October 2024

Optimize asset performance with crude stability monitoring

October 2024

Optimize asset performance with crude stability monitoring

For nearly a century, Grace catalysts have kept fuel and petrochemical feedstocks flowing from the industry’s largest refineries to the trucks, trains, planes, and ships that keep our world running.

We are leveraging our long history of innovation in fluid catalytic cracking to develop products that enable lower carbon fuels and help meet the challenges of the energy transition.

34 Turning a challenge into an opportunity

10 Middle East: oil market shepherd

Nancy D. Yamaguchi, Contributing Editor, examines the Middle Eastern oil sector, with a focus on its role in stabilising oil markets amongst constantly shifting geopolitics.

18 Optimising asset performance with crude stability modelling

More than ever refiners are looking for opportunity crudes to increase economic profitability and optimise finished product delivery. Wesley Teasdale and Timothy Oubre, Halliburton Multi-Chem, explain how these crudes, along with overall crude diet changes, can have far-reaching impacts on multiple refining processes.

23 The next step in dissolution recycling

Polymer recycling presents both a critical challenge and an opportunity to incorporate sustainability in industrial practices worldwide. To achieve widespread, long-term adoption, the practice must be supported by effective methods. Luis Hoffmann and Emmanuelle Chauveau, Sulzer, explain.

27 Diesel no.2: the biomass-based alternative Jim Aiello, Merichem Technologies, USA, discusses the rise of renewable diesel and the global transition to cleaner fuels.

31 Sustainable fuels are here

The world’s first commercial production plant for ultra-low carbon eFuels began supplying product to customers in 2023. But what will it take to bring these sustainable, hydrogen-based fuels to the mainstream? Liz Myers and Roger Harris, Infinium, USA, explain.

Fabio E.G. Ferrari, Luca E. Basini, Leonardo Falbo and Edoardo Disarò, NEXTCHEM Tech, Italy, explain the opportunity for valuable hydrocarbons to be utilised from the flaring of associated petroleum gas (APG).

41 Going greener

Larry Emch, Integrated Global Services (IGS), USA, presents advanced solutions for reducing emissions and improving process efficiency at refineries.

44 Peak performance

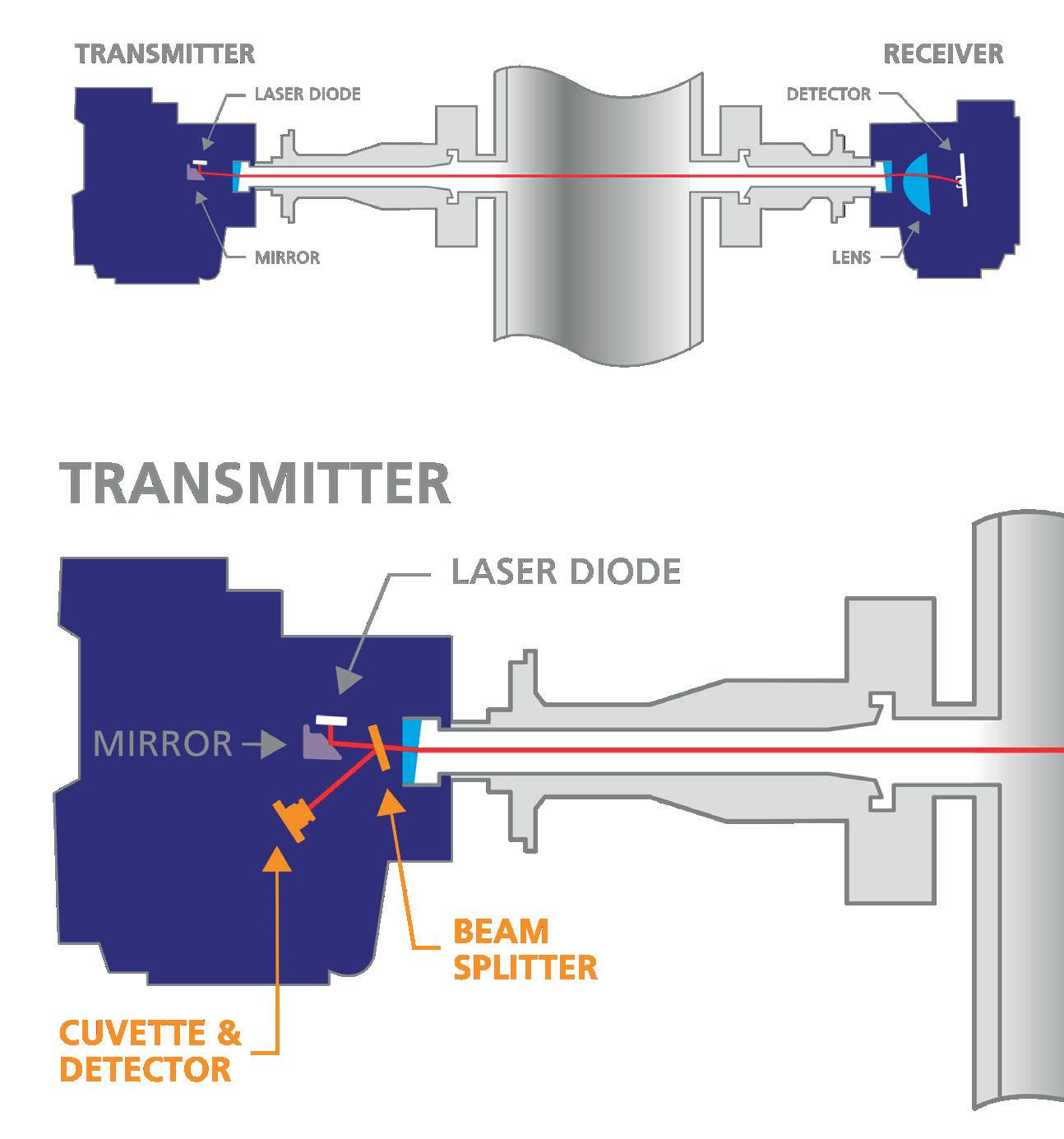

Rhys Jenkins, Servomex, UK, explains how tunable diode laser (TDL) gas analysis technology supports more efficient combustion for cleaner industry.

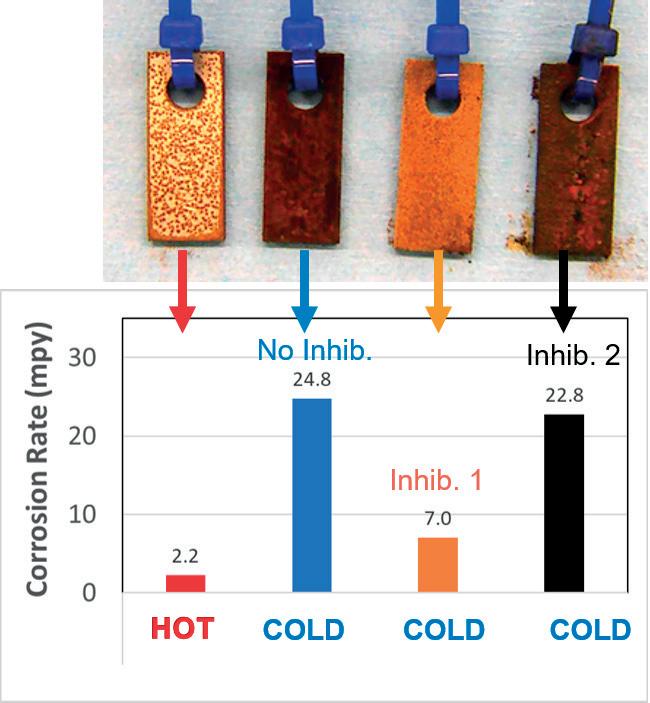

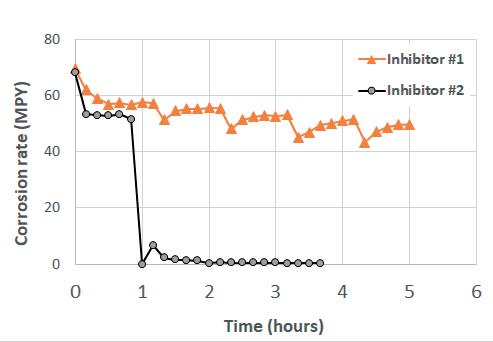

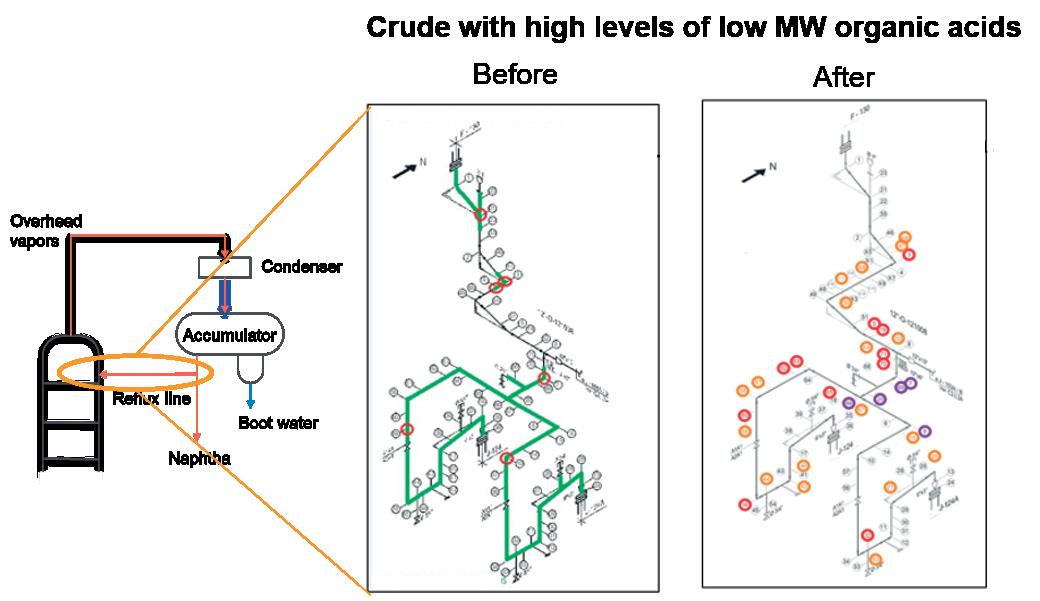

50 Controlling nucleation corrosion

Osvaldo Heredia and Maria Alma Droppelmann, ENAP, Trevor Place, Enbridge Inc., and Moshood Adewale, Tatiana Barbosa and Luis Orellana Galarce, Veolia Water Technologies & Solutions, explore how nucleation corrosion in liquid hydrocarbon systems can be mitigated and present a case study examining nucleation corrosion in a refinery distillation overhead reflux line.

57 The power of prediction

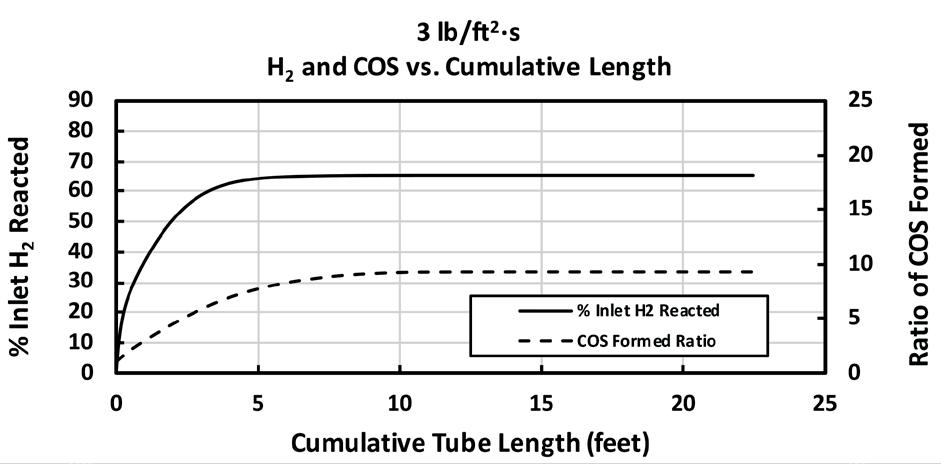

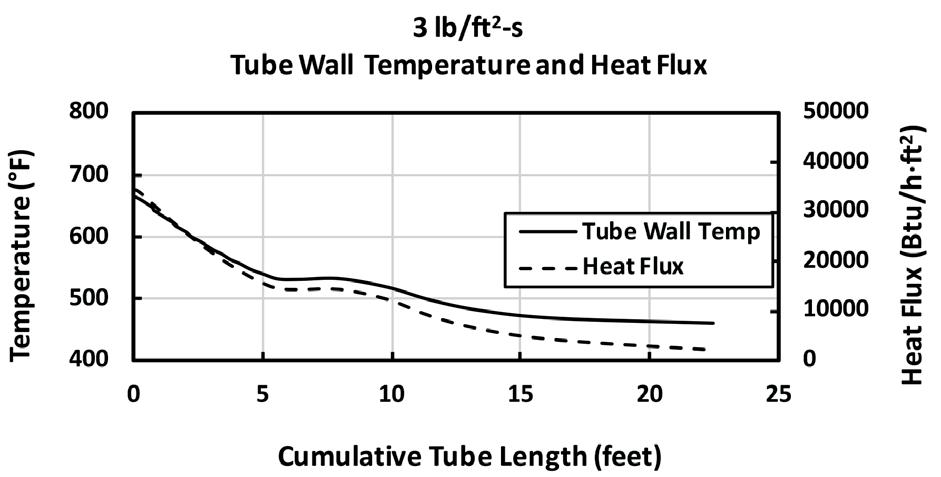

G. Simon A. Weiland, Optimized Gas Treating, Inc., USA, highlights the advantages of predictive sulfur recover unit (SRU) simulators and how they can help to optimise plant operations.

63 Playing offence

Tim Gale, Cameron Hamari, and Brett Seales, 1898 & Co., USA, explain why adopting an offensive approach is the best strategy to defend against cyber threats in the downstream oil and gas sector.

68 Looking back to see ahead

Bernard Montel, Tenable, France, explores the benefits of adopting a preventative cybersecurity stance in the downstream industry.

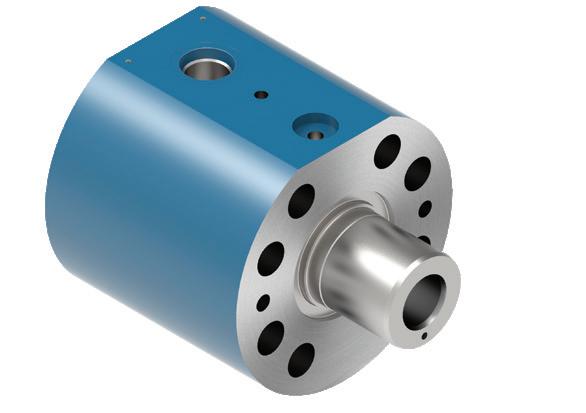

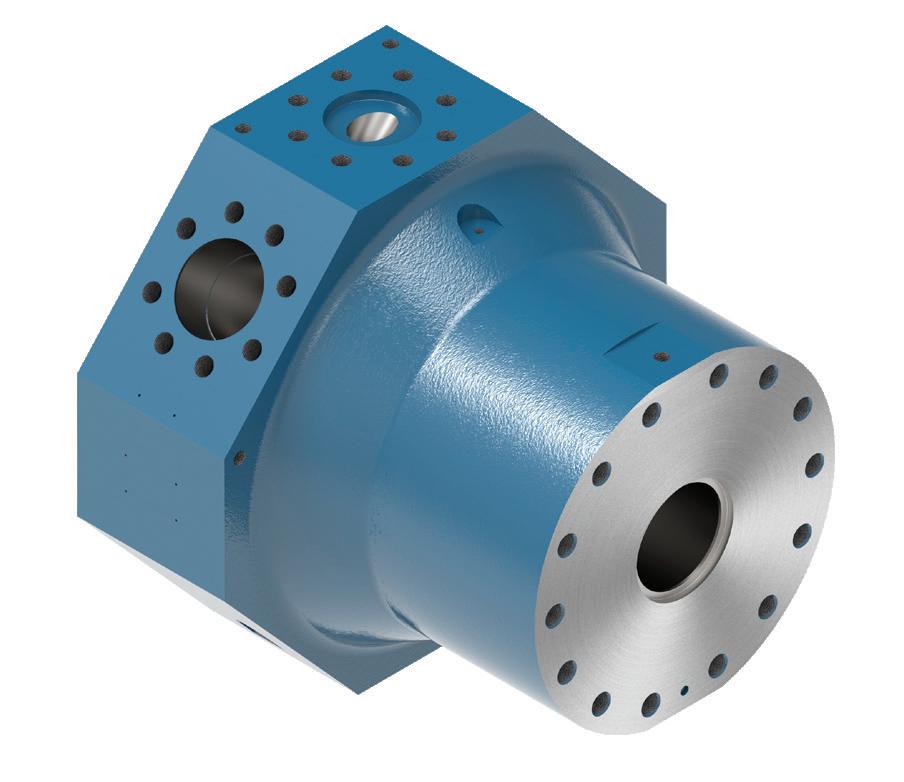

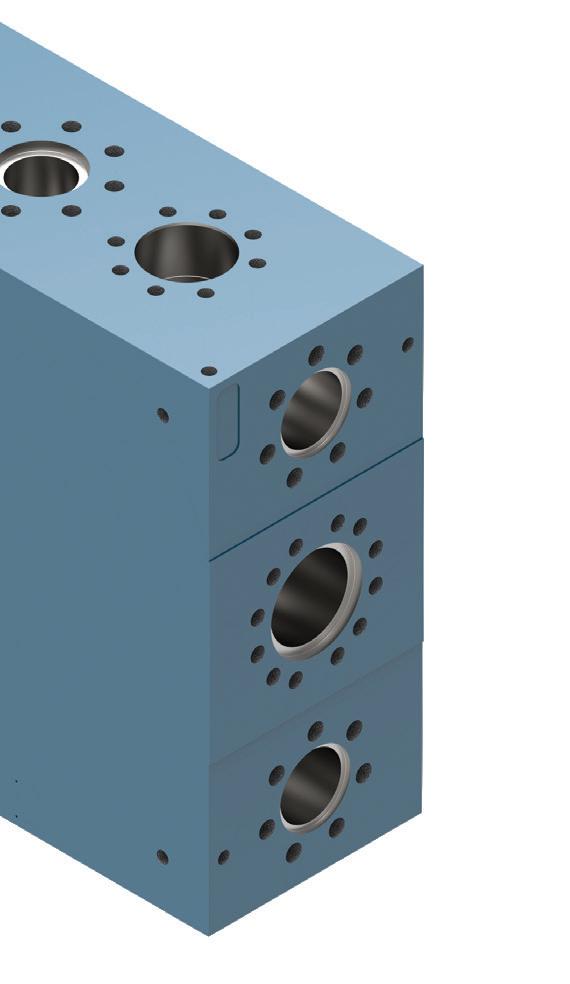

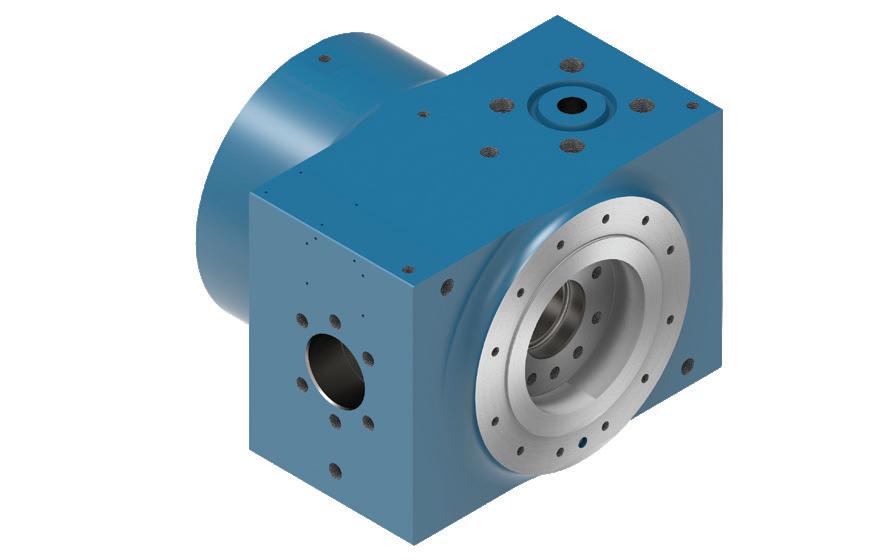

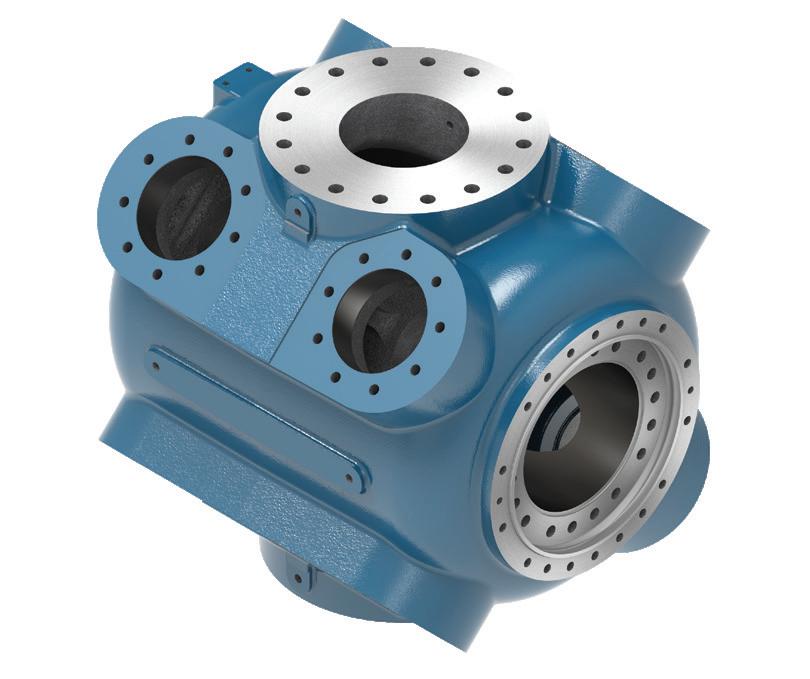

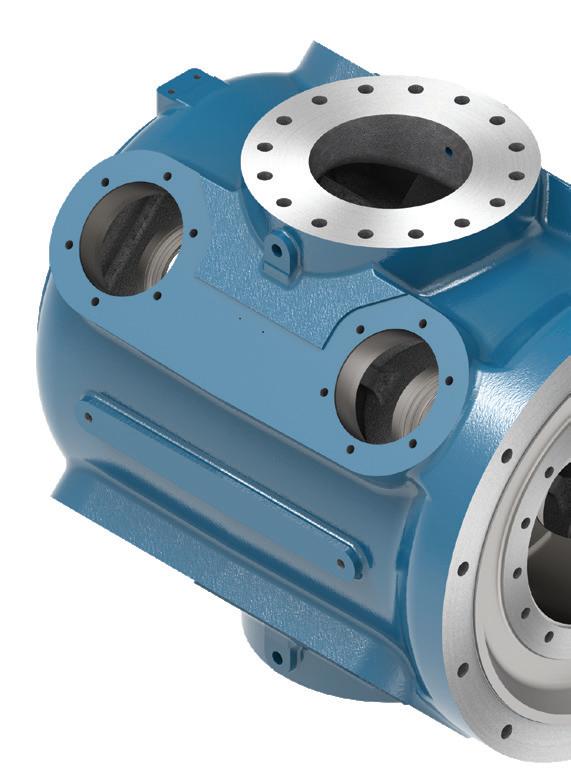

Halliburton Multi-Chem provides industrial water and process treatment solutions to refineries and petrochemical plants. Through onsite technical service and engineering support, the company helps customers with business goals, including improving reliability, increasing throughput, and enhancing the efficiency and flexibility of operating units. Halliburton Multi-Chem’s aim is to protect assets and maximise value.

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

ASSISTANT EDITOR Poppy Clements poppy.clements@palladianpublications.com

EDITORIAL ASSISTANT Emilie Grant emilie.grant@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Ella Hopwood ella.hopwood@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

HEAD OF EVENTS Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT ASSISTANT Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATOR Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITORS Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail). Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999

CALLUM O'REILLY SENIOR EDITOR

The energy transition has hit a number of hurdles in recent times. Geopolitical uncertainty, complexities within the supply chain, and higher inflation have combined to make the transition to a cleaner energy future more challenging. In its recent ‘Energy Transition in Oil and Gas’ report, GlobalData notes that heightened energy security fears have increased the focus on fossil fuels and led some companies to scale down their energy transition pursuit. Meanwhile, in its ‘Global Energy Perspective’ report, McKinsey & Co. states that the global energy transition is entering a “new phase”, which is marked by rising costs, complexity and technical challenges: “Growing energy demand and resulting emissions could affect the pace of the energy transition, which will require a rethink of both low-carbon and fossil fuel strategies to meet the goals outlined in the Paris Agreement.”

McKinsey’s analysis demonstrates that the build-out of clean energy technologies has not been fast enough to meet growing energy demand worldwide. And although there are concerns that the pace of the energy transition will slow in the short-term as the world navigates choppy geopolitical waters, it’s very clear that change is both necessary and inevitable. In early September, Hydrocarbon Engineering hosted its inaugural ‘World Energy Transition Conference’ a virtual event dedicated to exploring innovative decarbonisation technology and solutions that are driving the transition to a low-carbon energy future. The conference featured a number of very interesting presentations from leading subject matter experts. In the opening keynote presentation, Jon Hansen, Head of Energy Scenario at Rystad Energy, outlined decarbonisation pathways for the downstream sector. He introduced a “toolbox” of opportunities for the sector to effectively reduce emissions. These include improving energy efficiency (optimising plants, minimising power consumption and implementing an energy sourcing strategy), carbon capture, utilisation and storage (CCUS), switching to alternative fuel sources, adopting clean hydrogen, and integrating renewable energy systems and pursuing electrification strategies.

During the conference, we also gained an insight into Wood Mackenzie’s outlook for oil demand growth, courtesy of Alan Gelder, Vice President of Refining, Chemicals and Oil Markets. Alan spoke of the value of petrochemical integration and explained why now is the time for refiners to plan to adapt in order to thrive during the energy transition.

If you missed Alan’s presentation, you can read more about his thoughts in a brand-new supplement to Hydrocarbon Engineering that we are launching next month. EnviroTech 2024 will include a range of interesting technical articles and case studies exploring innovative technology and solutions that will help your business thrive within the energy transition. In addition to Wood Mackenzie’s keynote piece, EnviroTech 2024 will include articles from leading experts on a range of topics including emissions reduction, energy efficiency, CCUS, SAF, electrification, blue hydrogen, renewable energy integration, and much more. If you would like to be a part of EnvrioTech 2024 or a future edition of this new supplement, please reach out to us via the contact information on the left of this page. And to ensure you don’t miss out on a free copy of this supplement sent directly to your inbox, scan this QR code and follow the simple on-screen instructions.

We are a world leading manufacturer of sulphur processing equipment as well as solutions for downstream silo/stockpile storage and reclamation, and bulk loading systems for truck, rail and ships.

ROTOFORM PASTILLATION

With 700+ systems in use by the sulphur industry, Rotoform is the world’s most widely used process for small to mid-capacity production of premium quality pastilles and offers unrivalled product uniformity and environmentally friendly operation.

SG DRUM GRANULATION

Where higher capacity is required, our SG rotating drum system is a fully automated, ‘once through’, sulphur granulation process based on a size enlargement process by continued coating of seed material.

KEY FEATURES

Solidification capacity up to 280 mtpd.

Duplex steel belts alloyed for maximum lifetime.

Pastilles according to SUDIC premium quality spec.

KEY FEATURES

Capacity up to 2,000 mtpd.

Single pass, no need for screens.

Process simulation to suit all conditions.

Simple operation, precise control.

Worley will support Shell with the transformation programme at its Energy and Chemicals Park Rheinland, converting the site into a base oil production unit, and enabling the production of renewable hydrogen at the facility.

Worley is supporting Shell on a project that will convert a hydrocracker

into a production unit for base oils at the Wesseling site in the facility, near Cologne, Germany. The Wesseling site plans to stop processing crude oils in 2025. The new base oil plant will have a production capacity of around 300 000 tpy. This is equivalent to around 9% of the EU and 40% of Germany’s demand for base oils.

BASF has announced that it has inaugurated a new world-scale production plant for alkyl ethanolamines at its Verbund site in Antwerp, Belgium.

This new investment will increase the company’s global annual production capacity for alkyl ethanolamines, including dimethyl ethanolamine (DMEOA) and methyl diethanolamine (MDEOA), by nearly 30% to over 140 000 tpy.

The new plant is an important part of the BASF production network for this portfolio at the company’s sites in Ludwigshafen, Germany; Antwerp, Belgium; Geismar, Louisiana; and Nanjing, China.

The versatile alkyl ethanolamines are mainly used as precursors for gas treatment chemicals, for flocculants applied in water treatment, and as binders between pigments and resins in the coatings industry.

Wood has been awarded a three-year contract to operate and maintain the Freepoint Eco-Systems plant in Hebron, Ohio, US.

The flagship facility spans 25 acres, utilising a 260 000 ft2 warehouse, making it one of the largest advanced recycling facilities in the world.

This facility will apply advanced pyrolysis recycling technology to convert approximately 90 000 t of end-of-life plastics into a petrochemical feedstock, pyrolysis oil, through a depolymerisation process. The feedstock can then be used in applications such as food-grade and medical-grade plastic packaging.

Wood will provide full facility operations and maintenance management, employing upwards of 100 people, supporting Freepoint Eco-Systems with operational readiness processes including the development of safety and maintenance management systems.

EET Fuels (trading name of Essar Oil (UK) Ltd), which plans to create the world’s leading low-carbon process refinery, has progressed to the front-end engineering design (FEED) stage of its industrial carbon capture (ICC) project.

The company has appointed Toyo Engineering India Pvt Ltd (Toyo-India) (100% subsidiary of Toyo Engineering Corp., Japan) to carry out the FEED phase – an integral part of the project management process. Toyo-India will oversee design completion, project de-risking, detailed costing analysis and

other vital work. Completion of FEED will enable the company to take Final Investment Decision (FID) on the ICC project.

Upon completion (expected in 2028), the ICC project will capture carbon dioxide emitted from Stanlow refinery’s full-residue fluid catalytic cracking (FCC) unit – one of Europe’s largest units. Leveraging Stanlow’s unique location, the captured CO2 will use a repurposed existing gas transportation network and be permanently sequestered into depleted gas fields in Liverpool Bay, as

part of the HyNet industrial decarbonisation cluster in the North West of England.

The ICC project is expected to capture approximately 1 million tpy of CO2, removing around 45% of all Stanlow’s emissions. The project has applied for the right to negotiate with the UK government for a revenue support mechanism as part of the Department of Energy Security and Net Zero’s Track One expansion programme in the carbon capture, usage and storage (CCUS) cluster sequencing process.

15 - 17 October 2024

AFPM Summit

New Orleans Louisiana, USA summit.afpm.org

15 - 17 October 2024

ESF MENA

Riyadh, Saudi Arabia

www.europetro.com/esfmena

04 - 07 November 2024

ADIPEC

Abu Dhabi, UAE www.adipec.com

11 - 14 November 2024

ERTC Lisbon, Portugal

www.worldrefiningassociation.com/event-events/ertc

20 November 2024

Global Hydrogen Conference

Virtual www.accelevents.com/e/ghc2024

03 - 05 December 2024

Valve World Expo Düsseldorf, Germany www.valveworldexpo.com

10 - 12 December 2024

17th National Aboveground Storage Tank Conference & Trade Show

The Woodlands, Texas, USA www.nistm.org

21 - 22 January 2025

NARTC Houston, Texas, USA

www.worldrefiningassociation.com/event-events/nartc

24 - 27 February 2025

Laurance Reid Gas Conditioning Conference

Norman, Oklahoma, USA pacs.ou.edu/lrgcc

6 - 10 April 2025

AMPP Annual Conference + Expo Nashville, Tennessee, USA ace.ampp.org

20 - 22 May 2025

ESF North America

Houston, Texas, USA www.europetro.com/esfnorthamerica

Air Products has completed the sale of its LNG process technology and equipment business to Honeywell for US$1.81 billion in cash. First announced in July 2024, closing conditions for the transaction have been fully met and regulatory approvals received.

The divestiture of the LNG process technology and equipment business is strategic, reflecting Air Products’ focus on its two-pillar growth strategy to profitably grow

its core industrial gases and related equipment businesses, and to deliver clean hydrogen at scale.

With the sale, related assets, manufacturing capability and personnel associated with the LNG process technology and equipment business have transferred successfully to Honeywell. This is the fourth acquisition Honeywell has closed in 2024 as part of its disciplined capital deployment strategy.

Woodside has signed a sale and purchase agreement (SPA) with JERA for the long-term supply of LNG to Japan.

Under the SPA, Woodside will supply approximately 0.4 million tpy of LNG over 10 years on a delivered basis, commencing in April 2026.

LNG delivered to JERA under the SPA will be sourced from volumes across Woodside’s global portfolio.

The execution follows the announcement in February 2024 whereby Woodside reached an agreement for the sale to JERA of a 15.1% non-operating participating interest in the Scarborough Joint Venture.

Woodside expects the Scarborough equity sale to JERA to be completed before the end of 2024.

EnerMech has become the integrated service contract supplier of choice to KENT Energies Ltd for ExxonMobil’s new low sulfur diesel facility at its Fawley Petrochemical Complex, located in Hampshire, UK. The project comprises the construction of the new low sulfur diesel facility encompassing the development of a new hydrogen plant at the country’s biggest integrated complex. It aims to help reduce the

UK’s reliance on diesel imports and pave the way for the potential production of sustainable aviation fuel (SAF). The project will increase the output by 38 000 bpd.

Chuck Davison, EnerMech CEO, said: “This contract represents a major milestone for the business as it partners us with KENT Energies to support ExxonMobil and one of the UK’s most strategic petrochemical sites.”

Ever-changing market conditions, global economic challenges, and the shared journey of the energy transition all mean it is crucial to evaluate easy-to-implement and costeffective improvement opportunities. At Shell Catalysts & Technologies, our solutions open new possibilities for smarter investments while preserving cash through revamping, reconfiguring, or optimising your existing assets. Our experts co-create tailored solutions while keeping your margins in mind – ensuring the investments you make right now can help you maintain your competitive advantage into the future.

Learn more at catalysts.shell.com/revamps.

Superior process and water treatment solutions supported by service excellence

Superior process and water treatment solutions supported by service excellence

Halliburton Multi-Chem collaborates with customers to improve reliability, increase throughput, and enhance operating unit efficiency and flexibility. We offer a broad range of chemistries, equipment, automation, and services to help our customers maximize asset value.

Halliburton Multi-Chem collaborates with customers to improve reliability, increase throughput, and enhance operating unit efficiency and flexibility. We offer a broad range of chemistries, equipment, automation, and services to help our customers maximize asset value.

Our experienced team provides onsite technical services and engineering support. We listen to understand your challenges and respond with solutions.

Our experienced team provides onsite technical services and engineering support. We listen to understand your challenges and respond with solutions.

Nancy D. Yamaguchi, Contributing Editor, examines the Middle Eastern oil sector, with a focus on its role in stabilising oil markets amongst constantly shifting geopolitics.

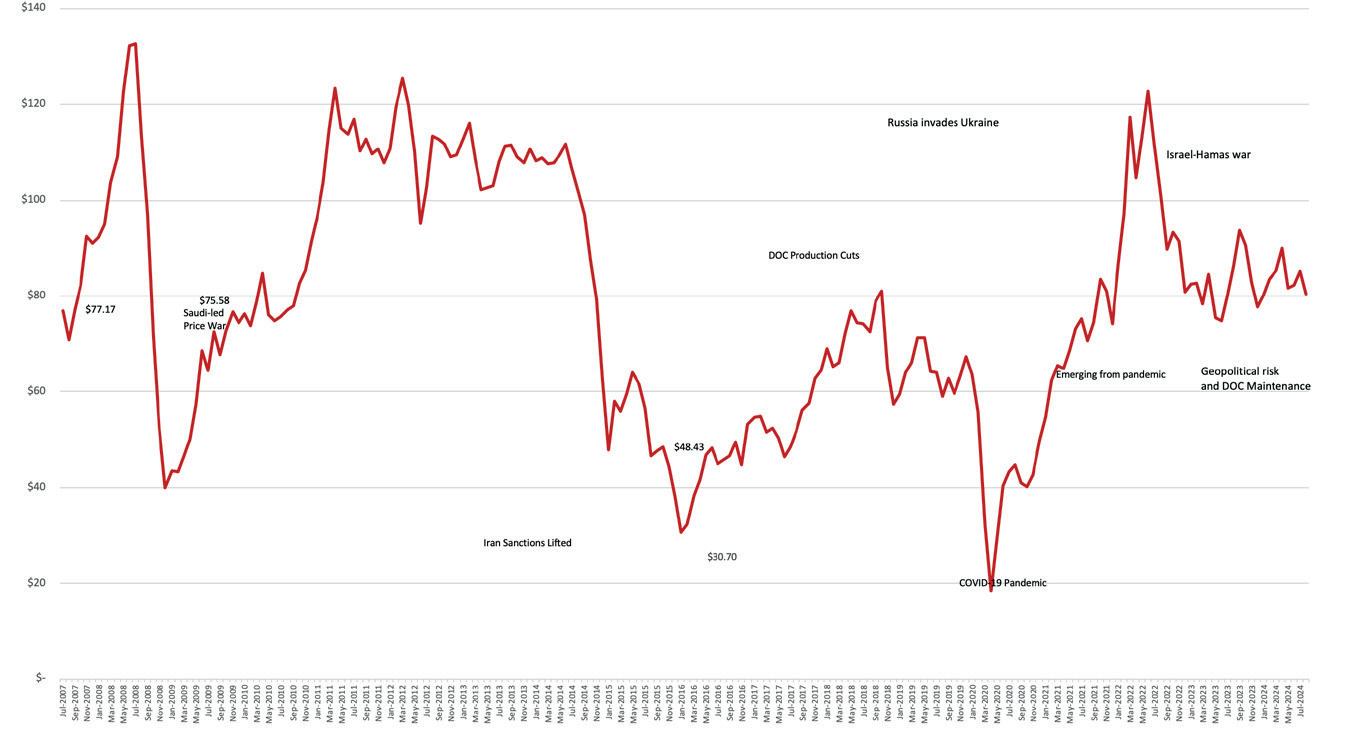

The past year has brought sustained geopolitical risk and elevated prices for oil. In retrospect, however, prices have eased considerably since early 2022, when Russia invaded Ukraine and Brent crude spot prices jumped above US$120/bbl. This war is now in its third year. Consumers dread additional price spikes and supply disruptions, but the market has been far calmer than expected, without spikes and crashes. The Israel-Hamas war caused another uptick in prices in late 2023, but prices did not surge above US$100/bbl. In late August 2024, strife in Libya shut in roughly half of the country’s production, but as this issue of Hydrocarbon Engineering goes to press, prices have not risen.

The global oil market is a constantly shifting entity, with so many players that no one can claim to control it. The Middle East, however, is the site of the largest OPEC producers, immense reserves, rapidly growing demand, and a significant downstream industry. This article provides a briefing on the Middle Eastern oil sector, with a focus on its crucial role in stabilising the global market, despite a continuing stream of geopolitical risk factors. OPEC producers and their allies have had notable and enduring success via the Declaration of Cooperation (DoC). This success

appears to be aiding the producers in their quest to be shepherds of the global oil market.

In December 2016, OPEC member countries and 11 non-OPEC oil producing countries met at OPEC Headquarters in Vienna, Austria. They signed the Declaration of Cooperation (DoC). OPEC states that the DoC’s official goal is ‘to contribute to a secure energy supply and lasting stability for the benefit of producers, consumers, investors and the global economy.’1 OPEC’s membership currently consists of Algeria, Angola, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Republic of the Congo, Saudi Arabia, the UAE, and Venezuela. Ecuador, Indonesia and Qatar are former OPEC members. Producer countries meeting with OPEC in 2016 were Azerbaijan, the Kingdom of Bahrain, Brunei Darussalam, Equatorial Guinea (which joined OPEC in 2017), Kazakhstan, Malaysia, Mexico, the Sultanate of Oman, the Russian Federation, the Republic of Sudan, and the Republic of South Sudan. The DoC was launched to be a platform for producers to discuss market issues and cooperate in market stabilisation efforts.

The DoC countries became known as the OPEC+ Group, though the group refers to itself as the DoC. Many market analysts predicted that this group would not be able to hold together for long, much less agree upon meaningful production controls that would stabilise prices. The DoC prizes consensual decision making, and it is a challenge to have such a large, diverse group of 23 countries reach consensus. But time and time again, they have achieved this. The DoC countries set and maintained a programme of production ceilings that began to finally drain some of the global oversupply. Prices began to recover. When countries exceeded their production allowance, this was often called ‘cheating’ in the trade press, but the group stayed together and managed compliance internally.

Saudi Arabia often used its immense production capacity to singlehandedly rebalance the DoC’s output.

Now, in 2024, the DoC group has proven its staying power, and it is a key shepherd in the market, constantly monitoring and forecasting supply and demand. Some countries have requested that OPEC raise production to help ease prices, including India, where demand growth is very strong.

The DoC’s plan is to gently raise production in 4Q24. However, OPEC recently revised downward its forecast of global demand in 2024 from 2.25 million bpd to 2.11 million bpd, so it is possible that the group will maintain disciplined production ceilings.

When futures market or spot prices for crude and products surge, ‘geopolitical risk’ is often cited as the cause. This has become such a huge catchall phrase that a brief discussion is needed. Reviewing recent history identifies geopolitical risk factors including, but not limited to:

n Trade disputes, particularly over strategic commodities (including oil and energy).

n Economic sanctions, which can disrupt trade and cause economic damage.

n Political instability, including civil unrest, can force regime change.

n Borders and disagreements over access to infrastructure and resources (once again including oil and energy).

n Globalisation, a double-edged sword that allows countries to grow together, yet also allows the spread of distress from one region to another.

n Natural disasters, such as earthquakes, storms and floods, which can cut across national boundaries and stymie relief efforts when cross-border relations are unfriendly.

n Geographic features such as canals and choke points.

n Armed conflict and outright war.

This list is not exhaustive. It is also near-universal – can there possibly be any country on Earth that is immune to geopolitical risk? However, it is striking that all these factors have affected the Middle East, since the concept of geopolitical risk tends to focus on the global petroleum market. Indeed, the recent past has been a time of sustained geopolitical risk, to the point that it must be considered the norm rather than the exception. The number and types of geopolitical risk factors seem to keep growing, and events in one area easily spread to others. If these risks are now the norm, they often are ‘baked in’ to market outlooks and investment strategies. Have OPEC and the DoC countries become more adept at balancing the market?

The recent price trends discussed in the section following suggest that this may be true.

Oil prices have spiked and slumped repeatedly since the first oil prices shock of the 1970s, but prices have been surprisingly stable over the past year. Figure 1 tracks monthly spot prices for Brent crude from 2012 through August 2024. In March 2012, prices exceeded US$125/bbl. Saudi Arabia launched its oil price war in 2014, ramping up production to recapture market share and push out higher-cost producers. Prices began to fall, subsiding to the US$50 - 70/bbl range. In early 2016, however, sanctions on Iran were lifted, and prices collapsed as Iranian exports rose. The DoC group launched its production cut agreement to support prices. In 2020, the COVID-19 pandemic caused the greatest price collapse in history, with Brent spot prices bottoming out at US$18.38/bbl in April 2020.

Oil prices began to rise steadily as the world emerged from the pandemic, as did prices for many other commodities. During the slump, investment in many economic sectors had been stifled, not just in the oil sector, and the recovery in demand outpaced recovery in output. Many countries cooperating in the OPEC+/DOC group had production ceilings that exceeded the volumes they were able to produce. Saudi Arabia alone seemed to have spare production capacity.

Prices shot up when Russia invaded Ukraine in early 2022, reaching US$122.71/bbl in June 2022. The market gradually adjusted despite the continuation of this war. Prices eased into the US$75 - 85/bbl range.

Poorer-than-expected economic data from China could have moved prices even lower, until the Israel-Hamas war brought prices back into the

The industry leaders in nitrogen rejection, BCCK’s NiTech® technology has enabled operators to profitably recover once bypassed reserves for decades. Whether a single or dual tower design, our proven design has become the industry standard for both higher and lower N 2 inlet gas streams. BCCK’s latest NiTech enhancement is designed to achieve methane contents in the vent as low as 10 ppmv, resulting in minimal methane losses to the environment. Stay Ahead of the Curve with BCCK’s most sustainable technology yet.

www.bcck.com • 1-800-922-2599

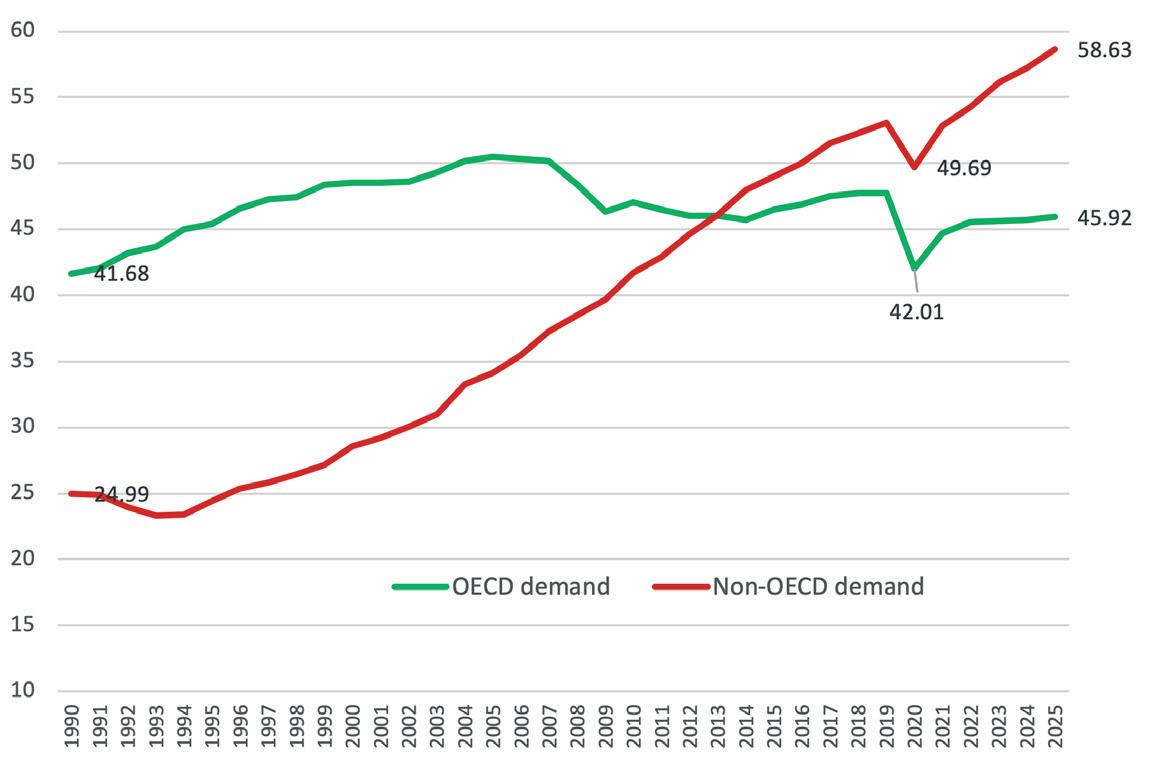

2. Non-OECD countries dominate global oil demand, (million bpd). Source: US Energy Information Administration.

US$85 - 90/bbl range in late 2023. The market adjusted to this as well, and prices since then have stayed mainly in the range of US$80 - 85/bbl. At the end of August 2024, conflict in Libya shut in over half of the country’s production, reportedly around 700 000 bpd. Yet daily spot prices for Brent crude, rather than rising, slid below US$80/bbl in early September 2024.

Middle Eastern oil producers continually monitor global oil demand. Producers must assess whether weaker-than expected demand will force oil into inventory and weigh upon prices, or whether hotspots in demand will produce prices spikes and disruptions. All international energy agencies track these forces, and they produce their best-guess forecasts of future demand. Naturally, there is a strong focus on events in the largest markets, where seemingly small events can translate into demand shifts totalling hundreds of thousands of barrels up or down.

A mind-boggling shift is occurring in oil demand in the Organisation for Economic Co-operation and Development (OECD) and non-OECD markets, as shown in Figure 2. According to the US Energy Information Administration (EIA), in 1990, OECD oil consumption was 16.69 million bpd more than non-OECD consumption. However, non-OECD demand grew quickly, and it caught up with OECD demand in 2013. The EIA forecasts that non-OECD demand will exceed OECD demand by 12.71 million bpd in the year 2025.

According to the Energy Institute (EI)’s and BP’s Statistical Review of World Energy, during the decade from 2013 through 2023, OECD oil demand fell at an average rate of -0.1% per year, led by a -0.4%/year drop in the EU.2 Historically, the OECD countries accounted for the bulk of the world’s oil consumption and imports. In 1973, OECD demand accounted for 75% of global demand. The oil price shocks of the 1970s cut OECD demand, and growth began to be led by the rest of the world.

Over the past decade, oil demand grew by 2.1% per year in the non-OECD countries. The fastest growth, 2.3% per year, was in the Asia-Pacific market. China was the key to this growth, where demand expanded at 4.6%/year. The EI reported that Chinese oil demand was 16.577 million bpd in 2023, second only to the US, where demand totalled 18.984 million bpd. Currently, the Chinese economy is facing headwinds caused in part by a property market slump. China’s GDP growth in 2024 may fall short of its 5% target, which will have knock-on impacts on oil imports and refinery activity.

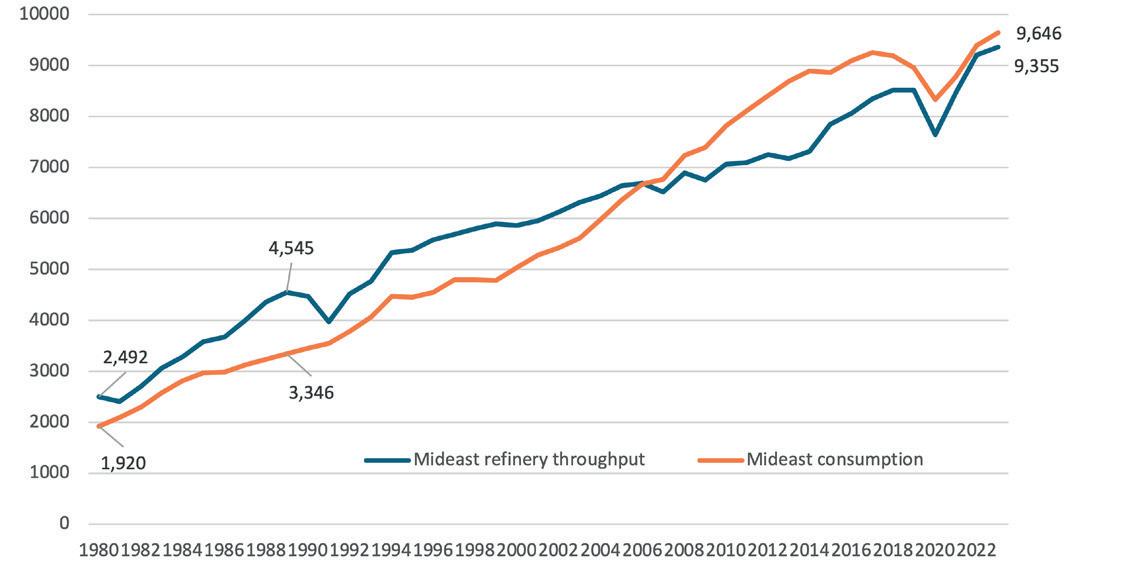

Like much of the non-OECD world, Middle Eastern oil demand has been growing, and the refining sector has been pressed to keep up with demand. Figure 3 shows the upward trend in Middle Eastern demand juxtaposed against the region’s refinery throughput. In 1980, demand of 1.92 million bpd was 0.572 million bpd below refinery throughput of 2.492 million bpd. In the 1980s, Saudi Arabia launched its plan to build export-oriented refineries, or ‘EXORS’. The goal was to capture the value-added of refining local crudes. Saudi Arabia’s refinery throughput jumped from 610 000 bpd in 1980, to 1 512 000 bpd in 1990, and to 1 669 000 bpd in 2000. Other Middle Eastern countries also launched refinery construction programmes, including export-oriented facilities. As Figure 3 illustrates, refinery throughput was comfortably higher than demand in the 1980s and 1990s. Yet demand grew even more swiftly, surpassing throughput by the year 2006. The great majority of refined fuel stayed within the region rather than being exported. At the time, the idea of ‘EXORS’ became ‘INDORS.’

Despite continued growth in the refining sector, throughput has not exceeded demand since 2006. The COVID-19 pandemic caused the sharp drop in demand and throughput seen in 2020. Both recovered and grew again between 2022 and 2023.

Given the strength of Middle Eastern oil demand, the focus of refinery expansions shifted partly to domestic markets, but not entirely. Technologically, the Middle East could increase its refinery runs and expand exports, but as was illustrated in Figure 2, demand stagnated and began to fall in many of the OECD countries that had inspired some of the export plans. Middle Eastern refiners looked also to the booming Asia-Pacific region, but refinery expansion programmes there were even

API’s Process Safety Site Assessment Program (PSSAP®) demonstrates a commitment to a culture of safety and continuous improvement at refining, petrochemical and chemical sites.

PARTICIPANTS BENEFIT FROM SHARED LEARNING, INDUSTRY BENCHMARKING, EXPERIENCED ASSESSORS AND MORE. To learn more visit:

more extraordinary than they were in the Middle East. Between 1980 and 2010, the Middle East added 4.632 million bpd of refinery capacity. The Asia-Pacific region added 17.904 million bpd, nearly four times as much. Although the Asia-Pacific region is a key customer for Middle Eastern exports, its refining industry satisfies the majority of its fuel demand.

Refinery expansion in the Middle East has been impressive, but there has been less incentive to invest in export-oriented facilities when utilisation rates have been lacklustre. According to the EI, in the early 1990s, refinery utilisation rates were often 90% and higher. Rates dropped below 90% in 2009 (the Great Recession) and never again achieved 90% utilisation. Rates collapsed to 74% during the COVID-19 pandemic. The year 2022 brought them back to 85%, but 2023’s utilisation rate dipped again to 81%. In comparison, OPEC reported that in July 2024, US refinery utilisation rates averaged 92.3%, European utilisation rates averaged 84.6%, and the selected Asian countries of Japan, China, India, Singapore and South Korea had a utilisation rate of over 94%.3

Despite relatively low refinery utilisation rates, there are several refinery projects underway or recently completed. These include fuel quality upgrades for domestic and export markets. Some projects were delayed during the COVID-19 pandemic, but 2022 - 2024 brought renewed activity.

Saudi Arabia’s recent refinery project was the 400 000 bpd Jazan refinery. This was completed in late 2021 and began to ramp up production and export capabilities in 2023. The refinery was run at 50% capacity initially. At full capacity, the refinery is designed to produce up to 75 000 bpd of gasoline, 250 000 of ultra-low sulfur diesel (ULSD), and 90 000 of vacuum residue. The vacuum residue provides feedstock for the integrated gasification combined cycle plant. The Jizan refinery started exporting refined products in early 2022. The completion of the hydrocracker is boosting ULSD output for export and cutting exports of lower-value vacuum gasoil and residual fuel oil. In 2023, Saudi Aramco and TotalEnergies also awarded contracts for the US$11 billion Amiral Project, a petrochemical plant integrated with the SATORP refinery.

Kuwait completed its 615 000 bpd Al Zour refinery in November 2022, after a delay caused by the COVID-19 pandemic. It exported its first cargo of naphtha, low-sulfur fuel oil, and jet fuel that month. This project is part of Kuwait’s Environmental Fuel Project (EFP). EFP was formerly known as the Clean Fuels Project, which upgraded the Mina Abdulla and Mina al-Ahmadi refineries. The Al Zour refinery has three 205 000 bpd crude distillation units, plus three 110 000 bpd atmospheric residuum desulphurisation units to produce low-sulfur fuel oil for use in the rapidly growing power sector. Transport fuels output will comply with EURO5 standards. There are three 62 000 bpd diesel hydrotreaters, two 53 000 bpd kerosene hydrotreaters, and two 18 200 bpd naphtha hydrotreaters.

Iraq’s 140 000 bpd Karbala grassroots refinery started trial operations in September 2022. The refinery was inaugurated by the Prime Minister in April 2023, producing only fuel oil at the time. The plan is to have the refinery start by refining 70 000 bpd of crude, then to ramp up to the full 140 000 bpd as the downstream units come online. This refinery was long-awaited. Construction began in February 2014. It faced numerous delays, but it will be a sophisticated plant capable of producing EURO standard fuels. The Basra refinery expansion project was delayed

by a contract dispute, but it is making progress once again. Iraq secured a loan for the project in August 2023, which will expand crude capacity by 70 000 bpd and will add a catalytic cracking unit. Iraq awarded the contract for the planned 300 000 bpd Faw refinery to the China National Chemical Engineering Company. Iraq plans several other refinery projects as well.

QatarEnergy awarded the contract for its Laffan Refinery 1 Upgrade project, which focuses on maintenance and safety.

In Oman, the government is working with Kuwait Petroleum International to build a joint venture refinery known as ‘OQ8’ at Duqm. This will be a 230 000 bpd deep conversion refinery with hydrocracker plus coker. The project is nearly complete, and the crude unit started operations in April 2023. The timing has been less urgent, however, because of the COVID-19 pandemic, and because of the expansions completed at the Sohar refinery, which now has a capacity of 198 000 bpd.

The global oil market is complex, and it has so many moving parts that no single entity can claim to control it, though hundreds of entities try to predict it. The price shocks of the 1970s and 1980s set producers and consumers at opposite corners. OPEC and the Middle East were often seen as adversaries by importing countries. The Middle East adapted to changing market conditions first by engaging in producer-consumer dialogue, often via OPEC. Eventually, both sides reached the conclusion that huge price swings, followed by alternating boom-bust cycles in demand, were bad for everyone.

The market is now changing, and Middle Eastern oil producers are changing as well. The traditional importers of the OECD have tamped down demand, working toward sustainable, carbon-neutral energy whenever possible. Oil demand growth has shifted to the non-OECD world, though many of these countries also are working toward cleaner energy. Moreover, OECD production has risen, largely because of the success of US oil production. US crude production grew to an average of nearly 13.1 million bpd during the 1H24, making it the largest oil producer in the world. This has greatly reduced the need for imports from the Middle East, thereby easing the supply-demand balance.

Middle Eastern producers have been adapting by having not only producer-consumer dialogue, but also producer-producer dialogue. Outside of the world of oil, the DoC is not well-known, but inventing and maintaining it has been a largely-unsung diplomatic feat. There is no doubt that this group can move the market. Indeed, there have been times when the market seemed to need adjustment, and the DoC stated that it would have a meeting. This became known as ‘verbal intervention’, because prices might move without any action being taken. The last two years have been ones of constant geopolitical risk, yet oil prices have been relatively stable in the US$80 - 85/bbl range. Why have they not spiked above US$100/bbl? There are too many moving parts to be sure, but supply and demand have been kept in reasonable balance. The Middle East and the DoC have worked since 2016 to shepherd the market and promote stability.

References

1. https://www.opec.org/opec_web/en/press_room/7063.htm.

2. https://www.energyinst.org/statistical-review.

3. OPEC Monthly Oil Market Report, (12 August 2024).

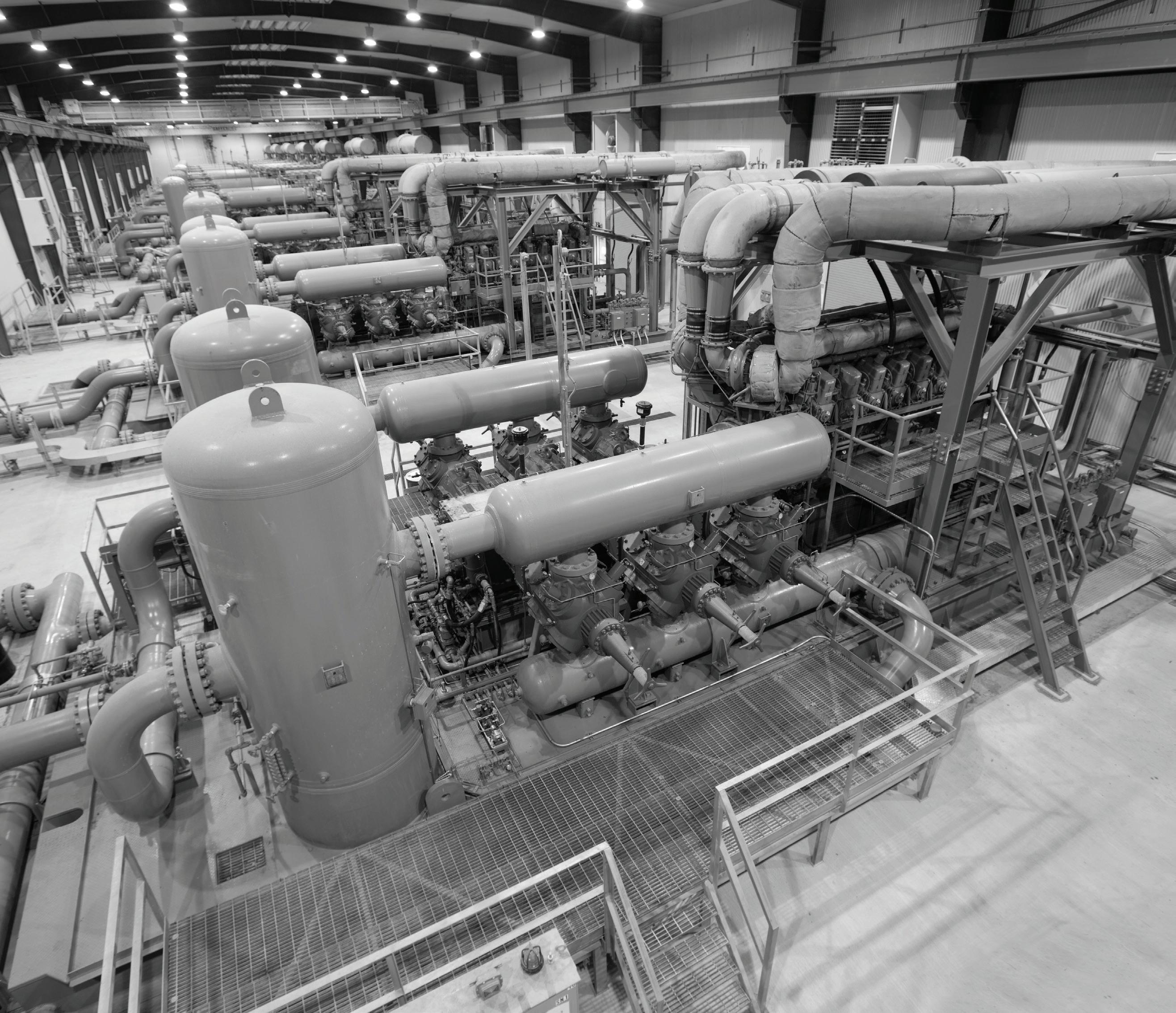

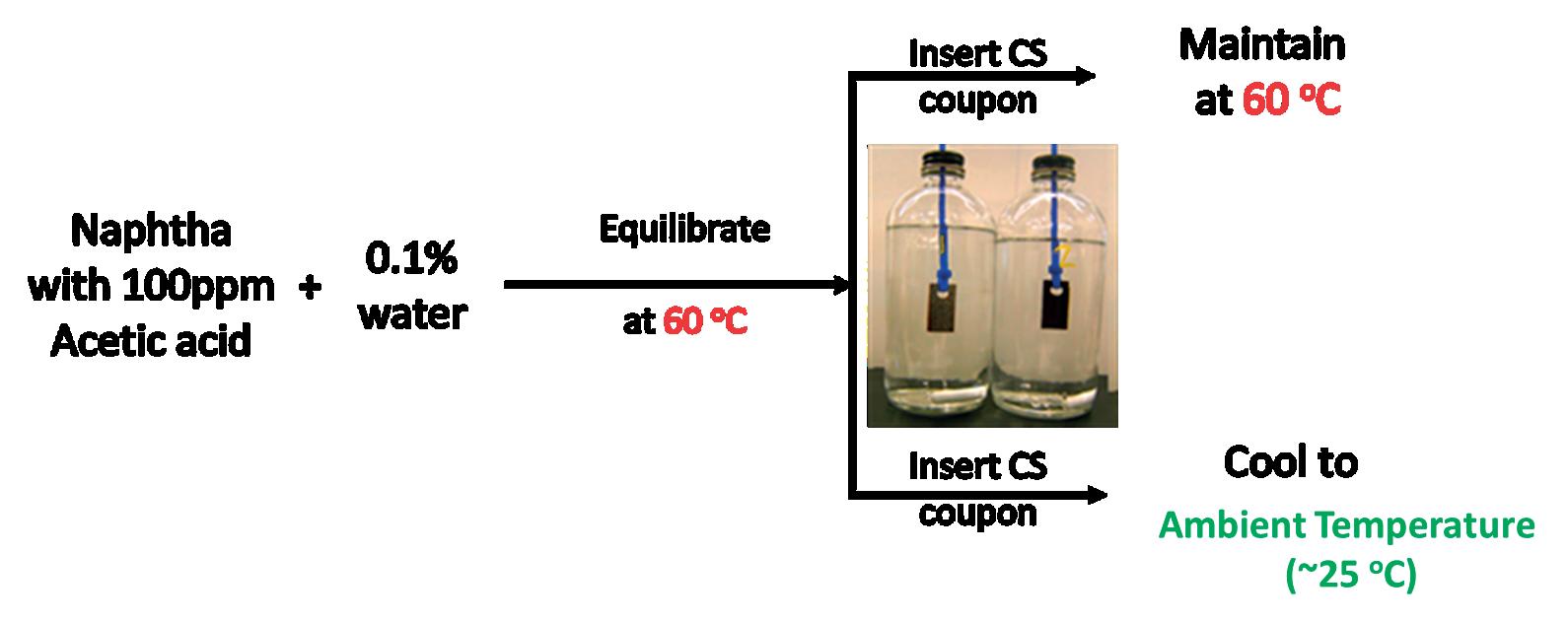

More than ever refiners are looking for opportunity crudes to increase economic profitability and optimise finished product delivery. Wesley Teasdale and Timothy Oubre, Halliburton Multi-Chem, explain how these crudes, along with overall crude diet changes, can have far-reaching impacts on multiple refining processes.

Crude purchasing and blending is an integral part to the overall health of a refinery’s operation.

Sourcing long-term crude contracts and market spot purchases allows refineries to optimise their output for the consumer. The economic drivers for which crudes are purchased and processed at certain ratios typically do not involve the stability of the actual crude blend.

A challenging crude blend can have far-reaching impacts on several areas of the refinery.

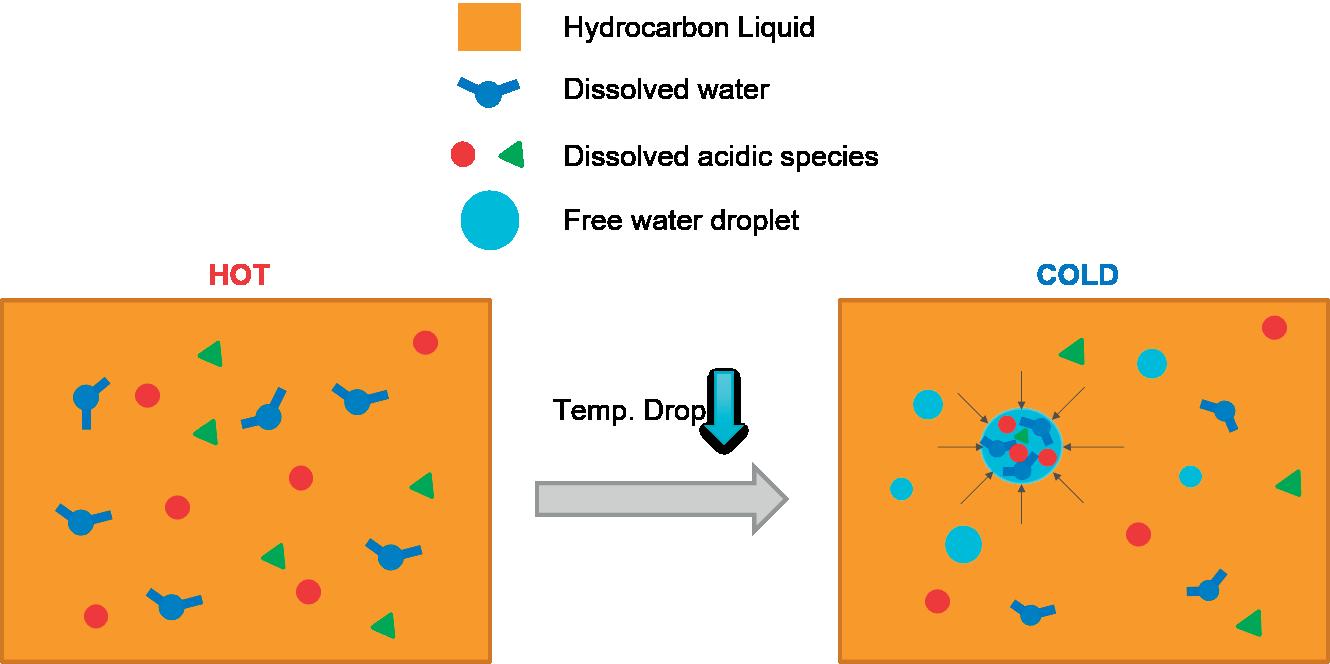

Incompatible or unstable crude blends can impact tank farm operations, fouling in multiple areas including cold and hot preheat trains and/or distillation towers, desalter reliability, and wastewater issues.1

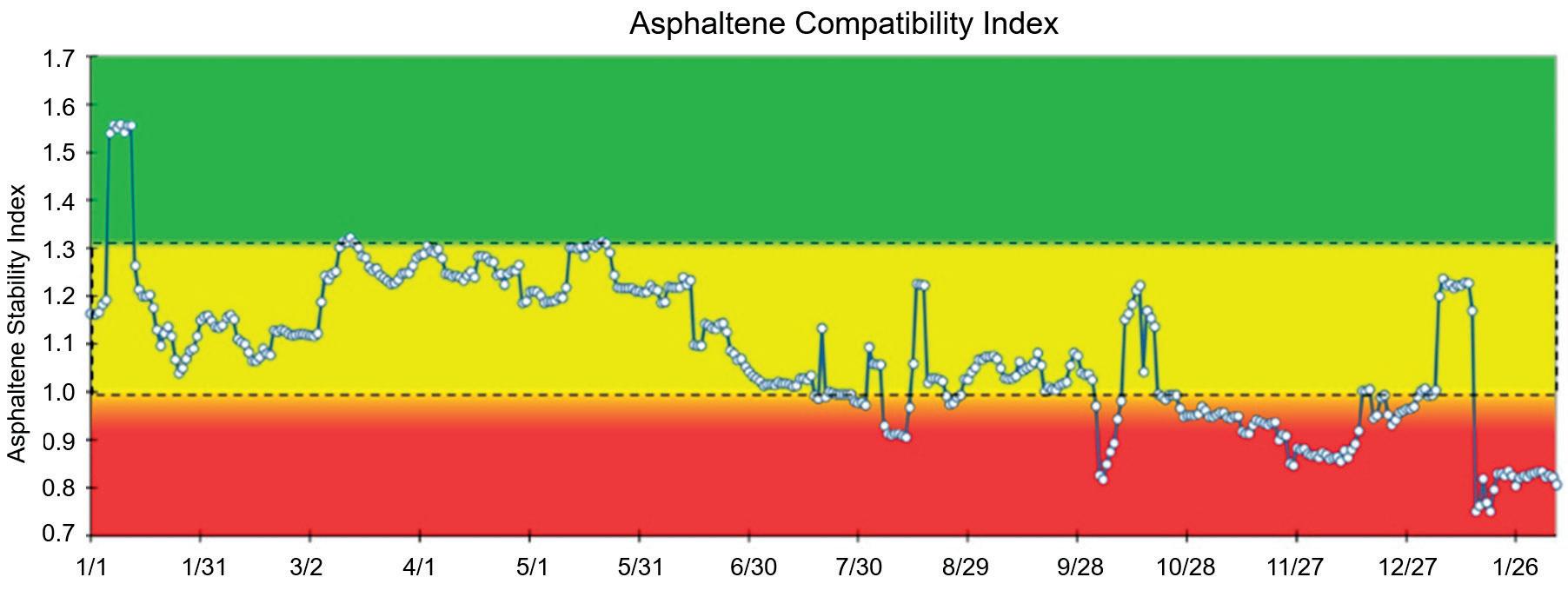

As these challenges have developed, a response to understanding the cause and mitigating the risks has also been studied. Crude stability testing has emerged as central to the method of reliably processing various crude diets. When stability testing and predictive modelling are combined, technical solutions can be developed to facilitate the most economical operation of the refinery, and in some cases, process the most extreme crude diets with minimal or no interruption.

The increased presence of opportunity crudes on refinery slates is driving more crude compatibility issues for refiners. It is a lucrative business but demands an effective treatment programme to help mitigate against challenges such as separation in tanks, fouling in preheats, and emulsion stability in desalters.

Crude stability and asphaltene precipitation are a balance of the chemistry of the individual crudes and the proposed blends. Asphaltenes exist in many, but not all, crudes and they are stabilised within the crude based on the total chemical balance of that crude. If that balance is shifted by blending of multiple crudes together, then the solubility of the asphaltene in the crude can be reduced, forcing them out of the solution. In some cases, even individual crudes may be in such a state that asphaltenes are not stable prior to blending.

Understanding how a refinery’s typical crude diet behaves is critical, especially when an opportunity crude is introduced to the diet. When routine stability testing and modelling of the traditional diet are tracked with monitoring of unit operations – a baseline for expected performance can be established. Subsequently, when a change in diet – either by opportunity crude or ratio of crude feed – is introduced, modelling can be used to look for potential challenges and then plans can be developed to mitigate these risks.

Without upfront analysis of what is coming into a refinery and a treatment plan, there is a big and potentially costly risk for refiners to take.

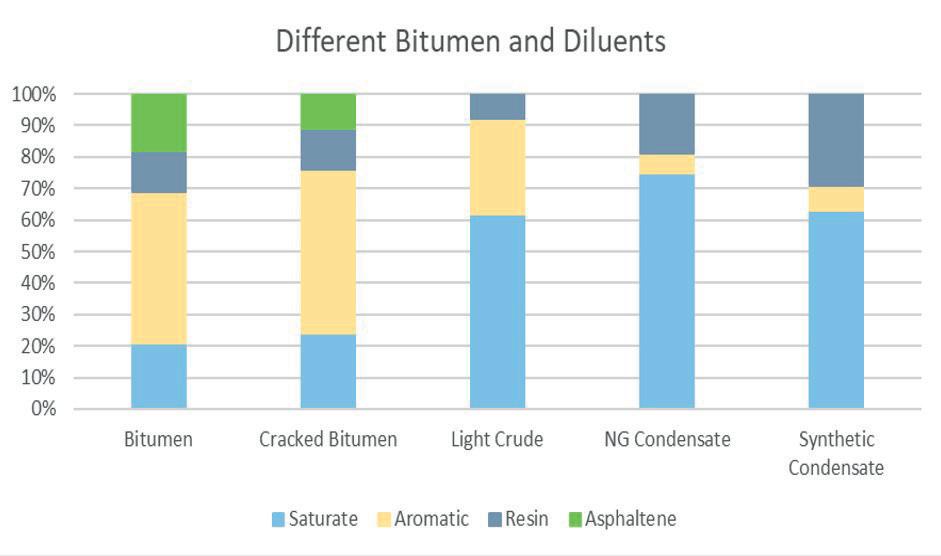

Crude oil can be classified compositionally by several techniques, one of these being the saturate, aromatic, resin, and asphaltene (SARA) analysis. When crudes are blended, the new crude blend can change compositionally and the balance keeping asphaltenes in solution can be altered enough to cause them to precipitate.2

The SARA analysis in particular is used to describe crude oil when referencing asphaltene stability because this analysis identifies the fractions of the oil that influence stable or unstable conditions.3 Saturates are nonpolar, saturated hydrocarbons, existing in linear, branched, or cyclic form. Aromatics contain one or more aromatic rings and act as good solvents for asphaltenes. Resins and asphaltenes have polar substituents. To distinguish between the two, asphaltenes are defined as n-heptane insoluble.3

Conducting SARA analysis on individual crudes can lead to a better understanding of how those crudes may potentially behave when blended. The colloidal instability index (CII) is a scale that looks at the components of the SARA analysis and relates how stable a crude oil potentially is. Typically used for reservoir monitoring, CII is useful for understanding the component relationship of various crudes.2

Refiners, however, usually are not concerned with one crude, but the blend of crudes and the economic incentives particular blends may offer. Understanding how the individual components of crude oil can impact a new blend’s stability is critical.1 By looking for potential negative impacts, steps can be taken to modify and lessen the risks of those impacts.

Crude assays, although frequently outdated, are another resource affording a preliminarily gauge of problematic blends. Using the example in Table 1, blending Canadian diluted bitumen (DilBit) with shale oil containing a higher paraffin and lower aromatic content could be problematic. The ratio of the blends is also critical, as well as understanding that the higher the asphaltene content does not necessarily lead to more deposition.

Find out more at arielcorp.com/applications

While water and process treatment programmes involving mechanical, operational, and chemical solutions will always be part of the solution, advances in these areas need to be made as crude compatibility issues become more prevalent.

Crude stability testing is one area where advances are being made and the results are showing. There are a few models employed by different chemical vendors in the market. The approach which Halliburton has seen the best results from includes a testing model that allows for a comprehensive review and modelling of crude blends. This in turn allows for the proper selection of chemicals – either part of a vendor’s portfolio or a customised chemistry designed to inhibit asphaltene precipitation.

The model which has had great success involves sourcing several crude samples, which are analysed in the lab and the resulting testing data is entered into the model. Within the model, it is possible to select a blend of as few as two crudes or multiple ones (in the double digits).

n Refinery had unexpected crude unit upset.

n 100 000 bbl of Albian heavy synthetic stranded on a barge, substantial demurrage costs.

n Crude model predicted no issue.

n Samples obtained and hand blends evaluated and aligned with model results.

n Crude processed without incident.

n US$1.5 million in margin opportunity and demurrage savings realised.

n Effluent hydrocarbon carry-under observed at desalters.

n Upset corresponded with a change in the ratio of crudes being processed, same crudes different % of each.

n Model showed new blend to be near incompatible.

n Stability test performed, confirmed model output.

n Increased emulsion breaker achieved desired brine quality, limiting impacts at waste water while this blend was processed.

Based on the percentage of the different crudes blended and the physical properties from the lab analysis, the model can calculate areas of compatibility, near compatibility, and incompatibility (Figure 2). This allows operators to identify if there will be issues with the blend – and if so, plan for the right chemistry and appropriate chemical response.

The quality of the data put into the model impacts the quality of the output from the model. There are several issues and factors that need to be satisfied and reviewed by experienced users to validate the conditions of the model. This includes knowing the ratio of blended crudes, collecting multiple samples from key points in the process, and performing several tests for flocculation, emulsion tendency, asphaltene concentration, solvency, wash water quality impact, solubility, slop impact, and more.

The capability to generate this data not only allows for real-time monitoring, but scheduled future blends can be modelled for compatibility. The goal being not to change the crude blends, but to be aware if chemical adjustments need to be considered before the blend is created to minimise any issues the model predicts. So, instead of chasing a problem, the problem’s impact can be lessened.

If not monitored, incompatible crude blends will create process issues across a refinery that can lead to downtime, equipment repairs, and loss of production and revenue.

When crudes are mixed, these blends can disrupt the balance of the individual crude components – saturates, aromatics, resins, and asphaltenes, leading to compatibility issues.

Asphaltenes are solid particles in the bulk oil. They are the heaviest and most polar component within crude oil. When blending them with saturates (i.e. paraffins), the solvency of the asphaltenes in the crude blend is limited. Resins and aromatics within the crude can stabilise them; however, if the ratio of resins and aromatics to saturates is disrupted, asphaltenes can fall out of solution (destabilised) and create challenges for refiners.

Water and process treatment programmes involving mechanical, operational, and chemical solutions are the solution. The strength of their performance requires effective upfront crude stability testing and subsequent modelling of the data by experts, who have experienced treating different crude types. This combination can ensure the power of the model is used effectively to maximise the value of a refiner’s assets.

1. BAMBINEK, K., PRZYJASNY, A., and BOCZKAJ, G., ‘Compatibility of Crude Oil Blends – Processing issues related to asphaltene precipitation, methods of instability prediction – a review’, Industrial & Engineering Chemistry Research , (2023), 62, 2 - 15.

2. ASHOORI, S., SHARIFI, M., MASOUMI, M., and SALEHI, M.,: ‘The relationship between SARA fractions and crude oil stability’, Egyptian Journal of Petroleum, (2017).

3. FAN, T., WANG, J., and BUCKLEY, J., ‘Evaluating Crude Oils by SARA Analysis’, SPE 75228, (April 2002).

economic and environmental viability. The process typically requires significant energy input and can generate byproducts that need further treatment, adding complexity and cost.

Dissolution recycling has captured the space between mechanical recycling and chemical recycling technologies, offering superior product purity and quality over mechanically recycled polymers while preserving polymer structure. It allows for lower energy consumption and related CO2 footprint compared to other technologies that break down polymers into smaller fragments, like pyrolysis.

Sulzer Chemtech is at the forefront of this innovation with its DEVOTM technology, a solution designed to optimise the separation of solvents from polymers in such dissolution recycling processes. This technology not only enhances environmental benefits, but also significantly improves economic efficiency and product quality.

The global production of plastics hit a staggering 400 million t in 2022. Only 55 million t were recycled – a fraction of which ended up in landfills (174 million t) or was mismanaged (82 million t) in 2019 – as per the Organisation for Economic Cooperation and Development (OECD).1

The 2023 UNEP report2 further reveals that 56% of the generated plastic waste is dumped in landfills or dumpsites, posing a severe threat as hazardous chemicals can seep into the environment.

There are several key reasons explaining low recycling rates, including the difficulty with collection and sorting, the limited amount of recycling infrastructure and technology maturity, as well as economic viability. If industry is going to achieve circularity of products and materials, these issues must be addressed, and one of the key ways of achieving this is through the use of dissolution recycling.

This innovative process offers a promising middle ground between mechanical recycling and chemical recycling. It is one of the few technologies that keeps the polymer structure intact, as it does not involve any chemical reactions, which break down polymer chains into primary building blocks.

Most existing plants are on a pilot and demonstration scale, but as the technology quickly matures and the demand for recycled plastics grows, larger commercial-scale plants with a capacity of thousands of tons per year have now become viable.

The effectiveness of plastic recycling often depends on the consumer waste management systems in place within a country. In many regions, specific types of plastic are collected separately to streamline the recycling process.

For instance, in Switzerland, PET bottles have long been collected separately and successfully recycled back into new bottles, creating a closed-loop system. Similarly, polyolefin bottles are also collected, but the systematic collection of other types of consumer plastics is still in its early stages.

To enhance the efficiency and quality of recycling, advanced sorting and washing technologies are being developed. These innovations are crucial as they allow for the more effective separation of different plastic types, removing contaminants and improving the purity of recycled materials. As these technologies evolve, they promise to simplify subsequent recycling steps and significantly enhance the overall quality of recycled polymers, leading to more sustainable and high-quality recycled products.

As its name indicates, the core of dissolution recycling is the dissolution step itself, where a solvent, or mixture of solvents, selectively dissolves a specific type of polymer. The choice of solvent is crucial and is based on its ability to effectively dissolve the target polymer while leaving others intact, but also on other technical and environmental aspects as well as on economic factors like availability and price.

Polymers do not dissolve instantaneously; the solvent needs time to diffuse into the polymer through the surface and disentangle the polymer chains. This process is faster with lower molecular weight polymers, at higher temperatures, and smaller particle sizes. Smaller solvent molecules tend to diffuse faster than larger ones.

Several methods were developed to speed up dissolution, such as applying microwaves or adding a small portion of a non-solvent. Ideally, the selected solvent dissolves only the target polymer, and not the others. 3,4

After the initial dissolution, the next phase in the recycling process focuses on separating the target polymer from impurities and any undissolved plastics. This separation can be accomplished using various methods, such as filtration or centrifugation, to purify the solution. Despite these efforts, the solution may still contain unwanted additives like colourants, antioxidants, and processing aids. To address this, the solution undergoes further

purification, often involving adsorbing agents or other methods designed to remove these residual contaminants.

After purification, the target polymer is optionally selectively precipitated from the solution. This is typically accomplished by adding an antisolvent or by adjusting the temperature or pressure to induce the polymer to solidify and separate from the solution.

The final steps of the process involve the critical task of separating the remaining solvent from the polymer. This is typically done through devolatilisation, which can be carried out using either static or rotating equipment.

Sulzer’s DEVO technology was initially created for the purification of virgin plastics, but it also enables recycling facilities to increase the quality of recycled polymers and the overall throughput, optimising their processes.

This is achieved through a multi-stage process that increases the polymer concentration from initial concentrations of 5 - 20 wt% to the required residual solvent level, typically achieving > 99.9 wt% polymer concentration. It uses static mixer heat exchangers and degassing chambers with customised internals. The number of degassing stages is designed according to the needs of the process and could vary according to the process requirements.

The process starts with a polymer solution of 5 - 20 wt% concentration, which is heated up to temperatures where the saturation pressure of the volatile becomes higher than the pressure in the flash chamber.

The heat exchangers are engineered for optimal thermal transfer, allowing the rapid evaporation necessary for solvent removal while preserving polymer integrity. Since the solution’s viscosity is low in this stage, the volatile is removed rapidly by evaporation. Vapour bubbles form and expand, and the volatile leaves the solution.

The equipment is designed to avoid the entrainment of the polymer by the volatile gas stream. During this process, the temperature is lowered due to the evaporation energy required, and viscosity increases due to the temperature decrease and concentration increase. The now concentrated polymer solution leaves the vessel at the bottom and is transferred to the next stage.

Second stage: intermediate concentration

In the second stage, the now higher viscous polymer solution undergoes further solvent removal. The solution is reheated prior to entering the degassing chamber to reach the optimal conditions for removing volatiles. The concentration is increased to over 90 wt%.

The system maintains tight control over process conditions to prevent polymer degradation, ensuring consistent quality.

Third stage: final purification

The final stage employs heat exchangers, such as the Sulzer mixer reactor (SMR TM ), again to set the

Up dated with data from DOE partnership & extensively tested within the EU-funded carbon capture consortium, “SCOPE ”

Updated with data from DOE partnership & extensively tested within the EU-funded carbon capture consortium, “SCOPE ”

Updated with data from DOE partnership & extensively tested within the EU-funded carbon capture consortium, “SCOPE ”

➢ Thoroughly tested as part of EUfunded consortium , “SCOPE”

➢ New 1-CESAR model updated with cutting edge lab and plant data from DOE partnership

Applications:

Applications:

Applications:

➢ P ower generation

➢ Power generation

➢ Power generation

➢ CO2 capture from LNG -fueled ship s

➢ CO2 capture from LNG -fueled ship s

➢ CO2 capture from LNG -fueled ship s

➢ Hydrogen production via reforming :Reliable

➢ Renewable methane from landfill gas and organic waste

➢ Renewable methane from andfilll gas and organic waste

➢ Renewable methane from landfill gas and organic waste

➢ Renewable methane from landfill gas and organic waste

➢ Hydrogen production via reforming

➢ Hydrogen production via reforming

➢ Hydrogen production via reforming

➢ 2CO capture from LNG fueled- ship s

➢ P ower generation

Reliable:

Reliable:

Reliable:

Applications:

➢ New CESAR-1 model updated with cutting edge lab and plant data from DOE partnership

➢ New CESAR-1 model updated with cutting edge lab and plant data from DOE partnership

➢ New CESAR-1 model updated with cutting edge lab and plant data from DOE partnership

pU dated with data from DOE partnership & extensively tested within the funded-EU carbon capture ,consortium “SCOPE ”

➢ Thoroughly tested as part of EUfunded consortium , “SCOPE”

➢ Thoroughly tested as part of EUfunded consortium , “SCOPE”

➢ Thoroughly tested as part of EUfunded consortium , “SCOPE”

temperature of the now very viscous solution. Volatile removal is now controlled by diffusion of the volatile to the interface between molten polymer and gas phase. Therefore, this process requires increased residences times and efficient renewal of the polymer/gas interface.

At this point, a stripping agent may be added for enhanced performance. The effect of the stripping agent is, firstly, the reduction of the partial pressure of the volatile in the vapour phase and, hence, the equilibrium concentration in the polymer phase; secondly, it improves the foaming of polymer melts.

By designing the optimal internals for the degassing chamber, residence time can be controlled, and polymer concentrations greater than 99.9 wt% can be achieved. This step is critical for end-uses demanding the highest purity levels, eliminating solvent traces to meet existing standards of the polymer industry.

After the devolatilisation, additives can be blended into the polymer stream prior to pelletisation to tailor the final product properties.

Devolatilisation is essential for dissolution-based polymer recycling processes, requiring precise control of interphase generation, pressures, and temperatures to effectively separate volatile components. Different technologies, such as DEVO and twin-screw degassing extrusion, offer varied approaches to this process.

While both methods are effective, DEVO technology uses static equipment that excels in handling wide ranges of viscosity polymers, offering a streamlined and efficient solution. In contrast, twin-screw extruders are dynamic, allowing for rapid volatile reduction but with different operational characteristics.

The following sections will compare the key benefits of DEVO technology against degassing extrusion.

In dissolution recycling processes, two key factors determine the degradation of the recycled polymer: the shear rates and the combined temperature/time profile the material experiences over time.

DEVO technology uses static devolatilisers that offer precise temperature control, minimising mechanical energy use and allowing for optimal polymer quality. By recirculating a fraction of the devolatilised stream, DEVO ensures consistent heat application and milder temperature profiles, reducing the risk of polymer degradation.

While degassing extruders constantly renew the polymer surface, they operate at higher shear rates, especially with viscous media, leading to increased temperatures and potential material degradation. DEVO operates at around 90% lower shear rates with highest shear rates appearing in the polymer pumps and maintains lower peak temperatures, which helps preserve the polymer’s molecular weight – a critical factor for all polymers, but specifically for materials like polyesters, polyamides, and polyolefins.

DEVO technology utilises static equipment that significantly lowers both CAPEX and OPEX. Compared to degassing extrusion, it achieves lower total investment costs not only through reduced equipment costs, but also by minimising outside battery limits (OSBL) costs.

A major factor in these savings is the reduction in electric power demand by up to 90%, made possible by shifting from electricity to more cost-effective energy sources like natural gas. Optionally, DEVO can be operated using renewable energy sources.

Unlike extruders, which depend entirely on electricity, the technology can harness heat from energy recovery sources such as waste incineration and fuel gases. This results in operational cost savings of 60 - 70% per kWh. Beyond energy savings, DEVO’s maintenance costs are notably lower than those of typical degassing extruders. This is because its rotating equipment is limited to gear pumps, which require significantly less maintenance compared to the more complex systems in extruders.

The technology was initially developed for the traditional polymer industry and has been proven in more than 40 reference projects at capacities up to 450 000 tpy, achieving remaining VOC levels in the parts per million (ppm) range.

The technology’s reliability is enabled by extensive piloting facilities in Switzerland, ensuring that scale-up from small technical size to industrial capacities is seamless and predictable.

Dissolution recycling presents a promising solution for achieving high-quality plastic recycling, especially for polymer streams that are difficult to recycle mechanically. It allows for the removal of impurities, several additives, and degradation products, producing a recycled material with properties comparable to virgin plastics.

As the demand for high-quality recycled plastics continues to grow, driven by sustainability trends and regulatory pressures, advanced technology enables the recycling industry to meet increasingly strict recycling targets while delivering materials with qualities close to those of virgin polymers.

The authors would like to acknowledge the valuable contributions of Irina Yarulina, Ulla Trommsdorff and Simone Ferrero, Sulzer.

1. https://www.oecd.org/en/topics/resource-efficiency-and-circulareconomy.html

2. United Nations Environmental Programme and Secretariat of the Basel, Rotterdam and Stockholm Conventions, ‘Chemicals in plastics: a technical report’, Geneva, Switzerland, (2023).

3. TRIEBERT, D. and HANEL, H., https://researchoutreach.org/articles/ waste-starting-materials-solvent-based-recycling-polymer-industry/ 4. KraussMaffei, Coperion brochure on integrated devolatilisation processes.

Jim Aiello, Merichem Technologies, USA, discusses the rise of renewable diesel and the global transition to cleaner fuels.

Renewable diesel, often made from hydrotreated vegetable oils (HVO) and biomass-based diesel, is now an established and growing industry. It provides one of the most efficient direct routes to lowering greenhouse gas emissions. Although it is produced from used cooking oils (UCO), waste animal fats (tallow), and/or certified sustainable vegetable oils, such as soybeans and rapeseed, renewable diesel – unlike fatty acid methyl ester (FAME) based biodiesel – has a nearly identical chemical structure to petroleum diesel and is 100% renewable and sustainable. It is a drop-in alternative to petroleum diesel and requires no vehicle modifications. Renewable diesel is the latest, greenest diesel on the market.

In its ‘Short-Term Energy Outlook’, released on 6 February 2024, the US Energy Information Administration (EIA) reported expectations of increased renewable diesel production by approximately 30% annually in 2024 and 2025. Production capacity continues to expand, with California at the eye of the storm as the primary driver of demand.

In Europe, a strategy for lowering greenhouse gas emissions from road transport is driving a series of regulations, such as the Renewable Energy Directive (RED). This has spurred the use of renewable diesel in the EU in recent years. Further expansion is planned through the end of 2025, making it one of the largest biofuel markets globally.

In the face of fluctuating market conditions for traditional oil-derived fuel markets, refiners are increasingly focusing on the energy transition. Their goals are to improve the profitability of their assets and secure long-term operations while reducing greenhouse gas emissions and moving towards carbon neutrality. Many refineries around the world are producing renewable fuels at either existing refineries that will continue to process crude oil, or those that are idle and have existing infrastructure to accommodate new processing units to refine renewable fuels.

The HVO process produces renewable fuels via hydrogenation and hydrocracking of vegetable oils and animal fats using hydrogen and catalysts at high temperatures and pressures. The oxygen is stripped in a reactor with a catalyst that often requires sulfiding to promote conversion chemistry and avoid catalyst deactivation. Dimethyl-disulfide (DMDS) –which is the most commonly used chemical for sulfiding the catalyst – is converted to hydrogen sulfide (H2S), and the oxygen from the feedstock is converted to carbon dioxide (CO2) and water during the deoxygenation reaction.

The hydrocarbon liquids exit the reactor and are routed to a three-phase separator, where the water is removed, and vapours are collected for cleaning and recycling. The hydrocarbon liquids are then routed to an isomerisation reactor before being separated into various cuts to create light fuels, sustainable aviation fuels (SAFs), and renewable diesel fuel.

The vapours from the separator are then routed to an amine unit to remove the H2S and CO2 formed in the deoxygenation reactor. The treated gas from the amine unit is rich in hydrogen and recycled to the HVO process. A slipstream may be used as fuel gas. Acid gases may be further processed

to reduce H2S at the site depending on other units that may be operating at the refinery.

In August 2019, a multinational oil and gas company based in Europe operating a biofuel refinery with renewable diesel production commissioned a LO-CAT® unit to serve as the SRU to treat the amine unit offgas. LO-CAT, which stands for Liquid Oxidation CATalyst, is a patented, wet scrubbing, liquid redox system that uses a chelated iron solution to convert H2S to innocuous, elemental sulfur.

The existing higher capacity Claus SRU had been shut down when petroleum oil processing ceased. The typical minimum H2S content for a feed to a Claus unit is 35 mol%, but that condition cannot be met when the HVO process with lower H2S loading is operating. Modified Claus units can operate with limited reduction of H2S in the feed stream, but to achieve >99.9% sulfur recovery, a tail gas treating unit is required downstream of any Claus SRU, which increases cost. Turndown conditions can also negatively affect Claus unit sulfur recovery efficiency.

A highly flexible sulfur recovery process was needed to account for the range of feed gas conditions. The selected process needed to achieve high recovery percentages over a wide range of operating flow rates and H2S concentrations. The refiner’s requirements were:

n Maintain sulfur removal efficiency at turndown conditions.

n Handle minimum H2S concentration in the feed acid gas stream.

n Guarantee to meet customer requirements.

The LO-CAT process operating at this location employs a rectangular-shaped autocirculation vessel. The equipment was installed and ran successfully for the first full year of service. During the first unit turnaround, the LO-CAT solution was drained from the autocirculation vessel and stored for use after the turnaround. The vessel was opened, cleaned, and inspected. There was a small amount of sulfur buildup on the vessel’s floor. The unit was cleaned with a warm water wash, and no corrosion was noted. The shutdown for maintenance took one week –the equivalent of 98% availability in the first year of operation.

In 2020, the biorefinery reached full operation with a five-fold increase in biofuel productions compared to 2019. The unit has been running continuously and successfully since that time.

The LO-CAT process utilises an aqueous iron solution with the catalytic performance enhanced by a proprietary blend of chemicals. The H2S is converted to elemental sulfur by redox chemistry according to the following overall reaction:

Direct oxidation reaction: H2S + 1/2 O2 → H2O + S°

The redox reaction is carried out in separate sections of the process, as summarised below:

Absorber: H2S + 2Fe++ → S° + 2Fe++ + 2H+

Oxidiser: ½ O2 + H2O + 2Fe++ → 2OH– + 2Fe+++

• Simple hydraulic installation − no welding

• Helium leak tight seal to 1x10 -10 cc/sec

• 100% Lot tested to ensure unmatched quality

• Pressure ratings Up to 7000 PsiG (483 BarG)

• Wide range of sizes and ASME/ASTM certified materials available

ASME PCC-2 Compliant Heat Exchanger Tube Plugging System

877.383.1029 l est-sales@curtisswright.com l cw-estgroup.com/he-24

Trusted by plants around the world as their go-to tube leak solution, Pop-A-Plug Tube Plugs from Curtiss-Wright are engineered for optimal performance throughout the life cycle of heat exchanger equipment. Controlled hydraulic installation eliminates welding and time-consuming pre-/post-weld heat treatments that can cause damage to tubes, tube sheet ligaments, and joints.

The exothermic absorber reaction represents the oxidation of H2S to elemental sulfur and the accompanying reduction of the ferric iron state (active) to the ferrous iron state (inactive). This reaction is irreversible and not equilibrium dependent. The oxidiser reaction (also exothermic) represents the oxidation of the ferrous iron back to the ferric iron state.

LO-CAT technology produces a sulfur ‘cake’, which contains approximately 65% sulfur, 35% moisture, and trace amounts of proprietary chemicals. It does not produce any other products or byproducts, so no additional treatments are required. The process is inherently safe because the reaction occurs in the aqueous phase at near-ambient temperatures. The removal of sulfur is not affected by turndown conditions, and the process can be applied to almost any vapour stream containing H2S.

Liquid redox is an economical process for H2S removal and sulfur recovery within a given range. On the low end of sulfur recovery of less than 1 long tpd, non-regenerative chemical absorbents (scavengers) such as SULFURTRAP® EX are likely to be more economical due to the low capital cost of a lead, lag two-vessel design, even with the higher operating costs. As the sulfur removal requirement increases, operating costs become prohibitive using scavengers or adsorbents. This is when a liquid redox process is advantageous due to significantly lower operating costs. The higher capital cost of a LO-CAT unit is quickly paid out in operating savings vs replacement of the non-regenerative scavenger or adsorbent.

Fleets across the US that have switched to renewable diesel have found that they can reduce emissions using the same infrastructure as diesel, and operating characteristics remain the same or better as with petroleum diesel.

Titan Freight Systems has been providing overnight services across the Pacific Northwest for more than 50 years. To reduce emissions by 20%, in 2010, the company installed air deflectors, side skirts, low-rolling-resistance tyres, and other aerodynamic improvements to its fleet of inline trucks and trailers, each of which travels 144 000 miles annually. By 2019, their investments had only reduced emissions by 6%. Titan switched to renewable diesel, which led to a 36% reduction in emissions over the entire three-state fleet and lowered its overall maintenance costs.

In partnership with industry, the National Renewable Energy Laboratory (NREL) has evaluated alternative fuels’ in-use performance in delivery, transit, and freight vehicles.

In 2015, in cooperation with United Parcel Service (UPS) and Clean Cities’ National Clean Fleets Partnership, NREL compared the fuel economy and emissions impact of renewable diesel vs petroleum diesel in fleet vehicles.

To gather real-world operational field data, NREL instrumented 12 vehicles – six regional tractors and six package-delivery vans – with data recorders. Representative drive cycles were selected for chassis dynamometer evaluation to determine the fuel economy and emissions impact of renewable vs petroleum diesel in a controlled setting. Fuel properties of the renewable diesel and petroleum diesel were also analysed, which revealed that the renewable diesel was less

dense than petroleum diesel and exhibited a higher mass-based heating value yet lower volume-based heating value.

The NREL tests concluded that renewable diesel reduces CO2 emissions by 4.2% on average compared to petroleum diesel, which is attributable to the higher mass-based heating value and lower carbon-to-hydrogen ratio of renewable diesel. Fuel consumption and economy trended strongly with mass, and volume-based heating values, respectively, leaving the engine thermal efficiency unchanged for a given cycle.

UPS is now one of the world’s largest users of renewable diesel.

The City of Oakland became an early adopter of renewable diesel. The city transitioned its fleets from petroleum diesel as part of its low-cost strategy to meet sustainability goals. The cities of San Diego and Long Beach have followed suit.

In 2022, Neste, Altens, and TRAPIL collaborated on the first-ever transport of renewable diesel by pipeline from Le Havre in northwestern France to Gennevilliers, just outside Paris. By transporting fuel via pipeline vs tanker trucks, greenhouse gas emissions were reduced by 92% compared to conventional logistics. Altogether, they transported 3.5 million litres of renewable diesel, which helped make large volumes of renewable diesel available widely in the region, especially to large cities such as Paris.

In 2023, New York City announced its plans to convert all heavy-duty vehicles in its fleets to renewable diesel, which includes more than 12 600 on- and off-road trucks.

The rise of renewable diesel is a direct response to the growing concerns over the carbon emissions associated with fossil fuels. Demand currently outpaces supply, with major fuel producers investing in retooling petroleum refineries to produce renewable diesel and jet fuel.

The US Department of Energy (DOE) Alternative Fuels Data Center substantiates the increase in interest with reports that domestic production and plants under construction are growing significantly. The Union of Concerned Scientists calls the renewable diesel production capacity in the US ‘a massive expansion’.

The International Energy Agency (IEA)’s latest ‘World Energy Investment’ report, released in 2023, reveals that approximately US$2.8 trillion was spent on energy in 2023. More than US$1.7 trillion was invested in clean technologies, which underscores the potential and importance of renewable fuels in the energy sector.

The global transition to renewable fuels is not just a trend. It is a significant shift towards sustainable energy consumption and represents a practical solution that balances ecological concerns with economic needs and performance expectations. It is a crucial step in the decarbonisation of the transportation sector.

fuels as an alternative to emissions-heavy fossil fuels. Methane, food crops and alcohol are being used to create some volume of these novel fuel alternatives. But those feedstocks are costly, not easily obtained and controversial, and the industry needs scale to meet global decarbonisation targets.

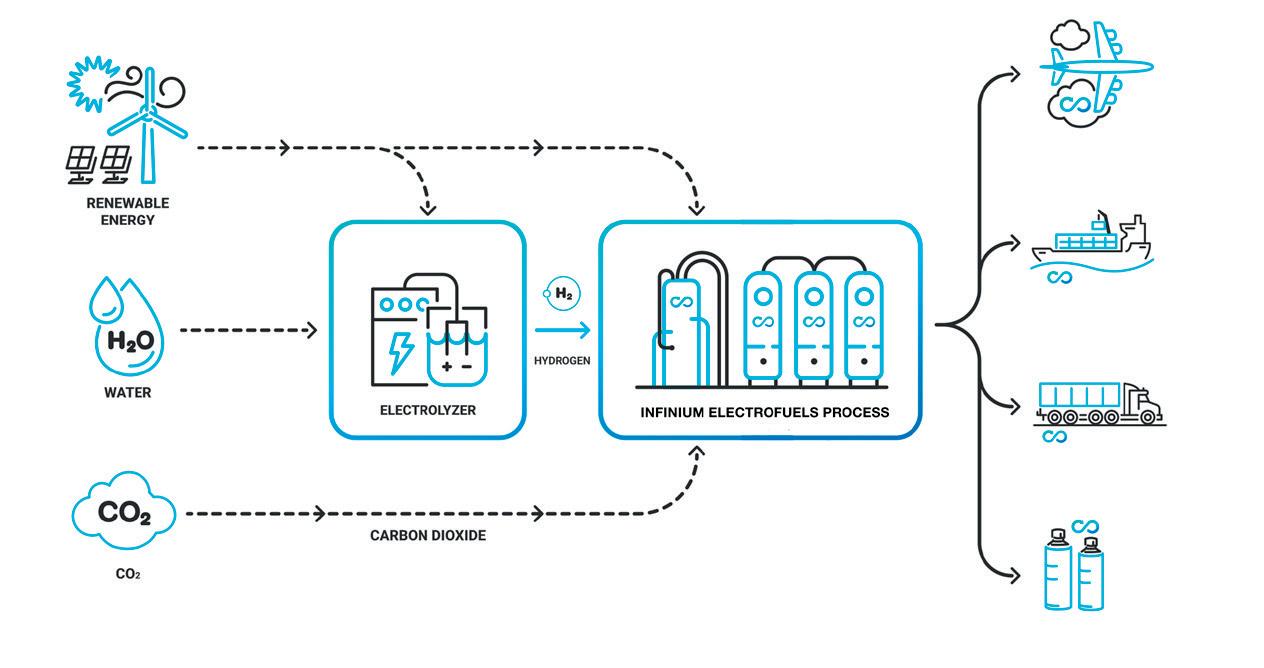

US-based clean fuels provider Infinium has taken a different approach. Using what is known as a power-to-liquids (PtL) pathway, a new class of sustainable electrofuels, or eFuels, came to market last year for the first time. These eFuels are created through a proprietary

technology platform that takes water, renewable power (from solar or wind farms) and waste carbon dioxide (CO 2 ) to create ultra-low carbon eFuels.

These eFuels offer new hope for industries ranging from trucking to aviation and even manufacturing. They net out to 90% or greater lower lifecycle greenhouse gas emissions over today’s fossil-based fuels, making them a suitable option for the long overdue decarbonisation of the global supply chain.

But how does it all work?

In 2023, Infinium began operations of its Project Pathfinder production facility in the Port of Corpus Christi, Texas, US.

The site is the first eFuels production facility in the world to produce commercial volumes of fuels that are being shipped to customers today.

The plant is strategically located in Corpus Christi largely because the necessary feedstocks for the eFuels –notably water, waste CO 2 and renewable energy – are plentiful in the area.

Waste CO 2 is captured from Howard Energy Partners, a Texas-based midstream energy provider with operations nearby. The capture of this CO 2 not only prevents its release into the atmosphere, but also gives it a new, meaningful purpose as a necessary feedstock.

Power is sourced from local wind and solar assets, and water is readily accessible and recycled as part of Infinium’s production processes.

With plentiful feedstocks and strong business relationships, it has been possible to bring the Project Pathfinder plant online in record time.