13 minute read

LNG through Russia's eyes

Alexander Klimentyev, Inna Kirilkina, Amina Talipova, and Jinsok Sung, Russian Small and Mid-scale LNG Research Group, Russia, outline Russia’s LNG industry, including its main producers, plants, and the wider LNG market.

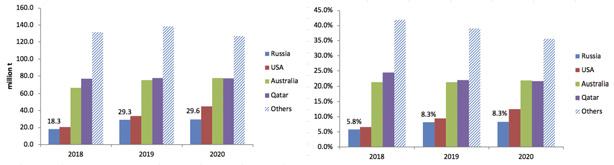

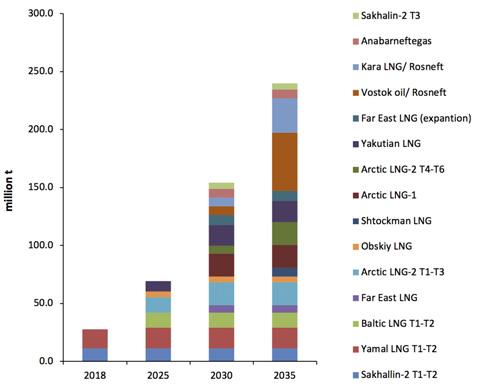

NG production in Russia is 8.3% of the global production and one of the fastest-growing industries in the country, with 29.6 million tpy of operating capacities as of 2020 (Figure 1). Therefore, LNG export development is one of the high-priority targets for the Russian government. In the most recent State Energy Strategy, total LNG capacities are expected to reach 140 million tpy.

The Russian LNG industry is comparably young and dates back to 2009 when the consortium of Sakhalin Energy and foreign investors’ LNG plant was put into operation. At that time, the projected capacity was 9.6 million tpy, with the Asian market as the final place of destination. Japan and South Korea were the biggest consumers of Russian LNG and remain so until today. It took almost 10 years for NOVATEK to establish the 16.5 million tpy Yamal LNG plant. It is located in the Arctic zone, designed for severe weather conditions, and based on the Yuzhno-Tambeyskoe large gas-condensate field. Not without government support – which entirely sponsored the construction of marine port Sabetta – the plant started fully operating at the end of 2018.

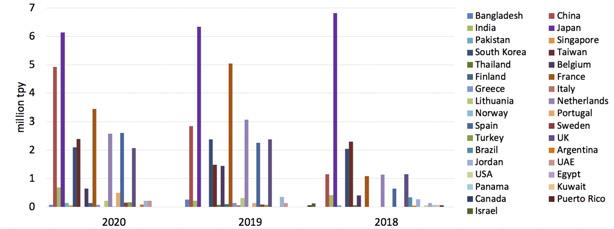

Another ambitious project by NOVATEK is the Arctic LNG 2 project that is currently under construction. The project is expected to exceed Yamal LNG capacities by almost 3 million tpy. As of 2020, Russian LNG from two plants was exported to 33 countries (Figure 2).

Russian LNG projects can also be differentiated geographically by destination and by the contracts/portfolio structure. Both Yamal and Sakhalin plants have contracted volumes to China on delivery ex ship (DES) terms. Gazprom has long-term African and Indian deliveries in its portfolio with EGAS and GAIL. In contrast, NOVATEK’s portfolio includes other market players such as Total, Shell, Gunvor, and is very similar to Cheniere’s portfolio. Compared to other big market players such as Qatar, the US, or Australia, Russia is prone to act in all regional directions.

The average duration of contracts in Russia varies from five to 20 years, where the shortest contracts were signed in recent years.

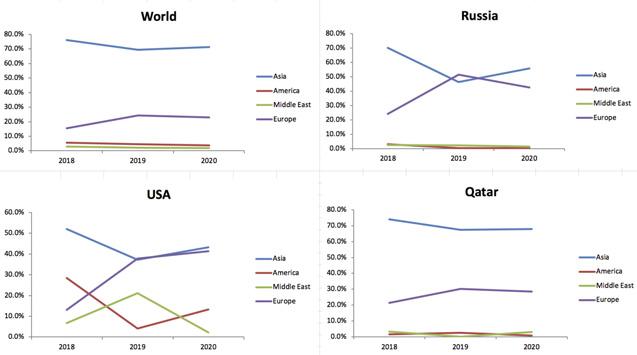

A comparison of the main markets for the largest LNG producing companies (Qatar, Australia, US, and Russia) demonstrates the different strategies: Asia is the only one used for Australian projects (more than 99.5% from produced LNG). Qatar followed world market trends and the change in sales in the world has mirrored the sales of Qatar’s LNG facility. The US and Russia are finding a balance between different regions in Asia/Europe, and the Middle East/North America.

The Sakhalin and Yamal giants do not limit the history of Russian LNG. On the contrary, mid and small scale LNG plants are actively developing to cover the internal demand for natural gas, mainly in remote and distributed areas. In particular, NOVATEK has been operating Kryogas-Vysotsk mid scale LNG since 2019 and is planning Obsky mid scale LNG by 2023. However, with rapidly changing reality and global prospects for natural gas, the company adjusts its strategy and advances technologies. Thus, Obsky LNG today is considered a potent ammonia producer for future hydrogen industry development. Gazprom, the most prominent incumbent in the Russian gas industry, actively involves small and mid LNG plants in its strategy along with its only Sakhalin Energy plant. If all conceived LNG projects of all capacity sizes were realised in Russia, the total LNG production might reach approximately 250 million tpy by 2035 (Figure 4). In Russia, there are currently six operational LNG export projects. The Sakhalin-2 LNG exports LNG to the Asia Pacific region, mainly nearby East Asian countries. As a result of its geographical position, Yamal LNG sends LNG cargoes across the world. The majority of the produced volume is delivered to European countries and Asia, albeit smaller volume. Vysotsk LNG is a mid scale LNG project on the Russian Baltic shore. There are three small scale LNG export projects: Kriogaz LNG; SiTek; and Gazprom Transgaz Ekaterinburg (GTE). Kriogaz LNG is located in Pskov, not far from Estonia; SiTek is located in the Republic of Sakha-Yakutia in East Siberia; and GTE is located in Ekaterinburg. Kriogaz LNG sells LNG small scale cargoes by trucks, mainly to the countries on the Baltic Sea, whereas SiTek and GTE export all of their LNG to Mongolia and Kazakhstan, respectively.

Figure 1. World LNG capacities and the shares of primary LNG producers. Source: based on GIIGNL data.

Pricing

Figure 2. Russian LNG export by country of destination. Source: based on GIINGL data.

Table 1. Greenhouse gas (GHG) management on Russian LNG projects

GHG management Sakhalin-2 Yamal LNG Baltic LNG Yakutian LNG Far East LNG

CCS

Hydrogen in the fuel mix

Renewables

e-LNG

Nuclear power energy

High-pressure gas pipelines

C2+ and rare gas extraction

Utilisation of cold ambient air

Short transportation distance

Complex logistics and LNG transhipment

Carbon offsets In 2020, among the four significant destinations of Sakhalin-2 LNG, China paid the lowest price, with imports priced at slightly below US$3.9/million Btu. Chinese companies imported spot LNG cargoes only because they do not have a long-term contract with Sakhalin-2 LNG. Several Japanese companies, KOGAS of South Korea and CPC of Taiwan, all have long-term contracts with Sakhalin-2. In 2020, annual average spot LNG prices maintained a lower level than term-contracted LNG. Therefore, LNG import prices to China recorded the lowest range compared to companies purchasing LNG from Sakhalin based on long-term contracts. Small scale LNG from Ekaterinburg to Kazakhstan costs slightly below US$4/million Btu on average.

In the same year, Yamal LNG export prices to Asian countries were recorded higher than European countries. This is because LNG prices in Asia are frequently higher than those in the European market. For example, the Japan-Korea marker (JKM) price level maintained higher than the TTF-European hub price throughout the year. At the same time, transportation costs to the Asia Pacific region were also higher than those to Europe. As a result, the average LNG price from the Yamal to European customers was higher

Investments and export regimes

The Russian LNG industry is getting more and more interesting for foreign investors. The level of maturity of any economic sector could be, to some extent, estimated by the activity of foreign investors. In the case of Russian oil and gas, foreign money was mainly welcomed in offshore upstream and midstream projects. It is clearly explained by the international practice of co-operation in technically and economically complicated projects. Usually, one country cannot provide the necessary level of expertise. Sakhalin-1 and 2 might be good examples. Figure 3. Markets of primary LNG producers (share from countries’ produced For Russian LNG liquefaction facilities, LNG). Source: based on GIINGL data. already operating and under construction, the following outline the oil and gas giants intensely interested in Russian gas import: Sakhalin-2: Shell Concern; Mitsui Group; Mitsubishi Group. Yamal LNG: Total; CNPC; Silk Road Fund. Arctic LNG 2: Total; CNPC; CNOOC; Japan Arctic LNG B.V. (Mitsui & JOGMEC Consortium). Far East LNG: Exxon Mobil; SODECO; ONGC Videsh Ltd. Among the proposed projects, Kara LNG is being considered by BP Russian Investments Ltd and Q.H. Oil Investments Ltd (Qatar Investments Authority). It is essential to note that foreign investors try to participate in all strategically crucial facilities, including floating storage and terminals. For example, TotalEnergies is a 10% owner of floating LNG storage in Murmansk and Kamchatka. Small LNG projects are also interested in foreign aid, but several obstacles exist for successful international co-operation. Most of them occurred due to certain peculiarities Figure 4. LNG plants operational and planned. Source: #LNGmap project. of Russian export legislation. Currently, there is no legal restriction, and the small scale LNG project could attract foreign finance or any other contribution through different types of joint venture, partnerships, or other co-operation agreements. But one of the unavoidable and very reasonable conditions in most cases is the LNG export contract which proves the project feasibility and guarantees investment return. So, the critical issue for an LNG project is to make sure the potential product is already sold. Among Russian companies, only two giants – Gazprom and Novatek – could afford to meet these conditions. Rosneft is negotiating its right to join this exclusive LNG exporters club. There is a substantial concern that in case of failure, Rosneft will not keep its LNG ambitions. Given the abundant gas reserves in Russia and existing infrastructure, one of the critical limitations for LNG project realisation and further export to the global LNG market remains in the regulatory area. The existing regime restricts export for small or mid scale LNG producers and requires potential LNG exporters to own the entire value chain – from the license to production to transportation. The export legal framework should be liberalised in case of taxes on LNG and pipeline gas to increase Russian LNG export. LNG export monopoly was fixed by the federal law ‘About Gas Export’ in 2006. The decision was backed by the necessity

than TTF prices on average. Belgium paid in the region of US$4.8/million Btu, the highest price among European buyers. Among Russian LNG export destinations, small scale LNG volumes of SiTek from the Republic of Sakha-Yakutia to Mongolia received the highest value with an annual average sales price of over US$12/million Btu. Average sales prices of Vysotsk LNG recorded US$4/million Btu, higher than TTF price by approximately US$0.9/million Btu. Lithuania and the Netherlands paid lower than TTF from Vysotsk LNG – they paid US$1.7/million Btu and US$2.2/million Btu on average, respectively. Thus, average LNG prices to European and Asian countries were higher than TTF and JKM in 2020. However, it is worth noting that in 2020, spot gas prices maintained a record low level due to the demand shock caused by the pandemic.

On the other hand, the price of term-contracted LNG stayed at a relatively higher level in the same year. This is because most of the production volume of Sakhalin-2 LNG and Yamal LNG is devoted to customers under a long-term contract. In 2021, on the contrary, TTF and JKM prices rocketed, and spot LNG prices are experiencing the highest level in history. Therefore, in 2021, it is anticipated that the average LNG price from the majority of term-contracted cargoes around the world will be considerably lower than spot prices, including Sakhalin-2 LNG and Yamal LNG.

to maximise budget income in the condition of rising LNG export prices and high margin sales.

In 2013 the law was changed. LNG export was allowed to the entities – federal fields developers whose licensed activity before 1 January 2013 presumed LNG production or exploration gas for further liquefaction.

As a result, the export right was granted to specific fields which met certain extra conditions. For example, Yamal LNG and Arctic LNG 2 are fuelled from those gas fields where gas could be exported without Gazprom permission. Due to this crucial legal point, NOVATEK managed to attract an appropriate investors pool and promoted LNG production and export as its main strategic line.

It is essential to mention that this law does not regulate LNG export by the entities operating under Product Sharing Agreements (PSA).

At the moment, seven projects are being allowed to export LNG: PJSC Gazprom, PJSC Rosneft, PJSC Yamal LNG, Gazprom Export Ltd, Arctic LNG 1 Ltd, Arctic LNG 2 Ltd, and Arctic LNG 3 Ltd.

Indeed, a restrictive LNG export legislature is one of the critical obstacles for Russian LNG export expansion. Several projects have already stopped due to this reason. For example, Gorskaya LNG, Pechora LNG, and some small scale LNG projects did not manage to persuade investors without signed, valid export agreements.

In 2019 several alterations to the Gas Export Law were made, but they did not let other companies export gas and simply added some new fields developed by NOVATEK to the list of gas export fields.

However, the damage for Russian interest became apparent, and the Energy Strategy of Russia 2035 presumes some liberalisation (permission to sell without Gazprom control) in the case of mid (2 million tpy) and small (80 000 tpy) LNG projects.

Also, in parallel, it is expected that gas tax reform will cut taxes on pipeline gas and increase taxes on LNG, including the particular obligation for localisation of LNG liquefaction equipment and national gas carrier priority.

Figure 5. Russian LNG exports price by country (annual average in 2020). Source: based on data from the Federal Custom Service of the Russian Federation.

Figure 6. Carbon footprint of selected LNG plants. Source: IEA Environmental Integrity Project, Emission Increase Database, November 2019.

Carbon footprint

Natural gas has the role of a transition fuel, because emissions produced from using natural gas are significantly lower compared with oil fuels and coal. The carbon neutral LNG will improve the ecological position on the energy market for an extended period.

On the other side of the coin is natural gas, highly criticised for methane leaks and required greenhouse gas (GHG) management to stay on the market long-term.

Carbon footprints are managed at all steps of the production chain, including gas production, transportation, liquefaction, LNG shipment, and regasification.

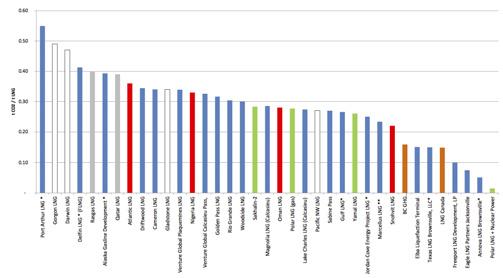

Sakhalin-2 has a specially developed programme called ‘Ecological LNG.’ Russian companies have a low-carbon footprint due to the cold environment and actively improve technological development and renewable energy sources. So the use of Russian LNG will decrease CO2 emissions not just in the case of a coal to gas switch, but also in the case of Australian or US LNG to Russian LNG.

Even with a low CO2 footprint due to the cold climate site, Russian LNG projects implement different ways to manage GHGs through the entire value chain.

The most diverse ways include the use of electric drivers combined with nuclear power, and producing additional products such as ethane, C3+, and rare gases.

Russian LNG plants have completed several deliveries of carbon neutral LNG cargoes. There are three cargoes of carbon neutral LNG delivered from Russian LNG plants: two for the Asia market (CPC and Hokkaido Gas were buyers for Taiwan and Japan respectively) and one for the UK (Shell was the buyer). The carbon offsets were well-to-wheel.

Conclusion

Known as the largest pipeline exporter globally, Russia has a significant potential for LNG industry development. Given enormous gas reserves, the second largest natural gas market globally, and geographical access to big LNG consumers, Russia can export gas through the well-developed gas network infrastructure.

The success of Yamal LNG in the Arctic is an encouraging example for other producers in Russia to strive for their success and drive the industry development. Today, Russia is aiming to achieve its vast potential to become a global LNG sector leader, since it has the potential to produce up to 250 million tpy in Baltic, Antarctic, and Pacific basins and accelerate the growth of the domestic LNG market.