US motorsport market research

Motorsport, and particularly professional motorsport, has traditionally pushed the possibilities and technologies of consumer mobility and the automobile by providing a platform for key stakeholders to advance and innovate products. Motorsport has been and still is used as a laboratory to experiment with future technologies, demonstrate prototypes, advance the capabilities of road cars, and increase brand awareness.

Sustainability is becoming a greater area of focus across motorsport, both on and off the track. The world governing body of motorsport, the FIA, has introduced environmental accreditation policies. Professional teams strive for a net zero carbon footprint, and host destinations and sponsors choose motorsport properties to reflect their environmental and sustainability goals. Shaping the future of said properties through their commercial influence.

Since 2014, many FIA motorsport properties have adopted a more sustainable powertrain platform in response to vehicle manufacturers’ changing solutions, driven by regulatory changes by governments impacting buying behaviour of the public, and to promote a more environmentally responsible message. This has largely been led by electric vehicles (Formula E, eTCR, Extreme E, World Rallycross), hybrid/sustainable fuel solutions (Formula 1, WRC) and in some cases hydrogen fuel cell power (ACO).

Beyond these blue riband FIA sanctioned series’ exists a vast global network of professional, club and grass roots motorsport properties that continue to compete with internal combustion engines (ICE).

Understanding the intentions of these properties to become more sustainable and reduce their carbon footprint could provide commercial opportunities for sustainable fuel such as Sustain. It is with this in mind that Coryton has engaged ROOTS. to examine the domestic motorsport market of the USA and gather input from motorsport figureheads to better understand the appetite for sustainability and specifically the potential of a sustainable fuel for future ICE competitions.

“Many regions in the world still rely on internal combustion engines and they will continue to do so due to the lack of EV infrastructure there. We therefore need a double approach with our technologies. There is a need to go electric in regions where it is possible, such as western Europe, and develop e-fuel solutions for the existing ICE cars elsewhere”.

Nico Rosberg, Motorsport.com, May 2022Coryton has engaged ROOTS. to provide an analysis of the USA motorsport market and explore the appetite for a sustainable fuel solution as well as a sense of sustainability awareness among USA motorsport stakeholders. ROOTS. has experience working with a range of competitors, championships, and rights holders in US motorsport and is well placed to provide this kind of feedback to Coryton.

The purpose of this research was to present Coryton with an overview of the US motorsport market including authentic and current feedback from active competitors and businesses in this sector. For the purpose of this project ROOTS. categorised conversations and target stakeholders into 3 main categories:

1. Competitors/Teams - active competitors or teams participating in one or more ICE motorsport competitions in the USA.

2. Championships/Events - Race series organisers or venues who operate with or host ICE races.

3. Brands/Sponsors - Businesses who invest in or sponsor ICE motorsport properties.

In addition to desk-based research, and a select number of surveys, ROOTS. performed research through video/telephone conversations with connections, colleagues, and influential organisations in the USA.

Conversations typically lasted 60 minutes and were guided by each prospect’s own situation or challenge related to their ICE motorsport position and underpinned by a list of guiding questions that would allow ROOTS. to compare feedback.

04.1

The Clean Air Act (CAA)(1970) was released 52 years ago in the USA to improve air quality and reduce GHG emissions. Despite this, air pollution continues to be one of America’s greatest areas of concern.

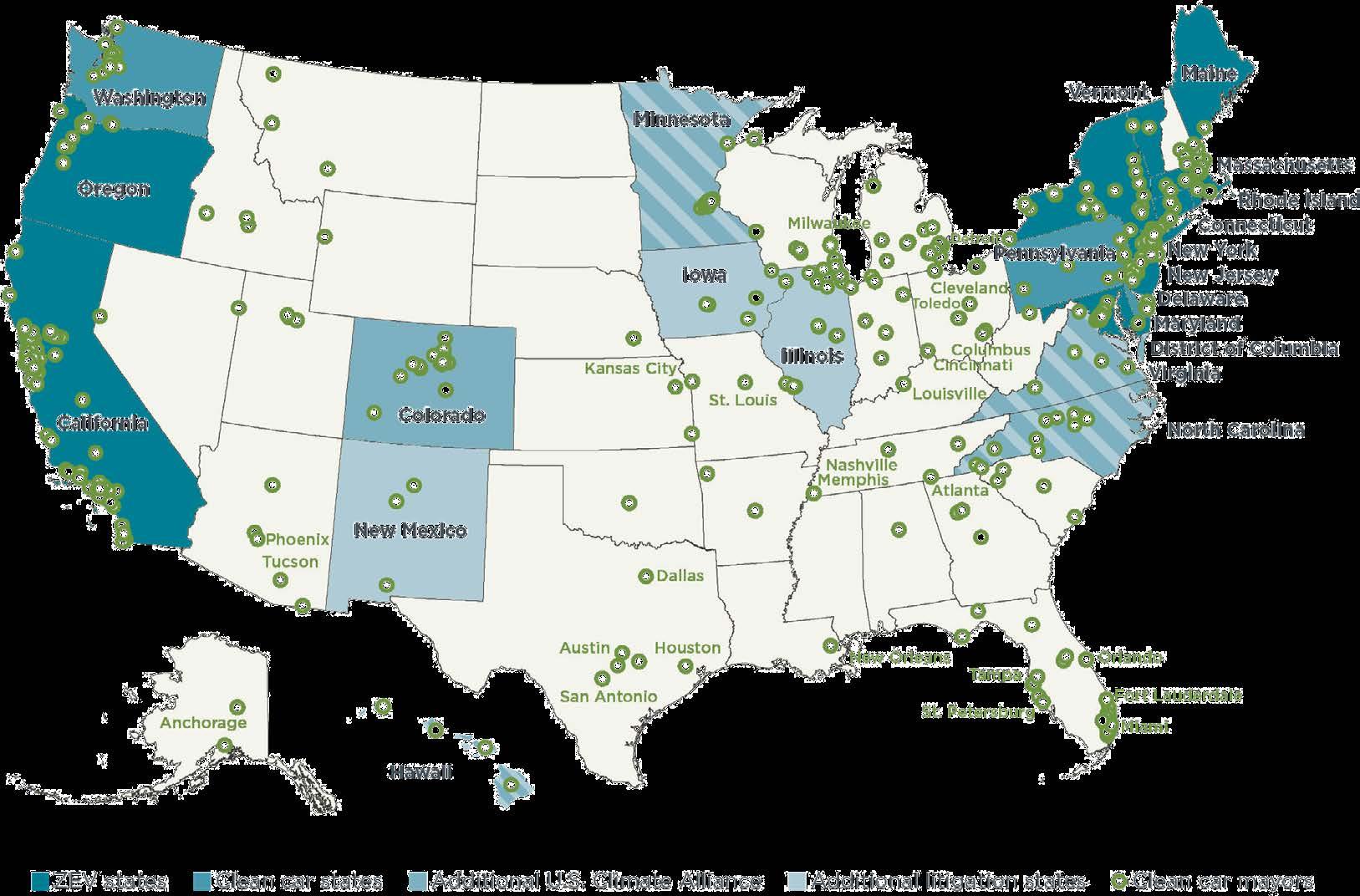

The US government has taken measures in an attempt to combat emissions such as rejoining the Paris Climate Agreement and funding more renewable energy projects. Many states across the US have their own environmental regulations with zero-emission vehicles (ZEV) or lower emission vehicle mandates in place to reduce GHG emissions. Minnesota, New Mexico and Nevada are planning to implement car regulations and EV requirements on a local level in line with California’s for more-stringent tailpipe emissions.

Despite the number of laws, regulations and standards in place to reduce an increase in oil and gasoline consumption, a recent survey conducted by Pew Research centre stated that 55% of respondents opposed phasing out the production of new gasoline cars and trucks by 2035, while 43% supported it. Almost half (45%) said they are not interested in the purchase of electric vehicles. In 2021, gasoline made up 54% of the US transportation fuel consumption and continues to be the most common light-duty vehicle fuel.

A major component of California’s GHG emission reduction program is the Low Carbon Fuel Standard (LCFS).The LCFS is one of the earliest measures California identified as a way of reducing greenhouse gas emissions. Regulations regarding the LCFS were approved by the California Air Resources Board (CARB) in 2009 and they began implementation on January 1, 2011. Further LCFS amendments were approved by CARB in December 2011 and implemented in 2013. By increasing the range of low-carbon and renewable fuels, the LCFS aims to decrease California’s transportation fuel pool’s carbon intensity which results in reducing petroleum dependency and improved air quality.

North America’s Pacific Coast is the world’s fifth largest economy with a combined GDP of $3 trillion, representing 55 million people. Several states along the Pacific Coast are working together as part of the Pacific Coast Collaborative to build a low-carbon economy of the future, including British Columbia, Washington, Oregon, California, and the cities of Vancouver, Seattle, Portland, San Francisco, Oakland, and Los Angeles. In 2016, Pacific Coast Collaborative jurisdictions renewed their commitment to developing a low-carbon transportation fuel market in their region.

The Pacific Coast Collaborative has developed a strategy to match its partners’ dedication to a future of low-carbon transportation. Through these initiatives the use of all low-carbon modes of transportation, such as ride-sharing, cycling, walking, and zero-emission passenger cars are being promoted, as well as transit and the build of new infrastructure that will broaden the range of available modes of transportation.

Phillips 66 is investing heavily to convert San Francisco into one of the world’s largest renewable fuels facilities, Rodeo Renewed, which is expected to cost up to $850 million and is scheduled to operate commercially by the first quarter of 2024. Phillips 66’s CEO and Chairman, Greg Garland, stated that Rodeo Renewed would help to reduce their carbon footprint while providing reliable and affordable energy. This project aims to produce 800 million gallons of renewable transportation fuels (renewable diesel, gasoline, aviation fuel) per year which would reduce lifecycle carbon emission by almost 65%, which is equal to 1.4 million cars being removed from California’s roads. The scheme is also set to reduce 55% of pollutant emissions on site and 160 million gallons of water per year.

The consumption of Renewable energy is going to increase over the years as per the graph above. For the first time in 2019, renewable energy usage exceeded coal usage, according to USA Facts, which is a big step towards the US’ goal of net-zero carbon emissions by 2050.

Motorsport properties, and in particular motorsport venues, are regularly subject to community and environmental examination surrounding their routine events and operations. While European venues work to strict legislation in terms of noise regulation and restrictions, the USA motorsport research did not reflect the same challenges. The majority of organisers and venues that we spoke to did not seem too concerned about any environmental (noise/air quality) policies or regulations impacting their operations. In most cases local governments and communities were welcoming of the positive economic impact that motorsport brings through tourism spend and employment. For motorsport facilities located in rural areas or for racing series who visit outlying race tracks, their business is valuable to local communities, economies and workforce.

Competitions like the American Rally Association, who can attract over 100 competition crews, plus event and support staff to rural locations and towns across a multi-day event, represent a valuable economic impact to these communities. Whilst their operations must remain environmentally responsible, environmental concerns are not prohibitive to the overall attraction and importance of these events for their host destinations.

On a larger scale, the USA continues to invest in attracting the world’s biggest motorsport properties that present large visitor revenue opportunities. The recent addition of Miami GP to the F1 calendar and the announcement of a new Las Vegas GP proves that motorsport can still leverage major tourism revenues for host destinations in the USA. The average visitor to Miami for the race spent $1,940 while in the city – nearly double the typical non-Formula 1 visitor.

Traditional domestic motorsport events such as the Indy 500 remain important economic drivers for their venues and can compete with the economic impact of other major sporting events like the Super Bowl.

Indianapolis Motor Speedway President Douglas Boles commented :

“I think over the course of the full season here in the state of Indiana, we drive about a billion dollars in economic impact. And that’s through the teams that are located here, the jobs that are created here. The Indy 500 alone is somewhere between 350 and 400 million of that. So if you think about that, that’s like having a couple Super Bowls every year here at the Indianapolis Motor Speedway”.

Indianapolis Motor Speedway President Douglas Boles

The popularity of renewable race fuels is set to continue with more series and global championships adopting the technology in 2023.

In 2022, the FIA World Rally Championship became the first FIA World Championship to use a drop in sustainable race fuel. From 2023, Indycar will move to a renewable Shell race fuel, while Japanese Super GT is moving to an ETS Racing equivalent. FIA/CIK Karting will also move to a P1 Bio Fuel in 2023, although concerns around the cost of the karting product are already being raised.

VP Racing fuels, who dominate the USA domestic motorsport market, have announced their intentions to produce a sustainable fuel in the future. The company recently announced that it has been hard at work developing biofuels that make use of bio-renewable components, and that it will soon be including biofuels as part of its current range of performance fuel products.

At the 2022 edition of the WEC 1000 Miles of Sebring, TOTAL Energies introduced their fully sustainable racing fuel Excellium Racing 100. Sourced entirely based on the circular economy model and without a single drop of oil, this biofuel draws its energy from the recycling of residual biomass from the wine industry. Excellium Racing 100 is a racing fuel that meets the requirements of the FIA, car manufacturers, and the European directive on renewable energies (RED). Over its life cycle, it states that it will allow for greenhouse gas (GHG) emissions savings of at least 65%.

Apart from the impact created by the electrification of transportation, traditional fuels (diesel and gasoline) also face competition from other lowemission alternatives, such as hydrogen, and renewable fuels.

Americans lean against the idea of phasing out ICE vehicles by 2035: 55% say they oppose phasing out the production of ICE cars and trucks by 2035, compared with 43% who support this proposal.

When asked how likely they would be to seriously consider purchasing an electric vehicle (EV), 42% of Americans say they would be very or somewhat likely to seriously consider purchasing an electric vehicle. A slightly larger share (45%) say they would be not too or not at all likely to do this (13% say they do not plan to purchase a vehicle in the future).

Political parties continue to be deeply divided over whether to end the production of cars and trucks with internal combustion engines. About twothirds of Democrats favour phasing out ICE cars and trucks by 2035 (65%). In contrast, just 17% of Republicans support this idea, while an overwhelming majority (82%) oppose it.

According to the National Highway Traffic Safety Administration and Environmental Protection Agency, the increased usage of gasoline by 2025 will result in up to 800 million tons more carbon dioxide emissions which is equivalent to emissions of Austria, Bangladesh and Colombia.

The economic and social value of motorsport combined with growing environmental concerns has positioned environmental impact at the core of conversations around the future of motorsport. In addition to the obvious CO2 emissions, noise pollution, tyre usage, carbon impact of motorsport logistics, and threats to biodiversity can all be attributed to motorsport, either in the professional realm or at grassroots level.

In recent years many motorsport federations, stakeholders, and figureheads have spoken out on the impact of motorsports on the environment. Aside from competitions based around electric vehicles, governing bodies and venues are adopting environmental accreditation programmes focussed on reducing environmental impact.

Sebastien Vettel, Aston Martin F1 Driver, July 2022.

The world governing body of motorsport, FIA, now has a robust Environmental Accreditation Programme for their members. Many teams, venues, and organisers have adopted the FIA Environmental Programme in their quest to minimise the environmental impact of their motorsport operations.

‘The FIA Environmental Accreditation Programme is aimed at helping motor sport and mobility stakeholders worldwide to measure and enhance their environmental performance. By introducing clear and consistent environmental management into motorsport and mobility, it provides stakeholders with a three-level framework against which to accredit their activities’.

Hydrogen has seen a reemerging interest as a possible solution to creating zero-emission motorsport vehicles. At consumer level, many manufacturers have light-duty hydrogen vehicles for lease or sale in California with access to hydrogen fuelling stations. The high costs of fuel cells and limited availability are the major problems faced by the industry. There are a total of 48 hydrogen filling stations in the USA and most of them are located in California.

Electricity is not a magical solution to the world’s emissions problems either. Electrification alone is not a sustainable solution to meet global transportation needs when you take into account an electric vehicle’s entire lifecycle and the necessary infrastructure upgrades.

“Obviously, travelling the world, racing cars and burning resources, literally, are things that I cannot look away from. Once I think you see these things and you are aware, I don’t think you can really unsee it. When it comes to the climate crisis, there is no way that F1 or any sport or business can avoid it, because it impacts us all”.

In the context of Motorsport the alternatives of of hydrogen- and and electric vehicles have arrived, but each with different challenges.

Hydrogen fuel cells are complex and can be difficult to integrate into a motorsport package. Managing hydrogen supply in a controlled motorsport venue and the associated regulations and permissions required also adds to the complexity of this alternative. Electric vehicles and powertrains have become a lot more prevalent in global motorsport, both as a single seater formula package and more recently in a conventional ‘road car’ silhouette. Again, EV has presented multiple challenges. For some motorsport fans the lack of noise, atmosphere and smell of ICE has proven difficult to accept. EV championships are often targeted with ‘green washing’ in terms of the materials and electricity source used for their charging. The homologation cycle of EV motorsport is also proving a challenge, largely due to the speed at which OEM technology advances in the EV space. Where motorsport traditionally led the way in terms of ICE development, with EV motorsport the technology can often find itself lagging behind the latest prototypes of mainstream electric mobility.

As a result, motorsport and the automotive industry have now started to pay attention to drop-in sustainable fuel as a possible solution.

The FIA introduced 100% sustainable fuel in the FIA World Rally Championship in 2022.

Nitro RX proclaimed to have the quickest, most powerful electric rallycross car called FC1-X in 2021.

Shell and NTT INDYCAR announced their sponsorship in May 2022 which stated that from the beginning of 2023, Shell will be providing a 100% renewable race fuel to reduce 60% of GHG compared to fossil-based gasoline making them the first US-based motorsport series to be racing with this product.

Sources state that NASCAR will start demo races with an electric car in Feb 2023.

IMSA collaborated with Michelin and VP racing fuel and released a set of initiatives for a Green programme in affiliation with the US Environmental Protection Agency (EPA) and SAE international. The programme will pursue racing protocols in an effort to reduce the championship’s carbon emissions

Grand Prix Trois Rivieres in Canada (Street Circuit) subsidised the introduction of P1 Bio Fuel to one of their racing categories in 2022 in an effort to support local community environmental initiatives.

With 3 races now planned in the USA, Formula 1 will introduce their ‘drop-in’ sustainable fuel from 2026, further adding to the awareness of these products among US consumers.

Throughout our conversations with multiple USA Motorsport Stakeholders (Competitors, Organisers, Venues) some common themes and consistent messaging was detected. Whilst each stakeholder, due to their different roles within the motorsport ecosystem, viewed sustainable fuels from a slightly different angle, our conversations presented similar findings around the following key points:

At present, the majority of those who we spoke with are not under political, sponsor or community pressure to adopt sustainable methods to reduce their environmental impact. Even organisations such as Formula Drift, an exclusive ICE race series with urban events in Long Beach, California, feels that local environmental policy is aimed at large industrial organisations as opposed to motorsport/entertainment properties.

In contrast, Grand Prix Trois Rivières (Quebec Street Race) voluntarily introduced a P1 Racing bio-fuel to one of its racing categories in order to enhance their existing environmental policy (GreenP3R) & support local community and political ‘green initiatives’. None of the competitors or Championship organisers who we spoke with explained that any existing sponsors or commercial partners are actively pursuing a reduction or examination of environmental impact.

Our contacts were consistent in stating that a sustainable race fuel is currently a ‘nice to have’ option. There is acknowledgement that sustainable race fuel can become important to safeguard the future of ICE motorsport, but presently there is no pull for the product coming from the sporting/ competitor side. That said, it was noted that during planning for the next instalment of ‘Travis Pastrana Gymkhana’ (a viral video series that has grossed tens of millions of views) supported by Subaru, the topic of using a sustainable fuel was proposed by the OEM, albeit as an optional component of the overall project, not a priority.

When discussing grassroots motorsport with the president of Virginia International Raceway, he explained the ‘red-blooded American’ motorsport fans in rural USA still lack an appreciation for the environmental impact of their race cars nor do they seek sustainable products to operate them. This is reflected in the automotive culture of these communities where diesel powered work vehicles, SUV and 4x4 are still most common as the primary means of transport.

Whilst professional or manufacturer racing teams can often absorb the costs of advanced technologies or more expensive technical regulations, the grassroots competitor is a lot more sensitive to operational costs. This was confirmed to us during our conversation with John Mason, Managing Director of Tillotson Karting. Tillotson manufactures the fuel and carburettor components for competitive Karts as well as the Tillotson T4 Kart for a global network of National T4 Karting leagues. John presented an example of how CIK/FIA Karting is moving towards a P1 Bio Fuel from 2023. Whilst the move to sustainable fuel is seen as a positive step for the sport, by its nature Karting is the entry level for motorsport competitors and is heavily dependent on cost management. Whilst the premium European CIK Karting events may have the ability and profile to sponsor, subsidise or warrant a more expensive fuel, the extensive network of Karting competitors are likely to resist or object to any regulation that increases their cost of competition. Sources confirmed this is amplified in the USA where CIK or premium Karting competition is not as widespread. In the USA entry level motorsport can often be found at rural stock car raceways where environmental awareness or green initiatives are not present yet.

Throughout our conversations with USA motorsport figureheads, it was clear that there is an awareness around the introduction of alternative and sustainable fuels to motorsport competitions. There is however a lack of understanding around the technical side of the products, their components, lifecycle, and how they differ in their construction to achieve a NET Carbon Zero status.

Words like sustainable, renewable, synthetic & bio-fuel were often used interchangeably. Understanding around the synthesis or refinement of the product was lacking. Tailpipe emissions and engine tuning upgrades require further information and explanation.

With the above in mind, it is clear that the ‘Sustain’ brand must create succinct and simple messaging and storylines around the product so that stakeholders can quickly understand the product and the process that produces a sustainable fuel. Aside from a sustained PR and media campaign, leveraging the social media storytelling capabilities of USA motorsport influencers could be a valuable tool to overcome this issue.

ICE motorsport is feeling the effects of the mobility movement to Electric Vehicles. There is an anxiety amongst many competitors that their vehicles and sport has become a target in the fight against carbon emissions and that the future of ICE motorsport is uncertain. With this in mind, there is enthusiasm and support for any technologies and products that reduce the environmental impact of ICE motorsport and help to protect the future of ICE powered racing.

Organisations such as USAC who sanction an extensive range of ICE motorsport, both at professional and grassroots levels, consider sustainable fuels as an integral and complementary part of their future. Whereas the ICE powered vehicles of local and regional competitions will never be replaced by EV in similar numbers, USAC acknowledges that there is a responsibility amongst competitors, venues, championship promoters and sanctioning bodies to play their part in reducing their environmental impact. USAC are part of ACAS (6 clubs that make up an organisation that coordinates governing body duties of motorsport in the USA). ACAS includes USAC, IMSA, NASCAR, IndyCar & NHRA. The current opinion of the ACAS president is that OEM and ‘bio-fuel manufacturers’ should lead the way in terms of distribution and promotion of sustainable fuel to motorsport competitors.

Vermont Sports Car (VSC) who operate the motorsport programmes of Subaru North America are also enthusiastic regarding the role that sustainable fuels can play in the future of ICE motorsport. Subaru has not moved as quickly into the EV space as some other OEM marques and will retain an ICE motosport programme in ARA Rally for the foreseeable future. Whilst a Subaru EV is planned in the future (collaboration with Toyota), Vermont Sports Car are keen to adapt a sustainable fuel for competition and incorporate the product into their overall environmental strategy as a business and continue their overall reduction in environmental impact.

In summary, the key takeaways from our conversations with various USA motorsport stakeholders regarding the appetite for sustainable fuel are as follows:

At present there is little or no acute demand for sustainable fuels in USA motorsport generally. This could change based on specific state legislation or if a commercial partner/sponsor to a particular championship makes it a requirement.

Whilst there is an acceptance that a sustainable race fuel would be integral to safeguarding the future of ICE motorsport, at present sustainable fuel is seen as a ‘nice to have’.

Education around the product, its production, its benefits to the environment, the future of the sport, storytelling opportunities and ‘first mover advantage’ connected to commercial benefits is critical. Succinct and easy to understand facts need to be communicated effectively. Creating awareness/understanding of how sustainable fuel may answer air quality and other environmental regulations/issues that governments are trying to tackle while protecting key economic pillars in the US can provide an entry point.

Cost will always be a key point for consideration amongst grassroots competitors, many of whom can use ‘pump gas’. Professional and well supported racing teams are more accepting of moving towards a sustainable fuel.

VP Racing dominate the USA racing fuel landscape and secure exclusive supply through contingency deals with various series’ / championships. VP have yet to enter the sustainable race fuel market so the short term opportunity to capitalise in this space exists before VP Racing introduce their own sustainable race fuel.

Strengths

USA distribution and supply chain via ASPEN

Experienced staff with motorsport application experience

DAKAR and TCR experience/case study

USA office/personnel

Positive environmental impact

Weaknesses

Cost of product

Lack of knowledge and education around the science of the product

No market share/unknown brand in USA motorsport

Lack of resources in servicing a motorsport Championship

Lack of dedicated motorsport marketing department, unlike competitors (VP Racing)

Opportunities

First mover and thought leader in the market

Increasing awareness due to Indy car / Shell deal

Increasing awareness due to F1 Drop in fuel strategy

Emerging appetite for sustainable fuels in particular States - example Pacific Coast

Future-proof ICE motorsport for fans

Blank canvas to build a dedicated ‘Sustain’ strategy from sales, marketing and comms

Threats

Emerging competition in USA. P1 Fuel and VP Racing

Legislation around Electric Vehicles and H2 technologies taking preference to sustainable

Cost of components affecting the price of production

Global energy market costs

Global supply chain threats

Environmental and political threats to USA ICE motorsport and motorsport facilities

Prior to beginning our research, the following points were given by Coryton as key criteria to identify a possible entrypoint for Sustain in the USA.

Key criteria:

The supply chain to a possible Partner must be efficient and manageable.

The Partner should be ‘relatively high profile’ and capable of generating significant media attention around the switch to sustainable fuel.

The Partner should hold a desire to push ESG credentials.

Geographically, a populous location or presence of the Partner (such as California) would be desirable and/or areas where motorsport has a strong base.

The Partner should not represent a ‘major sponsorship’ investment, more so an acceptance of the product on a technical/sustainable level.

Based on the above criteria and following our research, we propose that Coryton pursue a strategic partnership with a national motorsport sanctioning body with particular focus on activating this strategic partnership through a Partner Race Series aligned with this Sanctioning Body. On this basis ROOTS. propose that the following organisations would merit further investigation as reputable partners for launching the Sustain brand in the USA.

Strategic Partner Sanctioning Body - The United States Auto Club (USAC). Race Series Partner - The American Rally Association (ARA).

Strategic partnership: USAC

USAC is the most diverse motorsport governing body in the USA. It both owns and sanctions an extensive inventory of competitions and vehicles. Known historically for short course and circle track racing, in 2008 USAC expanded dramatically, moving into circuit racing and extending their sanctioning reach into other motorsports.

USAC would provide a valuable partnership to Coryton in terms of motorsport policy, future technologies and political/sporting influence. A partnership with USAC would provide Coryton with visibility and forecast around an extensive breadth of grassroots and professional USA motorsports and early detection of those properties who would/could adapt a sustainable fuel solution in the future.

The American Rally Association is a series of USA-based stage rallies, owned and sanctioned by USAC. ARA consists of 9 large national events and 10 regional events across multiple states in the USA. The large national events attract over 100 competitors with the regional events hosting approximately 50 competitors.

Competitors in O4WD and RC2 classes at all ARA National Championship events run the official fuel specified by ARA.

For 2022, the specified ARA fuel is FIA Homologated R5.1 fuel supplied by VP. Fuel is priced at $75.00 per Pail or $681 per Drum.

For example, the 2022 100 Acre Wood Rally (National) ran 16 x O4WD Vehicles and 5 x RC2 Vehicles.

Typical O4WD Event Mileage : 300+ Miles including stage and transit.

Typical O4WD SEASON fuel consumption: 3,300 litres per Vehicle per SEASON. (Subaru team)

Average season requirement for the entire O4WD Category : 50,000 Litres approximately.

Fuel is made available for pre-purchase prior to every National event and delivered on location. Fuel is delivered to the service park by the fuel manufacturer and from there is distributed to the teams by ARA. 80% of ARA events use a centralised service park with ambitions to move ALL service parks to a centralised model in the near future.

ARA is the premium stage rally series in the USA. It features high profile drivers such as Brandon Semenuk, Ken Block, and Travis Pastrana and is heavily supported by brands such as Subaru North America, Red Bull, Ford Performance, Hoonigan Racing, DirtFish, and Cooper Tire.

Whilst ARA doesn’t possess an extensive terrestrial broadcast package, through its competitors and sponsors it does present a valuable social/ digital media platform which can be leveraged for engaging storytelling and content.

Visually, ARA presents a motorsport image consistent with the visual references of Sustain - vehicles performing in synergy with the natural environment.

ARA provides access to a variety of internal combustion vehicles, from classic Mark II Ford Escorts to works Subaru Impreza. This presents Sustain with an opportunity to show how sustainable fuels can perform across a wide range of vehicles.

In addition to the action sports superstars like Pastrana and Semenuk, ARA also attracts high profile up and coming talent like Lia Block, daughter of Rally, Rallycross and Gymkhana legend Ken Block.

Sustain has already proven through the Dakar relationship with Prodrive that off road motorsport, rally and endurance can provide a suitable platform to both communicate and validate the Sustain product. A partnership with ARA would extend that brand position and can provide complementary activation and communication opportunities to Dakar.

ARA stages both national and regional events throughout the USA. From New England to Oregon and California to Texas, ARA Rallies take place in a variety of locations and conditions.

Washington State and Oregon feature heavily across the ARA schedule with California now coming on to the calendar from 2022 as a regional event. A partnership with ARA could present a platform for activating the product in the Pacific North West, a region that we have already identified as supportive and influential to renewable fuels through the Pacific Coast Collaborative.

ARA have previously taken a leading role with Sustainable Fuels and came close to agreeing a supply deal with P1 Racing Fuels. Ultimately the deal did not proceed due to concerns over price, approximately $30+ per gallon, which ARA felt they would need to subsidise. P1 Racing Fuels do not have an efficient supply chain nor distribution service in the USA, so a brand with reliable service supply routes in America should be in a stronger position to build a sustainable fuel partnership with ARA and their competitors and teams.

Throughout our conversations with USA Motorsport figureheads, there was a consistent concern that the technology and science behind the sustainable fuel product would not be understood by the majority of USA grassroots competitors. It was felt that a simplified message around the environmental merits and performance capability of the product would need to be created and consistent across all messaging within the US motorsport community.

Key points for consideration and explanation:

Meaning & explanation of net carbon zero fuel. Sustainable versus renewable fuels.

Tailpipe emissions from a sustainable fuel. Components of Sustain (Biomass etc).

Cost comparison.

Effects on engine internals. Requirements to adapt engine tuning.

Presenting and communicating this information could be leveraged through brand ambassadors and sponsorship, targeted social media campaigns, sustained motorsport PR, paid digital advertising.

Should Coryton have interest in the above-mentioned opportunities and see merit in exploring ARA Rally and USAC as viable partnerships to launch the Sustain brand in the USA, we would propose the following as next steps in this project.

Define a scope of partnerships and agree key metrics or performance indicators that are most important in the short, medium and long term for Coryton. These can include fuel supplier agreements supported by a commercial rights negotiation/agreement.

Map out a strategy for partnership activation, amplification, communication, and execution and agree how Coryton can best leverage the partnership to achieve KPI’s and return on investment.

Confirm Corytons presence in the USA in terms of administrative contacts, headquarters and supply chain to USA motorsport customers.

Boxall, Jake. “How Formula E helped change motorsport.” Motorsport.com, 15 May 2022.

https://www.motorsport.com/formula-e/news/how-formula-e-helped-change-motorsport/10304779/.

Lutsey, Nic, and Peter Slowik. “U.S. states and cities take responsibility on clean cars.” International Council on Clean Transportation, 21 August 2018.

https://theicct.org/u-s-states-and-cities-take-responsibility-on-clean-cars/.

Hijazi, Jennifer. “States Adopt California Car Rules Amid National Standards Debate.” Bloomberg Law, 26 March 2021.

https://news.bloomberglaw.com/environment-and-energy/states-adopt-california-carrules-amid-national-standards-debate.

“Low Carbon Fuel Standard | California Air Resources Board.” California Air Resources Board.

https://ww2.arb.ca.gov/our-work/programs/low-carbon-fuel-standard/about.

“latest news and company stories.” Phillips 66, 11 May 2022.

https://www.phillips66.com/newsroom/220511-rodeo_final_investment_decision/.

“U.S. Renewable Energy Factsheet | Center for Sustainable Systems.” Center for Sustainable Systems.

https://css.umich.edu/publications/factsheets/energy/us-renewable-energy-factsheet.

“Americans now use more energy from renewable sources than from coal.” USA Facts, 26 March 2021.

https://usafacts.org/articles/coal-usage-energy-mining-jobs/?utm_source=usnews&utm_medi- .

Walsh, Fergal. “Local Miami economy boosted by $350m following 2022 grand prix.”

Motorsport Week, 27 July 2022.

https://www.motorsportweek.com/2022/07/27/local-miami-economy-boosted-by350m-following-2022-grand-prix/.

“Indy 500 is ‘great for our economy,’ IMS president says ahead of Sunday’s race.” Yahoo Finance, 27 May 2022.

https://finance.yahoo.com/video/indy-500-great-economy-ims-201040661.html.

Punsalang, Enrico. “VP Racing Fuels Is Developing Biofuels With Renewable Components.” RideApart, 28 December 2021.

https://www.rideapart.com/news/557460/vpracing-biofuels-under-development/.

“WEC: TotalEnergies to debut renewable fuel at Sebring.” FIA, 15 March 2022. https://www.fia.com/news/wec-totalenergies-debut-renewable-fuel-sebring.

Zirm, Sandra. “Super GT Championship introduces 100% renewable ETS Racing Fuels from 2023.” HCS Group, 13 June 2022.

https://www.h-c-s-group.com/super-gt-championship-introduces-100-renewable-ets-racing-fuels-from-2023-percent-renewable-ets-racing-fuels/.

“Americans Divided Over Direction of Biden’s Climate Change Policies.” Pew Research Center, 14 July 2022.

https://www.pewresearch.org/science/2022/07/14/americans-divided-over-direction-of-bidens-climate-change-policies/.

Richards, Giles. “Sebastian Vettel reveals climate crisis fears influenced his F1 retirement.” The Guardian, 28 July 2022.

https://www.theguardian.com/sport/2022/jul/28/four-times-world-champion-sebastian-vettel-to-quit-formula-one-at-end-of-season.

“Environmental accreditation programme | Federation Internationale de l’Automobile.” FIA.

https://www.fia.com/environmental-accreditation-programme.

“Americans Divided Over Direction of Biden’s Climate Change Policies.” Pew Research Center, 14 July 2022.

https://www.pewresearch.org/science/2022/07/14/americans-divided-over-direction-of-bidens-climate-change-policies/.

“Use of hydrogen - U.S. Energy Information Administration.” EIA.

https://www.eia.gov/energyexplained/hydrogen/use-of-hydrogen.php.

Brown, Alex. “Electric Cars Will Challenge State Power Grids.” The Pew Charitable Trusts, 9 January 2020.

https://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2020/01/09/electric-cars-will-challenge-state-power-grids.

“Alternative Fuels Data Center: Biodiesel Vehicle Emissions.” Alternative Fuels Data Center.

https://afdc.energy.gov/vehicles/diesels_emissions.html.

Hatton, Gemma. “Sustainable fuels in motorsport and high-performance applications.” Professional Motorsport World, 8 March 2022.

https://www.pmw-magazine.com/features/sustainable-fuels-in-motorsport-and-high-performance-applications.html.

“FIA WRC switches to 100% sustainable fuel from 2022 – P1 Fuels.” P1 Fuels, 5 September 2021.

https://www.p1fuels.com/fia-wrc-switches-to-100-sustainable-fuel-from-2022/.

“Shell and IndyCar Will Introduce Renewable Race Fuel for NTT IndyCar Series in 2023.” Shell Global, 27 May 2022.

https://www.shell.com/business-customers/lubricants-for-business/news-and-media-releases/2022/shell-and-indycar-will-introduce-renewable-race-fuel-for-ntt-ind. html.

“Sustainability | IMSA.” IMSA, https://www.imsa.com/imsa-sustainability/.

“VP R5.1.” VP Racing Fuels, https://vpracingfuels.com/product/vp-r-5-1/?c=223&.

100AW Performance Rally Group, https://100aw.org.

Nitro Rallycross / Thrill one

Brett Clarke Chip Pankow Chief Revenue officer & General managerICE Supercar category car is struggling in light of EV introduction.

ICE RX Supercars are too expensive to run for support category competitors.

P1 provide a biofuel for the NRX Next support category and Supercar support category but P1 is not a favourable supplier due to supply chain efficiencies.

A Side-By-Side (SxS) ICE category is being introduced to the overall events in the USA in 2022. NRX is keen to communicate a sustainable fuel as part of their overall environmental story.

At the moment it’s a marketing tool and sponsorship will be an important point of leverage for motorsport to adopt the technology. JR would like to ‘do the math’ on how using sustainable fuels could help him offset the carbon footprint of his programmes (burning tyres etc).

Chris Yandell Chief Marketing OfficerSustainable fuel is not a must-have at the moment but is a nice talking point. Education around the blend will be important and it must become an important part of the conversation around the future of ICE motorsport.

Indycar is coming to the end of the ICE era - OEM is reluctant to invest further in Engines. 2025 should signal the Hybrid intro - Chevy / Honda / Toyota are leading it and will likely dictate the energy policy of the championship.

USAC

Scot Elkins

Circuits are more concerned with noise pollution than air pollution, however, feels that every venue should be interested to look at a sustainable fuel option.

USAC are part of ACAS - 6 clubs that make up an FIA-type governing body. Includes: USAC, IMSA, NASCAR, IndyCar, NHRA

ACAS president is of the opinion that OEM and Bio Fuel manufacturers should lead the way.

There is a lot of mixed messaging generally around sustainability in motorsports.

Some FD drivers are using Ethanol but 50-70% are using E85. Ignite fuels are pretty aggressive on their pricing.

In 2023 the FIA/CIK are introducing a P1 biofuel to karting. The main problem is that it’s X2 the price - karting is already under pressure to reduce costs. Karting in the USA is an unusual market. Not as refined as Europe. Dirt track karting is very popular but very ‘rural’. Those competitors have very little awareness or appetite for biofuels or nett zero carbon competitions.

Every track wants a fuel deal and should be receptive to a more sustainable alternative due to local community pressures.

Tracks predominantly need fuel supply for OEM testing, track days, and racing schools.

EVERYONE is using VP Racing Fuels. VP sponsorship deals provide race series’ with a profit margin on the sale of gas to competitors - this margin equates to the value of the sponsorship.

Ford

Canadian Motorsport is under pressure from green initiatives at local and federal levels. GP3R already has an environmental policy in place - GreenP3R. In 2022 GP3R subsidised the cost of a local championship Sustainable Fuel (P1) for their event.

Sustainable fuels don’t feature in Ford’s future - from 2025/26 the product range is predominantly B.EV.

Customers for fuel would be quite sensitive to price and feel that the sustainable fuel price would be unattainable. Most circuits have multi-year exclusive contracts/deals in place with fuel partners - the best opportunity for a new fuel brand would be with street circuits that are more open to one-off deals.

They have looked into Sustainable fuel in recent years and got pretty close. (P1)

Main issue was price @ $30+ per gallon which ARA would have to subsidise

Would like to pursue sustainable fuel in the future if made sense commercially.

Only top tier series will care about moving towards a sustainable fuel. Connect with SEMA which is very active in Washington DC and has also started to carry out emission testing for aftermarket parts. SEMA could be partners in lobbying particular lawmakers and states.

Grand Prix Trois Rivieres Dominic Fugere General manager Performance