The 202 -202 Section 125 Cafeteria Plan year begins 0 /01/2023 and ends 08/31/202 . All benefits elected during the annual open enrollment will be effective 0 /01/2023.

New Hire Eligibility - e l yee l y re eligible r be e it t e t y t e t ll wi g y r t rt te t ele t y r be e it y r y r te ire y t ele t y r benefits within this period you will not be eligible to enroll in benefits until the following open enrollment period.

anging ene i e i ns After the annual open enrollment ends you will not be eligible to ma e a change until the ne t annual open enrollment period unless you e perience a ualifying life event. Some e amples of ualifying life events are birth death marriage divorce adoption and loss of coverage by dependents. Appropriate documentation must be provided for life events and all changes must be made within 0 days of the event.

ide s r t e 2023 202 an ea

edical Plan - Allegiance enefit Plan anagement C A Subsidiary

e i e en ans The district offers supplemental retirement and deferred compensation plans. The mni roup is the third party administrator that manages the district s plans. To setup a new plan ma e changes to a current plan or re uest a loan distribution please contact The mni roup.

an ene i and n en n a i n

le ible e i g N ti l e e

er i e S e i l r rt e t l Humana i bility The H rt r H it l e ity The H rt r i tri t i r i e er r i r riti l ll e i e t r e etlife

it

1

If you should have any questions regarding your supplemental benefits, please contact ployee Bene its er ices roup o ice at 0- 0 -5100 For questions regarding Medical, please contact the district or BC directly.

CONTACT INFORMATION 202 -202

MEDICAL……………………………… … ……..…..page(s) 5-14 1 0 1 00 2 22 …………… ……………………………….page 29-32 1 00 2 0 0 ...page(s)33-34 Phone: 1-800 2 22 Website: www. .com Humana.………………................................................................. .........page(s) 15-20 1 00-233-4013 Humana .........page(s) 21-26 Phone: 1 00 0 00 1 ........................................page(s) 35-43 Phone: 1-800 2 22 Website: www. .com 1 12 - page(s) 44-46 Phone: 1-800- 2 22 Website: www. .com .... s(s) 27-28 1 00 2 2

TABLE OF CONTENT S

CONTACT INFORMATION 202 -202 47--51 Phone: 1- 00 2 2 Websi te: www. .com 52 Phone: 1- 0 Website: www. .com …………………………………… ……........…… …page(s) 53-55 Phone: 1- 0 Website: www. .com ............................................................................page(s) 58-64 Phone: 1-8 0 Website: ........ page(s)65-68 0 221 21 0 0 221 200 56-58 1 00 1 00 1 00 69-70 1 00 22 0 71 1 0 3 LEAVE AND ABSENCES POLICY…..…………………………………………………………………………pages(s)72-73

n en ns i ns THEbenefitsHUB

i e ess To access your employer online enrollment site T benefits you can login to the following website www.mybenefitshub.com comalisd

se na e The i s si a a e s of your as na e followed by the i s e e of your i s na e followed by the as digits of your SS ample mployee ame - obert Smith SS 12 - 5- ser ame smithr

e a ass d e e as a e cluding Punctuation follow by the as digi s for your

ass d ese mployees will prompted to update the password once you enter the site.

0 Phone 0 0 -5100

5 anda Street

4

2

ew raunfels Te as 1

Comal ISD

Which Plan is Right for You?

Questions to Consider

• How much coverage do I need?

• How often do I access health care?

• Are my doctors innetwork?

• Do I prefer higher premiums or pay as I go?

• Do I have regular prescriptions? .

Employee Health Benefits

2023-24

5

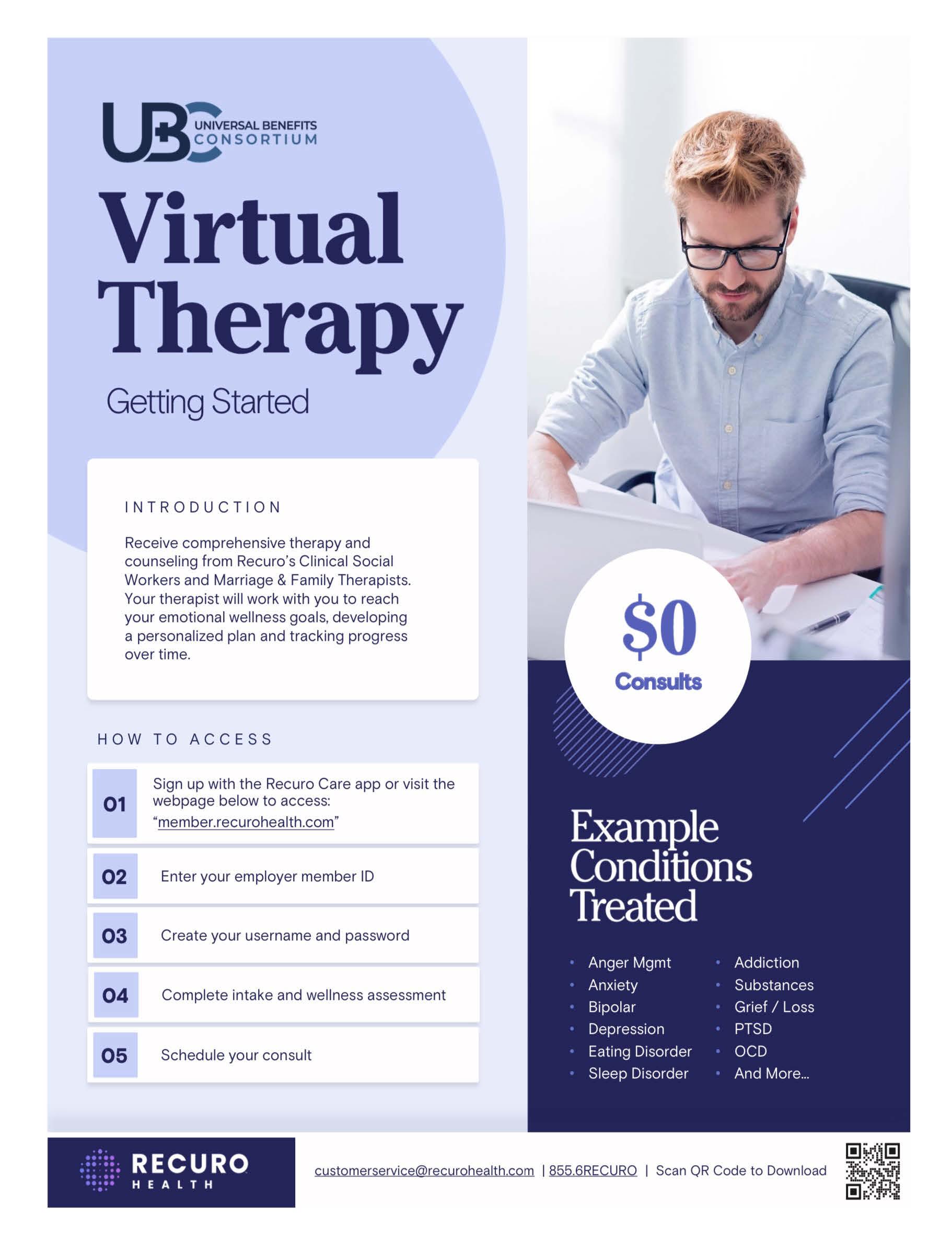

Benefits for UBC Members

The Cigna Open Access Plus Network provides you with access to healthcare professionals nationwide to address your health concerns.. This UBC plans offer a range of coverage options to best meet the needs of you and your family. This provides you a great deal of flexibility and the option to save significantly on your health insurance premiums.

Choice and Control

The Cigna Open Access Plus Network

•

•

•

Need Assistance? help@UBC-Benefits.com

Cigna Nationwide Network with over 1 million healthcare professionals

•

No referral necessary to see a specialist

Lower Out-of-Pocket maximums

Select plans offer In and Out of Network

6

Benefits

Plan Summary

Wellness Benefits at No Extra Cost Things to Know • NationwideNetwork • No PCP Referrals • HSA Compatible Plan available Monthly Premiums Employee Only Employee and Spouse Employee and Child(ren) Employee and Family $0 $418 $146 $597 HD/HSAPlan • Lowest Premiums • Zero cost for Employee Only Coverage • Nationwide Network • No PCP referrals • Integrated Drug Deductible • Compatible with a Health Savings Account Mid Plan • Low Deductibles • Copays for doctor visits • Nationwide Network • No PCP referrals • No Drug Deductible • Free Generic Drugs LowPlan • Low Premiums • Copays for doctor visits • Nationwide Network • No PCP referrals • No Drug Deducitble • Free Generic Drugs HighPlan • Lowest Deductibles and Out of Pocket Maximums • Copays for doctor visits • Nationwide Network • No PCP referrals • No Drug Deductible • Free Generic Drugs $307 $1,192 $674 $1,537 $216 $983 $536 $1,284 $563 $1,763 $1,053 $2,231 $0 after Deductible $0 after Deductible $0 $30 Copay $60 Copay $0 $30 Copay $60 Copay $0 $30 Copay / 50% after Deductible $60 Copay / 50% after Deductible $0 $0 after Deductible $0 after Deductible $75 Copay $300 Copay + 30% of balance $75 Copay $300 Copay + 30% of balance $75 Copay / 50% after Deductible $300 Copay + 20% of balance Integrated with Medical $0 after Deductible 30% Retail / $125 Mail Order (after Ded) 30% Retail / $125 Mail Order (after Ded) 50% up to a max of $1500 None $0 Retail and Mail Order 30% Retail / $125 Mail Order 30% Retail / $125 Mail Order 50% up to a max of $1500 None $0 Retail and Mail Order 30% Retail / $125 Mail Order 30% Retail / $125 Mail Order $50% up to a max of $1500 None $0 Retail and Mail Order 30% Retail / $125 Mail Order 30% Retail / $125 Mail Order 50% up to a max of $1500 In Network Only $6,450/$12,900 0% after Deductible $8,150/$16,300 Nationwide No In Network Only $2,000/$4,000 30% after Deductible $6,500/$13,000 Nationwide No In Network Only $4,000/$8,000 30% after Deductible $6,600/$13,200 Nationwide No In / Out of Network $1,500/$3,000 / $5,000/$10,000 20% / 50% after Deductible $4,000/$8,000 / $10,000/$20,000 Nationwide No Doctor Visits Primary Care Specialist Recuro 24/7 Virtual Acute & Behavioral Immediate Care Urgent Care Emergency Care Prescription Drugs Drug Deductible Generics (30 day Supply/90 day supply) Preferred Brand Non-Preferred Brand Specialty Plan Features Type of Coverage Individual / Family Deductible Coinsurance Individual / Family Maximum Out-of-Pocket Network Primary Care Provider (PCP) Required

2023-24 UBC Rate Sheet • FreeRecuro24/7 VirtualAcute& BehavioralVisits • Zero cost Employee Only coverage available • Low Cost Prescription Drugs $0 $0 $0 $0 Recuro 24/7 Virtual Visits *after$420DistrictContribution 7

FINDING A DOCTOR IN OUR DIRECTORY IS EASY

Is your doctor or hospital in your plan’s Cigna network? Cigna’s online directory makes it easy to find who (or what) you’re looking for.

SEARCH YOUR PLAN’S NETWORK IN FOUR SIMPLE STEPS

Step 1

Go to Cigna.com, and click on “Find a Doctor” at the top of the screen. Then, under “How are you Covered?” select “Employer or School.”

Step 2

Change the geographic location to the city/state or zip code you want to search. Select the search type and enter a name, specialty or other search term. Click on one of our suggestions or the magnifying glass icon to see your results.

Step 3

Answer any clarifying questions, and then verify where you live (as that will determine the networks available).

Step 4

Optional: Select one of the plans offered by your employer during open enrollment. (OAP) Network Open Access Plus

That’s it! You can also refine your search results by distance, years in practice, specialty, languages spoken and more. Search first. Then choose Cigna.

There are so many things to love about Cigna. Our directory search is just the beginning.

After you enroll, you’ll have access to myCigna.com – your one-stop source for managing your health plan, anytime, just about anyplace. On myCigna.com, you can estimate your health care costs, manage and track claims, learn how to live a healthier life and more.

Questions? Call 1-800-Cigna24

Offered by: Cigna Health and Life Insurance Company, Connecticut General Life Insurance Company or their affiliates.

Providers and facilities thatparticipatein theCignanetwork are independent practitionerssolely responsible forthe treatmentprovided totheir patients.Theyare notagentsof Cigna. Productavailability may vary by location andplantypeandis subject to change. All group health insurance policiesandhealthbenefitplans containexclusions and limitations. For costs anddetailsof coverage, see your plan documents.

All Cigna products and services are provided exclusivelybyorthrough operatingsubsidiaries of CignaCorporation,includingCignaHealth andLife InsuranceCompany(CHLIC),Connecticut General Life Insurance Company, CignaBehavioralHealth, Inc.,and HMO or service company subsidiariesof CignaHealthCorporation, including CignaHealthCare of Arizona,Inc.,CignaHealthCare of California, Inc., CignaHealthCare of Colorado,Inc.,CignaHealthCare of Connecticut, Inc., CignaHealthCare of Florida,Inc.,CignaHealthCare of Georgia, Inc., CignaHealthCare of Illinois,Inc., CignaHealthCare of Indiana,Inc.,CignaHealthCare of St.Louis, Inc., CignaHealthCare of NorthCarolina, Inc., CignaHealthCare of NewJersey,Inc.,CignaHealthCare of SouthCarolina,Inc., CignaHealthCare of Tennessee,Inc.(CHC-TN), and CignaHealthCare of Texas, Inc.Policyforms:Medical: OK - HP-APP-1 etal., OR - HP-POL38 02-13, TN - HP-POL43/HC-CER1V1 etal. (CHLIC); GSA-COVER, et al. (CHC-TN). The Cigna name,logo,andotherCignamarksareownedbyCignaIntellectualProperty, Inc.

880087 g 08/19 © 2019 Cigna. Some content provided under license.

8

What is the most cost-effective way to access care after hours?

- Compare YourOptions:

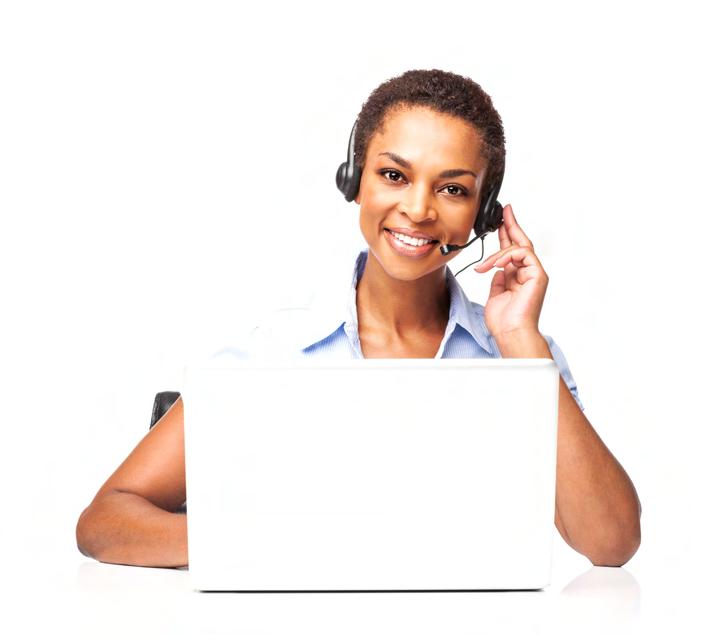

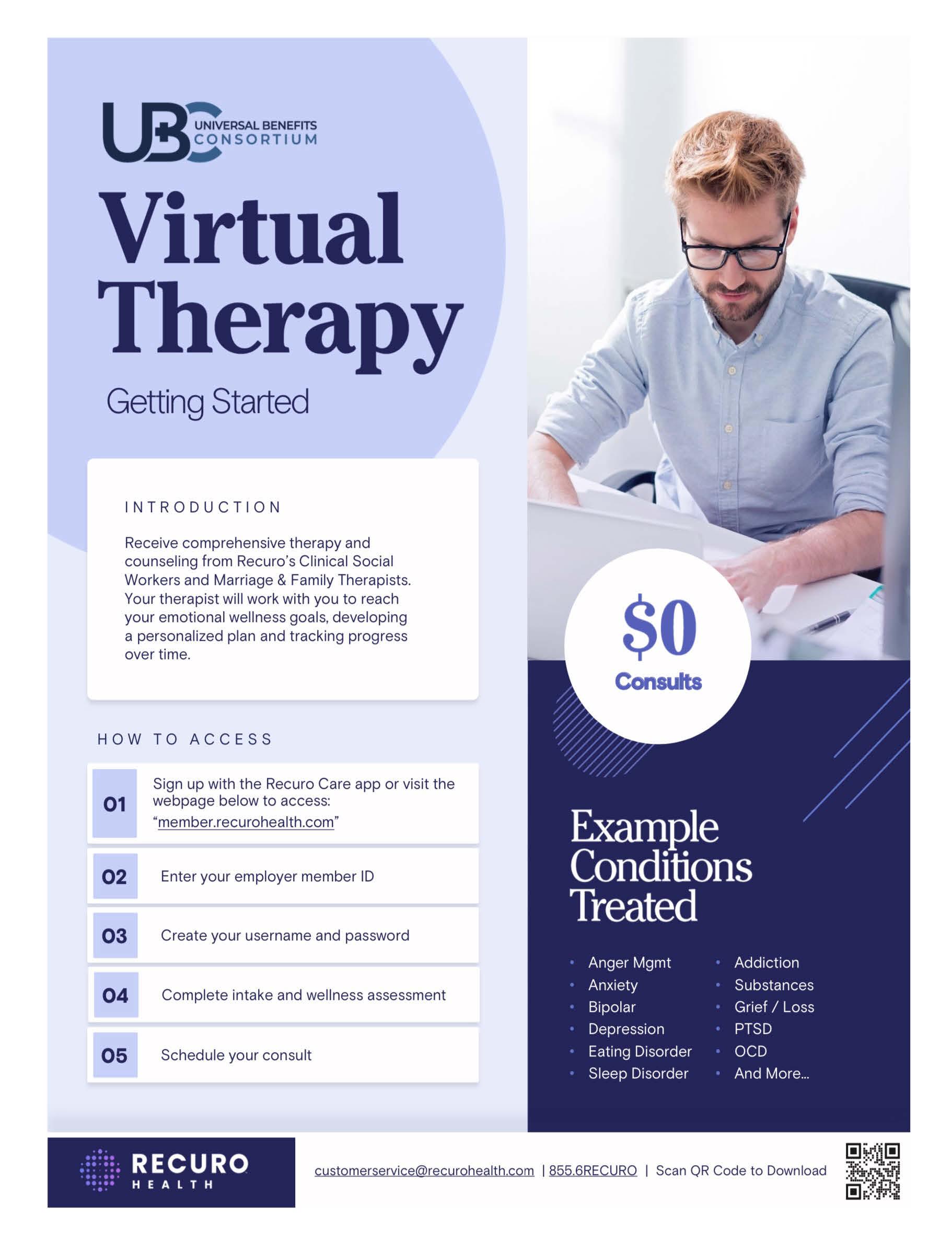

Recuro Health - Telemedicine

Cost:$0

Your employer offers you and your family membersa Telemedicine service Available 24/7. Board Certified doctors can diagnose, recommend treatment and prescribemedication viaphone or video from anywhere -your home, office or while onvacation.

855-673-2876 member.recurohealth.com

Average Cost:$175 13

Urgent Care Centers

At these walk-in medical clinics, doctors and nurses provide immediate care for non-life-threatening illnesses and injuries (sore throat, ear infections, stomach pains, minor cuts, COVID tests, etc.) Urgent care centers often cost much less than going to the ER and may provide much faster care. Many offer evening, weekend, and 24-hour services. Appointments may be needed.

Hospital Emergency Rooms

Average Cost:$2,000

Usually located in ahospital, an ER provides immediate, emergency care for serious and lifethreatening illnesses andinjuries (heart attack, major broken bones, allergic reactions, shortness of breath, etc.)

Free-Standing Emergency Rooms

Average Cost:$4,000

Avoid these if possible. These centers fulfill the same need as a hospital ER, but typically do not contract, and are not in network. The cost at these facilities is much higher for both you, and the medical plan.

If the facility is not attached to a hospital, and has "EMERGENCY" in the name, it is a Free-Standing Emergency Room.

When you or someone you know has alife-threatening medical problem, call 911immediately.

LB UNIVERSAL BENEFITS co J ,< u ,.,;

9

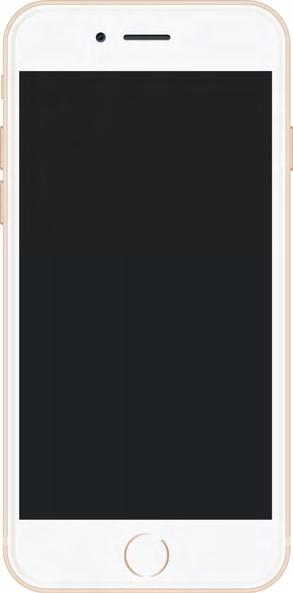

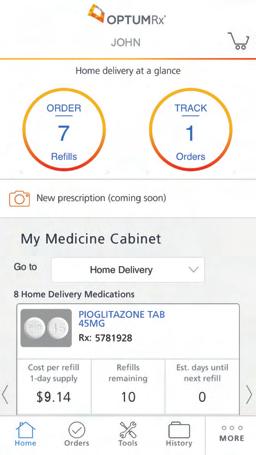

The OptumRx app

The OptumRx® App makes the online pharmacy experience as simple as possible. You can easily:

• Refill or renew a home delivery prescription

• Transfer a retail prescription to home delivery

• Find drug prices and lower-cost options

• View your prescription claim history or order status

• Locate a pharmacy

• Access your ID card, if your plan allows

• Set up refill reminders

• Track your order

Over Download the OptumRx App now from the Apple® App Store or Google Play™

10

Discover the convenience of home delivery from OptumRx

Home delivery is safeand reliable, and you get:

• A three-month supply ofyour medication, saving you time and possiblymoney

• Free standard shipping

• Phoneaccessto pharmacists 24 hours a day, 7 daysa week

• Helpful reminders letting you know when to take or refillyour medications

It’s easy tosign upandstart saving. Just choose oneofthe optionsbelow:

• Ask your doctor to send an electronic prescription to OptumRx.

• Visit optumrx.com or use the OptumRx app. From there, you can fill new prescriptions, transfer others to home delivery and more.

• Call the toll-free number on your member ID card to speak to a customer service advocate.

Manage your medication from your mobile phone.

Download the OptumRx® app today.

All Optum trademarks and logos are owned by Optum, Inc. All other brand or product names are trademarks or registered marks of their respective owners. © 2018 Optum, Inc. All rights reserved. 64801A-062018

11

Member Services

Quick Reference Card

Member Services for Member Support

RxBenefits' experienced, high-performing call center team delivers a superior level of service.

Availability

Member Services assists you with questions or concerns regarding your pharmacy benefits such as:

Benefit Details

Claims Status

Pharmacy Network

Coverage Determination/Inquiries

Mail and Specialty Scripts

Pharmacy Information

800.933.0765 or CustomerCare@rxbenefits.com

7:00 AM to 8:00 PM CT Monday – Friday

Key Details on Common Issues

Pharmacy Benefits & Coverage Inquiries

As plan members, you and your dependents can call for questions related to:

Coverage Questions

Clinical Programs

Copay

Deductible Issues

Paper Claims

Submit prescription receipts along with your specific PBM's claim form to be processed for direct reimbursement. Claims should be mailed to the address listed on your ID card or fax them to RxBenefits at 205.449.5225.

Copyright © 2020 RxBenefits, Inc. All Rights Reserved. 12

lB�ERSALBENEFITS CONSORTIUM,.,,. Virtual Urgent Care GettingStarted INTRODUCTION Access board-certified physicians 24/7, 365 days a year for urgent medical needs. Doctors will discuss your symptoms, confirm a diagnosis, and prescribe any needed medication. Video and telephone-based visits are available, with an average wait time of just ten minutes. Consult Fee: $0 HOW TO ACCESS Sign up with theRecuroCare app or visit the 01 webpage below to access: "member.recurohealth.com" 02 Enter your employer member ID 03 Create your username and password 04 Complete your medical history 05 Schedule your consult 'Registering youraccount isnot required to use theservice, you can call 855.6RECURO anytime for24/7 access to doctors. Ex pie Conditions Treated Acne/Rash Insect Bites Allergies Nausea Cold/ Flu Pink Eye GI Issues Respiratory Ear Problems UTl's Fever And More... ,::::;. RECURO customerservice@recurohealth.com I 855.6RECURO I Scan OR Code to Download •·;•• HEALTH 13

14

Preventiveservices

• Routineoralexaminations(3peryear)

• Bitewingx-rays(2filmsunderage10,upto4films ages10andolder)

• Routinecleanings(3peryear)

• Periodontalcleanings(4peryear)

• Fluoridetreatment(1peryear,throughage16)

• Sealants(permanentmolars,throughage16)

• Spacemaintainers(primaryteeth,throughage15)

• OralCancerScreening(1peryear,ages40and older)

Basicservices

• Emergencycareforpainrelief

• Amalgamfillings(1pertoothevery2years, compositeforanterior/frontteeth)

• Oralsurgery(toothextractionsincluding impactedteeth)

• Stainlesssteelcrowns

• Harmfulhabitappliancesforchildren(1per lifetime,throughage14)

• Periodontics(scaling/rootplaningandsurgery 1perquadrantevery3years)

• Endodontics(rootcanals1pertoothperlifetime and1re-treatment)

Majorservices

• Crowns(1pertoothevery5years)

• Inlays/onlays(1pertoothevery5years)

• Bridges(1pertoothevery5years)

• Dentures(1pertoothever5years)

• Denturerelines/rebases(1every3years,following 6monthsofdentureuse)

• Denturerepairandadjustments(following 6monthsofdentureuse)

• ImplantRelatedServices(crowns,bridges,and dentureseachlimitedto1pertootheveryfive years.Coveragelimitedtoequivalentcostofa non-implantservice.Implantplacementitselfisnot covered.)

SGB0028A TEXAS HumanaDentalTraditionalPlusComalISD TXHLJ4QEN01/22 15 1-800-233-4013|Humana.com Ifyouusean IN-NETWORKdentist Ifyouusean OUT-OF-NETWORKdentist Calendar-yeardeductible (excludesorthodontiaservices) Individual $50 Family $150 Individual $50 Family $150 Deductibleappliestoallservicesexcludingpreventiveservices. Calendar-yearannualmaximum (excludesorthodontiaservices) $1,000+extendedannualmaximum(seesectionbelow)

100%nodeductible 100%nodeductible

80%afterdeductible80%afterdeductible

x

0%afterdeductible 0%afterdeductible

xs[pspace

x

Orthodontiaservices

Membersmayreceiveadiscountonnon-coveredservicesofup to20%.Membersmaycontacttheirparticipatingproviderto determineifanydiscountsareavailableonnon-covered services.

Non-participatingdentistscanbillyouforchargesabovetheamountcoveredbyyourHumanaDentalplan.Toensure youdonotreceiveadditionalcharges,visitaparticipatingPPONetworkdentist.Membersandtheirfamiliesbenefit fromnegotiateddiscountsoncoveredservicesbychoosingdentistsinournetwork.Ifamembervisitsaparticipating networkdentist,thememberwillnotreceiveabillforchargesmorethanthenegotiatedfeeforcoveredservices.Ifa memberseesanout-of-networkdentist,coinsurancewillapplytotheusualandcustomarycharge.Out-of-network dentistsmaybillyouforchargesabovetheamountcoveredbyyourdentalplan.

Waitingperiods

Employer-sponsoredfunding: 5+enrolledemployees

1 Lateapplicantsnotallowedwithopenenrollmentoption.

2 Waitingperiodsdonotapplytoendodonticorperiodonticservicesunlessalateapplicant.

$38.82

$55.34 Family: $76.70

*Thisisnotasubstituteforaquote.RatesmustbeapprovedbyHumanaDentalunderwriting.

SGB0028A TXHLJ4QEN01/22 16 1-800-233-4013|Humana.com Questions? Simplycall1-800-233-4013tospeakwith afriendly,knowledgeableCustomerCare specialist,orvisit Humana.com . TEXAS HumanaDentalTraditionalPlusIfyouusean IN-NETWORKdentist Ifyouusean OUT-OF-NETWORKdentist ExtendedAnnualMax Additionalcoverageforpreventive and basic servicesafterthecalendar-yearmaximumismet (excludesorthodontia) 30% 30%

Enrollmenttype PreventiveBasicMajor Orthodontia Initialenrollment,openenrollment No No No Notavailable andtimelyadd-on Lateapplicant 1,2 No 12months12monthsNotavailable

Monthlyrates*(12deductionsperyear) Employee:

Employee+spouse:

$26.24

Employee+child(ren):

x

Preventiveservices

• Routineoralexaminations(3peryear)

• Bitewingx-rays(2filmsunderage10,upto4films ages10andolder)

• Routinecleanings(3peryear)

• Periodontalcleanings(4peryear)

• Fluoridetreatment(1peryear,throughage16)

• Sealants(permanentmolars,throughage16)

• Spacemaintainers(primaryteeth,throughage15)

• OralCancerScreening(1peryear,ages40and older)

Basicservices

• Emergencycareforpainrelief

• Amalgamfillings(1pertoothevery2years, compositeforanterior/frontteeth)

• Oralsurgery(toothextractionsincluding impactedteeth)

• Stainlesssteelcrowns

• Harmfulhabitappliancesforchildren(1per lifetime,throughage14)

• Periodontics(scaling/rootplaningandsurgery 1perquadrantevery3years)

• Endodontics(rootcanals1pertoothperlifetime and1re-treatment)

Majorservices

• Crowns(1pertoothevery5years)

• Inlays/onlays(1pertoothevery5years)

• Bridges(1pertoothevery5years)

• Dentures(1pertoothever5years)

• Denturerelines/rebases(1every3years,following 6monthsofdentureuse)

• Denturerepairandadjustments(following 6monthsofdentureuse)

• Implants(crowns,bridges,anddentureseach limitedto1pertootheveryfiveyears)

ExtendedAnnualMax

Additionalcoverageforpreventive,basic,andmajor servicesafterthecalendar-yearmaximumismet (excludesorthodontia)

SGB0028A TEXAS HumanaDentalTraditionalPlusComalISD TXHLJ4QEN01/22 17 1-800-233-4013|Humana.com Ifyouusean IN-NETWORKdentist Ifyouusean OUT-OF-NETWORKdentist Calendar-yeardeductible (excludesorthodontiaservices) Individual $50 Family $150 Individual $50 Family $150 Deductibleappliestoallservicesexcludingpreventiveservices. Calendar-yearannualmaximum (excludesorthodontiaservices) $1,250 +extendedannualmaximum(seesectionbelow)

100%nodeductible 100%nodeductible

80%afterdeductible80%afterdeductible

x

50%afterdeductible50%afterdeductible

xs[pspace

30% 30%

Orthodontiaservices

Childorthodontia-Coverschildrenthroughage18.Planpays 50percent(nodeductible)ofthecoveredorthodontiaservices, upto:$1,000lifetimeorthodontiamaximum.

Non-participatingdentistscanbillyouforchargesabovetheamountcoveredbyyourHumanaDentalplan.Toensure youdonotreceiveadditionalcharges,visitaparticipatingPPONetworkdentist.Membersandtheirfamiliesbenefit fromnegotiateddiscountsoncoveredservicesbychoosingdentistsinournetwork.Ifamembervisitsaparticipating networkdentist,thememberwillnotreceiveabillforchargesmorethanthenegotiatedfeeforcoveredservices.Ifa memberseesanout-of-networkdentist,coinsurancewillapplytotheusualandcustomarycharge.Out-of-network dentistsmaybillyouforchargesabovetheamountcoveredbyyourdentalplan.

Waitingperiods

Employer-sponsoredfunding: 5+enrolledemployees

1 Lateapplicantsnotallowedwithopenenrollmentoption.

2 Waitingperiodsdonotapplytoendodonticorperiodonticservicesunlessalateapplicant.

Monthlyrates*(12deductionsperyear)

Employee: $42.72

Employee+spouse: $67.96

Employee+child(ren): $93.22

Family: $133.02

*Thisisnotasubstituteforaquote.RatesmustbeapprovedbyHumanaDentalunderwriting.

SGB0028A TXHLJ4QEN01/22 18 1-800-233-4013|Humana.com Questions? Simplycall1-800-233-4013tospeakwith afriendly,knowledgeableCustomerCare specialist,orvisit Humana.com . TEXAS HumanaDentalTraditionalPlusX

Enrollmenttype PreventiveBasicMajor Orthodontia Initialenrollment,openenrollment No No No No andtimelyadd-on Lateapplicant 1,2 No 12months12months12months (24monthsfor5-9

enrolledemployees)

Feelgoodaboutchoosing aHumanaDentalplan

Makeregulardentalvisitsapriority

Regularcleaningscanhelpmanageproblemsthroughout thebodysuchasheartdisease,diabetes,andstroke.*

YourHumanaDentalTraditionalPreferredplanfocuses onpreventionandearlydiagnosis,providingthreeroutine cleanings,orfourperiodontalcleanings,alongwiththree routineperiodicexamspercalendaryear.

*www.perio.org

GotoMyDentalIQ.com

Takeahealthriskassessmentthatimmediately ratesyourdentalhealthknowledge.You'llreceivea personalizedactionplanwithhealthtips.Youcanprint acopyofyourscorecardtodiscusswithyourdentistat yournextvisit.

x Tipstoensureahealthymouth:

• Useasoft-bristledtoothbrush

• Choosetoothpastewithfluoride

• Brushforatleasttwominutestwiceaday

• Flossdaily

• Watchforsignsofperiodontaldiseasesuchasred, swollen,ortendergums

• Visitadentistregularlyforexamsandcleanings

Didyouknowthat74percentofadultAmericansbelieve anunattractivesmilecouldhurtaperson'schancesfor careersuccess?*HumanaDentalhelpsyoufeelgood aboutyourdentalhealthsoyoucansmileconfidently.

*AmericanAcademyofCosmeticDentistry

UseyourHumanaDental benefits

Findadentist

WithHumanaDental's TraditionalPreferredplan,youcan seeanydentist.Membersandtheirfamiliesbenefitfrom negotiateddiscountsoncoveredservicesbychoosing dentistsintheHumanaDental TraditionalPreferred Network.TofindadentistinHumanaDental's Traditional PreferredNetwork,logonto Humana.com orcall 1-800-233-4013.

Knowwhatyourplancovers

Theothersideofthispagegivesyouasummaryof HumanaDentalbenefits.Yourplancertificatedescribes yourHumanaDentalbenefits,includinglimitationsand exclusions.YoucanfinditonMyHumana,yourpersonal pageat Humana.com orcall1-800-233-4013.

Seeyourdentist

YourHumanaDentalidentificationcardcontainsallthe informationyourdentistneedstosubmityourclaims. Besuretoshareitwiththeofficestaffwhenyouarrivefor yourappointment.Ifyoudon'thaveyourcard,youcan printproofofcoverageat Humana.com .

Learnwhatyourplanpaid

AfterHumanaDentalprocessesyourdentalclaim,you willreceiveanexplanationofbenefitsorclaimsreceipt.It providesdetailedinformationoncovereddentalservices, amountspaid,plusanyamountyoumayoweyour dentist.Youcanalsocheckthestatusofyourclaimon MyHumanaat Humana.com or by calling 1-800-233-4013.

HumanagroupdentalplansareofferedbyHumanaInsuranceCompany,HumanaDentalInsuranceCompany,Humana InsuranceCompanyofNewYork,HumanaHealthBenefitPlanofLouisiana,TheDentalConcern,Inc.,HumanaMedical PlanofUtah,CompBenefitsCompany,CompBenefitsDental,Inc.,HumanaEmployersHealthPlanofGeorgia,Inc.or DentiCare,Inc.(d/b/aCompBenefits).InArizona,groupdentalplansinsuredbyHumanaInsuranceCompany.InNew Mexico,groupdentalplansinsuredbyHumanaInsuranceCompany.

Thisisnotacompletedisclosureofplanqualificationsandlimitations.Youragentswillprovideyouwithspecific limitationsandexclusionsascontainedintheRegulatoryandTechnicalInformationGuide.Pleasereviewthis informationbeforeapplyingforcoverage.Theamountofbenefitsprovideddependsupontheplanselected.

Premiumswillvaryaccordingtotheselectionmade.

SGB0028A TEXAS PolicyNumber: TX-70090-HC1/14 Plansummarycreatedon: 4/27/2309:34 TXHLJ4QEN01/22 19 1-800-233-4013|Humana.com HumanaDentalTraditionalPlus

20

Vision plan benefits for Comal ISD .

1 Eye exam copay is a single payment due to the provider at the time of service.

2 Eyewear copay applies to eyeglass lenses / frame and contact lenses. Eyewear copay is a single payment that applies to the entire purchase of eyeglasses (frame and lenses)

3 Contact lenses and related professional services (fitting, evaluation and follow-up) are covered in lieu of eyeglass lenses and frames benefit

4 Lasik Vision Correction is in lieu of eyewear benefit, subject to routine regulatory filings and certain exclusions and limitations

The Plan discount features are not insurance.

All allowances are retail; the member is responsible for paying the provider directly for all non-covered items and/or any amount over the allowances, minus available discounts. These are not covered by the plan.

Discounts are subject to change without notice.

Disclaimer: All final determinations of benefits, administrative duties, and definitions are governed by the Certificate of Insurance for your vision plan. Please check with your Human Resources department if you have any questions.

.

. . . . . . .

. . . . . . . .

21

Creating and logging in to your member account

Superiorvision.com gives you quick access to your vision benefts information. Member account information is shared by all covered family dependents-family members may log in as the primary member.

Step

1

From the home page of superiorvision.com, select “Members” from the navigation.

Step

2

From the Members page, click the “Member Login” button.

Step 3

If you have already set up your account, enter your username and password, if not, click “Create a new account”.

Step 4

From the Create Your New Account page, the primary account member can set up an account with their own username and password and have immediate access to the secure Member area of the website.

What can I do in my member account?

Use your member account to easily locate an in-network eye care professional, view your benefits and eligibility, print your ID card, download forms, and more.

SVS_ MKG18-0282v001 07/2018 from 1 (800) 507-3800 superiorvision.com

22

Find an in-network provider

It s easy to fnd an in-network provider. Follow the simple instructions below to get started.

ere s how to fnd a provider near you

1.Visit superiorvision.com and click “Locate a Provider.”

2.Enter your location information.

3.Select the “Insurance Through Your Employer” option.

4.Pick the Superior Select Southwest network.

5.Choose your desired distance.

6.Select the “Find Providers” button.

Want to narrow your search results?

nce you re at the search results page, you can refne the results by the name of the provider, the name of the practice or the services that are o ered.

I found a provider. Now what?

Once you’ve selected an in-network provider, call them to verify provider network participation, services and acceptance of your vision plan. Not all providers at each o ce or optical store are in-network providers, nor do they participate in all networks.

SV-MKG18-0296v001 PDF 10/2018 from superiorvision.comFollow us @SuperiorVision 1 (844) 549-2603

23

New ways to use vision benefts online

hrough our new relationship with - Contacts.com, you ll soon be able to utili e your vision benefts at your convenience from your home or on the go.

- Contacts is the most recogni ed online contact lens retailer in the industry. hey have an established reputation for their customer service, backed by an industry-leading Net romoterScore of .

• market share in the online contact lens market

•Most extensive inventory with 98% orders in stock including spherical, astigmatism toric, multifocal, colored, and transition lenses from every ma or manufacturer Alcon, Cooper ision, ohnson ohnson, and ausch Lomb

• ase of ordering with -click reorders

• Mobile app and prescription upload

• est-in-class service and delivery speed

• live customer service of calls answered in seconds or less

• Live calls chats with the highest service levels vin the industry

• ay-over-time solution

When will I be able to use my eye wear material bene�t online? You ll be able to use your benefts to shop for glasses and contacts online on March ,

Check your bene�t details for coverage, plan and network information.

S -Mv DF

- superiorvision.com -

24

New ways to use vision benefts online

You now have an in-network online shopping solution that includes seamless integration with vision benefts and automatic claims submission through our new relationships with Glasses.com

lasses.com is one of the most trusted online stores for popular eyewear brands, including prescription glasses and sunglasses.

• rice range to ft any budget

• Free in-person ad ustments after purchase

• Free shipping and returns

• ide product selection including lu ury brands, accessible fast fashion, and sport, including ay- an, akley, rada, alph Lauren and Michael ors

• Customer service available through phone, email, and chat

• A variety of lens options available for every need essential, premium, ultra-premium, photochromatic

• ne of the quickest manufacturing and delivery timelines in the industry

• irtual try-on technology

• ay-over-time solution

When will I be able to use my eye wear material bene�t online? You ll be able to use your benefts to shop for glasses and contacts online on March ,

Check your bene�t details for coverage, plan and network information.

superiorvision.com -

S -Mv DF

25

DOWNLOAD THE SUPERIOR VISION APP TO YOUR PHONE • •� t ty CLFit l)(lri ( CREATE AN ONLINE ACCOUNT

in with the username and password you use to access your Member account on SuperiorVision.com, or you can create an account in the app. VIEW YOUR VISION BENEFITS

Review your vision benefits and the benefits for any dependents

See when you are eligible for services 000 SuperiorVision.com ' ·� Go d Ri •r ,o Eh,-r Op u,,t<c-.u ,Co1t1ct Lons F1tir •0 E�•.-rOpAIU6, c-aet1 ,Co1� L\ns fiting o ph BroW 00 <t • � Gt,ld I,, 0 ' (�e.wr01$pnsod COKtl lCn\1 Uni Fitm, LOCATE A PROVIDER • Find a provider in your network

Get directions

Call the provider GET YOUR MEMBER ID CARD

View your ID card full screen

Print or email your ID card GET IT ON � Google play I � SUPERIOR VISION See yourself healthy 26

Log

•

•

•

•

•

•

Health Savings Accounts

Start saving more on healthcare.

A Health Savings Account (HSA) is an individually-owned, tax‐advantaged account that you can use to pay for current or future IRS‐quali ed medical expenses. With an HSA, you’ll have the potential to build more savings for healthcare expenses or additional retirement savings through self-directed investment options¹ .

How an HSA works:

•You can contribute to your HSA via payroll deduction, online banking transfer, or by sending a personal check to HSA Bank. Your employer or third parties, such as a spouse or parent, may contribute to your account as well.

•You can pay for quali ed medical expenses with your Health Bene ts Debit Card directly to your medical provider or pay out-of-pocket. You can either choose to reimburse yourself or keep the funds in your HSA to grow your savings.

•Unused funds will roll over year to year. After age 65, funds can be withdrawn for any purpose without penalty (subject to ordinary income taxes).

•Check balances and account information via HSA Bank’s Member Website or mobile device 24/7.

Are you eligible for an HSA?

If you have a quali ed High Deductible Health Plan (HDHP) - either through your employer, through your spouse, or one you’ve purchased on your own - chances are you can open an HSA. Additionally:

•You cannot be covered by any other non-HSA-compatible health plan, including Medicare Parts A and B.

•You cannot be covered by TriCare.

•You cannot be claimed as a dependent on another person’s tax return (unless it’s your spouse).

•You must be covered by the quali ed HDHP on the rst day of the month. When you open an account, HSA Bank will request certain information to verify your identity and to process your application.

What are the annual IRS contribution limits?

Contributions made by all parties to an HSA cannot exceed the annual HSA limit set by the Internal Revenue Service (IRS). Anyone can contribute to your HSA, but only the accountholder and employer can receive tax deductions on those contributions. Combined annual contributions for the accountholder, employer, and third parties (i.e., parent, spouse, or anyone else) must not exceed these limits.2

Annual HSA Contribution Limits

Individual = $3,850

Family = $7,750

Annual HSA Contribution Limits

Individual = $

Family = $

Catch-up Contributions

According to IRS guidelines, each year you have until the tax ling deadline to contribute to your HSA (typically April 15 of the following year). Online contributions must be submitted by 2:00 p.m., Central Time, the business day before the tax ling deadline. Wire contributions must be received by noon, Central Time, on the tax ling deadline, and contribution forms with checks must be received by the tax ling deadline.

Accountholders who meet these quali cations are eligible to make an HSA catch-up contribution of $1,000: Health Savings accountholder; age 55 or older (regardless of when in the year an accountholder turns 55); not enrolled in Medicare (if an accountholder enrolls in Medicare mid-year, catch-up contributions should be prorated). Spouses who are 55 or older and covered under the accountholder’s medical insurance can also make a catch-up contribution into a separate HSA in their own name.

27

How can you bene t from tax savings?

An HSA provides triple tax savings.3 Here’s how:

•Contributions to your HSA can be made with pre-tax dollars and any after-tax contributions that you make to your HSA are tax deductible.

•HSA funds earn interest and investment earnings are tax free.

•When used for IRS-quali ed medical expenses, distributions are free from tax.

IRS-Quali ed Medical Expenses

You can use your HSA to pay for a wide range of IRS-quali ed medical expenses for yourself, your spouse, or tax dependents. An IRSquali ed medical expense is de ned as an expense that pays for healthcare services, equipment, or medications. Funds used to pay for IRS-quali ed medical expenses are always tax-free.

HSA funds can be used to reimburse yourself for past medical expenses if the expense was incurred after your HSA was established. While you do not need to submit any receipts to HSA Bank, you must save your bills and receipts for tax purposes.

Examples of IRS-Quali ed Medical Expenses4:

Acupuncture

Alcoholism treatment

Ambulance services

Annual physical examination

Arti cial limb or prosthesis

Birth control pills (by prescription)

Chiropractor

Childbirth/delivery

Convalescent home (for medical treatment only)

Crutches

Doctor’s fees

Dental treatments (including x-rays, braces, dentures, llings, oral surgery)

Dermatologist

Diagnostic services

Disabled dependent care

Drug addiction therapy

Fertility enhancement (including in-vitro fertilization)

Guide dog (or other service animal)

Gynecologist

Hearing aids and batteries

Hospital bills

Insurance premiums5

Laboratory fees

Lactation expenses

Lodging (away from home for outpatient care)

Nursing home

Nursing services

Obstetrician

Osteopath

Oxygen

Pregnancy test kit

Podiatrist

Prescription drugs and medicines (over-the-counter drugs are not IRS-quali ed medical expenses unless prescribed by a doctor)

Prenatal care & postnatal treatments

Psychiatrist

Psychologist

Smoking cessation programs

Special education tutoring

Surgery

Telephone or TV equipment to assist the hearing or vision

impaired

Therapy or counseling

Medical transportation expenses

Transplants

Vaccines

Vasectomy

Vision care (including eyeglasses, contact lenses, lasik surgery)

Weight loss programs (for a speci c disease diagnosed by a physician – such as obesity, hypertension, or heart disease)

Wheelchairs

X-rays

¹ Investment accounts are not FDIC insured, may lose value and are not a deposit or other obligation of, or guarantee by the bank. Investment losses which are replaced are subject to the annual contribution limits of the HSA.

2 HSA funds contributed in excess of these limits are subject to penalty and tax unless the excess and earnings are withdrawn prior to the due date, including any extensions for ling Federal Tax returns. Accountholders should consult with a quali ed tax advisor in connection with excess contribution removal. The Internal Revenue Service requires HSA Bank to report withdrawals that are considered refunds of excess contributions. In order for the withdrawal to be accurately reported, accountholders may not withdraw the excess directly. Instead, an excess contribution refund must be requested from HSA Bank and an Excess Contribution Removal Form completed.

3 Federal tax savings are available regardless of your state. State tax laws may vary. HSA Bank does not provide tax or legal advice. Please consult with a quali ed tax or legal professional for tax related questions.

4 This list is not comprehensive. It is provided to you with the understanding that HSA Bank is not engaged in rendering tax advice. The information provided is not intended to be used to avoid Federal tax penalties. For more detailed information, please refer to IRS Publication 502 titled, “Medical and Dental Expenses”. Publications can be ordered directly from the IRS by calling 1-800-TAXFORM. If tax advice is required, you should seek the services of a professional.

5 Insurance premiums only qualify as an IRS-quali ed medical expense: while continuing coverage under COBRA; for quali ed long-term care coverage; coverage while receiving unemployment compensation; for any healthcare coverage for those over age 65 including Medicare (except Medicare supplemental coverage).

Pleasecallthenumberonthebackof

yourHSABankdebitcardorvisitusat

www.hsabank.com

© 2019 HSA Bank. HSA Bank is a division of Webster Bank, N.A., Member FDIC. HSA_060419

28

What is a Flexible Spending Account (FSA)? Help Make Medical Costs Painless. Visit fsa.nbsbenefts.com for more info or call one of our Beneft Specialists at 800-274-0503 Salt Lake City, UTHeadquarters Dallas, TX | San Diego, CA | Honolulu, HI 800-274-0503 fsa@nbsbenefts.com How Much Can I Save with an FSA? FSANo FSA Annual Taxable Income $24,000$24,000 Health FSA $1,500 $0 Dependent Care FSA $1,500 $0 Total Pre-tax Contributions -$3,000 $0 Taxable Income after FSA $21,000$24,000 Income Taxes-$6,300-$7,200 After-tax Income$14,700$16,800 After-tax Health and Welfare Expenses $0 -$3,000 Take-home Pay$14,700$13,800 You Saved $900$0 29

How to Spend

Spending is easy

Partial List of Eligible Expenses:

Our convenient NBS Smart Card allows you to avoid out-of-pocket expenses, cumbersome claim forms and reimbursement delays. You may also utilize the “pay a provider” option on our web portal.

Medical/Dental/Vision Copays and Deductibles

Prescription Drugs

Physical Therapy Chiropractor

First-Aid Supplies Lab Fees

Flexible Spending Account (FSA)

Account access is easy

Get account informati on from our easy-to-use online portal and mobile app. See your account balance, contributions and account history in real time.

Life’s not always fexible, but your money can be.

From baby care to pain relief, shop the largest selection of guaranteed FSA-eligible products with zero guesswork at FSA Store. Is your health need

FSA-eligible? Find out using our comprehensive Eligibility List . Get $10 of using code NBS1819 . Shop FSA Store at fsastore.com/nbs

Two Types of FSAs

Psychiatrist/Psychologist

Vaccinations

Dental Work/Orthodontia Eye Exams

Laser Eye Surgery Eyeglasses, Contact Lenses, Lens Solution

Prescribed OTC Medication

Enrollment Consideration

After the enrollment period ends, you may increase, decrease, or stop your contribution only when you experience a qualifying “change of status” (e.g. marriage, divorce, employment change, dependent change). Be conservative in the total amount you elect to avoid forfeiting money at the end of the plan year.

To take advantage of a health FSA, start by choosing an annual election amount. This amount will be available on day one of your plan year for eligible medical expenses. Payroll deductions will then be made throughout the plan year to fund your account.

A dependent care FSA works diferently than a health FSA. Money only becomes available as it is contributed and can only be used for dependent care expenses.

Both are pre-tax benefts your employer ofers through a cafeteria plan. Choose one or both — whichever is right for you.

What is a Cafeteria Plan?

A cafeteria plan enables you to save money on group insurance, healthcare expenses, and dependent care expenses. Your contributions are deducted from your paycheck by your employer before taxes are withheld. These deductions lower your taxable income which can save you up to 35% on income taxes!

30

What is a Dependent Care Assistance Program (DCAP)?

The Dependent Care Assistance Program (DCAP) allows you to use tax-free dollars to pay for child day care or elder day care expenses that you incur because you and your spouse are both gainfully employed.

To participate, determine the annual amount that you want to deduct from your paycheck before taxes. The maximum amount you can elect depends on your federal tax fling status ($5,000 if you are married and fling a joint return or if you are a single parent, $2,500 if you are married but fling separetely)

Your annual amount will be divided by the number of pay periods in the plan year and that amount will be deducted from each paycheck.

Who is an eligible dependent?

You can use the DCAP for expenses incurred for:

•Your qualifying child who is age twelve or younger for whom you claim a dependency exemption on your income tax return.

•Your qualifying relative (e.g. a child over twelve, your parent, a spouse’s parent) who is physically or mentally incapable of caring for himself or herself and has the same principal place of abode as you for more than half of the year.

•Your spouse who is physically or mentally incapable of caring for himself or herself and has the same principal place of abode as you for more than half of the year.

Special Rule for Parents Who Are Divorced, Separated, or Living Apart

Only the custodial parent can claim expenses from the DCAP. The custodial parent is generally the parent with whom the child resides for the greater number of nights during the calendar year. Additionally, the custodial parent cannot be reimbursed from the DCAP for child-care expenses while the child lives with the non-custodial parent because such expenses are not incurred to enable the custodial parent to be gainfully employed.

What are eligible expenses for the DCAP?

The expenses which are eligible for reimbursement must have been incurred during the plan year and in connection with you and your spouse to remain gainfully employed.

Examples of eligible expenses:

•Before and After School and/or Extended Day Programs

•Daycare in your home or elsewhere so long as the dependent regularly spends at least 8 hours a day in your home.

•Base cost of day camps or similar programs.

Examples of ineligible expenses:

•Schooling for a child in kindergarten or above

•Babysitter while you go to the movies or out to eat

•Cost of overnight camps

Salt Lake City, UT - Headquarters | Dallas, TX | San Diego, CA | Honolulu, HI 18 (800)274-0503

| service@nbsbenefits.com | www.nbsbenefits.com 31

What does it mean to be “gainfully employed”?

This means that you are working and earning an income (i.e. not doing volunteer work). You are not considered gainfully employed during paid vacation time or sick days. Gainful employment is determined on a daily basis.

If you are married, then your spouse would also need to be gainfully employed for your day care expenses to be eligible for reimbursement.

You are also considered gainfully employed if you are unemployed but actively looking for work, you are self-employed, you are physically or mentally not capable of self-care, or you are a full-time student (must attend for the number of hours that the school considers full-time, must have been a student for some part of each of 5 calendar months during the year, cannot be attending school only at night, does not include on-the-job training courses or correspondence schools).

What are some other important IRS regulations?

•You cannot be reimbursed for dependent care expenses that were paid to (1) one of your dependents, (2) your spouse, or (3) one of your children who is under the age of nineteen.

•In the event that you use a day care center that cares for more than six children, the center must be licensed.

• You must provide the day care provider’s Social Security Number/Tax Identifcation Number (EIN) on form 2441 when you fle your taxes.

What are some other important IRS regulations?

The IRS allows you to take a tax credit for your dependent care expenses. The tax credit may provide you with a greater beneft than the DCAP if you are in a lower tax bracket. To determine whether the tax credit or the DCAP is best for you, you will need to review your individual tax circumstances. You cannot use the same expenses for both the tax credit and the DCAP, however, you may be able to coordinate the federal dependent care tax credit with participation in the DCAP for expenses not reimbursed through DCAP.

For more information, please call 1(800) 274-0503

Salt Lake City, UT - Headquarters Dallas, TX | San Diego, CA | Honolulu, HI www.nbsbenefts.com

service@nbsbenefts.com 26 32

800-274-0503

The Ultimate Peace of Mind for Employees and Their Families

The Harrison’s Story

• Jim and his family were at a local festival when his daughter, Sara, suddenly began experiencing horrible abdominal and back pain, after a fall from earlier in the day.

• His wife, Heather, called 911 and Sara was transported to a local hospital, where it was decided that she needed to be fown to another hospital.

• Upon arrival, Sara underwent multiple procedures and her condition was stabilized.

• After further testing, it was discovered that Sara needed additional specialized treatment at another hospital requiring transport on a non-emergent basis.

Based

And then, the Bills came!

Any Ground. Any Air. Anywhere.TM

No matter how comprehensive your local in-network coverage may be, you still have signifcant exposure to out-of-network emergency transportation. Moreover, when you and your family travel outside your area, there is an 80% chance of being picked up by an out-of-network provider.

A MASA Membership prepares you for the unexpected. ONLY MASA MTS provides you with:

• Coverage ANYWHERE in all 50 states and Canada whether at home or away

• Coverage for BOTH emergent ground ambulance and air ambulance transport REGARDLESS of the provider

• Non-emergent transport services, which are frequently covered inadequately by your insurance, if at all For more information, please contact your local MASA MTS representative or visit www.masamts.com

As a MASA Member If a Non-MASA Member Sara would pay*If In-Network**If Out-of-Network** 911 Ground Ambulance Cost: $1,800 $0$300$1,600 Emergent Air Ambulance Cost: $45,000 $0$4,000$30,000 Non-Emergent Air Transport† Cost: $20,000 $0$20,000$20,000 Total Out-of-Pocket Cost $0$24,300$51,600 *Benefit is dependent on Membership Enrolled. **Out-of-pocket dollars vary dependent on provider, distance, health plan design, current status of deductible and out-of pocket max. These figures are an example of the costs one may incur. †More and more health plans are not covering interfacility transports on a non-emergent basis.

FLYER_COMP_B2B

on a true story. Names were changed to protect identities in compliance with HIPAA.

33

and the ir f am ili e s s ho r tcom i ng s o f hea lth i nsur ance cover age by p r ov i d i ng them w ith comp r ehensive financ i a l p r otecti on

For only $14 a month!

A MA S A Membe rs h i p p r epa r e s you f o r the unexpected and g i ve s you the peace o f m i nd to acce ss v i ta l eme r gency med i ca l t r an s po r tat i on no matte r whe r e you li ve , f o r a m i n i ma l month l y f ee .

• One l ow f ee f o r the en t ir e f am il y

• NO deduct i b l e s

• NO hea lthque s t i on s

• Easy c l a i m s p r oce ss

. .

. . . . . m g ound a po a o m g a po a o on m g a po a o pa a o U S /Canada U S /Canada U S /Canada

S /Canada .

U

Your Broker or MASA Representative

* Please refer to the MSA for a detailed explanation of benefits and eligibility, 34

BENEFIT HIGHLIGHTS FOR: Comal Independent School District

EDUCATOR DISABILITY INSURANCE OVERVIEW

What is Educator Disability Income Insurance?

Educator Disability insurance combines the features of a short-term and long-term disability plan into one policy. The coverage pays you a portion of your earnings if you cannot work because of a disabling illness or injury. The plan gives you the flexibility to choose a level of coverage to suit your need.

You have the opportunity to purchase Disability Insurance through your employer. This highlight sheet is an overview of your Disability Insurance. Once a group policy is issued to your employer, a certificate of insurance will be available to explain your coverage in detail.

Why do I need Disability Insurance Coverage?

More than half of all personal bankruptcies and mortgage foreclosures are a consequence of disability 1

1 Facts from LIMRA, 2016 Disability Insurance Awareness Month

The average worker faces a 1 in 3 chance of suffering a job loss lasting 90 days or more due to a disability 2

2Facts from LIMRA, 2016 Disability Insurance Awareness Month

Only 50% of American adults indicate they have enough savings to cover three months of living expenses in the event they’re not earning any income 3

3Federal Reserve, Report on the Economic Well-Being of U.S. Households in 2018

ELIGIBILITY AND ENROLLMENT

Eligibility You are eligible if you are an active employee who works at least 15 hours per week on a regularly scheduled basis.

Enrollment You can enroll in coverage within 31 days of your date of hire or during your annual enrollment period.

Effective Date Coverage goes into effect subject to the terms and conditions of the policy. You must satisfy the definition of Actively at Work with your employer on the day your coverage takes effect.

Actively at Work You must be at work with your Employer on your regularly scheduled workday. On that day, you must be performing for wage or profit all of your regular duties in the usual way and for your usual number of hours. If school is not in session due to normal vacation or school break(s), Actively at Work shall mean you are able to report for work with your Employer, performing all of the regular duties of Your Occupation in the usual way for your usual number of hours as if school was in session.

35

FEATURES OF THE PLAN

Benefit Amount You may purchase coverage that will pay you a monthly flat dollar benefit in $100 increments between $200 and $8,000 that cannot exceed 66 2/3% of your current monthly earnings. Earnings are defined in The Hartford’s contract with your employer.

Elimination Period

You must be disabled for at least the number of days indicated by the elimination period that you select before you can receive a Disability benefit payment. The elimination period that you select consists of two numbers. The first number shows the number of days you must be disabled by an accident before your benefits can begin. The second number indicates the number of days you must be disabled by a sickness before your benefits can begin.

For those employees electing an elimination period of 30 days or less, if your are confined to a hospital for 24 hours or more due to a disability, the elimination period will be waived, and benefits will be payable from the first day of hospitalization.

Maximum Benefit Duration Benefit Duration is the maximum time for which we pay benefits for disability resulting from sickness or injury. Depending on the age at which disability occurs, the maximum duration may vary. Please see the applicable schedules below based on the Select benefit option.

Select Option: For the Select benefit option – the table below applies to disabilities resulting from injury.

Age Disabled Maximum Benefit Duration

Prior to 63 To Normal Retirement Age or 48 months if greater

Age 63 To Normal Retirement Age or 42 months if greater

Age 64 36 months

Age 65 30 months

Age 66 27 months

Age 67 24 months

Age 68 21 months

Age 69 and older 18 months

Select Option: For the Select benefit option – the table below applies to disabilities resulting from sickness.

Age Disabled Maximum Benefit Duration

Prior to Age 65 36 Months

Age 65-68 To Age 70, but not less than 12 months

Age 69 and over 12 months

Mental Illness, Alcoholism and Substance Abuse, SelfReported or Subjective Illness

You can receive benefit payments for Long-Term Disabilities resulting from mental illness, alcoholism and substance abuse or self-reported or subjective illness for a total of 12 months for all disability periods during your lifetime.

Any period of time that you are confined in a hospital or other facility licensed to provide medical care for mental illness, alcoholism and substance abuse does not count toward the 12 month lifetime limit.

Partial Disability Partial Disability is covered provided you have at least a 20% loss of earnings and duties of your job.

36

Other Important Benefits

Survivor Benefit - If you die while receiving disability benefits, a benefit will be paid to your spouse or child under age 26, equal to three times your last monthly gross benefit.

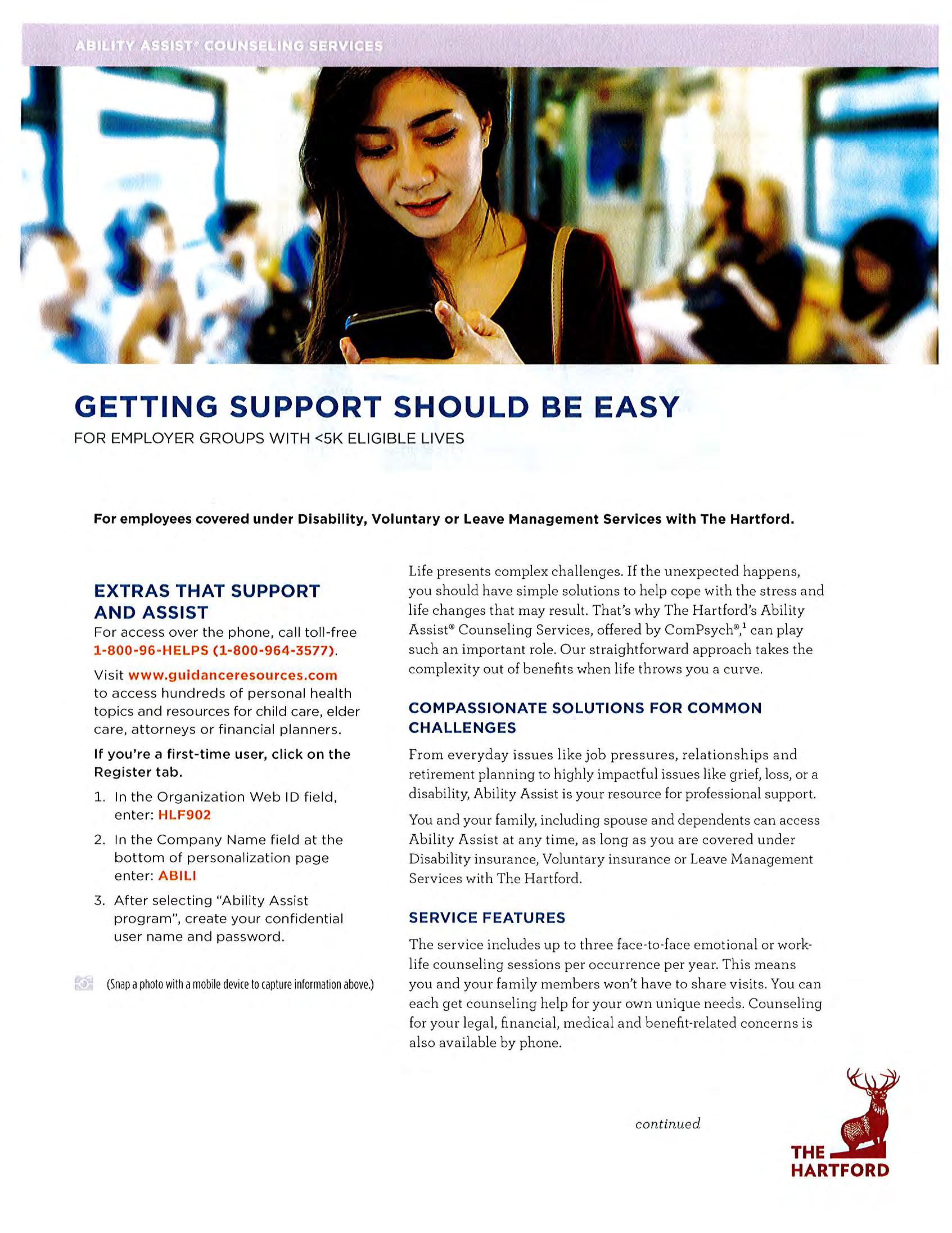

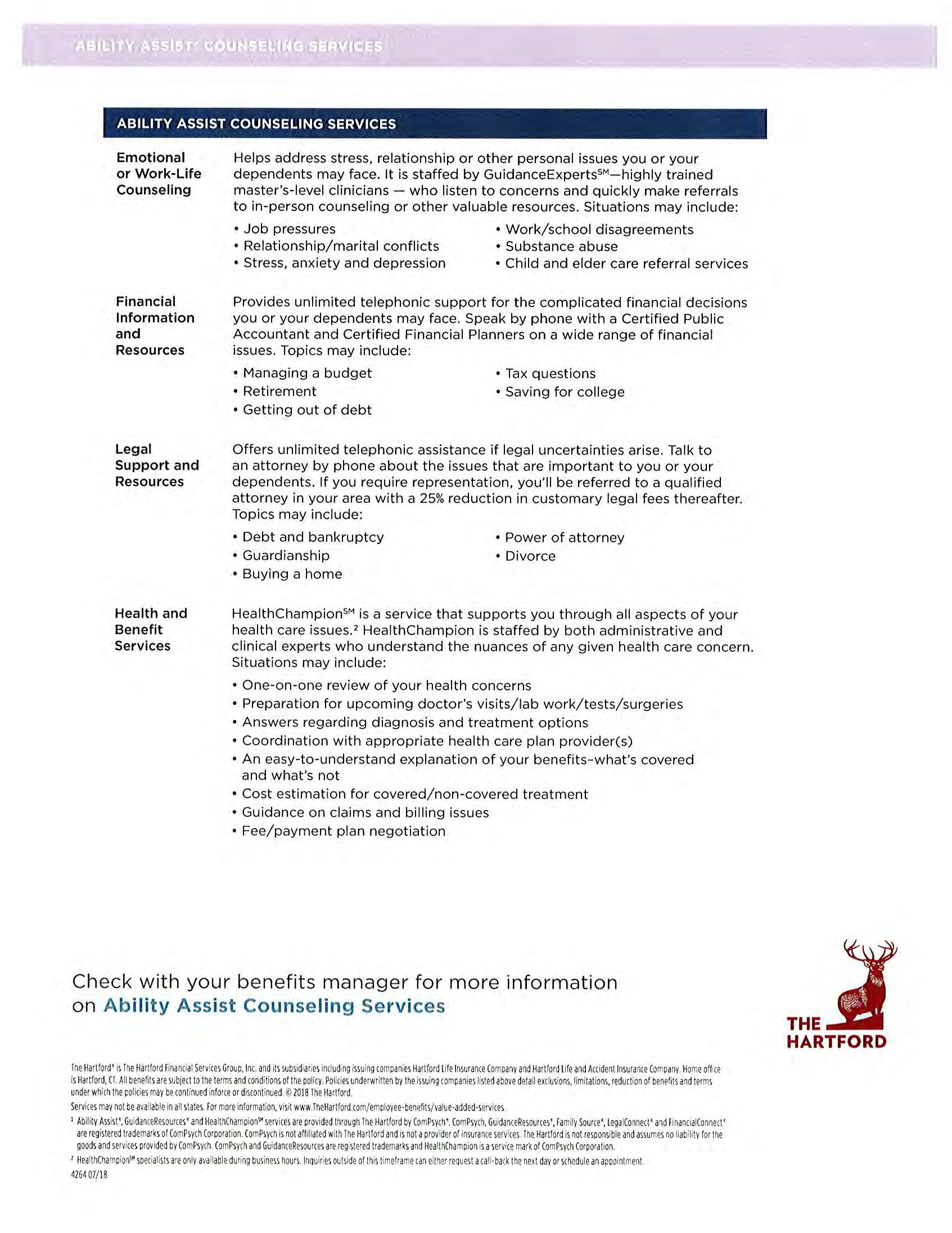

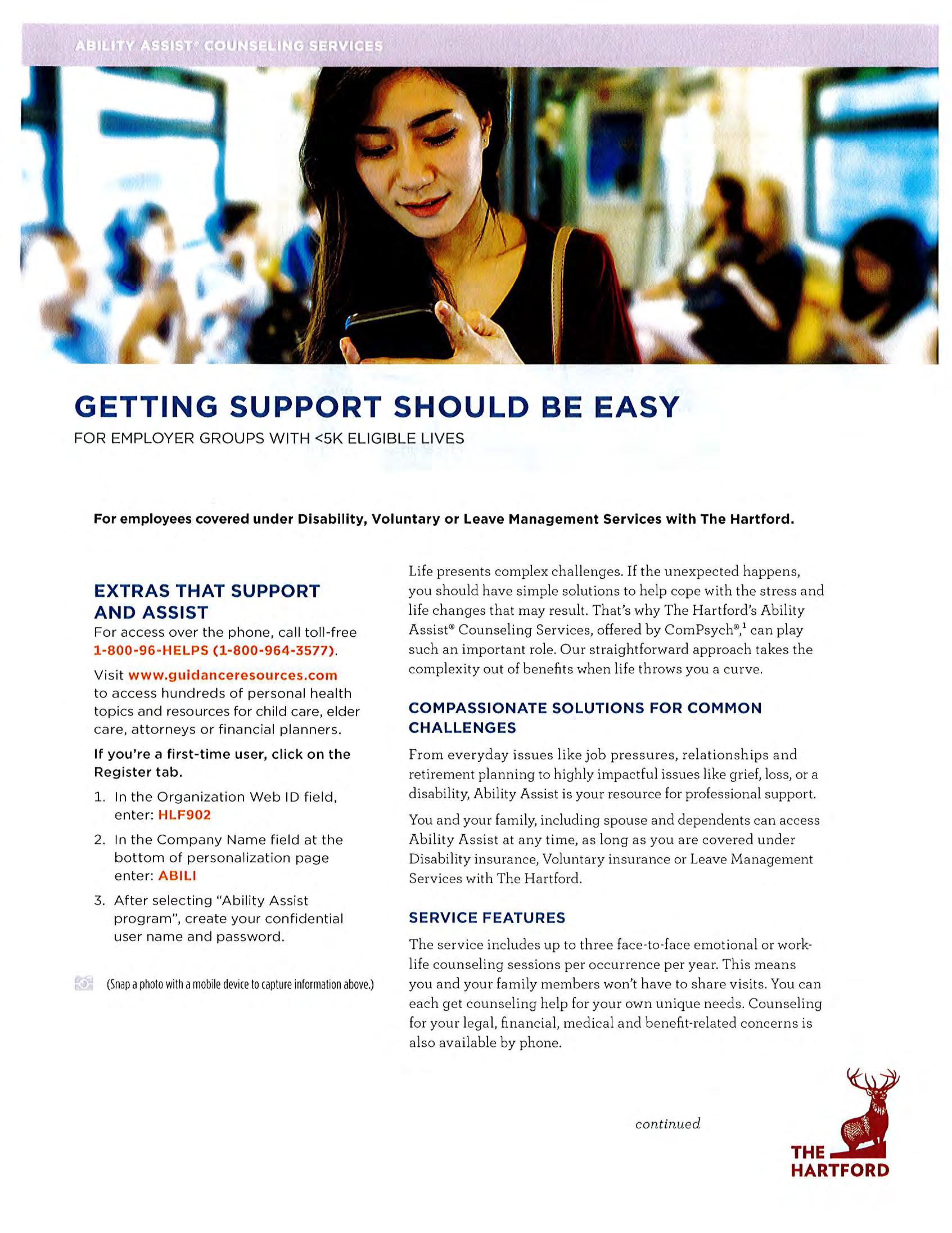

The Hartford's Ability Assist service is included as a part of your group Long Term Disability (LTD) insurance program. You have access to Ability Assist services both prior to a disability and after you’ve been approved for an LTD claim and are receiving LTD benefits. Once you are covered you are eligible for services to provide assistance with child/elder care, substance abuse, family relationships and more. In addition, LTD claimants and their immediate family members receive confidential services to assist them with the unique emotional, financial and legal issues that may result from a disability. Ability Assist services are provided through ComPsych®, a leading provider of employee assistance and work/life services.

Travel Assistance Program – Available 24/7, this program provides assistance to employees and their dependents who travel 100 miles from their home for 90 days or less. Services include pre-trip information, emergency medical assistance and emergency personal services.

Identity Theft Protection – An array of identity fraud support services to help victims restore their identity. Benefits include 24/7 access to an 800 number; direct contact with a certified caseworker who follows the case until it’s resolved; and a personalized fraud resolution kit with instructions and resources for ID theft victims.

Workplace Modification provides for reasonable modifications made to a workplace to accommodate your disability and allow you to return to active full-time employment.

PROVISIONS OF THE PLAN

Definition of Disability Disability is defined as The Hartford’s contract with your employer. Typically, disability means that you cannot perform one or more of the essential duties of your occupation due to injury, sickness, pregnancy or other medical conditions covered by the insurance, and as a result, your current monthly earnings are 80% or less of your pre-disability earnings.

One you have been disabled for 24 months, you must be prevented from performing one or more essential duties of any occupation, and as a result, your monthly earnings are 66 2/3% or less of your pre-disability earnings.

Pre-Existing Condition Limitation

Your policy limits the benefits you can receive for a disability caused by a pre-existing condition. In general, if you were diagnosed or received care for a disabling condition within the 3 consecutive months just prior to the effective date of this policy, your benefit payment will be limited, unless: You have been insured under this policy for 12 months before your disability begins.

If your disability is a result of a pre-existing condition, we will pay benefits for a maximum of 12 weeks.

Continuity of Coverage If you were insured under your district’s prior plan and not receiving benefits the day before this policy is effective, there will not be a loss in coverage and you will get credit for your prior carrier’s coverage.

Recurrent Disability

What happens if I Recover but become Disabled again?

37

Benefit Integration

Periods of Recovery during the Elimination Period will not interrupt the Elimination Period, if the number of days You return to work as an Active Employee are less than one-half (1/2) the number of days of Your Elimination Period. Any day within such period of Recovery, will not count toward the Elimination Period.

Your benefit may be reduced by other income you receive or are eligible to receive due to your disability, such as:

•Social Security Disability Insurance

•State Teacher Retirement Disability Plans

•Workers’ Compensation

•Other employer-based disability insurance coverage you may have

•Unemployment benefits

•Retirement benefits that your employer fully or partially pays for (such as a pension plan)

Your plan includes a minimum benefit of 25% of your elected benefit.

General Exclusions

You cannot receive Disability benefit payments for disabilities that are caused or contributed to by:

•War or act of war (declared or not)

•Military service for any country engaged in war or other armed conflict

•The commission of, or attempt to commit a felony

•An intentionally self-inflicted injury

•Any case where your being engaged in an illegal occupation was a contributing cause to your disability

•You must be under the regular care of a physician to receive benefits

Termination Provisions

Your coverage under the plan will end if:

•The group plan ends or is discontinued

•You voluntarily stop your coverage

•You are no longer eligible for coverage

•You do not make the required premium payment

•Your active employment stops, except as stated in the continuation provision in the policy

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries, including underwriting company Hartford Li fe and Accident Insurance Company. Home Office is Hartford, CT. All benefits are subject to the terms and conditions of the policy. Policies underwritten by the underwriting company listed above detail exclusions, limitations, reduction of benefits and terms under which the policies may be continued in force or discontinued. This Benefit Highlights Sheet explains the general purpose of the insurance described, but in no way changes or affects the policy as actually issued. In the event of a discrepancy between this Benefit Highlights Sheet and the policy, the terms of the policy apply. Complete details are in the Certificate of Insurance issued to each insured individual and the Master Policy as issued to the policyholder. Benefits are subject to state availability. © 2020 The Hartford.

38

Comal Independent School District

Select Option – Monthly Premium Cost (based on 12 payments per year)

Accident / Sickness Elimination Period in Days Annual Earnings Monthly Earnings Monthly Benefit 7/ 7 14 / 14 30 / 30 60 / 60 90 / 90 180 / 180 $3,600 $300 $200 $5.68 $5.18 $3.80 $3.42 $3.30 $2.54 $5,400 $450 $300 $8.52 $7.77 $5.70 $5.13 $4.95 $3.81 $7,200 $600 $400 $11.36 $10.36 $7.60 $6.84 $6.60 $5.08 $9,000 $750 $500 $14.20 $12.95 $9.50 $8.55 $8.25 $6.35 $10,800 $900 $600 $17.04 $15.54 $11.40 $10.26 $9.90 $7.62 $12,600 $1,050 $700 $19.88 $18.13 $13.30 $11.97 $11.55 $8.89 $14,400 $1,200 $800 $22.72 $20.72 $15.20 $13.68 $13.20 $10.16 $16,200 $1,350 $900 $25.56 $23.31 $17.10 $15.39 $14.85 $11.43 $18,000 $1,500 $1,000 $28.40 $25.90 $19.00 $17.10 $16.50 $12.70 $19,800 $1,650 $1,100 $31.24 $28.49 $20.90 $18.81 $18.15 $13.97 $21,600 $1,800 $1,200 $34.08 $31.08 $22.80 $20.52 $19.80 $15.24 $23,400 $1,950 $1,300 $36.92 $33.67 $24.70 $22.23 $21.45 $16.51 $25,200 $2,100 $1,400 $39.76 $36.26 $26.60 $23.94 $23.10 $17.78 $27,000 $2,250 $1,500 $42.60 $38.85 $28.50 $25.65 $24.75 $19.05 $28,800 $2,400 $1,600 $45.44 $41.44 $30.40 $27.36 $26.40 $20.32 $30,600 $2,550 $1,700 $48.28 $44.03 $32.30 $29.07 $28.05 $21.59 $32,400 $2,700 $1,800 $51.12 $46.62 $34.20 $30.78 $29.70 $22.86 $34,200 $2,850 $1,900 $53.96 $49.21 $36.10 $32.49 $31.35 $24.13 $36,000 $3,000 $2,000 $56.80 $51.80 $38.00 $34.20 $33.00 $25.40 $37,800 $3,150 $2,100 $59.64 $54.39 $39.90 $35.91 $34.65 $26.67 $39,600 $3,300 $2,200 $62.48 $56.98 $41.80 $37.62 $36.30 $27.94 $41,400 $3,450 $2,300 $65.32 $59.57 $43.70 $39.33 $37.95 $29.21 $43,200 $3,600 $2,400 $68.16 $62.16 $45.60 $41.04 $39.60 $30.48 $45,000 $3,750 $2,500 $71.00 $64.75 $47.50 $42.75 $41.25 $31.75 $46,800 $3,900 $2,600 $73.84 $67.34 $49.40 $44.46 $42.90 $33.02 $48,600 $4,050 $2,700 $76.68 $69.93 $51.30 $46.17 $44.55 $34.29 $50,400 $4,200 $2,800 $79.52 $72.52 $53.20 $47.88 $46.20 $35.56 $52,200 $4,350 $2,900 $82.36 $75.11 $55.10 $49.59 $47.85 $36.83 $54,000 $4,500 $3,000 $85.20 $77.70 $57.00 $51.30 $49.50 $38.10 $55,800 $4,650 $3,100 $88.04 $80.29 $58.90 $53.01 $51.15 $39.37 $57,600 $4,800 $3,200 $90.88 $82.88 $60.80 $54.72 $52.80 $40.64 $59,400 $4,950 $3,300 $93.72 $85.47 $62.70 $56.43 $54.45 $41.91 $61,200 $5,100 $3,400 $96.56 $88.06 $64.60 $58.14 $56.10 $43.18 $63,000 $5,250 $3,500 $99.40 $90.65 $66.50 $59.85 $57.75 $44.45 $64,800 $5,400 $3,600 $102.24 $93.24 $68.40 $61.56 $59.40 $45.72 $66,600 $5,550 $3,700 $105.08 $95.83 $70.30 $63.27 $61.05 $46.99 $68,400 $5,700 $3,800 $107.92 $98.42 $72.20 $64.98 $62.70 $48.26 $70,200 $5,850 $3,900 $110.76 $101.01 $74.10 $66.69 $64.35 $49.53 $72,000 $6,000 $4,000 $113.60 $103.60 $76.00 $68.40 $66.00 $50.80 $73,800 $6,150 $4,100 $116.44 $106.19 $77.90 $70.11 $67.65 $52.07 $75,600 $6,300 $4,200 $119.28 $108.78 $79.80 $71.82 $69.30 $53.34 $77,400 $6,450 $4,300 $122.12 $111.37 $81.70 $73.53 $70.95 $54.61 $79,200 $6,600 $4,400 $124.96 $113.96 $83.60 $75.24 $72.60 $55.88 $81,000 $6,750 $4,500 $127.80 $116.55 $85.50 $76.95 $74.25 $57.15 $82,800 $6,900 $4,600 $130.64 $119.14 $87.40 $78.66 $75.90 $58.42 $84,600 $7,050 $4,700 $133.48 $121.73 $89.30 $80.37 $77.55 $59.69 $86,400 $7,200 $4,800 $136.32 $124.32 $91.20 $82.08 $79.20 $60.96 $88,200 $7,350 $4,900 $139.16 $126.91 $93.10 $83.79 $80.85 $62.23 $90,000 $7,500 $5,000 $142.00 $129.50 $95.00 $85.50 $82.50 $63.50 $91,800 $7,650 $5,100 $144.84 $132.09 $96.90 $87.21 $84.15 $64.77 $93,600 $7,800 $5,200 $147.68 $134.68 $98.80 $88.92 $85.80 $66.04 $95,400 $7,950 $5,300 $150.52 $137.27 $100.70 $90.63 $87.45 $67.31 $97,200 $8,100 $5,400 $153.36 $139.86 $102.60 $92.34 $89.10 $68.58 $99,000 $8,250 $5,500 $156.20 $142.45 $104.50 $94.05 $90.75 $69.85 $100,800 $8,400 $5,600 $159.04 $145.04 $106.40 $95.76 $92.40 $71.12 $102,600 $8,550 $5,700 $161.88 $147.63 $108.30 $97.47 $94.05 $72.39 $104,400 $8,700 $5,800 $164.72 $150.22 $110.20 $99.18 $95.70 $73.66 $106,200 $8,850 $5,900 $167.56 $152.81 $112.10 $100.89 $97.35 $74.93 $108,000 $9,000 $6,000 $170.40 $155.40 $114.00 $102.60 $99.00 $76.20 $109,800 $9,150 $6,100 $173.24 $157.99 $115.90 $104.31 $100.65 $77.47 $111,600 $9,300 $6,200 $176.08 $160.58 $117.80 $106.02 $102.30 $78.74 $113,400 $9,450 $6,300 $178.92 $163.17 $119.70 $107.73 $103.95 $80.01 $115,200 $9,600 $6,400 $181.76 $165.76 $121.60 $109.44 $105.60 $81.28 $117,000 $9,750 $6,500 $184.60 $168.35 $123.50 $111.15 $107.25 $82.55 $118,800 $9,900 $6,600 $187.44 $170.94 $125.40 $112.86 $108.90 $83.82 $120,600 $10,050 $6,700 $190.28 $173.53 $127.30 $114.57 $110.55 $85.09 $122,400 $10,200 $6,800 $193.12 $176.12 $129.20 $116.28 $112.20 $86.36 $124,200 $10,350 $6,900 $195.96 $178.71 $131.10 $117.99 $113.85 $87.63 $126,000 $10,500 $7,000 $198.80 $181.30 $133.00 $119.70 $115.50 $88.90 $127,800 $10,650 $7,100 $201.64 $183.89 $134.90 $121.41 $117.15 $90.17 $129,600 $10,800 $7,200 $204.48 $186.48 $136.80 $123.12 $118.80 $91.44 $131,400 $10,950 $7,300 $207.32 $189.07 $138.70 $124.83 $120.45 $92.71 $133,200 $11,100 $7,400 $210.16 $191.66 $140.60 $126.54 $122.10 $93.98 $135,000 $11,250 $7,500 $213.00 $194.25 $142.50 $128.25 $123.75 $95.25 $136,800 $11,400 $7,600 $215.84 $196.84 $144.40 $129.96 $125.40 $96.52 $1 00 $11 550 $7, 00 $2 . $1 . $ . $1 . $1 . $9 . $1 0,400 $11 00 $7, 00 $ . $ . $1 8. 0 $1 . $12 . $9 . $1 2,200 $11, 50 $7, 00 $2 . $ . $1 0. 0 $ . $ . $ . $1 ,000 $12,000 $ 000 $2 . . $1 2. 0 $1 . $1 . $ . 39

C loohcStcirtsiD :rebmuNP667718

DROFTRAHSEKAMYSAETF ELIAMIALC pet:wonKnehws’tiemitSfimialc a el.

ytilibasimargorpYruoddeganam .droftraHT

fer’uoytnesbamorf,krownacesivdauoynehwIfia cmial. ruoyecnesba,deludehcshcusgnimocpu latipso,yatsllach3 0syadroirpruoytsalyadkrow.fI ,deludehcsnesaelpllacua snooselbissop

pet:evaHsihtnoitamrofni.ydaerS

• ,emaNsserddadnarehtoyeknoitacfiitnedi.noitamrofni

• emaNruoytnemtrapeddnatsalllufyadevitca.krow

• ehTerutanruoymialcevael.tseuqer

ruoYgnitaerts’naicisyhp,eman,sserddaenohpdna•xaf n.srebmu

S pet:ekaMeht.llachtiWruoynoitamrofni,ydnahllacehT Hdroftra-- . ll’uoYdetsissaagnirac

p lanoisseforll’ohwekatruoy,noitamrofnirewsnaruoysnoitseuq elfiruoymialcssecorpruoyevael.tseuqera

8 4219-745-66 8 Pycilo667718

CLAIMS continued AMIALCTOF nehwIfimialc a el.si ruoyecnesba ,yatsllacs3 0syadroirpruoytsalyad wkro. esaelpllacaelbissop noos s.

F HTIWMIALCECNEDIFNOC

40

ECNATSISSAG

Eretfa n evydelfi mialcsahneeb, yam snoitseuqt o ruOlaog i ecneirepxe oslallacu er’eWerehw h.ple

EVITISOPR

Y ,egdelwonk e tahwuoyera ,yawg yfilauqrofdnay ruoy.efilg

KCIUSTCAFQ

T s’droftraHlaogplehteguoyhguorhtruoy emiyawamorfkrowhtiwytingiddnatsissauoyt a yaw.nacpeeKehtdracwolebaefasecalp erutuf.esull’eWerehtnehwuoydeen.suf

THEHARTFORD.COM/GROUPBENEFITS

(Please cut here and keep in your wallet.)

WHEN YOU CALL THE HARTFORD WILL ASK YOU TO PROVIDE :

• ,emaNsserddadnarehtoyeknoitacfiitnedi i .noitamrofn

• emaNruoytnemtrapeddnatsalllufyadevitca w.kro

T ecnarusnIynapmoC ecfifO,droftraH.TCa yciloprebmunD667718.

• ehTerutanruoymialcevael.tseuqer

• ruoYgnitaerts’naicisyhp,eman,sserddadnaenohp a xaf.srebmun

33690620003002AC sthgir.devreser5

This card is not proof of insurance HO WT OFELIAMIALC 41

42

43

CeoverageTypOndnaboj-ffo42()ruohO ndnaboj-ffo42()ruoh

derevostnevECIssenlldnayrujniI ssenlldnayrujni

F tnemenfinoClatipsoHyaDtsriUotp1dyaraeyrep$1000,$2000, D tnemenfinoClatipsoHylia()+2yaDUotp30raeysyadrep$100$100

D tnemenfinoCUCIyaD()+1Uotp10raeysyadrep$200$200

A ®tsissAPAE2 ,laicnanfilagellanoitomeseussiIdedulcnIdedulcn

H noipmahChtlaeS2Myrujni evitartsinimdA–&lacinilctroppusollofgniwsuoiresssenlliIdedulcnIdedulcn

. . . C ove r age Type O n and o ff - j ob (24 hour) O n and o ff - j ob (24 hour) O n and o ff - j ob (24 hour) C ove r ed E ven t s I ll ness and i n j ury I ll ness and i n j ury I ll ness and i n j ury HSA C ompa t i b l e ? Y es Y es Y es $500 $1 , 000 $2 , 000

. . . .

A 4-day stay in the hospital

could cost around $10,000.1

.

?elbitapmoCHYY

Eeeyolpm ylnO $169.3 $(064.)yad rep $262.4 $(008.)yad rep Eeeyolpm esuopS &/ rentraP $221.5 $(038.)yad rep $464.3 $(134.)yad rep Eeeyolpm )ner(dlihC & $222.5 $(038.)yad rep $463.3 $(134.)yad rep Eeeyolpm ylimaF & $342.8 $(162.)yadrep $647.5 $(261.)yad rep . . . . . . 44

.raM.71021“ lliw.diap2F .degnahc3R 4H noipmahChtlaeSMadnAtsissAytilib® eradedivorphguorhtehTdroftraHhcysPmoC® tondetailfifahtiwehTdroftraHdnatonaredivorpecnarusni.secivresehTdroftraHtonelbisnopser .hcysPmoCa

. . . . . . . . . . . . . . . .

. . . . . . 4 5

.egarevocAypocT .reyolpmet

ECNARUSNIG L SNOISULCXE T snoisivorpeht p.ycilo

.setarotcetorpY

O :)noitatimiLeeyolpmederusnirednuynarehtolatipsohytinmedniycilopnettirwrednuehT tnuomaH

ehtretal:fop

•t rehtoycilop

•t rehtoycilop

E.snoisulcx morfdesuac:yb

•S lanoitnetninoitciflni-fles

•V dellortnoc s lanoisseforp

•V noitprosba noitapicitrapa,toir•V v lagellinoitapucco

•I noitcivnocrofaemirc

•T retrahc)enilria o redlohycilop

•R daor-ffoseitivitca ( ,)selcihevgnicar

•P lanoisseforp-imesyticapac

•P gnah,gnidilgeci c ,gnireeniatnuom p ,warkat,gninilkcals s ksirseitivitca

•T setatSadanaC

•A yna,etats c ehtetacfiitrec eht,yratilim•I w reyolpme ,wal:rofT

•E snoitacilpmocfoereht

•A ebutnoitazilitref

•S lasreverfoereht

•A cihtapoemohsecivres

•A ehtetacfiitrec

•S ehtetacfiitrec

•M gnidulcni;ecitcarplam

•T derevocnosrep

•C fi()elbacilppa

•E evitcurtsnocer:yregrusydobtraplanoitcnuftcefed

•D ,tnemtaerttpecxe:roftnediccaylamona

E ycilop.deussi

N SECITO

T rojamlacidem .egarevocc

T ecnatpecca tneuqesbus.smialco

P ecnarusniycilop o XIXmargorp .ecnarusni( .tnelaviuqe5

.

46

TdroftraH®.ynapmoCemoHeciffO

Form:10M014-rplticEXP-A-M-1LOR05-01-13 UnderwrittenBy purelife-plus Portable,PermanentIndividualLifeInsurancefortheEmployeeandFamily FlexiblePremiumLifeInsurance toAge121 PolicyForm:PRFNG-NI-10 ProductHighlights PermanentLifeInsurance toAge121 MinimalCashValue PremiumsDedicatedPrimarily toPurchaseLifeInsurance LevelPremiumGuarantees CoverageforaSignificant PeriodofTime UniqueLimitedRighttoPartial RefundofPremiumifFuture PremiumRequiredto ContinueCoverageIncreases NoSurrenderChargesApply AcceleratedDeathBenefitDue toTerminalIllnessIncluded ConvenientPremiumPayments ThroughPayrollDeduction PortableWhenYouLeave Employment ApplicationforLifeInsurance ExpressIssue|MonthlyPay foruseonlyin Alaska,Colorado,Hawaii,Iowa,Kentucky, Nebraska,TexasandUtah Fortheeligibleemployeesof COMALISD 47

Portable,Permanent,IndividualLifeInsuranceforEmployeesandTheirFamilies

Asanemployee,youcanapplyforvaluablelifeinsuranceprotectiononyouandyourfamilyundereligibilityguidelines establishedforyouremployer.Youremployerhasconvenientlyagreedtopermityoutopaypremiumsthroughpayroll deduction.Thisisasummaryonly.Policyprovisionsprevail.Thisbrochureisnotacontractoranoffertocontract.

MinimalCashValues Buythispolicyforitslifeinsuranceprotection,notitscashvalue.Theprimarybenefitislifeinsurance. PaymentoftheTablePremiumproducesasmallcashvalue(BenchmarkCashValue).

PermanentLifeInsuranceCoverage Unlikegrouptermlifeinsurance,PureLife-plusisapersonallyowned,permanentindividuallife insurancepolicytoage121thatcanneverbecanceledorreduced aslongasyoupaythenecessarypremiums,evenifyourhealth changes.

GuaranteedPeriod Continuous,timely,anduninterruptedpaymentoftheTablePremiumguaranteescoveragefortheGuaranteed Periodshown.TexasLife(We)cannotlegallypredictthepremium requiredtocontinuecoverageaftertheGuaranteedPeriod.Itmay belower,thesame,orhigherthantheTablePremium.However,if thepremiumtocontinuecoverageiseverhigher,Weguaranteea limitedrighttoapartialrefundofpremium(describedbelow).

GuaranteedLimitedRighttoPartialRefundofPremium IfapremiumhigherthantheTablePremiumiseverrequiredtocontinue coverageaftertheGuaranteedPeriod,youhavethechoiceto:

a.Paythehigherpremium(s)requiredtocontinuecoverage;or,

b.Surrenderthepolicyandreceiveapartialrefundofpremium equalto120timestheminimummonthlypremiumdueat issue(tenyearsworthofTablePremium).Youareeligible forthisrefundiftheactualcashvalueequalsorexceedsthe BenchmarkCashValueandyouhavetakennopriorpartial surrenders.

Portable Onceissued,continuedemploymentisnotacondition tocontinuecoverage.Coverageisguaranteedaslongasrequired premiumsarepaid,evenafteryouretireorterminateemployment.Whenemploymentends,youcanpayequivalentmonthly premiumsdirectlyorbybankdraft(formonthlydirectpaymentswe addamonthlyfeenottoexceed$2.00).Othermodesareavailable.

AcceleratedDeathBenefitDuetoTerminalIllness Forno addedpremium,thepolicyincludesanAcceleratedDeathBenefit DuetoTerminalIllnessRider(FormICC07-ULABR-07).Iftheinsured becomesterminallyillyoumayelecttoclaimanacceleratedbenefit whiletheinsuredisstillaliveinlieuoftheinsuranceproceeds otherwisepayableatdeath.Thesinglesumbenefitis92%ofthe insuranceproceedslessanadministrativefeeof$150.Thisisnot along-termcarebenefit.TerminalIllnessisaninjuryorsickness diagnosedandcertifiedbyaqualifyingphysicianthat,despite appropriatemedicalcare,isreasonablyexpectedtoresultindeath within12months.Otherconditionsandlimitationsapply.Theright toacceleratebenefitsunderthisriderdoesnotextendtoanyChild TermLifeInsuranceRider.However,iftheAcceleratedbenefitis paid,theChildRiderispaid-upterminsuranceasiftheinsured

haddied.PaymentoftheAcceleratedDeathBenefitterminates thepolicyandallotheroptionalbenefits/riderswithoutfurther value.

IndividualandFamilyCoverageisEasytoApplyFor Subjecttoage andamountrestrictions,youmayapplyforanindividualpolicy onyourlifeoryourspouse’slife(seechartnextpageforspouse’s minimum/maximumamounts).Anindividualpolicyfor$25,000is alsoavailableoneachofyourchildrenages15days 26,andeven oneachofyourgrandchildrenages15days 18.(Youmaycover childrenages18andyoungerundertheChildTermLifeInsurance Riderinlieuofindividualpolicies.)Proofofinsurabilityisrequired. Mostpoliciesareissuedbasedupontheanswerstothreeworkand healthrelatedapplicationquestions.

texaslife istheoldestlegalreservelifeinsurance companydomiciledinTexas,establishedin1901.

Policy Mechanics and Other Important Details Premiums are flexible. However, we highly recommend payment of the Table Premium during the Guaranteed Period, and no partial surrenders or policy loans. Table Premium produces a small cash value (Benchmark Cash Value). Paying a lesser premium results in an actual cash value which is less than Benchmark Cash Value, causing the policy to lapse. Premiums less a premium load create cash value to pay monthly administrative loads and cost of insurance. Cash value is currently credited the guaranteed interest rate of 4.00% per annum. We may, at any time, credit higher than the guaranteed interest rate. Likewise, We may charge cost of insurance rates which are less than the policy’s maximum rates, but only when actual cash value equals or exceeds Benchmark Cash Value. No surrender charges apply. Loads include 4.00% of premium, $ 1.50 per month and monthly administrative loads. Two year suicide and contestable clauses apply (one year suicide clause in Colorado). The policy loan rate is 7.40% in advance. Surrenders and loans may be deferred for up to six months.

Form:10M014-rplticEXP-A-M-1LOR05-01-13 48

importantnotices|pleasereadthefollowingnoticesregardingaccelerateddeathbenefitscarefully

ImportantNotice Theinsuranceproceeds,cashvalues,andloan valueswillallbereducedtozeroandwillnolongerbepayableif TexasLifepaystheAcceleratedDeathBenefit.

ImportantTaxNotice TheAcceleratedDeathBenefitunderthis riderisintendedtoqualifyforfavorableincometaxtreatment undertheInternalRevenueCodeof1986. IftheAcceleratedDeath Benefitqualifiesforsuchfavorabletaxtreatment,thebenefitwill beexcludablefromyourincomeandnotsubjecttofederalincome taxation.Taxlawsrelatingtoaccelerationoflifeinsurancebenefits arecomplex.Youshouldconsultaqualifiedtaxorlegaladvisorto

determinetheeffectonyou.NeitherTexasLifenoritsagentsare authorizedtogivetaxorlegaladvice.