Commercial Services (pg 36):

©2025 Real Estate Publishing Corporation February/March 2025 • VOL.25 NO.1

Commercial Services (pg 36):

©2025 Real Estate Publishing Corporation February/March 2025 • VOL.25 NO.1

By Brad Lutz, Managing Partner of Baker Barrios Chicago, National Multifamily Director

Each January, the National Multifamily Housing Council’s annual meeting offers leaders in the sector the opportunity to connect, share best practices and hear from thought leaders regarding what’s on the horizon for the apartment market. This year featured many compelling sessions touching on the all-important focus on technology, AI and data, but the undercurrent that carried throughout the tech talk was this: Ultimately, the multifamily industry is and will always be about people. We couldn’t agree more.

While reliance on technology and artificial intelligence to achieve more “people first” designs might seem like an oxymoron, the data provided by these increasingly sophisticated tools can very much improve lifestyle features and design elements of multifamily housing.

“The art challenges the technology, and the technology inspires the art.”

Although this quote from Pixar’s chief creative officer John Lasseter is about making animated films, it certainly applies to the multifamily industry, too. Tech advancements are developed to provide solutions for the needs of multifamily designers, builders, owners and managers while, at the same time, our designs and operations are completely influenced by the technology available now and in the future.

Results-driven real estate management company with more than 4,000 Units Throughout Illinois, Indiana and Wisconsin

Daniel Management Group (DMG) has made a significant mark within Chicago and beyond for delivering first-rate property management programs focused on exceptional customer service, seamless integration of technology, and a respect for the environment. As one of the leading property management companies in the Midwest, we are dedicated to providing quality, customized living experiences our residents deserve through unyielding attention to detail and a professional, service-minded management style.

From managing suburban garden communities to neighborhood mixed-use walk-ups, DMG has cultivated a long-standing reputation of providing communities where residents thrive and owners expectations are exceeded. www.danielmanagement.com |

NATIONAL MULTIFAMILY HOUSING COUNCIL ANNUAL MEETING RECAP: PUTTING PEOPLE FIRST, TECHNICALLY SPEAKING Each January, the National Multifamily Housing Council’s annual meeting offers leaders in the sector the opportunity to connect, share best practices and hear from thought leaders regarding what’s on the horizon for the apartment market.

O’HARE TAKES FLIGHT WITH NEW CRE INVESTMENTS Entering 2025, investors are seeing plenty of runway for commercial real estate in Chicago, including the area around O’Hare International Airport.

CHICAGO SUBURBAN OFFICE MARKET

Q4 2024 SUMMARY Chicago’s suburban office market remains sluggish. The overall vacancy rate in 2024 was 23.7%, unchanged from 2023, due to the removal of inventory rather than increased demand.

TURF TALK: COMMERCIAL LANDSCAPING & SNOW REMOVAL STRATEGIES

Trending Commercial Landscapes for 2025: What Property Managers Need to Know

TAKING IT TO THE STREETS AND THE ROOFTOPS

In Chicago’s neighborhoods, residents and retailers are interdependent, without local retail, residents may be forced to look elsewhere for conveniences.

PEOPLE ON THE MOVE The latest promotions, milestones and achievements in the world of commercial real estate.

SOME RELIEF FOR THE OFFICE SECTOR? PLANNED OFFICE-TOAPARTMENT CONVERSIONS HIT RECORD HIGH It’s a big jump: The number of apartments set to be converted from office spaces has soared from 23,100 in 2022 to a record-setting 70,700 in 2025.

MIDLOCH’S TIM DONOVAN: MULTIFAMILY REMAINS A TOP INVESTMENT CHOICE ACROSS THE MIDWEST As managing director of Midloch, Tim Donovan understands the Midwest’s multifamily market and the demand for it.

INVESTORS EAGER AGAIN TO SINK THEIR DOLLARS IN MULTI-TENANT PROPERTIES? NORTHMARQ REPORT SUGGESTS THAT THEY ARE Searching for positive news in the commercial real estate industry? Take a look at investor demand for multi-tenant commercial properties.

NOT AT A STANDSTILL: THE LOGISTICS CAMPUS IN GLENVIEW MORE EVIDENCE THAT INDUSTRIAL CONSTRUCTION IS STILL TAKING PLACE IN THE MIDWEST

It’s true that industrial construction has slowed throughout the Chicago market. That doesn’t mean, though, that developers aren’t still planning major industrial projects here. COMMERCIAL

PUBLISHER Mark Menzies menzies@rejournals.com

EDITOR Dan Rafter drafter@rejournals.com

VICE PRESIDENT OF SALES & MW CONFERENCE SERIES MANAGER Ernie Abood eabood@rejournals.com

VICE PRESIDENT OF SALES Frank E. Biondo frank.biondo@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@rejournals.com

MARKETING & EVENTS COORDINATOR Allison Kim Allison.kim@rejournals.com

EDITORIAL ADVISORY BOARD

ALISSA ADLER Colliers

GEORGE KOHL Savills Jeff Krusinski Krusinski Construction Co.

RONALD C. LUNT Hamilton Partners

JOHN M. MOYSEY Avison Young

NANCY A. PACHER CBRE

JONATHAN STEIN Inland Real Estate Group

GREGORY T. WARSEK Associated Bank

CHRIS WOOD Cushman & Wakefield 1010 Lake St. #210 Oak Park, IL 60301 312.933.8559 Website: www.rejournals.com www.rejournals.com

By Emily Johnson

Entering 2025, investors are seeing plenty of runway for commercial real estate in Chicago, including the area around O’Hare International Airport.

As a small, centrally located submarket with proximity to the airport and local attractions like Allstate Arena and the Donald E. Stephens Convention Center, the O’Hare area has proven resilient after the pandemic and is attracting new investments across diverse real estate sectors, even ahead of the airport’s planned expansion, whose first phase is expected to open in 2028.

Large events downtown have helped bolster hotels throughout the region, including near O’Hare, where hotels reported a 54.5% year-over-year growth in revenue per available room during last summer’s Democratic National Convention, according to data from CoStar. The O’Hare submarket ranked second only to Chicago’s central business district, which reported a 74.7% increase during the convention, to $162.70.

This suggests more travelers are preferring to stay near O’Hare during short trips to Chicago, taking advantage of public transit to commute to and from downtown. To capitalize on demand from both business and leisure travelers, firms like Bradford Allen are updating existing properties and, in some cases, introducing new brands. In November, Bradford Allen began a $25 million renovation to transform the Hyatt Rosemont Chicago/O’Hare hotel, located across the street from the recently expanded Rivers Casino, into the new Hyatt Centric Rosemont, marking the concept’s first location in suburban Chicago.

Once open this spring, the 206-room Hyatt Centric Rosemont will be one of only a few lifestyle hotels near O’Hare, combining the efficiencies of a big brand like Hyatt with the design and service of a boutique hotel. The extensive improvements entail a full gut rehab of the property, with updated guest rooms, 12,000 square feet of modernized meeting space, a refreshed ballroom capable of accommodating 500 people and improved fitness center. In addition, what once was an American eatery will be transformed into an upscale, beverage-forward destination restaurant with outdoor seating.

Bradford Allen hopes the hotel, with its location near the airport, casino, Fashion Outlets of Chicago and other attractions, will be a convenient option for short-term travelers who don’t have the time or budget to stay downtown but still desire an “urban lifestyle” hotel destination with elevated dining and other amenities you typically don’t find in the suburbs.

The office market near O’Hare is outperforming the suburban average, with total vacancy standing at 21.6% at the end of the fourth quarter compared to 26.3% for the suburbs overall, according to research from NAI Hiffman.

Roughly bordered by Cumberland Road, Touhy Avenue, Higgins Road and Allstate Arena, the O’Hare office submarket is relatively small, both geographically and in terms of square footage, at only 14 million square feet (compared to 40 million square feet, for example, in the East-West Corridor along Interstate 88). The area was never overbuilt with offices because available development space is so limited, according to Joel Berger, senior managing director of Bradford Allen, helping to keep its vacancy rate lower than some other submarkets. Its central location in Chicagoland has become a major selling point as more businesses push return-to-office policies in 2025 and beyond and is helping to drive office demand.

Glenstar, along with a high-net-worth private investor, last October acquired and recapitalized Presidents Plaza, a two-tower,

831,000-square-foot office complex near O’Hare. The partnership paid $62 million for the property and set aside nearly $16 million to build out spec suites, or built-out, movein ready office spaces, as well as upgraded building amenities including a golf simulator. Other upgrades included a redevelopment of the three-story atrium lobby, three-level health club, tenant lounge, café with full seating and 6,300-square-foot conference center facility.

Another bullish sign for the O’Hare submarket is the new $34 million ice arena under construction across the street from Allstate Arena by general contractor Nicholas & Associates.

Located on 3 acres, the new 103,000-squarefoot, two-rink complex will offer prime ice time for youth hockey groups; nightly ice time after 10 p.m. for adult hockey leagues; and exclusive daytime use of one of the rinks by the Chicago Wolves professional hockey team. The complex will also contain a bar, restaurant and physical therapy clinic when it opens next year.

So far, almost a dozen hockey clubs have signed agreements to use the space, and organizers hope, with its location near O’Hare,

that the venue will host regional and national hockey tournaments as well.

Multifamily transaction velocity has been robust in the O’Hare submarket over the past year. There were 10 deals in 2024 for apartment buildings of six units or more, equating to more than $11.5 million in sales volume, according to CoStar data. Interra Realty brokered half of them, most recently the $3.7 million sale of a two-property, 24-unit multifamily portfolio located just east of the airport, a transaction that closed in October 2024.

According to Paul Waterloo, managing director at Interra, several factors contribute to the strength of the O’Hare multifamily market in addition to its excellent location, including healthy rental performance, low tenant turnover and value-add opportunities.

Many of the apartment buildings in the O’Hare submarket are held by long-term owners. When one of them goes up for sale, they typically do so with below-market rents. This provides an opportunity for the new owner to make renovations that enhance property value and command higher rents. In

fact, the O’Hare submarket is known for the long tenures of its renters. The low turnover rate helps owners minimize maintenance costs and fosters more predictable revenue streams, making the market particularly attractive to investors. Apartment buildings near O’Hare do not hit the market very often, but when they do, investors seeking reliable returns and growth potential are quick to put in offers.

The airport itself is a major source of area employment, driving demand for rental housing nearby, while convenient public transit and highway access also allows for an easy commute to downtown and other job centers.

O’Hare also boasts a stronger-than-average industrial market, with a total vacancy rate of 4.1%, compared to 5.8% for the broader suburbs as of the fourth quarter of 2024, according to NAI Hiffman. Demand remains particularly strong for smaller facilities, but land availability is extremely limited.

To address this challenge, developers are identifying smaller infill sites — sometimes by combining multiple parcels — where they can renovate or, more commonly, build

new Class A warehouses. Last year, CRG announced plans for The Cubes at ORD, a 66,552-square-foot speculative industrial project on 4.27 acres at 3901 Fleetwood Drive in Franklin Park, Ill., immediately southeast of the airport. The multimodal facility has direct access to Interstate 294 and O’Hare and can accommodate small and mid-size users looking for modern space in one of Chicago’s most supply-constrained submarkets.

The examples above show the resolve and appeal that the O’Hare submarket demonstrates across multiple real estate sectors, even in today’s higher interest rate environment.

This momentum will continue due to strong fundamentals, such as tight supply and proximity to one of the world’s busiest airports. As we look ahead to O’Hare’s expansion, the surrounding area is well-positioned to remain a hub of activity and standout performer in Chicagoland’s real estate market.

Emily Johnson is president of Taylor Johnson Public Relations,a Chicago-based PR agency focused exclusively on real estate for more than 45 years.

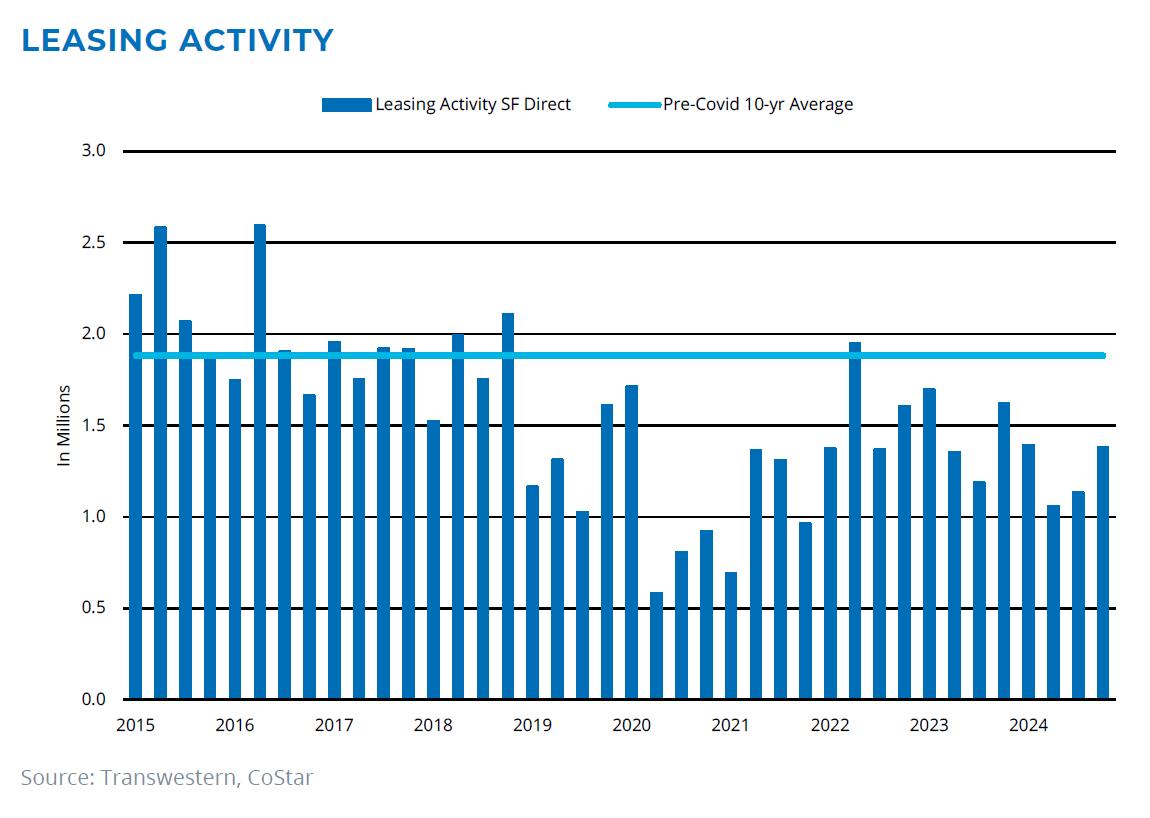

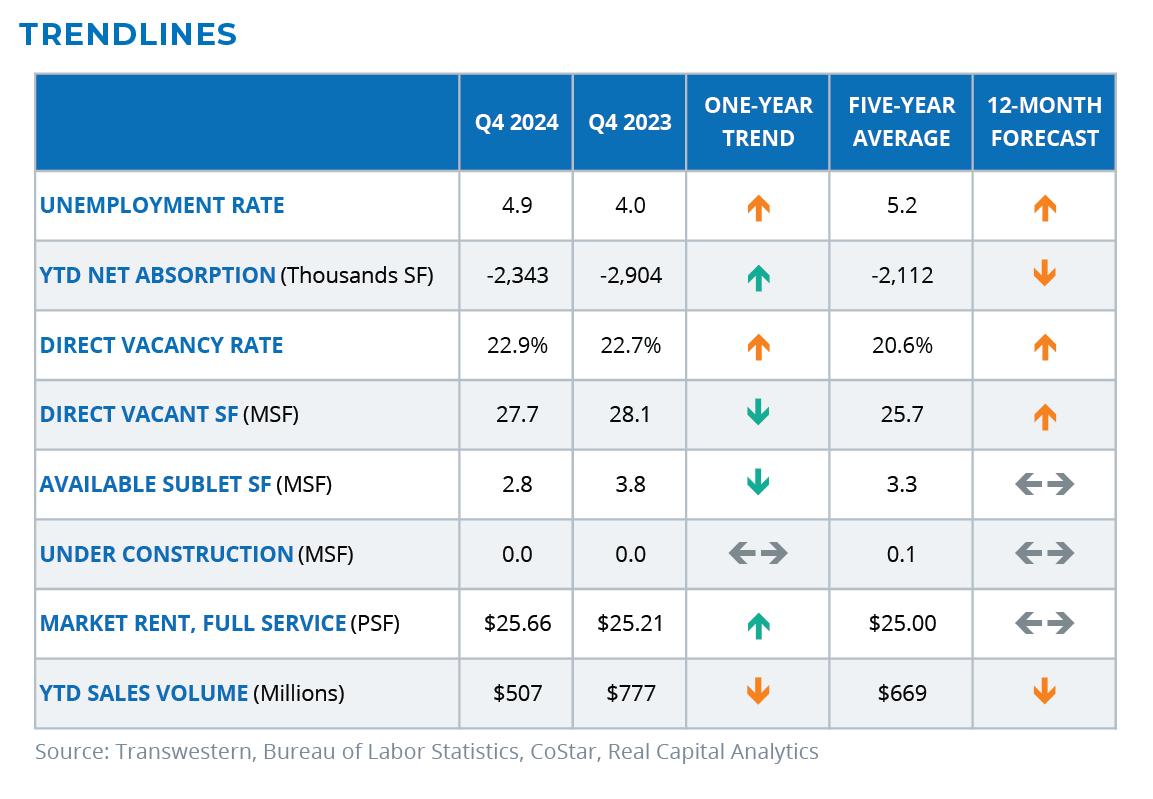

By Transwestern Chicago Research

Chicago’s suburban office market remains sluggish. The overall vacancy rate in 2024 was 23.7%, unchanged from 2023, due to the removal of inventory rather than increased demand. Direct leasing activity in the fourth quarter of 2024 totaled 1.38 million square feet, significantly below the quarterly average of 1.9 million square feet observed in the decade leading up to 2020.

A sharp reduction in inventory remains the most realistic path to market recovery, as a significant increase in demand seems unlikely. Since the fourth quarter of 2022, approximately 3.9 million square feet of office space has been removed from the suburban market, a trend expected to continue with redevelopment-focused purchases. For the suburban office market to improve, more outdated inventory must be removed, and remaining property owners need to invest in property improvements, spec suite build-outs, and tenant improvement allowances for new leases. This may be challenging, as more buildings face financial difficulties, leaving tenants with fewer properties owned by financially stable entities. As buildings are acquired at low prices for replacement or conversion, values will fall, potentially leading to higher-quality office spaces at more affordable rents.

By Tom Marsan

Tom Marsan is a certified snow professional who has been in the landscaping and snow removal industry for about two decades. He is an active member of ILCA and SIMA and is currently the general manager at Beverly Companies in Chicagoland.

Commercial landscapes are evolving beyond mere aesthetics. They’re becoming strategic assets that attract tenants, boost property value, and align with sustainability goals. With changing climate conditions, shifting tenant

expectations, and technological advancements, the role of outdoor spaces has never been more important.

Property managers who invest in thoughtful landscaping will not only enhance curb appeal but also create functional environments that foster long-term productivity.

The latest trends in commercial landscaping are redefining how businesses approach their outdoor spaces. Whether it’s incorporating smart

irrigation systems, installing multifunctional hardscapes, or embracing sustainable designs, staying ahead of these developments can set a property apart in a competitive market.

Sustainability remains a cornerstone of modern landscaping. In Chicago, there’s a growing emphasis on incorporating native plants into commercial landscapes. These indigenous species are adapted to the local climate, requiring

less water and maintenance, which promotes environmental stewardship and cost efficiency.

Plants like the Black-Eyed Susan not only thrive in Chicago’s conditions but also support local biodiversity. By choosing native flora, property managers can create vibrant, eco-friendly spaces that resonate with environmentally conscious tenants.

Water conservation is a pressing concern, and smart irrigation systems offer a solution by delivering precise water amounts based on real-time data. These systems adjust watering schedules according to weather conditions, ensuring

optimal hydration for plants while minimizing waste. Implementing smart irrigation not only supports sustainability goals but also reduces utility expenses, appealing to cost-conscious property managers.

“Sustainability remains a cornerstone of modern landscaping. In Chicago, there’s a growing emphasis on incorporating native plants into commercial landscapes.”

The trend of outdoor workspaces has gained momentum, especially with the rise of remote and hybrid work models. Creating comfortable outdoor areas equipped with seating, shade, and

reliable Wi-Fi can enhance tenant satisfaction by offering alternative work environments.

These spaces encourage productivity and provide a refreshing change from traditional indoor settings, making properties more attractive to pro-

spective tenants. The more reasons you can give a customer for coming to your property the better.

A balanced combination of hardscaping (patios, walkways, and stone features) and softscaping (plants, trees, and lawns) creates visually appealing and functional outdoor areas. In Chicago, where seasonal changes are pronounced, durable hardscape materials paired with hardy plant selections ensure year-round usability and minimal maintenance.

This integration not only enhances aesthetic appeal but also defines spaces for various activities, contributing to a property’s overall functionality.

Urban settings often face space constraints, making vertical gardens and green roofs innovative solutions for adding greenery. These installations maximize limited space, improve air quality, and provide insulation, leading to energy savings. Incorporating vertical plantings can transform blank walls into vibrant, living art pieces, enhancing the property’s visual

appeal and demonstrating a commitment to sustainability.

Strategic outdoor lighting extends the usability of spaces into the evening and improves safety. Energy-efficient LED lighting can highlight architectural features, illuminate pathways, and create ambiance. For instance, uplighting trees or installing fixtures that accentuate building facades can add a dramatic effect, making the property more inviting and secure for tenants and visitors alike.

As sustainability becomes a top priority, property managers are turning to eco-friendly maintenance solutions that reduce environmental impact and operational costs. Battery powered landscaping equipment, such as electric mowers and trimmers, is gaining popularity as an alternative to traditional gas powered tools, cutting down on emissions and noise pollution.

Additionally, organic lawn care practices, like compost-based fertilizers and natural pest control methods, are helping to maintain

healthy landscapes without harmful chemicals. By adopting these sustainable maintenance strategies, commercial properties can enhance their green initiatives while ensuring long-term landscape health and efficiency.

Incorporating a variety of plant species that bloom at different times ensures that commer-

cial landscapes remain attractive throughout the year. Seasonal plantings can provide continuous color and interest, enhancing curb appeal. Thoughtful selection of plants that offer vibrant displays in spring, summer, and fall keeps the landscape engaging, while evergreens and ornamental grasses can add structure and color during the winter months.

Adding water features such as fountains or ponds can create a tranquil atmosphere, serving as focal points in commercial landscapes. Beyond aesthetics, water features can aid in noise reduction and support local wildlife. Incorporating elements like rain gardens can also manage stormwater runoff, addressing environmental concerns and contributing to the property’s sustainability initiatives.

Property managers are increasingly favoring low-maintenance landscaping solutions that reduce upkeep costs and resource consumption. Utilizing drought-tolerant plants, installing automated irrigation systems, and choosing durable hardscape materials can minimize maintenance efforts. This approach ensures that the landscape remains attractive with less intervention, allowing property managers to allocate resources more efficiently.

By embracing these trends, property managers can create dynamic, sustainable, and appealing outdoor spaces that enhance property value and tenant satisfaction. Staying informed about these developments ensures that commercial properties remain competitive and aligned with contemporary expectations.

Some raise concerns that all this reliance on technology has come at the expense of actual people and human interaction, but when leveraged in the right way, these tools and the data they provide can be used to create a more personal experience for residents and building staff alike. Here’s how:

Give the people what they want. Even before they know they want it.

While tracking resident usage of amenity spaces, etc. using tech is nothing new, we now can take it a step further and use that information to not just know what residents are doing now but predict what they will do in the future. And, of course, design or adapt properties accordingly.

By examining resident behavior patterns over time, AI tools can suggest what they may seek in the future. For example, if AI identifies a trend in decreased usage of a community demo kitchen or party room, but steady usage of co-working space, it would make sense to convert the under-utilized space into co-working. Or

perhaps a property includes a studio space for yoga separate from the main fitness center, and AI picks up on the fact it’s always booked on weekends but rarely during the week. It would be advantageous to have a flex option for that space to make it something residents would use during the week, like a conference room. The key is how much more quickly AI would pick up on this trend, allowing

“Some raise concerns that all this reliance on technology has come at the expense of actual people and human interaction.”

developers to be ahead of the curve. And having space designed from the beginning to be adaptable will make these shifts all the easier and more cost-effective.

AI can also interpret settings for lights, heating and cooling, and adjust accordingly, creating a more comfortable environment for your residents while

also saving money on utility costs by not wasting energy.

Our team at BBA and other colleagues in our industry are taking this data a step further when working with clients to design multifamily properties, using data and information gathered from operating properties to reconfigure amenity offer-

ings, adjust common spaces and tweak floorplan designs.

Create the seamless experiences renters already know they want.

In 2024, apartments.com listed numerous tech-focused and AI-powered amenities as new trends to watch in apartment living. By 2025, they’ve become some of the most highly sought after features for residents, and buildings that are designed to accommodate them will certainly have an advantage in attracting and retaining residents, as well as being better equipped to adapt to future advancements.

Charging for electric vehicles, keyless entry and access, smart home features and appliances and automated package systems are among the features residents rank high, all of which require integrated tech as part of the building’s design.

Additionally, high-speed internet and excellent cell signals are a must, especially with many people still working at least partially from home. Co-working spaces are a top amenity, but that doesn’t just mean desks and conference tables. Residents expect the same level of connectivity in their WFH space as they would in their corporate office, and if your building wasn’t designed with the infrastructure to

“Residents appreciate the convenience of apps allowing rent payment, maintenance requests, amenity reservations and building updates –and staff love the increased efficiency of these streamlined services.”

support that, your co-working space won’t be of value to your renters.

Free up onsite management for more person-to-person connections.

Residents appreciate the convenience of apps allowing rent payment, maintenance requests, amenity reservations and building updates – and staff love the increased efficiency of these streamlined services, allowing more time for connecting on a

Our collective insight, gained from years of partnering across service lines, creates consistently great outcomes for our customers. We leverage that combined knowledge to help you achieve project success, executing projects flawlessly and delivering high value for your organization and a positive impact on your people. For us, it’s more than developing the land or constructing the building; it’s about facilitating and creating spaces where people thrive.

personal level with their renters or tending to tasks that require hands-on attention. That increased time spent caring for residents as well as the property translates into stronger overall community connection, which, no matter how tech-reliant we become, still ranks high for residents, staff and owners.

It’s an exciting time in our industry, and the advancements in software to improve design, operations, efficiency and commu-

nications are something to embrace. But, as with any tool, it’s only as good as the person using it. That’s why no matter how automated things become, multifamily housing is still and will always be about people.

You can learn more about the National Multifamily Housing Council at nmhc. org and, if you’re a member, find a recap of the January annual meeting there.

By Michael Millar, Open Slate Communications

In Chicago’s neighborhoods, residents and retailers are interdependent. Without local residents, retailers, restaurants and entertainment venues likely wouldn’t generate the traffic necessary to be successful. And without local retail, residents may be forced to look elsewhere for conveniences.

Nearly five years after the start of the Covid pandemic that decimated retail, neighborhood retail is playing out better than expected, said Joe Schwieterman, Director, Chaddick Institute, DePaul University.

“There are hot and cold pockets, however,” he cautioned. “In some neighborhoods they are gobbling up the space while others haven’t seen the magic.”

Chris Brewer, VP AECOM agreed, stating in his keynote address, “The retail apocalypse is almost over.”

During the first quarter of 2025, DePaul University’s Real Estate Center and Chaddick Institute hosted “Takin’ It to the Streets: The Surprising Strength of Chicago’s Neighbor-

Panel participants included, from left to right, Emi Adachi of Heitman, Ryan Segal of Acadia Realty Trust, Sarah Wilson of Uptown United and the Uptown Chamber of Commerce, Ian Tobin of Lincoln Square/Ravenswood Chamber of Commerce, and Vig Krishnamurthy of CDOT.

hood Retail,” a conference that brought together professionals whose careers are closely linked to neighborhood retail.

Emi Adachi, Co-Head Global Investment Research, Heitman, said according to CoStar statistics, Chicago’s downtown vacancy rate is 5.5%; in the neighborhoods it is as low as 3%.

“Retail has emerged stronger than it’s been in years,” she said. “The market is very healthy in many submarkets, but challenges remain in others.”

Opportunities vary by street and neighborhood. Brewer named two areas that differ substantially. Andersonville is a strong submarket where there may be fully occupied storefronts along entire blocks. By contrast, in Edgewater significant gaps persist even on major blocks. In some cases, the vacancies may be due to the quality of the space. This is often exacerbated by the economic choices of landlords unwilling to deploy capital into low-cost basis assets. “There may be fewer marketable spaces than you’d think,” Brewer said.

Ciere Boatright, Commissioner of Planning & Development for Chicago said there is a need to focus on the repopulation of the city “in a strategic, responsible and holistic way.”

Boatright took part in a fireside chat with Reagan Pratt, Douglas and Cynthia Endowed Director, the Real Estate Center, DePaul University.

“We need to ensure that the rising tide lifts all boats,” she said. “We want to attract the national retailers and keep the ‘mom and pop’ operations.”

Pratt noted this is crucial because the “mom and pops” are most often the urban pioneers, pushing locational and neighborhood boundaries.

Boatright’s time in the private sector shaped her views and outlook for the City. “I understand the Chicago challenges and opportunities. I’m here to cut the tape and move the needle. We all know time kills deals.”

Boatright said because of the work she and the department have done, a zoning process that used to average 131 days now averages only 79.

The department is also working on more proactive zoning regulations to streamline the process. One example is the proposed elimination of parking minimum requirements in certain places. This allows private developers to provide parking based on market dynamics, without being bound to outdated rules and regulations.

Boatright did not discount any of the challenges that Chicago is facing, but noted that they are challenges being faced by cities across the U.S.

Adachi led a panel discussion generating perspectives from a retail property owner, two neighborhood Chamber of Commerce leaders, and a representative from the Chicago Department of Transportation.

Ryan Segal’s firm, Acadia Realty Trust, is a publicly traded REIT (AKR) that operates nationally with a market cap of $2.77 billion dollars. The firm has considerable holdings in Chicago’s Gold Coast market, the Halsted/Armitage area, and near Clark & Diversey.

Segal characterized the Halsted/Armitage area as having a lot of clicks to bricks in the area—retailers that started online but later added stores. Because of the demographics of the area, Segal said there is a waiting list for space. Those supply and demand forces have translated to 20% rent growth in a one-year time period and 50% growth over five years.

He noted similar popularity in the Clark and Diversey market area because “people like to stay close to home.”

“The retail properties in these neighborhoods and corridors are attracting institutional investors. It’s not just happening in highly recognized corridors like Michigan Avenue.”

Some retail areas, such as Uptown, Ravenswood and Lincoln Square are driven by a mixture of unique retail experiences and iconic entertainment venues.

Uptown is an established, immigrant-based community where many businesses, including restaurants, coffee shops and retailers, are closely linked to the neighborhood’s proximity to en-

Director of

venues.

United and the Uptown Chamber of Commerce said there is a significant correlation between show nights at places like Aragon Ballroom, Metro and Double Door, and higher sales volumes.

of the challenges

are the result of red line construction projects. Now, with construction nearly done, other challenges include older vacant properties that need capital to compete. Often long-time owners with

Pratt of the

led a fireside chat with Ciere Boatright of the City of Chicago.

a low-cost basis eschew capital investment in the retail space when the residential component of the asset provides adequate cash flow.

Operationally, “Many businesses, especially restaurants, experience a real squeeze between

attracting customers and paying employees,” Wilson said. “Because of lingering Covid issues and material cost increases, restaurants report that the price per check remains about the same, but patrons are coming less often.”

Vig Krishnamurthy, managing deputy commissioner, Planning and Design, CDOT relayed that Chicago has 4,000 miles of streets and 7,000 miles of alleys that CDOT makes sure work.

He said the department oversees a Streetscape Program that is tasked with “determining what goes where and why. Under its jurisdiction, CDOT decides the location of speed bumps, bike lanes, stop lights and sidewalk benches,” among other things.

The quality of the environment is very important to the $500 million Streetscape program he said. With so much history and culture woven into the fabric of Chicago’s neighborhoods, the department strives to sustain, enhance and cultivate a sense of place.

“We build on what is there, so it doesn’t come across as contrived,” he said. “We strive to create a place to be, not just a place to go through.”

Ian Tobin, VP and Director of Community Development Lincoln Square/Ravenswood Chamber of Commerce, described his neighborhood community as “fiercely local—the port of entry for Europeans.”

Given some of the demographic similarities to Ravenswood and other established Chicago neighborhoods like Southport, the area has similar challenges, including low vacancy resulting from strong rent increases which is leading some long-time tenants to vacate.

Tobin said that given overall economic conditions (and uncertainty) one of the greatest

conflicts is the length of leases. Landlords want longer term leases, but some businesses are hesitant to make that commitment. Further, because of some landlord’s reluctance to focus on deferred maintenance, some spaces need significant upgrades to meet the needs of restaurants and other users.

Tobin is optimistic about the potential impact of upcoming transit-oriented redevelopment projects. “With a focus on neighborhood planning, saying yes to the plan has made it possible to drive development.”

And, of course, much of the retail and entertainment sectors rely on transportation and related infrastructures that provide greater access for customers, business owners and employees.

According to Helen Bailey, one of the owners of Pioneer Realty Group, a residential realtor that focuses on for sale and rental properties in Chicago’s neighborhoods, retail is vital to Chicago’s neighborhoods

A vibrant neighborhood impacts the value of real estate. The retail and entertainment fabric of the neighborhood are what draw people to want to live and work here. It’s what drives business.

“The price of apartments and homes are worth what a tenant or buyer is willing to pay,” she said. The neighborhood impacts pricing more than anything else. When you think about what makes a location desirable, much of that is the feeling and the vibrancy it evokes.”

Michael Millar is a principal of Open Slate Communications and a member of the Executive Advisory Board ofThe Real Estate Center atDePaulUniversity.

The

Trina Sandschafer has joined Project Management Advisors, Inc. (PMA), a national provider of owner’s representative and advisory services, as the firm’s new Vice President and Managing Director – Chicago.

This strategic hire is an investment in PMA’s Chicago office and reinforces its strength across the Midwest region, where the firm continues to grow.

Sandschafer is a seasoned architect and executive with experience in both design and business leadership. She sees the evolution from traditional architecture practice to owner’s representation and advisory as a natural fit. Sandschafer characterized her new role as a way for her to use strategic thinking and explore new opportunities to drive impact for PMA clients.

Sandschafer’s previous roles include Executive Vice President and Design Principal at Kahler Slater, where she led the expansion of the firm into the Chicago market, and Design Principal at Booth Hansen, where her work can be seen across Chicago, from collaborating with the Chicago Housing Authority on the Plan for Transformation to partnering with Draper and Kramer at 61 East Banks Street. Sandschafer has also led multiple graduate studios at the University of Illinois at Urbana-Champaign, exploring the future of adaptive reuse and the shift in multifamily residential design.

Sandschafer, who holds a Master of Architecture and serves as Chair of the Illinois School of Architecture Alumni Advisory Board at the University of Illinois at UrbanaChampaign, is a champion for advancing the architecture profession, showcasing the many ways that architecture shapes our world.

Hiffman National, the property management and advisory services division of Oakbrook Terrace, Illinois-based real estate services firm NAI Hiffman, appointed Gannon O’Brien to the role of director of property management services, effective Feb. 10.

In this role, O’Brien will focus primarily on further expanding the firm’s portfolio of office properties under management in downtown and suburban Chicago, as well as Houston; Dallas; Indianapolis; Kansas City, Mo.; Kansas City, Kan.; Cincinnati; Columbus, Ohio; Charlotte, N.C.; Tampa, Fla.; and Orlando, Fla.

Award-winning Hiffman National has grown to more than 275 professionals in the U.S., including its west suburban Chicago headquarters, four additional hub locations and 20 satellite offices. With a mission to make life easier for its clients and team members, Hiffman combines a hands-on, customized approach and advanced property management technology, including its tenant app, Hiffman HQ, to successfully manage more than 90 million square feet of industrial, office and retail properties for 60 institutional and individual owners.

O’Brien joins Hiffman National with over 10 years of office property management experience, successfully developing and leading high-performing teams while overseeing daily operations, tenant and capital improvement projects, lease

promotions, milestones and achievements in the world of commercial real

administration, sustainability initiatives and financial reporting functions for more than 5 million square feet of commercial real estate over the course of his career.

Prior to joining Hiffman National, O’Brien was vice president, office property management, at Stream Realty Partners, where he supported business development efforts and oversaw a portfolio of office and mixed-use properties for institutional clients in Chicago and the surrounding suburbs. Prior to Stream, he spent nearly seven years at Zeller, most recently as vice president/general manager for 311 S. Wacker Drive. O’Brien got his start in commercial property management with MB Real Estate, where he held property management roles at 55 W. Wacker Drive and 205/225 N. Michigan Ave. in Chicago.

O’Brien holds a bachelor’s degree from The Catholic University of America and has multiple licenses and certifications including Certified Commercial Investment Member (CCIM), Certified Manager of Commercial Properties (CMCP) and Real Property Administrator (RPA). He is also a licensed real estate managing broker and serves as a member of the BOMA/Chicago Labor Committee and Chicago Real Estate Network (CREN) Board of Directors.

Chicago’s Development Solutions Inc. promoted Shannon Cox to director of construction — interiors group.

With 20 years at Development Solutions Inc., Coxhas played a key role in shaping the firm’s reputation for delivering high-quality workplace interiors.

During course of his career, Cox has successfully led the construction of more than 200,000 square feet of office space across downtown Chicago and its surrounding suburbs.

In his new role, Cox will oversee the firm’s high-profile interior projects. He will also help mentor and develop Development Solutions Inc.’s next generation of construction professionals.

Chicago’s Kiser Group added Frankie Nix as an Advisor.

Specializing in multifamily investment sales, Nix will focus on the Logan Square, Humboldt Park, Bucktown and Wicker Park neighborhoods, bringing his firsthand ownership experience and financial expertise to serve investors in these evolving markets.

As a local property owner, Nix understands the unique challenges and opportunities that come with managing multifamily assets. His experience navigating tenant relations, city ordinances, property tax appeals, and budgetconscious renovations allows him to provide valuable, realworld insights to his clients. His goal is to find tailored solutions that align with each investor’s objectives.

Chicago’s Skender hires project executive in Mission Critical group

Skender, a full-service construction firm based in Chicago, hired Andrew Lehrer as Project Executive in its growing Mission Critical group.

A distinguished engineering leader with more than 20 years of experience in critical and resilient infrastructure, Lehrer brings deep expertise in highperformance, always-on facilities, advanced laboratory environments, critical operations hubs, high-rise mixed-use and corporate headquarters projects.

Lehrer joins Skender following noteworthy leadership roles at Environmental Systems Design, Inc. (ESD) and Cannon Design, where he led large, diverse teams of engineers and oversaw complex, large-scale projects across the life sciences, high-tech, and mission-critical sectors. He created ESD’s life sciences business unit – leading the design of mechanical, electrical, plumbing and technology engineering for a series of complex, infrastructure-heavy, resilient assets.

A licensed professional engineer in Illinois and California, Lehrer has designed and implemented cutting-edge solutions for some of the industry’s most demanding environments. His expertise in liquid cooling infrastructure—essential for AI-centric data centers—positions Skender as a leader in next-generation digital facilities.

Lehrer has worked closely with Skender for more than two decades. His deep relationships within the team and shared approach to collaborative problem-solving made joining Skender a natural next step.

Lehrer is an advisor, mentor, and industry thought leader, serving as a Washington

University in St. Louis MEMS advisory board member, ASHRAE member, and former executive board member of ACE Mentor Chicago. His client portfolio also includes work with the Obama Presidential Center, Chicago Public Schools, and the University of Illinois Urbana-Champaign.

Oakbrook Terrace, Illinois-based NAI Hiffman and Hiffman National, the firm’s property management and advisory services division, apppointed Paul Grusecki as managing director – head of advisory services.

Grusecki will be based in Hiffman’s headquarters in Oakbrook Terrace and lead the firm’s Advisory Services group, whose integrated platform serves owner, occupier and lender clients in markets across the country.

Grusecki joins Hiffman after more than 14 years at Chicago-based CIBC Bank USA, where he was most recently managing director, head of commercial real estate special loans and other real estate owned (REO). Grusecki has overseen $3 billion in distressed commercial real estate transactions over his career and sold $1 billion in office properties and mortgages in the past six quarters.

In this role, Grusecki will be tasked with expanding Hiffman’s project services, workplace solutions, lender services and lease administration offerings, which along with the firm’s management and brokerage capabilities, provide clients with a comprehensive suite of real estate solutions. He will also expand relationships with major lenders and loan servicers to provide strategic counsel, real-estate-owned (REO) management and brokerage services, and receivership services to troubled debt portfolios.

Summit Design + Build added Summer Stevens as Business Development Manager, leading growth and client relations in the Chicago market.

Stevens brings extensive industry experience to Summit, having previously served as Business Development and Marketing Coordinator at Key Construction in Tulsa, Oklahoma. Her expertise in fostering strong client relationships, identifying new opportunities, and driving strategic partnerships will be instrumental in further expanding Summit’s presence in the Chicago area.

In her new role, Stevens will focus on expanding Summit’s footprint in key sectors, cultivating new business opportunities, and reinforcing the firm’s reputation for excellence in construction and development.

Laurence Morgan has rejoined Savills in its Chicago office as Vice Chairman.

The industry veteran brings nearly 35 years of diverse experience to the firm where he previously served from 1992-2004.

Morgan will be tasked with developing new client relationships by providing tenant advisory services and transaction management for corporate clients across all industry sectors including office, industrial, and critical facilities. Prior to Savills, he founded his own firm Morgan Real Estate Advisors, Inc.

Daniel Management Group, a Chicago-based multifamily management and investment company, made four promotions across senior leadership to start the year.

DMG has experienced steady and significant growth over the last five years, reaching the milestone of managing more than 4,000 units across three states and more than seventy employees by the end of 2024. Today’s promotion enables the company to be able to continue to grow while delivering the personal touch and attention to detail that is the company’s hallmark approach.

Kenia Rivera is promoted to Vice President of Property Management. Kenia has been with DMG for almost four years, starting as a multi-site property manager and quickly becoming promoted to Regional Property Manager and Senior Regional Property manager. VP of Property Management is a new role for DMG and positions Kenia to work closely across departments to implement services for residents and property owners. Kenia will be responsible for leading and providing guidance to the property management team, ensuring effective collaboration and high performance across all levels. Kenia will also work closely with Roger Daniel, president and founder to identify and execute opportunities for portfolio expansion across the Midwest.

role to assist with DMG’s growth strategy, Jonathan will develop and implement operational strategies and initiatives to drive efficiency, profitability, and growth. He will be responsible for relationships with vendors, contractors, and service providers to ensure high-quality service and cost-effectiveness. Additionally, Jonathan will be responsible for innovation both bringing emerging practices to DMG as well as implementing best practices across the organization.

Lauren Evett is promoted to Senior Regional Property Manager. Lauren is a valued member of the team that oversees several key portfolios across all three states where DMG operates. With this promotion Lauren will increase the number of portfolios she manages while also increasing her financial reporting and budgeting responsibilities. Hannah Murray-King is promoted to Senior People Operations Manager. This new role for DMG is created to meet the needs of DMG’s growing employee population. With more than seventy employees, Hannah’s role and responsibilities will be critical to ensure there is effective onboarding, training and HR support across the everexpanding team.

Effingham, Illinois-based Agracel, Inc., a provider of industrial real estate development solutions, promoted Richard Blackwell to vice president of business development.

In his expanded role, Blackwell will continue to drive Agracel’s mission of fostering industrial real estate growth and economic development opportunities across the country.

Since joining Agracel 2018, Blackwell has demonstrated leadership in forging relationships with industrial brokers, corporate real estate executives, site selectors and economic development professionals. His strategic initiatives have strengthened Agracel’s market presence and success in the industrial real estate sector.

Blackwell cultivated his strong business acumen throughout his more than 20 years of experience in both local and regional economic development, investor relations, real estate development and public policy.

The Chicago Chapter of the Society of Industrial and Office Realtors (SIOR) named its new executive board officers.

Ryan Moen, SIOR, Principal and Co-Founder of Versa Real Estate Services, will serve as 2025 Chicago Chapter President and lead the organization which includes nearly 200 of the top office and industrial real estate brokers in the Chicago market. Additional board members are:

· Vice President: Bill Lussow, SIOR, Principal,Bespoke Commercial Real Estate Services

· Treasurer: Joshua Hearne, SIOR, Principal, Cawley Commercial Real Estate Services

· Secretary: John Cassidy, SIOR, Principal, Lee & Associates of Illinois

· Director-at-Large: Rawly Lantz, SIOR, Principal,Cawley Commercial Real Estate Services

· Past President: Peter Billmeyer, SIOR, Co-Founder and CEO, Bespoke Commercial Real Estate Services

“In 2025, we will be laser-focused on building our organization for the next general of SIOR professionals,” said Moen. “The value that comes from not only earning the designation, but living its values, is immeasurable. Working with an SIOR is about gaining access to market knowledge, industry expertise, reliability, and honest insight. We are all stronger advisors because of our affiliation with SIOR, much to the benefit of our clients.”

• One of Chicagoland’s

• Over 1,300 new residential units added to market since 2022

• More than 3,000 new residential units approved for future construction

• $114K median household income

• Join several new high end retailers and restaurants in this evolving commercial area

By Dan Rafter

It’s a big jump: The number of apartments set to be converted from office spaces has soared from 23,100 in 2022 to a record-setting 70,700 in 2025, according to the latest research from RentCafe.

RentCafe in its Feb. 10 Market Insights report said that office conversions now make up nearly 42% of the nearly 169,000 apartments planned from future adaptive reuse projects.

This is good news for the office sector. It’s no secret that older, outdated office spaces are struggling to attract tenants. By removing these buildings and converting them to offices, owners can gain some relief from high vacancy rates.

Conversions can also help with the shortage of apartment units that many cities across the country face.

“Market Insights report said that office conversions now make up nearly 42% of the nearly 169,000 apartments planned from future adaptive reuse projects.”

The problem? Not many office properties are good candidates for conversions to multifamily. Conversions are expensive, and many office buildings don’t come with floor plates that

lend themselves to conversion. Others are in locations that don’t make sense for multifamily.

Still, RentCafe reported that office-to-apartment conversions are increasing in popularity, with 2025 set to reach a record-breaking mile-

stone of almost 71,000

While office properties make up the greatest share of future conversions, other property types are slated for conversion to new uses, too.

RentCafe reported that hotel properties make up 22% of future planned conversions, while factories make up 11% and warehouses 6%.

The number of upcoming office-to-apartment conversions totaled just 23,100 units in 2022 before doubling to 45,200 in 2023. This growth continued in 2024 when the pipeline of future office-to-apartment conversions reached 55,300, RentCafe said.

New York leads the country with an office-to-apartment pipeline of 8,310. In the Midwest, Chicago leads the way with a pipeline of 3,606 apartments set to be converted from offices. And in Texas, Dallas leads the way with 2,725 office-to-apartment conversions in the pipeline.

Minneapolis has a pipeline of 1,873 planned apartments, while Cincinnati’s stands at 1,753 and Kansas City, Missouri’s, at 1,676. In Cleveland, the pipeline is at 1,619, while it stands at 1,294 in Omaha.

By Dan Rafter

As managing director of Midloch, a private real estate investment company with offices in Milwaukee, Chicago and Minnesota, Tim Donovan understands the Midwest’s multifamily market and the demand for it. And his prediction? Investors will continue to sink their dollars into multifamily assets in 2025.

Why? Despite the challenge of high interest rates, the multifamily sector remains an attractive one for investors, especially as the demand from tenants for apartment units continues to rise.

We spoke with Donovan about the strength of the multifamily sector and what investors are looking for from this investment type. Here is some of what he had to say.

Are investors still looking at multifamily properties as a home for their investment dollars?

Tim Donovan: It certainly remains a popular investment choice. I was at the National Multifamily Housing Council conference in Las Vegas last month. The amount of positive buzz around the conference was strong. The industry is adapting to the new reality that interest rates might be higher for a longer period. That

has not taken the wind out of the sales of people’s interest in it as an asset class.

If anything, investors’ interest in multifamily is picking back up. The industry had been a little turbulent during the last 12 to 24 months. With that comes a lot of opportunity for investors. Investors will see some of the better buying opportunities in multifamily during the next 12 to 24 months.

Why is this such a good time to buy multifamily properties?

Donovan: It has been more challenging for investors to find compelling opportunities in

this space in the last year than it had been for quite a while. The gap between sellers’ expectations and what buyers were willing to pay has been a very real challenge for the last 18 months. Sellers wanted pricing from six months prior, while buyers wanted pricing that was more indicative of the here-and-now environment. Now that we are in a more stable interest rate environment, the bid-ask spread has come down a bit. Sellers realize that this is the new normal for the time being, so they are being more realistic with their pricing.

There are also quite a few multifamily buildings that buyers purchased in 2021 and 2022 that were financed with too much leverage.

People are forced to sell

properties because of the way

rates have

They are forced to sell at prices below what they bought these multifamily properties for a couple of years ago. Prices now look more like they did in 2017 and 2018 than they did in 2020 and 2021. That is a little alarming for the investors who closed these deals in the early 2020s. But it is also refreshing for investors today to see these opportunities to buy at the pricing of five to six years ago, especially when new construction costs are so high.

I suppose that if the costs of new construction remain elevated, that makes investing in an existing multifamily building even more attractive, right?

Donovan: Construction pricing remains well above what it was five or six years ago. At the same time, the pricing of existing product has been pulled back. If you think that construction pricing isn’t going to fall significantly in the next few years, and that new buildings being built today are more expensive to build, it does feel like a good time to buy existing multifamily properties at a discounted price.

Are there any parts of the United States in which you prefer to invest in multifamily properties?

Donovan: It depends. We do tend to favor the Midwest, though. We have our hometown bias, of course, but this is a good time to invest in places that routinely miss the highest highs or the lowest lows. In some of the more popular Sunbelt markets today, markets in which we saw historically strong rent growth, we see that the new supply there is showing some occupancy weakness. We are not seeing that in the Midwest markets. In the Midwest we see stable occupancy.

We are most excited about Midwest markets with long-term stability. You are still able to get those good value buys in the Midwest. There is also less competition with other investors in the Midwest historically. We are a fan of the slow-and-steady Midwest markets. At times like this, you are glad to have those reliable cash flows.

It look like preferred equity is playing a big role in helping some of these investment deals close today.

Donovan: Yes. We are starting to see deals now in which the buyers can’t get the leverage they historically would have gotten because of the interest rate environment. Private equity helps fill the gap. Traditionally, senior debt would have covered about 70% to 80% of a deal. Now it might only cover 60%. Private equity can fill the gap that this leaves.

We are also seeing deals coming out of construction loans or that were financed with a shorter-term bridge loan. Private equity can help pay the debt down and recapitalize the deal, set it up with more success going forward.

What are you seeing with multifamily investors who must now refinance their existing loans? What challenges do they face

now that interest rates are so much higher than they were when they originally took out their loans?

Donovan: We are seeing that lenders are being amicable to working with owners when they are missing a loan covenant here or there. Lenders are doing everything in their power to work with their borrowers, which is refreshing to see. But that is also keeping deal flow from hitting the market. Lenders are not forcing their hands on making people realize a paper loss in today’s world. Lenders might give you a nine- or 12-month extension to give you time to get your operations in line. Lenders understand the circumstances of today’s market. They are not in the business of owning real estate. They are giving owners more time to let the market work itself out.

There are some instances where lenders would not be made whole in a market sale. If the deal was to go to market, the lender would only get 70% or 80% of the loan amount back. Lenders don’t want to take a loss. Instead, they’ll roll up their sleeves and let the market work itself out. In that instance, everyone gets to the other side and gets their capital back.

By Dan Rafter

Searching for positive news in the commercial real estate industry? Take a look at investor demand for multi-tenant commercial properties.

Northmarq reported that investors sunk $53.9 billion in multi-tenant commercial properties during the fourth quarter of last year. That’s an increase of 36.8% from the third quarter and meant that in all of 2024 multi-tenant properties saw $166.9 billion worth of sales.

That final year-end tally beat 2023’s by 2.9%.

Of course, not all commercial sectors attracted as much attention from investors. Northmarq reported that the industrial sector accounted for $22.8 billion of investment sales in the fourth quarter, representing a quarterly jump of 31%.

In what many might consider a surprise, office transactions increased by more than 60% in the fourth quarter of last year when compared to the third, reaching $19 billion. That number is lower than what the office sector had seen during its strongest quarters, but it is the strongest performance for this struggling sector since the third quarter of 2022.

The retail sector saw $12 billion in investment sales volume in the fourth quarter. That quarter was its strongest performance in more than a year, according to Northmarq.

Northmarq reported that cap rates for multitenant investments rose modestly at the end of 2024, increasing by four basis points to an average of 7.05%. This, though, marks the highest average cap rate in more than a decade.

Private investors were active in 2024, with Northmarq reporting that they accounted for 55% of the buyer pool for multi-tenant commercial properties last year. Private investors were

particularly busy in the retail sector, accounting for 63% of the assets traded in this sector.

Institutional buyers accounted for 22% of the overall investment sales market, focusing mostly on industrial multi-tenant properties. REITs, which favored office and retail properties, accounted for 11% of multi-tenant investment sales in 2024.

Buoyed by this good news, Northmarq predicted an even stronger 2025 for the multi-tenant market. Northmarq says that investors in this space should continue to favor industrial and e-commerce-related assets.

By Dan Rafter

It’s true that industrial construction has slowed throughout the Chicago market. That doesn’t mean, though, that developers aren’t still planning major industrial projects here.

Why? The Chicago area remains one of the top locations for industrial end users thanks to its location in the center of the country, robust transportation infrastructure and strong workforce.

Evidence of this is taking place now in the Chicago suburb of Glenview, Illinois, where contractor PREMIER Design + Build Group recently completed construction work for the first phase of The Logistics Campus, a master-planned logistics campus in Glenview

Properties.

Joe Ahrens, senior vice president and industrial market leader with PREMIER, said that the location made this the ideal site for Dermody’s development.

“It was all about the location,” Ahrens said. “The land is located right off the interstate. In terms of the infrastructure, there’s already been a lot of work done to the roads. We also had a good partner in Glenview welcoming the development. Glenview was committed to seeing a project of this magnitude completely through. These factors made it very attractive for the development to locate there.”

This is a unique project for several reasons. Chief among them? The emphasis on preserving the land surrounding the campus.

An example of this? According to information provided by PREMIER, Dermody worked with one of the largest arborists in the country to transplant mature trees on the 232-acre site. Nearly 400 trees were dug up and moved to a temporary nursery, which was cared for by a local landscaping company. That company also handled replanting the trees as trails were built through the greenspace for tenants and community members to enjoy nature on the campus.

This might seem like an unusual step. But the Village of Glenview has high standards for

tree preservation. The village considered preserving these trees as a key part of the project.

“There is a perception of industrial sites being giant concrete monoliths with pavement everywhere,” Ahrens said. “That is not what this project is.”

Land preservation was just one unique challenge. PREMIER also had to navigate permitting challenges early in the construction process because of the complexity of The Logistics Campus. This required PREMIER’s team members to adapt quickly to keep the project’s construction on schedule.

Ahrens said that the challenges of this project were mostly tied to the sheer size of it.

“A lot of different municipal partners had to be consulted,” he said. “There were a lot of people involved with this project, a lot of people paying attention to what was happening on this site. We had to get all these partners on the same page with one plan. That can be challenging. But everyone did get on the same page here because everyone was so committed to getting this project done.”

To ensure that the construction schedule was followed, Dermody Properties and PREMIER maintained regular communication with each other and with the project’s design consultants, trade partners and local government bodies.

Ahrens said that the work done early in the planning phase helped make sure that The Logistics Campus project proceeded smoothly.

“This project was set up very well for success by a lot of people who put a lot of work into it before PREMIER was brought to the table,” he said.

Phase 1 of The Logistics Campus includes more than 1.2 million square feet spread across five buildings. An additional 2 million square feet is available for future phases.

After PREMIER completed the first phase’s final work, which included connecting the public utility infrastructure and wrapping up work on landscaping, pavement, pathways

“There were a lot of people involved with this project, a lot of people paying attention to what was happening on this site. We had to get all these partners on the same page with one plan.”

and signage, construction on Phase 1 officially ended with all five buildings achieving LEED Silver certification.

While no one can predict the future, Ahrens said that he expects to see an increase in industrial construction in the Chicago market in 2025.

As Ahrens said, every market is cyclical, including Chicago’s. He pointed to 2010 and 2011 when developers delivered a large amount of spec industrial space. Back then,

industry observers wondered how quickly tenants would absorb this space.

The answer? They absorbed it quickly. That resulted in even more spec industrial construction in 2012 and 2013. That space took a little longer to fill. But once it did, developers again began building industrial spaces.

That’s what is happening today, Ahrens said. In the early days of COVID, developers rushed to build more industrial space to meet the demand from consumers who wanted products delivered to their doors quickly. Today, it is

taking slightly longer to fill existing buildings, which has resulted in a slowdown in new spec construction.

Ahrens, though, said that this is just another cycle. And soon, once those spaces do get absorbed, more building will take place.

“What follows one of these slower periods is more building,” Ahrens said. “It’s a cyclical thing. We are just on the verge of seeing another uptick in new construction.”

One Parkview Plaza, 9th Floor

Oakbrook Terrace, Illinois 60181

Key Contacts:

Jean Zoerner-Illinois, JMZoerner@midamericagrp.com; Brad Lefkowitz-Michigan, blefkowitz@midamericagrp.com; Brandon O’ Connell-Minnesota, boconnell@midamericagrp.com; Jim Vaillancourt-Wisconsin, jvaillancourt@midamericagrp.com;

Services Provided: Mid-America provides strategic consulting services that maximize net operating income, net cash flow, and accelerate property appreciation. We provide property and construction management, leasing, due diligence, and market analysis. Additionally, we offer MA Building Services, a self-performing porter and maintenance company offering our clients cost savings and improved accountability for related services.

Company Profile: Mid-America Real Estate is #1 in retail real estate services in the Midwest, with full service offices in Illinois, Michigan, Minnesota, and Wisconsin. Our exclusive focus on retail property, combined with cutting-edge technology and unsurpassed service, distinguishes Mid-America within the industry and provides clients with a competitive edge. For more information, visit www.midamericagrp.com.

S74 W16853 Janesville Road

Muskego, WI 53150

P: 414.369.3511 | F: 414.435.0251

Website: outlookmgmt.com

Key Contact: Ray Balfanz, President/Partner, ray@outlookmgmt.com

Services Provided: Full service property and asset management services, financial analysis and reporting; budget preparation and expense reconciliations; lease administration; construction management; preventative maintenance and consulting services.

Company Profile: Outlook Management Group, LLC AMO provides comprehensive property and asset management services for all asset classes in multiple states and markets.

Notable Properties Managed: Washington Corners, Naperville, IL; Ironwood Office Park, Glendale, WI; Wood River Condominiums, West Bend, WI; Seven 10 West Luxury Apartments, Chicago, IL; MDJD Aesthetic MOB, Rockford, IL, Ascension Health MOB Milwaukee, WI; Henry Ford Health Systems Pharmacy Services Bldg. in Rochester Hills, MI; Henry Ford Medical Center in West Bloomfield, MI.

MERIDIAN DESIGN BUILD

9550 W. Higgins Road, Suite 400 Rosemont, IL 60018

P: 847.374.9200 • F: 847.374.9222

Website: meridiandb.com

Key Contact: Paul Chuma, President; Howard Green, Executive Vice President

Services Provided: Meridian Design Build provides construction and design/build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Description: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Venture Park 47, Huntley, IL - 729,800 sf speculative industrial facility for Venture One Real Estate. Lion Electric, Joliet, IL - 928,500 sf electric bus / medium duty truck assembly plant for Clarius Partners. Greenwood Truck Terminal, Greenwood, IN - 125 door truck terminal on 43 acres for Scannell Properties

PRINCIPLE CONSTRUCTION CORP.

9450 West Bryn Mawr Ave., Suite 120 Rosemont, IL 60018

P: 847.615.1515 | F: 847.615.1598

Website: pccdb.com

Key Contacts: Mark L Augustyn, COO, maugustyn@pccdb.com, James A. Brucato, President, jbrucato@pccdb.com

Services Provided: Since 1999, Principle Construction Corp. has been a leading design-build general contractor serving the industrial markets of Chicago Metro, Southern Wisconsin, and Northwest Indiana. We specialize in designing and constructing exacting solutions for our clients, including:

• Built-to-Suit Facilities • Speculative Facilities • Warehouse and Distribution Centers

• Logistics and Cross-Dock Facilities • Industrial Outdoor Storage • Industrial and Manufacturing Plant • Tenant Improvements • Expansions and Additions • Food Processing Facilities • Specialty Projects

Recently Completed Projects include:

• 8,205 SF animal shelter for Heartland Animal Shelter, at 586 Palwaukee Dr., in Wheeling, IL.

• 12,560 SF showroom and outdoor pool park for Doheny Enterprises, at 5307 Green Bay Rd., in Kenosha, WI

• Phase 1 renovation project for SMW Autoblok, at 285 Egidi Dr., Wheeling, IL

2000 Center Dr., Suite East C219 Hoffman Estates, IL 60192

P: 847.392.6900

Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com

Services Provided: Victor Construction Co., Inc. manages projects from ground-up site developments to interior buildouts, specializing in retail, industrial, and commercial markets.

Company Profile: Established in 1954, Victor Construction Co., Inc. is a third generation general contractor that specializes in commercial, industrial, and retail construction. Victor Construction is known as one of the most efficient and dependable general contractors in the Chicago metropolitan area and has earned the reputation due to meticulous project management, cost-effectiveness, budget awareness, and prime first-rate workmanship. Commitment to the clients’ goals is what keeps satisfied customers returning to Victor Construction for all of their construction needs—We Build for Your Success!

Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

VILLAGE OF HOMER GLEN ECONOMIC DEVELOPMENT

14240 W. 151st Street Homer Glen, IL 60491

P: 708.301.0632

Website: HomerGlenIL.org

Key Contact: Janie Patch, Economic Development Director, jpatch@homerglenil.org

Services: Resource center for brokers, developers, site selectors and businesses providing space and property inventory, trade area demographics, site selection assistance, custom tours, coordination through entitlement process, business opening process guidance and retention services.

Demographic Info: Strategic Will County location 25 miles southwest of Chicago with two I-355 interchanges between I-55 and I-80. Average household income of $154,800. Trade area population of 83,000. Prime commercial corridors include Bell Road, 143rd Street and 159th Street (State Route 7). 159th Street is improved with 4 lanes and access to Lake Michigan water and sanitary sewer.

Recent CRE Activity: The Villas of Old Oak (46 ranch duplexes) completing full build out. New food specialty and restaurant openings include South Viet, OneZo Boba Tea, Sultan Sweets and Cervantino’s. Restaurant with drive-thru position available at Homer Glen Bell Plaza with Pet Supplies Plus, Dollar Tree and Taco Bell, SWC 143rd/Bell.

ECONOMIC DEVELOPMENT CORPORATION

OF MICHIGAN CITY

Two Cadence Park Plaza

Michigan City, IN 46360

P: 219.873.1211

Website: www.edcmc.com

Key Contacts: Clarence Hulse, Executive Director, chulse@edcmc.com

Karaline Cartagena Edwards, Economic Development Manager, kcedwards@edcmc.com

Services/Demographic Info: Up-to-date inventory of commercial buildings, site selection and orientation tours

Incentives: Tax-Increment Financing, Façade Improvement Grants, Property Tax Abatements, Enterprise Zones, Job Training Programs

Recent CRE Activity: Double Track Northwest Indiana: $1.6 Billion development reducing train travel to Chicago to 60 minutes; The Franklin at 11th St. Station: $100 Million Development with Residential & Retail Space; “You are Beautiful”/ SoLa: $311 Million Mixed-Use Multi-Family Development with 235 boutique hotel rooms & 174 Luxury Condos; Burn ‘Em Brewing: $3 Million Expansion project with 30 new jobs.

DEIGAN & ASSOCIATES, PLLC

28835 N. Herky Drive Lake Bluff, IL 60044

P: 847.682.7381

Website: http://www.deiganassociates.com

Key Contact: Michele Brady, Director Business Development & Real Estate Services, mbrady@deiganassociates.com

Services Provided: The Deigan Group provides client responsive, results oriented environmental consulting and remediation services, with a focus in land-based work, including Brownfield Redevelopment, Power Plant Decommissioning/Redevelopment, Strategic Environmental Planning, Property Assessments and Site Remediation, Compliance/Permitting, Employee Exposure Testing/Safety Monitoring Asbestos Surveys/Mold/Indoor Air Quality, Waste Minimization/ Recycling/ Sustainability Plans, Successful Grant Writing. Company Profile: A full-service environmental consulting organization specializing in defining environmental business risk and removing environmental uncertainties for property development sites. Our wide range of experience within the environmental industry helps us provide realistic cost-saving strategies for our clients with the goal of reducing their overall environmental liability and obstacles to redevelopment.

MARQUETTE BANK

1628 W. Irving Park Road, Unit 1D Chicago, IL 60613

P: 708.873.8639

Website: emarquettebank.com

Key Contact: Patrick Tuohy, Senior Vice President, ptuohy@emarquettebank.com

Services Provided: Multifamily/apartment building lending for all Chicagoland. Fast, local decision making. Dedicated local servicing staff. Simple, no-hassle paperwork. Quick close. Flexible terms. All clients enjoy ZRent – an automated, hassle-free, nocost way to collect monthly payments from tenants.

Company Profile: Marquette Bank has 20 branches, loan office and $2 billion in assets. Independently owned/operated since 1945. Offering clients full-service, banking, financing, insurance, trust and wealth management services.

REINHART BOERNER VAN DEUREN S.C.

1000 N Water Street, Suite 1700 Milwaukee, WI 53202

P: 414.298.1000

Website: reinhartlaw.com

Key Contact: Joseph Shumow, Shareholder, jshumow@reinhartlaw.com

Services Provided: Reinhart is a full-service, business-oriented law firm that delivers innovative, value-added solutions for today’s most important real estate needs, including land use and zoning; tax-incremental financing; tax credits; leasing; construction; and condemnation and eminent domain issues.

Company Profile: With the largest real estate practice in Wisconsin and offices throughout the Midwest and across the country, Reinhart’s attorneys offer clients customized real estate insight rooted in broad knowledge and deep experience to help you capitalize on opportunities no matter where you do business.

180 North LaSalle Street, Suite 3010 Chicago, IL 60601

P: 312.917.2307 P: 312.917.2312 | F: 312.596.6412

Website: wvproptax.com

Key Contacts: Francis W. O’Malley, Managing Partner fomalley@wvproptax.com; Jessica L. MacLean, Partner jmaclean@wvproptax.com

Services Provided: Worsek & Vihon, LLP represents tax payers in Illinois by limiting their property tax liabilities through ad valorem appeals. We have over 40 years of experience and can handle basic to the most complex assessment issues while offering the dependable, personalized attention our clients deserve. We have experience representing owners of all property types. In addition to filing thousands of appeals with the Cook County Assessor, we have been involved in numerous proceedings before various Boards of Review, the Illinois Property Tax Appeal Board, and the Circuit Court of Illinois, and have appeared before the Illinois Appellate and Supreme Courts. Company Profile: Worsek & Vihon LLP, is a team of experienced attorneys singularly focused on real estate tax law. The firm is dedicated to minimizing property tax liabilities through strategic tax portfolio management, well-researched, creative appeal preparation and aggressive advocacy.