Volume 11 Issue 01

Cover Image: After the market storms of 2022, light will beging breaking through the clouds in the year ahead.

From the Editor

After an abysmal year in the markets, will we see a nice rebound in the year ahead?

05

The Story in Charts

A look at some of the charts which have helped shaped the news over the past several weeks

strategIc vIsIon

The Economic Malaise of the 1970s

It was a decade marked by inflation, prolonged gas lines, a wildly-fluctuating market, and a general sense of malaise; are we doomed to repeat this period?

Investment tactIcal awareness

08

2023 Market Outlook and Tactical Asset Allocation

The Fed will end its rate hike cycle early in the year, the US economy will begin a new expansion phase, and sentiment will be more upbeat

Investors are discretionary poised for real

Under the radar

US Breakthrough in Nuclear Fusion

Bright Ideas Being Ignored

A maritime shipper, biotech, soda bottler: Four ideas that ignored—by investors and the

Disney shocker: Hapless Chapek fired as Iger returns to lead the company

California dreaming: burger flippers could soon have a $22 per hour minimum wage

Budweiser’s awesome response to Qatar’s classless move to ban beer

The despicable acts of Michael Avenatti come home to roost

The imperial FTC will lose in court and Microsoft will be allowed to buy Activision Blizzard Top quotes of the month...

Franklin on Patience

Johnson on Being Genuine

Pliny the Elder on Renewal

From the Editor/

Lessons From the Past Year, Predictions for 2023

In our Penn Wealth Report which outlined the year ahead, 2022, we had two ominously similar charts in this section: the stock market returns from 1997 through 1999, and 2019 through 2021. Here is what we wrote:

“Despite a few market pullbacks, there remains unbridled enthusiasm for stocks in general and the high-flying NASDAQ in particular.... After three scorching-hot years...expect single digit gains in the major benchmarks. We would not, however, rule out a negative 12-month period.”

We saw inflation on the horizon, and expected gold—a natural inflation hedge—to have a strong year. Gold began the year at $1,831 per ounce and finished the year down exactly $1, to $1,830. With the Fed funds rate at zero, we expected a down year in bonds. Indeed, the Bloomberg US Aggregate Bond Index had its worst year since the index’s inception in 1977. It was simply a horrendously ugly year from start to finish, and from every vantage point around the world.

Will the markets stage a comeback in 2023, or is this another 1973-74 period? (See “The Economy of the 1970s.”) Fortunately, back-to-back losses are quite rare in the markets. The S&P 500 had a four-year losing streak one time, a three-year streak twice, and a two-year streak once. That said, the same factors that led to 2022’s woes are still with us going into 2023, plus one: worries over a recession which most have already added into the equation.

But it’s not all bad news. Investors were obsessed with the Fed last year, and for good reason. After all, we had seven rate hikes for an aggregate 4.25% rate change over the course of nine months. We expect another 50-75 basis points of hikes to be added early in the year, followed by an elongated pause.

What’s the good news? The Fed is almost done hiking, and the US economy can easily adapt to—and grow within—a 5% Fed funds environment. In fact, the average historical effective Fed funds rate is 4.6%. Investors are seriously overreacting to what we see as a mild recession and a manageable terminal rate.

Making predictions for the market’s movement over a oneyear period can be a fool’s errand, but we will do it anyway. And, unlike so many who changed their predictions as last year dragged on, we will stand by ours.

We see a 12% gain for the S&P 500, which would bring it back to 4,300. The NASDAQ, which lost one-third of its value last year, should be able to put together a 16% gain, bringing it to 12,100. We are most excited about the potential for the small-cap Russell 2000, which we see hitting 2,100 by year end, or a 19% gain. As mentioned, we project the Fed funds rate to top out around 5% and stick there for some time. We still believe in gold, which should hit $2,200 per ounce—a 21% gain. Finally, we see oil stuck in a trading range, closing the year at $85 per barrel, or just 6% above its 2022 closing price.

—MSHPenn Wealth Publishing

Subscription Information https://www.pennwealthreport.com

Penn Wealth Publishing Commerce Plaza, 7th Floor 7300 West 110th Street Suite 700-#8008 Overland Park, KS 66210-2332

Michael S. Hazell Editor-in-Chief

It is quite rare for the markets to decline multiple years in a row, and we don’t see that happening in 2023; we do see the US outperforming other regions, and gold rallying well above $2,000/ounce

The Year in CharTs

Charts tell the story. Here are some of our favorites from the past month. For the top business and economic stories of the week, visit Penn...After Hours at www.penneconomics.com.

2022 stock market returns...

There was nowhere to hide in 2022, with the exception of energy stocks and certain commodities. Bonds dropped double digits in value, while the NASDAQ lost one-third of its value. Gold was flat, while the real return of cash was negative due to runaway inflation. It was the worst year for the markets since 2008, but even in that rough year we could hide in bonds.

A deeper dive into S&P returns...

The S&P 500 dropped 19.44% in 2022 in its worst year since the financial crisis of 2008, when it was down 38.49%. Back-to-back down years are unusual for the benchmark: It has been down four years in a row one time (19291932), three years in a row twice (1939-1941, 2000-2002), and two years in a row once (1973-1974). (The origin of the S&P goes back to the 1920s, though the index wasn’t officially launched until 1957.)

The great home rush stumbles...

Home prices were going up at insane rates as sellers were asking whatever they wanted— and often getting bids above that level. There is always a reversion to the mean, and it began taking place in 2022 as interest rates began rising. The US Pending Home Sales Index, which registers 100 as the baseline (2001 activity level), hit its second-lowest level on record in November—behind only “Pandemic April” of 2020.

American History

The Economy of the 1970s

For investors with an eye toward the coming decade of the 1970s, there were blue skies on the horizon. American ingenuity and technological prowess, with the help of a brilliant German rocket scientist by the name of Werner von Braun, had just pulled off one of the greatest achievements in the history of mankind: landing humans on a world outside of Earth.

Unemployment was sitting at 3.5% (as it is now), and the economic engine of the world was notching impressive rates of growth, as measured by US GDP.

Millions of Americans were also flocking to an investment vehicle known as the mutual fund: baskets of (generally) stocks packaged together for easy purchase. While the 401(k) company plan wouldn’t come onto the scene until 1978, money was still flooding into equities as we entered the new decade. Nascent investors were about to get a hard lesson in risk management.

Warning: spoiler alert coming. On 31 December 1969, the Dow Jones Industrial Average finished out the decade of the 1960s at a level of 800. On 31 December 1979, the Dow closed the trading session at 839. An entire decade, and the DJIA had gained all of 39 points! Who could have possibly seen that coming?

Instead of one cataclysmic event, it was a toxic mix of poor fiscal decisions, an easy money policy, and geopolitical turmoil which caused the lost decade.

Dependence on unstable regions to fill energy needs

According to the US Energy Information Administration, a barrel of crude cost just under $3 in 1970. At that time, oil production in the US was peaking around 10 million barrels per day (BPD). Despite that impressive production rate, global demand among non-communist nations had more than doubled in the previous decade, from 19 million BPD to over 40 million BPD, with a Middle East-based group known as OPEC controlling some 55% of the world’s proven reserves. Oil prices remained relatively stable, however, until a military incursion in late 1973 sparked the first major global oil crisis.

On 06 October 1973, during the Jewish holy day of atonement known as Yom Kippur, Egyptian forces attacked Israel from across the Suez Canal while Syrian troops simultaneously invaded the Golan Heights region—an area it had lost during the Third ArabIsraeli War in 1967. The attack was cheered on by the other OPEC nation-states. With the help of the United States, however, Israel—led by the most capable General Ariel Sharon—quickly regrouped and took the offensive. By November, a ceasefire had been called. As punishment for supporting Israel, OPEC initiated an oil embargo against the United States, Canada, the United Kingdom, Japan, and the Netherlands. The confusion caused massive gas lines and shortages of fuel in the United States, as well as a quadrupling of oil prices. By the end of the embargo in March of 1974, oil was selling for around $12 per barrel.

Energy prices were a major component of the runaway inflation which epitomized the decade. Americans were suddenly spending an inordinate amount of their income to simply fuel their vehicles, with little left over for discretionary spending and savings. This had a deleterious effect on the American psyche, further reinforcing the decade of gloom.

We have certainly experienced a massive increase in the price of oil and gas over the past few years. The average price at the pump for one gallon of gas more than doubled between the start of 2021 and June of 2022, rising from $2.33 to

2022 began disconcertingly similar to 1970, so are we doomed to repeat the era of disco, stagflation, and a flailing stock marketThe cost of living soared in the ‘70s while wages and the stock market flatlined

$5.11 in eighteen months. But that is a far cry from the tenfold increase witnessed in the ‘70s. Furthermore, the United States is now the leading producer of oil and natural gas in the world. Sadly, our refining capabilities are sorely lacking, but the idea of OPEC holding us hostage once again is fanciful—despite the organization’s recent decision to cut production by two million BPD.

Not so much in Europe. To get a feel for what it was like in the United States during the first oil embargo, look no further than Europe’s current energy crisis. An over-reliance on a mercurial madman for oil and gas has created a quite similar condition, with Europeans suddenly paying as much as ten times more to cool their homes as last year. As bad as it was on the continent this past summer, expect it to be worse this winter. Arrogance tends to mute the lessons of the past.

The floating dollar and the WIN debacle

As if wage and price controls weren’t enough, Richard Nixon also ended the gold standard which had been enacted under the Bretton Woods Agreement. Now that the US dollar was no longer pegged to the price of gold (at $35 per ounce), the convertibility of US dollars held by the central banks of foreign into gold was halted. This led to a major devaluation of the dollar as holders rushed for the exits. Ultimately, the greenback dropped in value by one-third over the course of the decade.

of the 1970s and most certainly helped to form the lost decade.

Keynesian economics advocates as much government spending as is needed to spur economic activity, debts and deficits be damned. Although Nixon and Carter, the bookend presidents of the decade, were of different parties, both adopted Keynes’ heavy-handed approach of government control.

Stagflation

Quite ironically, President Richard Nixon’s 1971 measures to prioritize US economic and jobs growth, and to stem the tide of inflation, led to a wretched condition known as stagflation: a persistently high rate of inflation combined with high unemployment and a stagnant economy. In essence, his government controls only exacerbated the very conditions was trying to quell.

The three pillars of Nixon’s New Economic Policy were noble: create better jobs in the US, staunch the rising cost of living, and defend the US dollar from global speculators. The goals may have been noble, but the medicine was poisonous.

Tax cuts, which can certainly spur economic activity, also generally lead to higher inflation. To counter this, the president ordered a 90-day freeze on prices and wages—the first wage-price freeze since World War II. Following the 90-day period, increases would have to be approved by a “Pay Board” and a “Price Commission.”

Putting an artificial lid on natural processes can have disastrous results—a lesson communist China still refuses to learn. Nixon’s actions to stem inflation by decree ended up causing scarcity—producers reduced supply and shipped more of their goods to Canada, and shoppers increased demand by gobbling up groceries at the capped prices. This scheme was an unmitigated disaster.

With respect to the dollar, there is little comparison between the 1970s and 2022. The dollar, which now finds itself at parity with the euro, is sitting at its strongest levels in two decades thanks to a healthier (than the rest of the world) economy and a Fed intent on controlling inflation with higher rates. While this makes US goods more expensive for foreign buyers, it makes foreign goods—and travel—cheaper for Americans.

By December of 1974, just four months after Gerald Ford assumed the presidency, inflation in the United States had hit 12.34%. He declared inflation “public enemy number one,” and unveiled a new program called Whip Inflation Now, or WIN.

The cornerstone of WIN was a grassroots appeal for every American to put more away in savings and purchase fewer discretionary items. The new president also pushed for $16 billion in tax cuts to spur economic activity, worked with congress to increase defense spending, and signed ERISA (the Employee Retirement Income Security Act of 1974) into law to encourage workers to save more through company retirement plans.

As one could imagine, Ford’s opponents jumped on the rather hokey name of his program and lambasted his simplistic approach to a complex problem. For all of the lampooning, however, one fact stands out: When Gerald Ford assumed office the rate of inflation in the US was over 12%; by the time Jimmy Carter took over, it was sitting below 5%.

Keynes, a second oil shock, and the Fed John Maynard Keynes was a British economist of the early 20th century. His theory of macroeconomics, with its emphasis on heavy government intervention, dominated the political landscape

When Nixon delinked the dollar from gold, massive deficits would be the inevitable result. If the government could print money with reckless abandon, it is simply a matter of time before runaway inflation enters the scene.

Fiscal responsibility seemed virtually nonexistent in the 1970s—a trend which has continued to the current day. With the US suddenly running perennial deficits, the national debt nearly tripled over the ten-year span.

In addition to a ham-handed government approach, a second oil shock was brought about by the 1978-79 Iranian Revolution. While the relatively small drop in the global oil supply didn’t warrant the move, crude prices more than doubled—from $15 to $37 per barrel— between January of 1979 and February of 1980. Of course, the revolution also gave rise to the 444-day nightmare for 52 American hostages held captive in Tehran. In many ways, this horrendous event fittingly capped the dark decade just passed.

Arguably, the most astute move Jimmy Carter made in the battle against persistent inflation came in July of 1979 with his nomination of Paul A. Volcker to serve as the 12th Chairman of the Federal Reserve. Serving under two presidents (Reagan renominated him in the summer of 1983), Volcker attacked inflation like none of his eleven predecessors.

The treatment was painful: he began a tightening cycle that didn’t stop until the US economy had undergone two recessions (in 1981 and 1982) and the federal funds rate had hit an astronomical 22%! In the end, his bold gambit worked; when Volcker left office in 1987, inflation had been tamed to a 3.4% rate.

Through the prism of the 1970s, the tantrums being thrown over the specter of a possible 5% terminal fed funds rate seem ludicrous. We could control neither the oil shocks of the 1970s nor the global pandemic and geopolitical instability of this decade. We can, however, avoid a repeat of the economically bleak ‘70s by having the courage to do what is needed on a fiscal and monetary level. The current Fed chief seems committed, but do

we, as Americans, have the stomach for it?

“Arrogance tends to mute the lessons of the past.”

Asset Allocation & Outlook

2023 Market Outlook

From an investor’s standpoint, 2022 ranks right down there with 1974, 2002, and 2009. Those were the years America suffered painfully through the aftermath of an oil shock, a dot-com tech bubble burst, and a global financial meltdown, respectively. This year, it has been roaring inflation—spurred by increased demand and constrained supply chains, a war in Eastern Europe, and a Fed hell-bent on reining in prices through rate hikes.

At the start of the year the US housing market was booming, buoyed by consumers flush with cash (they had saved up during the heart of the pandemic) and ultra-low mortgage rates. In January, rates were hovering around 3%; in November, they were sitting just below 7%. This means that a $400,000 home with a $1,700 monthly mortgage payment (not including taxes and insurance) at the start of the year would now cost a homebuyer approximately $2,700 per month. But it gets even worse: a spike in prices of approximately 15% year-on-year pushes that monthly payment over $3,000. Those deciding to rent instead were in for an equal shock, with the average lease payment going up 14% from last year, through October.

There have been a few bright spots on the year from an ecomonic standpoint: The US unemployment rate has been hovering within twenty basis points either side of 3.5% since spring, and hefty wage increases have been brought about by the tight labor market. Perversely, these two trends—lower unemployment and higher wages—have provided the Fed even more fuel to keep the rate hikes charging along.

A generation of traders with no bear market experience

We are not facing a second tech bubble pop like we had between 2000 and 2002, but one aspect of that meltdown was very much alive going into 2022: A new generation of investors with virtually no bear market experience was wantonly buying into companies with horrendous financials. Similar to 1999, the individuals within this group weren’t receptive to cautionary tales. At least until their world was turned upside down.

In the heart of the frenzy, we issued our Penn Wealth Report with the cover title: The Show Must Go On. We had bear market experience; the experience of witnessing the Nasdaq drop 78% from top to bottom. The experience to know that AMC EntertainmentAMC $8 was worth $5 per share, not the $73 per share it hit in the summer of 2021. The experience to know that NFTs were akin to Tulipmania in the 1630s. The sense to know that “diamond hands” was a really ill-conceived strategy.

What has been so different this time around was the lack of a good hiding place from the carnage. While stocks were dropping in value, so were bonds. The famed 60/40 stock-to-bond asset allocation model was a disaster, as two negatively-correlated (historically, anyway) asset classes were moving downward in tandem. But now, despite the dour mood among both investors and analysts, conditions are about to change.

The end of rate hikes on the horizon as inflation turns a corner

Rate hikes have a lag effect, with the Fed’s actions historically taking an average of six months to begin showing results. That appears to be holding true yet again, as the CPI and PPI rates are finally starting to subside (the Fed began tightening this past spring). Furthermore, unemployment is beginning to move higher as companies across the spectrum move to cut costs—sadly, that means layoffs.

Valuations were high, but spiking inflation and the Fed’s response were the main catalysts for the downturn

As mentioned, the mood among investors hasn’t been this dark in a long time—another good sign. When the figurative towel is finally thrown in, that is generally the time to begin loading up on quality companies.

The Fed will end its rate hike cycle early in the year, the US economy will begin a new expansion phase, and sentiment will be more upbeat

Most of us remember the likes of Pets.com during the tech bubble, or WorldCom, or Enron. But many don’t remember the way that truly outstanding tech companies were also dragged down to massively undervalued levels. Tech was out of favor—to put it mildly—and just about everything in the Nasdaq was shunned. That turned out to be an incredible opportunity for investors, and we believe a similar opportunity now exists.

And the 60/40 asset allocation strategy left for dead must now be resurrected: bonds and other fixed-income instruments haven’t looked this attractive in nearly a decade. With rates moving back to more normalized levels—where they will probably remain for some time—we need to begin our 2023 portfolio construction build with the boring old cash/ fixed asset class.

Building a solid foundation of cash and fixed income

Each individual’s personal Risk Tolerance Level, the result of a number of different factors, will determine—along with economic outlook—what percentage of cash and fixed income should be maintained in a given portfolio. However, this must be the starting point for the construction of any portfolio, no matter how aggressive the owner might be.

Just as we wouldn’t live in a home, from a basic ranch to a mega mansion, that didn’t have a stable foundation, everyone needs cash and fixed income. That may seem obvious, but we have reviewed many portfolios virtually devoid of this basic layer.

The general financial planning rule of maintaining enough cash to cover six months worth of expenses is a good place to start. If $4,000 per month would be enough to pay a family’s mandatory expenses, then $24,000 in cash or equivalents should be on hand or immediately accessible.

Beyond that, risk tolerance and the economic environment should determine any excess. For example, as rates were near zero and destined to head up, we reduced exposure to fixed-income investments and padded the cash segment. Money market rates were near zero and not keeping up with inflation, but we knew that the value of bonds would drop as rates rose. Cash also serves as dry powder to deploy as opportunities arise elsewhere.

The fixed-income arena is more diverse than many realize, so it is important to define which areas of this asset class to invest in right now, and which to avoid. Let’s focus our discussion on maturity, credit quality, category, and geographic location.

Laddering a bond portfolio involves spreading out maturities between short-, medium-, and long-term instruments, be they corporates, munis, Treasuries, or agency bonds. Typically, the further out one goes on the maturity ladder the higher the yield they will receive—longer bonds fluctuate in value more than shorter ones, so investors expect to be compensated for the increased volatility risk. That is not currently the case.

An inverted yield curve exists when a fixed-income investor can buy a shortterm bond with a higher yield than its longer-term counterpart. For example, we can currently buy a one-year Treasury Bill yielding just under 5%, a ten-year Note yielding 3.75%, and a 30-year T Bond yielding 3.8%. Therefore, we see absolutely no reason to take extra duration risk (duration measures the level of bond volatility as interest rates change) by going out too far on the maturity spectrum. Load up on one- to five-year maturities with rates at this level.

yield arena, also known as junk bonds. These are bonds issued by companies with lower creditworthiness forced to pay a higher yield to entice buyers to take on added risk. Some examples can be found in the SPDR Bloomberg High Yield Bond ETFJNK $91: Caesars Entertainment, Carnival Corp, and Vodafone PLC.

Our rationale for avoiding high yield bonds right now is twofold: As we near a recession, some of these issuers will find themselves under even more duress; and if they found it challenging to raise capital with rates near zero, what level of financial strain will they face as their cost of capital goes up due to higher rates?

That said, we do always have at least one high yield bond fund in the Strategic Income Portfolio; that investment is (currently) the Buffalo High-Yield fundBUFHX $10, which holds 129 bonds and offers investors a 5.7% yield. The fund’s max drawdown—losses from price top to price bottom—is just 26%, or well below the average junk bond fund.

While it is always best to load up on individual bonds when rates are attractive, another fund idea we like can be found with floating rate/bank loan ETFs. These are baskets of short-term loans which will constantly adjust up as rates move higher.

Finally, we like tax-free municipal bonds (historically low default rates) and taxable corporate bonds issued This is a busy chart, but here is the key takeaway: bonds moved down in tandem with stocks in 2022—an anomoly

One fixed-income category we are steering clear of right now is the high

Copyright 2023. All Rights Reserved.

...the 60/40 asset allocation strategy left for dead must now be resurrected: bonds and other fixed-income instruments haven’t looked this attractive in nearly a decade.

...we simply consider gold one of the greatest hedges available against global chaos and fiscal irresponsibility.

by high-quality companies with good cash flows and strong balance sheets (think Microsoft, Apple, Lockheed-Martin, and the like).

As for foreign bonds, there are very few regions around the world which look attractive to us right now. Keep in mind that many European nations actually went negative with their bond yields, and they are facing an ugly combination of trying to ease inflation with rate hikes while also battling economic malaise. Our advice holds true for both developed nations and emerging markets around the globe. Through much of 2023, stick with domestic fixed-income vehicles.

All that glitters is gold

Since we began our portfolio construction with an area that not too many investors get excited about, let’s keep that train rolling with another investment shunned by many as passé: that ancient store of value, gold.

Unlike most other precious metals such as silver, platinum, and palladium, gold really doesn’t have many industrial uses. In those ceaseless advertisements we receive about the minerals essential to EVs and the general future of mankind, gold is always left out.

And 2022 was nothing to write home about with respect to gold’s performance, except to say it far outperformed stocks and bonds. Beginning the year at $1,831 per ounce, gold sits at $1,811 as we write this. Nonetheless, we see three major reasons to continue owning this alternative throughout 2023.

Since gold is dollar-denominated, it often moves opposite the value of the dollar. The dollar has been strong this year, reaching parity with the euro for the first time in twenty years. As the Fed begins to taper its rate hikes, and as other countries continue to raise rates, we don’t expect dollar strength to continue. As the dollar falls in value, gold should benefit.

Gold was also shunned this past year in favor of the “new greatest hedge against volatility”—cryptos. What a joke that turned out to be. We never bought into that narrative, but even we didn’t see crypto crashing like it did. Sorry crypto bugs, gold will continue to stand the test of time.

Finally, we simply consider gold one of the greatest hedges available against global chaos and fiscal irresponsibility. Sadly, we will not wake up in 2023 to a calmer, more responsible world. It may be too late to force politicians and central banks to re-embrace the gold standard (imagine how that would have curbed disgraceful overspending), but we do see the metal trading well above $2,000 per ounce next year. In other words, expect double-digit gains in gold for 2023. After the year we just went through, is anyone really willing to brush aside those returns?

Our favorite styles and market caps for next year We distinctly remember all of the stories about the death of value in the late 1990s. There was a “new paradigm” shifting the global economy, and value was as antiquated as gold. That talk sounded mighty similar

Copyright 2023. All Rights Reserved.

to what we were hearing in 2021. Why would an investor put good money into dying, anti-ESG (their words, not ours) companies like Dow ChemicalDOW $51 or Chevron CorpCVX $181 when they could be buying a cloud-based computing company with unlimited potential? Never mind the fact that said company wouldn’t be profitable until 2030! Meanwhile, the Dows and the Chevrons of the world went merrily along, making money hand over fist.

We are not against growth stocks in 2023, by a long shot. In fact, many have been so beaten down that they now look like value plays. Think MicrosoftMSFT $255 , AppleAAPL $147 , UberUBER $28, and similar names. In fact, we will go out on a limb and include TeslaTSLA $195 in that group (see our story on ten stocks which could excel in 2023). However, we do favor a balanced approach in the year ahead, with a roughly equal weighting between value and growth companies.

As for size, we are very bullish on the small-cap space—a segment which has been pummeled over the past year. Small caps, which can generally be defined as companies between $250 million and $2 billion in size, generate an overwhelming percentage of their revenues domestically, making them less vulnerable to a strong US dollar and weak overseas conditions.

Our favorite investment vehicle in this space is the Invesco S&P SmallCap Revenue ETFRWJ $116, which holds nearly 600 North American small- (50%) and micro-cap (50%) companies. Companies with strong balance sheets and cash flow statements will rule in 2023, and those are precisely the firms this fund identifies.

With a tiny average P/E ratio of 9.58, the fund uses a rules-based approach which re-weighs securities based on revenue earned, with a max weighting of 5% in any one name. The fund rebalances quarterly based on this factor. Loaded with undervalued names flying under the radar, this investment is well poised to not only weather the economic downturn, but to excel as the US economy rebounds.

Moving up in market cap size we find our second-largest holding in the Penn Dynamic growth Strategy, the Pacer US Cash Cows 100 ETFCOWZ $49. This aptly-named fund selects investments by screening the Russell 1000 index for the top 100 companies based on free cash flow yield.

Free cash flow, or what remains after a company has paid expenses, interest, taxes, and long-term investments, is one of the most powerful indicators of a company’s financial health. These are companies often ignored by those easily distracted by flashy promises of future growth; they are firms which simply churn out profits quarter after quarter. Gilead SciencesGILD $89 , Phillips 66PSX $107, and FreeportMcMoRanFCX $40 are three top holdings in COWZ, though the fund is weighted by free cash flow with any given holding capped at 2% at time of rebalance. The fund is reconstituted and rebalanced quarterly.

While large companies still make up a plurality of our cap-weighted segments, we are cautious of giant multinationals (MNCs) which generate a bulk of their revenues overseas—especially from China. While we continue to hold great American firms like Apple and QualcommQCOM $123 in our strategies, these MNCs will face additional challenges as the rest of the world tries to shake out of its slowdown. Of course, the challenges for communist China go further than simply battling a recession as Western companies (wisely) continue to diversify away much of their country risk.

While there are bull markets somewhere around the world at nearly all times, they are presently getting harder to find. Our international allocation is the lowest it has been in years, but investors should look to countries poised to benefit from the manufacturing migration out of China. Specific recipients include: Singapore, Vietnam, India, and Taiwan— though we are avoiding the last name on that list due to the very real threat of Chinese confrontation.

For a sliver of a more risk-on portfolio, investors may want to put some money to work in the iShares MSCI Poland ETFEPOL $15. That country reminds us of the US during its strongest days of economic growth. Another “Wild West” country is Australia: the iShares MSCI Australia ETFEWA $23 holds 59 solid Aussie firms—many in the Basic Materials sector (an area we are overweighting).

Sectors to embrace—and avoid—in 2023 The single sector we are most bullish on for 2023 is Health Care, for a plethora of reasons. First and foremost, it can be considered a defensive sector; no matter

what the econony is doing, people still need to be treated for conditions and they still need to take their medications. Additionally, many blockbuster drugs are in the late stages of the pipeline, which will fuel growth throughout the year. Biotechs, which had a rough 2022 as a group, should see a healthy rebound next year.

Financials is another sector we are overweighting in the year ahead. The zero interest rate environment made for razorthin spreads—the difference between the interest banks pay for deposits and the rate they charge on loans. The higher the Fed funds rate goes (within reason), the larger the spread for the banks.

Consumer Staples also gets a green light for next year, as these companies generally make the products which people will continue buying in a downturn. Examples would include General MillsGIS $86 , Archer-Daniels MidlandADM $91, and Dollar GeneralDG $246 .

Rounding out our strongest-conviction sectors would be Industrials, specifically the Aerospace & Defense segment. Companies such as Lockheed MartinLMT $491 , RaytheonRTX $100 , Northrop GrummanNOC $542, and General DynamicsGD $251 are providing the free world with the tools needed to fight— and beat back—tyranny. The companies which will rebuild our crumbling infrastructure also reside within this sector.

Our overall outlook for 2023

After an ugly 2022 we expect a nice bounceback in the market next year, buoyed by an end to rate hikes, the early stages of an expansion (following a mild US recession), and a taming of inflation. To reiterate our previous comment, when the mood is most sullen and dour, the time to buy is typically at hand. The “silly” money (NFTs would be the poster child) has largely been flushed out of the market, and it is time for the serious money to move back in.

While we will get more in depth throughout the year with respect to sectors and individual investments, this brief guide should provide a good starting point. For sample asset allocations, see the next page; for specific investment ideas, see our six Penn strategies in the back section. As always, let your personal Risk Tolerance Level guide your decision making. Happy investing!

After an ugly 2022 we expect a nice bounceback in the market next year, buoyed by an end to rate hikes, the early stages of an expansion...and a taming of inflation.

Portfolio Construction

Tactical Asset Allocation—Winter 2022/23

Capital preservation portfolio

The Capital Preservation Portfolio is for the most risk-averse investors. The goal of this model is what the name implies: protecting capital. Finally, after more than a decade of lousy fixed-income options, we have viable investments in shorter maturity bonds. Still, as rates continue to rise, we urge caution with respect to these vehicles, as most will still go down in value as rates go up. We recommend individual bonds right now, as they will guarantee (barring insolvency) a full return of principal. This is one reason we avoid open-ended bonds funds. Load up on government, agency, and strong corporate issues.

Risk Level 45

Growth & Income PortfolIo

The Growth & Income Portfolio may be ideally suited for those either in retirement or nearing retirement. The goal is to generate a stream of cash (via dividends and interest) which can provide a nice monthly “paycheck” to owners, but still provide enough growth from the principal to allow for an annual cost of living raise. How much should be taken out of this portfolio on a monthly basis? Take the portfolio’s current value times 0.05, divide that number by twelve, and you have the answer. Don’t let anyone tell you that more can or should be taken out. If more is needed, it should come from elsewhere.

Risk Level 51

These four allocations are based on our view of the short-term investment and economic horizon, and are for informational purposes only. Always consult your investment professional when designing your own portfolio. To identify your Personal Risk Number, visit the Penn Wealth Risk Management page.

Conservative Growth Portfolio

The Conservative Growth Portfolio is where a plurality of Americans “fit” within the investor spectrum. Strong growth is desired, but there are no income requirements needed from the portfolio. This investor can focus on the widest array of investments available, but must still be cognizant of market risks. We are backing off a bit from real estate due to recession concerns and a stall in the back-to-work movement, but are keeping our “alternatives” allocation where it was. We have increased our fixed-income allocation due to favorable opportunities, and are tilting back toward growth in equities.

Risk Level 61

Growth Portfolio

The Growth Portfolio is designed for Americans with the highest appetite for risk. Whether relatively young, or having a large enough income base to take on more risks, this investor has the freedom to pursue more exotic investment vehicles. We are still keeping a relatively large (24%) allocation within the cash and fixed-income style boxes, but this is by design. It is important to keep some powder dry to take advantage of new opportunities as they arise. We have reduced our international exposure as developed Europe enters recession, and have increased our small-cap holdings due to their domestic (sales) focus.

Risk Level 69

The Future of Energy

US Notches Breakthrough in Nuclear Fusion Technology

Nuclear fusion, which produces none of the radioactive waste of fission, holds great promise for the field of energy generation

We need look no further than Europe, which had fully commited itself to renewable energy and had all but banned fossil fuels, to realize that the world has a serious energy crisis. Ordinary citizens face a freezing winter thanks to energy rationing and a quadrupling of utility bills. The rich irony is crystal clear: While embracing wind and solar within its own borders, the continent became appallingly reliant on fossil fuels provided by a dictator to the east.

Fossil fuels are, to be sure, a limited resource which must eventually be replaced by renewables. That said, wind and solar will never amount to more than a small fraction of the solution. Nuclear energy—the type produced by some 437 active reactors worldwide— provides a real answer, but the specter of radioactive waste will forever hang over the industry. So-called “green hydrogen,” which is produced by splitting water into hydrogen and oxygen via electrolysis, holds promise, but serious storage and transportation challenges remain. New technolgies are needed. Enter nuclear fusion.

What is nuclear fusion, and how does it differ from the process used by current reactors?

Current nuclear reactors, which are responsible for generating some 10% of the world’s energy needs, create power through nuclear fission, or the splitting of heavy atoms. Nuclear fusion, as the name implies, does just the opposite: it creates power by merging two light nuclei to form a single, heavier nucleus. Since the total mass of the resulting nucleus is less than the mass of the two original nuclei, the leftover mass becomes energy. If harnessed at scale, the energy created could be virtually limitless. The process is clean, creating no radioactive waste along the way.

The challenge and the (American) breakthrough

In the 1930s, scientists discovered that nuclear fusion was possible. In the following decade, serious research in the field began taking place in the United States, the UK, and the Soviet Union. The initial major challenge for the programs derived from the fact that fusion reactions require temperatures of hundreds of millions of degrees. This makes sense when considering that this exact process is what powers our own sun and every other star in the universe.

With the advent of the laser in the 1960s, it became possible to generate the heat needed for nuclear fusion, but another major problem soon surfaced. It turns out that the amount of energy required to create nuclear fusion was always greater than the amount of energy produced; meaning no real-world applications were possible. It didn’t matter how much energy was produced if it always took a greater amount to produce it.

On the 5th of December, a massive breakthrough occurred. Scientists, engineers, and technicians at the National Ignition Facility, part of the Lawrence Livermore National Laboratory outside of San Francisco, achieved a net gain in a controlled nuclear fusion test.

Fusion ignition is the point at which a nuclear fusion reaction becomes self-sustaining—possible because more energy is being generated than is needed to create the reaction. Specifically (in this case), a laser drive using roughly 2 megajoules of energy created 3 megajoules of power. Researchers at the facility have been working to achieve this specific breakthrough since 2009.

The potential The main “ingredients” required for nuclear fusion are deuterium, which can be extracted inexpensively from seawater, and tritium,

which can be produced artificially by irradiating lithium metal. Imagine a nearly limitless energy source with no chance of disastrous accidents taking place and no longterm waste. It may seem too good to be true, but that is what nuclear fusion offers the nation able to break the code, at scale, of fusion ignition.

Critics argue that adding nuclear fusion to the power grid is twenty years off, “and always will be,” but advocates believe we could have a prototype fusion power plant up and running in the next decade. Not only are billionaire investors suddenly discovering this exciting field, governments and publicly traded companies are increasing their funding at a rapid clip. This technology will, undoubtedly, revolutionize the energy sector.

Investing in Nuclear Fusion

Commonwealth Fusion Systems, LLC, a spinoff of MIT’s Plasma Science and Fusion Center, has already raised nearly $2 billion in funding as it races to achieve fusion ignition. There are nearly three dozen other such operations around the world, attracting high-visibility individual investors as well as government and corporate funding. While most of the companies performing the cutting-edge research are private, a handful of publicly traded companies are also in the game.

Chevron Technology Ventures, a funding arm of Chevron CorpCVX $174 which is tasked with uncovering and developing future energy sources, recently made a sizable investment in Zap Energy. Zap’s is building a compact, scalable, and cost-effective fusion core which it argues has the shortest path to commercial viability. Chevron, a member of the Penn Global Leaders Club, has been increasing its focus on clean, renewable energy sources.

AlbermarleALB $212 is the world’s largest lithium miner, with operations—and customers—around the world. Fusion requires lithium, and this US-based company is well-positioned as the source for this ingredient.

Livent CorpLTHM $19 is another US-based, pure-play lithium producer—and our preferred company in the space. With a minimal amount of debt, LTHM’s debt/equity ratio is 19%. We would value the company’s shares between $35 and $40.

SNC-Lavalin GroupSNC.TO $25 is a Canadian engineering and construction firm which operates within the smart grid/nuclear energy space. The company is part of an international consortium aiming to deliver nuclear fusion on a commercial scale.

The First Trust NASDAQ Clean Edge Smart Grid Infrastructure ETFGRID $87 is comprised of companies involved with the electric grid and associated industries. Top holdings include Johnson Controls InternationalJCI $64, Quanta ServicesPWR $140, and HoneywellHON $213 .

The contents of this report reflect the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

Fundamental Analysis

Ten Stocks to Buy for 2023

When the markets become rough and tumble and investors begin making decisions based on fear, a system already filled with dislocations becomes rife with opportunities. The longer the volatility continues, the greater those opportunities become.

While analysts are beginning to sound a bit less dire about the markets in 2023, most are still quite bearish due to the drubbing they took this past year. This has caused a mass case of myopia, obscuring companies poised to make big gains in the year ahead.

Here, we highlight ten companies we like for 2023; firms either being ignored or downright spurned by the so-called experts. No echo chamber claptrap, just gutsy calls—plus a no-brainer or two.

The dominate leader in content creation When it comes to creating digital content, whether for advertising and marketing or pure publishing, there is one dominant global name: AdobeADBE $335 This $156 billion industry leader began making a massive shift away from product sales and toward a subscription model several years ago with its Adobe Creative Cloud. CC now boasts some 26 million paid subscribers, and the untapped portion of the total addressable market is still enormous.

Adobe shares topped out at $700 in November of last year, right as the NASDAQ was hitting its peak. This company was unfairly lumped in with tech players which have yet to turn a profit. A 50% jump in ADBE shares would bring the price just back up to $500—a reasonable expectation.

The happiest place on earth Here’s a pick we didn’t see coming. The Walt Disney CompanyDIS $86, which was once a nearly permanent fixture in our porftolio mix, was unceremoniously jettisoned when the board selected Bob Chapek to take over in the CEO role. He lived up (or down) to our expectations, and bungled virtually every possible tactical and strategic decision. After a really stupid political flip-flop (why do companies feel the need to insert themselves into domestic politics?), the board doubled down on its bad decsion and extended his contract by three years!

The directors finally realized the error of their ways after an exceptionally bad earnings report, and they fired Chapek without warning. Bob Iger, the arrogant

yet highly skilled former CEO, agreed to come back for a set number of years to help right the ship. We have full faith that he will do it.

Very few companies can get away with raising prices for their goods and services the way Disney can. Park prices have become eye-poppingly expensive, yet the throngs continue. As travel picks back up, they will remain at peak capacity.

The streaming side of the business also has great potential, yet it was bungled by Chapek—highlighted by his run in with movie star Scarlett Johansson. Iger is a Hollywood schmoozer who will quickly unruffle feathers and get the company’s movie business back on track (needed after an Avatar sequel flop).

Disney has a forward P/E of 22, down from more than twice that a year ago. Sitting below $100, DIS shares could easily spike 50%.

A disruptor in the Travel & Leisure industry

AirbnbABNB $88 gave the sleepy travel industry its first real makeover in generations. The traditional hotel/ resort model was tossed on its head, creating a new way for people to travel and for ordinary citizens to tap into this $9 trillion global industry.

Tourism accounts for some 10% of the global economy, yet the recipients of this fertile income stream were becoming more and more concentrated. Airbnb changed that by democratizing the process, allowing average, ordinary citizens the ability to market their abodes to the masses on the company’s impressive platform.

Competitors are pounding at the door, but we don’t believe they will be able to replicate the company’s model, especially with skilled founder Brian Chesky’s almost paranoid moves to remain the industry leader. We had planned to buy ABNB shares immediately after they went public, but they opened at such a premium we simply couldn’t justify the purchase. Now, this company with $10 billion in cash reserves and just $2 billion in debt is sitting near its all-time low stock price. Analysts have a dozen reasons to avoid the stock; we offer one simple reason to buy: it is massively undervalued.

Global defender of freedom James Taiclet, who could pass for the twin brother of altruistic actor Gary Sinise, has quite an impressive résumé. After graduating from the United States Air

Copyright 2023. All Rights Reserved.

After the year we’ve just had, opportunities abound for astute investors; here is a rather eclectic list of some of our favorite names for the new year

Force Academy, he went on to log some 5,000 flight hours in (primarily) the C-141B StarLifter. Today, he leads the very company whose aircraft he flew in the Air Force, Lockheed MartinLMT $475

Take Boeing CEO Dave Calhoun, flip the script 180 degrees, and you have Taiclet—one of the strongest leaders in the industry. Unlike many of our other big calls for 2023, Lockheed remains near its all-time high share price. That doesn’t change the fact that this company, along with its famed Skunk Works lab, churns out the most advanced weapons systems in the world, and will continue to do so well into the future.

With geopolitical turmoil on the rise and defense budgets growing within nearly every Western nation’s budget, Lockheed Martin should be a cornerstone of just about every stock portfolio.

A disruptor in the field of transportation

What Airbnb did for travel accommodations, Uber TechnologiesUBER $25 did for transportation. Before this company came along, citizens who wished to get from point A to point B in a city had, in essence, one option: the taxi cab. Being as polite as possible, that option was not exactly one which fueled enthusiasm.

Despite being attacked by the old guard and their willing accomplices in positions of power, Uber has been an unstoppable force for good. Providing individuals with the ability to earn extra income as contract drivers, and riders with a pleasant experience backed by exceptional technology, this company has proven itself under all economic and political conditions.

As with Airbnb, the competition is flooding in; but Uber, with its 110 million users in 63 countries, will maintain its dominance. At their current price of $25, we see at least a 100% upside for the shares.

Transportation on a higher plane

No airline in world is embracing the future of air travel like United AirlinesUAL $38. Scott Kirby has transformed United, the globe’s third-largest carrier, from the butt of jokes under hapless CEO Oscar Munoz, to a forward-looking leader in aerospace.

In addition to implementing a number of enhancements to improve the flying experience, Kirby recently made a stunning deal to buy 15 Boom Supersonic aircraft and an option to buy 35 more. The company also inked a deal for a fleet of Archer Aviation vertical-take-off-andlanding (VTOL) air taxis and 200 Heart Aerospace all-electric airliners.

Kirby has invested a lot in the future of United, and we fully expect these investments to pay off in spades. Investors don’t realize what he is building, which is why shares of UAL remain stuck in the $40 range—they are easily worth $65 in the short term and substantially more over time.

The world’s easiest shopping experience Remember how frustrating the shopping experience used to be? We would either spend time and gas money driving around town, or pay exorbitant shipping fees to get an item delivered. With its inventory of over 12 million items and two-day free shipping for members, AmazonAMZN $85 has changed the way Americans shop.

It amazes us how investors have shunned Amazon over the past year, driving the company’s shares down 55%. This is a firm which had $386 billion in net sales and moved $600 billion worth of merchandise last year. And that does not even take into account the company’s lucrative Amazon Web Services (AWS) unit.

When the company performed its 20-1 stock split earlier in the year, the shares were adjusted from $3,000 to $150, and we considered them reasonably valued. Now, at $85, they trade at a 61% discount to that adjusted price. We believe Amazon shares will work their way back up to the $200 range relatively soon.

Power generation for the masses Talk about a market disconnect—and a great scenario for astute investors who act on logic rather than emotion. Generac HoldingsGNRC $90 is the dominant leader in the home standby generator market, with a 70% market share. And there are few more promising areas for investors than solutions for an energy-hungry world. Think of the rolling blackouts in California, or the winter storms last year in Texas. Americans demand power in their homes, and they are willing to pay to help assure that power remains intact.

Shares of Generac have been decimated over the past year, dropping from $524 in November of last year to $90 as we write this. Perhaps the 64 multiple at its high was a bit rich, but the company operates in the black year after year and its P/E ratio now sits under 14.

We are also excited about Generac’s move into clean energy and the ability of its PWRcell system to not only store energy from solar cells or the grid, but also to communicate with the local utility company’s system to provide continuity.

We believe GNRC shares are fairly valued at $135, or 50% above current price.

A Canadian cannabis player setting its sights south of the border

Opportunity presents itself when investors have completely given up on a position which remains poised for robust growth. Check out the share price of Tilray BrandsTLRY $3 to find such an example.

Tilray, a Canadian cannabis player which also happens to own Breckenridge Distillery and SweetWater craft brewery, has an extensive international distribution business and is well-poised to permeate the US market when the drug is legalized at the federal level. Once that happens, in fact, the company will exercise notes to take majority control of MedMen, the preeminent US cannabis company (federal law currently prohibits foreign entities from buying into the domestic market, so the company astutely bought convertible notes last year which it will exercise once legal).

Tilray is the only Canadian pot company anywhere near positive free cash flow, and CEO Irwin Simon—founder of Hain Celestial—is the ideal visionary at the helm. We could see TLRY going up fourfold, to $12 per share.

The dominant EV maker for decades to come

We saved our favorite for last. It seems as though everyone hates trailblazing EV manufacturer TeslaTSLA $112 these days. Granted, Elon Musk, one of the most brilliant minds in American business, has always had his haters, but they came out of the woodwork—and became unhinged—after he purchased Twitter. Once sitting at $414.50, Tesla shares now trade at a 52-week low of $112.

Tesla has produced nearly one million vehicles through the first three quarters of the year, but that is not all the company makes. In its gigafactories, the firm also produces advanced lithium-ion batteries as well as its Powerwall and Powerpack energy storage systems.

To feed those systems, Tesla also makes and installs rooftop solar panels as well as advanced solar power collecting shingles. While the company has been forced to pause scheduling new installs (likely due to component supply issues), expect the unit to ramp back up in 2023.

Investors willing to ignore the headlines and buy stock in Tesla right now should be richly rewarded: we would place a fair value on the shares at $250.

There you have it, our rather eclectic group of ten stocks to buy for 2023. Of course, investors should always assure they maintain a well-balanced portfolio based on their own Risk Tolerance Level.

Leisure Equipment, Products, & Facilities

The content of this report reflects the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred. This is not a solicitation to buy. Always consult your investment professional before investing any money.

Topgolf Callaway Brands Corp

We distinctly remember, several years back, reading about the imminent demise of golf in America. Country clubs were struggling or folding, and cockamamy schemes—like making the holes bigger— were being floated to keep ordinary Joes in the game. It turns out those predictions were the equivalent of a triple bogey.

While the pandemic certainly encouraged the outdoor sport at a time when most indoor establishments were closed, we had already become a big believer in a place called Topgolf: a multilevel driving range “experience” which was attracting people to the sport like never before.

A sports entertainment destination full of high-tech features, heated bays, and plenty of food and booze, Topgolf is becoming the modern-day version of what bowling alleys and video game arcades were in the ‘70s and ‘80s: a destination where friends can meet, play, drink, and spend lots of money. As we come close to entering a recession, think people will balk at the $50 per hour average bay rental? Think again. There is nearly always a waiting list for the bays.

Having undergone three, two-for-one stock splits since then, initial investors who hung on would have been rewarded with a nearly 400% return since the IPO, or approximately 14% per year. Here’s an interesting point, however: Back in both the summer of 1997 and the summer of 2021, ELY shares were trading up over 800%.

Ever on the cutting edge, Callaway made the strategic decision to buy Topgolf in early 2021. We believe this was a brilliant move which cemented the company’s position of leadership in the industry and attested to its forward-looking philosophy. It even changed its ticker symbol to MODG, fully intent on being the face of “modern golf.”

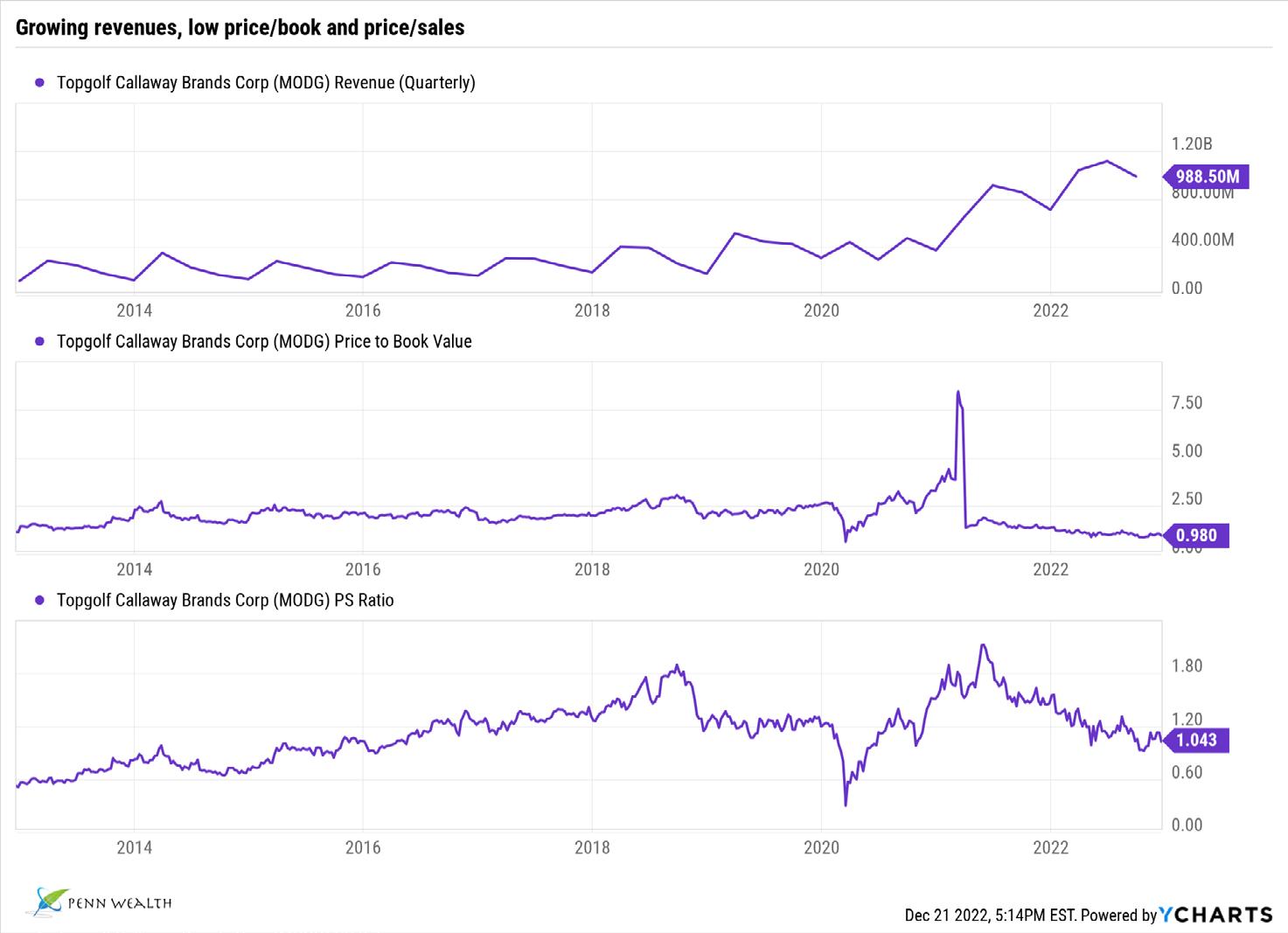

Key growth drivers and financial health

In 2020, Callaway had $1.6 billion in sales; in 2021, with its new acquisition, the firm had $3.1 billion in sales; over the trailing twelve months, revenue hit nearly $4 billion in sales. That trend is impressive, and we expect it to continue.

Topgolf is certainly the key driver of growth going forward, and the company has plans to open ten new venues each year. That unit alone will soon be generating $2 billion in revenue per year, and the figure should more than double by the end of the decade. While the apparel and golf equipment brands don’t have the same lofty trajectory, they operate perennially in the black.

Callaway becomes the face of modern golf

While Callaway was founded in 1982, the company really took off in the early 1990s when it introduced a radically improved clubhead design. When Merrill Lynch helped bring the company public under the ticker “ELY” in 1992, it did so at $20 per share and with a $200 million market cap.

Despite dishing out some $2.66 billion for Topgolf, this $3.6 billion small-cap firm has managed its finances well. Its current debt load sits at $1.1 billion, making its debt-to-equity ratio an enviable 0.306. Revenues have grown 15% per year for the past five years, and the company’s gross profit margin is 61.67—well ahead of its peers.

Price target

We added MODG to the Intrepid Trading Platform at $19.50 per share with a $30 per share initial price target. We have a $16.75 stop loss on the position.

Investors are being told to shun consumer discretionary names in favor of defensives as we near a recession, but there are some cyclicals poised for real growth at prices too low to ignore

...Topgolf is becoming the modern-day version of what bowling alleys and video game arcades were in the ‘70s and ‘80s.

INVESTMENT PROFILE

Founded in 1982 in Carlsbad, California by Ely Callaway, Topgolf Callaway is a leading designer, manufacturer, and marketer of high-quality golf clubs, balls, bags, and golf-related accessories. The company purchased fast-growing sports entertainment company Topgolf in 2021, and changed its name earlier this year to reflect the acquisition. With a $3.6 billion market cap, the firm generated $204 million in net income from $4 billion in sales over the trailing twelve months.

Suitable for the Intrepid Trading Platform

Topgolf Callaway may have been a pandemic darling, but it has staying power—as evidenced by its growing revenue stream, a price-to-book below one, and a price-to-sales ratio right at one. Despite these numbers, shares of the company have dropped 45% from their high, offering investors a great potential entry point.

The contents of this report reflect the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

JPMorgan Equity Premium Income ETF

While we are tilting heavily toward blue-chip value names in general this year—companies which tend to provide higher dividends, few investors would expect to live off of the income generated by this aggregate group. Granted, the 2.54% yield of the SPDR S&P Dividend ETFSDY $125 is only around 1% lower than the current yield on a 30-year Treasury (astonishingly), but income-oriented investors want the best of both worlds: a generous income stream plus the potential for growth of capital. At the very least, not the erosion of principal that both their bond and equity portfolios had to deal with in 2022. There may be a solution to this dilemma.

The JPMorgan Equity Premium Income ETFJEPI $55, which is managed precisely like its open-ended sister fund (JEPIX), holds a nice mix of some 130 investment vehicles. Common blue-chip names like PepsiPEP $182 , Union PacificUNP $210, and HoneywellHON $214 are included, and there is a 15% allocation to higher-yielding convertibles, but those factors don’t explain the fund’s stunning 12.51% (9.64% 12-month rolling) yield.

We used to work with an experienced broker who loved selling closed-end funds to clients looking for yield. Many of these beasts, by their charter, would spit out 9-10% “yields.” The more we questioned these funds, however, the less we liked the answers. In essence, the managers would use high risk leverage—borrowing money to fund purchases—to create income. A dangerous gambit in down markets.

While we recalled those closed-end funds as we began evaluating JEPI, the experienced management team of Hamilton Reiner (35 years experience) and Raffaele Zingone (31 years experience) employs a quite different approach.

A unique options strategy generates yield

In an effort to reduce volatility, the fund uses a hedged equity strategy to meet its dual objectives of generating income and providing growth potential. Using an options overlay of out-of-the-money S&P 500 index calls, distributable monthly income is generated—the income being derived from the premiums gained by selling these instruments. Each month, 100% of the dividends and all of the gains made by selling the options are paid to shareholders.

On the equity side of the equation, paying a dividend is not a prerequisite for being included in the club. The managers seek companies with strong pricing power, lower volatility, and—based on their proprietary research—an undervalued stock price. AbbVieABBV $163 , Exxon MobilXOM $109, and VisaV $206 are also top holdings in the fund. Although the ETF version was just launched in May of 2020, it has already amassed $17 billion in assets under management.

So, why did we buy the ETF version of the fund instead of its open-ended clone? First and foremost, we can liquidate an ETF intraday, as opposed to being at the mercy of the remainder of a session. This means we can also place a stoploss order on the vehicle if so desired. Furthermore, the cost of owning the ETF is roughly half that of the expense ratio on JEPIX. ETFs also hold more favorable tax profiles.

JEPI has a beta of 0.69, a risk level of 47/99, and an expense ratio of 0.35%. It is a recent addition to the Penn Strategic Income Portfolio: 25 holdings designed to provide a steady stream of income while attempting to avoid erosion of principal.

Income investors are starved for yield while equity investors want a buffer of safety; this strategy may help on both fronts

Under The radar

Four investments being ignored—or missed—by the financial press Costamare

CostamareCMRE $9 is a micro-cap ($1 billion) global shipping company based out of Monaco. The company leases its fleet of 76 containerships to major operators for short-, medium-, and long-term charters. Customers include the likes of COSCO, A.P. MollerMaersk, and Evergreen. Founded in 1974 in Athens, Greece, Costamare has a forward P/E of 2.4, a debt-to-equity ratio of 1.5, and a dividend yield of 5.03% based on the current share price. The company, a perennial money maker, earned $435 million in 2021 from $800 million in sales, for a gross profit margin of 55%. We would place a fair value on the shares at $16, or nearly double where they currently trade.

ExelixusEXEL $15 (ek suh LICK suhs) is a small-cap ($5.4B) biopharma firm engaged in the discovery, development, and commercialization of small-molecule therapies for the treatment of cancer. The company’s lead molecule, cabozantinib, is approved for treatment of thyroid cancer under the name Cometriq and for the treatment of kidney and liver cancer under the name Cabometyx. Thanks to a number of smart collaborations with big pharma players, Exelixis has been able to achieve major milestones in drug development without the astronomical costs typically associated with the process. The company earned $231 million in 2021 from $1.8 billion in revenue, has a $1.5 billion cash war chest, and is debt free. We would place a $27 fair value on the shares.

Asahi Kasei CorpAHKSY $14 is a Tokyo-based holding company founded precisely 100 years ago. Through its various subsidiaries, the firm is organized into four segments based on product or service: chemical and fibers, homes and construction, electronics, and healthcare. The majority of Asahi’s revenue comes from Japan, making it a pure international play. (It should be noted that we are bullish on Japanese equities for 2023.) With its small multiple of ten, the firm generated $1.44 billion of net income from $22 billion in revenue for the fiscal year ending March, 2022. This $10 billion Basic Materials company has a clean balance sheet, low beta (0.6717), and 3.53% dividend yield, making it worthy of review for investors searching for solid overseas companies.

It has been quite a while since we talked about a beverage distributorship, and when we did it typically involved booze delivery. Arca ContinentalEMBVF $8 is a Mexico-based bottler and distributor of primarily Coca-Cola products throughout Latin America. Beverage sales account for 90% of the company’s revenue, with snacks accounting for the other 10%. Arca primarily operates within Mexico, Ecuador, Peru, and northern Argentina, though the company’s snack brands include Wise in the US. With a tiny P/E multiple of six and a dividend yield of 4%, this $14 billion mid-cap value firm might be a good fit for international exposure within a portfolio. The company has free cash flow of $1.2 billion and earned $724 million from $10 billion in revenue over the trailing twelve months. With much of the world on the precipice of recession, this defensive name looks attractive.

Trading Desk

Actions we have taken at the Penn Trading Desk, plus a look at what other Wall Street analysts have to say...

Penn: Buy Travel ServiceS firm

To remain on top of all trades as they happen, subscribe to our Twitter feed @ PennWealth. All trade details can be found at the Penn Wealth Trading Desk .

We wanted to buy AirbnbABNB $82 when it first went public, but it spiked so high so fast that we just couldn’t justify it. That said, we have always maintained a healthy respect for the firm and its management team. When the shares fell 60% below their Feb ‘21 high of $219.94 on a downgrade, we jumped in. Could the shares go lower? Of course. But we see great upside potential, a very strong balance sheet, a dynamic leader in Brian Chesky, and a dominant leader in the travel and leisure space. We added ABNB shares to the Global Leaders Club with an initial price target of $145/share.

Penn: Buy mining comPany Freeport-McMoRanFCX $30 is a US-based, $45 billion global mining company with proven mineral reserves of copper, gold, and molybdenum. This global miner has major operations in North America, South America, Asia, and Africa. The majority of the company’s revenue is derived from the sale of copper, with more than 70% produced going to applications which deliver electricity. (EVs use around four times as much copper as internal combustion engines, or ICE.) We added FCX to the Global Leaders Club @ $30.50 with a $45 initial target price on the shares and a $27.50 stop loss to protect principal.

Penn: oPen STmicroelecTronicS

STMicroelectronicsSTM $37 is one of Europe’s largest chipmakers, manufacturing thousands of products for a wide array of industries. The shift away from Chinese-produced semiconductors should greatly benefit this company, especially in the EV industry. Added to the New Frontier Fund at $37/sh.

lifecycle services. When you think the future of AI and automated factories, think Rockwell. The company plummeted after missing Q1 earnings estimates and cutting full-year profit guidance due to supply chain issues. The 14% drop (-38% YTD) gave us a golden opportunity to buy this excellent mid-cap industrial in the New Frontier Fund. Opened at $215.

Penn: Buy advance auTo ParTS

Advance Auto PartsAAP $155 has been our favorite player in the do-it-yourself auto repair market for years. Incredibly, considering the outrageous price of both new and used cars right now, investors have thrown in the towel on this gem, driving its price down to a 52-week low. That is when we struck. We purchased AAP shares within the Intrepid Trading Platform at $155, with an initial target price of $200 and a stop at $139.50.

Penn: Buy walT diSney co

The Walt Disney CoDIS $100 has been in our doghouse ever since the hapless Bob Chapek took over as CEO in February of 2020. That all changed with the unexpected firing of Chapek and a new two-year contract for previous CEO, Bob Iger. There are a lot of fences to be mended after the ham-handed Chapek, but we believe Iger can bring this company back. We purchased shares in the Global Leaders Club for $100 w/$150 price target.

Penn: Buy modg in inTrePid

The content of this report reflects the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

Penn: Buy rockwell auTomaTion

RockwellROK $215 is a pure-play automation company spun off from Rockwell Collins in 2001. The firm operates in three segments: intelligent devices, software & control, and

Founded in 1982, CallawayMODG $19.50 went public in 1992 on the back of its revolutionary line of golf clubs. In early 2021 the company purchased Topgolf, changing its name to Topgolf Callaway and its ticker to MODG. Topgolf Callaway not only represents the future of golf, it is responsible for bringing throngs of new players to the sport through its entertainment destination Topgolf. The unit will be a massive growth driver for the firm. We added MODG to the Intrepid Trading Platform at $19.50 with an initial price target of $30 and a stop loss at $16.75.

The hapless wonder is gone; time to dive in at a discount...

Gold will have a strong year in 2023; FreeportMcMoran will reap the benefits

When you think of the future of robotics and automation, think Rockwell

Topgolf Callaway represents the future of golf, both in the US and around the world

Weekly Business Report

The content of this report reflects the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

national deBt

the national deBt, Fed Balance sheet, Budget deFicit, and gdp: a quick and dirty guide

When the terms national debt, budget deficit, Fed balance sheet, and GDP are thrown around, we suspect that many Americans’ eyes tend to gloss over. However, just as every American family should know its financial position at any point in time, it is our duty to understand the basics of how the government is spending our money. Spoiler alert: it is not pretty.

Let’s start with the national debt, the most eye-popping of figures. As of right now, per USDebtClock.org, the United States is indebted to the tune of $30 trillion. We have been hearing a lot about the Fed’s balance sheet lately, which currently adds up to just shy of $9 trillion. The “good news” is that this amount, which is a combination of mostly Treasuries and mortgage-backed securities, is included in the $30 trillion national debt.

The Fed has already begun tapering its massive spending program, and aims to actually begin reducing that $9 trillion this year. Per a recent CNBC business survey, the general consensus is that the Fed should be able to reduce its balance sheet by $2.8 trillion over three years, which would bring the total down to roughly $6 trillion. Sadly, that is still well ahead of the $4.3 trillion on its books just prior to the pandemic.

So, this means that our federal debt should be reduced by $3 trillion as well, right? Not exactly. The government has estimated that it will receive $4.2 trillion in revenue in fiscal 2022. Unfortunately, the nonpartisan Congressional Budget Office predicts that, out of the $4.2 trillion in revenue, the government will actually spend approximately $6 trillion. This is fully legal, as there is no “balanced budget” amendment in the US Constitution. This means that, in one single year, the United States will have a budget deficit of $1.8 trillion, more that offsetting the Fed’s planned balance sheet reduction.

Of course, interest must be paid on any debt load (“servicing the debt”). A full 7.3% of all revenue collected by the US government, or some $305 billion, will be needed to service the national debt this year. And that is with historically-low interest rates. As interest rates rise, that 7.3% will grow, and grow, and grow.

Gross Domestic Product, or GDP, measures the total value of goods and services produced in a country in a single year. For the United States, that figure is sitting right at $23 trillion—far ahead of second place you-know-who, and certainly the envy of the world. The debt-to-GDP ratio is easily determined by dividing the amount of debt a country owes by the amount of its GDP in a given year.

For historical perspective, America’s debt-to-GDP ratio at the time of the Stock Market Crash of 1929 was 16%; upon entering World War II it was 44%; during the 1973 oil embargo it was 33%; and during the 9/11 attacks it was 55%. In 2012, something ominous happened; an economic “death cross,” if you will. That is the year our national debt overtook—chronically and perennially—our GDP. Right now, America’s debt-to-GDP ratio sits at 130%, and projections have that figure steadily rising over the coming years.

For comparison, Venezuela’s ratio is 214% and the United Kingdom’s is 85%. China’s debt-to-GDP ratio in 2021, according

to the IMF, was roughly 70%. That country has responded by growing its spending by the weakest rate (0.3% y/y) in nearly two decades—a feat much more easily accomplished in a one-party communist dictatorship than in a representative republic.

And there we have it: a quick and dirty guide to federal debt, balance sheets, budget deficits, and GDP. Understanding these numbers and ratios is the first step in solving the problem. The next step is actually admitting that these numbers represent an unacceptable condition and will ultimately lead to an existential national threat. The third and fourth steps involve brainstorming for solutions and then implementing actions which will increase income and reduce expenditures. It is time to hold those in charge of the national credit cards accountable for their actions, and to demand more responsible behavior. But that would take yet another “stick” (in addition to a balanced budget amendment) in the form of mandatory term limits.