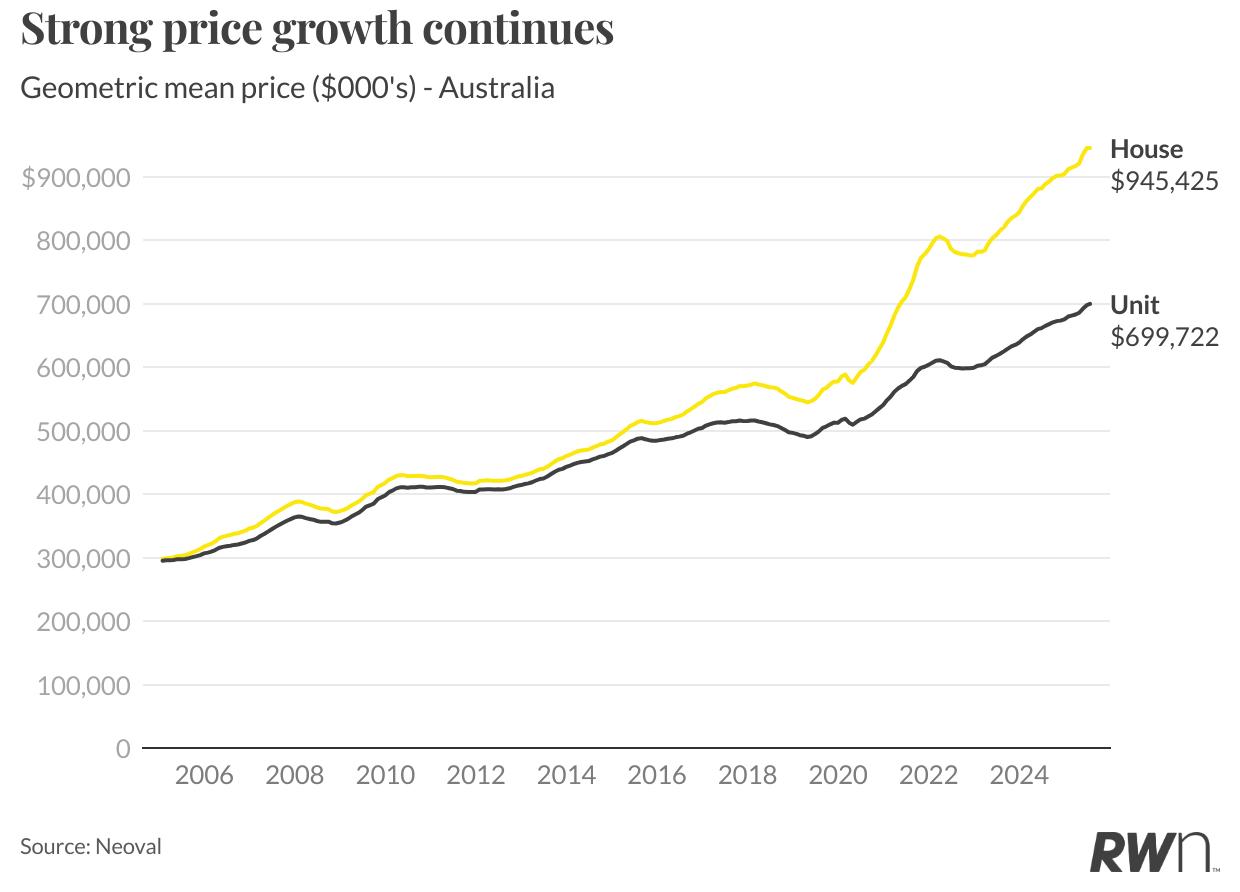

Australia’s property market demonstrated its underlying strength in July 2025, with national house prices reaching $945,425 and unit prices achieving $699,722. The market’s resilience is evident in the long-term trajectory, with both sectors maintaining solid annual growth of 6.4 per cent for houses and 5.2 per cent for units despite the Reserve Bank’s surprise rate hold in July.

The data reveals the market’s capacity to withstand monetary policy shifts, with prices now sitting near historic highs across all markets following the dramatic recovery from pandemic lows. This trajectory reflects the fundamental supplydemand imbalance that continues to underpin price appreciation across both housing segments, positioning the market well for renewed acceleration once the anticipated August rate cuts commence.

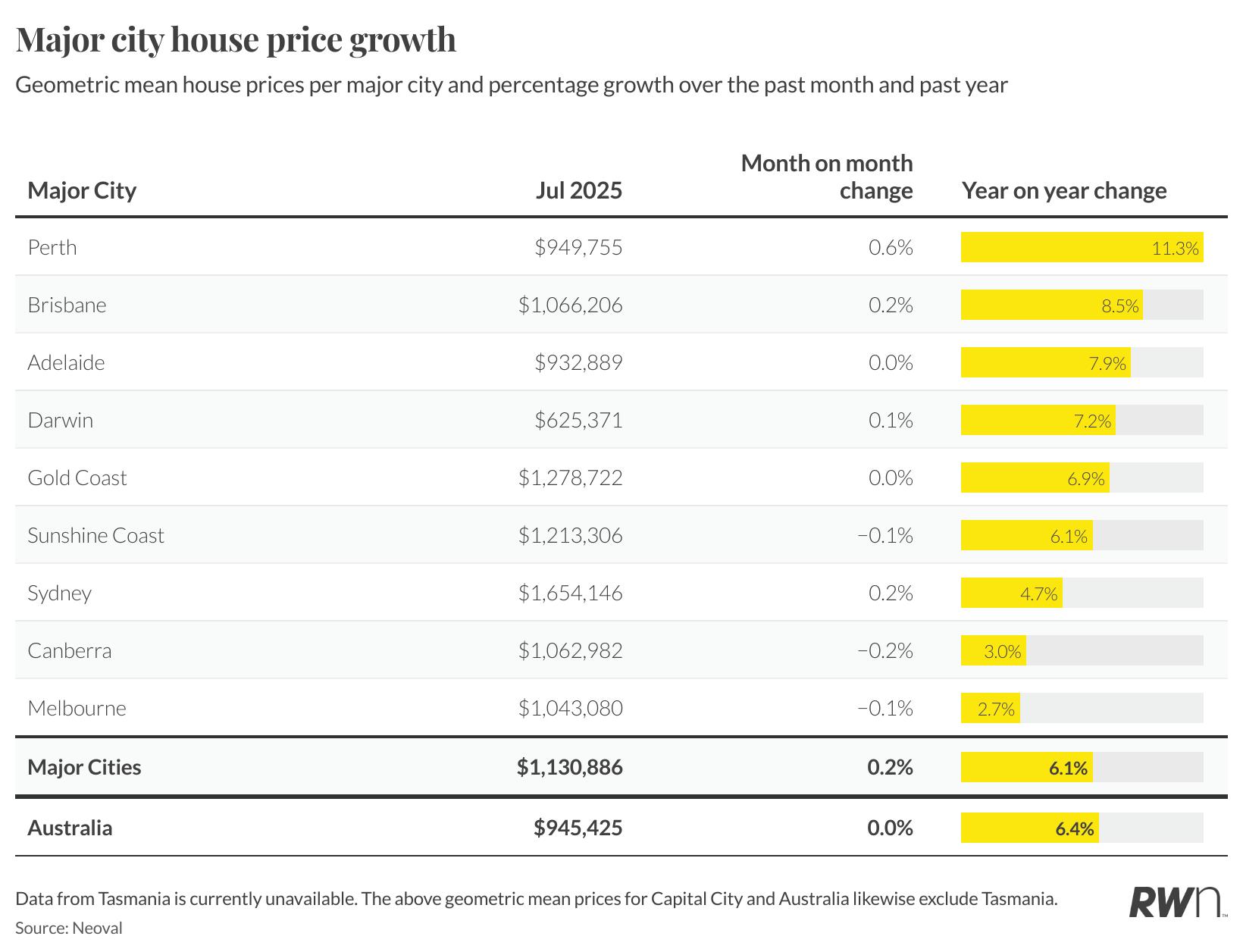

July’s metropolitan housing data reveals the immediate impact of the Reserve Bank’s rate hold decision, with markets showing varied responses to the pause in monetary easing. Perth maintained its leadership position with a mean price of $949,755, recording 0.6 per cent monthly growth and exceptional 11.3 per cent annual appreciation. Brisbane and Sydney both managed modest 0.2 per cent monthly gains, reaching $1,066,206 and $1,654,146 respectively, while their annual growth rates of 8.5 per cent and 4.7 per cent demonstrate sustained momentum.

The standout performance across smaller capitals reinforces the trend towards more affordable markets, with Adelaide, Darwin and Gold Coast all maintaining solid annual growth above six per cent. Melbourne and Canberra experienced slight monthly contractions of -0.1 per cent and -0.2 per cent respectively, reflecting their sensitivity to interest rate expectations. However, the modest nature of these declines suggests markets are positioning for the widely anticipated August rate cut cycle.

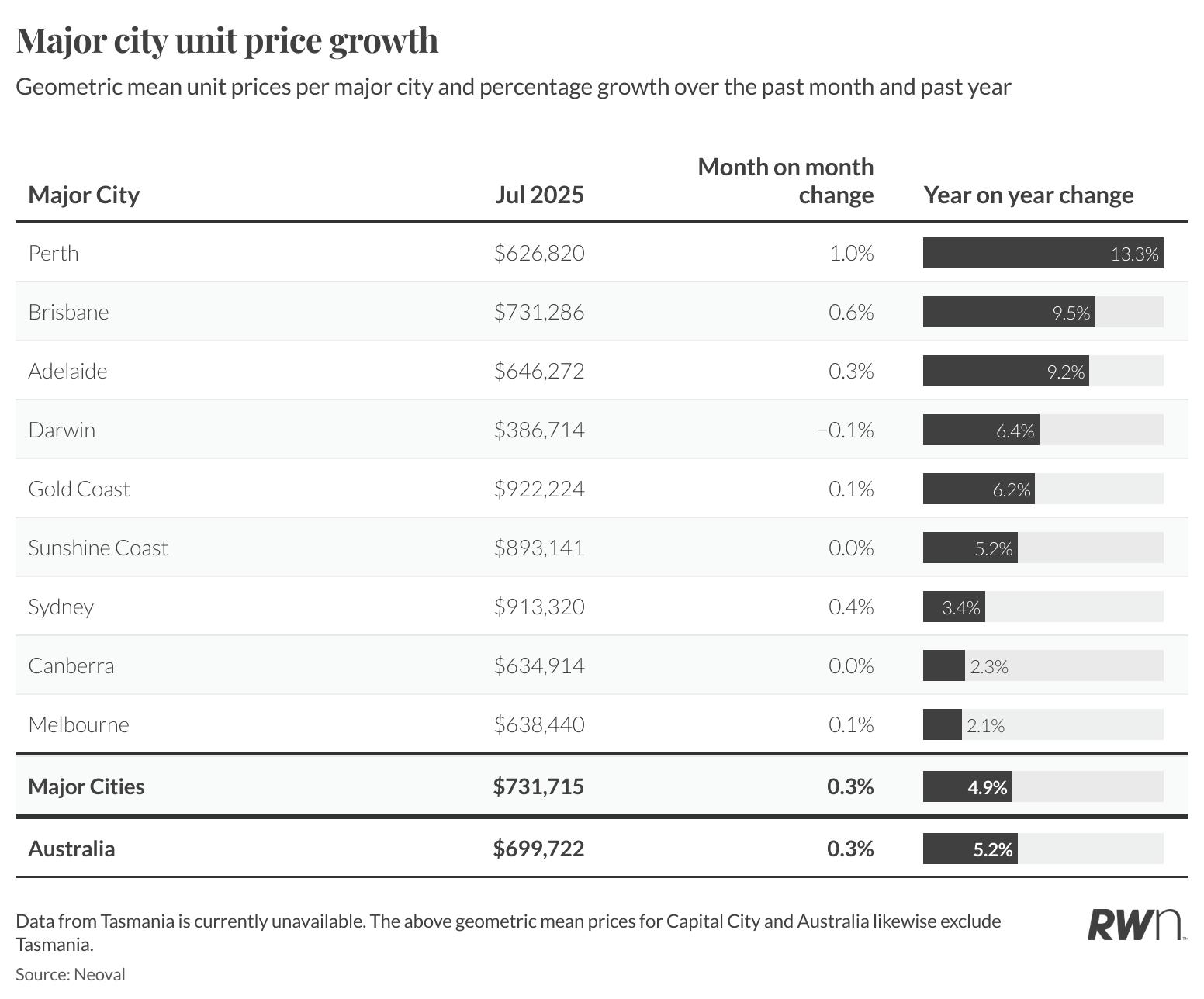

Major city unit markets showcased remarkable resilience during July’s rate hold period, with several markets posting solid gains that contrast sharply with housing sector moderation. Perth units maintained their exceptional momentum with 1.0 per cent monthly growth, reaching $626,820 and delivering outstanding 13.3 per cent annual appreciation. Brisbane and Adelaide units both recorded healthy 0.6 per cent and 0.3 per cent monthly gains respectively, demonstrating the sector’s appeal amid affordability constraints.

Sydney units provided the standout performance among the larger markets, accelerating to 0.4 per cent monthly growth and reaching $913,320, representing the only major market segment to improve during the rate hold period. This unit market strength reflects the structural shift towards higher-density living as housing affordability pressures intensify. The combined major cities unit performance of 0.3 per cent monthly growth, alongside 4.9 per cent annual appreciation, positions this sector as increasingly attractive for both investors and owner-occupiers facing price pressures in the detached housing market.

Regional housing markets demonstrate exceptional resilience, with annual growth rates consistently outpacing metropolitan areas despite supply constraints. Regional Western Australia leads with 12.2 per cent annual appreciation to $557,411, followed by regional South Australia at 10.5 per cent growth reaching $478,982. Regional Queensland maintains solid 9.7 per cent annual growth, with mean prices now at $763,135.

The pattern of modest monthly contractions across several regional markets, including regional Victoria (-0.6 per cent) and regional Northern Territory (-0.7 per cent), reflects the temporary pause following the rate hold decision. However, the strong annual growth rates across all regions demonstrate the underlying momentum that has characterised these markets throughout 2025, positioning them well for renewed acceleration as rate cuts commence.

Regional unit markets continue to outperform their metropolitan counterparts, with strong growth evident across most states despite the July rate hold. Regional Western Australia leads with annual appreciation of 12.2 per cent, reaching $425,003, while regional South Australia follows closely with 11.1 per cent growth to $306,485. Regional Queensland maintains solid momentum with $650,134 mean prices and 8.5 per cent annual growth.

The resilience of regional unit markets reflects both affordability advantages and supply constraints that have intensified throughout 2025. Monthly movements remained modest but positive across leading markets, with regional Western Australia, regional South Australia and regional Queensland all recording 0.2 - 0.4 per cent gains. The combined regional performance of 6.6 per cent annual growth significantly exceeds the national average, highlighting the structural advantages these markets maintain.

MAJOR CITY HOUSE PRICES (%CHANGE) | SINCE LAST MONTH

$ GEOMETRIC MEAN PRICE % CHANGE IN PRICE

Source: Neoval Updated as of July 2025

Source: Neoval

REGIONAL HOUSE PRICES (%CHANGE) | SINCE LAST MONTH

LISTINGS ACTIVITY

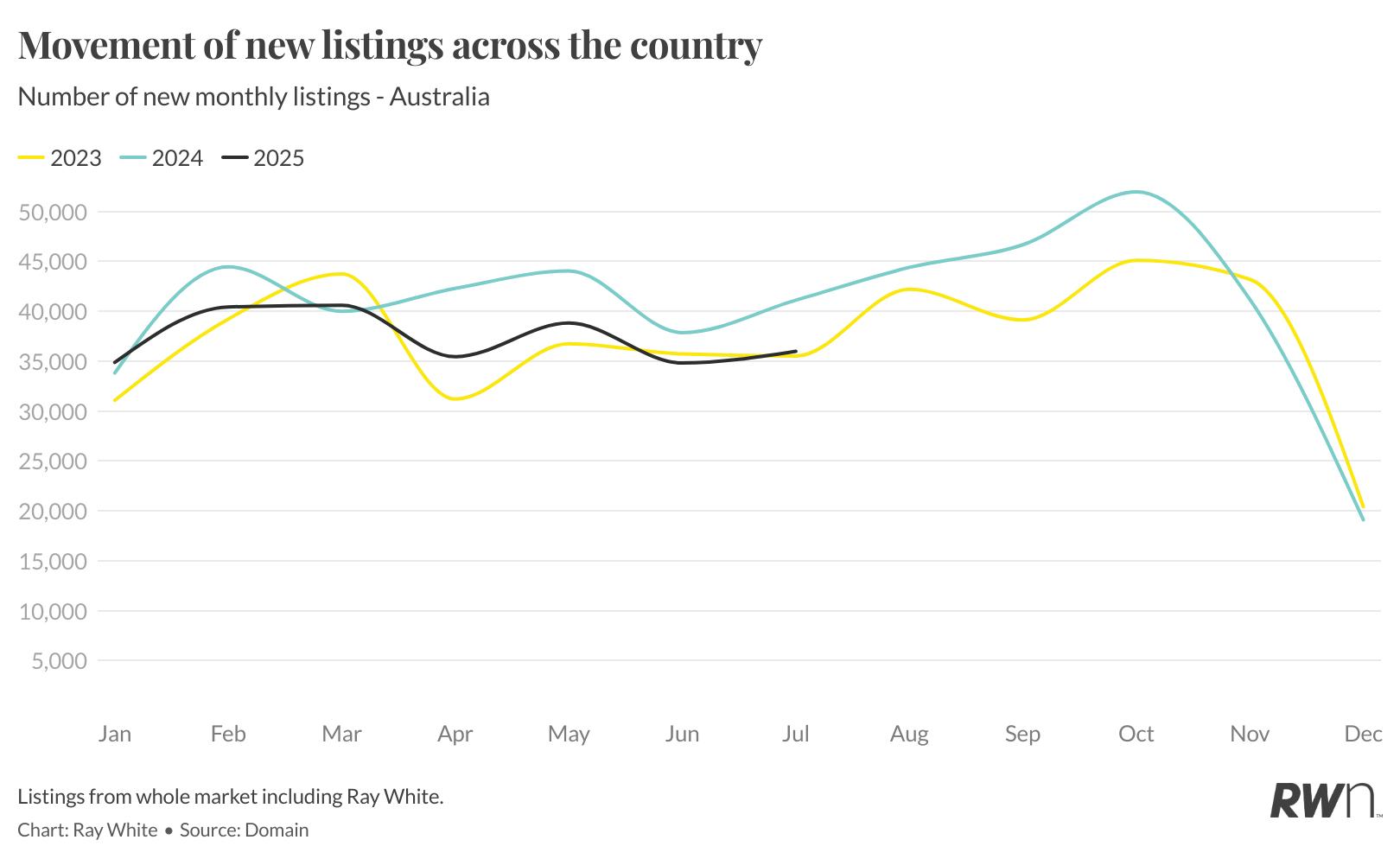

The national listing trend reveals the fundamental supply shortage that continues to underpin market strength, with new listing volumes consistently below both 2023 and 2024 levels throughout 2025. July’s preliminary data shows 35,989 new listings nationally, trending marginally ahead of 2023 July data. These results highlight the constrained supply conditions that have driven competitive bidding and sustained price growth.

This persistent undersupply, combined with limited construction activity and population growth pressures, creates the foundation for continued price appreciation once monetary policy easing resumes. The gap between current listing levels and historical norms demonstrates the structural imbalance that has characterised Australian property markets, explaining the resilience shown even during periods of interest rate uncertainty.

New listing activity across major cities tells a story of persistent supply constraints, with combined major cities recording just 26,862 new listings in July 2025. The annual decline of 11.1 per cent underscores the ongoing shortage of properties coming to market, creating the competitive conditions that have sustained price growth throughout the interest rate cycle.

Sydney leads absolute volumes with 8,475 new listings, though this represents only modest 1.1 per cent annual growth. Melbourne’s 7,391 listings show a concerning 12.6 per cent annual decline, while Brisbane’s 3,707 properties reflect an 11.4 per cent drop year-on-year. The most dramatic reductions are evident in Adelaide (-29.0 per cent), Perth (-20.3 per cent) and the Sunshine Coast (-20.5 per cent), highlighting the supply shortage that continues to drive competitive bidding conditions across these markets.

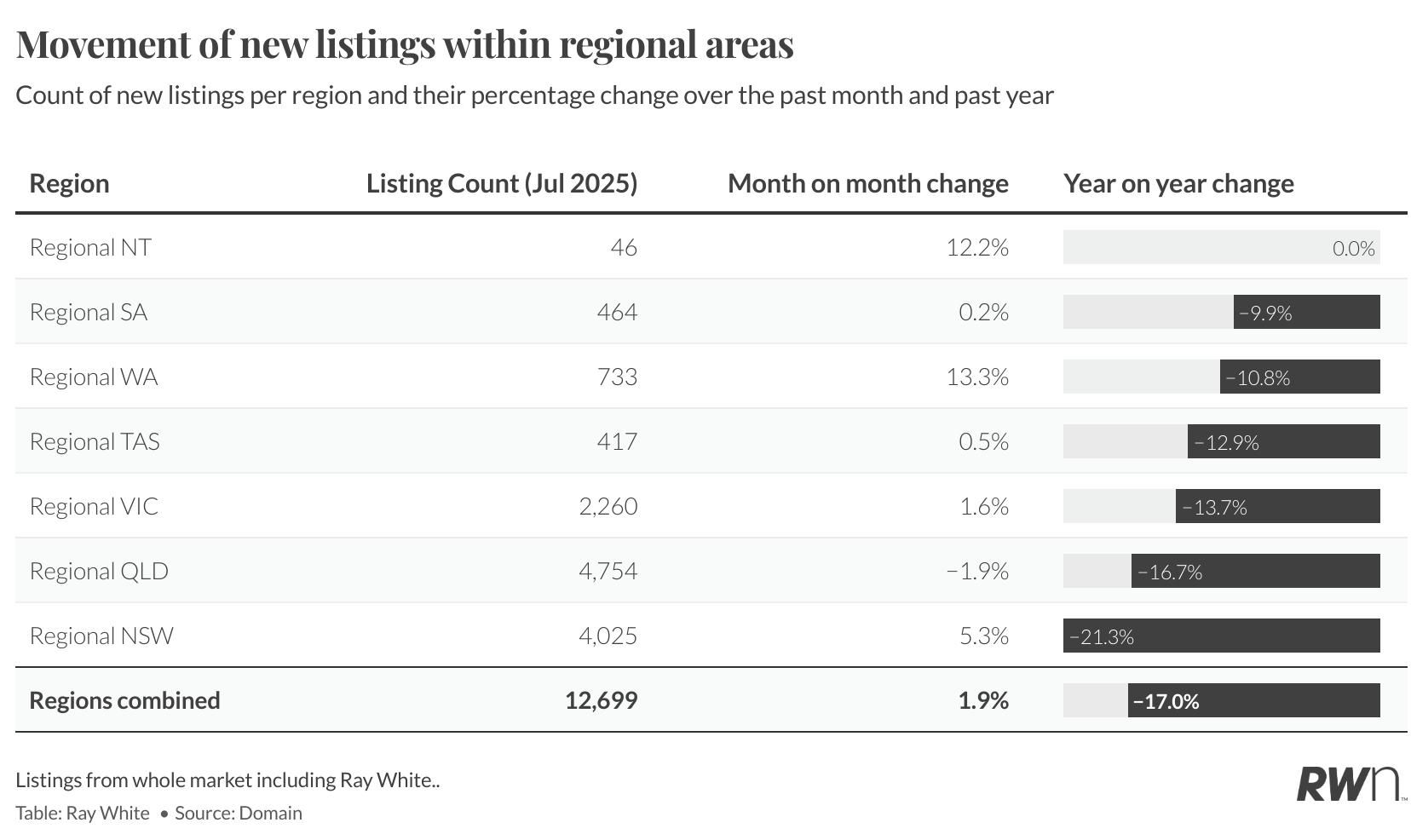

Regional listing activity presents an even more constrained picture, with combined regional areas recording just 12,699 new listings in July, down 17.0 per cent annually. This supply shortage is most pronounced in regional New South Wales (-21.3 per cent), regional Queensland (-16.7 per cent) and regional Victoria (-13.7 per cent), creating the scarcity conditions that have sustained regional price appreciation.

The monthly data shows mixed results, with regional Western Australia posting a strong 13.3 per cent increase and regional Northern Territory up 12.2 per cent, offsetting declines in other states. However, the annual trends reveal a systematic reduction in available properties across most regional markets, explaining the sustained competitive pressure and price growth that has characterised these areas throughout 2025.

AUCTION INSIGHTS

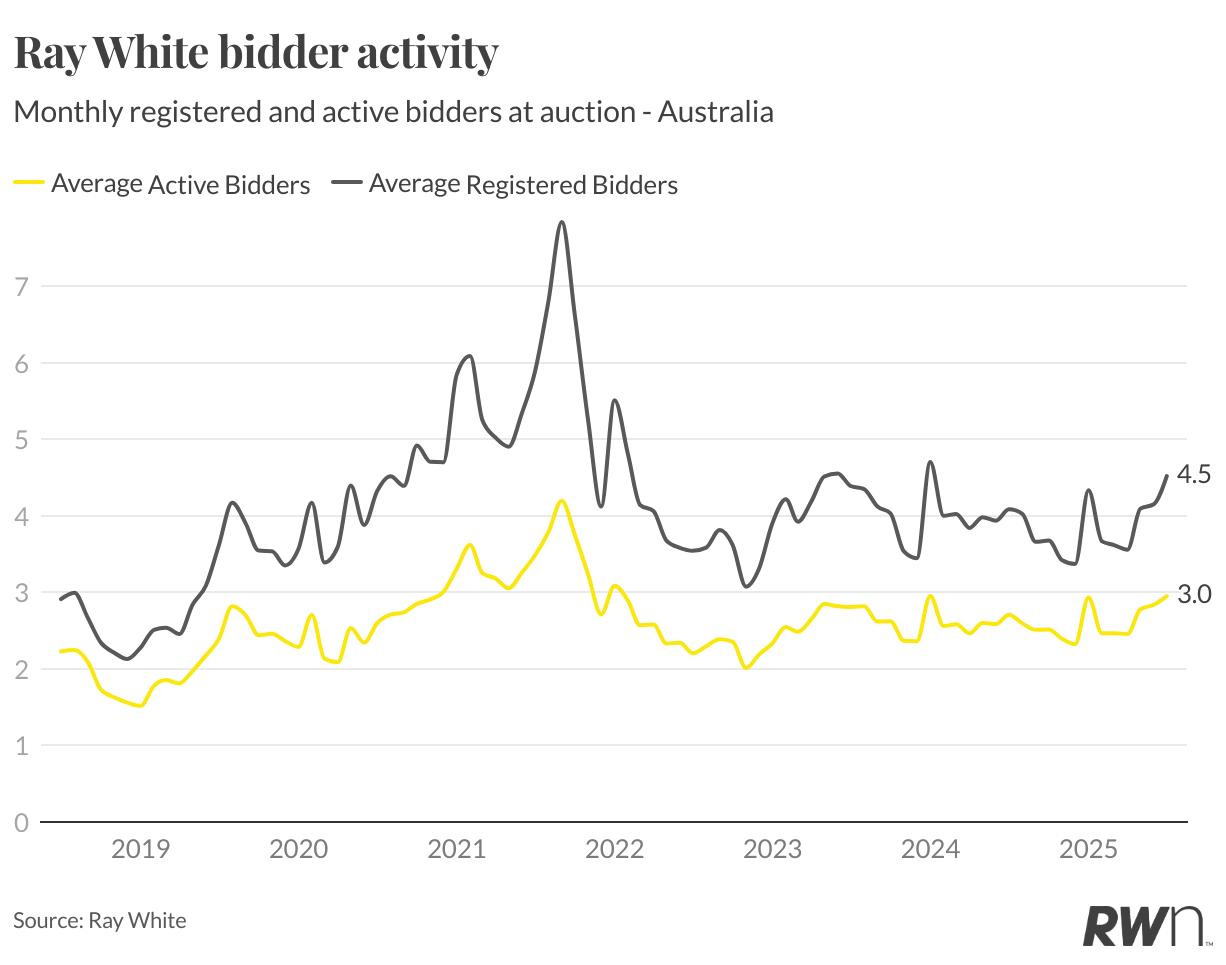

Ray White’s bidder activity data reveals the competitive dynamics driving current market conditions, with registered bidders averaging 4.5 per auction in July 2025 and active bidders maintaining approximately 3.0 per property. This represents a recovery from the pandemic lows of 2019 and demonstrates sustained buyer engagement despite interest rate uncertainties. The gap between registered and active bidders highlights the selective nature of current market participation, with buyers carefully evaluating opportunities in the constrained supply environment.

The current bidder levels reflect the competitive tension created by limited listing volumes across most markets. While below the exceptional peaks witnessed during 2021-2022’s ultra-low rate environment, the consistent 4.5 registered bidders per auction demonstrates healthy competition that supports the elevated clearance rates observed throughout 2025. With anticipated rate cuts expected to stimulate additional buyer activity, these bidder metrics provide a foundation for potentially intensifying auction competition in the months ahead.

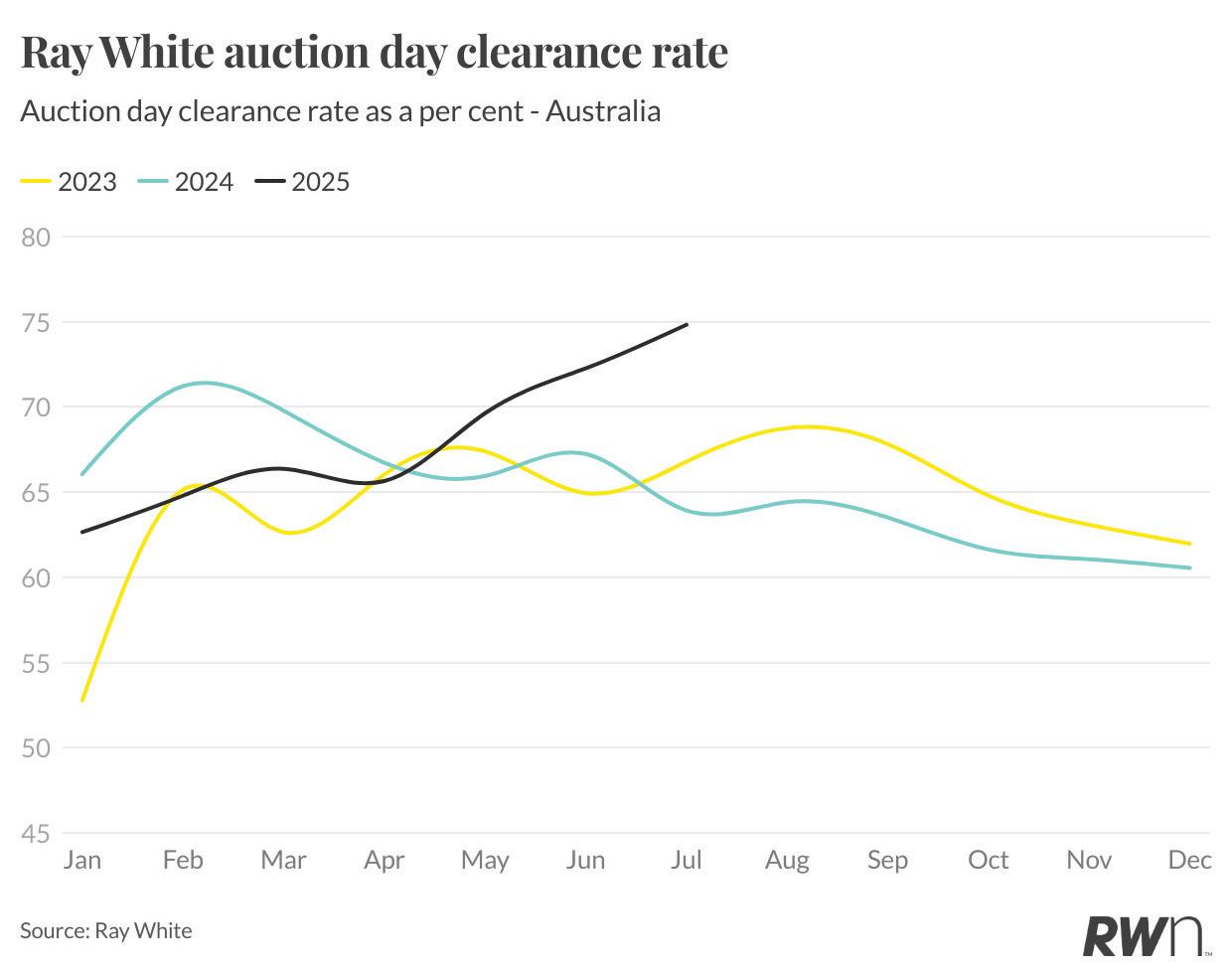

Ray White’s auction clearance rates demonstrate the intensity of buyer competition in the constrained supply environment, with the 2025 performance significantly outpacing both 2023 and 2024 results. The current trajectory shows clearance rates reaching 74.8 per cent in July, representing a substantial improvement from the same period in previous years and highlighting the competitive dynamics created by limited property availability.

This exceptional clearance rate performance reflects the combination of supply constraints and pent-up buyer demand that has characterised the market through 2025. The sustained strength in auction outcomes, even during the July rate hold period, demonstrates the underlying demand pressures that continue to drive market momentum. With the anticipated August rate cuts expected to further stimulate buyer activity, these already elevated clearance rates suggest intensifying competition ahead.

Ray White’s total unconditional sales reached $8.0 billion in July 2025, demonstrating the group’s continued market strength despite seasonal and interest rate headwinds. This performance maintains the elevated baseline established through 2025’s strong opening months, reflecting both sustained transaction volumes and the impact of continued price appreciation across markets.

The July result aligns with typical seasonal patterns while preserving the momentum built throughout the year’s early months. With interest rate cuts now anticipated and listing conditions remaining constrained, this sales performance provides a solid foundation for the expected market acceleration in the months ahead. The consistency of Ray White’s results throughout the rate hold period demonstrates the underlying strength of market fundamentals and buyer demand.

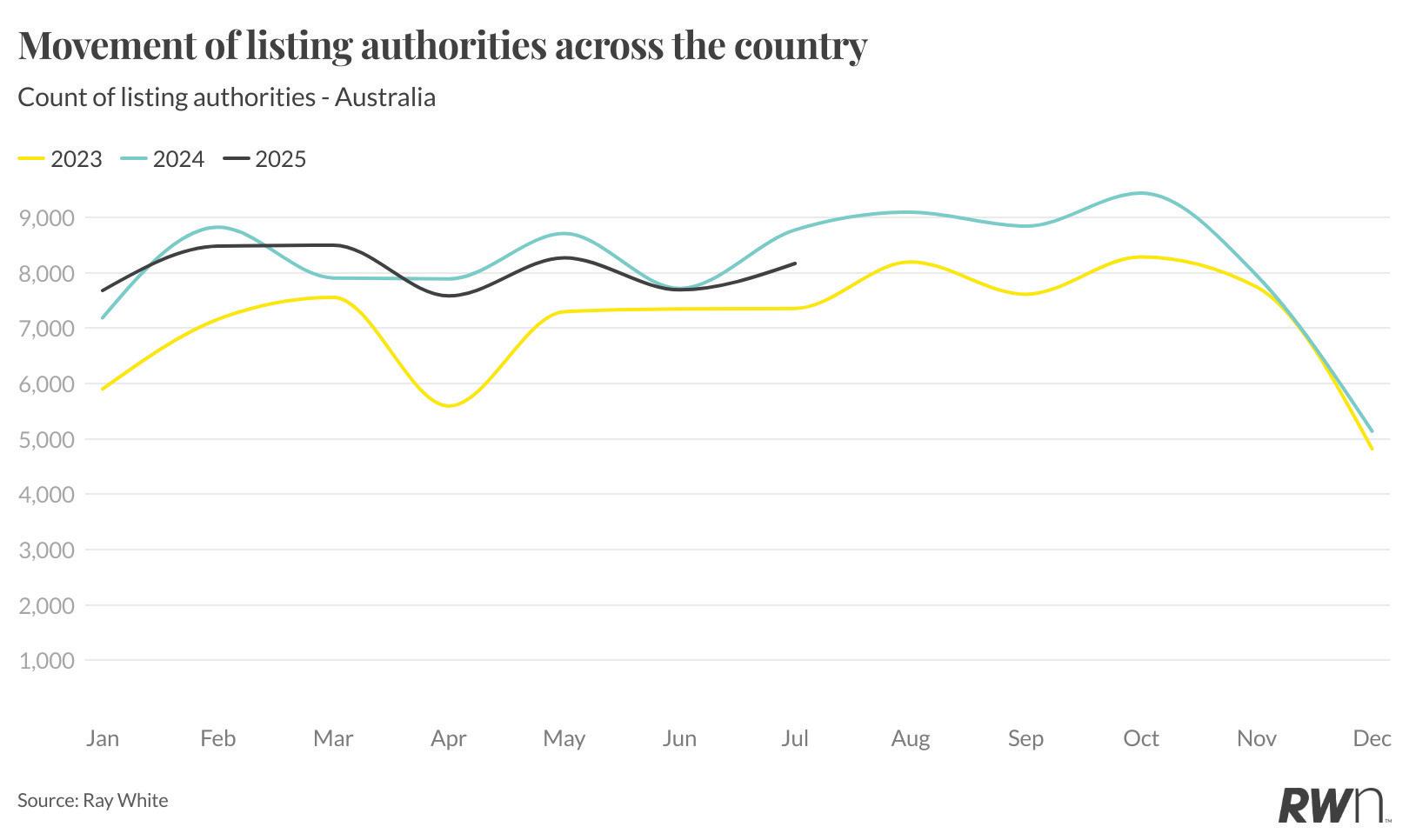

Ray White’s listing authorities data provides crucial insight into future market supply, with July 2025 recording 8,167 new authorities compared to 8,773 in July 2024. This represents a modest decline from the previous year but maintains levels consistent with the constrained supply environment that has characterised 2025. The seasonal pattern shows typical winter moderation, with authorities tracking below the peak spring levels but above the traditional summer lows.

The data reveals vendor sentiment remains cautious, with many property owners delaying listing decisions pending clearer signals on interest rate direction. The July figure of 8,167 authorities suggests a measured approach to bringing properties to market, contributing to the supply shortage that continues to underpin competitive bidding conditions. With the anticipated August rate cuts likely to encourage more vendors to enter the market, the current authority levels may represent the seasonal low point before renewed spring activity.