CHINESE ENTREPRENEUR

03

专访陈伟富

Interview with Edy Tan Wei Hock

16

专访马来西亚中华总商会(中总)总会长拿督吴逸平硕士

Interview with ACCCIM President Datuk Ng Yih Pyng

03

专访陈伟富

Interview with Edy Tan Wei Hock

16

专访马来西亚中华总商会(中总)总会长拿督吴逸平硕士

Interview with ACCCIM President Datuk Ng Yih Pyng

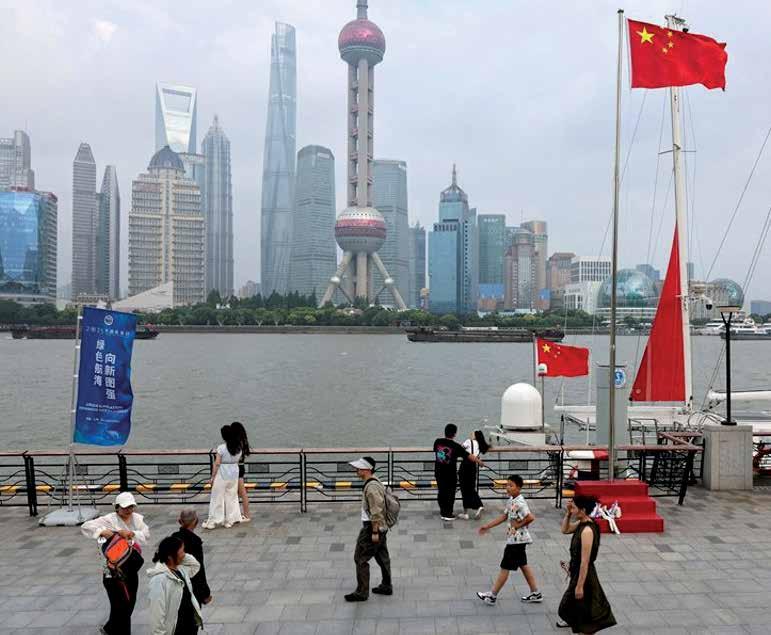

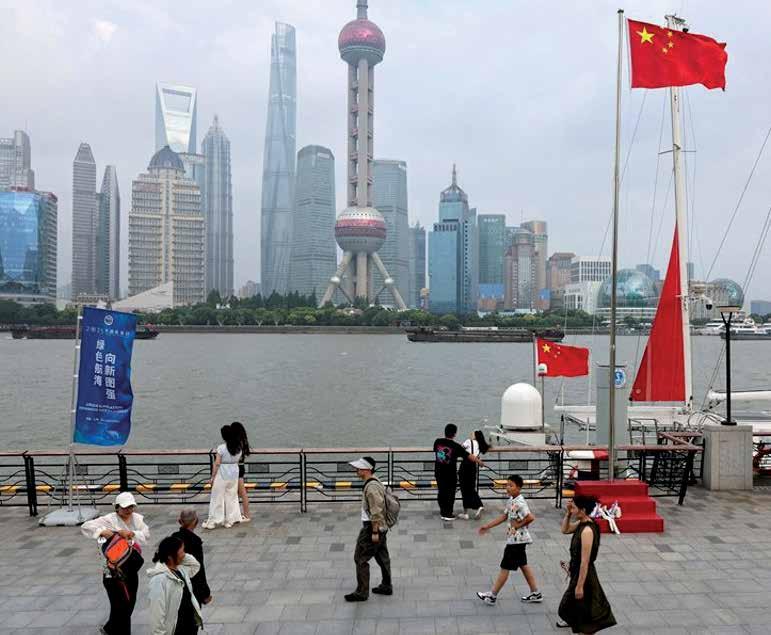

Despite China’s economic growth above market expectations for Q2 2025, analysts remain pessimistic amid the poor showing for consumer demand and the real estate sector. Lianhe Zaobao China news correspondent Yush Chau and journalist Meng Dandan find out more.

Amid the looming shadow of the China-US trade war, China’s economy grew 5.2% in Q2 2025, slightly higher than market expectations. Although economic growth for the first half of the year was at 5.3%, economists forecast a significant slowdown in China’s economic momentum for the second half of the year. In the face of weak domestic demand and escalating global trade risks, there is increased pressure on Beijing to introduce a new round of stimulus.

China’s National Bureau of Statistics (NBS) released the latest economic data on 15 July, showing GDP growth of 5.2% year-onyear in Q2 2025. This marked a slowdown from 5.4% in Q1, but slightly above the 5.1% predicted by Reuters and Bloomberg. During a press conference, Sheng Laiyun, deputy director of NBS, described the Chinese economy in the first half of 2025 as “maintaining steady growth with good momentum, showcasing strong resilience and vitality”.

Specifically, China’s value-added industrial output for enterprises above designated size increased 6.8% year-onyear in June, up 1 percentage point from May and better than the forecast of 5.6% by economists. However, total retail sales of consumer goods in June only grew by 4.8% year-on-year, a slowdown of 1.6 percentage points from May, indicating a decline in consumer momentum beyond market expectations.

YUSH CHAU

China news correspondent, Lianhe Zaobao

MENG DANDAN Journalist, Lianhe Zaobao

Beijing Bureau

Translated by James Loo, Grace Chong, Candice Chan

According to Bloomberg’s analysis, sales of consumer goods such as beverages, tobacco, alcohol and cosmetics declined year-on-year in June, and the growth of catering services also slowed considerably, dragging down overall consumer performance. Nevertheless, the sale of home appliances, communication equipment and furniture maintained its strong growth due to government subsidies.

Consumption is the main driver of China’s GDP growth, with officials stating that final consumption expenditure contributed 52% to economic growth in the first half of the year.

Michelle Lam, Greater China economist at Societe Generale, opined that even as China’s GDP growth exceeded expectations, its economic fundamentals leave much to be desired. The current situation showed a pattern of “strong supply, weak domestic demand”, and export resilience is unlikely to last over the long term.

... besides the uncertainties China’s economy faces due to the China-US trade war, protracted unresolved tariff issues between the US and other countries would further exacerbate the global trade slowdown and indirectly impact China’s economy. — Tommy Xie, Head of research for the Greater China region, OCBC Bank

Tommy Xie, head of research for the Greater China region at OCBC Bank, told Lianhe Zaobao that exports and trade were the core factors spurring China’s GDP in the first half of the year. Moving into the second half, besides the uncertainties China’s economy faces due to the China-US trade war, protracted unresolved tariff issues between the US and other countries would further exacerbate the global trade slowdown and indirectly impact China’s economy.

Since US President Donald Trump announced the reciprocal tariffs in April, the US has reached various framework agreements with the UK, China and Vietnam. Currently, the US is pressuring trade partners such as the European Union and Canada to secure deals before new tariffs take effect on

1 August. Meanwhile, China and the US are in a 90day pause that is set to expire on 12 August, with no new tariff rates agreed upon yet.

Lynn Song, ING chief economist for Greater China, assessed that while China and the US are unlikely to return to the peak tariff rates seen in April, the risk of further escalation remains. “This uncertainty will most likely continue to cap investment growth and weigh on overall confidence,” he noted.

Latest statistics also show that China’s fixedasset investment grew 2.8% year-on-year in the first half of the year, slowing from 3.7% in the first five months. Infrastructure and manufacturing investment rose 4.6% and 7.5% respectively, but real estate development investment fell 11.2%, highlighting the persistent contraction in the property market.

The real estate market is closely linked to inflation trends, and with persistent sluggish prices, a continued downturn could trigger a negative feedback loop, where consumers expect further price drops and delay spending. Thus, achieving effective “reflation” will be key to future policy. — Xie

Xie noted that the momentum of the real estate recovery has weakened again, dragging on China’s economy. The real estate market is closely linked to inflation trends, and with persistent sluggish prices, a continued downturn could trigger a negative feedback loop, where consumers expect further price drops and delay spending. Thus, achieving effective “reflation” will be key to future policy.

Addressing questions about the economic outlook for the second half of the year, NBS’s Sheng stated at the press conference that despite considerable external uncertainties and internal pressures from structural

adjustments, GDP grew by 5.3% in the first half of the year, laying a solid foundation for meeting the annual growth target.

The Chinese Communist Party is set to hold a Politburo meeting in late July to assess the current economic situation and plan economic work for the second half of the year. Analysts suggest that due to weakening export momentum, persistent price declines and low consumer confidence, China’s economy will face greater downward pressure in the second half, making it challenging to achieve the official growth target of around 5% for the year.

Although Beijing has ramped up infrastructure spending and consumer subsidies, alongside steady monetary easing,

Reuters cited analysts who believe that if economic growth slows significantly, the government may further ramp up deficit spending. Meanwhile, some observers note that the first half’s economic performance has provided policymakers with more room to manoeuvre, making the official interpretation of the current economic situation a key focus of the upcoming Politburo meeting.

In June, China’s new home prices fell at the fastest monthly pace in eight months, as property investment slumped to a historic low of 11.2% year-on-year in the first six months.

According to data released on 15 July by the NBS, new home prices in 70 major

... current property policies largely follow the previous direction, with “few strong or new stimulus measures”. As a result, the effectiveness of these policies in supporting the market recovery is weakening, and the broader economic foundation is not particularly strong. —

Zhang Xiaoduan, Deputy Dean, Research Institute at Cushman & Wakefield

and medium-sized cities dropped by 0.3% month-on-month in June, widening by 0.1 percentage point compared with the previous month, while 56 cities saw a decline in new home prices, up from 53 in May. The secondhand housing market was equally sluggish, with prices falling in 69 cities, the worst performance since October of last year.

NBS’s Sheng said at the press conference that real estate sales are declining year-onyear in terms of volume and revenue. “This requires greater efforts to push the real estate market to halt the decline and return to stability,” he said.

The Chinese government has already introduced numerous measures to revive the real estate sector. Last month, Premier Li Qiang pledged at a State Council meeting to step up efforts to stabilise the property market and reverse its downturn. In September last year, a comprehensive package of real estate policies helped spark a recovery in the housing markets of several cities. However, the market cooled again in May this year, and residential sales continued to decline in June.

Zhang Xiaoduan, deputy dean of the Research Institute at Cushman & Wakefield, told Lianhe Zaobao that the declines in housing prices and sales in May and June are fluctuations typical of a market that is bottoming out, and do not signify a broader deterioration of the property sector.

She also emphasised the need for more supportive measures for the real estate sector. She noted that current property policies largely follow the previous direction, with “few strong or new stimulus measures”. As a

result, the effectiveness of these policies in supporting the market recovery is weakening, and the broader economic foundation is not particularly strong. Against this backdrop, she said, further stimulus will be needed to ensure a steady rebound in the market.

“... the government could purchase some of the unsold housing stock and repurpose it as subsidised housing or talent housing for young people. This approach could help support the stabilisation and recovery of the real estate market.”

— Associate Professor Gu

Qingyang, LKYSPP, NUS

Wang Qing, chief macro analyst at Golden Credit Rating, said real estate policies are likely to be further intensified in the second half of the year. The focus will be on increasing the acquisition of subsidised housing, advancing the renovation of dilapidated housing and urban villages, and accelerating loan disbursement for projects on the real estate “white list”. The few cities that still have home purchase restrictions are also expected to ease them further.

Gu Qingyang, an associate professor at the Lee Kuan Yew School of Public Policy (LKYSPP) at the National University of Singapore (NUS), told Lianhe Zaobao that the challenges in China’s real estate sector are not just about household income — the crux lies in expectations. He said, “People believe that housing prices may continue to fall, so they are holding back and waiting on the sidelines.”

To reverse public pessimism about the property market and quickly halt the downward spiral, he suggested that the Chinese government should step up its intervention, particularly by increasing direct government purchases of housing.

He said, “For example, the government could purchase some of the unsold housing stock and repurpose it as subsidised housing or talent housing for young people. This approach could help support the stabilisation and recovery of the real estate market.”

This article was first published in Lianhe Zaobao on 15 Jul 2025, and later in ThinkChina on 16 Jul 2025. ThinkChina is an English language e-magazine by Lianhe Zaobao. SCCCI collaborates with ThinkChina to cross-share content. www.thinkchina.sg

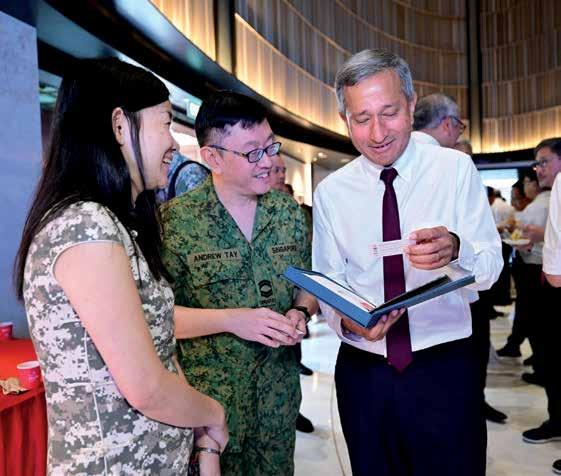

SAF DAY COMBINED REDEDICATION CEREMONY 2025

AIKEN DIGITAL PTE LTD

ALLBRIGHT LAW OFFICES (SINGAPORE) PTE LTD

ALVAREZ & MARSAL (SE ASIA) PTE LTD

ARROWDYNAMIC VENTURES PTE LTD

ASIA SAFE PTE LTD

ASIATIC FIRE SYSTEM PTE LTD

ASTRIA CONSULTING PTE LTD

BAY KENG LEONG

BELLAWIN PTE LTD

BERTDA SERVICES (SOUTHEAST ASIA) PRIVATE LIMITED

CHAN YUET HEI PHOEBE

CHEN JUAN

CHEN LIN NICOLE

CHEONG MEI LIN KEELY

CHUA YONG JUN DEXTER

CHUA ZHEN YANG ALOYSIUS

CNE INVESTMENT PTE LTD

CREDENCE MANAGEMENT CONSULTING PTE LTD

DEXIN ASSURANCE

DG-RICH HOLDING PTE LTD

DIGIMAGIC COMMUNICATIONS PTE LTD

ECOLE HOTELIERE DE LAUSANNE PTE LTD

ED&C

EPICSENSE ASSURANCE

FENG HUIYUAN

FORVIS MAZARS LLP

FUTUREEDGE BUSINESS ADVISORY PTE LTD

GETSOLAR PTE LTD

GOH WEI NAM MARTIN

HAN WEI

HE QIFANG

HELICONIA CAPITAL MANAGEMENT PTE LTD

HWA KONG TRADING CO (PTE) LTD

IMPETUS ASSURANCE PUBLIC ACCOUNTING CORPORATION

INNOMFG PTE LTD

INNOVARE MANAGEMENT SINGAPORE PTE LTD

JBS PRACTICE PUBLIC ACCOUNTING CORPORATION

JNC SECRETARIAL SERVICES PTE LTD

JT INTERNATIONAL SINGAPORE PTE LTD

JUKI SINGAPORE PTE LTD

KINGDEE INTERNATIONAL SOFTWARE GROUP (SINGAPORE) PTE LTD

KUO JING YING RACHEL

KUOK THAI LUK KELVIN

LI SHIRAN

LIM CHIN HUAI DESMOND

LIM JIONGTING

LIN HANWEI

LO YUE FAI LAWRENCE

LOH SENG YUE ALEX

LUMEN EDUCATION PTE LTD

LUO XIAO BRADY

MEJGA ENGINEERING TRADING PTE LTD

NANYANG VALLEY PTE LTD

OAKS LEGAL LLC

PANG HENG WEE

PDR GROUP (SEA) PTE LTD

PERFECT 7 PTE LTD

PROGRESSIVE SERVICES PTE LTD

SCENT JOURNER PTE LTD

SHARP LEARNERS TUITION AND ENRICHMENT CENTRE PTE LTD

SHENHAO (SINGAPORE) PTE LTD

SINGAPORE SING-CHINA INTERNATIONAL TRAINING GROUP PTE LTD

SKYHAWK CULTURE PTE LTD

SUN HUAHUA SOFIA

TAN & TEH

TAN GEK LIAN SHIRLEY

TAN NAN CHOON

TAY TENG YEW

TEH JUN WEN JENNIFER

TEO YI JIA SARAH MICHELLE

TOTAL ACCOUNTING SOLUTIONS KNOWLEDGE (TASK) PTE LTD

TRIKA (S) PTE LTD

TUV NORD (THAILAND) LTD (SINGAPORE BRANCH)

VISION FINANCIAL

WANG ANNI

WINSPIRE SOLUTIONS PTE LTD

XINHE GLOBAL COMMODITY SUPPLY CHAIN PTE LTD

YANG SHENGFANG

YEO HAK BOON MELVYN

YEW YI HUP KEE EATING HOUSE

ZHANG LIJUN

ZHANG XINYAN

ZHENG GUOSHAN

ZY FUTURE INTERNATIONAL PTE LTD

ANDREW TONG WAI KIT

YE FANG

KAREN LAU HIU YAN

SHERROY ONG BENG CHWEE

ZHAO XIAOHANG

BILL TAN SOON MUN

ALTON NEO CHUN HOW

BAY KENG LEONG

YANG JINFENG

CHEW KHENG CHIEW

PHOEBE CHAN YUET HEI

CHEN JUAN

NICOLE CHEN LIN

KEELY CHEONG MEI LIN

DEXTER CHUA YONG JUN

ALOYSIUS CHUA ZHEN YANG

LIU JIANHONG

LEONGCHOONG CHENG

ZHAO YANG

DIANA DAI XINHUA

DONALD LIM THENG SIONG

BAO CHEN

PAUL GOH TECK HONG

CHAN JINN YIN

FENG HUIYUAN

CHIN CHEE CHOON

ANG FUNG FUNG

CHEW BOLONG

MARTIN GOH WEI NAM

HAN WEI

HE QIFANG

CYNTHIA CHIA JIEHUI

PHILIP HONG KAI TIONG

TERENCE NG CHI HOU

HON CHONG EIK

BELINDA YU PUI LAM

JANAMANCHI BALASUBRAMANIAM

DENIECE WONG CHIAN PENG

BALA JOANNE ARCHANA

GOH TANG CHEOW

LIU YUJIE

RACHEL KUO JING YING

KELVIN KUOK THAI LUK

LI SHIRAN

DESMOND LIM CHIN HUAI

LIM JIONGTING

LIN HANWEI

LAWRENCE LO YUE FAI

ALEX LOH SENG YUE

YI TIANQI

BRADY LUO XIAO

TAY CHER KHIN

DELIA LIN WANNENG

LEE SOO CHYE

PANG HENG WEE

ASHER TAN PIT SHENG

CELESTE SEAH HUEI YI

GARY LOW XIACHAO

JOYCE LIAN CAIJUN

DUAN YUANYUAN

CHEN HUAN

XU JING

JIAO HAIYANG

SOFIA SUN HUAHUA

TEH KWANG HWEE

SHIRLEY TAN GEK LIAN

TAN NAN CHOON

TAY TENG YEW

JENNIFER TEH JUN WEN

SARAH MICHELLE TEO YI JIA

KENNETH HO KAH KIAT

TAN YONG KENG

SNOW NAW HNIN PWINT PHYUSON

KALYANAM VENKATESH

WANG ANNI

KULKARNI JITENDRA

WUREN JIRIGALA

YANG SHENGFANG

MELVYN YEO HAK BOON

ZHANG MEILAN

ZHANG LIJUN

ZHANG XINYAN

ZHENG GUOSHAN

WANG LINGREN

Founder & Group Chief Executive Officer

Head of Singapore Office

Tax Director

Director

Vice General Manager

Business Development Manager

Managing Director

Associate Branch Director

Group Chairman

Managing Director

Client Advisor

Director

Chief Executive Officer

Consultant

Not Applicable

Marketing Director

Vice Chairman

Executive Director

Partner

General Manager

Owner and Managing Director

Regional Director - Head of Business Development

Chief Executive Officer

Director

Project Manager

Partner, Audit & Assurance, Head of Business Development & Marcom

Director

Director

Principal Consultant

Project Manager

Managing Director

Chief Corporate Officer

Managing Director

Managing Director

Director

Director

Managing Director

Director

Director

Director

General Manager

Senior Product Manager

Not Applicable

Manager, Channels and Partnerships

Senior Director

Director

Managing Director

Director

Founder and Chief Executive Officer

Founder

Founder & Chief Executive Officer

Chairman

Founder & Director

Managing Director

Business Consultant

General Manager, Singapore

Chief Executive Officer

Partner

Creative Director

Director

Managing Director

Managing Director

Director

Head of Sales and Client Solutions

Managing Partner

Director, Membership Engagement

Director

Director

Secretary

Manager, Doctors’ Engagement

Director

Studio Manager

Head of Sales & Business Development

Director

Patent Attorney

Chief Executive Officer

Chief Executive