Pull over, the economy’s check engine lights are on What does the hiking of the interest rate mean in the larger scheme of things?

By Ariba Shahid There are two kinds of people. The first are the stable ones. As soon as they see the ‘check engine’ light on their cars turn on, they pull over and call a mechanic. At most, they will take the risk of taking their car to the mechanic themselves. The other kind of people are the chaotic ones. These are the ones that not only ignore their check engine light as if it means nothing, but when the car engine starts rumbling and making scary noises they turn up their stereo to drown out the noise and ignore the problem. Of course, eventually the car will break down and the mechanic’s job (and cost) will be doubled. The economy is often analogised as a car. The question is, how are we handling our check engine light? The emergency monetary policy com-

MACROECONOMICS

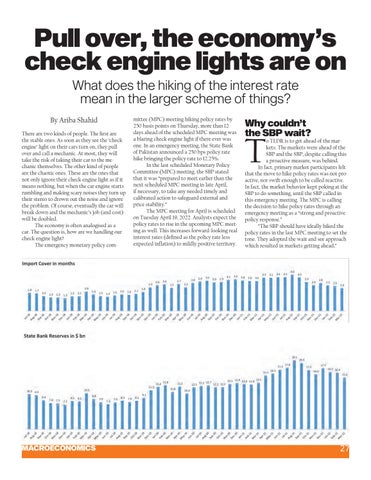

mittee (MPC) meeting hiking policy rates by 250 basis points on Thursday, more than 12 days ahead of the scheduled MPC meeting was a blaring check engine light if there ever was one. In an emergency meeting, the State Bank of Pakistan announced a 250 bps policy rate hike bringing the policy rate to 12.25%. In the last scheduled Monetary Policy Committee (MPC) meeting, the SBP stated that it was “prepared to meet earlier than the next scheduled MPC meeting in late April, if necessary, to take any needed timely and calibrated action to safeguard external and price stability.” The MPC meeting for April is scheduled on Tuesday April 19, 2022. Analysts expect the policy rates to rise in the upcoming MPC meeting as well. This increases forward-looking real interest rates (defined as the policy rate less expected inflation) to mildly positive territory.

Why couldn’t the SBP wait?

T

o TLDR is to get ahead of the markets. The markets were ahead of the SBP and the SBP, despite calling this a proactive measure, was behind. In fact, primary market participants felt that the move to hike policy rates was not proactive, nor swift enough to be called reactive. In fact, the market behavior kept poking at the SBP to do something, until the SBP called in this emergency meeting. The MPC is calling the decision to hike policy rates through an emergency meeting as a “strong and proactive policy response.” “The SBP should have ideally hiked the policy rates in the last MPC meeting to set the tone. They adopted the wait and see approach which resulted in markets getting ahead,”

27