Staggering Cost of Obesity Care –

What’s Next for Self-Insured Employers?

As your business grows, so will your healthcare expenses. Customized captive insurance from QBE creates strength to self-fund your employee healthcare coverage, allowing you to increase transparency and reduce the cost of risk. The QBE Captive Curve® solution model removes barriers to entry and allows you to move easily to new strategies.

Take advantage of QBE’s Captive Curve solutions:

• Fronted policy that is “AA-” rated by S&P for single-parent and group captive programs.

• Reinsurance placement covering direct writing captive insurers assuming Medical Stop Loss (MSL) risk.

• Agora, an open MSL group captive that makes it more efficient to participate in a group program.

Together, we’ll find a solution so no matter what happens next, you can stay focused on your future.

By Laura Carabello

By Anthony Murrello

By Alston & Bird,

By Bruce Shutan

Written By Laura Carabello

care is exacting a heavy toll on self-insured employers. Soaring costs and increased demand for new weight-loss drugs -better known as GLP1s -- are an outsized addition to most health plan budgets. Mounting pressures to offer programs that address workplace weight bias are also burdensome. The vast number of studies and surveys being conducted on this topic are indicative of the difficulties facing self-insured companies of every size and scope.

These all add up to exorbitant annual costs of obesity-related illnesses in the US, including direct medical costs for treating chronic diseases which are substantial and rising. Medical experts advise that obesity is linked to a variety of health problems like hypertension, hyperlipidemia, heart attack, strokes, various cancers, early-onset arthritis – even mental health risks for depression, anxiety, suicidal ideation and substance abuse.

Clearly, individuals with obesity are an expensive population. The Centers for Disease Control and Prevention (CDC) tell us that these individuals incur approximately $1,861 more in medical expenses compared to those with a healthy weight. The National Institute of Health indicates that the spend on weight loss dietary supplements is approximately $2.1 billion/year.

From the perspective of employers and employees, total economic costs and implications of obesity and being overweight are even higher. The most recent report from Global Data, a leading data and analytics company, shows that of the 158 million civilian employees on non-farm payrolls, 30% (46.9 million) are classified as having obesity and 34% (53.8 million) have overweight, causing a staggering $425.5 billion in annual economic costs to US businesses:

$146.5 billion in higher medical costs for employees and their dependents

$82.3 billion in higher absenteeism (missed workdays)

$160.3 billion in higher presenteeism (reduced productivity due to illness)

$31.1 billion in higher disability costs

$5.2 billion in higher Workers’ Compensation Program costs.

Regrettably, CDC further reports that only 2 in 5 young adults are weight-eligible and physically prepared for basic training in the U.S. military. What’s more, the Wisconsin Collaborative for Healthcare Quality reports the direct and additional hidden costs of obesity are stifling businesses and organizations that stimulate jobs and growth in U.S. cities. They cite demographics which play an important role regarding prevalence and cost:

In the 10 cities with the highest obesity rates, the direct costs connected with obesity and obesityrelated diseases are roughly $50 million per 100,000 residents. Amid estimates that the nation will incur higher costs for disability and unemployment benefits, businesses are suffering due to obesity-related job absenteeism to the tune of $4.3 billion annually – with these costs expected to rise.

In the “good news, bad news” report, the number of U.S. states with adult obesity rates at or above 35% dropped slightly in 2024 compared to a year prior -- BUT – the number remains far higher than just a decade ago.

What’s driving the news is that the latest "State of Obesity" report from the nonprofit, nonpartisan Trust for America's Health (TFAH) shows that nineteen states have adult obesity rates at or above 35% vs. only 3 states that had that rate 10 years ago.

Mayo Clinic provides the right answers with the right care

Complex is costly. Did you know that, on average, 1% of employees account for 30% of overall health costs2? This is often due to complex, misdiagnosed or undiagnosed medical conditions.

The Mayo Clinic Complex Care Program helps employers simplify the complex, by providing quick and easy access to the top-ranked hospital in the world. Our collaborative approach to medicine helps minimize costs and frustrations by identifying the right patients and delivering the right diagnosis and care.

What states are on the rise? Oregon (+16%), Nevada (+12%) and South Dakota (+12%), while the highest states are West Virginia (41.4%), Mississippi (40.4%) and Louisiana (39.2%). It is stunning that the NO state had an obesity rate under 25% for the first time since 2011, when the data begins.

Glenn Fisher, CEO, NavMD, offers this perspective, “Obesity remains one of the most pressing health and financial challenges of our time. The costs— measured in rising claims, comorbidities, lost productivity, and human suffering—continue to escalate. GLP-1 medications have disrupted budgets, delivering real outcomes but at a premium price.”

Many employers and payers are implementing criteria for prescribing and reimbursing weight loss drugs, balancing access with sustainability.

“Looking ahead, demand is unlikely to fade, and long-term affordability will require strategies to taper or “wean” members off medication, paired with holistic lifestyle and behavioral programs,” he continues. “Beyond drugs, weight management, nutrition, digital coaching and value-based care models are being explored to curb costs and improve health.”

Reiterating the message that GLP-1 medications are effective but costly and straining self-insured employers’ budgets, Jessica Lea, CEO, Tria Health, says, “With 40% of employees affected by obesity, demand for support is strong, but long-term, sustainable solutions are essential. This is why Tria Health developed Choose to Lose, requiring active participation in behavior management before members can access anti-obesity medications.”

Lea maintains that this helps members build lasting habits and in addition, they receive pharmacist oversight to ensure these high-cost medications are working as intended, reducing waste.

“By aligning medication coverage with behavior management, employers gain a framework that promotes accountability, improves health outcomes and delivers measurable impact,” she concludes.

Keith W. Kennerly, founder & CEO, PayRx, Inc., agrees that GLP-1s are transforming obesity care, adding this caveat, “But their recurring costs can destabilize even the most well-managed self-insured employer plans. At PayRx, we work with brokers and sponsors to help convert these highcost exposures into predictable, budgetable spend — blending patientlevel analytics (diagnosis, procedure, adherence) with structured financial reinsurance tools.”

He reaffirms the goal to give CFOs and advisors a better way to avoid sudden premium hikes, lasers, or access delays, noting, “GLP-1s may reshape metabolic health for the better, but without financial innovation, their cost trajectory could overwhelm traditional benefit design. We believe plans deserve both: better care and better financial control over trenddriving therapies.”

The marketplace is responding as Tim Church, MD, MPH, PhD, chief medical officer, Wondr Health emphasizes, “Obesity care affects both the health of our people and our healthcare costs. Like many

employers, we’ve seen growing demand for GLP1s and take a careful, clinically guided approach to coverage. For us, that includes prior authorization, medical criteria and participation in a lifestyle program.”

Dr. Church explains that the Company supports employees through its own comprehensive programs, plus additional support for fitness, mental health, family well-being and more.

“It’s the same approach we offer our clients – evidence-based, sustainable and built for real-life results,” he says. “The costs go well beyond claims— they also show up in absenteeism, lower productivity and disability. To manage both cost and outcomes, we’ve implemented criteria such as prior authorization with BMI requirements, and participation in our behaviorchange program as part of GLP-1 coverage.”

He projects that while costs may eventually decline as more medications enter the market, demand for GLP-1s is expected to remain strong due to their significant results and expanding use in treating chronic conditions beyond obesity.

“As these medications become a long-term component of care, pairing them with proven, behavior-change programs is essential to drive sustainable outcomes, improve adherence and maintain cost control over time,” he continues. “But looking ahead, the real cost of obesity care will depend on how proactive we are. Investing in prevention with proven weight management solutions—before conditions progress—can significantly bend the cost curve and protect both employee health and the bottom line.”

Body mass index (BMI) is the traditional way of defining or measuring overweight and obesity. CDC characterizes BMI as a quick, safe, and reliable screening measure that is inexpensive, noninvasive and easily collected during routine health care visits to assess a person's weight relative to their height.

BMI ranges of adults ages 20 and older

18.5 to 24.9

25 to 29.9

30+

40+

Source: National Institutes of Health

However, public health experts acknowledge the limitations of BMI, leading to calls for more comprehensive diagnostic criteria with criticism that BMI does not differentiate between fat and muscle mass. As a result, a bodybuilder with a high amount of muscle might be classified as obese even if their body fat percentage is healthy.

BMI is far from perfect as the Obesity Association™, a division of the American Diabetes Association®, advocates that instead, a diagnosis should be based upon an overall assessment of the individual – including their metabolic, physical and psychological wellbeing.

The outlook for rising obesity paints a dismal forecast. Researchers publishing in the Journal of the American College of Cardiology came to this conclusion: “By 2030, ∼50% of American adults will be obese, and there will be significant disparities in the prevalence of obesity among demographic subgroups. Obesity disproportionately affects individuals from low socioeconomic backgrounds as well as racial and ethnic minority populations, and the prevalence of obesity rises as the burden of adverse social determinants of health (SDOH) increases.”

This report also confirms that obesity is not an equal opportunity disease. In late 2024 the National Center for Health Statistics issued a data brief demonstrating significant reductions in obesity and severe obesity prevalence in adults were only seen in specific groups: White individuals, males, college graduates, those with private insurance and higher-income households—while divorced, separated, or widowed individuals saw a notable increase.

Employers and advisors need more than a solution. They need deep roots they can rely on. Berkley Accident and Health provides the strength, real-world experience, and long-term commitment that help every partnership grow and thrive.

Strength

Rated A+ (Superior) by AM Best and named a Ward’s 50 Top Performer1

Stability

20 years of consistent leadership in self-funding

Strategy

Long-term, sustainable health risk management

Solutions

Innovative programs for every risk objective

To

With 5% weight loss, which is achievable through lifestyle counseling that helps people improve their diet and physical activity levels, 22% of workers with obesity would no longer meet the criteria for obesity.

With 25% weight loss, which often requires medical intervention, 78% of people with obesity could move out of obesity.

Sustained weight loss of 25% for people with obesity could reduce average healthcare expenditures by $4,830 cumulative over 5 years—with estimated savings of $7,950 among workers with Class III obesity (BMI of 40.0 or greater or BMI of 35.0 or greater with at least one serious obesity-related condition.)

Source: Global Data

Experts now understand that obesity is a disease, influenced by genetics, hormones, the environment and lifestyle behaviors. Back in 2013, the American Medical Association (AMA) announced this designation, largely dispelling the idea that obesity is caused by insufficient willpower, lack of discipline and bad choices. Conversely, many authorities lay blame on the changing food industry: portion sizes are bigger, and foods contain more fats, more sugar and more calories, making it easier than ever before to overeat.

Putting culpability aside, weight stigma is affecting workers. Key takeaways from the Weight at Work Report 2025, in which Levity surveyed 1,000 full-time American employees about weight stigma, company culture and the impact of weight-loss medications in the workplace, show that while many employees feel accepted, weight stigma still affects a meaningful share of the workforce, especially younger employees and women. These experiences can shape how people feel at work, whether they are productive, pursue promotions or even stay in their jobs.

· 1 in 6 employees say they feel judged at work because of their weight.

· Over 1 in 10 employees say they've been passed over for a promotion because of their weight.

· 1 in 7 employees on weight-loss medication say how they feel or are treated at work because of their weight influenced their decision to take it.

· Over 1 in 4 employees say they would consider using weight-loss medication if their employer covered it, and 3% already do.

· 11% of employees who recently quit say weight or body image played a role in their decision. Top 5 industries where workers report judgment based upon weight: real estate, retail. hospitality, public service and technology.

· Many employees (78%) say their company culture isn't appearance-focused; however, over 1 in 5 employees (22%) say it is somewhat or very.

Source: American Diabetes Association

Until now, behavioral health has been left out of the conversation, although many recognize it is a known risk factor for and comorbidity of obesity. Dr. Robert Mines, founder and chief psychology officer, Mines & Associates, an organization that since 1988 has provided obesity care weight management programs and has been recognized as a pioneer in applications of cognitive behavioral interventions, adherence and compliance with weight management strategies, stresses, “Obesity is a complex psychological, and medical condition which requires a wholistic team approach for the obese individual and their families. Programs advocate for comprehensive wellness programs, biometric screenings and personalized coaching to reduce obesity-related costs. This includes chronic condition care management and at-risk disease management programs, which include targeted interventions for obesity and related conditions.”

He also reports that most plans require prior authorization, BMI thresholds and documented failure of lifestyle interventions before approving GLP1 coverage. Some insurers mandate a six-month behavioral modification program before access

“MINES provides behavioral health coaching and therapy (as needed) as critical for discontinuation and long-term success,” he explains. “Persistence rates drop to 8–15% after three years, often due to cost and side effects, making structured off-ramp programs essential. Programs under development include lifestyle coaching, nutrition counseling and digital health tools to maintain weight loss post-GLP-1 therapy.“

Unfortunately, it’s also now come to light that people with severe obesity are likely to face discrimination when seeking health care, with many clinics outright refusing to see them. Researchers used a “secret-shopper” method to attempt to schedule an appointment for a patient weighing 465 pounds at practices across five specialties (dermatology, endocrinology, ob/gyn, orthopedic surgery, and ear, nose and throat --ENT) in four metropolitan areas -- Boston, Cleveland, Houston and Portland, Oregon. Results of this new study were published recently in the Annals of Internal Medicine:

Interestingly, ENT doctors were the least likely to schedule a visit with the patient, with only 48% agreeing to see the person versus the overall rate of 59%. On the other hand, endocrinologists were most willing to schedule an appointment, and most likely to have offices designed to accommodate severely obese people.

Here’s the reality: about 1 in 6 clinics (16%) that were willing to schedule the patient asked them to endure potentially humiliating workarounds, such as needing to stand during the exam because there would be nowhere to sit or to drape themselves with a sheet because no gowns would fit them.

• About 2 in 5 (41%) of clinics refused to schedule an appointment for a hypothetical patient weighing 465 pounds, according to findings.

• “We’ve reached our limit for bariatric patients at this site,” one receptionist with an orthopedic surgeon’s office said without providing a reason.

• More than half (52%) of respondents lacked the facilities or equipment that could meet the basic standards of care for patients with a body mass index (BMI) of 60 or greater -- no exam tables or chairs with a high enough weight limit, sufficiently wide hallways and doorways or large enough gowns.

Alarmingly, the National Institute of Health data suggests that 30% of cancer cases are associated with unhealthy dietary practices. Scientists are calling for increased awareness and understanding of the influence of excess weight on cancer risk which could empower earlier interventions, new frontiers for tailored treatment and opportunities to support long-term health.

Research presented at ENDO 2025 revealed that obesity-related cancer deaths in the U.S. have tripled over the past two decades. Thirteen types of obesity-related cancers now account for 40% of all cancer diagnoses.

What began as a medication for treating diabetes, researchers soon discovered that GLP-1s (glucagon-like peptide-1) have an interesting side effect – reducing hunger. This makes them highly effective for weight loss, and they quickly gained immense popularity due to their highly effective weight-loss results. Amplified by celebrity endorsements, widespread discussion on social media and high visibility advertising, these medications transformed from a diabetes treatment into a cultural phenomenon -- despite ongoing discussions about cost, safety and supply.

Utilization continues to escalate, as researchers at Rand report that about 12% of all U.S. adults ages 18 and older have already tried using these drugs to control their weight. Earlier this year, McKinsey reported there were 11 GLP-1s on the market with indications for diabetes and weight loss, with many approved throughout the year and more than 40 others in the pipeline.

According to the American Journal of Managed Care (AJMC), GLP-1s accounted for just 1% of total prescription costs in 2020, but by early 2025, they represented 21%- a reflection of their rapid adoption and growing impact on healthcare budgets.

MedWatch, a leader in health plan management, has observed similar patterns across the plans it oversees. “We saw a 20% increase in pharmacy spend just from covering our Type II diabetic population,” says Sally-Ann Polson, president and CEO of MedWatch.

To address this financial challenge, MedWatch implemented targeted criteria for GLP-1 coverage. “Access is limited to members diagnosed with Type II diabetes and/or a BMI of 30 or higher with a weight-

related comorbid condition,” Polson explains. “Additionally, members must participate in a behavior modification and GLP-1 support program. The drugs and program are carved out of our medical plan and only offered where we have found the ability to reduce the drug cost by 2/3rds the cost.”

Despite these restrictions, she affirms adoption remains high with 16% of the eligible population enrolled. “We’re now paying only one-third of what we were previously paying to our PBM,” Polson notes. “Our goal is to improve compliance and maximize the effectiveness of these medications. Most participants are expected to experience significant weight loss and transition off the program within 12 to 14 months. This isn’t meant to be a lifelong treatment, but rather a catalyst for sustainable lifestyle change.”

MedWatch’s program boasts an 80% three-year sustainable weight loss rate, thanks to its holistic approach. “It’s not just a drug program- it’s a lifestyle transformation,” Polson emphasized. “By providing branded GLP-1 medicationsnot compounded or imported- we’re able to offer this opportunity to more individuals at a significantly reduced cost, contributing to a healthier workforce.”

Looking ahead, MedWatch anticipates continued demand for GLP-1s, driven by the rising prevalence of obesity and its link to a range of chronic conditions.

Recognizing that GLP-1s are not a permanent solution, MedWatch’s comprehensive weight management program remains affordable for its clients. “We believe GLP-1s should be used as a tool, not a lifelong treatment,” says Amy Tennis, BSN, MBA, MedWatch’s senior vice president of Clinical Care. “Our program combines low-dose GLP1s, lifestyle coaching, and behavioral support to help members adopt sustainable habits. Ongoing coaching is essential to ensure lasting results and reduce the risk of relapse.”

Some public health experts and market observers have identified the drugs as a weight loss ‘staple’ in American homes, with predictions that GLP-1s will soon be part of the U.S. health care infrastructure. According to data from KFF, over 12% of Americans have tried these medications and nearly 40% using them solely for weight loss.

But GLP-1 drugs have become troublesome for employers primarily due to their skyrocketing cost: A single GLP-1 prescription can cost over $1,000 or as high as $1,500, a month. Consider the expense for a company when just a small percentage of the workforce wants the drug and the impact of pharmacy expenditures that can quickly climb into the millions.

Another key concern is what happens once a person stops taking the medication, since there is a potential to regain the lost weight? Already, studies reported in JAMA document that many GLP-1 users quit within a year — often due to side effects, high costs or insurance issues.

Employees simply cannot keep up with the high price tag of GLP-1s. Northwestern Medicine cardiologists attest that 50% to 75% of those who take GLP-1 drugs reportedly stop taking them within a year due to their price tag. They say the staggeringly

Health plans can be complex. Relationships shouldn’t be.

Our dedicated account management teams have decades of expertise and knowledge in the self-funded landscape. They pride themselves on delivering to meet your needs, no matter the scale of plan or program. And they’re always just a call, text, or email away.

When you need solutions, AmeriHealth Administrators has them.

Experience. Insight. Support. How it should be. Let’s start our relationship today. Visit amerihealthtpa.com.

high discontinuation rates of GLP-1s should raise alarms for clinicians, policy makers and public health experts.

Now a growing number of researchers, payers and providers are exploring deliberate “deprescription,” which aims to taper some patients off their medication after they have taken it for a certain amount of time or lost a certain amount of weight.

For benefits decisions makers, these issues have become one of their worst budgetary nightmares. While many employers cover GLP-1s for diabetes, also covering them for obesity adds significant and often unpredictable financial pressure. In some instances, as obesity-related GLP-1 costs have surpassed those for cancer and other high-cost specialty conditions, employers are forced to reassess their benefit strategies. It often comes down to balancing the aspiration to offer comprehensive coverage with the pressing need to manage budgets.

Fisher stresses that GLP-1s are already straining budgets as some employers on the NavMD platform report GLP-1 drug spending now represents 10.5 % of total annual claims, up from 6.9 % in 2022.

“There’s early evidence suggesting clinical benefit may offset downstream costs —patients on GLP-1s over a year showed reduced medical expenses in some analyses,” says Fisher. “But a recent two-year claims analysis showed overall annual costs rose 46 % (driven by drug spend) compared to 14 % in a matched control group.”

By supporting people in the moments that matter, we can improve health outcomes and help employers manage costs.

For over 40 years, self-funded employers have trusted Sun Life to help them manage financial risk. But we know that behind every claim is a person facing a health challenge and we are ready to do more to help people navigate complicated healthcare decisions and achieve better health outcomes. Sun Life now offers care navigation and health advocacy services through Health Navigator, to help your employees and their families get the right care at the right time – and help you save money. Let us support you with innovative health and risk solutions for your business. It is time to rethink what you expect from your stop-loss partner.

Ask your Sun Life Stop-Loss Specialist about what is new at Sun Life.

For current financial ratings of underwriting companies by independent rating agencies, visit our corporate website at www.sunlife.com. For more information about Sun Life products, visit www.sunlife.com/us. Group stop-loss insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states, except New York, under Policy Form Series 07-SL REV 7-12 and 22-SL. In New York, Group stop-loss insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 07-NYSL REV 7-12 and 22-NYSL. Policy offerings may not be available in all states and may vary due to state laws and regulations. Not approved for use in New Mexico.

© 2024 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. The Sun Life name and logo are registered trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us.

BRAD-6503-z

#1293927791 02/24 (exp. 02/26)

It appears that GLP-1s are gaining approvals in the growing treatment market for diseases beyond diabetes and obesity into large and varied patient populations such as cardiovascular, kidney and liver health. Researchers are reportedly exploring them as potential treatments for cancer, neurodegenerative diseases, alcohol use disorder and metabolic dysfunction-associated steatohepatitis (MASH). One overlooked example is that the drugs improve patient eligibility for surgeries such as gastric bypass or transplants by helping people meet BMI requirements.

GLP1s have their cheerleaders. David Adamson, MD, FRCSC, FACOG, FACS, CEO of ARC Fertilitybelieves the demand will continue because the GLP1s are effective for most people.

“While side effects exist, most people find the weight loss benefit to be much greater than the side effects,” he counsels. “Additionally, over time I think it is highly likely that the drugs will be shown to be safe, making them even more attractive. Financially, the cost will likely come down with competition and generics while the economic benefits with lower direct health care costs and less societal economic burden will make the drugs financially sustainable.”

Dr. Adamson also advocates for diet, exercise, weight management and wellness programs that promote changed habits and are very important adjuncts to GLP1s, adding, “Many people can wean themselves off the drugs and still maintain their weight loss.”

Additional kudos from Tim Foster and Dr. Ajay Dalal, HonestRx Consulting, who extol the role of these drugs to transform care for diabetes, obesity and other conditions.

“Adoption is accelerating: 13% of U.S. adults have used them, with 35% expressing interest,” they report. “Yet costs remain high$12K-$14K annually per patient, adding ~$7,800 per user versus non-users.”

They observe that coverage for obesity is uneven, with large employers more likely to include these drugs, noting, “New approvals and oral formulations will expand demand further. Traditional management tools have proven insufficient. Employers must explore innovative models -- such as outcomes-based contracting, integrated care and compounding -- to balance affordability, access and long-term value. Compounding offers the most affordable access in the market today."

Advisors at WTW report survey results showing that 70% of employers who do not currently offer weight loss drugs would do so if costs were lowered. High costs contribute to the migration to compounded drugs as a way to save money or obtain drugs when there is a shortage of branded product. These are medications customized by a compounding pharmacy and are prepared for individual patients based upon a doctor's prescription.

However, they are not FDA-approved and have not undergone the same rigorous testing for safety and effectiveness. This lack of FDA approval raises concerns about potential impurities, incorrect dosages and inconsistent active ingredients. During a drug shortage, the FDA can allow compounding pharmacies to create compounded versions of a drug but when the shortage is resolved, the FDA typically requires pharmacies to stop. The FDA has stated that the shortage of certain weight loss drugs has ended and has ordered compounding pharmacies to stop producing them.

But in their desperate attempt to get weight-loss drugs, consumers turn to the hundreds of telehealth companies, concierge medical practices, and medical spas that have over the last few years built huge businesses offering these compounded versions of popular GLP-1 obesity drugs.

While safety warnings persist, they can also create a different type of costly exposure for employers: When employees take these black market or compounded injectable drugs, they often panic with the onset of abdominal pain and head to the hospital emergency room – an expensive treatment setting.

Payers remain conflicted about whether pharmaceutical treatment for obesity should be covered. Navigating this coverage terrain requires a delicate balance of fiscal responsibility and commitment to employee well-being. The Pharmaceutical Strategies Group conducted a comprehensive survey of over 200 healthcare payers, including health plans and employers, to better understand their perspectives on the use of GLP-1s for treatment of obesity.

Respondents were asked to rate their organization’s viewpoint regarding coverage of obesity medications on a scale from 1 (lifestyle condition — should not cover) to 10 (chronic condition to treat — should cover). The average score was 5.4, with similar numbers of respondents on each side of the scale. It appears that payers are almost evenly split in their perspectives on treatment of obesity, with some regarding pharmaceutical coverage for obesity as a response to a chronic medical condition, while others see it more as addressing a lifestyle issue.

This split underscores the complex factors behind coverage decisions, as stakeholders assess the clinical realities of obesity against beliefs about personal responsibility and concerns about long-term benefit.

When it comes to coverage decisions on diabetes vs. obesity, nearly all survey respondents cover GLP1s for type 2 diabetes (T2D), versus only 39% who provide coverage for obesity. About 17% of plans are actively considering coverage of GLP-1s for obesity, and another 5% previously covered these drugs but have since excluded them.

While the NIH reports that 73 percent of Americans are categorized as overweight or obese, only 11.6 percent have been diagnosed with diabetes. This translates into millions of patients that will lose their insurance coverage for GLP-1s in 2026, sending shock waves throughout patient communities.

Earlier this year, Tufts Health Plans told members that it would no longer be covering Zepbound for obesity after also ceasing coverage of Wegovy for obesity.

Blue Cross Blue Shield of Massachusetts has also announced a new policy that applies to self-insured and fully insured companies: it will stop covering GLP-1s for obesity in 2026 for employers with <100, although employers with >100 employees can choose to cover the drugs at an additional cost.

CVS Caremark removed Zepbound from its formulary in 2025.

Harvard Pilgrim Health Care is ending GLP1 coverage for weight loss for most commercial plans starting January 1; large fully insured employers with >100 employees can opt to pay for continued coverage. Members of these plans will be required to complete a 6-month behavioral modification program before accessing the medication unless they are already using it.

While high costs are a major factor for both employers and health plans choosing to withdraw coverage, other factors such as low patient adherence and early discontinuation also play a role. Plan sponsors are now forced to scrutinize utilization patterns, clinical outcomes and cost-effectiveness, as CMS has opted not to require coverage for obesity treatments in Medicare for 2026, leaving commercial payers to independently navigate the issue.

But the stakes go beyond health costs with a competitive labor market emphasizing that benefits send a clear message about an employer’s values. 9amHealth surveyed over 1,300 Americans and discovered that workers are willing to leave their jobs (or stay at one they hate) and cut back on spending across the board to get their hands on these medications. In fact, 67% of respondents stated they would be “likely” or “very likely” to stay at a job they didn’t like in order to sustain coverage for weight loss medication.

Healthline reports that an increasing number of employees say they would take a new job if it came with GLP-1 coverage. Beyond generational trends, access to GLP-1s is quickly becoming a premium benefit that top performers and high-value talent segments use to compare employers. If employees lose coverage, employers may also lose top performers to organizations willing to treat it as a premium benefit -- a turnover cost few companies can afford to ignore.

Employers tend to view obesity as a chronic condition, while health plans lean slightly toward viewing obesity as a lifestyle condition. Employers are more likely than health plans to offer obesity GLP-1 coverage (43% vs. 29%).

Over 75% of health plans and over 50% of employers are moderately or very concerned about off-label use of GLP-1s approved for type 2 diabetes, but awareness of how much current spend is off-label is notably lower: nearly half of employers and a quarter of health plans are unsure.

Employers may see coverage of these drugs as a way to support mental health, reduce absenteeism, and improve overall productivity while health plans are more likely to evaluate obesity treatment through the lens of clinical effectiveness balanced with cost-efficiency, considering the large percentage of members who would be eligible to take the drugs.

Additionally, health plans operate within broader regulatory and actuarial frameworks, which can slow the adoption of coverage for emerging treatments.

Source: 2025 Pharmaceutical Strategies Group

According to WTW’s 2024 Best Practice Survey, employers that currently cover GLP-1 medications are also implementing restrictions, including lifestyle modification requirements (69%), trialing lower-cost medications first (63%) and limiting therapy duration (63%). One in seven (14%) employers covering GLP1s for obesity are considering discontinuation due to cost, and 20% of employers report that they cover GLP-1s for obesity only at a BMI of 35 or more. Employers will have new opportunities to optimize their benefits as new GLP-1 formulations and competitors enter the market.

Bracing themselves for the new wave of obesity medications that are expected to literally dwarf the diabetes spend, employers are recognizing that medication alone isn’t enough to treat the disease. The critical question is this: are GLP1s a short-term fix or a sustained program to lose and sustain weight loss? Some benefit firms that acknowledge the benefits of GLP-1s are adopting a more nuanced approach to the drugs, prioritizing behavioral changes first.

What is becoming obvious is that without intensive lifestyle intervention and medication access management to drive outcomes and control cost, members will be left on next-generation obesity medications for the long term – and employers will bear the expense.

Moving from claims cost to performance indicators will require employers to reframe obesity -- not simply as an isolated diagnosis, but as a broader indicator of employee wellbeing that impacts population systemic health risk and organizational performance. While some employees are hesitant to enroll in weight-loss programs due to stigma, others may not realize the full potential of the program. Nutrition programs are not just for individuals with obesity as many join with goals tied to sports performance, chronic disease

management or simply building healthier long-term habits.

GlobalData recommends actionable steps for employers:

Offer insurance coverage and wellness programs for obesity care at parity with other chronic diseases

Implement wellness programs

Foster a culture of support and inclusion that recognizes and accommodates the needs of employees with obesity

Provide education and resources to employees to educate them about the health risks associated with obesity as well as strategies for obesity care and weight management.

Weight loss involves more than eating well and exercising regularly since every individual has unique, complex needs. A personalized, holistic approach that includes health coaching is often recommended along with reduced co-pay incentives for active participation in lifestyle programs to achieve sustainable results.

Dr. Mines observes that both internal and external sources agree demand for these drugs will remain high or increase due to expanded indications (sleep apnea, fatty liver disease) and strong consumer interest.

“However, insurers are tightening coverage or dropping weight-loss indications to control costs,” he says. “Without aggressive price negotiations or federal intervention, GLP-1 drugs will remain far above costeffectiveness thresholds, requiring up to 80% price reductions to meet standard benchmarks.

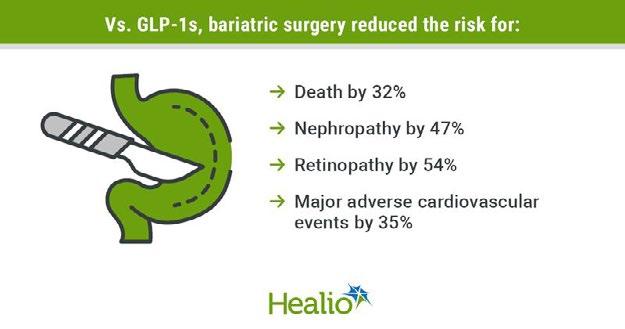

Remarkably, there is still support for bariatric, weight-loss surgery vs. medication. Doctors at the Cleveland Clinic maintain that people with obesity and diabetes who undergo bariatric surgery face a significantly lower risk for several adverse health outcomes when compared to those treated with GLP-1s. They point to new data showing that surgery should not be reserved as a last resort but should be part of early, shared decision-making for patients with type 2 diabetes and obesity, providing benefits beyond medications alone.

With increased demand for weight loss drugs, some high-profile stakeholders are rolling out new programs.

In an effort to make it easier for its members to access weight management medications, WeightWatchers is setting up a way for employers to subsidize GLP1 prices and joining forces with Amazon Pharmacy. Members will be able to access information on real-time medication availability, automated coupon savings and home delivery for key medications. Amazon Pharmacy will automatically apply coupons for members at the point of checkout with same day delivery available as an option.

While it’s not a “done deal,” there’s some suggestions from the White House to reduce the cost of popular weightloss drugs like Ozempic to $150 a month. CNN says this would be a game changer. TrumpRx launches in 2026. a government-backed initiative to lower prescription drug costs by creating a direct-to-consumer website.

Not to be outdone, drug manufacturers Eli Lilly and Novo Nordisk have started selling the products directly to patients at about $500 a month. Employers are being incentivized by startups such as RxSaveCard and Andel to subsidize part of the cash price for their workers. They can pay less than they would if they covered the drugs through insurance and, with a subsidy, employees could get the treatments at a lower cost than if they paid the full cash price on their own.

->->->Fast Forward

While only about 2% of adult patients are taking a GLP-1 drug to treat obesity or overweight as of June 2025 (FAIR HEALTH), pharmaceutical companies are competing to capture more market share. They are launching new drugs or introducing lower-cost oral versions positioned to drive down the cost of the injectables – although doctors at UT Health San Antonio say injectable delivery methods don’t seem to deter many patients.

Looking ahead, employers will surely play an important role in obesity care management. Goodpath, a virtual provider of integrative care for chronic conditions, offers a practical playbook for 2026 that may include these activities:

1. Audit the at-risk population now. Run the numbers on who’s currently using GLP-1s, why they were prescribed, and what’s at stake if coverage changes. Look beyond claims data. High-risk, high-value employees may be the ones most affected. Understanding that profile now gives you room to make intentional choices instead of scrambling later.

2. Create a safe landing zone for those losing coverage. When employees lose access to FDA-approved GLP-1s, many will turn to compounded versions from online or local pharmacies. Some of these products are safe and legitimate; many are not. The risks include incorrect dosing, contamination, untested formulations, and in some cases, entirely different molecules.

3. Integrate alternatives, not just exclusions. If full coverage is off the table, give employees other routes to address weight and related conditions. That could include partial coverage with clear clinical criteria,

We study it, research it, speak on it, share insights on it and pioneer new ways to manage it. With underwriters who have many years of experience as well as deep specialty and technical expertise, we’re proud to be known as experts in understanding risk. We continually search for fresh approaches, respond proactively to market changes, and bring new flexibility to our products. Our clients have been benefiting from our expertise for over 50 years. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ transplant needs.

wraparound programs for side-effect management and habit change, or access to nutrition, behavioral health, and metabolic care services. Amid all the hype, new data from Truveta Research suggests that the anti-obesity drug boom may actually be cooling, as overall prescribing of GLP-1 medicines remained relatively flat for the three months ending in September. This may indicate a trend that even with more approved uses for the drugs, the high cost, variable insurance coverage policies and the fact that many patients can't stay on them are softening some expectations.

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

Do you aspire to be a published author?

We would like to invite you to share your insight and submit an article to The Self-Insurer! SIIA’s official magazine is distributed in a digital and print format to reach 10,000 readers all over the world.

The Self-Insurer has been delivering information to top-level executives in the self-insurance industry since 1984.

Articles or guidelines inquiries can be submitted to Editor at Editor@sipconline. net

The Self-Insurer also has advertising opportunities available. Please contact Shane Byars at sbyars@ sipconline.net for advertising information.

Ensure every claim is accurate, appropriate, and compliant with proactive Payment Integrity solutions from Vālenz

We engage early and often to guide TPAs and employers through the entire claims process—supporting financial health, reducing wasted spend, and driving significant cost savings.

Written By Bruce Shutan

of longstanding challenges associated with treating complex behavioral health conditions, psychiatrists and neuroscientists are increasingly embracing precision psychiatry. The approach marks a paradigm shift toward more meaningful evidence-based, data-driven decision-making, and is expected to produce greater efficacy and lower costs for self-insured behavioral health benefits.

Dani Kimlinger, CEO of MINES and Associates, Inc. sees a bigger appetite now for precision in the diagnosis and treatment of mental health conditions to counteract a one-size-fits all approach. It’s already reducing trial and error in treatment, she explains. For example, clinicians are suggesting alternatives to antidepressant or antianxiety medication that have been blindly prescribed for years without much progress being made.

“We tend to see that a lot of these prescriptions are coming through primary care – not necessarily through behavioral health trained psychiatry, which can be a challenge,” she says (see accompanying story).

As many as 89% of job seekers now cite mental health coverage in their top three considerations for choosing a new job, observes Johnny Crowder, founder and CEO of Cope Notes. But in order to harness the power of these benefits beyond pursuing a more data-driven strategy, he says they need to be accessible without having to jump through a lot of hoops while workplace wellness should be regularly promoted.

In the mental health arena, Enthea C-Founder and CEO Sherry Rais has noticed the discourse has changed in conversations with employers, payers and unions that are no longer willing to just freely dispense Xanax, lithium or other scripts to treat various illnesses. In short, they’re tired of investing in mainstream psychiatric treatments that fall short on efficacy.

“The goal is more accurate diagnoses and personalized or individualized treatment plans

that lead to better outcomes,” she says. “What I’m hearing from employers is a growing frustration about these costly initiatives that aren’t effective. They want things that are outcomes-based and will actually work, and they want things that will address the specific needs of their population.”

For example, blue-collar industries and unions might have high incidents of substance use disorder, whereas suicidal ideation is higher among first responders. She explains that ketamine is the only medicine that reduces suicidal thoughts in as little as four hours, calling it a literal lifesaver and game changer.

People with certain brain derived neurotropic factor genotypes who are depressed have better outcomes after ketamine-assisted therapy, she adds. Genetic testing could be used to determine if someone would be like a good candidate for this type of alternative mental health treatment.

The use of ketamine and psychedelic-assisted therapy, including psilocybin and stellate ganglion block, are some of the most promising areas for applying precision mental health therapy, according to Rais, whose firm integrates those treatments with psychiatry and psychotherapy as part of a holistic therapeutic process.

Interventional psychiatry treatments directly change brain function and increase neuroplasticity by using a compound and combining that with talk therapy rather than being given in isolation with talk therapy as an option. She says these treatments are four times more effective than taking antidepressants alone or having talk therapy alone. The results have enabled Enthea to grow from 3,000 covered lives just two years ago as a workplace benefit to 300,000.

Rais says ketamine and psychedelic providers such as Journey Clinical, Skylight Psychedelics, Innerwell, Field Trip Health and Homecoming Health collect data across the patient journey from pre-treatment screening to post-ketamine therapy to track moods and adjust treatment dosage and frequency in real time.

This data collection may reveal that someone is better candidate for more somatic integration vs. cognitive integration, which then leads to personalized treatment plans in the context of ketamine assisted therapy and personalized doses.

While the U.S. Food and Drug Administration has granted these psychedelic treatments for various mental health conditions “breakthrough” status, they have not yet been approved for such usage at the federal level. Rais surmises that methylenedioxymethamphetamine, commonly known as MDMA or ecstasy, will be approved in 2026 followed by LSD and psilocybin. The latter drug has been decriminalized in Oakland, Calif., and the District of Columbia, and is being used as part of supervised treatment in Oregon and Colorado.

“We’re entering a completely new era in mental health where we are actually tailoring the experience to the individual,” Rais opines. “We want treatments that are effective, that have good outcomes that allow people to see a big difference.”

In rethinking behavioral health treatments, there’s an inherent need for speed when it comes to dispensing the most appropriate care. Kimlinger believes the precision approach could be beneficial on the primary care side because PCPs have such little time with their patients and simply adding a certain blood test could help cut through the noise on pinpointing the right treatment. “The longer that someone’s on an ineffective treatment, the greater risk they have to chronic illnesses, disabilities or their disabilities furthering other negative outcomes,” she says.

Precision psychiatry allows people to access care early and often, according to Kimlinger. “It’s important to think about the whole person as you go through and provide them support and treatment,” she says. “It’s not a one-size-fits-all approach.”

One area that she’s excited about is brain scan feedback in precision medicine, which is becoming bigger and broader. “If we can find a way to shorten the time to find an effective treatment for someone and improve outcomes, especially for folks who aren’t responding to the standard treatment, I think it’s a huge win for everyone,” she adds.

The clinical response to precision psychiatry across MINES & Associates’ PPO and employee assistance program networks has been mixed. “We have therapists that said, ‘Gosh, I went and got trained in brain spotting because I had clients that wanted that,’ or ‘I went and got ABA [applied behavioral analysis] trained for autism because there’s a shortage, and I want to be able to meet clients where they are be able to provide that specialty care,’” she reports.

The point of service also is a factor. While most of Kimlinger’s clients engaged in virtual care following Covid, there has been a trend back to in-person sessions – with as many as 57% choosing that traditional option last year rather than video, telephonic or message-based care.

In small towns, however, she believes virtual counseling can be very helpful because a patient doesn’t necessarily want his or her car to be seen outside a mental health appointment or be spotted in the lobby of a therapist office.

But there are obstacles. From a social-determinants-of-health point of view, she points out that not everyone is able to effectively engage in virtual counseling because they may live in a small apartment with their partner or family where they don’t have a quiet, private place for therapy. And if they’re a victim of domestic violence, it wouldn’t be safe to engage in those conversations at home.

Wherever people choose to receive therapy, she says “it has to be humancentered. It has to meet people where they are. What is the modality that works best? Do they need someone who has a trauma-treatment background? Do they want a BIPOC [Black, Indigenous and People of Color] provider? What is the best fit for this person and who gets to decide that? How do we help people engage effectively?”

While many people would welcome precision psychiatry, there are barriers to consider, cautions Tayebe Shah-Mirany, vice president of PsycHealth Care Management, LLC. For example, most information at the disposal of clinicians addresses swaths of the population, not individuals.

“That’s why you have so much error in pharmaceuticals that are available to physicians when they’re trying to treat a particular mental illness like depression or anxiety,” she explains.

Another issue is that the pharmaceutical industry has invested fewer dollars in the development of some drugs because the populations are more heterogeneous, not individualized. That means uncovering common brain function is more like the luck of the draw.

Precision medicine has created an ability to biomark various types of cancers and determine whether or not a certain drug is going to work for a particular person. But doing the same in psychiatry isn’t easy because no two brains are the same.

“If you can get more personalized because you can start to see patterns in people’s brains, that’s how you’re able to get more individualized,” Shah-Mirany explains. “You’ll be able to actually get to a point where you might know who has a predisposition, and you can take action before the disease even presents itself. You can also determine what the prognosis is going to be.”

The Centre for Precision Psychiatry in Quebec is creating a database to elevate evidence-based, datadriven decision making, Shah-Mirany says, noting that the biggest hurdle is getting a usable output for massive amounts of information that psychiatrists and psychologists can access to significantly improve outcomes.

If the industry could have a better understanding of various subtypes within, say, depression and anxiety to create more pinpointed drugs, then she believes pharmaceutical companies will likely develop more psychiatric drugs that promise greater efficacy, and therefore, return on investment.

The thinking behind precision psychiatry is that stopping patients from having complications caused by being on the wrong medication will improve outcomes and lower cost. The approach also holds promise for polypharmacy. “Imagine if you could eliminate the number of drugs people are on and the side effects because you could more precisely understand their condition and develop drugs more precise and multifaceted?” Shah-Mirany suggests.

Stealth Advance | Revolutionizing Stop-Loss

Stealth Advance delivers rapid reimbursements, traditionally only available in bundled arrangements, to the more flexible and competitive unbundled stop-loss market.

Lightning Fast Process claims up to $5M in just 72 hours, no more cash flow crunches

Stay Independent

Keep your competitive stop-loss pricing without sacrificing speed

Seamless Process

Our team handles all funding requests; you just get paid faster

Predictable Costs

Transparent monthly fees

Stealth Advance | Bridging the Gap Between Independent and Bundled Stop-Loss.

The time for faster reimbursements starts now.

Speak with your Stealth sales representative today!

QR code to be added

Perhaps no one knows the growing importance of applying precision to actually measuring seemingly subjective mental health results better than Crowder, whose firm provides daily text messages that combined peer support and positive psychology to help improve mental and emotional health.

His company began collecting individual testimonials from hundreds of happy users, which fell short of expectations from prospective employer customers. So, he documented case studies, then funded a formal research study that was later published in the Journal of Medical Internet Research to show a return on investment – only to learn that the qualitative study needed to be a quantitative study, which would take another 18 months to complete, followed by six to 12 months to have it published in the Journal of Mental Health.

“I’m learning that there are infinite levels to this game,” observes Crowder, a suicide survivor who grew up with severe mental illness.

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 35 years.

My case manager was fantastic. She was pleasant to talk to and she did quite a bit of digging to find me an approved physician and facility. I’m not sure what would have happened without her.

—Satisfied Member

Dani Kimlinger, CEO of MINES and Associates, Inc., recognized the potential of precision psychiatry in 2017 when her company teamed up with Tamara Caronite, a subject matter expert on precision-medicine solutions.

Together, they sought to support an evidence-based approach to integrating behavioral health services into a primary care setting, including the intervention strategy of pharmacogenetics testing. That effort would help PCPs understand medication management and pass that information on to behavioral health professionals through case managers, which helped gain clarity, address complex needs faster and speed access to the most appropriate treatment.

When partnering with Caronite to determine, for instance, which antidepressants worked best based on genetics, she thought the approach was interesting and unique. “They had great data,” she recalls.

The program included protocol-based pharmacogenomics testing with recommendations, training, education, medication management, document management, reporting and care pathways to navigate through case managers to behavioral health providers.

Caronite, founder of DoradoCare, cites two compelling arguments for pharmacogenetic testing. One is a trial-and-error approach that fails two-thirds of patients on psychiatric medications, causing suboptimal results, adverse reactions, treatment complications and unnecessary suffering. The other is that research has evolved to high-level evidence sufficient for clinical practice in some cases.

“Drug choice is among the top modifiable risk factors in improving outcomes,” she says. “The challenge, and call to action, is to establish a standard for which to evaluate and satisfy a clinically sufficient solution that has meaningful impact and can be measured back to ROI expectations. Otherwise, the business and clinical propositions aren’t fulfilled.”

A strong case can be made for transitioning from subjective to objective prescription evaluation and from trial and error to evidence-based prescribing, Caronite says. However, not all tests are equal with payers facing an influx of products, mostly companies upselling software and ancillary services.

The fact is that many testing services are insufficient for clinical practice. For example, medication recommendations vary substantially between companies. “These tests may be data-driven to a company’s knowledge base but not to clinical practice standards: accurate to a target but not the target,” she says, suggesting that self-insured health plans use an objective vetting criteria for evaluating products.

Ultimately, the MINES and Associates experiment fizzled out, which Kimlinger describes as “an early adopter problem” involving a bold solution that was ahead of its time. She likened that experience to launching video and message-based counseling not catching on before the pandemic, noting that the timing was off in both cases.

However, her understanding is that it’s more accessible now to engage in precision psychiatry support and, therefore, it could be a good time for self-insured behavioral health plans to go to market with this approach.

“If you’ve seen one depression case, you’ve seen one depression case,” she says. “Everybody’s genetic makeup is different, but we also believe that there’s a psychology component that comes in addition to the genetic makeup that can predispose people to different treatments.” – Bruce Shutan

Written By Anthony Murrello

TheTSelf-Insurance Institute of America, Inc. (SIIA) has released its 5th Annual Captive Industry Survey, a comprehensive benchmark study designed to track the evolution, challenges, and growth of the captive insurance sector. With input from nearly 70 captive companies, service providers, brokers, and owners, this year’s report paints a detailed picture of an industry that continues to mature, adapt, and expand even amid economic uncertainty and regulatory change.

When planning for this year’s survey began, SIIA’s Captive Insurance Committee set several clear objectives. The team aimed to increase the number of responses and broaden participation to include a wider range of industry perspectives—particularly brokers and prospective captive owners—while maintaining a standard of consistency in order to observe meaningful year-over-year trends. The findings offer a rare panoramic view into the state of the captive marketplace, revealing not only where the industry stands today, but also where it’s heading.

The 2025 data underscores a consistent theme across all respondent groups: The captive industry remains both resilient and forward-looking, with leaders optimistic about long-term opportunities for innovation and growth. This report also represents the collaborative spirit of industry leaders, as SIIA’s Captive Committee – particularly our Captive Survey Working Group – spent countless hours reviewing the voluminous amount of data and emerging trends to ensure a high-quality, insightful, and actionable resource for the entire industry.

“For the fifth consecutive year, respondents expressed a bullish outlook on the future of the captive industry,” said members of SIIA’s Captive Committee. “This continued optimism reflects an industry that is evolving strategically, embracing complexity, and strengthening its role in modern risk management.”

Respondents rated their confidence in the future of the captive industry at 8 out of 10, maintaining a strong level of optimism even as it dipped slightly from previous years’ near-perfect ratings (over the last four surveys, respondents had reported a score of 9)

Committee Chairman George Belokas, (also President at GPW and Associates, Inc.) points out that the bullish sentiment is supported by the data, noting “The industry sentiment has remained positive each year of the survey and we have continued to see that growth in the number of new captive formations.”

The metrics do indeed reinforce the strong outlook for the industry. Captive formations also remain strong, outpacing captive closures by a rate of 4 to 1. In total, respondents reported over 400 captive formations this past year. Additionally, the staffing numbers suggest a strengthening market, as 73% of responding companies reported adding staff in the past year, with an average of 9 new hires per company. This is up from 2024 when 64% of companies reported hiring staff. Growth was strongest in management, account, underwriting, and sales roles—further evidence of an industry scaling up to meet increasing demand.

For the third consecutive year, medical stop-loss (MSL) captives represented the fastest-growing area of activity, cited by 62% of respondents. Cyber coverage (17%) and professional liability (13%) followed as areas of increased use, underscoring the industry’s adaptability to evolving risks.

In response to this trend, this year’s survey included a new MSLspecific section of questions. Through this line of questioning, respondents revealed what they considered to be the top barriers of entry for MSL captives. The top reported barrier was capitalization and financial requirements, with respondents listing initial capital and buy-ins as their top concern. The second most common response was related to data and underwriting barriers. Many respondents highlighted that getting the right data for proper underwriting/risk evaluation was often times a challenge. Respondents also listed market competition, regulatory, and expertise/model design as additional barriers.

Belokas notes that the survey findings mirror what many are seeing in practice: “As healthcare continues to trend up, cost containment remains a focus area for the captive insurance industry.”

Indeed, cost containment emerged as the defining theme of this year’s survey. High-cost and specialty drugs, PBMs, and healthcare inflation accounted for nearly one-third of all cited emerging risks. These issues are pushing captive owners and service providers to think more strategically about pooling, retention, and renewal management. Other notable areas of concern include cyber threats and regulatory scrutiny—particularly from the IRS—highlighting the need for ongoing compliance vigilance and diversified

For the third consecutive year, price inflation topped the list of operational concerns, selected by 35% of respondents. Mergers, acquisitions, and consolidation tied with creative business solutions (22% each) came in as the next most common trends. Interestingly, staffing shortages—previously a growing issue—

With over 25 years of expertise in benefits administration, Pinnacle Claims Management simplifies enrollment, streamlines administration, and elevates the client experience during the most important time of the year. We work hand-in-hand with Benefit Consultants like you and provide:

Seamless online enrollment through our user-friendly benefits portal

Bilingual support for diverse employee populations

Tailored communications and onboarding materials

Hands-on support from a dedicated account management team

We take the stress out of open enrollment so you can focus on what matters most – your clients.

Interestingly, 65% of respondents reported either not seeing or being affected by regulatory trends this past year. Despite continued IRS audits, the overall Federal regulatory and Congressional legislative landscape relating to captive insurance had remained relatively quiet for a period of years. However, in January 2025, in the waning days of the Biden Administration, the IRS released its Final Regulations on section 831(b) micro captives. These regulations took effect immediately upon publication on January 14, 2025.

Bailey Roese, a Partner at Dentons Law firm, summarizes the industry impact saying “Despite continued IRS scrutiny of micro-captives, including the final regulations issued earlier this year, the survey results indicate that the overall outlook for the captive industry remains positive, and many of those with captives taxed under Section 831(b) are choosing to keep them despite the new disclosure requirements. Alternatively, some are revoking their election but choosing to stay in a captive program – highlighting how important captives are as a risk management tool for smaller businesses.”

As compared to the Federal level, legislative and regulatory activity at the State level throughout the last year has been largely encouraging for the captive industry. This continues the trend observed over the last couple of years, in which States have enacted policies designed to promote and encourage the growth of captive insurance by creating a favorable environment for captive arrangements. This year, these measures have focused on striking a balance between effective oversight and operational flexibility, simplifying licensing processes, reducing administrative hurdles, and offering targeted incentives aimed at fostering a regulatory climate that enables captives to thrive as a strategic tool for risk management and economic development.

This state-level support is likely driving a continued trend of captives being increasingly re-domiciled from offshore to onshore locations. While those that do are still in the minority (only 26% of respondents reported doing so), the number has gone up each of the last three years. A survey record of 34 captives were re-domiciled onshore this past year, with the most reported destinations including Kentucky, Tennessee, Utah, Vermont, North Carolina, and Indiana.

A major focus of this year’s survey was expanding broker participation, which revealed several telling insights. Brokers leveraging captive strategies reported using a diverse range of structures, most commonly single-parent and group captives, followed by stop-loss-focused programs. Among those already working with captives, 90% expect demand to rise over the next five years, citing risk management improvement and cost savings as top drivers. For the first time in survey history, 100% of captive owners reported no plans to close or exit their programs—clear evidence of industry confidence and program stability.

However, the survey also found that education remains a key gap among brokers and prospective owners who have yet to explore captive strategies. Many cited a lack of understanding as the primary barrier, pointing to a significant opportunity for industry outreach.

“My biggest takeaway from the survey is in the broker section. Of those that are leveraging captive strategies with their clients, 100% said they are ‘highly likely’ or ‘likely’ to continue using these solutions with other clients.” said Dave Gillis, SVP of Business Development at Captive Resources. He added, “This not only sends a strong signal to the market, it also underscores the enduring value of captive solutions. As brokers grow more sophisticated and the full range of structural options becomes clearer, captives will increasingly rise from the margins of ‘alternative solutions’ to become a mainstream, go-to strategy for employers.”

The 2025 survey makes one point clear: The captive industry is not only expanding but maturing, and SIIA remains central to that progress.

SIIA continues to advocate for the fair treatment and growth of captives at both the Federal and State levels, working closely with members of Congress, the IRS, and State Regulators. SIIA’s engagement focuses on educating policymakers about the fundamentals of captive insurance, its economic role, and the challenges industry stakeholders face.

Equally important is education within the industry itself. In addition to Conference Panel Discussions, the annual Survey and Trend Report, and resource materials, SIIA has developed new tools such as its Captive 101 course, a concise series of webinars and materials that introduce the basics of captives. Later this year, a Captive 201 course will launch, exploring more advanced topics and emerging industry issues. SIIA is also partnering with Captive.com to produce a podcast series, further expanding educational access.

The 2025 SIIA Captive Industry Survey tells the story of a sector in the midst of a strategic and sustainable expansion phase. Captives are not just weathering economic and regulatory change, they are proving their long-term value as adaptive, resilient tools for managing risk and promoting financial stability. While challenges remain—from inflationary pressures to educational gaps—the direction of the captive market is unmistakable: Forward, innovative, and essential to the self-insurance ecosystem.

For the full 2025 SIIA Captive Industry Survey & Trend Report, visit www.siia.org.

Anthony Murrello is SIIA’s government relations manager and supports the association’s captive insurance committee.

OnOWritten By Alston & Bird Health Benefits Practice

October 16, 2025, the Departments of Labor, Health and Human Services (HHS), and the Treasury (collectively, “the Departments”) jointly released Part 72 of Frequently Asked Questions (FAQs) regarding the implementation of certain provisions of the Affordable Care Act (ACA). These FAQs clarify how standalone fertility benefits can be structured under existing law and are part of a broader policy initiative first announced in Executive Order (“EO”) 14216, “Expanding Access to In Vitro Fertilization.”

Among the EO’s recommendations was the issuance of regulations or guidance to allow employers to expand access to fertility coverage through excepted benefits. While these FAQs do not alter current law, the Departments have indicated their intent to propose new rulemaking in this area which will likely provide additional options for providing such benefits.

The guidance provides an overview of a complex area of law involving four categories of coverage collectively referred to as “excepted benefits.” Excepted benefits generally do not have to comply with certain federal laws that typically apply to employer group health plans—most notably, the ACA’s market reform requirements—provided certain conditions are met. Stand-alone fertility benefits can currently be offered through two of the four categories of excepted benefits without triggering ACA compliance requirements.

Independent, noncoordinated excepted benefits include coverage for only a specified disease or illness and hospital indemnity or other fixed indemnity insurance. Employers often offer stand-alone voluntary insurance coverage for a specified disease, such as cancer; similarly, they could offer coverage for fertility benefits. To qualify as an independent, noncoordinated excepted benefit, the following conditions must be met:

• The benefit must be provided under a separate policy, certificate, or contract of insurance.

• There must be no coordination between the provision of such benefits and any exclusion of benefits under any group health plan maintained by the same plan sponsor.

• Benefits must be paid with respect to an event, regardless of whether benefits are provided under any group health plan maintained by the same plan sponsor.

If these conditions are satisfied, an employer could offer a specified disease or illness policy covering infertility as an excepted benefit, regardless of whether the employee is enrolled in the employer’s traditional group medical plan. The benefit could be designed so that even part-time employees who are not eligible for the employer’s traditional group medical plan could enroll in the excepted benefit fertility coverage.

It is important to note that fertility benefits offered through this exception cannot be self-funded by the employer. Independent, noncoordinated excepted benefits must be provided under a separate policy, certificate, or contract of insurance. Offering insured stand-alone coverage for fertility benefits may be costly, as individuals at higher risk for fertility challenges or with pre-existing conditions are more likely to purchase such coverage, increasing premium costs. However, if the adverse selection issues can be overcome, this coverage would be compatible with participation in a health savings account (HSA), since insurance for a specified disease or illness does not disqualify an individual from contributing to an HSA.

Limited excepted benefits include, but are not limited to, certain types of health reimbursement arrangements (HRAs). Regulations specify that certain HRAs (and other account-based group health plans other than health flexible spending accounts) can qualify as limited excepted benefits if they meet specific conditions. These HRAs are known as excepted benefit HRAs, or “EBHRAs.”

Conditions for EBHRAs:

• The benefit must not be an integral part of the plan (other group health plan coverage must be available for the plan year).

• Benefits are limited in amount (for 2025, the limit is $2,150).

• No reimbursement of certain health insurance premiums (except for coverage consisting solely of excepted benefits).

• Uniform availability to all similarly situated individuals, regardless of health factor.

For employers who prefer to self-fund fertility benefits—even for employees not enrolled in an employer’s major medical group health plan—an EBHRA may be an option that would not be subject to other group health plan mandates like the ACA. However, with an annual maximum of just $2,150 in 2025, the cap is well below the cost of typical fertility treatments. By comparison, and not mentioned in these FAQs, an HRA integrated into the employer’s group health plan can provide unlimited, uncapped annual benefits. Although an integrated HRA would not be a stand-alone fertility benefit, it remains an option for employers wishing to self-fund a fertility benefit instead of offering it as a covered treatment or service under the major medical plan.

Another drawback to an EBHRA (or even an integrated HRA) is that reimbursements for fertility expenses are limited to medical expenses as defined under Internal Revenue Code (“Code”) Section 213(d). Guidance and rulings in the area of fertility benefits have not kept pace with the lifestyles and expectations of would-be parents. For example, many women may expect coverage for egg storage, regardless of the length of storage, to be a 213(d) medical expense.

However, there is uncertainty as to whether the expense would qualify if it is for undefined future conception rather than temporary storage necessary for immediate conception. Expenses related to surrogates are also not Code Section 213(d) medical expense. Even fertility expenses for same-sex couples who may not meet a medical definition for “infertile” have not been formally addressed by the IRS in guidance applicable to all taxpayers. Clarification and expansion of 213(d) status to some of these expenses would be helpful for plan sponsors and plan participants alike.