rsir.com/marketreport

rsir.com/marketreport

The real estate market is a living, breathing ecosystem—constantly shifting in response to economic trends, policy changes, and demographic forces. As we advance with 2025, understanding these factors is more critical than ever. This is why we at Realogics Sotheby’s International Realty (RSIR) are proud to present this 2025 Market Report—a deep dive into past performance, current conditions, and what’s ahead for the housing market.

Inside, you’ll find:

Market Data & Forecasts – Analyzing sales trends, inventory shifts, and price movements across the Puget Sound region.

Economic Insights – How interest rates, inflation, and national policies are influencing real estate.

Legislative Impacts – Key takeaways from House Bill 1110 and zoning changes shaping housing supply.

Generational Wealth & Housing Trends – Understanding the Great Wealth Transfer and shifting buyer demographics. The evolution of parental gifts and financing to expand homeownership opportunities for the next generation.

Local Market Snapshots – Year-over-year comparisons of median prices, closed sales, and price-persquare-foot across key counties and communities in Washington.

The Luxury & New Development Market – A closer look at emerging high-end and new construction real estate opportunities.

At RSIR, we go beyond transactions. Our Global Real Estate Advisors are market experts, studying economic indicators, tracking policy changes, and timing the market to help our clients maximize opportunity and make informed decisions. Backed by Sotheby’s International Realty’s global network, our insights extend to referral markets, offering access to exclusive market intelligence worldwide.

This resource will help you navigate one of life’s most significant financial investments. Whether you are a buyer, seller, or investor, our report will provide you with the knowledge needed to stay ahead of the market and seize opportunities with confidence.

Connect with one of our trusted Global Real Estate Advisors to discuss the report and how you can best utilize its findings in your own real estate journey.

Andrea J. Savage Chief Marketing Officer

Realogics Sotheby’s International Realty rsir.com

1 of 1

The 2024 Puget Sound region real estate market presented similar obstacles to 2023’s market. Consistently high mortgage rates—which remained above 6 percent throughout 2024—affected affordability for buyers searching for a home and left sellers wondering whether to trade in their lower rates for the current higher rates. However, despite the challenges, the desirability of these unique markets endures, and with a savvy approach, strategic buyers and sellers were successful in their endeavors.

In addition to affordability, many potential buyers struggled with searching for their property within markets with lower inventory compared to previous years. However, 2024 brought some relief, with a 14.05% year-over-year increase in residential and condominium new listings, totaling 93,077 properties in 2024. This increase provided buyers with more selection, whether they were looking for an in-city condominium in King County or a waterfront escape in Island County. The month of May brought the highest number of new listings, keeping in line with the annual boost of activity that the market typically sees each spring.

There were slightly more closed sales in 2024 than in 2023, with a 5.58% increase year over year to 67,788 sales. This figure is significantly lower than the previous 10 years’ totals (excluding 2023). However, there was a silver lining for sellers, with median sales prices up 6.67% year-over-year for condominium and residential homes. King and San Juan County topped the list with median sales prices of $850,979 and $850,000, respectively.

Despite the various obstacles in 2024, the price growth witnessed across the past decade in the Puget Sound region proves that the market is resilient. For buyers and sellers seeking unparalleled representation, enlisting the help of a trusted Realogics Sotheby’s International Realty advisor can make all the difference in their real estate journeys. Seattle | $1,395,000

NWMLS data. Information was obtained from sources deemed reliable but cannot be guaranteed. Reader is encouraged to perform independent due diligence before acting upon reports outlined herein. Errors and omissions excluded.

$895,000 (K 6.32%)

RESIDENTIAL HOMES

$340,000 (K 27.97%)

CONDOMINIUMS

$619,950 (I 5.08%)

RESIDENTIAL HOMES

$365,000 (I 19.67%)

CONDOMINIUMS

$507,000 (I 7.99%)

RESIDENTIAL HOMES

$430,500 (I 13.59%)

CONDOMINIUMS

$647,000 (I 0.31%)

RESIDENTIAL HOMES

$489,000 (I 7.47%)

CONDOMINIUMS

$550,920(I 2.02%)

RESIDENTIAL HOMES

$353,500 (I 1.00%)

CONDOMINIUMS

HARBOR

$355,000 (I 2.90%)

RESIDENTIAL HOMES

$277,450 (I 25.54%)

CONDOMINIUMS

$419,900 (I 4.98%)

RESIDENTIAL HOMES

$435,000 (K 2.03%)

CONDOMINIUMS

$515,000 (I 1.98%)

RESIDENTIAL HOMES

$334,000 (I 1.37%)

CONDOMINIUMS

$330,600 (I 0.18%)

RESIDENTIAL HOMES

$252,494 (K 8.18%)

CONDOMINIUMS

$635,000 (I 7.99%)

RESIDENTIAL HOMES

$427,500 (I 10.68%)

CONDOMINIUMS

$580,000 (I 4.5%)

RESIDENTIAL HOMES

$427,500 (I 10.68%)

CONDOMINIUMS

$775,000 (I 6.9%)

RESIDENTIAL HOMES

$524,500 (I 8%)

CONDOMINIUMS

$600,000 (I 9.29%)

RESIDENTIAL HOMES

$393,000 (K 0.93%)

CONDOMINIUMS

KING

$960,000 (I 9.09%)

RESIDENTIAL HOMES

$560,000 (I 8.74%)

CONDOMINIUMS

$564,000 (I 5.42%)

RESIDENTIAL HOMES

$398,750 (I 1.21%)

CONDOMINIUMS

$415,000(I 3.8%)

RESIDENTIAL HOMES

$190,000 (K 39.7%)

CONDOMINIUMS

$530,000 (K 0.93%)

RESIDENTIAL HOMES

$415,000 (I 3.11%)

CONDOMINIUMS

The median closed sales price of residential homes and condominiums is shown for each county and percentage difference from 2023.

The Puget Sound region housing market witnessed an inflection point in 2024; reversing direction for two consecutive years of declining home sales. By year-end, median home prices returned to prior benchmark values set in April 2022. A new year spawned rising inventory levels and improved pending sales counts, and rising home prices persist today. Market pundits are calling for a 1015% overall increase in aggregate sales volumes in 2025 and further improvement in 2026. A new market cycle has arrived, and consumers are acclimating to the reality of higher mortgage rates and the Trump administration.

Looking back, Federal Reserve Chairman Jerome Powell used a fiscal sledgehammer, rather than a scalpal, to curb inflation with eleven bank rate hikes since March 2022 (the US inflation rate peaked at 9.1% in June 2022). Thin supply and a lack of affordability led to an omnipresent 37% peakto-trough slowdown in home purchase demand regionally, when comparing the sugar high of 2021 (when 30-year mortgage rates averaged below 3%) to the market shock of 2023 (when comparative rates more than doubled to top 7%). The first of three bank rate cuts didn’t occur until the Fed’s September 2024 meeting, but little relief has been felt in mortgage rates since. Powell is in “no rush” to make further cuts amidst a surprising spike in inflation and paused further cuts in January 2025. Albeit, threats of tariff wars and stock market turbulence are sparking recessionary fears but such an event may actually force the Fed to respond and lead to lower mortgage rates.

Most notably, the US general elections on November 5th forced voter consumption of many consequential policies, both locally and nationally. Such political theater was certainly “cause for pause” for many sidelined buyers and sellers. The attempted repeal of the Washington State

Capital Gains Tax (noted for driving some of Washington’s wealthiest residents to tax-friendlier states) was also significant. Savvy consumers need to be confident in the direction of the economy, and their country at large, before making any moves. Marketers know “a confused mind says no,” and collectively, this creates a self-fulfilling prophecy. America experienced its lowest residential sales volumes in three decades in 2024, and while the Pacific Northwest is a leading economic engine per capita, it remains to be seen if President Trump’s “golden age” is even possible, as promised.

Other notable considerations included the impact of House Bill 1110, which will fundamentally change the residential zoning in the larger municipalities; a return-to-work mandate by tech titans, led by Amazon’s massive (and repopulating) office footprint in urban areas; and a wealth injection caused by artificial intelligence, record stock portfolios, and aging demographics, to name a few drivers.

Check out our podcast channel, Market Perspectives, to hear industry experts discuss local and global market trends. Scan the code to listen.

Agent members in the Northwest Multiple Listing Service (NWMLS) closed more than $54 billion in residential and condominium homes in 2024 across 67,788 transactions, which was a 12.5% increase in volume on just 5.58% more units.

According to the closely-watched S&P/CaseShiller Home Price Index, median housing costs continued to rise, averaging 40 bps per month within the most active central Puget Sound region of King, Snohomish, Pierce, and Kitsap counties (the median price system-wide was $600,000). Inventory levels improved in 2024 by 14% with 93,077 listings, ending the year with approximately two months of supply, which is below a balanced market of three months.

King County remains the most populated, the most active, and the most costly submarket in the Pacific Northwest, with 23,272 units closed, which posted a median sales price of $850,979. Seattle is one of the least affordable housing markets in America, with the typical resident spending more than half their income on housing.

The greatest challenge homebuyers face is the combined lack of adequate housing choice, supply, and overall attainability. On average, there are less than half of the available homes to choose from compared with a decade ago. According to recent CENSUS data and reporting by the Puget Sound Business Journal, “Seattle-Tacoma-Bellevue metro area added 66,666 new residents last year, the 10th-largest increase among all metro areas in the country. The 1.6% growth rate brings Seattle metro’s population to 4.15 million. Since 2021, Seattle has grown by 128,279 people.” Additionally, asking prices are higher, and mortgage rates remain elevated in the mid-to-high 6% range. In an analysis by local real estate economist Matthew Gardner, the annual income required to afford a monthly payment of a median-priced residential home in King County was $184,689 in Q1-2021. Fast forward to today and the qualifying income for the same home needs to be $262,386 (a 42% increase).

In a sustained trend, King County’s preferred Eastside school districts were the hottest regional markets in 2024, where median home prices skyrocketed double-digits compared to 2023. Mercer Island posted the highest submarket prices at $2.436 million on a 8.77% gain, but Issaquah posted the highest annual value increases of 13.80%, with median prices of $1.6 million. The Seattle area saw increases too, but that was modest compared to the Eastside, and softness was especially felt in the in-city condominium market. These urban submarkets struggled to support resale price appreciation due to the fact that new construction supply has reset in value and draws attention below $1,000 per square foot (which is well below replacement costs). However, buying the “dip” at the beginning of a new market cycle is a prudent strategy, and an urban revival is happening. Overall, 2024 ended on a high note in an immediate correlation to political and fiscal policies, with fourth-quarter sales volumes increasingly eclipsing the prior year. The Fed cuts to the bank rate began in the September meeting (resulting in a 1% correction in aggregate); the general election concluded without major controversy or disruption; and the markets liked the outcome with a sustained rally on Wall Street. To be sure, major indices such as the Dow Jones Industrial Average, the NASDAQ Composite, and S&P 500 had been trending near or topping all-time performance valuations, creating a wealth effect and adding to consumer confidence. However, recent market jitters surrounding the potential of recession were not ruled out by President Trump in what he called a “period of transition”.

This graph is sourced from the NWMLS Annual Statistic and Review Highlights. All data is provided by the NWMLS.

The new year brought with it strong job growth and, surprisingly, a climb in US inflation in January but declines in February (the Consumer Price Index settled at 2.8%, slightly less than expected). A stubbornly elevated inflation rate and threat of tariff wars suggest a low likelihood of a rate cut during the March 2025 Fed meeting. Many analysts are curbing prior estimates to perhaps only 25-50 bps drops by year-end. When also considering the greater bond yield spread with the 10-year U.S. Treasury, house hunters face the double-edged sword of higher home prices and steeper monthly costs of borrowing. All said, more buyers are stepping up and more sellers are cashing in.

The National Association of Realtors Chief Economist Lawrence Yun is calling for around 10% increase in US existing home sales in 2025, with slightly more in 2026

79.1% of

Source: FHFA National Mortgage database for mortgaged

(10-15%). He predicts the mortgage rate will stabilize “near 6%.” Closer to home, Gardner thinks most homeowners in Washington remain “locked-in” to their current mortgage, with 79% having a rate below 5%. (See graph to the left, which illustrates the percentage of homeowners benefiting from historically low rates.) He anticipates “periods of turbulence will continue,” but “rates will trend modestly lower this year,” with a graduation from 6.7% in Q1-2025 to 6.4% in Q4-2025. Notwithstanding affordability issues, Gardner also believes home prices will build on gains from 2024, which could top 15% over two years. This reality begs whether a “higher for longer” mortgage rate is just an inconvenient distraction from buying property when home prices keep rising and equity gains far outpace perceived premiums on monthly payments. Consumers understand they can always refi, but they cannot rebuy – the rate is variable, but the strike price is forever.

Greater inventory would help. Overall, permit issuance is still well below the average in the region, especially with products for sale, and the cost to deliver new construction is climbing. Unlike 15 years ago in the “Great Recession” (when a glut of bank-owned inventory and receivership of new developments created a buying opportunity of a lifetime), no such bargains are available today. The lender lessons learned during the Global Financial Crisis have programmed a new reality of wellqualified borrowers. Furthermore, considerable equity gains in home values endure, so there is simply no distress. At best, a modest “Housing Recession” presented opportunities during the rapid rise of mortgage interest rates post-pandemic for a brief time in 2022 and 2023, but that window has closed. The sustained demand for work-from-home or hybrid workweeks (for those residing in exurban locales) has kept demand and prices softer for in-fill markets, but that is also reversing course now. So are building commuter times, which is causing an urban renaissance.

As homeownership becomes increasingly unattainable for many buyers due to rising costs and elevated mortgage interest rates, the market is shifting toward more efficient, thoughtfully designed housing solutions. This “Goldilocks Living” concept isn’t about sacrificing quality or livability—it’s about finding the right balance between affordability, space, and smart design. Consumers have shown they can adapt to living in smaller homes, but they cannot stretch beyond their financial means—something has to give.

A solution for attainable homeownership lies in two distinct product categories ahead: in-city condominiums built in high volume and accessory dwelling units

Homeownership is evolving in response to economic pressures, policy changes, and shifting generational needs. Affordability challenges and rising mortgage interest rates have forced buyers to rethink how and where they live, while new legislation is reshaping the housing landscape. Meanwhile, a major demographic shift—the largest transfer of wealth in history—is set to redefine housing demand for years to come.

This year, three key trends stand out: the rise of “Goldilocks Living,” the impact of House Bill 1110, and the generational forces shaping homeownership. Each plays a pivotal role in how inventory, affordability, and demand will unfold in 2025 and beyond.

(ADUs) and detached ADUs (DADUs), both influenced by House Bill 1110. In both cases, the “thought per square foot” is as important as the “price per square foot.”

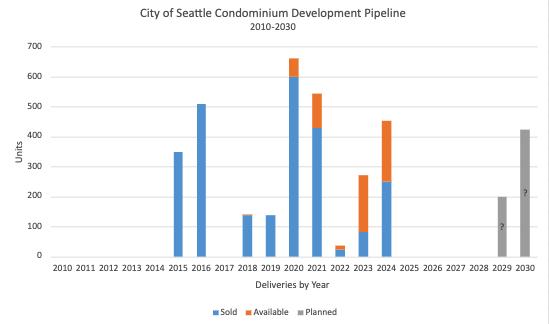

Gardner’s homebuyers’ analysis to qualify for a median-priced condominium in Seattle in Q1-2021 was $105,381, compared to current requirements of $144,161—a 37% increase. The overhang of new construction products, especially in downtown Seattle, is quickly burning off. No new high-rise condominium groundbreakings have occurred since 2020, and none are expected in the near future, given that market values remain 30-40% below replacement costs.

Conversely, landlords are benefiting. Since 2010, 94% of all multifamily units built in downtown Seattle have been rental apartments rather than for-sale condominiums. The Emerald City is now home to more leasing tenants than homeowners.

$0+ 65

$50+ 154

$100+ 258

$150+ 540

$200+ 947

$250+ 1771

$300+ 2873

$350+ 4116

$400+ 5048

$450+ 5591

$500+ 5573

$550+ 5296

$600+ 4795

$650+ 4441

$700+ 3769

$750+ 3487

$800+ 2704

$850+ 2686

$900+ 1867

$950+ 1810

$1M+ 8881

$1.5M+ 3487

$2M+ 1426

$2.5M+ 1714

There is a silver lining—approximately 500 new condominium units remain available, following a wave of 1,924 new condominiums delivered since 2020. However, only 160 units are priced below $800,000, a psychological benchmark lower than King County’s median home price. As more renters transition to homeownership—driven by a return to office life and increased stock-based compensation among tech workers—inventory is absorbing from the bottom up.

If just 2% of renters who moved into a new apartment tower since 2010 decided to buy a comparable unit, the entire current condominium inventory would be absorbed. Yet, with no new high-rise condominiums on the horizon and a permitting timeline of four to five years for a new tower, demand could outpace supply much sooner than anticipated.

Meanwhile, developers remain cautious, navigating inflationary construction costs, complex financing, and presale restrictions. Under the Washington State Condominium Act, a buyer’s earnest money deposit is capped at 5% and cannot be released to the developer until closing—a hurdle for capital stacks and investor confidence.

“No new groundbreakings of a high-rise condominium building have occurred since

2020.”

RSIR staff, pictured above, celebrated 15 years of excellence this year. Established in 2010, the brokerage is consistently the largest affiliate in Washington State for Sotheby’s International Realty, representing 72 percent of the sales volume for the brand with more than $21 billion in cumulative sales volume to date.*

*Source: Trendgraphix research per NWMLS data comparing Realogics Sotheby’s International Realty franchise performance versus the top ten largest aggregated brokers in the study area of 22 Washington State counties in the Pacific Northwest (not including other affiliated franchises with its aggregated brand performance). NWMLS data may not include off-market transactions or referral sales not captured in the region. Data excludes licensed brokers in Realogics Referral Exchange, Inc.

House Bill 1110 (HB1110), also known as the “Missing Middle” housing legislation, became a mandate by Washington State Governor Jay Inslee in March 2023. It effectively “up-zones” residential lots and will require local municipalities in King, Snohomish, Pierce, and Kitsap Counties to deliver bylaws and ordinances by July 2025 (currently, only the City of Redmond has complied). This goal of densification, especially within Tier 1 cities of more than 75,000 residents on land that is near light rail or rapid transit stations, will encourage homeowners to create ADUs and DADUs on their residential lot (a fourplex or sixplex could replace a single house). This could be either for rent or for sale, adding to the inventory of affordable housing. The value of the underlying land for redevelopment will, in many cases, be greater than the house and lot that exists today.

“The bill aims to increase the number of middle housing options in areas that are typically zoned for single-family homes.”

ADU/DADU SINGLE-FAMILY

Realogics Sotheby’s International Realty has assembled an experienced team of thought leaders on this policy and incorporated the use of artificial intelligence (and specially trained real estate advisors) to explore where and how these legislated changes will affect local housing markets. This includes playing matchmaker between “make-memove” sellers and homebuilders eager to deliver on the policy promises. The overall inventory gains will take years to manifest and may fall short of the impact of multiple 500-unit residential towers (assuming they are supported by market fundamentals and willing developers). HB1110 will provide benefits over time and become an elixir for would-be sellers to unlock land for redevelopment.

Looking ahead to the rest of 2025, and to balance this decade for that matter, two demographic profiles will redefine the regional housing marketing, and they are at opposite positions in life. The first is the Millennial or Generation X consumer who is migrating from renting into homeownership (as discussed previously), and many will get a boost from parents in helping to purchase (if not outright receiving an inheritance). The second is the aging Baby Boomer and Silent Generation, who are increasingly reaching retirement and comprising what will become a $90 trillion “Great Wealth Transfer.” Extraordinary equity gains will pass down to the next generation, and there will be a large divesting from active investments (like rental properties and commercial businesses) to passive ones (like REITs and Delaware Statutory Trusts seeking capital gains tax deferrals). An aging population is seeking lifestyle advantages, such as downsizing to a single-level, lock-and-leave residence, and exploring second-home markets.

38

Years Old

The median age of first-time home buyers in the U.S.

72.7

Million

In 2024, Millennials surpassed Baby Boomers to become the largest group of homebuyers.

Source: National Association of Realtors, 2025.

Realogics Sotheby’s International Realty has been a thought leader on these topics and has aligned with global wealth management teams, tax deferral strategists, and key real estate referral partners to assist in the expanding demand for solutions.

Upon Inauguration Day, President Trump wasted no time with aggressive executive orders, including tariffs on foreign imports and what’s poised to become a mass deportation of undocumented residents, potentially including those holding important roles in the workforce. These policies are broadly viewed as adding to housing inflation as approximately a quarter to a third of all homebuilding products and trade workers are impacted, passing on costs that consumers will need to pay for new homes.

Kurt Reiman, Head of Fixed Income, CIO Americas at UBS Financial Services of UBS Wealth Management, opined on the direction of the macroeconomy and housing during a recent Market Maker event with Realogics Sotheby’s International Realty. While President Trump referred to a “Golden Age” of America ahead, that may prove challenging to deliver given that the Oxford Dictionary describes it as: “an idyllic, often imaginary past time of peace, prosperity, and happiness.” While it is true that the stock market is booming, the US society remains divided, and certain campaign promises are lofty. Reiman was quick to comment: “Policy matters, but it’s not everything,” reminding the audience that podium statements and even executive orders are often the beginning of processes and are not a result. In many cases, directives need to work through the House and Senate, which Reiman noted are held by the slightest of advantages for the Republican Party.

Reiman agreed the US economy is doing well, citing, “The consumer is in decent shape. Real incomes are growing, leverage among households is not particularly alarming, consumers have money, and they are out spending it.” He added, “Inflation is generally coming down, but stubbornly, not moving as quickly as it has been. Labor markets are still strong.” Regarding taxes, Reiman believes prior tax cuts are only being extended and not falling like they did in 2017, when corporate rates were reduced from 35% to 21% and income tax rates across the board came down. That provided a “really nice tailwind for the economy, which lasted for several years,” he said. “The risk is that they do not get extended because Congress cannot come to some agreement over what is the magical deficit figure or there are holdouts because spending is too high or there is not necessary relief on SALT (State and Local Taxes) deductions. The debt ceiling was not addressed. There are a lot of negotiations in Congress to get tax cuts. All these campaign promises are probably a bridge too far. Interest expense on the US deficit is now greater than defense spending. There is not a lot of movement on capital gains.”

“The consumer is in decent shape. Real incomes are growing, leverage among households is not particularly alarming, consumers have money, and they are out spending it.”

Jonathan Woloshin, Head Real Estate & Lodging Research at UBS Wealth Management Chief Investment Office, thinks the SALT deduction could increase from $10,000 to $20,000 or $30,000, but unlikely back to unlimited. That would be helpful to residential ownership benefits.

UBS believes it is going to take some time to get the necessary votes to corral members of Congress around what is going to be an exceedingly difficult deficit number to accept, so there will be a lot of “horse trading” on fiscal tightening. Reiman cautioned, “This is not a windfall. This is not 2017, when tax rates

were cut. There are constraints. Additional tax rate relief for either corporations or individuals is unlikely. The only way we are going to get there is offsetting spending cuts or a lot of revenue coming in from tariffs, which is its own potential threat.”

The collective summarized the 2017 tax cut is “already priced into the housing market,” but SALT deductions are encouraging yet not as likely a “make-me-move” moment for luxury consumers. A more significant incentive would be increasing the capital gains allowance of single sellers to $250,000 or married couples to $500,000, as hinted by President Trump, but Woloshin agrees that pressure on Congress will be to resist the loss of revenues. He said, “The Trump administration is going to have to pick their spots, and maintaining the 2017 tax cuts, I think, is going to be a higher priority than expanding some of these things, especially that will benefit the wealthy.”

The SALT deduction limits were especially punitive to wealth in pricey markets like California or New York State. This, in part, motivates buyers to seek out lower tax environments, like Washington State, which also does not have a state income tax.

There could be a Trump administration incentive for sellers to sell to first-time buyers. Such a tax credit could exacerbate the problem by creating more demand for the same supply. Woloshin looked at the distribution of mortgages and wondered what incentives could be for people to sell. He said, “Roughly 40% of the homes in the US are mortgagefree. On the balance, about 21% have a rate below 3%, 55% have a rate below 4%, and 73% have a rate below 5%. Current 30-year fixed mortgage rates have hovered in the 6% to over 7% spectrum.”

Could the year 2025 become the modern-day “Roaring Twenties”? In some ways, perhaps, but whether history repeats itself as an American Gilded Age remains to be seen. Let’s hope this decade ends better than a century ago, having learned valuable lessons from past economic, governmental, and societal oversights.

“A housing boom chased record-low mortgage rates, and home equity lines of credit supported many other lifestyle pursuits.”

It is hard to ignore consistencies from a century ago when the Spanish Flu was reportedly responsible for killing 675,000 Americans (more than World War I). On the other side of such a devastating health pandemic was a euphoric oasis and global calm without geopolitical strife. Similar to the explosion of new industries in the 1920s, today’s economy is being reshaped by artificial intelligence and automation. According to a report by PwC, AI is expected to contribute up to $15.7 trillion to the global economy by 2030, fueling new efficiencies, consumer experiences, and job creation—while also displacing traditional roles at an unprecedented rate. US cities rebounded amidst technological change, widespread prosperity, and an innovative age of American culture.

In the 1920’s, new industries (and consumer products), coupled with a surge of cheap credit and robust advertising, encouraged spending on a wave of new luxuries, and supported a booming economy. The Republican Party introduced tax cuts, wages increased, and the stock market soared, creating a wealth effect. This was the “Great Gatsby” era; the US population was urbanized; and high-rises like The Empire State Building, The Chrysler Building, and the Rockefeller Center stand today as landmarks of American renaissance and confidence. But the good times came to an end amidst a stock market crash (lack of debt coverage allowing unregulated speculation), numerous social injustices, a global trade war, agricultural insufficiencies, and rampant crime. The Great Depression had begun and then there was World War II.

Similar to this history, the Covid-19 pandemic began a century later in 2020 and is said to have killed a million Americans. The US economy and society suffered, and cities deurbanized as work-from-home realities radically challenged the traditional office workplace. Prior tax cuts (2017) and a slashed Fed fund rate in response to economic woes created a new wealth effect. A housing boom chased record-low mortgage rates, and home equity lines of credit supported many other lifestyle pursuits. Many real estate brokerages (and agents) had their best years ever but that sugar high was shortlived. This time, however, the world has not been free of war with ongoing strife in Ukraine and Gaza.While it’s too soon to know the outcome of policies like foreign trade tariffs and resulting inflation, deportation impacts on the workforce, and the Department of Government Efficiency, the stock market had clearly been “roaring” but was not tested by the potential of recession, and Wall Street

is watching. Flush credit may come via the sustained inheritance in the Great Wealth Transfer while a boon of innovations and new fortunes gather around artificial intelligence.

Fear not another Black Thursday stock market crash – that seems unlikely with regulatory oversight, and home equity and consumer wealth have never been greater. The Pacific Northwest economy is also fortunate to be among the top five regions in the US to benefit from high-tech advancements, venture capital, and significant tech titan headquarters or regional satellite offices that chose Washington for recruiting and retention. Our urban markets offer a significant runway of available office space for inbound companies to land, bringing with them job and population growth that begets housing demand. The moderate climate, rich culture, recreational lifestyle, enviable schools, and for the most part, tax-friendliness will continue to make the region a beneficiary of immigration and investment. That said, the enduring presence of a capital gains tax on securities for residents and onerous estate taxes will cause many to think about whether the Evergreen State is forever their home when divesting from portfolios or exploring the next move in the sunset of life. Upon the recycling of residential homes, a rise in downsizing and second-home ownership demand will greatly increase real estate transactions and demand for wealth management and tax deferral strategies.

Consumers seeking attainable homeownership options in a “small town” may choose to drive to, or float to, new boom-burbs as ex-pats of King County. The multi-billion dollar investment in the Interstate 90 East Expansion Project is making the 80-mile commute to the mountain town of Cle Elum more accessible, while “missing middle” housing products are programmed into its future. Likewise, the historic milltown of Port Gamble on the Kitsap Peninsula is poised for restoration and is just an hour commute via a quick transit ride to Kingston and a 45-minute foot-ferry to downtown Seattle.

“Fear not another Black Thursday stock market crash – that seems unlikely with regulatory oversight, and home equity and consumer wealth have never been greater.”

Tadashi Shiga, Founding Member of Realtie, LLC

Who is involved in Realtie, LLC and why was this organization formed?

I co-founded Realtie, LLC with Ofer Avnery to bring together real estate expertise and technology. We created Realtie to revolutionize how real estate professionals, developers, and homeowners navigate land acquisition and development by leveraging artificial intelligence alongside Northwest-based real estate experts, including top brokers, architects, developers and homeowners. This unique combination of AI-driven insights and local expertise ensures a comprehensive, hyper-local approach to identifying opportunities and streamlining the development process. Recognizing inefficiencies in traditional real estate analysis, Realtie integrates AI-driven data, hyper-local expertise, and brokerage insights to identify opportunities and streamline transactions. Our goal is to help brokers, developers, and homeowners make informed decisions, maximize property potential, and adapt to changing zoning regulations such as House Bill 1110.

“The bill aims to increase the number of middle housing options in areas that are typically zoned for single-family homes.”

Tadashi Shiga Executive Director of Land Division Realogics Sotheby’s International Realty

What is House Bill 1110?

House Bill 1110 is the most impactful upzone in Washington State history in a generation, reshaping the landscape of residential development. This transformative zoning reform is designed to address the housing crisis by legalizing middle housing in areas previously restricted to single-family homes. The legislation mandates that cities allow duplexes, triplexes, and fourplexes in certain neighborhoods, unlocking new development opportunities and increasing housing supply. By breaking down outdated zoning barriers, HB 1110 fosters more walkable, diverse, and inclusive communities while providing homeowners and developers with new ways to maximize property value. It is a forward-thinking response to the state’s growing demand for housing and a critical step toward creating more affordable and attainable living options for future generations.

When was this approved and how does it get adopted by municipalities?

House Bill 1110 was signed into law in May 2023. Municipalities must update their zoning codes to comply by 2025, integrating the changes into their comprehensive plans. Some cities are proactively implementing the law, while others are working through infrastructure and policy adjustments to meet the mandate.

The Sotheby’s system by REALTIE is a trailblazing AI platform that transforms the complexity of real estate development potential into clear, fact-based insights. Engineered with a human-in-the-loop, deterministic approach, our system aggregates vast datasets and local zoning rules to deliver actionable intelligence for brokers. Built from the ground up with next-generation SAFE AI principles, it stands as a thought leader in responsible, transparent, and reliable AI implementation.

Why have mortgage rates more than doubled since 2020?

In simple terms, the United States government has spent too much money. There was too much money chasing too few goods which increased prices. The cash infused into the US economy during Covid led to the lowest interest rates in our lifetime and overstimulated the market. That, combined with the additional stimulus packages signed into law in 2021 and 2022, exacerbated an already overheated economy and inflation rose quickly. The Federal Reserve increases the Federal Funds rate in an effort to slow the economy and consumer spending. By making everyday purchases more expensive, there is less demand and consumers buy less. Less demand causes prices to decrease or stabilize, which helps to curb inflation. While there isn’t a direct correlation between the Fed Funds rate and mortgage interest rates, Federal Reserve moves do have a ripple effect on other interest rates, including mortgage rates.

Carese Busby Loan Officer | NMLS #619429

Movement Mortgage

What is the difference between the Fed funds and prevailing mortgage rates?

Fed Funds rate is a short-term rate and is the overnight interest rate at which banks borrow from the Federal Reserve and lender to each other to balance each night and it’s a key tool used by the Federal Reserve to influence the overall economy and to curb inflation. It primarily influences credit cards, home equity lines of credit (aka HELOC) and other short-term loan rates.

Mortgage rates are long-term rates and are closely tied to the 10 YR Treasury yield. When Treasury yields rise, mortgage rates follow. Supply and demand for mortgages also influence mortgage rates along with inflation expectations. While there isn’t a direct correlation between Fed Funds and mortgage rates, the actions of the federal reserve influences consumer confidence, which influences bond market investment and activity, which in turn influences mortgage rates.

How can parents help their children purchase their first home in a tax-friendly way?

Parents can give their children down payment funds while they are still alive versus waiting until they have passed on and/or co-sign on the loan to help them qualify. Many don’t realize they can gift well beyond the annual gift limits without a tax liability. The biggest challenge for most first-time homebuyers is the down payment, so having the parents help through down payment assistance can allow the first-time homebuyer to purchase sooner and start accumulating wealth through equity. Becoming a homeowner earlier in life allows a consumer to create exponentially more wealth over time.

Disclaimer: Movement Mortgage and RSIR recommend seeking the advice of an estate attorney or CPA to discuss specifics as every situation is different.

How is the US inflation rate affected by the Fed funds rate?

When inflation rises above the target set by the Federal Reserve of say 2%, the Federal Reserve increases the Fed funds rate. It becomes more expensive for banks to borrow money and banks pass on these increased costs to consumers and businesses in the form of higher interest rates on loans, credit cards, and mortgages. This leads to reduced spending by consumers and decreased investment by businesses. This slows the economy with the goal of maintaining price stability at the target inflation rate. When inflation is too low, the Federal Reserve may lower the fed funds rate to stimulate spending and the economy.

with Carese Busby from Movement Mortgage

What are the allowable personal income tax deductions for homeowners and how might that change with policies heralded by President Trump?

The Great Recession was a systemic financial crisis, and the housing market was the match that lit the fire that started it all. Nearly all sectors of the economy were affected, not just housing. It was triggered by a bursting of the US housing bubble and very loose credit guidelines. At that time, in 2007 to 2009, there was plenty of inventory of homes and demand was even with supply and if you could fog a mirror, you qualified for a home loan and risky home loans were made to consumers that couldn’t afford their loan. As the crisis unfolded, more and more people defaulted on their loans as they lost their jobs, and many major financial institutions collapsed due to a liquidity problems associated with how they were leveraged. There were widespread foreclosures and plummeting home values.

A housing recession, by contrast, is specifically within the housing sector which may or may not lead to a broader economic recession. It’s caused by an oversupply of homes, rising rates, declining consumer confidence, and changes in economic conditions. The impacts are limited to the housing section and will lead to a decrease in construction jobs and a slowdown in related industries.

How would you describe the US housing market and state of the mortgage industry to provide borrowers with confidence in the system?

Housing is the backbone of the United States economy, and it supports many adjacent industries including; real estate, construction, lending, and energy. It’s simple supply and demand. The US housing market is strong and resilient. The challenges include low inventory, increasing prices, and affordability. Higher rates are keeping many would-be sellers from listing their homes causing a “lock-in” effect. The mortgage industry is well-regulated, and buyers have to qualify and demonstrate they can afford the mortgage payment in order to get approved for a loan, which wasn’t the case pre Great Recession. Buyers should feel confident buying homes in this environment.

Why are so many Generation X and Millennials perpetually renting instead of buying their first home?

These generations have significant headwinds unlike older generations. Rising home prices outpace their wages and price them out of the market, student loan debt strains finances and limits their ability to qualify for a loan, and constraints in saving for a down payment keep these consumers from buying a home. Furthermore, the cost of essential expenses have risen which further squeezes Gen X and Millennial budgets, along with job instability and lifestyle preferences for more mobility and flexibility, has led to lower homeownership rates for this demographic.

What is your response to would-be buyers that are waiting for an economic recession or glut of inventory to hit the market before making a move?

Wait at their own peril. The math is not in the buyer’s favor for the foreseeable future. There is a math problem in the Puget Sound region. More people want to buy than there are houses to meet the demand. Regardless, low inventory trumps everything else including interest rates. This means home prices will continue to rise for the foreseeable future because more people are lined up to buy homes than there are homes available. Economics 101 tells us that prices will continue to rise in this environment with those factors present.

How can tech workers with Restricted Stock Units qualify for a mortgage but not be required to sell a bounty of stock when buying a home?

Borrowers with RSUs can qualify for the loan using the RSU as part of the income qualification component without having to sell the stock to qualify. They can choose to use other funds for down payment and closing costs.

What do you believe will be the general trend for mortgage rates in the first half and second half of 2025?

I don’t anticipate much movement in the first half of 2025 as the markets wait to see things shake out with proposed policies of the Trump administration.

I expect rates will continue a slow, downward trend in the second half of 2025.

with Carese Busby from Movement Mortgage

What submarkets and product segments are you seeing that feel like a particular opportunity today?

Condos, condos, condos. Condos used to be the go-to for first-time homebuyers for their starter home, but over the past two decades, the starter home has evolved to $1-million-plus homes. Condos are not nearly as competitive as townhomes and single-family homes and there may be flexibility on price and/or seller credit opportunities, which can help buyers with more favorable loan terms. Condos are a great way for a first-time homebuyer to get into the market and start building equity. Condos are also a great way for downsizers to sell their large homes they’ve owned for years and potentially buy a condo and a second home somewhere they like to travel. It’s also a great opportunity for consumers who are now returning to work in urban areas to buy a second home condo to stay at during the work week and return to their primary home, that they may have purchased outside of commuting distance during the Covid era, on the weekends.

What are the allowable personal income tax deductions for homeowners and how might that change with policies heralded by President Trump?

Under the Tax Cuts and Jobs Act (TCJA), effective 2018, consumers can deduct mortgage interest through standard deduction or itemized deduction. Most people opt for the standard deduction because on average their yearly mortgage interest is less than the standard deduction. If consumers’ mortgage interest is more than the standard deduction amount, they can choose to itemize so they can write off more. State and local income or sales taxes are also allowed to be deducted under itemization along with some other deductions.

What are helpful metrics to watch out for to better predict the trajectory of mortgage rates?

The 10-year treasury yield is the best guide to see the direction of mortgage rates. These bonds are considered a benchmark for long-term interest rates.

Why doesn’t President Trump just issue an executive order to lower rates and encourage more home sales demand?

A presidential executive order doesn’t have the power to influence interest rates and encourage demand. The Federal Reserve operates independently of the president and consumer confidence and sentiment is largely responsible for home sales demand. The better consumers feel about the economy and their future, the more likely they are to spend money. The more nervous they feel, they tend to hunker down and spend less.

The TCJA expires this year and if an extension is not passed, an estimated $4 trillion in tax increases are set to take effect on January 1, 2026, and would revert back to pre-TCJA levels and therefore, tax hikes.

The TCJA lowered individual tax rates, doubled the child tax credit, essentially doubled the standard deduction in an effort to reduce the need for itemization, and doubled estate and gift tax exclusion amount per decedent.

Pre-TCJA allowed consumers to deduct mortgage interest and state and local taxes, however, they will need to go back to itemizing these deductions.

Check out our podcast: How Condos Can Lead to Building Wealth Scan the code to watch.

Not all lenders are created equal, and not all homeowners fit into the same box. We put people before profits and are your best mortgage matchmakers. No matter your unique situation, we have a solution.

Self-employed? Use bank statements instead of tax returns

An investor? Qualify without tax return income limitations

First-time homebuyer? Access down payment assistance

Buying your dream mansion? Super jumbo loan up to $5M

Long-term rate lock? Secure a loan from 120 to 360 days

Selling a home? Lock in a rate for your future buyer

Reverse mortgage? We’ve got you covered Our specialized experienced teams aim for full processing in only 7 days. No more waiting around for weeks or months for a lender to reach final approval.

Your

of

King County is the most populated county in Washington state. The total 2024 closed sales volume—up 20.1% year-over-year —far exceeds that of any of the neighboring counties.

$960K

19,024

1,938

1,815

According to NWMLS data, King County’s 2024 single-family home market showed notable trends. New listings peaked in May, while pending sales saw their highest volume in April. Closed sales had two peaks, in both May and October, while active listings were at their highest in September.

27.4% % CHANGE VS. LAST YEAR

According to NWMLS data, King County experienced a 27.4% year-over-year increase in single-family home sales priced at $1 million or higher.

There were more sales in Kitsap County in 2024 than in the previous year, increasing by 9% to 3,777 closed listings. There was also growth in all other data points analyzed in our reporting.

Pierce County saw growth all around, with the most notable year-over-year increase in the total sales volume figure, illustrating the overall price growth and increase in sales in this county during 2024. $564K

Island County’s 2024 sales price and average price per square foot experienced moderate growth, both up 5.1% year over year.

Homes spent more time on the market in Jefferson County in 2024 than the previous year at an average of 57 days on market.

24

8,251

Snohomish County’s total sales volume in 2024 was up by 16% compared to 2023’s total volume. The median sales price increased by 6.9% to $775,000.

Nestled in Downtown Kirkland, Fog Rose

is a haven of elegance, offering a refined afternoon tea experience and elevated catering. The passionate team is dedicated to hospitality, crafting beautiful moments through exquisite desserts, artful small bites, and thoughtfully curated charcuterie boards.

In breaking down the market data by residential homes versus condominiums, we gain a clearer picture of which counties boast a more diverse range of housing options. Although King County held the top position for both residential and condominium median sales prices in 2024, Snohomish’s condominium market was not far behind with the second highest median sales price.

Creating environments that embrace the beauty of our communities through exceptional experiences and a portfolio of extraordinary homes.

When we look around the neighborhoods surrounding our Realogics Sotheby’s International Realty offices, we see communities that welcome their residents. For this reason, we strive to offer more than a mere workplace for our brokers; we seek to design lifestyle showrooms and experiences that can be shared with friends and clients alike. Whether you visit us to peruse our portfolio of remarkable listings, indulge in a glass of wine, have a bite to eat, or appreciate a local artist’s work, you can expect to be treated like a family member. So please, come in—our doors are always open, and we’ve saved a seat just for you.

Six conveniently located branches that serve you.

With a legacy of excellence, Realogics Sotheby’s International Realty (RSIR) and Sotheby’s International Realty (SIR) are industry leaders, backed by powerful numbers that prove their unmatched expertise. As part of a globally recognized brand, SIR’s network spans 1,000 offices in 81 countries. RSIR upholds this standard locally, delivering record-breaking results and bespoke service that clients trust.

Realogics Sotheby’s International Realty Holds the #1 Position Compared to Our Peers in Washington State

Realogics Sotheby’s International Realty’s New Developments team represents the region’s most comprehensive portfolio of new home opportunities from sea to sky. Get a closer look at their incredible projects on their recently launched website.

Learn more at: rsir.com/developments

Luxury real estate, redefined. Follow them to explore the most exciting new projects in Seattle and beyond.

First Hill | 800 Columbia Street | Priced from the $400,000s | Move in Today

Perfectly at home in Seattle’s historic First Hill neighborhood,where heritage buildings and tree-lined streets blend with modern architecture, Graystone is an elegant collection of one-of-a-kind condominium residences that embody Seattle’s relaxed and refined style.

TheGraystone.com

Offered by Daniels Real Estate and Greentown

Alki Beach | 1250 Alki Avenue SW | Priced from $1 Million | Move in Today

The best and only offering of its caliber in Seattle’s Alki Beach, Infinity Shore Club is an exclusive collection of 37 condominium homes. Now over 60% sold, this boutique building offers one-plusden-, two-, and three-bedroom homes with large exterior terraces overlooking the Puget Sound.

Offered by Vibrant Cities, LLC InfinityShoreClub.com

Situated at the base of Crystal Mountain, Rainier Chalet Condominiums offers one-, two-, and three-bedroom homes coming soon to Enumclaw. With a Rainier Chalet Condominiums residence, you’re at the gateway to unmatched natural beauty.

RainierChalet.com

Enumclaw | 2200 Mountain View Drive | Priced from the $300,000s | Occupancy 2026 Offered by Rainier Lodging, LLC

Quincy | 23524 Grand Cru Drive NW | Priced from $1.5 Million | Move in Today

Nestled in sun-soaked Central Washington along the tranquil Columbia River. Each home offers floor-to-ceiling windows, a generous open layout, ensuite bathrooms, high-end finishes, and an indoor/outdoor living area—all designed to take full advantage of the stunning views.

CrescentRidgeResort.com

Offered by Hadley Properties

In the Pacific Northwest, where housing supply has chronically struggled to keep pace with demand, new construction is essential for attainability, consumer choice, and shaping the future of living. Beyond simply adding inventory to the region’s housing shortage, today’s homebuyers seek more: innovative designs, lifestyle amenities, branded experiences, and exciting destinations to call home.

Dehlan Gwo | Vice President of New Developments | Realogics Sotheby’s International Realty

As more homeowners seek to transition from single-family homes to walkable, amenity-rich communities, condominium estates like Infinity Shore Club offer a sophisticated solution. These residences provide spacious, lock-and-leave living with minimal maintenance, ideal for snowbirds and those with second homes. To ease the transition, RSIR and Vibrant Cities introduced the Early Occupancy Program, allowing buyers to move in while preparing their previous homes for sale.

While Seattle boasts significant wealth and impressive residential compounds (of the single-family home variety), it has long lacked true luxury attached housing comparable to offerings in New York, Miami, and San Francisco. RSIR New Developments recognized this demand early on, beginning with Fifteen Twenty-One Second Avenue, a pioneering project that proved the appeal of larger-format condominiums. Today, the trend toward full-service, amenity-rich residences continues, catering to downsizers, young families, and those seeking effortless luxury living in prime urban locations.

Downtown Seattle is experiencing a resurgence, driven by pragmatic leadership, improved public safety, and the return to in-person work. As the downtown population swells and the retail and restaurant scene revives, major projects like the Convention Center expansion, Seattle Waterfront, and the planned Lid I-5 project are enhancing the city’s appeal. Confidence in the condo market is growing. Graystone on First Hill has led this momentum, finishing 2024 as Seattle’s best-selling condominium with over 50 new sales.

More than 85% of the newly developed condominium units since 2015 have already sold. However, no major condo developments have broken ground in five years. With new supply unlikely in the next several years, due to elevated land and high rise construction costs, history suggests a severe condo shortage is on the horizon, similar to past droughts in both Seattle and Bellevue. Meanwhile, Washington State’s House Bill 1110 encourages density in single-family zones but does little to address the urban condominium shortfall. Without stronger incentives for development, Seattle’s condo inventory will continue to shrink, driving prices higher as demand outpaces supply.

As demand for attainable housing grows, medium and high-density living is expanding into traditionally singlefamily suburban markets. Rainier Chalet Condominiums in Enumclaw offers a rare chance to own a lock-and-leave residence near Crystal Mountain Resort, blending year-round recreation with everyday convenience. This trend is also reshaping suburban hubs like Sammamish Town Center and Totem Lake, where for-sale multi-family developments are thriving. Additionally, aging malls near transit expansions, like Northgate, present future opportunities for redevelopment into vibrant mixed-use communities. These shifts signal a broader move toward quality condominium, cottage, and townhome living in areas once dominated by single-family homes.

Resort markets are seeing a resurgence as buyers return to second-home destinations, seeking four-season attractions and flexibility. Crescent Ridge Resort, a new luxury community on the Columbia River, offers a perfect blend of water sports, wine country retreats, and skiing, with large garages for recreational toys and short-term rental options. As these markets mature, today’s buyers demand high design, diverse home plans, and resort-style amenities that cater to their lifestyles. Builders are responding with customized homes and community features that transform seasonal towns into dynamic, year-round destinations.

Scan to read the full report and explore insights.