96

berries

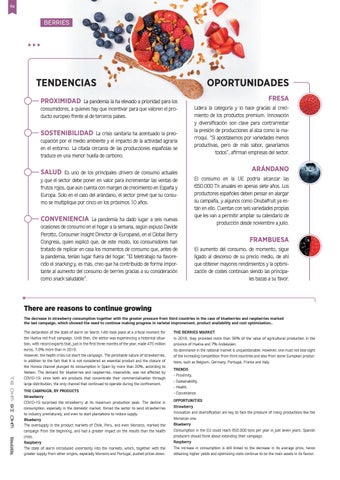

TENDENCIAS

OPORTUNIDADES

PROXIMIDAD

La pandemia la ha elevado a prioridad para los consumidores, a quienes hay que incentivar para que valoren el producto europeo frente al de terceros países.

SOSTENIBILIDAD La crisis sanitaria ha acentuado la preocupación por el medio ambiente y el impacto de la actividad agraria en el entorno. La citada cercanía de las producciones españolas se traduce en una menor huella de carbono. SALUD

Es uno de los principales drivers de consumo actuales y que el sector debe poner en valor para incrementar las ventas de frutos rojos, que aún cuenta con margen de crecimiento en España y Europa. Solo en el caso del arándano, el sector prevé que su consumo se multiplique por cinco en los próximos 10 años.

CONVENIENCIA

La pandemia ha dado lugar a seis nuevas ocasiones de consumo en el hogar a la semana, según expuso Davide Perotto, Consumer Insight Director de Europanel, en el Global Berry Congress, quien explicó que, de este modo, los consumidores han tratado de replicar en casa los momentos de consumo que, antes de la pandemia, tenían lugar fuera del hogar. “El teletrabajo ha favorecido el snacking y, es más, creo que ha contribuido de forma importante al aumento del consumo de berries gracias a su consideración como snack saludable”.

FRESA Lidera la categoría y lo hace gracias al crecimiento de los productos premium. Innovación y diversificación son clave para contrarrestar la presión de producciones al alza como la marroquí. “Si apostásemos por variedades menos productivas, pero de más sabor, ganaríamos todos”, afirman empresas del sector.

ARÁNDANO El consumo en la UE podría alcanzar las 650.000 Tn anuales en apenas siete años. Los productores españoles deben pensar en alargar su campaña, y algunos como Onubafruit ya están en ello. Cuentan con seis variedades propias que les van a permitir ampliar su calendario de producción desde noviembre a julio.

FRAMBUESA El aumento del consumo, de momento, sigue ligado al descenso de su precio medio, de ahí que obtener mayores rendimientos y la optimización de costes continúan siendo las principales bazas a su favor.

There are reasons to continue growing

Who is Who '21

The decrease in strawberry consumption together with the greater pressure from third countries in the case of blueberries and raspberries marked the last campaign, which showed the need to continue making progress in varietal improvement, product availability and cost optimization.. The declaration of the state of alarm on March 14th took place at a critical moment for the Huelva red fruit campaign. Until then, the sector was experiencing a historical situation, with record exports that, just in the first three months of the year, made 475 million euros, 7,6% more than in 2019. However, the health crisis cut short the campaign. The perishable nature of strawberries, in addition to the fact that it is not considered an essential product and the closure of the Horeca channel plunged its consumption in Spain by more than 20%, according to Nielsen. The demand for blueberries and raspberries, meanwhile, was not affected by COVID-19, since both are products that concentrate their commercialization through large distribution, the only channel that continued to operate during the confinement. THE CAMPAIGN, BY PRODUCTS Strawberry COVID-19 surprised the strawberry at its maximum production peak. The decline in consumption, especially in the domestic market, forced the sector to send strawberries to industry prematurely, and even to start plantations to reduce supply. Blueberry The oversupply in the product markets of Chile, Peru, and even Morocco, marked the campaign from the beginning, and had a greater impact on the results than the health crisis. Raspberry The state of alarm introduced uncertainty into the markets, which, together with the greater supply from other origins, especially Morocco and Portugal, pushed prices down.

THE BERRIES MARKET In 2018, they provided more than 56% of the value of agricultural production in the province of Huelva and 7% Andalusian. Its dominance in the national market is unquestionable; However, one must not lose sight of the increasing competition from third countries and also from some European productions, such as Belgium, Germany, Portugal, France and Italy. TRENDS - Proximity. - Sustainability. - Health. - Convenience. OPPORTUNITIES Strawberry Innovation and diversification are key to face the pressure of rising productions like the Moroccan one. Blueberry Consumption in the EU could reach 650.000 tons per year in just seven years. Spanish producers should think about extending their campaign. Raspberry The increase in consumption is still linked to the decrease in its average price, hence obtaining higher yields and optimizing costs continue to be the main assets in its favour.