2025 EMPLOYEE BENEFITS GUIDE

Leander ISD Benefits is pleased to provide you with the information you’ll need to enroll in benefits. We believe this comprehensive enrollment guide will make it easier for you to learn about your benefit plan options, decide on the levels of coverage that are best for you and your family, and compare costs before completing your online enrollment.

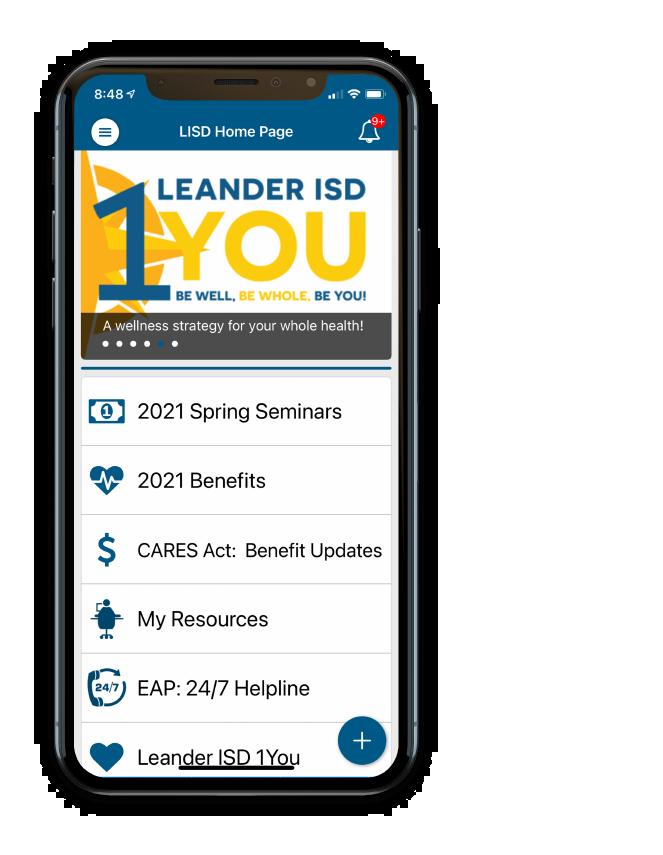

The LISD Benefits app is designed to help you navigate our benefit offerings and is personalized based on your enrollment elections.

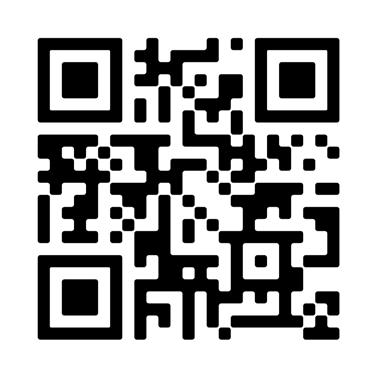

Step 1: From the camera on your smartphone scan the above QR code.

Step 2: Follow the steps to complete the registration process.

Step 3: You will be prompted to download the app where you will enter your username and password that you just created.

Step 4: You are now in the app!

If you have any questions, please

1You is a comprehensive wellness strategy made up of six key initiatives to support the whole you. LISD wants to partner with you on your whole health and well-being. To empower you to be your best at work! Leander ISD cares about the whole student and the whole employee!

• Team Building/ROPES

• ELE Childcare Program

• LISD Volunteer Opportunities

• LEEF Mudstacle

• Heroes Mentoring

• Wellness Champion Program

• EAP Counseling Sessions

• MDLive - Mental Health Marriage/ Family Counseling

• LISD Baby Showers

• Parental Leave

• Failing forward Culture

• Professional DevelopmentOpportunities

• IT Classes

• Aspiring Leaders Program Mentor program

• IAto Teacher Pipeline

• New to Profession Learning Community

• WebResources

• Massage Discounts

• Free Headspace App

• Flu Clinics

• Gym Discounts

• MDLive -Physical Health

• Nurse Chat

• Medical, Dental, Vision Insurance

• Retirement Planning Workshops

• PersonalFinance 101

• District Provided$10K in Life Insurance

• ID TheftProtection Option

Yes. All benefits eligible Leander ISD employees must completeOpenEnrollment to elect orwaive benefits forthe2025 Plan Year. In order to continue your benefits, enrollment must be completed by the deadline. This includes recent new hires.

Visit www.leanderisd.org/benefits or call the Benefits Service Centerat833-667-1172.

USER NAME:

EnteryourLeander ISD email: firstname.lastname@leanderisd.org.

(Please note - youremail address may include a middle initial)

PASSWORD:

Last Name (First letter of lastname is capitalized) + Last 4 Digits ofSocialSecurityNumber

You are eligible to enroll in the LISD Benefits Program if you are aregular employee working at least 20 hours per week in a permanent position.

Your legal spouse

Children under the age of26, yoursor your spouse’s

Dependentchildrenof any age who are disabled

Childrenunderyourlegal guardianship

When adding dependents forthe first time, supporting documentsarerequired to provedependency.For a spouse, we require a copyof a marriagecertificate. For a child, we require a copyofthe birth certificate. Please upload documents to Benefit Place.Without documents, coverage will be dropped.

To enroll a disabled dependent, pleasecomplete the DisabledDependentAuthorizationformandsubmit to carrier. This form is located in theDocumentLibrary at the upper righthandcorneroftheenrollment screen.

The benefits you choose will remain in effect throughout the plan year (from January 1—December 31). You may only add or cancel coverage during the year if you have a qualifying change in family or employment status that causes you to gain or lose eligibility for benefits. Qualifying changesmay include:

A change in yourlegalmarital status

A change in yournumber of dependents as a result ofbirth,adoption, legal custody, or if your dependent childsatisfies orceases to satisfy eligibility requirements for coverage, or the death of a dependent child or spouse

A change in employment status for you or your spouse

Loss or gain of eligibility for other insurance (including CHIP & Medicaid 60day notification deadline

Notify leanderisdbenefits@benefitfocus.com or call 833-667-1172 oftherequestedchange within 30 calendar days ofthechangein status. Therearenoexceptions to this rule.

Employees will receive new Medical cards only if a change was made. For most plans, you can login into the carrierwebsiteandprint a temporary ID cardor give your providertheinsurance company’s phone numberto call and verify yourcoverage.The Health SavingsAccount provider will be newthis year so ALL participants will be receiving new cards. Only new participants of the Flexible Spending Account will receivecards.Dentaland Vision cards will be provided; however, theyare also not required.

Questions: Contactyour LISD Benefits Service Centerat833-667-1172 oremail leanderisdbenefits@benefitfocus.com.

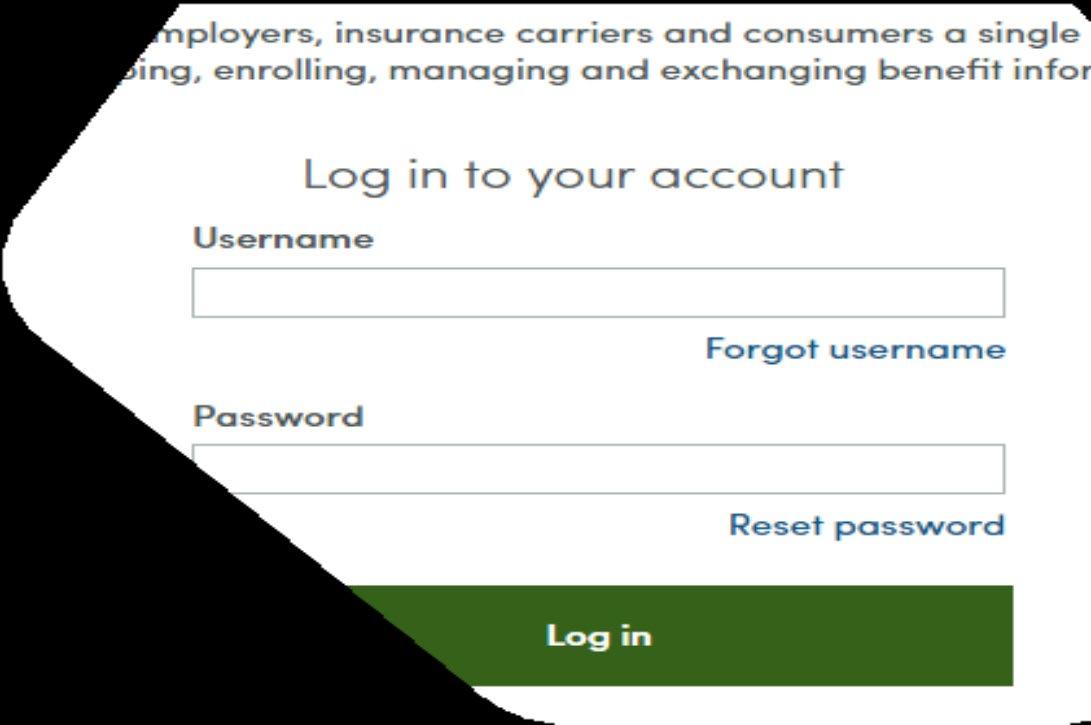

Use your browser to navigate to this website: https://secure3-enroll.com/go/LeanderISD

Enter your username and password.

USERNAME: Leander ISD Email

For Example: john.smith@leanderisd.org

PASSWORD: Last Name (case sensitive, first letter of last name must be capitalized) + Last 4 digits of Social Security Number

For Example: The password for John Smith whose SSN is 123-45-6789 would be Smith6789

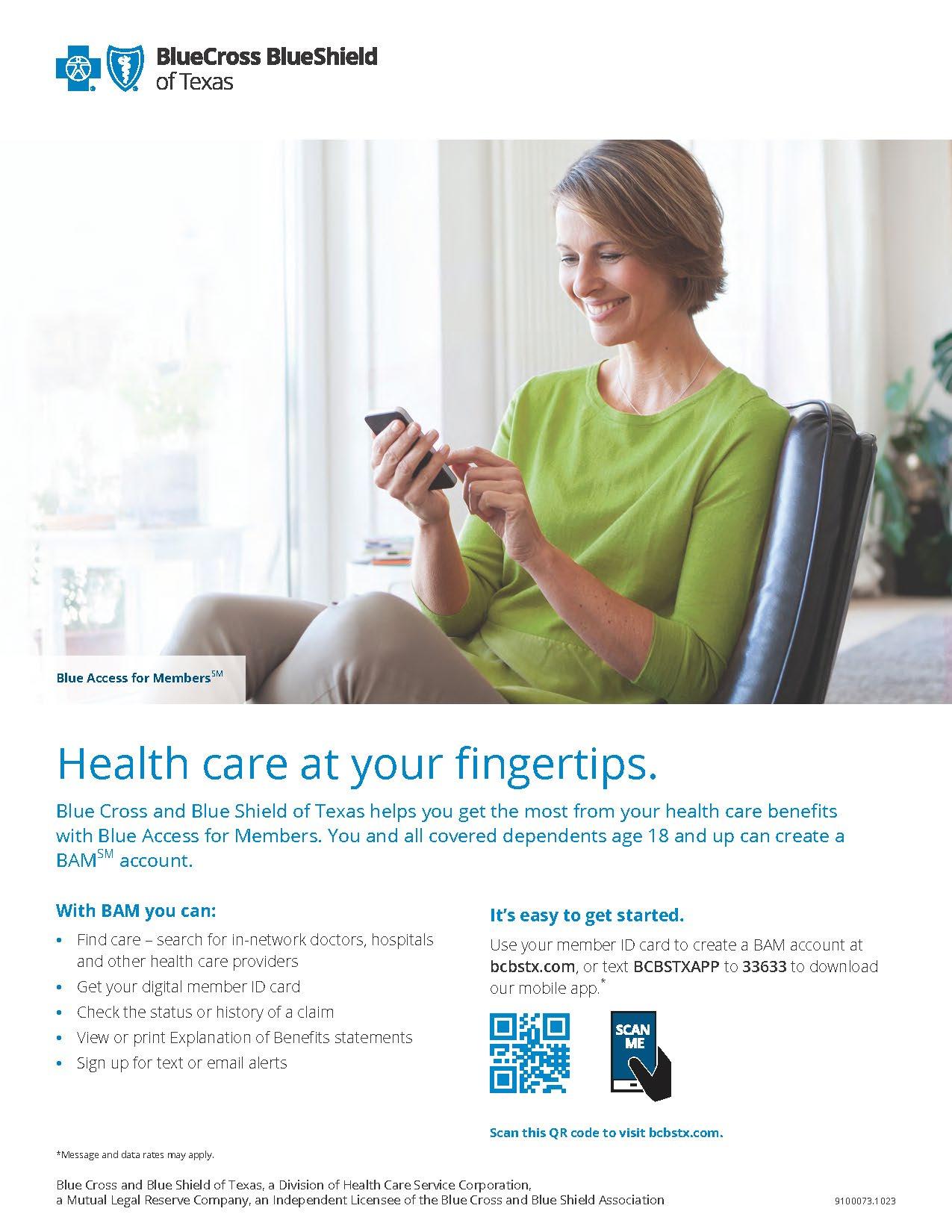

Medicalinsurance is essential to your well-being,and you have five optionsavailable to you with LISD There is a traditional PPO Plan and two ConsumerDirectedHealthPlans (CDHP) providedthroughBlueCross BlueShield of Texas. Thereare also two coverageoptionsprovidedthroughHealthcareHighways. See page 18for information regardingtheHealthcareHighway plans

UnderthePreferredProviderOrganization (PPO) plan, you will becovered with thesameprovidernetwork as the CDHP plans but have lowerout-of-pocket expenses formedical services. You areable to go in-network and out-of-networkforyourpractitioners.Keep inmind that going in-network will give you themostcoverage and lowest out-of-pocket expense.

When a Consumer Directed Health Plan (CDHP) meets certainguidelines, it can be paired with a Health Savings Account (HSA), where you setaside pretax dollarsfor qualifiedhealthcarerelatedexpenses for you andyour dependents The CDHP plans (also referred to as highdeductibleplans) allow you to save moneyonyour medicalpremiumand access all ofthesame providersas PPO participants Eligible participantsenrolled in a CDHP will receive $42 contributionmonthlyfromSchool District into your HSA

District health nsurance will be primary coverage even if you are enrolled in coverage elsewhere.

LISD provides you andyour eligible dependents with MDLIVE if you enroll in oneofthe LISD medical plans. MDLIVEgives you 24/7/365phoneconsultations with one of their appointed, board-certified physicians. PPO participantspay$35perhealthconsultation, CDHP participantspay$44perhealthconsultationuntil your deductible is reached,then co-insuranceonly beyond thatpoint. PPO participants pay $50 and CDHP participantspay $80-$175for Talk Therapy.

*Employee is married to another LISD employee.

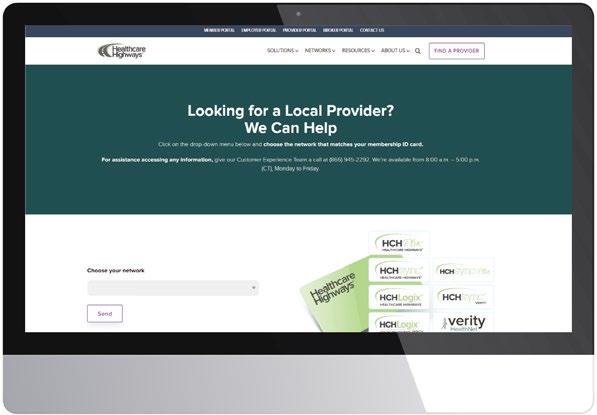

In addition to thethreeplansavailable with BlueCrossBlueShieldof Texas, you also have access to two more medicalplansthroughHealthcare Highways (HCH)

It’s important to note that both HCH plan options are EPO (Exclusive Provider Organization) plans. Meaning, when you select one of the Healthcare Highways Health plans, you must access health care services from doctors, hospitals, and other care providers who are within the HCH Sync network. Costs will not be covered when utilizing care outside of the HCH Sync network

Healthcare Highways Sync network provides access to local quality doctors and hospitals found not only in Leander and surrounding areas, but across the whole state of Texas and Oklahoma.

This high deductible plan is ideal for individuals that only frequent the doctor a few times a year and are ok paying a slightly higher co-pay for services in exchange for a lower monthly premium

This lower deductible co-pay plan is ideal for individuals with more healthcare needs and can benefit from lower out-of-pocket expenses.

For assistance, please contact Healthcare Highways at 833-841-6710.

District health nsurance will be primary coverage even if you are enrolled in coverage elsewhere.

LISD provides you and your eligible dependents with MDLIVE if you enroll in one of the LISD medical plans. MDLIVE gives you 24/7/365 phone consultations with on of their appointed, board-certified physicians. Participants pay $35 per health consultation and $80$175 for Talk Therapy.

*Employee is married to another LISD employee.

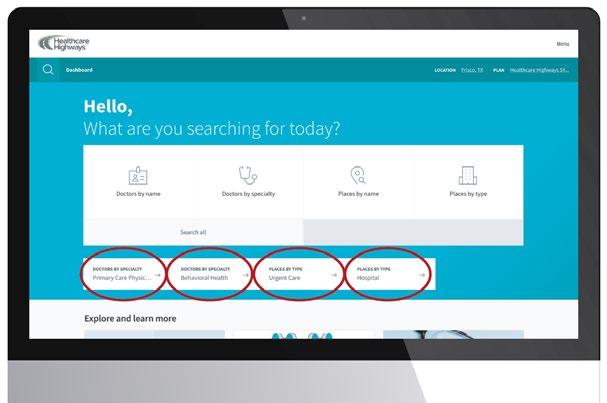

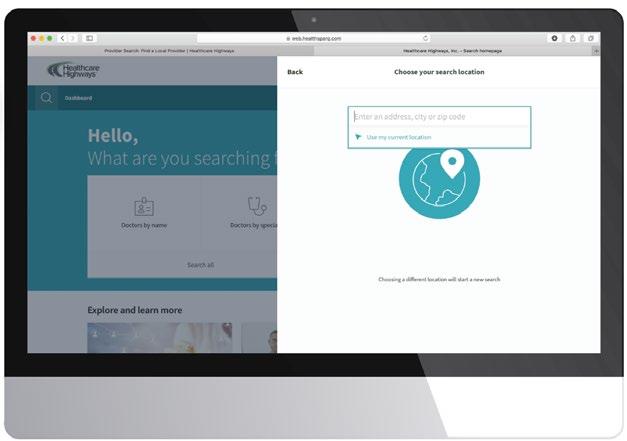

Scan the QR code above or go to healthcarehighways.com and click on the Find a Provider button in the upper right of the screen.

A drop-down menu will appear with different networks listed. Be sure to match the network logo on the front of your member ID card with the one listed on the screen.

Example ID Card shownabove.Check the “Medical Plan Network” section for your network logo. Match the network name with the listing in the drop down.

Now you can start your search for doctors, hospitals, specialists and more by selecting the icons on the main dashboard. if you’re searching for a primary care provider, a specialty like behavioral health, or to find an urgent care in your network.

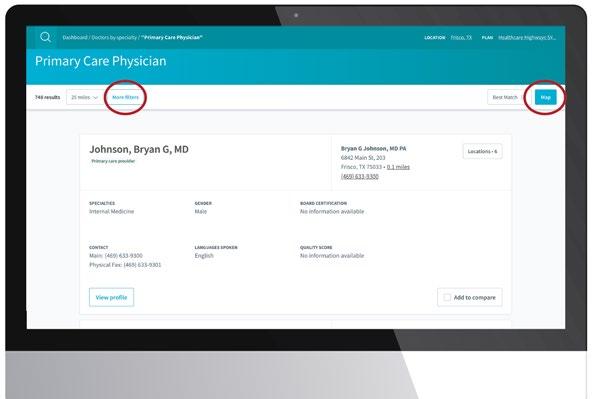

By selecting the Map button, you can view the location of your related search. You can also customize your results by distance, name, or by overall best match.

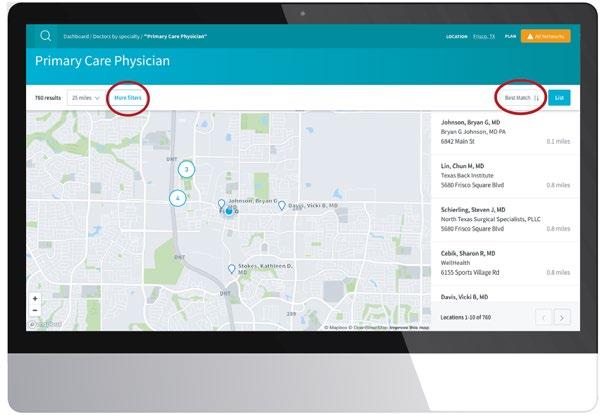

2. You’ve now accessed the provider search page. It’s important to have your member ID card near-by for reference when choosing your network.

Start your search by entering your search location. Provide an address, city, or zip. You also have the option to allow us to use your current location.

At any time you can check to make sure that your location and network

are correct.

6. A list of one or more providers, facilities, or locations will appear, depending on your search parameters. A full profile card will be visible and will display all the information you’ll need to know in order to make your selection. Use the map and filter section to further customize your search.

By selecting the More Filters button a filter screen will appear and will provide you the option to narrow your search by filters such as distance, patient age, preferred language, and more.

We provide you with personalized care management and navigation assistance to help eliminate barriers to health and well-being. Our care coordination team is comprised of care coordinators, registered nurses (known as care managers), and behavioral health professionals. This team works directly with you and your primary care providers (PCPs) to identify, understand, and take control of health risks and chronic diseases so that you have the best health outcomes possible.

Care Decision Support

Helping you decide where, when and how to get the right and most affordable medical care.

Quality and Prevention

Helping you take advantage of preventative services to maintain a healthy lifestyle.

Provider Selection Assistance

Helping you locate the right doctor or facility based on your need.

Transition of Care

Providing you with education and resources from a hospital or care facility with what you need to heal.

Complex Care Support

Helping you maintain a healthy lifestyle when facing a major health event

Behavioral Health Support

Helping you establish care with a behavioral health provider for disabilities, stress, behavioral health needs and substance abuse.

Medication Support

Helping you understand your medications and provide guidance on how to take them correctly.

Chronic Disease Support

Helping you with an ongoing condition like COPD, asthma, diabetes, hypertension, heart disease and obesity to maintain a healthy lifestyle.

With MDLIVE, you can access a doctor from your home, office, or on the go–24/7/365. Our boardcertified doctors can visit with you either by phone or secure video to help treat any non-emergency medical conditions. Our doctors can diagnose your symptoms, prescribe medication, and send prescriptions to your pharmacy of choice.

Let’s Start. How it works.

1. Activate your account

Sign up online by going to mdlive.com/hch or download our app.

2. Choose a doctor

Choose from a large network of boardcertified doctors.

3. Resolve your issue

Receive care when you need it. Call (855) 848-8813.

What we do. For Providers.

We work with primary care providers (PCPs) to provide them the tools and additional support they need to ensure patients follow the best care pathway to optimal health outcomes. Our predictive analytics, access to patient health claims information, and technology platforms make it easier for us to work with the PCPs to leverage patient and peer insights in treatment planning. Our care coordination team members work directly with you and your PCPs to understand and follow treatment plans so that you have the best health outcomes possible across all health risk tiers.

Provider/system mapping

Helping you connect with a PCP and coordinate care using the Healthcare Highways care team

Data analytics & management

Helping aggregate and analyze data to identify populations at risk, measure costof care, and share insights

We provide more timely interventions on identified health problems, tackling identified health risks earlier to avoid or reduce the occurrence of major health events for you. Through an engaged relationshipbetween you,your PCP, and your care coordinators, everyone who is aligned with the agreed upon treatments and medication plan, shares a common goal towards a health outcome, and works together to manage care. Moreover, we think data matters and that better outcomes arise from better access to data by all stakeholders, especially you and your providers. Data helps personalize treatment planning, improves PCP practice efficiencies, raises overall quality of health outcomes, and reduces the total cost of care.

All members have access. If you're a member with identified chronic conditions and health risks, you will receive a call from the Healthcare Highways care coordination team to jump start your engagement with information, available services, and resources.

Member Outreach

Referral support

Helping you efficiently receive referrals from your PCP to optimal specialists and facility partners

The care coordination team will help you fully understand your treatment plan, will monitor your progress, and will help eliminate any delays in treatment. The care coordination team uses tracking tools, and recommend community resources, a web-based library, and educational programs to help you reach your health goals.

• Access to BCBS’s full network

Prime Rx

• Strong local network of providers you may already use

• Care coordination • Frontier Direct Care

MDLive Virtual Visits

• No Out-of-Network coverage, except for emergencies

• Out-of-Network included

• Wellness Program

• Onsite Representative

Frontier DirectCare(FDC)is your front door to healthcare. FDC providespersonalizedand accessible direct primary care from your own dedicated primary care provider Frontier Direct Care is includedas a standardhealthbenefitbyLeander ISD for all medicalplans,regardlessof which carrierorplan you elect

As a Frontiermember,you’llreceivedirectcontact informationfor yourProviderandtheir Medical Assistant, including their cell phonenumber. You can call, text, oremailthem asneeded. You may scheduleappointments in person, virtually, orbyphone – whichever is mostconvenientfor you

Forurgent medicalconcerns after hours that cannot safely wait, you canmessageyourprovider for aroundthe clockaccess to care

• Dedicated primary care providers (PCP)

• Unlimited access to your PCP (in-person and virtual)

• Custom brick and mortar clinic

• Frontier Direct Pay: concierge care navigation and negotiation* for referral services (specialty needs, direct contracts, cancer solutions, etc.)

• Over 1,000 free* prescriptions with convenient home delivery

ThroughFrontier DirectCare’s concierge-style approach to medical care, you’llexperience lower clinical wait times (<2 minutes vs up to 3 hrs), comprehensive whole-person care with a provider that knows you (average visit duration of 30-60minutes vs 7-11minutes), faster lab resultsdelivery time (2 days vs 5-7 days),andreduced ER andUrgentcare costs.

If you areenrolled in oneof LISD’s copayplans (BCBSPPO 1500, HCHACOCopay1000, or HCH ACO Copay5000), there is no cost! All expenses for medical treatmentthrough Frontier DirectCare and negotiated services through Frontier Direct Pay arecovered100%- there is no co-payandnodeductible!

*Due to IRS regulations associated withHDHPHSA plans, if you are enrolledin oneof LISD’s HDHP plans (BCBS HDHP 1650or BCBS HDHP 3300), youwillpay for anynon-preventivemedical treatment until you reachyour deductible (the cost will bedetermined by the services youreceive) . Once you have met yourdeductible,there is no cost!

How do I enroll?

What will my FDC visit cost?

Frontier DirectCare is included as a standard health benefitby Leander ISD for all medicalplans,regardless of which carrier or plan you elect

Preventive Visit:$0

$0 – if you enroll in a Co-pay plan (BCBS PPO 1500, HCH ACO Co-pay 1000, or HCH ACO Co-pay 5000) you have no copay and no deductible

Non-Preventive Visit: Visit fee will vary based on services provided, but a typicalvisitaverages $66 You may use yourHSA to pay for your visit fee.

Dueto IRS regulations associated with HSA contributions, you willpay for any non-preventive medical treatment until you reach your deductible. Once you have met your deductible,there is no cost!

What happens if I need labs?

There will be no cost for labs taken or ordered by Frontier Direct Care

What happens if I need to see a specialist, have imaging done, or have surgery?

There will be no cost for services referred, ordered and arranged by Frontier Direct Care/Frontier Direct Pay

Will services go towards my deductible / outof-pocket maximum?

No, since there is no cost for services through Frontier Direct Care, you will not have anything applied to your deductible or out-of-pocket maximum.

Most labs will be drawn at the clinic. You will pay for the cost of your labs, unless you have met your deductible. You may use your HSA to pay for the cost of your labs

You will pay the cost for your services until you have met your deductible. If you’re able to pay upfront for these services, you may take advantage of Frontier’s concierge negotiation services lower pricing. Or you can utilize your insurance network and be billed for services. You may use your HSA to pay for these services.

Yes! All fees paid for services until you reach your deductible will be applied. Once your deductible ismet, you will not have anyadditional out-of-pocket costs for services through Frontier DirectCare.

Visit your Frontier PCP with a medical need: Easily schedule an appointment via website, phone or app.

Walk into an FDC clinic: Designed to be an inviting comfortable environment, like your favorite coffee shop. Your provider is waiting to greet you as you walk in the door.

Meet with your PCP: Spend 30-60 minutes with your provider, instead of the national average of 8 minutes. Talk about any health needs you have instead of only one.

Frontier Concierge: If a referral is needed to see a specialist, Frontier guides you step-bystep including provider selection, scheduling, payment negotiations getting your results.

Experience world class aftercare: Your provider calls to follow up with you to discuss any results.

Whether you are looking to cope with a specifichealth problem, handle your emotions better, or simply to feel more positive and energetic, thereare plenty of waysto take control of yourmental health - starting today.

Getcarewhenandwhere you need it. Virtual visits allows you theoption to consult a doctorby phone, mobile app,oronlinevideoanytime, anywhere. Speak with a licensedcounselor, therapist, or psychiatristforsupport. Calling a doctor is less expensivethanan office visit! You canchoose who you want to workwith forissues such as:

Remember to takecareofyourmentaland emotional health!Sometimes it’s hard to balancethe demands of family, work, andpersonalneeds. YourEmployee Assistance Program (EAP) is here to help:

Traumaand loss

Relationship problems

And more!

8 counselingsessionsperneedare available

No cost to you andthemembersof your household. Available 24/7/365

Financialinformationand resources

Legalsupportand resources

Sign upat https://work.headspace.com/educators-tx/member-enroll with your district emailaddress to get started.It’sFREEto all LISD employees!

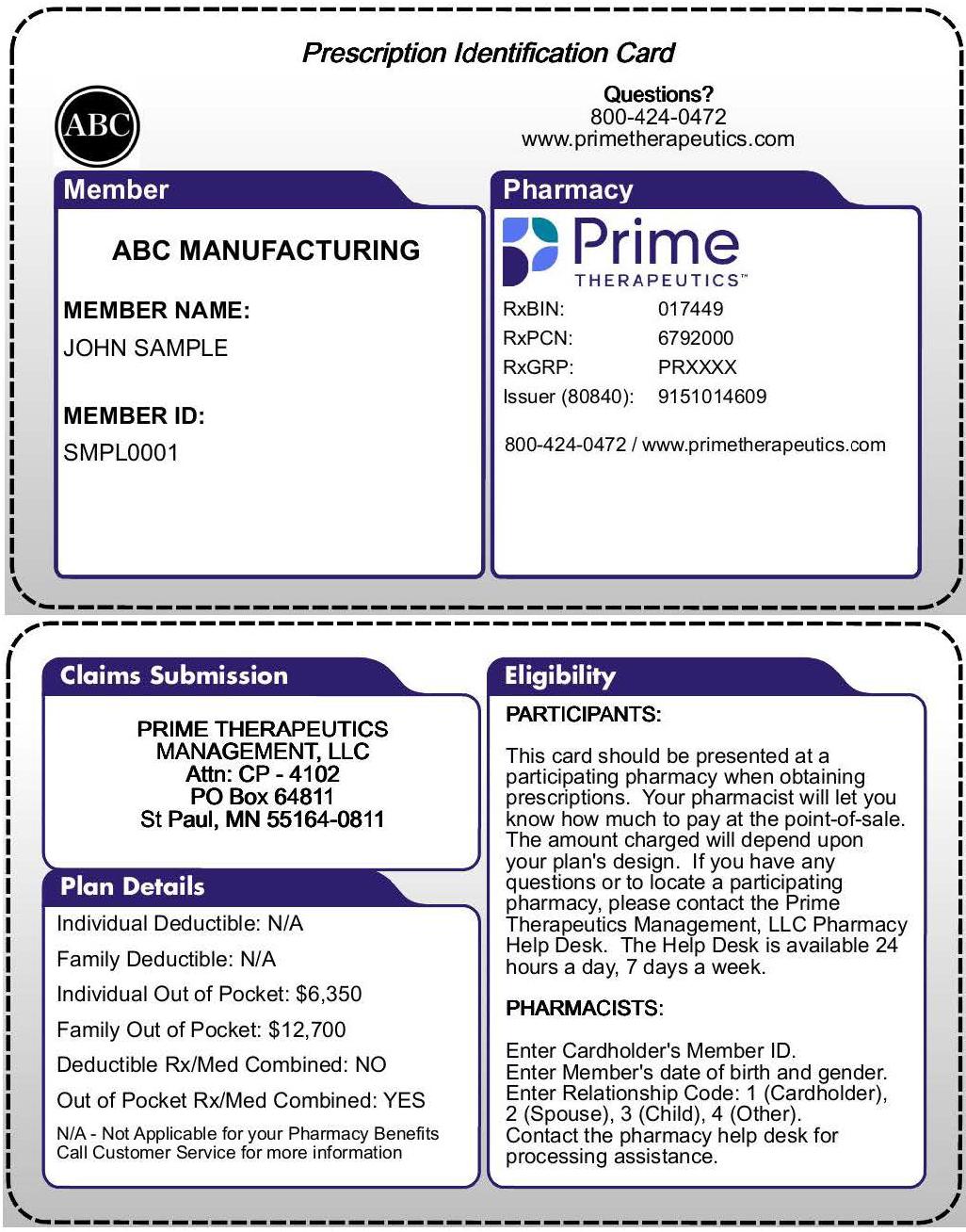

For those enrolled in Leander ISD Medical Insurance, Prime Therapeutics is your Pharmacy Benefit Manager (PBM).

Pleaseshowyourmember ID card and prescriptionatanynetworkpharmacy to get yourmedication Prime Therapeutics offers a largenetwork of majorchains,regionalpharmaciesandindependent stores Visit PrimeTherapeutics com/Member/Documents to see a list ofnetworkpharmacies

With home delivery, you cangetup to a 90-daysupplyof many ofthemedications you may take everyday To getstarted, ask yourprovider to writetwo prescriptions: onefor a 30-daysupply to fill right away atyourlocalpharmacy,andonefor a 90-day supply withrefills, to startyourhomedelivery service Then,chooseoneoftheoptionsbelow:

• Ask your provider to prescribe to Prime Therapeutics Pharmacy LLC (Home Delivery, Orlando).

• Ask your provider to fax your prescription to 888.282.1349. Faxed orders need to come from a doctor’s office and include patient info and diagnosis.

• Mail us your 90-day prescription and home delivery order form with payment to Prime Therapeutics Pharmacy, P.O. Box 620968, Orlando, FL32862. To find home delivery order forms, visit PrimeTherapeutics.com/PatientForms.

You can access the Accord drug list by visiting PrimeTherapeutics.com/Member/Documents Additional helpful resources are also available, including:

• Drug search tools

• Coverage limits and other restrictions

• Copayment tier placement

• Pharmacy listing

Visit PrimeTherapeutics.com or call 800.424.0472. Support is available to members, pharmacies and prescribers 24 hours a day, 7 days a week.

HealthSavingsAccount is a tax-advantagedmedicalsavingsaccountavailable to employees who areenrolled in a high-deductiblehealthplan.Thefundscontributed to theaccountarenotsubject to federalincometaxatthe time ofdeposit. Unlike a flexible spendingaccount (FSA), funds roll overandaccumulateyear to year if not spent.

You cancontribute to your HSA via payroll deduction,onlinebankingtransfer,orbysending a personalcheck to WEX Your employer may contribute to youraccountas well.

You canpayforqualifiedmedicalexpenses with your WEX Debit Card directly to your medical providerorpayout-of-pocket. You caneither choose to reimburseyourselforkeepthefunds in your HSA to growyour savings.

You canmake a withdrawalatany time.

Reimbursementsforqualifiedmedicalexpenses are taxfree. If you aredisabledorreachage65, you can receive non-medicaldistributionswithout penalty, but you mustreportthedistributionsas taxable income. You may also useyourfundsfor a spouseor tax dependentnotcoveredbyyour High Deductible Health Plan (HDHP).

Unused funds willroll over from year to year. After age 65,fundscanbewithdrawnforany purpose without penalty(subject to ordinary income taxes).

AnHSA provides triple taxsavings.Here’s how:

1. Contributions to your HSA canbe made with pre-taxdollarsandanyafter-tax contributionsthat you make to your HSA are tax deductible.

2. HSA fundsearninterestand investment earningsaretax-free

3. Whenusedfor IRS-qualified medical expenses,distributionsarefreefrom tax.

If you have a qualified High DeductibleHealth Plan (HDHP) - through LISD - chancesare you can open an HSA.

Exceptions:

You cannotbecoveredbyanyothernonHSA - compatiblehealthplan,including Medicare Parts A and B.

You cannotbecoveredby TriCare

You cannothave accessed your VA medical benefits in thepast90days (to contribute to an HSA).

You cannotbe claimed as a dependent on anotherperson’staxreturn(unless it’s your spouse).

You mustbecoveredbythequalified HDHP onthe first dayofthe month.

You oryourspousecannotbeenrolled in a full-purpose FSA.

When you openanaccount, WEX will request certaininformation to verify youridentityand to process your application.

WHAT ARE THE 2025 IRS CONTRIBUTION LIMITS?

Contributionsmadeby all parties to an HSA cannot exceedtheannual HSA limit setbythe Internal Revenue Service (IRS).

Combinedannualcontributionsfortheaccount holder andemployermustnotexceedthese limits.

Individual =$4,300

Family = $8,550

Accountholders who meetthesequalifications are eligible to makean HSA catch-upcontribution of $1,000:Healthsavingsaccountholder;age55or older (regardlessofwhen in theyearanaccount holder turns55);notenrolled in Medicare (if an account holderenrolls in Medicare mid-year, catch-upare 55 oroldermusthavetheir own HSA in order to make the catch-up contribution.

You canuseyour HSA to payfor a wide rangeof IRSqualifiedmedicalexpensesforyourself,your spouse, ortaxdependents. An IRS-qualifiedmedical expense is definedasanexpensethatpaysfor healthcare services, equipment, or medications. Funds used to payfor IRS-qualifiedmedicalexpensesare always taxfree. HSA fundscanbeused to reimburseyourselffor past medicalestablished. While you donotneed to submit anyreceipts to WEX, you must save your bills and receipts for tax purposes.

WEX providesuniqueopportunities to invest Health Savings Account (HSA) funds in self-directed investmentoptions. Only HSA fundsabove $1,000 in your HSA WEX cash accountcanbe transferred to yourinvestmentaccount. It’s a great way to potentially grow HSA fundsforhealthcare expenses, or save funds as a nestegg for retirement. Additional investmentinformationcanbefound at www.wexinc.com.

Currentparticipants in aHDHP Medical Plan with a HealthSavingsAccount, who decide to change between BCBS & HCH MedicalPlans with a Health SavingsAccount, will receive a newcard with a new account number from WEX after Open Enrollment. You will need to usethenewcard,as the previouscard will becanceledafteryour balance has beentransferredover.Detailed instructionson this accountbalancetransfer will beprovidedwhen the newcardsare issued.

Examplesof IRS QUALIFIED MEDICAL EXPENSES can befound at IRS.GOV

Toll-free: 866-451-3399

Note: For login help, select Option 2.

Ask a question: customerservice@wexhealth.com

A Flexible Spending Account allows you to save moneybypayingout-of-pockethealthand/ordependent carerelated expenses with pre-taxdollars. Your contributionsaredeductedfromyourpaybeforetaxesarewithheld and youraccount is front-loaded with anannualamount.Because you aretaxedon a loweramountof pay, you pay less in taxesand you havemore to spend.

A Cafeteriaplanenables you to save moneyon group insurance, health-relatedexpenses,and dependent-care expenses. You may save asmuchas35percenton the cost ofeachbenefitoption. Eligible expensesmust be incurred with theplanyearandcontributionsareuse-itor-lose-it. Remember to retain all your receipts.

After theenrollmentperiodends, you may increase, decrease,orstopyourcontributiononlywhen you experience a qualifying“changeofstatus” (marriage status, employment change, dependent change. Be conservative in thetotalamount you elect to avoid forfeitingmoneythatmaybe leftin youraccountat the endofthe year.

Medical FSA—$2,750 (2021)

Limited Purpose FSA—$2,750 (2021)

Dependent Care FSA $5,000 (2021)

WHAT HAPPENSIFIDON’TUSE ALL OF MY FUNDS BY THEEND OF THE PLAN YEAR(DECEMBER

LISD grace periods statethat you have until March15th of 2026 to incur expenses on your past year FSA and until March 31st to submit claims.

You may use the card to pay merchants or service providers that accept MasterCard® credit cards,so there is no need to pay cash up front,thenwaitfor reimbursement

LIMITEDPURPOSEFSA EXAMPLE EXPENSES

Dental • Vision • Lasiksurgery • Root canal

• Before and After School and/or ExtendedDay Programs.

• Theactualcareofthedependent in your home.

• Preschool tuition.

Acupuncture • Bodyscans • Breastpumps • Chiropractor

• Co-payments • Deductible • Diabetes Maintenance • Eye Exam & Glasses • Fertility treatment

• First aid • Hearingaids & batteries • Lab fees • Laser Surgery • Orthodontia • Physicalexams • Expenses • Pregnancy tests • Prescription drugs • Vaccinations

For over-the-counter products, you can visit: www.fsastore.com

DESCRIPTION

Approved by Congress in 2003, HSAs are actual bank accounts in employees’ names that allow employees to save and pay for unreimbursed qualified medical expenses tax-free.

Allows employees to pay out-of-pocket expenses for copays, deductibles & certain services not covered by medical plan, tax-free. This also allows employees to pay for qualifying dependent care tax-free. Limited FSA funds can be applied to eligible dental & vision expenses only.

EMPLOYER ELIGIBILITY

PERMISSIBLE USE OF FUNDS

CASH-OUTS OF UNUSED AMOUNTS (IF NO MEDICAL EXPENSES)

YEAR-TO-YEAR ROLLOVER OF ACCOUNT BALANCE?

BCBS CDHP 1650 Plan & BCBS CDHP 3300Plan

& Employer

family (2025)

Employees may use funds any way they wish. If used for non-qualified medical expenses, subject to current tax rate plus 20% penalty.

Permitted, but subject to current tax rate plus 20% penalty (penalty waived after age 65).

Yes

(2025)

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Not permitted

No, Leander ISD does have a Grace Period which allows employees to file claims up to March 31st. DOES THE ACCOUNT EARN INTEREST?

HospitalIndemnityinsurancepays a cash benefit if you oraninsureddependent(spouseor child) areconfined in a hospital for a covered illness or injury. Thebenefitsarepaid inlump sumamounts to you and canhelpoffset expenses thatprimaryhealthinsurancedoesn’tcover (like deductibles, co-insuranceamountsor co-pays), or benefitscan be usedforany non-medicalexpenses (like housing costs, groceries,carexpenses, etc.).

If you’replanning to have an in-patient hospital procedure in 2025, this plandoes NOT have pre-existing exclusions. (Childbirthis eligible.)

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, treatment and dental disease.

You can choose any dentist, but your out-of-pocket costs will likely be lower if you select contracting dentist. Preventive care services are covered at 100%, including oral exams, fluoride treatments, sealants and routine cleanings. Basic and Major services are covered at 80% and 50%, respectively, after an annual deductible of $50/$150.

EE Only

$29.21

EE + Spouse $53.04

EE + Child(ren) $65.16

EE + Family $88.70

PPO:

DentalGuard Preferred Group #041581 guardiananytime.com

For assistance,pleasecontact Guardian at888-482-7342.

MAJOR RESTORATION

WAITING PERIODS

COVERED FAMILY MEMBERS

Oral evaluations - 2 per calendar year

Prophylaxis: routine cleanings 3 per calendar year

X-rays: routine - 2 per calendar year

X-rays non-routine

Fluoride application - through age 18

Sealants: per tooth - through age 14

Space Maintainers: non-orthodontic

Emergency Care to relieve pain

Restorative fillings

Oral Surgery: simple extractions only Crowns: prefabricated stainless steel/resin

Inlays and Onlays Prosthesis Over Implant

Crowns: permanent cast & porcelain Bridges & Dentures

Oral Surgery: all except extractions

Extractions of impacted teeth

Anesthesia: General & IV sedation

Periodontics: minor & major

Endodontics: minor & major

Denture Relines, Rebases & Adjustments

Repairs: Bridges, Crowns & Inlays Repairs: dentures

This plan does not include any waiting periods.

When you choose coverage yourself, you can also provide coverage for: Your spouse, Dependent children up to age 26

EE Only

EE + Spouse

EE + Child(ren)

EE + Family

BASIC RESTORATION

MAJOR RESTORATION

ORTHODONTICS

$43.05

$78.32

$96.61

$131.19

Guardiandental covers THREE routine cleanings per calendar year

WAITING PERIODS

COVERED FAMILY MEMBERS

Oral evaluations - 2 per calendar year

Prophylaxis: routine cleanings 3 per calendar year

X-rays: routine - 2 per calendar year

X-rays non-routine

Fluoride application - through age 18

Sealants: per tooth - through age 14

Space Maintainers: non-orthodontic

Emergency Care to relieve pain Restorative fillings

Oral Surgery: simple extractions only Crowns: prefabricated stainless steel/resin

Inlays and Onlays Prosthesis Over Implant

Crowns: permanent cast & porcelain Bridges & Dentures

Oral Surgery: all except extractions

Extractions of impacted teeth

Anesthesia: General & IV sedation

Periodontics: minor & major

Endodontics: minor & major Denture Relines, Rebases & Adjustments

Repairs: Bridges, Crowns & Inlays Repairs: Dentures

Orthodontic treatment: - Including Orthodontic Exams

X-rays, Extractions, Study Models & Appliances –through age 18

This plan does not include any waiting periods.

When you choose coverage yourself, you can also provide coverage for: Your spouse, Dependent children up to age 26

Vision insuranceprovidescoverageforroutine eye examinationsandmaycover all orpartofthe costs associated with contactlenses,eyeglassesand vision correction.

For assistance,please contact VSP at 800-877-7195.

Walmart, and Sam’s Club: $85 allowance after eyewear

You will receive an additional 20% savings on the amount that you pay over your allowance. This offer is available from all participating locations except Costco, Walmart and Sam’s Club

Polycarbonate (child up to age 18), and Ultraviolet (UV) coating

Progressive, Polycarbonate (adult), Photochromic, Anti reflective and scratch resistant coating and tints

Standard:$55

copay, Premium: $95 - $105 co-pay, Custom: $150$175 co-pay

Disability insuranceprotectsoneofyourmostvaluable assets, yourpaycheck. This insurance will replace a portion ofyourincome if you become physically unable to work due to sickness or injury.

Didyou know?

Be aware of Elimination periods. For example, you must be disabled for 60, 90, or 180 calendar days before benefits apply.

For assistance,please contact TheHartford at 866-547-9124.

WHY DO I NEED LONG-TERM DISABILITY COVERAGE?

WHAT IS DISABILITY?

HOW MUCH COVERAGE WOULD I HAVE?

WHAT DOES “ACTIVELY AT WORK” MEAN?

HOW LONG DO I HAVE TO WAIT BEFORE I CAN RECEIVE MY BENEFIT?

Most accidentsandinjuriesthat keep people off the job happenoutsidetheworkplaceand therefore are not covered by workers’ compensation.

Typically, disability means that you cannot perform one or more of the essential duties of your occupation due to injury, sickness, pregnancy or other medical condition covered bytheinsurance,and as a result, your currentmonthlyearnings are 80% or less of your pre-disability earnings.

Once you have been disabled for 24 months, you mustbe prevented from performingone or more of the essential duties of anyoccupationand as a result, yourcurrentmonthlyearnings are 60% or less of your predisability earnings.

You may purchase coverage that will pay you a monthlybenefit of 40%,50%,60% or 70% of your monthly income, to a maximum monthlybenefit of $7,500. Your planincludes a minimumbenefit of 10% of your elected benefit.

You mustbe at work with your Employer on your regularly scheduled workday. On that day, you must be performing for wage or profit all of your regular duties in theusual way and for yourusualnumber of hours. If school is not in session due to normal vacation orschool break(s), Actively at Work shall mean you are able to report for work with your Employer, performing all of the regular duties of Your Occupationin theusual way for yourusualnumber of hours as if school was in session.

You mustbedisabled for at least thenumber of days indicatedbythe elimination periodthat you select before youcan receive a Long-Term Disability benefit payment.

*For those employees electing an elimination period of 30 days or less, if you're are confined to a hospital for 24 hours or more due to a disability, the elimination period will bewaived,andbenefits will be payable from the first day of disability.

You cannot receive Disability benefit payments for disabilities that are caused or contributed to by:

• War or act of war (declared or not)

• Military service for any country engaged in war or other armed conflict

• The commission of, or attempt to commit a felony

• An intentionally self-inflicted injury

• Any case where you’re being engaged in an illegal occupation that was a contributing cause to your disability

• You must be under the regular care of a physician to receive benefits.

Mental Illness, Alcoholism & Substance Abuse:

• You can receive benefit payments for Long-Term Disabilities resulting from mental illness, alcoholism and substance abuse for a total of 24 months for all disability periods during your lifetime.

• Any period of time that you are confined in a hospital or other facility licensed to provide medical care for mental illness, alcoholism and substance abuse does not count toward the 24-month lifetime limit.

Pre-existing Conditions: (Initial 12 month only)

• If you were diagnosed or received care for a disabling condition within the 3 consecutive months just prior to the effective date of this policy, benefits are limited to 4 weeks.

• Your benefit payments may be reduced by other income you receive or are eligible to receive due to your disability.

How will my lovedonesbetakencareofwhen I‘m gone? This question isn’t somethinganyonewants to think about, but if someonedependson you forfinancialsupport,then life insurance is your answer.

This benefit is availablefor full-time employees who are actively at work onthe effective dateand working a minimum of 20 hours per week.

Since everyone’sneedsaredifferent, this plan offers flexibility for you to choose a benefit amountthat fits yourneedsand budget

Issue (forthose with current coverage only)

Employeesare eligible to increaseby $10,000 and spousesby $5,000 with noevidence ofinsurability requirements.

If you elect a benefit amount over the Guaranteed Issue Amountshown above for you or your eligible dependents, you will need to submit a Statement of Insurabilityformfor review. Basedonhealth history, you and/oryourdependents will beapproved or declinedforinsurancecoverageby OneAmerica.

You may beable to addcoverageorincrease your benefitamount if you apply within 30days from the date of a life event. Examples of a life event include marriage,the birth of a child, or adoption

provides $10,000 BasicLife Insurance Policy for all employees. Be sure to addyour beneficiary information when enrolling.

Portability

Should your coverage terminate for any reason, you may be eligible to take the term life insurance with you without providing Evidence of Insurability. You must apply within 31 days from the last day you are eligible. The portability option is available until you reach age 70.

OR Conversion

Should your life insurance coverage, or a portion of it, cease for any reason, you may be eligible to convert your Group Term Coverage to Individual Coverage without providing Evidence of Insurability. You must apply within 31 days from the last day you are eligible.

If diagnosed with a terminal illness and have less than 12 months to live, you may apply to receive 25%, 50% or 75% of your life insurance benefit to use for whatever you choose.

If approved, this benefit waives your and your dependents’ insurance premium in case you become totally disabled and are unable to collect a paycheck.

Upon reaching certain ages, your original benefit amount will reduce to a percentage as shown in the following schedule.

• You may select a minimum Life benefit of $10,000 up to a maximum amount of $500,000, in increments of $10,000, not to exceed five times your annual salary.

• Employee must select coverage to select any spouse or child coverage.

• Married couples who both work at LISD cannot cover each other as spouses and only one of the employees m ay cover dependent children.

• Dependent coverage cannot exceed 100% of the Voluntary Term Life amount selected by the Employee.

If AD&D is selected,additional life insurance benefits maybepayable in theeventofanaccident which results in deathordismembermentasdefined in the contract.

• Employee: Up to $500,000, in $10,000 increments

• Spouse: 50% of the employee AD&D benefit

• Child: 10% of the employee AD&D benefit

AD&D Guaranteed Issue

Employee: $500,000, Spouse: $250,000, Child: $50,000

Optionaldependent AD&D coverage is available to eligible employees You must selectemployee coverage in order to coveryourspouse and/ orchild(ren). If employee AD&D is declined, no dependent AD&D will be included

Uponreachingcertainages,youroriginal benefit amount will reduce to thepercentageshown in the following schedule:

Lifetime Benefit Term helpsprotect you andyour familyif you were nolongerable to provideforthem. Your family canreceive cash benefitspaid directly to themuponyourdeaththattheycanuse to helpcover expenses like mortgagepayments,creditcarddebt,childcare,college tuition andotherhousehold expenses.

Guaranteed Issue is available to all employees, spouses, and child(ren).

Guaranteed BenefitsDuringWorking Years

DeathBenefit is guaranteed100%when it is needed most duringyourworkingyears when your family isrelying onyour income.

Accelerates up to the lesser of $150,000 or 75% of the applicable death benefit.

The rider will restore 100% of the death benefit that is accelerated under the Chronic Condition Rider, leaving a full death benefit for the beneficiary.

If you need LTC, you can access yourdeath benefit while you are living forhomehealthcare, assisted living, adultdaycareandnursinghomecare. You get4%ofyourdeathbenefitpermonth while you are living forup to 25months to helppayfor LTC.

Accelerates either 4%of the death benefit amount for a monthly benefit or 20% of the death benefit amount as one-time lump sum payment.

You andyour family continuecoverage with no loss ofbenefitsorincrease in cost should you terminate employment.

Cancerinsuranceoffers you andyour family supplementalinsuranceprotection in theevent you or a covered family member is diagnosed with cancer. It pays a benefit directly to you to help with expensesassociated with cancer treatment.

A Cancer Policy pays you cash benefits based on diagnosis, certain procedures, screenings, and treatments. For assistance,please contact Guardian at 800-541-7846.

WHEN YOU HEAR THAT YOU HAVE CANCER, YOU THINKABOUT A LOT OF THINGS.THEONETHING YOU DON’T WANT TO THINKABOUT IS HOW TO PAY FOR ALLTHE EXPENSES THAT COME FROM YOURMEDICALCAREAND RECOVERY.

Employee: $2,500

INITIAL DIAGNOSIS BENEFIT AMOUNT

Spouse: $2,500 Child: $2,500

INITIAL DIAGNOSIS WAITING PERIOD 30 days

PORTABILITY

RADIATION THERAPY CHEMOTHERAPY

RADIATIONTHERAPY & CHEMOTHERAPY SCHEDULES

Employee:$5,000

Spouse: $5,000

Child: $5,000

Included without Evidence of Insurability Included without Evidence of Insurability

Schedule amounts up to a $10,000 benefit year maximum

Injected Cytoxic Meds: $800/Week; Pump Dispensed Cytoxic Meds: $800/Week Refills; Oral Cytoxic Meds: $400/Prescription, $1,200/Month; Cytoxic Meds Administration by Other Method: $800/Week; Exter- Method: $1,500/Week; External Radiation nal Radiation Therapy: $650/Week; lnsertion of lnterstitial/lntracavity Adm in of Radioisotopes/Radium: $800/Week; Oral or IV Radiation : $650/Week

Schedule amounts up to a $20,000 benefit year maximum

Injected Cytoxic Meds: $1,600/Week; Pump Dispensed Cytoxic Meds: $1,500/Week Refills; Oral Cytoxic Meds: $750/Prescription, $2,250/ Month; Cytoxic Meds Administration by Other Method: $1,500/Week; External Radiation Therapy: $1,300/Week; Insertion of Interstitial/Intracavity Admin of Radioisotopes/Radium: $1,625/Week; Oral or IV Radiation: $1,300/Week PRE-EXISTING CONDITION

AIR AMBULANCE

AMBULANCE

ANESTHESIA

ANTI-NAUSEA

BLOOD/PLASMA/PLATELETS

EXPERIMENTALTREATMENT

EXTENDED CARE

FACILITY/SKILLED NURSING

HOME HEALTH

HORMONE THERAPY

HOSPICE

HOSPITAL CONFINEMENT

ICU CONFINEMENT

IMMUNOTHERAPY

MEDICAL IMAGING

OUTPATIENT / AMBULATORY

SURGICAL CENTER

PROSTHETIC

RECONSTRUCTIVE SURGERY

$1,500/trip, limit 2 trips per hospital confinement

$200/trip,limit 2 trips per hospital stay

25% of surgery benefit

$50/day up to $150 per month

Bone Marrow: $7,500 Stem Cell: $1,500

50% benefitfor 2nd transplant

$1,000 benefit if a donor

$100/day up to $1,000/month

$100/day up to 90 days per year

$50/visit up to 30 visits per year

$25/Treatment up to 12 treatments per year

$50/day up to 100 days/lifetime

$300/day for first 30 days; $600/day for 31st day thereafter per confinement

$400/day for first 30 days; $600/day for 31st day thereafter per confinement

$500 per month

$2500 lifetime max

$100/image up to 2 per year

$250/day, 3 days per procedure

Surgically Implanted: $2,000/device, $4,000 lifetime max

Non-Surgically:$200/device,$400 lifetime max

Breast TRAM Flap

$2,000

Breast reconstruction $500

Breast Symmetry $250

Facial reconstruction $500

Biopsy Only: $100

Reconstructive Surgery: $250

Excision of a skin cancer:$375

$2,000/trip, limit 2 trips per hospital confinement

$250/trip,limit 2 trips per hospital stay

25% of surgery benefit

$50/day up to $250 per month

Bone Marrow: $10,000 Stem Cell: $2,500

50% benefitfor 2nd transplant

$1,500 benefit if a donor

$200/day up to $2,400/month

$150/day up to 90 days per year

$100/visit up to 30 visits per year

$50/Treatment up to 12 treatmentsper year

$100/day up to 100 days/lifetime

$400/day for first 30 days; $800/day for 31st day thereafter per confinement

$600/day for first 30 days; $800/day for 31st day thereafter per confinement

$500 per month

$2500 lifetime max

$200/image up to 2 per year

$350/day, 3 days per procedure

Surgically Implanted: $3,000/device, $6,000 lifetime max

Non-Surgically: $300/device, $600 lifetime max

Breast TRAM Flap

$3,000

Breast reconstruction $700

Breast Symmetry $350

Facial reconstruction $700

Biopsy Only: $100

Reconstructive Surgery: $250

Excision of a skin cancer: $375

SKIN CANCER

Excision of a skin cancer with flap or graft: $600

Excision of a skin cancer with flap or graft: $600

Critical Illness insurance is designed to supplement your medical and disability coverage easing the financial impacts by covering some of your additional expenses. It provides a benefit payable directly to the insured upon diagnosis of a covered condition or event, like a heart attack or stroke.

Critical Illness Insurance pays a lump sum benefit if you are diagnosed with a covered illness or condition. Critical Illness Insurance is a limited benefit policy.

Features of Critical Illness Insurance include:

Guaranteed Issue: No medical questions or tests required for coverage

Flexible: You can use the benefit money for any purpose you like.

Portable: Should you leave your current employer or retire, you can take your coverage with you.

Your premium is based on your Issue Age, meaning your initial rate is based on your age at the time your coverage becomes effective. Rates will not increase due to age.

Your Initial Benefit provides a lump-sum payment upon the first diagnosis of a covered condition. Your plan pays a recurrence benefit for the following covered conditions: heart attack, stroke, coronary artery bypass graft, full benefit cancer, partial benefit cancer and all other cancer. A recurrence benefit is only available if an initial benefit has been paid for the covered condition. There is a benefit suspension period between recurrences. Initial benefits and recurrence benefits will be paid until the total benefit amount has been reached.

Employee may choose a lump sum benefit of $10,000 to $30,000 in increments of $10,000.

-Spouse: 100% of Employee Benefit.

-Child: 50% of Employee Benefit.

INVASIVE CANCER (LEUKEMIA, MULTIPLE MYELOMA)

CHILDHOOD ILLNESSES & DISORDERS: Autism Spectrum Disorder, Cerebral Palsy, Cleft Lip or Cleft Palate, Clubfoot, Congenital Heart Defect, Cystic Fibrosis, Diabetes-Type 1, Down Syndrome, Hemophilia, Multisystem Inflammatory Syndrome (MIS), Muscular Dystrophy, and Spina Bifida

Afteryourcoveragehasbeen in effectforthirtydays,Guardian will provideanannualbenefitof$50percalendar year fortakingoneofthe eligible screening/prevention measures.Guardian will payonlyonehealthscreeningbenefit per coveredpersonpercalendar year.

Your premium is basedonyour Issue Age,meaningyourinitialrate is basedonyourageatthe time your coverage becomes effective, andyourrates will notincreasedueto age.

Accident Insurance pays cash benefits directly to you or anyone you choose regardless ofany othercoverage you have. Benefits are designed to coverhealthplangaps for out-of-pocketexpenses like deductibles, copays, and coinsurance. LetAccident Insurance helptakecare of your bills so you can takecare of yourself and your family.

EMPLOYEE

EMPLOYEE + SPOUSE

EMPLOYEE + CHILD(REN)

EMPLOYEE + FAMILY

$11.22

$17.75

$18.58

$29.31

Improve your health and fitness through our wellness benefits. For assistance,please contact TheHartford at 800-547-4205.

Paysyou $100soonafter you reportyour first claim forcoveredbenefits. If you getinjured,they can beginprocessingyour claim rightoverthephone so you canget cash fast.

Your benefitsincrease25%,up to $1,000per person peryear,forinjuriesresultingfrom participating in organizedsports. Playing sportscanlead to injuries andunwelcomeexpenses.TheHartford will increase yourbenefits to helppaythose expenses.

They pay cash benefits for admission, daily confinementand recovery. Whether you are released to a RehabilitationCenter following a hospitalstayor you recoverathome,theypay a daily recoverybenefit to help with your transition.

Your coveragecannotbecanceledaslongas your premiumsarepaidas due.

You cankeepyourcoverageeven if you change employers or retire.

Emergenciescanhappen to anyone,anytimeand anywhere. Are you prepared?

Emergent Ground Ambulance transport can easily surpass $2,000andcanreachashighas$5,000.

Emergent Air Ambulancetransportsfrequently cost more than $40,000, reachingashighas $70,000.

Themonthlyfeecoversemployee,spouseandchildren up to age 26. Nodeductibles. Easy claim process

For assistance,please contact MASA at800-423-3226

EMERGENT GROUND TRANSPORTATION U.S./Canada U.S./Canada EMERGENCY AIR TRANSPORTATION U.S./Canada U.S./Canada

Every day, families facethefinancialburdenofunexpectedemergencymedicaltransportation. A medical transport membershipensuresthepeaceof mindin knowingthat a life-savingmedicaltransportdoesn’thave to jeopardize your family’s financial security. *Basic Coverage Area (BCA) includes U.S., Canada, Mexico, and the Caribbean (excluding Cuba)

Legalplansprovidevaluablebenefitsthatcoverthemostcommonlegalneeds you mayencounter, such as creating a will, healthcarepowerofattorney, orbuying a home. This plan also provides access to quality lawfirms for advice, consultation, and representation.

Dependents must be added on the plan to be able to use services with Texas Legal.

For assistance,please contact Texas Legalat800-252-9346.

Estate Planning (Wills, Trusts, Living Wills & Powers of Attorney) Covered

Family Law (Divorce or- Modification/Establishment or Enforcements) Covered

Bankruptcy (Chapter 7 or Chapter 13) Covered

Traffic Tickets Covered

Financial Counseling Covered

Family Immigration Assistance Covered

Prenuptial or Postnuptial Agreement Covered

Defense of Misdemeanor Charge Covered

Defense of DWI/DUI Covered

Adoption Covered

Defense of Civil Action Covered

Defense of Insanity or Infirmity Covered

Defense of Juvenile/Children's Court Covered

Habeas Corpus Covered

Defense of Driving Privileges 6 Hours Covered

General Legal Services Covered

Consumer Protection Covered

Uncontested Name Change 4 Consultations Covered

Attorney Consultation Covered

Probate Proceeding Covered

Residential Real Estate Transaction Covered

Expunction & Order of Nondisclosure Covered

Public Intoxication Covered

Guardianship of Adult or Minor Covered

Protective Order Covered

Legal Access Service Covered

Each ofthebenefits listed belowareavailable to Texas Legalmembersonceperplanyearperaccountunless otherwise specified. Pre-existing mattersarenotcovered(althoughthe In-Networkdiscountapplies). See endoftablefor more general exclusions.

Telephone-based general legal advice and consultation, meant for quick answers to your legal questions. This service only provides general guidance and is not intended for individual legal representation. For further legal services, please use the online Texas Legal Attorney Finder to locate an attorney in your area.

Members may seek legal advice regarding a potential or current legal issue to assess whether an Attorney is agreeable and satisfactory for the establishment of an Attorney-Client relationship.

IN-NETWORK DISCOUNT

Legal advice, negotiations, correspondence, and document review and preparation. This benefit is available in a variety of areas of law including but not limited to the following matters: Debtor / Creditor, Elder, Tenant, Medical Claims. Social Security, Tax, Worker's Compensation, and Wrongful Death. This benefit is designed to cover services that are not excluded from coverage, but not explicitly covered.

If a matter is not resolved before a claimed Covered Legal Service is exhausted, is not covered but not excluded by the Policy, and/or is pre-existing, Members receive a 25% discount from a Participating Attorney's usual and customary hourly rate.

Includes preparation, filings and appearance for pleadings, motions, discovery, pre-trial and/or settlement conferences and/or trial preparation and trial in the defense of most civil actions. Includes representation in a hearing for the determination of a dog being a "dangerous dog“ (e.g. your dog bites someone).

Includes representation for negotiations and any legal action required for the enforcement of written or implied warranties or promises (e.g. a refrigerator warranty or poor/incomplete workmanship from a home contractor).

COVERAGE/BENEFIT

HABEAS CORPUS

MISDEMEANOR

Includes court proceeding for preliminary matters in a criminal action such as bond reduction or failure to provide speedy trial or hearing.

Includes arraignment, plea negotiations resulting in disposition without trial, and/or trial preparation and proceedings. Does not apply to traffic violations, disturbing the peace, and public intoxication.

Includes initial appearance, plea negotiations resulting In disposition without trial, trial preparation and proceedings. and sentencing hearing. if applicable.

DRIVING/BOATING WHILE INTOXICATED

PUBLIC INTOXICATION

DEFENSE OF INSANITY/ INFIRMITY

JUVENILE/ CHILDREN’S COURT

Includes arraignment, plea negotiations resulting in disposition without trial, and/or trial preparation and proceedings for defense of driving/boating while intoxicated or under the influence of drugs.

Includes defense of a charge of public intoxication including arraignment and preparation and plea negotiations resulting in disposition without trial or trial.

Includes arraignment, plea negotiations resulting in disposition without trial, and/or trial preparation and proceedings where the participant is a defendant in trial to determine competency to stand trial or where the state seeks the involuntary commitment of the participant.

Includes representation for Juvenile / Children's court proceedings for dependents listed on policy under the age of 18.

TRAFFIC TICKET

DEFENSE OF DRIVING PRIVILEGES

EXPUNCTION/ORDER OF NONDISCLOSURE

Includes defense of a traffic violation, punishable by fine only. in which a Participant is a defendant, including misdemeanor arraignment or initial appearance and preparation and plea negotiations resulting in disposition without trial.

Includes arraignment, plea negotiations resulting in disposition without trial, and/or trial preparation and proceedings.

Includes representation where a participant petitions a court to purge. alter, or forbid release of records of arrests, prosecutions, and criminal dispositions.

Occupational driver’s license excluded

OR

Includes representation for a participant for creating a premarital (prior to marriage) or marital property agreement (after getting married) where no issue is contested.

Consultations, negotiations, preparation and pleadings through trial if needed. Includes term initiating parental rights.

Includes representation in an uncontested name change proceeding for a participant or a minor of which the participant is a conservator.

Divorce, Contested without children

Divorce, Contested with children Modification,

or

of Family Law Order, Uncontested

Includes representation in proceedings for a protective order designed toprotect someone againstfamily violencewhere a participant is either theapplicant or respondent.

Includes representation in a proceeding where a participant petitions to be appointed as a guardian. Not intended to provide services for suits affecting the parent-child relationship.

Includes assistance and advice in the completion and filing of one Form 1-130 plus supporting documentation on behalf of an alien relative. Also provides for the Attorney to attend inter- views involving USCIS and respond to Requests for Evidence. Not intended for use with aliens who entered or stayed in the US unlawfully.

1. Codicil(s) -An update or change to a Will

1a. Will(s) & Testamentary Trust(s) - Wills that provide for the distribution of assets and/or a Trust(s) that forms upon the death of the Participant(s)

ESTATE PLANNING

1 OR 1A OR 1B. 2, 3 OR 4 OR ANY COMBINATION OF THE NUMBERED OPTIONS

1b. Will(s) & Living Trust(s) - An estate plan that includes Will(s), Testamentary Trust(s) and revocable or irrevocable Living Trust(s), including any needed Deeds.

2. Living Will(s) / Advance Directive(s) to Physician for up to 2 Participants, 1 Document per Participant

3. Power(s) of Attorney for up to 2 Participants, 2 Documents per Participant

4. Additional Documents: Declaration of Guardianship, HIPAA Release, and/or Disposition of Remains for up to 2 Participants, 3 Documents per Participant

Includes representation for probate proceedings for estates with or without a will, including petitioning a court to admit a will to probate and/or appointing an administrator.

The policy participant must be an executor or devisee of the will or an heir of an estate without a will. Does not apply for filing claims against an estate as a creditor.

With a Will and Uncontested

With a Will and Contested, Without a Will and Contested or Uncontested

Includes representation in the transaction of selling or purchasing a primary residence single piece of real property including the review and drafting of all legal documents. Does not apply to construction or improvements.

Preparation and court proceedings for Chapter 7 - liquidation.

for Chapter 13 - all or partial repayment.

FINANCIAL COUNSELING

Members have access to a broad array of services offered by Transformance (transformanceusa.org), including bankruptcy counseling and education, budget and credit coaching, debt management planning, student loan coaching, and numerous online resources including daily financial webinars.

Identity Restoration specialist are immediately available to help you address credit and non-credit related fraud.

Credit Monitoring actively monitors your Experian file for indicators of fraud.

LOST WALLET PROTECTION

IDENTITY THEFT INSURANCE

IDENTITY THEFT RESTORATION

Experian will assist an enrolled Participant with canceling and replacing a Participant's credit and debit cards when their wallet is stolen.

Experian provides enrolled Participants with $1 Million in coverage for reimbursement of certain fees, lost wages, and fraud losses related to identity recovery.

Experian will communicate and negotiate with credit bureaus in order to remove negative information from a Participant's credit history that resulted from identity theft and credit fraud. (separate enrollment not necessary).

This information is a general explanation of the Group Legal Services Preferred Plan. A detailed Texas Legal Certificate of Coverage is included in new member kits, and in case of a discrepancy between the Summary of Benefits and the Certificate of Coverage, the Certificate of Coverage controls.

• In-Network: Applies to services rendered by a Texas Legal Participating Attorney PAYMENTS FOR SERVICES ISSUED DIRECTLY TO TEXAS LEGAL PARTICIPATING ATTORNEYS.

• Out-of-Network: Services rendered by a non-Texas Legal Participating Attorney PAYMENT FOR SERVICES ISSUED DIRECTLY TO TEXAS LEGAL

Thebenefits on the following pages are always available anddo notrequire enrollment during designated enrollment periods.

• If you join or leave LISD in the middle of your duty calendar, your leave days will be pro-rated based on actual days employed.

• Both state and local days accumulate and carry over to the next school year, but local days cap out at 30 days.

• If you came to LISD from another TX school district, official service records are required to update State day balances.

Employees will receive up to 5 days of bereavement leave upon the death of an immediate family member. The leave request must be submitted along with documentation of the family member’s death (documentation can include an obituary, funeral service program, certificate of death, newspaper article, or other similar document). FOR QUESTIONS, PLEASE EMAIL: leaverequest@leanderisd.org

Your Employee Assistance Program regularly helps people much like yourself locate the services they need to help family members and themselves cope with life’s challenges. Frequently the hardest part of a decision is doing the research to make your choice.

EAP provides you and your household members with valuable, 24/7, FREE confidential services.

Per problem, per year. Short-term counseling sessions which include assessment, referral, and crisis services for you and your household members. (Same-day appointments available for urgent/crisis callers, or facilitation of immediate hospitalization).

A Life Coach can help with regular telephone sessions. A coach will collaborate with you in a thought-provoking process.

Legal and Financial services are provided by a lawyer or financial professional specializing in your area of concern. Available online or by telephone.

Customized EAP website featuring resources, skill-building tools, online assessments, and referrals.

Resources and referrals for everyday needs. Available by telephone.

Reimbursement for emergency cab fare for eligible employees and dependents that opt to use a cab service instead of driving while impaired.

Telehealth solution that offers the option of telephonic or video counseling.

FEATURES:

• Access your EAP at the click of a button

• Theapp supports telephonic or video calls, instant messaging (IM), short message service (SMS), video, and articles

• Answered 24 hours a day, 365 days a year

• Members can connect with experts instantly or decide for a later appointment

• Accessible by iOS and Android devices

• Browse curated self-help resourceswith a few swipes on the phone

iConnectYou isanapp thatinstantlyconnects you with professionals for in-the-moment support andhelp finding resources for you and your family.

To access iConnectYou, download the appfrom the AppStore (iPhone) or Google Play(Android)and register usingthe iCY passcode below. Foradditional information, you may accessyour EAP’s website following the detailslisted below.

Toll-Free: (888)993-7650

Email: eap@deeroaks.com

Website: www.deeroakseap.com

Username/Password: leanderisd

iConnectYou Registration code: 245119

Deer Oaks remains concerned aboutyour safety and the safety of others. Therefore, we encourage you to callfor a ride in the event that you feelunable to drive due toimpairment bya substance or extremeemotional condition. Such circumstances may include over consumption ofalcohol, drowsiness due to medication, orifyou areextremely upset/ troubled over a situation (i.e. you receive bad newsat work, you arelaid off or let go, learn of a deathin thefamily, finalize a divorce, etc.)

As part ofyour EAP program, DeerOaksreimburses you and your dependents for cab, Uber and Lyft fares up to$45.00 (excludes tip) once per year. The process is simple, and like allother EAP services, confidential. Your receiptmay be submitted up to 60 days from date of service.

Simply call ourHelpline for instructions onhow to submityour receipt. It maytake up to 45 daysfor reimbursement.

• Initial Telephonic Consultation & Assessmentby a Work/ Life Consultant

• Answers to Questions about Work/Life Topics such asthe difference between care options (e.g. day care centers vs. family day care homes) orhowto evaluate providers

• Guidance onhow to manage work, personal, andeveryday issues

• 3-5 confirmed referrals to providers in your area within 12hours of the request

• Supportfor you, as well asthose in your family/ household

To help you make time for what matters most, you and your family have access to an EnhancedWork/Life Program providedthrough your EAP. Thisservice offers telephonic assistance froma professional Work/Life Consultant to providesupport,guidanceand referrals for any work, personal, or everyday issuethat’s important to you.

Consultants are able to assistwith nearlyendless resources such as findingpet sitters, childandelder care facilities, tutors,home repair, veterinarians,andmovingservices. Below are afewof the topics for which we can provide resource and referralservices:

Adoption Agencies

Raising Teenagers

AdopteeSupport Groups Tutors

Before& After School Care

In-Home Care

Nanny Agencies

SpecialNeedsChild Care

International Study Programs

Child Development

Kindergarten Programs

Enrichment Programs

School District Profiles

2 and 4 YearColleges

Continuing Education

Admissions Testing

Blended Families Cancer Care Centers

RetirementCommunities

Alzheimer’s Support

Pet-sitters / Kennels

Apartment Locators

VolunteerOpportunities

Diet & NutritionPrograms

Chronic Condition Support Groups

Legal Aid Organizations

Mortgage Brokers

Thepathtopersonalandprofessionalsuccessisnotalwaysclear.Thisiswherea Life Coachcanhelp.Withregulartelephonesessions,youandyourcoachcollaboratein athought-provoking,creativeprocessto navigate lifetransitionsandmaximizeyour personalandprofessionalpotential.

TOLL-FREE: 888-993-7650

WEBSITE: www.deeroakseap.com

EMAIL: eap@deeroaks.com

• Aninitial 45- to 60- minute session with yourcoach to establishvision, goals and the creation of anaction plan

• Up to five 30-minute follow-up coaching sessions to make sure you are on track to achieve your goals

• Follow-up calls scheduled at a time that is convenient for you and set at the end of each appointment

• Ongoingsupportive email communication for sharing of resourcesand progress check-ins

The EAP Benefitcovers 8 confidentialshort-term counseling visits FREE of charge to employees and their families. Employees also have access to unlimited 30 minutechat sessions for in-the- moment support. These do not counttoward your 8 sessions. 1-888 - 993 - 7650 | www.deeroakseap.com

Username: leanderisd Password: leanderisd iConnect Youapp (code: 245119 ) LISD has somegreat FREE resourcesfor YOU ! www.leanderisd.org/benefits

Headspace is a meditation and sleep app that teaches you how to meditate, breathe,and live mindfully. For FREE access:

• On your mobile phone or computer, visit HeadSpace's educators’ enrollment page.

• Enter your Leander ISD email address

• Click Get Started and you will receive an email invitation to join Enrollmentin LISD benefits is not required. These benefits are automatically available to all LISD employees.

Onsite Breast Exams. Bexa is not a Mammogram.

Leander ISD Benefits is providing free breast exams with Bexa. We've chosen breast exams with Bexa for a reason: there is no discomfort, they are radiation-free, have extremely accurate results, and you get your results back immediately. It only takes 30 minutes out of your workday. If you are not scheduled for a mammogram this year, this is the perfect solution!

Early detection of abnormal tissue is critical to the treatment, quality of life, and survival of breast cancer. We’re bringing these convenient and important exams to you because Leander ISD is committed to your health. To be eligible for a breast exam with Bexa, you must be a female employee age 40+ on the Leander ISD medical plan. Sign-ups are required and appointments are limited. Click below to reserve your time now. If you have any questions, go to mybexa.com, see the attached FAQ, or reach out to BenefitsDept@leanderisd.org.

The Teacher Retirement System of Texas Plan is a defined benefit plan. Once you qualify for normal retirement, you are eligible to receive a monthly pension.

Texas law requires all benefits-eligible employees to be automatically enrolled in TRS at the time they are hired.

Your TRS pension provides monthly payments for life at your retirement. Not many retirees enjoy such security these days. You’ve been saving for this!

The TRS retirement plan is a governmental, tax-exempt plan that ranks as the sixth largest public pension plan in the U.S. TRS’ sheer size and history of success attract many excellent investment opportunities that ultimately benefit you. Employee and employer contributions go into a large trust fund managed by financial professionals. Benefits available from TRS are determined by a formula using a combination of years of service credit in TRS, annual salary and a multiplier established by state law.

As you plan to retire, take advantage of TRS’ personal approach. Meet with a TRS benefits counselor at a local session, visit the Austin office, or give them a call. TRS can help you choose the best timing and payment schedule for your needs. You can also choose options that extend monthly benefits to your loved ones after your death.

If you have 10 years of service with TRS when you retire, you can also qualify for retirement healthcare benefits. TRS offers retiree health plans for retirees that are both eligible and not eligible for Medicare.

A TRS member has the right to receive a lifetime annuity after 5 years of service credit with TRS and upon meeting age and service requirements. For more information regarding your TRS account, please visit the TRS website at www.trs.state.tx.us or call 1 - 800 - 223 - 8778.

LISD - Contact: Brenda Federal & State Reporting Analyst / 512 - 570 - 0062

To help supplement your TRS retirement, LISD offers both a 403(b) and 457 (b) retirement plans. Employees can begin contributing to either of these optional retirement plans at any time (there is no Open Enrollment period). TCG is the third-party administrator for LISD’s optional retirement plans.

403(B) PLAN

PLANS)

INVESTMENT OPTIONS:

EARLY WITHDRAWAL PENALTY TAX

WHEN CAN I WITHDRAW MONEY FROM MY ACCOUNT?

Fixed/Variable interest annuities or mutual funds/custodial accounts

10% (goes away at age 59 1/2 or age 55and retired

•Age 59 1/2

•Separation from employer

•Disability

•Death

•Unforeseeable emergency

Permitted with loans from all qualified plans limited to the lesser of $50,000 or one-half of vested benefits

(or $10,000 if greater)

STEP ONE: Create an account with an approved vendor: www.region10rams.org/403b-vendors.

STEP TWO: Set up online RAMS account access: www.region10rams.org/enroll.

» Click the enroll button and enter your employer on the following page.

»Follow each step until you get a confirmation notice… & you’re done!

Managed allocation or self-directed mutual funds.

None

• Age 59 1/2

• Separation from service

• Disability

• Death

• Financial hardship

Permitted with loans for all qualified plans limited to the lesser of $50,000 or one-half of vested benefits

(or $10,000 if greater)

Register at:

www.region10rams.org/ enroll

» Simply choose your desired monthly contribution and investment option!

For assistance, please contact TCG Administrator at 1-800-943-9179.

For assistance,please contact TCG at 800-943-9179.

LocalsBusinessesarehappy to showtheirappreciationforyourhard work by offeringemployee perks. Offers are not endorsedby LISD and will bepostedatthe district discretionon the Leander ISD website Employeesshouldnotethatthey may berequired to showtheirLISDbadge to prove eligibility If you havequestionsabout a postedoffer,please call thesponsoringbusiness directly

(Leander Independent School District / Staff / Benefits)

You are able to perform your regular occupation for the employer on a full-time basis, either at one of the employer’s usual places of business or at some location to which the employer’s business requires you to travel. If you will not be actively at work at the beginning of the year, please notify your benefit’s administrator.

The period once per year during which existing employees are given the opportunity to enroll in or change their current elections.

The amount you pay each plan year before the plan begins to pay covered expenses.

Individual designated to receive the proceeds of your life insurance policy in the event of your death.

January 1st through December 31st.

After any applicable deductible, your share of the cost of a covered healthcare service, calculated as a percentage (for example, 20%) of the allowed amount for the service.

Specific dollar amount you must pay your provider per visit.

Statement or proof of individual’s physical condition, occupation and other information, determining acceptance of applying employee for coverage.

The amount of coverage you can elect without answering any medical questions or taking a health exam. Guaranteed coverage is only available during initial eligibility period. Actively-at-work and/or preexisting condition exclusion provisions do apply, as applicable by carrier.

In-network doctors, hospitals, optometrists, dentists and other providers who have contracted with the plan as a network provider. Lowers charges and reduces out-of-pocketexpenses. Out-of-network charges a higher payment and higher out-of-pocket cost.

30 business days the amount of time after your Start Date that you must make benefit elections within.

Out-of-Pocket: expenses you must pay for healthrelated services that are above your monthly premium.

Out-of-Pocket Maximum: The most an eligible or insured person can pay in co-insurance for covered expenses per plan year.

January 1st through December 31st.

Applies to any illness, injury, or condition for which the participant has been under the care of a health care provider, taken prescription drugs or is under a health care provider’s orders to take drugs, or received medical care or services (including diagnostic and/ or consultation services). See the plan outline for more specific information on each benefit.

IRS guidelines allow you to make changes outside of Open Enrollment for the following defined reasons:

• Marriage/Divorce

• Birth or Adoption

• Death of spouse or covered child

• Change in your or your spouse’s work status that affects eligibility

• Child Eligibility

• Medicare Eligibility

Traditional amounts charged for a particular service by most physicians. R&C charges vary by location and by service provided to you. R&C charges apply when you go out-of-network and you must pay amounts exceeding the R&C maximum.

Legal Notices can be found on LEANDERISD.ORG

Leander Independent School District / Departments / Human Resources / Benefits

HIPAA SpecialEnrollment Notice HIPAA Privacy Practices Notice

Children’sHealth InsuranceProgram (CHIP) Notice Women’s Health & Cancer Rights(WHCRA) Notice Newborns’ and Mothers’ Health

Protection Act Notice Mental HealthParity Opt-Out Notice

Medicare Part D CreditableCoverage Notice USERRA

ContinuationCoverage Notice

GeneticInformation Nondiscrimination Act (GINA) Notice COBRA

ContinuationCoverage Rights Notice