AILWAY G E

SERVING THE RAILWAY INDUSTRY SINCE 1856

SECOND-HALF REBOUND HOPES FOR A

How Long Will the Current Freight Car Market Cycle Last?

TECH FOCUS – M/W

Track Geometry, Rail Flaw Detection

NEW LOCOMOTIVE BUILD MARKET

Nonexistent for Now?

WWW.RAILWAYAGE.COM JUNE

2023

American high-speed rail at 220 miles per hour

The fastest trains in America will be more luxurious, more accessibleincluding the features specified by the Rail Vehicle Access Advisory Committee (RVAAC) - and more capable - with ability to scale steep grades at speed - when compared to competitors. Modern, Buy America compliant high-speed rail will happen here – now is the time.

usa.siemens.com/highspeedrail #TransformTheEveryday

June 2023 // Railway Age 1 railwayage.com Railway Age, USPS 449-130, is published monthly by the Simmons-Boardman Publishing Corporation, 1809 Capitol Avenue, Omaha, NE 68102. Tel. (212) 620-7200. Vol. 224, No. 6. Subscriptions: Railway Age is sent without obligation to professionals working in the railroad industry in the United States, Canada, and Mexico. However, the publisher reserves the right to limit the number of copies. Subscriptions should be requested on company letterhead. Subscription pricing to others for Print and/or Digital versions: $100.00 per year/$151.00 for two years in the U.S., Canada, and Mexico; $139.00 per year/$197.00 for two years, foreign. Single Copies: $36.00 per copy in the U.S., Canada, and Mexico/$128.00 foreign All subscriptions payable in advance. COPYRIGHT© 2023 Simmons-Boardman Publishing Corporation. All rights reserved. Contents may not be reproduced without permission. For reprint information contact PARS International Corp., 102 W. 38th Street, 6th floor, New York, N.Y. 10018, Tel.: 212-221-9595; Fax: 212-221-9195. Periodicals postage paid at New York, N.Y., and additional mailing offices. Canada Post Cust.#7204564; Agreement #41094515. Bleuchip International, PO Box 25542, London, ON N6C 6B2. Address all subscriptions, change of address forms and correspondence concerning subscriptions to Subscription Dept., Railway Age, PO Box 239 Lincolnshire IL 60069-0239 USA; railwayage@omeda.com; or call +1 (402) 346-4740; FAX +1 (847) 291-4816. Printed at Cummings Printing, Hooksett, N.H. ISSN 0033-8826 (print); 2161-511X (digital). FEATURES 8 22 26 30 34 Guide to Equipment Leasing Hopes for a Second-Half Rebound Tech Focus – M/W Rolling Laboratories New-Build Locomotives Nonexistent for Now? Timeout for Tech Rail and Wheel Crack Inspection TTC Operated by ENSCO Cybersecurity Regs and Standards COMMENTARY 2 40 From the Editor ASLRRA Perspective DEPARTMENTS 4 6 7 36 38 38 39 Industry Indicators Industry Outlook Market People Professional Directory Classifieds Advertising Index COVER PHOTO BNSF unit grain train at Granite, Idaho. Sean Kelly photo. June 2023 22 AILWAY GE MERMEC, Inc.

AILWAY GE

SUBSCRIPTIONS: 1 (402) 346-4740

Historically Speaking

You most likely already know this (I hope), but Railway Age, due to its advancing years, can legitimately say it’s a part of railroad history.

This year marks 167 years (since 1856) of continuous publishing—191 if you include The American RailRoad Journal, one of our antecedents, established in 1832 as the very first railway trade journal. Our complete print-to-digital history is at https://www.railwayage.com/about-us/.

On that note, I’m happy to annouce that Railway Age and Railway Track & Structures (founded 1905) have entered into a new partnership with the National Railway Historical Society (NRHS) to present the “Outstanding Railroad Historic Preservation Award.” Designed to recognize a railroad for its efforts in railway preservation, the intent is to honor and recognize a North American commoncarrier railroad for a historically significant preservation project completed or put into operation within the past five years.

Projects may include locomotives or any type of rolling stock, buildings, stations, a rail line, or a significant rail line feature, such as a bridge, viaduct, tunnel, etc. Projects that result in returning the asset to use as originally intended will be prioritized vs. a static display or no-longer-operational asset. Projects accessible to the general public will be prioritized for recognition.

A judging committee comprised of NRHS, Railway Age and RT&S (including me and my RT&S counterpart, David Lester) will review all nominations and announce three finalists in early September 2023. The Award winner is

expected to be announced at the Railway Interchange conference in early October 2023, in Indianapolis.

Something you may not know: The NRHS was founded in Lancaster, Pa., in 1935. The following year, Robert G. Lewis (1916-2011), a Pennsylvania Railroad employee, who in 1947, joined Railway Age as an associate editor and later became our publisher (and who hired me in 1992), founded with nine other people the NRHS Philadelphia Chapter. So, it’s fitting that we partner with the NRHS on an historic preservation award. I think Bob Lewis would be quite pleased.

“The National Railway Historical Society has established its interest in rail history and preservation through our Historic Grants program, and saving and sharing media,” NRHS president Tony White notes. “We are excited to partner with Railway Age and RT&S to recognize a significant North American railroad preservation project. Since our mission is to preserve railroad history in all its forms, we developed this award to honor a railroad for its efforts in railroad preservation. I look forward to hearing from our members—and Railway Age and RT&S subscribers—about what they think best exemplifies the spirit of railroad preservation today.”

The nomination period is open until July 31, 2023. NRHS members and Railway Age and RT&S subscribers may nominate a railroad preservation project via the form on the NRHS website: https://nrhs.com/ outstanding-railroad-historic-preservationaward/. Get involved!

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200

www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

JENNIFER McLAWHORN Managing Editor, RT&S jmclawhorn@sbpub.com

HEATHER ERVIN Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Peter Diekmeyer, Alfred E. Fazio, Michael Iden, Don Itzkoff, Bruce Kelly, Ron Lindsey, David Nahass, Jason Seidl, Ron Sucik, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Art Director: Nicole D’antona

Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors

Kevin Smith ks@railjournal.co.uk

David Burroughs dburroughs@railjournal.co.uk

David Briginshaw db@railjournal.co.uk

Robert Preston rp@railjournal.co.uk

granted by the copyright owner for the libraries and others registered with the Copyright Clearance

permission

photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the Circulation Director.

Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not be responsible for safekeeping or return of such material.

Member of:

Simon Artymiuk sa@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 1 (402) 346-4740

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

2 Railway Age // June 2023 railwayage.com FROM

EDITOR

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service. Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform. Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call

Canada and International) +1 (402) 346-4740, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com.

Office

not

copies

provide extra postage.

Send changes of

to:

Age,

Photocopy rights: Where necessary,

Center

THE

WILLIAM C. VANTUONO Editor-in-Chief

(US,

Post

will

forward

unless you

POSTMASTER:

address

Railway

PO Box 239, Lincolnshire, IL 60069-0239, USA.

is

(CCC) to

Ultrasonic Rail Flaw Inspection Services

Ultrasonic rail flaw inspection is the most effective way to detect defects in rails. Plasser American’s ultrasonic rail flaw detection system combines high-speed ultrasonic electronics with user-friendly interface and detailed reporting. This inspection solution is capable of measuring at speeds up to 45mph with a resolution of 4mm for both stop/verify and continuous testing. Hi-rail trucks as carrier platform offer high flexibility and a wide range. Whether you need traditional stop/verify or continuous testing services, our team with over 30 years of industry experience will deliver you the results and reports you require.

HIGH CAPACITY I PRECISION I RELIABILITY

”Plasser & Theurer“, ”Plasser“ and ”P&T“ are internationally registered trademarks plasseramerican.com

Industry Indicators

’RAIL INTERMODAL CONTINUES TO STRUGGLE’

“Rail intermodal continues to struggle,” the Association of American Railroads commented last month. “U.S. intermodal volume was 12.7% lower in April 2023 than in April 2022. April’s decline was the 14th straight and 20th in the past 21 months. In 2023 through April, volume was 3.97 million containers and trailers, down 10.9% (484,228) from last year and the fewest for January to April since 2012. Year-to-date container volume was down 9.5%; trailer volume was down 28.3%. Trailers accounted for 5.8% of intermodal units in the first four months of 2023, a record low. Meanwhile, carloads were better: Total originated carloads on U.S. railroads in April were up 1.8% over April 2022 and averaged 234,159 per week—the most in six months. Year-to-date, total carloads were 3.93 million, up 0.6% over the first four months of 2022 and the most for January to April since 2019.”

Railroad employment, Class I linehaul carriers, APRIL 2023

(% change from

TRAFFIC ORIGINATED CARLOADS

FOUR WEEKS ENDING APRIL 29, 2023

(+7.31%)

(+4.67%)

and Structures 28,715 (+1.80%)

of Equipment and Stores 18,030 (+3.58%)

(other than train & engine) 4,891 (+4.22%) Source: Surface Transportation Board

4 Railway Age // June 2023 railwayage.com

Intermodal MAJOR U.S. RAILROADS BY COMMODITY APR. ’23APR. ’22% CHANGE Trailers 51,25466,767-23.2% Containers 894,059 1,016,425 -12.0% TOTAL UNITS 945,3131,083,192 -12.7% CANADIAN RAILROADS Trailers 0 0 Containers 249,809296,361-15.7% TOTAL UNITS 249,809296,361-15.7% COMBINED U.S./CANADA RR Trailers 51,25466,767-23.2% Containers 1,143,868 1,312,786 -12.9% TOTAL COMBINED UNITS 1,195,122 1,379,553 -13.4% FOUR WEEKS ENDING APRIL 29, 2023

Source: Rail Time Indicators, Association of American Railroads

APRIL

Transportation

51,556

Executives,

8,159

Professional

10,040

Maintenance-of-Way

Maintenance

TOTAL EMPLOYEES: 121,391 % CHANGE FROM APRIL 2022: +5.09%

2022)

(train and engine)

(+7.39%)

Officials and Staff Assistants

and Administrative

Transportation

MAJOR U.S. RAILROADS BY COMMODITY APR. ’23APR. ’22% CHANGE Grain 85,00388,297 -3.7% Farm Products excl. Grain 3,1942,83012.9% Grain Mill Products 36,94936,738 0.6% Food Products 24,98225,814-3.2% Chemicals 132,893137,570-3.4% Petroleum & Petroleum Products39,93636,6908.8% Coal 258,436248,3384.1% Primary Forest Products 4,3584,628-5.8% Lumber & Wood Products 12,84013,604-5.6% Pulp & Paper Products 19,64620,966-6.3% Metallic Ores 24,70318,81731.3% Coke 12,675 13,322 -4.9% Primary Metal Products 34,52535,570-2.9% Iron & Steel Scrap 18,10818,303 -1.1% Motor Vehicles & Parts 59,37452,89112.3% Crushed Stone, Sand & Gravel 89,71181,810 9.7% Nonmetallic Minerals 12,88115,144-14.9% Stone, Clay & Glass Products 30,40330,810-1.3% Waste & Nonferrous Scrap 14,87215,729-5.4% All Other Carloads 21,14821,785-2.9% TOTAL U.S. CARLOADS 936,637 919,656 1.8% CANADIAN RAILROADS TOTAL CANADIAN CARLOADS 325,872 309,4965.3% COMBINED U.S./CANADA RR 1,262,509 1,229,152 2.7%

TOTAL U.S./Canadian CARLOADS, APRIL 2023 VS. APRIL 2022

1,262,5091,229,152

Short Line And Regional Traffic Index

TOTAL U.S. Carloads and intermodal units, 2014-2023 (in millions, year-to-date through APRIL 2023, SIX-WEEK MOVING AVERAGE)

June 2023 // Railway Age 5 railwayage.com

APRIL 2023 APRIL 2022 Copyright © 2023 All rights reserved.

CARLOADS BY COMMODITY ORIGINATED APRIL ’23 ORIGINATED APRIL ’22 % CHANGE Chemicals 53,765 45,67417.7% Coal 20,679 20,022 3.3% Crushed Stone, Sand & Gravel 29,381 25,98813.1% Food & Kindred Products 11,957 11,513 3.9% Grain 25,775 30,413-15.3% Grain Mill Products 8,056 8,275-2.6% Lumber & Wood Products 9,351 9,949-6.0% Metallic Ores 2,927 3,036 -3.6% Metals & Products 20,855 20,201 3.2% Motor Vehicles & Equipment 10,500 8,35825.6% Nonmetallic Minerals 2,145 2,602 -17.6% Petroleum Products 2,375 2,01717.7% Pulp, Paper & Allied Products 15,711 17,588 -10.7% Stone, Clay & Glass Products 14,305 13,520 5.8% Trailers / Containers 39,229 42,959-8.7% Waste & Scrap Materials 11,717 11,516 1.7% All Other Carloads 69,381 71,313-2.7% AILWAY GE Visit http: //bi t.ly/rai l jobs To place a job posting, contact: Jerome Marullo 732-887-5562 jmarullo@sbpub.com ARE YOU A RAILROAD OR SUPPLIER SEARCHING FOR JOB CANDIDATES? RA_JobBoard_1/3Vertical.indd 1 7/27/21 3:02 PM

STB Eyes Alternatives to URCS

THE SURFACE TRANSPORTATION BOARD (STB) IS EVALUATING PUBLIC COMMENT on a new report that identifies and evaluates alternatives to the Uniform Railroad Costing System (URCS) that could be used as a replacement general-purpose costing methodology. If the Board moves forward with a modification proposal, “further opportunity for comment will be provided.”

STB uses URCS for a variety of regulatory functions. URCS is implemented in rate reasonableness proceedings as part of the initial market dominance determination; at later stages, it is used in parts of the STB’s determination as to whether the challenged rate is reasonable, and, when warranted, the maximum rate prescription. Among URCS’s other uses: to develop variable costs for making cost determinations in abandonment proceedings; to provide the railroad industry and shippers with a standardized costing model; to cost the STB’s Carload Waybill Sample to develop industry cost information; and to provide interested parties with basic cost information regarding railroad industry operations.

“URCS is an accounting allocation method using Class I railroad data as reported annually to the STB,” explains Railway Age Capitol Hill Contributing Editor Frank N. Wilner. “URCS was developed by STB predecessor Interstate Commerce Commission in 1978 and adopted for use in 1989. URCS replaced Rail Form A, an accounting allocation system in use since 1939 that contained elements dating to 1907. URCS, however, was developed using now-antique mainframe computers with low processing speeds, and although it was given updates in 1993, 2009 and 2011, its reliability is questionable.

“A 2015 Transportation Research Board report, Modernizing Freight Rail Regulation, characterized URCS as ‘a cost allocation scheme that has no economic foundation.’ In an Aug. 9, 2019, Railway Age online article, URCS: Love It or Hate It, We’re Stuck with It, former STB Chief Economist William F. Huneke compared URCS to ‘a classic car lacking modern GPS and satellite radio [with] built-in averages from a time when railroads, rather than shippers, owned most of the freight car fleet and line hauls were shorter as the modern merger movement had not yet run its course.’

“A key gripe of shippers is STB’s prior refusal

to allow movement-specific adjustments to system-average URCS costs.”

STB in 2020 commissioned Laurits R. Christensen Associates, Inc. to perform a study and write a report to identify and evaluate alternatives to URCS, the STB reported in an Oct. 26 Federal Register notice. According to Wilner, it is a follow-up on a 2008 Christensen report, A Study of Competition in the U.S. Freight Railroad Industry and Analysis of Proposals that Might Enhance Competition, which said: “[Rail rate increases] do not appear to be excessive from a financial market perspective. The railroad industry is pricing at levels generating earnings that maintain or slightly exceed those necessary to ensure financial viability [which] implies that there is little room to provide significant rate relief to certain groups of shippers without requiring increases in rates for other shippers or threatening the railroads’ financial viability.”

In its new 203-page report, Christensen evaluated alternatives to URCS “that could better or more efficiently reflect the operating environment of the modern railroad industry. The project focused on costing methodologies that could be used as replacements or major structural updates to URCS to generate movement-specific variable costs for regulatory purposes.”

According to Christensen, the project:

• “Assessed the economic cost measure(s) that URCS or a successor cost system should represent given the regulatory applications of URCS.

• “Identified economic assumptions under which URCS or successor cost systems produce economically appropriate measures of costs for railroad movements.

• “Evaluated whether alternative costing methodologies and structural updates to URCS could generate economically valid railroad variable costs for regulatory purposes.

• “Implemented URCS alternatives and updates and compared model costs and revenue-to-variable cost (R/VC) ratios to current-methodology URCS.

• “Quantified the effects of URCS alternatives and updates on the application of the STB’s jurisdictional threshold for market dominance determinations.

• “Considered advantages and disadvantages of URCS alternative and updated approaches, including the ability to reflect current railroad operations and adherence to the costing principles in the Railroad Accounting Principles Board (RAPB) Final Report.”

Christensen reached the following main conclusions:

• “Short-run economic costs (marginal and incremental costs) are appropriate for the statutory application of URCS.

• “URCS and similarly structured models can produce short-run economic costs for railroad movements, but URCS costs depend materially on input values based on ‘stale’ analyses and non-empirical assumptions.

• “Using Carload Waybill Sample (CWS) data to reveal movement cost information has promise but also practical and theoretical challenges.

• “URCS variability inputs can and should be updated, but limitations of the R-1 annual report data may merit consideration of changes to cost reporting requirements.

• “The ‘Hybrid’ model is a feasible alternative for costing Class I movements, and its costs generally are plausible where different from legacy URCS.

• “Updates to URCS Phases I and III can improve movement costing largely within the existing URCS framework.

• “Both the Hybrid alternative and URCS update approaches have merit, with the key tradeoffs related to the validity of the Hybrid’s use of NEIO regression models to measure movement-specific costs.

•“Implementing either the Hybrid model or a significant URCS update will materially affect application of the STB’s statutory jurisdictional threshold.”

6 Railway Age // June 2023 railwayage.com

Industry Outlook

Gateway Developments

The Gateway Development Commission (GDC) on May 22 named a shortlist of qualified teams who will receive an invitation to submit a proposal in response to a Request for Proposals (RFP) to serve as a Delivery Partner for the Hudson Tunnel Project (HTP). The Delivery Partner “will provide key areas of support to help deliver the HTP.” Shortlisted teams include Joint Venture of Bechtel-HNTB; Hudson Delivery Partnership (Atkins North America, Inc., Arup US Inc., The McKissack Group, Inc.); and MPA Delivery Partners (Parsons Transportation Group of New York, Inc., Arcadis of New York, Inc., Mace North America Limited). The shortlisted teams are among those that submitted a Statement of Qualifications (SOQ) in early May in response to a Request for Qualifications (RFQ) issued by GDC through Amtrak.

WORLDWIDE

Hong Kong public transport operator MTR CORPORATION has awarded an approximately $14.9 million (£12 million) contract to WABTEC CORPORATION for the modernization of 25 Mk3 batteryelectric locomotives. The service life of the locomotives, built by Wabtec in 1996 and 1997, is slated to be extended by more than 15 years, according to the manufacturer. The project covers upgrading the locomotives’ existing control electronics; a datalogger that provides comprehensive diagnostic capabilities will be included; upgrading motor alternator control units; replacing battery charger units; and designing and building new automatic test equipment “to ensure the newly refurbished electronic racks meet different modes of operation,” according to Wabtec.

NORTH AMERICA

SECURITYSCORECARD prime contractor ALVAREZ LLC and distributor CARAHSOFT TECHNOLOGY CORP. have been selected by the TRANSPORTATION SECURITY ADMINISTRATION (TSA) to provide SecurityScorecard subscriptions, which will allow railroad and pipeline owner/operators to assess their public-facing internet applications and services with cybersecurity vulnerability monitoring, ratings and threat intelligence. “While use of the subscription service is not directed or required by any TSA cybersecurity security directives, TSA’s private-sector partners who elect to use the subscription will receive access to SecurityScorecard’s comprehensive security ratings and automated assessments,” the company said. “Owner/operators will receive findings in patented, easy-tounderstand, ‘A to F’ graded scorecards with collaborative mechanisms to remediate observed cybersecurity risks. This allows for more effective compliance reporting, improved communication and informed decision-making.” SecurityScorecard said that it will also provide TSA with “high-level reports containing data on the cybersecurity vulnerabilities

affecting the rail and pipeline sectors.”

PSC GROUP, a North American provider of product handling, site logistics, railcar repair and sustainability services for the petrochemical, refining and marine industries, has acquired the assets of STEEL LINE RAIL, a provider of mobile railcar repair, inspection and valve maintenance services for the petrochemical, refining and railcar leasing industries throughout the U.S. and Mexico. Acquisition of Steel Line Rail, which was founded in 2018 as a mobile repair and inspection company in Marshall, Tex., and has since expanded its service offerings to include mobile railcar repair service across the continental U.S., ASSOCIATION OF AMERICAN RAILROADS (AAR) certifications and an in-house valve shop for repair, testing and certification of tank car valves, marks PSC Group’s fifth acquisition since partnering with AURORA CAPITAL PARTNERS in 2019, including PROKAR, INC., FRYOUX TANKERMAN SERVICE, AKROTEX EXTRUSION and THERMOPLASTICS SERVICES, INC. The company also recently announced the opening of its Advanced Recycling Facility in Baytown, Tex.

June 2023 // Railway Age 7 railwayage.com MARKET Gateway Development Commission

2023 GUIDE TO EQUIPMENT LEASING

A SECOND-HALF REBOUND HOPES FOR

BY DAVID NAHASS, FINANCIAL EDITOR

Summertime is fast approaching. With the COVID-19 pandemic “o cially” over, it is time to turn attention to di erent matters, such as the immanent defaulting of the U.S. debt or the threat

of a moderate to severe El Niño to develop in the summer and fall of 2023 with a signi cant probability of extending into the winter of 2024. e El Niño pattern brings a host of domestic and global weather challenges. On the plus side, El Niño is generally

not correlated to a high-risk Gulf and Atlantic hurricane season.

Like many things in life, El Niño is a risk and reward proposition. e potential global impact of a severe El Niño is estimated to be more than US$3 trillion over

Bruce Kelly

8 Railway Age // June 2023 railwayage.com

HAVE TO BE

A GAMBLE

With nearly 140 years of financial strength and stability, DJJ is also known for our creative transportation solutions. Contact us today to discuss private fleet or leasing options. RailGroup@djj.com www.djj.com

GETTING

SCRAP

YOUR

METAL TO THE MILL DOESN’T

the next ve years (according to a study by NOAA). On the other hand, according to NOAA, in the U.S. in 2021, there were 20 separate billion-dollar weather and climate disasters. e total cost for these events was $145 billion. e estimate for the economic impact of weather and climate disasters in 2022 is $165 billion.

e “bene t” to the hurricane zone from Texas to Florida and up the East Coast of the U.S. may be a fraction of the global impact of El Niño, and the total impact to the U.S. would be re ected globally and domestically in di erent ways. One dramatic impact could be potential of West Coast ooding if another one or two years of severe winters (and subsequent potential ooding) were to occur.

But readers of the Railway Age Guide to Equipment Leasing didn’t come for weather forecasting. e railcar lease market has continued the upward pressure on lease rates and tautness in availability. We are now entering (if one counts back to the early days of the COVID-19 pandemic) almost three full years of sequential increases in lease rates. As any industry veteran will tell you, what makes this current cycle di erent from previous cycles of increasing lease

rates on railcars is two separate and impactful points.

One is the long duration of the current cycle, and that this current cycle, even in the face of a potential recession, does not show any signs of near-term abatement. Two is that railcar manufacturing has always been a boom/bust series of events that built the supply to satiate the need in the moment of demand. However, in this current cycle, railcar manufacturing has maintained an austerity.

Call it labor, call it materials, call it decreases in total industry-wide production capacity, or call it supply chain di culties, all these factors have contributed to what feels like a secular change in the railcar manufacturing marketplace. Among other factors, this new, lower production cycle is causing cyclical rental cycle stability.

In previous cycles, lessor owners and end users (shippers) would have demanded more production, more components and more deliveries. e call for more, still heard in the alleys and byways from those that use and deploy rail assets for fun and pro t, remains unanswered.

is cycle is further driven by ongoing (seemingly never-ending) challenges to

utilization associated with poor railroad service and ongoing hiring issues being faced by the railroads. Raise your hand if you cringed when the railroads indicated a hiring pause in the face of a potential recession!

While this may or may not be the new normal, it is certainly di erent. But wait— several questions remain. First, is there an imminent recession that is unavoidable? In March, as the rst quarter was coming to a close, the signs were ashing red. Logistics companies (e.g. J.B. Hunt) were harbingering a failed freight rebound amid a massive inventory glut; intermodal loadings YOY for the rst 20 weeks of 2023 are down 11%. Consumer sentiment has been bending to the negative, as there has been a clear scaling back on purchases in an uberin ationary environment. It’s a negative fact pattern. True to this new normal, where everything is just di erent than it may have been in the past, news suggesting the inventory glut is being burned through at a faster rate than expected has recently bubbled to the surface. Hopes for a second-half of the year rebound might actually have some modest merit.

Second, who is the primary bene ciary

10 Railway Age // June 2023 railwayage.com

Bruce Kelly

2023 GUIDE TO EQUIPMENT LEASING

A lease type that’s tailored to your rail activities. Each business is unique. That’s why we offer per diem leases tailored to your rail transportation needs. With access to our extensive railcar fleet, you can find solutions to scale your business for market demand – and new opportunities. Get started today at citrail.com ©2023 First-Citizens Bank & Trust Company. All rights reserved. CIT and the CIT logo are registered trademarks of First-Citizens Bank & Trust Company. MM#12708

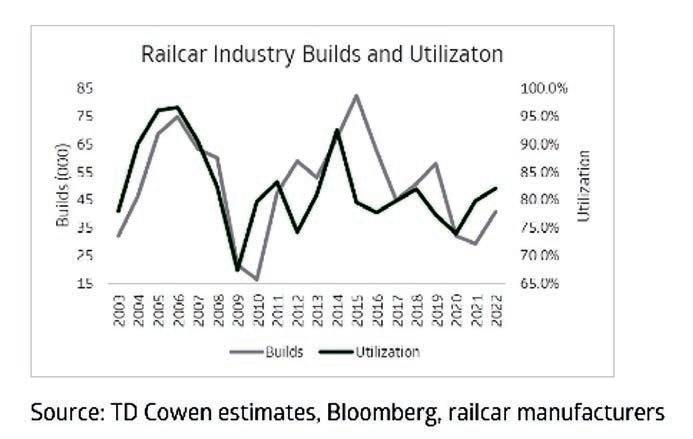

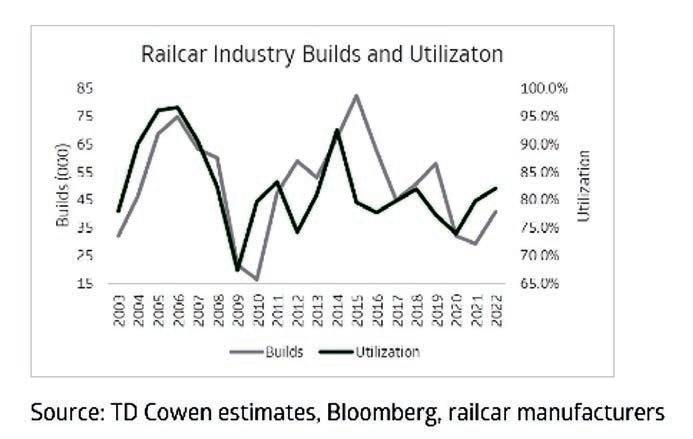

of this new austerity? It feels a bit like El Niño (see the tie in?) where a few might be bene tting, while the larger population seems to be excluded from receiving equal bene t. Carry that thought a bit further. Many lessors of railcars have been the beneciary of increasing lease rates. Contrarily, it is di cult to nd an end-user of cars that would suggest higher lease rates and higher interest rates provide them any bene t. is is where things get interesting. ere are, more or less, ve primary competing interests in the world of moving freight by rail (and they o en overlap). Railroad, manufacturer, car owner, car user and component supplier. Of these parties, car owners stand to receive the greatest bene t from increasing lease rates. See chart, p. 18, courtesy of Matt Elkott, TD Cowen Machinery and Transportation OEM analyst (and frequent Railway Age contributor), which layers railcar utilization over railcar deliveries. See how utilization precedes a runup in manufacturing. See further how utilization has been running ahead of production since, you guessed it, the time when lease rates started to rise. Need a cherry on top? In 2020, when the utilization percentage started to rise, there were almost 600,000 cars in storage. Today there are fewer than 300,000.

With new car prices being so stratospheric, one might feel that the OEMs are making bank on their new lower volume austerity. e choice to increase net pro ts over generally improving gross revenue is

one of the factors behind today’s perception of railroad ambivalence about growing their franchise. It represents, to the casual observer (though this does not imply veracity on any level), the foundational mindset of PSR: Earn more money with fewerpeople, fewer cars, fewer locomotives, etc.

Recently, the Wall Street Journal highlighted that Wall St’s focus on margin/pro t over revenue was leading retailers to make it harder for consumers to execute item returns for free. e key takeaway from the reporting? “ e move to reduce returns is part of a sea change in retailing that is giving priority to pro ts over growth.”

It would seem then that rail is a leading indicator, a trendsetter one might say, in leading the Wall Street community in an occasionally elusive chase to improve pro ts rather than to increase revenues. In speaking with Elkott on the WSJ article, he had a similar thought, noting, “It may not be farfetched to think of a clamp down on returns as the retail industry’s version of PSR: an e ort to expand margins at the expense of the service o ering and the top line, at least initially.”

e problem is that, for railcar OEMs, it just isn’t true, even at today’s lo y railcar pricing. Railcar OEM margins have been compressed for some time, since passing through increased pro t margin during a period of rapidly increasing feedstock and personnel expenses is challenging. Companies are going to need railcars just like people are going to need clothes (though

most clothes don’t last 50 years). e question is, where is the ex point between price, demand and satisfying one’s investors?

is is an equally interesting question relative to the railroads. If the railroads survive regulatory scrutiny and can choose only high-margin business, that could, Elkott notes, “translate to a net reduction in freight market volumes, but it could improve freight network uidity. Both are potential mild headwinds to equipment demand.”

e conclusion is that, for the current rental market and those reaping bene ts from it, the path forward is not clear. If there is a tilt to recession and freight levels decline, system velocity could free up cars and so en demand for new builds. If demand for cars continues and new car production stays at historically reasonable levels, owning railcars might be the best long-term investment. Viscerally however, it feels that to make that new price paradigm stick, in ation must continue at current levels.

at seems somewhat far-fetched, even if, for the moment, other countries are forecasting in ation to have a tighter grip on their economy. See the U.K.’s recent indication of in ation staying above 5% for the remainder of 2023. It’s unclear that a bet against the U.S. economy (for rising in ation) sounds smart right now. Carl Icahn might suggest that following Warren Bu et’s advice to not bet against the U.S. economy is the better play.

12 Railway Age // June 2023 railwayage.com

Bruce Kelly

WISKERCHEN

KERSHAW

75

CAPITAL. MAXIMIZE PROFITS. INCLUDE RELAM IN YOUR PROJECT PLANNING CONTACT US TO START PLANNING TODAY.

lets you save your capital. Planning ahead ensures accurate operating budgets. Call us before contracts are signed to ll out your eet with the pro ts you need. Get accurate rental rates right away Plan longer lease terms at lower rates Get the equipment you need when you need it • • •

HARSCO TX16 PRODUCTION TAMPER

GRAPPLE TRUCK

SKYTRIM

G3 SAVE

Leasing

CONTACT US. LET’S TALK BUSINESS. 800.962.2902 quotes@RELAMinc.com RELAMinc.com RELAM, Inc. 7695 Bond Street Glenwillow, Ohio 44139

NORDCO SHUTTLEWAGON RAILCAR MOVER

Higher lease rates continue to support high secondary market values on many used car classes. It is interesting to note, however, that recent, call it consolidation in the railcar lessor space has led to a kind of “wealth gap” or death of the middle class in leasing. ere are, based on most recent data, six companies with operating eets of more than 80,000 railcars, three companies with eets of more than 30,000 and fewer than 80,000, and then a large handful of those with fewer than 30,000.

While there is plenty of liquidity chasing new opportunities for investment, today’s high lease rates cannot o en support a new investor’s desire to enter the market or an existing investor’s desire to grow through acquisition. It also suggests that

scale doesn’t lead to increases in margin. One only has to observe GATX’s “trust the process” ideology to see that consistency play out over the long term.

Will end users nd ways to use cars for longer to avoid paying new car prices and higher lease rates? Will they look to control costs by entering into more structured nancing vehicles or through more direct purchases? at also remains to be seen.

e other notable news item parked next to the one on tightening retail return policies: An article highlighting the $600MM in corporate stock buyback programs YTD. To quote a recent note from Tony Hatch about an 18% increase in big truck rig-related fatalities, “I haven’t seen the date for the scheduled Congressional hearings—have you?”

AROUND THE MARKET

e lease market continues to show stability at the higher price levels that have been in place for a while. e mix of so ened railcar deliveries, higher interest rates and railcar service issues continues to favor lessors, who continue to press the advantage on lease rates, length of term and on lease terms and conditions. As noted above, the current environment shows no signs of abatement.

Here’s what is happening around the market:

Covered Hoppers for Grain: Hate to repeat last year’s note, but “Wow, just wow!” Lease rates on grain hoppers continue to show incredible strength and an almost non-existent inventory of available cars.

14 Railway Age // June 2023 railwayage.com

Bruce Kelly

Learn more at www.gbrx.com/leasing

2023 GUIDE TO EQUIPMENT LEASING

Jumbo hoppers larger than 5,100cf are leasing for high $600s to low $700s full service (FS) with term lengths of greater than 5 years (there are higher numbers. In what might be the biggest 90s throwback ever, 4,750cf hoppers are in the high $400s FS for 3-5 years, with numbers reaching into the $500s. Hurtful.

Covered Hoppers for Sand and Cement: Ongoing strength in this market continues to support higher lease rates but without any additional improvements from 2022 levels. While stored inventory continues to decrease, there are still cars in storage, and that is collaring the upside in this market. Some spot rates continue to ex into the mid to high $200s FS. While rates can go higher depending on who is footing the freight and the return expenses, there are a fair number of deals also being done at rates in a lower range, especially if the term is short.

Covered Hoppers for Plastics: Inventory on these cars is generally nonexistent as well. And, with new car prices in the low $120,000s or higher and higher interest

rates, these hoppers are at high rates. For 6,200cf cars, new(er) cars are being quoted above $850 FS, and that is with some term on them. at rate is made more signi cant as the maintenance on these cars is lower than on most car types. Inventory on the smaller 5,800cf cars is also on fumes, with rates in the low $500s FS.

PD Hoppers: is market generally doesn’t get overbuilt, so when service slows, rates tend to increase. For the smaller 5,125cf car, expect rates in the high $600s to low $700s, and for the jumbo, more modern 5,660cf car, think low to mid $800s. Most of these cars are leased FS.

Mill Gondolas: is market had been ambling along and then recently exploded with newer 286 GRL six foot side gons jumping up to the high $600s FS for ve years. Older 263 GRL cars are staying in the mid $400s. ere is some new building in this segment. Probably a decent investment for the long term.

Boxcars: 50-foot and 60-foot plate F boxcars are in demand, and rates have

remined at high levels. Expect numbers in the mid to high $600s FS for both sizes, and limited availability of cars for lease.

Coal Cars: Coal loadings are up slightly from last year, and this is a er a fairly mild winter. ere are suggestions of longterm low-price stability for the natural gas market (Henry Hub is at $2.50 a er hitting $2.00 in April, per MMBTU) that could impact demand, but at the moment it has not created much of a drag. Rates continue to be high here. Looking for a gondola? You’re easily in the mid $400s FS if you have the car already. New lessees are going to be more than $500 FS for 5 years. Look for higher numbers as terms shorten. Rapid-discharge hoppers have rates that are running from $50 to $75 per car per month higher.

Tank Cars: Lots of chatter here on what the fate of this market will be after the East Palestine derailment. There is little talk about design changes, but an acceleration of the May 2025 and May 2029 regulatory threshold for Packing

16 Railway Age // June 2023 railwayage.com

SUPPORT SMBC ©20 14 SMBC Rail Services would appreciate the opportunity to earn your business. SMBC Rail offers a comprehensive and diverse portfolio of all car types tailored to meet all your transportation needs. Please contact us at sales@smbcrail.com, or visit us at our website, smbcrail.com

TOGETHER, WE KEEP OUR WORLD MOVING FORWARD For more information, go to UTLX.COM 855-UTLX-NOW leasinginquiry@utlx.com LEASING & SALES REPAIR & MAINTENANCE MANUFACTURING

Group I and all additional flammables (dates respective) is still on the table. Tanks continue to show strength in all segments, even with weakness generally in chemicals loadings (down 5.3% YOY). Food grade tanks have risen into the

high $800s (or even low $900s) depend ing on age, FS with term. Pressure cars for propane and butane (112J340s) are in the low to mid $600s with term. 23,000gallon and 25,000-gallon 117J tanks are also in short supply, and rates are in the

high $800s to low $900s. Tanks for crude have also been active with limited avail ability, and rates in the high $700s for used cars. For new cars, don’t expect anything that starts lower than $900. In the retrofit market (117Rs), FS lease rates are into the high $700s and low $800s. Plain vanilla DOT111As are floundering a bit, now that the May 2023 ethanol dead line has passed. With high maintenance and recertification costs, lessors are going to think long and hard about the decision to keep these cars working or to just cut and run. Right now, this is a “take what you can get” market.

Aggregate Cars: Continued infrastruc ture demand keeps this market at strong levels. Newer 286K GRL cars continue to show strength into the mid to high $600s FS. is market is not expected to change much in the near term.

Got questions? Set them free at dnahass@ rail n.com.

Equipment Leasing Guide Pro le Directory follows on pp. 20-21.

18 Railway Age // June 2023 railwayage.com 2023 GUIDE TO

EQUIPMENT LEASING

Find the right vendors for your business in the Railway Age Buyer's Guide. Search for products, research vendors, connect with suppliers and make confident purchasing decisions all in one place. RailwayResource.com AILWAY Get listed in the Directory, visit RailwayResource.com/AddYourCompany Railway Age Buyer's Guide is powered by MediaBrains Inc. ©2023.

Supplier Spotlight

AILWAY GE

IL W OMEN IN RAIL

NOVEMBER 2, 2023

Chicago,

CONNECT.

INSPIRE. INNOVATE.

Network and collaborate with a diverse group of women and allies who are making a difference in the rail industry. Learn how railroaders can maintain the momentum of inclusion, build strong support networks, and take advantage of ever-broadening career opportunities.

WHY ATTEND:

• Discover career advancement and development opportunities

• Learn about the career path s of women leaders and how today’s railways are supporting them

• Explore DEI (Diversity, Equity and Inclusion) initiatives

• Learn about mentorship best practices—from finding a mentor, to serving as one

• Discover how ERGs (Employee Resource Groups) are established for community building and support

• Connect with your peers— both upcoming talents and accomplished women in rail

REGISTER: www.railwayage.com/womeninrail

SPONSORSHIPS: Jonathan Chalon | jchalon@sbpub.com | 212.620.7224

equipment leasing guide

DIRECTORY LEASING RESOURCE

The 2023 Guide to Equipment Leasing (pages 8 through 18) is supported by companies that provide equipment leasing and financial services and products to the rail industry. All of these firms have advertisements elsewhere in this section or have used paid profile space to present their background and capabilities.

Union Tank Car Company is a leading designer, builder and full-service lessor of railroad tank cars and other specialized railcars. Together with its Canadian affiliate Procor, UTLX owns a fleet of approximately 120,000 railcars for lease to customers in chemical, petrochemical, energy and agricultural/food industries. UTLX manufactures tank cars in the U.S. and performs railcar maintenance services at more than 100 locations across North America. UTLX is part of Marmon Holdings, Inc., a Berkshire Hathaway company.

Union Tank Car Company 312-431-3111

leasinginquiry@utlx.com

UTLX.com

R S ,

RailSolutions, LLC provides a broad variety of railroad equipment-related consulting, technical and advisory services to financial institutions, railroads, shippers and fleet operators with a primary focus on equipment valuation and appraisal services. Additional areas of expertise include railcar and locomotive inspections, equipment repair and overhaul cost analysis, and portfolio valuations. Rail Solutions, LLC draws on over 40 years of railroad industry experience in developing multiple quantitative valuation models supported by both a sound base of market data and advanced analytical techniques.

Michael E Mahoney - President

1401 Walnut Street, Suite 500 Boulder, CO 80302 (646) 258-5812

mmahoney@railsolutions-llc.com

www.railsolutions-llc.com

June 2023

20 Railway Age //

railwayage.com

Railroad Equipment Leasing And Maintenance (RELAM) Inc. provides excellent quality MoW equipment for short- or long-term leasing. We work with you to provide customized solutions that maximize your productivity and profitability. Tell us about your upcoming projects, and we do the rest by delivering a program that works for you. From tie and rail replacement to surfacing equipment, car movers to vegetation equipment, and excavators to Wiskerchen hi-rail trucks; RELAM has the equipment you need. Facilities are located near Cleveland OH, St. Louis MO, Sacramento CA and Northern WI.

Request a proposal or more information at quotes@relaminc.com or call 800-962-2902

equipment leasing guide

The David J. Joseph Company’s Rail Group provides a broad range of transportation services throughout North America: single investor, freight cars, portfolio evaluation, purchases and sales of portfolios, and private fleet management. Other services include freight car inspections and engineering services from design of new cars to complete ISL extended life, modifications and analysis; in addition to railcar dismantling for scrapping and parts reclamation.

The David J. Joseph Company Rail Group a NUCOR® company

300 Pike Street • Cincinnati, OH 45202

Tel.: 513-419-6200 • Fax: 513-419-6221

Contact: info@djj.com

www.djj.com

The Greenbrier Companies is a leading international supplier of railroad equipment and services to global freight transportation markets. Greenbrier designs, builds, and markets freight railcars in North America, Europe and Brazil through its wholly owned subsidiaries and joint ventures. We are a leading provider of railcar wheel services, parts, maintenance and retrofitting services. Greenbrier owns a lease fleet of over 12,000 railcars, manages nearly 450,000 railcars and offers fleet management, regulatory compliance and leasing services to railroads, lessors and rail shippers. Learn more about Greenbrier at www.GBRX.com.

Info@GBRX.com

Thomas P. Jackson, Vice President of Marketing & General Manager One Centerpointe Drive, Suite 200 Lake Oswego, OR 97035

Tom.Jackson@GBRX.com

TrinityRail® provides our customers with comprehensive rail transportation products and services designed to provide value by optimizing the ownership and usage of railcars.

Available is an owned and managed fleet of approximately 141,000 railcars as well as fleet management solutions, administrative services and dedicated customer support. Access is also provided to TrinityRail’s extensive engineering and manufacturing platform, maintenance, parts, and on-site field support for operational assistance and training.

More information is available at www.trinityrail.com.

Gregg Mitchell, EVP, Chief Commercial Officer 14221 N. Dallas Parkway, Suite 1100 Dallas, TX 75254 800-631-4420

www.trinityrail.com

Our Rail division offers a full suite of leasing and financing solutions to rail shippers and carriers across North America. We’re a top lessor of highcapacity railcars and offer flexible lease terms, a diverse fleet and dedicated customer service that’s focused on building long-term relationships. Our turnkey-ready cars are available to support your increasing demand, free up capital for growth and minimize out-ofservice time.

Let’s explore how our full suite of services can help support your operating priorities and power your growth.

www.citrail.com

SMBC Rail Services is committed to providing innovative railcar leasing solutions to the North American rail industry. We are a full-service lessor of long-lived rolling stock, offering comprehensive rail leasing and finance solutions. Our fleet of railcars is one of the youngest and most diversified in North America, consisting of more than 52,000 railcars. Our leasing experts can work with you to find the right transportation solution for your rail operations. For more information, please contact sales@smbcrail.com.

Tina Beckberger

Senior Vice President Leasing

SMBC Rail Services LLC

300 S. Riverside Plaza, Suite 1925 Chicago, IL 60606

www.smbcgroup.com/americas

June 2023 // Railway Age 21 railwayage.com

The David J. Joseph Company a NUCOR® company

LABORATORIES ROLLING

By Marybeth Luczak, Executive

Measuring and monitoring track geometry and detecting aws beneath the track surface not only allows railroads to take action before failures occur, but also helps them to manage maintenance proactively, prolonging asset life.

e following suppliers provide updates on their latest equipment and services to assess and manage track health, plus their insights on where the market is headed.

MERMEC INC., AN ANGEL COMPANY

San Francisco Bay Area Rapid Transit (BART)

District last month unveiled its newly acquired rail inspection vehicle from MERMEC that measures track position, curvature, smoothness and alignment, plus wear and corrugation, which contribute to train noise. e $10

million, diesel-powered “rolling laboratory” is part of MERMEC’s ROGER series and was developed over the past nine years under Build America Buy America Act requirements, according to Scott McLaughlin, Vice President of Business Development-West for MERMEC. It uses lasers, sensors and cameras as well as measuring and data management systems to create a comprehensive track pro le, all while traveling at speeds of up to 70 mph. Among its capabilities, the vehicle can create three-dimensional surface scans of the area around the track and capture hi-de nition images that detect abnormalities in components such as concrete ties and fasteners. It can also capture video in both normal and low-light conditions, including in tunnels, and infrared thermal imagery. GPS, axle counters and radio-frequency identi cation tags pinpoint problem-area locations.

According to McLaughlin, MERMEC also recently released Rail Studio, “a platform that incorporates both arti cial intelligence and in-cloud-based storage, and is able to visualize, analyze and interact with data from multiple collection systems,” including those from di erent vendors.

What’s next? “We are constantly interacting with our customers, getting valuable feedback, and making adjustments and improvements so the next iteration of our equipment provides more information and is more robust,” McLaughlin reports.

PLASSER AMERICAN CORPORATION

“Automation remains a hot topic” in the track geometry space, Plasser tells Railway Age. “Customers want to be able to cover the same amount of track with fewer people.” Also important today: eet management and data

22 Railway Age // June 2023 railwayage.com BART

TECH FOCUS — M/W

BART’s MERMEC-built rail inspection vehicle uses lasers, sensors and cameras as well as measuring and data management systems to create a comprehensive track profile, all while traveling at speeds of up to 70 mph.

Editor

What’s new, what’s next in track geometry and rail flaw detection systems.

analysis. e company says it “continues to provide customers with new and improved platforms to bring track geometry and track maintenance together.” Data generated through Plasser machines are compatible, it points out, which saves track time by eliminating the need for pre-measurement. Additionally, partnerships with other railroad technology companies allows Plasser to integrate third-party data into its domains.

e future of track geometry will be a mix of manned and autonomous vehicles, Plasser tells Railway Age—both of which it will o er in the near future.

Plasser recently entered the ultrasonic rail aw detection (URFD) market and reports supplying both hi-rail and rail-bound options for service or purchase. e company is providing (or mobilizing to provide) Class I’s, Class IIs and transit agencies with URFD services, which it says will continue to expand in 2024 and 2025 within North America.

While Plasser says that “there is a sizeable need” for URFD for both stop and verify and continuous testing, it does “see a move away from eddy current and stop/verify and go with higher speed systems such as phased array, and a switch to continuous testing to cover more track within tighter schedules.”

Now under development is Plasser’s phased array system, which has entered the nal stages of testing. It was designed to inspect the rail and nd defects in the presence of surface conditions such as horizontal split heads, deep rolling contract fatigue and squats. “ is new technology will replace the eddy current systems to check the rst few millimeters of the rail for defects,” PAC reports.

ENSCO RAIL, INC.

“ e North American market has fully embraced the bene ts of rail-bound autonomous track geometry systems,” Rail Division Manager Jackie Van Der Westhuizen reports. “Currently, the number of autonomous railbound track geometry vehicles far outnumbers manned vehicles.”

ENSCO Rail recently deployed its rst autonomous rail-surface imaging systems for a Class I railroad, and additional autonomous joint bar imaging systems for existing customers. “ ese systems accompany autonomous track geometry measurement systems to assess rolling contact fatigue and rail damage [and] to monitor rail integrity and inspect,” Van Der Westhuizen tells Railway Age.

What’s new in research and development?

e company has developed digital twin capabilities, “made possible by combining our automated VAMPIRE processing with autonomous track geometry,” Van Der Westhuizen says. “With this capability, we can predict potential derailment locations in advance and provide instructions on how to correct defective conditions to prevent accidents.” Additionally, the company is leveraging its Automated Maintenance Advisor to predict future track conditions, he says, “which results in actionable maintenance plans and asset management strategies.”

ENSCO Rail also provides ultrasonic rail aw systems (URFS), and it anticipates “a persistent need for more frequent and faster testing,” according to Van Der Westhuizen. “We expect that advancements in sensors, data analysis and machine learning will facilitate more sophisticated and accurate inspection techniques. is progress will fuel the development of continuous testing and automated inspection, which can rapidly scan vast segments of railway tracks and detect potential aws or defects, thereby minimizing derailments and service disruptions.” Also, there is a growing trend to integrate and augment URFS with other types of inspection technologies, such as visual inspection, thermal imaging and magnetic particle inspection, he reports. “By combining these di erent inspection techniques, rail maintenance teams can get a more comprehensive understanding of track condition and make more informed decisions about maintenance and repairs.”

HARSCO RAIL

Harsco Rail o ers the Callisto track geometry measurement system, which can be mounted on a hi-rail vehicle or integrated into a Harsco tamper’s control system. e portable, hi-railmounted system is currently hard-wired to a keyboard and touchscreen monitor in the cab, but within a year, the company may eliminate most wires by implementing Bluetooth communications, according to Tom Leiby, Director of Measurement Products. Harsco Rail is also working to improve how operators input data and to provide scalable track-geometry graphs, he tells Railway Age

A Class I railroad is currently out tting its tamper eet with Callisto Protamp, which allows for a high-speed, pre-work track recording without the need for buggy extensions, Leiby says. is increases productivity as well as safety.

On the R&D side, Harsco Rail is testing an autonomous vertical rail displacement measurement system that it anticipates will be commercially available in rst-quarter 2024. Mounted on heavy-weighted freight cars or almost any type of rail-bound equipment, the system will detect “mud spots” or weak points in the railbed that are not always visible, according to Leiby. “By knowing where these spots are, you can watch them, and/or undercut or do other work to eliminate them and stop the stress on the rail,” he explains.

In addition to track geometry inspection services, the company will soon o er ultrasonic rail aw detection services, Leiby reports.

HERZOG

“Rail aw detection is a critical aspect of ensuring the safety and dependability of transit and freight rail systems,” Herzog tells Railway Age. “By using powerful ultrasonic technology (UT) and comprehensive data collection and analysis, Herzog’s hi-rail testing vehicles are capable of servicing rail tracks in any environment.” e company o ers turnkey Continuous Testing (CT) services and says that its CT platforms “are designed to capture robust and highly accurate data within short work windows, enabling a thorough assessment of rail infrastructure conditions.” ese platforms, Herzog adds, employ multiple inspection technologies on a single vehicle, allowing for customization. Among the key features of its CT equipment and data processing are:

• SmartProbe technology: “ e detection instrumentation within the wheel probe signi cantly accelerates processing time,” according to Herzog. “With 14 transducers per rail, it provides a superior signalto-noise ratio and comprehensive coverage using 24 UT channels.”

• Geometry system: is system evaluates track gauge, alignment, curvature, surface conditions, cross-level, super-elevation, warp and twist.

• Joint bar inspection: “High-de nition line scan cameras integrate detailed images of both the gauge and eld side of the rail joint bar into the UT so ware data stream,” Herzog says. “ is integration enables the quick identi cation of missing bolts, broken fasteners or cracks in the sh plate.”

• Historical record: Each indication is tracked across survey runs and prioritized based on its anticipated severity, according to Herzog, which notes that

June 2023 // Railway Age 23 railwayage.com TECH FOCUS — M/W

analysts can reference previous inspection scans and photo imagery to monitor any growth or changes.

• Pattern recognition: “UT data is analyzed using machine learning algorithms that automatically identify and classify various types of anomalies or defects that may be present in the rail,” Herzog reports.

HOLLAND LP

How railroads use track geometry data is changing, with a move from reactive to proactive, data-driven maintenance, according to Senior Director of Product Development Sabri Cakdi. Since tracks are inspected multiple times per year, railroads can overlay data and look for trends. “In the past, you would provide an inspection technology to a railroad and they would run it, operate it, get a report and that was it,” he says. “Now, they ask us to integrate

our system’s output to a cloud-based system.”

Another trend, Cakdi says, is the use of portable track geometry systems in yards. “If you look at Federal Railroad Administration derailment rates, there has been a huge reduction in main line derailments, but yard derailments are still signi cant,” he reports.

Holland’s portable Track Inspector is a full geometry system that o ers two individual rail sensors depending on con guration and use, and can be mounted, con gured and calibrated by one person in less than an hour, according to the company. Cakdi points out that the Argus® track measurement technology no longer uses a conventional wheel-mounted encoder; this has been replaced with a noncontact speed and distance measurement device so there are no hardware reliability issues.

Holland also o ers Locomotive UGMS, a locomotive-based autonomous track geometry

and rail pro le measurement system. “Taking advantage of existing train routes, Locomotive UGMS provides continuous testing along critical network corridors while eliminating the need for track time,” the company reports.

KAWASAKI TRACK TECHNOLOGIES

e current and long-term outlook for autonomous track inspection systems remains promising, Program Manager Ryoji Negi tells Railway Age. KTT’s locomotive-mounted “high-reliability, low-maintenance and lowcost per mile” system provides the geometry data rail owners need to identify and more quickly respond to potential problem areas, he says. Over the past year, the company has added a web-based track condition viewer and updated the system to include more realtime data, as well as functionality to download geometry strip charts. Cloud storage options are also available.

KTT is currently testing an automated fastener inspection system. Mounted on a locomotive, processing is completed on board and exceptions sent to customers in near real time. “ is system is taking high-speed imagery of rail, ties, fasteners, ballast, and other track components and providing the data for our machine learning algorithms,” Negi says. “Initial results have been very promising and KTT is targeting early 2024 to have production systems available for installation. Once various fastener and tie combinations are completed, KTT will be able to utilize the same technology to identify potential exceptions on ties, joint bars, ballast and other track components.”

LORAM TECHNOLOGIES, INC.

LTI can target substructure issues and their underlying origins by integrating historical track geometry data provided by railroad

24 Railway Age // June 2023 railwayage.com TECH FOCUS — M/W Loram

Technologies, Inc.

Offering immediate access to

to: • Meet regulatory requirements • Prevent potential derailments • Keep railways running safely and efficiently The

reber.acacia@ensco.com | (570) 728-7998 | www.ensco.com/rail

Rail Doctor software brings together and aligns for analysis track geometry data collected by the railroad and GPR and LiDAR data collected by Loram Technologies Inc.

Ultrasonic

Rail Flaw System (URFS) services

Leader In Automated Track Inspection

For the latest updates follow ENSCO Rail on LinkedIn

customers with information derived from its Ground Penetrating Radar (GPR) and LiDAR systems. ese systems measure ballast fouling, moisture conditions and track formation, and provide information about right-of-way topography, drainage ditch location, and depth and cut/ ll conditions, respectively. e company’s Rail Doctor so ware brings together and aligns all data for analysis and, ultimately, to help railroads with substructure maintenance management—a proactive approach.

“ e geometry data is a very good tool to nd out where the track is not performing correctly, where it’s deteriorating,” says Hamed F. Kashani, Manager of Railway Geotechnics. “We can then go and look for the root cause of the problem and recommend to the railroad how to x it.” Once any problems are corrected, LTI can monitor the track to determine if the provided solution was the right one.

e company is actively working on research projects with two universities to determine the best machines to resolve speci c problems, according to Kashani. For instance, if a certain amount of fouling in the center of the track is detected by GPR, is undercutting or shoulder

ballast cleaning the best way to x it? “We want to nd the best and economical solution for the condition,” he says. e company is also taking steps toward nding correlations between substructure and superstructure (rail and crosstie) defects as well as automating data collection and increasing the speed of analysis.

RAILWORKS MAINTENANCE OF WAY

“Automated track geometry inspections continue to be an important part of our Maintenance of Way Division and for RailWorks as a company,” says Jason Deaton, Vice President and General Manager. “Providing accurate, reliable track geometry services for Class I’s, short lines and transit agencies across North America gives our customers an opportunity to view and understand their railroads’ health in real time.”

According to Deaton, customers are not only implementing track geometry inspections more frequently, but also using data so ware to view and analyze data in more detail to better manage maintenance resources, personnel and budgets. “Having the ability to view multiple or overlapping inspections allows customers to pinpoint locations that require attention before they

become a track defect or problem area,” he says.

RailWorks is currently exploring technologies that can be incorporated into its Track Geometry Service Platform.

WABTEC CORPORATION

Customers today want more testing done faster, says Dave Staton, Vice President, General Manager of KinetiX Rail Inspection Technologies at Wabtec. It’s about “how fast can you get in, how fast can you get out,” he says. “And they want predictive results. ere’s a lot of things that go into being able to make that happen. And part of that becomes our ability to enhance our analytical capabilities in evaluating inspection data by adding and integrating arti cial intelligence into our background so ware.”

On Jan. 1, Wabtec brought track inspection, including ultrasonic rail aw detection, under its KinetiX umbrella, which already comprised wayside inspection, such as hotbox detectors and bearing acoustic monitors. “Part of our vision is to connect those disparate inspection technologies to derive insights,” reports Alan Fisher, Group Vice President, Logistics, Analytics and Digital Mine at Wabtec.

June 2023 // Railway Age 25 railwayage.com TECH FOCUS — M/W

NONEXISTENT FOR NOW? NEW LOCOMOTIVE BUILD MARKET

BY DON GRAAB, TRAINGLE BROTHERS & ASSOCIATES LLC

BY DON GRAAB, TRAINGLE BROTHERS & ASSOCIATES LLC

It looks as though we will see three consecutive years with no new locomotives built for the North American market. This downward trend in production has been evident since late 2016 in that an average of only 77 units per year were built in the three years (2018-2020) preceding the current drought of new units. It is safe to say, in the era of diesel-electric locomotives this is unprecedented.

Fair questions to ask: “How can this be?” “Can railroads continue to buy no new locomotives?” “If so, how long can this last?”

There are numerous circumstances that contributed to this situation. Let’s begin with Precision Scheduled Railroading (PSR). Since dieselization and multiple unit (MU) control, railroads have understood longer, heavier trains reduce fuel and crew costs, which are railroads’ two primary expenses. When a lower Operating Ratio (OR) is management’s

objective, you cannot beat this combination. Along the journey, the advocates of PSR realized the next lever to pull for longer trains was Distributed Power (DP), which allows the continued progression of closely matching the tractive effort of a locomotive consist to train weight, yielding lower costs. While there has been much negative publicity about the longer trains of the PSR era, DP use has many tangible benefits.

Railroads buy new locomotives for two reasons: renewal of their fleet and new business. Presently, the demand for new units generated by new business is zero. The pandemic certainly put the chill on new locomotive orders, and we have not recovered since.

Railroads are most competitive when hauling large, bulky, heavy stuff. The shift away from manufacturing to a service economy combined with aggressive “offshoring” of manufacturing has not been kind to railroads. Significant traffic from

Asia moving on land in containers has offset these losses. However, in recent years a growing amount of inbound Asian traffic has been diverted from the West Coast to the East Coast, resulting in shorter rail hauls.

Looming in the background is the continued erosion of coal traffic, which peaked in 2008. In 2022, coal production was down 49% from 2008. While you can read about surges in coal shipments, coal loadings resemble a sine wave with a steady downward slope. Traffic goes up and traffic goes down, but over longer periods of 18-36 months the trend is obvious.

On top of this, Class I carriers have a limited enthusiasm for the new Tier 4 emissions-compliant locomotives. Their higher purchase price and increased maintenance expense are a deterrent to acquisitions. Contributing to the current situation, in 2014, the highest year of new domestic deliveries since 2008, there was a

26 Railway Age // June 2023 railwayage.com

In the diesel-electric era, it’s unprecedented.

Don Graab (all photos)

MOTIVE POWER

surge in the purchase of road units before Tier 4 took effect (Jan. 1, 2015). About that time, significant volumes of Bakken crude oil were also moving by rail.

Returning to the fact that major railroads buy new locomotives for purposes of fleet renewal, the railroads have been more actively addressing the health needs of their locomotive assets than it may appear. For the first time in 65-plus years of diesel freight operations, the “capital” rebuilding of road units has surpassed new locomotive purchases for fleet renewal.

Let’s expound on capital rebuilds. Unlike the more routine engine overhaul, which is “expensed” from the annual operating budget, rebuilds are a life extension event where the cost is funded from the capital improvement budget. Upon completion of the rebuild, a locomotive asset is depreciated over its now-longer useful life. Notable programs from the past include Illinois Central’s “Paducah Rebuilds” where GP9 locomotives were upgraded to GP10 models; Sante Fe’s program at Cleburne, Tex., where U30C units were rebuilt as C30-7 locomotives; and other programs including work performed at Conrail.

The rebuilding activity that has taken place more recently is not fundamentally different, just far more pervasive. With a bias from my long-time employer, I would suggest that the current level of enthusiasm for capital rebuild programs started with Norfolk Southern (NS) under the direction of then-CEO Wick Moorman. Witnessing the complete rebuild of yard and local units in Altoona, Pa., and facing

the huge capital requirements of PTC plus a large aging Dash 9 fleet, Moorman advocated leveraging the shop capabilities to offer a lower capital alternative for fleet renewal. This focused NS shops on the rebuilding of road units, but NS included AC traction as part of its vision for the future of rebuilt road power. This generated pressure for the two locomotive builders to participate, and both Progress Rail and GE Transportation (now Wabtec), with their aging SD70M and C44-9W DC models, were soon actively

engaged. While the first Dash 9 units to emerge with AC power were delivered to BNSF, programs from both builders quickly followed at NS. Later, this concept expanded to include upgrading or rebuilding of first-generation AC units.

All the Class I railroads have participated in this capital rebuild activity, although neither BNSF nor Kansas City Southern have been active recently. While this rebuild process was originally envisioned to convert DC road units to AC traction motors (sometimes referred

June 2023 // Railway Age 27 railwayage.com

hollandco.com #HollandRail

Portable Inspection Solutions

Gauge

and Full Geometry options available for any hi-rail vehicle with a standard hitch mount.

MOTIVE POWER

to as DC2AC conversions), most units

Let’s go into more detail about how

produce configurations for both modules that are identical to those for new locomotives. This results in a new microprocessor control system, new relays, power contactors, wiring, IGBT inverters, electronic air brake systems and associated hardware such as air conditioning and cab seats. The diesel engine, traction motors, traction alternator, air compressor, and sometimes the truck assemblies are also rebuilt, after which the locomotive is painted and sometimes renumbered. From the viewpoint of an operator, the locomotive looks and feels like a new unit. The additional useful life of these renewed assets is estimated to be 15-20 years. It is believed these capital rebuild locomotives have demonstrated reliability equal to new Tier 4 locomotives at 50% of the cost.

28 Railway Age // June 2023 railwayage.com

TRUCKS AND EQUIPMENT FOR ALL YOUR RAIL AND TRANSIT NEEDS. R ENTA L SYSTEM S, INC. PHILADELPHIA 800.969.6200 DENVER 800.713.2677 DANELLA.COM/RENTALS

Despite the prospects of “reshoring/nearshoring,” we are a ways off from seeing a resurgence of heavy manufacturing in the U.S. and any associated uptick in rail traffic. Currently, there are few signs rail traffic is facing a rebound. In fact, statistics reveal just the opposite. Further, coal traffic will continue to decline while many first-generation AC locomotives remain viable candidates for capital rebuild programs. Railroad managers sense the current locomotive technology has reached a plateau where it is not changing much. Railroad management, conscious of ambitious Environmental, Social and Governance (ESG) goals, are anticipating the conversion to alternative fuels, namely hydrogen. A few are even expecting the next round of new locomotives to be driven by hydrogen fuel cells, not Internal Combustion Engines (ICE).

One of the unexpected consequences of the capital rebuild activity could be a spike in new locomotive demand. This would occur when locomotives that were new and never rebuilt age out at 20-25 years of useful life during the same year or years capital rebuild units reach the end of their second life. In other words, at some point, the retirement of shorter-life rebuilds is likely to coincide with the retirement of the new units that were built before rebuilding became popular. This will result in a peak demand for new power around the years 2034-2038. The likelihood of this occurring depends on capital rebuild life. The shorter the second life, the more likely a spike in demand. If the useful life of the rebuilt units turns out to be the same as the life of new units, no spike in demand will take place.

Predicting the demand for new locomotives is difficult. This is not the first time a change in operating practices has resulted in a large decrease in new locomotive production. But it is the first time production dropped to zero. What we know from the past is that locomotive demand often increases rapidly with little warning. When it does, it seems like the big railroads all want new locomotives at the same time.

Historically, railroads chose to retire locomotives based on issues with the diesel engine or overall locomotive reliability. When new diesel engines offer little fuel savings advantage, railroads are more willing to restore engine longevity with overhauls. When overall locomotive reliability declines, it is often driven by declining traction motor reliability. Rather than buy new traction motors, railroads have chosen to buy new locomotives, because replacement traction motors are quite expensive.

If new locomotive demand soars, it could easily exceed supply for a period of months or years. If prices soar as well, overseas builders could gain interest in the North American market. The flow of component parts such as traction motors may be impacted by increased production of electric vehicles and the competition for copper. Based on recent experience, the availability of skilled workers to assemble locomotives may be another looming challenge.

At some point, we will see a rebound in the demand for new locomotives. Presently, no one knows when this will occur. But the longer the resurgence is delayed, the more likely the return to new unit production will initially be a bumpy road for the railroad industry.

June 2023 // Railway Age 29 railwayage.com

RAIL AND WHEEL FATIGUE CRACK DEFECTS INSPECTION IMPERATIVE

By Gary T. Fry, Ph.D., P.E., Vice President, Fry Technical Services, Inc.

By Gary T. Fry, Ph.D., P.E., Vice President, Fry Technical Services, Inc.

Welcome to “Timeout for Tech with Gary T. Fry, Ph.D., P.E.”

Each month, we examine a technology topic about which professionals in the railway industry have asked to learn more. is month, our subject is fatigue defects that form in railway wheels and rails. Although this is prime material for a very thick volume (or two), our focus will be on a subset of safetycritical issues. Along the way, I will include a few brief callouts to related topics that hint at the breadth involved in these problems. Let’s get started!

In the January 2022 “Timeout for Tech,” I provided a general overview of metallic fatigue. e key takeaways were these:

Fatigue cracks in steel are neither manufacturing defects nor the result of manufacturing defects. Rather, fatigue cracks in steel are a result of routine use in service ey are caused by repeated load applications that give motion to atomic-scale imperfections called dislocations.

Dislocations are misalignments present in the crystal lattices of all metals, including steel. Dislocations individually may be on the order of 0.00000004 inches in length, but they occur in great numbers.