ATHOMECOLORADO.COM

ESTATE

Gabe Bodner

Duane Duggan

Tom Kalinski

Bill Myers

Juli Saris

ADVERTISING CONSULTANTS

Thais Hafer

Toni McNeill

REAL ESTATE ADVERTISING DIRECTOR

Mary Romano

MANAGING EDITORS

Greg Stone

Misty Kaiser

Submit your news or home-related events to gstone@dailycamera.com

To advertise, call 303.473.1456.

A Marketing Feature of

©2023 Prairie Mountain Media.

By Juli Saris CSU Extension Boulder CountyThose of us who have been planting vegetables in our gardens always plant too much for ourselves. Our chest freezers are stuffed, and our pantry is chock-a-block full of jars of tomatoes and pickles. More than we can possibly eat. What to do with all that excess?

Many of us are also just dipping our toes in the garden soil for the first time this season, excited to grow food for ourselves and our neighbors. But how to start? That’s what Grow & Give is all about.

Grow & Give was created and is supported by Colorado State University Extension to address the need for more fresh, locally grown produce grown in home gardens and shared when possible.

Gardeners across the state donate their abundance to neighbors in need, food pantries and food banks, senior facilities and places of worship. In 2021, more than 55,000 pounds of fruits and vegetables were donated from more than 30 counties across Colorado. This level of donation makes a huge difference for families who are struggling to put a healthy dinner on the table.

The educational resources at growandgivecolorado.org are free to everyone, and many are also available in both English and Spanish language versions. Videos,

Boulder Valley School District Plant Sale

Free – May 12, 4-6 p.m.;

May 13, 8 a.m.-4 p.m.;

May 19, 12-6 p.m.

May 20, 8 a.m.-4 p.m. BVSD Greenhouse

6600 Arapahoe Road, Boulder food.bvsd.org/plant-sale

Friends of the Longmont Library Book Sale

$5 – May 11, 13, 9 a.m.-8 p.m.;

to-do lists, ideas for planning your garden or season extension are all available on the user-friendly site. Check out the Colorado Vegetable Guide, which is a comprehensive, crop-by-crop downloadable book that covers planting, pests and harvest — it is so helpful.

Grow & Give also has plenty of solid information about how to harvest and donate your excess produce. Donation labels, an interactive map of local hunger relief organizations and even recipes make giving easy.

May 12, 9 a.m.-5 p.m. Longmont Library

409 Fourth Ave., Longmont longmontcolorado.gov/Home/ Components/Calendar/Event/4983 8/1300?curm=05&cury=2023

Growing Gardens: May Plant Sale

Free – May 14, 20, 21, 8 a.m.-4 p.m. 1630 Hawthorne Ave., Boulder > growinggardens.org/event/ community-plant-sale-weekend-1

The most common vegetables donated were squash, sweet corn and tomatoes, but fruits, vegetables and herbs of all types are welcome. There are so many vegetables that do well here in Colorado and are easy to grow. Radishes, green beans, kale, peppers and spinach are all appreciated. And don’t forget herbs — oregano, cilantro, mint and thyme all do well here in Colorado and will add pizzazz to every vegetable.

And if all you have is a small plot in your back yard or a container on your porch, that’s OK, too — you don’t need a truck farm to participate in Grow and Give. You can donate however much is more than you need; there is no minimum donation. Even one pound of produce can make a difference, so don’t feel shy about this.

So that CSU Extension can design programming to support gardeners, they ask individuals and community gardens to register and track their donations. The timely Grow & Give newsletter will keep you up on gardening topics, too.

Happy gardening, growing and giving.

For more information on this and other topics, visit extension. colostate.edu or contact your local CSU Extension Office.

Boulder Home Professional Happy Hour

Presented by the Boulder Chamber

Free – May 18, 5-6 p.m. 1630 Hawthorne Ave., Boulder > boulderchamber.com

Native Colorado Pollinators

Presented by CSU Master Gardeners

Virtual – May 14, 12 p.m. > lovgov.org/Home/Components/Calendar/ Event/102189/20?curm=6&cury=2023

2022, jumping 5.5 points to 66.8. The percentage of consumers that expect mortgage rates to go down grew to 22%, compared to only 12% last month. However, the combined HPSI components are still a net negative.

TOM KALINSKI

Home buyers nationwide sense a positive change in the air, which can be chalked up to one reason: They expect mortgage rates to drop. Though the U.S. Federal Reserve increased rates in early May, comments from the Chairman of the Federal Reserve suggested a potential hike pause.

“Rates dipped after the news, and economists are expecting mortgage rates to gradually decline over the course of this year and into 2024,” reports Realtor.com. The expectation of falling mortgage rates is enough to make a growing percentage of home buyers feel a lot more optimistic about the housing market, according to a Fannie

Mae poll published Monday.

Fannie Mae surveys consumer sentiments about home purchases each month and then reports its ndings in the Fannie Mae Home Purchase Sentiment Index® (HPSI). In April, the HPSI rose to its highest level since May

Affordability — or the cost of housing — quelled positive sentiment toward homebuying, with only 23% of respondents indicating it’s a good time to buy a home. The continued high home prices “remain the primary reason given by consumers who think it’s a bad time to buy a home,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist.

The home-buying sentiment increase in April “was the largest in over two years, primarily driven by consumers’ more optimistic mortgage rate expectations,” Duncan said.

Those who responded to the survey believe mortgage rates

will fall over the next year, which Duncan says could be due to a combination of factors, “including an awareness of decelerating in ation, market suggestions that monetary conditions will ease in the nottoo-distant future, and, of course, actual mortgage rate declines during the month.”

The share of respondents who said it’s a good time to buy a home rose to 23% in April, increasing 3% over March, while the percentage who say it is a bad time to buy decreased from 79% to 77%. The net share of those who say it is a good time to buy increased by six percentage points month over month.

On the sell side, respondents who say it is a good time to sell a home rose 4%, from 58% to 62%. Those who say it’s a bad time to sell decreased by 2%,

CONTINUED - See Page 18

GREELEY – Effective June 12, 4Rivers Equipment’s Ag division will merge with 21st Century Equipment to create a 26-store organization serving western Nebraska, eastern Colorado, and southeastern Wyoming. 4Rivers Equipment will continue to grow its construction division separately.

This merger, which is subject to approval by John Deere, combines the forces of two leading companies in the industry, creating a stronger, more innovative team that is better positioned to meet the evolving needs of its customers.

The decision to merge was made after careful consideration and with the ultimate goal of enhancing customer service. By combining resources, expertise, and technology, the merged company will be able to provide enhanced support to customers.

“We are excited to announce this merger, which will combine

our complementary strengths and expertise to create a stronger, more diversified company,” Keith Kreps, COO of 21st Century Equipment said. “Together, we will be well positioned to serve our customers and to drive growth and innovation in our industry.”

CEO of 21st Century Equipment Owen Palm added, “This is a huge win for our customers who will now have access to a greater selection of used inventory and parts, while our employees will all benefit from more growth opportunities in the expanded organization.”

4Rivers Equipment’s Chairman of the Board, Mark Romer, is also excited about the merger: “Both teams have tremendous groups of people who have a great focus on what they need to do to take care of customers. What really excites me about the merger is bringing those groups together and getting to a scale where we have more

resources to take care of customers. I think it’s particularly important for technology, training, and for our people as the scale allows us to have more specialization. I look forward to continuing to innovate and grow our Construction and Forestry division as 4Rivers Equipment.”

4Rivers Equipment is pleased to announce that Mike Meth, the longtime General Manager of 4Rivers Ag, will assume the role of Regional Manager over the western region,

which is comprised of the former 4Rivers location. 21st Century Equipment will continue to be headquartered in Scottsbluff, NE. The merger of 4Rivers Equipment Ag and 21st Century Equipment marks a significant milestone in the history of both companies. The two are excited about the future opportunities this merger will bring and look forward to continuing to serve its customers and partners with excellence.

5 Bedrooms • 6 Bathrooms • 6,904 SQFT • $2,650,000

Impressive 2-story in Somerset Estates tucked back on a private cul-desac with gorgeous Long’s Peak Views & adjacent to HOA open space Car aficionado’s will love the 7-car attached and fully finished/heated garage. Seller added an incredible additional 4-car garage with oversized door, floor coating and a bonus 855 SQFT space above the garage that makes the ideal home office, guest suite or studio space.

3

Wonderful townhome backing to expansive open space with mountain views offers plentiful windows, soaring ceilings & tons of natural light in a quiet and private setting. Recent updates include new LVP flooring, paint, light fixtures & blinds 2 bedrooms up with a loft plus a finished lower level with bedroom and bath 2-car oversized garage & great location with easy access to Hwy 36, Superior and extensive trail system.

4 Bedrooms • 3 Bathrooms • 3,635 SQFT • $629,900

Impressive Former Model Home in Summit View Estates has been well maintained and offers an inviting covered front porch and spacious open floor plan. The ranch-style home offers 1800 SQFT of main floor living, generous sized kitchen with large center island & stainless appliances & main floor primary suite w/ direct access to private back patio

Professionally finished basement w/ family room, bar, bedroom & bath

5 Bedrooms • 3 Bathrooms • 3,375 SQFT • $1,800,000

Impeccably maintained & meticulously restored charming 1910 bungalow sits on an oversized 1/3 ACRE lot with a 2-car detached garage & studio space. The traditional floorplan offers extensive wood flooring, updated kitchen and baths, newer windows, light fixtures, & paint The finished basement has a separate outdoor entrance, 3 bedrooms, bath & small kitchenette that could be used as a short-term rental

Open Sat. 12-2pm $895,000

Multi-level 6bd/3ba. Great views and privacy!

w w w 3312.wkre.com

Jim Green: 303-775-2553

911 High Mountain Drive Berthoud

Open Sat. 1-3pm $1,799,999

New Custom Home 2 acres. Incredible Views!

w w w 911 wkre.com

Janet Borchert: 720-564-6034

Open Sat. 12-2pm $850,000

Spacious Nor th Boulder End Unit Townhome

w w w 3177 wkre.com

Liz Benson: 303-589-8957

Open Sat. 12-3pm $1,370,000

Stunning modern townhome. w w w.1225.wkre.com

Ardee Imerman: 303-946-5458

Open Sat. 11am-2pm $1,699,000

Gorgeous, fully remodeled modern home w w w.7150.wkre.com

Beth Goltz: 303-570-9906

Open Sat. 12-2pm $1,370,000

Fantastic custom built craftsman home w w w.1413 .wkre.com

Eric Wright: 303-883-7245

New Listing! $670,000

Great value in Meadow Glen neighborhood!

w w w.1085-1.wkre.com

Jen Rutherford: 720-388-9818

New Listing! $665,000

Spacious townhome in the quiet Meadow Glen.

w w w 1085 wkre.com

Jen Rutherford: 720-388-9818

BOULDER OFFICE: 303 .443 .2240

LONGMONT OFFICE: 303 776 3344 wkre.com

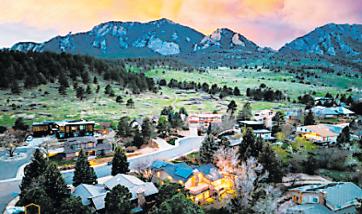

New Listing! $995,000

All the best that mountain living offers. w w w.560.wkre.com

Dan Kingdom: 303-541-1924

Thrive Home Builders Patio & Cour tyard Homes

T W O N E W

M O D E L S

N O W O P E N

3004 Helmsman St For t Collins, CO 80524

L i v e a s g o o d a s h e a l t hy f e e l s

.

W e l c o m e to S o n d e r s F o r t C o l l i n s , a n e w h o m e c o m m u n i t y t h a t ’s l i f e - e n l i v e n i n g a n d l i f e - e n r i c h i n g W h e r e l i f e - l o n g l e a r n i n g , h e a l t h a n d w e l l n e s s , s o c i a l c o n n e c t i o n s , a n d o u r s h a r e d a p p r e c i a t i o n f o r n a t u r e a r e f r o n t a n d c e n t e r

L o w - m a i n t e n a n c e , s i n g l e - l e v e l l i v i n g n e w h o m e s f r o m B r i d g e w a t e r H o m e s

a n d T h r i v e H o m e B u i l d e r s

N e w h o m e s f r o m t h e h i g h $ 5 0 0 s | S i x m o d e l s n o w o p e n

L i m i t e d n u m b e r o f w a t e r s i d e c u s t o m h o m e s i t e s f r o m t h e m i d $ 5 0 0 s

S O N D E R S F O R T C O L L I N S C O M

© 2 0 2 3 W a t e r s ’ E d g e D e v e l o p m e n t s I n c A l l p r i c i n g , p r o d u c t s p e c i f i c a t i o n s p l a n n e d a m e n i t i e s l a n d s c a p i n g a n d t i m i n g i s s u b j e c t t o c h a n g e w i t h o u t p r i o r n o t i c e

By Cathy Hobbs Tribune News Service (TNS)

By Cathy Hobbs Tribune News Service (TNS)

From slipcovers to painted floors and reclaimed wood, no clear style may define what some consider “countryinspired decor.” But infusing country elements with a modern edge is becoming more popular in the design world. The result is furniture that is often handcrafted by artisans as well as decorative elements that are often vintage or even salvaged.

Here’s our guide to bringing modern country style into your space.

Salvage yards can often be a treasure trove of fabulous finds, from old doors to furniture, kitchen cabinets and more.

When looking to buy salvage, here are some tips that can assist in your search:

Go online. In many instances, a salvage yard will have photographs of their inventory online, so you can preselect before making a trip.

Compare pricing. Many businesses that sell salvage are reselling items that have been donated to them, while others are reselling items they purchased. You will likely snag a bargain either way, but it helps to know your bargaining power.

Visit on delivery day. Nothing beats an opportunity to secure new

merchandise before it is snapped up.

One of the main appeals of countryinspired furniture and accessories is its old look and feel. When looking for decor opportunities, consider using old items in unusual or unexpected ways.

Looking for ideas? Consider these tips.

Old doorknobs come in all different shapes and sizes and can be used for everything from door pulls to creating an interesting wall feature in which you can hang floral arrangements or dried herbs.

Mason jars remain purposeful and useful in a number of different ways around the home, and they can also be repurposed and used in home decor. Some ideas include: painting them muted colors, rubbing them with a sanding block to make them appear old, wrapping portions of the

jar with twine or filling with moss and topping with a succulent, using the mason jar as more of a vase.

Dried flowers aren’t the only natureinspired option for those looking for country-inspired decor. Other ideas include hanging dried herbs or lavender. The look is organic and attractive with long-lasting fragrance.

Succulents are not only hardy but versatile. Try placing succulents on a small bed of stones or embedded in moss for a modern look. Succulents look especially attractive when paired with natural elements such as wood and branches.

Cathy Hobbs is an Emmy Awardwinning television host and a nationally known interior design home staging expert and shortterm rental/vacation home designer. Contact her at info@ cathyhobbs.com or visit her website at cathyhobbs.com.

Many people, especially first-time home buyers, are interested in the ongoing debate about buying or renting a home. Both options have advantages and disadvantages that make the decision difficult. To make an informed choice, it’s crucial to comprehend mortgage payments and other expenses related to homeownership. This article will aim to offer valuable insights to assist you in evaluating your options and deciding on the best course of action for your financial situation and future objectives.

BILL MYERSPurchasing your first home can be challenging, from amassing enough savings for a down payment to comprehending mortgage loans. It’s crucial to evaluate your financial situation and credit score upfront. It’s wise to seek guidance from a financial advisor to ensure you’re on solid ground before taking the plunge into homeownership. They can advise you on how much money you need to save for your home purchase and guide you through the process.

If you are considering mortgages, there are different types of loans available: Conventional, Federal Housing Administration (FHA), Veterans Affairs (VA), and U.S. Department of Agriculture (USDA) loans. These loans have different requirements, down payment amounts, interest rates, and eligibility criteria. To determine your creditworthiness, mortgage lenders assess your credit score, debt-toincome ratio, and employment history. It is essential to shop around for the best mortgage loan, as it can lead to significant savings in the long term.

When it comes to the cost of homeownership, your monthly

mortgage payment is just one of many factors to consider. This payment usually covers principal, interest, property taxes, and homeowners insurance. Buy a property in a community that requires it. You may also have to pay Homeowners Association (HOA) fees. In addition to your mortgage, you’ll need to budget for closing, appraisal, and origination fees. Planning for future home repairs and maintenance expenses is essential. Hence, you have enough money set aside for these inevitable costs.

The amount needed for a down payment depends on the home’s purchase price and the type of loan you choose. Strategies to save for a down payment include opening high-yield savings or money market accounts offering higher interest rates than traditional savings or checking accounts. Balancing your financial goals, such as saving for a down payment and repaying student loans or credit card debt, is crucial.

Down payment assistance options may be available to help first-time buyers, such as family members offering financial support, grants, or government programs like Fannie Mae or Freddie Mac.

Choosing the appropriate mortgage type to meet your financial objectives is vital. If you have surplus funds, you should pay off high-interest debt or increase your down payment, which will reduce your monthly payments. To maintain financial stability throughout homeownership,

it’s critical to have an emergency fund and cash reserves. Use a mortgage calculator to estimate your monthly payments and interest, which will assist you in planning accordingly.

When buying a home, there are many costs beyond the purchase price. Some of these costs include home inspection, title insurance, and real estate agent fees. You may also need to set up an escrow account to cover real estate taxes and homeowners insurance, which can increase your monthly payment. Additionally, there are other fees, like appraisal and origination fees, that you’ll need to pay when closing on the home. Budgeting for other expenses, such as buying furniture and appliances and covering any necessary repairs, is essential. These expenses can add up quickly once you move into your new home.

Owning a home has many advantages, including building equity, enjoying lower interest rates, and taking advantage of mortgage interest deductions. Additionally, the potential for property value appreciation can contribute to long-term wealth. Homeownership can provide financial stability and freedom, making it a sound investment for many individuals. However, renting may be a better option for some people. Renting provides flexibility and mobility, ideal for those anticipating job or lifestyle changes.

Additionally, it requires less

upfront costs as renters typically only need to provide a security deposit and first month’s rent, as opposed to the large down payment required when purchasing a home. Renting involves less responsibility for home repairs and maintenance, as the landlord usually handles these issues. Finally, renting lets you focus on managing debt and improving your credit score.

If you are considering buying a home, it’s essential to establish a solid financial footing first. This includes paying off high-interest debts, saving money for unexpected expenses, and improving your credit score. It can also be helpful to seek advice from experienced professionals in the real estate industry, such as agents and mortgage lenders, to make the home-buying process smoother. Additionally, understanding your responsibilities as a homeowner, such as maintaining and repairing your property, and paying property taxes and homeowners association fees, will prepare you for homeownership challenges.

Deciding whether to buy or rent a home is a crucial choice that requires thoughtful evaluation of your finances, lifestyle, and plans. To make the right decision, focus on establishing financial stability, learning about the home-buying process, and seeking advice from trustworthy experts. Remember to prioritize your financial health and long-term goals regardless of your choice.

Naturally kind and friendly, Bill loves interacting with people of all walks of life. With a fishing rod in his hand & a whistle he enjoys walking local streams, biking with wife Natalie & singing songs of childhood. Eager to share his experiences & knowledge of real estate he is deeply versed in home, commercial & land or exchanging his tag line is “Creative & Solution Based Real Estate ~ serving Coloradans for nearly 45 years”. His desire is to enrich the lives of people he’s in contact with. Call Bill at 970.599.0011 or e-mail billmyersrealtor.com.

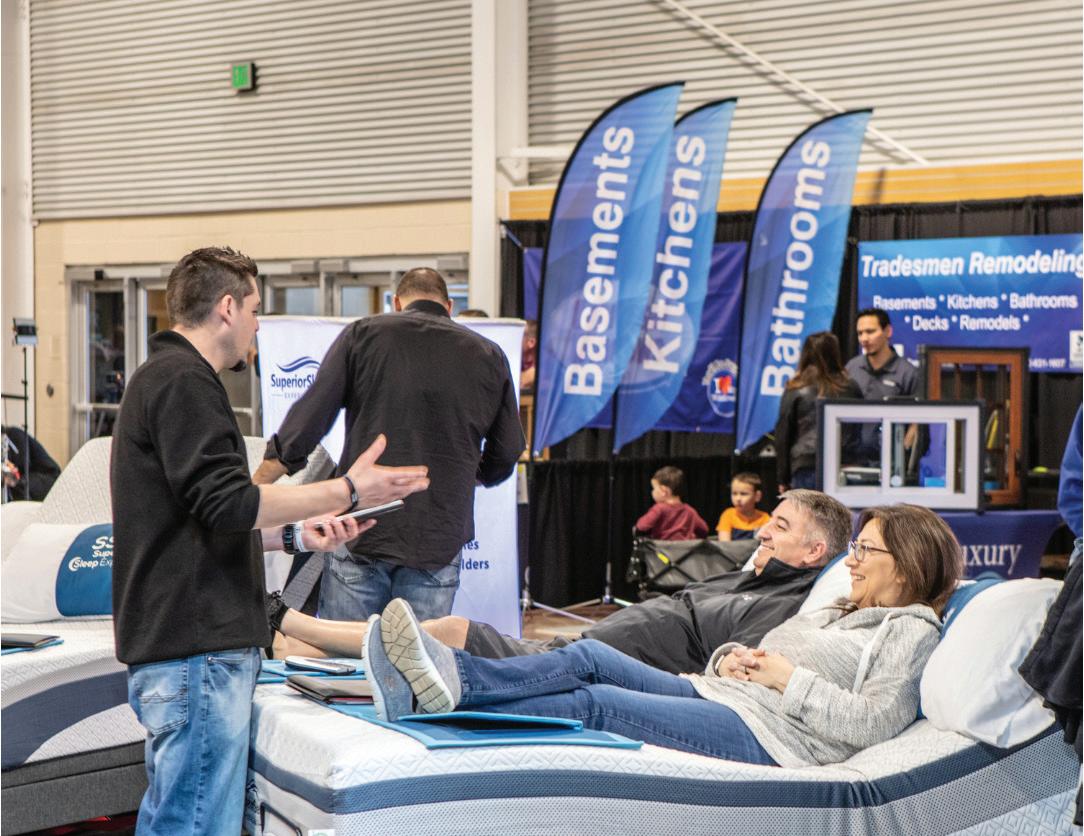

Spring brings new beginnings. It’s a season of growth and new life. As the days and grass get longer, many homeowners embark upon the tradition of spring cleaning. From boosting the curb appeal with landscaping and deck maintenance to tackling home improvement projects that were sitting on the back burner, spring often inspires people to brighten their space just in time for summer.

e 2023 Northern Colorado Home Builders Association Home & Remodeling Show is the perfect place to jumpstart your spring cleaning and get inspired. e Home Show takes place May 12-14, 2023 at e Ranch at the

Larimer County Fairgrounds and Events Complex. Doors are open Friday, May 12, noon to 6 p.m., Saturday, May 13, 10 a.m. to 6 p.m., and Sunday, May 14, 10 a.m. to 4 p.m. Admission is free to all. ousands of Northern Coloradoans attend this exciting annual event. Dozens of local business owners will be on hand showcasing their products and services. It’s your chance to get hands-on and see the latest home and garden trends, ask the experts questions, shop for products and nd the right t for your next project. e Home Show is sponsored by American Legend Homes, Hartford Homes, the Better Business Bureau, Element

Flooring and Design Center, ServPro of Fort Collins, At Home Colorado and iHeart radio stations Big 97.9, 92.9 e Bear and KBPI 107.9.

e Home & Remodeling Show also features exciting giveaways and seminars. Be one of the rst attendees to enter the doors each day for an opportunity to snag a free toolkit.

Take a break from exploring the show oor and attend one of the many seminars. Show seminars will cover a wide range of topics. It’s your chance to learn about the latest trends, home security and technology, and get how-to advice from the experts.

Be sure to take the time to

swing by the Home Show Yard Sale. Local businesses generously donated new and gently used tools, and other construction materials for customers to purchase at a heavily discounted rate. is is one Yard Sale you shouldn’t feel guilty about going on a shopping spree. Proceeds from the Yard Sale will bene t the NoCo HBA Foundation, which is NoCo HBA’s charitable arm. e NoCo HBA Foundation partners with NoCo HBA members and other local organizations to fund community projects across Northern Colorado and support people in need.

e Home Show is meant to be a convenient place for homeowners to nd reliable help. e Home

Show features professional designers, remodelers and specialty contractors. All NoCo HBA member-vendors are licensed and bonded professionals. is gives the consumer peace of mind and an added level of security knowing anyone you meet is a vetted professional held to the highest standards.

NoCo HBA is an organization of residential construction and related professionals who are dedicated to high ethical standards. Members aim to raise the pro le of the building industry and help their neighbors in Northern Colorado thrive. NoCo HBA was charted in 1967. Members also belong to the Colorado Association of Home Builders and the National Association of Home Builders. NoCo HBA represents every segment of the residential building industry across 54 municipalities and eight counties including Greeley, Loveland, Windsor, Fort Collins, and the surrounding areas.

NoCo HBA is best known by the public for its annual events like the Home & Remodeling Show and Parade of Homes, which takes place in the fall. e awardwinning Northern Colorado Parade of Homes is the premiere new construction open house event of the year. It’s an opportunity for people to see the latest innovations in new construction and check out new neighborhoods popping up across the area. ese annual events are designed to help inspire homeowners while also showcasing the craft and commitment of

industry professionals, and raising awareness of its members.

e U.S. housing market has taken NoCo HBA members and homeowners on a wild ride over the past few years. Starting in 2020, the pandemic shifted how people looked at their space. Many homeowners moved out of metropolitan areas in favor of life in a more rural setting. Remote work grew in popularity which created a demand for space in the home to be turned into o ces. Meanwhile, all the changing demands, shutdowns, regulations and restrictions created a dynamic housing market. Record-low

mortgage interest rates prompted a lot of people to buy and were able to get into the home of their dreams. Yet, homeowners also faced home, supply and labor shortages which slowed down new construction times, hampered remodels and created erce competition in the housing market. is dynamic market has started to even out. A lot of the bidding wars are over, inventory is slowing returning to the market, many of the supply shortages are over and mortgage interest rates are rising. ere are mixed predictions as to what’s ahead, but experts don’t expect a housing market crash like

the Great Recession of 2008. NoCo HBA is committed to maintaining a thriving housing market in Northern Colorado. rough education and advocacy, the organization helps members and homeowners. e Home & Remodeling Show is the perfect way to spend Mother’s Day weekend and stay out of the rain.

Find the support you need to complete your next project or get ideas for an upcoming DIY project. With professional designers, remodelers, and specialty contractors the NoCo Home Show is your one-stop shop this Spring.

Fri., May 12, 12-6 p.m. Sat., May 13, 10 a.m.-6 p.m. Sun., May 14, 10 a.m.-4 p.m.

The Ranch Larimer County Fairgrounds and Events Complex

Admission is free

nocohba.com/home-show

TIMNATH – Thirty-six students from Thompson Career Campus in Loveland took part in a work-based learning event hosted by Hartford Homes in Timnath on Thursday.

These students, participants in the Careers in Construction program at TCC sponsored by Northern Colorado Home Builders Association, are enrolled in a pre-apprenticeship certification program designed to prepare them for careers in residential construction. Students in the program earn Department of Labor recognized certificates as well as a 10-hour OSHA workplace safety certification, all while earning their high school diplomas.

The program is designed to be experiential in nature, not just academic. At the work-based learning event, students gained firsthand experience of the construction workplace, participating in handson learning activities supervised by industry professionals.

TCC’s construction students, along with 2,400 of their peers statewide, will soon graduate into one of the hottest job markets for construction workers and tradesmen in a generation. With 40% of all electricians approaching retirement age in the next decade, for example, opportunities have never been more abundant for young, industrious workers willing to strap on a tool belt and build the next generation of Colorado homes.

I recently spoke to a financial advisor about a client’s retirement plan that I wanted to share with you. The situation is such that the client is getting ready to retire and he was looking at ways to reduce his expenses to ensure that his retirement income and his retirement accounts would be setup in a way that he would be able to meet all his financial obligations and still be able to have some fun in retirement.

As we started to dive into this client’s financial picture, it was clear that this client’s income was going to be less in retirement since he was not going to be receiving a pension and he was only going to be receiving social security income. Additionally, this client had done a very good job of saving and had a significant amount of money saved in his portfolio and he also owns a home

with a lot of home equity.

As we started to investigate this client’s situation, the financial advisor told me that the client decided to pay off his mortgage to eliminate the mortgage payment which was just under $2,000 per month as that was his largest monthly expense. It was at that moment that I raised the question, why would someone do that? The financial advisor then simply said that was the simple solution to reduce his monthly expenses. I then asked to clarify, so you are saying that the client took $400,000 out of his portfolio which was producing a solid 6% return on investment (which is over $24,671 annually), to save less than $24,000 of annual expenses? Plus, the $400,000 in the portfolio is not only producing a decent rate of return but when the client took out the money to pay off the mortgage, he was forced to pay over $50,000 in taxes, which means he needed to pull out over $450,000 from his portfolio.

So, I got back to the basic question, why would someone take hundreds of thousands of dollars (in this case it was $450,000) out of their

portfolio to pay off a mortgage? I realized at that point it was just the simple solution, it was like hitting the “easy” button”. However, after doing the math and running the numbers, the simple solution was not the best solution. The reality is that the money was producing a better rate of return in the portfolio annually than the mortgage was even costing the client each year. Additionally, if the client really wanted to reduce expenses in retirement, it would have been just as easy and achieved the same goal by utilizing a Home Equity Conversion Mortgage (HECM). The client could have gotten a HECM to payoff the mortgage and eliminate his need for making a mortgage payment (you are still required to pay the property taxes, homeowner’s insurance and maintain the home) and this would have not only reduced his monthly expenses but it would have allowed him to keep the $450,000 in his portfolio, continuing to earn a return on his investment and not have to pay the $50K in taxes. Is this a little more complicated than just paying off the mortgage?

Maybe, but it would create a far better financial outcome for this client as the client would have had more money in his portfolio to use in retirement. Now this client simply has more equity, which he cannot use in retirement and less cash. However, if this client wants to get a HECM now, he still can which will allow his access to some of the equity in his home and convert the equity back to cash. It is also important to note that this is just an illustration and this same math could be applied to a situation with a lesser mortgage balance as well and achieve a similar outcome.

Gabe Bodner is a retirement mortgage planner and licensed mortgage originator in Colorado. Gabe utilizes the latest research from the top researchers to assist his clients to live for today and plan for tomorrow. To reach Gabe, call 720.600.4870, e-mail gabe@bodnerteam.com or visit reversemortgagesco.com.

To view a more cities and a more complete list of new home communities and builders across the Colorado Front Range, view our interactive map online at: www AtHomeColorado com/NewHomeMap

ur region is home to more than 700,000 residents and includes some of the most diverse, natural landscapes and sustainable development along the Northern Front Range of Colorado It’s no wonder why those who live here stay and why our the area is coveted as a place to relocate to Here we highlight a selection of the area ’ s new home communities and which builders are building where

Farmstead

Builder: Sage Homes

Rose Farm Acres

Builder: Richmond American

Heron Lakes –

TPC Colorado

Builder: Landmark Homes, Lifestyle Custom Homes, Toll Brothers

Velo Condos

Builder: Thistle Velo LLC

Baseline Colorado

Builders: Boulder Creek

Neighborhoods, Meritage Homes, Thrive Home Builders

Vive on Via Varra

Builder: Meritage Homes

Coal Creek Commons

Builder: Century Communities

Colliers Hill

Builders: Boulder Creek

Neighborhoods, KB Home, Richmond American

Compass Builder: Lennar

Erie Highlands

Builder: Oakwood Homes

Erie Village Builder: Porchfront Homes

Flatiron Meadows

Builder: KB Home, Taylor Morrison, Toll Brothers

Morgan Hill Builder: Lennar

Rex Ranch

Builder: Taylor Morrison

Westerly

Builder: McStain Neighborhoods, SLC Homes Wonderland Homes

Wild Rose Builder: Lennar

Barefoot Lakes

Builder: Brookfield Residential, Creekstone Homes, Lennar, Richmond American Homes

Seasons at Silverstone

Builder: Richmond American Homes

Northridge Trails Townhomes

Builder: Hartford Homes

Promontory

Builder: Journey Homes

Park House Thompson River Ranch

Builder: Oakwood Homes

The Ridge at Johnstown

Builder: Bridgewater Homes

Pintail Commons at Johnstown Village

Builder: Richfield Homes

Mountain View Builder: Baessler Homes

Blue Sage

Builder: Markel Homes

Avalon Meadows

Builder: Von’s Colorado Concepts

Silo

Builder: Cornerstone Homes

Silver Creek

Builder: Markel Homes

Highlands at Fox Hill

Builders: Dream Finders Homes, Landmark Homes

Terry Street Townhones

Builder: New Leaf Properties

LOUISVILLE

North End

Builder: Markel Homes

The Enclave at Dakota Glen

Builder: Glen Homes

The Enclave at Mariana Butte

Builder: American Legend Homes

Eagle Brook Meadows

Builder: Bridgewater Homes, Challenger Homes

The Lakes at Centerra

Builder: Bridgewater Homes, Landmark Homes, KB Home

Kinston at Centerra

Builder: Richmond American Homes, Dream Finders Homes

Brookstone

Builder: Windmill Homes

Sunfield

Builder: Windmill Homes

Downtown Superior

Builder: Thrive Home Builders, Remington Homes

Heights at Downtown Superior

Builder: Toll Brothers

Lanterns at Rock Creek

Builder: Boulder Creek

Neighborhoods

Montmere at

Autrey Shores

Builder: Koelbel

Rogers Farm

Builder: Boulder Creek

Neighborhoods

Harmony Builder: Landmark Homes

Serratoga Falls

Builder: American Legend Homes, Richmond American Homes

Timnath Lakes Builder: Toll Brothers

Trailside

Builder: Wonderland Homes

Wildwing Patio Homes

Builder: Hartford Homes

Country Farms Village

Builder: Landmark Homes

Greenspire

Builder: Windmill Homes

RainDance

Builder: American Legend Homes, Hartford Homes, Wonderland Homes

Seasons at Hunters Crossing

Builder: Richmond American Homes

Vernazza Builder: Landmark Homes

Village East Builder: Journey Homes

“We originally thought we did not need an agent to help us with our new home purchase and after several months of frustration, a friend suggested we contact Mar y at Boulder Home Source, within a month she helped us find the perfect new build and negotiated a lower rate and upgrades that we never expected ” The Smiths

Well cared for 1200sf ranch on a cul-de-sac and open space. 3BR + studio/office, 1-car garage, shed. Fully fenced,

dropping from 40% to 38%.

Home prices continue to drag home buying, and more survey respondents expect home prices to go up in the next 12 months. The rise over March was 5%, going from 32% to 37%, while the percentage who say home prices will go down increased from 31% to 32%.

Duncan said April’s optimism may not continue since consumers report “uncertainty about the direction of home prices.” The median price of an existing home nationwide was $375,700, as the National Realtors Association reported in April. A new home was $449,800, according to the Census Bureau.

“Until affordability improves for a larger swath of the homebuying public,” Duncan added, “we believe home sales will remain subdued compared to previous years.”

The U.S. Federal Reserve have

increased interest rates 10 times over the past 14 months, causing mortgage rates to more than double.

Read more at:

• realtor.com/news/trends/ potential-home-buyers-aremore-optimistic-on-housingmarket-for-one-big-reasonfannie-mae-says/

• fanniemae.com/researchand-insights/surveys-indices/ national-housing-survey

Tom Kalinski is the broker/owner of RE/MAX of Boulder, the local residential real estate company he established in 1977. He was inducted into Boulder County’s Business Hall of Fame in 2016 and has a 40-year background in commercial and residential real estate. For questions, email Tom at tomkalinski33@gmail.com, call 303.441.5620, or visit boulderco.com.

Boulder has a rich history and residents actively want to preserve aspects of that past. In 1974, the City of Boulder created the Historic Preservation Program in response to a citizen-driven effort to recognize and protect buildings and sites important to Boulder’s history. Initially, five individual landmarks were designated, and in 1978 Floral Park was the first historic district established within the city. Since the beginning of the program, more than 1,300 properties have been preserved including nearly 200 individual landmarks and 10 historic districts.

In May of each year, we celebrate our history with Archaeology and Historic Preservation Month. In Boulder on May 15, there will be a reception and program starting at 6 p.m. acknowledging owners of recently designated landmarks, local authors, and award recipients, all of whom have made contributions to Historic Preservation in Boulder County. This event is free and open to the public and will be held at Chautauqua Community House, 301 Morning glory Drive, Boulder. For more information about the event, go to: bouldercolorado.gov/ events/31st-annual-square-nailawards-ceremony.

The historic preservation program is made of up of several parts:

The Landmark Designation’s purpose is to honor, preserve, and protect buildings and areas that showcase Boulder’s past. Targeted properties are those of historic, architectural, and aesthetic value. You can search

for designated properties by address on the city’s website at: bouldercounty.gov/propertyand-land/land-use/historicpreservation/designated-historicsites.

When someone owns a property over 50 years old and would like to tear it down to build something new, the demolition permit requires approval from the Historic Preservation program. The Demolition Review process is intended to avoid the loss of buildings that have significant historical value.

If a property is an individual landmark or located in an historic district, and the owner desires to make exterior changes, a review by the Landmarks Board is required before alterations can be made. If approved, the owner is issued a Landmark Alteration Certificate. The intent of the design review is to ensure that the proposed changes won’t destroy the historical significance for which

the property was originally landmarked.

Established Design Guidelines benefit both the owner of the landmarked property and the Landmarks Board. The owner can use the guidelines for ideas on improving the property while maintaining the historic nature of the property. The Landmark Board uses the guidelines as a framework for their decisions in the Design Review approval process.

In addition to the City of Boulder’s desire to preserve its historic places, there is also a national program that recognizes these sites: The National Register of Historic Places. The National Registry began in 1966, authorized by the National Historic Preservation Act. Boulder has some very special places listed on this registry, with the headliner being the Colorado Chautauqua, designated as a National

Historic Landmark and one of 25 properties so designated in the state of Colorado. Other properties on the National Registry are the Arnett-Fuller House at 646 Pearl, Highland School at 885 Arapahoe, Carnegie Library at 1125 Pine, Boulderado Hotel at 2115 13th, Mt. St. Gertrude’s Academy at 970 Aurora, and the Downtown Boulder Historic District.

Learn more at: bouldercounty.gov/propertyand-land/land-use/historicpreservation.

If you are interested in finding out about the past details of your historic home, the Carnegie Library in Boulder has digital records of the Historic Home Inventory and a wealth of information.

Duane has been a Realtor since 1982. Living the life of a Realtor and being immersed in real estate led to the inception of his book, Realtor for Life. For questions, e-mail DuaneDuggan@boulderco.com, call 303.441.5611 or visit boulderco.com.

BERTHOUD

3312 Meining Road

$895,000

Sat., 12 p.m.-2 p.m.

Cynthia Hogarth

WK Real Estate

(303) 579-4884

BERTHOUD 911 High Mountain Drive

$1,799,999

Sat., 1 p.m.-3 p.m.

Dennis Culver

WK Real Estate (303) 618-3366

BOULDER

3177 Westwood Court

$850,000

Sat., 12 p.m.-2 p.m.

Matthew Jensen

WK Real Estate (303) 819-6494

315 Arapahoe Ave., #202

$860,000

Sun., 1 p.m.-3 p.m.

Jillian Fowler

Coldwell Banker (303) 884-2032

3301 Arapahoe Ave., E-122

$925,000 Sun., 1 p.m.-3 p.m.

Suzy Williamson

RE/MAX Alliance

(720) 491-9885

1007 Tantra Park Circle

$1,000,000

Sat., 11 a.m.-1 p.m.

Steve Altermatt

RE/MAX of Boulder

(303) 441-5669

5318 5th St., Unit F

$1,365,000

Sat., 10 a.m.-2 p.m.

Donald Cicchillo

RE/MAX Alliance

(303) 875-2241

1225 Kalmia Ave.

$1,370,000

Sat., 12 p.m.-3 p.m.

Dana Runge

WK Real Estate

(303) 883-7245

448 Pearl St.

$1,539,000

Sat., 11 a.m.-2 p.m.

Digger Braymiller

RE/MAX of Boulder

(720) 234-6390

3888 Saint Vincent Place

$1,595,000

Sat., 11 a.m.-3 p.m.

Lynn Ryan

RE/MAX of Boulder

(303) 489-0309

7150 Cedarwood Circle

$1,699,000

Sat., 11 a.m.-2 p.m.

Kate Kelley

WK Real Estate

(303) 775-9250

536 Maxwell Ave.

$1,750,000

Sat., 1 p.m.-3 p.m.

Marybeth Emerson

Slifer Smith & Frampton

(720) 394-1997

935 11th St.

$2,350,000

Fri., 11 a.m.-3 p.m.

Marybeth Emerson

Slifer Smith & Frampton

(720) 394-1997

935 11th St.

$2,350,000

Sat., 1 p.m.-3 p.m.

Marybeth Emerson

Slifer Smith & Frampton

(720) 394-1997

619 Quince Circle

$2,470,000

Sat., 10 a.m.-12 p.m.

The Bernardi Group at Coldwell Banker

(303) 402-6000

1715 View Point Road

$3,000,000

Sat., 1 p.m.-3 p.m.

Terry Larson

RE/MAX of Boulder

(303) 589-3028

1401 Mariposa Ave.

$4,890,000

Fri., 1 p.m.-4 p.m.

Marybeth Emerson

Slifer Smith & Frampton

(720) 394-1997

ERIE

1146 Eichhorn Drive

$735,000

Sat., 11 a.m.-1 p.m.

Mark Bosley

RE/MAX Alliance

(970) 846-5813

566 Mathews Circle

$995,000

Sat., 1 p.m.-3 p.m.

Katie Kuosman

WK Real Estate (720) 937-8076

LAFAYETTE

452 Levi Lane

By Markel Homes

Starting from $529,900

Fri. - Mon., 11 a.m.-5

p.m.

Marlita Lazo

Markel Homes (303) 651-9565

452 Levi Lane

By Markel Homes

Starting from $529,900

Thurs., 11 a.m.-5 p.m.

Marlita Lazo

Markel Homes (303) 651-9565

LAFAYETTE

777 Keatons Way

$1,197,000

Sat., 12 p.m.-3 p.m.

Stan Meade Meade Builder Services and Real Estate, LLC (303) 817-7777

LAKEWOOD

234 Zang St.

$520,000

Sat., 12 p.m.-2 p.m.

Susan Martin

RE/MAX Alliance (720) 470-7939

LONGMONT

801 Confidence Drive, #12

$449,950

Sat., 10:30 a.m.-12:30 p.m.

Suzy Williamson

RE/MAX Alliance

(720) 491-9885

5801 Grandville Ave

By Markel Homes

Starting from $614,900

Fri. - Thurs., 11 a.m.-5 p.m.

Roz Pinon

Markel Homes

(720) 583-2170

7415 Rodeo Drive

$1,425,000

Sat., 1 p.m.-3 p.m.

Kana Chambers Jones

RE/MAX Alliance (303) 960-1769

4302 Nelson Road

$3,775,000

Sat., 12 p.m.-2 p.m.

Kevin Murray

RE/MAX Alliance (303) 818-9249

LOUISVILLE

2410 Rose Court

$1,495,000

Sat., 11 a.m.-1 p.m.

Shannon McGuire

RE/MAX Alliance (303) 475-2297

NIWOT

6504 Daylilly Court

$2,497,000

Sat., 1 p.m.-3 p.m.

Suzy Williamson

RE/MAX Alliance

(720) 491-9885

To list your open house or view this week’s open houses in more detail, visit: openhomes.athomecolorado.com

Sponsors:

s your current home no longer functional for your lifestyle? Are you looking to downsize or are you buying a first home? Now is the perfect time to consider a new build. This month, we’ll highlight the area ’ s finest builders and models available. Just clip this page and schedule a time to meet with a builder at your convenience to discuss more ways to make your dream home a reality View homes at: AtHomeColorado.com/2023-Colorado-New-Home-Showcase

The Following Northern Colorado Home Sales were supplied by Colorado Weekly Homebuyers List Inc., 303-744-2020. Listed are the buyer, the property address, the seller and the amount.

• R Fickel -- 1936 Quarter Lane, Barbara J Miller, $100,000.

• Miguel and Jessica Morales -- 204 S 3rd St., Kristopher and Laura Kooi, $430,000.

• Jackson Kaufman -- 1015 3rd St., Jamie Mccawley, $465,800.

• Ray Frakes -- 803 Birdie Drive, Craig B Farr, $490,000.

• Dean Edwards -- 576 Ranchhand Drive, Shawnalea and Angela Poe, $600,000.

• Lucy and Stephen Copperberg -- 1487 Rivergate Way, Melody Homes Inc, $750,000.

• Kerrie Malone -- 2588 Heron Lakes Parkway, Rhoades Real Estate LLC, $2,316,500.

• Kathryn Knox -- 4625 16th St. Apt 4, Shayla K Deyoung, $185,600.

• Matthew and Kelli Daguiar -- 5916 Gunbarrel Ave. Apt F, Park and Kelsi Roberts, $421,600.

• Jason Actis -- 1141 Monroe Drive Apt D, Simona Errico Kelley, $445,000.

• Elizabeth Hastings -- 3353 Madison Ave. Apt U114, Katharine Mason, $480,000.

• Roger and Heather Clark -2882 Sundown Lane Apt 105, Randall and Lauren Reddington, $529,000.

• Nelson David -- 4475 Laguna Place Apt 203, Thuy K Le, $530,000.

• Keith Cooke -- 597 Lakeshore Drive, Seth L Cousin, $725,000.

• Luke Vernon -- 1527 Marshall Road, Nancy Beth Zimmerman, $945,000.

• Rebecca Baron -- 8484 Stoneridge Terrace, Eric Uihlein Frauen, $1,000,000.

• Andrea and Seth Binion -2344 Mapleton Ave., Juliana Forbes, $1,188,500.

• Eric and Stephanie Estey -1100 Quince Ave., Matthew and Judith Richtel, $1,535,000.

• Katie Meusling -- 2161 Jona-

than Place, Daniel and Boyce Sher, $1,650,000.

• Indigo Starr -- 755 Terrace Circle S, Alexander and Tie Gerber, $1,720,000.

• Steven Wallis -- 5339 Olde Stage Road, 5339 Osr LLC, $1,980,000.

• Andrew Fink -- 421 Highland Ave., Steven and Morg Silverman, $3,750,000.

• Jesus Lozano -- 3614 Sienna Ave., Steve Rice, $85,000.

• Ida Padilla -- 3648 Ponderosa Court Unit 3, Michael Damato, $295,300.

• Eliah Klausner -- 3830 Belmont Ave., M L LLC, $301,000.

• Sara Perea -- 3758 Ponderosa Court Unit 3, Loretta L Flohr, $305,000.

• Dustin and Dustin Jorden -3313 Collins Ave., Thomas H Stroh, $360,000.

• Desiree and Adrian Lopez -4212 Rockcress Road, D Wp Evans LLC, $409,000.

• Rigo Macias -- 1609 40th St. Court, Mary D Sanchez, $410,000.

• Jacob Schumacher -- 1617 32nd St., Rocky Mount Invest Group LLC, $443,000.

• Emmanuel Puentes -- 12902 Bay St., Lennar Colo LLC, $580,000.

• Duane and Marion Harris -- 6320 Red Cedar St., Yes Homesales LLC, $260,900.

• Brittney Jacobsen -- 7018 Todd Court, Melody Homes Inc, $435,000.

• Robert and Arianna Carlisle -6900 Zig Place, Melody Homes Inc, $442,800.

• John and Kelly Cummings -- 7111 Fraser St., Lgi Homes Colo LLC, $487,900.

• Bulmara Rodriguez -- 7015 Fall River Drive, Landon and Kylie Candy, $499,900.

• Kelley and Chris Castaneda -- 5427 Bear Lane, Michael Eugene Stout, $525,000.

• Jose Garces -- 6803 Fraser Circle, Danika E Reuterskiold, $546,000.

• Hugo Romero -- 9049 Harlequin Circle, Daniel Richard Campbell, $600,000.

• Michael and Jennifer Deherrera -- 8731 Triple Crown Drive,

Larry and Channa Thornton, $673,000.

• Jared and Jill Bodammer -6328 Saratoga Trail, Stephen J Fredericksen, $685,000.

• Christina Hartzell -- 4607 Homestead Court, Chelsey Rasmussen, $320,000.

• Arely and Griselda Islas -- 4930 W 9th St. Drive, James and Bonnie Parker, $331,200.

• Linda Baeza -- 4641 Zion Drive, Ray and Lorenza Frias, $335,000.

• Jeffrey and Joanna Sheffler -- 1001 43rd Ave. Unit 14, Georgia Steiner, $350,000.

• Karina Munoz -- 1321 27th St., Veronica Hernandez, $355,000.

• Brian Peterson -- 2402 49th Ave. Court Unit 28, Robert E Murphy, $372,500.

• Alexa Castilleja -- 6721 4th St. Road Unit 2, Hartford Constr LLC, $376,400.

• Enrique Figueroa -- 2442 Apple Ave., Payton and Felicia Chacon, $385,000.

• Jesse Biederman -- 2318 44th Ave., Brandon Joe Thompson, $400,000.

• Brenda Mosqueda -- 401 E 28th St. Drive, Griselda Ramirez, $405,000.

• Marina Raymundo -- 2102 22nd Ave., Joshua James Griebat, $435,000.

• Maria Hernandez -- 6121 1st St., Melody Homes Inc, $455,000.

• Julio and Leanne Campos -- 4335 W 31st St., E Irene Connolly, $465,000 .

• Kiani Moran -- 325 N 45th Ave. Court, Chris A Hofbauer, $475,000.

• Anthony and Sergio Velasquez -- 6113 1st St., Melody Homes Inc, $485,000.

• Dorothy Hoff -- 6552 18th St., Randy and Lisa Young, $498,000.

• Margarito Valenzuela -- 8108 21st St. Road, Kevin and Jennifer Wampler, $515,000.

• Cindy Wesley -- 3324 66th Ave., Brenda F Tousley, $545,000.

• Tuan Nguyen -- 404 66th Ave., Hartford Constr LLC, $550,000.

• Whitney and Johannes Fourie

-- 1285 49th Ave., Kim and Betty Creasy, $585,000.

• Gaylord and Jeannette Naill

-- 1827 Aa St., Guillermo and Maria Hernandez, $1,825,000.

• Jake Rawls -- 258 Cardinal St., Baessler Townhomes Colo LLC, $369,900.

• Ryan Unangst -- 250 Cardinal St., Baessler Townhomes Colo LLC, $371,000.

• Victor Williamson -- 3677 Pinonwood Court, Matthew and Caitlin Tanner, $472,000.

• Christopher and Megan Sandholm -- 4413 Mountain Sky Court, Journey Homes LLC, $477,200.

• Colleen Clark -- 479 Thrush Place, Melody Homes Inc, $490,000.

• Nicholas Drennanantonidis -- 388 Thrush Place, Melody Homes Inc, $510,000.

• Tyler and Taylor Gentleman -- 307 Honeysuckle Way, Erick Haro Topete, $515,000.

• Aaron and Candace Smith -120 King Ave., Tyler and Emily Cawiezell, $518,000.

• Toby and Kerl Mattingly -- 760 Crestone St., Century Land Holdings LLC, $530,000.

• Anastasia Ramirez -- 2635 Doe Ridge Way, J J Constr Northern Colo LLC, $549,600.

• Michael and Janet Moskalski -3528 Whisperwood Court, Juli Richart, $568,000.

• Alexander and Nicole Nodich -- 4508 Moose St., Aspen View Homes LLC, $619,000.

• Sheldon and Brittany Smith

-- 4524 Moose St., Aspen View Homes LLC, $623,000.

• Phillip Buschang -- 2003 Terry St. Apt 101, Jerry L Lanser, $245,000.

• Austin Craig -- 1812 Jewel Drive, Shirley Bailey, $390,000.

• Nikolay and Aganisa Kuyarov -- 1211 Bistre St., Hayden Anderson, $410,000.

• Willyn Webb -- 721 Lashley St., Cameron and Jessica Hoehn, $440,000.

• Stacy Ludwig -- 1227 Aspen St., Larry Lynn Johnston, $445,000.

• Jeffrey Passarelli -- 2622 Denver Ave., Leslie A Sawyer, $460,000.

• Deborah Brew -- 801 Confidence Drive Unit 3, Nicholas Bryan Fenichell, $460,000.

• Jenelle Mann -- 845 Martin St., Jeffrey T Lupinski, $482,000.

• Kevin Saenz -- 10606 County Road 15, Jose Garces,

$535,000.

• Roberta Thorne -- 2318 Collyer St., Peres Family Trust, $545,000.

• Andrew Eberly -- 481 High Pt. Drive, Dfh Mandarin LLC, $560,400.

• • Guangyu Zhu -- 478 Homestead Parkway, Ismael Martinez Morales, $565,000.

• Mason and Morgan Mcgahen -- 2416 Yukon Drive, Kb Home Colo Inc, $571,200.

• Alexander Brunt -- 1400 Northwestern Road, Amy K Miller, $590,000.

• Nicole Finan -- 519 Cameron Court, Dekovern Invest LLC, $610,000.

• Dane Peterson -- 1475 Wildrose Drive, Stephen and Lucy Copperberg, $620,000.

• Andrew and Meghan Wagner -- 2399 Yukon Drive, Kb Home Colo Inc, $650,000.

• Mark and Karen Furnari -- 2408 Yukon Drive, Kb Home Colo Inc, $669,100.

• Linda Ramesbotham -- 460 Westview Court, James and Kathleen Murphy, $700,000.

• Davis and Sarah Driver -- 1324 Reserve Drive, Thomas and Denise Heinen, $735,000.

• Heather and Jennie Crate -- 619 Folklore Ave., Aj Living Revocable Trust, $740,000.

• Shirley and Eric Andrewssharer -- 815 Collyer St., Peter Klayman, $760,000.

• Alexander Goepfert -- 2443 Eagleview Circle, Mark and Ann Sondergard, $780,000.

• Lisa Mcclellan -- 1017 Sugar Beet Circle, Kevin and Sarah Vogel, $785,000.

• Brian and Tamara Carter -- 2414 Spotswood St., Stephanie Katrine Reicherts, $785,000.

• Matthew Peterson -- 405 Overbrook Lane, Dfh Mandarin LLC, $800,000.

• Jason Wiener -- 2444 Eagleview Circle, Richard and Katherine Burton, $804,000.

• Sunjoo Park -- 5842 Grandville Ave. Unit A, Markel Homes Constr Co, $824,800.

• Lewis and Angela Horne -3817 Fowler Lane, Ronald and Lori Aadsen, $1,005,000.

• E and Tracy Kosberg -- 4636 Palmer Court, Matthew Stephen Brett, $1,450,000.

• Matthew and Mary Brett -- 4540 Palmer Court, Stillian Strong Living Trust,

$1,800,000.

• William and Shelley Davis -1203 Gard Place, Karen Roth, $335,000.

• Carlos and David Zapatero -- 906 Janice Court, Opendoor Property Trust I, $422,000.

• Erin Dalton -- 4117 Rockcress Place, Jason Cannon, $432,000.

• Jordan Pacific -- 525 W 9th St., Alkats Properties LLC, $445,000.

• Mark Donovan -- 3521 Sheridan Ave., Linda and Kim Stenson, $450,000.

• Trinidad Diaz -- 1829 Sagittarius Drive, Shannon Trierweiler, $465,000.

• Karen Philips -- 2406 Empire Ave., Cathi Gunderson, $476,100.

• Araina Muniz -- 2524 Painted Turtle Ave., Lennar Colo LLC, $485,000.

• Clayton Henning -- 1526 Tracy Drive, Danielle and Ryan Batten, $490,000.

• Wanda and James Moore -- 3242 Da Vinci Drive, Aspen Homes Colo Inc, $504,800.

• William and Travis Locklear -- 3915 Sand Beach Lake Court, Susan and Michael Salz, $510,000.

• Lisanne Belcher -- 215 Snow Goose Ave., Kelly C Curtis, $520,000.

• Andrew and Kate Corre -- 2427 Cabin Creek Ave., Lennar Colo LLC, $530,000.

• Lalo Lopez -- 2451 Cabin Creek Ave., Lennar Colo LLC, $570,000.

• Alan Schmitz -- 1633 Silver Leaf Drive, Kevin and Kathryn Binder, $599,000.

• Susan Zapanta -- 2438 White Pelican Ave., Dfh Mandarin LLC, $606,100.

• Tracey Cotterell -- 487 Promontory Drive, Robert A Garcin, $610,000.

• Aislinn Demarco -- 5290 Crabapple Court, Andrew C Hoburg, $707,000.

• Kelly Ungerman -- 164 Two Moons Drive, Karen Marie Philips, $849,900.

• Leslie Ruybal -- 2553 Bluestem Willow Drive, Francis and Jessica Berring, $969,000.

• Donald Wills -- 4444 Nolan Lake Court, Bridgewater Homes LLC, $1,139,600.

• Ernest and Jennifer Crownover

-- 3175 Sophia Court, Mark and Katherine Rau, $1,680,000.

• Colin Ksobiech -- 3400 Dryden Place, Richfield Homes LLC, $490,000.

• Jeanette Barnard -- 3341 Chilton Drive, Richfield Homes LLC, $509,200.

• Claudia Amaya -- 4152 Limestone Ave., Melody Homes Inc, $510,000.

• Margaret and Jerry Thorstad -- 13722 Siltstone St., Melody Homes Inc, $590,000.

• Penni Sandoval -- 4415 Garnet Way, Melody Homes Inc, $627,400.

• Brittany Pack -- 2187 Pineywoods St., Nathan and Kassia Walcott, $715,000.

MILLIKEN

• Alexander Veen -- 807 Forest St., Harrison Winn, $367,000.

• Dylan and Nicole Stern -- 1150 S Marjorie Ave., Lee and Michelle Barfoot, $459,900.

SEVERANCE

• Sarah and Philip Barone -1274 Baker Pass St., Colin and Kari Brauer, $505,000.

• Danielle Marrs -- 1228 Lily Mountain Road, Aspen View Homes LLC, $512,500.

• Kalene Quezada -- 615 Sawyers Pond Drive, Melody Homes Inc, $526,200.

• Michael and Kirstie Turay -1168 Bowen Pass St., Aspen View Homes LLC, $535,000.

• Karena and Joseph Lawrence -- 1104 Cortez Way, David and G Ried, $855,000.

• Jacob and Brenica Torre -- 6009 Sunny Crest Drive, Brandon and Jamie Bohn, $330,000.

• Carol Labellepropst -- 6001 Goodnight Ave., Hartford Constr LLC, $657,000.

• Todd Sledge -- 2753 Vallecito St., Hartford Constr LLC, $725,000.

• Kyle and Erin Hicks -- 5232 Cloud Dance Drive, Alec and Jessica Hermanson, $750,000.

• Sandra and Joseph Haynes -5129 John Muir Drive, Hartford Constr LLC, $800,800.

• Kevin and Lindsey Spears -- 6123 Washakie Court,

Julio and Susanna Chavarria, $807,500.

• Julio and Susanna Chavarria -- 1052 Monterra Lane, Artesia Lot Holdings LLC, $950,000.

• Jade Shinn -- 1068 Monterra Lane, Artesia Lot Holdings LLC, $1,057,500.

• Francis Pingatore -- 985 Greenbrook Drive, Journey Homes LLC, $443,700.

• Jeremiah and Juliann Little -- 1019 Greenbrook Drive, J J Constr Northern Colo LLC, $472,300.

• Usman Khan -- 915 Maplebrook Drive, J J Constr Northern Colo LLC, $483,500.

• Mikaela Perea -- 4 Cyprus Court, Matthew and Rebecca Beal, $525,000.

• Benjamin and Tiffanie Carrico -- 2174 Longfin Drive, Lynn M Haydenugarte, $532,500.

• Teresa Rodehorst -- 460 Wind River Drive, Timothy and Barbara Roy, $537,000.

• Hamid Chitsaz -- 6045 Holstein Drive, Melody Homes Inc, $560,000.

• Peter and Catherine Harper -- 2172 Grain Bin Court, Emily and Preston Stanfill, $568,000.

• Val and Berni Dildey -- 1971 Floret Drive, Stephen and Kim Dornan, $580,000.

• Garyn Anaya -- 4510 Bishopsgate Drive, Xiao Yan Yuan, $585,000.

• Cedric and Francoise Law -1963 Shadow Lake Drive, Ryan and Jeri Bingham, $620,000.

• James and Eileen Cain -- 6238 Vernazza Way Unit 4, Vernazza Townhomes LLC, $638,000.

• Courtney Isbell -- 2094 Autumn Moon Drive, Carolyn Isbell, $712,000.

• Barbara Metzdorff -- 1973 Captiva Court, Joshua W Nolting, $850,000.

• Bruce and Toni Lundak -- 1640 Flourish Court, Th Raindance Windsor LLC, $889,000.

• Robert and Melinda Harrison -6348 Valhalla Drive, Dallas and Jane Everhart, $1,245,000.

• Martin and Audrey Miller -- 7963 Rising Sun Court, Todd and Shauna Sledge, $1,285,000.