AILWAY G E

SERVING THE RAILWAY INDUSTRY SINCE 1856

MULTIPLIER FORCE

DRONE TECHNOLOGY TAKES FLIGHT

NEXT-GEN FREIGHT RAIL

A Future with Autonomous Trains?

MARVEL

SERVING THE RAILWAY INDUSTRY SINCE 1856

NEXT-GEN FREIGHT RAIL

A Future with Autonomous Trains?

MARVEL

As I write this, it’s the late afternoon of Friday, Aug. 29, the end of one of the strangest weeks I’ve ever encountered in my 33-plus years at Railway Age— on top of all the crazy things flying out of the White House practically every day since January. In the space of one week, hedge fund Ancora resurfaced from the swamp and mounted an ugly, nonsensical, fabricationfilled attack on CSX and CEO Joe Hinrichs (our current Railroader of the Year), proclaiming that CSX, only because Union Pacific and Norfolk Southern announced their intended combination, must pursue a merger with either BNSF or CPKC—both of which responded with, “Dumb idea. Get lost.” Then, POTUS 47, once again invoking his The Apprentice reality TV persona, told STB Member Robert Primus, “You’re Fired!”

With Primus ejected from 395 E Street SW in Washington, D.C. (p. 6.), the odds of UP+NS being approved in roughly two years most likely have increased. The STB has its work cut out, because this transaction falls under merger rules that will be invoked for the first time since they were written in 2001. So, should any other railroads be rushing toward the altar, further complicating what already is an extremely complex undertaking?

No, per l’amor di Dio! Not now. Let’s keep our heads screwed on straight and see how this all plays out. Cool your jets. There are several ways the other four Class I’s can “combine,” in terms of operations and improved services—and they’re doing it.

Now, you might say, “Who does this intelligentone think he is?” But I’m just agreeing with Keith Creel, Warren Buffett and Joe Hinrichs.

(Of course, I’m glad they said it first.)

CPKC “is not interested in participating in immediate rail industry consolidation, despite suggestions by some that it take part,” Creel said. “CPKC does not believe that further rail consolidation is necessary for the industry as currently structured.”

Buffett and Greg Abel met with Hinrichs in Omaha alone, without advisors present. They told him they would not make a bid for CSX, adding they “believed they could cooperate more to gain some of the same benefits that would come from combining the two companies.” Hinrichs confirmed this in a session with Jim Cramer, the animated, rapid-fire-dialogue (that’s putting it mildly) host of CNBC’s Mad Money—who called Ancora “some fund I don’t know jack about.”

Jim may not know jack, but sure knows Joe, as do we. Hinrichs highlighted the importance of “collaboration over consolidation,” stating, “The biggest problem that needs to be solved is interchanges.” He also pointed to CSX’s “robust network, best-inclass margins and high employee engagement … Our focus is on creating value for shareholders and serving customers better so that we can profitably grow the business. That involves people working effectively together.”

Oh, by the way, Cramer prefaced his questioning of Hinrichs with this: “First, just so people know, Railway Age is the most important publication in this industry, and you are the railroad man of the year.”

Thanks for the plug, Jim! But can you talk a little slower? I’m having a hard time understanding you at my advancing age.

WILLIAM C. VANTUONO Editor-in-Chief

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service.

Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform.

Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) 847-559-7372, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage.

POSTMASTER: Send changes of address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA.

Photocopy rights: Where necessary, permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the

Director. Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not

keeping or return of such material.

Member of:

for

SUBSCRIPTIONS: 847-559-7372

EDITORIAL AND EXECUTIVE OFFICES Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

JENNIFER McLAWHORN

Managing Editor, RT&S jmclawhorn@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Dan Cupper, Alfred E. Fazio, Justin Franz, Gary Fry, Michael Iden, Don Itzkoff, Bruce Kelly, Joanna Marsh, David Nahass, Jason Seidl, Ron Sucik, David Thomas, Frank N. Wilner

Art Director: Nicole D’Antona Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors Kevin Smith

ks@railjournal.com

David Briginshaw db@railjournal.com

Robert Preston rp@railjournal.com

Mark Simmons msimmons@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 847-559-7372

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

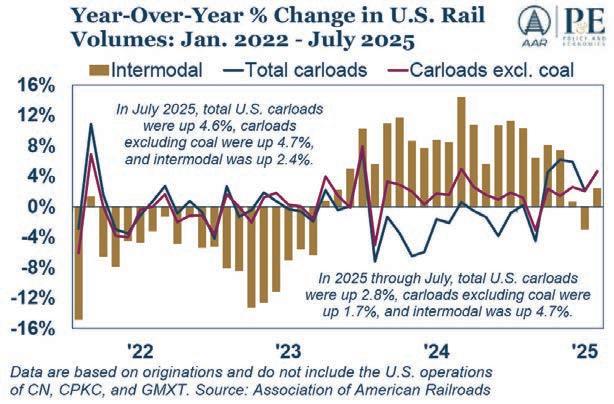

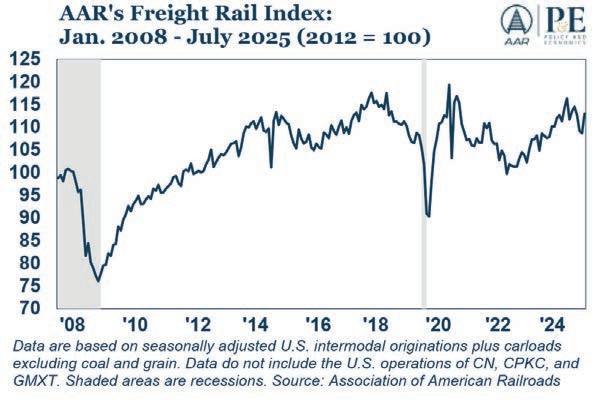

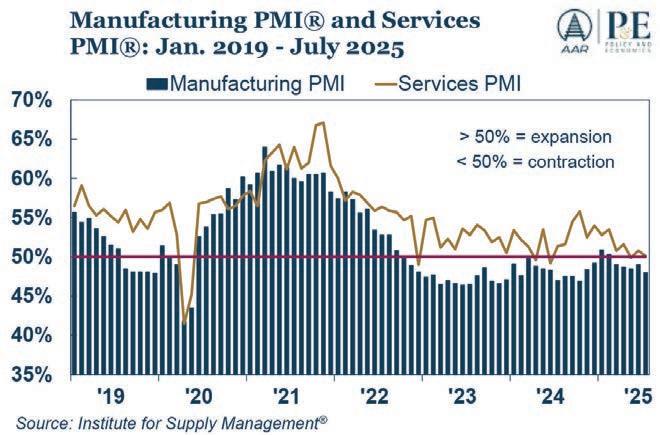

“Recently released economic data point to mounting headwinds,” the Association of American Railroads reported last month. “Preliminary U.S. job growth in July was just 73,000—well below expectations—while revisions erased most previously reported job gains in May and June. Add to that a services sector teetering on the edge of contraction, consumer spending that’s losing momentum, weak consumer confidence, inflation that’s creeping higher, and a manufacturing sector that remains stagnant, and the economic picture looks hazy. Nevertheless, rail volumes are holding up, indicating goods movement remains resilient despite the headwinds. Looking ahead, though, sustained pressure on labor markets and consumer demand could eventually weigh on freight activity.

“U.S. rail intermodal shipments rebounded in July, rising 2.4% over last year and reversing a 2.9% decline in June (intermodal’s first year-over-year decline in 22 months). In July 2025, intermodal originations averaged 270,175 units per week, the second most ever for July (behind July 2018). For the year to date through July, U.S. intermodal volume was 8.33 million units, up 4.7% (371,000 units) over last year and the third most ever (behind 2018 and 2021).

“Several factors likely contributed to intermodal’s dip in June and recovery in July. A drawdown in business inventories during Q2 (discussed below) suggests many firms were selling off stockpiles rather than placing new orders in June, temporarily dampening freight demand. Also, a decline in U.S. goods imports in June weighed on intermodal volumes, which rely heavily on containerized imports from ports. As inventories thinned and port activity normalized, intermodal volumes recovered in July. This suggests that while underlying demand may be fragile, it remains fundamentally intact, at least for now.

“Meanwhile, U.S. total carloads rose 4.6% in July 2025 over July 2024, their fifth straight increase. In July, 15 of the 20 carload categories tracked by the AAR saw gains, the most since December 2023. Total carloads averaged 224,568 per week in July 2025, the most for July since 2019. In 2025 through July, total carloads were up 2.8%, or nearly 186,000 carloads, over last year.

“The AAR Freight Rail Index (FRI) measures seasonally adjusted rail volumes excluding coal and grain. The index rose 4.0% from June 2025 to July 2025, its first increase in four months, returning the index to its highest point in four months.

“U.S. carloads of grain were up 13.5% in July 2025 over July 2024, their 17th year-over-year increase in the past 18 months. Through July, grain carloads were up 6.9%

(nearly 43,000 carloads) over last year. Rail carloads of grain are highly correlated with U.S. grain exports, much of which move by rail. According to the USDA, U.S. grain exports in tonnage terms were up 5.8% in the first half of 2025 over the same period in 2024 and were the most since 2022.

“U.S. coal carloads extended their recent gains, rising 4.5% (nearly 13,000 carloads) over last year, marking their fifth consecutive monthly increase. Relatively easy comparisons (due largely to reduced coal carloads last year associated with the Baltimore bridge collapse) are now largely over. In 2025 through July, coal carloads were 1.79 million, up 6.1%, or more than 100,000 carloads, over last year. Excluding coal, U.S. carloads rose 4.7% in July, their best year-over-year percentage increase in 11 months.

“In June 2025, U.S. rail carloads of chemicals fell 0.6% from a year earlier, their first decline in 22 months. In July 2025, they rose 3.3%, beginning (we hope!) a new streak of carload gains. Carloads averaged 32,978 per week in July 2025, the most ever for July and consistent with data from the Federal Reserve that says U.S. chemical production today is the highest since 2008. Year-to-date U.S. carloads of chemicals through July were 1.02 million, up 1.9% from 2024 and the most ever for the first seven months of the year.

“In July, Industrial Products carloads were up 3.6% over last year, their third straight year-over-year monthly gain and their biggest monthly percentage gain in 19 months. In July, the increase was driven by gains in carloads of motor vehicles (up 8.7%), chemicals (up 3.3%), and primary metal products (mainly steel, up 13.2%).”

THE FIRING BY POTUS 47 OF OUTSPOKEN SURFACE TRANSPORTATION BOARD (STB) MEMBER AND DEMOCRAT ROBERT E. PRIMUS AUG. 27 LEAVES THE FIVEMEMBER AGENCY SHORT TWO MEMBERS AS IT AWAITS A FORMAL MERGER APPLICATION FROM UNION PACIFIC (UP) AND NORFOLK SOUTHERN (NS). By early morning Aug. 28, Primus’ name was removed from the STB website’s listing of members.

The three remaining members are Chairman Patrick J. Fuchs, Michelle A. Schultz and Karen J. Hedlund. Fuchs and Schultz are Republicans; Hedlund a Democrat.

Significantly, there is no statutory quorum requirement at the STB. It may function with even just a single member, as it did for a 54-week period between mid-May 2003 and late May 2004 when two vacancies caused Chairperson Roger Nober to become the lone STB member. There was a recurrence of a oneperson STB for 16 days in January 2019 when Chairperson Ann D. Begeman awaited the arrival of reinforcements. At the time, the STB was a three-member agency. The 2015 Surface Transportation Board Reauthorization Act increased its size to five.

This is the first time in the 138-year history of the STB and its Interstate Commerce Commission predecessor that a member has been fired by a President. The STB’s statute provides for dismissal for cause—misconduct, poor performance, or other substantial breaches of job duties—but carries due

process protection allowing the terminated official to hear the allegations and respond. No such allegations were made against Primus by POTUS 47.

Primus, age 55 and a former House of Representatives staff member, told The Wall Street Journal, which first reported the firing, that he intends to challenge his removal in federal court. He is not alone. Just days earlier, POTUS 47 fired Federal Reserve Board member Lisa Cook, who is pursuing legal action. In her case, POTUS 47 alleged misconduct related to conduct outside her official duties.

Both the STB and Federal Reserve are independent (from the Executive Branch) regulatory agencies—STB members nominated by the POTUS for five-year terms; Federal Reserve Board members for 14 years, with Senate confirmation required for each of the agency’s members.

How long Primus’ challenge to his firing may take to move through the judicial system is unknown, and likely will be tied to other such challenges that will ultimately reach the Supreme Court.

Primus, who was nominated in 2020 by POTUS 47 during the President’s first term, was renominated by President Joe Biden to his second (and final by statute) term that was to expire Dec. 31, 2027. Since his arrival, Primus has been a frequent outspoken critic of railroad service, operations and hiring practices.

During his time as a Board member—and eight months as a President Joe Bidennamed Board chairperson, following the

retirement of Democrat Martin J. Oberman— Primus never advanced a regulatory reform initiative (a priority of POTUS 47). He preferred a soapbox from which to admonish railroads at the expense of missing numerous statutory deadlines.

In December, Primus challenged the “quality” of data provided the STB by the Association of American Railroads (AAR) as “substandard,” with AAR President Ian Jefferies responding by calling out Primus as choosing to “forego information gathering, fact checking, and basic courtesy and cooperation in favor of publicity.”

Previously, while chairperson, Primus, without consultation with other STB members, summoned rail officials to Washington for a public hearing at which he excoriated them over hiring practices and implementation of Precision Scheduled Railroading (a strategy to improve productivity and lower costs, and opposed by rail labor). Days earlier, Primus was hosted by the Transportation Division of the International Association of Sheet Metal, Air, Rail and Transportation Workers (SMART-TD), telling its leadership, “Thank you for letting me represent you.”

Primus was the lone “no” vote when the Board approved the merger of Canadian Pacific and Kansas City Southern to form CPKC. He cited market-power concentration and concern that mergers “degrade working conditions, depress wages and impair or eliminate organized labor.”

Upon election to his second White House term in January, POTUS 47 demoted Primus from the chairpersonship and elevated Fuchs. That likely would have occurred regardless of Primus’ record as chairperson, as STB chairpersons serve at the pleasure of the President and typically are changed out when Presidential administrations change. Being fired is another matter.

Notably, while Primus has had testy exchanges with railroad CEOs, his exchanges with UP CEO Jim Vena have been cordial, with Vena recently paying a personal visit to Primus.

Currently, the STB has a Republican vacancy awaiting POTUS 47 nomination. Whether courts allow a nominee to fill Primus’ now vacant Democratic seat, ahead of a judicial determination on his firing, is to be seen.

– Frank N. Wilner

Amtrak last month awarded design-build contracts and begun pre-construction activities for three rail yard modernization projects on the Northeast Corridor (NEC), in Washington, D.C. New York City and Boston. Similar projects are under construction in Philadelphia and Seattle, and another is in planning for Rensselaer/Albany, N.Y. Amtrak said the upgrades are necessary to support new Airo trainsets arriving on more than a dozen routes over the coming years. The new rail yard facilities will help create a consistent maintenance system that “improves efficiencies and reduces turnaround times during repairs or inspections, while also improving safety and overall working conditions for employees.”

For Boston’s Southampton Yard, the SPS New England-Railroad Construction Company (RCC) Joint Venture will design and construct a new maintenance facility and renovate existing facilities to support Northeast Regional, Acela, and Long Distance trains connecting with cities such as Chicago, New York, Philadelphia, Baltimore, Washington D.C., and Richmond. Improvements Include construction of a new two-track Maintenance & Inspection facility, and renovation of the existing two-track regional Service & Inspection facility into a two-track Service & Cleaning facility. Completion is expected in 2029.

For New York City’s Sunnyside Yard, the Scalamandre-Citnalta Joint Venture will design and construct new maintenance, inspection and servicing facilities, as well as other related upgrades, to support Northeast Regional, Acela, Long Distance, and commuter trains connecting with cities such as Albany, Boston, Chicago, Philadelphia, Baltimore, Washington D.C., Richmond, Raleigh, Charlotte, Miami, and New Orleans. Improvements include construction of a new two-track Maintenance & Inspection facility, construction of six new Service & Cleaning tracks with canopy coverage, consolidation of commissary, employee workspace, material storage, and parking into a single location within the yard, including a modular office compound, and bringing 11 existing service platforms to a state of good repair (required to clean/prepare trains for passenger service and store trainsets when not in operation). Other infrastructure upgrades include reconfiguration of two major interlockings and tracks connecting the yard to the NEC. Completion is expected in 2030.

For Washington, D.C.’s Ivy City Yard (pictured), the Clark-Herzog Joint Venture will design, construct, and renovate new and existing maintenance and servicing facilities to support Northeast Regional (including state-supported Amtrak Virginia service), Acela, Long Distance and commuter trains connecting with cities such as Boston, New York, Philadelphia, Baltimore, Richmond, Charlotte, Savannah, Miami, New Orleans, and Chicago. Improvements Include construction of three new exterior Service & Cleaning tracks with canopy coverage, renovation of two existing two-track maintenance facilities to include a new drop table, and replacement of the existing water main infrastructure within and around the yard, which provides flexibility to serve multiple trainsets across various facilities. Completion is expected in 2030.

The NEW YORK METROPOLITAN TRANSPORTATION AUTHORITY (MTA) last month approved the tunnel-boring contract for Phase 2 of the Second Avenue Subway project, which will extend the Q train from 96th Street north to 125th Street to Park Avenue, delivering new transit access to East Harlem residents. The contract, valued at $1.972 billion, was awarded to CONNECT PLUS PARTNERS, a joint venture of Halmar International and FCC Construction. It is the second of four construction contracts for the Q train extension. The Phase 2 tunnel will extend from 116th Street to 125th Street. Crews under this contract will also excavate

space for the future 125th Street Station, and in a “cost-containment measure that saves the MTA $500 million,” will outfit the tunnel along the route that was built in the 1970s to accommodate the future 116th Street Station. The work to bore the new tunnel, between 35 and 120 feet below Second Avenue, is expected to take place using 750-ton machines equipped with 22-foot diamond-studded drill heads. Early work will commence later this year, with heavy civil construction starting in early 2026 and the tunnel boring itself expected to begin in 2027. The line’s first construction contract was awarded in January 2024 for utility relocation work. Crews

working under that contract are relocating underground utilities from 105th Street to 110th Street on Second Avenue at the site of the future 106th Street Station, in order to facilitate the subsequent construction of the station. Crews working under the third contract will build the underground space for the future station at 106th Street and Second Avenue. That contract is currently in procurement. The fourth and final contract will cover the fit-out of the three stations, at 106th, 116th, and 125th Streets, and the systems needed to run train service, such as track, signal, power and communications. This contract is currently in design.

On e’s eyes are wide shut not to acknowledge a polarizing dispute ensnaring railroads and their captive shippers—those lacking effective transportation alternatives—in a muddy morass as to whether railroads are revenue adequate .

The debate is not inconsequential, as partial economic deregulation in 1980 (Staggers Rail Act) preserved protections—as administered today by the Surface Transportation Board (STB)— for some 20% of traffic considered captive to rail. Whether and what railroads are pronounced by the STB as revenue adequate has significant impact on captive shippers, as when railroads seek to raise rates, a revenue adequacy determination places with railroads a burden of defending that action.

Revenue adequacy, as defined by statute, means earning enough to cover total operating costs, including depreciation and obsolescence, plus a competitive return on invested capital sufficient over the long term to attract more of it to maintain a railroad’s large and costly infrastructure, including locomotives and rolling stock. It’s a mouthful, so no wonder railroads and their customers can’t agree on the determination process.

Congress instructed the STB to make an annual revenue adequacy determination, which it does by comparing each carrier’s return on net investment (ROI) with the rail industry’s after-tax cost of capital. The cost of capital is determined from the interest paid on debt and an estimate of returns shareholders require for their investment risk. If a railroad’s ROI exceeds the industry’s cost of capital, the carrier is considered revenue adequate.

Once a railroad is determined by the STB to be revenue adequate, it must, when seeking a rate increase, demonstrate “with particularity” its need for higher revenue; the harm it would suffer if prevented from collecting it through

higher rates; and why a shipper without effective transportation alternatives should pay those higher rates.

Captive shippers say most, if not all, Class I railroads are—and have been since at least 2015—revenue adequate. Thus, they say, the STB should constrain— which it has not done—future rail rate increases to no more than the revenue adequate carrier’s actual cost increases incurred in handling the freight. The progeny of this debate is an acrimonious rhetorical loop as illustrated in this abridged version:

SHIPPERS: Railroads absolutely are revenue adequate. Warren Buffett’s legendary Berkshire Hathaway holding company would never have purchased BNSF in 2010 were it not revenue adequate. As far back as 1995, the president of the Association of American Railroads spoke of the industry’s “new golden age.”

RAILROADS : Buffett’s strategy is long-term value investing. He bought BNSF because he considered it undervalued. The STB did not find BNSF revenue adequate at the time of its purchase in 2009 or in 2010.

SHIPPERS: Then why, since 2010, have railroads paid out more than $270 billion in stock buybacks and dividends?

RAILROADS: Capital is a coward. During times of uncertainty, investors withdraw and seek return of their capital for use elsewhere.

SHIPPERS: PSR and crew size reduction are Wall Street-driven strategies to “goose” short-term returns and stock price but are not effective over time at attracting freight from trucks and satisfying shipper wants. Railroads should be investing profits in service improvements.

RAILROADS: Notions of “build it and they will come” best belong in baseball-themed novels and movie scripts. Opposition to smaller crew size and PSR encourages stagflation—increased operating costs, higher freight rates to recover them, loss of traffic to lowercost truck competitors and a return to excess capacity that contributed to the railroads’ darkest financial days when service quality was an oxymoron.

SHIPPERS: STB predecessor Interstate Commerce Commission (ICC) ruled in 1985 that a railroad should not use its market power “to consistently earn, over time, an ROI above the cost of capital.” By avoiding a revenue adequate designation, they are doing just that.

RAILROADS: Investors have expectations that railroads will earn greater than their cost of capital consistently over time, or they will find better investment opportunities. The result of capping returns at the cost of capital will be deferred maintenance and an inability to renew plant and equipment—essential to meet shipper wants.

SHIPPERS: The STB’s failure to impose rate constraints on revenue adequate railroads is troubling. By STB calculations, Union Pacific has been revenue adequate every year since 2011. CSX has been revenue adequate every year since 2018. No railroad ever said in its annual report it is revenue inadequate.

RAILROADS: Annual STB revenue adequacy determinations look backward, not forward. They do not incorporate headwinds that are substantial,

Coal, long the railroads’ mainstay traffic, is down 50% since 2014. Its successor, intermodal (containers and trailers on flat cars), faces significant headwinds. Among them are selfdriving trucks; the peril of Congress permitting longer and heavier trucks on federal-aid highways; legislative resistance to reducing the shortfall in heavy-truck user fees assessed for pavement and bridge damage; rail labor’s resistance to smaller crew size, automated safety inspections and costreducing operating strategies such as Precision Scheduled Railroading (PSR); and activist regulators wanting to micromanage and preserve unproductive jobs.

as mentioned. They are a historical accounting snapshot.

Although the STB opened a proceeding in 2014, inviting comments on how its revenue adequacy determination methodology might be improved; and although railroads in 2020 asked the STB to consider whether railroads require a return greater than their cost of capital to attract adequate investment, the STB discontinued both proceedings in July 2025. It said “the public interest would be better served” by devoting scarce resources to other matters.

Although captive shippers still can file complaints that rail rates are unreasonable, they have ceased doing so, citing millions of dollars in costs to pursue those challenges and “minimal expectation” of victory.

For the foreseeable future, captive shippers are unlikely to find salvation at the STB or before Congress owing to a political atmosphere discouraging federal agency regulation. That leaves shippers distrusting the STB, and railroads saying results disliked by shippers confirm there is no market power abuse.

Shippers are not alone in criticizing the STB’s superintending of its revenue adequacy responsibility.

The National Academy of Sciences’ Transportation Research Board concluded in a congressionally funded study that an annual revenue adequacy determination “serves no constructive purpose.” Economist Alfred E. Kahn—acknowledged as the “father of airline deregulation”—said the STB’s annual revenue adequacy determination produces “nonsensical results.”

An example is STB’s using stock prices as part of determining industry-wide cost of capital. Berkshire Hathaway-owned BNSF, which earns one-third of the Big Four railroads’ total revenue (BNSF, CSX, Norfolk Southern and Union Pacific), has no publicly traded stock, leaving a gaping

Revenue adequacy, as defined by statute, means earning enough to cover total operating costs, including depreciation and obsolescence, plus a competitive return on invested capital sufficient over the long term to attract more of it to maintain a railroad’s large and costly infrastructure, including locomotives and rolling stock. It’s a mouthful, so no wonder railroads and their customers can’t agree on the determination process.”

hole in the STB’s analysis.

STB staff also is critical. In 2019, an STB internal Rate Reform Task Force said the agency’s methodology can result in a railroad being found revenue adequate in a single year and still not be long-term revenue adequate; or be found revenue in adequate in a single year even though it is long-term revenue adequate.

If the process is broken, captive shippers have an option to exploit an upcoming window of opportunity presented by the consolidation desire of Union Pacific and Norfolk Southern—and, maybe, BNSF and CSX.

Imagine a contractual transaction that would help railroads demonstrate enhanced competition resulting from merger, as is required of applicants. In exchange for shippers supporting merger, the railroad applicants would agree to link future rate changes to service performance metrics, with penalties for failure to meet minimum standards. The Gordian knot to solve is that service failure penalties will not cause fewer future commitments.

Railroads are enthusiasts of such market-based performance standards, long advocating they replace prescriptive

safety regulation. UP may be ready to deal. CEO Jim Vena has already promised, in exchange for labor support, workforce lifetime income protection.

Resentment and anger between railroads and captive shippers are inevitable so long as each views the relationship as a zero-sum game, where when one “wins” the other “loses.” Crafting a symbiosis through arms’ length bilateral agreements is preferable to third-party determinations, as rotating third parties (new regulators, new lawmakers) can be polar opposites. History is replete with examples.

Railway Age Capitol Hill Contributing Editor Frank N. Wilner is author of Railroads & Economic Regulation,” available from Simmons-Boardman Books, 800-228-9670.

FRANK N. WILNER

October 15 & 16, 2025

Hyatt Regency Schaumburg Schaumburg, IL

Women in Rail 2025 is a must-attend event, highlighting diverse experiences and practical strategies for moving the industry forward. The third annual conference features dynamic panels, a celebratory awards luncheon, and the chance to network with a wide-reaching group of like-minded rail professionals.

Join Us For:

• Leadership Journeys in Freight Rail, Passenger Rail & Engineering

• Railroading’s Heroes

• Commanding the Track: Your Leadership Toolkit

• Executive Edge: Branding, Negotiation & Presence

• Trackside Impact: Environment & Community

• Allyship to Action: Maintaining a Culture of Belonging

Supporting Organizations

• Railway Age Women in Rail Awards

• RT&S Women in Railroad Engineering Awards

A 21st century facility that builds on its 19th century roots.

BY DAN CUPPER, CONTRIBUTING EDITOR

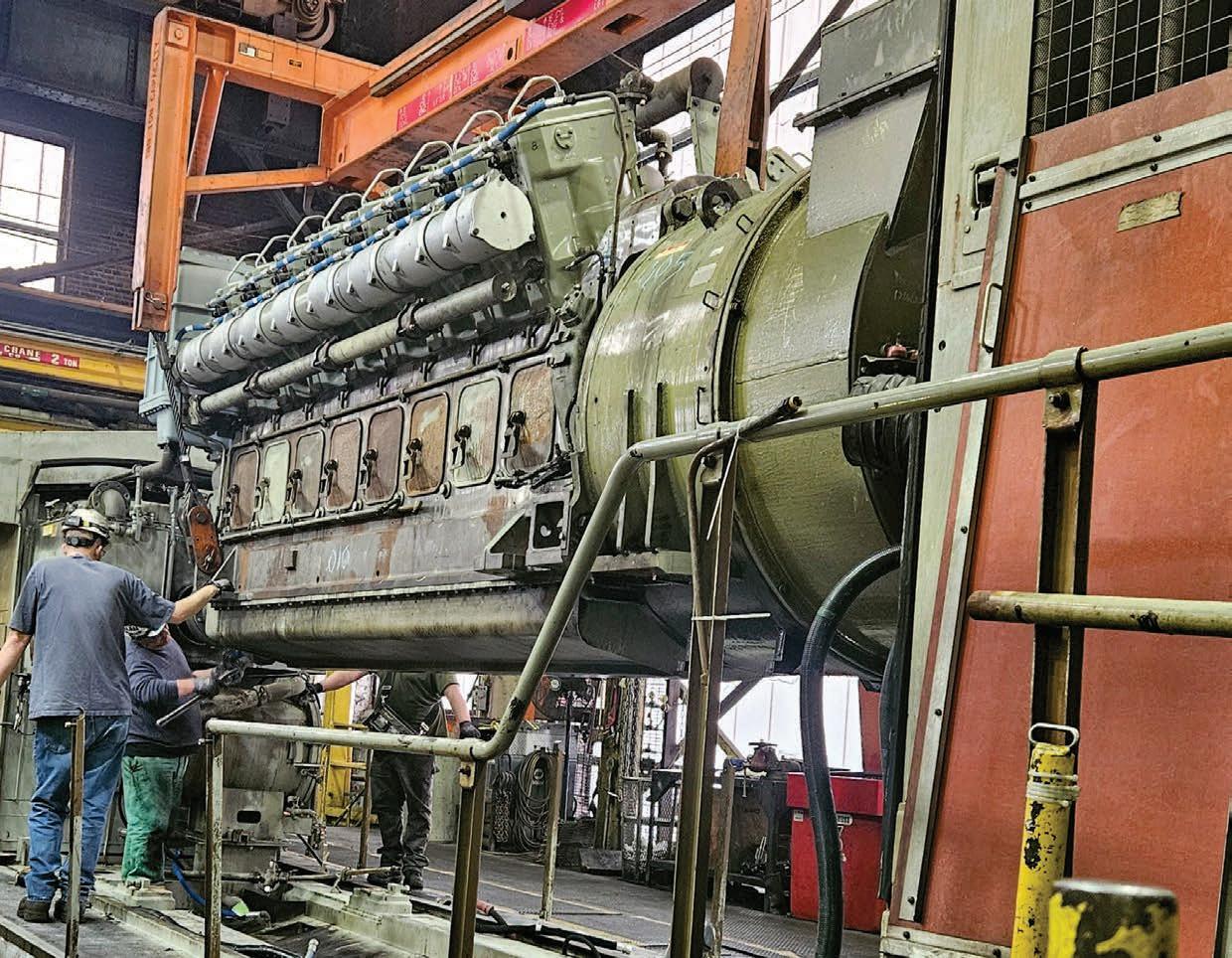

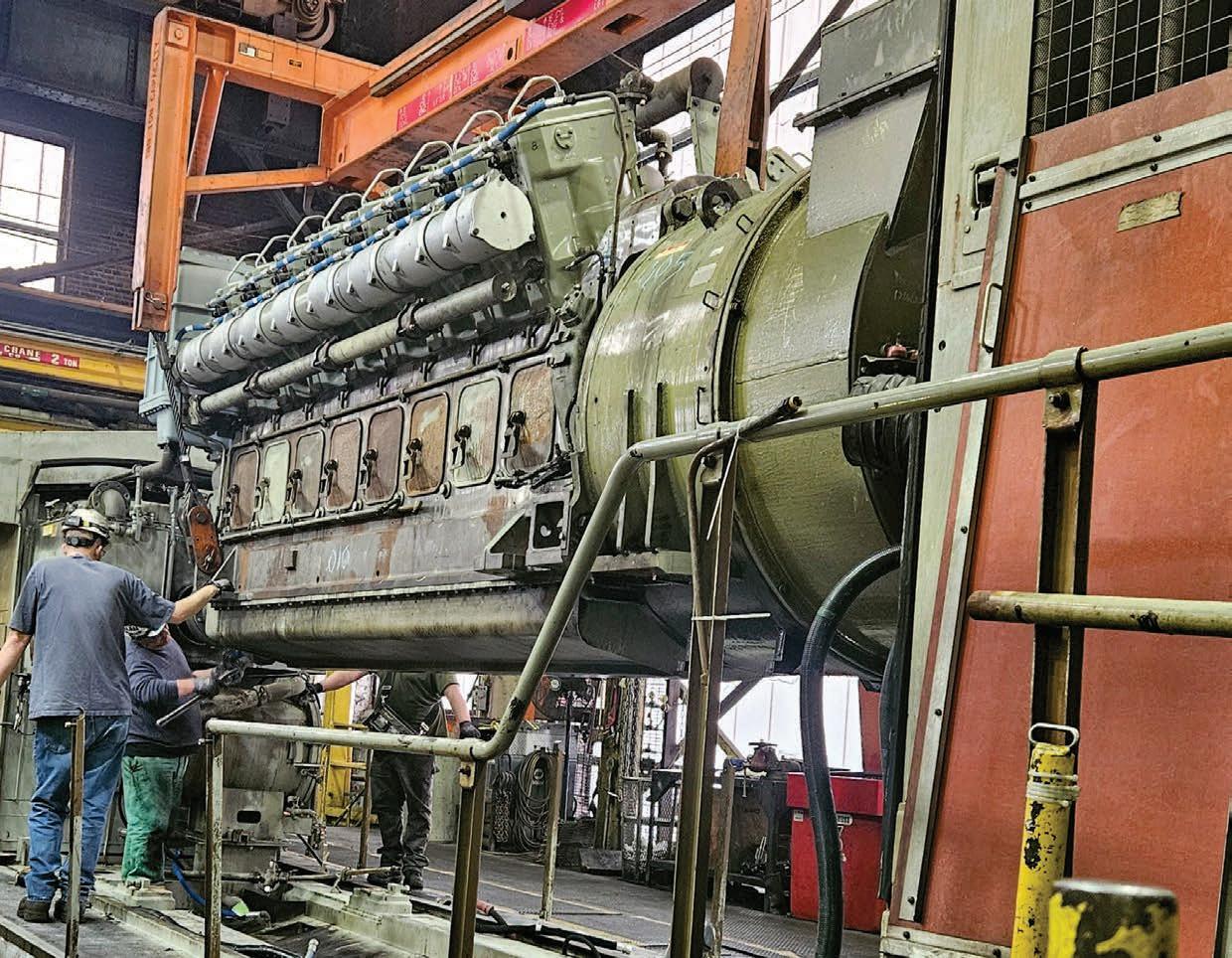

Repairing and rebuilding locomotives in Altoona, Pa., has been a blue-collar activity for a very long time, and Norfolk Southern’s Juniata Locomotive Shop continues that tradition, which dates back 175 years.

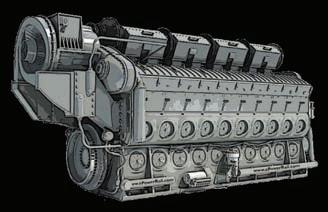

Situated in the heart of the Allegheny Mountains, where NS’s Pittsburgh Line main line snakes up and over a 2,100-foothigh summit via the renowned Horseshoe Curve landmark, the 70-acre complex stands as the railroad’s sole heavy repair shop. It handles scheduled engine and truck overhauls, wreck repairs, and

capital-upgrade programs that turn out rebuilt and updated units at half the cost of buying new locomotives. It is largest locomotive repair facility in America, and many observers say it is also the most complete and most modern such shop on any Class I carrier.

“The team at Juniata Locomotive Shop plays a vital role in keeping our operations running safely and efficiently,” said NS Chief Operating Officer John Orr. “Their ability to effectively maintain and rebuild locomotives gets engines back on line faster, which keeps freight moving. What’s equally impressive is the legacy

behind their work. Some families there are fifth-generation railroaders. That deep history and pride in their craft make Juniata a cornerstone of our railroad.”

The complex consists of one main building, the E&M (Erecting & Machine) Shop, housing 27 tracks, supported by 15 other buildings devoted to specialty functions such as welding, machining, blacksmithing, painting, emissions testing, and inventory storage. In all, they total 1.3 million square feet of working area, with about 30 acres under roof.

Some of the buildings date to 1889, when the Pennsylvania Railroad expanded its

shop facilities from downtown Altoona, which began repairing equipment almost as soon as rails reached the area in 1850.

Opened in 1924 with a footprint measuring 340 feet by 680 feet, the E&M shop was designed to build and overhaul steam and electric locomotives in four bays, “A” through “D,” which remain in use today. It was converted to handle diesel-locomotive work in the 1950s and further updated in the 1960s. When PRR merged with the New York Central Railroad in 1968, the resulting Penn Central closed some facilities in Altoona, such as the former Test Department, but retained the heavy repair work.

When Conrail took over from the bankrupt PC in 1976, it centered all of its systemwide heavy locomotive work at Juniata. As part of its investment, Conrail added an “E” bay to the west end of the E&M shop in 1980, enclosing an open space between that building and the 1889 Juniata Shops buildings.

NS acquired its share of Conrail in 1999, including Juniata, and, like Conrail, concentrated all heavy repairs and capital programs there.

The shop currently employs around 430 skilled workers in seven trades, a shadow of the 16,000 shop workers PRR employed across a 218-acre complex during the ’teens and 1920s. But that was when the PRR—then the largest railroad in America—designed, built, tested, updated, and overhauled everything that moved—locomotives and passenger

and freight cars—and much that didn’t. Between the Juniata shops and the older Altoona Machine Shops, PRR built 6,587 steam locomotives, 283 electric units, and three gas/diesel units for a grand total of 6,873 in that era.

Even very large railroads no longer build their own locomotives and cars, but the tradition of expertise in locomotive design, technology and construction remains strong at Juniata. From traction motors to prime movers, from trucks to cab interiors, from frames to emissions testing, the shop handles all aspects of maintaining, repairing, and modernizing NS’s fleet of motive power. That fleet comprises 3,149 locomotives (with 700 more listed in storage), running throughout the road’s 19,500-mile, 22-state system in the East, South and parts of the Midwest.

Employees at Juniata are represented by seven crafts: boilermakers, carmen, clerks, electricians, firemen and oilers, machinists, and sheet-metal workers.

Juniata might be called the “mother ship” for a half-dozen other NS shops that handle light and running repairs. Its distribution center takes in and sends out components needed to carry out routine locomotive and car maintenance, both to and from the shops and to and from suppliers. Each with its own long history, these system shops are situated at Enola and Conway, Pa. (former PRR), Bellevue,

Ohio (former Nickel Plate Road), Chattanooga, Tenn. (former Southern Railway), Elkhart, Ind. (former NYC), and Shaffer’s Crossing (Roanoke), Va. (former Norfolk & Western). The center also serves smaller regional shops.

In addition to overhauling road and yard units as they come due, Juniata has long been a center for capital, or totalrebuild, programs.

The most recent of these projects is converting older DC-traction General Electric/Wabtec Corp. six-axle road units (Dash 9-40C and Dash 9-44CW models) into AC-drive AC44C6M locomotives in a joint program with Wabtec. NS’s currentyear budget calls for a total of 79 conversions (NS Nos. 4881-4939), of which 20 are being completed at Juniata (NS Nos. 4940-4959). By the end of 2025, NS will operate a fleet of 1,000 AC-converted units, including Electro-Motive Diesel/ Progress Rail SD70M-2s converted to SD70IAC units.

Each unit in this program gets a new Model FDL-A (FDL-Advantage) diesel engine, which Wabtec has supplied since 2023. Earlier, Juniata rebuilt FDL engines for the AC44C6M conversions handled there.

According to NS, the process takes about nine weeks: two weeks to dismantle and prepare a locomotive, four weeks to rebuild it with new and reconditioned components, including a new cab; a week

to test it in the Juniata Test Shed, and a week to paint it (two weeks for specialty paint schemes).

As a result, NS reports a 25% greater fuel efficiency, 40% greater availability/reliability (cutting delays), and 55% increase in hauling capacity. Among the upgraded features are energy management systems such as Trip Optimizer software, an Automatic Electronic Start Stop system to conserve fuel, improved emissions controls, and advanced diagnostics.

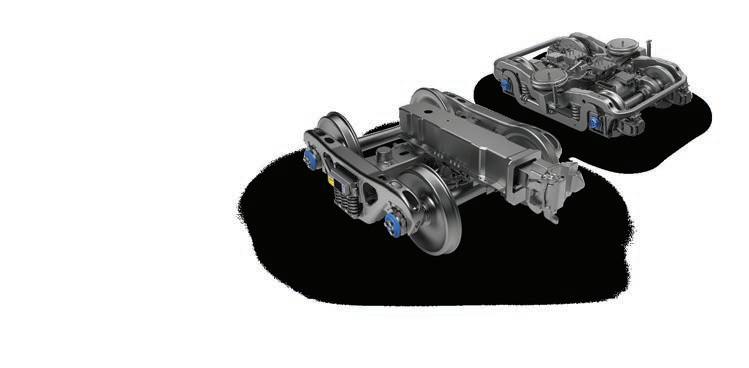

A second capital upgrade project under way is life-extension overhauls to yard and local power, converting ElectroMotive Diesel, formerly Electro-Motive Division, SD40-2 units (six-axle former road locomotives dating to the 1980s) to SD40-3s. This involves installation of new microprocessor control systems, truck overhaul, engine overhaul, and installation of Positive Train Control if needed for the assigned territory.

It also incorporates the addition of a Juniata-designed “Admiral” low-nose short-hood cab, so named for an inwardslanting windshield design that mimics that of a naval vessel. It was suggested

as a means of reducing glare by a retired admiral, Paul Reason, who was a member of the NS Board of Directors at the time.

The cab superstructure also incorporates crashworthiness standards to protect the crew in the event of a collision. The low nose is built with one-inchthick steel, compared to the quarter-inch used by the original manufacturer, EMD. Cabs are built by a fabricator, Curry Rail Services, in nearby Hollidaysburg, Pa., which occupies part of the former NS Hollidaysburg Car Shop.

Since 2021, Juniata has completed upgrades on 50 of these units (NS Nos. 6400-6449), with several more under way.

Of the two programs, Jennifer Bailey, Director Mechanical Operations, said, “These are substantial capital projects that extend the life of the asset.” Bailey, who oversees the entire Juniata Locomotive Shop operation, added: “Understanding the capabilities of shops on the NS system and the need to balance our assets and workload across the system gives me an even greater appreciation for the valuable work performed at Juniata by the skilled employees here.”

Bailey has been at Juniata since 2017. While an engineering student in college,

In the E&M Shop “A” Bay, eight Wabtec/GE FDL-series primemovers are lined up prior to installation. Juniata Locomotive Shop, Jan. 25, 2022.

she worked in a co-op program with NS before hiring on in 1999 as a management trainee in the Mechanical Department. She has stayed in that department ever since, working at locomotive shops at Chattanooga, Tenn.; Shaffer’s Crossing, Va.; Bellevue, Ohio; and Birmingham, Ala.

Kevin Kelly, Senior General Supervisor responsible for the Juniata Capital Line, said, “I’m a fan of this program. We can extend the life of these locomotives—it’s much cheaper than [buying] a new locomotive.” The cost of a new road unit can range from $3 million to $4 million.

“We’re doing work here that nowhere else on the [NS] network can do,” he said. “No one else can fly the locomotives (lifting engines from one workstation track to another with one of two 200-ton cranes in “A” and “D” bays) the way we do.” As a result, he said, “The guys have a lot of pride in their work.”

Besides these capital programs, other major projects Juniata has handled for NS are:

• GP5 0 to GP38-3 conversions (NS Nos. 5801-5836).

• GP59E mothers and slugs (NS Nos. 6649-6661).

• SD50 to SD40E conversions (NS No s. 6300-6358).

• SD6 0 to SD60E rebuilds, including NS-designed wide-nose “Crescent” cab (NS Nos. 6900-7035).

• Fou r- and six-axle ECO locomotives and slugs (partially governmentfunded projects).

• Cab upgrades (with the “Admiral” cab) to GP38-2 and SD40-2 units.

Among the tasks handled at Juniata:

• Car rying out wreck repairs and heavy overhauls.

• Ove rhauling diesel prime movers (88 of them for 2025).

• Rebuilding alternators and generators.

• Rebuilding prime-mover power assemblies.

• Rebuilding traction motors and wheelsets to provide “combos” for the entire NS system.

• Rebuilding locomotive trucks (36 of them in 2025), which includes axle work, wheel replacement, and reprofiling treads and flanges to meet tolerances.

• Str aightening wreck-deformed cast-iron trucks in an 1,800-degree furnace.

• Cutt ing steel plate up to 7 inches thick with plasma technology.

• Pro ducing signage and decals for the NS system.

• Des igning and manufacturing spare parts.

The paint shop is the last stop after a locomotive has been overhauled or rebuilt. A standard NS black-and-white Thoroughbred paint scheme, featuring Topper the NS horse mascot on the locomotive nose, takes about a week (five shifts) to complete. The job includes preparation, sanding, applying primer, masking, painting the finish coat, and drying. It takes twice that amount of time and labor—as much as 750 hours—to apply a specialty paint scheme with decorations, striping, logos, and an array of colors. These include NS’s popular heritage schemes, which honor 23 of the predecessor railroads that formed the present-day

NS. Among those painted by Juniata are Pennsylvania, Nickel Plate Road, Norfolk & Western, Conrail, Lehigh Valley, Tennessee, Alabama & Georgia, and Delaware & Hudson.

Others include a unit that honors military veterans (NS SD60E No. 6920), two First Responders units (SD60E No. 9-1-1 and GP38-2 No. 5642) and a “Thank You to Our Railroaders” unit (AC44C6M No. 4822). No. 5642 travels with NS’s safety training train, which each year offers classroom and handson instruction in dealing with hazmat incidents to first responders at dozens of stops around the NS system.

NS conducts locomotive exhaust emissions testing for units in its own fleet; most other Class I’s except Union Pacific;

the Association of American Railroads; and the two major manufacturers, Wabtec (GE) and Progress Rail (EMD).

The department assesses gaseous and particulate (soot) emissions and measures opacity of exhaust, all according to a carefully spelled-out procedure, with results rigorously tabulated. In collaboration with AAR, the federal Environmental Protection Agency determines which types of units each railroad will test in a given year at Juniata.

“We are the only Class I railroad that has its own indoor test facility,” said Mike Reindl, a gang leader for emissions testing.

NS devotes nearly all its resources at Juniata to its own fleet. In the past, Conrail and later, an NS subsidiary, Thoroughbred Mechanical Services TMS), operated an insourcing program that solicited

Freshly outshopped from Norfolk Southern’s Capital Rebuild line, Wabtec (General Electric) AC44C6M unit No. 4943 glistens with a fresh coat of paint in NS’s Juniata paint shop, wearing the road’s standard black-and-white Thoroughbred scheme. Aug. 15, 2025.

With Brush Mountain as a backdrop, the 70-acre Juniata Locomotive Shop complex lies tucked between NS’s Pittsburgh Line main line and Altoona’s Fourth Avenue. The white building at rear is the E&M Shop.

locomotive mechanical work from other Class I roads, passenger and commuter carriers, short lines and regional roads, and leasing companies. Among its clients were Amtrak, MTA Metro-North Railroad, New Jersey Transit, Florida East Coast, GATX, Helm Leasing, Railpower Technologies and Union Pacific. NS later ended the TMS program.

Juniata also assembled locomotives from kits supplied by GE and EMD— some for Conrail and NS and some for other railroads. For a brief period, November 1998 to June 1999, both programs were under way at Juniata, the only time in American history that new locomotives of GE and EMD—traditional competitors—were built under the same roof, according to the history website Altoonaworks.info.

As a demonstration of NS’s commitment to the future of Juniata, the company about 10 years ago undertook a $53 million project to replace a coalburning generating plant with a gas-fired system. The company estimates that it saves $4 million annually in fuel costs and cuts carbon-dioxide emissions by 29,000 tons per year. It normally supplies all the shop’s electrical needs, but the complex can rely on a commercial utility when the gas-fired plant is off line for maintenance or repair.

Although not considered motive power, NS’s office-car passenger fleet is housed and maintained on the Juniata Locomotive Shop complex.

Workers prepare the cars for Office Car Special trains, when NS officials inspect the railroad or entertain shippers, public officials, and railroad families.

Painted in a deep red with gold striping that recalls the colors of former Norfolk & Western passenger trains such as the Pocahontas and Powhatan Arrow, the cars represent an amazing variety of styles and pedigrees. Employees assigned to the long building where they’re kept, Miscellaneous Shop No. 2, must look after not only mechanical parts such as brake shoes and couplers but also window glazing; upholstery; interior decorating; plumbing, heating and air conditioning; head-end power; and bedroom and kitchen furnishings.

A few of the 20-some cars began life as heavyweight 1920s-era open-platform observation cars, while others are more modern, from the lightweight streamlined-car era of the 1940s and 1950s. The oldest dates from 1911; the newest was built in 1954. Most are named for states through which NS operates.

Some are configured with sleeping compartments and office workstations; others are set up with dining or lounge

space, a gym, or a crew room. In addition to inspection-trip duty, the Office Car Special train makes a journey each April to the Masters golf tournament at Augusta (Ga.) National Golf Club, where it serves as a stationary reception area for NS officers entertaining guests.

Out on the road, the most popular cars are Nos. 23, Buena Vista, and 24, Delaware. Buena Vista is a theater car, with tiers of rearward-facing seats arranged in an inspection gallery that allows passengers to look back at the track as it recedes behind the moving train. Originally built by the Budd Co. for Santa Fe Railway’s San Francisco Chief passenger train, Delaware is a fulllength dome car, with lounge seats and tables arranged along the length of the elevated viewing cabin.

As Director Mechanical Operations, Bailey reflects on the long history of the facility she manages this way: “Leading the shop is such a privilege and extremely rewarding. I’m constantly amazed by the level of skill, dedication, and pride the team brings to their work. Every day, I see incredible craftsmanship, creative problem-solving, and a deep commitment to doing things the right way. Because our work matters. It’s inspiring to see how much ownership each person here puts into what they do.”

Our strategy for ensuring your business stays on course includes our fleet of six manufacturing plants, five service centers, and 24 local sales offices.This diverse manufacturing capability allows us to offer flexibility while meeting your needs through our direct sales team and application engineering experts. Since 1878, Okonite has been a benchmark in the industry—all of our products are proudly made in the U.S.A.

1 & 2

Fairmont Pittsburgh Pittsburgh, PA

Light Rail 2025 delivers a focused, in-depth look at the technical, environmental, and socio-economic challenges of planning and operating light rail transit (LRT) systems in today’s urban environments.

Who Should Attend Professionals in LRT planning, operations, civil and systems engineering, vehicle technology, and signaling.

Program Content Includes

• Major New-Builds and System Expansions

• Capital Program Management

• Extreme Weather Events: Planning and Mitigation

• Innovations in Rider Experience

• Alternative Propulsion Technologies

• Special Regional Tour

Connect with LRT professionals from around North America!

Andy Lukaszewicz Deputy Chief Officer Rail Ops Pittsburgh Regional Transit

Casey Blaze Deputy Project Mgr.

Greater Cleveland Regional Transit Auth

Ida Posner COO Railroad Development Corp.

Justin Selepack Dir., Railcar Maintenance Pittsburgh Regional Transit

Nate Asplund President Pop-Up Metro, LLC

Rachel Burckardt, P.E. SVP/Sr. Project Mgr., Northeast Lead WSP USA

Bryan K. Moore Project Mgr., Railcar Replacement Program

Greater Cleveland Regional Transit Auth.

John Mardente Civil Engineer, Passenger Rail Div. Federal Railroad Administration

Barbara M. Schroeder, P.E., P.M.P. Rail Transit Project Manager Benesch

Drones are helping railroaders assess risk, reduce dwell, and boost efficiency and safety.

BY MARYBETH LUCZAK, EXECUTIVE EDITOR

Railroads are employing drones equipped with high-resolution cameras for inspections to improve efficiency and safety.

The technology—also called unmanned aircraft systems (UAS)—is being used across yards and intermodal facilities, around bridges, along track, to aid with service interruptions and weather emergencies, and to add “eyes in the sky” for security purposes, for example.

BNSF and CSX shared with Railway Age their drone applications. Currently, Part 107 of the Federal Aviation Administration’s regulatory framework allows commercial users to operate drones that are within their “line of site” and weigh less than 55 pounds apiece, among other limitations, according to Michael Ibanez, Manager of BNSF | Tech.

In 2014, BNSF was one of the first companies authorized by the FAA to fly commercial drones, such as fixed-wing models and quadcopters. BNSF began by using drones to aid in the manual inspection of the railroad’s more than 13,000 bridges. As needed, drones piloted by the inspection team capture high-definition video of areas not easily seen—assisting in the detection of structural steel failures and indications of stress, for instance. According to John Martin, Director of BNSF | Tech, inspectors can review the footage during flight or load it onto a computer to view on a large monitor.

In 2015, the railroad conducted the first commercial “beyond visual line of sight” (BVLOS) flight without visual observers (VO’s) in the United States covering more than 135 miles of its Clovis Subdivision. In this first

flight, BNSF tested the viability of fixed-wing drones to perform inspections using computer vision. This successful demonstration accelerated BNSF’s automated inspection efforts.

Since then, BNSF has expanded the types of drones it employs and in 2021 began routine remote flights; the FAA granted the railroad one of the first national Class G airspace waivers to do so across its 32,500 route-mile network, which spans 28 states and three Canadian provinces. During such BVLOS flights, the drone is flown out of the view of the pilot, who monitors its status from a remote location. Martin likens remote operation to a self-driving car. While the flight mission is “keyed up” by the pilot, the drone operates autonomously on a route designed by the railroad and learned by the drone through AI and machine learning; the pilot can intercede if there is an abnormality.

The FAA waiver allows the railroad to inspect intermodal facility inventory, which helps improve not only yard dwell time but also customer service. “We use drone technology to make sure we always have an accurate inventory of where our customers’ freight is in a facility,” Martin tells Railway Age. This ensures that freight either gets onto the proper train as scheduled, or onto the truck for the last mile delivery. “With millions of containers coming through our terminals every year, being able to precisely locate each shipment is key to efficiency,” he says. “Drones, combined with other automated technologies, provide near real-time location updates of our customer’s containers.”

Adds Ibanez: “When we tell a customer their freight will be there on Monday at 11 a.m., drones are helping us meet those expectations.”

Dedicated drone pilots handle remote operations at BNSF’s Flight Center in Fort Worth, Tex. BNSF performs about 1,200 flight hours per month across two intermodal facilities.

At BNSF, drone technology also plays an important role in incident response and assessing weather emergencies and natural disasters. “Drones help us understand how we can restore service for our customers as quickly as possible,” Martin says. More than 250 employees across its network are licensed pilots who aid in supporting this fast-response capability. Drones also play an important role in freight security, “putting more eyes in the sky” to spot bad actors, for instance.

Additionally, civil engineering teams are deploying drones mounted with LiDAR to plan construction and improvement projects.

What’s next? The Class I railroad is working to expand drone use across not only its intermodal terminals, but also its switch yards. And while it has invested in automated machine vision systems and locomotives equipped with laser profilometer systems to measure track health, BNSF is evaluating how drones can help inspect other critical assets.

Martin tells Railway Age that the railroad is researching fixed-wing drones that can cover 200 miles of track. “The ability to cover longer distances will unlock new capabilities,” he points out. “It’s something we’re actively working on in the industry. We’re also investigating drone swarm technology, where the drones work and communicate with each other autonomously to accomplish a task.”

Last year, the FAA granted BNSF another waiver, which allows a pilot to remotely operate up to six drones simultaneously, helping

“efficiently scale the technology.”

In July, the U.S. Department of Transportation released a proposed rule to “normalize” BVLOS flights, including detailed requirements for safe operations (see PerformanceBased Regulations, p. 22). BNSF is hopeful that the new rule “takes flight.”

“We’re committed to being on the forefront of how we can leverage [drone] technology to better serve our customers,” Martin sums up.

CSX has been implementing drone technology since 2015. More than 320 FAA Part 107-certified pilots operate 250-plus drones across the company’s bridge, engineering, police, mapping/surveying, and transportation departments. Drones are outfitted with sensors to accomplish different tasks. The police, for instance, have drones with thermal technology to perform surveillance at night for enhanced security operations.

Drones supplement manual bridge inspections to take railroaders out of harm’s way. “That’s been a great success story for us,” CSX Technical Director of GIS Services Patrick Barnett tells Railway Age. “Equipped with collision avoidance, drones allow bridge inspectors to get right up close to the structure and its components to keep those employees safe verses having to get underneath a bridge.”

Drones also help with disaster recovery. “We used them [last fall] following Hurricane Helene and the damage it caused to the Blue

Ridge Subdivision,” he says. “Being able to go in there and assess very quickly with drone technology enabled us to make decisions quickly.” Blue Ridge, a 60-mile stretch of railroad in North Carolina and Tennessee that handles some 14 million gross tons of freight annually, suffered extensive damage due to flooding. It has taken roughly 10 months to get the roadbed ready for track panel installation.

CSX also employs autonomous drone technology at 13 sites spanning 10 yards across its some 20,000 route-mile network in 26 states, the District of Columbia, and the Canadian provinces of Ontario and Quebec. As a supplement to manual inspections, drones outfitted with sensor cameras are helping to measure track gauge, identify broken rail and detect switch-point gaps of greater than 1/8th of an inch, for instance. “The way I like to tell people is we’re flying at 150 feet, and we’re detecting if the [switch-point gap] is greater than the width of a credit card,” Barnett says. “We’re working toward identifying defects that can potentially cause a derailment in a yard.”

In February, the railroad received BVLOS approval from the FAA for autonomous or remote drone operation at those yards. Rollouts to identify track defects will begin at the end of this year. The railroad is approved to fly drones at 150 feet above ground level and operate at two-plus miles in each direction from where the drone site is located through 2027, according to Barnett. Hypothetically, he says, an employee working as a “drone pilot”

at the Command-and-Control Center in Jacksonville, Fla., could be overseeing drone operations in New York. An employee in a yard office could launch the operation via the CSX computer system, confirming that a track is clear, for example. This action would trigger the drone to perform an automated and programmed inspection and stream data to the Command-and-Control Center in real time.

With the new FAA waiver, “we went from needing three individuals on the ground to operate a drone to not needing someone there, so that has been a monumental milestone for our company, and it’s one that leads the industry and something we’re very proud of,” Barnett says.

In the future, CSX expects to implement remote drone operations at additional yards and consider implementing drones for lineof-road track inspections. “This will take additional dialogue with our federal regulators because we are talking about a vision of inspecting 50 miles at a time,” he says, noting that CSX would pair drones with other types of technologies. Combined, that would not only reduce track time and improve operations but also increase railroader safety. “Safety is our number one priority,” Barnett stresses.

Last month, the FAA and Transportation Security Administration proposed “performancebased regulations to enable the design and operation of UAS at low BVLOS altitudes and for third-party services, including UAS Traffic Management, that support these operations.”

Comments are due on or before Oct. 6, 2025.

The proposal is necessary to support the

integration of UAS into the national airspace system, according to the FAA and TSA in their Notice of Proposed Rulemaking. It is also intended to provide a “predictable and clear pathway for safe, routine, and scalable UAS operations that include package delivery, agriculture, aerial surveying, civic interest [to include wildfire recovery, wildlife conservation, and public safety], operations training, demonstration, recreation, and flight testing.”

According to the FAA and TSA, operations would occur at or below 400 feet above ground level, from “pre-designated and accesscontrolled locations.” The TSA also proposes making “complementary changes to its regulations to ensure it can continue to impose security measures on these operations under its current regulatory structure for civil aviation.”

“To date, the FAA has allowed some such [BVLOS] operations through individualized exemptions and waivers to existing regulations,” according to the NPRM. “This NPRM leverages lessons learned from individual exemptions and waivers to create the repeatable, scalable regulatory framework … that would allow for widescale adoption of UAS technologies.”

Under the proposed rule, all operators would need FAA approval for the area where they intend to fly. They would identify boundaries and the approximate number of daily operations, as well as takeoff, landing, and loading areas, the FAA explained in a fact sheet. They also “would ensure adequate communications coverage and procedures in cases where the communications with the drone are lost.” The FAA noted operators “would have to be familiar with airspace and flight restrictions along their intended route of flight including reviewing

Notices to Airmen,” and “be required to identify and mitigate any hazards.”

Operators would also use Automated Data Service Providers “to support scalable BVLOS operations,” the FAA said. “ADSPs could provide services to keep BVLOS drones safely separated from each other and manned aircraft.” The FAA would approve and regulate these entities and require services to “conform to industry consensus standards following vetting and testing.”

Additionally, drones would have technologies that “enable them to automatically detect and avoid other cooperating aircraft,” the FAA said. They would also “yield to all manned aircraft broadcasting their position using ADS-B” and “could not interfere with operations and traffic patterns at airports, heliports, seaplane bases, space launch and reentry sites or facilities where electric Vertical Takeoff and Landing aircraft take off or land.”

“It is encouraging to see this long-overdue BVLOS rule released,” Association of American Railroads President and CEO Ian Jefferies says. “America’s freight railroads commend Secretary [Sean P.] Duffy and the USDOT for advancing a forward-looking policy that could help unlock the full potential of unmanned aircraft systems across our national transportation network. Routine BVLOS operations hold tremendous potential for railroads— enhancing safety, speeding up inspections, and improving emergency response in ways that were previously limited. AAR members have long advocated for a rule that offers clarity, scalability, and meaningful safety benefits, and while we are still reviewing the rule in full, we are optimistic that [the] action represents a significant milestone toward that goal.”

Will federal regulations be updated to incorporate advanced tech like drones as part of the track inspection process? “While we can’t speculate about specific future regulatory developments concerning track inspections, FRA will continue to explore and embrace industry’s use of new and innovative technologies including UAVs in railroad operations,” FRA tells Railway Age, noting that railroads use drones for a variety of applications, including for bridge inspections as long at such use is part of the approved bridge management plan. It added that while “FRA is aware that railroads are interested in using drones as part of their track inspection processes, from a

technical perspective at this point, drones are of limited utility for track inspection because they cannot measure the track under load.” Following is FRA-sponsored research:

• Railroad Bridge Inspection Using DroneBased Digital Image Correlation. https:// railroads.dot.gov/elibrary/railroadbridge-inspection-using-drone-baseddigital-image-correlation, 2023

• Utilization of Unmanned Aerial Vehicles in Accident Reconstruction. h ttps://railroads.dot.gov/elibrary/ utilization-unmanned-aerial-vehiclesaccident-reconstruction, 2022

• Line-of-Sight Analysis Using Drones and Photogrammetry. https://railroads.dot. gov/elibrary/line-sight-analysis-usingdrones-and-photogrammetry, 2021.

• AXIS: An Automated, Drone-Based, Grade Crossing Inspection System. https://railroads.dot.gov/elibrary/axisautomated-drone-based-grade-crossing-inspection-system, 2020.

• An Automated, Drone-Based Inspection System. https://railroads.dot.gov/ elibrary/automated-drone-based-inspection-system, 2020.

• Automated Track Centerline Following for Drone Flight Automation. https:// railroads.dot.gov/elibrary/automatedtrack-centerline-following-droneflight-automation, 2022.

ONBOARD RAIL VISION, SENSOR PERCEPTION AND WARNING SYSTEM

HORUS enhances train operator situational awareness by sensing and identifying objects in and around the corridor in realtime. Continuous assessments provide the basis for optimized rail operations and maintenance activities.

HORUS is proven in use across light rail, heavy rail, passenger and metro rail environments.

HORUS SENSORBAR

Environmental data is collected by sensors, either externally mounted inside a HORUS SensorBar or built into the rail vehicle. Live data is then processed by an onboard computer.

Driver interface view

ADVANCED DRIVER ADVISORY SYSTEM

The interface delivers real-time information including alarms and warnings, speed, distance to stop, signal aspect and upcoming infrastructure. Functionality is customizable to an operator’s business requirements.

HORUS’ view: The system analyzes rail infrastructure in real-time.

Detection

Collision Avoidance

Detection

Location Assurance Front-of-Train Event Recording

Performance Monitoring

Trip Stop

Hear the 4AI Systems team present at these upcoming conferences:

Railway Age’s Light Rail

October 1-2, Pittsburgh

Railway Age’s Next-Gen Rail Systems

October 30-31, Jersey City

International Heavy Haul Association

November 17-21, Colorado Springs

October 30 & 31, 2025

Hyatt Regency Jersey City

Jersey City, NJ

Railway Age’s Next-Gen Train Control has been the industry’s single-most important communications and signaling event since 1995. For our 30th anniversary, we are expanding our program to encompass the entire system. Expert-led sessions will examine the complex integrations incorporating signaling, train control, telematics, artificial intelligence, deep data analysis, cybersecurity measures and more.

Register and connect with industry leaders, explore innovations, and stay ahead of rail project trends and regulations.

Sponsorships: Contact Jonathan Chalon, 212.620.7224, jchalon@sbpub.com

Kris Kolluri President & CEO NJ Transit

Clarelle DeGraffe General Manager PATH (invited)

Dustin K. Lange Sr. Dir. Engineering Norfolk Southern

Mario Péloquin President & CEO VIA Rail Canada

Jonathan Kirby Sr. Dir., NJT PTC NJ Transit

Brian Yeager Dir., Advanced Tech. & Train Reliability Norfolk Southern

Tom Prendergast CEO Gateway Development Commission

Matthew Kim AVP, IS Enterprise Strategy CPKC

Steven Vant Chief Engineer C&S Conrail

Imagine a future where autonomous freight trains in North America operate across long distances. This future is one the industry must consider if it wants to compete against trucking and its futuristic vision of autonomous truck platoons, according to those working to bring autonomous operations to freight rail. “If it can help the industry be more efficient and productive, it can bring more volume to the network,” Philip Moslener, Wabtec Corporate Vice President Advanced Technologies, told Railway Age.

Autonomous rail already exists in many places around the world, such as airport peoplemovers or driverless rapid transit like Honolulu’s Skyline system. But taking rail to the next level and incorporating autonomous technology into the freight rail space, like that used in Rio Tinto’s Australian operations, requires the ability to handle complex situations. Unlike airport people-movers and rapid transit, which operate in a captive, self-contained environment, autonomous freight rail must have systems that can anticipate, analyze and respond to various situations occurring along an open right-of-way, in real time.

“You need to have what’s called a perception system,” Moslener said. He and his team research new technologies, such as those incorporating AI (artificial intelligence), and see how they can be leveraged in rail operations to support market share growth and reduce carbon emissions. “It could be cameras, LiDAR (Light Detection and Ranging), heat sensors, acoustic sensors, you name it. That’s one of the fundamental building blocks of any autonomous system—rail, truck, cars, whatever.”

MxV Rail has been working to develop increased levels of automation in North American freight rail. Researchers there have been benchmarking efforts against what’s been done in Australia, and they’ve also studied automation advancements in the automotive space, according to Joe Brosseau, Assistant Vice President of Communications and Train Control. “Overall, the approach to automation in North America has been an incremental development roadmap, essentially adding technologies piece by piece to attain nearterm benefits that will increase safety, operational consistency and efficiency, but building those things on a pathway to higher levels of

automation,” he said.

When the freight rail industry initially explored automation several years ago, it looked first at designing the full specifications of what would be required for autonomous operations, according to Brosseau. However, as time went on, the industry realized that one huge system would lead to unreasonable costs with no benefit for a long period of time. “In 2021, we redesigned the program to focus more on an incremental approach where we can gain benefits along the way but still be on a pathway to what we call high automation,” he said.

Now the rail industry uses a multipronged approach to develop automation technology. This approach seeks to incorporate Positive Train Control (PTC), the

existing overlay system that enforces speed restrictions and train separation, among other safety-critical tasks.

Researchers have been exploring how PTC can interact with sensors that would enable autonomous operation, including those that detect and identify right-of-way obstacles, for example. Information from those sensors would interact with PTC to set up stop or speed targets. Some in the industry call this “PTC 2.0.”

“PTC enforces the maximum speed limit, but it’s still incumbent on the crew to look out for obstacles in front of the train,” Brosseau said. “With the restricted speed enforcement enhancement, we essentially add some of these sensing capabilities to detect obstacles.” The PTC system gets the

BY JOANNA MARSH, CONTRIBUTING EDITOR

focused on one specific technology. We want to see what’s out there,” Brosseau said. “We’re setting up a program for next year where we hope to be equipping locomotives with some of the technology now available in the supply market, essentially demonstrating if it has the potential to meet our requirements for restricted speed enforcement, specifically.”

MxV Rail has been working with suppliers to conduct testing at MxV Rail’s Pueblo, Colo., campus, but Brosseau hopes next year will see deployment in revenue service operations so that MxV Rail and others can collect information in different operating environments. “There’s a lot we can do at our facility in terms of testing out fundamental functions of the technology,” Brosseau said. “But for this type of sensing technology, we need to see how it operates when there’s dense foliage, for instance, which we don’t have here in Colorado. We want to collect information from a more diverse environment.”

information on the obstacle and automatically forces the train to slow down. MxV Rail has also explored how energy management can promote automation in manual control zones, according to Brosseau.

MxV Rail doesn’t directly investigate use of rail AI applications, but it does indirectly review its use. The various sensing capabilities that MxV Rail is testing with the supply community also involve machine vision capabilities, for example; “AI that’s interpreting data and then providing that information to automation systems, energy management or PTC, to detect obstacles,” Brosseau said. Indeed, suppliers such as Wabtec use AI to develop sensors that take in data from the environment. The AI assists in situational analysis and trajectory planning,

according to Philip Moslener.

MxV Rail spends a lot of its time in autonomous rail researching sensing capabilities. One aspect of that is evaluating the radar technology being used in some of the automotive automation space and developing proof-ofconcept testing. “It’s a low-cost technology, and from what we’ve seen, it may be capable of doing what’s needed for restricted speed enforcement operations, our current focus on the incremental roadmap,” Brosseau said. Another aspect is working with suppliers with technology they believe can meet requirements for the automation space. They involve several different sensor types, among them cameras, video, radar and LiDARs. “We’re not

Like MxV Rail, Wabtec approached the concept of constructing an autonomous rail system by thinking in terms of multiple building blocks. These include perception, supervisory and PTC systems. This approach has helped Wabtec develop Teleops (photos, opposite), its solution for when an autonomous freight train breaks down in a remote location and there is no one on board to take care of the problem.

“Teleops is basically the ability for somebody to go on board the train virtually,” Moslener said, likening the program to situations where someone in an IT department assesses a work computer remotely. “Teleops means ‘operation from a distance.’ So, it’s somebody at a desk, with the controls, patching themselves into the train and controlling it.” Wabtec has demonstrated the technology on its locomotives at its Erie, Pa., test track.

Although Teleops is still in the research and development phase, Wabtec is using some of its elements now, according to Moslener. “We can use it today, for example, to prepare trains for departure,” Moslener said. “In a yard, it takes a long time to initialize a train and prepare it for operation. Why can’t we do it from an airconditioned office?”

Another Wabtec R&D project is the Maverick, a small autonomous locomotive that would haul short trains traveling distances less than 750 miles, such as between a port and a distribution center. Designed to haul 10 to 15 railcars, a Maverick would be equipped with perception and teleoperation

technologies, enabling it to be operated from a remote dispatch center. Its purpose is to capture a short-haul, just-in-time market that tends to be underserved by the rail industry and where transloading from truck to rail is cost-prohibitive.

Development of Wabtec’s R&D projects depends in part on market demand and interest in these offerings, according to Moslener. However, “we’ve found that as we develop these technologies, we come up with other ideas,” he said. “Teleops is going to be needed for a large, fully autonomous train, but we can use it today in certain applications.” For example, a mining customer in Brazil is interested in using Teleops for unmanned zone operations where it’s too dangerous for humans because of landslides.

Through its work on Teleops, Wabtec has developed Pathfinder, a technology that can be implemented on older, low-horsepower locomotives to allow them to use new digital equipment and sensors that one day may allow for autonomous operations. “If you want Netflix on your older TV, what do you do? You change the TV, or get a Roku Streaming Stick,” Moslener said. “Think of Pathfinder as a Roku Stick for an older locomotive. Pathfinder, with its digital technologies and PTC, can be plugged in, allowing older low- and mediumhorsepower locomotives to be outfitted with new technology.”

Wabtec describes Pathfinder as “a small

digital slug designed to automate the train, not necessarily the locomotive. It detaches the brain from the brawn, where the lowhorsepower unit still relies on its existing propulsion technology, but all the intelligence and automation in how to run the train resides in Pathfinder.”

Meanwhile, the R&D team at Progress Rail has been developing Talos (above), which the company describes as “leveraging machine learning to analyze and optimize train routes, as well as develop customized strategies for individual routes that factor in operational conditions. Talos incorporates track topography, train consist information, route data and historical analysis to build a unique and optimized operating strategy resulting in significant improvements in fuel and/or time efficiencies, The technology will also enable the locomotive engineer to focus on safety and situational awareness.”

Talos has been designed “for use in all locomotive makes and models,” and Progress Rail engineers have been testing the technology at MxV Rail. The company says the train, controlled by AI, operated more than 200 miles “without human intervention, operating flawlessly with independent power.”

“Talos is more than an energy management system—it’s a bridge to the future of autonomous freight rail,” Sammy Akif, Progress Rail Vice President of Advanced Rail Technology, told Railway Age. “By integrating

an AI-based controller and machine vision safety systems, Talos transforms traditional rail operations into an intelligent, sustainable network. As the industry moves toward automation, Talos stands out as a scalable, interoperable platform designed to optimize fuel, reduce emissions and seamlessly connect legacy infrastructure with nextgeneration locomotive technologies.”

Discussing autonomous freight rail operations in North America may sound glamorous or futuristic, but for some, the elephant in the room is whether autonomous trains will replace workers. Moslener said he believes that wouldn’t be so, and Teleops is being designed with the understanding that automation will still require some level of human involvement in the loop.