The New Real Estate

The

The

Biological

The

bank is trying to kill me, Sir, but I shall kill it.

WEALTH REPORT PENN WEALTH PUBLISHING | INVESTMENT INTELLIGENCE VOLUME 8/Issue 04 01 Nov 2020 Copyright 2020. All Rights Reserved. Penn Wealth Publishing.

THE PENN

Weapons

seismic shifts about to reshape the way investors look at real estate? IN THIS ISSUE Editor’s Desk: Write off Value Stocks at Your own Peril

Are

Andrew Jackson’s Bank War

world’s new greatest threat is quite ancient

Changing REIT Landscape

PAGE 08 America’s Rare Earth Renaissance

PAGE 12 A REIT that is recession-proof?

PAGE 15 Four bright ideas being ignored

ON

ON

ON

Cover: Cell towers like those owned by American Tower and Crown Castle International will play a critical role in America’s 5G rollout. These companies are in the niche REIT industry.

9393 West 110th Street, 51 Corporate Woods, Overland Park, KS 66210 913.538.7174 www.pennwealthreport.com member.services@pennwealth.com penn wealth publishing Copyright 2020. All Rights Reserved. 2 penn wealth Report volume 8 issue 04 01 nov 2020

Photo licensed

stRategic vision

American Campus Communities

Despite operating in a recession-proof market, this REIT got hammered in spring.

Cohen & Steers REIT ETF

With a concentrated group of holdings in strong niche real estate markets, this fund offers investors a unique play.

undeR the

Bright Ideas Being Ignored

A grocer, a diversified utility, a life sciences tech firm, and a bank loan fund: Four ideas that are being missed—or ignored—by investors and the press.

Upgrades,

The World’s New Greatest Threat

Biological warfare is about as old as war itself, but the pandemic will be the catalyst for a massive ramp-up in America’s biosecurity effort.

Actions we have taken at the Penn Trading Desk, plus a look at what other Wall Street analysts have to say, along with accompanying charts.

Weekly Business RepoRt

18

The truly unthinkable is happening: San Francisco landlords are being forced to lower rental prices to retain tenants

Ford desperately needed new blood, instead they simply transfused their own

In intriguing turn of events, the CalPERS chief investment officer abruptly resigns

19

Penn Global Leader Target Corp. notches a blowout quarter

Disney’s restructuring plans do not assuage our concerns

Sorry Apple haters, the iPhone 12 super-cycle is coming

SpaceX selects Microsoft to run its Starlink cloud computing network

The Penn WealTh report Copyright 2020. All Rights Reserved. Wealth. SucceSS. happineSS. 01 nov 2020 penn wealth Report volume 8 issue 04 3 09 12 06

Income Portfolio Dynamic Growth Strategy Global Leaders Club Intrepid Trading Platform New Frontier Fund

Strategic

Top Quotes of the Week

20 21

12

Downgrades, & Trades

16

RadaR

intelligence

FRont MatteR investMent

at your own peril: we have been down this road before. The Year in Charts A look at some of the charts which shaped the news over the past few weeks. 04

Editor’s Desk Write off value stocks

06 America’s Rare Earth Renaissance Fortress Value Acquisition Corp is funding America’s return to rare earth mining; it is about time someone takes the lead. 09 05 14 the penn stRategies the tRading desk 22 24 26 28 30

Changing REIT Landscape Real estate investment trusts can be dynamic, wealth-building, income-producing vehicles, but beware of the seismic shift about to take place. 10 08

tactical aWaReness The

15

Jackson’s Bank War In the election year of 1832, President Andrew Jackson delivered one of the most powerful vetoes in US history.

Andrew

From the Editor/

Write off Value Stocks at Your Own Peril

Investors are gobbling up growth stocks and shunning their value cousins; we’ve been here before.

I vividly recall the period. Perhaps it was the fact that I was a young broker with the daunting dual mandate of accumulating new assets while effectively managing those I already controlled. More than likely, however, it was simply the frenetic nature of the stock market at the time that made such an impact.

In less than the span of a decade, between the mid- to late’90s and the early years of the new millennium, we went from glowing promises of an enduring and paradigm-shifting “New Economy” to a market crash and a massive reshuffling of the winners and losers. Suddenly, the vaunted growth stocks were dogs and the hated and impugned value stocks were on top—at least relatively.

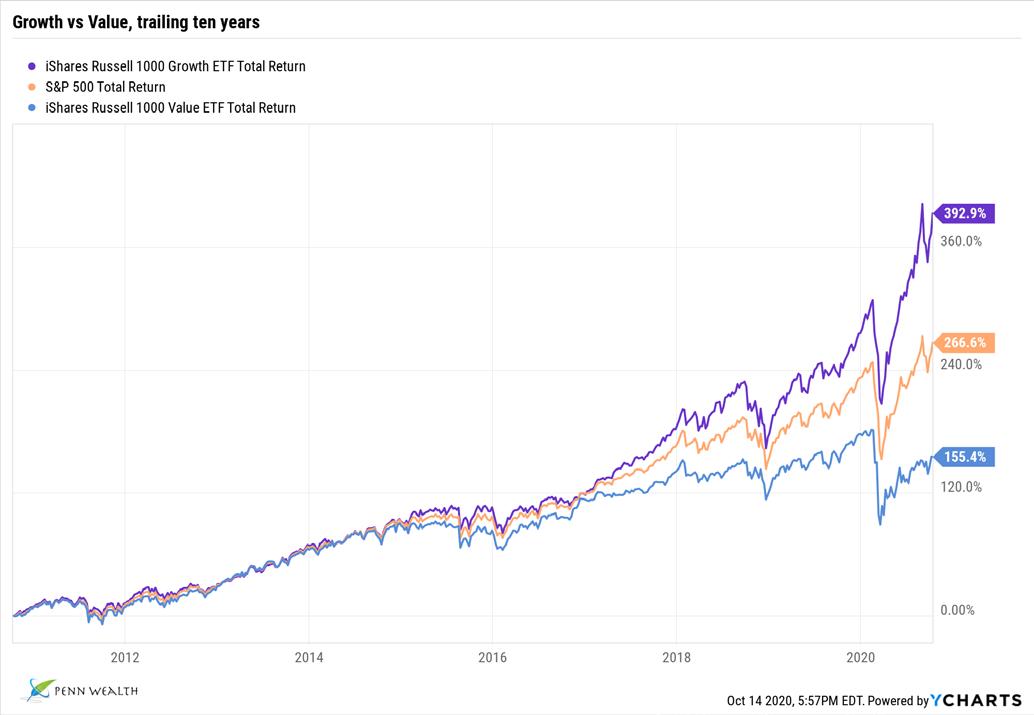

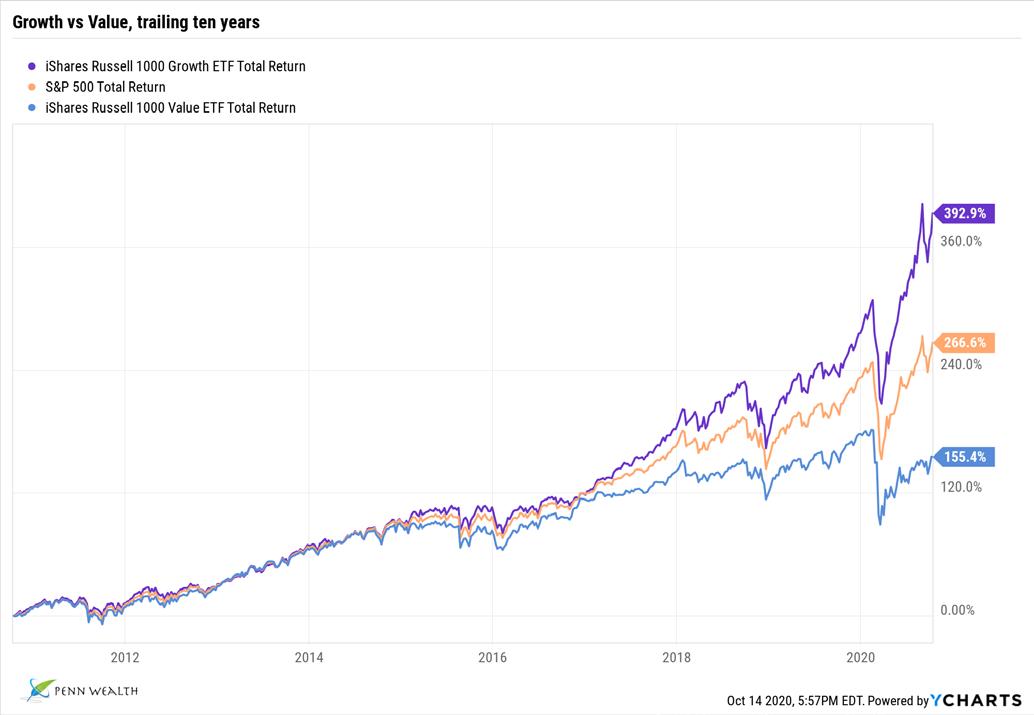

Take a look at the chart below. It represents the total return over the past decade of growth stocks versus the S&P 500 versus value stocks. The disparity is stunning. Growth stocks rose nearly 400% while their value counterparts were up just 155%. Examples of companies in the growth category include such

names as Netflix (NFLX), Salesforce (CRM), and Fastly (FSLY). In other words, companies with enormous P/E multiples and paltry to no dividend yields.

The chart for the past ten years looks ominously similar to the growth versus value story of the 1990s. But take a look at the second chart, which quantifies the great reversal of fortunes that took place between 2000 and 2010. A 44% gain over the course of a decade (for value) may not seem that impressive, but it sure beats the 23% loss growth investors had to contend with.

We love great growth stories, and aren’t against investing in tech names which have yet to turn a profit, but the growth over value argument being espoused by many market analysts sure sounds a lot like the “New Economy” argument they tried to sell us two decades ago. Having managed money through that incredible market period, here’s our advice to investors: You don’t need to sell your beloved growth names; just begin sifting through the earnings-rich value names to balance your portfolio.

—MSH

https://www.pennwealthreport.com

Michael S. Hazell editor-in-chief

Michael S. Hazell editor-in-chief

Penn Wealth Publishing

Information

Subscription

Publishing

Park, KS 66210 4 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved.

Penn Wealth

9393 West 110th Street 51 Corporate Woods Suite 500 Overland

The MonTh in CharTs

Muting the recovery...

Many parts of our economy did, indeed, get a “v-shaped” recovery. Unfortunately, millions of Americans are still suffering the economic effects from the China-borne pandemic. Certainly nowhere near the 7 million claims mark reached in March, the most recent week’s 898,000 new claims reflects the announced furloughs and layoffs from companies such as Walt Disney, Hilton, and shipping giant Maersk.

Charts tell the story. Here are some of our favorites from the past month. For the top business and economic stories of the week, visit Penn...After Hours at www.penneconomics.com.

When these high-flying Internet tech names (you know, the ones which have never generated a dollar of net income) come crashing back to earth, it will be brutal for the investors holding the bag. Want a taste of what the carnage will look like? Look no further than cloud platform provider Fastly (FSLY $86). After a slight revenue miss, shares plummeted by onethird. At $86 per share, we still wouldn’t touch this hot potato.

A rare bright spot...

There hasn’t been much to celebrate this year, but the pandemic was the catalyst for a positive metric (though the wonkish economists consider it a negative): the savings rate among Americans has skyrocketed. The long-term average of 9%, which is actually higher than we expected, was dwarfed by the 33% savings rate in the early months of the pandemic. Of course, this has been dropping precipitously as the lockdowns have subsided.

Penn Wealth Report Copyright 2020. All Rights Reserved. 01 nov 2020 penn wealth Report volume 8 issue 04 5

Déjà vu...

Andrew Jackson’s War Against the Second Bank of the United States

The Constitution of the United States, written in 1787 and ratified the following year, is the longest surviving active charter in the history of the world. The brilliance of the document is embodied in the fact that it laid out exactly what a centralized government could—and, more importantly, could not—do.

To protect the sovereignty of the nation, for example, the federal government had the power to maintain a standing army. But the Founders were very keen to assure power resided at the lowest possible level, assuring the rights of the individual were not trampled by a draconian central authority.

During his presidency, President Barrack Obama lamented the fact that the Constitution was a set of “negative rights,” outlining what the federal government could not do rather than what it could do. Statements such as this, from the leading individual authority of the time, illustrate the foresight and brilliance of the Founders.

The authors of the Constitution were acutely aware of the inclination of individuals in power to become so comfortable in their position that abuse of power, at the expense of individual rights, was almost a given. It is fair to say that the entire document was written with this in mind, and this revolutionary contract for the young nation would serve as a master guardrail to prevent such abuse.

It is human nature for individuals to see things through the prism of the contemporary world, failing to understand that most modern-day conditions are anything but unique. Hence, the oft-repeated argument by many that the Founders could not possibly foresee—let alone plan for—what would transpire long after they were gone. But their collective prescience, shaped by an extensive understanding of history, was nothing short of remarkable. They understood that history repeated itself, and that humans would continue to act in a predictable manner.

Take the modern power struggle between those who believe that only a central government can manage the needs of a population, and those who believe power should reside at the lowest possible level. That precise battle was raging 200 years ago, as evidenced by Andrew Jackson’s war on the Second Bank of the US.

The Hamiltonian Second Bank receives its first charter. It would probably come as a surprise to most that the Second Bank of the United States, given a 20-year charter by Congress in 1816, was actually a private corporation. While accountable to the US Treasury, it was anything but a bank of the people.

The bank’s primary shareholder was the federal government, with several thousand wealthy Europeans and several hundred wealthy Americans owning virtually all of its shares. The bank was responsible for handling the fiscal transactions of the government, and for helping to assure the access to capital for continued economic growth.

Despite being built upon the concept of a meritocracy, the US more resembled an aristocracy in the early 19th century. That was certainly the case with respect to the Second Bank, which loaned virtually no money to “average” Americans or small business owners, and the attitude of its pompous president, Nicholas Biddle. But a seismic shift was about to rock the country.

6 penn wealth Report volume 8 issue 04 01 nov 2020 Copyright 2020. All Rights Reserved. strategic vision The American Spirit

In the election year of 1832, President Andrew Jackson delivered one of the most powerful vetoes in US history

1837, by Ralph E.W. Earl; Public Domain

The first outsider to become president. For the entire forty year period following George Washington’s first election in 1788/89, presidents hailed from the seats of power at the time; namely, Virginia and New England. That template was shattered in 1828 with the election of Andrew Jackson.

It wasn’t just that Jackson, who soundly beat establishment darling and incumbent president John Quincy Adams, was from the frontier that shook the powers that be, it was his radical talk of empowering ordinary Americans from the middle and lower classes of society. America may have been founded upon the principles of individual rights, but the working class “rabble” was barely taken into consideration by the ruling elites like Adams.

Imagine the shock waves felt throughout Washington after nearly 650,000 voters—roughly 60% of the total—cast their ballots for the interloper. Did Jackson arouse passion amongst the electorate? The 1828 election brought out nearly twice as many voters as had the previous election in 1824. And Jackson’s radical talk was not a hollow campaign ploy, as his detractors would soon find out.

Jackson’s opponents make a terrible miscalculation. President Andrew Jackson’s support for the common man wasn’t academic, it was personal. From early in his career he had faced financial hardship, and he squarely placed the blame on banking institutions which he saw as merely a tool for the wealthy.

Despite his experience-based leanings, Jackson was not overtly antagonistic toward the Second Bank of the United States—at least initially. In a wonderful piece of historic irony, it was his detractors—a group which vehemently hated the president and strongly supported the bank—who ultimately sealed the bank’s fate.

Bank president Nicholas Biddle had a brilliant mind and the arrogance to go with it. As is often the case, his strong intelligence came at the expense of his ability to deal with others; namely, his political savvy was lacking. He was almost the inverse of Jackson, whose intelligence level was constantly being (unfairly) impugned by his political enemies, but who possessed a dynamic personality which drove them crazy. His connection with the American people was undeniable.

In the election year of 1832, Biddle joined in an unholy alliance with Jackson’s enemies in the US Senate, first among them being Henry Clay of Kentucky. In a move that lived up to his moniker of “Tsar Nicholas,” Biddle actually used thousands of dollars of bank money to try and defeat Jackson in his reelection bid. This move was an enormous political gift for the adroit president, who provided it as evidence that the bank was tainted and simply a tool for the ruling elite.

In the senate, Clay was making his own miscalculation. Even though the bank’s 20-year charter was not up until 1836, he applied for its re-charter four years early, believing Jackson would not be so bold as to veto it in the midst of his reelection battle. A rather remarkable gambit, considering “Old Hickory’s” storied career.

Being painted into a corner like this enraged Jackson, who railed against the bank’s “rag money” (fiat

currency not backed by hard assets such as gold and silver) and questioned the very constitutionality of the institution. Forced into action by Biddle and Clay, Jackson issued his rallying cry to his faithful vice president, Martin Van Buren: “The bank is trying to kill me, Sir, but I shall kill it!” To a delegation of bankers urging the re-charter, Jackson was even more blunt: “You are a den of vipers and thieves. I intend to rout you out, and by the eternal God, I will rout you out.”

The end of the bank and a rousing election victory. Biddle’s political missteps didn’t end when he joined forces with Clay for the early re-charter push. He arrogantly ordered thirty thousand copies of Jackson’s veto message to be printed up and disbursed to help Clay win the presidential election. On the campaign trail— another odd move for a “nonpartisan” banker—Biddle proclaimed, “This worthy president thinks that because he has scalped Indians and imprisoned judges he is to have his way with the Bank. He is mistaken.”

The result of Biddle and Clay’s slick maneuver? Andrew Jackson and Martin Van Buren went on to win a landslide victory, pulling 219 electoral votes to Clay’s 49, and winning 16 of the 22 states. Jackson’s new Secretary of the Treasury, Roger B. Taney, withdrew all public funds from the bank— effectively killing it—and placed the proceeds in the state banks.

Today, Americans decry the charged political atmosphere. It is important to understand the issues, however, and to realize that this level of intensity is a natural byproduct of a vibrant republic.

Penn Wealth Reportstrategic vision 01 nov 2020 penn wealth Report volume 8 issue 04 7 Copyright 2020. All Rights Reserved.

“The bank is trying to kill me, Sir, but I shall kill it!”

1833 cartoon depicting Jackson destroying the Second Bank as Uncle Sam nods approval; Public Domain

Rebuilding America’s Rare Earth Juggernaut

Fortress Value Acquisition Corp is funding America’s return to rare earth mining; it is about time someone takes the lead.

For the better part of a decade, we have decried the disgraceful US abandonment of rare earth mining—the discovery and extraction of mineral resources needed in high-tech equipment, from EV batteries to the latest generation of American jet fighters. This was akin to the US decision to give up its ability to launch astronauts into space with American rockets from American soil. The latter offense forced us to rely on the good graces of Russia; the former, on China. Both decisions were near-treasonous, in our opinion.

The last US-based rare earth miner was Molycorp, which extracted minerals from the Mountain Pass mine in the Mojave Desert region of California. Up until not that long ago, Mountain Pass was the world’s foremost supplier of seventeen critical rare earth minerals.

Mountain Pass began operations in 1952 during the heat of the Cold War. Not only did the mine turn out to be a major source of uranium deposits, it also held the moniker of being the single largest source of rare minerals—substances needed for the rapidly-advancing field of electronics—in the world over the course of four decades.

Then, in the late ‘80s and early ‘90s, China began a massive and wanton effort to control the rare earth industry. With little concern about the effects on the land, and no concern for private rights, the Communist Party of China began systematically taking ownership of a growing number of mines in the country. Simultaneously, they also began creating relationships with both Western and Japanese mining partners to “gain” the intellectual property needed to dominate the market.

The next step in the master plan was to flood the market with these critical materials, forcing private companies such as Molycorp to become unprofitable. Once out of the way, China would have the leverage needed to control the market. Thanks to Western apathy, the plan worked beautifully: Molycorp went out of business and China began restricting the export of these materials at will.

Fortress Value, MP Materials, and America’s return. Fortress Value Acquisition CorpFVAC $12 is a special-purpose acquisition company (SPAC) which funds specific, highly-promising enterprises with the goal of unlocking shareholder value. The SPAC recently partnered with MP Materials—a firm founded by

part of the Molycorp creditor group—whose stated mission is to “restore the full rare earth supply chain to the United States of America.” MP Materials owns and operates the Mountain Pass mining operation. In effect, investors can now buy ownership in America’s resurgent rare earth mining business by purchasing shares of Fortress Value. But should they?

Top US officials, both within the DoD and the Trump administration, have made it clear that the US must regain its leadership in this arena for national security purposes. Couple that with the fact that MP Materials is the only major domestic player, and the outlook is promising. Our biggest challenge with the investment right now is the lack of financials—this reinvigorated entity is simply too new for the figures to paint an accurate picture of valuation. MP had $10M in EBITDA in Q1, and it projects that figure will grow to an annualized rate of $250M by 2023. Still, these are projections.

In our opinion, the strongest positive driver for the company going forward is the global EV renaissance. All electric motors in every EV battery require rare earth materials to function, and manufacturers such as TeslaTSLA $2,050 will soon have an American supplier.

While we’re not ready to place Fortress Value in a Penn strategy just yet, it is on our radar. If nothing else, this is one more sign that we continue our economic decoupling from China, and that is a good thing.

Penn Wealth Report investment intelligence command & control tactical Awareness 8 penn wealth Report volume 8 issue 04 01 nov 2020 Copyright 2020. All Rights Reserved. Mining operations at Mountain Pass; Image courtesy of MP Materials Metals & Mining

Biowarfare: The World’s New Greatest Threat

One of the most sobering exercises I took part in as a member of the United States Air Force was biological warfare training. At the unique series of blasts from the base sirens, we would hold our breath, grab our chem warfare mask, puff out as strongly as possible, and don the alien-looking headgear. During these exercises, which assumed a chemical/biological threat was imminent, we lived and worked in our chem suits, known as MOPP gear, complete with attached detection equipment which would alert users of the presence of biologic agents. I remember thinking, “dear God, I pray we never need to use this equipment in a realworld scenario.”

The Covid-19 pandemic, which would be called the Wuhan Virus were it not for the warped, politically-correct zeitgeist in which we live, may have originated in a wet market or in a BSL-4 pathogens lab, but one fact is irrefutable: ground zero was Wuhan, Hubei province, China. Actually, another fact is irrefutable: Communist Chinese authorities could have contained the biological nightmare to the local area were it not for their own wanton, arrogant, selfish concerns. Communists.

The Wuhan Virus made us think back to those days of living in our MOPP gear. It also made us recall the female Iraqi scientist known as “Dr. Germ,” Rihab Rashida Taha al-Awazi, who performed unspeakable acts against living creatures as part of Saddam Hussein’s biological weapons program. Dr. Germ, along with a counterpart nicknamed “Mrs. Anthrax” by US officials, was released from custody in 2005. How much confidence do we have in UN agencies such as the World Health Organization to track and monitor such nefarious actors?

Would a nation actually unleash biologic weapons?

We know that biowarfare research is taking place around the globe, but what are the odds that even a rogue nation would ever unleash such weapons against their enemies?

When considering that question, it is important to consider the “accidental release” scenario. Evidence continues to mount that the pandemic did, indeed, come from Wuhan’s BSL-4 lab, but that the infectious agent’s release was accidental. If China, which is no doubt skilled in the study and handling of biological

agents for potential use in warfare, could allow this accidental release, one must wonder about the safety protocols in place at similar facilities in North Korea and Iran. It is academic to ask whether or not such a nightmare would be unleashed on purpose or by accident—the horrific results would be the same.

It is certainly within the realm of possibility that volatile nation-states such as North Korea or Iran would intentionally use biological weapons against their enemies. While the US has worked tirelessly—at least recently—to keep nukes out of the hands of these adversaries, both have active biowarfare programs. And monitoring these programs is immensely more difficult than tracking nuclear weapons development.

America’s nascent biosecurity effort. One would certainly hope that the current nightmare the world is suffering through would foment a massive global effort to avoid a repeat, but history has shown us what short memories humans seem to have. And communist China will use its welltuned propaganda machine to distort the truth and obfuscate the subject. Nonetheless, the US has been developing its own nascent but growing biosecurity program for the past two decades.

Operation Dark Winter was a high-level bio-terrorist attack simulation conducted at Andrews AFB in June of 2001. The scenario was a smallpox attack on US cities which mushroomed into a national health emergency. The disturbing summary of findings from this exercise led to the creation of the Biomedical Advanced Research and Development Authority (BARDA) under the auspices of the US Department of Health and Human Services. BARDA’s mission is to prepare for acts of bioterrorism and develop a series of potential responses and countermeasures. The organization also serves as an interface between the government and the biotech industry.

On the heels of the current pandemic, we can expect America’s biosecurity program to grow exponentially. As was the case with cybersecurity, we can also expect a number of new investment opportunities to arise as companies line up to join the effort. In the next Penn Wealth Report, we will outline some of the potential winners in this critical battle.

command & control TacTical Awareness Copyright 2020. All Rights Reserved. 01 nov 2020 penn wealth Report volume 8 issue 04 9 Biosecurity

Biological warfare, in some form or another, is about as old as war itself, but the pandemic will be the catalyst for a massive ramp-up in America’s biosecurity effort.

MOPP (level) 4; Courtesy of the USAF

The Changing REIT Landscape

The first REIT, or real estate investment trust, I ever invested in for clients was Health Care REIT, symbol HCN, back in the late 1990s. The company, which is now called Welltower (WELL $24-$50$93), owns a diversified healthcare portfolio of over 1,700 senior housing, medical office, and acute care properties in the United States, Canada, and the UK. Back then, I was attracted to the fat dividend yield and the story: an aging US population would create an ever-increasing demand for such facilities. Today, I am attracted to WELL for precisely the same reasons—although there is validity as to why the shares are 42% off their 52-week high.

While there are many facets to the healthcare arena, in aggregate they make up just one small slice of the real estate pie. The comprehensive and wide-encompassing scope of the real estate market makes REITs one of the most dynamic and exciting sectors in which to invest. And right now, there is a massive transformation going on which—we believe—will change the way investors need to look at these vehicles.

Let’s consider some of the traditional corners of this market, the shifting land on which they are built, and some new entrants which few could have foreseen just a generation ago—back when I was piling into HCN.

Not just the great American skyline

When the term “REIT” is mentioned, some immediately picture giant buildings which form the skyline of any major city. Others may picture large apartment complexes or retirement communities. And, indeed, office REITs. But there are a number of other options for investors in this sector.

The group’s diversity is impressive, given the fact that it is actually the second-smallest of the eleven sectors representing all publicly-traded firms. With an aggregate market cap of $2.2 trillion, only the Utilities sector lags—with a market cap of $2.1 trillion. Putting that in perspective, the combined size of all publicly-traded REITs is close to being surpassed by the market cap of one company: Apple (AAPL, now worth roughly $2 trillion). The largest REIT is American Tower (AMT), at $112 billion.

A large percentage of REITs operate within the small- and mid-cap arenas, with market caps between $300 million and $10 billion. We consider that an attribute rather than a detriment, as many of our most lucrative investments have been uncovered by looking down the market cap scale, not up.

For example, while we hold Apple in the Penn Global Leaders Club (GLC) and believe it will continue to excel, it would require a massive effort for it to become a $4 trillion company—especially considering the world didn’t have a $1 trillion publicly-traded company until two years ago (it was Apple, by the way). But consider Taubman Centers (TCO $38), a $2.3 billion retail REIT we own within the Strategic Income Portfolio (SIP). Taubman could double in size and still fit comfortably in the center of the mid-cap range. In other words, REITs tend to offer excellent growth opportunities.

Beyond their growth potential, there is another major reason we are attracted to REITs. Note that we said Taubman was held in the SIP, which seeks out income-generating investments for clients and members. Taubman generates an impressive 7% income stream for investors via its dividend rate. Considering the 10-year Treasury currently yields just over onehalf of one percent, many conservative, fixed-income investors are attracted to REITs throughout the economic cycle.

But REITs are not “buy and forget” investments. They are prone to wild swings based on external factors, such as changes in the tax laws, demographic shifts, and economic activity. Nothing proves this point more than the current pandemic.

How the pandemic has disrupted the sector

Going into 2020, the biggest concern in REITs revolved around the retail space. With a slew of high-profile bankruptcies, from JC Penney to Neiman Marcus to Brooks Brothers, retail REITs such as Simon Property Group (SPG), Macerich (MAC), and CBL & Associates (CBL) watched as their share prices got slashed by over half. The press glommed on, declaring that the Age of Amazon had arrived, and that Americans had decided to shun the malls in favor of online shopping.

10 penn wealth Report volume 8 issue 04 01 nov 2020 Copyright 2020. All Rights Reserved. investment intelligence

Real Estate Investment Trusts

Real estate investment trusts can be dynamic, wealth-building, incomeproducing vehicles, but beware of the seismic shift about to take place.

The contents of this report reflect the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

Many real estate analysts were encouraging investors to steer clear of retail REITs, focusing instead on “safer” segments such as office space properties. And that seemed to be reasonable advice at the time, as the economy was roaring and unemployment was at a 50-year low—meaning high occupancy rates for landlords and ever-increasing rates.

Then the pandemic hit, causing a transformational shift in the landscape that no one could have predicted. Suddenly, companies which had spurned the “work from home” movement were embracing the concept—or at least forced to deal with it. Office space REITs such as Boston Properties (BXP $86) and Vornado Realty Trust (VNO $36) watched as their relatively stable share prices plunged. The staid reliability of these stalwarts is diminishing, but out of the carnage new opportunities are bubbling to the surface.

Cell tower REITs: a play on 5G Leading into the current health crisis, there was already a major new force in the real estate sector: cell tower REITs. There are approximately 250,000 cell towers in the US today, which may seem like an incredible amount—until taking into consideration the massive need for 5G transmitters.

We have talked extensively about the next generation of telecom technology, and the billions which will be spent on its rollout. Since 5G waves can travel only around a half-mile or so, experts project 500,000 new cell towers of varying sizes will need to be built over the coming years. A handful of specialty REITs own and lease these towers and the fiber optic lines which also house 5G antenna base stations.

As we mentioned earlier, American Tower is already the largest publicly-traded REIT in the country, and its P/E ratio of 58 is an indication of the excitement surrounding this market segment. AMT owns roughly 180,000 cell towers throughout the world, generating most of its revenue by leasing space on its towers to wireless carriers. Despite its rich valuation, we see plenty of global growth opportunities ahead for this Boston REIT.

Coming in second and third, respectively, are Crown Castle International (CCI $165, 40K towers) and SBA Communications (SBAC $303, 30k towers), two other solid choices in the space.

While these top-three names don’t provide investors much of a dividend yield, that is not the case for $1.9 billion smallcap player Uniti Group (UNIT $10). This Arkansas-based specialty REIT, which

owns over 124,000 route miles of fiber in the US, generates a 5.79% dividend yield at its current price.

As for coming space-based providers of 5G, such as Elon Musk’s Starlink system, keep in mind that the low-latency signals being beamed back down to earth will still require ground-based transmitters to complete their journey. Cell tower REITs have a bright future ahead of them.

Data storage: Our lives in the Cloud

We heard a tech industry analyst comment in mid-July that the pandemic has pushed telecom technology to a point that would have otherwise taken a generation to reach. We thoroughly agree.

For all of the human suffering and global economic destruction that has taken place over the past half-year, one truly exciting unintended consequence has been the advancement and adoption of tools which allow us to work from virtually any location in the country. From a cybersecurity standpoint, since workers cannot store sensitive data on local devices, this has meant an explosion in cloud storage demand.

Since “the Cloud” doesn’t exit in the skies, but in real bricks-and-mortar buildings, there are a number of outstanding data storage REITs to choose from. Our favorites, which range from $4 billion to $77 billion in size and carry yields of between 2% and 8%, are: Equinix (EQIX), CyrusOne (CONE), QTS Realty Trust (QTS), CoreSite Realty Corp (COR), and Iron Mountain (IRM). And yes, that happens to be the order in which we would recommend researching for possible purchase.

Virtual stores need real warehouses

A story on disruption in the REIT sector couldn’t be complete without circling back to the Age of Amazon. If new telecom darlings like Zoom (ZOOM $266) were coming into their own during the pandemic, then it is fair to say that $1.6 trillion online retailer Amazon (AMZN $3,186) was busy climbing to new levels of the stratosphere. The world was on a global lockdown, retailers were closed,

and Americans were turning to Amazon en masse to order their goods—and the company delivered.

But stop to consider the magnitude of the logistics needed to deliver millions of boxed goods per day. The company completed this herculean task through a network of massive warehouses scattered throughout the country; warehouses which are probably owned by an industrial REIT.

Our favorite industrial REIT is Prologis (PLD $104), which controls nearly one billion square feet of high-quality industrial and logistics facilities around the globe, with each earning a steady stream of monthly income from tenants such as Amazon. Investors willing to take on a little more risk (PLD has a market cap of $77B and a yield of 2%) might want to consider Stag Industrial (STAG $33), a $5 billion mid-cap with a 4.35% yield, or Monmouth Real Estate Investment Corp (MNR $15), a $1.4 billion small-cap with a 4.64% yield.

Contrarian plays in the sector

The segments of the real estate market we have mentioned thus far have good momentum behind them, but what about promising areas of the sector which were unfairly punished during the downturn?

Take American Campus Communities (ACC $34, 5.5% yield), for instance. As one of the largest owners of student housing properties in the country, investors fled this well-managed company under the assumption that students wouldn’t return to normal dorm life anytime soon. Or consider AvalonBay Communities (AVB $155, 4% yield), which owns a portfolio of 275 high-end apartment complexes around major metropolitan areas. We added both of these names to the Strategic Income Portfolio last month.

Want to buy a basket of REITs to take advantage of the shifting landscape? The iShares Cohen & Steers REIT ETF (ICF $105) seeks out specialized market players well-positioned for future growth. (Prologis is the number one holding.) See the ETF Spotlight section of the Report for details on this concentrated fund.

01 nov 2020 penn wealth Report volume 8 issue 04 11 Copyright 2020. All Rights Reserved. investment intelligence

American Campus Communities Inc

Successful investing is largely a game of seeing opportunity where others see trouble; boarding the ship as others are fleeing. It may seem counterintuitive, but the greatest opportunities arise in the midst of chaos. For a great illustration of this point, let’s consider a niche corner of the real estate investment trust industry: residential REITs engaged in the management of student housing on or near college campuses.

Talk about a recession-proof industry. No matter where the economy resides along the economic cycle, millions of high school grads perennially flock to college campuses to begin their matriculation. Who could ever envision a year in which that wouldn’t happen. Then the pandemic hit, sending millions of students home early this past spring to finish their courses online, and raising the specter that they may not be able to return this fall.

Our favorite player in the residential REIT market focusing on campus housing has been—and remains—American Campus Communities (ACC $20-$34$51), a 27-year-old, $5 billion mid-cap which has turned a profit every year for the past decade. Serving 68 colleges and universities, ACC owns and manages 166 student housing properties which contain an aggregate 112,000 beds. Considering the overwhelming percentage of the firm’s revenue is derived from short-term leases to students, it is somewhat understandable that shares of ACC are sitting down nearly 30% year-to-date.

Is that price drop warranted? We don’t believe so. To be sure, the company has felt pain from the pandemic. With students being forced out of their rooms early in the spring semester and summer camps being universally canceled, the company lost approximately $32 million in Q2 revenue—a 15% drop from the second quarter of 2019. But we believe investors extrapolated out the worst possible scenario in their minds for the upcoming school year.

The facts don’t support the fear.

To say investors tend to be shortsighted and reactionary is a massive understatement. In the case of ACC, the dour sentiment is refuted by the facts as we head into fall. The big drop in the share price from around $50 seemed to be based on an assumption that the company would see heavy cancellations for rooms, but that has not played out.

According to founder and CEO William Bayless, at least 63 of the 68 colleges and universities the company serves have already announced a plan to return to some semblance of normalcy this fall. In most cases, that means a hybrid approach: less-dense in-classroom studies combined with distance learning. And temporary distance learning or not, kids apparently want to stay on or near their respective campus, as evidenced by a 90.1% pre-leasing rate for ACC rooms. That is down just slightly from last summer’s 93.5% rate. And the deadline to pull out without commitment has largely passed.

Another factor in ACC’s success revolves around the type of accommodations they offer. The old dorms we may remember, with the facilities down the hall, have been replaced by more spacious—and more private—facilities which may house two students in a room, and one shared bathroom between two rooms. In the age of the pandemic, this newer standard presents far fewer sanitization challenges than the old barracks-style dorms. Another reason we like ACC over its competition.

A bet on a return to normalcy.

We don’t know precisely how the upcoming school year will be impacted by the virus, but we do see a fundamentally sound company which appears to be selling at a discount. We see no reason for the shares not to return to the $50 range as the medical threat subsides. In the meantime, shareholders will receive nearly a 5.5% rocksolid dividend yield. We added ACC to the Strategic Income Portfolio at $34.43/share.

12 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Residential REITs The content of this report reflects the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

Despite operating in a recession-proof market, this REIT got hammered in spring.

...we believe investors extrapolated out the worst possible scenario...for the upcoming school year.

ACC @ $34

Symbol: ACC

Class: Mid-Cap Core

Sector: Real Estate

Industry: Residential REIT

Purchase Price: $34.43

Target Price 1*: $40.00

INVESTMENT PROFILE

Founded in 1993 by current CEO William Bayless, American Campus Communities is a $5 billion residential REIT engaged in the acquisition, management, and development of student housing properties on and near universities throughout the United States. As the largest owner of high-quality student housing properties in the country, ACC currently owns 166 student housing properties containing approximately 112,000 beds. Revenues are derived from short-term leases.

American Campus Communities’ revenue has grown every year for the past decade, and net income is perennially in the black. The company generates strong quarterly free cash flow throughout the year. Free cash flow has remained positive in every period going back to (and including) 2010.

See disclaimers on the back cover of The Report. This is not a solicitation to invest. Always consult your financial professional before making an investment. *As of date/time written Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence 01 nov 2020 penn wealth Report volume 8 issue 04 13 Suitable for the Strategic Income Portfolio

The Callaway House, UT—Austin, off-campus; photo courtesy of ACC

ICF @ $104

The contents of this report reflect the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

iShares Cohen & Steers REIT ETF

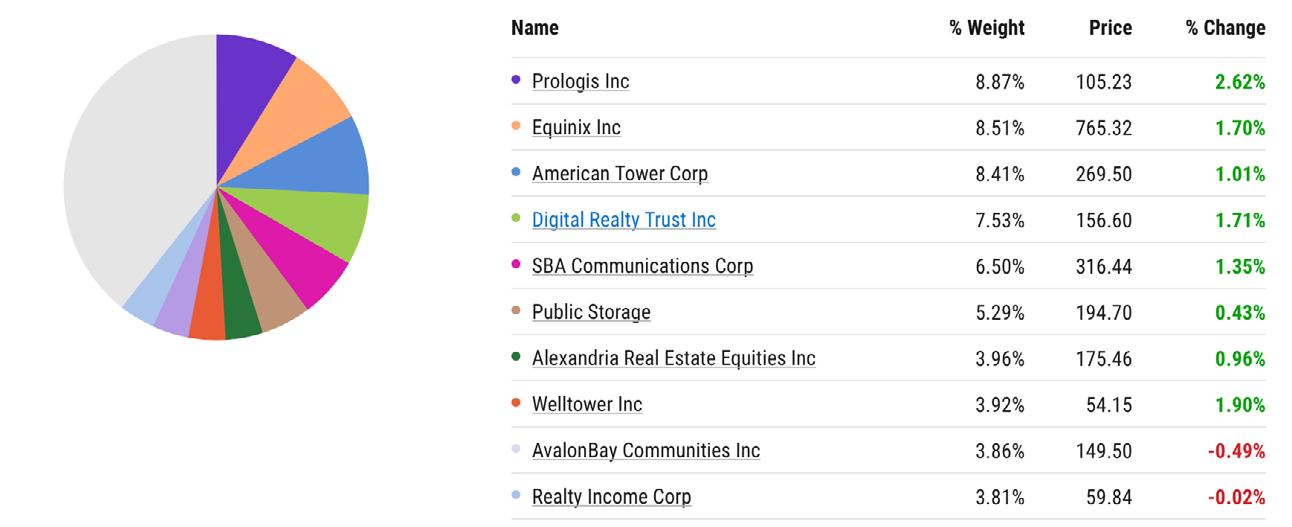

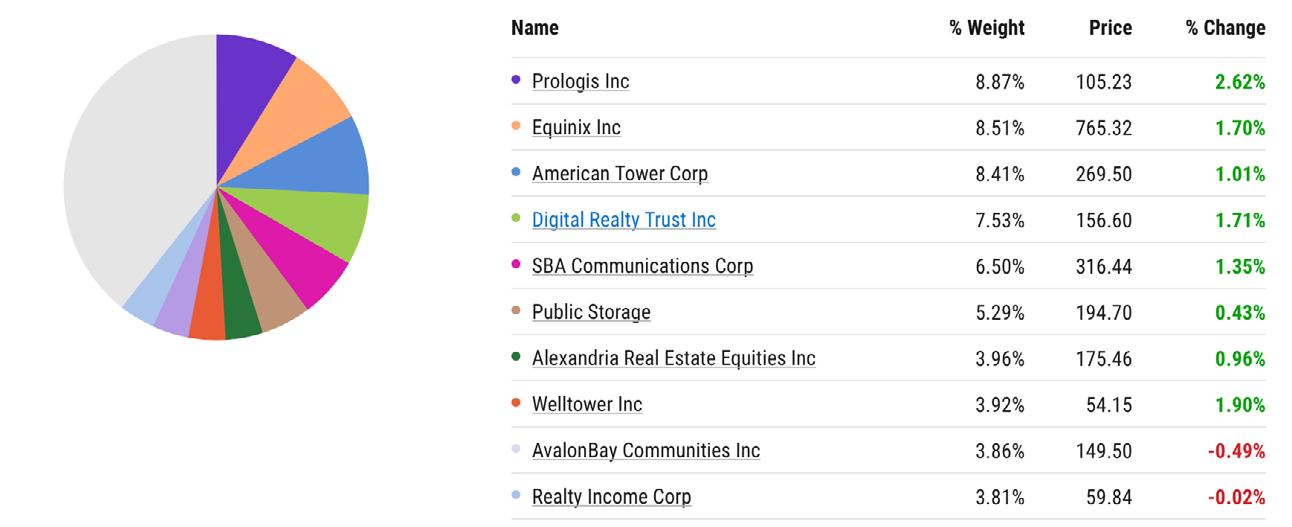

Following the theme of our REIT discussion in this issue, we searched out—and discovered—an exchange traded fund that fits in nicely with our narrative. While most REIT ETFs are heavily weighted toward the usual suspects, office and retail space, the iShares Cohen & Steers REIT ETF (ICF $104) has a plurality of its assets in the type of specialized REITs we are looking to for strong growth going forward.

underperformed its benchmark and a positive number indicating outperformance. ICF has an alpha (5Y) of 0.5145 while VNQ carries an alpha (5Y) of -0.3964. Point to ICF.

Of course, these two measures are backward-looking, so we must perform a fundamental analysis of investments based on what we see on the horizon. This analysis is what ultimately attracted us to ICF over its peers.

A changing landscape for REITs.

The Cohen & Steers REIT ETF has a concentrated portfolio of just over two dozen REITs, with the top ten positions holding nearly 60% of the fund’s value. The top three holdings are Prologis (PLD), Equinix (EQIX), and American Tower (AMT), which are focused on logistics facilities (e.g. an Amazon warehouse), cell towers (think 5G), and data networking centers (“the cloud”), respectively. These three areas are precisely where we want to be in the real estate sector going forward.

While not the largest REIT ETF, this fund’s $1.8 billion in assets under management (AUM) makes it a viable, top-tier choice. Furthermore, we prefer to stay away from the largest funds, as they tend to have less maneuverability. For comparison, the big dog in the space, the Vanguard Real Estate ETF (VNQ), boasts a cumbersome $56 billion in AUM and holds 181 REITs in its portfolio. In our opinion, too large and too many. Typically, being enormous does not mean increased safety or a better return. But let’s put that statement to the test in this case.

Beta is a measure of risk comparing an investment to the overall market. A beta of 1 would signify equal risk, and the larger the number the more risk implied. ICF has a beta (5Y) of 0.6956 while VNQ carries a beta (5Y) of 0.8032. Point to ICF.

Similarly, alpha is a measure of performance, with a negative number indicating an investment has

ICF has been around since January of 2001 and carries an expense ratio of 0.34%—impressively low for a specialty fund of this type. The fund’s lead manager, Greg Savage, has over a dozen years of tenure with the investment. All of the holdings are North American-based, with 45% being large-cap companies and 55% being in our favored mid-cap range. A truly dynamic specialty fund being ably managed.

We added ICF to the Dynamic Growth Strategy (our ETF portfolio) on 11 May 2020 @ $96.46 per share.

14 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence ICF offers a dynamic mix of strong REIT sectors; Table courtesy of iShares ETF Spotlight

With a concentrated group of holdings in strong niche real estate markets, this fund offers investors a unique growth play.

ICF’s top ten holdings account for nearly 60% of the fund’s total weight; Graph courtesy of YCharts

Under The radar

Four investments being ignored—or missed—by the financial press

Grocery Outlet Holding

Consumer Defensive

Grocery Stores

Grocery Outlet Holding Corp (GO $28-$37-$48) is a fascinating story in a usually boring industry: grocery stores. This $3.4 billion US-based mid-cap offers quality, name-brand products generally priced 40% to 70% below conventional retail chains. The stores are run by independent operators, and are designed to create a neighborhood feel through personalized service and localized offerings. The outlet, which was founded by Jim Read (who began selling highly-discounted military surplus the year after World War II ended), now has over 300 locations, primarily on the West Coast and in the Pacific Northwest. A fascinating story, good free cash flow, and strong growth potential.

Black Hills Corp (BKH $48-$54-$87) is a mid-cap ($3.8B) diversified utility which provides regulated gas and electric power to states in the Midwest and mountain regions. The firm also runs a mining operation via its Wyodak Resources division. With steady revenue of roughly $1.7 billion annually, the firm had $200 million in net income last year and cash flow of $7.02 per share. BKH has fallen out of favor with hedge funds recently, dragging its share price down from $87 to $48, before the shares rebounded to their current level of $54. With an ultra-low beta of 0.3049 (5Y) and a dividend yield of 4%, the shares are worth a look for income-oriented investors.

iCAD Inc (ICAD $10) is a micro-cap ($238M) growth company in the Life Sciences Tools & Services industry. The New Hampshire-based firm, which has been in business since 1984, provides cancer detection and radiation therapy solutions and services. The company offers a range of upgradeable computer aided detection (CAD) solutions for the detection of breast, prostate, and colorectal cancers. Its Xoft Axxent system delivers high dose rate, low energy radiation to target cancer while minimizing exposure to surrounding healthy tissue. Based on its success, the Axxent system is now additionally being deployed for the treatment of non-melanoma skin cancer. Shares of ICAD topped out at $15.31 in March, leading into the pandemic-driven downturn.

One of our current favorites in the Penn Strategic Income Portfolio is our senior loan fund, the SPDR Blackstone GSO Senior Loan ETF (SRLN). Senior loans are debt instruments issued by a bank to a company to fund any number of projects or to retire existing debt with higher interest rates. Note the term “senior.” This means that, in the case of bankruptcy, owners of senior bank loans will be paid first as assets are liquidated—before creditors, preferred shareholders, and stockholders. SRLN currently owns around 220 such senior loans outstanding to companies such as: Bass Pro Shop, Petsmart, Athena Health, and Rackspace Technology. The average maturity of these loans is a comforting 4.72 years, and the beta is 0.0859. Our favorite aspect of the fund in these days of ultra-low rates? It yields 5%.

01 nov 2020 penn wealth Report volume 8 issue 04 15 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Hills Corp Utilities Diversified iCad Inc Healthcare Health Info Services SPDR® Blackstone / GSO Senior Loan ETF Fixed Income Bank Loans

Black

3 2 1 4

Trading Desk

Actions we have taken at the Penn Trading Desk, plus a look at what other Wall Street analysts have to say...

Penn: OPen AVB in StrAtegic incOme (02 Jul 20) AvalonBay Communities is a $22 billion real estate investment trust which owns 275 apartment communities. We added this undervalued firm to the Strategic Income Portfolio @ $159.15. AVB carries a 4% dividend yield, and our initial target price is $182.

Penn: Close sTAA

(06 Jul 2020) Our $59 stop on Staar Surgical (STAA) hit, closing the position in Intrepid with a 38% one-month gain.

Penn: Close PsX

(09 Jul 2020) Our Phillips 66 made a 30% charge since purchase and stopped out at $59. We will look at adding again if it falls back below $50/share.

Penn: oPen MGM

(10 Jul 2020) There are certain companies at certain prices at certain times where you know that you will look back and say, “Did I really get it for that price?” We believe MGM Resorts Int’l (MGM), selling for $16/ share, is one such company. The $8 billion resort, despite its exemplary management, clean books, and 3 p/e ratio, has seen its shares crushed due to Covid-19 sentiment. We jumped. Total contrarian play. Our target price is 100% from purchase price.

Penn: Close ClX

(13 Jul 2020) Our Clorox shares stopped out at $229 (above our target) for a 14.5% s/t gain.

Penn: oPen XlB

(16 Jul 20) We have been underweighting materials for years. Now, we believe the sector will experience a mean reversion over the coming twelve months. We have added XLB, the Materials Select Sector SPDR, to the Dynamic Growth Strategy as a satellite position @ $60.67/share. PPG, SherwinWilliams, and DuPont are some top names.

Penn: Close DIs

(17 Jul 2020) Closing our Disney position in the Global Leaders Club @ $119.43 and taking our long-term gains.

Penn: oPen ACC

(23 Jul 2020) American Campus Communities (ACC $34), the country’s largest provider of campus housing, has been unfairly beaten down over fears of the fall semester. We added the REIT, with its 5.41% dividend yield, to the Strategic Income Portfolio at $34.43.

Penn: eXChAnGe lArGe CAP FunDs (05 Aug 2020) We have replaced YACKX with the VanEck Vectors Morningstar Wide Moat ETF (MOAT) in the Dynamic Growth Strategy—as a satellite position— at $54.40 per share. This concentrated and eclectic group of around 50 holdings seeks to replicate the Morningstar Wide Moat Focus Index—companies which have been determined to hold wide competitive advantages over their respective industry peers.

Penn: oPen TheMATIC eTF (21 Aug 2020) We added another thematic position to the Dynamic Growth Strategy: The Robo Global® Robotics & Automation ETF. This thematic science & technology fund is heavy in small- and mid-cap names such as Nvidia, Intuitive Surgical, and Zebra Technologies. We are using the fund to take advantage of the coming boom in robotics and automation. Opened ROBO @ $46.87.

Penn: oPen CAnADIAn BAnk (12 Oct 2020) Canada’s $53 billion Bank of Nova Scotia (BNS), also known as Scotiabank, is the country’s truly “international bank.” Well poised to take advantage of a post-pandemic global growth spurt, this financially-sound institution has a P/E ratio of 10 and a dividend yield of 6.14% (as of time of purchase). We opened BNS @ $43.43 in the Strategic Income Portfolio.

16 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

To remain on top of all recommended trades as they happen, be sure and subscribe to our Twitter feed @ PennWealth. All trade details can be found at the Penn Wealth Trading Desk .

The content of this report reflects the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

At $26 per share, Delta Airlines is a true deep value play. Unloved by many, but not us.

TCO fell 25% within minutes of news that Simon was out of the deal.

Our Chipotle ran up so quickly that we had to take the profits. Will add again at a lower price.

After its 38% run-up in one month, TER hit our stop and closed.

01 nov 2020 penn wealth Report volume 8 issue 04 17 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Teradyne in New Frontier Open DAL in Penn Contrarian Investor Opened TCO in Penn Contrarian Investor

for 66% s/t gain

Close

Close Chipotle

Weekly Business Report

real estate investment trusts

the truly unthinkaBle is happening: san Francisco landlords are Being Forced to lower rental prices to retain tenants

My first apartment, located in a Spanish architecture building on the Country Club Plaza in Kansas City, came with a Murphy bed, a micro-sized kitchen, no bedroom (the cool term “studio” quickly lost its appeal), and a $200 per month lease—utilities included. I thought of that old place while researching the average monthly cost of a one-bedroom apartment in San Francisco. The answer: $3,629 for approximately 747 square feet—utilities not included. That means, using the old 30% rule, a denizen needs to be making almost $150k per year to justify that pint-sized pad they live in.

But something quite remarkable is taking place right now. Rents in the city, which have always advanced with the regularity of a Swiss watch, are suddenly reversing course. We have often joked that landlords would rather have a place sitting vacant than give someone a deal, but the health crisis has put that joke to the test. For the second month in a row, the median rental price of a one-bedroom apartment in the city has fallen; in fact, it now costs 12% less ($3,280) to live in that one-bedroom than it did a year ago.

At first blush, this new trend might not make much sense. After all, if big tech (along with virtually every other industry) is embracing remote work for the long haul, wouldn’t that mean office REITs would be the ones getting pounded, not residential landlords? Yes, but it has everything to do with location. The remote work environment means employees don’t have to live near their company, merely in a location with reliable Internet access. The numbers buttress that point: nearly one out of ten renters who had leases up over the past quarter chose not to renew. Certainly, some had the decision made for them as they lost their situations, but most simply decided to move to greener—and cheaper—pastures in the suburbs. Evidence of that is borne out by the fact that rents are still rising outside of urban centers.

What first appeared to be a temporary situation is rapidly morphing into a transformational moment in America: as employers embrace new communications technology and encourage remote workers, office REITs and dense urban zones are going to face critical challenges.

Based on these trends, we have adjusted our exposure to real estate in several Penn strategies—downward with respect to the office space names, and upward with respect to industrial (data storage, logistics) and specialty REITs—such as those which own cell towers.

Ford desperately needed new Blood, instead they simply transFused their own Blood

Let’s take a sobering trip down memory lane from the standpoint of Ford Motor Co (F $4-$7-$10), beginning near the start of this century. Between 2001 and 2006, shares of the car company, founded in 1903, fell 50% under Bill Ford Jr., great-grandson of founder Henry Ford. Then came the company’s last successful CEO, Alan

Mulally, who presided over a 178% rise in the shares. In July of 2014, Mulally retired and handed the reins over to Mark Fields. By the time Fields was ushered out in 2016, shares had dropped another 35%. Finally, we had Jim “Buddy” Hackett, who became CEO in 2017. We had high hopes for this pick, as he had been the head of Ford’s Smart Mobility subsidiary, the company’s self-driving car initiative. Another 38% drop later, Hackett is gone.

Reasonable business minds would fully grasp the need to find new blood to reinvent the car company, which managed to lose $2.123 billion over the trailing twelve months on $130 billion in revenues. So, what dynamic pick did the the board of directors make? They elevated the firm’s chief operating officer, Jim Farley, to the CEO role. In a comment apparently designed to instill confidence, Chairman Bill Ford said that Hackett will remain in an advisory role to Farley until next spring. Whew, glad to hear that.

Of interesting note: one component of the $2.123 billion in losses was the higher warranty costs (around $5 billion) incurred by the company due to quality control issues on their late model vehicles. Not a comforting sign for an automaker operating in a hyper-competitive industry.

Much like Boeing, this once-great company has buried its head in the sand and refuses to accept what needs to be done. What should we expect when the same people who ran the companies into a ditch are the ones responsible for hiring the new blood?

in

intriguing turn oF events, the calpers chieF investment

The California Public Employees’ Retirement System, or CalPERS, is the state-run pension and health benefits agency of California, responsible for the retirement plans of nearly 2 million California public employees, retirees, and there families. The organization manages roughly $400 billion in assets. Based on the nature of the business and the state in which it sits, one can only imagine the level to which politics permeates the body.

Against that backdrop, we have Chief Investment Officer Ben Meng, who has served in that role for the past two years. It wasn’t

18 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligenceweekly Business Report

The start of this century doesn’t much resemble the start of the last one for Ford Motor Company.

oFFicer aBruptly resigns

automotive

The content of this report reflects the personal views, opinions, and research of Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. This is not a solicitation to buy. Always consult your investment professional before investing any money.

government watchdog

Some of our favorite stories pulled from recent Penn...After Hours reports

his first stint at the organization, however, as he worked at the agency from 2008 to 2015—before leaving to become deputy chief investment officer for China’s State Administration of Foreign Exchange, in charge of China’s $3 trillion or so in foreign reserves.

Meng abruptly “resigned” his CIO role this week, citing a desire to spend more time with his family. California State Controller Betty Yee, however, said in a statement that she was “incredibly disappointed” to hear about Meng’s lapse in judgment and failure to adhere to standard conflict-of-interest policies.

While that cryptic message tells us Meng didn’t leave on his own accord, it certainly raises more questions than it answers. Adding to the intrigue, Indiana Rep. Jim Banks recently wrote a letter to California Governor Gavin Newsom requesting a thorough investigation into Meng’s relationship to the Chinese Communist Party. CalPERS added roughly 100 Chinese firms to the stock portion of its portfolio over the past year. Against a stated target return of 7% per year, the fund has underperformed under Meng, notching a return of just 4.7% for the 2019-20 fiscal year.

As of now, CalPERS has just 71% of the assets it needs to meet the pension requirements of its members.

penn gloBal leader target corp notches a Blowout quarter

As if they weren’t already on a tear, shares of Penn Global Leaders Club member Target Corp (TGT $149) popped another 9%—reaching yet another record high—after the retailer posted a simply stunning quarter.

Overall, online and in-store sales were up 24.3% for the quarter, with the company attracting ten million new customers to its digital platform. Earnings per share blew past the expected $1.62, hitting $3.38, and profits rose by 80%, to $1.7 billion.

Target breaks its merchandise down into five categories—all five showed strong growth. The company’s electronics line was up 70% year-over-year, with the other six categories—to include beauty and apparel—rising by about 20% each. Despite launching just a year ago, Good & Gather, the firm’s private label grocery brand, rose above the $1 billion in total sales mark.

When a company reports surprise earnings, either to the upside or the downside, we like to review what the analysts were saying leading into the announcement. Our favorite came from Morningstar: the investment research firm had a one-star (sell) rating on TGT with a fair value of $98/ share. Oops. We bought TGT shares during that nightmarish week before Christmas, 2018.

disney’s restructuring plans do not assuage our concerns

There really are no “buy and forget” companies out there anymore. The idea of owning a static group of blue chip stocks to hold for the long term is a relic of the past. Take three of our historic favorites: General Electric (GE), Boeing (BA), and Walt Disney (DIS). There was a time not that long ago when we couldn’t imagine not owning these three juggernauts in our core portfolio. It’s amazing how complacency and poor management can ravage a company virtually overnight.

While that condition has certainly gripped the former two names, what about Disney? We wrote disparagingly about Bob Iger’s decision to step down after he assured investors he would remain on as CEO at least until 2021. Then we found out that Disney employees (who are now 28,000 fewer in number) had to hear the news from an interview Iger gave to a business network. Not cool, Bob. Taking over Iger’s role would be Bob Chapek, the former head of Disney’s parks. Based on our underwhelming early view of Chapek and Iger’s cavalier attitude toward employees, we took our huge DIS profits earlier this year when we closed our position.

Now comes word that Disney will make a major structural shift in its operations. With an eye on direct-to-consumer, the $235 billion firm will create a new unit focused on the marketing and distribution of content, separating that function from the content creation unit. It is clear that the move is designed to foster migration away from the company’s 100-year-old relationship with movie theaters and toward the direct-to-consumer model. Perhaps the first test of this new unit was the decision to charge Disney+ users $30 to stream the production of Mulan. Not a great first step. There is no doubt that Disney+ was a brilliant move; one that helped the company maintain critical revenue while the parks were being shuttered due to the pandemic. That being said, we are still not sold on the new leadership team and still question the strategic vision of the company going forward.

In fairness, it isn’t the company’s fault that Disneyland in California remains closed—that condition is the result of an inept government in Sacramento. We continue to watch DIS stock closely, as there will come a time, hopefully by the end of 2021, when the company’s major revenue drivers—the parks—are back at full capacity.

01 nov 2020 penn wealth Report volume 8 issue 04 19 Penn Wealth Report Copyright 2020. All Rights Reserved. weekly Business

We purchased TGT shares during the retail wreck week of late December, 2018

media & entertainment

multiline retail

We predict the Apple iPhone 12 will spur a new super-cycle for the $2 trillion electronics giant.

It is a bizarre state of affairs. Rarely do you hear any of the 100 million Apple (AAPL $120) iPhone users in the US take to social media to bash the device’s main competition—the Samsung Galaxy, but an odd number of Galaxy users seem to be preoccupied with hating on the iPhone. One petulant Galaxy-phile took to Twitter following the iPhone 12 event to proclaim, “We’re like on Galaxy 24 now.” It would probably take a clinical psychologist to explain their hatred for Apple, but the only thing that matters to us is this: Apple continues to innovate, and the launch of the iPhone 12 5G device lineup will bring about a new super-cycle for the company.

Forget all of the talk about limited 5G coverage. To be sure, it will take years to put up the millions of little devices throughout the country needed to bring this hyper-speed technology to everyone, but the train has left the station—and soon enough, everyone will be clamoring for it. Furthermore, millions of Americans have held off on upgrading their iPhones until 5G devices became available. Finally, many countries around the world, especially in Asia, have built out a larger 5G infrastructure than the US. This makes sense when we consider the state and local government impediments in the US versus the lack of such challenges in “less free” countries. Trade wars and anti-American sentiment aside, Apple will sell hundreds of millions of iPhone 12s globally.

So, let the Apple haters continue to throw their tantrums; we remain focused on what the $2 trillion Cupertino-based company has in store for us next. Remember, it will require new devices to take advantage of 5G technology, and that holds true for the iPad and Mac lineups as well as the iPhone. Stay tuned.

At $120 per share, Apple remains a buy. It currently holds the distinction of being our largest portfolio position, and we don’t see that changing anytime soon.

spaceX selects microsoFt (not amazon) to run its spaceBased cloud computing network

It is almost embarrassing to watch Jeff Bezos pretend to compete with Elon Musk for commercial space dominance. He’s like a little kid donning an astronaut costume and proclaiming, “take that Neil

Armstrong!” In his own mind, Bezos’s Blue Origin is right up there with SpaceX; hell, maybe better. Of course, in reality Blue Origin continues to be the pet project of the world’s richest man while SpaceX is busy launching astronauts into orbit and building out a massive fleet of satellites which will provide high-speed Internet service to even the most remote parts of the globe. (Right on cue, Bezos stated that Blue Origin is going to build an even better satellite system—despite the lack of even one satellite in orbit.)

In a move that should come as no surprise, SpaceX just selected Microsoft’s (MSFT $214) Azure service to operate and manage its cloud computing needs for the Starlink system, barely considering Amazon (AMZN $3,226) Web Services (AWS) as an option. Considering the scope of the project, which will consist of linking cloud, space, and ground capabilities, crunching almost unfathomable amounts of data, and helping to control the orbits of SpaceX satellites, this was a huge win for Microsoft. Beyond the Starlink project, Musk’s SpaceX also landed a demo contract from the Pentagon for a new generation missile warning system. Assuming the demo leads to deployment, Microsoft would certainly get that contract as well.

Recall that Amazon is currently suing the US government due to the Pentagon’s decision to go with Azure for its $10 billion JEDI program, snubbing AWS. We see very little chance of the lawsuit changing the outcome of the JEDI contract, though we wonder how it might have poisoned the well for Amazon’s hopes of landing government contracts in the future.

For its core business of online retailing, no other company can compete with Amazon—which is why we own it within the Penn Global Leaders Club. We just wish Bezos would shut up and let someone else run the company. Maybe he could run Blue Origin full time and work on landing one single contract.

20 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. weekly Business Report

sorry apple haters, the iphone 12 super-cycle is coming

consumer electronics

Image courtesy of Apple

application & systems soFtware

“There are so many people working so hard and achieving so little.”

Andy Grove, semiconductor pioneer

Persistence

“To reach a port we must sail, sometimes with th wind, and sometimes against it. But we must not drift or lie at anchor.”

Oliver Wendell Holmes, Sr.

Alacrity

“Be thou the rainbow in the storms of life. The evening beam that smiles the clouds away, and tints tomorrow with prophetic ray.”

Lord Byron

01 nov 2020 penn wealth Report volume 8 issue 04 21 Penn Wealth Report Copyright 2020. All Rights Reserved. weekly Business report weekly Business

of the Week (For more, visit our blog at PennWealth.wordpress.com)

Quotes

Achievement

1813; Public Domain

Creative Commons

1879, by Armstrong & Co.; Public Domain

Penn Strategies

Penn Wealth Report investment intelligence Copyright 2020. All Rights Reserved. 22 penn wealth Report volume 8 issue 04 01 nov 2020

Penn Strategic Income Portfolio

01 nov 2020 penn wealth Report volume 8 issue 04 23 Copyright 2020. All Rights Reserved. investment intelligence

Penn Strategies

24 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Penn Dynamic Growth Strategy

01 nov 2020 penn wealth Report volume 8 issue 04 25 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Penn Strategies

26 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

01 nov 2020 penn wealth Report volume 8 issue 04 27 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Penn Global Leaders Club

Penn Strategies

28 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Penn Intrepid Trading Platform

The Penn Intrepid Trading Platform is precisely what the name implies. Up to eleven positions are held at any one time, though the number may be far less based on market conditions. The goal of the trades made within the ITP is to notch short-term, double-digit gains (10% would be considered a “win”), while protecting each position with a tight stop-loss order (perhaps 5-7% below purchase price). To calculate the size of a trade, the entire portfolio value is divided by 12, with the share price divided by that number. Note we hold a maximum of 11 positions: the other one-twelfth is always held in cash. On occasion, a half-position may be taken in a stock.

01 nov 2020 penn wealth Report volume 8 issue 04 29 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Penn Strategies

30 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Penn New Frontier Fund

01 nov 2020 penn wealth Report volume 8 issue 04 31 Penn Wealth Report Copyright 2020. All Rights Reserved. investment intelligence

Penn Wealth Publishing

Your use of this report and the information in the products provided is subject to applicable copyright laws and regulations. You agree to use the products and services provided only for personal purposes. The services and the content provided are the property of Penn Wealth Publishing, LLC, and all content is protected by copyright and other intellectual property laws. You understand and agree that Penn Wealth Publishing owns all legal rights, titles, and interest in all content appearing in the report and in the products provided, including but not limited to the copyrighted content, trademarks, servicemarks, logos, and domain names.

Content in the report and within the products include the views, opinions, and recommendations of the individuals at Penn Wealth Publishing. While measures are taken to help assure the accuracy of data, no guarantees can be made and the firm is not liable for any losses incurred by subscribers. The products and services offered provide information designed to educate the general public. This information does not take into account the unique circumstances which may affect an individual’s decisions and nothing within the information provided should be deemed as personalized advice tailored to an individual’s needs. Do not invest in any of the ideas or recommendations presented in this report without first consulting a financial professional familiar with your unique situation. All investments have risk, including the possible loss of the prinicipal invested. Penn Wealth Publishing is not responsible for the results of actions taken based on the information presented.

This report and its corresponding products may provide hyperlinks to websites. These links are provided only for your reference and convenience, and this does not imply that the firm endorses the operator of or the content within these sites. You are solely responsible for determining the extent to which you use any content on any website we may provide a link to, and you agree not to hold Penn Wealth Publishing responsible for the content or operation of such sites.

9393 West 110th Street, 51 Corporate Woods, Overland Park, KS 66210

913.538.7174 www.pennwealthreport.com member.services@pennwealth.com

32 penn wealth Report volume 8 issue 04 01 nov 2020 Penn Wealth Report Copyright 2020. All Rights Reserved.

Michael S. Hazell editor-in-chief

Michael S. Hazell editor-in-chief