Auckland Central Market Report.

04. Market CommentIs that optimism in the air?

06.

Auckland Central Statistics July 2024

08. Recent Sales July 2024

14.

Article – Tony Alexander: House prices will be rising before the end of the year

18.

Article – Kelvin Davidson: Mortgage interest rates are dropping - what happens next? 22.

LoanMarket Update

12. Case Study & Auction Update with Cameron Brain

16.

Our month in Review Top Stories & Events from the City Realty Group

20. Property Management Latest Rental Listings

24.

Our Awards & Accolades Ray White Auckland Central & Wynyard Quarter

Is that optimism in the air?

Economic analyst and commentator Tony Alexander, 4 July: “The chances of interest rates being cut by the Reserve Bank before Christmas keep increasing.”

In his latest agent survey Alexander reports: “Whereas a month ago only 1% of agents said buyers were displaying FOMO – fear of missing out – now 10% say that. This is still well below average but the lift is interesting.”

NZ Herald One Roof, 24 July: “Westpac has cut its mortgage rates for the second time in three weeks, undercutting its rivals in the process. The five major banks have all announced changes to their home loan rates in the past week.”

NZ Herald One-Roof, 29 July: “Households can see better times ahead. That’s likely to reflect the now-widespread expectation that the Official Cash Rate will have started to drop before the end of the year, with some mortgage rates already falling. Adding to the good news on that front, the inflation expectations measure from ANZ’s consumer confidence survey fell further in July and is now back to its lowest level since September 2020.”

Susan Edmunds of RNZ quoted Kiwibank with a longer term prediction in early July. “Economist Sabrina Delgado, Kiwibank, said while it still expected the official cash rate (OCR) to be cut in November – earlier than many other forecasts – it was next year that the full impact of a fall in interest rates would be felt. Kiwibank expected the OCR to be at 4.5% by next June, compared to 5.5% at present, and 3% by the following June.”

Kiwibank chief economist Jarrod Kerr said: “Falling interest rates would have a psychological impact on borrowers, even if they could not take advantage of them yet. Just knowing interest rates are falling is also quite important.”

Director of City Realty Group, Daniel Horrobin says: “We track our open home visitor numbers religiously week to week and what those figures reflected in mid July was a sudden spike in visitor numbers when compared to the weekend prior. We can only put this down to media commentary surrounding interest rate optimism.” On that topic, over the month of July we met 356 open home visitors, up 30% on June.

Michelle Moffit from Realestate.co.nz also reports positive news in her July update. “Total traffic to realestate.co.nz was up 20.9% yearon-year. Our most engaged users, on our app, increased to an all-time high, up 25.6% on June 2023, and 8.0%, when compared to the month prior.”

Our sales team on the ground are reporting an increase in inquiry generally. It was heartening to see new faces in the auction room during July, hopefully another positive indicator. The recent activity is reflected on our sales board for the month which is looking the healthiest it’s been for some months.

“It is interesting to note however,” adds Daniel, “the number of central city properties for sale on Trade Me property has remained steady, hovering around the low 600’s since March this year. Maybe the new-found optimism will give owners more confidence to come to the market, particularly as September and spring loom on the horizon.”

“In summary we remain cautiously optimistic that the property market in general, and the central city market in particular, will benefit from positive news dominating the headlines this past month.”

Over the month of July we met 356 open home visitors, up 30% on June.

Total Sales

July 2024

46

July 2023

There was a -62% decrease in the total number of sales year on year.

Total Sales Value Median Sales Price Median Days On Market

July 2024

$15,779,000

July 2023

July 2024

July 2023

124 $51,837,885 $305,000 38.5

There was a -69.5% decrease in the total sales value year on year.

Source: REINZ

There was a -11% decrease in the total median sale price year on year.

July 2024

$269,500 60

July 2023

There was a 55% increase in the total median days on market year on year.

Recent Sales.

AUCKLAND CENTRAL

$280,000

Sales data is from REINZ and covers the entire Central Auckland property market.

Results shaded in yellow denote a sale by City Realty Limited.

1 Bed (or Studio) Median Sale Price 2 Bedrooms 3+ Bedrooms By number of bedrooms $260,000 $780,000

Our Recent Sales

901/1 Greys Avenue, Auckland Central 2 Beds / 2 Baths / 1 Car

G07/6a Nugent Street, Grafton 1 Bed / 1 Bath / 1 Car

11 Ripon Crescent, Meadowbank 4 Beds / 2 Baths

3M/99 Customs Street West, Auckland Central 2 Beds / 2 Baths / 1 Car

305/8 Ronayne Street, Auckland Central 3 Beds / 1 Bath

1102/207 Federal Street, Auckland Central 2 Beds / 1 Bath / 1 Car

1201/1 Hobson Street, Auckland Central 2 Beds / 2 Baths / 1 Car

814/1 Parliament Street, Auckland Central 1 Bed / 1 Bath

104/10 Flower Street, Eden Terrace 2 Beds / 1 Bath / 1 Car

8 Fergusson Avenue, Sandringham 3 Beds / 2 Baths

19/216 Manuka Road, Bayview 3 Beds / 2 Baths / 1 Car

716/6 Dockside Lane, Auckland Central 2 Beds / 1 Bath / 2 Cars

8 Fergusson Avenue, Sandringham

118 Groups through Open Homes

60+ People Attended Auction

23 Private Enquires

7 Building Inspections

3 Week Auction Campaign $1.8m Pre-Auction Offer in 1st Weekend

9 Registered Bidders $2,05m Property CV Sold for: $2,090,000

LUKE CROCKFORD

Spring Surge. Market boosts Auction Activity.

As we approach the vibrant spring season, the real estate market is gearing up for a surge in activity. With just under two weeks before the official start of spring, City Realty Group is witnessing a steady increase in our auction pipeline.

This uptick is driven by homeowners eager to capitalize on the traditionally heated spring market, a time when buyer interest typically peaks, leading to increased competition and, often, higher sale prices.

Our year-to-date auction statistics provide a snapshot of the market’s current dynamics. At City Realty Group, we’ve maintained a relatively stable clearance rate of 57.84% across our network of offices. Breaking this down, 5% of our properties have sold prior to their scheduled auction date, while approximately 53% have found new owners either at auction or shortly after. These figures highlight the resilience of the auction process, even in a market that has seen its fair share of challenges.

The recent drop in the Official Cash Rate (OCR) is a significant development that could influence market behavior in the coming months. While the impact of this rate cut may not be immediate, it is likely to bolster confidence among both buyers and sellers.

For potential buyers, lower borrowing costs could enhance affordability, encouraging more active participation in the market. On the other hand, sellers might see this as an opportune time to list their properties, anticipating stronger buyer demand as we move into the final quarter of 2024.

Looking ahead, our projection is that the next four months will be bustling with activity. The combination of seasonal market trends, coupled with the recent OCR adjustment, suggests a dynamic period for auctions. Whether you’re considering selling or buying, the spring market is shaping up to be a time of opportunity. At City Realty Group, we’re ready to help you navigate this exciting phase, ensuring that you make the most of the current market conditions.

Stay tuned for further updates as we continue to monitor market trends and share insights to help you achieve your real estate goals.

“Looking ahead, our projection is that the next four months will be bustling with activity.”

Tony Alexander: House prices will be rising before the end of the year

The Reserve Bank’s rate cut gamblewhy the sudden change of heart?

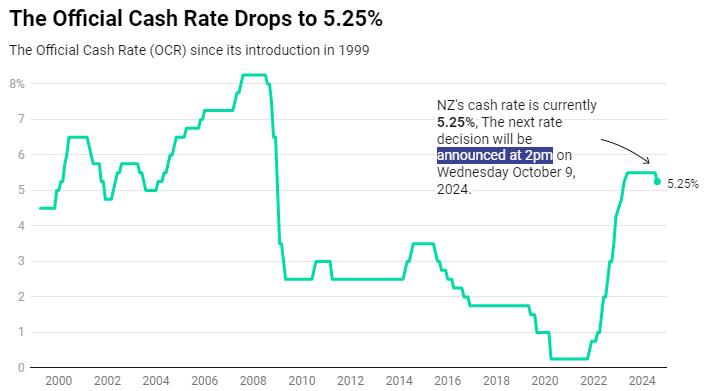

ANALYSIS: The Reserve Bank has just validated market expectations of an easing of monetary policy with a 0.25 point cut in the cash rate to 5.25% (although I had thought they would hold out to October).

The RBNZ predicts the rate will fall below 4.5% in the middle of 2025, then 3% come the end of 2026. On that basis householders can reasonably expect the likes of the one-year fixed mortgage rate will fall to around 5% and perhaps slightly under come the end of 2026.

Only three months ago the RBNZ said it wouldn’t cut the OCR rate until August 2025 and warned that it might in fact need to take the rate higher. ANZ economists even predicted early this year that the rate

would rise to 6%. Why such a huge change in a very short time?

First, as I’ve noted here for at least the past year, just as the RBNZ over-loosened monetary policy during and immediately after the pandemic, it has now overtightened it. It kept the cash rate too high for too long – but only perhaps by 3-6 months.

While the outlook for growth is now so bad it sees our economy shrinking 0.6% for the four quarters of this year rather than growing 1% as they predicted in May, business pricing plans have remained much too high.

On average a net 25% of businesses since

Chart: NZ HeraldSource: Reserve Bank of New ZealandGet the dataCreated with Datawrapper

1992 have said they will raise their prices in the coming year. This was over a time when economic growth averaged 2.7% a year. Now with 0.6% shrinkage a still much too high net 38% still say they plan hiking their charges.

This tells us something important. The RBNZ decided to take a gamble. It is hoping that the new weakness in the economy, which it failed to acknowledge in May (hint you guys – read my monthly survey results), will crunch pricing plans quite quickly.

That may well happen. But the RBNZ noted many times in its commentary this time around that business pricing plans will be very closely monitored and need to change further. I can already tell from my latest monthly Business Survey run with Mint Design that the proportion of businesses saying they won’t now raise their prices has risen to 26% from 18% last month and a year ago a net 22% saying they would raise their prices.

Things are headed in the right direction and borrowers can look forward to lower mortgage interest rates. But before we get to sub-5% fixed rates more people will lose

their jobs, more businesses will go under, and there will be a lot more restructuring across most sectors in the economy. How quickly will the housing market respond to this new-found optimism about interest rates? I can already tell from my surveys of real estate agents and mortgage brokers that buyers are coming back – including some tentative investors. Sentiment is likely to improve further.

But listings are ahead over 33% from a year ago, job security is poor and set to remain that way, net migration flows are falling away very quickly, the rental market has recently shown new weakness, plenty of potential home-buying young Kiwis are leaving the country, and businesses are likely to keep their investment levels low until well into 2025.

Before the end of this year house prices are likely to be rising again. But it pays to remember that while interest rate levels are extremely important when it comes to housing market strength, so too are employment and access to credit. These areas will still take some time to improve.

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz

@raywhiteaucklandcentral

@raywhitewynyardquarter

@raywhitesandringham

@raywhite.mtroskill

Celebrating 10years of success with List Now & Karen Jackson

A huge congratulations to Karen and her team, an amazing business woman whose leadership has been truly inspiring.

Cleaning up your dirty secrets... with the House of Holly.

Rich Listers star Holly Cassidy has teamed up with the vacuum king Shark. Keep an eye out for that campaign hitting the media soon.

Our very own Holly Cassidy was on TV!

Holly shared her expert insight into building reports! Find out the ins and outs of what to look for in a building report.

Sales meeting magic with our Auckland Central office

Cameron Brain our auctioneer taking the team through the latest sales results

Auction Action in Sandringham

Luke Crockford & the team held another succesful Auction

Kelvin Davidson: Mortgage interest rates are dropping - what happens next?

The five things you need to know about the housing market this week.

1. Reserve Bank cuts the OCR

The Reserve Bank’s decision to cut the Official Cash Rate (OCR) from 5.5% to 5.25% came earlier than many had anticipated. I was expecting the cut to happen in October, others picked November. The RBNZ reasoned, however, that the risks to New Zealand’s struggling economy by delaying a cut outweighed any lingering inflation concerns.

The RBNZ’s forecasts suggest that the OCR might drop another 1.25 points or so by the end of 2025, reaching 4%. This implies a typical mortgage rate of maybe 5.5%. So will this be enough to jumpstart the housing market? Some kind of short-term bounce can’t be ruled out, given that lower interest rates tend to have an immediate effect on household sentiment, even if the actual impact on household finances is months down the line.

But it’s hard to see the housing market running away again: the odds of a lingering recession are high, unemployment is rising, the number of homes for sale is greater than the current buyer pool and banks are now operating with debt-to-income ratios.

2. Affordability is still very stretched

Another reason for caution is affordability. Even though house prices are well below their post-Covid peak, they are still out of step with Kiwi incomes by quite a large margin. CoreLogic’s latest Housing Affordability Report, covering the second quarter, showed the following pressures in the market:

- The value-to-income ratio across NZ was 7.7, down from 10.2 at market peak, but above the 20-year average of 6.8;

- The number of years it takes to save for a deposit is 10.2, down from a 2021 peak of

Housing market sentiment has changed since the Reserve Bank’s OCR drop. Artwork / Beth Walsh

13.6, but above the long-term average of 9.1;

-Mortgage repayments as percentage of median household income across NZ hit 54%, down a bit from the worst reading of 57% in Q2 2022, and above the long-term average of 43%;

- Renting is difficult too, absorbing 28% of median household income in Q2 2024, hovering at around a record high, and above the long-term average of 26%.

Lower interest rates and flatter rents will clearly help over the medium term. But wage growth has slowed too, and although property values may not spike higher, they’re unlikely to fall much further either. In other words, housing affordability could be a significant problem for a while yet, although the Government’s strong push on housing supply at present may well pay dividends in the long term.

3. Migration and rental growth continue to ease

Speaking of rents, the latest Stats NZ figures showed growth on the flow/new tenancies measure of just 2.5% in the year to July, below the average of 3.3%. In light of the reducing migration pressure (with arrivals slowing and departures continuing

to rise), this isn’t a surprise. Meanwhile, the high starting point for rents will also tend to limit any further growth, and there’s also been a sharp rise in available rental listings, perhaps due to factors such as the continued shift of first-home buyers out of rentals and into their own property and new-build investment stock hitting the market.

4. The ‘partial’ economic indicators remain sluggish...

Measured across so-called partial variables (timely/monthly stats which aren’t ‘official’ benchmarks), such as electronic card spending and the performance of manufacturing index (PMI) – which were both published last week – the economy remains soggy. That just adds more weight to the RBNZ’s decision, and also to signal more OCR cuts in coming months.

5. More bad news to come this week?

And on top of all of that, this week we’ll get the performance of services index and Stats NZ’s retail sales data for Q2. It’s difficult to imagine either of these measures recording a strong result. That simply adds to the wider story about NZ being in need of lower interest rates.

CoreLogic chief economist Kelvin Davidson: “Housing affordability could be a significant problem for a while yet.” Photo / Peter Meecham

Here’s what SuperCity Property Managment has for Rent this month.

Please see below our latest, available properties for rent. If you have any friends or family looking for accommodation please pass this list on to them!

$580 per week

L8/68 Mountain Rd, Mount Wellington 2 Beds / 1 Bath / 2 Cars

$480 per week

3F/10 Hobson Street, Auckland Central 1 Bed / 1 Bath

L2/18 Federal Street, Auckland Central 1 Bed / 1 Bath FOR RENT FOR RENT FOR RENT FOR RENT

Manager +64 21 193 3962 kurt.smith@raywhite.com

$700 per week

1E/18 Joseph Banks Tce, Remuera 1 Bed / 1 Bath / 1 Car

$450 per week

$450 per week

4F/182 Federal Street, Auckland Central 1 Bed / 1 Bath

$900 per week

G07/250 Kepa Road, Mission Bay 1 Bed / 1 Bath / 1 Car

L2/15 Union Street, Auckland Central 1 Bed / 1 Bath FOR RENT FOR RENT FOR RENT FOR RENT FOR RENT FOR RENT

$440 per week

$550 per week

8/11 Balfour Road, Parnell 1 Bed / 1 Bath

$700 per week

L11/1 Parliament St, Auckland Central 2 Beds / 1 Bath / 1 Car

$1,250 per week

7c/14 Emily Place, Auckland Central 4 Beds / 3 Baths / 1 Car

To view a full list of available properties for rent follow this link or scan the QR Code on this page.

However in a surprising move and with mounting pressure the Reserve Bank Governor today announced the decision to cut rates much earlier than expected, reducing the OCR

from 5.50% to 5.25%.

Economists were divided on whether the Reserve bank would cut interest rates. This has paved the way for further drops at the next OCR on October 9th 2024 and the final announcement for 2024 in November.

The Reserve Bank Governor stated that as long as inflation remains low, then they will continue to ease further.

Should I fix now? OR wait? and how long for?

Depending on your financial situation we recommend sticking to a short term fixed rate of no more than 12 months. We expect the fixed rates to be around 5-5.50% in 6-12 months time and floating to potentially settle at around 7%. Ideally you should be considering a longer term fixed rate option of 2-5 years when the rates are at their next low point.

To discuss the competitive investment loan options available speak to Jamie today.

Rate My Agent Awards

RAY WHITE AUCKLAND CENTRAL ARE PROUD TO BE ACKNOWLEDGED BY RATE MY AGENT FOR THE BELOW AWARDS

CURRENTLY PLACED

#1

Auckland Central

Agency of the Year 2025

#1

Agency of the Year 2025 Grafton

RateMyAgent is Australia’s leading real estate ratings and reviews website. It collects and verifies reviews from buyers, sellers, and landlords to provide an accurate and reliable assessment of real estate agencies. RateMyAgent Awards are independently judged based on verified customer reviews and sales data.

Our appraisals are on the house.

Are you considering selling your home, or simply curious about your property’s current market value?

Our expert appraisal team is here to help!

With an award winning team and years of experience, we understand the local market and provide insights that matter.

Never has there been so much data publicly available about what is happening in the property market. Are you ready to get started?

Request a no obligation appraisal today!

Meet the team.

SALES TEAM - AUCKLAND CENTRAL OFFICE

Daniel Horrobin

Cameron Brain

Pauline Bridgman

Mike Richards

Ady Huang Aileen Wu

Ben Parkes

Craig Warburton

Dom Worthington

Dusan Valenta

Gillian Gibson

Habeeb Urrahman

Carl Russell Carlos Del la Varis

Chris Cairns

Grant Elliott

Kristine Liu

Cheryl Whiting

Leo Zhang

Judi Yurak

Keisha Gutierrez

Krister Samuel

Holly Cassidy

Jeong Lee

Chris Guilford

Danika Ansley

Derek Yin

Manager

Wynyard Quarter, Sandringham & Mount Roskill

Belinda Henson

Casey Chen

Jean Byun

SALES SPECIALISTS

Our strongest team yet. Selling right across Auckland Central & City fringe

SALES TEAM - WYNYARD QUARTER OFFICE

OUR LOANMARKET MORTGAGE ADVISOR

WE CAN NEGOTIATE A LOWER RATE. WORK WITH A QUALIFIED AND COMPETENT MORTGAGE ADVISER

LoanMarket Mortgage Adviser

Marco Sahar

Michelle Yurak Ryan Bridgman

Sam Huang Steve King

Steve Kirk

Jamie Maclennan

Louise Stephens

Ross Tierney

Luke Crockford

Gabriela Galateanu

Andrew Bond Ainsley Lewis

Max Beliak

Tony Warren

Simon Lee

Lisa Zhang Leo Zhu