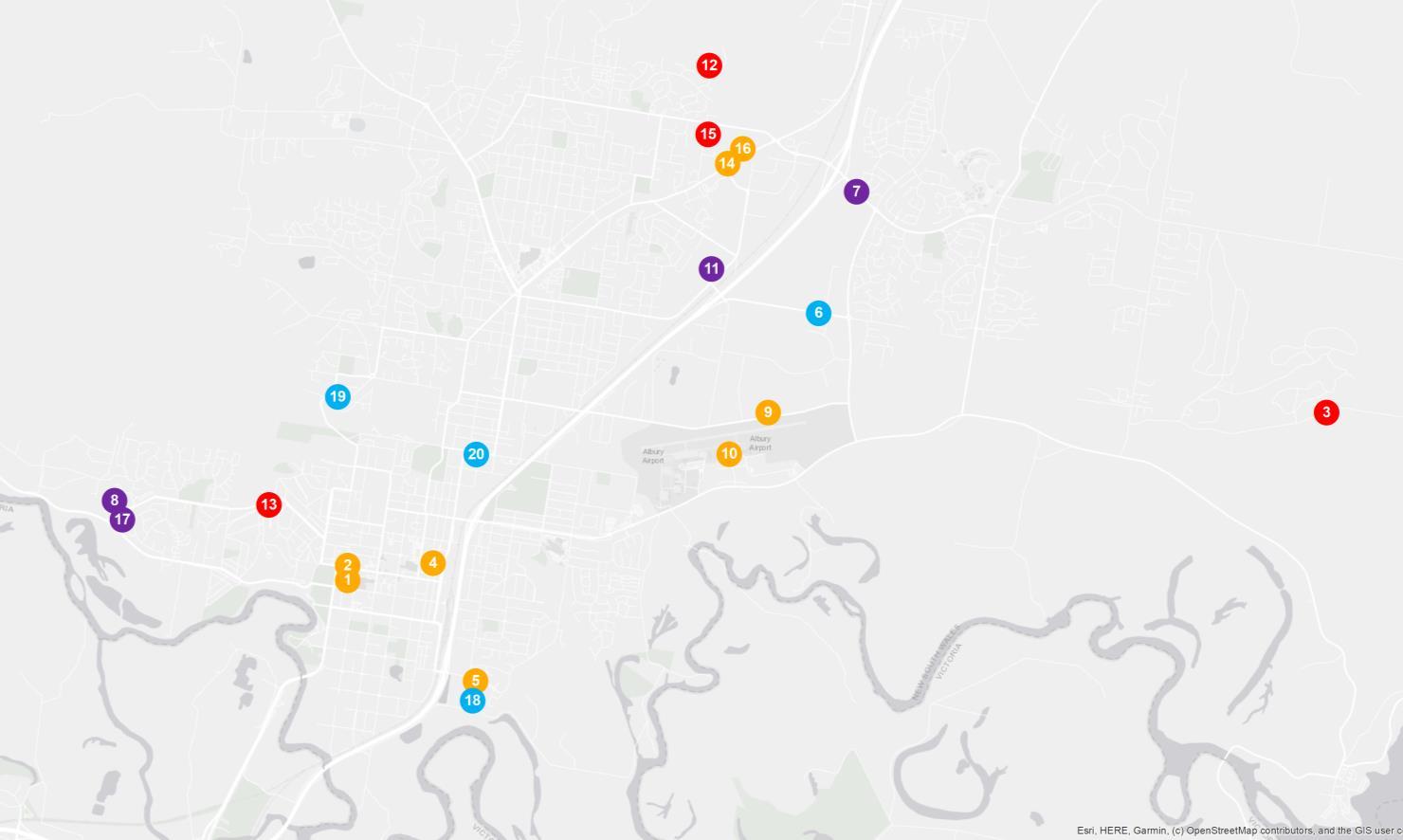

In 2024, which for this report captures sales data between January and December, the median sales price was $1,618 per sqm. This a record high since 2020, reflecting a 39.1% price increase in the past 12 months. During this time, commercial sales declined by -36.4%, to only 7 sales, confirming an undersupply in the commercial market.

Since peaking at 16 sales in 2021, the number of commercial transactions has steadily declined each year. Per sqm prices have nearly doubled compared to 2021, creating a valuable opportunity for owners to capitalize on their investments.

$1,618

Median commercial sale price per sqm in Albury (2024)

Total commercial property sales in Albury (2024) 7

Median industrial sale price per sqm in Albury (2024) $2,357

Total industrial property sales in Albury (2024) 14

The industrial sector recorded 14 transactions in 2024, with a median price of $2,357 per sqm. This represents a significant annual price growth of 28.3% compared to 2023, marking a record high for 2024. This is similar to the commercial market.

Industrial sales volumes also declined since 2021. While the market averaged 17 transactions per year between 2021 and 2023, only 14 sales were recorded in 2024. During this period, the median price per sqm has continued to rise, highlighting a highly competitive industrial market. There are only 5 industrial projects planned in the 1st half 2025, which will answer some of the demand. However, this is not enough, which suggests a further price increase is highly likely.

Note:

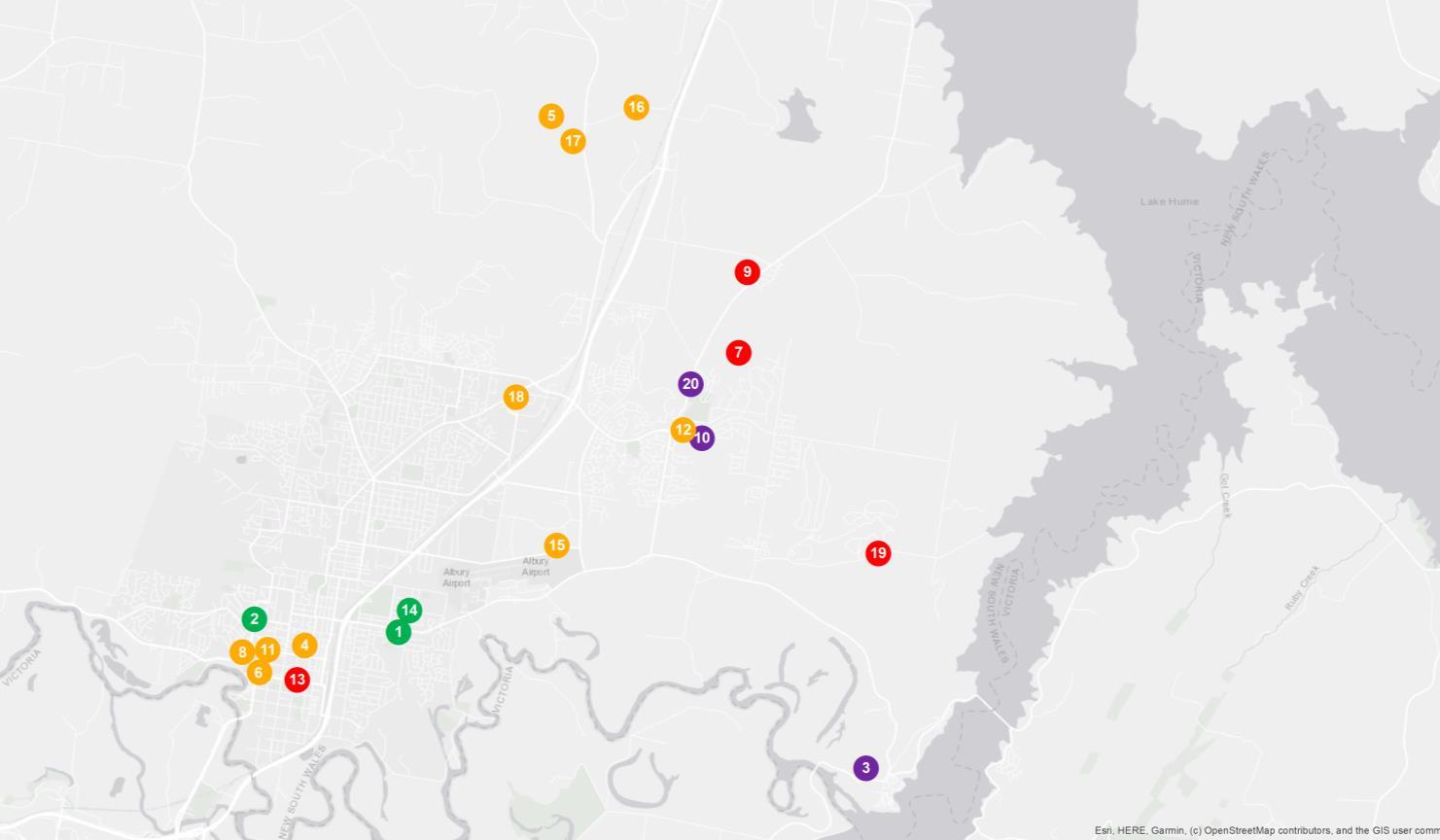

Located approximately 550km south-west of Sydney, the City of Albury is a local government area (LGA) in the Riverina region. It is a vibrant region that includes towns like Albury, Lavington, Thurgoona, and Hamilton Valley. The city of Albury features a diverse economy including agriculture, manufacturing, and retail industries. That said, compared to 5 years ago, the number of commercial and industrial sales have become scarce in 2024, at 7 and 14 sales, respectively.

The following report focuses on these property types specifically, analysing sales and leasing activity since 2020 to 2024. The entirety of 2024 is used for sales data, to provide a long-term view of the market (past 5 years); but quarterly data is used for leasing due to the nature of the rental market. This report analyses future development in 2024-2026, providing holistic understanding of the commercial and industrial markets in Albury.

The median net lease rate for commercial property in Albury* was $160 per sqm in Q4 2024, This is a slightly lower price compared to the past 6 months (Q2 2024, at $186 per sqm) and on a 12 months (Q4 2023, at $209 per sqm). Leasing activity has dropped to a historical low, with only 1 lease recorded in Q4 2024. This aligns with a sharp drop in business confidence, to -3 index points in November 2024 and remained at -2 index points in December 2024. This underscores a broader shift towards a more cautious market sentiment and temporary softer conditions.

$160

Median commercial net lease rate per sqm in Albury (Q4 2024)

That said, the commercial market is now experiencing temporary adjustment. This decline in lease rates aligns with a sharp drop in business confidence, which fell by 8 points to -3 in November 2024 before slightly recovering to -2 in December 2024, underscoring a broader shift toward more cautious market sentiment.

1

$120

Number of quarterly commercial leases in Albury (Q4 2024)

Median industrial net lease rate per sqm in Albury (Q4 2024)

Number of quarterly industrial leases in Albury (Q4 2024) 1

There was only 1 lease activity recorded in the Albury industrial market in Q4 2024, which, like commercial leasing; was the lowest recorded in the past 24months. In contrast to commercial, the median net lease rate per sqm for industrial property was $120 per sqm as of Q4 2024, an annual growth of 32.9% compared to $90 per sqm in Q4 2023. This is also higher than Q3 2024, which commanded $113 per sqm

This notable rise in lease rates can be attributed to a current undersupply, combined with a low number of industrial projects in the 2025 pipeline (when compared to the number of commercial projects planned). This intensified competition among renters, pushing up prices in Q4 2024.

Looking at the whole 2024, a majority, representing 60% of commercial leases, were taken on a Nett basis (based on 15 known leases). This is a continuing trend, which was evident for leases in the past 24months.

The dominant lease type in Albury’s* industrial market proved similar to the commercial market, with 65% of leases being adhered to on a Nett basis (based on 17 known leases).

The average days to let an industrial space has declined significantly in the past 12 months to Q4 2024, by -71.4% (to only 16 days). Comparatively, average days to let was 42 days, a -61.9% decline in the past 12 months. This suggests that even with a lower per-sqm pricing, there is eagerness in the market to secure industrial space for lease.

Albury* will benefit from an estimated $1.4B of planned projects, to commence construction in 2024-2026. 147 major projects are proceeding, which is 99.7% of the original pipeline. This is a significant percentage, considering the recent construction challenges. The majority planned key infrastructure projects, which will improve liveability for residents.

A key mixed-use project in the 1st half 2025 is 470 Wodonga Place & Smollett Street DevelopmentStage 2, which will add 25units to the market; as well as retail and commercial spaces.

Key residential projects in the 1st half 2025 include 710 Riverina Highway & Knoble Road Residential Subdivision – Hilltops (198 land lots) and 793 Pemberton Street Townhouses (3Townhouses).

Townhouses and land lots are the main ready-tosell stock type planned, suggesting an undersupply of stand-alone houses in the short term.

In 2025, total project value has increased across all sectors (compared to 2024), with infrastructure and mixed-use developments seeing the most significant growth. In terms of project numbers, the focus has shifted from infrastructure in 2024 (15 projects) to mixed-use in 2025 (32 projects). These projects enhances liveability for residents and attract more people to the area, ultimately driving higher demand for housing. Growth in the residential sector is high, from 4 to 16 projects in 2025, however most will supply land lots. Thus, an undersupply in ready-to-sell stock remain.

Proceeding Projects: Estimated Value

In the 1st half of 2025, 7 commercial projects are planned, including the Woolworths Thurgoona Supermarket and the Albury-Wodonga private hospital additions. The Plover Street Roadworks Reconstruction ($600M) is the sole infrastructure project planned, aiming to improve local transport and connectivity.

5 industrial projects are planned in the 1st half of 2025, including 147 Corrys Road & Venture Circuit Warehouse ($2.9M) and 46 Ruby Court Storage Units ($805K). These developments aim to answer some of the current undersupply, particularly in the leasing market.

• Advisory and consultancy

• Market analysis including profiling and trends

• Primary qualitative and quantitative research

• Demographic and target market analysis

• Geographic information mapping

• Project analysis including product and pricing recommendations

• Rental and investment return analysis

Access to accurate and objective research is the foundation of all good property decisions.

Our research team is made up of highly qualified researchers who focus solely on propertyanalysis.

Our research services span over every suburb, LGA, and state within Australia; captured in a variety of standard and customised products.