PIONEER IN LITHIUM-ION TECHNOLOGY

Driving the future: Jungheinrich's Lithium-ion leadership

ARGON & CO DRIVES MICRO-FULFILMENT SHIFT

Addressing the property crunch.

DEMATIC ROLLS OUT UNIFIED PLATFORMS

Boosting visibility and workforce.

Driving the future: Jungheinrich's Lithium-ion leadership

ARGON & CO DRIVES MICRO-FULFILMENT SHIFT

Addressing the property crunch.

DEMATIC ROLLS OUT UNIFIED PLATFORMS

Boosting visibility and workforce.

Australian 3PL Coghlan’s warehouse transformation is a gamechanger. With Dematic’s ColbyRACK high-density storage and mezzanine solution, Coghlan boosted capacity by 10%, streamlined workflows, and cut costs—all within their existing building footprint.

The scalable design supports future growth, while Colby’s locally-based engineering teams enabled rapid response to ensure compliance with evolving regulations. Coghlan now operates more efficiently and impresses clients with a layout built for performance. For companies facing similar challenges, Colby delivers smart, scalable solutions with Australian-made, quality racking and shelving that works.

Learn more at www.colby.com.au

MHD Supply Chain Solutions is published by Prime Creative Media

379 Docklands Drive, Docklands VIC 3008

Telephone: (+61) 03 9690 8766

Website: www.primecreative.com.au

THE TEAM

Chairman: John Murphy

CEO: Christine Clancy

Managing Editor: Mike Wheeler

Editor: Phillip Hazell

Business Development Manager: William Jenkin

Design Production Manager: Michelle Weston

Art Director: Blake Storey

Graphic Designers: Danielle Harris, Jacqueline Buckmaster

Client Success Manager: Caitlin Pillay

FOR ADVERTISING OPTIONS

Contact: William Jenkin

william.jenkin@primecreative.com.au

SUBSCRIBE

Australian Subscription Rates (inc GST) 1yr (11 issues) for $99.00 2yrs (22 issues) for $179.00

To subscribe and to view other overseas rates visit: www.mhdsupplychain.com.au or Email: subscriptions@primecreative.com.au

ACKNOWLEDGEMENT

MHD Supply Chain Solutions magazine is recognised by the Australian Supply Chain Institute, the Chartered Institute of Logistics and Transport Australia, the Supply Chain and Logistics Association of Australia and the Singapore Logistics and Supply Chain Management Society.

Isystems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. The opinions expressed in MHD are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

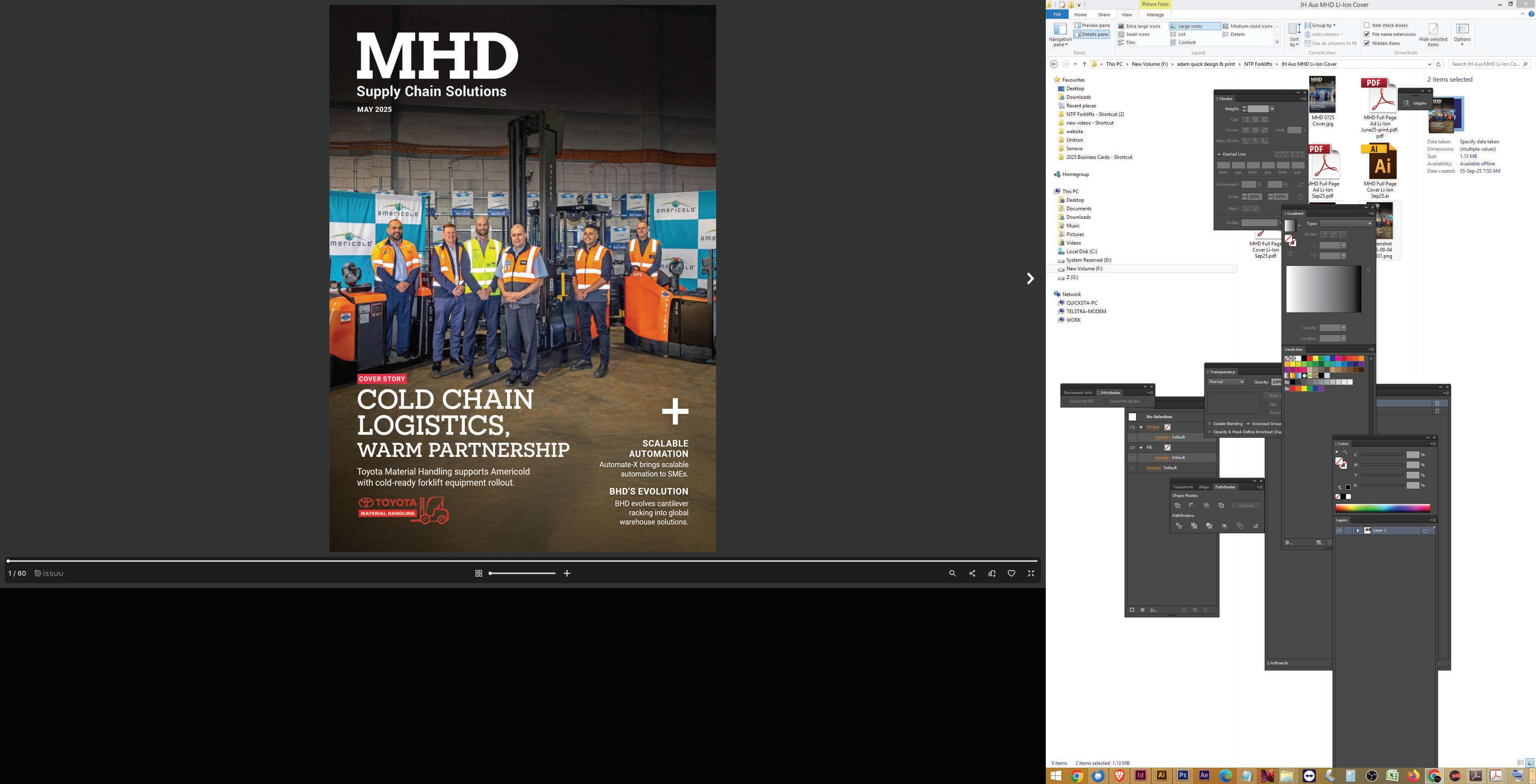

f there’s one theme running through this month’s stories, it’s that logistics and supply chains are no longer operating quietly in the background – they’re front and centre in shaping Australia’s future.

Take Defence’s new $1.5 billion contract with Toll. On the surface, it’s another big government deal. But look closer and it’s a signal of where priorities are shifting. By consolidating two separate contracts into one national framework, Defence isn’t just chasing efficiency; it’s admitting that resilience – the ability to move quickly and decisively when it matters most – has become just as critical as cost or scale. That’s a lesson the private sector can’t ignore.

Then there’s Amazon, pumping $200 million into Victoria with new facilities and 700 jobs. For locals in Cranbourne West and Ravenhall, this means opportunities on their doorstep. For the wider industry, it’s a reminder of the standard global players are setting bigger footprints, faster delivery, and a workforce trained to handle tomorrow’s technologies. It’s not just about more parcels moving through the network – it’s about raising expectations for what “good” looks like in logistics.

Meanwhile, DHL’s cold chain expansion in Malaysia is a story we should all take note of. Pharmaceuticals and medtech aren’t niche sidelines anymore – they’re massive growth engines, and logistics providers that can prove reliability and compliance in this space will shape the next decade of trade flows across Asia Pacific.

Alongside these developments, DP World’s Trade in Transition report reminds us that businesses are already making bold moves in response to turbulence –building visibility through better data, pursuing multimodal corridors, and balancing nearshoring with friendshoring. These shifts reflect a reality many of us already know: resilience is no longer a side benefit, it’s the foundation.

This month’s Most Sustainable Warehouse column showcases a practical example. L’Oréal has committed to a new $40 million facility in Queensland, designed to complement its Melbourne site and deliver faster, more sustainable service across its 30 brands. With all its Australian and New Zealand sites already carbon neutral, L’Oréal’s expansion demonstrates how growth and sustainability can align in a competitive industrial market.

Together, these stories are signposts. They show an industry being reshaped in real time – by government, multinationals, and local operators alike – and they challenge us to think about how quickly we’re willing to adapt.

The question for all of us now is simple: are we treating resilience and sustainability as optional extras, or as the strategy itself?

Happy reading!

12 Jungheinrich drives lithium-ion forklift efficiency, sustainability

14 Argon & Co drives microfulfilment, retrofit strategies

18 TMHA powers Richgro sustainability with electric forklifts

28 Adaptalift supports Northline with fleet renewal partnership

32 Linde embeds safety into warehouse operations daily

20 Dematic unifies warehouse platforms for smarter operations

24 WRD Wells boosts warehouse safety with shadow boards

EVENTS, SPECIAL FEATURES AND REGULARS 03 Ed’s letter

Industry News 36 MegaTrans 2026 38 Special Feature: Amazon expansion

Bulk Handling 2026 42 SCLAA 44 Special Feature: Postal service disruptions

Most Sustainable Warehouse Column

Decision Maker Commentary

ASCI

People on the Move 58 Product Showcase

Jungheinrich advances lithium-ion forklifts with in-house design, boosting

cutting costs,

and supporting

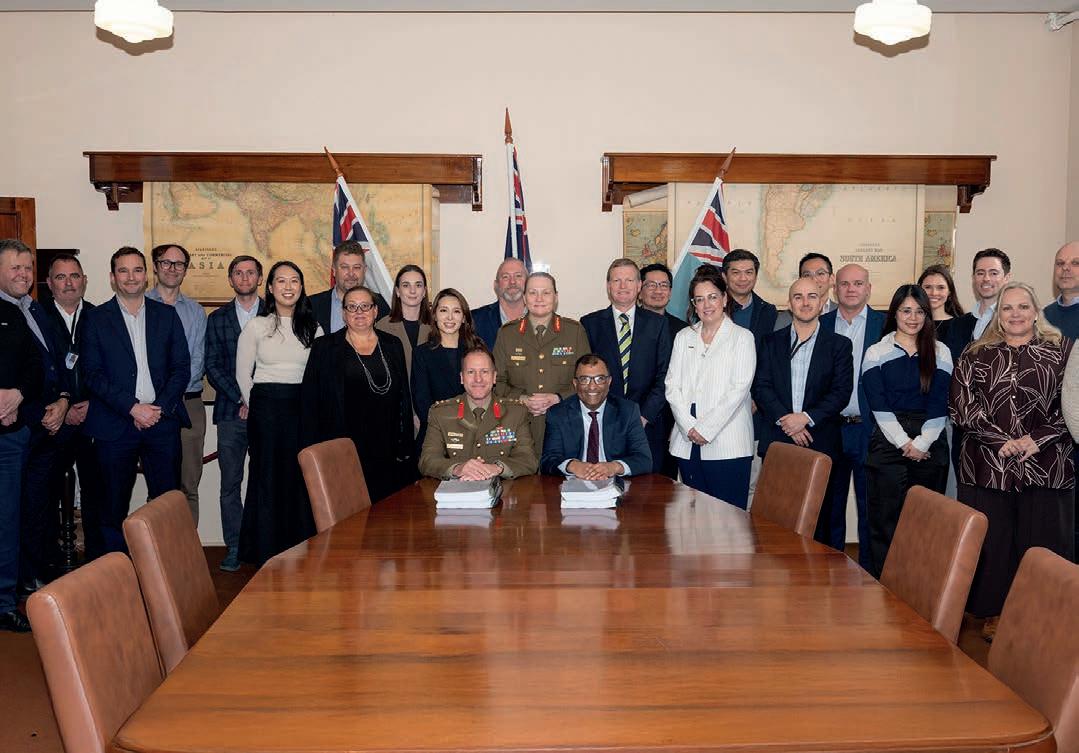

Defence has signed a new $1.5 billion national logistics contract with Toll Remote Logistics to deliver vital equipment, supplies and support across Australia, consolidating its supply chain operations into a single streamlined framework.

The Defence Theatre Logistics (DTL) contract brings together two existing agreements and marks a major shift in how Defence manages its warehousing, national distribution, and retail store services. The deal builds on the work of previous providers Linfox and Ventia, while establishing a unified model designed to improve resilience and responsiveness.

Chief of Joint Capabilities, Lieutenant General Susan Coyle, says the arrangement would strengthen Defence’s

logistics backbone, a priority identified in the 2024 National Defence Strategy.

“The consolidation of two existing contracts will see Defence logistics systems strengthened, which is a key element of national resilience and the National Defence Strategy,” LTGEN Coyle says.

Under the 10-year agreement, Toll will manage more than 50 sites nationwide, operating a distribution network that links bases, depots, and forward operating locations. The contract also covers retail services at selected locations, enabling Australian Defence Force members to order, transact, and collect items locally.

Commander Joint Logistics, Major General Carla Watts, says the deal would provide the efficiency and reach

needed to support both day-to-day operations and sustained conflict scenarios.

“By improving efficiency, reducing duplication and simplifying delivery of equipment, supplies and support, the ADF will be better equipped to sustain protracted operations during conflict,” MAJGEN Watts says.

The shift to a single national provider is expected to cut complexity, deliver faster flows of materiel, and underpin Defence’s ability to surge logistics capacity when required. In thanking Linfox and Ventia for their past contributions, Defence emphasised continuity of service while focusing on long-term supply chain resilience. ■

The NSW Government has unveiled a refreshed National Freight and Supply Chain Strategy alongside a new National Action Plan, aiming to future-proof Australia’s freight networks against growing challenges.

Originally launched in 2019, the Strategy has been updated following a review that confirmed its core foundations remain strong but recommended a sharper focus on nationally significant actions. The refresh comes after years of unprecedented disruption, including COVID-19, labour shortages, extreme weather events and geopolitical tensions.

With freight volumes projected to grow by 26 per cent between 2020 and

2050, the government says targeted action is needed to ensure the nation’s supply chains remain efficient, resilient and safe. The updated Strategy sets out four priority areas: productivity, resilience, decarbonisation, and data.

The accompanying five-year Action Plan commits governments and industry to a set of initiatives, including a National Freight Resilience Plan to coordinate responses to major disruptions, and a Freight Infrastructure Investment Framework to guide longterm planning. Other measures will model current and future network needs, and advance safety research on batteries and zero-emission technologies for freight vehicles and locomotives.

Infrastructure, Transport, Regional Development and Local Government Minister Catherine King says the updated approach reflects the vital role freight plays in everyday life.

“Without a viable and reliable freight network, Australia stops,” Ms King says. “As industry and consumer demand grows, it’s vital our roads, rails and ports can accommodate increasing freight movements with resilience, efficiency and emissions-reduction front of mind.”

Safety remains a central theme across all actions, underscoring the Government’s message that strong, secure, and sustainable freight systems are critical to both national resilience and economic growth. ■

DHL Global Forwarding has expanded its life sciences and healthcare capabilities in Asia Pacific with a new dual-certified cold chain facility at Kuala Lumpur International Airport’s (KLIA) Free Commercial Zone.

The 38,000-square-foot site is the first at KLIA to hold both DHL’s Air GxP certification and IATA’s CEIV Pharma certification, covering storage ranges of 15–25°C and 2–8°C. The facility supports up to 105 EU pallets and offers dual secure cages, automated real-time monitoring, and 24/7 operations.

DHL says the investment sets a new benchmark for pharmaceutical logistics in the region. In addition to cold rooms and advanced environmental monitoring, the facility incorporates

eco-friendly infrastructure such as energy-efficient compressors and CFC/ HCFC-free materials. It also features a dehumidification system tailored for pharmaceutical applications and a designated temperature-mapped area for sensitive products.

The company is the only forwarder at KLIA offering reefer truck transfers from pick-up to terminal, ensuring cold chain integrity while minimising third-party handling. All shipments are managed by trained Life Sciences Specialists who undergo annual compliance training.

“Malaysia is strategically located to serve as a regional hub for global medical technology companies,” says Praveen Gregory, Managing Director, Singapore, Malaysia and Brunei, DHL

Global Forwarding. “As demand across Asia Pacific accelerates, we are ready to lead with best-in-class facilities and expertise to support our customers.”

The move strengthens DHL’s network of 37 Air GxP-certified and 12 IATA CEIV Pharma-certified stations across Asia Pacific, including Sydney, Singapore, Tokyo and Shanghai. Earlier this year, DHL announced a €500 million investment in life sciences infrastructure across the region, part of its Strategy 2030 growth plan.

For Australian pharmaceutical and medtech supply chains, the expansion reinforces Kuala Lumpur’s role as a key consolidation hub within Asia Pacific’s fast-growing healthcare logistics market. ■

Coles has achieved its longstanding goal of sourcing 100 per cent renewable electricity across its national operations, covering more than 1,800 supermarkets and distribution centres.

The milestone, detailed in the retailer’s FY25 Sustainability Report, has contributed to an 81.3 per cent reduction in combined Scope 1 and 2 greenhouse gas emissions compared to its FY20 baseline. By hitting its target five years ahead of schedule, Coles has surpassed its original commitment to cut emissions by more than 75 per cent by FY30.

The transition was achieved through a mix of on-site solar installations, renewable electricity contracts with Origin Energy and CleanCo, large-

scale generation certificate (LGC) arrangements, and energy efficiency initiatives such as refrigeration upgrades. Coles now has 139 sites fitted with solar panels, generating 33,803 MWh of renewable electricity in FY25 alone.

Anna Croft, Coles’ Chief Commercial & Sustainability Officer, said the achievement reflects both responsibility and ambition.

“We recognise our responsibility, as one of Australia’s largest energy users, to reduce the greenhouse gas emissions associated with our operations.

Achieving our target of sourcing 100 per cent renewable electricity shows important progress towards decarbonising our operations, as we work towards delivering our

climate ambitions,” she said.

The FY25 report also highlights progress in other sustainability areas. Coles donated the equivalent of 39.1 million meals to SecondBite and Foodbank, maintained more than 42 per cent of women in leadership roles, introduced its first electric prime mover with Linfox, and awarded $3.5 million in sustainability grants through its Nurture Fund. The company also diverted 88 per cent of solid waste from landfill and increased recyclable packaging in its Own Brand ranges to 87.6 per cent.

Looking ahead, Coles has refreshed its sustainability strategy for FY26-30, with a focus on decarbonisation, supplier partnerships, and building a more resilient supply chain. ■

At Vanderlande, we’re more than an integrator –we’re your partner in automation.

> Expert engineering teams designing with precision

> Proven on-time, on-budget project management

> Dedicated and reliable service that keep operations running seamlessly

What sets us apart? We don’t just connect systems, we integrate technologies into one solution, built around your business needs today and ready to scale for tomorrow. Learn more at www.vanderlande.com/warehousing

A range of Jungheinrich lithium-ion forklifts boost performance, cut costs, and supports sustainability. Here’s how.

Jungheinrich has established itself as a prioneer in the electric and lithium-ion forklift industry. The company launched its first lithiumion-powered trucks in 2011. In 2018, Jungheinrich introduced the ETV 216i, the world’s first reach truck with an integrated lithium-ion battery concept.

Lithium-ion technology is becoming the new industry standard. Jungheinrich’s solutions aim to deliver higher performance with reduced energy consumption. Whether stacking, loading, unloading, or manoeuvring in tight spaces, these trucks can deliver consistent productivity and efficiency both indoors and outdoors.

According to Martin Strogilakis, Head of Product Management at Jungheinrich Australia, more Australian customers are choosing lithium-ion solutions not only for operational advantages but also

for long-term return on investment and sustainability.

“Jungheinrich supports this transition with a comprehensive consultation process that begins with assessing operational requirements and site conditions,” he says. “The company works closely with customers to develop tailored solutions based on real operational data, guiding them through concept development, implementation, and continuous improvement as a

long-term business partner.”

Anthony Zhao, Energy Expert at Jungheinrich Australia, highlights the importance of expert guidance throughout the sales process.

“Many customers have questions about electrical infrastructure, landlord requirements, or insurance implications,” he says. “Jungheinrich provides clear, practical advice to help navigate these challenges and ensure a smooth transition to lithium-ion technology.”

Customers are drawn to Jungheinrich’s lithium-ion solutions for several reasons. Operationally, the batteries are maintenance-free, eliminating the need for water refilling or cleaning. This reduces downtime and labour costs. The ability to charge quickly and opportunistically during breaks means there is no need to change batteries between shifts, resulting in higher truck availability and improved productivity.

From a financial perspective, lithium-ion batteries offer a longer lifespan than lead-acid alternatives and consume less energy. Maintenance costs are lower, and the components –designed to work seamlessly together – require less servicing. Jungheinrich works with customers to analyse shift patterns and energy usage, helping them understand the potential costs and benefits, including any necessary infrastructure upgrades.

“While lithium-ion fleets may have a higher upfront cost, the return on investment often results in the lowest total cost over the life of the equipment,” says Martin.

According to Anthony, sustainability and safety are also major advantages.

“Jungheinrich’s lithium-ion batteries produce no harmful emissions or acid leaks and contribute significantly to reducing CO2 emissions – by around 20 per cent compared to lead-acid and

up to 50 per cent compared to diesel trucks,” he says. “The use of lithium iron phosphate (LiFePO4) chemistry ensures high safety and thermal stability, while strict environmental standards are met across the product range.”

A key differentiator is Jungheinrich’s in-house development of trucks, batteries, and chargers. This integrated approach ensures all components are engineered to work together, supporting energy management, operating times, and faster charging. With full control over the production process, Jungheinrich aims to guarantee consistent quality, fewer breakdowns, and the ability to adapt solutions to customer needs.

With technical expertise, integration of systems, and a focus on sustainability, Jungheinrich’s lithiumion solutions are positioned to deliver performance, reliability, and long-term value for modern operations. ■

In-house trucks, batteries, and chargers work seamlessly together for efficiency. Images: Jungheinrich

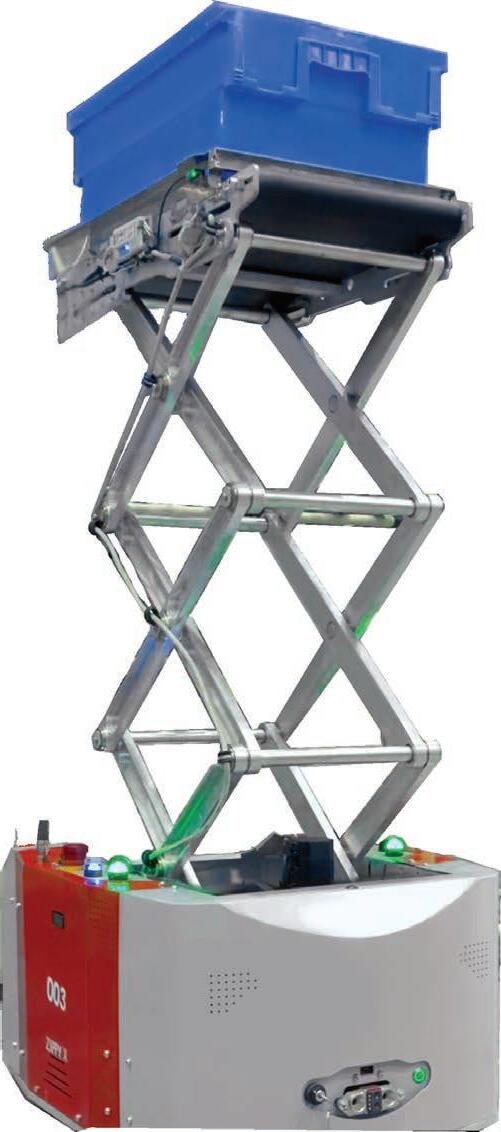

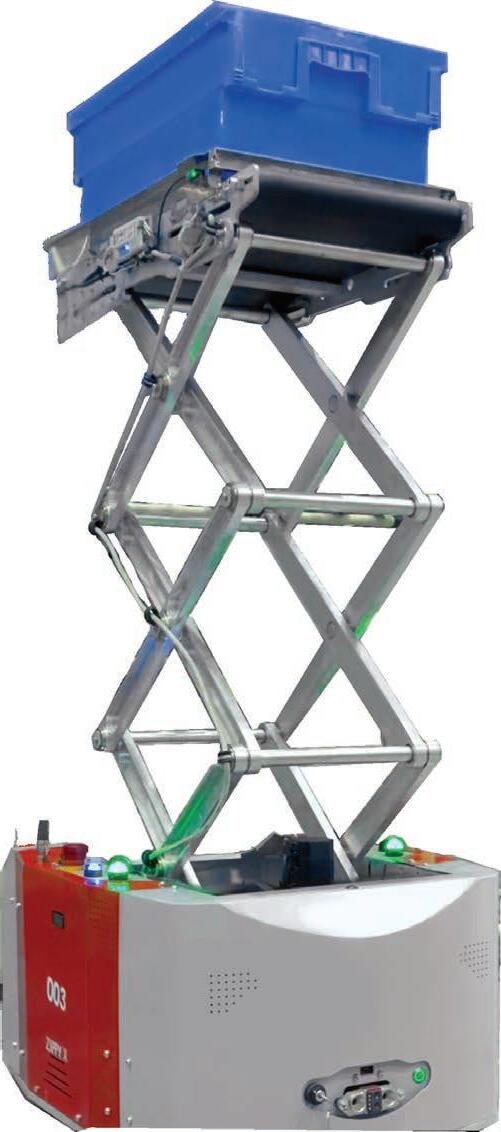

Argon & Co outlines how micro-fulfilment centres and retrofits are reshaping strategies amid Australia’s industrial property squeeze.

Australia’s industrial property sector is under strain. Land availability in key urban precincts is shrinking, construction and financing costs have risen, and e-commerce growth continues to push delivery networks harder. Together, these forces are reshaping how businesses think about logistics real estate.

For decades, large greenfield warehouses on the outskirts of cities were the default response to growing demand. But that model is no longer

enough. The sector is now embracing micro-fulfilment centres (MFCs) and retrofitting existing properties to create new layers of capacity in suburbs and inner-city corridors. These solutions don’t replace big distribution centres; instead, they complement them, unlocking space closer to customers, where speed matters most.

Lauren Alati, Managing Principal at Argon & Co, stresses that the crunch is less about the total number of warehouses and more about where they

are. Speculative builds continue, she notes, but too many are located on the fringe, far from the dense catchments that drive same-day and next-day delivery demand.

“We’re not running out of warehouses,” she says. “But we are running out of effective distribution points in the places customers actually live.”

Vacancy rates reinforce the point.

Nationally, warehouse vacancy is about 2.5 per cent, but inner-city precincts

remain tighter. For operators, that scarcity of well-located land has become the real constraint shaping strategy.

James Lee, Partner at Argon & Co, underlines the shift in customer expectation. Being in the same city or even the same metropolitan region is no longer enough.

“If you want to do fast delivery, you need inventory in the same postcode as your customer,” he explains. “That’s the only way to reliably reach the door quickly.”

Micro-fulfilment takes hold

Micro-fulfilment has become one of the fastest-growing responses to these pressures. Compact, highly automated hubs are being deployed close to dense urban populations to cut down delivery distances and costs while boosting service speed.

The concept flips the traditional cost equation. James argues that instead of treating inner-city rent as a drag, MFCs turn location into an asset. Paying more to be close to customers can drive loyalty and capture new revenue streams that offset higher lease costs.

Technology is central to the model. Robotic goods-to-person systems, shuttle automation, and AI-driven order consolidation allow operators to handle high volumes of small orders in tight spaces. By layering automation with advanced warehouse management and execution systems, businesses can make expensive sites perform like large, highly efficient distribution centres.

James describes it as multiplying the value of space. Robots don’t reduce rent, but they allow every square metre to generate greater throughput. In effect, automation transforms a highcost lease into a productive investment.

“A robot doesn’t sign a lease or pay a cent in rent, but when you deploy automation in a small, expensive urban warehouse, it multiplies the value of every square metre,” he says. “By combining robotics with smart layout, mezzanines, and AI-driven fulfilment systems, you can dramatically increase throughput, reduce labour costs, and squeeze far more productivity out of

the same floor space.

Industries with high-frequency, time-sensitive delivery needs are leading the shift. Grocers, for example, are using MFCs to handle online orders quickly and reduce substitution rates for perishables. Pharmacy and convenience retailers benefit from proximity because of their small, frequent orders. Fashion and electronics also see gains from reducing delivery times and improving order accuracy. Even healthcare and high-value B2B operators are beginning to use micro hubs to boost responsiveness.

Woolworths’ early automation pilots and Coles’ partnership with Ocado illustrate the direction of travel. For many retailers, the challenge is no longer whether MFCs work, but how quickly they can scale.

While micro-fulfilment grabs attention, retrofitting existing properties is equally critical in addressing the property crunch. Vacant supermarkets, under-utilised shopping centres, and older light-industrial sites are all being transformed into last-mile facilities.

Lauren describes retrofits as a form of “urban surgery.” The first step is diagnosis.

“First, you need a precise diagnosis –understanding the layout, ceilings, floor loads, and zoning,” she says. “Then comes the incision: every modification, from mezzanines to automation, must be exact to maximise space.”

The approach is not without challenges. Many urban buildings lack the access or clear heights needed for efficient logistics. Local zoning rules can also slow progress, especially where freight activity clashes with nearby residential areas. But despite these hurdles, retrofits often prove faster, more cost-effective, and more sustainable than waiting years for greenfield projects to reach completion.

Mezzanines have long been seen as the simplest way to multiply floorspace, doubling capacity without changing postcodes. Yet Lauren notes that rising material and labour costs are eroding their simplicity. Retrofitting into live operations is disruptive and expensive. Increasingly, compact automation systems like AutoStore are emerging as viable alternatives, providing dense storage and throughput in spaces where mezzanines may no longer be the best answer.

The industrial property crunch is

not just changing the behaviour of occupiers; it is also reshaping how developers and landlords approach the market. Traditionally passive landlords are becoming more like strategic partners, offering build-to-suit urban hubs, redeveloping obsolete retail sites into logistics nodes, and co-investing in conversion costs.

Lauren points to ESR’s development at Moorebank Intermodal Terminal in New South Wales and Aware Real Estate/Barings’ investment in the Austrak Business Park at Somerton in Victoria as examples of this shift. By leveraging rail connections, these projects enable freight flows from port to warehouse, reducing movements and supporting more resilient logistics networks.

Despite the rise of urban nodes, large distribution centres remain indispensable. The most likely longterm outcome is a hybrid model, where bulk storage and throughput are handled by large regional facilities, while micro hubs and retrofitted sites

provide speed and customer proximity.

James compares the model to public transport.

“Supply chains are interconnected, dynamic systems – living organisms that must adapt as customer needs and operating environments evolve,” he says. “That said, this is evolution, not revolution. The nucleus of the network will remain the large, efficient ‘big box’ warehouses that handle bulk storage and throughput.”

This hybrid approach is already visible. Coles and Woolworths operate large customer fulfilment centres alongside micro-automation nodes. Other retailers are pursuing similar dual-network strategies, recognising that scale and speed must work together.

The industrial property crunch is not a temporary blip. James is clear that structural forces – urbanisation, persistent e-commerce habits, and customer expectations of speed – will sustain the shift toward denser, more distributed networks.

“This isn’t a fad,” he says. “It’s a new layer in supply-chain geography.”

Population density adds another dimension. While Australian cities are far less dense overall than counterparts in Asia, inner-city pockets in Sydney and Melbourne approach similar levels. These are precisely the areas where microfulfilment economics are most compelling. James notes that Sydney is already experimenting with multistorey warehouses, a response to both high rents and land scarcity. At the same time, housing shortages are pushing governments toward denser urban living, making last-mile hubs even more essential.

Sustainability is also driving strategy. Regulations on embodied carbon and energy performance are making retrofits more attractive than greenfield builds, as re-use lowers carbon footprints and avoids land take. Lauren stresses that sustainability is no longer an optional add-on but a design constraint. The networks that thrive will be those that align with both city planning frameworks and climate goals.

Australia’s industrial property crunch has forced a rethink of how supply chains are structured. Large regional distribution centres will remain the backbone, but the rise of micro-fulfilment and retrofitting is adding new layers of agility, resilience, and proximity to the network.

Lauren and James are clear: the future of logistics real estate is not about choosing between big boxes or urban hubs, but about balancing both. Companies that adapt property strategies to squeeze more from existing assets, integrate automation, and partner with developers, will be best placed to meet the challenge of fast, efficient, and sustainable delivery.

In a market where the last mile defines customer experience, those choices will increasingly decide who wins. ■

65 10+

200,000+

LITHIUM-ION BATTERIES INSTALLED

21%

100% CHARGING IN 80 MINUTES, 30 MINUTES OPPORTUNITY CHARGING TO 50%

Gardening product manufacturer

Richgro Garden Products has improved the sustainability of its green manufacturing operations with the help of Toyota Material Handling Australia (TMHA), after ordering a new fleet of Toyota battery electric forklifts and TMHA sweepers.

The Western Australia-based Richgro is a fourth-generation family-owned and operated business specialising in fertilisers, soil conditioners, potting mixes, mulches and compost, and has been essentially operating off the grid since 2015.

Richgro’s primary manufacturing and warehouse facility in the Perth suburb of Jandakot is powered by an anaerobic digestion plant that converts up to 150 tonnes of food waste per day into 100 per cent carbon-free green electricity.

Richgro has been a TMHA customer

for the past five years under a longterm rental agreement, and when the time came to renew the contract and change over its equipment, it made sense for the company’s material handling equipment to match its sustainable ethos.

TMHA Area Sales Manager, Blair Martin, says that after being shown around Richgro’s facility last year and seeing its anaerobic digestor, it made sense for the company to use forklifts powered by their own energy source.

“I woke up in the middle of the night and went ‘why have they got gas trucks when we can offer them electric trucks?’” says Blair. “Why would you not use the power you’re harnessing to power the trucks? So that’s where it all came from.”

Richgro Managing Director, Tim Richards, agreed that switching

Richgro’s long-term rental fleet to battery electric made was the ideal choice for multiple reasons.

“We’re making the move to electric for a couple of reasons – because we produce our own green energy, and it makes sense that we utilise this energy to run our electric handling equipment, and reducing our carbon footprint forms part of that decision as well,” says Tim. “We decided when it was time to renew our current Toyota forks that we opted to go with electric this time around.”

Richgro has ordered five Toyota 8FBN 2.5-tonne electric forklifts and one TMHA electric sweeper to help keep its warehouse tidy, all of which will be recharged using its off-grid power system.

Tim says the reliability of the machines and fast servicing experience

provided by TMHA was a key reason for Richgro renewing its contract with a second long-term rental agreement.

“They’re a very reliable machine,” he says. “The operators never say a bad word about them, which is generally a good sign that they’re happy. And there’s absolutely no issues when it comes to the service side of things. If there’s an issue, they’re straight on to it, fixing it quickly and efficiently so we’re very happy from that perspective.

“We’re very happy with the uptime of the machines, I can’t think of any big issues where we’ve had a machine down for an extended period of time, which has been great.”

With the near-silent operation of the battery electric machines bringing a change from the company’s previous units, Blair helped Richgro spec its units up with buzzers to increase safety in the workplace.

“I think Richgro’s biggest query was how to make sure people can hear them coming, so we’ve added squawkers, which is a buzzer to let people be aware of the machine,” he says. “From the driver’s point of view, they love the way the electric unit drives. They like that the manoeuvrability of the mast is more intuitive.”

Along with the new fleet of electric equipment, Richgro also outright owns

three gas-powered forklifts, with a view to replace those with battery electric units when they reach the end of their reasonable working life. Tim says he was satisfied by the performance of his Toyota machines and the service provided by TMHA over the course of their working relationship.

“We’re very happy,” Tim says. “Honestly, I have nothing to complain about – we would have looked elsewhere if we weren’t happy, and we’re more than happy to stay with

Toyota. Their reliability, their service, their parts, their backup, they’re great to deal with.

“I’ve always driven Toyota cars for a reason – they’re not necessarily the cheapest, but they’re extremely reliable and you never seem to have too many issues, and I think that transfers into the forklift fleet as well. If someone came to me and said they were looking for a fleet of forklifts, I’d be more than happy to recommend Toyota.”

Richgro began over a century ago in 1916 working in stock feed and has evolved into a team of 85 members with products sold nationwide in nurseries and hardware stores including Bunnings and Mitre 10. With an estimated customer base of more than 3 million people, Richgro offers a range of products to keep both residential and industrial gardens healthy and productive, while ensuring jobs and manufacturing remains in Australia.

Its anaerobic digestion plant uses food waste gathered from supermarkets, food processors and breweries in and around the metropolitan Perth area to produce carbon-free electricity and can even return excess power back into the grid. ■

For more information visit www.toyotamaterialhandling.com.au or freecall 1800 425 438

Warehouse management systems remain vital to distribution, but they often miss daily realities. Dematic highlights unified platforms that add visibility and help teams work smarter.

For decades, Warehouse Management Systems (WMS) have been the operational backbone of distribution. They track orders, inventory and shipments with precision. Yet the day-to-day reality on the warehouse floor looks different. Staff are making splitsecond adjustments, equipment is being pushed to its limits, and processes are constantly evolving just to keep pace.

Much of the pressure warehouses face comes from the gap between what WMS record and what is happening in real time. Labour is harder to find and retain, fulfilment channels are multiplying, and automation is becoming the norm. Supervisors are being asked to make decisions on the fly with very little visibility of what is actually occurring at ground level.

According to Lee Koutsos, Director, Connected Workforce Solutions (CWS) at Dematic, while the role of WMS remains central, achieving the level of visibility businesses need today depends on complementary capabilities that make its data accessible and actionable.

“WMS isn’t going anywhere,” he

explains. “But what we often see is that the data it generates is locked away in the background. Customers don’t always know it’s there, or how to use it. Once we expose that information in a simple, accessible way, they can start to see where improvements are possible.”

In practice, this means giving supervisors visibility of the small but important details that sit between those order milestones: how long a pick actually takes, where bottlenecks form, or how operators are performing in real time. With that information, businesses can adjust on the fly rather than waiting for the end of the shift to find out what went wrong. Which is exactly what unified platforms promise to deliver.

These unified platforms sit between the WMS and the warehouse floor. They connect devices such as scanners, voice systems, vision systems and AMRs, then capture every scan, confirmation, movement and task duration. Instead of waiting until the end of the shift

for data, supervisors can see what is happening while it happens.

“If you cannot measure it, you cannot manage it,” says Robert Deane, Southern Regional Sales Manager at Dematic Australia at Dematic. “A unifying platform across multiple technologies gives businesses insight into their own operations so they can optimise with evidence, not gut feel.”

There’s a key distinction between a WMS and a unified platform. WMS excels at orders and inventory; what needs to be done, where stock is located and how it moves across the network. Unified platforms focus on how that work is carried out. A WMS might specify that two items need to reach a tote by a certain time. The unifying layer captures who picked them, how far they walked, whether the right location was scanned, whether other items were collected along the way, and how long the trip took. With this kind of data, supervisors can see patterns that were previously invisible. A single aisle might consistently slow operations, an operator might struggle with accuracy at certain times of the

shift, or a seasonal change in demand might make a slotting decision suddenly inefficient.

Once those patterns are visible, solutions can be implemented quickly. For example, at one customer site, Dematic’s software team noticed an issue in the analytics where dropouts kept occurring in one area. They called the operations team and discovered a Wi-Fi access point had failed. This meant it was picked up before it was even reported on the floor. In another case, analysis revealed a fast-moving stock keeping unit (SKU) was stored in a spot that added minutes to every pick. A quick re-positioning delivered immediate time savings.

The biggest challenge in warehouses today is not only the speed of goods moving in and out, but the people who make it happen. Staff turnover remains high, and many operators leave within weeks of starting. Supervisors spend valuable time training new recruits, often through complex systems that are difficult to learn and frustrating to use. Even those who stay can feel disconnected from their performance, with little real-time feedback or recognition.

Unified platforms help by changing how tasks are presented and measured. Instead of juggling multiple systems, the platform takes order data from the WMS and translates it into clear, stepby-step instructions across devices.

Each scan, confirmation and movement is captured in the background and presented in dashboards, so progress can be tracked in real time. For new recruits this means easier onboarding, while for supervisors it provides the visibility to coach and redeploy staff as needed.

“Retaining new recruits can be very challenging in a warehouse environment,” Lee says. “Introduce a gaming element and it can completely change motivation levels.” He explains that simple features like progress targets or light competition between operators can give staff a sense of achievement throughout the day.

“It creates a genuine increase in job satisfaction,” he adds, noting that some sites have reported a lift in retention when employees feel more engaged with their work.

The ability to tailor workflows also helps accommodate different working styles. One operator may prefer the

familiarity of scanning, while another finds voice more efficient, and a third might like using vision-based confirmation. With a unified platform, all three approaches can be supported without sacrificing consistency in measurement or performance. The result is a more flexible and peoplecentred workplace, where technology adapts to staff rather than forcing staff to adapt to technology.

While unified platforms are emerging around the world, Dematic has taken a different route by building its solution close to home. The company’s software team in Australia designed and wrote the code for its Connected Workforce Platform (CWP), drawing on years of experience with local operations and the challenges they face.

Many of Dematic’s competitors rely on overseas vendors for their software.

Any change request or customisation often means long lead times, expensive add-ons and a frustrating wait. Lee says Dematic’s local development team is able to adapt far more quickly. “Our response time being local knocks a lot of cost and delay out of the equation. You are dealing with people who know the market and can adapt quickly.”

Control is another differentiator. As Dematic supplies the software and the hardware, customers have a single point of accountability rather than juggling multiple vendors.

“The fact that our engineering capability sits here in Australia means we can respond quickly and adapt to customer needs,” Lee explains. “This Supervisors review live performance data on Dematic’s platform.

is a clear differentiator in the market place.”

Just as importantly, Dematic has not taken a standardised approach. The platform has been built to reflect the realities of Australian businesses, whether that’s managing seasonal changes in SKU profiles, supporting hybrid automation environments, or helping supervisors improve staff retention in a tough labour market.

“We saw an obvious need in the market that was not being addressed,” Lee explains. “So, we built a platform to meet it.”

The warehouse of the future will be more optimised, more data-driven and more people-focused, but the way supervisors interact with systems is shifting. Unified platforms give businesses a way to add new technologies into the mix without the need for complicated WMS changes as a unified platform such as CWP is WMS agnostic.

They are less about replacing the systems warehouses already depend on and more about unlocking their full potential. By bridging the gap between strategy and execution, these platforms give businesses the confidence to act on evidence rather than instinct.

Deane points out that without this new layer of visibility, continuous improvement becomes guesswork.

“Without data, companies are flying blind. They might make a change based on gut feel, only to discover months later that the adjustment made things worse. With visibility, you can see the impact in real time and adapt before small problems turn into bigger ones.”

For supply chain businesses, unified platforms mean clearer workflows and a greater sense of purpose. For supervisors, they mean faster insights and fewer blind spots. And for the industry, it signals a shift towards warehouses that are not only more productive, but also more resilient and ready to adapt to future distribution demands. ■

For more information, visit www.dematic.com/en-au/

WRD Wells’ range of custom 5S shadow boards cut downtime, prevent cross contamination, and enhance warehouse safety with colour-coded tool storage.

Warehouses are busy, highpressure environments where efficiency depends on organisation. Forklifts, pallets and racks are carefully arranged, yet the small everyday tools that keep sites clean and safe often end up misplaced.

That’s WRD Wells come in. The company, a long-standing supplier of hygiene and food safety solutions in Australia and New Zealand, offers customised 5S shadow board systems that help warehouses and production

sites stay organised, compliant, and safe. These colour-coded tool stations are becoming a fixture in food factories, warehouses and freight hubs, helping operators keep equipment in order and operations running smoothly.

“Shadow boards are a really simple way to help companies stay on top of their workflow and processes,” says Christine Venables, Commercial Manager, WRD Wells. “If someone has a red broom, they know it lives on the red board. If it’s blue, it goes on the

blue board. Everyone knows where things belong.”

The idea comes from the lean manufacturing “5S” framework –Sort, Set in Order, Shine, Standardise, Sustain. While the principles have long been applied in production lines, Christine says warehouses are now adopting them to save time and avoid disruption.

A foothold in food and beverage

According to WRD Wells General

Manager, Arto Taalikka, food and beverage manufacturers have been the earliest and strongest adopters.

“The largest industry is food and beverage manufacturing. 5S systems are par for the course,” he says.

In these environments, organisation isn’t just about tidiness but food safety.

“In a standard warehouse, if tools are unorganised, you lose time. In food, you could cross contaminate – which is always a very serious issue,” Arto adds.

Supermarkets, quick-service restaurants and pharmaceutical operators have also embraced the system. Warehousing and distribution are seen as future growth sectors.

“5S in warehousing and DC’s is a definite growth area, and we see a big opportunity to offer our 5S solutions to this industry over the next 12 months,” Arto says.

Outside manufacturing, freight operators are turning to shadow boards for everyday housekeeping. Arto says that the company has supplied freight operators in Victoria and Queensland with systems for managing everyday cleaning tools such as brooms, shovels and brushes. Bigger sites tend to get the most benefit.

“The larger the warehouse, the more interest there is in boards at both ends of an aisle. It saves time and ensures consistency,” he says.

The advantages are wide-ranging, from efficiency gains to improved safety.

“Increased efficiency is the biggest one – reducing downtime and improving workflow,” says Arto.

The tools also enhance visibility, minimise tool loss and damage, and help maintain compliance. They

contribute to safety by ensuring tools are not left on the floor where they could pose a tripping hazard.

Christine adds that the wasted time searching for equipment is often underestimated.

“People walking around looking for the right broom or dustpan –that’s a big killer. Studies in lean manufacturing show how much time is lost searching for tools,” she said.

“You can save a lot of money just by knowing exactly where things are.”

There are maintenance benefits, too. Tools stored properly are less likely to be damaged, cutting replacement costs. For managers, the boards serve as a silent supervisor.

“The board does the talking. It tells staff where the red broom goes and ensures the right tool is used in the right area,” Christine says.

The boards are built to suit different needs. Standard PVC panels weigh under 20 kilograms and can hold 15 to 20 kilograms of tools, while stainless-steel models are available for heavy-duty use. Smaller formats are also being developed for tighter spaces. Customer feedback has been consistently positive. Most start small but expand quickly.

Christine explains that most businesses start with just a couple of boards, but within six months they are often equipping entire warehouses or factories, as the cost savings quickly become clear.

“They don’t always need to be huge boards. Smaller versions, even down to A4 size, can be fitted onto racking ends or confined areas,” she says.

Arto adds that multicultural

workforces benefit from the visual clarity of shadow boards, reducing language barriers in tool management.

“Many warehouses are multicultural, and when you have the image of the tool and the item code that you need to order more, it’s very easy to do,” he says. I haven’t heard any bad feedback on anyone having a shadow board – the feedback is always very positive.”

While the boards are practical by design, the next step is digital integration. Arto says that QR codes and NFC technology are the natural next step, enabling users to scan a code that links directly to an ordering portal or a maintenance log. Materials innovation is another focus. Stainless steel, polypropylene and new panel types are being tested for durability and hygiene. There is also scope for customisation.

“Why stick with plain blue? Customers could print their own branding or images directly onto the board. That opens up new opportunities,” Arto says.

At its core, the shadow board is about reducing waste – of time, effort and money. For operators under pressure to lift efficiency and maintain compliance, the simplicity is what makes it work. Christine emphasises that visual management is built on simplicity, with standardised, colour-coded, and easily accessible tools ensuring staff always know what to use and where it belongs.

“Automation doesn’t remove the need for cleaning or compliance. If anything, it makes it more important. Shadow boards scale with the business, whether it’s a food factory, a DC or a freight hub,” Arto affirms.

From food factories to freight warehouses, shadow boards are proving a small but powerful tool in keeping operations efficient, compliant and safe. What started as a lean manufacturing concept has become a fixture in modern supply chains. As the company looks ahead, the focus is on expanding into new markets and integrating digital features. But the principle remains the same: simple, standardised systems that make warehouse work easier.

“Simple systems often make the biggest difference,” Christine. “That’s exactly what shadow boards are doing for warehouses today.”■

Combining internal combustion-like power with clean energy, the Hyster XTLG Outdoor Electric Forklift Series delivers the performance, durability, and reliability you’ve come to expect from Hyster — now powered by integrated lithium technology. Available in capacities from 2 to 7 tonnes, it’s the sustainable solution that doesn’t sacrifice strength, speed, or uptime.

Adaptalift partners with Northline on a seven-year fleet renewal, prioritising safety, technology, and responsive service.

Northline, an Australian-based transport & third-party logistics provider (3PL), is reaching the final stages of rolling out new Hyster material handling equipment across its sites nationwide through a long-term partnership with Adaptalift Group. The seven-year deal covers everything from automated pallet jacks to 16-tonne counterbalance forklifts, giving the transport business a refreshed fleet with modern safety features, smart technology, and a support model built around responsiveness.

Adaptalift had supplied container straddles to Northline in the past. That started to change when Vince Tassone, Adaptalift’s Head of Business

Development, drew on his three decades in transport and logistics to put forward a plan. His industry background gave Northline confidence that they were speaking with someone who understood the realities of running a national transport network.

“They’d been with their incumbent supplier for a long time and were into their second cycle of equipment,” Vince says. “It was simply time to bring in new materials handling equipment that would support their stringent safety and operational goals.”

Northline Chief Operations Officer, Brett Curtis, added: “During the tender process, Adaptalift came with lots of different ideas and solutions, and sold

us on a more collaborative approach with some technology smarts that we thought would assist us in making better decisions.”

The fleet upgrade is wide-ranging. Alongside forklifts and pallet movers, the rollout includes container straddles and specialised equipment spread across metro and regional depots. Each machine has been delivered with features specified by Northline to improve safety and efficiency.

Telemetry was top of the list.

Adaptalift fitted its Speedshield system across the fleet, allowing managers to track usage in detail – from operator logins and idle time to impacts and load weights. Other features included

automated fork positioners, built-in weight scales, and mandatory pre-start and post-start checklists backed by reporting.

“There was strong alignment between what Northline wanted and what we could provide,” Vince explains. “They put safety front and centre, and we were able to deliver features like our newly released Adaptalift Connect service app, that matched that commitment.”

Service as the real differentiator

For Northline, moving away from its long-time supplier wasn’t just about replacing old machines. The tipping point came down to service. Vince says the business was encouraged by Adaptalift’s promise of responsiveness.

“Our difference in the market isn’t

about one brand being better than another,” Vince says. “It’s the service. It’s about how quickly we respond and how willing we are to work through challenges. That willingness is what sets us apart.”

That claim was tested early. As part of the rollout, new forklift models were introduced to the Australian market, and some teething issues emerged. Adaptalift worked closely with its OEM partner Hyster to resolve them quickly and ensure that Northline wasn’t impacted.

“We never just delivered machines and walked away,” Vince says. “If there was a problem, we owned it and fixed it. That reassured Northline that we’re in this for the long haul.”

Brett added: “We meet with Adaptalift once a week… they’ve come to the

table and provided us with solutions to address any issues we were having. Even in areas where we had excess equipment, they understood and worked with us to remove assets, so we didn’t incur unnecessary costs.”

Like most large projects, the rollout faced some delays, particularly around global shipping challenges. But Adaptalift stepped in with equipment from its rental fleet to bridge the gap and keep Northline running.

“Any delays we had, we covered with our expansive range short term rental fleet,” Vince says. “That meant Northline could continue operating without disruption. It showed them we’re committed to making the partnership work, even when challenges crop up.”

“They reacted really quickly… not

everybody would have done that,” says Brett. “They threw in an additional forklift to help us, parked the others up, and ensured branches could continue to operate.”

By September 2025, about 85 per cent of the fleet had been delivered, with the remainder due to arrive within weeks.

The agreement has also opened the door for broader collaboration. Beyond forklifts and pallet movers, Northline has turned to Adaptalift for scissor lifts, cleaning equipment, and even discussions around truck rentals. For both companies, they hope their partnership becomes more than a simple supplier arrangement.

Vince notes that with both companies

being privately and Australian-owned, there is a natural sense of shared understanding between them.

“Northline now has the option to lean on our full suite of products, not just forklifts, to support their operations,” he says.

Set over seven years, the deal gives both parties a stable foundation. For Northline, it means access to a fleet that’s fit for purpose and supported by a partner prepared to adapt as their needs evolve. For Adaptalift, it demonstrates the value of service, responsiveness, and relationshipbuilding in an industry where downtime comes at a high cost.

“This has been a genuine two-way relationship,” Vince says. “Northline has worked with us, and we’ve worked

with them. They’ve been patient when we’ve faced challenges, and we’ve delivered solutions to keep them moving. That kind of mutual approach is what will carry us through the next seven years.

Brett explained that the business is focused on building long-term partnerships rather than short-term arrangements, emphasising a desire to establish relationships with local, likeminded businesses.

“We’re a very strong values-based business, and for that, we like to have partnerships with similar types of businesses,” he says. “And that’s probably the thing that attracted us to Adaptalift – still a family-based business that has some strong values and they were similarly aligned.” ■

Warehouse safety requires planning, training, and effective technology. Here’s Linde Material Handling’s offering in the safety space.

Across Australia, forklifts and other material handling equipment (MHE) are the workhorses of supply chains. They keep goods moving, orders fulfilled and warehouses running smoothly. But with all that productivity comes risk. Forklifts remain one of the biggest causes of serious workplace injuries –often in busy warehouse environments where people and machines share the same space.

The message from safety regulators

and equipment providers is consistent: most of these accidents don’t have to happen. By thinking about safety from the ground up – from the choice of equipment and warehouse layout to how operators are trained and how teams work day to day – businesses can cut down incidents and make sure their people go home safe.

Warehouse activity is rarely steady. High-traffic times – from peak trading periods to the surge of e-commerce fulfilment – increase pressure on both

operators and equipment. Congested aisles, tighter schedules, and faster vehicle movements raise the likelihood for human error.

Planning for busy periods is central to any good safety strategy. Simple measures like clear traffic routes, marked pedestrian zones, and physical barriers or signage can go a long way in keeping people and machines apart. On top of that, technology can provide an extra safeguard – tools such as motion sensors, reversing alerts, and better

lighting help operators stay aware and avoid mistakes when the pressure is on.

As Linde MH’s Unrivalled Safety e-guide puts it: “Separation isn’t just a layout decision – it’s a business-critical safety strategy.”

Even the best safety systems can’t replace awareness on the ground. Forklift operators work in fast-moving, constantly changing spaces, where blind spots, tall racking, and shared walkways make staying alert essential.

Data from SafeWork NSW and WorkSafe Victoria shows that pedestrians are the group most often injured in forklift incidents. That’s why safety training can’t stop with operators. Everyone who shares the warehouse floor – from pickers to supervisors – needs to understand

pedestrian zones, floor markings, and the risks of stepping into shared operating areas.

Building awareness into daily briefings and reinforcing it during peak times helps create a culture where safety stays front of mind and training isn’t just about getting a forklift licence. Operators need regular refreshers that cover new technologies, updated layouts, and different load types to keep their skills sharp and their workplaces safe.

The e-guide stresses that “comprehensive training – both theoretical and practical – is nonnegotiable”. Regular refreshers ensure that operators remain confident in using features like interlocking seatbelts, speed-limiting functions, and energy management systems. Importantly, training should cover not only machine operation but also

awareness of high-risk areas such as blind intersections, rack aisles, and loading docks.

While human vigilance is critical, technology plays a powerful role in reducing risk. Linde Material Handling’s approach, influenced by its “Vision Zero” philosophy, is to eliminate workplace incidents through built-in safety features.

Key technologies include:

• Visibility systems such as Linde VertiLight and LED Stripes, which illuminate work areas evenly without glare. Linde BlueSpot and TruckSpot project visual warnings onto the floor, alerting pedestrians to moving forklifts, while stationary projectors mark thoroughfares.

• Operator warning systems like Linde Safety Guard, which uses transmitters

to create proximity alerts between forklifts, personnel, and infrastructure.

Surround View provides 360-degree camera coverage, while Linde Reverse Assist Radar and AI-powered cameras detect pedestrians and obstacles when reversing.

• Load handling safety through Dynamic Mast Control, Linde Curve Assist, and Linde Safety Pilot, which monitor stability and automatically adjust performance to prevent tipping or rack collisions.

These features combine to protect both operators and pedestrians, particularly during high-demand operating periods when focus can waver. Another often-overlooked risk area is refuelling and recharging. According to the guide, these routine tasks are “among the most hazardous aspects of forklift operation”.

For diesel and LPG forklifts, refuelling must occur in ventilated, ignition-free zones, with safe manual handling practices for heavy cylinders.

For electric fleets, lead-acid batteries require full charging cycles and specialist handling, while lithiumion options offer safer “opportunity charging” during short breaks.

Embedding these practices into daily routines not only keeps teams safe but also extends the life of fleets and reduces downtime.

Warehouse design plays as critical a role in safety as equipment choice. Layouts that physically separate people and machines – through barriers, exclusion zones, and dedicated pedestrian walkways – reduce collisions and improve flow.

But design alone is insufficient. As the Linde Material Handling guide highlights, “even the best layout is only as effective as the team using it”. Training, signage, and reinforcement of traffic rules ensure layouts function as intended.

Australia’s material handling safety standards, such as AS 2359, set

important minimum requirements. These standards cover rated load capacities, braking systems, and seatbelt interlocks. Yet compliance alone does not guarantee safety.

Industry leaders like Linde exceed these requirements, introducing speed limitation when masts are raised, ergonomic compartments to reduce fatigue, and noiseminimising designs to improve operator comfort. The aim is to create controlled, low-risk environments that go beyond ticking regulatory boxes.

As Allan Spackman, Technical Manager for Warehousing at Linde Material Handling, explains: “All Linde counterbalance machines have seatbelts fitted and interlocks to prevent operation without the seatbelt being fitted properly.”

The consistent message across the Unrivalled Safety e-guide is that technology and training are only effective when embedded in a broader safety culture. From operators to pedestrians, from warehouse managers to senior leaders, everyone shares responsibility for ensuring colleagues go home safely.

“Chemist Warehouse wouldn’t have been able to grow like we’ve been able to without the shared vision towards continuous improvement of trusted partners like Linde,” says David Brennan, GM of Supply Chain at Chemist Warehouse.

Similarly, Bruce Hansen, National Fleet Manager at Fonterra, highlights Linde’s “focus on safety” as a deciding factor in equipment choice.

For businesses across logistics and warehousing, that vision is an important reminder this National Work Safe Month: safety isn’t a checkbox. It’s an ongoing commitment.

“We’ve tried other brands, but Linde consistently proves to be the best,” says Bruce. “Their reliability, performance, the ergonomics and their focus on safety are unmatched. It’s a no-brainer for us.” ■

See who’s leading in WMS, TMS, ERP & more

Discover innovative platforms transforming logistics, warehousing and transport management in the 2025 MHD Software Showcase

MegaTrans 2026 is set to unite Australia’s freight sector to address growth, sustainability, digitisation, and collaboration challenges.

Australia’s freight and logistics sector is entering a period of sustained growth and structural change. Driven by expanding consumer demand, shifting expectations, and mounting infrastructure constraints, the sector is under increasing pressure to modernise. Long-term projections from Infrastructure Australia indicate freight volumes will rise by more than 26 per cent by 2050, underscoring the urgency for scalable systems, smarter collaboration, and more sustainable operations.

Against this backdrop, MegaTrans 2026 will return to Melbourne on 16–17 September, reaffirming its role as the country’s premier logistics and supply chain event. Staged at the Melbourne Convention and Exhibition Centre, the two-day gathering is designed as both a showcase and a conversation hub, bringing together operators, suppliers,

technology providers, and policymakers to address the sector’s most pressing challenges.

While the event will feature an expansive trade exhibition, its core purpose lies in fostering collaboration across the supply chain. Stakeholders working at different ends of the freight network rarely have the opportunity to connect in the same space. MegaTrans bridges that divide, creating an environment where ideas can be exchanged, lessons shared, and longterm strategies considered.

Previous editions of the show have demonstrated its capacity to draw diverse participation, with attendees ranging from major transport and infrastructure operators to technology start-ups, industry associations, and government agencies. This breadth of

involvement ensures the discussions are not confined to a single niche but instead reflect the interconnected nature of modern supply chains.

The sustainable supply chain of the future

MegaTrans 2026 will continue with its theme, The Sustainable Supply Chain of the Future. Sustainability is no longer a peripheral concern but a core priority for freight and logistics businesses navigating the twin pressures of regulatory scrutiny and consumer expectation. Across the exhibition floor, solutions will spotlight emissions reduction, fuel efficiency, energy transition, and circular economy practices, alongside technologies that support transparency and compliance in environmental reporting.

Digital transformation will feature prominently. As freight networks

become more complex, software platforms are increasingly central to efficiency, compliance, and customer service. Transport management systems, warehouse orchestration tools, and integrated real-time data platforms will be presented by a range of exhibitors, demonstrating how automation and digitisation can streamline operations and reduce manual friction.

The role of artificial intelligence is also expected to attract attention. AI-enabled assistants, predictive analytics, and decision-support tools are rapidly moving from experimental to mainstream use in logistics. The event will showcase how these technologies can help operators scale with structure, improve coordination, and make day-to-day workflows faster and more reliable.

Beyond the exhibition floor

MegaTrans is not only about technology displays. Its conference program is structured to place innovation in context, featuring a line-up of government representatives, business leaders, and research experts. Topics will include infrastructure investment, freight resilience, workforce development, automation in last-mile delivery, and the impact of digitisation on regulatory compliance.

Sustainability will again run through many of the discussions, with panels expected to examine the pathway to net zero across freight modes, the development of green freight corridors, and strategies for balancing growth with environmental responsibility. By combining thought leadership with practical examples, the program aims to provide both vision and actionable insight.

Complementing the exhibition and conference is the Careers Hub – a dedicated initiative to connect students, graduates, and job seekers with employers across the freight and logistics ecosystem. This element reflects one of the sector’s persistent challenges: attracting and retaining the talent required to sustain growth. By providing a visible entry point for new professionals, the hub reinforces the industry’s focus on long-term workforce development.

Exhibition bookings for MegaTrans 2026 are now open, with early registrants receiving access to premium floor positions and targeted promotional support in the lead-up to the show. For suppliers and service providers, the value lies in direct engagement with decision makers

who are actively seeking solutions to operational challenges. Previous events have confirmed the event’s ability to connect exhibitors with an audience spanning road, rail, ports, warehousing, and e-commerce – a reach that extends across the full supply chain.

For participants, the opportunity is twofold: to see first-hand the technologies and solutions shaping freight operations, and to be part of the conversations guiding the sector’s strategic direction. With freight demand forecast to continue rising, the ability to align operational needs with emerging solutions will be critical.

The timing of MegaTrans 2026 is significant. With supply chains still recalibrating after years of disruption, the next phase of investment and innovation will determine how effectively the system can absorb growth. The event provides a focal point for these discussions, ensuring stakeholders from every segment of the sector are part of shaping what comes next.

As Australia positions itself for the decades ahead, events like MegaTrans provide more than visibility for products and services. They create a forum where strategy meets execution, where immediate operational needs intersect with longterm planning, and where the sector can collectively chart its path forward.

The challenges facing freight and logistics are not isolated to capacity or infrastructure. Complexity, sustainability, and digital integration are all now central to the conversation. MegaTrans 2026 offers the industry an arena to take stock, share insights, and explore the tools and partnerships required to navigate these challenges.

For operators, suppliers, technology partners, and policymakers alike, the event promises not only to showcase what is possible, but to shape the trajectory of the sector for years to come. ■

Amazon has officially opened two new sites in Victoria – a 52,000 sqm fulfilment centre in Cranbourne West and a delivery station in Ravenhall – creating 700 jobs and strengthening delivery capabilities across Melbourne.

Amazon Australia has celebrated the official opening of its third fulfilment centre (FC) in Victoria, with government and community leaders joining company representatives to cut the ribbon on the 52,000 square metre facility in Cranbourne West.

The Hon. Danny Pearson, Minister for Economic Growth, Jobs and Trade, Cr Stefan Koomen, Mayor of the City of Casey, and Pauline Richards, State Member for Cranbourne, attended the event alongside Amazon Australia Country Manager, Janet Menzies. The new facility is expected to create more than 500 jobs locally and improve delivery outcomes for Melbourne customers while supporting Victorian small businesses that use the Amazon platform.

The opening marks part of a broader investment by the global retailer, which has committed $200 million to Victoria through the launch of two new,

purpose-built sites – the Cranbourne West FC and a delivery station in Ravenhall. Together, the facilities will generate 700 new jobs across the city and expand Amazon’s logistics footprint in one of Australia’s fastestgrowing regions.

Spanning two levels, the Cranbourne West fulfilment centre covers 52,000 square metres – the equivalent of two and a half AFL fields. Once fully operational, it will have the capacity to store up to four million products sold on Amazon.com.au, ranging from electronics, books, and beauty products to furniture and everyday essentials. Roles at the site will include entrylevel positions with on-the-job training as well as more specialised opportunities across operations, human resources, engineering, and workplace health and safety. The majority of

positions are permanent, full-time roles offering leading pay, subsidised private healthcare, and up to 20 weeks of paid parental leave.

For local residents, the facility represents more than just a large warehouse. As employee Violet Chang explained, the site has brought meaningful change to daily life. “As someone who lives in Cranbourne West, it’s great not having to commute a long way to get to work. It’s great that this site has created hundreds of jobs and brought new energy to the area. I also enjoy working the flexible shifts of four days on and three days off, as it’s given me more time to spend with my family.”

The second site to come online this month is an 8,800 square metre delivery station in Ravenhall, located in Melbourne’s northwest. The facility will act as a local distribution point for packages, supporting last-mile delivery

and creating more than 200 jobs.

Importantly, it also provides opportunities for local entrepreneurs to partner with Amazon through the Delivery Service Partner program or to earn additional income via the Amazon Flex platform. Both initiatives broaden the ecosystem of small businesses and contractors connected to Amazon’s logistics operations in Victoria.

Amazon Australia Country Manager, Janet Menzies, highlighted the significance of the company’s latest investments.

“Melbourne was the home to our first Australian fulfilment centre in 2017, and we are thrilled to continue investing in Victoria with the opening of our new purpose-built sites in Cranbourne West and Ravenhall,” she says.

“We’re proud to be creating hundreds of high-quality local job opportunities, offering on-the-job training and exciting career paths in a safe and positive environment. At Amazon, we’re focused on providing our customers with great value, wide selection, and fast delivery. These new sites strengthen our ability to meet these commitments for our Victorian customers.”

Menzies also noted the importance of supporting the small-to-mediumsized Australian businesses that sell on Amazon.com.au. “The new fulfilment centre in Cranbourne West will create additional opportunities for local businesses to expand their reach, not just in Victoria but across the entire country. We’re excited to help these businesses grow and better serve their customers through our enhanced logistics network.”

For the Victorian Government, Amazon’s investment has been welcomed as a sign of confidence in the state’s workforce and economic resilience. The Hon. Danny Pearson MP described the expansion as “a vote of confidence in our workforce and small business – and it sends a clear message that Victoria’s economy is going from strength to strength.”

The City of Casey, which has

experienced rapid population growth, is also set to benefit. Mayor Cr Stefan Koomen says: “The City of Casey is thrilled to welcome the creation of hundreds of new local jobs with the opening of Amazon’s new fulfilment centre in Cranbourne West. More than 65 per cent of our residents’ travel to work by car. Every minute that they save on their journey to and from work means more time spent with those they love or doing activities that bring joy to their everyday lives.”

Koomen added that Amazon’s decision reinforced the city’s “strategic advantages as a premier destination for investment and innovation.”

The Cranbourne West FC forms part of Greenlink Estate, developed by ESR Australia. Simon Sayers, Head of Development at ESR Australia & NZ, says the project had been designed in close collaboration with Amazon.

“We are delighted to welcome Amazon to Greenlink. This state-ofthe-art facility has been developed to support their Victorian expansion. Since its launch, the Greenlink Estate has attracted a diverse mix of global and local operators, reinforcing its position as a key destination for premium logistics and industrial spaces.”

Sayers also emphasised the sustainability and connectivity aspects of the estate, which features 800 metres of direct frontage to the Western Port Highway and access to arterial roads, alongside environmental

and wellness initiatives.

“Greenlink sets the benchmark in modern, sustainable industrial real estate, and we look forward to Amazon commencing operations and enjoying all of the benefits the site offers.”

Both the Cranbourne West fulfilment centre and Ravenhall delivery station are equipped with advanced technology to streamline operations and improve consistency for Australian shoppers. The investment builds on Amazon’s wider logistics network in Victoria, which now includes three fulfilment centres, three delivery stations, and a new robotics facility under construction in Craigieburn.

For customers, the expansion means improved delivery speeds and access to a wider product range, particularly for Prime members in Melbourne who already benefit from next-day delivery. For local communities, it translates into hundreds of jobs, reduced commute times for workers, and additional business opportunities for entrepreneurs.

As Amazon continues to scale its presence in Victoria, the dual openings reflect the convergence of global e-commerce growth with local infrastructure development. For the state, the $200 million investment is both an economic boost and a signal of confidence in its long-term potential as a logistics hub. ■

Bulk 2026 returns with exhibitions, a technical conference, awards, and networking – showcasing the latest in bulk handling innovation.

Get ready, The Bulk Handling Technical Conference and Expo (Bulk 2026) is returning in 2026 with a fresh new format that blends the exhibition floor you know and love with a world-class technical conference.

Scheduled for 16–17 September 2026 at the Melbourne Convention & Exhibition Centre, this biennial event will connect leading suppliers with senior decision makers, engineers, operators, procurement professionals, and contractors from across the country.

A cross-sector showcase

The newly added conference is curated by the experts at the Australian Society for Bulk Solids Handling (ASBSH),

exploring the latest research, practical case studies, and innovations shaping the future of bulk materials handling across industries such as mining, agriculture, ports, food processing, construction, and manufacturing.

Covering flow properties, storage design, conveying solutions, dust control, and process optimisation, the program will attract senior engineers, researchers, consultants, and global specialists. By offering both technical depth and practical application, the conference creates a platform where knowledge can move seamlessly between research and industry practice.

Held in the heart of Australia’s logistics and industrial capital, the event reinforces Melbourne’s role as

a hub for industrial innovation and investment.