AILWAY G E

SERVING THE RAILWAY INDUSTRY SINCE 1856

scriptions:

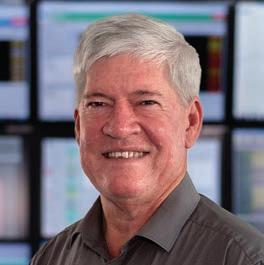

Jim Wolfe: ‘Be Reasonable, Fair and Objective’

The Surface Transportation Board’s fifth member, who will fill the retired Marty Oberman’s seat and on whose appointment blessing of Union Pacific’s marriage with Norfolk Southern (p. 6) will partially rest, is at this writing to be determined. Thus the bright red box (he or she will undoubtedly be a Republican) with a question mark on this month’s “Watching Washington” column (pp. 8-9). But as we were going to press, Frank N. Wilner, our intrepid Capitol Hill Contributing Editor, discovered the most likely choice—and he was more than happy to speak with Railway Age.

He’s James E. Wolfe, 62, a third-generation railroader. “He’s little known publicly, if at all, beyond a small segment of the rail industry, owing to his career efforts to avoid the public eye such as through opinion-page writing and public speaking,” Wilner points out.

“Merger decisions are best made transparently and absolutely free from political interference,” Wilner notes. “Suddenly pivotal at the STB is disciplined, systematic and knowledgeable direction as it prepares to measure the benefits and drawbacks of the largest rail merger in almost three decades. If approved, the marriage will create what even railroad baron John Pierpont Morgan couldn’t accomplish—a truly transcontinental railroad providing seamless Atlantic Coast to Pacific Coast service. As such, essential is a nominee experienced in every aspect of railroading, from the ballast to the C-Suite to the labor negotiating table, and versed in the intent, history and nuances of the STB’s controlling statute. Rather than a grandstander with an agenda, the nominee must

be—and perceived by stakeholders to be— committed to neutrality and able to contribute specialized proficiency.”

Jim Wolfe fits this description to a T-rail. Wilner describes him as “an attorney with in-depth knowledge of commerce law; a working background in freight and passenger rail (Union Pacific, Amtrak, Illinois DOT); first-hand dealing with Congress and Executive Branch agencies; and understanding of official Washington political nuances.”

Between 1997 and 2023, Wolfe, a graduate of Loyola University and DePaul University’s College of Law, was Chairperson and CEO of Chicago-based Knight Engineers and Architects, which focused on aviation, highway and rail infrastructure projects in the public and private sectors. That included serving as the Class I railroads’ lead negotiator for the Chicago CREATE Program.

Why does Jim Wolfe have interest in an STB nomination? “I would like to be part of the process that moves the STB back to its intended legislative purpose of being the economic regulator of freight rail, and not some Orwellian entity that tries to micromanage railroad operations while simultaneously inundating the railroads with burdensome requests for data and never-ending litigation,” he told Wilner. “The STB has a narrow scope—be reasonable, fair and objective. STB members should be neutral, non-biased arbitrators who understand railroads, their customers and competitive markets.”

Amen, I say to you!

WILLIAM C. VANTUONO Editor-in-Chief

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service.

Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform.

Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) 847-559-7372, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage.

POSTMASTER: Send changes of address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA.

Photocopy rights: Where necessary, permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than

keeping or return of such material.

Member of:

AILWAY GE

SUBSCRIPTIONS: 847-559-7372

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

JENNIFER McLAWHORN

Managing Editor, RT&S jmclawhorn@sbpub.com

HEATHER ERVIN Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing

Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Dan Cupper, Alfred E. Fazio, Justin Franz, Gary Fry, Michael Iden, Don Itzkoff, Bruce Kelly, Joanna Marsh, David Nahass, Jason Seidl, Ron Sucik, David Thomas, Frank N. Wilner

Art Director: Nicole D’Antona Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes Conference Director: Michelle Zolkos Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors Kevin Smith

ks@railjournal.com

David Briginshaw db@railjournal.com

Robert Preston rp@railjournal.com

Mark Simmons

msimmons@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 847-559-7372

Reprints: PARS International Corp. 253 West 35th Street 7th Floor

New York, NY 10001

212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

AI that powers Real Results

Talos™ leverages machine learning and arti cial intelligence to create customized strategies for each train’s speci c makeup, managing and optimizing every mile of the journey.

By adapting to train behavior and customer operational objectives, Talos offers higher overall fuel savings up to 25% and equally impressive emissions reductions.

Talos also improves safety by rigorously managing train handling, helping prevent break-in-twos with the best in-train force management in the industry.

Saving fuel, reducing emissions, and improving operational safety — it’s how we keep you rolling.

Talos is integrated into the locomotive operator display. Scan to learn more about Talos.

Industry Indicators

‘CONTINUED UNCERTAINTY ON AND OFF THE RAILS’

“In recent months, the U.S. economy has defied easy characterization, caught between signals of underlying strength and uncertainty regarding the road ahead,” the Association of American Railroads reported last month. “Rail freight volumes have followed that lead, reflecting a mix of cautious optimism and lingering hesitation across key sectors. The uncertainty characterizing both the economy and freight markets is likely to continue because key drivers of economic momentum—including the labor market, consumer spending, inflation levels, interest rates, and economic policies across the globe—remain fluid.”

“U.S. rail intermodal originations fell 2.9% (31,000 containers and trailers) in June 2025 from June 2024, their first year-over-year decline in 22 months. June’s decline comes amid broader uncertainties impacting global supply chains that have tempered international shipments. In June 2025, U.S. rail intermodal volume averaged 260,834 units per week, below the 2016-2005 average for June of 263,991.

“For 2Q25, intermodal was up 2.0% over last year. For the first six months of 2025, U.S. intermodal volume totaled 6.98 million units, up 5.1% (340,000 units) over last year and the third most ever for January to June (behind 2018 and 2021). Looking ahead, intermodal performance will hinge on a range of factors, including developments impacting global supply chains and the strength of consumer-driven freight demand. These trends are always difficult to predict.

“Meanwhile, total U.S. rail carloads (excluding intermodal) rose 2.1% (nearly 19,000 carloads) in June 2025 over June 2024, their fourth straight year-overyear increase—the first time that’s happened since late 2021. In June, 10 of the 20 carload categories tracked by the AAR had year-over-year gains. Total U.S. rail carloads averaged 226,259 per week in June 2025, the most for June since 2021. In the 66 months since January 2020, only 14 months had a higher weekly average than June 2025 did.

“Total carloads were up 4.8% in 2Q25 over 2Q24, their biggest quarterly percentage gain since 3Q21. In the first half of 2025, total carloads were up 2.4%, or 136,000 carloads, over last year.

“The AAR Freight Rail Index (FRI), a gauge of seasonally adjusted rail volumes excluding coal and grain, fell 0.5% from May 2025 to June 2025, bringing the index to its lowest point since May 2024. June’s decline mainly reflects intermodal softness. Seasonally adjusted carloads excluding coal and grain and excluding intermodal rose 0.7% in June from May, reflecting pockets of strength for certain key rail sectors amid current economic uncertainties.

“The first half of 2025 offered few clear signals, and the months ahead may be no different. Freight volumes, like the broader economy, will likely continue to reflect a mix of competing forces—some supportive, others restraining—as businesses and consumers navigate an unsettled economic landscape.”

Industry Outlook

Norfolk Southern + Union Pacific: It’s Official

THE SPECULATION IS OVER: UNION PACIFIC AND NORFOLK SOUTHERN ON JULY 29 ANNOUNCED THEIR AGREEMENT TO, IN A COMBINED CASH AND STOCK TRANSACTION VALUED AT MORE THAN $250 BILLION, MERGE AND CREATE THE FIRST U.S. TRANSCONTINENTAL RAILROAD. UP is the acquiring company. Under the terms of the agreement, UP will acquire NS in a stock and cash transaction. NS shareholders will receive, for every share of NS stock, one share of UP stock plus $88.85 in cash, “implying a value for NS of $320 per share based on UP’s unaffected closing stock price on July 16, 2025, and representing a 25% premium to NS’s trading day volume weighted average price on July 16, 2025,” both railroads stated. “The value per share implies an enterprise value of $85 billion for NS, resulting in the creation of a combined enterprise of more than $250 billion.”

UP will issue a total of approximately 225 million shares to NS shareholders, “representing 27% ownership in the combined company on a fully diluted basis, and providing the ability of NS shareholders to participate in the upside of the combined company’s growth opportunities and synergies. The agreement is structured without a voting trust and includes a $2.5 billion reverse termination fee. The cash portion of the transaction will be funded through a combination of new debt and balance sheet cash. At closing, the combined

business will have a strong balance sheet and Debt to EBITDA of approximately 3.3x, supporting a balanced capital allocation strategy. The combined company will continue to prioritize and maintain a strong balance sheet and investment grade rating. Based on 2024 results, the pro-forma combined company would have revenues of approximately $36 billion, EBITDA of approximately $18 billion, operating ratio of 62%, and free cash flow of $7 billion. The transaction is expected to be accretive to UP’s adjusted EPS per share in the second full year after closing and rising to high single digit accretion thereafter.” As well, both companies will suspend share repurchases but will continue to pay dividends.

The transaction, expected to be filed with the Surface Transportation Board within six months, undergo a 15-month review process and close by early 2027, is “expected to unlock approximately $2.75 billion in annualized synergies and deliver substantial long-term value for UP and NS shareholders,” the Class I’s said. The combined company will be headquartered in Omaha, Neb. Atlanta, Ga., “will remain a core location for the combined organization over the long-term with a focus on technology, operations, and innovation, among other priorities.”

Jim Vena, UP CEO (top, at left), will be CEO of the combined company, dubbed the “Union Pacific Transcontinental Railroad,” and “has committed his intent to remain at

UP for at least the next five years,” UP and NS noted. “Through integration and beyond, talented leaders from both companies will work together to deliver on the combination’s full value creation potential. The experienced UP and NS management teams will continue to independently run each company until the transaction’s closing.” At closing, three NS Directors, including Mark George and Richard Anderson, are expected to join the UP Board of Directors after completing the corporate governance process.

Vena and George acknowledged that combining the two companies “will not be easy,” but that their cultures “are closely aligned” and that both will continue to operate “without distraction.”

“These legendary companies will seamlessly connect more than 50,000 route-miles across 43 states from the East Coast to the West Coast, linking approximately 100 ports and nearly every corner of North America,” UP and NS said. “This combination will transform the U.S. supply chain, unleash the industrial strength of American manufacturing, and create new sources of economic growth and workforce opportunity that preserves union jobs. Together, [we] aim to be the safest railroad in North America and deliver the service customers rely on with operational excellence. The combined company will deliver faster, more comprehensive freight service to U.S. shippers by eliminating interchange delays, opening new routes, expanding intermodal services, and reducing distance and transit time on key rail corridors. A more truck-competitive solution, the Union Pacific Transcontinental Railroad will decrease highway congestion, reducing wear-and-tear on taxpayer-funded roads.”

Will the Norfolk Southern name and iconic “Thoroughbred” prancing horse logo on a black locomotive carbody fade into history as another fallen flag—just like all prior UP acquisitions (Missouri Pacific, Western Pacific, Missouri–Kansas–Texas, Chicago, Rock Island & Pacific, Chicago & North Western, Southern Pacific)? In a joint interview with Mark George, Jim Vena said it will not. That remains to be seen. – William C. Vantuono

Rail Equipment Call: Decision Paralysis Continues

TD Cowen recently hosted a call with industry executives from the rail equipment market. From that, we heard order books are seeing no notable growth, attributable to tariff uncertainty, and used car valuations are increasing. Bonus depreciation likely won’t be an incremental driver of rail equipment demand. Consolidated rail service hasn’t seen improvements despite Class I emphasis.

Tariff uncertainty continues to pressure the order book. Railcar end users are unwilling to make capital decisions due to volatile policy, and the second quarter is expected to be on par or slightly below weak first-quarter levels. The inquiry-to-order conversion rate remains weak, and panelists noted that railcar users need six to seven months of forecast clarity to justify the capex. While panelists are seeing speculative purchases up slightly, the bulk of ordering activity is replacement or linked to new plants. Bonus depreciation in the tax bill is likely not a big driver of incremental demand for rail equipment. Interest rates play a much more significant factor for purchase decisions; our panelists believe that if we get tariff clarity along with other tailwinds (bonus dep, rate cuts), then this should drive demand for rail equipment, but tax bill on its own is not a needle mover. Rail service has been a shallow roller coaster, and one panelist (who surveyed 29 terminals) saw terminal dwell worsen sequentially in the second quarter. June was not any better than May, according to our panelist who looked at terminals on both the East and West coasts. Certain carriers on each coast have performed marginally better than their competitor, though there have been no noteworthy service improvements despite Class I emphasizing its importance in recent quarters.

Used car valuations are elevated despite the relatively tepid demand picture. Inflation in manufacturing input costs for new cars has led railcar customers to the used market. One panelist attested to a 30%-45% increase in the cost of five-year assets. While lease rates are fairly reasonable (down slightly) at this time according to panelists, used price surge and consolidation in the lessor fleet could result in upward pricing pressure in the future (the GATX wells fleet now accounts for approximately 25% of the aggregate lessor fleet).

Panelists discussed the various channels through which a transcontinental rail merger could impact the equipment market. Merger-driven carload growth enabled by fewer interchanges would support increased equipment demand in the long term. Near-term service impacts resulting from recalibrating the network could also support intermittent equipment demand. However, longer term, fluidity and efficiencies would likely allow the railroads to do more with less equipment. It is too early to tell how these puts and takes would net out. – Jason Seidl, Elliot Alper and Uday Khanapurkar, TD Cowen

NEW JERSEY TRANSIT last month released a Request for Qualifications (RFQ) for special prequalification for the final design, construction, and commissioning of the Northern Rail Maintenance-of-Way Facility, a major infrastructure initiative located in Clifton, N.J. According to the agency, the new facility will replace the “aging and floodprone” Wood-Ridge location, “creating a more resilient and modernized base of operations to support NJT’s growing maintenance and repair needs. It will enhance NJT’s ability to maintain the right-of-way and railroad infrastructure by providing modernized space for maintenance, servicing and repair of vehicles. The design will enhance the current functions performed at the existing facility, accommodate increased maintenance

demands and incorporate updated features that meet current codes and operational needs.” The project includes demolition and environmental abatement of an existing building and substructures at 99 Kuller Road; construction of three new buildings across two NJT-owned sites; site grading, new access roads and dedicated parking areas; and coordination of site utilities and integration of maintenance equipment. The special prequalification process will evaluate design-build teams based on their technical qualifications, relevant experience and project approach, the agency noted. Following the evaluation, NJT says it anticipates shortlisting the most qualified firms to move forward to the next phase. At that point, a formal Request for Proposal (RFP) will be issued.

WABTEC and INTERMODAL TELEMAT-

ICS B.V. (IMT), a Dutch-based rail telematics technology company, last month entered into an agreement that allows Wabtec to be the exclusive distributor of IMT’s telematics solutions for railcars in the major European freight markets. This agreement “leverages IMT’s technology and Wabtec’s presence to deliver smart, connected railcar solutions across Europe. It is a step forward in the Wabtec’s digital transformation strategy, aimed at providing fully integrated, data-driven solutions that optimize rail operations. By combining IMT’s telematics expertise with Wabtec’s in-depth knowledge of braking systems and rail technology, the two companies will offer their customers smarter maintenance, enhanced safety and improved operational efficiency.”

Watching Washington

Union Pacific + Norfolk Southern: What Comes Next?

Following weeks of “perhapses,” “maybes,” and a “conceivably” or two—self-serving bait for valuable feedback—railroads Union Pacific (UP) and Norfolk Southern (NS) have officially announced merger plans (p. 6).

BNSF and CSX have yet to signal a defensive strategy. And how CN—which previously stood outside the chapel watching rival Canadian Pacific (CP) wed Kansas City Southern (KCS)—reacts is another mystery. Not to be ignored is a rich history of “inconsistent merger applications,” by which snubbed brides ask the rail regulator—Surface Transportation Board (STB) in this instance—to order a menage-a-trois as a condition of the primary merger. That could occur with UP-NS or, if it occurs, BNSF-CSX.

Although the STB has exclusive authority under the law to approve or reject a railroad merger application, the law directs STB to “accord substantial weight” to comments of the Department of Justice’s Antitrust Division (DOJ).

It could be two years before the stereotypical fat lady sings as numerous pre-merger formalities must first be satisfied. Once the STB accepts a formal merger application, it has 15 months for evidence gathering and deliberation before issuing a final “yes” or “no”—unlikely before mid- or late-2027. (For more information on railroad mergers, visit the Merger Resources quick link on the STB website.)

An early problematic hurdle is avoided by the absence of a voting trust under which shares of the railroad to be “acquired” are placed with a neutral trustee, permitting the two railroads to operate independently while awaiting an STB decision on the merger application.

In 2016, when CP sought to acquire NS, DOJ said it had “serious competitive concerns” with the voting trust—the deal voluntarily scuttled ahead of STB deciding. In 2021, STB’s rejection of a voting trust derailed a CN-KCS merger attempt. The STB did, however, approve a voting trust ahead of the CPKC merger.

Handicappers’ Guide

If you wager on who votes how, consider: Chairperson and Republican Patrick J. Fuchs, 37, serving a second term expiring Jan. 14, 2029, is self-committed to “transparency,” to “follow the law” and assuring captive shippers “have access to markets on reasonable terms.” Coupling that to a voting record favorable and unfavorable to railroads, suggests he has no agenda—and is unlikely to adopt one given his relative youth and importance of preserving future opportunities in the public or private sector.

Republican Michelle A. Schultz, 53, whose first term expires Jan. 11, 2026, will require, if she is to cast a vote in 2027, a second nomination by POTUS 47 (who nominated her during his first term) plus Senate confirmation. Said to have a “cautious approach” to matters of first impression, Schultz has been in lockstep with Fuchs—for independent reasons and not political or “me-too,” say sources. She recently recommended, following listening sessions with attorneys practicing before the STB, a streamlining of processes and procedures to speed decision making.

Democrat Robert E. Primus, 55, is in his second and final (by statute) term that expires Dec. 31, 2027. He has had testy exchanges with rail CEOs, but a cordial one over service and operational issues with UP CEO Jim Vena. Primus’ thumb is perceived on the scales in favor of rail labor and against carrier harmonizing of headcounts based on

productivity improvements. At a rail labor gathering, he said, “Thank you for letting me represent you.” Primus, the lone “no” vote when the CPKC merger was approved in 2023, cited market-power concentration and concern that mergers “degrade working conditions, depress wages and impair or eliminate organized labor.”

Democrat Karen J. Hedlund, 77, whose first term expires Dec. 31, 2025, will require renomination by POTUS 47 (her first was by President Biden) and Senate confirmation if she is to cast a vote in 2027. She may consider retirement, but if a merger filing is made—merger decisions among the most significant of STB responsibilities—she might seek a second term. When recently asked about a rail merger, Hedlund said, “Bring it on.”

A fifth seat (to fill former Chairperson Martin J. Oberman’s vacancy) is open for a Republican nominee. There is no evidence POTUS 47—pro-business and anti-regulation—has an opinion on rail mergers. The Heritage Foundation-produced Project 2025, which POTUS 47 has followed closely, makes no mention of the STB or rail mergers.

Presidential politics still matters, as the STB chairperson serves at the President’s invitation and the President chooses nominees.

Notable is that few corporations are as closely aligned with Republican administrations. Ronald Reagan’s Transportation Secretary Drew Lewis became UP

Patrick J. Fuchs

Michelle A. Schultz

Watching Washington

chairperson and CEO. Andrew Card was George H.W. Bush’s Transportation Secretary and then George W. Bush’s chief of staff before becoming a UP Board member—as did Vice President Dick Cheney. A UP “funeral train” transported the casket of the elder Bush from Houston to College Station, Tex., for burial in 2018.

This balances against a current thinskinned President whose loyalty to others is transactional and never enduring. George H.W. and son George W. Bush were harshly evaluative of POTUS 47’s first term (20172021). George W. Bush neither endorsed nor supported POTUS 47’s 2024 reelection. Cheney publicly endorsed POTUS 47 opponent Kamala Harris. Well documented is that POTUS 47 does not forget slights.

Nonetheless, there appears no justification to presume STB Republican members are under White House pressure to vote other than as the evidence leads them independently.

New Merger Rules

Should the now announced UP-NS merger intent advance to a formal merger application before the STB, it will be the first decided under New Merger Rules adopted by the agency in 2001. The CPKC transaction was decided under an exception to those rules owing to KCS’s small size relative to other Class I railroads—the STB in 2001 saying a KCS transaction would “not necessarily raise the same concerns and risks as other

potential mergers between Class I railroads.”

The New Merger Rules increase applicant burdens to demonstrate the transaction is in the public interest and enhance—not simply preserve—competition. Said the STB in 2001:

“While further consolidation of the few remaining Class I carriers could result in efficiency gains and improved service, the Board believes additional consolidation in the industry is also likely to result in a number of anticompetitive effects, such as loss of geographic competition, that are increasingly difficult to remedy directly or proportionately. Offering some new or enhanced rail-to-rail competition or other competitive benefits is likely to be necessary to resolve substantial difficulties to tip the balance in favor of the public interest.”

CSX and NS, which in 1998 gained STB approval for joint acquisition of Conrail, later termed the 2001 New Merger Rules “apparent antagonism toward mergers.”

Competition enhancements might include constructing choke point bypass routes around Chicago and St. Louis; allowing segment rates where bottlenecks exist; offering reciprocal switching and trackage and traffic rights (the latter permitting freight solicitation); and demonstrating how train speeds will increase and terminal dwell times will improve. Advances in driverless trucks make cost savings and efficiencies from merger-created single-line service essential to improving the railroads’ competitive

position, as intermodal growth increasingly is essential to railroad financial health.

The New Merger Rules also require an assessment of “downstream effects.” Most obvious are responsive mergers creating an east-west transcontinental duopoly, although such already exists regionally (and in Canada). Also to be provided is a “service assurance plan” to cure unexpected hiccups during the merger transition.

Is the STB prepared? While its fiscal year 2026 budget request of $40.8 million is a $7 million cut, Fuchs cites cost savings from eliminating “wasteful” contracts, not filling attrition-created “non-core” vacancies, plans to implement artificial intelligence for repetitive tasks, and clearing out long-inlimbo cases.

Railway Age Capitol Hill Contributing Editor Frank N. Wilner was a White House appointed chief of staff to Republican STB member Gus Owen when the 1996 UP-Southern Pacific merger was approved. He is author of Railroads & Economic Regulation,” available from Simmons-Boardman Books, 800-228-9670.

FRANK N. WILNER

Capitol Hill

Contributing Editor

Robert E. Primus

Karen J. Hedlund

To Be Determined

Organic Growth or Doing More With Less?

Statistics indicate that married couples are better savers and do better financially than single people. It’s not over most married couples’ natural propensity to nest vs. the go-go life of a swinging single. Two people sharing one set of common expenses is more cost-effective and efficient than a single household. According to The Wall Street Journal, the median net worth of married couples between the ages of 25 and 34 is nine times that of similarly aged single households. That frees up more capital for fun (vacations and nice cars) and savings and therefore leads to the perception of a better quality of life. This is not true just for people, but for corporations as well.

The announcement that Union Pacific intends to acquire Norfolk Southern (p. 6) wasn’t the most surprising news wire in 2025. (That might be that the museum commemorating the great Johnstown, Pa., floods was closed due to … wait for it … flooding.) The buzz surrounding a possible transcontinental railroad merger was quite intense. UP’s initial announcement that it was in “advanced discussions” with NS could have been a product of confirmation bias, but more likely it was a response to a Presidential Administration that seems friendly to some kinds of business.

Jason Seidl, Wall Street Contributing Editor for Railway Age, noted that UP was reading the politics in the room and that this overture felt serious. Seidl said that UP was expecting the fifth STB board member to support a merger and that the railroad hired an investment bank to assist in the evaluation. He was correct! As long-time Financial Edge columnist Tony Kruglinski often said, “If they’re spending money, then I know they’re serious.”

It had become difficult to pick up any state of the rails summary that didn’t discuss the possibility of a transcontinental merger. Some were surprised by the target of NS over CSX, but that was just noise. The real news is that if the six Class I’s become five, how long will it be before there are four or even three?

In a similar yet completely different vein, in mid-June, GATX announced an acquisition of Wells Fargo Rail in

conjunction with Brookfield Asset Management. Over a period of ten years, GATX will have the option to acquire almost 100% of the Wells Fargo Rail fleet. This will make GATX the largest operating lessor of railcars and locomotives in North America and give them control/ ownership of 23% of the operating lessorowned railcar fleet.

Railcar operating lessor consolidation has been on a low simmer over the past decade. Some of the impetus has been a private equity infusion (directly or indirectly) into the railcar market; some has been the recognition that railcar prices (and rental rates for leasing cars) hadn’t exactly kept up with inflation.

After this transaction, there will be five railcar operating lessors with more than 100,000 cars, a couple with fewer than 100,000 and more than 20,000, and a larger group with 20,000 or fewer.

Here’s the point: North American rail is an incredibly mature industry that runs fluidly (more or less) over a continent. The industry frets and frets and frets again and again over growth. Mergers and acquisitions at lofty levels between some of the largest companies in a segment is about expense consolidation and reduction, efficiency and of doing more with less. It is rarely about increased prospects for organic growth.

Some people can convince (or con) themselves that a transcontinental railroad will provide better service. A railroad that can move intermodal across the country and avoid the Chicago interchange can be better at moving that freight. Ask most shippers what generally offers them better service and most would say having two railroads compete for the same business. Mergers promise improvements. North American rail hasn’t always delivered on those promises.

Mergers at these levels seem almost defensive as well as opportunistic. Like a married couple, the sum of two may deliver better financial reports together than separately.

Key differences between the mergers exist: A new railroad is not going to appear anytime soon. Generally, the existing

It has been difficult to pick up any summary that didn’t discuss a transcontinental merger. Some may be surprised by Union Pacific’s target of norfolk southern over CSX, but that is just noise. The real news is that if the six Class I’s become five, how long will it be before there are four or even three?”

track is all the track there is going to be. Railcar leasing is different than running a railroad. Even if the industry only intends to produce about 30,000 railcars in 2025, new railcars are easier to manufacture than new lines of track. Lessor consolidation at these levels can allow new entrants into the market that could steal market share from larger companies.

Both deals amplify the ubiquitous concerns about growth that have been and will continue to dominate the rail industry news cycle..

Got questions? Set them free at dnahass@ railfin.com.

DAVID NAHASS President Railroad

DEDICATED TO KEEPING YOUR WORLD MOVING.

For over 100 years, A. Stucki has been a driving force in the global railroad industry. We’re not just a manufacturer of parts we’re a trusted partner, providing comprehensive solutions to keep our nation’s railways safe, efficient, and reliable.

From humble beginnings as a small foundry, we’ve grown into a diverse company with expertise in every aspect of railroading. We design, manufacture, and supply a wide range of products from critical freight car components to innovative draft and braking systems.

Freight Car and Locomotive Parts

Our engineered solutions ensure that your fleet operates at peak reliability and meets the highest industry standards. Our product offering encompasses a complete range of rail car components to support the full spectrum of rail operations.

Maintenance of Way

Our single-source solution for a wide variety of maintenance needs includes essential track materials to specialized equipment. Our focus on both product excellence and customer support solidifies our position as a reliable partner in maintaining and improving railroad infrastructure.

Repair & Reconditioning Services

Our reconditioning and repair services help save money by prolonging the life of your essential rail components through expert maintenance and repurposing. By maximizing your investments and minimizing downtime, we keep your railcars rolling.

Engineering & Manufacturing

Our state-of-the-art facilities combine precision engineering with advanced manufacturing capabilities to deliver bespoke solutions and components that exceed expectations. We leverage cutting-edge technology to ensure exceptional quality and reliability.

LIGHT RAIL 2025

PRESENTED BY RAILWAY AGE AND RT&S

PLANNING, ENGINEERING AND OPERATIONS

OCTOBER 1 & 2

Fairmont Pittsburgh Pittsburgh, PA

Light Rail 2025 delivers a focused, in-depth look at the technical, environmental, and socio-economic challenges of planning and operating light rail transit (LRT) systems in today’s urban environments.

Who Should Attend Professionals in LRT planning, operations, civil and systems engineering, vehicle technology, and signaling.

Program Content Includes

• Major New-Builds and System Expansions

• Capital Program Management

• Extreme Weather Events: Planning and Mitigation

• Innovations in Rider Experience

• Alternative Propulsion Technologies

• Special Regional Tour

Connect with LRT professionals from around North America—register by 8/22 to save!

Speakers Include

Andy Lukaszewicz Deputy Chief Officer Rail Ops Pittsburgh Regional Transit

Casey Blaze Deputy Project Mgr.

Greater Cleveland Regional Transit Auth

Ida Posner COO Railroad Development Corp.

Justin Selepack Dir., Railcar Maintenance Pittsburgh Regional Transit

Nate Asplund President Pop-Up Metro, LLC

Rachel Burckardt, P.E. SVP/Sr. Project Mgr., Northeast Lead WSP USA

SPONSORS

Bryan K. Moore Project Mgr., Railcar Replacement Program

Greater Cleveland Regional Transit Auth.

John Mardente Civil Engineer, Passenger Rail Div. Federal Railroad Administration

Barbara M. Schroeder, P.E., P.M.P. Rail Transit Project Manager Benesch

annual winter prep report

Norfolk Southern works closely with its Class I peers to coordinate traffic flows and share resources during major winter events.

WARM-UP WINTER WEATHER

Railroads and suppliers use innovative technologies to counter the effects of sub-zero temperatures.

BY CAROLINA WORRELL, SENIOR EDITOR

Railroads are vulnerable to extreme weather conditions, and they need to prepare for winter’s onslaught well before operations and the flow of goods are affected. Innovative technologies are needed in critical areas of train operation and functionality. Several railroads and suppliers share with Railway Age how they ready themselves for sub-zero temperatures.

CANADIAN PACIFIC KANSAS CITY

“We pioneered railroading in the harsh Canadian winter,” CPKC tells Railway Age.

“Challenging weather conditions can have a significant impact on railway operations. Each year, across our North American network, we plan for the challenges associated with railroading in extreme weather to mitigate the impacts to the extent possible so that we can continue delivering for our customers.”

As part of CPKC’s winter weather contingency planning, the Class I analyzes weather data and meteorological models to forecast the type, severity, and geographical scope of anticipated winter conditions. While weather forecasts are not exact, they guide critical preparation efforts, CPKC noted. Winter plans are developed for each region,

rail yard, and facility across the network, while assets and resources such as snow removal equipment and sand are strategically placed to facilitate rapid responses to winter weather. Contingency plans also address Operations, Engineering, Mechanical, and Operations Center personnel.

“CPKC prioritizes winter preparedness to mitigate the significant challenges extreme weather poses to railway operations. Operational adjustments, such as implementing shorter train lengths in certain conditions, are required to maintain safety, which always must be the priority,” the Class I said. CPKC says it continues to invest in the people, equipment, and

Norfolk Southern

ANNUAL WINTER PREP REPORT

infrastructure needed to safely and efficiently transport traffic throughout the winter and all other seasons. For example, this year, CPKC is taking delivery of 100 new Tier 4 locomotives.

“Collaboration with customers complements these efforts by preparing facilities for winter weather. Safety here remains a cornerstone, with measures like snow and ice removal prioritized throughout the rail network.”

CSX

The CSX winter readiness strategy is a coordinated effort led by the Class I’s engineering and mechanical teams with a strong focus on employee and operational safety, CSX tells Railway Age. As winter weather can pose operational challenges for the transportation industry, CSX takes a proactive approach to seasonal preparedness to ensure its network remains resilient and safe.

This, CSX says, includes ensuring employees are ready for cold-weather conditions, aware of emergency procedures, and equipped with the proper personal protective equipment, such as boot spikes and thermal gear. Walking paths are routinely inspected for hidden hazards, and salt is strategically placed to mitigate slips and falls.

Rail infrastructure is inspected and winterized, and key assets like switch heaters, snow blowers, and generators are tested and staged for rapid deployment. During the spring and summer months, switch heaters are upgraded, and new heaters are installed at additional locations. This year, CSX installed more than 30 new heaters across its network in high traffic locations like Chicago, Indianapolis, Cincinnati, Louisville, and Philadelphia.

CSX’s preparedness strategy also includes exploring innovations that enhance winter operations, the Class I said. “We leverage advanced technologies, including dual electric and propane switch heaters, to effectively reduce

weather-related disruptions. CSX works closely with our customers and other railroads to coordinate traffic flows and maintain fluidity across our network during peak winter conditions.”

NORFOLK SOUTHERN

“As a Class I railroad, we know that winter weather can pose serious challenges to our operations. That’s why we take a proactive, systemwide approach that begins in the summer to ensure we’re ready to keep freight moving safely and efficiently—even in the harshest winter conditions,” NS tells Railway Age

“We install and maintain switch heaters across our network to prevent ice and snow from freezing critical track components. In areas prone to drifting snow, we use snow fences and windbreaks to reduce accumulation. We also prioritize drainage maintenance to prevent flooding and ice buildup from snowmelt.

“Our mechanical teams work ahead of the season to winterize locomotives and railcars. That includes inspecting and insulating air brake systems, using fuel additives to prevent gelling, and ensuring batteries and electrical systems are cold-weather ready. We also conduct cold weather testing on new equipment to ensure it performs reliably in extreme conditions.

“We use remote sensors to monitor track temperature, rail stress, and switch status in real time. In some areas, we deploy drones to inspect hard-to-reach or snow-covered infrastructure. Our predictive analytics tools (DTI portals and ATGMS technology) help us anticipate weather impacts and adjust operations before disruptions occur.

“When temperatures drop, we may shorten train lengths or adjust speeds to reduce the risk of break-apart. We also pre-stage snow removal equipment and mobile response teams in highrisk areas. Our dispatchers use contingency routing plans to reroute traffic around blocked

or congested corridors.

“We work closely with our Class I peers to coordinate traffic flows and share resources during major winter events. Through joint dispatch centers and data-sharing platforms, we stay aligned and responsive across the broader rail network.”

GENESEE & WYOMING

Winter preparedness across G&W’s U.S. railroads most impacted by winter weather (namely those in the Northeast and upper Midwest, as well as through South Dakota, Kansas, and Utah) begins in late summer/early fall with the following activities:

• Conduct industry audits to ensure the ground is free of debris that snow would otherwise cover up and cause a hazard.

• Pre-order supplies such as switch brooms, winter boots, hats, hand warmers and gloves.

• Dig out any dirt or mud that builds up on or near a switch, so the switch is less likely to freeze and is easier to operate when temperatures fall below freezing.

• Perform company vehicle audits to ensure compliance before winter.

• Ensure all switch heaters are in good working condition.

Just before the arrival of winter weather, G&W says it ensure there are salt buckets at the doorways and steps of the company’s office and depot locations and that switch brooms are available on locomotives.

“Our Safety Department reminds frontline employees of the importance of clothing layers and winter hydration,” G&W tells Railway Age. “Customer service sends an email to all customers with tips for winter preparedness; trainmasters communicate with interchange partners to ensure we have a good plan in place to avoid weather-related delays and congestion; and roadmasters communicate with snow removal contractors to ensure contracts are in place as needed.”

“In terms of actions related to interchanges, we increase communication with Class I partners, as well as the frequency of our interchanges with them,” G&W said. Some of this, the company adds, is due to increased business during this time but also to stay current on traffic and remain well prepared for weatherrelated disruptions and delays.

Examples of location-specific actions in the Northeast and Midwest include:

• Buffalo & Pittsburgh Railroad stages

Winter preparedness across G&W’s U.S. railroads most impacted by winter weather begins in late summer/early fall.

Genesee & Wyoming

programs, the company says, allow railroads to install necessary equipment in advance of the winter months and avoid unfavorable fuel costs and emissions.

Hotstart says its product line is “constantly evolving.” From minor product enhancements

that are more SCADA capable for remote operations, programming, and monitoring. “Most of our customers want open source for the SCADA package or that we incorporate the user’s package into our systems. Proprietary packages are not attractive. While our company is small, we are

designs that contribute to improved reliability and dependable performance—even in the extreme cold weather conditions.

To support operation in winter environments, NYAB Engineering— working with Knorr-Bremse’s Central

PERFORMANCE ON TRACK®

Buy

America

System Solutions for Future-Proof Networks

Nortrak is more than special trackwork. We offer in house design and manufacture of 100% Buy America compliant integrated railway system solutions featuring:

• special trackwork

• switch machines

• zentrak monitoring systems

• concrete ties

» » » » » » » »

• direct fixation fasteners

• resilient clips, pads and insulators

• premium rail

• engineering design services

Are you planning to upgrade your rail infrastructure or start a new project? Get in touch with your Nortrak Sales Professional to learn how we can assist you.

voestalpine Railway Systems Nortrak ww w.v oe st alpi ne.c om/ n ort rak

Keep all type and logos 1/2 inch from trim

ANNUAL WINTER PREP REPORT

Materials Laboratory—developed a new rubber compound for O-Rings and K-Rings, paired with Dow Corning Molykote M55 grease. This combination, NYAB says, delivers improved cold-weather durability, maintaining sealing performance at temperatures as low as –60°F. Testing shows the new compound retains performance up to four times longer than previous materials, with more than 12 times greater wear resistance. These enhancements, NYAB adds, are projected to reduce rubber-related failures and extend the usable life of brake system components by up to 60%.

WABTEC

Wabtec’s Train Analysis Tool is helping railroads identify and resolve problems. The Train Analysis Tool remotely collects key parameters from all the locomotives in a consist. Analytics are used to identify the root cause of issues impacting propulsion and braking performance. The results are presented to “Diesel Doctors” at the Wabtec’s Mechanical Help Desk as a “Sense.” Senses help a Diesel Doctor quickly identify the root cause of problems reported by the train crew and provide

WHEN

feedback on how to resolve them.

For example, to accelerate identifying frozen blowdown valves, Wabtec incorporated analytics in the Train Analysis Tool to provide a Sense when it detects a possible frozen unit. This new Sense, the company says, is expected to have a significant impact during the upcoming winter season.

“The future is bright for the Train Analysis Tool as it evolves Train Level Diagnostics,” Wabtec notes. “The ability to monitor the entire train and pinpoint problems for crew or responder resolution results in service interruption reduction opportunities such as UDE (undesired emergency brake application) detection and prevention.”

Frozen engine blocks and locomotive components are a recurring winter problem for railroads, Wabtec tells Railway Age. Locomotives will occasionally not dump coolant water in below-freezing temperatures due to various failure modes. When this happens, the water expands into ice and can cause catastrophic engine damage. In many cases, railroads can spend more than $1 million per year on freeze-related damages.

After an extensive investigation and follow-up lab and field testing, Wabtec has launched “new and improved” AL-X Water/Coolant Drain Valves that are significantly better performing for specific failure modes compared to legacy designs. The new valves are available in Standard (DL2.1) and SAE (Magnum) thread sizes and both variants are now equipped with dome style handles. According to Wabtec, AL-X Drain Valves provide much better tamper resistance and have a proprietary T-handle attached to a magnetic flag to provide a clear indication when a valve is disabled. The AL-X Drain Valves are a plug and play solution requiring no modifications to the locomotives and they can also be applied to EMD locomotives.

Wabtec says it has completed its first winter of biofuel testing with positive results around the use of biodiesel and renewable diesel blends in cold weather. Fuel temperature testing in Erie, Pa., and field testing in Canada have shown that B20 manufactured to the appropriate cloud point can be used down to –40ºC with appropriate petroleum diesel blends. Wabtec’s engine and locomotive biofuel upgrade kits will be available

ANNUAL WINTER PREP REPORT

in 2025 to support railroad decarbonization plans through use of up to B20 and R100. These kits, combined with Wabtec expertise, “can be used to support carbon reduction plans at railroads while maintaining operations even in cold weather,” the company notes.

Other technologies that Wabtec offers to help customers in winter operations include Advanced Rail Cleaner (ARC) Traction Antilock Braking System (TABS), and Sub-freezing AESS for increased fuel efficiency. Wabtec has been expanding its AESS solutions by developing new summer/winter algorithms to optimize fuel savings, shutdown time, and increase cold weather shutdown availability across customer platforms. “As AESS continues to increase fuel savings, it becomes even more important to protect lead acid batteries from failure,” the company said. “Cold weather can exacerbate battery problems leading to a locomotive’s failure to start. Wabtec’s new StartSaver ultra-capacitor system supplements the lead acid battery ensuring a successful locomotive start even in the harshest conditions. It also contributes to increased fuel savings with reduced battery charging time and lengthens the

life of batteries by 50%.”

In addition, Wabtec works with customers to evaluate commonly used winter components and performs analysis on a yearly basis. In preparation for winter, Wabtec adjusts inventory levels for the winter season to protect operations and reduce equipment unavailability.

RAILWAY EQUIPMENT CO.

RECo’s products, such as track switch heaters and remote monitoring systems, are designed to ensure smooth railway operations during harsh weather conditions, the company tells Railway Age. “With our remote monitoring capabilities you are able to troubleshoot remotely and know if your units are running as intended to ensure the switches stay clear during winter conditions.”

According to RECo, customers are increasingly seeking advanced monitoring solutions and energy-efficient products, reflecting a shift towards technology integration and sustainability. “There is also significant interest in our new redundant switch heater, which RECo has developed to use both Natural Gas/Propane and Electric, a first redundant system in the industry,” the company said.

There have been numerous installations of track switch heaters and remote monitoring systems in the past two years, enhancing winter preparedness for railways, RECo said. “We have seen a shift towards our GHAB Concentrator, which can aid in monitoring up to 12 switch heaters in one location, [feeding] this information back to the central office [and] providing realtime status updates on the heaters.”

RECo says it continually updates its products to incorporate the latest technology and improve efficiency, with new developments in remote monitoring and energy-efficient systems. “We have recently tested our first combo unit in two locations this past winter to optimize efficiency, as well as to improve fuel efficiency in remote areas,” the company tells Railway Age. “RECo is focusing on developing more sophisticated monitoring systems and eco-friendly heating solutions to meet evolving customer needs. We are particularly excited about test results of our new induction heating system and Combo units.”

FRAUSCHER SENSOR

TECHNOLOGY USA INC.

“Keeping a signaling system operating reliably in

Railway Equipment Co excels in manufacturing robust switch heaters, ensuring operational reliability and safety during harsh winter conditions. Our Sno-Net technology allows railroads to remotely monitor these heaters, providing maintenance teams with a crucial advantage during cold winter days and nights.

[extreme winter] conditions is obviously a priority for operators, since harsh weather can negatively impact systems that rely on shunting,” Frauscher tells Railway Age. “This significant problem can be alleviated by incorporating axle counters. Inputs to the system are provided via our IP68 rated wheel sensors that are immune to the effects of these conditions, providing robustness, high reliability and increased safety.”

“What our customers are asking for today is an answer that never changes. Every operator, whether freight or transit, has the safe operation of their signaling systems at the very top of their priority list—year in and year out. After meeting this basic need, in recent years operators have expressed the need for ways to merge and analyze data from various data points to better monitor their systems and gain the ability to recognize and fix issues before they cause issues,” the company said. “To meet this need, we have developed Frauscher Insights, an advanced diagnostic suite that recognizes and prevents potential failures at an early stage. It utilizes train detection data to enable warning and error messages on the dashboard and also provides an interactive track plan. This real-time display of system status makes fault detection more efficient, so that potential downtimes can be recognized at an early stage and possibly avoided.”

“Our recommendations for operators to properly prepare for the winter months is consistent from year to year. Addressing any concerns with individual trackside components by conducting required inspections or testing and maintenance where necessary is very important,” the company tells Railway Age. “The flexibility and compatibility of Frauscher systems allow for an individual unit to be replaced without replacing an entire line or system. For example, a track circuit that has previously had issues during winter weather can be replaced with two-wheel sensors that can be seamlessly incorporated into the track circuit system. Road salt, snow, ice and deteriorated track and ballast are particularly hard on some signaling technology. Inspecting the system before these conditions are present will allow needed replacements and fixes to be implemented before winter downtime events occur.”

“Our commitment to continuously develop products and services that meet the needs of the industry is nearly four decades old,” the company said. “The growing and ever-changing effort to digitize rail operations, with the resulting plethora of available information, provides exciting opportunities to use that information to improve rail operations.” Frauscher Advanced

ANNUAL WINTER PREP REPORT

Data Transmission FAdT is a versatile data transmission solution that can facilitate the exchange of any digital input-output data between different locations, supporting both vital and nonvital applications. It allows for the connection of various sensors and switches, bypassing the inherent limitations of each specific component. FAdT allows for the connection of any input or output device, supporting Ethernet-based transmission for a high-speed and reliable data exchange. Communication based on Frauscher’s proprietary protocol enables seamless data transfer between locations, or from a particular location to higher-ranking systems. “The FAdT is bidirectional, modular, expandable and scalable, empowering railway operators with greater flexibility. The robust hardware design ensures resistance to environmental conditions, resulting in a cost-efficient, durable, and reliable solution, even for winter use,” the company noted.

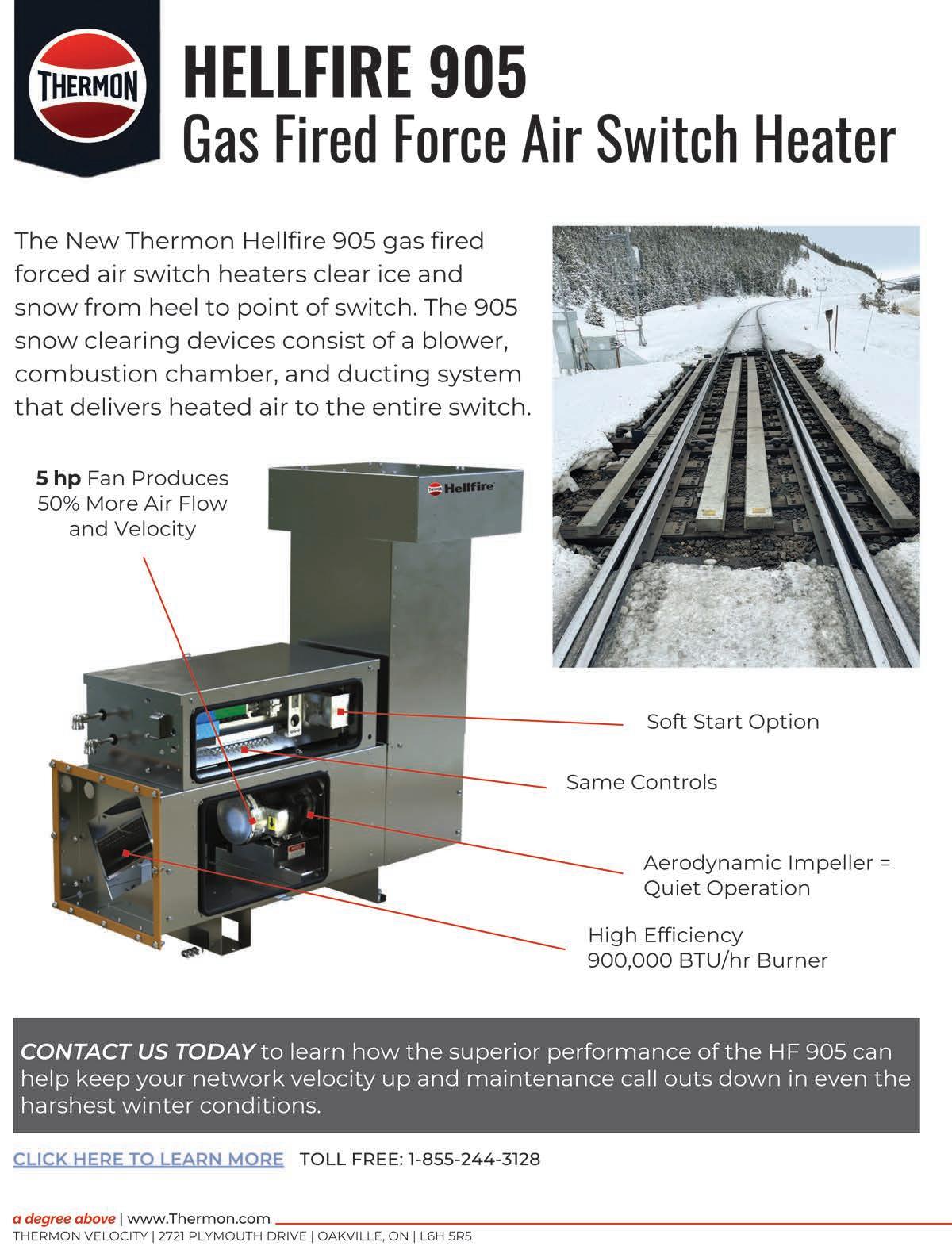

THERMON

Thermon’s array of snow-clearing devices are designed to reliably withstand even the harshest winter storms, the company tells Railway Age. By offering a variety of options such as electric elements, hot air blowers and high velocity ambient air blowers, “we ensure our customers have their selection of high performing products that are appropriate for their applications,” Thermon says. “Our SCD’s are designed with safety, efficiency and quality in mind to carry our customers through the winter and result in less maintenance, decreased down time and increased dependability.”

According to Thermon, buyers are looking for cost savings, decreased lead times and reliable quality products. “We have centralized our manufacturing to our San Marcos, Texas, facility to reduce costs, improve lead times and keep our

quality superior to our competitors. We continue to work closely with the railroads to exceed their expectations and keep costs down while delivering dependable products consistently,” the company notes.

Thermon says it urges customers to plan early and order material ahead of winter to prepare for any unforeseen roadblocks that may arise. The company is currently working on its next generation of Hellfire gas fired blowers with trials expected to take place this winter. “We are revolutionizing our current design to include updated components, expanded communication capabilities, OLED character display + organized status LEDs, and a new forward-thinking design. We will continue our innovation efforts to ensure we are always staying ahead of the curve with our customer’s needs.”

ZTR

ZTR’s KickStart technology is built to solve one of the most critical challenges in cold weather: reliable locomotive starts. Available in two variants: KickStart Starting Assist and the more advanced KickStart Battery and Starting Manager (BSM), the solution supports starting reliability, protects battery health, and helps railroads minimize costly downtime during winter. By reducing the need for idling to recharge batteries, KickStart also supports Automatic Engine Stop-Start (AESS) systems like SmartStart, improving sustainability and fuel efficiency during harsh weather.

ZTR has initiated KickStart BSM pilot programs with two Class I’s. These pilots, the company says, have focused on improving battery-related starting performance in challenging weather, with successful results in reducing cranking voltage drop and electrical charge ripple.

PDI’S PowerHouse™ Hybrid (U.S. EPA Smartway-verified) saves five to nine gallons of fuel per hour as compared to an idling locomotive.

TrinityRail® Delivering More Than Just Tank Cars

Tank cars play a crucial role in the supply chain. They are indispensable to modern logistics, enabling the safe and efficient transportation of a wide range of commodities. Today, TrinityRail is an industry-leading supplier of tank cars with a focus on design, manufacturing, maintenance, and other value-added services.

Our engineers focus on tank car designs that leverage a need for rigorous regulatory compliance, evolving product specifications, and innovative features to deliver a robust, high-quality car to move products safely and efficiently. Given the regulatory environment, we are active in industry and federal rule making bodies and apply focused, quality assurance processes throughout our tank car operations.

Innovation can be seen in the introduction of features such as a robust, service-proven draft sill, a highly configurable operating platform based on commodity and customer specific needs, coil systems to promote greater operational efficiencies, and new, ergonomic

safety appliances.

The manufacturing environment has changed significantly. In the 1980s, the railcar manufacturing industry went through a prolonged downturn with extensive consolidation and contraction. Our company, with a long-term history of operational flexibility and dedication, not only survived but prospered. By the end of the decade, demand had slowly returned and we had built industry-leading tank car manufacturing resources along with the beginnings of a service-focused view of the market. Since 1990 alone, we have produced over 220,000 tank cars, establishing TrinityRail as a leader in the tank car manufacturing space touching customers and building relationships throughout multiple tank car markets including the chemical, agriculture, and food products sectors.

The growth of the tank car market has also driven a need for repair and maintenance services to help tank car owners maximize fleet utilization and remain in compliance with industry regulations. TrinityRail combines full-service maintenance shops with growing on-site and fast-track operations along with a growing network of mobile repair units to provide greater touchpoints and capabilities for

our customers’ tank car maintenance needs. We have also seen the expansion of automated technologies to enhance quality control and employee safety. Earlier in 2025, as part of the American Chemistry Council’s Responsible Care® Awards Program, we were proud to be presented with a Product Safety Award for the Tersus Robotic Tank Car Cleaning System.

TrinityRail identified the challenge of minimizing confined space entry in hazardous tank car cleaning operations. To address the issue, the Tersus system was implemented which effectively removes residual commodities from tank cars without requiring personnel to enter confined spaces. This enhances workplace safety while efficiently cleaning and preparing tank cars to return to service.

Leasing with TrinityRail provides access to one of the largest fleets in North America with over 140,000 owned and managed railcars. In addition to leasing’s financial benefits, you can better manage your fleet by being more responsive to changing business conditions, commodity requirements, and the regulatory environment. You also gain access to TrinityRail’s comprehensive line of pressure and non-pressure tank cars and extensive in-house engineering and fleet management expertise. A growing supply of tank car parts are available as well as on-site operational assistance and training.

Tank cars are continuously moving products across North America including hazardous commodities. To help ensure these products are moved safely and responsibly, solutions are being developed to help drive greater insight and clarity into tank car logistics. For more than forty years, rail shippers have been increasingly relying on software and services from RSI Logistics to make their rail shipping simpler, more efficient, more insightful, and more cost-effective. Rail solutions from RSI include railcar tracking and management software, rail rate analysis software, rail logistics services, rail terminal services, rail data and insights, and yard management. Access to real-time, actionable data to optimize and visualize your supply chain and better manage your tank car fleet has never been greater. Learn more about our tank car products and services at www.trinityrail.com.

Tank car maintenance and support from TrinityRail Mobile Repair

STABLE MARKET— FOR NOW

North America’s tank car fleet is relatively young. Regulations, though tricky and challenging,

should benefit carbuilders, component suppliers and lessors.

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

Tank cars, the second-largest railcar group in the North American fleet after covered hoppers, represent the most diverse commodity base in

railroading. They are their own ecosystem, with a whopping 854 STCC (Standard Transportation Commodity Code) designations. Chemicals and Refined Products represent the largest subgrouping of the

commodity groups, each with more than a half-million loads annually.

Tank car designs have mostly stabilized after the post Lac-Mégantic period of evolution and redesign. The replacement

Bruce Kelly

rate is approximately 8,000 cars annually, excluding regulatory requirements to phase out older, hazmat-carrying cars. In 2024, approximately 10,000 new units were built.

Regulatory issues remain on the table, among them HM-246, governing veryhigh hazard-commodities, mostly TIH (Toxic Inhalation) commodities such as chlorine, anhydrous ammonia and ethylene oxide. More regulatory changes fall under the FAST Act, such as HM-251, governing hazardous flammable liquids

TANK CAR SPECIAL REPORT

like crude oil and ethanol. There is potential for regulation acceleration in the wake of East Palestine.

Tank car regulations are tricky and challenging, but should benefit carbuilders, component suppliers and lessors. The U.S. and Canadian governments enacted legislation updating the phaseout date of all tank cars used for transport of flammable liquids, except DOT-117J (new) and DOT-117R (rebuilt) cars, to May 1, 2029. The phaseout is applicable to loaded and residue shipments.

According to U.S. DOT Hazardous Materials Regulations, all jacketed and unjacketed legacy Class 111s, as well as jacketed and unjacketed enhanced Class 111s (also called CPC-1232s), will be prohibited from importing, offering for transport, handling or transporting unrefined petroleum products, ethanol, and Class 3 flammable liquids in Packing Group I. Under Transport Canada’s Containers for Transport of Dangerous Goods by Rail standard, the same restrictions apply for Packing Groups I, II and III.

New legislation affecting tank cars is the OBBBA (One Big Beautiful Bill Act), which significantly impacts the Section 45Z Clean Fuel Production Credit, extending the credit period, modifying feedstock requirements and clarifying rules related to Foreign Entities of Concern (FEOCs). Specifically, the OBBBA extends the sale deadline for eligible fuel under Section 45Z to Dec. 31, 2029. It also introduces stricter domestic feedstock requirements for fuel produced after Dec. 31, 2025, limiting eligible feedstock to that produced or grown in the U.S., Mexico or Canada. Additionally, the OBBBA introduces restrictions on FEOCs claiming the credit, with specific rules for entities related to or conducting significant transactions with FEOCs, impacting various clean energy credits including 45Z.

For this report, Railway Age asked tank car market stakeholders for their longterm view on the tank car market. What types will be in demand and why? What is the regulatory outlook? The equipment finance perspective?

“The rental market for tank railcars is the most service oriented of any operating lessor dominated railcar leasing market,”

says Railroad Financial Corp. President and Railway Age Financial Editor David Nahass. “That’s not exactly news—it has been that way for some time. However, as the cost of maintaining a tank car continues to rise, that dynamic continues to favor lessors who can provide the necessary levels of service to their customers.

“What specifically has changed? The regulatory process and record-keeping requirements provide lessors an opportunity to flex their financial muscle and expertise to the benefit of their customers. Specifically, the ten-year required recertification process for all tank railcars, HM-216, is costly, and shop availability can be sporadic. Railcar end users need to maintain technical and operational expertise to handle the process in a timely, efficient and cost-effective manner. Having a lessor partner to help with the process is a draw for end users.

“Overall, the rental market for tank cars continues to remain relatively robust even as the market has seen some limited pockets of weakness. There is anecdotal evidence that rates have retreated from loftier highs of late 2024, but there is fundamental strength underpinning the market that is unlikely to dissipate in the near future. There are a few core reasons for this:

1. “Tank railcar supply is running below at the rate of replacement.

2. “The replacement cycle for cars included in HHFT (high hazard flammable trains) is not yet completed.

3. “Growth in the chemicals loadings segment (chemicals, along with petroleum and petroleum products are the largest commodity groups for tank railcar use).

4. “Even with modest annual production of new tank railcars, tank railcar prices remain elevated vs. prepandemic prices.

“The industry has handled the HM-216 bubble well—better than many people expected. Tank railcar supply remains consistent, so expectations for a downturn in rates should be tempered. The costs of tank railcar maintenance seem to be rising more rapidly than the cost of new cars; that would suggest continued opportunities for lessors to provide high-level service to customers and to maintain strong leasing

margins into the near future.”

At Railway Age’s Rail Insights 2025 conference, Nahass spoke with Katherine Suprenuk, President of Leasing and Manu facturing, Union Tank Car Company & Procor (a Marmon/Berkshire Hathaway Company), about the tank car market. “We’ve talked about circumstances that might change the demand cycle and potentially be drivers for increased build ing of new cars,” Nahass said. “Addition ally, we see fleet attrition in many classes of assets due to the aging of cars. Can you imagine a time where, because of having had low backlogs for some time, we

observed. “Even with the tariffs and other economic related uncertainty, the economy seems like it’s poised for a downturn. We’re not sure, but are we seeing it to some degree in the plastics market as an example? Do you see continued strength through the remainder of the year in the chemicals segment, or will we see economic weakness cause a little bit of a pullback?

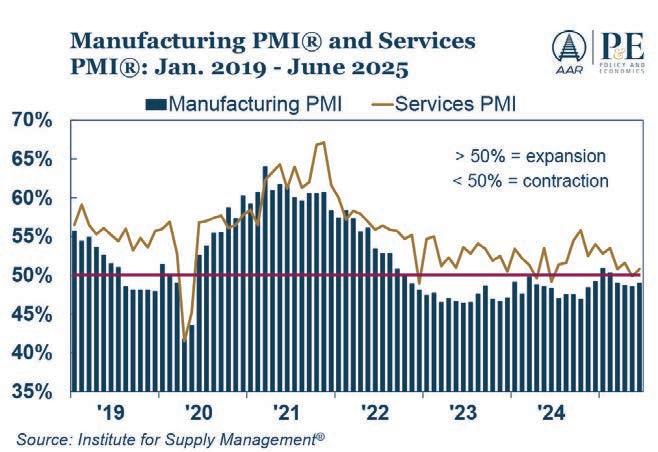

“Chemicals are very relevant for tank cars,” Suprenuk said. “Half of tank car loaded moves comes from chemicals. We do watch that closely, and you’re right, that has been a relative bright spot in the loadings profile for things moving in tank cars. But the year-over-year growth we’re seeing is about one percentage point year to date, which is more modest. Generally, I believe it should be positive in 2025, but the growth may wane to some extent. Looking at the broader economic context, there’s other indicators that are showing signs of contraction in manufacturing. The PMI (Purchasing Managers Index) has been signaling a slowdown for the past several months. GDP (Gross Domestic Product) and IP (Industrial Production) forecasts show modest year-over-year growth. All this points to continued fragility in overall demand, which if it continues could soften chemicals to some degree. But I still think for the year, it’ll probably be up vs. last year.”

“Are there notable regulatory initiatives under way that could shape the tank car market and have an impact on all the things we’ve been discussing?” Nahass asked.

“There’s one area that could have a significant impact on the industry in a positive way: HM-265, which addresses hazardous materials regulations. Last year, PHMSA (Pipeline and Hazardous Materials Safety Administration) put forth a notice of proposed rulemaking (NPRM) that proposes revising the hazardous materials regulations. Union Tank Car, through the RSI (Railway Supply Institute), submitted input through the normal comment process as we usually do, and that will help shape the regulations, aiming overall to increase efficiency while maintaining safety standards that we have. With this evolving NPRM, there are a couple of areas related to deregulation of authority that RSI would like to see included in a final rule. One relates to quality assurance programs for tank car repair shops. The other has to do with tank car design approvals.”

“As for existing quality assurance programs, the AAR owns and enforces them. The proposal is that we allow tank car facilities to adopt any established quality assurance program and still be subject to audits against that program, giving them more flexibility. This would align the AAR with what is already in place at Transport Canada. As for tank car designs, currently they require approval by the AAR Tank Car Committee. On the table is making it acceptable to use ‘design-certified engineers’ instead of the existing AAR approval process. Both these changes, if implemented, would promote efficiency and innovation. The tank car supply industry is quite supportive. We view these changes to be in alignment with the objectives of the current Administration, and we hope that PHMSA continues to make HM-265 a priority and push it forward.”

“The tank car fleet is young, so replacement will play less of a role in tank deliveries than regulatory and commodity growth drivers,” says TrinityRail Chief Commercial Officer Charley Moore. “Deliveries for HM-251 and HM-246 compliance are

“We view the long-term tank car outlook as stable, led by replacements.” – The Greenbrier Companies, Inc. Vice President of Marketing and General Manager Tom Jackson.

ongoing, and tank cars move key commodities integral for North American Energy Transition, like soybean oil, renewable diesel and acids. Regulatory requirements have been a big driver in new and existing tank car demand over the past several years. Shippers continue to make progress in complying with HM-251 and HM-246. In addition, qualification requirements for existing tank cars are a big driver of elevated maintenance events and costs for shippers and lessors. As well, we have seen strong interest for telemetry within the tank car fleet. Given the sensitive

nature of some of the commodities moved in tank cars, increased visibility to location, temperature, etc., can give tank car shippers a competitive edge.”

“We view the long-term tank car outlook as stable, led by replacements, with some modest growth at roughly 10,000 units annually for the next five years,” says The Greenbrier Companies, Inc. Vice President of Marketing and General Manager

Tom Jackson. “One of the key areas driving this growth is renewable feedstock, particularly from seed oils such as soybeans. Our confidence in this outlook was further bolstered by the recent passage of the 45Z tax credit within the OBBBA on July 4. While we do not foresee major growth catalysts like those experienced during the Ethanol Boom or the Crude-by-Rail eras, this stability is beneficial from a builder’s planning perspective, as it allows us to avoid significant production ramp-ups and ramp-downs.

“Additionally, we are expecting modest growth in the Pressure tank car segment. Of the 450,000 tank cars in service, General Purpose (GP) tanks make up 80% of the total, while Pressure tanks comprise the remaining 20%. Interestingly, we expect the Pressure segment to outpace the growth of GP tanks over the next five years. This anticipated growth is largely driven by the regulatory phase-out deadline of May 1, 2029, for other flammable liquids in Packing Groups II and III.”

“The tank car fleet is young, so replacement will play less of a role in tank deliveries than regulatory and commodity growth drivers.” – TrinityRail Chief Commercial Officer Charley Moore.

FREIGHT RAIL

AI EVOLUTION

Artificial Intelligence is a controversial subject—though not for railroads when it comes to safety, if used properly.

BY JOANNA MARSH, CONTRIBUTING EDITOR

The North American freight rail industry needs multiple technologies informed by artificial intelligence and machine learning to counter and address the complex needs of the vast North American rail network, sources told Railway Age. The railroads are responsible for monitoring 1.6 million railcars and more than 26,000 locomotives traveling on 140,000 of railway track located in diverse terrain, and AI-informed technologies ranging

from ultrasounds and electromagnetics, to drone-based inspection systems, optical-based systems and LIDAR, help to do just that.

“When we talk about the railroads— and this is true for applications in other fields, like in aerospace or pipeline or any industry—not everything can be inspected, mainly because there is a lot of variability in the equipment part,” said Anish Poudel, a Principal Investigator II with MxV Rail’s nondestructive evaluation team. Poudel is involved in testing

AI-informed technologies at MxV Rail. And that’s why “we rely on multiple technologies to kind of overcome the limitations of one technology versus another. So there is always a benefit of using multiple technologies that will allow you to see things differently,” he said.

AI’S EVOLUTION IN FREIGHT RAIL

The use of AI and machine learning in the freight rail industry has been well under way for quite some time. For instance, among the Class I

ADVANCED TECHNOLOGY

MvV Rail’s LTTS TrackEi™ Optical broken rail detection system, currently under evaluation at FAST under the AAR SRI rail inspection technology program. It uses Machine Vision technology on an edge computing device coupled with deep neural network architecture to intelligently capture visual defects using cameras and characterize it using AI/ML algorithms.