getting the flu who has direct primary care doesn’t have to go anywhere else. They can get their treatments prescribed at home or go to an individual office because they have that relationship with direct primary care, and it will not, in most cases, develop into pneumonia.”

MEASURING INTANGIBLES

However, there may be other roadblocks ahead to making DPC work in a captive setting. Mike Van Ham, SVP of health risk management at Captive Resources, LLC, notes that DPC is still a relatively new care delivery model that may not yet be widely accessible across all regions of the U.S. Another challenge is the difficulty quantifying the longterm value of DPC visits, specifically measuring the prevention of medical events such as a heart attack or chronic disease through more proactive care.

“How can you measure the conditions that never happened?” he asks, noting that while the return on investment may not always be immediately quantifiable, the value of proactive care is significant.

Still, those concerns pale in comparison to a system driven by misaligned incentives that's increasingly unsustainable. The marketplace is evolving, and Van Ham notes a growing dissatisfaction among traditional primary care physicians, including those working within larger hospital systems, who are willing to embrace an unknown and untested method of compensation based on monthly subscriptions rather than health insurance.

“If you talk to the physicians who started and own these direct primary care setups, they’re actively stepping away from a transactional model where patient visits are limited to five minutes in order to meet revenue targets,” he observes. “They want to return to the heart of practicing medicine. They want to get to know their patients, the holistic aspect of that person and truly build a relationship.”

Over the long run, Sagen says the goal of many DPC-focused group captives is to use the ceded premium as an incentive to ensure that the covered population utilizes the enhanced primary care. He believes this model would have more of an influence over the course of a health plan member’s treatment journey if a quality DPC operation is in place and steering patients to the appropriate care. This should reduce the risk of that group captive population over time.

Dale Sagen

Don McCully

Underwriters, however, are concerned about program utilization and lag time in appointments. Even if an employer is paying an upfront cost for DBP, Sagen says, sometimes health plan members still don't use the service and end up in the emergency room or an urgent care center.

Many times, not everyone is signing up or receiving an appointment in the first six months of access to a DPC practice because of a supply

chain issue or poor promotion, he says, noting the importance of incentivizing individuals to see their DPC doctor.

DPC physicians have a finite amount of time to meet with patients and, therefore, may have a limited ability to grow their practice to meet the needs of an employer and possibly the entire community, he says. A quick way to scale up a DPC operation is to utilize technology, but he fears it could dilute the quality of that risk-management solution.

ADVANCING PREVENTIVE MEDICINE

While frustration is mounting with a sick-care system that merely reacts to rather than anticipates illness, Van Ham says DPC builds on a back-to-basics approach that helps prevent problems from occurring and can stave off disease and chronic conditions. Many employers are seeing tremendous value in this proactive model.

He says regular checkups and preventive screenings from doctors who are unencumbered by time constraints can help identify earlyonset diseases and conditions before they become a financial concern and undermine quality of life.

Where medical stop-loss captives can help elevate the DPC model is the fact that employers in these arrangements have a vested interest in always wanting to ensure they’re improving clinical outcomes and lowering costs, according to Van Ham. “They’re purchasing stop-loss in a more efficient way, and they’re seeing the rewards and benefits

Mike Van Ham

of doing that on an ongoing basis,” he observes.

His team’s focus is on the totality of medical spend, not just stop-loss spec hits – in other words, first-dollar coverage and using primary care to treat musculoskeletal disorders, cancer, diabetes, and other chronic conditions and diseases. They’re also deeply involved in cardio-metabolic management, including the evolving GLP-1 space involving weight-loss drugs.

DPC not only lowers the cost to the member by making them more engaged with a physician but also reduces potential future claims that can’t be priced in stop-loss insurance, McCully says. While noting that the DPC movement wants claims incurred from those doctor visits priced into stop-loss, he points to a disconnect “because we aren’t looking at the frequency of claims as often or as granular as direct primary care requires," and that stop-loss is about anticipating costly catastrophic claims.

With self-insurance, he adds, the objective is to pay known claims below the specific limit and use insurance for claims above the specific limit, which would be for catastrophic events. The impact of DPC on stop-loss may be indirect. For example, McCully says

a reduction in certain areas of claims below that spec will decrease the cost of an employer’s aggregate coverage year over year.

"It will lower the overall cost of health insurance for the sponsoring employer who adds direct primary care," he says, "so renewals will be easier."

DPC establishes a philosophy for employers who want to improve clinical outcomes, as well as have more productive and happier employees.

Granting 24-hour access to a DPC doctor with whom an employee can cultivate a oneon-one relationship is going to reduce emergency room visits,

sick days and sick care in general because this proactive approach addresses health concerns in advance, according to McCully. The challenge is proving the preventive value of, say, catching a flu before it becomes inpatient pneumonia, but steering to a lower-cost location that in many cases provides superior outcomes results in significant employer savings.

USING HSAS TO PAY FOR DPC

Even with the promise of 24/7 access to a doctor, few employees are incentivized to spend an extra $100 a month for DPC on top of payroll deduction, observes McCully, noting how 30 to 40 years ago, fully insured carriers started reducing reimbursements for primary care, which resulted in fewer of those visits.

But within the One Big Beautiful Bill Act passed over the summer, there’s a provision that will allow health plan members to use a health savings account (HSA) to pay for DPC, which could serve to open up this model to a much wider population. The thinking is that an HSA contribution will serve as a stronger incentive for a health plan member to enroll in DPC, which is a taxable event for the employer and a benefit for the member.

Whether captives will be able to build out the DPC model in the years ahead, pressure will likely mount to achieve greater certainty in the captive space.

Given that the medical stop-loss market has hardened, more aggressive steps must be taken for captives to get a better handle on insurance risks, according to John W. Sbrocco, founder and program director of Virtue Health. For example, he says certain risk parameters and more risk sharing from the partners of self-insured health plans likely will be required for captive consortium programs to help stem losses.

“The claims are now so big that they cannot catch up to what’s going on,” he says of captive program managers, predicting the emergence of a more performance-based model. “But when you have risk in the game, you’re going to have an incentive to jump on that claim and manage it the best you can.” One such example would be monitoring the annual loss ratios of TPA and pharmacy partners in the program.

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 35 years.

Do you aspire to be a published author?

We would like to invite you to share your insight and submit an article to The Self-Insurer! SIIA’s official magazine is distributed in a digital and print format to reach 10,000 readers all over the world.

The Self-Insurer has been delivering information to top-level executives in the self-insurance industry since 1984.

Articles or guideline inquires can be submitted to Editor at Editor@sipconline.net

The Self-Insurer also has advertising opportunities available. Please contact Shane Byars at sbyars@ sipconline.net for advertising information.

Captives Eyed for Cell and Gene Therapy

As captive insurance grows in popularity across the self-insurance community, all eyes will continue to be glued to the way it’s used for managing various costly claims that health plan sponsors are expected to struggle with in the future.

Mike Van Ham, SVP of health risk management at Captive Resources, LLC, believes the pharmaceutical and biotechnology space is ripe for expansion in the medical stop-loss captive arena as medicine increasingly incorporates advanced therapies.

He cites the rise of cell and gene therapies, alongside specialty drugs, which are reshaping treatment models and supplementing – or in some cases reducing the need for – certain traditional medical procedures. The challenge will be paying for expensive procedures, some of which he notes could be as high as seven figures, but also potentially curative.

For now, he points out that only a small percentage of the U.S. population is eligible for such therapies, and most stop-loss underwriters are able to underwrite the current risk. “But that said, the pipeline is not stopping,” he says, “so that risk is always going to continue to increase, and the likelihood of having that type of a claimant on your plan for any given employer is going to continue to increase.”

Don McCully, president of Medical Captive Underwriters, wonders how much premium self-insured employers have to add from their actuaries as gene therapies expand. “It may not work on a finite population where a single-parent captive is the best way for large employers to access captive solutions,” he says. It may be a viable solution to transfer cell and gene therapy in a safe place for, say, 10,000 or 15,000 health plan members, but he believes a more prudent approach would be for a consortium of stoploss vendors to create an excess carrier that pools their covered lives as part of a collaborative effort that just focuses on this area.

An interesting component involving these treatments is addressing the curative nature of gene therapies. “What happens if you have a $3 million therapy that guarantees a cure, and then you leave the plan, go somewhere else and get sick again?” McCully inquires. “I can’t track it as a stop-loss carrier, and the other stop-loss carrier doesn’t know that they’re going to collect the next payment for the same therapy, but it really should benefit the person who paid the claim in the past, not the current claimant.”

Uncertainty also arises in other areas. For example, he reflects on how cell and gene therapies can be priced when each of these stealth-like products is so unique. In contrast, there are a finite number of human organs to transplant as part of a fixed indemnity program.

Whatever the case, Van Ham considers lasers a strategic lever and believes that as the market moves forward with more cell and gene therapies, there will be centers of excellence and other tactics that drive better outcomes and lower costs. The key is to make sure these design and solution strategies are part of the overall plan coverage.

“Many times, if you get better outcomes, you can identify better savings as well,” he says. “So, I think there’s always going to be an opportunity to probably take a little bit off the sticker price on some of these treatments, and it just becomes a matter of using that lever strategically.” – Bruce Shutan

Unscrambling the Definition of Transparency

IWritten By Laura Carabello

It's often been said that ‘transparency’ builds trust and serves as the single most important ingredient in the recipe for success. While there is little argument over the basic meaning of healthcare transparency, executing on the promise of healthcare pricing transparency has not been that simple.

Essentially, the term describes making crucial information readily available and understandable, so that individuals can navigate the healthcare system with confidence and make choices that best meet their health and financial needs. As various stakeholders claim they are trying to make the system more trustworthy, patient-centered, accountable and ultimately, more efficient and effective, experience tells a vastly different story.

Pricing transparency is a high priority for SIIA. Christine Cooper, CEO, aequum, who serves as chairperson of the SIIA Price Transparency Committee, provides this guidance: "The Committee is addressing a pressing challenge in today’s healthcare landscape: ensuring that price transparency rules translate into meaningful, usable data for self-funded health plans.:

Cooper describes the work of this diverse and active Committee as ‘focused,’ adding, “We are bringing our ideas to Congressional staff and regulators to shape legislation that refines definitions and expands access to claims and pricing information. From advocating for practical update requirements for machine-readable files, to advancing concepts like tokenized claims data and attestation standards, we are seeking to ensure transparency is not just a compliance exercise, but a tool that delivers clarity, accountability, and real value to self-insured plans.”

DEFINING TRANSPARENCY

Throughout the marketplace, healthcare transparency is often interpreted differently, depending upon the stakeholder.

Heather Cox, president of Insights & Empowerment at Zelis, says her organization defines transparency as, “The actionable clarity of healthcare pricing and value—not just publishing numbers, but making them meaningful, comparable, and accessible to all parties involved. True transparency means understanding the cost, quality, and financial impact of care decisions before services are rendered. It’s not just about

showing a price tag—it’s about empowering smarter choices through data-driven insights and seamless digital experiences.”

Some stakeholders question whether health transparency is more buzzword than breakthrough.

Erin Weenum, VP of Benefits Strategy, Employee Benefits, KEYS & Tribute Captive, Leavitt Great West Insurance, probes, “What does the term transparency even mean anymore?” she queries. "In the self-insurance world, transparency has become a fashionable term, a catch-all buzzword that everyone throws around, but few define consistently. Employers, TPAs, brokers, and vendors all seem to have their own version of what it means. And honestly, that’s a big part of the problem.”

She maintains that at her organization, they believe transparency isn’t just a talking point, it’s a tangible right, adding, “It means the employer gets full, raw access to all claims datano filters, no black boxes. Every dollar spent should be traceable and understandable. If an employer can’t see where every penny of their health plan dollars is going, how can they truly make informed decisions?”

Weenum contends that, unfortunately, most of the industry doesn't share this view: “For many, ‘transparency’ stops at a fancy cost estimator tool or a vague wellness report, neither of which provides the clarity needed to control costs or understand what’s really happening inside a plan.”

And Barbora Howell, CEO, TrueClaim, is concerned that ‘transparency’ has lost its meaning altogether.

“Let’s be honest, it’s promised everywhere and delivered almost nowhere,” she attests. “At TrueClaim, we focus on building tech that shows every stakeholder what’s actually happening in real time. If you’re an employer, you should know what you’re paying for, what’s left, and what’s coming - just like a bank account. No one would accept a checking account that hides the balance. Why accept that in healthcare?”

Howell views it as a two-part problem: “Patients need good information, and they need to act on it. The data piece is solvable, but engagement is the real challenge. Change is hard, and most people

Erin Weenum

Heather Cox

Christine Cooper

stick with what they know. Getting someone to choose a better option means meeting them where they are, with relevance and trust.”

While exact definitions of transparency vary across the industry, Zac Hanson, vice president of growth, RxPreferred Benefits, shares, “Our view is that healthcare transparency means full data access and plan control, enabling an ecosystem where price, quality, and outcomes data are accessible, accurate, and actionable to support informed decisions.”

He feels that stakeholders have not fully done their jobs to effectively empower patients with the information they need to make informed decisions about their care, treatment options, providers and costs.

Hanson asserts, “Many existing tools are fragmented, complex, or lack real-time, personalized cost and quality data. Our goal is to equip members with clear, actionable information so they can make informed choices and access the most appropriate care at the best possible cost.”

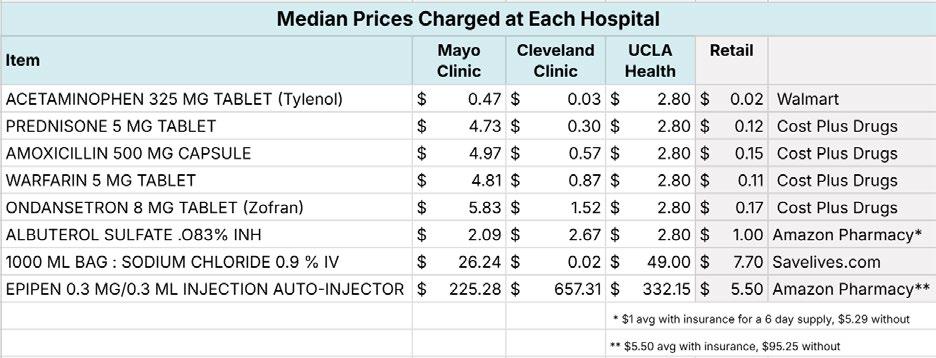

Source: American Hospital Association https://www.aha.org/fact-sheets/2023-02-24-fact-sheet-hospital-price-transparency

In pharmacy benefit administration, Lori Daugherty, CEO of RxLogic, stresses that transparency often serves as shorthand for several different things -- pricing visibility, rebate clarity and compensation disclosure, among others.

“What’s less clear is what’s actually required, what’s optional and what’s possible,” she states. “For many plan sponsors, the challenge isn’t willingness—it’s infrastructure. That’s why we built our technology

Zac Hanson

One-screen claims processing Auto-adjudication and benefit loading Real-time edits and rule customization

platform to support transparency from the start, enabling clients to track every transaction, separate out financial flows and report with precision. More importantly, it gives clients control over how their benefit programs operate— and how much visibility they provide.”

For Robert McCollins, CCO, Employers Healthcare Alliance (EHA), a community of HR/Benefits Professionals that are singularly aligned in making healthcare affordable without sacrificing -- rather improving -- access to high quality care for employers and their work families, comments, “I couldn't care less about a vendor touting that they are transparent. Even a bad contract that screws you can be transparent. Give me character and integrity all day long.”

What he means by that is following some do’s: Do they put the member/patient first...ALWAYS! Do they manage the client's finances like they were their own without sacrificing quality? Do they make the complicated simple and easy? If I "TRUST" the solution partner, their contracts/agreements will reflect their culture and reputation.”

While Jeff Gasser, CEO, Deerhold, has seen self-insured employers, TPAs, and other intermediaries making strides in providing patients/members with consumer shopping tools that allow them to access healthcare pricing data, he argues, “The complexity of many of these patient/memberfacing tools leads to low engagement and underutilization, limiting the effectiveness of the available price transparency data. While TPAs and other stakeholders have leveraged data analytics and reporting to offer insights into plan performance, costs and provider networks, their patient-facing tools are often overly complicated.”

He points to Deerhold’s Tara product that addresses this challenge with a simple, user-friendly platform, delivering a clear understanding of the costs of procedures, in-network providers that perform that procedure and full visibility into deductibles and accumulators. This

simplicity ensures patients/ members can confidently navigate their healthcare costs and options.

Finally, this perspective from Brett Wilkinson, Chief Sales Officer, ClaimChoice: “Healthcare transparency is still far from where it needs to be. It is one of those terms that gets thrown around so much that it risks losing meaning. For some stakeholders, it's simply about publishing prices or making compliance checklists. For others, it's tied to quality metrics, outcomes data or patient satisfaction scores.”

He expresses that transparency means actionable clarity, noting, “It means providing information that’s easy to understand, relevant to the user, and useful in real decision-making.”

Transparency only matters if it changes behaviors and outcomes.”

Wilkinson concedes, “We’ve made progress, but we’re still a long way from “effective.” Too often, information is technically available but practically

Rob McCollins

Jeff Gasser

Brett Wilkinson

Delivering More Value with Seamless Ancillary Benefits

Unlock the potential of Stealth Ancillary products, designed to help brokers offer customized, cost-effective plans. Work with a team of industry leaders who provide data-driven insights and access to top ancillary carriers. Together, we negotiate competitive, high-performing solutions tailored to your clients’ needs.

Our Ancillary Services Include:

Customized Benefit Analysis & Plan Design

Dedicated Account Management Support

End-to-End Carrier Coordination

Flexible Implementation and Service Options

Centralized Billing & Commission Management

Partner with us to elevate your client offerings today.

inaccessible. It’s buried in portals, scattered across vendors, or presented in a way that most members have a difficult time understanding.”

He acknowledges that empowerment happens when we bridge that gap to provide clear data paired with guidance, countering, “The reality is most employers and members don’t have time to become experts in healthcare navigation. They want a trusted partner to connect the dots and guide them toward better choices without overwhelming them.”

TRANSPARENCY LACKS CONSISTENCY

Shawn Evans, CEO, Integrated Payor Solutions, a DC Risk Solutions Company, says while there tends to be some consistency, “I find it depends on who’s profiting from the current situation to what is considered ‘transparency.’ Everyone is happy to point fingers when it is a competitor or a third party. But when it is your organization’s income -- not so much. We define transparency as the full and complete disclosure of all relevant facts so a plan fiduciary can make a fully informed decision on what is in the best interest of the plan sponsor and members without bias or appearance of bias.”

Shawn Evans

Proceed With Confidence

Mind Over Risk

We study it, research it, speak on it, share insights on it and pioneer new ways to manage it. With underwriters who have many years of experience as well as deep specialty and technical expertise, we’re proud to be known as experts in understanding risk. We continually search for fresh approaches, respond proactively to market changes, and bring new flexibility to our products. Our clients have been benefiting from our expertise for over 50 years. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ transplant needs.

Tokio Marine HCC – A&H Group

HCC Life Insurance Company operating as Tokio Marine HCC – A&H Group

Evans insists that the information is out there and available, “But the interest we see from members to use it is very limited. Most price comparison tools we see get maybe 10% participation, which makes it very hard to move the cost needle.”

This perspective from Jason Hopkins, cofounder and partner, Concierge Benefit Services and Concierge Administrative Services, points to the wide diversity of interpretation across the self-funded industry.

“The term ‘transparency’ is often used for the stakeholders' gain, as a marketing tool to imply integrity or openness,” he affirms. "I do believe there is a baseline of transparency that our industry is trying to achieve, which is a positive move in the right direction to accomplish the goal of most TPAs -- to provide excellent service, accurately adjudicate claims and reduce costs.”

He says the firm takes a constructive view of transparency as a means of accountability, adding, “With one of Core Values being to Live by the Golden Rule, that's transparency! Our definition and perspective of transparency is being an open book, building trust, and fostering a better decision-making organization with clearer communication with clients. I feel this aligns with the intent of healthcare transparency, openness and accessibility of information regarding cost, quality and service.”

Dr. David Adamson, MD, founder and CEO, ARC Fertility, is of the mindset that in most cases, patients are not empowered with information.

“The healthcare system is fragmented and financially opaque

David Adamson

bill these hidden fees, making it nearly impossible to understand what’s real and what’s padded.”

Brokers aren’t off the hook either, as she continues, “In the name of “innovation,” many introduce a swarm of unbundled vendors who promise to slash costs on specific types of claims. But here’s the catch: when you layer in commissions, admin fees, and “per member per month” charges, the end result is often more expensive than just using a traditional discount through a major network.”

She also points a finger at vendors, "Many capitalize on the crisis of cost. They know healthcare has become unaffordable, so they offer highly targeted 'solutions' or niche carveouts and clever tricks for specialty claims. But when you zoom out, these point solutions may not align with the overall health and financial goals of the employer or member. They may solve a problem, but often at the cost of creating new ones elsewhere in the plan.”

Hopkins counters, “TPAs, brokers, and consultants have taken steps to empower employers by providing data analytics to help make the best decisions for their employees and company. TPAs continue to eliminate opaque practices. With AI, innovative ways of providing more consistent education to members, and more transparent steps for provider cost, self-insured employers can

benefit from TPA, broker and consultant provided tools.“

He argues that the TPAs, brokers and consultants that remain outdated in practices and systems often lack transparency and are insufficient in supplying member engagement apps, sites, data access and education.

“At Concierge, our largest current investment focuses on empowering members and employer groups with front-end access, provider and treatment information, and cost-controlling programs,” he says. “There is a very visible contrast between the progressive intermediaries and the outdated self-funded administrators. The progressive partners have shifted to meaningful member engagement with emphasis on transparency, education, and a value-based care approach. These steps, in turn, boost positive outcomes and reduce unnecessary spending. It is a tech-forward environment we now live in, and Concierge is working hard to become a tech-driven TPA that empowers members to make informed decisions.”

Howell agrees that AI finally lets us build healthcare experiences that feel personal and intuitive, noting, “It’s like messaging a smart friend who knows your preferences, budget and provider quality. Whether it’s text, app, or voice, the more relevant the recommendation, the more likely a member is to act on it, and that’s how we move the needle on both cost and quality.”

Advocacy in Action

Americans want Healthcare Pricing Transparency

Despite the extensive and ongoing industry discussions about the need for healthcare price transparency, it appears that the American public is far from "tired of hearing about it. A new poll by Echelon Insights from the Patient Rights Advocate organization reports that 96% of those surveyed agree that people “deserve to know the price of their healthcare before they receive it.”

If up-front transparent healthcare pricing is in such demand, why do these issues still remain?

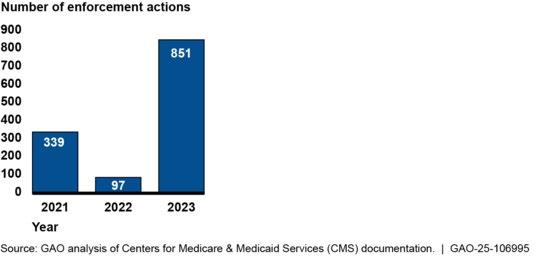

· Continued Non-Compliance: Despite federal rules requiring hospitals to post standard charges, compliance has been lagging. Studies in 2022 found that fewer than 6% of hospitals were fully compliant, with a 2024 report finding compliance for only two-thirds of hospitals sampled.

· The Struggle to Shop for Care: The lack of transparency makes it difficult for consumers to compare prices and make informed decisions, especially for services they can schedule in advance ("shoppable services").

· Surprise Medical Bills: A significant percentage of adults (41%) have received surprise medical bills, highlighting the need for clearer upfront cost information.

· Potential for Cost Savings: Healthcare price transparency has the potential to significantly reduce healthcare costs, with some experts suggesting savings of up to $1 trillion annually if fully implemented.

REGULATORY ENVIRONMENT & ENFORCEMENT

Back on January 1, 2021, Centers for Medicare & Medicaid Services (CMS) required each hospital operating in the United States to provide clear, accessible pricing information online about the items and services they provide in two ways:

As a comprehensive machine-readable file with all items and services.

In a display of shoppable services in a consumer-friendly format. This information would make it easier for consumers to shop and compare prices across hospitals and estimate the cost of care before going to the hospital. CMS announced that it would be auditing a sample of hospitals, in addition to investigating complaints that are submitted to CMS. Hospitals were warned that they may face civil monetary penalties for non-compliance.

Fast forward to February 25, 2025, when President Trump signed an Executive Order to empower patients with clear, accurate and actionable healthcare pricing information. The order directs the Departments of the Treasury, Labor, and Health and Human Services to rapidly implement and enforce the Trump healthcare price transparency regulations, which were slow-walked by the prior administration. The departments must ensure hospitals and insurers disclose actual prices, not estimates, and take action to make prices comparable across hospitals and insurers, including prescription drug prices. They must update their enforcement policies to ensure hospitals and insurers are in compliance with requirements to make prices transparent.

STOP LOSS INSURANCE

Prudential’s Stop Loss insurance helps reduce unpredictable risks from self-funded medical plans. This way you can focus on giving your employees the coverage they deserve, while helping to reduce your worries about the increased frequency of catastrophic claims.

Get Stop Loss insurance from a partner you can rely on:

•A highly rated, experienced carrier recognized for over 150 years for strength, stability, and innovation

• Efficient, responsive service with streamlined processes across quoting, onboarding, and reimbursements

•A dedicated distribution team that works hand-in-hand with your existing relationships

•Flexible policy options so we can build a coverage plan that meets the unique needs of your organization

Did you know, medical and prescription drug costs are expected to rise 9% annually?1

See how Prudential can help you manage the risk from your self-funded medical plan.

For more information, contact us at stoploss@prudential.com or visit our website: www.prudential.com/stoploss

The EO is intended to lower costs for American families and help patients and employers get the best deal on healthcare. Self-insured employers are quickly learning that prices vary widely from hospital to hospital in the same region, as CMS reports:

One patient in Wisconsin saved $1,095 by shopping for two tests between two hospitals located within 30 minutes of one another.

One economic analysis found that President Trump’s original price transparency rules, if fully implemented, could deliver savings of $80 billion for consumers, employers, and insurers by 2025.

Employers can lower their healthcare costs by an average of 27% on 500 common services by better shopping for care.

Gasser maintains that the purpose of Hospital Price Transparency (HPT) and Transparency in Coverage (TIC) regulations is to make costs accessible, but the data in the machine-readable files is complex and non-standardized, requiring significant computing power, which limits usability by patients/members and employer groups.

“These are significant barriers,” he asserts. “Also, the inconsistency in compliance across hospitals and payers undermines accountability and enforcement, which is pretty nonexistent at this point. Recent 2025 mandates for standardized formats and stricter enforcement show progress, but time will tell if this has a meaningful impact on consistency across all providers and payers.”

At this point in time, he contends that there hasn’t been a meaningful impact of the regulations, “And the EO didn't provide much specificity or action. Time will tell.”

Cox agrees that HPT, TIC and the No Surprises Act (NSA) have laid a strong regulatory foundation, but accountability is still a work in progress. Enforcement has been inconsistent, and many hospitals and plans still struggle with data quality, standardization, and usability.

She points out, “One of the biggest barriers is data overload without context—machine-readable files that are often incomprehensible to the average consumer. If you are only checking the box of compliance, you are not bringing true transparency to members and meeting your members’ needs.”

Cox advocates for a shift from raw compliance to intelligent transparency: curated, contextualized data that drives real decisions.

“Until we bridge the gap between regulation and consumer experience, the promise of transparency will remain under-realized,” she says. “The recent EO has certainly reinvigorated enforcement efforts, especially around hospitals posting actual prices rather than estimates. CMS has ramped up audits and penalties, signaling that non-compliance is no longer a slap on the wrist—it's a reputational and financial risk.”

While TIC regulations will be enforced, all payers need to get real about compliance. “The pressure is mounting, too, with increased scrutiny on cost estimator tools and advanced explanations of benefits,” she counters. “At Zelis, we see this as an opportunity—not a threat. Organizations that embrace transparency as a strategic advantage will not only mitigate risk but build trust and loyalty in a competitive market.”

Source: https://pirg.org/edfund/resources/post-the-price/

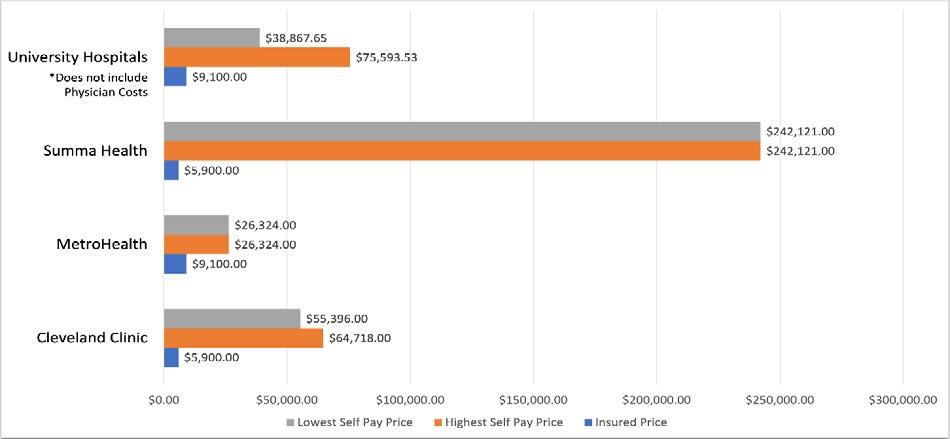

Range in available prices for total knee replacement. This graph indicates the highest and lowest self-pay and insured prices within each hospital system we reviewed in the Cleveland area. Note that the prices for University Hospitals do not include physician costs. All prices found between February and April 2024.

On May 22, 2025, CMS issued new guidance reinforcing this EO to ensure that hospitals "provide meaningful, accurate information about their charges for healthcare items and services.” CMS believes that its guidance will reduce healthcare costs, encourage competition, and provide consumers with information to make informed choices.

According to attorneys at Snell and Wilmer, the new guidance reinforces that hospitals must display actual dollar amounts — not estimates — in their files, including payer-specific negotiated charges and estimated allowed amounts derived from historical data.

As a result, CMS is discontinuing the use of placeholder values such as “999999999” and expects hospitals to calculate and encode the average dollar amount the hospital has received for an item or service using electronic remittance advice transaction data from the prior 12 months.

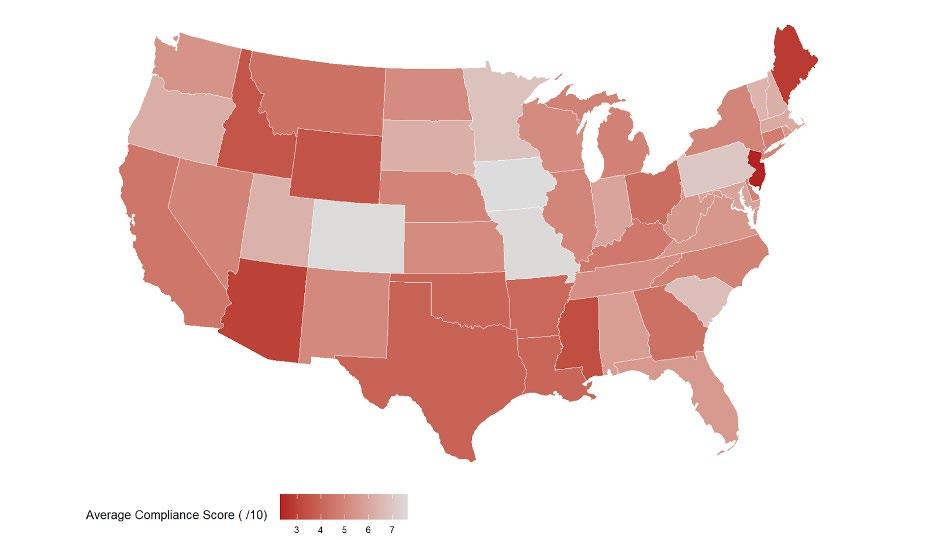

HOSPITAL PRICE TRANSPARENCY COMPLIANCE BY STATE

Lighter shades correspond to higher average compliance scores; darker red shades to lower average compliance scores. According to the analysis, Colorado and Minnesota were among the states with the highest average compliance scores, while Arizona and Wyoming were among the lowest.

Source: Healthcare Data Analytics https://hcpricing. com/blog/ hospital-pricetransparencycompliance-bystate-3-takeaways/

Dr. Adamson discerns, “I know there are transparency regulations that largely apply to hospitals, but that many hospitals have not complied with the regulations and that there do not seem to be particularly significant repercussions from reporting or not or for the content of the reports. Also, my understanding is that much of the information released is not easy to interpret, especially for patients.”

He perceives that transparency, if it occurred, would be immensely helpful, enabling all stakeholders, but especially patients, to assess the cost and quality, i.e., the value of their healthcare purchases.

“This would drive competition and efficiency and reduce costs,” he states. “However, the US healthcare system has become complex because this has enabled many stakeholders to profit even though they are providing little value to the end payer—the patient/individual citizen and, just above them in the payment chain, employers.”

Dr. Adamson believes that transparency would focus attention on the patients, the providers and the employer payers, enabling them to create a much more cost-effective and value-driven system.

“We are not close to those goals because the regulatory framework is insufficiently effective and enforced,” continues. “Achieving those goals will require a concerted effort by patients, policy makers and employers to create innovative high-value systems that show by example what is possible. This is happening now, but change is seriously challenged by many stakeholders with deeply embedded interests in the current system.”

Wilkinson maintains that while the intent of regulations is strong, the execution is lagging: “The regulations have created a framework for greater accountability, but compliance doesn’t always translate into clarity for the end user. One major barrier is the complexity of the data itself. Raw, machine-readable files are not usable for the average consumer. In addition, carriers and hospitals interpret and implement the regulations differently, which leads to inconsistency across the board.

He insists that without integration into broader tools or systems, transparency efforts often remain siloed, making it difficult for both employers and members to see the full picture.

“Until we solve for usability and standardization, the regulations will feel like an industry requirement more than a consumer benefit,” says Wilkinson.

While he views President Trump’s EO as a definite amplification of enforcement, especially in terms of public penalties and increased oversight, “It sent a clear message that transparency isn’t optional. For hospitals and health plans, the risk is real: not just financial penalties, but reputational damage. In the self-insured space, that matters because with the increase in fiduciary lawsuits, employers are watching. A carrier or facility that fails to meet transparency expectations may find itself losing trust and, ultimately, losing business.”

REQUIREMENTS FOR GROUP HEALTH PLANS

The final transparency rules require a price comparison tool with price estimates of all common healthcare items and services; and machine-readable files (“MRF”) posted (and timely updated) by hospitals and health plans detailing in-network and out-of-network pricing for medical services and prescription drugs.

According to My Benefit Advisor, group health plans are required to create and post the MRF for innetwork rates and out-of-network allowed amounts that went into effect for plan years beginning on and after January 1, 2022. Employers with fully insured plans must ensure their carriers comply, while those with self-funded plans should contract with third-party administrators to meet disclosure requirements. The question remains whether these mandates are enforceable.

Source: Row Zero. https://rowzero.io/blog/hospital-price-transparency-cms-standard-charges-files

Even with mandates, Weenum says real transparency remains out of reach, “Regulatory efforts like the No Surprises Act and machine-readable files were supposed to be game-changers. But let’s be honestthe current medical billing ecosystem is so convoluted that even with mandates, true transparency is still elusive.”

Here’s her description of how it typically goes: a plan member calls the hospital asking for a cost estimate. The hospital says they can’t give one until a prior authorization is in place. The TPA tries to help but can’t

Our Roots Run Deep

get the data because the billing department hasn’t received the codes from the provider. Round and round it goes - a frustrating circle that helps no one and ends with a member flying blind.

“Even when cost data is available, it’s often buried in machine-readable files that no average person can understand,” she states. “And the No Surprises Act? It’s rarely followed, especially by the worst offenders like air ambulances and anesthesiologists. Members still get balance-billed, and they still have to chase down their TPA to fix it. It’s not transparency; it’s chaos.”

Enforcement helps, but it’s not the fix, advises Weenum: “Stronger enforcement of price transparency rules is a step in the right direction. The real prize will come if (and when) hospitals and networks are forced to publicly disclose their negotiated rates. For decades, this has been the industry’s best-kept secret, and it’s long overdue for exposure.”

She refers to a moment when carriers flirted with hybrid models based on reference-based pricing, which offered a glimmer of hope.

“But that movement has largely fizzled. Instead, we’re back to secret charge masters and confidential negotiations, which undermine the entire idea of an open market,” she insists. “Still, even if full transparency becomes reality, it won’t solve the root problem: cost. We can publish pricing data all day, but that doesn’t change the fact that the costs themselves are out of control. Data might help us understand how bad the problem is, but it won’t fix it.”

Evans and colleagues are familiar with regulations but insist, “The greatest barrier we find is the lack of quality and consistent data in a standardized format. After that, the lack of enforcement has led to many clients ignoring the regulations and waiting until there are fines and penalties being enforced.”

They state that the impact of President Trump's Executive Order is to be determined, adding, “It will not be clear until there is some real enforcement. As many of the staff have been let go at the enforcement agencies, there is a mixed message from the current administration.“

But Evans holds that the potential for transparency to drive efficiency, enable comparison shopping and promote competition is definitely there: “The question is whether there is the will on the part of the entrenched players who drive the political dialogue. If the BUCA's were on board, the market would move. However, it is very clear from current litigation that they are keen to keep the status quo for as long as possible.”

Hopkins maintains that as a TPA providing claims administration for self-funded employers, his organization strives to stay up-to-date and compliant with all US healthcare transparency regulations.

“With the requirements aiming to have posted hospital negotiated rates and cash prices, Concierge has contracted with a platform for price transparency,” he shares. “This allows us to remain compliant with laws such as the No Surprise Act, Transparency in Coverage Act, and leverage behavioral economics in a system environment.”

“Recent executive orders have addressed these challenges with stronger CMS enforcement and standard formats,” adds Hopkins. “At the end of the day, Concierge takes a responsibility to educate the member of accessible data, because until members use the tools provided, success is limited.”

Are they improving accountability? Hopkins answers, “Some hospitals are publishing data as required, some members are researching the available data to lower costs. For those engaged, it has improved accountability. With any regulation, there are barriers and challenges

These issues include massive files, misleading data, lack of education to the member on how to access the data, and CMS not consistent in reporting format standardization or applied penalties for non-

Hopkins doubts that he is alone in stating that he is still learning the impact of President Trump's EO.

“I do know the goal of the order is to make America healthy, empower patients, he continues. “With President

Payment Integrity

penalties for hospitals and health plans that fail to comply, there is definitely a heightened awareness of the requirements. Not just penalties will apply, a 'non-compliance" CMS list will be posted along with potential legal action. This order requires insurers and hospitals to conduct internal audits.”

As President Trump stated, "transparency is no longer negotiable." Concierge has engaged Compliance Officers, outside counsel, and support from SIIA that aids in their ability to stay up to date with Eos and regulatory requirements.

For Zac Hanson, familiarity with the regulations is a step forward, but he cautions, “But impact has been limited by data complexity, inconsistent compliance, and low consumer awareness. Transparency is a catalyst for change; it can drive efficiency, competition, and cost reduction by enabling smarter healthcare choices. Misaligned incentives, however, have limited transparency in the industry, consistently resulting in higher costs, but with the increased visibility and an emerging market of innovators, healthcare is poised for change and positive transformation.”

NAVIGATING AN UNEVEN REGULATORY LANDSCAPE

Daugherty emphasizes that the regulatory and market environment for transparency is active but uneven.

"More immediately relevant to SIIA stakeholders are the ERISA compensation disclosure rules that take effect on October 12, 2025," she explains. "These rules require all plan service providers, including technology platforms, to disclose every dollar of direct and indirect compensation tied to a plan. These requirements are not limited to PBMs. Any entity involved in administering plan benefits is subject to review."

These include:

Rebates (retained or passed through)

Spread pricing

Mail-order margins

Licensing fees for data and technology

Performance incentives or service-based bonuses

In parallel, Daugherty reports that several states have begun introducing or enforcing their own transparency-related rules. For example:

• Florida mandates full rebate pass-through and prohibits spread pricing across both government and commercial lines. Louisiana and North Dakota require PBMs to disclose rebate information and act in the interest of plan sponsors.

• Texas, Maine and Oklahoma have moved to strengthen licensing, audit rights and reporting requirements, though enforcement varies.

Lori Daugherty

“Even in these states, there is no national standard for rebate pass-through or real-time financial reporting,” she continues. “Many laws focus on Medicaid. Others require only aggregate data. No state currently mandates real-time, individual plan-level rebate transparency across all markets.”

Dr. Adamson observes that there are transparency regulations that largely apply to hospitals, adding, “But many hospitals have not complied with the regulations, and there does not seem to be particularly significant repercussions from reporting or not or for the content of the reports. Also, my understanding is that much of the information released is not easy to interpret, especially for patients.”

GETTING CLOSER TO A “FIX”

While many feel that progress has been made, we’re not there yet.

Many self-insured employers have invested in tools like price comparison platforms and benefit navigation services, but adoption and usability remain uneven,” acknowledges Cox. “The challenge isn’t just providing data—it’s translating it into intuitive, personalized guidance. At Zelis, we believe that empowerment comes from integrating transparency into the care journey, not bolting it on as an afterthought. When employers, payers, and consultants align around a shared goal of member engagement, we see real movement: lower costs, better outcomes, and higher satisfaction. But to scale this impact, we need to go beyond compliance and embrace consumer-centric design.”

Weenum insists that if we’re serious about fixing healthcare, “…transparency can’t be the endpoint - it has to be the starting line. We need to attack the cost structure itself.”

She points to the influence of private equity in medicine that has skewed priorities toward profits over patients, “Hospital monopolies have created pricing power that crushes competition. Barriers to entry for new medical professionals have kept the supply of care artificially low.”

Transparency, in its truest form, is empowering. “But for it to matter, we must also address the entrenched financial and regulatory systems that make healthcare so expensive in the first place,” says Weenum. “Until then, ‘transparency’ risks becoming just another feel-good label — talked about often, delivered rarely.”

Source: Waystar

Hopkins upholds the value of transparency to enable comparison shopping and promote competition, especially on services such as labs and elective procedures.

"We are closer but maybe not completely there yet," he concedes. "Most patients still do not shop for care, partly due to limited financial incentives for them to do so. Plans need to be restructured to promote rewards for savings to the member."

His organization has begun to do so by creating benefit programs focused on averaging provider cost or acceptable provider rates, incentives and savings.

“Again, the infrastructure is being built to drive efficiencies and promote comparison,” he acknowledges. “Members have to be educated, shown how to access the data and be incentivized. Once this becomes the trend, we will see transparency achieve its goals.”

Looking ahead, Daugherty forecasts that transparency will not be a static requirement, adding, “It will continue to evolve, through regulation, litigation and market pressure.” The most effective response is not to wait for a final rule but to build the capability now. Based upon this outlook, we don’t believe that plan sponsors need to overhaul their systems every time expectations shift. Our approach will already have the tools in place.”

Wilkinson concurs that the potential for transparency is enormous, affirming, “Transparency should drive smarter shopping, better negotiations, and more competition. Right now, we’re still at the stage where the data exists, but the delivery is inconsistent. Comparison shopping in healthcare isn’t like buying a flight or booking a hotel. There are more variables to consider and often, more emotion.”

That said, with better integration and proactive guidance, he insists that transparency can absolutely help reduce costs, noting, “We need

to stop congratulating ourselves for posting prices and start measuring success by outcomes: Are members choosing better care? Are employers saving money without sacrificing quality? That’s the real test.”

If transparency occurs, all agree that it will be immensely helpful, especially for patients to assess the cost, quality and value of their healthcare purchases.

Dr. Adamson reflects, “The US healthcare system has become complex because this has enabled many stakeholders to profit even though they are providing little value to the end payer—the patient/individual citizen and, just above them in the payment

chain, employers," says Dr. Adamson. “Transparency would focus attention on the patients, the providers and the employer payers, enabling them to create a much more cost-effective and value-driven system.

He concludes that we are not close to those goals because the regulatory framework is insufficiently effective and enforced, noting, “Achieving those goals will require a concerted effort by patients, policy makers and employers to create innovative high-value systems that show by example what is possible. This is happening now, but change is seriously challenged by many stakeholders with deeply embedded interests in the current system.”

Gasser is bullish on the power of price transparency data to drive efficiency and promote competition across both payers and providers, as well as allowing consumers to be empowered when navigating healthcare services.

“The transparency data has driven far more efficiency and data accuracy for employee benefit brokers and stop-loss carriers/MGUs," he affirms. "These entities previously relied primarily on discount off-billed charge metrics from payers to identify the most cost-effective network for an employer group or to inform underwriting models when determining the risk associated with a group.”

He says that transparency data allows for the use of an independent source, such as Deerhold, to associate local Medicare rates with the transparency data to illustrate the most cost-effective networks as a percentage of Medicare. This ensures always associating current payer-provider contract rate data within the quoting process.

All agree that the potential for transparency is enormous and can reshape the healthcare marketplace by enabling consumers to compare costs and quality, just as they do in other industries. McKinsey research shows that even modest increases in comparison shopping could impact up to 25% of healthcare claims spend, potentially unlocking gains in affordability for consumers.

“But we’re not close to full realization yet," cautions Cox. "Fragmented data, low health literacy, and limited incentives still hinder progress. We are working to close these gaps by delivering curated, consumer-friendly insights, integrated into the member journey, which make comparison shopping not just possible, but practical. When transparency becomes intuitive and actionable, it will drive competition, reduce waste, and ultimately, bend the cost curve.”

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

Sources:

https://www.mckinsey.com/industries/healthcare/our-insights/how-price-transparency-could-affect-ushealthcare-markets

CMS Issues New Guidance to Expand Healthcare Price Transparency - Law Offices of Snell & Wilmer

https://www.patientrightsadvocate.org/blog/new-poll-an-unparalleled-96-of-americans-supporthealthcare-price-transparency#:~:text=This%20level%20of%20support%20is,and%20Actionable%20 Healthcare%20Pricing%20Information.%E2%80%9D

https://carrumhealth.com/blog/transparency-in-healthcare-benefits/#:~:text=Research%20shows%20 that%20transparency%20increases,the%20industry%20as%20a%20whole.

https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-announcesactions-to-make-healthcare-prices-transparent/#:~:text=Trump%20Announces%20Actions%20to%20 Make%20Healthcare%20Prices%20Transparent,-The%20White%20House&text=EMPOWERING%20 PATIENTS%20THROUGH%20RADICAL%20PRICE,requirements%20to%20make%20prices%20transparent.

Hospital Price Transparency Enforcement Updates | CMS

New Executive Order Addresses Price Transparency Rules

Steadfast protection for the unpredictable

Loss Insurance that can help you weather any storm

Our Stop Loss Insurance mitigates the impact of costly medical claims through flexible contracts, customizable plans and a consultative, client-focused approach. Our experience and service in the Stop Loss market has provided a guiding hand for 50 years - while maintaining a pulse on new trends. We work with self-funded groups down to 100* lives and individual deductibles down to $25,000. Our Stop Loss Edge program offers an innovative way to take advantage of self-funded health plan coverage for employers with 100*-500 employees. Whether you’re carving out Stop Loss for the first time or an experienced client looking for cost containment solutions, we can help. We’ll be by your side every step of the way.

Visit voya.com/workplace-solutions/stop-loss-insurance for more information

* 150 enrolled employee minimum for policies issued in CA, CO, CT, NY, or VT. Excess Risk (Stop Loss) Insurance is issued and underwritten by ReliaStar Life Insurance Company (Minneapolis, MN) and ReliaStar Life Insurance Company of New York (Woodbury, NY). Within the State of New York, only ReliaStar Life Insurance Company of New York is admitted, and its products issued. Both are members of the Voya® family of companies. Voya Employee Benefits is a division of both companies. Excess Risk Policy #RL-SL-POL-2013; in New York Excess Risk Policy #RL-SL-POL-2013-NY. Product availability and specific provisions may vary by state and employer’s plan. ©2025 Voya Services Company. All rights reserved. CN4405221_0527 216993 216993_050125

The power to get it done.

AmeriHealth Administrators is one of the largest national third-party administrators. We provide innovative, value-based health benefits programs and outsourcing services for self-funded health plans and other organizations.

Whether locally focused or on a national level, our scalable capabilities allow us to service many unique customers, including self-funded employers, Tribal nations, international travelers, and labor organizations.

Learn how we can help you successfully navigate and thrive in

environment. Visit amerihealthtpa.com.

TATUM RE & SIIA – A STORY OF PARTNERSHIP

Editor’s Note: This is the first in a periodic series of articles written by SIIA member companies where they discuss their positive engagement with the association and share related views on the future of the self-insurance industry. If you would like to tell your story, please contact Mike Ferguson at mferguson@siia.org.

Written By Dominic Hagger

IIntroduction

I’m Dominic Hagger – CEO of the Tatum RE Group, which encompasses Tatum RE – our US-based Reinsurance Intermediary; Tatum Consulting – our Consulting arm, which provides a range of consulting services to clients throughout the Accident & Health sector and Secan & Partners Ltd, which is our fully accredited Lloyd’s Broker, based in London, England.

Our group of companies assists clients in structuring and designing programs, partnering up the various program partners and handling all of the subsequent facets of program business; we have a real focus on the Self-Insured market. We are heavily involved in the Captive market too, and of course, our main function is to place reinsurance for the primary insurance carriers, assuming the original risks and exposures.

We launched in July 2019 – at that point, it was solely me. We're now 25 staff, in our 7th year of operation and are operating both in the USA and the UK, providing our clients with access to all US as well as international insurance and reinsurance markets.

We are well on the way to building the premier independent reinsurance intermediary both in the USA and the UK. Our mission is very simple – we aim to ensure our clients' financial security and peace of mind. We are passionate about providing a personalized, quality service and maintaining our broad market access. Much of what we do is create partnerships; hence our trademark of ‘Empowering Partnerships.’

SIIA INVOLVEMENT – PAST & PRESENT

My personal career now spans nearly 40 years, and yes, I've been a member of and have been engaged with SIIA right from the beginning. It is so important to garner the strength of combining the industry’s knowledge and experience, and I believe SIIA does this. It is absolutely vital for our industry, whether that Self-Funded focus is Medical Stop-Loss, Workers’ Compensation or some other specific area, that we have a forum to combine together, join forces and tackle the problems and issues that we face. There is great strength in our collaboration.

SIIA provides a recognized and respected voice, and when an industry issue arises, SIIA is often the first to recognize this and, through its membership and advocacy platforms, that issue is then addressed. Our membership of SIIA, and just as importantly, our engagement with SIIA, allows us jointly to help address and shape the market. There are so many examples of this – here are just three:

- SIPAC

o Unfortunately, so much of what we wrestle with every day is in the political landscape. Having the SelfInsurance Political Action Committee is of critical importance to ensuring that the self-insured industry has a voice and can provide input at the top table where many of the key decisions are made. Tatum RE is pleased to support this Committee.

- SIIA Committees and Task Forces

o There are numerous Committees and Task Forces that have been formed by SIIA. These are created in response to pertinent issues within the industry and again, are critical in addressing these issues,

responding to them and ensuring that we, as an industry, are fully engaged in such matters.

I, as well as numerous of our team members, have participated on these Committees and/or Task Forces. That engagement has sought to address the issues at hand, and it has supported the industry overall, including both the self-insured community and the ultimate risk takers.

- Future Leaders

o I’m not saying anything new here; it has been said many times, but we are an industry that desperately needs to engage with our Future Leaders. It is so important that industry veterans pass on their knowledge and experience to the younger generation. This generation is the future, and we can teach them a lot; they, too, can teach the industry veterans – their approach and outlook are different from those in their more mature years, and we must embrace that; it can only help to look at the same old problems through a somewhat different lens.

STAYING FOCUSED ON KEY INDUSTRY ISSUES

I feel that we as an industry are facing a number of very important issues today; some have been ongoing and developing over time, others are relatively new, and, of course, it seems as though there is a new issue nearly every week! To focus on a few matters that I consider to be at the top of the agenda, I would suggest the following:

o Non-Disclosure / Lack of Transparency

No risk taker, whether they are self-insured, an insurer, a reinsurer or a captive, should assume risk without being able to truly evaluate it. This is becoming more and more challenging, especially when certain healthcare providers attempt to prevent the payers/risk takers from seeing certain data and information, hiding behind the ‘confidentiality and/or proprietary’ masks! We have recently had clients who have been told ‘…we can’t show you the total billed charges or discount amounts, due to this information being proprietary….’ This is a preposterous stance and should be outlawed. Yes, we need confidentiality and a secure, deidentified and encrypted method of sharing data and information; however, we must deal with fully transparent parties. This is just another example of buying something before you know the price. We wouldn't do that with our own money, and we should understand why your insurer or reinsurer shouldn’t do this either. Maybe this is a matter for SIPAC to pick up on!

o Healthcare vs Healthcare Financing

This matter is somewhat connected to the first point above, but the majority of people don’t differentiate enough between

healthcare and healthcare financing – likely through insurance; they are two separate things, albeit often connected in our world. We should all have access to quality healthcare, but insurance doesn’t (and shouldn’t) pay for everything. We continue to see advocacy groups and regulators attack certain risk management tools without fully understanding their impact and affordability. We need to bring all parties together to find a compromise between achieving social objectives while maintaining the fundamental premise of insurance.

o Medical Lasers

Quite often in the medical market, you will hear the term ‘laser;’ this is when an individual is targeted due to a current medical condition, and typically, they are held to a higher (sometimes significantly) deductible or self-insured retention. In the Medical Stop-Loss arena, 'No New Laser' policies are available, but this is probably offered by less than half of the market. This situation places huge uncertainty for Self-Funded Employers.

o Cell and Gene Therapies

One of the great things about the US healthcare industry is that it is the world leader in developing medicines and new approaches to addressing medical conditions. Newly approved Cell & Gene therapies for cancers and certain rare diseases have given individuals new hope for longer and better lives. As an industry, we are, of course, concerned about the extremely high cost of these therapies, many of which are priced at $1M+ (some much greater) for one course of treatment or a single shot! As an industry, we must find ways to pool these costs, or the alternative may be that these wonderful and often lifesaving treatments will simply not be covered under many health plans.

It’s also worth mentioning here that large claims in general are growing and at a rapid pace; they don't necessarily have to be related to CGT. As an industry, we need to stay on top of this trend and do everything possible to ensure the reasonableness of such charges.

o Technology / Artificial Intelligence

For those of us who have been in the workforce for a long time, it is very easy for us to recognize just how important technology is and what a significant role it plays in our world today. The speed of

HIGH-COST MEDICAL CLAIMS REQUIRE HIGH-POWERED NEGOTIATIONS

Lower your expenses on in- and out-of-network claims with savings as high as 90%

Our expert attorney negotiating team helps you avoid overpayment and achieve exceptional savings on your claims—even the highest cost treatments.

H.H.C. Group is your trusted partner to verify costs and ensure billing accuracy – more savings on more claims. Real People. Real Savings.

Carmie Johnson Coding Auditor

technological advances is immense, and AI is increasing this evermore. In the Medical Stop-Loss arena, AI is used for Small Group Underwriting as well as to enhance operational efficiency overall. As an industry, we must continue to embrace AI and apply it to its best use. Don't be afraid of AI; AI is not your competition – but don’t be the only competition that doesn’t have AI in your locker!

o PPO vs RBP vs DPC

Over the past 5 years or so, the industry has explored ways to deal with the ever-increasing costs being incurred through traditional PPO (Preferred Provider Organization) networks; one such response has been the introduction of Reference Based Pricing (“RBP”), and the results have been phenomenal. And importantly, these results have not just been good for the patient and the payer, but also for the provider. We also recognize that there are challenges to this method of reimbursement, one being the accessibility to care; another being the education process for both the user and the provider. But the results have been truly meaningful – be determined and hang in there. The Direct Primary Care (“DPC”) model is another alternative; again, this method of contracting and reimbursement can be meaningful and is certainly worth exploring further.

o Captives

We have seen significant and growing use of captives over recent years, which is another form of selfinsurance. Tatum RE is very active in this space and works on captives domiciled in both on-shore and off-shore locations and with various captive managers and vendors. Also, through our Lloyd's Broker Secan & Partners Ltd, we have placed some very unique captive reinsurances, such as traditional aggregate stop-loss covers right through to balance billing coverage. I see this area as one that has grown significantly over the past 5 years and one that will continue to do so for some time to come.

Dom Hagger

You look out for them, we look out for you.

Our team is here to help navigate and protect self-funded plans through even the most complex situations. With nearly 50 years’ experience in the stop loss business, we earn the trust of our partners and customers by following through on our promises and supporting every plan with professional, informative and responsive service. Learn how Symetra Stop Loss can help protect your self-funded plan. Visit us at symetra.com.

FIELDING CATASTROPHIC CURVEBALLS

With large claims on the rise, data-driven solutions take center stage

TheTWritten By Bruce Shutan

state of catastrophic claims management has become worrisome across the self-insured community, but data-driven solutions are helping shore up that sinking landscape.

Industry research suggests that huge claims are clearly on the rise. There was a 45% increase in $1 million claims, a 55% increase in $2 million claims and a whopping 292% increase in $5 million claims just last year, according to Guy Carpenter and Oliver Wyman’s second annual joint stop-loss market update.

A recent report by the A&H Group, a member of the Tokio Marine HCC group of companies, mirrored those findings. It noted, for example, that the frequency of stop-loss claims above $2 million is now up as much as 1,251% since January 2014, when the Affordable Care Act removed the cap on health benefit payments. Self-insured employers were roughly 13.5 times as likely to receive a claim at that level last year as in 2013.

These headwinds, of course, make it challenging for stop-loss insurance carriers and medical stop-loss captives to rein in catastrophic claims. “Insurers are responding with higher rates and stricter terms, all while the industry adapts to new AI capabilities,” according to Jay Ritchie, president and CEO of Tokio Marine HCC – A&H Group.

Keeping stop-loss insurance renewal rates manageable is often a struggle, and in some cases, carriers choose not to re-bid at all when an employer’s population experiences a high volume of catastrophic claims, which usually are north of $500,000.

Experts say members who drove most claims in one year may not be a factor the following year, while those who were not significant cost drivers in the past year may become major claimants in the upcoming year. By relying too heavily on last year’s highcost members, carriers risk missing opportunities to price competitively or preserve margin.

A MOVING TARGET

The sheer amount of $1 millionplus claims today is not close to what they were within the industry even just five or 10 years ago, notes Scott Byrne, president of Blackwell Captive Solutions. "A lot of that has to do with advances in medicine –groundbreaking new treatments that are great from a societal standpoint," he says.

But paying these enormous bills has become unsustainable for many employer groups, producing a compounding effect. On the fully insured side, Byrne says groups are "constantly paying for sins of the past" through significant rate increases, and we're seeing that same kind of claim activity in the self-insured world."

This vicious cycle actually can be a moving target because large claims tend to clear up for different reasons, including high-cost claimants finally receiving appropriate treatment or finding new coverage through a spouse’s plan or individual coverage health reimbursement arrangement.

Whatever approach is pursued to get a better handle on claims, selfinsured health plans need to manage them from both a clinical and cost perspective. Bruce Roffe, president and CEO of HHC Group and a licensed pharmacist, notes that the former is about determining usual, customary and reasonable fees for hospitalization, while the latter addresses whether the services that are being provided are experimental or investigational in scope and the therapy being administered follows appropriate protocols.

In the pharma area where he has expertise, an example of that would involve step therapy. Mindful that drugs are a huge chunk of healthcare costs and will only continue to escalate, he believes we're at the cusp of a revolution in terms of drug therapy and the types of genetically engineered drugs that are being created.

On the cost side, he says reinsurers aren’t necessarily bound by PPO discounts and that Medicare serves as the best benchmark to negotiate affordable rates. Depending on the diagnosis-related group, Medicare will develop an arithmetic and geometric mean length of stay to calculate reimbursement rates.

As part of this dual approach through which clinical and costcontainment measures are simultaneously considered, it’s invariably all about mining employee data. “We’re as much a computer company as we are a service company,” Roffe notes.

UNPACKING SURPRISE CLAIMS

When examining catastrophic claims, industry sleuths are always working to uncover – and head off – the element of surprise. Ali Panjwani, founder and CEO of Merit Medicine, describes upside-down loss ratios as the single biggest proponent of surprise claimants, explaining how the process unfolds when underwriting and pricing the risk of a self-insured group.

Bruce Roffe

Scott Byrne

Consider, for instance, that very little information is typically available for carriers in the request for proposal (RFP), with a generally limited turnaround time for responding. It’s an even tighter window for ultra-small level-funding business. That RFP likely includes a census file of some demographic information and a large claims report that only covers a sky-high spend threshold that’s usually half of the policy’s spec deductible. And with healthcare information known for only about 2% to 5% of the group's overall enrollment, he says, "there may be very highcost claimants who just fell under the radar because they never got captured in one large claims report."

Those mystery claimants can rise in risk in the following year and significantly affect the loss ratio for a particular group. On the flip side, he notes that the risk of many of the large claimants could plummet the following year because of surgery, diseasemodifying therapy with better efficacy or other factors.