PRIVATE CREDIT GUIDE

Your go-to resource for understanding the private credit landscape, showcasing expert insights, unique fund strategies, and exclusive investment opportunities.

PRIVATE CREDIT GUIDE

Welcome to our special report on some of Australia’s most compelling private credit opportunities, designed for wholesale investors seeking income, capital preservation and portfolio diversification. In this report, we highlight six leading private credit funds, each offering unique strategies, risk management approaches and market exposures.

Across these chapters, you’ll learn how these funds deliver stable income through real estate-backed loans, corporate credit and first-mortgage structures, while maintaining disciplined lending and active portfolio oversight. We also explore target returns, investment horizons and the expertise of the managers behind each fund, showing how private credit can complement traditional portfolios.

Our esteemed sponsors bring deep experience to each strategy: AltX and Zagga in real estate private credit, Capital Prudential in development and senior lending, Challenger in multisector corporate credit, Metrics in corporate loan origination, and Pallas in first-mortgage commercial real estate.

This report is more than a guide – it’s a window into investment approaches that combine income, capital protection and access to markets traditionally reserved for institutions. Here’s a quick look at what you’ll get in this report:

AltX Credit Fund : Unlocking opportunities in Australian private credit outlines a fund that aims to give wholesale investors access to Australia’s

growing private real estate debt market, delivering steady income backed by real property.

With six different share classes, investors can choose the mix of returns, risk and liquidity that best suits their goals. Supported by AltX’s strong track record, hands-on management and solid independent ratings, it offers a flexible option for diversifying portfolios.

Capital Prudential’s Senior Income Fund and Wholesale Real Estate Income Opportunity

Fund walks you through Capital Prudential’s two flagship private credit funds, both designed to generate steady income from real estate-backed lending. The Senior Income Fund targets Reserve Bank of Australia (RBA) cash rate +5 per cent p.a. with conservative first-mortgage loans, while the Wholesale Real Estate Income Opportunity Fund pursues higher yields of RBA cash rate +7 per cent p.a. through more complex deals. Together, they provide access to diversification, disciplined risk management and Australia’s growing nonbank lending market.

Challenger IM

Credit Income

Fund highlights a floating-rate, multi-sector credit strategy designed to generate consistent income with

THIS REPORT IS MORE THAN A GUIDE – IT’S A WINDOW INTO

INVESTMENT

APPROACHES

THAT COMBINE INCOME, CAPITAL PROTECTION AND ACCESS TO MARKETS TRADITIONALLY RESERVED FOR INSTITUTIONS.

lower volatility than traditional fixed income. By investing across both public and private credit markets, the fund targets Bloomberg AusBond Bank Bill Index +3 per cent p.a. after fees, while keeping interest rate and credit risk tightly managed. With an experienced team, strong governance and a proven platform dating back to 2005, this fund gives you access to opportunities once reserved for banks and institutions.

Metrics Direct Income Fund discusses a strategy designed to deliver monthly cash income, low capital volatility and diversification by investing in Australia’s corporate loan market. The fund provides exposure to a portfolio of 300+ loans diversified across industries and credit quality, with the added benefit of floating-rate protection against inflation. Backed by Metrics’ experienced direct origination team, this fund gives you access to stable, income-generating opportunities traditionally dominated by banks.

Zagga Feeder Fund : Delivering determinable income through Australian real estate private credit will walk you through a strategy built to generate stable monthly income while preserving capital, backed by secured loans over real assets.

This fund invests in a diversified portfolio of senior real estate debt, supported by conservative lending standards, independent valuations and active monitoring. With strong independent ratings and Zagga’s specialist expertise in private credit, it offers access to one of the most resilient and fast-growing segments of the market.

The Pallas Senior Income Fund introduces a first-mortgage commercial real estate strategy designed for wholesale investors seeking regular income, low volatility and portfolio diversification. The fund invests in a diversified portfolio of senior-secured Australian and New Zealand CRE loans, backed by strong capital protection measures, including loan impairment buffers and conservative loan to value ratios. Actively managed by Pallas Capital’s experienced team, it offers access to high-quality, asset-backed income alongside institutional investors.

CHALLENGER IM CREDIT INCOME FUND

The Challenger IM Credit Income Fund is a floating rate, multi-sector credit strategy which invests across high quality, predominantly investment-grade opportunities. The fund invests across public and private credit opportunities to take advantage of relative value in both markets, targeting a higher level of income than public market strategies while offering a defensive and diversifying investment solution with limited interest rate risk.

THE CREDIT Income Fund aims to provide clients with consistent income accompanied by lower levels of volatility than traditional fixed income strategies. As a leader across multiple private lending markets since 2005, the Challenger IM team is able to unlock opportunities which have historically been largely limited to banks and a small number of large and specialised institutions.

Key features of the fund

Low volatility and regular income

The fund aims to achieve superior absolute returns over the medium to long term while offering capital stability and a steady income stream.

Superior diversification

The fund invests across both public and private credit markets, providing the opportunity to allocate to the most attractive sectors over time.

Focus on risk

The fund aims to reduce market risk by maintaining a relatively short spread duration and limiting credit risk, targeting an average investment grade rating.

Experienced team

The team’s breadth of experience allows them to exploit market inefficiencies across all sectors in the global credit market.

Strong governance

Investors benefit from a robust governance framework including an independent credit risk management team within the Challenger Group.

Who is the fund suitable for?

The fund is best suited to investors who:

R equire an investment with consistent levels of income.

Understand and are willing to accept a higher level of liquidity risk in order to generate higher returns than daily liquid fixed income products.

Have an investment horizon greater than three years.

Fund facts

Investment return objective: The fund aims to achieve superior absolute returns over the medium to long term while offering capital stability and a steady income stream.

Performance target: Bloomberg AusBond

Bank Bill Index + 3% after fees

Liquidity: Monthly with 10% fund level gate

Distribution frequency: Quarterly

Recommended investment horizon: 3 years +

Fees (Class A): 0.60% p.a.

Minimum initial investment (Class A):

Key mitigants to risk

L ow-interest rate risk with maximum one-year duration.

All assets hedged to Australian dollars minimise currency risk.

Covenant to maintain average investment grade credit rating limits the risk of the manager taking on excessive levels of credit risk.

A 10 per c ent cap on monthly redemptions reduces the potential for large withdrawals to negatively impact remaining unitholders.

For a full description of the risks related to investing in the fund please refer to the product disclosure statement (PDS).

fidante.com/au/CHAL-PDS-CIF.pdf

The Challenger IM Credit Income Fund has received two ratings – a “Highly Recommended” rating from Zenith and a “Recommended” rating from Lonsec Research.

Why Challenger IM?

Our investment platform was established in 2005 and as one of the only investment managers in Australian private credit that has pre-Global Financial Crisis experience, we aim to be the first call for borrowers requiring scalable, flexible and tailored lending across corporate, asset-backed and commercial real estate markets. Direct engagement, combined with scale of capital and experienced underwriters, allows us to provide more flexible solutions to borrowers and to charge an appropriate excess return for such solutions. Challenger Investment Management employs rigorous and comprehensive practices regarding risk and governance in private credit investing. We take a robust fair value approach to valuations, striving to ensure all our clients are treated fairly and equitably at all times. Upfront fees are paid to our investors, minimising conflicts of interest

and the independent credit risk team, responsible for risk assessments and ratings, is separate from the investment team, ensuring downside risk is appropriately considered and mitigated in every deal we do.

How to invest

You can invest in the Challenger IM Credit Income Fund online through Boardroom or by contacting a Fidante BDM: E: bdm@fidante.com.au

P: 1300 721 637

Disclaimer: The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (Challenger IM Credit Income Fund - Class A (HOW8013AU) assigned June 2025) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at https://www. zenithpartners.com.au/our-solutions/investment-research/regulatory-guidelines/

The ratings published on 11/2024 for Challenger IM Credit Income Fund – Class A and 11/2024 for Challenger IM Multi-Sector Private Lending Fund – Class P are issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). Ratings are general advice only and have been prepared without taking account of investors’ objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec Research assumes no obligation to update. Lonsec Research uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2025 Lonsec. All rights reserved.

To learn more about how Challenger can help, click here

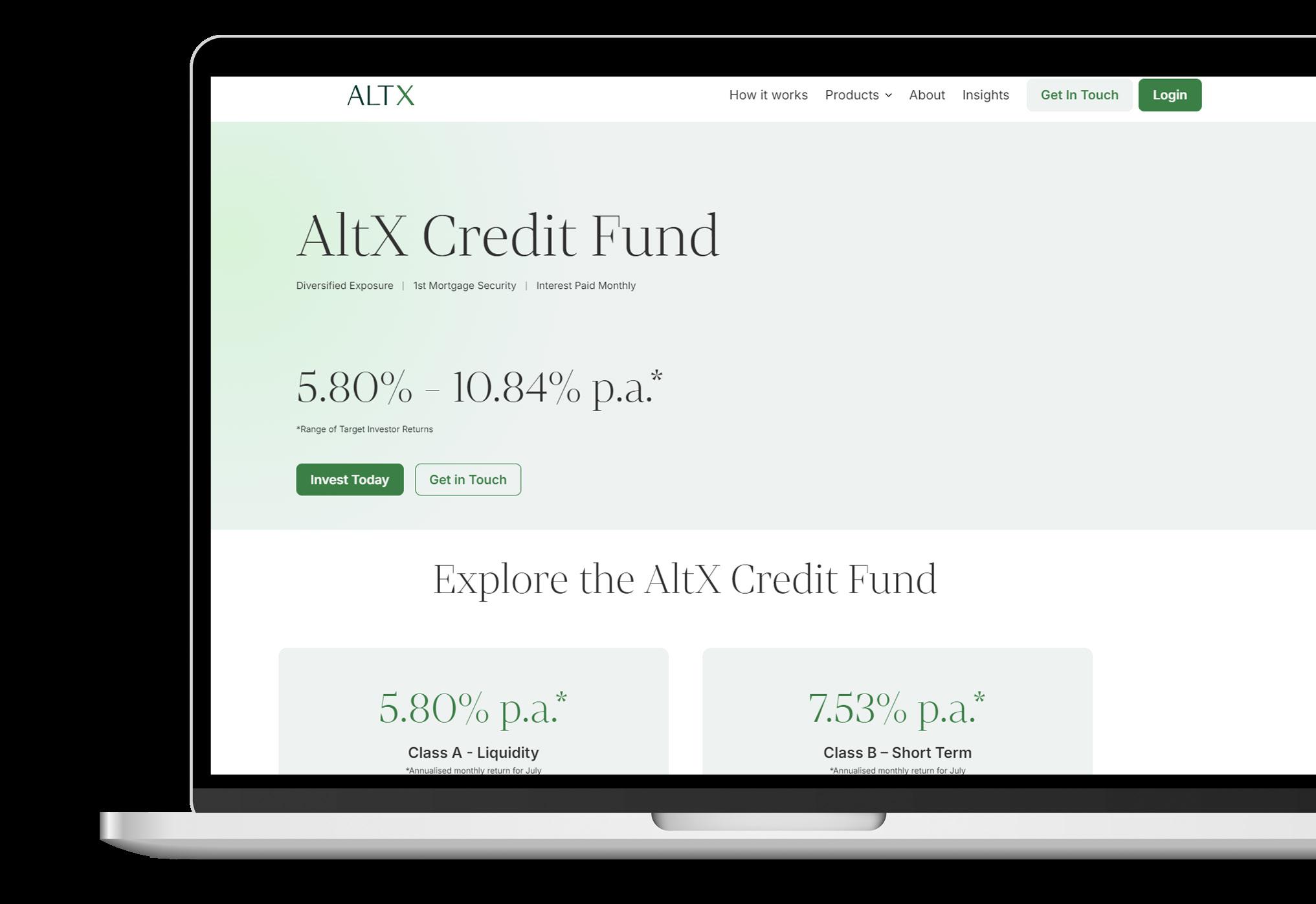

ALTX CREDIT FUND

UNLOCKING OPPORTUNITIES IN AUSTRALIAN PRIVATE REAL ESTATE CREDIT

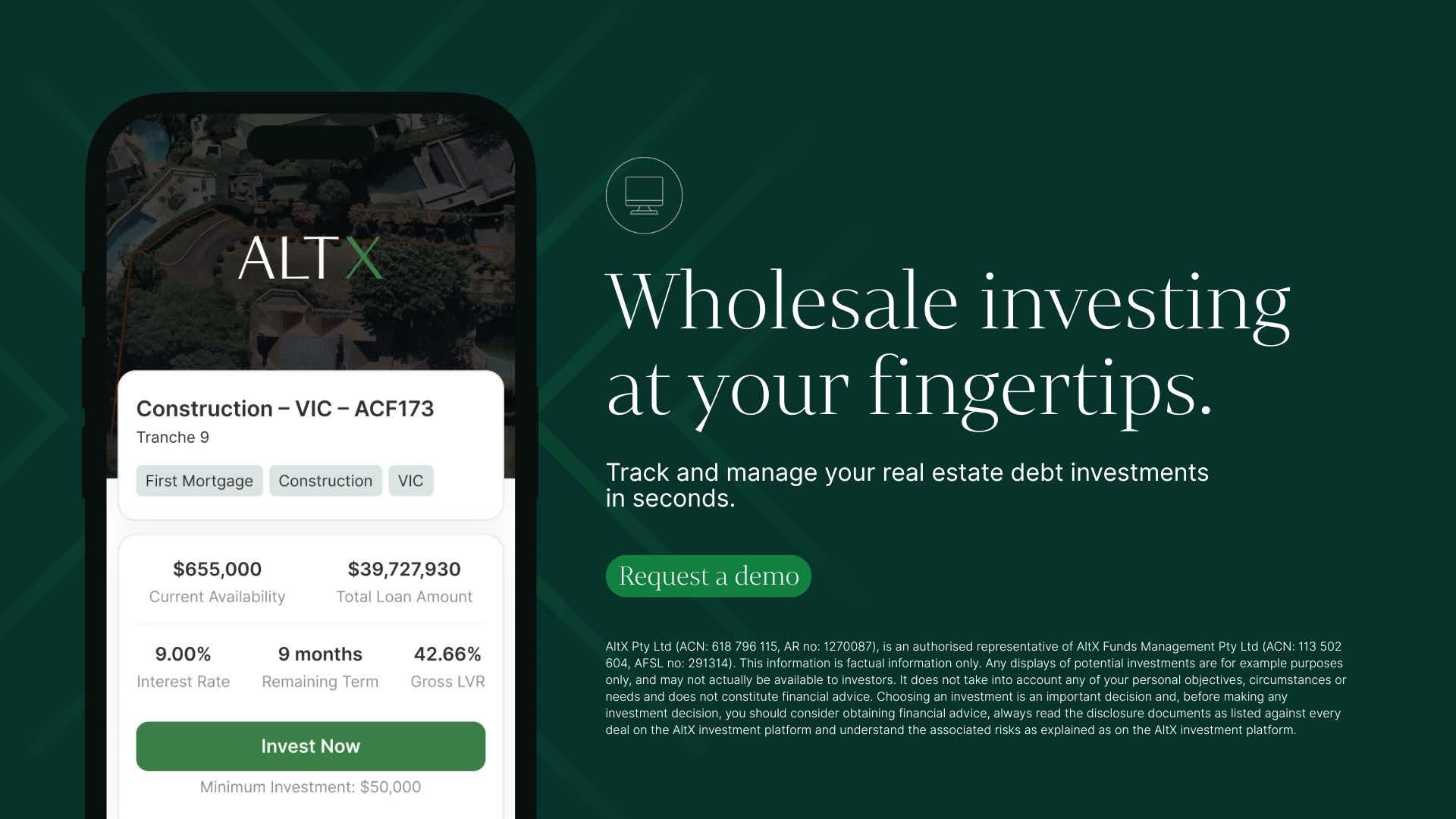

Founded in 2012 and part of the AltX Financial Group, AltX focuses singularly on real estate debt investment opportunities in the Australian market. Established in April 2024, the AltX Credit Fund taps into this market, offering attractive risk-adjusted returns amid a low-interest-rate environment and constrained bank lending.

As banks reduce their exposure to certain real estate sectors, private credit managers like AltX are increasingly filling the financing gap, delivering consistent income streams secured by tangible real estate assets.

The AltX Credit Fund delivers regular returns to wholesale investors, providing sophisticated market participants with bespoke investment solutions designed to balance risk, liquidity and return.

One of the defining features of the AltX Credit Fund is its multi-class share structure, offering six distinct classes tailored to investor risk appetite, return expectations and liquidity preferences.

Each class provides exposure to a diversified portfolio of debt investments, which could include residential, commercial, industrial, construction and development loans to Australian borrowers.

Since inception, the AltX Credit Fund has demonstrated strong performance consistency, with share class annualised returns ranging from +5.80 per cent to +10.84 per cent p.a. as of July 2025*. This steady income generation is underpinned by a stable pipeline of real estate loans and disciplined credit practices.

Class A – Liquidity

return

Investment focus: Diversified first mortgage loans secured by real estate assets.

Class B – Short term

Investment focus: Diversified first mortgage loans with short-term durations.

Class C – Senior Debt Target return +8.21 per cent p.a.*

Investment focus: Senior first mortgage loans with no exposure to construction loans.

Class D – Diversified Target return

+9.74 per cent p.a.*

Investment focus: Combination of first and second mortgage loans.

Class E – Construction

Target return

+9.31 per cent p.a.*

Investment focus: First mortgage loans secured against construction projects.

Class F – Institutional

Target return: Tailored to institutional investor requirements.

Investment focus: Customised portfolios based on specific mandates.

Learn More

More

More Learn More Learn More

The AltX Credit Fund employs a disciplined investment approach centred on secured real estate lending, performing rigorous due diligence, assessing borrower creditworthiness, property valuations and market conditions. The portfolio is actively managed to diversify across property types, loan terms and geographic regions to mitigate concentration risk.

Risk management is paramount. By focusing predominantly on senior secured first mortgage loans, the AltX Credit Fund limits credit exposure and prioritises capital preservation. The inclusion of second mortgages and construction loans in select share classes is balanced by careful underwriting and robust collateral coverage.

Moreover, AltX’s diligent credit analysis framework and conservative loan-to-valuation ratios underpin the fund’s resilient risk-return profile.

This disciplined credit process ensures that each investment is thoroughly vetted, aligning with AltX’s commitment to capital preservation and consistent performance for its investors. The fund has also garnered respected independent endorsements. Independent Investment Research (IIR) awarded a “Recommended” rating, highlighting the fund’s attractive risk-adjusted return prospects.** Evergreen Ratings granted

a “Commended” rating, acknowledging AltX’s governance standards and operational excellence. These accolades reinforce investor confidence in AltX’s capabilities.

Investors can invest in the AltX Credit Fund through a streamlined online platform offering real-time portfolio monitoring, simple investment and redemption processes and transparent, real time reporting.

Backed by strong performance, robust governance and a reputable management group, the fund is well-positioned to capitalise on the growing demand for alternative credit investments in Australia.

For wholesale investors seeking to diversify portfolios with private credit secured by tangible assets, the AltX Credit Fund offers an attractive and professionally managed solution.

Disclaimer: This document is for informational purposes only and does not constitute financial advice. Past performance is not indicative of future results. Investment involves risk; investors should seek professional advice before investing.

*Annualised monthly return for July

**Evergreen Ratings Pty Ltd (ABN 91 643 905 257) (‘Evergreen Ratings’) is Authorised Representative 001283552 of Evergreen Fund Managers Pty Ltd trading as Evergreen Consultants (ABN 75 602 703 202, AFSL 486275). The group of companies is known as ‘Evergreen’. Evergreen is authorised to provide general advice to wholesale clients only. The report is only available to wholesale clients.

**This publication has been prepared by Independent Investment Research (Aust) Pty Limited trading as Independent Investment Research (“IIR”) (ABN 11 152 172 079), a corporate authorised representative of Australian Financial Services Licensee (AFSL no. 410381. IIR has been commissioned to prepare this independent research report (the “Report”) and will receive fees for its preparation.

Learn more: Visit altx.com.au/credit-fund for detailed information, investment criteria and to start your investment journey with AltX Credit Fund.

METRICS DIRECT INCOME FUND

The Metrics Direct Income Fund seeks to provide investors with monthly cash income1, low capital volatility, and portfolio diversification by actively originating and managing well-diversified loan portfolios via investments in Australia’s corporate loan market.

The Fund’s investment strategy is to provide investors with exposure to Australian corporate loans, diversified by borrower, industry, and credit quality. Through active portfolio management, Metrics seeks to implement active strategies designed to balance delivery of the target return, while preserving investor capital.

Target return

The Fund targets a return of the RBA Cash Rate plus 3.25 per cent p.a. (6.85 per cent p.a. net of fees)2 throughout the economic cycle.

Fund features

D iversified portfolio of 300+ corporate loans 3: The Fund portfolio provides exposure to over 300 loans, diversified across borrowers, industries and the credit spectrum.

~2 years: Average credit duration for loans in the portfolio.

1 00% ANZ: 100 per cent Australian and New Zealand domiciled companies.

D irect loan origination: Direct origination by a well-resourced, highly skilled and experienced team.

M onthly cash income1: Australian companies who borrow from Metrics are required under

their contractual obligation to pay interest at regular intervals. This enables Metrics to offer Fund investors monthly cash income.

L ow capital volatility 4: Corporate loans exhibit a low correlation with public market securities. Over the past decade, corporate loan loss rates have remained below 1 per cent, even during economic downturns, with a peak of 0.67 per cent post the Global Financial Crisis.

M anagement fees and costs: 0.58 per cent of the Fund’s NAV5.

1. I ncome payments depend on success of underlying investments and are at the responsible entity’s discretion.

2. Thi s is a target return and may not be achieved. RBA Cash Rate is currently 360 bps p.a.

3. The fun d may not always be successful in constructing a diversified loan portfolio.

4. S ource: Major Bank APS 330 reporting. Past performance is not a reliable indicator of future performance.

5. E xcluding impact of performance fees.

Investment risks

All investments are subject to risk, which means the value of your investment may rise or fall. Before making an investment decision, it is important to understand the risks that can affect the value of your investment. A summary of some of the main risks are outlined below. Please refer to section 8 of the PDS for a more comprehensive list of potential risks before making an investment decision.

C redit and default risk

L everage risk

M arket and economic risk

Investment strategy risk

Liquidity risk

Portfolio construction

P roperty market risk

Why invest in the

Fund

The Australian corporate loan market represents a large and active segment of Australia’s corporate fixed income market, which can provide superior risk-adjusted returns compared with other fixed income investment opportunities. As an experienced investment team that understands the various sources of income available from, and risks associated with corporate loans, Metrics believes it is well placed to implement investment strategies and processes to maximise returns from this asset class.

Performance

Fund performance as at 31 July 2025.

Notes. (6) Annualised (7) Inception date 01 July 2020. Past performance is not a reliable indicator of future performance. Returns greater than one year are annualized. Income payments depend on the success of the underlying investments and are at the responsible entity’s discretion. Fund returns are net of fees and in AUD. Calculations are based on exit prices after taking into account ongoing fees and costs. No allowance has been made for entry fees or taxation. RBA Cash Rate as at 13/08/2025 360 bps p.a.

Research Ratings

The Fund has been independently rated by Zenith Investment Partners, Bond Adviser, Lonsec Research and Independent Investment Research.

Ratings are subject to Terms and Conditions which can be found here: https://metrics.com.au/terms-and-conditions/ Ratings are only one factor to be taken into account when making an investment decision. How to invest

The minimum initial investment for an investor is $1,000. To apply for units in the Fund, you can either:

C omplete an online application at www.metrics.com.au/mdif 2. Ma ke an investment via platform – refer to your IDPS operator’s requirements

Before making an application for units in the Fund, please read the Product Disclosure Statement (PDS), Additional Information Booklet and Target Market Determination (TMD) available at http://www.metrics.com.au/mdif

Platform availability

Credit Partners Pty Ltd (Metrics) ABN 27 150 646 996 | AFSL 416 146. The information provided is issued by Equity Trustees and has been prepared to provide you with general information only. In preparing this information, Equity Trustees did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Equity Trustees, Metrics nor any of their related parties, their employees or directors, provide any warranty of currency, accuracy, completeness or reliability in relation to such information or accept any liability to any person who relies on it. Neither Equity Trustees nor Metrics guarantees repayment of capital or any particular rate of return from the Fund. All opinions and estimates included in this website constitute judgments of Metrics as at the date of website creation and are subject to change without notice. Past performance should not be taken as an indicator of future performance.

You should obtain and carefully consider in their entirety the current Product Disclosure Statement (PDS), Target Market Determination (TMD) and any updated information and continuous disclosure notices (Additional Disclosures) before making an investment decision in respect of the Fund and assess whether the Fund is appropriate given your objectives, financial situation or needs. If you require advice that takes into account your personal circumstances, you should consult a licensed or authorised financial adviser.

The PDS, TMD and any Additional Disclosures in respect of the Fund are available at www.metrics.com.au/mdif

Zenith Investment Partners: The Zenith Investment Partners ("Zenith") Australian Financial Services License No. 226872 rating (assigned June 2025) referred to in this document is limited to "General Advice" (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at this link

Bond Adviser: For all important information regarding BondAdviser Product Assessments please see the final page of the BondAdviser Fund Report or visit www.bondadviser.com.au

Lonsec: The rating issued 09/2025 is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2025 Lonsec. All rights reserved.

Independent Investment Research (IIR): The IIR rating requires to be read with the full research report that can be found on the issuers website (or upon request) together with their full disclaimer that is found on the front cover of their research note. IIR requires readers of their research note to obtain advice from their wealth manager before making any decisions with respect to the recommendation on this note. The note is not general advice just financial information without having regard to the financial circumstances of the reader.

To learn more about how Metrics Credit Partners can help, click here.

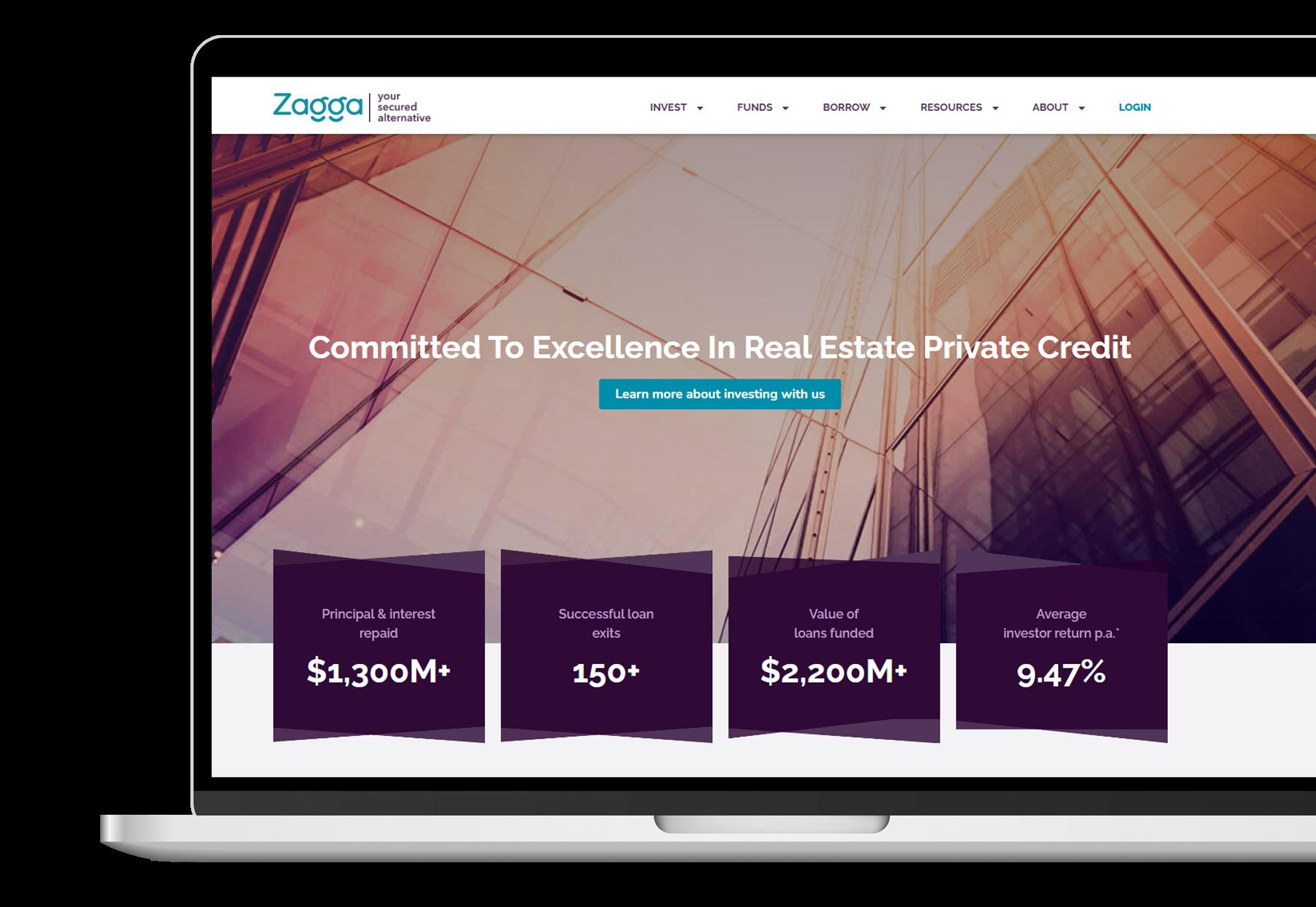

ZAGGA FEEDER FUND:

DELIVERING DETERMINABLE INCOME THROUGH AUSTRALIAN REAL ESTATE PRIVATE CREDIT

The Zagga Feeder Fund offers wholesale investors direct access to Australian real estate private credit investments.

Structured to balance stable income with capital preservation, the Fund invests in a carefully diversified portfolio of secured real estate loans, all originated and actively managed by Zagga, a specialist investment manager with a proven track record in this sector.

At its core, the Fund is designed to deliver measured, risk-adjusted exposure to one of the most resilient and structurally supported segments of private credit. By adhering to conservative lending standards, securing loans against real assets in Australia, and maintaining rigorous due diligence throughout the origination and monitoring process, the Fund prioritises both investor protection and sustainable income.

In a market characterised by long-term housing demand, constrained supply, and bank retreat from development lending, the Fund provides investors with a compelling opportunity to access high-quality transactions while benefiting from Zagga’s specialist expertise.

Market context

Private credit is one of the fastest-growing global asset classes, now exceeding AU$200 billion1 in

Australia, supported by bank retrenchment and strong housing demand.

1. Preqin 2024 Global Report: Private Debt

Fund

structure and investment strategy

The Fund is a managed investment scheme that invests directly into an underlying secured loan portfolio comprised of Australian commercial real estate debt transactions.

Transactions are selected following detailed credit assessment and due diligence, with conservative credit standards applied consistently.

Key features:

Loan types: Primarily first-ranking senior debt.

Loan terms: Typically, between 6 and 24 months.

Security: Registered mortgage security supported by independent valuations.

Borrower profile: Experienced sponsors with demonstrable track records in the property sector

Loan-to-value ratios (LVR): Generally, less than 65 per cent, with additional covenants or requirements applied where appropriate.

Loans are diversified across property types (residential, commercial, mixed-use and industrial) and geographies, predominantly along Australia’s eastern seaboard.

Risk management

Risk management is central to the investment process. The following measures are applied: Conservative LVRs: Ensuring a buffer against potential declines in property values.

Independent valuations: All security assets are valued by third parties before loan origination.

Ongoing monitoring: Loan performance and project milestones are actively tracked.

Exit strategies: Loans are structured with clear repayment pathways, such as sales or refinancing.

Diversification: Portfolio construction avoids concentration in any single borrower, sector, or location.

Independent validation

ZILT has been rated 4-star SUPERIOR (investment grade) by SQM Research for five consecutive years and holds a VERY STRONG rating from Foresight Analytics, reflecting confidence in its governance, credit processes and track record.

These ratings provide investors with additional assurance that ZILT – and by extension, the Fund – is managed to a consistently high standard, with strong emphasis on capital preservation and quality execution.

Performance and returns

The Fund targets RBA cash rate + 5 per cent p.a. (8.60 per cent at 12 August 2025), with periodic distributions. Returns are supported by floating- rate loan structures.

Manager track record

Zagga is an Australian investment manager established in 2016, specialising in real estate private credit within the commercial real estate debt sector.

Since inception, the firm has:

Originated and managed over AU$2.5 billion in loans.

Grown total funds under management to over AU$1 billion (as at June 2025).

12-month trailing returns graph

Actively and successfully navigated a number of enforcement and workout situations, such that investors have received payment of their full principal and interest across all discharged loans.

Investor suitability

The Fund is intended for wholesale investors who:

Seek stable, income-generating assets with defensive characteristics.

Value capital preservation supported by secured, real estate-backed loans.

Prefer exposure to the Australian market with its strong legal and regulatory frameworks.

Want access to private credit returns with shorter investment durations compared with other private markets strategies.

Email: info@zagga.com.au

Website: www.zagga.com.au

Phone: 1300 192 442

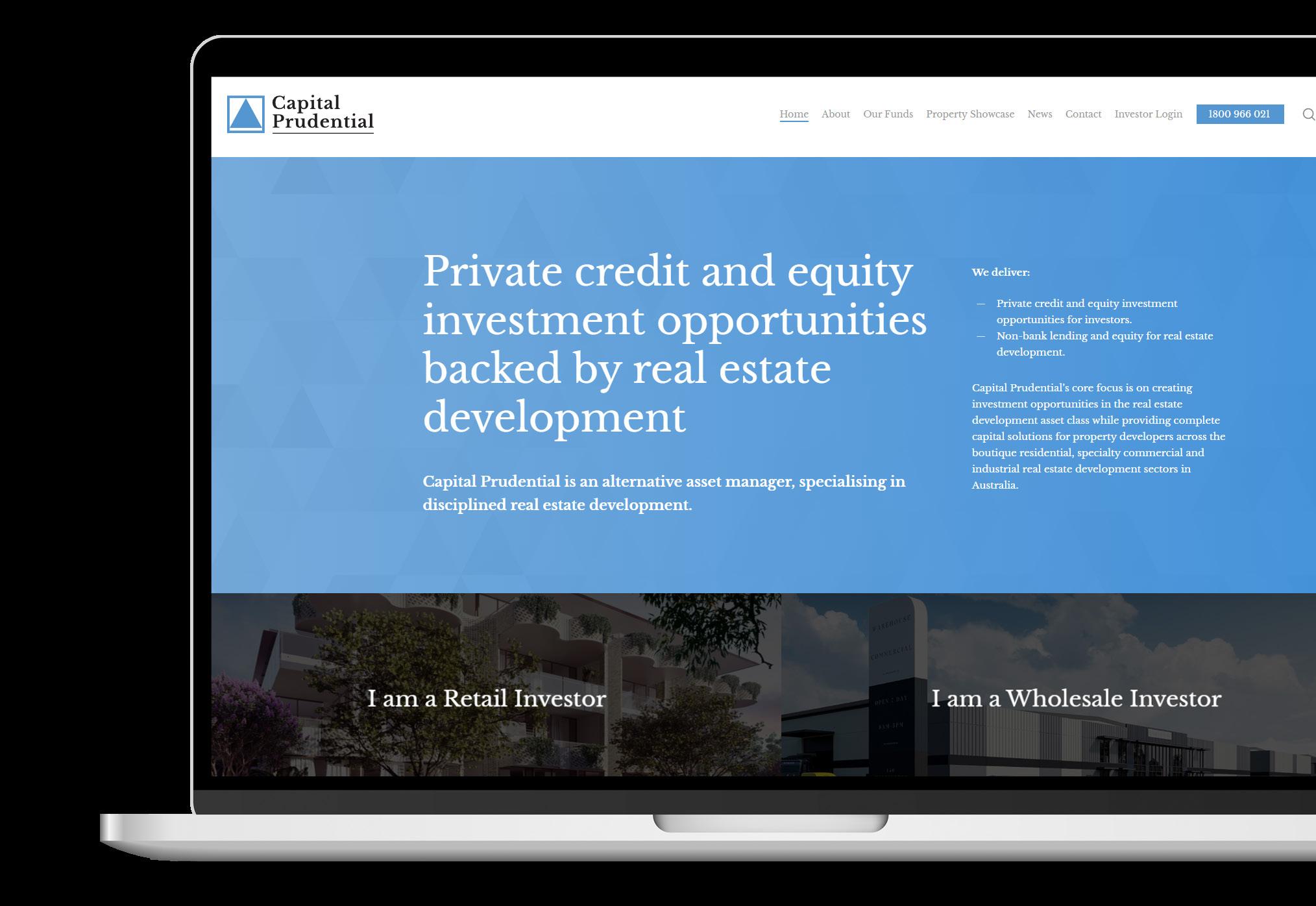

CAPITAL PRUDENTIAL

SENIOR INCOME FUND AND INCOME OPPORTUNITY FUND

Capital Prudential is one of the leading Australian alternative asset managers, focused on delivering strong investor returns through private credit and development equity strategies.

Our two complementary Australian privatecredit funds target monthly income from real estate backed loans secured by registered mortgages, underpinned by disciplined LVRs, robust covenants and active management. Designed for wholesale investors seeking robust risk-adjusted returns, capital preservation and access to quality deals, while providing diversification from listed equities and traditional fixed income. We originate and actively manage build-to-sell transactions and third-party mortgage-secured loans.

Market context

With banks allocating capital selectively, non-bank lenders are bridging funding gaps, especially in mid-scale projects requiring speed and structuring. This supports pricing power and robust covenants for disciplined credit providers. We pursue opportunities where collateral quality, sponsor capability, verified costs and clear exits align, and avoid weak counterparties. Construction-cost volatility and builder solvency risk highlight the need for active loan management, strong finance documents and managers with real workout and enforcement experience.

Manager edge

The Capital Prudential team has a proven track record across private and institutional mandates, combining hands-on project monitoring, deep local expertise in property and private credit, and a disciplined investment approach. Our in-house capability and borrower–sponsor relationships, backed by proprietary deal access help unlock opportunities and drive outcomes.

Key benefits of investing with us include:

Access to deals: Long-standing relationships in mid-scale development and investment markets create proprietary and repeat pipelines.

Underwriting discipline:

Conservative LVRs; independent valuation and QS (cost-tocomplete) reports; sponsor and real estate due diligence; clear exits.

Active management: Staged drawdowns, cash controls, monthly construction monitoring, project control group attendance, covenant/ site/QS checks, early-warning triggers.

Selec tive risk exposure: Ability to flex across senior, stretched-senior, wholeloan and mezzanine, supported by in-house development capability and a strict process.

Governance: Experienced investment committee, including an independent chair, with institutional-grade oversight.

Strategy Snapshots

CP Senior Income Fund (SIF)

Targets monthly income of RBA cash rate + 5.00 per cent (net of fees and costs). Focus on registered first mortgages with conservative LVRs and priority controls. Facilities include acquisition finance, residual stock, construction and refinance for experienced sponsors. The portfolio targets a weighted-average LVR of ~65 per cent across mid-scale residential (incl. BTR), industrial/ logistics and select commercial assets.

CP Income Opportunity Fund (IOF)

Targets monthly income of RBA cash rate + 7.00 per cent (net of fees and costs). Invests selectively in mortgage-backed subordinated and senior loans, including equity-like investments (including development equity), pursuing cycle-aware spreads with tight covenants and intercreditor discipline. Compared with SIF, IOF accepts moderately higher leverage (target WALVR ~75 per cent) and complexity where collateral quality, sponsor capability and documentation strength support returns.

KEY FEATURES

/ Borrower focus

residential (incl. dev/BTR), industrial/logistics, select commercial

‘build to sell’ residential, industrial/ logistics, alternatives

The fund focuses on build-to-sell mid-scale developments across residential, industrial/ logistics, alternatives and convenience retail. Risk management in focus Our approach is proactive, designed to identify issues early and preserve value throughout each loan. We begin with comprehensive due diligence on borrower strategy, project risks and market dynamics, and prepare finance documents that anticipate foreseeable challenges, including clauses that trigger early engagement to resolve issues before default. Precedent documents are reviewed regularly to reflect market practice and regulatory change.

Disclaimer: For Wholesale Clients only. This is general information and not an offer or personal advice. Any target returns are objectives, not forecasts; capital is at risk, liquidity is not guaranteed, and distributions are variable. Returns shown are net of fees and costs. Redemptions occur on a quarterly basis with 30 days’ notice per the IM and are not guaranteed. Read the IM and seek independent advice before investing.

*Target returns only, net of fees and costs; not guaranteed. Returns may not eventuate, and any investment may fall in value.

A structured monitoring framework underpins monthly updates from project managers, quantity surveyors and specialist consultants. As part of the project team, we probe progress, financial health and emerging risks; facilities include flexibility for targeted restructuring, clear review triggers tied to milestones and strong collateral packages to protect and recover value. Where consensual outcomes are not achievable, our workout and enforcement experience protects investors’ capital. We work closely with stakeholders and

throughout.

Access and next steps

Advisers and wholesale investors can contact us for more information, including the Information Memorandum (IM) and a concise onboarding pack.

Email: investment@capitalprudential.com.au

Capital Prudential is one of the leading Australian alternative asset managers, delivering superior investor returns from real estate through private credit and development equity funds.

With deep private and institutional experience, we take a hands-on approach, managing every stage from site identification to project completion, so you can invest knowing your capital is in expert hands.

Exclusive development access

Our partner network provides early access to premium opportunities. We co-invest with our clients for true alignment and transparency.

End-to-end capital and oversight

We deliver capital solutions and disciplined management across the full development lifecycle.

Expertise in managing risk to drive returns

We actively mitigate risk, unlock value and enhance returns.

Embedded property capability

In-house expertise accelerates deal execution, drives growth and creates value, even in distressed markets.

Strong independent governance

Independent oversight ensures rigour, discipline and effective risk management.

Aligned incentives –co-investment and profit sharing

We invest alongside our clients, sharing in the upside to ensure aligned outcomes.

PALLAS SENIOR INCOME FUND

Pallas Capital’s flagship first mortgage (senior debt) fund designed for private wealth advisers and their wholesale clients, including SMSF accounts.

The fund aims to build and maintain a diversified portfolio of investments to provide investors with attractive risk-adjusted returns (paid monthly in cash), backed by first mortgage commercial real estate (CRE) loans.

Who is this fund for?

The fund may be suitable for wholesale investors seeking regular income, low capital volatility and a strategy offering diversification away from traditional fixed income and equity investments.

It represents an opportunity to diversify portfolios and invest in higher yielding assets, overseen by a manager that has attracted significant support from leading global financial institutions. Investors should consult their financial adviser to discuss how an allocation to PSIF might assist in meeting their investment objectives.

Investment objective

The fund aims to provide investors with attractive risk-adjusted cash returns, supported by investments with an exposure to a diversified portfolio of registered first mortgage debt investments to the private Australian and New Zealand commercial real estate debt markets.

What is commercial real estate (CRE) debt?

Commercial real estate debt is a subset of private debt. It is any debt where the money borrowed is used for commercial real estate purposes. This includes construction loans, pre-development loans, investment loans, vacant land loans and residual stock loans.

Fund strengths

Exclusive access to the manager’s institutional grade facilities, providing look-through exposure to granular lookbooks of prudent, institutionalgrade first mortgage loans.

Focus on the mid-market SME lending segment, which has more depth and breadth. Strict portfolio parameters and governance structures supporting attractive riskadjusted returns.

Asset (property)-backed investment, with capital protection (registered first mortgages).

Management alignment via a loan impairment protection (LIP) mechanism, a credit enhancement fund structure that provides a “first loss buffer” up to $10 million in aggregate in relation to fund investments.

Access to an active specialist manager

Actively managed by a leading institutional-grade APAC real estate investment manager.

Independent custodian: Bank of New York Mellon.

Portfolio parameters

Investments: 100 per cent registered first mortgages and cash.

Limits: Land/Pre-development ≤50 per cent

construction ≤60 per cent New Zealand assets ≤25 per cent.

Maximum single exposure: $30 million (relates only to single loan SPV lenders, not diversified “pool” lenders).

Maximum loan tenor: 36 months.

Portfolio weighted avg LVR limit: 66 per cent.

Prohibited Investments: No related party loans.

Fund NAV protection: Loan impairment protection mechanism.

Platform access

Mason Stevens, HUB24, Powerwrap, Netwealth, Spectrum, Praemium and BT Panorama.

Research ratings

SQM Research – Superior 4 Star Rating

Bond Adviser – Approved (Stable Outlook)

Performance at a glance

Since inception annualised net distribution of 9.81 per cent performance, above target by 0.67 per cent per annum.

Key metrics 1

Number of fund investments: 176

Arrears or defaults 2: 0 per cent

Weighted avg term to maturity: 6.33 months

The fund’s five Pillars of capital defence

Capital stack structure

Loans typically written at 65 per cent LVR, providing a 30–35 per cent equity buffer. SME borrower/sponsor personal guarantee and/or corporate guarantee.

Conservative credit underwriting

Most loans include minimum interest reserves, providing a ~4-month buffer for issue resolution.

For construction loans, interest is fully capitalised within facility limits.

Capital loss buffers

The fund invests in pool lenders that are funded by global financial institutions. Each pool lender has a 5 per cent first loss buffer subscribed by Pallas Group. For example, the PFT2 institutional lending vehicle has a ~$25m first-loss layer of subordinated notes that would incur all losses before the fund’s investment was exposed.

Portfolio management

A team of 75+ investment professionals ensures institutional-grade loan origination, credit underwriting and ongoing management.

Loan impairment protection

The manager has committed to absorb losses incurred by the fund due to impairment of loans made by it, up to $10 million in aggregate. Maximum drawdown: $2.5 million per impaired loan (pro-rated to fund investment amount).

1 On a look through basis.

2 Reported on >90 days basis and rounded to the nearest decimal.

About Pallas Capital

P allas Capital is an institutional-grade debt and equity investment manager specialising in the finance of Australian and New Zealand commercial real estate.

$9.1 billion: Total investment managed since inception (2016).

$3.4 billion : Open and performing investment across 300+ transactions.

$1.7 billion+: Total institutional discretionary capital under management (approved facility limits, subject to drawdown).

$5.7 billion: Fully repaid investments across 750+ transactions.

$620 million+: Paid to investors as interest/ trust distributions.

$0: No loss of capital or interest/distributions on any Pallas investment to-date.

Disclaimer: This guide has been prepared by Pallas Capital Pty. Limited (ACN 616 130 913), as Corporate Authorised Representative (ASIC No. 001257625) of Pallas Funds Pty. Limited (ACN 604 352 347), the holder of Australian Financial Services Licence No. 473475 (together, “Pallas”). The information contained in this guide provides general background information only and should be read in that context. This information is exclusively for “wholesale clients” as defined in the Corporations Act 2001 (Cth).It is not investment or financial product advice, it does not take into account the investment objectives, financial situation or needs of any particular person and it is not intended to be used as the basis for making an investment decision. This guide is not, and does not constitute, an offer to sell or a solicitation, invitation or recommendation to purchase any securities and neither this guide nor anything contained in it forms the basis of any contract or commitment. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in this guide. To the maximum extent permitted by law, none of Pallas, its related bodies corporate, shareholders or respective directors, officers, employees, agents or advisors, nor any other person accepts any liability, including, without limitation, any liability for any loss or damage arising from the use or reliance of information contained in this guide. This guide may include “forward-looking statements”. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond the control of Pallas and its officers, employees, agents or associates that may cause actual results to differ materially from those expressed or implied in such statement. Actual results, performance or achievements may vary materially from any projections and forward-looking statements and the assumptions on which those statements are based. Pallas assumes no obligation to update such information. The opinions, advice, recommendations and other information contained in this guide, whether express or implied, are published or made by Pallas, and by its officers and employees in good faith in relation to the facts known to it at the time of preparation. You may use this information in this guide for your own personal use, but you must not (without Pallas’ consent) alter, reproduce or distribute any part of this publication, transmit it to any other person or incorporate the information into any other document. All amounts are in Australian Dollars unless otherwise specified. The SQM rating indicated in this guide is issued by SQM Research Pty Ltd ABN 93 122 592 036; AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the information memorandum and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

Contact Pallas Capital today to discuss how we can assist you and your clients.

wealth@pallascapital.com.au

WITH THANKS TO OUR PARTNERS