As Australia’s largest supplier and extruder of aluminium, Capral is committed to supporting Australian manufacturing with high-quality, locally produced aluminium extrusions. Our stateof-the-art facilities provide precision-engineered solutions for industries nationwide, from construction, to transport, and marine.

Choosing Capral is an investment in reliable supply, shorter lead times, and a stronger Australian manufacturing sector.

When you need Australian-made aluminium, Capral can do.

Chairman: John Murphy

CEO: Christine Clancy

Managing Editor: Mike Wheeler

Editor: Jack Lloyd

jack.lloyd@primecreative.com.au

Design: Alejandro Molano

Head of Design: Blake Storey

Sales/Advertising: Emily Gorgievska Ph: 0432 083 392 emily.gorgievska@primecreative.com.au

Subscriptions

Published 11 times a year

Subscriptions $140.00 per annum (inc GST) Overseas prices apply Ph: (03) 9690 8766

Copyright Manufacturers’ Monthly is owned by Prime Creative Media and published by John Murphy.

All material in Manufacturers’ Monthly is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published.

The opinions expressed in Manufacturers’ Monthly are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

© Copyright Prime Creative Media, 2024

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Head Office

379 Docklands Drive Docklands VIC 3008

P: +61 3 9690 8766

info@primecreative.com.au www.primecreative.com.au

Sydney Office Suite 11.01, 201 Miller St, North Sydney, NSW 2060

Printed by: The Precision Group

83-89 Freight Drive. Somerton Vic 3062 Ph: (03) 9794 8337

Welcome to the December edition of Manufacturers’ Monthly

In this month’s Decision Maker Column, Micro-X CEO Kingsley Hall examines how Australia’s manufacturing future will be shaped by agile, modular, biotech-driven SMEs that combine adaptability, compliance, and strategic partnerships.

Our Manufacturer Focus highlights the new Moderna Technology Centre in Melbourne, which pairs highly automated mRNA production with strong collaborations across government, academia, and industry.

This issue also features insights from Senator Tim Ayres, Capral, and regular contributors AMGC and CSIRO.

This year in Australian manufacturing has been one of diverse rhetoric, evolving trends, and wide-ranging opinions. One key takeaway from a year spent interviewing leaders across the sector is just how much this country still produces – often in ways many people don’t realise. From defence, shipbuilding, space and medical technology to pharmaceuticals, additive manufacturing, aerospace, robotics, steel, aluminium, chemicals, food and beverage, and batteries, Australia continues to deliver highquality products. Too often, the scale and quality of these operations are overlooked, and in my view, this lack of recognition remains one of the industry’s biggest challenges.

In the spirit of highlighting what more than 85,000 Australian manufacturing businesses can achieve, Minister for Industry and Innovation and Minister for Science, Tim Ayres, returns to the magazine to discuss the sector’s ongoing transformation. He explores how Australian manufacturing is being rebuilt through government policy, strategic investment, and a renewed focus on sovereign capability after decades of decline and offshoring.

This includes the Federal Government

intervention in key facilities like Whyalla Steelworks and partnering with state governments and private companies to secure critical minerals and smelting operations, supporting regional jobs and advanced industrial capability. Reforms to Australia’s anti-dumping system, along with international partnerships such as the US-Australia Critical Minerals Agreement, aim to create a fairer playing field and integrate the country into strategic global supply chains. Ayres also speaks to ambitious industry initiatives, including the $15 billion National Reconstruction Fund and the $5 billion Net Zero Fund, which are driving investment in advanced technologies, clean energy, and industrial electrification to strengthen economic resilience. Sharing the optimism for the manufacturing sector with Ayres, Kingsley Hall, CEO of Micro-X talks to how Australia’s manufacturing future will be shaped by modular systems, biotech integration, and agile SMEs that prioritise adaptability, compliance, and strategic collaboration. Here, he argues that organisations embracing modularity, lean operations, and collaborative ecosystems will be best positioned to innovate, scale, and thrive amid global uncertainty.

Practical examples of this potential are emerging

across the country. Moderna’s Melbourne Technology Centre – the Southern Hemisphere’s first end-toend mRNA facility – enables Australia to produce vaccines domestically, boosting health security and pandemic preparedness while supporting nearly 1,000 jobs and $220 million in annual GDP. By combining advanced automation, modular design, and a skilled workforce, the centre not only manufactures COVID-19 and respiratory vaccines but also anchors local R&D, supplier networks, and future mRNA therapies.

Meanwhile, RMIT researchers have developed a fruit-derived eyedrop using nanotechnology to deliver protective compounds directly to the retina, offering a needle-free approach to preventing age-related vision loss. By stabilising lutein in cubosome structures and sourcing materials from agricultural waste, the project merges cuttingedge science with sustainability and scalable biomedical manufacturing.

Australian manufacturing is proving that innovation, adaptability, and strategic investment can drive world-class outcomes. As the sector continues to rebuild and diversify, these advances demonstrate that the country’s industrial potential is vast – and only beginning to be realised.

Australian manufacturing and industrial markets are rapidly evolving. While operational excellence and product innovation have traditionally determined success, production is now shifting from labour-driven to technology-driven. To remain competitive, manufacturers must go beyond traditional strengths and adopt a more customer-centric approach. By better understanding diversity of the customer base, sales and service functions can become strategic differentiators, driving growth, improving margins, and reducing costs.

The retail sector offers valuable lessons for industrial manufacturers aiming to strengthen customer engagement and bridge the gap between B2B and B2C thinking.

1. Customer obsession alongside product passion manufacturers must balance product expertise with a deep understanding of customer challenges and priorities, evolving into problem solvers offering end-to-end solutions.

2. Balancing operational and customer-facing technologies

Investing in customer engagement tools like crm systems can streamline processes, provide customer insights and enable personalisation at scale.

3. Advanced customer segmentation approaches

Advanced segmentation leveraging distinct needs, preferences and behaviours, allows manufacturers to create tailored service offerings.

4. After-sales service, not an afterthought

Service offerings can generate higher margins than product sales, creating sustainable revenue streams and fostering loyalty.

5. Market driven forecasting

Poor forecasting leads to excess inventory, strained customer relationships, and inefficient production scheduling.

6. Compliance as a sales opportunity

Esg compliance can be a competitive advantage, helping both manufacturers and their customers meet obligations.

Competing solely on product, relationships, and price is no longer sufficient. A more customer-centric mindset and approach is essential to address rising acquisition costs, churn, and global competition. This includes:

1. Honest assessment of customer-centricity.

2. Strategic investment in front-office technologies.

3. Developing value-based customer segmentation.

4. Building service-specific business models.

5. Integrating sales and operations planning.

6. Adopting omnichannel engagement strategies.

KPMG has a proven track record of helping industrial manufacturers transform their sales and service approaches to achieve better commercial outcomes. Contact us to learn more.

Jennifer Westacott

Special Adviser

T: +61 2 9273 5680

E: jwestacott1@kpmg.com.au

Lisa Bora

Partner in Charge - Clients & Markets, Consulting

T: +61 416 111 010

E: lbora@kpmg.com.au

Richard Large

Director, Consulting

T: +61 2 9335 8093

E: rlarge1@kpmg.com.au

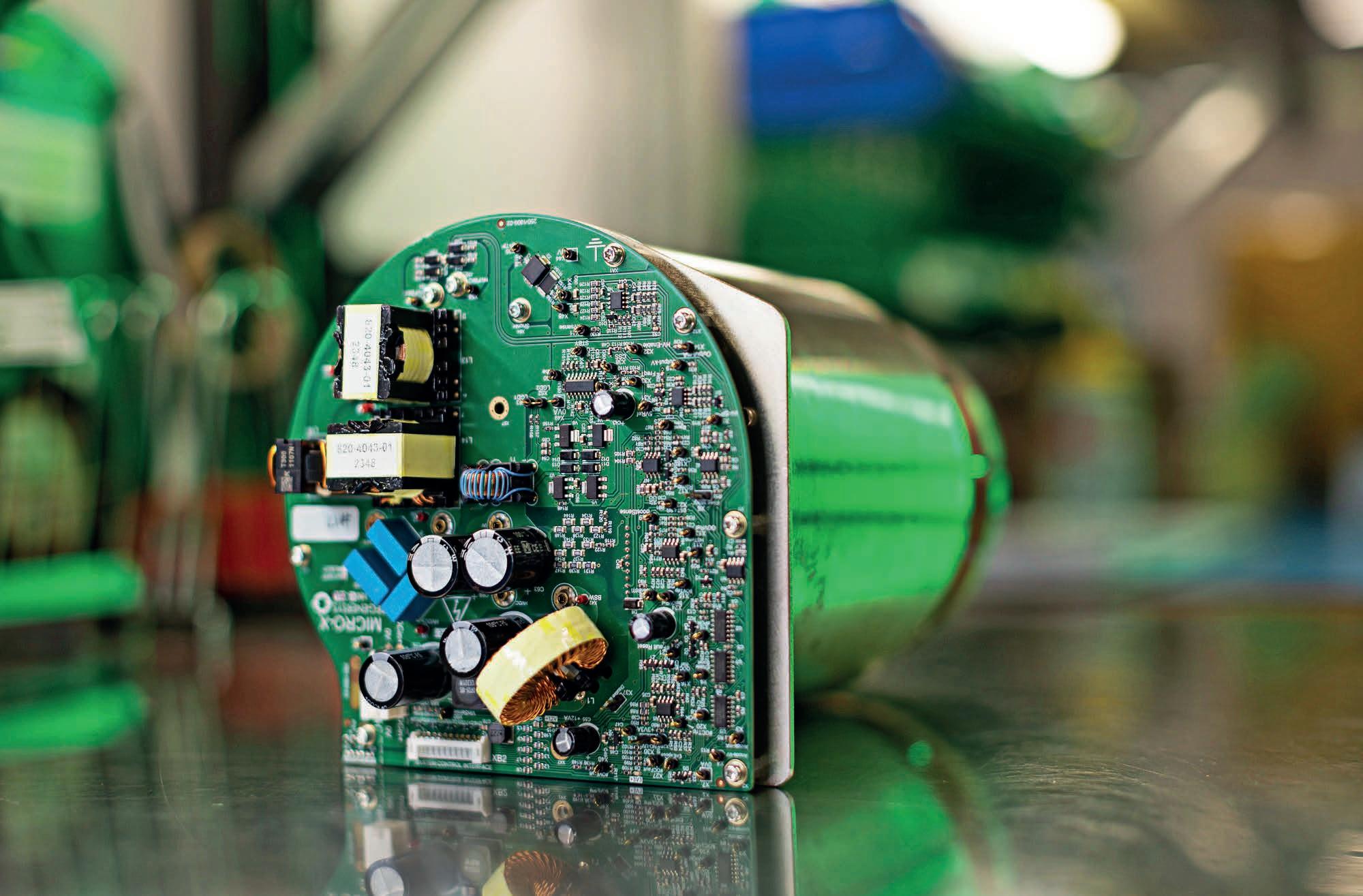

KINGSLEY HALL, CEO, MICRO-X

Australia’s manufacturing future will be defined by modular systems, biotech integration and smart partnerships that empower SMEs to innovate, adapt and thrive.

Manufacturing has always been about transformation; raw materials into products, ideas into reality, science into solutions that improve lives. Currently, the sector is undergoing one of its most profound transformations since the industrial revolution. For small and medium enterprises (SMEs) like Micro-X, this moment presents both an opportunity and a challenge: to stay ahead, to stay relevant, and to deliver value with speed and precision.

These changes provide new opportunities for smaller players to shine. While we continue to see mega-factories being built around the world, I believe the true manufacturing success stories of the next decade will be about companies who are agile, adaptable and who can integrate across disciplines, such as biology, engineering and digital systems, to deliver flexible platforms that are centred on meeting customer need.

Gone are the days when manufacturing success was defined by huge, fixed plants with sunk costs that tied manufacturers to one configuration for decades. Increasingly, the future belongs to modular, flexible, skid-based, and plug-and-play manufacturing systems.

This shift matters because capital risk is one of the greatest barriers to growth for SMEs. A multi-billiondollar corporation may tolerate a 10-year payback on a bespoke facility, but SMEs can’t afford that luxury. Modular systems enable businesses to scale up or down quickly, deploy smaller units, and reconfigure production lines without ripping out entire plants. It’s about lowering capital risk while raising adaptability.

For biotech in particular, modularity is vital. The sector is characterised by rapid change, short product cycles, and the constant evolution of

regulatory requirements. A modular facility isn’t just cheaper – it’s a hedge against uncertainty. You can validate and control each module, transfer processes between sites, and maintain consistency even as you innovate.

At Micro-X, we operate within a small manufacturing footprint that can be configured according to the different products being made on the line. Established by a group of former automobile workers, our facility learns from the best practices from the sector – lean manufacturing with precise quality control, and empowering workers to identify problems, devise solutions and engage management to quickly make changes. While automation and AI are increasingly being looked at to increase productivity, Micro-X uses data and automation strategically. We know that automation is not a panacea - our success and our innovation ultimately comes from our culture and our people.

Regulatory evolution: from barrier to enabler

Of course, innovation in biotech doesn’t happen in a vacuum. Regulatory frameworks are both guardrails and bottlenecks. As advanced therapeutics, biologics, biosimilars, and novel production processes, such as continuous manufacturing and single-use systems, gain traction, regulators are scrambling to keep up.

The regulatory process can be frustrating to companies who seek to be first to market. This is even more apparent with the recent changes in the European Union, where long processing delays to gain regulatory recognition through the Medical Device Regulation scheme are temporarily shutting companies out of a large market.

Speed-to-market is essential in biotech. But so is compliance. No matter how promising your molecule or process is, if you can’t navigate validation, traceability, and audits, you won’t reach patients or customers. That’s why SMEs must embed regulatory thinking and quality-by-design mindsets early. Compliance is not an afterthought; it must be part of the DNA of operations. This comes down to a combination of great processes and an experienced and trusted team.

The other reality shaping biotech SMEs is capital. Access to capital is a challenge across global biotech markets, with higher interest rates, investor risk aversion, and macroeconomic uncertainty all squeezing funding.

In tough capital environments, the temptation is to chase scale or diversify recklessly. Considering the constraints that SMEs currently face in accessing capital, this is a risky proposition. The answer is to double down on fundamentals while focusing on operational excellence and efficient resource use. Investors want to see discipline; clear value propositions, robust pipelines, and capital-light

strategies that can weather volatility. For SMEs, this means being ruthlessly efficient, running lean, and pivoting early when projects don’t deliver. From product development through to marketing, our team is given permission to identify new opportunities, make mistakes, learn from them quickly and adapt.

At Micro-X, we have also learned over time to focus on funded projects where we can walk alongside our customer, such as our Airport Passenger SelfScreening Checkpoint being developed with funding from the US Department of Homeland Security, or our Head CT for stroke diagnosis which is funded by the Australian Government in partnership with the Australian Stroke Alliance.

Because building full-scale capacity is often prohibitive, SMEs increasingly turn to strategic partnerships, licensing, outsourcing, or teaming with contract manufacturing organisations and contract development and manufacturing organisations. This is not a weakness – it’s a smarter way to access capabilities you lack while focusing internal resources on core competencies.

The biotech future will be shaped not by isolated firms, but by ecosystems: consortia, shared infrastructure, incubators, and clusters where capital, talent, and regulatory expertise are pooled. Governments can play a catalytic role here, funding shared pilot plants or enabling SMEs to access critical infrastructure without bearing the full cost burden.

At Micro-X, we are increasingly looking at these kinds of partnerships, while retaining manufacture of our patented core technology that is at the heart of our products. We continue to work with and seek new partnerships, where we can contribute our core technology and work with partners to bring new products to market. As an example, we are currently working with Malaysian security manufacturer Billion Prima to bring a next generation baggage and parcel

CT security scanner to market. Through these kinds of commercial partnerships, we can leverage the commercial skills of our partners while retaining and profiting from our core competencies.

There’s no denying that current global geopolitical uncertainties are spilling into capital and consumer markets, which have a flow-on effect to manufacturers. Despite the risks, I remain optimistic. The broader direction of manufacturing, particularly in biotech, is towards agility, convergence, and integration. SMEs who embrace modular platforms, invest in digital capability, embed compliance early, and leverage partnerships will not just survive, but thrive.

I’ve seen firsthand how these principles apply. We build mobile, miniaturised imaging systems using advanced materials and X-ray tubes made in Adelaide that were once thought impossible. Our success comes not from trying to replicate the scale of global giants – we can’t compete there – but from innovating in niche, high-value areas and building lean, adaptable systems that can expand globally with the help of quality partnerships.

The lesson is clear: the future of manufacturing won’t be written in concrete mega-plants. It will be written in modular units, digital models, collaborative ecosystems, and cross-disciplinary talent pools. SMEs with the courage to be agile, to focus, and to partner wisely will lead that future.

And that’s something to be excited about.

Western Australian engineering company Hofmann Engineering has been approved to supply locally made components for United States Navy nuclearpowered aircraft carriers, marking a breakthrough for the state’s defence industry.

The Bassendean-based company, founded in 1969, becomes the first Australian business cleared to provide parts for US naval assets. The approval is viewed as a step towards supplying components for Virginia-class submarines, which Australia will acquire under the AUKUS security partnership from 2032.

Defence industries minister Paul Papalia said the milestone aligned with the state’s broader “Made in WA” strategy, aimed at strengthening sovereign capability and embedding local businesses into global supply chains.

“I want to grow WA’s defence sector to become the state’s second largest industry after mining, creating jobs for generations and diversifying our economy beyond the resources sector,” he said. “WA’s defence industry has the expertise to deepen Australia’s strategic partnership with the US. Our skilled local workforce can accelerate the construction of Virginia-class submarines – benefiting both WA and our AUKUS allies.”

The achievement follows the WA Government’s $300,000 contribution to a program run by

Huntington Ingalls Industries (HII), the world’s largest builder of nuclear-powered submarines. HII is one of only two US companies building Virginiaclass submarines, which will play a key role in AUKUS defence cooperation.

The Supplier Capability Uplift Program, later absorbed into the Australian Submarine Supplier Qualification initiative, has also helped WA

businesses Dobbie, Marine Technicians Australia, Pressure Dynamics and Veem progress towards stringent US approvals.

Hofmann Engineering has grown from a small Perth-based backyard business into a local supplier, including for WA’s METRONET railcars. Its expansion into the US defence supply chain is expected to create jobs and diversify WA’s economy.

New research has reaffirmed the strength and appeal of caravan and camping travel in Australia, with the Caravan Industry Association of Australia’s 2025 Consumer Sentiment Report revealing that 88 per cent of Australians plan to caravan or camp in the next 12 months. The report highlights that Australians are increasingly seeking better-value alternatives to overseas holidays.

Of those surveyed, 77 per cent said caravanning offered better value than other types of holidays, while 76 per cent agreed it provided great value for money. Additionally, 50 per cent of respondents said they believed domestic travel offered greater overall value than international trips.

CEO of Australian manufacturer, Crusader Caravans, Serge Valentino, said the research reflects changing attitudes post-pandemic.

“We’re seeing a clear shift towards people wanting to buy vans for shorter, more frequent trips rather than long holidays,” he said. “With the recent release of our new MY25 models, we’re seeing a surge in demand that’s reminiscent of the unprecedented

levels experienced during the COVID pandemic.” The trend aligns with broader economic conditions. A separate report from the Tourism & Transport Forum (TTF) found that 58 per cent of Australians said the cost of living had impacted their travel decisions. Among those affected, 38 per cent are opting for shorter holidays, and 31 per cent are choosing to stay in Australia rather than go overseas.

“Caravanning lends itself beautifully to the impromptu nature of short stays,” Valentino said. “There’s no accommodation or flight bookings needed, you just hitch up and go, allowing you to travel off-season and stay as far or as close to home as you wish.”

Crusader is also investing in quality and sustainability through its EcoLite full composite panel construction, which makes its caravans lighter, more durable, and better insulated.

“We know that Australians are feeling economic pressures, but they still want to take breaks,” Valentino added. “Our caravans are designed to deliver long-term value and comfort, regardless of

season or distance. We’re building a product that helps people continue exploring Australia, affordably and flexibly.”

Victorian premier Jacinta Allan joined CEO of NEXTDC Craig Scroggie to announce NEXTDC will build a new $2 billion next-generation digital campus in Fishermans Bend. NEXTDC’s M4 Melbourne will feature an AI Factory, Mission Critical Operations Centre, and Technology Centre of Excellence – positioning Victoria as a national digital infrastructure hub.

It is set to create thousands of jobs in tech, AI, digital infrastructure, defence technology,

advanced research and more.

The tech hub will be part of the Government’s Fishermans Bend Innovation Precinct, which is set to become a centre of innovation in advanced manufacturing, engineering and design.

The precinct is projected to support up to 30,000 jobs in science, technology, engineering and associated fields by 2051. It will include the University of Melbourne’s new Engineering and Design campus, making it a suitable location for

NEXTDC’s new Technology Centre of Excellence. Victoria’s tech sector contributes more than $34 billion to the state’s economy and supports more than 306,000 workers – accounting for 30 per cent of Australia’s tech workforce.

Building on this work, the Government also released the Victorian Industry Policy, which sets out how government, businesses and researchers can work together to use new technology and grow local industries and jobs.

TAFE NSW’s managing director, Stephen Brady, is leaving the role after leading the organisation in overseeing reforms in the vocational education and training sector for the past three years. Brady was instrumental in leading TAFE NSW through the NSW VET Review, a State Government commitment to restoring TAFE to the heart of the VET sector.

With TAFE NSW now entering its new phase of implementing the VET Review, including finalising a new Operating Model and TAFE NSW Charter, new leadership is set to guide TAFE NSW through this next stage.

The process to appoint a new managing director will commence in due course with the interim, Chloe Read, deputy secretary, Education and Skills Reform, NSW Department of Education, acting in the role.

Read has served in several senior public service roles and has experience with more than 10 years at NSW Department of Education.

Queenslanders are one step closer to riding locally built trains, with a fullscale replica of a new Queensland Train Manufacturing Program (QTMP) train now on display for stakeholder testing. The high-fidelity mock-up, spanning 38

Moderna’s new technology centre in Melbourne is combining advanced mRNA manufacturing with a future-ready model for health security and innovation.

When the COVID-19 pandemic exposed the vulnerabilities of global supply chains, few countries felt the impact more than Australia. The country’s vaccine rollout relied heavily on overseas supply, sparking a reckoning on health security and sovereign capability. Out of that moment came a national ambition to build domestic resilience – and at the heart of it stands the Moderna Technology Centre in Melbourne (MTC-M), the Southern Hemisphere’s first end-to-end mRNA manufacturing facility.

For Emma Harrington, vice-president and site head at Moderna Australia, the creation of this facility was both a necessity and a national opportunity.

“Australia’s experience during COVID-19 really showed the need to have sovereign vaccine capability,” she said. “From reviews into the pandemic response, both federal and state governments recognised the importance of building domestic capability to ensure future health security.”

Melbourne’s deep research ecosystem, stable regulatory environment and commitment to innovation made it a natural choice. Supported through a partnership between the Federal and Victorian governments, the facility was designed to anchor a new high-tech industry with lasting health and economic benefits for decades to come.

Building a sovereign base for rapid response

Moderna’s MTC-M was established within the Monash Technology Precinct, a growing biomedical hub in Melbourne’s southeast.

Operationally complete in December 2024, the site represents the first time Australia has had the ability to produce mRNA vaccines from end to end – from drug substance through to fill-and-finish.

The facility has the capacity to produce up to 100 million vaccine doses per year in a pandemic situation, giving Australia the capability to pivot quickly and manufacture critical vaccines within months if new or emerging pathogens arise. Its initial focus is on respiratory illnesses, with the COVID-19 vaccine first to roll off the production line, followed by a respiratory syncytial virus (RSV) vaccine, and with future plans for a flu-COVID combination candidate pending regulatory approval.

“The government saw the need for pandemic preparedness,” Harrington said, “but as you’d know, you can’t just build a facility for the next pandemic and leave it sitting there cold. The model has to be sustainable – producing vaccines for seasonal illnesses like flu and COVID keeps that skill base operating.”

This flexibility is central to Moderna’s manufacturing philosophy. The site has been built with modularity and automation in mind, ensuring that it can adapt production lines swiftly without compromising quality or throughput.

Unlike the vessel-filled plants of traditional biopharma manufacturing, the company’s operation was designed to achieve high output from a compact footprint. The modular layout enables agile scaling while reducing overheads and resource intensity.

The plant features high-speed automated filling lines, as well as an automated visual inspection system and a dedicated packaging line. Single-use technologies are used throughout, enabling rapid changeovers between products and minimising cross-contamination risk.

“For the footprint that we have, each drug substance batch can produce up to four million doses with an approximate 60-day turnaround from manufacturing to release,” Harrington said. “It’s a much shorter timeframe for both manufacturing and release, and that will allow us to respond quickly and efficiently.”

Alongside advanced robotics, digital monitoring systems feed real-time data into quality control platforms, enabling immediate adjustments and predictive maintenance.

“The automation and digital systems here give us a level of precision and agility that’s unmatched,” Harrington said. “It also means our team can focus more on high-value activities – innovation, validation, and ensuring that everything we make meets the strictest global standards.”

These advances illustrate how far biomanufacturing has evolved. Automation now underpins nearly every step, from batch testing to packaging logistics, driving both consistency and scalability. Harrington said for a facility that must operate continuously rather than being mothballed between emergencies, efficiency is important.

Behind the advanced machinery sits a highly trained, multidisciplinary workforce. Across the full Moderna Technology Centre, around 130 to 140 personnel are employed, spanning drug-substance and drug-product manufacturing, quality assurance, engineering, supply chain management, and R&D.

All employees undergo specialised training in Good Manufacturing Practice (GMP) and mRNA production processes, ensuring that standards remain aligned with global best practice. Harrington said the emphasis on training has built one of the most skilled teams in Australia’s life sciences sector.

“We’ve built a relatively small but nimble team, and their specialised knowledge means every batch produced here meets the highest international safety and quality standards,” she said.

Quality is embedded at every stage. Each vaccine batch undergoes multiple rounds of testing, from raw materials through to finished product release, and is reviewed both internally and by the Therapeutic Goods Administration (TGA) before reaching the public.

The facility’s development was made possible by close collaboration with both the Victorian and Federal Governments, who viewed sovereign mRNA vaccine capability as a cornerstone of national health security. The Victorian Government’s initiative mRNA Victoria was instrumental, positioning the state as a hub for RNA-based research and manufacturing.

Moderna also works alongside Monash University through the newly established mRNA Workforce Training Centre and the Quantitative Pharmacology Accelerator, which focus on developing advanced

The solution for in-line measuring metal content in electroplating baths or liquids!

• Market-leading precision. Combination of measuring cell and software ensures best measuring performance and safety

• Maximum service life. High availability of 1 year due to innvative design and material selection.

• Intelligent self-monitoring. Fully automatic, preventive purging, monitoring and calibration processes ensure maximum uptime.

• One instrument for everything. Measure all metallic solutions such as zinc, nickel zinc/nickel, gold, chromium, palladium or rhodium.

• Safety in real-time. Live measurement results as well as simple and fast documentation of these.

• Up to 4 channels. Separate supply lines to the measuring cell prevent contamination.

• No time-consuming spot checks and information gaps. Stay continuously in the picture about your electroplating process.

skills and translational research capacity within the local ecosystem. In addition, Moderna will invest $266 million in national R&D initiatives over the decade to 2033, supporting research partnerships, clinical trials, and workforce development.

Harrington said this ecosystem approach is critical to sustainability.

“You can’t just have the manufacturer standing alone. Building partnerships with universities and government ensures we grow the talent pipeline and keep Australia at the forefront of biopharmaceutical innovation.”

A new catalyst for the economy

Beyond the health imperative, the economic case for domestic mRNA production is compelling. According to Australia’s mRNA Advantage – Jobs, Health and Economic Resilience, an independent report by Oxford Economics, the Moderna Technology Centre is expected to boost GDP by $220 million annually, supporting nearly 1,000 ongoing jobs directly and indirectly, and strengthening supply chains across multiple industries.

During construction between 2022 and 2024, the project supported 1,830 jobs per year and contributed $493 million to national GDP. Once operational, it is projected to generate $96 million

The MTC-M doesn’t just create vaccines; it anchors a domestic supply network that spans local suppliers, packaging partners, and research institutions.

in direct GDP each year, with a further $124 million in flow-on activity across professional, scientific, and technical services, manufacturing, retail, and logistics.

The report also estimates that the facility could help Australia avoid up to $4.8 billion in costs over 30 years by reducing reliance on imports, preventing lockdowns, and improving health outcomes in future pandemics. Around $1.33 billion of that figure stems from avoided lockdown costs, while $3.47 billion reflects health and wellbeing benefits such as reduced hospitalisations and mortality.

“The figure represents the value of being prepared,” Harrington said. “Local production

means vaccines can be manufactured and distributed faster, really minimising disruption, reducing economic loss, and improving public health outcomes.”

A large proportion of this $4.8 billion preparedness benefit stems from shortened vaccine rollout times during a health emergency. Faster domestic manufacturing means fewer weeks of lockdown and earlier population-wide immunity. The report estimates that by eliminating delays like those seen in 2021, Australia could avoid losses equivalent to $82 million per year in GDP terms – and reduce the human cost associated with delayed access to vaccines.

Harrington described the Melbourne site as “a warm base platform” – one that remains ready to scale instantly when required.

“The facility gives us the platform to grow, adapt and respond to future health challenges right here in Australia,” she said.

The MTC-M doesn’t just create vaccines; it anchors a domestic supply network that spans local suppliers, packaging partners, and research institutions. The Oxford Economics analysis found that in the operations phase, professional, scientific and technical services account for the largest share of economic contribution – about $104 million annually.

Flow-on effects extend into manufacturing, logistics, and financial services. The facility’s demand for precision components, sterile packaging, and laboratory consumables is already driving new opportunities for Australian suppliers and contract manufacturers. Harrington said building these relationships has been vital from day one.

“We’ve been really focused on developing

local suppliers wherever possible,” she said. “It strengthens the ecosystem and helps ensure that if another pandemic hits, we’re not waiting on components or materials coming in from overseas.”

While vaccines are the immediate focus, the MTC-M also serves as a springboard for broader research into oncology, rare diseases, and autoimmune conditions. Moderna’s mRNA platform can be adapted to target a range of diseases by encoding different protein sequences – a flexibility that makes it one of the most promising technologies in modern medicine.

These programmes remain in the clinical development phase, but the infrastructure and expertise established in Melbourne provide the foundation for future expansion.

“One of the advantages of mRNA technology is its flexibility,” Harrington said. “The same platform can be adapted for other therapeutic areas as research progresses.”

According to Oxford Economics, Moderna’s R&D activities are expected to generate $267 million in additional economic value nationally through productivity spillovers over the next decade, including $117 million in Victoria alone. These benefits reflect how innovation and skills developed through vaccine manufacturing extend beyond a single product line, strengthening Australia’s biomedical capability for years to come.

The creation of the Moderna Technology Centre has been described by Victorian Minister for Economic Growth and Jobs, Danny Pearson, as a “once-ina-generation investment in jobs, medical research and health security”. It’s a statement supported

by the numbers: nearly a thousand ongoing jobs, $220 million a year in GDP, and a warm-base platform capable of protecting Australians against future pandemics.

Oxford Economics’ Head of Economic Impact, Michael Brennan, put it more bluntly.

“Pandemic preparedness is not just a health priority – it’s an economic imperative,” he said. “Our modelling shows that the Moderna mRNA facility in Melbourne could save Australia billions in the event of a future health emergency by avoiding lockdowns, reducing health impacts and improving wellbeing.”

The partnership also exemplifies how government, academia, and private industry can co-invest in critical national infrastructure. With Monash University, mRNA Victoria, and federal agencies all playing a role, the facility has effectively created a new industrial category in Australia – one that blends science, technology, and advanced manufacturing.

For Harrington and her team, the focus now turns to production ramp-up and the delivery of the first Australian-made mRNA vaccines. Having secured its GMP licence from the TGA, the site expects to deliver its first batches to Australians within months.

“Our immediate focus is the respiratory vaccines portfolio,” she said. “But we’re also continuing to expand research collaborations and build local partnerships across industry and academia. Globally, mRNA science is advancing rapidly, and we’re proud that Australia is now part of that momentum.”

As the world continues to navigate evolving health threats, Moderna’s Technology Centre stands as a facility built not just for today’s needs but for whatever challenges may come next.

In combining sovereign capability with cutting-edge manufacturing, it embodies the future of Australian industry – agile, intelligent, and ready.

With the launch of the iQS platform, it was announced that next-generation welding processes would follow.

Introducing SpeedWave XT, an expansion of the advanced speed processes, and exclusive to the iQS platform.

SpeedWaveXT is an advanced synergistic waveformcontrolled process, suitable for the welding of medium to heavy aluminium plate. A leading process delivering cyclic symmetrical energy change at a constant wire feed speed.

The result is a fine chevron pattern weld profile, grain refinement to eliminate cracking and superior fusion and deposition to reduce weld porosity.

The cutting-edge SpeedWaveXT process coupled with the iQS platform delivers superior quality, performance and productivity.

To arrange a product demonstration contact david.wilton@lorch.eu

Partner and national manufacturing leader at RSM Australia, Louis Quintal, explores how digital transformation, resilient supply chains and global collaboration will determine how “Australian Made” progresses.

Australia’s manufacturing sector stands on the precipice of change. Beyond traditional boundaries, it now holds the potential to drive resilience and global influence. For business leaders and policymakers alike, the path forward is not simply about survival, but about reimagining what Australian manufacturing can achieve on the world stage. The imperative is clear, we must move from incremental improvements to bold, strategic leaps scaling with purpose and exporting with confidence.

With manufacturing contributing approximately 6 per cent to national GDP and employing nearly a million people, Australia’s sector is broad and vibrant. However, enduring global volatility, digital disruption, and shifting value chains demand more than operational excellence. The next generation of manufacturers must become architects of value leveraging advanced technology, leading with sustainability, and fostering cultures of continuous innovation. Now, more than ever, the sector’s legacy of adaptation must give way to a new era of proactive leadership and global engagement.

Defining global competitiveness

Globally competitive manufacturers distinguish themselves through far more than cost advantage. I firmly believe the future of our sector hinges on

the courage to innovate beyond the incremental. Visionary innovation must be at the heart of our strategy. It is not enough to keep pace, we must actively invest in disruptive research and development, forging partnerships with universities, startups, and research institutions. Only by doing so can we generate new intellectual property and unlock markets that have previously been out of reach for Australian manufacturers. Attracting and retaining top talent is equally paramount. Successful organisations will be those that nurture high performance teams and build a workforce equipped for the challenges of tomorrow. This means prioritising skills development, embracing diversity at every level, and cultivating leaders who can thrive in an environment defined by rapid change and uncertainty.

Our nation’s manufacturing reputation is a premium asset. The ‘Australian made’ label is globally recognised for its integrity, safety, and ethical standards. As industry leaders, it is our responsibility to elevate this brand, ensuring it becomes synonymous with excellence and trust in markets we enter. This is how we carve out a sustainable premium advantage on the world stage.

Finally, true leadership in manufacturing demands a relentless commitment to global benchmarking and collaboration. By measuring ourselves against

the best, adopting international best practices, and forging alliances across borders, we ensure that Australian manufacturing remains at the forefront of efficiency, quality, and customer experience. In this new era, it is our collective ambition and proactive engagement that will define our legacy and secure Australia’s place as a global manufacturing powerhouse.

To ensure sustained export success, it is imperative that leaders within the manufacturing sector champion a comprehensive and future-oriented strategy that addresses both the immediate and long-term needs of Australian industry.

Embracing digital transformation is no longer a choice, but a necessity. The implementation of Industry 4.0 technologies including artificial intelligence, robotics, and the Internet of Things must be recognised as the bedrock for building not just operational efficiencies, but entirely new business models and value propositions for customers. These advanced technologies have the potential to revolutionise traditional production processes, streamline supply chains, and enable manufacturers to anticipate and respond to shifting global market demands with greater agility. Equally significant is the commitment to constructing adaptive and resilient supply chains, which are anchored in robust local capability and agile enough to withstand external shocks be they geopolitical, climatic, or economic in nature. By developing deep supplier networks and

investing in risk management strategies, Australian manufacturers can ensure continuity, boost responsiveness, and turn potential vulnerabilities into sources of competitive strength. These resilient networks form the backbone of sustainable export growth, empowering businesses to seize new opportunities as they arise on the world stage.

Strategic market development must also be placed front and centre. Success in international markets demands more than ambition, it calls for rigorous analysis of data-driven insights to identify and prioritise high potential regions. Leaders should leverage this intelligence to shape unique, targeted value propositions and design tailored go-to-market strategies that resonate with local needs and regulatory environments. This proactive approach enables Australian manufacturers not only to enter new markets but to establish lasting, profitable footholds that can weather shifting global circumstances.

Furthermore, the importance of cultivating collaborative ecosystems cannot be overstated. World class exporters are distinguished by their ability to unite diverse stakeholders’ government agencies, research institutions, industry peers, and even competitors in pursuit of shared goals. Partnerships of this calibre enable the acceleration of innovation, the pooling of expertise, and the amplification of collective impact. By fostering

a culture of open collaboration, leaders create environments where bold ideas are nurtured, and transformative solutions can flourish.

I see our sector’s most pressing challenges of skills shortages, limited access to capital, hurdles in technology adoption, and vulnerabilities within our supply chains not as obstacles, but as powerful catalysts for transformation. To address the talent gap, it is essential that we forge stronger partnerships with educational institutions, ensuring that our workforce is equipped with the skills required for the future. At the same time, we must advocate for strategic skilled migration, recognising the role it plays in supplementing our talent pool and driving our industry forward.

Innovative approaches to financing are also paramount. By unlocking alternative sources of capital and developing mechanisms to derisk international ventures, we can empower manufacturers to expand their global reach and pursue ambitious growth strategies with confidence. Embracing change management is vital as well, accelerating the adoption of new technologies and driving digital transformation must become core priorities for every manufacturing leader intent on maintaining a competitive edge.

Finally, a renewed focus on developing local suppliers and investing in digital supply chain tools will be crucial for building resilience and agility. By strengthening these foundations, we can ensure that Australian manufacturing is not only responsive to disruptions but also positioned to seize emerging opportunities. In reframing our constraints as catalysts for creative problem-solving and systemic change, we lay the groundwork for a more robust, innovative, and globally competitive industry.

The journey toward export excellence is one of continuous improvement and learning. By committing to international benchmarking and the adoption of best practices, Australian manufacturers can ensure that they remain at the forefront of efficiency, quality, and customer experience. It is through this relentless pursuit of progress, combined with strategic foresight and a willingness to embrace change, that the sector will craft a legacy of leadership and secure Australia’s standing as a powerhouse in global manufacturing.

The mandate for Australian manufacturing is clear, move from incremental gains to transformational leadership on the world stage. By scaling for export, harnessing innovation, and mobilising a national vision for excellence, we can ensure “Australian Made” is not just a mark of quality, but of global leadership and future prosperity.

Fenestrate has blended innovative design, quality assurance, and collaboration with Capral Aluminium to deliver precision aluminium window fabrication since 2017.

When it comes to precision, performance and partnership, Victorian-based window and façade manufacturer Fenestrate has built its name on a foundation of quality engineering and collaboration. Established as a design and installation company before moving into fabrication, the business has grown into a specialist manufacturer for complex commercial and architectural projects across Australia.

At the heart of that evolution is a long-standing partnership with Capral Aluminium, whose range of extrusions and technical support has become integral to Fenestrate’s operations. From high-rise curtain walls to bespoke residential glazing, Capral’s aluminium products underpin the company’s capability to deliver window frame projects of every scale and specification.

“From house lots using Urban Plus revealed windows to 250mm deep Flashline sections, curtain walls and custom extrusions – we do it all,” said Fred Cooper, manager at Fenestrate. “We use Capral for all different types of projects, from 10-storey office buildings to architectural homes.”

From design to fabrication: a challenging transition

Fenestrate’s journey into full-scale fabrication marked a turning point for the business. Having spent years on the design and installation side, the transition into manufacturing required a shift in process control, quality assurance and technical knowledge. Cooper admitted the process

was stressful, despite the simple appearance of windows.

“A drain hole even a few millimetres off can cause leaks, and every part of the process needs precision,” he said.

This move has seen the company’s compact, but capable team invest in technology, machinery and training to bring fabrication in-house. This technology – including software – has become a cornerstone of Fenestrate’s production model.

An example of this is a digital quality assurance platform Fenestrate now uses called VisiBuild. This system tracks every stage of manufacturing through photos and digital records, ensuring traceability and accountability across the business. From cutting to sealing the joints of frames, to hardware and drain holes – everything gets documented to a point where on one job in Sandringham, the company had around 100,000 photos. The system has not only improved quality but also strengthened client relationships.

“On one site, our QA data actually proved that issues were caused by another trade, not us,” said Cooper. “It really does save time. The builder ended up adopting VisiBuild on future projects after seeing what we could do with it.”

Alongside technology, Fenestrate has built a strong relationship with Capral Aluminium, who it now sees as more than a supplier. According to Cooper,

the two companies share a relationship defined by open communication, technical collaboration and mutual respect – from product testing and design feedback to custom extrusion development.

“We’ve only ever fabricated with Capral’s Aluminium,” Cooper said. “They’ve got a solution for everything you could possibly need – whether it’s screening for a basketball court or a façade detail. It’s a one-stop shop, and they’re Australian. That’s important to us.”

This partnership extends to product innovation. Fenestrate often works with Capral’s technical team to refine designs or create bespoke profiles for architectural applications. Cooper said this sometimes involves sending the company CAD files for a custom extrusion, and also building the die and extruding the product, which are more often than not hard to make. Despite the difficulty, he said Capral always does it, and never says no.

“They ask us what we need, and if there’s demand, they make it happen. You can’t do that with other suppliers – and they’ve got the resources to back it up,” he said.

Capral’s commitment to testing and product performance is another area where the partnership shines. Fenestrate regularly engages with Capral’s technical department to witness testing and discuss design considerations for new products. One of these offerings is water inundation testing, which has seen Fenestrate clients do on-site hose testing, often beyond what the window is designed for, but Capral windows are still surpassing the tests. Seeing how they fabricate to withstand those pressures helps Cooper and his team improve their own methods.

Cooper recently visited to observe the testing of Capral’s new Panoramic Door, a slimline, minimalist sliding system designed for maximum glass visibility.

“There isn’t an Australian-made version of this door,” he said “The European ones are complex and hard to get locally, but Capral’s kept it simple and clean. You can tell they’ve listened to fabricators.”

A defining feature of Fenestrate’s experience with Capral is access to the right people – from local representatives to the technical engineers behind the products. Cooper said it’s convenient to talk directly to the technical department, who are the ones designing the windows, not just selling

aluminium. Having that line of communication has made a large difference for the company.

“He’ll answer the phone any time. He makes the effort, and he helps us out when we’re in a bind,” said Cooper.

Alongside its aluminium offerings and support, Fenestrate relies on Logical, a German-developed software platform integrated with Capral Aluminium’s product library. Cooper said the company would never have found the system without Capral, with its inclusion of Capral’s full systems being a deciding factor in choosing the software.

Logical handles everything from estimating and drafting to production, allowing seamless flow from design approval to fabrication. Cooper said if you draw a window for estimating and it’s approved, you just click a button – it goes straight to the saw, prints a barcode, and all the machining’s done automatically. He said it is a factor in allowing the team to not have to think about holes or hardware but instead focus on assembly and deliveries.

“It’s really powerful software for us,” said Cooper. “They introduced it to us about eight years ago, and as the software’s developed, we’ve developed with it. All our hinges, locks and strikes are pre-set, so production is quicker and more accurate.”

Fenestrate’s growth has been defined by its ability to take on technically demanding projects.

The company’s portfolio spans data centres, redevelopments and high-end residential builds, each presenting unique design and engineering challenges.

The company, working alongside Capral, has recently taken on two challenging projects and passed in flying colours. One of these was surrounding the NEXTDC in Tullamarine, where Fenestrate used Capral’s curtain wall system and had to manage deflections of up to 60mm because of counter-levers and lateral movement.

“The engineering was intense – we were in meetings every day for months,” said Cooper.

Another standout project was Morris Moor in Moorabbin, the transformation of the old Philip Morris cigarette factory into a contemporary commercial precinct. This involved the use of massive panels for skylights, external windows, auto doors – all in Capral suites. He insisted that the fact that everything landed at once made the project come together quickly and “look amazing”.

Backing Australian manufacturing Cooper emphasised that Fenestrate’s success comes down to its close-knit group where collaboration and knowledge-sharing are part of the daily rhythm. Cooper credits this culture for the company’s steady growth and ability to take on complex projects. Staff retention is high, with many long-term team members who understand every detail of the company’s systems.

“The people who’ve been with us from the start know everything back to front,” he said.

“They know how we want things done – honestly, they know how it should be done better than us sometimes.”

Cooper also attributed the businesses success to its partnership with Capral, something he described as a larger commitment to supporting Australian Industry. He admitted the experience when going to Capral’s Campbellfield site and seeing the billets of aluminium being turned to molten metal and pushed through the press right in front of you is rewarding.

“People come from all over the world to work on those dies. It’s a pretty cool place, and it’s something we want to support. We couldn’t do what we do without them,” he said.

As Fenestrate continues to expand its project portfolio and refine its in-house systems, that partnership remains the backbone of its success – built on shared innovation, trust and a commitment to Australian manufacturing.

“Capral back us, and we back them,” Cooper said. “It’s a partnership that works – and one that keeps helping us grow.”

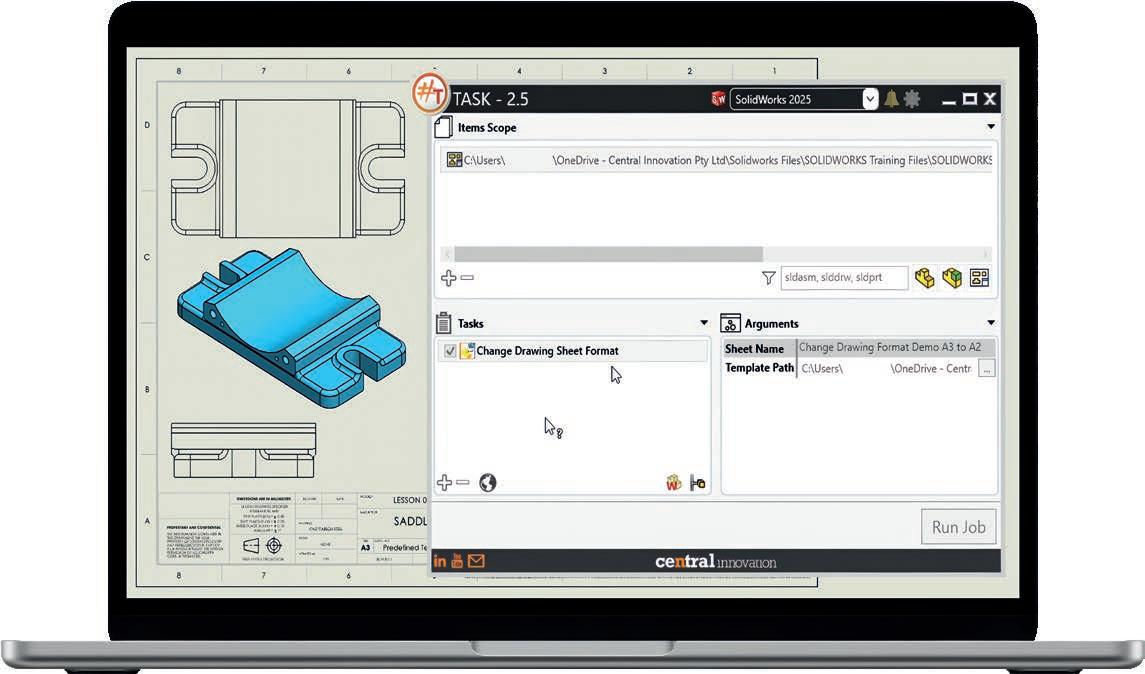

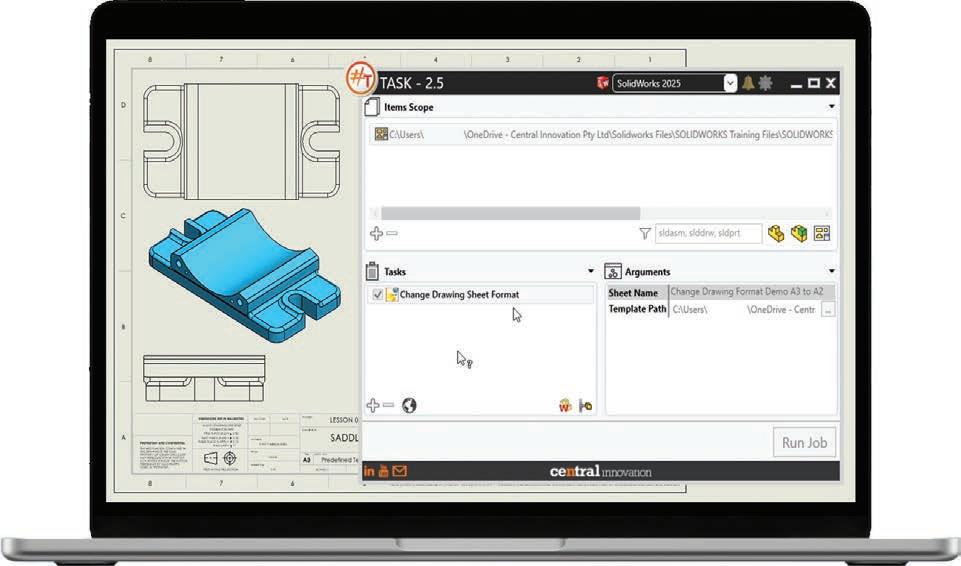

PROCADFAB has combined hands-on fabrication expertise with #TASK automation, improving efficiency, consistency, and production-ready outputs.

For Daniel Booth, founder of PROCADFAB, engineering design has always been grounded in real-world fabrication experience. With nearly 30 years in the industry – ranging from hands-on boilermaker work to leading engineering teams – Booth has seen the spectrum of design and production challenges. He launched PROCADFAB to apply this wealth of experience across diverse sectors, from mining attachments and materials handling equipment to stainless-steel, foodgrade assemblies.

“At PROCADFAB, we focus on solving real-world problems with practical design, responsive support, and a commitment to quality that drives efficiency and long-term value,” said Booth. “My background as a trade-qualified boilermaker gives me a very practical edge. I design with a fabricator’s mindset: can I build this? How will it be welded? How will it flow from sales to procurement to the workshop?”

This approach defines PROCADFAB’s consultancy model. The business combines engineering design with production collaboration, ensuring that concepts are not just technically accurate but also manufacturable. Using SolidWorks and advanced scanning technology, PROCADFAB delivers solutions that move swiftly from concept to production, or provides reverse engineering support where needed. The firm’s expertise spans aluminium, stainless steel, mild steel, and quench-and-tempered steels, making it adaptable to a range of fabrication challenges.

Despite its focus on efficiency, PROCADFAB once faced persistent workflow challenges, with the biggest bottleneck being production packages, Booth said because every PDF, DXF, and eDrawing had to be created manually by opening each file independently, on a project with 100 parts, that alone could take hours.

Booth said traditional tools were slow, unreliable, and prone to errors such as date-format changes or inconsistent metadata. Updating sheet formats and materials across large assemblies became a tedious task, costing team members several hours each week. This manual overhead limited productivity and increased the risk of human error, something Booth knew needed a smarter solution.

This all changed when Booth first encountered #TASK through Central Innovation, the creator of

Booth first encountered #TASK through it’s creator company, Central Innovation.

the software, of whom he has worked with for over a decade. Initially available as a free tool for CI customers, #TASK immediately stood out for its practical automation capabilities. The software was developed by Australian engineers as a SolidWorks personal assistant to save hours on file-admin tasks, and it is now used in more than 100 countries. #Task recently upgraded to version 2.5 – an update packed with new macros and available to all users with an active licence.

“We trialled it, it worked, and it quickly became part of the workflow,” Booth said. “CI didn’t need to be heavily involved early on; they were simply an active partner providing access and support if needed.”

#TASK 2.5 offers seamless compatibility with SolidWorks 2025, robust web-based licence management, and a suite of built-in macros designed for real-world engineering workflows. Its core value lies in automating repetitive tasks, reducing manual file edits, and maintaining data integrity across complex projects – features that aligned with PROCADFAB’s operational needs.

Since implementing #TASK, PROCADFAB has seen improvements in workflow efficiency. Batch output of PDFs, DXFs, and eDrawings is now reliable and fast, while updating metadata or sheet formats across large assemblies has become effortless.

“On a 100-part design, generating the full production package used to take around fi ve hours. Now it’s automated – what used to be three minutes per part is done in a single batch process in a matter of minutes,” Booth said.

Custom macros have further enhanced productivity. Booth has developed scripts that copy properties from parts to drawings, create complete production packages, resize revision tables, and remove unintended capitalisation. Combining these multiple processes into a single custom macro has been invaluable for Booth as it reduces rework risk and lets him focus on refining the actual design rather than processing files.

Batch processing is particularly transformative for PROCADFAB’s approach. Tasks that once required manual attention now run automatically in the background, freeing the team to focus on highervalue design work. The built-in licensing portal also simplifies administration, providing real-time visibility of token status and expiry dates – critical for multiseat and multi-site operations.

Booth points to a recent complex assembly project as a clear example of #TASK’s impact.

“#TASK handled all output generation, which saved around fi ve hours,” he explained. “The ability to integrate custom macros meant the project was delivered faster, more consistently, and with lower risk of errors.”

This approach extends beyond time savings. Automation reinforces PROCADFAB’s design philosophy, which prioritises accuracy, practicality, and manufacturability. Booth said when you automate a process, you minimise human error and ensure every output is consistent. Rules that you define become rules the system follows, which aligns with a quality-driven workflow. For a small consultancy, this consistency is a competitive advantage, enabling the delivery of more work without compromising quality.

Booth’s adoption of #TASK is not just about speeding up repetitive tasks – it reflects a broader philosophy of integrating technology into design processes. PROCADFAB views automation as a tool to support creativity and problem-solving, not replace it.

“Engineering will always be a creative field; you can’t automate imagination,” Booth said. “Designers rely on creativity to solve problems and then apply technical expertise to turn those ideas into reality. Automation helps by reducing processing time and enhancing consistency.”

For small- and medium-sized design consultancies, this philosophy offers an advantage. With growing labour shortages, increasingly complex designs, and tighter project deadlines, tools like #TASK enables leaner teams to produce more output without sacrificing precision or manufacturability.

Central Innovation remains a trusted partner in PROCADFAB’s workflow, with Booth praising the company’s technical support and responsive service. He said that over the years, he has built strong relationships with key people at CI, and

their technical support has consistently been prompt and helpful.

“Whenever I’ve needed assistance or clarification, they’ve been quick to respond and genuinely supportive,” he said. “This relationship ensures that PROCADFAB’s adoption of #TASK is both smooth and sustainable, giving the consultancy confidence in the tool’s ongoing reliability.”

Looking ahead, Booth believes that automation will play an increasingly central role in Australian fabrication and design. While engineering creativity

cannot be replicated by software, tools like #TASK allow designers to focus on higher-level problem solving and innovation.

PROCADFAB’s journey illustrates how practical, well-supported automation can transform a consultancy’s operations, providing measurable efficiency gains while maintaining high standards of design integrity.

From automotive to aerospace, Helmut Fischer’s tactile measuring devices are setting the standard for precision, durability and traceable quality assurance.

In modern manufacturing, precision is more than a performance metric – it’s the backbone of reliability, safety, and innovation. Across industries from automotive and aerospace to energy and electronics, quality assurance has evolved into an exact science. Yet one constant remains: the need to measure, verify, and trust the data.

This is where Helmut Fischer’s tactile measuring devices continue to have their impact. With more than seven decades of experience in material analysis, the German manufacturer has become synonymous with accuracy and endurance in coating thickness measurement and material testing. Its tactile instruments, built to perform in tough industrial environments, combine technological innovation with the reliability that production engineers demand.

The company’s tactile devices fall into two core categories – coating thickness gauges and material testing instruments – each designed to tackle complex measurement tasks with precision. The coating thickness gauges are engineered for a range of substrate-coating combinations. These include insulating coatings on conductive metals, such as anodised layers of paint on aluminium; non-magnetic coatings on magnetisable materials like steel; and copper thickness on printed circuit boards (PCBs).

Meanwhile, the company’s material testing instruments provide reliable measurement of electrical conductivity and ferrite content – crucial parameters in sectors where material integrity defines safety and performance. Together, these tactile devices underpin quality assurance across a vast array of industries.

Manufacturing is no longer confined to singlepurpose applications, and Fischer’s solutions reflect that diversity. Each device is engineered for versatility and repeatability across multiple production settings.

In the automotive sector, precision testing of both functional and decorative coatings is essential. Fischer’s devices are integral to quality control processes for paint and zinc coatings, cathodic dip coating, and even sound insulation foam. For electroplating, where tolerance limits are tight and uniformity is critical, the company’s tactile instruments ensure coating thickness meets

specification every time – whether on anodic layers, chrome plating, or complex geometries.

The anodising industry relies on Fischer’s gauges to verify aluminium raw materials before processing and to assess coating thickness post-treatment. This ensures that every aluminium profile or decorative anodised component achieves the required durability and corrosion resistance. In paints and varnishes, Fischer’s compact devices deliver accuracy even on ultra-thin coatings – a critical factor when finish quality and surface aesthetics define brand value.

Electronics manufacturers depend on Fischer’s instruments for non-destructive layer thickness measurement and material verification on PCBs, solder resist, and copper coatings. Similarly, in aerospace, where safety tolerances are absolute, Fischer’s devices support material testing, paint coating verification, and even heat-damage analysis during maintenance.

For the oil, gas, and petrochemical sectors, the stakes are even higher. Equipment operates in extreme environments, where anti-corrosion coatings protect assets worth millions. The company’s tactile devices deliver accurate readings on ferrite content, polypropylene coatings, and thermally sprayed aluminium across pipelines, tanks, and refinery vessels – all without destructive testing. In mechanical engineering, where machinery endures constant mechanical stress, continuous coating measurement is key to ensuring long-term wear resistance. Fischer’s gauges are equally at home measuring powder coatings or monitoring hotdip galvanising lines. Construction and infrastructure

projects also benefit from the company’s robust design philosophy. Its devices are used to test paint on zinc coatings, stainless alloys, and fasteners, meeting standards such as SSPC-PA2 for protective coatings on steel.

In the energy sector, particularly in emerging fields like battery manufacturing and heat recovery systems, Fischer’s tactile instruments help maintain consistent coating thickness in cladding processes and high-alloy steels – critical for performance and longevity. Even precious metal verification and marine applications benefit from the technology. The same accuracy that confirms gold authenticity can determine the integrity of anti-fouling or iron glimmer coatings exposed to saltwater and weathering.

What makes Helmut Fischer’s tactile measuring devices a trusted choice among engineers and quality control professionals is not only their measurement capability but their durability and design philosophy. Every device is built to withstand the harshest production environments. Fischer’s Quick-Measure design delivers fast, accurate results with minimal setup, while intuitive menus make operation straightforward, even for nonspecialist users.

The flexibility of the range is another defining feature, as Fischer offers simultaneous measurement and evaluation with up to eight probes, enabling testing across multiple points or components in a single workflow.

The company’s broad probe portfolio – more than 100 standard options – ensures there’s a configuration suited to virtually any application, from delicate surface coatings to rugged industrial finishes. Each probe can be easily calibrated, allowing users to maintain high levels of accuracy with minimal downtime.

For complex or non-standard applications, Fischer’s engineers can deliver customised solutions, including extended probes or bespoke fixtures tailored to unique measuring tasks.

While laser, ultrasonic, and optical systems often dominate headlines in the age of Industry 4.0, tactile measurement retains a distinct advantage: it physically interacts with the material, offering a level of reliability that purely optical systems can sometimes struggle to achieve, particularly on rough or curved surfaces.

This confidence in measurement makes tactile devices indispensable for quality audits, certification, and compliance with international standards. Fischer’s instruments are recognised for their traceability, repeatability, and long-term stability – three pillars of industrial metrology.

Helmut Fischer continues to evolve its tactile technology through research and customer collaboration. Its DMP10-40 series, for example, brings portable precision to the shop floor with

ergonomic design and data connectivity options. The FERITSCOPE DMP30 enables accurate determination of ferrite content in austenitic steels and weld seams, supporting corrosion resistance assessment in critical industries.

Meanwhile, the SR-SCOPE DMP30 provides non-destructive measurement of copper on PCBs, ensuring reliable performance in electronics manufacturing. The FISIQ-T software integrates tactile measurement with digital intelligence, enabling faster evaluation and documentation directly from the device.

As manufacturing becomes more data-driven, the importance of accurate, traceable, and repeatable measurement only grows. Whether it’s ensuring a coating’s corrosion resistance, verifying a conductive layer, or confirming the purity of a metal alloy, Fischer’s tactile devices deliver results manufacturers can act on with confidence.

In a landscape where every micron counts, Helmut Fischer’s tactile measuring devices stand out not just for their engineering precision but for their enduring contribution to manufacturing excellence. From the smallest PCB to the largest pipeline, Fischer’s technology continues to prove one simple truth: in measurement, as in manufacturing, the human touch still matters.

In October 2026, Perth will host one of Australia’s largest defence industry events: Land Forces 2026.

For the first time, the Land Forces 2026 International Land Defence Exposition, will be held in Western Australia, marking a pivotal moment for the state’s growing role in supporting national land defence capability.

Taking place from 6–8 October 2026 at the Perth Convention and Exhibition Centre, the event will bring together senior Army leadership, defence industry stakeholders, policymakers, and international partners to explore the future of land power in a rapidly evolving strategic environment.

Presented with the support of the Australian Army and organised by the AMDA Foundation, the event will showcase the full spectrum of land defence capability, from platforms and infrastructure to workforce. Its arrival in Perth reflects the state’s increasing importance in delivering key national programs, including littoral manoeuvre capabilities, Army base infrastructure, Guided Weapons and Explosive Ordnance (GWEO), and advanced technologies under AUKUS Pillar II.

Previously hosted in Brisbane, Adelaide, and Melbourne, Land Forces has become a cornerstone of Australia’s defence industry calendar. Its move to Perth for 2026 underscores Western Australia’s strategic geography, industrial capacity, and defence infrastructure, making it a suitable

location for discussions shaping the future of Army capability.

WA is already central to major defence initiatives. Its expansive coastline and proximity to the IndoPacific theatre support littoral operations, while ongoing base upgrades and logistics hubs enhance the Army’s operational readiness. The state’s growing role in the GWEO enterprise positions it as a hub for advanced manufacturing, testing, and sustainment of next-generation munitions. Combined with leadership in critical minerals and defencerelated research and development, WA is poised to play a defining role in the evolution of Australia’s land combat capabilities.

As a major supporter of Land Forces 2026, the Australian Army has been instrumental in shaping the event’s program. Army will lead a series of engagement opportunities designed to foster collaboration, innovation, and professional development.

Key highlights include:

• Chief of Army Symposium – The Australian Army’s premier event. A strategic forum bringing together Army leadership, industry, academia, and international partners to explore the future of land warfare, capability development and the evolving role of the profession of arms.

• Junior Leaders Forum – A unique opportunity for emerging Army leaders to engage with industry and thought leaders, fostering the next generation of defence leadership.

• Army Stand - Army will have a significant presence inside the exhibition halls, looking to engage with attendees, as well as strengthen and build partnerships with industry. These initiatives will be further enriched by the celebration of the 125th anniversary of the Australian Army in 2026, a milestone that underscores the enduring legacy and future trajectory of the nation’s land force.

Land Forces 2026 will feature a three-day industry exhibition, offering a platform for companies to showcase solutions and capability to national and international audiences.

Exhibitors will have direct access to decisionmakers, procurement leads, and program managers across Army, Defence, and government. Whether focused on vehicle platforms, robotics, autonomous systems, communications, sustainment, or infrastructure, Land Forces 2026 provides a unique opportunity to align with current and future capability priorities.

The event will also spotlight sovereign industrial capability, reinforcing the role of local industry in

delivering and sustaining complex systems. As Australia strengthens its commitment to self-reliance and resilience, Land Forces 2026 will highlight how domestic innovation contributes to national security.

As AUKUS enters its next phase, Land Forces 2026 will provide a forum to explore opportunities under Pillar II, focusing on shared advanced capabilities such as artificial intelligence, cyber, quantum technologies, and autonomous systems. These efforts will be tied to Army’s future needs and the broader AUKUS innovation ecosystem.

The event will support dialogue on enhancing interoperability with allies and accelerating capability development through joint experimentation and codevelopment.

Innovation will play a part in the event as sourcing new Australian ideas, technologies and research will be key to meeting the future needs of the Australian Defence Force. The Land Forces Innovation Pitchfest and Awards aims to support this need by sourcing Australian innovation at various stages of development, from ‘blue-sky’ thinking to developed technologies, and showcase them onsite via in a pitchfest –style series of presentations. Winners across four categories receive cash prizes to further personal and professional development and help take their innovation to the next level.

The event will also serve as a platform for international engagement, drawing official delegations and industry leaders from across the Indo-Pacific and allied nations. As Australia deepens regional partnerships and defence cooperation, the event will foster strategic dialogue on shared challenges, capability integration, and multilateral collaboration.

The decision to host Land Forces 2026 in Perth is both timely and strategic. As Australia’s defence priorities evolve, Western Australia has emerged as a key contributor to national capability.

Perth’s location, industrial capacity, and growing defence footprint make it a suitable setting to convene national and international stakeholders. Its proximity to the Indo-Pacific, combined with strong local engagement, offers a unique opportunity to connect Australia’s defence industry with global partners and supply chains.

Land Forces 2026 will reflect the strength and

diversity of Australia’s industrial base. While Perth is the host city, the event remains a national platform showcasing Australian innovation, capability, and strategic vision to the world by bringing the world to Australia.

For exhibitors, sponsors, and attendees, Land Forces 2026 is more than an event. It is a chance to contribute to a national effort to shape the future of land power across Australia and the broader region.

The event is supported by the Australian Army, the Western Australian Government, Defence West, and Business Events Perth.

Henkel’s Loctite brand is turning ESG principles into real progress through responsible chemistry and circular design.

For Henkel, sustainability is not a marketing trend, but a strategic pillar embedded in all aspects of its operations. Guided by its purpose, the company is reshaping the way industrial adhesives are formulated, manufactured, and delivered. Under its Loctite brand, recent upgrade to its Threadlocker range marks a clear step in advancing environmental safety and regulatory readiness without compromising performance.

Henkel’s “Responsible Chemistry” approach reflects its belief that innovation and sustainability are inseparable. The removal of chemical substances such as cumene hydroperoxide (CHP) and acetophenone (APH) from Loctite’s reformulated Threadlockers is not only a step toward easier handling but also a proactive response to the evolving global landscape of chemical regulation.