MORE THAN RAILCARS A PARTNERSHIP PURPOSE-BUILT FOR YOU

At FreightCar America, every relationship begins with collaboration, transparency and a fully accessible team ready to serve you. We take a customer-centric approach, working alongside you, from the design of your railcar to supporting you long after the sale. Innovation is woven throughout the FreightCar America experience. By listening closely to your needs, we create tailored solutions that enhance the efficiency of your operations and keep you on the track to success.

We’re proud to be Purpose-Built for You.

Primum Non Nocere

When I started freshman year at Essex Catholic High School, Newark, N.J., in September 1973, Latin had been dropped as a requirement. Though it’s the basis for many modern “Romance” languages—Italian, Spanish, Portuguese, French, Romanian, etc.— and is widely used today in scientific, legal and medical terminology, Latin is not a spoken language in daily life. One Latin phrase, though, is supposed to be applied to Surface Transportation Board merger decisions. This phrase is critical to the massive Union Pacific-Norfolk Southern proposed transaction, undoubtedly to date the most consequential of STB considerations.

Many doctors and nurses know the Latin phrase primum non nocere—“first, do no harm.” Associated with the Hippocratic Oath, it emphasizes avoiding actions that could cause more harm than good, and is a reminder to carefully consider potential risks and benefits of any medical action. The core idea is to prioritize patient safety by making thoughtful decisions that protect a patient from unnecessary risk.

The “patient” in this case is the North American railroad industry. The “doctor” sworn to practicing primum non nocere is the STB. On Nov. 28, BNSF filed with the STB for a separate proceeding “to examine, with remedies, its allegations that UP has a history of not honoring competitionenhancing commitments such as it agreed to in 1996 when merging with Southern Pacific,” notes Capitol Hill Contributing Editor Frank N. Wilner. “BNSF says such an investigation must come ahead of evaluating

the UP-NS merger application so as ‘to prevent further degradation’ of competitive options. BNSF says a longer timetable to permit a separate investigation is appropriate because STB precedent, ‘since time immemorial,’ prevents ‘old harms’ from being evaluated as part of merger application review. BNSF cites comments to that effect by now-retired STB Chairperson Martin J. Oberman in 2022 during agency review of the approved merger creating CPKC.

“Alleged by BNSF is a UP ‘pattern of obstructive conduct’ toward pro-competitive conditions imposed by STB in approving the 1996 UP-SP merger. That conduct, says BNSF, has systematically interfered with its ability to compete as was intended. Among BNSF’s examples of UP ‘obstructive conduct’ are giving ‘preference to its own trains’ at the Eagle Pass, Tex., Mexico border crossing; its claim of ‘exclusive use of new sidings’ at Baytown, Tex. (Houston region); and its ‘discriminatory dispatching’ of trains.

“Specifically, BNSF wants the STB—ahead of its review of the UP-NS merger application—to investigate ‘UP’s harmful conduct since the UP-SP merger; enforce the rights granted to BNSF to preserve competition; and modify the conditions of the UP-SP merger approval decision, as the Board deems necessary, to ensure customers are not further harmed by UP’s ongoing efforts to stifle, and its failure to preserve, competition.’”

More observations are on pp. 10 and 14. As we wind down a tumultuous 2025 and brace for a roller-coaster ride in 2026, all the best for a safe, peaceful, happy Holiday Season.

WILLIAM C. VANTUONO Editor-in-Chief

Railway Age, USPS 449-130 (ISSN 0033-8826), is published monthly with a special C&S Buyers Guide issue in December by the Simmons-Boardman Publishing Corporation, 1809 Capitol Avenue, Omaha, NE 68102-4905. Tel. (212) 620-7200. Periodicals postage paid at Omaha NE and additional mailing offices.

Subscriptions: Qualified individuals in the railway industry may request a complimentary subscription. All other subscriptions: US/Canada/Mexico; $100.00 per year. Rest of World $139.00 per year. Single copies $36.00 per issue.

For Subscriptions & address changes, please call (US, Canada & International) +1-847-559-7372, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com or write to: PO Box 239, Lincolnshire IL 60069-0239 USA.

COPYRIGHT© 2025 Simmons-Boardman Publishing Corporation. All rights reserved. Contents may not be reproduced without permission. For reprint information contact PARS International Corp., 102 W. 38th Street, 6th floor, New York, NY 10018, Tel.: 212-221-9595; Fax: 212-221-9195.

POSTMASTER: Send address changes to Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA

AILWAY GE

SUBSCRIPTIONS: 847-559-7372

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200

www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

JENNIFER McLAWHORN

Managing Editor, RT&S jmclawhorn@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Dan Cupper, Alfred E. Fazio, Justin Franz, Gary Fry, Michael Iden, Don Itzkoff, Bruce Kelly, Pauline Lipkewich, Joanna Marsh, David Nahass, Jason Seidl, Ron Sucik, David Thomas, Frank N. Wilner

Art Director: Nicole D’Antona

Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors

Kevin Smith

ks@railjournal.com

David Briginshaw

db@railjournal.com

Robert Preston rp@railjournal.com

Mark Simmons

msimmons@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 847-559-7372

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

Industry Indicators

‘RAIL INDICATORS POINT TO CAUTION AMID MANUFACTURING SOFTNESS AND FED EASING’

“The U.S. economy enters November on uneven footing,” the Association of American Railroads reported last month. “Equity markets have seen record highs, buoyed by strong tech earnings and recent Fed rate cuts, but consumer confidence has been slipping and manufacturing remains mixed at best—AI and data centers are surging, but traditional sectors like autos and construction are not. Freight rail traffic likewise is uneven: Grain and metals shipments are up, while intermodal volumes and automotive carloads have fallen. Against this backdrop, the industrial economy shows resilience in select areas even as broader growth faces headwinds from labor market strains and household budget pressures.

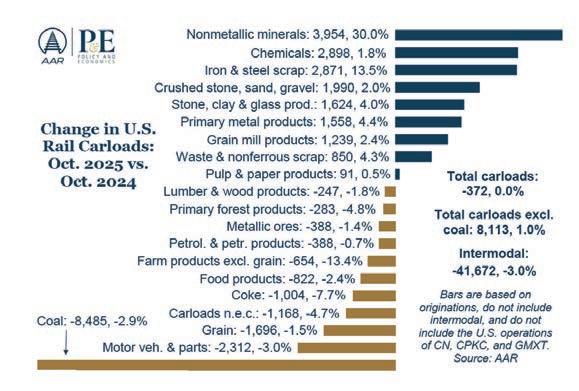

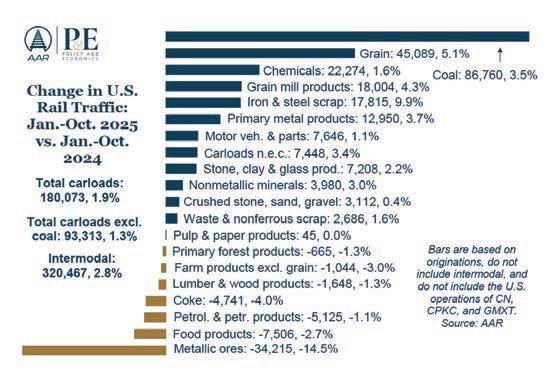

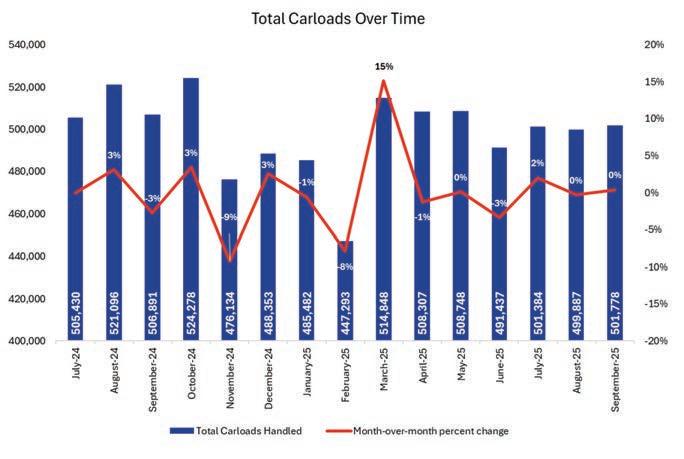

“In October 2025, total U.S. rail carloads were down a fraction (–0.03%) from October 2024, and 11 of the 20 major rail carload categories posted year-over-year declines. However, several key industrial commodities—including nonmetallic minerals, chemicals, and iron and steel scrap— saw gains.

“Total carloads averaged 225,547 per week in October, more than the weekly average for the first ten months of the year (222,273). Year-to-date total carloads through October were up 1.9%, or more than 180,000 carloads, over the same period in 2024. In 2025 through October, 13 of the 20 carload categories the AAR tracks saw year-overyear gains.

“U.S. rail intermodal shipments fell 3.0% in October 2025 from October 2024—the third year-overyear decline in the past five months for intermodal and the steepest percentage drop since August 2023. Historically, October is one of the strongest months for intermodal traffic: in the 25 years from 2000 to 2024, it was among the top three months for average weekly intermodal volume in 20 of those years. It won’t be this year: October’s weekly average of 273,747 units has already been surpassed by four other months. Still, that’s not a bad weekly average: it’s the 26th best month in our records (442 months) and it’s the fifth best average for October in history.

“October’s decline—and similar drops in two of the prior four months—reflect a combination of manufacturing malaise, a shift in consumer spending toward services, and front-loaded shipping patterns, all of which undercut what is normally a strong seasonal period for intermodal. Year-to-date intermodal volume through October was 11.94 million units—up 2.8% (over 320,000 units) over last year, the most since 2021, and the third-most ever.

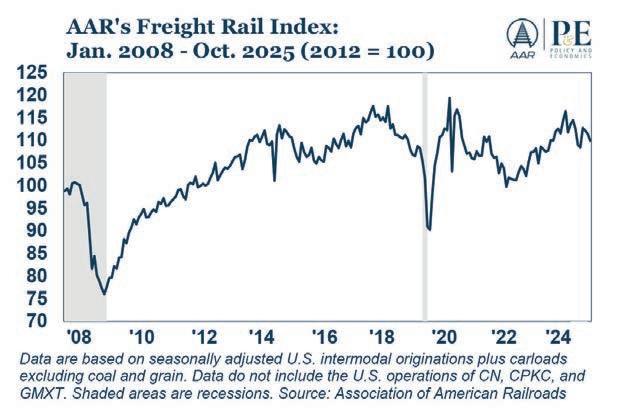

“The AAR Freight Rail Index measures seasonally adjusted month-to-month rail intermodal shipments plus carloads excluding coal and grain. As such, it is a useful gauge of underlying freight demand tied to industrial production and consumer goods flows. The index fell 1.4% in October 2025 from September 2025, its sixth decline in the past seven months. The index is 1.5% below its level from a year earlier.”

Industry Outlook

For Amtrak, ‘A Year of Records’

AMTRAK CLOSED ITS FISCAL YEAR 2025 (FY25, OCT. 1 2024 – SEPT. 30, 2025) ON SEPT. 30 WITH “RECORD RIDERSHIP AND REVENUE—marking another year of growth and strong performance, “underscoring the growing demand for Amtrak across the United States,” and “achieved alongside improvements in the customer experience, reinforcing Amtrak’s commitment to quality service as the foundation for future growth.”

Amtrak noted it provided 34.5 million customer trips, “setting all-time records for both ridership and revenue for the second consecutive year” and “through deliberate planning and thoughtful execution, increased network capacity by 4.3% despite the challenges of an aging fleet, and customers responded with a strong demand for quality service, driving revenue that outpaced ridership.”

Amtrak listed its preliminary FY25 results:

• Ridership: 34.5 million customer trips, a 5.1% increase over FY24 and a record.

• Adjusted Ticket Revenue: $2.7 billion, a first in Amtrak’s history and 10.4% higher year-over-year.

• Total Operating Revenue: $3.9 billion, a 9.1% increase over FY24. This figure includes payments from state partners for State Supported routes.

• Customer On-time Performance: Northeast Regional trains reached their highest on-time performance in recent years this September.

• Customer Service: Surpassed systemwide customer service goals, with historical bests in Wi-Fi, food and beverage, train status communications, and station signage.

• Miles Traveled: Amtrak passengers logged 6.9 billion miles in FY25, a new alltime high.

• New Services, New Trains: “Made history” with the launch of Amtrak Mardi Gras Service along the Gulf Coast and NextGen Acela on the Northeast Corridor; Borealis service drew more than a quarter million riders in the Midwest since its FY24 debut.

• Capital Investments: Record $5.5 billion, up nearly 25% year-over-year, in major projects and state-of-good-repair initiatives.

• Adjusted (Unaudited) Operating Earnings: Improved by 15.1% over FY24 to ($598.4 million), “on track to achieve train operational profitability by FY28.”

Throughout FY25, Amtrak said it “focused on running a great railroad, delivering reliable, high-quality service that earned customers’ trust. On-time performance closed the year on a high note with September showing the strongest gains thanks to a strong focus on operational performance, improved infrastructure reliability, and better scheduling. New car wash facilities in Seattle, Boston, New Orleans and Chicago boosted cleanliness, while faster terminal turn times and improved communications enhanced the travel experience. These efforts reflect Amtrak’s commitment to listening to customers and investing in solutions that matter.”

“Amtrak experienced unprecedented demand across its network, serving more riders than ever. This surge was felt across all service lines: the convenience and frequency of the Northeast Corridor continued to drive financial performance, State Supported services such as the Pacific Surfliner, Amtrak Cascades, Borealis, and Empire Service

achieved record gains, and Long-Distance routes saw increased capacity and strong ridership on iconic trains like the California Zephyr, Sunset Limited, and Coast Starlight.

Amtrak Guest Rewards also surpassed 20 million enrolled members, who now represent more than half of all riders.

“To meet the rising demand for train travel, Amtrak expanded its network by introducing new service and expanding options across the country. Amtrak Mardi Gras Service launched between Mobile, Ala., and New Orleans, carrying more than 18,000 riders in its first month and restoring Gulf Coast service for the first time in nearly 20 years. Borealis service between the Twin Cities and Chicago carried nearly a quarter million riders in its first full year, fueling a 227% year-over-year surge in corridor ridership since its FY24 launch.

“Fleet modernization accelerated with the launch of NextGen Acela, America’s newest high-speed train, which welcomed more than 60,000 riders in its first month of service. This milestone is part of a broader transformation that includes the shipment of the first Airo trainset from Siemens’ Sacramento facility for testing in Pueblo, Colo., the rollout of new Long-Distance locomotives, and interior upgrades across the Superliner fleet.

“Amtrak invested a record $5.5 billion in FY25 capital projects, a 24% increase over the previous year. This includes $1.1 billion for track, catenary, signal and structural maintenance, plus progress on major bridge, tunnel and station projects like the Portal North Bridge, Connecticut River Bridge, East River Tunnel, and William H. Gray, III 30th Street Station in Philadelphia. Rail yard upgrades to support the new Airo fleet advanced in Seattle and along the East Coast. Station modernization and Americans with Disabilities Act (ADA) compliance efforts, which included more than $182 million invested in FY25 alone, continued nationwide, making rail travel more accessible to millions.

“Looking ahead, Amtrak will continue rolling out NextGen Acela, debut Airo trains, and continue delivering reliable and customer-focused service. Strong financial performance in FY25 keeps Amtrak’s passenger trains on track to achieve operational profitability by FY28.”

William C. Vantuono

Proven Technology with Advanced Performance

Meet the GRM4000 : a heavy-duty, high-performance production & switch tamping machine with a double-tie unit. Enhanced throughput, up to 3,400 ft/hr reduces crew needs with the option to attach an autonomous stabilizer. Its ergonomic controls, AGGS & ATLAS automation, and smart weight distribution for road or rail transport, the GRM4000 delivers precision and peak efficiency. Upgrade to tomorrow’s tamping today.

HIGH CAPACITY I PRECISION I RELIABILITY

NJT Slates $917MM Multilevel I, II Overhauls

New Jersey Transit’s 429 Alstom (originally Bombardier)-built Multilevel I and II railcars are approaching 20 years of service and due for a recommended mid-life overhaul. NJT on Nov. 12 proceeded with its fleet modernization efforts as the agency’s Board of Directors authorized $917 million to overhaul the fleet. Funding not to exceed $917,058,512.41, plus 10% for contingencies, was authorized to overhaul NJT’s fleet of 329 first-generation Multilevel I vehicles, delivered between 2006-2009, and 100 Multilevel II vehicles, delivered between 2012-2013. An Expression of Interest (EOI) process “will be used to identify qualified rail vehicle overhaul contractors with proven experience in large-scale commuter railcar mid-life overhaul programs,” the agency said. “The EOI process will invite contractors to submit their qualifications, capabilities, and relevant project experience. Based on the evaluation of EOIs received, NJT will develop a list of contractors that will be invited to participate in the final procurement and contract award stage.”

NJT said the scope of work includes, but is not limited to, “ensuring the cars are in a state of good repair and improving the systems to ensure their reliability, and compatibility and interoperability with new Multilevel III vehicles, supplied by Alstom; enhancing passenger comfort with upgraded amenities and features to match Multilevel III vehicles such as USB charging ports; and promoting sustainability with energy-efficient systems and materials where feasible.” The contract award will be made in early 2026, according to NJ Transit President and CEO Kris Kolluri. The rebuilds will take 10 years, with an estimated completion in 2036.

ADVANCED POWER DYNAMICS

INC. (APD), a rail engineering company based in London, Ontario, signed a C$296 million contract with EGYPTIAN NATIONAL RAILWAYS to rehabilitate and upgrade 180 freight locomotives. “This program will bring a significant fleet of legacy Henschel and AdTranz locomotives back into reliable freight service,” APD said. “It will anchor Canadian expertise in a long-term rail-modernization effort in Egypt, supporting localization of

maintenance and spare-parts manufacturing in partnership with Egyptian industry, and create sustained engineering, projectmanagement and supply chain activity from our base in London, Ontario.”

THE LOS ANGELES COUNTY METROPOLITAN TRANSPORTATION AUTHORITY awarded CLEVER

DEVICES a contract for the Advanced Transportation Management System II (ATMS II) dispatching and vehicle

location program. The technology will be implemented on more than 500 railcars and 2,400 buses. Clever Devices will deploy a suite of cloud-hosted solutions, including CleverCAD, LMR and VoIP, Disruption Management, Real-Time Passenger Information and Reporting solutions, that will replace the previous ATMS I system, initially installed in 2004. The ATMS II project, the company noted, “will bring new and enhanced functionality to operations at LA Metro.”

William C. Vantuono

BUILT TO DELIVER

Watching Washington

Is a UP-NS ‘Fix’ In? Don’t Bet on It!

Union Pacific (UP) CEO Jim Vena’s September pilgrimage to the Oval Office—where Republican POTUS 47 picked his corporate pocket for a cash contribution toward a $300 million White House ballroom—has unjustly sullied the reputations of Surface Transportation Board (STB) Republican members rather than assure regulatory approval of a UP-Norfolk Southern (NS) merger. The STB, with a Republican majority, has sole statutory authority to approve the transaction.

Although the President said the proposed merger “sounds good to me,” and notwithstanding his being transactional—every interaction in expectation of a trade—the STB is independent of the Executive Branch.

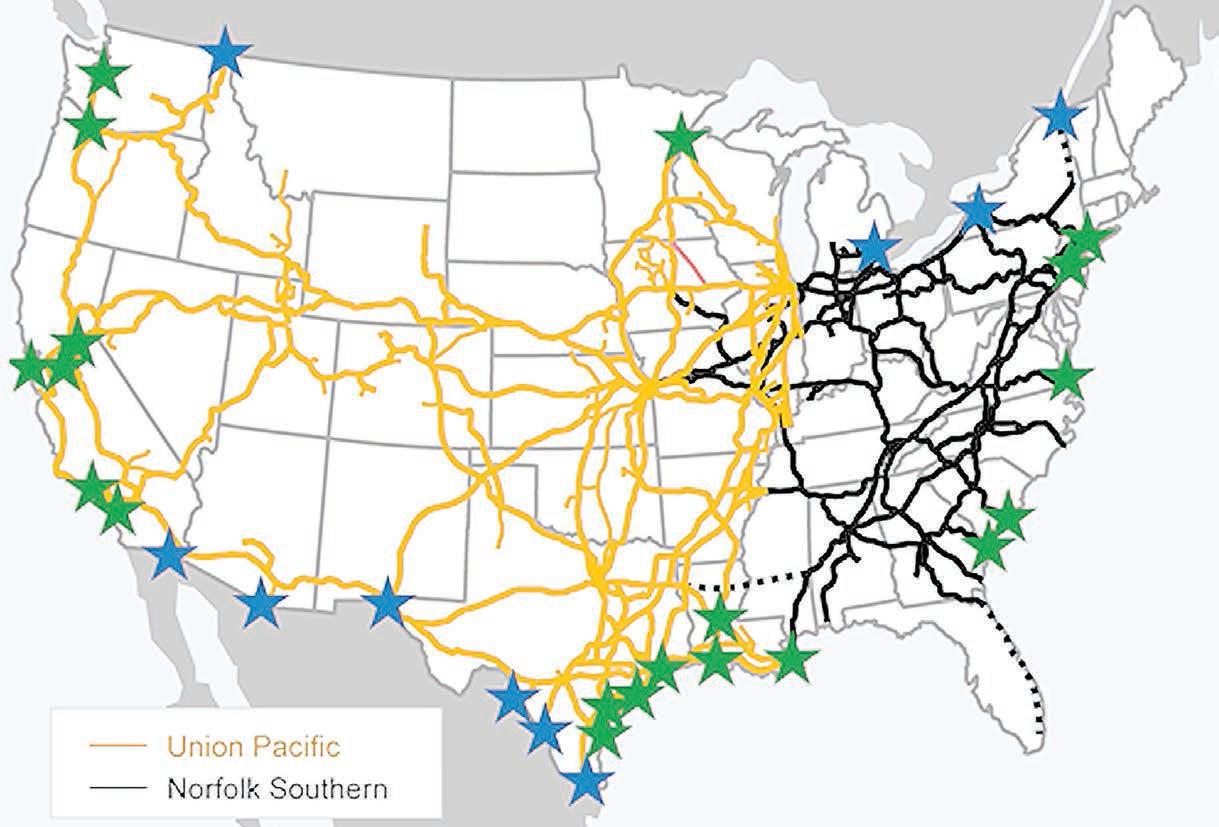

Beyond Vena denying a quid pro quo, those alleging his “gift” assures a “fix” are ignoring contrarian evidence. Today’s Republican Party embraces a populist ideology opposing concentrations of corporate power. Consider that a UP-NS merger will create the only U.S. Atlantic-Pacific railroad, with an enterprise value of $250 billion, dwarfing rival CSX’s $83 billion value and some 50% greater than that of BNSF (estimated, as BNSF is not publicly traded).

This isn’t to say the merger won’t or shouldn’t be approved. It is to say that even infamous mobster and outcomes-fixer Otto “Abbadabba” Berman, were he alive, couldn’t manipulate STB decision making.

The artificial intelligence supported record reinforcing this merger decision will be the most data-driven in the agency’s history. Collaboration is under way with the Department of Transportation’s John A. Volpe National Transportation Systems Center in Cambridge, Mass. Its data analysts, economists, mapping experts, mathematicians and statisticians will work with STB quantitative and legal experts to evaluate, with particularity, every submission of applicants and opponents. STB members will be deciding this merger in the brightest of sunlight.

Studied will be years of traffic flows, interchange commitments, impacts on joint facilities, track capacity, opportunities for (and effectiveness of) competitive access, and measurements of shippers’

Studied will be years of traffic flows, interchange commitments, impacts on joint facilities, track capacity, competitive access, and measurements of shippers’ transportation alternatives.”

transportation alternatives. An ill-defined common carrier obligation may gain amplification.

“Board members well know that this record will be reviewed by the courts, regardless of the outcome,” said retired STB Chairperson Martin J. Oberman in November in defense of non-partisan STB staff and the decisional independence of his former and still serving Republican colleagues— Chairperson Patrick J. Fuchs and Michelle A. Schultz—whom he recalls always parked their political leanings elsewhere.

Conspiratorial claims simply fail validation given shifting Republican orthodoxy.

In an Oct. 30 speech to the Charlie Kirkfounded Turning Point USA, Vice President J.D. Vance said, “I really worry about concentration in the corporate sector. I worry about big corporate monopolies. I worry that when you have only one or two companies dominating an entire sector, it’s bad for liberty and it’s bad for prosperity.”

In an April 28 speech at the University of Notre Dame Law School, Assistant Attorney General for Antitrust Gail Slater spoke against “the tyranny of monopoly,” recalling the consolidated market power of 19th century railroad and grain-elevator operators that “deprived farmers of fair, competitive returns for their crops.” Significantly, the 1995 ICC Termination Act instructed STB to give “substantial weight” to competition-related recommendations of the Justice Department’s Antitrust Division.

Additionally, numerous conservative Republican senators with close ties to POTUS 47—lawmakers who vote on STB budget requests—urged in an Oct. 30

letter to the STB “a rigorous and comprehensive evaluation not just for its potential short-term efficiencies, but for its ability to demonstrate clear and tangible long-term improvements in competition.”

Then there are the Aug. 19 CNBC remarks of POTUS 47’s Commerce Secretary Howard Lutnick, who observed “partnerships” might also deliver seamless transcontinental rail service, adding, “That’s not our issue. I’ll leave that to the regulators.”

Vena says he is “99.999% sure” the STB will approve the merger. He’d best be wagering on the strength of a yet-to-befiled formal merger application—not the bombast of a widely considered narcissist POTUS whose attention span is shorter than the length of stub track.

Railway Age Capitol Hill Contributing Editor Frank N. Wilner was assistant vice president, policy, at the Association of American Railroads and a White House appointed chief of staff to Republican STB member Gus Owen, who voted in favor of the 1997 UP-SP merger. He is author of “Railroads & Economic Regulation,” available from Simmons-Boardman Books, www. railwayeducationalbureau.com/product/ railroads-economic-regulation-an-insidersaccount/, 800-228-9670.

FRANK N. WILNER

Capitol Hill

Contributing Editor

‘We Need a Little Rate Cut Now’

The H olidays always bring the classic tussle between Ebeneezer Scrooge (preghosts) and Santa. In the holiday spirit, Santa (or the true spirit of the holidays) always wins out. (Don’t agree? Name a Holiday movie without a happy ending.) Unfortunately, in the non-cinematic world, reality often gets in the way.

The Federal Reserve Board of Governors is set to have the Federal Open Market Committee meeting on Dec. 10. The markets are atwitter (yes it was a word before the social media) about what the Fed may or may not do. Will it be a holiday joy or holiday horror?

The members of the Board seem split, and this is reflected in the market’s probability estimates of a cut moving from 90% to 40% to 75% over a few weeks. (Those of you reading this after Dec. 10 may already know the answer.) It’s a tough job in the moment as the economy fritters between growth, inflation and stagnancy. The choice by the Fed will certainly leave some constituency unhappy.

Generally, the industrial economy is bearing the brunt of a kind of weakness that has led to a great amount of uncertainty about 2026 and its prospects. Strip the rail economy of the low volume cha-cha-cha being played 24/7 as the industry waits for Union Pacific to file its STB application for the acquisition of Norfolk Southern, and there’s not much to be dancing about.

Recent conversations with supply chain professionals across several industrial commodity shippers suggests that many do not see a rebound until late 2026 (best case) or more likely 2027.

The numbers and fact pattern are bearing this out. With new railcar orders for 3Q25 languishing at just over 3,000 cars, it’s difficult to feel anything remotely bullish.

Jason Miller, the Eli Broad Professor in Supply Chain Management at Michigan State University, recently noted in a LinkedIn post about Home

Depot’s earnings that the mix of three bold factors—a significant slowdown in YOY sales, a slower pace of inventory turnover and a decrease in gross margins—indicates underlying market weakness and tariff related malaise. Furthermore, Home Depot offered no guidance for when demand may begin to accelerate.

Mr. Miller also points out recent downward revisions by the Federal Reserve to the index of Industrial Production that lowered August 2025’s numbers to levels not seen since February 2020. The IP numbers posted by the Fed reflect both industrial output and prices.

Need more holiday cheer? The Journal of Commerce reports that western borne shipping capacity from Europe is at peak volumes, the import slump from Asia due to earlier-in-theyear frontloading continues, and truck carriers are shrinking inventory of available (over) capacity to maintain pricing at today’s already low levels.

It is difficult to anticipate tariff clarity in the next six to nine months. If the Supreme Court rejects the current tariffs, expect 80% of them to be rerouted through other channels and be reinstated. Expect a 2026 push into the reshaping of USMCA with a possible scrapping and redrafting of the entire agreement still on the table. That will lead to continued uncertainty

and trepidation about investment.

The news is pretty grim, which from an outsider’s perspective does not lend credence to the railroad mega-merger as creating opportunities for growth. It continues to feel like a consolidation of earnings power without growth (cha-cha-cha). As Paul Denton, retired President and CEO of the Maryland Midland Railway, noted in his recent Railway Age opinion piece, “Fancy wording and expensive lawyer briefs dangled in front of the STB are window dressing. Ask any short line CEO or former rail shipper about ‘benefits’ from any prior rail merger.”

As the carol goes, maybe we just “need a little Christmas now” from the Federal Reserve. The consumer has propped the economy for some time now, and while the wealth gap mixed with stock market growth continues to support affluent spending, no amount of commodity fetishism can fill the gaps in the industrial economy. Consumers are pivoting to discount retailers and buying on early bargains. Anticipated holiday shopping growth YOY is expected to peak at 2%.

Even with its trepidations about the state of the labor market and the higher-than-targeted inflation, the Fed will likely hear the caroling in the hallways and give the gift that they hope will keep on giving: “Yes we need a little discount, need a little step down, we need a little rate cut now,” and provide the juice the economy seems to need. Onward to a better 2026.

Happy Holidays to you and your families and best wishes for a healthy and successful 2026.

Got questions? Set them free at dnahass@railfin.com.

DAVID NAHASS President

TRACY ROBINSON President & CEO CN

KEITH CREEL President & CEO CPKC

MARK GEORGE President & CEO Norfolk Southern

PATRICK FUCHS Chair STB

MICHELLE SCHULTZ Vice Chair STB

JOHN ORR EVP & COO Norfolk Southern

MARYCLARE KENNEY SVP & CCO CSX Transportation

CARL WALKER VP Engineering CSX

DAVID SHANNON General Manager RailPulse LLC

BUILDING A BEHEMOTH?

For most if not all of 2026, the industry will be preoccupied with the proposed Union Pacific-Norfolk Southern U.S. transcontinental merger.

BY WILLIAM C, VANTUONO, EDITOR-IN-CHIEF, WITH WALL STREET CONTRIBUTING EDITOR AND TD COWEN MANAGING DIRECTOR – INDUSTRIALS, AIRFREIGHT &

SURFACE

TRANSPORTATION JASON SEIDL

By now, we’ve all heard the often-repeated “standard,” practically boilerplate reasons why a merger of Union Pacific and Norfolk Southern into a coast-to-coast U.S. transcontinental megarailroad—a behemoth of unprecedented size and scope—would benefit human civilization: Freight shipments abandoning the highways for rail! Fewer interchanges! “Seamless” service! Improved service! Faster transit times! Less traffic congestion! Reduced greenhouse gases! Rail volume growth! More rail volume growth! Eroding market share reversed! A stronger economy! Happy employees! Improved safety!

There’s probably a good deal of truth to these potential benefits—but realistically, not to the degree that advocates of this merger would like us to believe. For sure, the good people at UP and NS will bust their collective butts getting things right, but history tells us that hiccups are inevitable. We can only hope that those busting their butts won’t bust a gut if the hiccups morph

into severe abdominal cramps. I’m not talking about a wholesale disaster, like the collapse of the Penn Central in 1970. That was a different time—and in the long run it led to major beneficial changes, like partial deregulation under the Staggers Rail Act of 1980. But let’s not forget the meltdown that occurred when UP acquired Southern Pacific.

At this writing in late November, the merger application is yet to be filed, but the voices of the opposition have been turning up the volume. This is understandable. A transaction of this size is bound to have some negative effects, particularly to other railroads. Those who expect to be caught in the megarailroad maelstrom will demand concessions, which the STB, I believe, will order as a condition for approval.

“The Surface Transportation Board should condition any approval on enforceable service quality metrics, strong gateway protections, guaranteed short line interchange access, transparent pricing and clear penalties for service

failures,” said U.S. Department of Transportation Infrastructure and Transportation Advisory Board member Brigham A. McCown, a former federal official, in a recent editorial.

“These guardrails are essential, not optional, to ensure competition is preserved and shippers benefit from the efficiencies promised.”

“The artificial intelligence supported record reinforcing this merger decision will be the most data-driven in [STB] history,” Capitol Hill Contributing Editor Frank N. Wilner notes in this month’s Watching Washington (p. 10). “Collaboration is under way with the Department of Transportation’s John A. Volpe National Transportation Systems Center in Cambridge, Mass. Its data analysts, economists, mapping experts, mathematicians and statisticians will work with STB quantitative and legal experts to evaluate, with particularity, every submission of applicants and opponents. STB members will be deciding this merger in the brightest of sunlight. Studied will be years of traffic flows,

Charles J. Granite City, Illinois

Matt L. Kansas City, Kansas

Jeremy E. Hammond, Indiana

Daniel M. Sahagún, Mexico

Guadalupe M. Fountain Inn, South Carolina

Tammy S. Camp Hill, Pennsylvania

Justin L. West Chester, Pennsylvania

2026 FREIGHT RAIL OUTLOOK

interchange commitments, impacts on joint facilities, track capacity, opportunities for (and effectiveness of) competitive access, and measurements of shippers’ transportation alternatives. An ill-defined common carrier obligation may gain amplification.”

If the merger goes through, then what? One industry veteran tells me BNSF and CN are already considering their options, and one of them will have to be first out of the departure yard with an offer to acquire CSX. It could turn into a competition, much like Canadian Pacific and CN engaged in over Kansas City Southern. CPKC, one of the most vocal critics of UP+NS (see Jason Seidl’s commentary, following), won’t need to seek a merger, I believe. The first and only North American single-line transnational, with its Canadian transcontinental system and north-south alignment into Mexico, can stand on its own.

is the STB’s guiding principle. The UP/NS application will be the most difficult mission the agency has ever undertaken. More on p. 2.

JASON SEIDL: ‘90%

CHANCE OF APPROVAL’

Looking back at the building of the original transcontinental railroad in the 1860s, the most impressive aspect was that it took just six years to complete, with immigrant labor laying nearly 1,800 miles of track and blasting 15 tunnels using mostly hand drills, black powder and nitroglycerine. Compare that to the maligned Big Dig in Boston, which took a decade longer to reach completion, was confined to a single city and was completed with modern machines and technology. Now, the railroad industry is facing the potential of combining two railroads into one coast-tocoast transcontinental operation in the U.S.

As backers and opponents line up to face off over the potential benefits and potential drawbacks, pundits abound to weigh in on

My thoughts around a 90% chance of the deal being approved by the STB have been in print for quite some time. We are confident that the Board will do a thorough job of evaluating the deal. This prognostication is also dependent on two things: 1) the White House’s desire to get a deal done will likely play a pivotal role, and 2) the UP does an excellent job of making sure it can create competition for those shippers losing options with a potential combination.

Lately, most of the news coming out about the deal has been on the negative side. This makes sense as we are at the stage of UP wrapping up its application, which easily includes hundreds of (but likely well over one thousand) letters of support from rail constituents. This lull has enabled most of the news to be on the negative side. Indeed, recently we saw a letter from a coalition of state attorneys general (Florida, Iowa, Kansas, Mississippi, Montana, North Dakota, Ohio, South Dakota and Tennessee)

tial merger. This group of AGs cautioned the

2026 FREIGHT RAIL OUTLOOK

STB that a potential UP/NS combination would create too much market concentration, thereby leading to reduced competition for rail supply chain constituents. They warned of issues with higher pricing, lower reliability and reduced innovation. While missteps from prior mergers have clearly provided enough backing for anyone to question how a proposed merger may impact reliability over the integration period, it may be harder to draw a straight line to the issues of higher prices and reduced innovation.

Since 2004, railroad pricing has risen every year, driven early on by renewals of longterm legacy contracts. Recently, rail pricing increases have been subdued by the longest downturn the trucking industry has seen in more than three decades. Eventually, the trucking industry should recover, but the rail industry must find a way to compete over the longer term. For this to happen, the rail industry must embrace innovation, not reduce it.

We wrote an extensive report on the very topic of growth for the rail industry in June. The report purposefully read as an open letter

to the industry, in which we urged it to focus on growth. We continue to believe the pathway to growth remains very viable for the rail industry. It must focus on delivering a consistent service product, increasing the ease of doing business and improving supply chain visibility. Opening new services in watershed areas will likely add growth, but if the railroads fail to follow through on those three items, long-term industry growth will likely return to underperforming the major economic indices.

The next six months will be pivotal for the deal, with the obvious first step of an application. The acceptance of an application with limited STB pushback would be a good first step for UP/NS. However, we expect there to be a fight from many in the industry led by Class I’s (CPKC and BNSF have been by far the most vocal critics), shipper associations (National Industrial Transportation League, American Chemistry Council, and Freight Rail Customer Alliance, to name a few), politicians, and some unions—although we note that UP has reached agreements with Brotherhood of Railway Carmen, International Brotherhood

of Boilermakers, National Conference of Firemen and Oilers, and SMART-TD.

We remain convinced that the STB will do a thorough job of evaluating the deal. While the Board will not be rushed, we do expect it to focus on the task in as much of an expedited manner as possible. Indeed, Chairman Patrick Fuchs has long said his No. 1 priority is to increase the accountability of the Board. The Chairman has acknowledged that the STB has a long-standing reputation of being too slow and somewhat inaccessible. Thus far, the current Board has shown productivity improvements over historical standards. Hence, if an application is presented to the Board in early December, we believe a review will be completed by the end of first-quarter 2027, with either four or five members voting on it (we fully expect Dick Kloster to be confirmed and believe there is a chance former Board member Robert Primus may return as well via court challenges). Until that time, we expect lots of news flow surrounding the deal and note that anything or everything could impact our current 90% prediction.

We’re current, are you? FRA Regulations

Mechanical Department Regulations

FRA News:

There are no new proposals or final rules to report for this issue. Be sure to check back next month to see if there are any changes to FRA regulations.

Railroad Operating Rules & Practices

49 CFR 217 to 218. Part 217: Purpose, Application, Definitions, Penalty, Operating Rules, Program of Operation Tests and Inspections; Program of Instruction on Operating Rules, Information Collection. Part 218: General Blue Signal Protection of Workers, Protection of Trains and Locomotives, Prohibition against tampering with safety services, Protection of occupied camp cars. Softcover. Spiral bound. Part 217 updated 7-31-25, Part 218 updated 7-1-25. BKROR Railroad Operating Rules & Practices $16.00

50 or more and pay only $14.50 each

Part 240–Qualification and Certification of Locomotive Engineers

This book affects locomotive engineers, trainers and supervisors. This final rule will clarify the decertification process; clarify when certified locomotive engineers are required to operate service vehicles; and address the concern that some designated supervisors of locomotive engineers are insufficiently qualified to properly supervise, train, or test locomotive engineers. 162 pages. Spiral bound. Updated 7-31-25

BKLER Qual. and Certif. of Loco. Engineers $17.95

Order 50 or more and pay only $16.15 each

Part 242–Conductor Certification

The Conductor Certification rule (49 CFR 242) outlines details for implementing a Conductor Certification Program. The FRA implemented this rule in an effort to ensure that only those persons who meet minimum Federal safety standards serve as conductors. Softcover. Spiral bound. Updated 7-31-25

BKCONDC Conductor Certification $16.00

Order 50 or more and pay only $14.50 each

Part 220: Railroad Communications

49 CFR 220. Minimum requirements governing the use of wireless communications in connection with railroad operations. Includes prohibitions, restrictions, and requirements for cell phones and other electronic devices. Softcover. Updated 7-1-25

BKRRC Railroad Communications $10.95

Order 50 or more and pay only $9.90 each

PASSENGER RAIL FOCUS

SUCCESS STORY

Jan. 16, 1864, marked the first day for passenger rail service between San Francisco and San Jose. Who knew that 160 years later, on Sept. 21, 2024, Caltrain would be operating electric trains along that same route?

“Now that we’re electrified, we’ve seen our ridership and our service increase with 104 trains a day, half-hourly weekend service,” said Brent Tietjen, External Affairs Manager for Caltrain. Indeed, this past September marked the one-year anniversary of electric

trains running on the corridor from San Francisco to San Jose. While Union Pacific still operates on parts on the segment and Caltrain’s diesel trains might run under certain circumstances, elsewhere Caltrain is “100% electric” and running on renewable power, according

Newly electrified, Caltrain is operating 104 trains per day with one million monthly riders.

BY JOANNA MARSH, CONTRIBUTING EDITOR

to Caltrain Public Information Officer Dan Lieberman.

The new Stadler US-built electric multiple-unit (EMU) trainsets offer amenities welcoming to the weary commuter, such as free Wi-Fi, power outlets at every seat and onboard

displays with digital trip information. But strong weekend travel is what has given Caltrain a boost in its ridership. Monthly ridership broke one million in September for the fourth consecutive month; for fiscal year 2025, which ended June 30, ridership was up 47%

over the previous fiscal year.

Weekend travel “is higher than it has ever been in Caltrain history,” as riders take advantage of a new offering of halfhourly weekend service, Lieberman said. “It’s just making it really easy to get around.” Caltrain also serves seven major league sports teams, tying with the New York Metropolitan Transportation Authority for having those connections.

EASING INTO ELECTRIC

Groundbreaking for infrastructure improvements to allow electric trains to run began in 2017, but the design feedback process ran from 2016 to 2019. The manufacturing and testing phase took place from 2020 to 2024.

Getting the political will to provide funding was “a major lift,” Lieberman said. Caltrain experienced smooth sailing after those first initial steps, although putting up hundreds of miles of AC catenary 20 feet above an active railroad was also a challenge, he said.

Caltrain purchased 23 seven-car bilevel KISS EMU trainsets (161 railcars) from Stadler US as part of the Caltrain Modernization Program, with options for 55 more. In addition to these, there is one four-car bilevel BEMU (batteryelectric multiple-unit) for use between Tamien and Gilroy.

KISS is an acronym for “Komfortabler Innovativer Spurtstarker S-Bahn-Zug,” which translated from German means “comfortable, innovative, sprint-capable suburban train.” Each EMU has a power output of 7,000 kW (9,387 HP).

“Although the Stadler bilevel EMUs are a proven product in Europe and have been in service overseas for several decades, these will be the first to be deployed in the U.S.,” Stadler said in September 2023. “Caltrain’s new Stadler trainsets will serve as the foundation for the first modern, electrified railroad in California.”

Stadler US built the trainsets at its facility in Salt Lake City, Utah. After construction, they underwent testing in Pueblo, Colo., at TTC Operated by ENSCO, where they were eventually certified by the Federal Railroad Administration for passenger service. Caltrain then began revenue service

PASSENGER RAIL FOCUS

operations in August 2024. “We did a soft launch in August of 2024. Two trains out every week,” Tietjen said. “We were happy with how smooth that transition went.”

Since the EMUs began running, Caltrain has experienced significant fuel and emissions savings, according to Lieberman. “We’re actually paying less than we did for diesel fuel at the moment,” he said.

The trainsets’ regenerative braking system has been returning about 23% of the power they receive from the electric grid. In October, Caltrain announced that its two primary power providers, San Jose Clean Energy and Peninsula Clean Energy, will allow it to qualify for a net billing rate starting in April 2026. This means that Caltrain could receive approximately $1 million annually for the clean power it sends back to the grid.

This financial benefit came about because of California AB (Assembly

Bill) 1372, which qualified regenerative braking from electric trains to be considered as a renewable electric generation facility.

“Electrification has completely transformed Caltrain.”

– Executive Director

Michelle Bouchard

FUTURE PLANS

While the electrification of the San Francisco-San Jose line for commuter rail service is largely complete, Caltrain

is still working to potentially electrify its network south of San Jose. Its purchase of the BEMU from Stadler US for the Gilroy spur used funding from the state of California, with the condition that Caltrain would lend the trainset to other corridors to experiment with electric power, according to Lieberman. “If we can help other localities decide to get these beautiful, modern trainsets, we’re very excited to help,” he said.

Stadler US in December 2024 signed an agreement with Caltrain to supply on-site technical support, maintenance management software implementation, full materials management for both preventive and corrective maintenance, and diagnostic assistance. The contract also allows both parties to opt-in the BEMU pilot train into this agreement, Stadler said.

Capital projects beyond electrification include plans to connect to downtown San Francisco via tunnel. According to the San Francisco County

Transportation Authority, the downtown Portal project will extend Caltrain and future California High-Speed Rail service from the 4th and King rail yard to the Salesforce Transit Center. The project, expected to be completed sometime in the 2030s, includes construction of a new underground station at 4th and Townsend streets. The Transbay Joint Powers Authority is responsible for the project.

Caltrain is also working on safety issues related to grade crossings, including deploying artificial intelligence to prevent incidents, according to Tietjen.

“Electrification has completely transformed Caltrain,” Executive Director Michelle Bouchard said in September. “We’re delivering cleaner, faster, more frequent service, and riders are responding in record numbers. This first year has shown what’s possible when we invest in sustainable rail, and we’re only just getting started.”

PASSENGER RAIL FOCUS

The Most Well-Timed Book!

Upon the heels of the proposed UP-NS merger, Frank N. Wilner shares his inside account of the development, failures, and successes of railroad economic regulation. Spoiler alert: It ain’t perfect.

Join Wilner, former White House-appointed chief of staff of the Surface Transportation Board, as he weaves through the pivotal decisions that helped shaped the economic environment railroads face every day. Spoiler alert: It ain’t over yet.

Don’t lose out. Order your copy of Railroads & Economic Regulation today!

“Frank Wilner has written an exhaustive history of our nation’s railroads and the complicated, intriguing and often confusing federal regulation and lawmaking.”

- Nick Rahall Member of Congress (West Virginia, 1977-2015)

“As a new member of the Surface Transportation Board, the book would have been indispensable to me. It places today’s regulatory issues into context based on their history and paints a picture of the characters who have made the railroad world what it is today.”

- Debra L. Miller Member, Surface Transportation Board, 2014-2018

Caltrain passengers like the service frequency, as well as the onboard amenties like free Wi-Fi.

SMOOTH SURFACES

Suppliers ensure users can continue to rely on tough yet resilient grade crossing surfaces to perform under heavy rail and road traffic.

BY CAROLINA WORRELL, SENIOR EDITOR

There are numerous ways to surface a highway/rail grade crossing—concrete, rubber, composite, and timber—to withstand the long-term pounding of heavy trains while providing a safe, smooth, jolt-free ride for motor vehicles. Following is a roundup of offerings from suppliers who responded to Railway Age’s inquiries about how they are continuing to innovate and improve on grade crossing surfaces.

ENSCO, INC.

ENSCO, Inc. operates the Federal Railroad Administration (FRA) Transportation Technology Center (TTC) in Pueblo, Colo.. In cooperation with partners

AtkinsRéalis and the University of South Florida’s Center for Urban Transportation Research (CUTR), ENSCO is working with industry to establish the FRA Grade Crossing Testbed (GX Testbed)—a flexible, real-world environment for evaluating grade crossing surfaces, warning systems, and communication technologies.

The GX Testbed, ENSCO tells Railway Age , will support government and industry research aimed at improving grade crossing safety through advancements such as reliable communication between motor vehicles and rail equipment, known as Cellular Vehicle-to-Everything (C-V2X). This technology will enable connected vehicles to receive real-time alerts about

approaching trains or occupied crossings, improving driver awareness, and reducing collisions.

TTC’s advanced infrastructure supports full-scale testing of surface materials, sensing systems like radar, LiDAR, and AI-driven cameras, and behavioral studies to understand how people respond under varying crossing conditions.

“Through this collaborative effort, ENSCO and its partners, as well as universities and industry suppliers, are helping to shape the next generation of transportation safety by combining smart infrastructure, advanced analytics, and connected-vehicle research in support of the FRA’s mission to reducing grade crossing incidents nationwide.”

Rio Tinto Mining in Australia

/

L.B. Foster

TECHNOLOGY FOCUS

HIRAIL CORPORATION

“The market for grade crossings is currently strong with the Class I’s, short lines, transit agencies and industries,” according to HiRAIL Director of Sales and Marketing Jim Overfelt.

HiRAIL is continuing its work developing new full-depth rubber crossing profiles to fit new concrete tie designs and new fastening systems. “The majority of concrete ties produced domestically are not flat or rectangular shaped like a timber tie,” Overfelt explains. “Most concrete ties have an area that slopes down from the rail seat toward the middle of the tie that meets a flat section in the middle. Over the course of many years, the concrete tie manufacturers have made these areas different lengths. As these dimensions change, we change to make our product fit the contour of the concrete tie. Our design capabilities allow the client to use the same concrete tie profile throughout their entire system and not have to transition to flat concrete ties or timber ties for their crossings.

“On top of the changes in shape, there have also been new fastening systems introduced that require us to add more clearance. Consequently, we end up changing our design to fit these requirements. It seems as though every year there is a new fastening system and concrete tie design, and we are fortunate to have the ability to design a crossing product that will accommodate it. We also seem to be getting more inquires for direct-fixation track crossings, which require a lot of the same design capabilities that we use for concrete or steel tie crossings.”

“Our customers are looking for a product that is low-maintenance, reliable and competitively priced,” Overfelt adds. “Customers are also looking for a product that can be recycled at the end of its life and that is manufactured in the U.S. HiRAIL offers all of these benefits, which I believe is the reason for much of our success.”

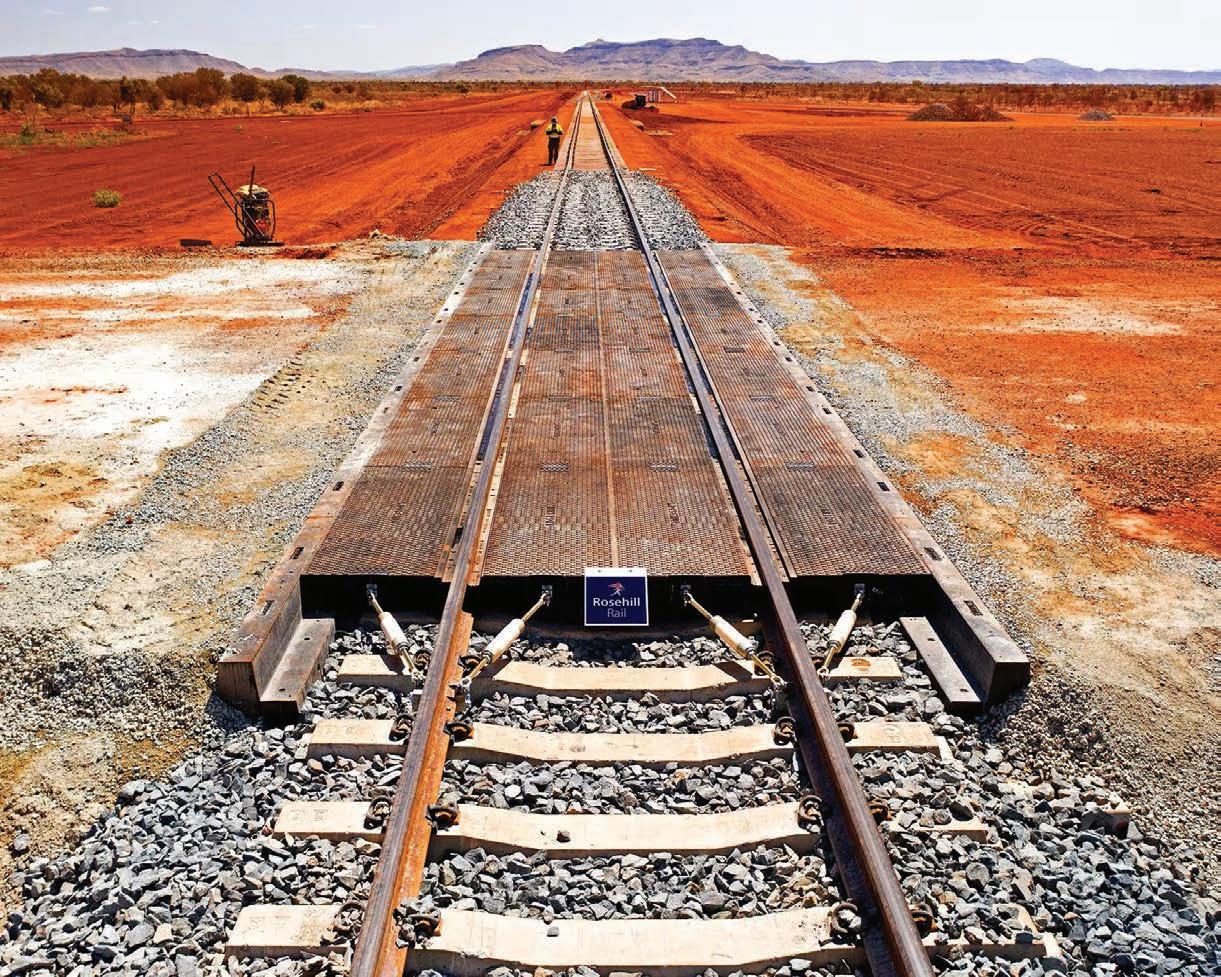

L.B. FOSTER

Through L.B. Foster’s partnership with Rosehill Rail, the company offers a wide range of rubber crossing panel systems to the North American market. Rosehill Rail’s focus has always been on developing crossing systems that perform reliably in the toughest environments, the

company notes.

The TITAN system, L.B. Foster tells Railway Age , “is the strongest and most durable surface-mounted crossing, designed specifically for sites that experience extreme axle loads, frequent heavy-haul traffic, or industrial vehicle movements. Built around a robust internal reinforcement structure, TITAN combines the flexibility of rubber with exceptional structural strength, allowing it to maintain stability and surface integrity even under constant impact and vibration.

“Each panel is precision molded from recycled rubber using L.B. Foster’s coldcure manufacturing process, producing a dense, dimensionally stable unit that locks together securely via tongue-and-groove joints. The result, the company says, “is a crossing that delivers the proven resilience of our modular systems, but with enhanced rigidity and load distribution across the entire installation. From main line freight and maintenance depots to industrial sidings, TITAN offers operators a dependable, heavy-duty solution that’s quick to install, simple to maintain, and built to last.”

The TITAN system has been installed at Rio Tinto Mining in Australia, as well as ferry ports in the United Kingdom and other heavy duty crossing areas in Romania and Czech Republic.

OLDCASTLE INFRASTRUCTURE

The market for concrete tub-style crossings

“was strong in 2025,” says John Jackson, National Account Manager – StarTrack Rail Products. “I expect that trend to continue as infrastructure upgrades remain a high priority. StarTrack has a strong reputation in the market, and customers want and expect a product that is cost-effective, durable, and virtually maintenance-free. Since its release in 1987, the StarTrack line of precast rail products has delivered the quality that customers expect from Oldcastle Infrastructure.” New products are in review to add to the StarTrack line; however, Jackson says he is “still reviewing the addition and how it would potentially affect my current product line.”

OMEGA INDUSTRIES INC.

“The year started with notable uncertainty due to the tariff rollercoaster,” Omega tells Railway Age. “Some projects were put on hold, and customers were reluctant to place orders as they had in the past year. As this year has progressed and companies have adapted to changing conditions, the industry has shown its resilience, and orders have now exceeded last year.”

Omega has developed and tested a new modular “Tub” style crossing panel built using a high strength 8,000 psi concrete mix. The Tub, the company says, “eliminates the need for ties, plates, and ballast, and does an excellent job of load distribution. As a result, the Tub excels in grade crossings with heavy load applications

Oldcastle Infrastructure’s StarTrack line was first released in 1987.

TECHNOLOGY FOCUS –M/W

like port terminals, steel mills, and recycling facilities.”

Recently, Omega purchased a new property in North Carolina and is in the process of moving its current Sanford, N.C., production operation. The new location will give the company more space and allow for more efficient material flow and product storage, according to Omega, which adds that “as always, our customers are looking for good communication, short lead times, fair pricing and a durable product.”

OMNI PRODUCTS INC.

“As 2025 unfolds, OMNI remains firmly positioned at the forefront of custom concrete grade crossing fabrication, supplying high-profile rail projects across the U.S., Canada, and Mexico, the company tells Railway Age. “With decades of engineering expertise, we confidently tackle virtually any grade crossing challenge— from standard installations to extreme

precision, durability, and consistent performance.”

OMNI’s product lineup, the company says, “reflects its long-standing commitment to manufacturing excellence. Whether clients require concrete panels, full-depth virgin rubber, or one of the company’s proprietary virgin rubber rail guard concrete tub modules, each solution is engineered for longevity and manufactured to exacting standards. Made proudly in America, OMNI’s rubber products come with a robust six-year factory warranty against rips and tears—an industry-leading guarantee unmatched by competitors.”

Among OMNI’s exclusive offerings is its steel-reinforced rubber, purpose-built for the most demanding environments, including heavy fork truck traffic. OMNI’s original VRA (Virgin Rubber Railguard) and the advanced VRA2 Railguard, both manufactured in-house, “provide the toughest solid virgin rubber rail seal available, designed to stand up to the harshest

OMNI’s capabilities extend even further through its ECR product line and Improved Concrete (IC) designs, which, the company says, “give clients flexible, application-specific options.” Its proprietary TraCast concrete tub modules are available in two configurations, including custom wide, heavy-duty versions engineered for extreme use. “The newest addition, TraCast 3 Heavy Duty Concrete Tub, delivers exceptional strength paired with cost efficiency, making it an ideal solution for demanding installations.”

With business “strong and steady heading into 2026,” OMNI says it “remains focused on meeting production schedules, delivering consistent on-time performance, and upholding its reputation for quality supported by responsive, expert customer service. Exceeding customer expectations continues to be the driving force behind the company’s growth.”

Looking ahead, OMNI says it is preparing to launch its “next major innovation,” OMNI HDPE EnviroTrakPans, “a

high-density polyethylene spill containment system engineered for long-term reliability in rail environments. Designed for superior spill capacity and exceptional resistance to impacts, UV exposure, and extreme temperatures, EnviroTrakPans install easily without motorized equipment and fit 115-pound rail and larger on both tangent and curved track. With minimal installation and maintenance costs, these HDPE pans offer a durable, cost-effective alternative for environmentally focused spill containment, the company noted. OMNI will also continue to provide a full array of steel spill pans— available in carbon, galvanized, stainless steel, and aluminum—to meet diverse operational needs.”

“With advanced engineering, unmatched warranties, and a growing portfolio of specialized solutions, OMNI remains a proven leader dedicated to supporting the rail industry’s evolving infrastructure demands,” the company says.

Omega Industries Tub-style crossing, Hawaii Narrow Gauge Railroad.

FOR PROGRESS PROVING GROUND

BY ACACIA REBER, HEAD OF BRAND STRATEGY & ENGAGEMENT, ENSCO, INC.

Each year, leaders from across the rail industry gather in Pueblo, Colo., share innovations and learn how they are tested in the real world. At the Federal Railroad Administration’s (FRA) Transportation Technology Center (TTC), operated by ENSCO, Inc., ideas are evaluated under realistic conditions to validate new technologies, improve safety systems and refine the tools that keep railways moving.

The TTC Conference & Tour, held in October 2025, provided an in-depth look at how research and testing at the site continue to shape the future of rail. It wasn’t merely a showcase; it was a continuing workshop highlighting the industry’s collective pursuit of safety, reliability and efficiency through datadriven experimentation.

INNOVATION GROUNDED IN EXPERIMENTATION

During the TTC Conference, presentations spanned research and testing that have taken place at the TTC, work currently under way

and programs being prepared for future validation. Collectively, they illustrated how experimentation at the site translates emerging ideas into measurable advances in safety, performance and operational advancements.

Much of the discussion focused on the evolution of energy systems, data analytics and inspection and control technologies. Siemens Mobility presented its work in hybrid propulsion, examining how diesel and battery power can be blended to balance performance, range and efficiency across varying duty cycles. Wabtec followed with a discussion on energy management and control systems, demonstrating how advanced analytics and power optimization software can reduce fuel consumption and emissions, minimize mechanical wear and improve operational consistency under realworld conditions. Wabtec also highlighted how advanced technologies are impacting asset monitoring and operations.

Other presentations addressed the digital infrastructure that underpins modern railway safety. AtkinsRéalis

presented advancements in digital twin modeling, demonstrating how data from track and bridge structures can be translated into virtual environments that help engineers forecast maintenance needs and evaluate performance before field changes occur. Voestalpine Signaling highlighted condition monitoring and wayside sensing technologies, including fiber-optic and thermal detection systems that identify early signs of component fatigue, bearing wear and rail stress in real time. These systems add a predictive layer of safety monitoring, turning the railway itself into a continuous diagnostic platform.

TTX shared results from railcar performance studies using instrumented vehicles at the TTC, generating data on vibration, wheel-rail interaction and bearing behavior, insights now guiding maintenance planning and fleet reliability programs across multiple operators. Railway Metrics & Dynamics (RMD) demonstrated how sensor-based derailment detection systems are being validated for detection speed and communication

TTC Operated by ENSCO

accuracy, improving emergency awareness and post-incident data collection.

Discussions also looked ahead to the next generation of freight technologies. Intramotev, a developer of autonomous railcar systems, presented its research concept for independently powered freight cars that could one day improve current yard operations, energy use and network flexibility through automation.

The program also included research perspectives from academic partners, including the University of South Carolina, Virginia Tech and others whose ongoing work contributes to the broader scientific foundation of rail safety, resilience and workforce development. Collectively, these efforts, whether completed, ongoing or in planning, demonstrate the depth of applied experimentation taking place at the TTC. The findings emerging from this research continue to inform the design of safer, more efficient, more resilient railway systems.

TURNING TESTING INTO SHARED KNOWLEDGE

Research presented in Pueblo reinforced how

applied testing benefits the broader rail ecosystem. Results from experiments at TTC inform design practices, training and operational standards throughout the industry.

Testing in controlled environments allows engineers to study how advances in vehicles, track and components behave under stress. The resulting data supports improvements in equipment reliability and network resilience. It also gives operators and manufacturers a common foundation for understanding performance, safety margins and lifecycle behavior insight that cannot be replicated in simulation alone.

By linking testing to education and collaboration, TTC transforms experimentation into knowledge the entire industry can use.

OPENING THE GATES: THE POWER OF DEMONSTRATION

Day Two of the TTC Conference offered what no slide presentation can replicate: direct observation. Once a year, the site opens its gates for a guided tour where attendees experience research in practice.

The 2025 tour featured five primary stops: fiber-optic track sensing, grade-crossing safety systems, advanced track tools, indoor and outdoor equipment displays and a live derailment demonstration. Each stop illustrated a different facet of applied safety research and product development, showing how sensors, vehicles, and infrastructure advances are mitigating risks and improving rail transportation.

Members of the Center for Surface Transportation Testing and Academic Research (C-STTAR) also shared highlights of their recent work funded through FRA research grants, focusing on transportation resiliency, training and workforce development; key areas that directly support the next generation of railway professionals.

Observing technology in operation helps participants connect the data presented during day one with the systems being tested. The TTC tour exhibits are changed each year to display various facility capabilities. Past events have featured hydrogen propulsion trials, grade crossing collisions and hazmat response exercises. That evolution reflects the site’s commitment to sharing new knowledge and exposing visitors to the latest developments in safety and technology. It’s not simply about access; it’s about leading through openness and learning.

Few facilities in the world can match TTC’s

combination of scale, security and readiness. The entire site is fenced, gated and monitored around the clock, with controlled access points and on-site emergency services, including a fire department and certified hazmat response team. This infrastructure allows research and high-risk testing to be carried out safely and responsibly.

Controlled derailments, such as the one conducted at this year’s tour, provide critical data on derailment mechanisms and vehicle-mounted sensor performance. Each test, no matter how specific, adds to a growing body of knowledge that strengthens the safety foundation of the rail industry.

By inviting the industry inside to observe site activities, TTC demonstrates that progress in transportation is accelerated through shared research.

CONTINUING TO LEAD THROUGH LEARNING

The TTC remains the rail industry’s classroom, laboratory and proving ground. Work conducted during the past year including hybrid propulsion, predictive monitoring and derailment studies, illustrate how today’s research is directly contributing to safer, smarter, more efficient rail operations.

Opening the site annually for the TTC Conference & Tour is at the core of the site’s mission. By showing the work rather than simply describing it, the center helps bridge the gap between innovation and implementation.

The 4th Annual TTC Conference & Tour, scheduled for October 20-21, 2026, will continue that effort, offering new insights into the technologies shaping rail’s future. The progress emerging from the TTC demonstrates to the industry that every advance in safety and innovation begins with the willingness to test, measure and learn.

Derailment demonstration during the 2025 TTC Conference & Tour.

People

MATTHEW DICK, P.E.

Engineering Systems Inc.

HIGH PROFILE: Engineering Systems Inc. (ESi) appointed Matthew Dick, P.E., as Head of Rail Strategy and Development. During his 25year career, Dick has performed derailment, collision, and fatality incident investigations, and has worked with the FRA, NTSB, and TSB. He recently served as Vice President of Strategy and Business Development at ENSCO Inc. His contributions to technology-driven railway safety includes leading the delivery of North America’s first Autonomous Track Geometry Measurement System (ATGMS) and deployment of the V/ TI Clusters Artificial Intelligence algorithm. Dick has served in various industry leadership roles including as Chair of the American Society of Mechanical Engineers (ASME) Rail Transportation Division and served as Chair of AREMA Committee 2 – Track Measurement and Assessment Systems.

LAURIE STILES

Marmon Rail/Railserve

HIGH PROFILE: Marmon Rail (part of Marmon Holdings, a Berkshire Hathaway company) promoted Laurie Stiles to President of Railserve Inc., leading the businesses of Atlanta-Ga.-based Railserve, an in-plant switching and associated services provider, and two other Marmon Rail companies: Frankfort, Ind.-based Ameritrack Rail, a fullservice rail contractor providing engineering and design services, new track construction, and existing track maintenance; and Longview, Tex.-based Powerhouse, a locomotive repair, air brake component repair, and maintenance services company. Stiles’ responsibilities include developing and driving growth strategies while leading more than 1,200 employees. Marmon Rail offers a portfolio of services across North America that include mobile repair, tank car leasing and manufacturing, and railcar movers.

The Port of New Orleans (Port NOLA) appointed Morten Møller Jensen to its executive leadership team as Chief Operating Officer (COO). Je nsen will oversee all

port operations, with direct responsibility for the day-to-day management and successful delivery of the Louisiana International Terminal (LIT), a transformative infrastructure project for the state and

region. With more than four decades of global experience in shipping, logistics, and port management, Jensen brings an extensive track record of operational excellence, strategic leadership, and international expertise. “Morten’s deep experience in both operations and international business development makes him exceptionally qualified to help guide Port NOLA through this critical chapter in our history,” said Beth Branch, CEO of Port NOLA and New Orleans Public Belt Railroad. Jensen has held senior executive roles across the world, including serving as CEO of MEDLOG USA and MSC’s Mexico & Central America region. He also held Managing Director positions with MSC in Sweden and Paraguay, as well as with Maersk in Pakistan and Afghanistan. Earlier in his career, he was Chief Operating Officer at Norden in Denmark and Managing Director for APM Terminals Southern Africa.

Derek Kissick rejoined Guardian Rail (formerly Cathcart Rail ), a provider of railcar repair, switching, storage, logistics and field services to North American freight railroads, in the newly created role of Chief Commercial Officer. Kissick has 20 years of industry experience, including senior leadership roles at Caltrax, Cad Railway, Appalachian Railcar Services, and most recently Marmon Rail. He served previously as Chief Operating Officer for Guardian Rail from 2021 to 2024, playing a key role in the diligence and integration efforts for three acquisitions. Kissick will be based at Guardian Rail’s corporate headquarters in Columbus, Ohio. “We welcome Derek back to Guardian Rail,” said CEO Scott Driggers. “His deep understanding of our business and the perspective he brings from diverse leadership assignments in the industry make him the ideal leader to advance our commercial strategy.” “I am excited to return to Guardian Rail and join the team with its renewed focus on safety, quality and service,” Kissick said. “I look forward to supporting our commercial efforts and applying innovative ideas and best practices to help Guardian Rail deliver exceptional value for our customers.”

The Railway Educational Bureau BOOKS

Guide to Freight Car Couplers and Draft Gear Systems

Learn maintenance procedures on various types of coupler and draft gear systems used on railway equipment. The book covers comprehensive information that identifies the various components, identification, inspection and gauging details for various systems used on railway freight cars. Chapters cover Type E, F, and E/F Couplers, Uncoupling levers, Yokes, Draft Gears, Cushioning Units, Hydra-Cushion Centerof-Car Unit, Slackless Drawbars, National Casting Articulated Connectors, ASF Articulated Connectors, and Spherical Articulated Couplings (SAC-1). Now in soft cover format.

BKCDG $78.95

General

Railroader: The Unfiltered Genius and Controversy of Four-Time CEO Hunter Harrison • BKHUNTER • $27.99*

Diesel-Electric Locmotives • by Walter Simpson • BKDIESEL • $54.95

Amtrak, America's Railroad: Transportation's Orphan and Its Struggle for Survival • BKAMARR • $40.00*

Train Wreck: The Forensics of Rail Disasters • Soft Cover • BKTW • $27.00*

American Steam Locomotives, Design and Development, 1880-1960 • BKASL • $40.00*

All About Railroading - Second Edition • BKAARR • $35.95

2024 Emergency Response Guidebook • BKERG • $8.95

Amtrak: Past, Present, Future • by Frank N. Wilner • BKAMTRAK • $39.95 * Operations

Managing Railroad Transportation • BKMRT • 39.95*

Railway Operations and Control - Third Edition • BKROC • $39.95*

Railroad Operations and Railway Signaling • BKRORS • $30.95

- Railroad Resources -

Managing Major Railway Programs

By Alfred E. Fazio and Anthony Fazio

Managing Major Railway Programs explains the analytical principles of Project Management as applied to executing large programs and major projects on active railways and rail transit systems. Topics include program set-up, Work Breakdown Structures (by Systems), Phasing and its relationship to maintenance of rail operations (and maintenance), Project Status including Earned Value Analysis and forecasting, risk management, System Safety (including FRA and FTA approaches), and Systems Integration/Systems Assurance.

The book is written and recommended for railway operating officials, as well as for Engineering Officers, and PM/CM professionals. Full color text pages.

Freight Car

The Double Stack Container Car Manual • BKDOUBLE • $23.95

Guide to Freight Car Air Brakes • BKFCAB • $78.50

Doorway to Safety With Boxcar Doors • BKBD • $31.95

Freight Cars: Lettering and Marking • BKK2CBK • $31.95

Guide to Freight Car Trucks • BKFCT • $104.95

Locomotive

Guide to Locomotive Mechanical Maintenance - SD & GP Locomotives • BKGLMM • $44.95

Guide Locomotive Electrical Maintenances • BKGLEM • $53.95

Fuel Saving Techniques for Railroads - The Railroader's Guide to Fuel Conservation • BKFUEL2 • $34.95

Guide to North American Diesel Locomotives

• BKGNADL • $27.99*

The Only Game In Town: The LOCOTROL Story • BKGAME • $69.99* Reference and Dictionaries

Dictionary of Railway Track Terms • BKRTT • $39.00

The Carman’s Dictionary • BKCD • $19.50

Track

Basic Principles of Track Maintenance • BKTMB • $150.00

Fundamentals of Railway Track Engineering • BKFRTE • $160.00

The Track Data Handbook • BKTDH • $56.50*

Passenger Development and Operation of New York's IRT and BMT • by Al Fazio • BKNYIRT • $65.95

Urban Transit: Operations, Planning, & Economics • by Vukan R. Vuchic • BKUTOPE • $155.00*

The Volume Needle Needs to Move

As we close out 2025 and look forward to a productive 2026, partnerships will be critical to short line success. We are cultivating our partnerships in Congress to ensure that short line priorities like supporting the CRISI program and maintaining current truck and size weight maximums are well understood and well considered in the upcoming Surface Transportation Reauthorization bill.

We’re partnering with leaders on both sides of the aisle and in both houses of Congress—particularly Sens. Mike Crapo (R-Idaho) and Ron Wyden (D-Ore.) and Reps. Mike Kelly (R-Pa.) and Mike Thompson (D-Calif.)—to find a tax legislative vehicle to modernize the successful 45G short line tax credit. And we’re working to partner with regulatory agencies to ensure that any new initiatives are safety-focused, data supported, and implementable by small business railroads.

Another critical partnership—that of short lines and Class I’s to create an affordable, reliable, and seamless freight network for our customers—is also top of mind for 2026.

Senior Class I railroad executives came out in force at the most recent 2025 ASLRRA Region meetings in Charlotte and New Orleans, and there was much to like about what they had to say. Presentations by Stefan Loeb of Norfolk Southern, Christina Bottomley of CSX, Jim Gunther of CN, Kenny Rocker of Union Pacific, Coby Bullard of CPKC, and Mark Ganaway of BNSF focused on the importance of their short line connections, the efforts they are making to strengthen those connections, and the work they are doing to accelerate carload opportunities.

Each presented encouraging operational data, industrial development and real estate initiatives, and technology innovations. Some showcased new programs to track Class I/short line interchange performance, jointly market certified sites, share railcars,

or create new short lines.

Each showcased their short line management teams, which these days have evolved well beyond just managing legal agreements and joint facilities to become potent teams dedicated to creating carload volume growth.

The expansion and elevation of these teams into Class I senior management is a relatively new development and one that has significantly benefited short lines and their customers by increasing their visibility throughout the Class I organizations.

The presentations were first-rate, informative, and encouraging, and there is no doubt that short lines liked what they heard. But as the saying goes, the proof of the pudding is in the eating.