DEEP DIVE GOODMAN GROUP ON

ACKNOWLEDGEMENTS

EDITOR IN CHIEF: Samuel Yu

AUTHORS: David Wang, Jungwoo Lee, Aman Madhyastha

DESIGNERS: Chloe Tazawa-Lim, Landrie Zuo

DISCLAIMER

1 The information in this free guide is provided for the purpose of education and intended to be of a factual and objective nature only. REISA makes no recommendations or opinions about any particular financial product or class thereof.

2. REISA has monitored the quality of the information provided in this guide. However, REISA does not make any representations or warranty about their accuracy, reliability, currency of completeness of any material in this guide.

3. Whilst REISA has made the effort to ensure the information in this guide was accurate and up to date at the time of the publication of this guide, you should exercise your own independent skill, judgement and research before relying on it This guide is not a substitute for independent professional advice and you should obtain any appropriate professional advice relevant to your particular circumstances

4. References to other organisations are provided for your convenience. REISA makes no endorsements of these organisations or any other associated organisation, product or service

5 In some cases, the information in this guide may incorporate or summarise views, standards or recommendations of third parties or comprise material contributed by third parties (“third party material”). Such third party material is assembled in good faith, but does not necessarily reflect the views of REISA REISA makes no representations or warranties about the accuracy, reliability, currency or completeness of any third party material.

6. REISA takes no responsibility for any loss resulting from any action taken or reliance made by you on any information in this guide (including without limitation, third party material)

PROPERTYINVESTMENTARM

Goodman’s Property Investment arm strategically acquires and holds real estate assets to generate long-term financial returns. Property Investment earnings consist of gross property income, less property expenses, plus Goodman’s share of the operating results of Partnerships that is allocable to property investment activities. The key drivers for maintaining or growing Goodman’s property investment earnings are increasing the quality and number of assets in the portfolio, maintaining or increasing occupancy and rental levels within the portfolio, and controlling operating and financing costs within Partnerships.

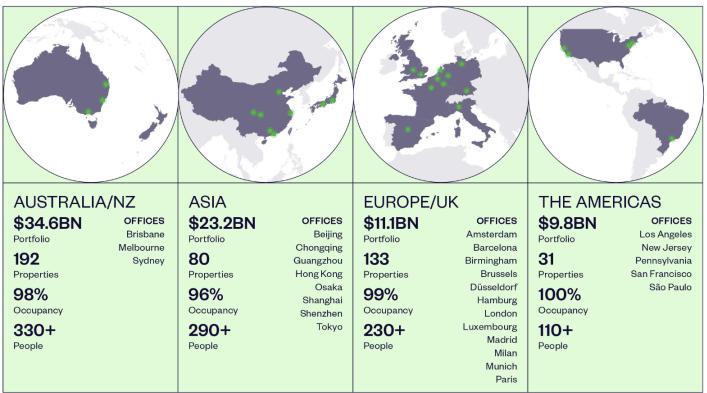

As of 1H25, Goodman holds an $84 4 billion property portfolio consisting of industrial assets characterised by low vacancy rates and minimal new supply in markets. As e-commerce activity continues to grow and logistics customers continue to optimise productivity using automation and technology, the digital economy remains a key driver of demand supporting the underlying property fundamentals and cash flows in Goodman’s portfolio.

Source: Company Filings

Source: Company Filings

DEVELOPMENTARM

Goodman’s Development arm undertakes site acquisition, planning and construction. Development earnings consist of development income, that is, development management fees and performance related revenues associated with managing development projects in Partnerships, plus net gains or losses from project sales, plus interest income on loans to development joint ventures, less development expenses. The key drivers for development earnings are the level of development activity, land and construction prices, property valuations and the continued availability of third party capital to fund development activity.

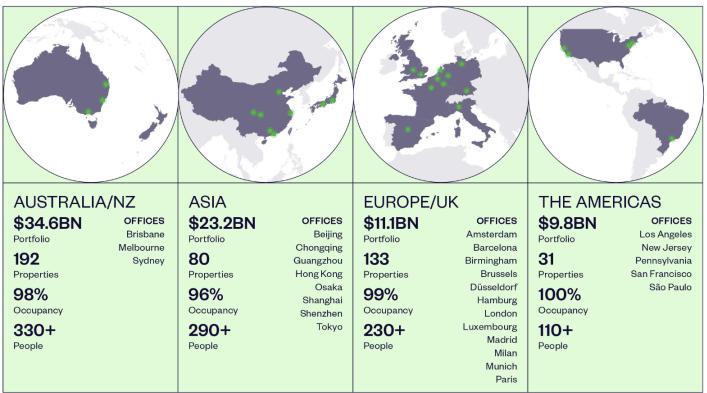

As of 1H25, Goodman’s Development arm consists of $13 0 billion work in progress (WIP) with data centres under construction representing approximately 46% of WIP. As data centre demand remains strong, Goodman’s development capability and financial capacity allows it to capitalise on significant opportunities, orienting the development workbook towards data centres and other higher intensity use outcomes.

Source: Company Filings

Source: Company Filings

MANAGEMENTARM

Goodman’s Management arm ensures the efficient operation, maintenance and optimisation of its real estate portfolio. Management earnings relate to the revenue from both managing the property portfolios and the capital invested in Partnerships including various transactional management and performance related revenues excluding earnings from managing development activities (which are captured in the Development arm). The key drivers for maintaining or growing management earnings are transactional activity levels, asset performance, increasing the level of external assets under management (AUM).

As of 1H25, Goodman’s Management arm consists of a total portfolio of $84 4 billion, with external assets under management of $70.8 billion from its partnerships. Infrastructure style investments like data centres are attracting significant interest.

02 INVESTMENT HIGHLIGHTS

Tailwinds supporting industrial sector and data centres

The expansion of the digital economy, particularly through the growth of e-commerce, cloud computing systems and adoption of AI and machine learning, is creating significant opportunity in Goodman’s focus sectors.

Focus on infill sites across gateway cities

The concentration of Goodman’s properties are in urban infill locations across gateway cities, characterised by favourable supply and demand fundamentals.

Capital raise to capture data centre opportunity

Goodman’s recent $4.0 billion capital raise (plus up to $400 million share purchase plan) will be used to fund the development of new data centre projects.

Competitive advantage in data centres

Goodman has procured a global power bank of 5.0 GW across 13 major global cities. With a strong track record and development capability, Goodman is well positioned to complete its data centre projects which represent 40% of its development book

03 REALESTATE PORTFOLIOOVERVIEW

Source: FY24 Annual Report

AUSTRALIA/NZ

$34.6 billion portfolio; 192 properties; 98% occupancy

Oakdale Industrial Estate

Address: 1 Oakdale Close, Horsley Park, NSW

Size: 3,452k sqm

RBR Hub

Address: Corner Riding Boundary Road and Mt Atkinson Road, Trugania, VIC

Size: 810k sqm

Interchange Park

Address: 19 Interchange Drive, Eastern Creek, NSW

Size: 238k sqm

$23.2 billion portfolio; 80 properties; 96% occupancy

ATL Logistics Centre

Address: Berth 3, Kwai Chung, Container Terminal, Hong Kong Size: 556k sqm

Goodman Chongqing Airport Logistics Park

Address: 19 Ruiyue North Road, Yubei District, Chongqing City, Western China Size: 306k sqm

Goodman Landport Logistics Estate

Address: Lugang Sanjing Road, Beichen District, Tianjin City, Northen China Size: 269k sqm

EUROPE

$11.1 billion portfolio; 133 properties; 99% occupancy

Dour Logistics Centre

Address: Rue Benoît, 7370 Dour, Belgium

Size: 212k sqm

Parchim I+II Logistics Centre

Address: Flughafenstraße, 19370 Parchim, Germany

Size: 192k sqm

Amiens Logistics Centre

Address: Rue Jules Verne, 80440 Boves, France

Size: 107k sqm

THEAMERICAS

$9.8 billion portfolio; 31 properties; 100% occupancy

Goodman Commerce Centre Eastvale

Address: Cantu-Galleano Ranch Road and Bellegrave Avenue, Eastvale, CA, USA

Size: 212k sqm

Goodman Logistics Centre Carlisle

Address: Exit 44 on Interstate 81, Carlisle, PA, USA

Size: 180k sqm

Goodman Logistics Centre Newberry

Address: Adjacent to Exit 35 on Interstate 83, Newberry, PA, USA

Size: 173k sqm

04 FINANCIAL SUMMARY

Source: Company Filings

Source: Company Filings

05 TRADING PERFORMANCE

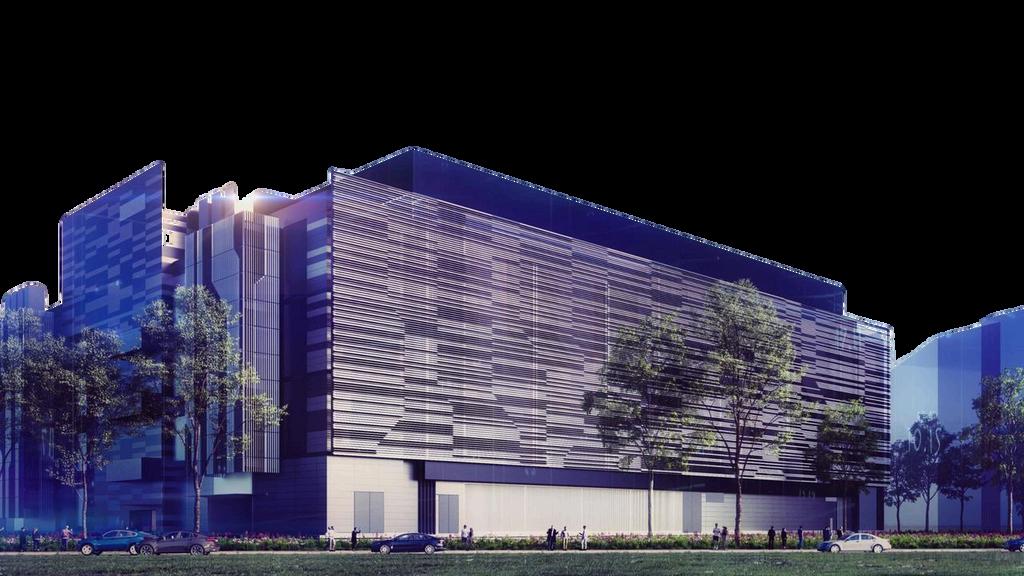

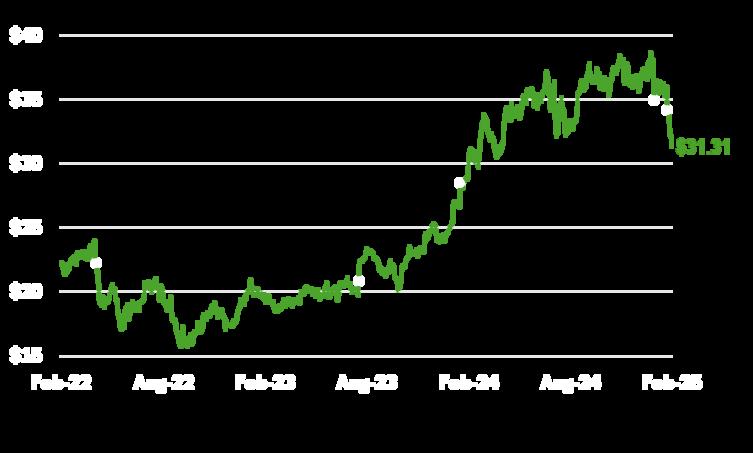

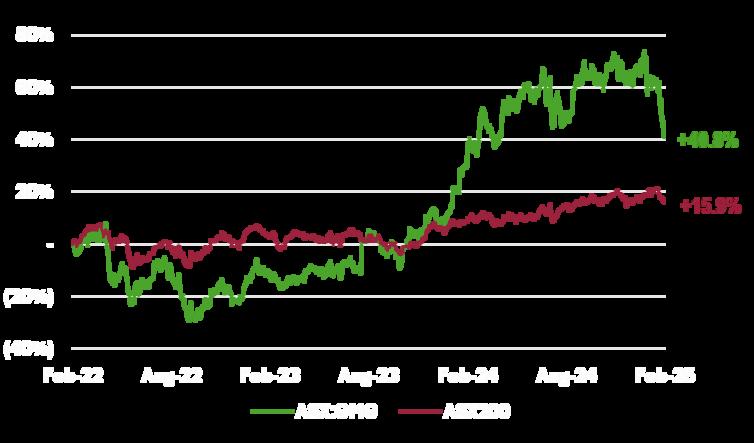

02 May 23: In response to rising inflation, the RBA lifted the cash rate for the first time since the pandemic from a historical low of 0.10% to 0.35%. (7.2%) change

17 Aug 23: Goodman releases FY23 results with operating earnings per share growth of 16%, beating initial forecasts of 11%. +5.7% change

15 Feb 24: Goodman releases 1H24 results, boasting a 25% increase in operating profit compared to the previous corresponding period +7.0% change

28 Jan 25: The announcement of Deepseek's low-priced AI model creates uncertainty of data centre demand (8.2%) change

20 Feb 25: Goodman announces a $4 billion equity raise at $33.50, a ~7% discount to last close (4.9%) change

SHAREPRICEVSASX200

3 YEAR TRADING PERFORMANCE ($ PER SHARE)(1)

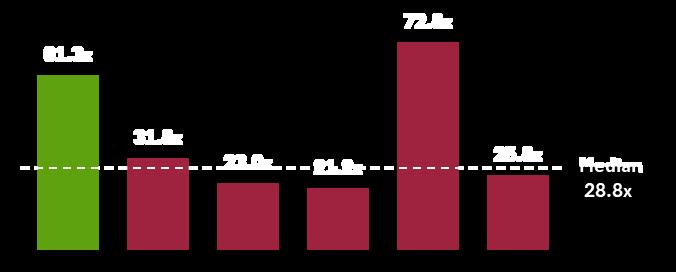

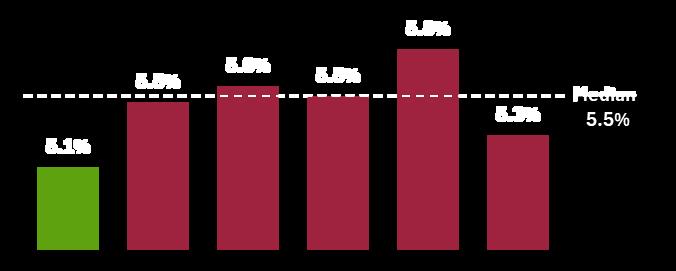

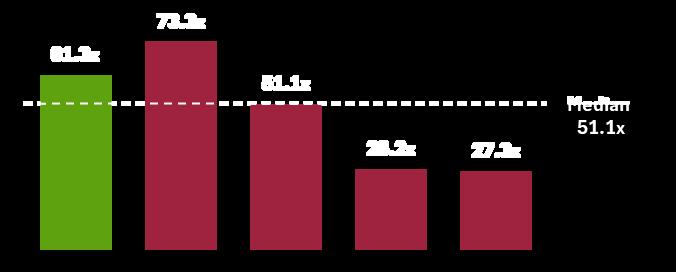

06 TRADINGCOMPS

Trading comparables, or “trading comps”, are a valuation method used to compare the value of a company or part of a company by comparing it to similarly publicly trading companies. The idea is similar to how real estate agents determine house prices by looking at recent listings of similar quality homes in the same area. In financial markets, analysts look at key financial ratios or metrics to gauge how a particular company is valued compared to its peers.

FUNDSMANAGEMENTCOMPS

Industria REIT

07 INVESTMENT RISKS

Supply and demand dichotomy may dissipate faster than expected For rental growth to persist, tenants need to remain focused on reducing proximity to their customers which is what drives demand for Goodman’s infill sites.

Earnings growth contingent on AUM growth

Amidst a volatile and uncertain inflation / interest rate market, raising further funds and therefore, growing earnings from management fees, can be a challenge.

Potential overestimation of the demand for data centres

Deepseek recently announced a cheaper and more energy-efficient AI chatbot that would require less data storage and cooling solutions, suggesting an overestimate of the future demand for data centres.

FY25 earnings per share dilution from capital raise

As more shares are issued following the $4.0 billion capital raise, the dilutionary impact calls into question whether Goodman is able to achieve earnings per share (EPS) growth in FY25.