Appetite waning for insurers in waste industry

By Inside Waste

NATURAL DISASTERS such as floods and bushfires, as well as those caused by human action (or inaction) such as battery fires in rubbish trucks and MRFs, are on the increase. In the case of the former, these have mainly been due to an array of weather patterns blamed on climate change. In the case of the latter there has been a proliferation of lithium-ion batteries designed to drive innovative technologies that have appeared over the past decade.

What that has meant for the resource recovery sector in increased risks. This is turn leads to either an increase in insurance premiums, or insurers unwilling to issue policies due to risk factors being too high. This has a knock-on effect of investors unwilling to put monies into new facilities, which in turn affects a council or other third-party’s ability to collect and recycle resources and dispose of waste.

At a recent symposium held by

the Victorian Waste Management Association, Steve Richards, a Senior Account Manager for insurance advisory firm RSM Group, outlined some of the challenges facing the industry when it comes to insurance. He was joined by Alan Brett, Head of Commercial Underwriting at Australasia Underwriting (AU).

Richards said that RSM has tried multiple approaches to present the waste industry in different ways to make it more appealing to insurers, but the “vast majority of the insurance market doesn’t really have an appetite” for the sector.

“[That lack of appetite]is coming from the reinsurers,” he said. “It’s not something that we think will change anytime soon, however we are seeing some capacity increase. Property valuations continue to be absolutely critical and those are really based on under insurance where you get penalised for a loss. Then there is the increased cost of construction that’s come through from restrictions and pressures on the

supply chain from COVID, which we’re still recovering from.”

He said that risk management is the absolute gold standard. If a company is managing a risk, and it’s willing to demonstrate how it can be managed, then it needs to convey that to a specialist broker.

Another impact on premiums, according to Richards, is the El Nino weather pattern. It usually means warmer and drier conditions with minimal rainfall, which can lead to an increased risk of bushfires around the country. And if bushfires do start having an impact, then premiums will increase.

There is also the impact of social license. For example, if you put in a plan to get a resource recovery plant up and running, what are the risks of it being rejected by councils or town planners, or whoever has a say in whether a project can go ahead? Again, this may impact on a business’s ability to rebuild its operations due to a chance in society’s expectations.

(Continued on page 14)

By: Mike Ritchie and Conor Mackenzie, MRA Consulting Group

There is an active debate in the Australian recycling and packaging sectors about the design of our Container Deposit Schemes. The key issues include:

1. What should the rebate value be?

2. Should the schemes include wine and spirit bottles (glass) like QLD has just announced?

With the introduction of the Victorian and Tasmanian schemes we will for the first time have a national container collection arrangement.

We want to talk to the rebate value in this article. What is the right value for the rebate? It is currently 10 cents.

History

South Australia introduced its CDS scheme in 1977. It has run continuously ever since. It started with a 5c bottle return rebate, which was then increased to 10c in September 2008.

When it was introduced, the value of 5c in 1977 was about 35c today (2024) based on RBA inflation rates.

Of course, given it was a fixed 5c, its value to the person returning a bottle decreased each year due to inflation. Think of the effective rebate value as the “pulling power” or gravitational pull, of the rebate. The “pulling power” decreases over time due to inflation, until it is lifted again by regulation.

If we plot the effective rebate value in 2024 values, against the capture rate of eligible containers, we can see what sort of impact the value of the rebate has on people’s behaviour.

(Continued on page 18)

Bush fires can have a huge impact on waste industry premiums. Image: Toa55/shutterstock.com.

3-Stage Grinding Process

Provides Faster Reduction

Astec - Peterson's powerful up-turn 3-stage grinding process provides better fracturing of material and a more consistent product, giving you just the product your buyers are looking for.

The Impact Release System

Protects Your Investment

Astec - Peterson's patented Impact Release System's air bags provides uniform grinding and protection from contaminated feedstock, a feature unique to Astec - Peterson grinders.

Land clearing, mulch, compost, asphalt shingle tiles, scrap wood, biomass, green waste-we can handle it am

www.komatsuforest.com.au

The Impact Cushion System

The Second Line of Defence

Urethane cushions and shear pins help protect the mill from catastrophic damage in the event of a severe impact from contaminants in the feedstock.

Astec - Peterson offers horizontal grinders from 433-839 kW, offering grinding solutions with output at the lowest cost per ton. Visit us at www.astecindustries.com and see why we have been leading the industry for over 35 years!

2710D Horizontal Grinder

5710D Horizontal Grinder

6710D Horizontal Grinder

Largest

Chief Operating Officer

Christine Clancy christine.clancy@primecreative.com.au

Managing Editor

Mike Wheeler mike.wheeler@primecreative.com.au

Brand Manager

Chelsea Daniel chelsea.daniel@primecreative.com.au

Design Production Manager

Michelle Weston michelle.weston@primecreative.com.au

Art Director

Bea Barthelson

Client Success Manager

Glenn Delaney glenn.delaney@primecreative.com.au

Head Office

Prime Creative Pty Ltd

379 Docklands Drive

Docklands VIC 3008 Australia p: +61 3 9690 8766 enquiries@primecreative.com.au www.insidewaste.com.au

Subscriptions +61 3 9690 8766 subscriptions@primecreative.com.au

Inside Waste is available by subscription from the publisher. The rights of refusal are reserved by the publisher

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Copyright

Inside Waste is owned by Prime Creative Media and published by John Murphy.

All material in Inside Waste is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. The opinions expressed in Inside Waste are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

Are waste facilities uninsurable?

Insurance is a necessity in the resource recovery sector, but getting coverage is getting harder. In some cases, insurers are baulking at offering any coverage. In this month’s issue, we hear from two insurance experts on what criteria insurers look at when covering infrastructure.

Why is there a reluctance to insure infrastructure in the resource recovery sector? There are a couple of glaring issues. One is the increase in unreliable weather patterns. Over the past couple of decades, the La Nina and El Nino weather phenomenon have meant there has been an increase in bushfires and floods in Australia. The other is the proliferation of lithium-ion batteries. As with any business, insurers are around to make money for their shareholders, not to be anyone’s friend. Risk is key to any decision they make. The knock-on effect of this?

Investors are reluctant to lay out capital to build new facilities.

Then there is the WorkCover aspect when it comes to the safety and health of staff. The waste/resource recovery industry has a plethora of jobs where safety is a critical aspect of the job.

Our two experts outline insurer

expectations and some of the mitigating scenarios that need to be addressed when heading into the insurance market.

edition is by Anne Prince, a doyen of the NSW resource recovery sector, who believes we are in for a rude awakening in the resource recovery targets. This will be of no surprise to anyone in the industry, but what makes Anne’s piece so compelling is the data that has been collected to show bureaucrats just how far away we are from meeting the targets. It is a comprehensive data set and is depressing reading. If anything, it might send a reality check to the public servants that make the decisions and set the targets.

Finally, the August/September issue is home to our popular Consultancy Registry. This registry has an array of consultants from around the country spruiking the different arenas in which they have expertise. As with last year, we have divided them into their different states, in the hope that this will make it easier for readers to use when it comes to researching companies that can meet their needs.

Until next time, good reading.

KIVERCO PS122 PICKING STATION

• 4 bay sorting - Recovers clean stone, wood, paper, plastics, card or other recyclable materials at the option of the operator

• Combines air separation, magnetic separation, and manual sorting in one compact unit

• Adjustable belt speed - 1200 mm wide picking belt adjustable to suit waste material and desired recovery required

• The hydraulic jack leg support offers rapid set-up and transport

Renew IT facility opens

A COLLABORATION between UNSW Sydney’s Centre for Sustainable Materials Research & Technology (SMaRT) and IT asset management company Renew IT has begun turning discarded hard plastics into 3D printer feedstock.

A UNSW-invented Plastics Filament MICROfactorie Technology module has been installed at Renew IT’s Sydney warehouse in Lane Cove, Sydney.

“Commercialising our Plastics Filament MICROfactorie Technology has taken a lot of time and effort, but it is a sustainable waste, recycling and manufacturing solution. We’re turning the hard plastics found in all modern electronic hardware but not subject to conventional recycling methods, into feedstock for a booming sector,” said UNSW SMaRT Centre founder and director, Professor Veena Sahajwalla.

“Filament is almost entirely imported to Australia and made from petrochemicals, so being able to make it locally from used plastics also reduces the environmental impacts from global freight. 3D printing is a wonderful technology enjoying rapid uptake but the tragedy is

until now 3D printing has been reliant on virgin plastics.

“These Plastics Filament MICROfactories have the potential to revolutionise 3D printer filament creation. I look forward to a time when 3D printing feedstock is sourced exclusively from recycled plastics,” she said.

UNSW Vice-President Societal Impact, Equity and Engagement, Professor Verity Firth said UNSW’s partnership with Renew IT has the potential to create genuine, large-scale change.

“The combination of Prof. Sahajwalla’s pioneering science and Renew IT’s commercial expertise and financial commitment can accelerate genuine change. This industry partnership is an exquisite example of UNSW’s commitment to societal impact,” she said.

UNSW Sydney is developing a Societal Impact Framework through which it seeks to maximise progress in environmental sustainability and resilience, social cohesion, health, and wellbeing, and economic prosperity.

“This venture addresses two wicked

issues,” said Renew IT CEO and founder James Lancaster. “Not only does it reduce virgin plastic production by creating 3D printing filament from waste items but it also stops hard plastic ending up in landfill.

“Electronic goods like televisions, computers and printers are being produced in ever-increasing numbers and often with increasingly short life-cycles, when they do reach end of life, the waste industry’s solution has been to deliver them to landfill.

“Dispatching hard plastics to landfill is

not a solution that sits easily with me. To re-purpose that plastic into a new product that’s increasingly in demand and which we can sell at a competitive price is a beautiful solution.”

If 3D printing feedstock can be competitively produced by recycling plastic, we shouldn’t be producing it with virgin materials, he said. By recovering high-quality plastics from e-waste for remanufacturing we can help organisations lower their Scope 3 emissions and boost local manufacturing.

Renew IT founder and CEO James Lancaster and UNSW SMaRT Centre founder and director Professor Veena Sahajwalla. Image: UNSW.

The Impaktor 250 evo is the perfect combination of shredder and crusher. Its compact dimensions, low weight, and quick setup times make it a game changer in waste processing efficiency.

For those interested in sustainable waste management, explore the possibilities with the ARJES Impaktor 250 evo.

E: sales@triconequipment.com.au www.triconequipment.com.au

Waste Expo offers learning opportunities for all

BSV Tyre Recycling Australia Pty Ltd Convicted and Penalised for improper Storage of Tyres at its Facility in Revesby, NSW

BSV Tyre Recycling Australia Pty Ltd (“BSV”) has been prosecuted by the Environment Protection Authority (“EPA”) for ten offences of contravening an environment protection licence (“licence”) that were committed in 2022. The prosecutions were brought because BSV stored waste tyres and waste tyre products in contravention of its licence at its facility in Revesby, NSW. The offences occurred on 30 March, 10 May, 31 May and 26 July 2022, respectively.

Since this time, however, BSV has changed ownership. The offences were committed by its previous directors. Moreover, since the change of ownership BSV has complied with the terms of the licence.

Waste tyres and waste tyre products represent a fire hazard if not stored in a proper manner. If waste tyres and waste tyre products catch alight, they are capable of causing actual harm to the environment. In this case, although no fires occurred, the offences caused potential harm to the environment. This included potential harm to air quality, nearby land and waters, human health, and property on neighbouring premises.

On 24 June 2024, the Land and Environment Court of NSW convicted BSV of ten offences of contravening an EPL and ordered BSV to:

(1) pay a monetary penalty totalling $161,200;

(2) pay the EPA’s costs in the sum of $45,000; and

(3) cause this notice to be published at its own expense.

WASTE EXPO Australia is one of the largest gatherings of waste management and resource recovery professionals in Australia.

There’s a reason for this. Behind the scenes, an advisory board brings together stakeholders from across the resource recovery, recycling, and waste industries. Together, they bring experience in a range of sectors ensuring the expo remains at the forefront of challenges and opportunities.

Michelle Mandl, general manager of communications, customer, and engagement with TOMRA Cleanaway, says evolving due to customer feedback is one factor behind Waste Expo Australia’s longevity and success.

On the advisory board for the past three years, Mandl says the expo has a strong national presence because of its curated conference program, plus an expo floor with more than 120 industry suppliers, most of who are at the cutting edge in their respective fields.

“Waste Expo Australia draws diversity from across Australia, and it affords fantastic learning and development opportunities,” Mandl said.

“Being co-located with All Energy Australia gives it another dimension for delegates to engage. That’s becoming more relevant as the renewable energy and waste sectors integrate.”

Staying relevant is vital, says Erin Ford, senior brand and marketing manager for Repurpose It. She says

board members continue to question industry trends, areas of concern, innovations, or gaps.

Case studies also play a central role in showing attendees what is, and can be, achieved within the industry.

“The expo is an area to learn and share knowledge,” Ford said. “Case studies can really step it up. They can show people the impact a company or technology is having.”

So, what does the 2024 event have in store?

Plastics, batteries, and the circular economy continue to be important.

“The number of abstracts that focused on plastics highlights that they are a huge area of concern,” Ford said.

“With single use plastics, we are trying to change embedded behaviours. We’re improving, but it’s still a big issue. And we have massive issues with batteries across all waste streams.

“The conference program will provide some insight into the challenges and what the industry is doing to address them.”

The expo has achieved 27 per cent visitor growth since the 2022 event. In 2023, more than 3500 professionals attended across the two days, putting exhibitors face-to-face with potential customers from Australia and overseas.

Attendees include local, state, and federal government, waste service providers, consultants, engineers, technology and equipment suppliers, project developers, facility managers and landfill owners/operators.

Ford said the cross-section of attendees is a drawcard, providing exhibitors with the chance to engage with people they would not normally see. She believes crowd numbers are bolstered because the expo is free to attend.

“It removes the financial barriers that could stop some people from attending,” she said. “As exhibitors, Repurpose It makes a lot of connections through the expo.

“Education is a big part of Repurpose It, and the expo gives us a chance to highlight what we do while listening to the consumer market.

“Nothing beats face-to-face business. Whether you are already in the industry, new to the market or expanding in it, Waste Expo Australia provides access to key decision-makers.”

The 2024 Waste Expo Australia, to be held at the Melbourne Convention and Exhibition Centre (MCEC) from 23-24 October, will focus on advancing toward sustainable resource recovery.

Local and international suppliers, including representatives from Ireland, Germany, France, and Japan, have confirmed their attendance. Exhibitor and sponsorship opportunities are still available.

The Australian Waste Expo has a strong national presence because of its curated conference program.

Clearing the way: Komatsu Waste Spec Dozers

Built for productivity and efficiency

The waste processing industry requires purpose-built equipment for moving highly variable materials. Komatsu creates machines and solutions designed specifically for the difficult terrain and materials involved with handling waste. Our advanced Dozers equipped with smart technology, are engineered for productivity to support your goals of a zero-harm environment.

From the CEO’s desk

The answer is product stewardship regulation

Environment Ministers will meet for the second time this year on 7 December, following the first 2018 Meeting of Environment Ministers (MEM) in April, which was in part a response to the import restrictions driven by China’s National Sword Policy and the effects this policy has had across the Australian waste and resource recovery (WARR) industry. Key decisions derived from the April MEM include:

Having just finished the 2024 ENVIRO circular economy conference in Brisbane, it struck me how loud the recurring themes were that we heard over the two days. Three in particular stood out – economics (imagine circular economy actually being about economics), regulation and leadership. All three are vital to successfully transitioning to a circular economy in 2030. However, when it largely comes to policy in this area we are severely lacking.

Early on day one, Richard Denniss presented me with a real ‘aha’ moment when he said fundamentally economics is the efficient allocation of scarce resources. After the shudder from remembering first year university economics class, I couldn’t help wondering why we do not talk more about this – and why on earth we do not act more like this in Australia. Yes, Australia is the lucky country, but our luck is not separate or distinct from the luck of the planet generally. And as Jill Riseley correctly peppered us with stats from the most recent Circularity Gap Report about the over consumption of the planet’s finite resources and the falling circularity rate of materials, frustration simply grew in the room about the lack of leadership we are seeing in Australia (despite all the rhetoric).

•Reducing waste generation, endorsing a target of 100% of Australian packaging being recyclable, compostable or reusable by 2025, and developing targets for recycled content in packaging.

• Increasing Australia’s domestic recycling capacity.

• Increasing the demand for recycled products.

• Exploring opportunities to advance waste-to-energy and waste-to-biofuels.

•Updating the 2009 Waste Strategy by year end, which will include circular economy principles.

It is time to take stock and examine what has been achieved since these decisions were announced. Now, seven (7) months may not seem like a long time, however in that time we have seen further markets close (Malaysia, Indonesia, Vietnam) and if you are an operator under continued financial stress, seven (7) months could make or break you.

As the United Nations states, some 50 per cent of global greenhouse gas emissions and 90 per cent of biodiversity loss and water stress is caused by resource extraction and processing – and as the Ellen Macarthur Foundation says up to 80 per cent of a product’s environmental impact is influenced by decisions made at the design stage. Quite simply we need to use fewer resources for longer.

How can we do that? Well, other than buying less, we can regulate more. And the most obvious and arguably effective way to do this is through product stewardship.

We all know the market will not fix itself and no matter where you sit in the supply chain, you will hear the consistent call for certainty and the need for a level playing field. To create the market conditions for the desired circular economy, we need regulation – but there appears to be complete reluctance to do this at scale.

Product stewardship means producers taking primary responsibility (including financial and operational) for minimising the environmental and human health impacts of products they put on the market, by implementing various actions across the entire product lifecycle. It provides a clear pathway for businesses and governments to operationalise circular economy objectives by designing out waste and pollution. It also helps keep products and materials circulating and restoring the environment, and let’s be clear – it must go well beyond the nebulous language that typically accompanies claims and pledges about circularity.

Following the April MEM, we have had three (3) states step in with varying degrees of financial assistance for industry (councils and operators). This should be expected considering almost all states (except Queensland and Tasmania) have access to significant waste levy income each year. On the eastern seaboard, Victoria has approximately $600 million in waste levy reserves in the Sustainability Fund and NSW raises more than $700 million per annum from the waste levy. There is certainly no lack of funds that can be reinvested into our essential industry.

Funding helps but as we know, the money goes a much longer way with Government support and leadership, as well as appropriate policy levers.

VICTORIA

Victoria has arguably been the most active and earnest in supporting the industry post-China, with two (2) relief packages announced to support the recycling industry, valued at a total of $37 million. The Victorian Government has also gone above and beyond all others states by announcing it would take a leadership role in creating market demand for recycled products.

When South Australia’s container deposit scheme began in 1977 it was one of only a handful of product stewardship schemes worldwide. By 2000, when Australia’s next major product stewardship scheme (for oil) was established, there were around 100. And there were about 400 in 2016 according to the OECD. While one Australian state was an early adopter of product stewardship, we are now being left behind globally.

SOUTH AUSTRALIA

For example, product stewardship regulations for packaging were introduced into Europe and Australia in the late 1990s. Europe was guided by the EU Packaging

Government announced a $12.4 million support package comprising $2 million of additional expenditure, $5 million additional funding for a loan scheme, together with targeted funding from the Green Industries SA budget. The Government has also offered grants for recycling infrastructure.

NEW SOUTH WALES

At first glance, New South Wales’ eye-watering $47 million recycling support package was heralded as the spark of hope industry needed. However, on closer inspection, the bulk of this package that was funded via the Waste Less, Recycle More initiative and therefore the waste levy, was not new, making it very difficult for stakeholders, including local government, to utilise the funds as they were already committed to other activities. Some of the criteria proposed by the NSW EPA also made it challenging for industry to apply to these grants. On the plus side, efforts are being made by the NSW Government to stimulate demand for recycled content through the intergovernmental agency working groups that have been established, though no tangible increase in demand or facilities have developed… Yet.

QUEENSLAND

Directive, which identified back then the growing problems of packaging waste, consumption of virgin non-renewable materials, the growing costs to government of waste management and the environmental and health impacts of hazardous components. Australia was guided by the National Environment Protection (Used Packaging Materials) Measure (NEPM). More than 25 years later, one has moved forward with a powerful new framework, and another has struggled to meet targets set.

Product stewardship shifts the economic burden of products and their impacts away from governments and the broader community to the producer and user. This increases the likelihood of genuine responsibility and investment by the private sector into activities to prevent and reduce waste, and increase lifecycle (eg design for reuse and repair), given the economic burden is placed squarely on those that benefit most from the products existence.

industry however the Queensland Government has embarked on the development of a waste management strategy underpinned by a waste disposal levy to increase recycling and recovery and create new jobs. The State will re-introduce a $70/ tonne landfill levy in March 2019. There are also strong attempts to use policy levers (levy discounts and exemptions) to incentivise the use of recycled material and make it cost competitive with virgin material. However, little has been done to establish new markets and Government has not taken the lead in the procurement of recycled material. There are grants available for resource recovery operations in Queensland although no monies have been allocated to assist in 2018. This is troubling as Queensland rolled out its Container Refund Scheme on 1 November, which will likely impact the cost and revenue models of the State’s MRFs – as we have seen most recently in NSW.

Let’s be real – without financial incentives we just are not going to get the systems shift we need, particularly when profit margins reward existing behaviour.

WESTERN AUSTRALIA

Further, following June’s Environment Ministers Meeting, it is clear there we are still tinkering and will not be getting a packaging product stewardship scheme in Australia until 2025 at the very earliest – some 27 years after the NEPM legislation. In the meantime, packaging has continued to grow with the latest APCO figures showing 6.98 million tonnes were placed on the market in 2021/22 (with 3.9 million tonnes recovered) – up from 5.45 million in 2017/18 (with 2.67 million tonnes recovered). Unless there is a financial obligation to recover the total amount and investment in the facilities and buy back, this will not shift.

The recent Planet Tracker report, The Plastic Recycling Deception, argued consumers have been made to feel responsible for low recycling rates and plastic producers have successfully passed the financial burden of dealing with its material onto others, including local councils and the WARR industry, while ignoring upstream measures to limit production, such as EPR, regulation or, for governments, taxation on production. It would be hard to argue these conclusions aren’t the case in Australia.

The Western Australian Government set up a Waste Taskforce in direct response to the China National Sword. As part of this announcement, the State Government urged all local councils to begin the utilisation of a three (3)-bin system - red for general waste, yellow for recyclables and green for organic waste - over the coming years to reduce contamination. While this taskforce is a step in the right direction, we are yet to see any tangible results from it or any funding for industry. In October, the WA Waste Authority released its draft Waste Strategy to 2030, which comprises a comprehensive and detailed roadmap towards the State’s shared vision of becoming a sustainable, low-waste, circular economy.

COMMONWEALTH

Cost must be worn where it belongs to manage the efficient use of scarce resources. This goes for soft plastics too. Unless the real cost of managing packaging is placed on the generator, with real systems shift that balances placed on market with bought from market, we will keep stumbling along for another 27 years with little progress and even more deterioration of the environment.

The argument is the same for many other product types – batteries, e-waste, paint, solar panels and the list goes on. If Australia sets a clear expectation that generators must take responsibility for the entire lifecycle of what they make, we will have a far greater circularity in Australia than the current 5.4 per cent.

Following the MEM in April, Australia now has a new Federal Environment Minister, Melissa Price, who in October reiterated to media MEM’s commitment to explore waste to energy as part of the solution to the impacts of China’s National Sword, which is troubling (EfW is not a solution to recycling). The Commonwealth has also backed the Australian Recycling Label and endorsed the National Packaging Targets developed by the Australian Packaging Covenant Organisation (APCO), which has to date, failed to incorporate industry feedback in the development of these targets. To the Commonwealth’s credit, there has been significant coordination in reviewing the National Waste Policy, with the Department of Environment bringing together industry players and States during the review process.

The updated Policy will now go before Environment Ministers on 7 December. The Commonwealth can play a key role – one that goes beyond the development of the National Waste Policy. WMAA is supportive of the Federal Government maximising the levers it has, including taxation and importation powers, to maintain a strong, sustainable waste and resource recovery industry.

Can anyone therefore please explain to me why on earth we are not moving rapidly towards a national product stewardship framework like the EU Waste Directives? Also, why are we stuck in a six-monthly cadence of Environment Ministers Meeting with very little progress towards regulation as a whole (and only tiny steps for a few products)?

AHEAD OF MEM 2

Maybe we need to go back to the start – we need leadership and regulation –sadly both appear to be currently missing in this space. When will we fix it, I am not exactly sure, but WMRR will keep fighting until we do.

Gayle Sloan, Chief Executive Officer, WMRR

There may be movement across Australia, with some states doing better than others, but the consensus is, progress is still taking way too long. It is evident that there are funds available in almost all States to assist with developing secondary manufacturing infrastructure, however the only way that this will really happen is if there is government leadership around mandating recycled content in Australia now, not later.

Unlike its neighbours, Queensland did not provide any financial support to

Voluntary schemes like the Used Packaging NEPM, under which APCO is auspiced, are not working. We have 1.6million tonnes of packaging waste in Australia, which needs to be used as an input back into packaging. Barriers to using recycled content in civil infrastructure must be identified and removed, and Government must lead in this field and prefer and purchase recycled material. A tax on virgin material should also be imposed as it is overseas. MEM must show strong leadership on this issue. Ministers have, since April, dealt directly with operators and councils that are under stress and we have a chance to create jobs and investment in Australia at a time when manufacturing is declining. Ministers have the opportunity to be leaders of today, not procrastinators – leaders of tomorrow and we are urging

NO DOWNTIME FLOORING

Appetite waning for insurers in waste industry

(Continued on from Cover)

He said one of the biggest emerging risks, which is especially pertinent to the waste industry where there is still a lot of manual labour aspects, is intercompany WorkCover recoveries. This can impact on a business, especially in a situation where WorkCover has paid out for somebody who has been injured, or on a claimable incident. WorkCover will look at who was the party that engaged the person who was injured, and who was the injured party working for at the time the incident occurred.

“And if they can recover against a third party, which is really just a separate entity to whom the injured person was employed by, then the (insurers) will go down that path,” said Richards.

He said that the easiest way to explain it is if you had one company that had two entities – let’s say RSM Waste Management, which had two subsidiaries, one that employed staff and the other that was known as RSM Trading that looked after the rest of the company’s business. The entity that employed the staff would pay the workers’ compensation premium.

However, once the bills have been paid by workers’ compensation, even if it is under the employment arm of the business, then the workers compensation insurer – depending on the circumstances – could go after the trading side of the business to recover

any monies it believes it is entitled.

“We’re seeing these scenarios coming through pretty thick and fast at the moment,” said Richards. “It’s got a three-fold effect on businesses. First and foremost: are your increase in WorkCover compensation premiums because claims increase?

“Second, you pay the excess, which these days starts at about $25,000 but $50,000 is becoming the norm, with even between $100-$250,000 for highrisk entities such as labour hire and transport industries.

“The third part is the policy that actually covers it, which is your public liability policy, which covers third-party bodily injury.”

Richards said from an insurance point of view, these are significant risks. RSM saw its first instance of WorkCover looking to recover monies about a year ago.

“Even though there’s a statute of limitations we had a client who was served eight or nine of these, and they’re all for incidents over the past seven years,” he said. “They’ve got an excess of $50,000 on each one and it’s coming from left field. It’s a pretty major emerging risk for us. The good news is, your public liability policy should cover it if the correct information has been disclosed.”

Unlike other insurance markets, such as a car or house, whereby incidents are covered off on (or not) pretty quickly, these longtail claims – as they are referred to within the

insurance industry – can take years to materialise after the date of loss. And, as Richards points out, they’re not something that insurers have factored into their rating but are doing so now.

AU’s Brett said that 50 per cent of his company’s gross written premiums come from the resource recovery sector. One of the most standard questions he gets almost every day is: “why is my property insurance so expensive?”

When it comes to the resource recovery industry, it is a culmination of factors. Brett said that the sector has incidents such as fires and other losses, which are significant – some would even say catastrophic – in insurance terminology.

“And the problem is globally, they are increasing in frequency,” he said. “This means that the market is reducing. Now, why is that? Well, in advanced economies across the world waste per capita is increasing. The UN Environment Agency suggests that in North America, Europe and here in Australasia, per capita waste has grown by 20 per cent in the past 20 years. And global waste is expected to double by 2050.”

He said that is great for those wanting to invest in the sector, but the increase in waste also means more combustible components entering recycling feedstock due to public negligence.

“And we’re having to underwrite that,” said Brett. “And that’s been exacerbated by China’s plastic import ban in 2018, which meant a significant amount of plastic began to be stockpiled in waste and recycling facilities, which have significant fire risks.”

He said that problem has been turbocharged by lithium-ion batteries entering the stock feed due to products such as smartphones,

smartwatches, vapes and even items such as personalised greeting cards, being discarded.

Brett provided statistics that showed in 2022 there were more than 300 fires in waste and recycling centres in North America – just under one a day. He said that was more than any other year. Data from the UK has shown that the number of fires in such facilities have doubled in the past decade.

Profit matters

When it comes to insurance of such facilities, Brett went into a deep dive as to how the insurers operate through risk selection, premium collection and claims management to create profit.

our reinsurance programs”, which impacts on profitability for their shareholders, “Or do we look to cleanse the potential volatility within those portfolios”, which many have now done. And that impacts on the resource recovery sector due to its propensity for high losses.

Brett said the Waste industry would have seen that their property options for insurance capacity greatly restricted as many insurers have decided to reduce their exposure or stop writing risks within the industry entirely.

What does that leave you with?” he asked. “Lloyd’s of London is probably the oldest insurance marketplace and have been around for over 400 years. Providing solutions for the most complex insurance challenges through a subscription model. The marketplace is made up of about 150 insurers or syndicates, which will take a small proportion of policies that could have potentially high risk.”

This means in the event of a loss, they only pay their proportion, which means that they can manage their overall profitability. Brett said the trick/skill for his company is to help those syndicates manage that volatility.

How to manage the insurance costs speak to your insurance broker and weigh up all the all options, said Brett.

“Waste and recycling facilities can be quite significant in respect to their square meterage,” he said. “Make sure that you are speaking to your broker

the waste and recycling sector, but in other sectors as well. We mandated as part of our insurance provision that unless you’ve asked us for a special dispensation, the policy states there isn’t to be any overnight charging. Also, when you do charge the forklift during work hours, make sure that the areas around forklift charging areas are free of combustible waste.”

The insurer would also expect that as part of good risk management practice, any combustible waste outside is a minimum of six metres away from the property assets that are being insured. Also be aware of unsorted stock feed as well, he said. In his experience, a lot of fires start/ spontaneously combust through direct sunlight. Then there are a facility’s electrical systems. Sometimes, as part of a policy, the insurer will ask for an annual thermographic survey. This will just test an electrical system to see if there are any heat spots that might need attending.

Finally, Brett mentioned the one item that is currently causing the most problems – lithium-ion batteries.

“There are a number of specialist recovery centres that operate just for this type of item,” he said. “But all waste and recovery sites should have a plan of what they need to do if lithium-ion batteries get into the stockfeed – a plan on how you identify and a plan of what you do in respect to storage and disposal.”

“Another impact on premiums is the El Nino weather pattern, which means warmer and drier conditions with minimal rainfall, which can lead to an increased risk of bushfires.”

Most insurers are publicly listed – meaning providing return to shareholders is the primary objective.

“And insurance is seen as a relatively stable return for shareholders,” said Brett. “A lot of pension funds will invest in the insurance sector. You pay your premiums then insurance underwriters like myself will underwrite risk, we will collect that premium, and then invest that premium. That investment minus operating costs and claims payments creates the insurer profit.”

Brett said many insurers will reinsure themselves to make sure the profit margin remains stable. However, in Australia and North America over the past five to 10 years, those reinsurance programs have dealt with a more claims due to the increased number of natural catastrophes.

He said that the insurance industry had to make a decision, which was “what do we do? Do we pay more for

about potential impact of an insurance claim on your operations. Do you have the cash flow to maintain a higher deductible? This will reduce your insurance premium.

“And from a risk management point of view, we love it when there’s a significant amount of investment in some of the new fire detection and protection technologies that are available.”

Brett said that prevention is better than the cure and went on to list some of the more hazardous situations that can arise in waste and resource recovery facilities.

Risk factors insurers don’t like Overnight electric forklift charging is a big issue.

“We see a significant number of fires emanating from overnight forklift truck charging,” he said. “Not just in

Brett said that once the risks are identified, an insurer will have a meeting and conversation about a facility’s readiness for dealing with lithium-ion batteries. He believes, the massive increase in the disposal of these type of batteries has caught both the industry and insurers off guard, which needs to be addressed collectively.

Finally, Brett touched on the insurance contract itself. He said it is important that it is read through thoroughly. His team tries to make it as simple as possible, and he makes sure that for every contract they create they have a conversation with the insurance broker/policy holder to make sure they understand their obligations and what is covered under the policy.

“Also, if you’re a tenant, make sure that you understand your property owner’s Insurance conditions, which will be set out in your tenancy agreement and may have specific requirements you need to adhere to,” he said.

The massive increase in the disposal of lithium-ion batteries has caught both the industry and insurers off guard. Image: Smile Fight/shutterstock.com.

With its multi-rotor design the Genox J-series pipe shredder easily shreds HDPE pipes of all sizes.

When combined with a Genox washing plant and Genox pelletising system, you can truly close the loop on HDPE pipes. Pipe to pellets. Pellets to pipe. This is the circular economy in action.

Genox make world-class recycling solutions, for real-world recycling applications.

Call: Email:

in 2008. It continued to decline thereafter, again due to the effect of inflation.

But we hear some of you saying –“Hold on a sec. The capture rate moves but not as much as the rebate value declines. Is the rebate value that important?”

Correct. The data does show that, but the capture data is buffered by another factor. Because MRFs also get the rebate, MRF recycling of eligible containers is included in the capture rates. So, all capture is underpinned by MRF recycling rates.

Put another way, in spite of changes to the rebate value, much of the capture would have happened anyway through

measured as the net increase in eligible container capture over and above what would have happened anyway under yellow bin and MRF collection systems.

After all, the purpose of the CDS is to capture containers that would have ended up in litter or the red bin headed to landfill. It was not designed to be a replacement for MRF recovery. The two are complimentary.

Unfortunately, many politicians talk CDS effectiveness by the total billions of containers recycled, when they should be talking about the net recovery due to the CDS alone.

It is important to note that there is a more recent argument made that CDS

Figure 1. The effect of the “pulling power” (effective rebate value in 2024 dollars) on total capture rate (%)

58 per cent of eligible containers, in the absence of a CDS.

Figure 2 provides the analysis of the rebate value against the net gain attributed to the CDS (i.e. capture from litter and red bin containers; taking out the 58 per cent that would have been recycled anyway; it is a slightly different number in different states, but the difference is consistent and shows the same effects). It shows that there is an even closer correlation of the effectiveness of the CDS system (net capture rates) with the rebate value “pulling power”. Higher rebate values

deliver higher capture rates and vice versa. Inflation erodes the rebate value over time, which reduces net capture rates.

Policy

South Australia has demonstrated that rebate value matters. Inflation erodes rebate value and with it, capture rates.

Five cents in 1977 (a 35c rebate value in 2024 values) provides the highest capture rate.

Anecdotal evidence suggests the 10c rebate is insufficient. The question is why have all new CDS schemes in Australia

adopted a 10c rebate in 2023/24?

The NSW EPA reports a 52 per cent reduction in eligible container litter with its 10c rebate. What would this be with a higher rebate value? Why stop at 52 per cent when the primary purpose of the CDS is to reduce litter? What effect would a 20c or 30c rebate have on litter?

Of course, the packaging and beverage industry is concerned about retail price rises and particularly the risk that consumers may substitute one product with a CDS container levy on its packaging, for another which has no CDS levy.

For example, swapping from bottled beer and wine, to tap water, which has no CDS levy. We think this is very unlikely. A small price increase will not get people to switch from drinking wine/beer to tap water.

We started the modern round of CDS schemes in 2017 in NSW, with the levy set at 10c. It has since reduced in value by 17 per cent. All other new schemes will have 10c rebates.

I further note that 10c rebate today is a 70 per cent discount on the starting value of the SA CDS in 1977. A 30c rebate today would go most of the way to reestablishing its “pulling power”.

If the primary purpose of the CDS is

Maximise Recovery... Reduce Landfill Costs

An array of CDS eligible containers at a NSW landfill in 2024. Image: Ron Wainberg, MRA consulting Group.

Figure 2. Effect of the rebate on net capture (taking into account yellow bin recovery)

“Of course, the packaging and beverage industry is concerned about retail price rises and particularly the risk that consumers may substitute one product with a CDS container levy on its packaging, for another which has no CDS levy.”

to reduce litter, then 10c is achieving half of the goal (for example 52 per cent litter reduction in NSW).

A compromise position would be an immediate increase of all schemes to 20c with a “watch and wait” policy to assess the effect on net capture rate and particularly on litter reduction.

Our economy has already borne the extra costs of the CDS collection system, so we should be working the system (capital) as much as possible. That means pushing the capture rate of eligible containers in litter and red bins as high as possible. That means, at the very least, adjusting the rebates to keep up with inflation.

Waste Expo Australia is Raising the Bar in 2024

Waste Expo Australia 2024 is expected to attract over 3,000 visitors from across Australia and beyond. The free-to-attend conference program will feature keynote speakers, panel discussions, and interactive sessions led by industry experts, policymakers, and thought leaders. Topics for the event will span policy priorities, challenges, innovations, and best practices in resource management, sustainability, and the creation of a circular economy.

wasteexpoaustralia.com.au

Registration is free for all industry professionals. Scan to find out more and to register.

“We are excited to bring together the waste and recycling industry for the 2024 Waste Expo Australia. We will be raising the bar with an expanded conference program and enhanced exhibitor presence, providing an unparalleled platform for knowledge exchange and networking. We hope to spark meaningful conversations and drive positive change in the industry”.

Sherri Pearson Exhibition Manager

The rebate value matters to the CDS capture rate, it matters to litter reduction, and diversion away from the red bin. Image: Beanykin/shutterstock.com.

Invest in quality machines that are backed by a national parts and service footprint for the ultimate

From material handlers, to trommels, stackers, grinders, screens, dozers and more. Our industry specialists will create a personalised solution for your business. Onetrak, the exclusive national distributor for Fuchs, Tigercat, Anaconda, Dressta, Hidromek and Striker.

Keeping greenhouse emissions under control in landfill environs

By Inside Waste

DR. BEN DEARMAN is first and foremost an environmental pragmatist. He knows that sustainability is key for the waste and resource recovery industry moving forward. His company, Ennovo, is at the forefront of making sure landfills are managed properly with the least impact on the environment.

For seven years, Dearman and his team have knuckled down to find solutions that meet industry and community standards when it comes to landfill management. With a PhD in anaerobic digestion and a thesis titled Anaerobic Digestion of Source-Separated Food Waste Followed by Composting, you could argue he is in the driving seat when it comes to understanding how waste works in landfills.

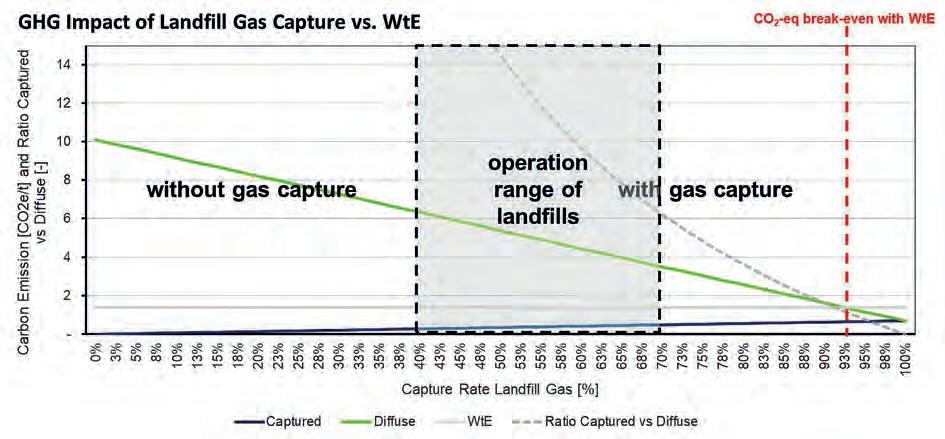

Dearman believes a lot of landfill gas capture enterprises are driven by the amount of power and carbon credits they can generate when capturing the gas and utilising it to create power or flare. He said that while this is an important part of the process, he sees it as a byproduct of what Ennovo is doing, not the principal reason. There are also other issues, such as managing landfill gas emissions and leachate.

“We’re driven by ensuring a very high standard of environmental management is maintained,” he said. “Doing this for the greater good and the environment is important because methane is a very potent greenhouse gas. We are also aware of the role leachate has in the process and how important leachate management is, because not managing it properly can have dire impacts on both groundwater and surface water.”

Dearman said that leachate is pumped out of the landfill, where it either evaporates or is sent to a treatment plant. Once treated, it can be disposed of properly.

One of the main services offered by Ennovo is managing the pumping system. It also offers a cost-effective leachate telemetry system that allows landfill operators to know where the leachate levels are in the landfill and whether the pumps are working properly.

“The telemetry system measures the leachate levels in a landfill,” he said. “There’re strict regulations about how deep that needs to be. Normally it’s only 300mm deep. It has to be in compliance constantly. That’s the beauty of the telemetry system – it’s telling you that

the depth of the leachate in real time, so you’re constantly getting real time data.”

Once a landfill is no longer taking in feedstock, it is capped, and the amount of leachate will abate. Dearman said that in theory, once that happens, the infiltration of the stormwater – which causes the leachate – shouldn’t exceed the evaporation that occurs in that landfill cap.

“To cap it, you can put geotextile membrane over the landfill, and then you can put some soil on top and plant plants,” he said. “Alternatively, it can be a much thicker soil layer, which is called a PhytoCap. They’re quite good to use in southern parts of Australia, but not so good in the tropics because of the amount of rain that occurs.”

Dangers of Landfills

Landfill owners have an obligation to manage their landfills, even legacy ones that have been closed for some time. There is even an argument that the legacy landfills from yesteryear need more attention because they were not subject to the stringent rules that now apply.

“Any owner of a landfill has an environmental duty to manage the environmental impacts,” said Dearman. “There’re legal obligations to manage human health around these sites. In the case of landfill gas, the consequences of it going wrong are quite severe if the gas builds up and enters buildings, and nothing is done about it. People can die. The management of it is incredibly important.”

Dearman said considerations just don’t include fugitive emissions that come out of the cap and have an impact on greenhouse gases – it’s also that lateral migration of the gas; i.e that which goes through the side of the landfill. In worstcase scenarios, this can include gases travelling up into buildings, creating an explosive atmosphere.

And what landfill owners and the general public have to be aware of, said Dearman, is that there are literally thousands of these legacy landfills around Australia. A lot are low risk and will not cause issues, but there are some that need to be managed carefully. Also, a lot of these old landfills, especially those in major cities and regional towns, are covered over with soil and turned into parks or recreational facilities like sports fields and club rooms.

“You’d be surprised at how many sites we’re going around that have sporting club buildings, and we look to detect methane in them,” he said. “And quite often we get a hit.”

Solutions

Dearman said there are several ways landfills can be managed successfully without causing a lot of disruption, while making for a much safer environment. Ennovo’s solutions are varied and include innovative pinwell systems, which are small extraction wells, but capable of mitigating the lateral migration of gas. They pair it up with a Lo-Cal flare to effectively manage the low-quality gas.

Once a landfill is no longer taking in feedstock, it is capped, and the amount of leachate will abate.

Ennovo is driven to ensure a high standard of environmental management is maintained for its clients. Images: Ennovo

“That flare has the ability to combust the landfill gas with a very low concentration of methane,” he said. “This means that it can operate over a long period of time. What the flare is doing is creating a vacuum and always sucking the gases out.”

Ennovo also installs interception

trenches and biofilters around the perimeter of landfills so that, as lateral migration occurs, it can intercept any gas. The company also owns the Gasflux continuous gas analyser technology, which is used on perimeter monitoring wells that surrounds a landfill. This technology detects both gas composition

and borehole flow.

“This means if there’s a positive pressure from the gases coming out of the landfill, we quantify that, and that goes into our landfill gas risk assessment plan,” Dearman said. “This is a well-recognised process for quantifying that risk.”

Legacy

Dearman said a rule of thumb is that once a landfill stops taking waste, it needs to be managed for about 30 years, which happens in stages. He said flaring the gas might be carried out for up to 15 years. Then it’s best to move to a passive system such as cut-off trenches or monitoring. That might happen for the last 10 years, depending on how much gas is being produced.

He said that although a lot of Ennovo’s clients, including councils and large waste management companies, are up to date on leachate and landfill gas requirements when managing a site, there is expertise lacking in some areas.

“That’s why we’ve been able to do quite well because we do know how to marry those technical consulting abilities with really good design and construction capabilities,” he said.

Dearman said one of the key features of Ennovo is that the company is not only

a consultancy, but it is also a supplier and designer of landfill gas management systems.

“When we talk about a particular design, we know if you can physically construct it, build it and operate it,” he said. “We’re not just behind the desk, white collar consultants. We do the full range. We employ people, from excavator operators to people with PhDs writing reports and interrogating data.”

Dearman said that Ennovo is a technology-driven company, and he loves the whole cradle-to-the-grave approach to a project.

“The technology in this space is phenomenal in terms of the speed at which it is developing, and it’s mainly around the detection of methane from landfills,” he said. “A lot of it is coming out of the oil and gas industry, where the ability of drones, fixed-wing aircraft, and satellites can pinpoint sources of methane and also quantify methane being released from point sources – whether it’s an oil and gas field or now landfill. The onus is really on operators to make sure they’re mitigating those emissions that have significant greenhouse gas impacts. That’s where we fit into being able to provide cost-effective solutions for our clients and for the broader benefit, too.”

Once a landfill stops taking waste, it needs to be managed for about 30 years.

*F R OM C ON VE NT I ON A L PLA ST ICS

Join the sustainable revolution at your warehouse—effortlessly!

LANDFILL-BIODEGRADABLE

SUPER DURABLE

AFFORDABLE

NO SHELF LIFE ISSUES

FITS STANDARD EQUIPMENT

SOFT-PLASTICS RECYCLABLE NO MICROPLASTICS

SHOP NO W

Landfilling plastic waste will be here for a while

By Ross Headifen Ph.D

IT IS BECOMING clear that our management of plastic waste is woefully underperforming. We have set targets many years in advance for recyclability, being recycled and recycled content in new products.

However, as we approach these target dates, report after report tells us that we will not only miss the targets but miss them by significant amounts. So much so that recycling of plastics waste has changed little since the targets were set six years ago.

There are some exciting things happening for plastic waste, but their scales are still small for this discussion.

Recent articles on waste management were published citing:

l An additional 650,000 tonnes a year of waste, including plastic, paper, glass, and tyres, will flood Australia’s recycling industry when the full waste export ban comes into effect in mid-2024, according to the Library of Congress. Landfill will likely be the destination for many of the plastics, particularly film, without mechanical drivers for a circular economy.

l The CSIRO says that just a 5 per cent boost to the recycling rate per year would create many jobs and add to the GDP. It also estimates that $100 billion would be required to get recycling rates up to 20-30 per cent

l Australian Packaging Covenant Organisation (APCO) reported recycling problems are clear enough, including that the collection, sorting, and reprocessing of materials, amounting to millions of tonnes of packaging, is uneconomical. It is clear that business as usual will not cut it.

It is interesting to look at some scenarios of plastic waste and the amount that will be recycled per year for the years to come. Australia uses approximately four million tonnes of plastic per year. The consumption of plastic is forecast to grow by at least three per cent per a year, i.e. doubling by 2050 with some saying it will triple (4.2 per cent growth per annum).

To keep plastic waste out of a landfill it has to be:

1) Made part of a circular economy where the plastic waste is returned to manufacturers to make similar products from it.

2) Burned in a waste-to-energy plant, of which there are only two about to commence operations in WA.

3) Repurposed to a use where it will be lost forever, such as road base.

Currently the amount of plastic recycled is claimed to be around 15 per cent. But this included repurposing

of plastic to other end-use functions, which is not the circular economy. The amount that is recycled and returned to original plastic manufacturers is much less.

Assume for this story it is two per cent. Let’s first look at first the business-as-usual situation of recycling increasing at an aspirational five per cent per year over the previous year. Becoming more aggressive, imagine we were able to increase recycling over that of the above by a factor of five year-on-year to 20 per cent increase per year.

Here it assumes that there will always be some residual plastic waste of approximately 20 per cent that will never be recycled, and the recycling rate goes up in line with the usage rate once 80 per cent recycling is reached. This scenario has the actual recycled rate at six per cent by 2030 if we get very optimistic and spend the $100 billion to get recycling up to 20 per cent by 2030. This would require increasing the recycling rate year-on-year by 43 per cent. Given our history this would be a very difficult number to reach.

What these plots graphs (right) show is that there will be considerable blue areas for the next decade or more and still significant blue areas or plastic

“The reprocessing of some materials is uneconomical, which makes it clear that business as usual will not cut it.”

rate compared to

Experienced Practical Experts

Landfill Services

Gas collection system (GCS) design and construct

Carbon credit reporting and management

Data management and reporting

Monitoring and maintenance

Leachate system installation and servicing

Advisory and strategy

Power generator servicing and maintenance

Landfill Products

Mobile flare hire

Lo-cal flare range

High temperature flare range

Gasflux continuous gas analysers

Leachate telemetry systems

Leachate pumps and controllers

Power and heat generation systems

Latest data shows bin targets are a mess

By Inside Waste

THE SOUTHERN Sydney Regional Organisation of Councils (SSROC) has found that data is key to increasing the recovery of household waste and recycling, planning services and education programs.

SSROC has finalised its eighth, and most comprehensive yet, audit of 2,444 households, sampling 7,471 red-, yellowand green-lidded bins to help identify trends in recovery and where further education is needed. In addition, SSROC also audited 698 piles of booked and scheduled clean-up collections to better understand what households throw out and improve recovery of these materials.

SSROC has been coordinating waste audits of kerbside services for its member councils since 1999, with one of the best longitudinal household waste data sets in Australia. In the past year, 11 SSROC councils audited household bins and eight of these councils also audited bulky waste piles.

Outcomes

In the general waste bin (red-lidded bin), loose food waste is the largest individual category at 30 per cent, which is consistent with previous audits.

However, there has been a growing amount of food and liquid left in containers (12 per cent of the red bin) and thrown in the bin, some of these are recyclable containers that if emptied and

placed in the recycling bin could have been recovered.

About 11.6 per cent of general waste is material that should be in the recycling bins, 2.5 per cent is garden organics (GO) that should be in the green waste bin, and 1.2 per cent of general waste is items that should be diverted to e-waste or hazardous waste services provided. While hazardous items only make up 1.2 percent it only takes one battery in a bin to start a fire. Batteries incorrectly thrown into kerbside bins are causing on average three fires a week in NSW.

Overall, the audit showed an increase in the amount of difficult-to-recover materials placed in the red bin including contaminated paper, soft plastics (7.4 per cent), nappies (6.9 per cent) and textiles (4.6 per cent). Fourteen per cent of that 4.6 per cent is wearable clothing that could have been reused instead of thrown away.

These figures highlight the need for greater stewardship of these materials by producers.

The recycling bin mostly consists of recyclable paper (42.5 per cent) and recyclable containers (37.7 per cent), with an average of 19.7 per cent contamination although many councils have lower rates of contamination. Trends data shows that the amount of recoverable material in the recycling bin has declined with the introduction of the NSW Container Deposit Scheme and the digitisation of news, making it harder to increase recovery.

The top five contaminants in the recycling bin include:

1. Bagged material at 4.6 per cent. This includes both bagged garbage at 2.6 per cent, as well as bagged recycling 2 per cent – recycling that is placed in bags into the recycling bin but cannot be separated at the processing facility due to safety risks, so it is classed as contamination whatever the content.

2. Contaminated paper (4.6 per cent) such as wet or soiled paper or cardboard, food takeaway bags.

3. Other plastics. Mostly hard plastics that cannot be recycled, 1.2 per cent.

4. Textiles/carpet (1.2 per cent)

5. Composite materials. Mostly paper, containerised food and liquid, and plastic film all at 0.9 per cent each.

Despite decades of recycling education, we still have a long way to go to get households to place only loose recyclable containers and packaging in the recycling bin and to ensure that products sold in Australia have packaging that can easily be recycled in Australia.

The garden organics bin (green-lidded bin) has consistently been over 96 per cent acceptable vegetation and consistently had a very low contamination rate.

SSROC councils audited clean-up collections in 2014 and again last year,

yet both times the largest component of clean-up waste was furniture representing almost third of clean up piles (28.8 per cent by weight). Fifty-four per cent of this furniture was deemed suitable for reuse had the resident donated, sold or passed on the furniture instead of putting it in the clean-up collection.

The next largest components of clean up piles by weight are wood (12.2 per cent), plastic (6.7 per cent), metal (6.4 per cent), white goods and electrical (5.4 per cent), e-waste (5.3 per cent), paper and cardboard (4.7 per cent), textiles (4.5 per cent), general waste (4.5 per cent), and several smaller categories.

The state government target for household waste is a diversion of 80 per cent materials from landfill. These audits are only a sample at a point in time, yet they show that we are not halfway there with an average diversion rate of 37 per cent.

Even when some of the loose food is recovered through upcoming food and garden organics roll outs, Australia will still be a long way from this target.

“Over time, we can see that the amount of recoverable material has declined yet we have seen an increase in products on the market that cannot be easily repaired or recycled in Australia,” said Helen Sloan, SSROC CEO. “We simply cannot recycle our way out of this mess, and we will not reach diversion targets without major interventions to design waste out of products and packaging.

“If we want to progress to a circular economy, we need the Federal Government to implement tougher measures to ensure that products placed on the Australian market can be recycled and are sold in recyclable packaging.

“We also need incentives for manufacturers and brands to make their products easier to repair and provide convenient take back collections for consumers. This is important for all products but especially bulky ones like furniture, whitegoods and other electrical goods, mattresses and textiles, as these products can’t be recycled easily once placed on the kerb and create safety issues in our streets and roads.”

People are still putting wrong items in bins. Image: Sabelnikova Olga/shutterstock.com.

DELIVERING A GREENER FUTURE

Komptech CEA is a leading supplier of machinery and systems for the treatment of solid waste through mechanical and mechanical biological treatments, as well as the treatment of biomass as a renewable energy source. Komptech CEA is proud to provide innovative solutions for handling waste and biomass.

Komptech CEA’s extensive range of products cover all key processing steps in modern waste handling. At Komptech CEA the focus is always on innovative technology and solutions ensuring maximum benefit to the customer. With local representation throughout Australia and National Parts Distribution Centre Komptechg CEA has the expertise and aftersales support to confidently support your business needs.

Like to know more? why not speak to one of our team today?

SHREDDERS TROMMEL SCREENS STAR SCREENS WINDROW TURNERS

TERMINATOR

Where Function Meets Technology

A slow-running, single-shaft shredder suited to all types of waste.

CRAMBO

Less Fuel, More Power

Ideal for shredding all types of wood and green cuttings.

MULTI STAR

Screening with a Star

Makes waste wood and biomass processing highly efficient.

NEMUS

Robust and Reliable

Combining the practic proven virtues of its predecessors with new solutions for even greater performance.

TOPTURN X

The Ideal Combination of Performance and Design

With a sturdy frame, powerful hydraulics and large drum, the Topturn X is ready to handle any work situation.

HURRIKAN S

Enhancing the quality of the recyclable output.

Providing effective removal of plastic film from screen overflow.

An Inconvenient Truth

By Anne Prince

AS SOMEONE who lives by the mantra, “You can’t manage if you can’t measure”, I’ve been looking at data to inform evidence-based decisions my entire career. Data removes the subjectivity. Many of us like to think we all know the answers, but the most objective way is to let the data do the talking.

The need for robust, current data has never been more relevant to our industry, particularly as the sector moves to larger and more expensive investments with longer payback periods. The stakes have never been higher. If we get it wrong – and we have – it has lasting impacts not only on investors but also on all levels of government supporting the projects with or without financial contributions. The industry takes a collective deep breath, and we all reflect on where we went wrong.

Recently, I took some time to look at a range of our datasets to inform and frame discussions with clients and conference audiences on exactly where we currently stand are, as well as to discuss our options and opportunities for improved outcomes.

If we all believe the data doesn’t lie, then we are all in for a shock with what I’m about to reveal.

The NSW government’s NSW Waste and Sustainable Materials Strategy 2041 contains a set of interim targets, including the reduction of total waste generated per person by 10 per cent and to achieve an 80 per cent average recovery rate from all waste streams by 2030. Looking at a current kerbside bin audit data from 17 metropolitan, regional and rural councils, involving 10,000 bins from 3,500 households in 2022-23 – effectively a snapshot of the state of NSW – we see some interesting challenges emerging.

One thing that does reduce household waste generation is not where you live but what type of housing you live in. Unsurprisingly, our data consistently shows that units and

In some instances food separation exceeds 60 per cent, but data shows, overall, it is a lot less. Image: 2rogan/stock. adobe.com.

apartments generate significantly less waste. Units generate about 10 kilograms per household per week compared to single dwellings, which generate twice that amount, at 20 kilograms per week.

Data shows that units and apartments generate a lot less waste than single dwellings. Image: alexgo. photography/Shutterstock.

Units generate virtually no garden waste and half the amount of recycling. With the push to more urban consolidation and medium-density developments, we might just win the war on waste generation per capita over time from the changing mix of housing stock.

However, achieving 80 per cent recovery is entirely different. Analysing our current kerbside performance, we are achieving an average of 37 per cent with our two-, three- or four-bins systems. Looking at three future possible scenarios, which I’ve called “utopia”, “possible” and “probable”, the data tells us we have some major hurdles ahead.

Utopia scenario

Under my “utopia” scenario, the assumptions are that:

l all households have access to recycling and FOGO services;

l every household separates 100 per cent of all target materials; and

l textiles and CRC items are also separated.

In the utopia scenario, the maximum possible recovery is 66 per cent.

Possible scenario

The assumptions under my “possible” scenario are that:

l we get no improvement in current kerbside systems’ performance based on the fact that if we haven’t got all households separating recyclables and garden organics after 30 and 20 years respectively, it’s not going to happen anytime soon;

l separation of food is 60 per cent; and

l separation of textiles and CRC items is 50 per cent.

The results show the maximum recovery we will get is 49 per cent — a long way short of 80 per cent.

Probable scenario

And just when you thought things

couldn’t get any worse, under my “probable” scenario things do look worse. While we all hear fabulous stories of food separation exceeding 60 per cent, our data tells us a different story. The average food recovery across these 17 councils was 30 per cent. That means there are some high achievers with 70 per cent, but there are more low achievers getting only 15 to 20 per cent, which brings the average down to just 30 per cent as a reality.

Under my “probable” scenario the assumptions are:

l there is no improvement in current kerbside systems’ performance as discussed under the “possible” scenario;

l separation of food is 30 per cent; and

l separation of textiles and CRC items is 30 per cent.

The results show the maximum recovery we will get is 44 per cent, an

even longer way short of 80 per cent. This is 2024 and we are six years away from 2030.

While I think we might make the waste-generation reduction target, I’m convinced, and the data tells me – we have no chance of getting anywhere near 80 per cent recovery. We have to rethink. And while nothing is impossible, business as usual is not going to get us anywhere near 80 per cent. Good public policy should be constantly reviewing data and then responding with supportive research and innovation. This approach is more likely to bring us closer to our targets. We have to ask ourselves: ‘what are the implications and ramifications for sector investment and political fall-out that may follow if we fail to get even close to “utopia”?’

Anne Prince is a director of APC Waste Consultants

UTOPIA SCENARIO

POSSIBLE SCENARIO

PROBABLE SCENARIO

Leading the charge in battery collection

By Inside Waste

IN THE REALM of sustainability and environmental responsibility, Ecobatt, part of the Ecocycle Group, has a network of more than 6,500 battery collection points strategically placed across the nation. Ecobatt provides solutions for consumer convenience and round-the-clock monitored smart sensor technology, offering proper disposal options for all portable batteries. This includes Lithium-ion batteries, which require safe collection and handling processes. This is to minimise physical abuse conditions at kerbside collections because they present a high fire risk for the waste management and recycling sector. The risk of improper disposal of household batteries is a prevalent concern for the industry nationally.

Notably, nearly half of all imported portable battery chemistries are Lithium-based. Ecobatt promotes safe and sustainable end-of-life battery management practices for consumers and industry alike.

A nationwide network