8 minute read

Mobile Money: The way forward for Pakistan

Mobile money is becoming huge globally. Is Pakistan keeping up?

By Ahtasam Ahmad

Advertisement

There was a time when phones were meant for calling and that was it. Within a decade of cellular phones becoming popular, however, phones began to double as not just a device for calling and messaging but as cameras, computers, calendars, clocks, and so much more. For the vast majority of the world, mobile phones are their primary computing device which they use the most.

And its uses are continuing to grow.

In 2022, the transactions involving ‘mobile money,’ which refers to payment services operated under financial regulation and performed from or via a mobile device (these include your bank app, QR codes, and services like JazzCash and EasyPaisa in Pakistan), increased to an all time high of more than $1 trillion globally. The world also saw an 18 percent increase in user accounts - all according to a report of the Groupe Speciale Mobile Association (GSMA) titled “State of the Industry Report on Mobile Money 2022.”

Pakistan has also been highlighted in the report, which points out the development in the Pakistani market ranging from growing user accounts to an uptake of digital financial services like loans and insurance. However, it went on to highlight the regulatory and socio-economic barriers that exist in the country’s ecosystem which can hamper the pace of adoption for mobile money amongst the masses.

The Industry

The mobile money service includes; transferring money and making and receiving payments using a mobile phone. While the service must be available to the unbanked. Also, the service must offer a network of physical transactional points which can include agents, outside of bank branches and ATMs, that make the service widely accessible to everyone. The agent network must be larger than the service’s formal outlets. The organization specifically excludes products and services linked to the traditional banking networks from its definition of mobile money to give a holistic view of the intended market segment.

In Pakistan the Digital Financial Services operators fall in the ambit of this study. As per the PTA annual report 2021, “The m-banking network has expanded to over 534,460 m-banking agents and 74.6 million m-wallet accounts. This network has enabled more than 2.2 billion annual transactions worth over PKR 8 trillion in 2021.” However, only 45.6 million of the accounts are classified as active user accounts.

The adoption of Mobile Money

The mobile money market has great potential to grow in the low and middle income countries as per GSMA. The case for Pakistan is no different, 70 percent of the country’s population is unbanked as per World Bank’s Global Findex Report and this provides an opportunity for existing and new services providers to bring in a substantial amount of customers.

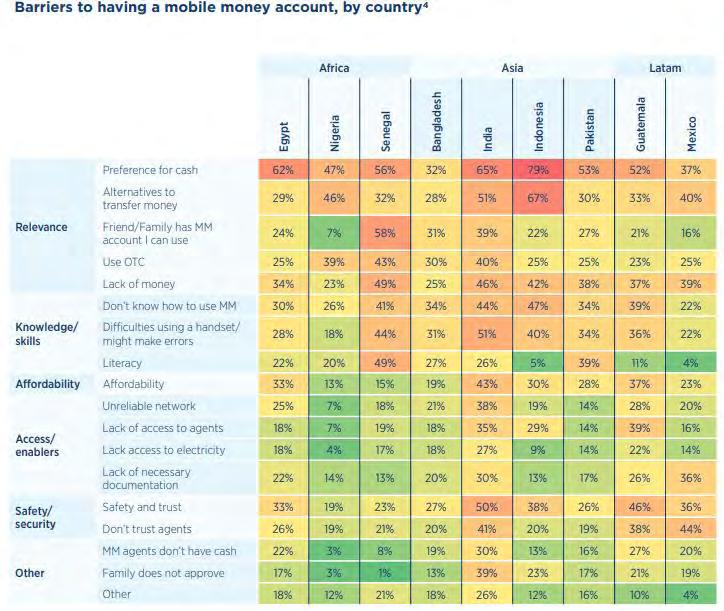

However, the process is hindered due to inherent problems in Pakistan’s socio economic structure. The primary barriers to adoption of mobile money include; lack of awareness, infrastructural limitations, internet penetration, smartphone possession and lack of documentation. These characteristics are not unique to Pakistan rather shared amongst the population living in the low and middle income countries.

One of the aforementioned barriers, Lack of Documentation, primarily pertains to an absence of official ID amongst the adult

Source: PTA Annual report 2021

population. As per GSMA, “close to 40 per cent of adults in low-income countries (LICs) do not have an ID, which limits their ability to use digital services.” Yet, through effective use of technology, this hurdle can be overcome. An example is Biometric for all (B4LL), a voice-enabled verification solution. Easypaisa is the first one to test this solution in collaboration with GSMA.

Omar Moeen Malik, Head of Easypaisa Business commented on the solution, “B4LL has been a highly useful asset for us to assess the utility of voice enabled biometric verification techniques for our customers.” The solution is developed to be supported on feature phones and low tech smartphones as a vast majority of the targeted audience is not in possession of more advanced devices.

Another key trend that prevails in the mobile money market across the globe is diver-

Source: GSMA

sification of services. As per GSMA’s State of the Industry Report on Mobile Money 2022, “A decade of growth in active accounts and transaction values has shown that mobile money is playing an increasingly important role in the daily lives of people in LMICs. It is also diversifying its value proposition. Beyond Peer to Peer transfers and cash-in/cash-out transactions, the growth of partnership driven “ecosystem transactions”,such as bill payments, bulk disbursements, merchant payments and international remittances, together with interoperable transactions, are accounting for a greater share of the global mobile money transaction mix.’’

Pakistan is on a similar route as now the mobile money platforms are aiming to develop a digital financial services ecosystem. In an interview with Profit, Irfan Wahab the CEO of Telenor also acknowledged the fact that his organisation as well as other market players were looking to expand beyond the conventional money transfer services.

M. Mudassar Aqil, CEO, Easypaisa while talking to Profit stated, “Our next step forward now is to convert Easypaisa into a digital financial services platform that allows any Pakistani to easily access a multitude of digital financial services including P2P payments, online purchases, savings, investments, and have access to basic insurance products amongst others. We have digitised our micro lending and have evolved a low-cost sustainable model with Easypaisa being the delivery channel.”

The reason is two-fold. Firstly, the opportunity is there to be availed but also, the regulatory environment became such that the move was inevitable. The overreliance on customer fee leaves the entities operating in the market vulnerable to regulatory shifts.

As per 2021 Global Adoption Survey by GSMA, “79 per cent of all mobile money provider revenue came from cash-out and P2P transfer fees. Higher competition in several markets has put significant pressure on prices, resulting in large reductions in cash-out fees, which still represent a significant proportion of provider revenues. Moreover, while most transaction fee waivers introduced by regulators during the COVID-19 pandemic were rolled back, some transactions remain zero-rated.”

The Pakistani market has experienced a similar change in dynamics. The money transfer fees formed a bulk of the mobile financial services revenue and a move to abolish IBFT charges by State Bank further propelled the speed of diversification amongst the segment.

The diversification drive has led to the introduction of several digital financial products including Loans, Insurance and Savings.

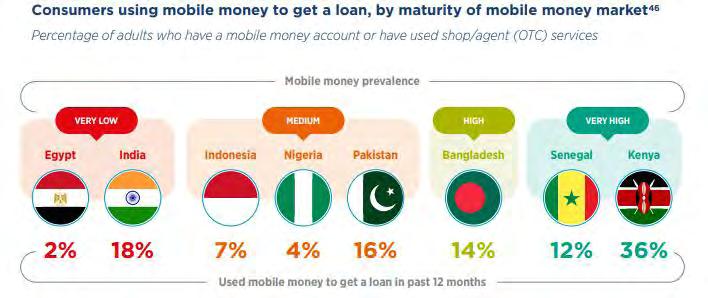

The GSMA State of the Industry Report on Mobile Money 2022, highlighted that Pakistan was an exception in adoption of mobile credit amongst its peer group as 16 percent

Source: GSMA

consumers took credit through the digital channel which is high compared to the prevalence of mobile money in the country.

However, it may seem as a positive indicator that the financially marginalised segment is able to avail credit which through conventional means it could never have, but this credit comes at a cost, an exceptionally high one. In Pakistan, One of the biggest providers of such loans is Jazzcash, which charges an interest of around 180 percent and a loan processing fee on top of it. It is likely that the increased uptake of credit products might be more influenced by service providers pushing it to the consumer rather than a genuine trend of consumer adoption.

Similarly, the GSMA report pointed out that after Covid-19, amongst its peer group, “only Pakistan shows a trend towards increased use of mobile money enabled insurance.” This again can possibly be due to a push from the service provider’s side as insurance business is a lucrative one with around 60 percent of initial year’s premium going out as commissions majority of which in this ends up with the mobile money operator.

Alarming gender gap

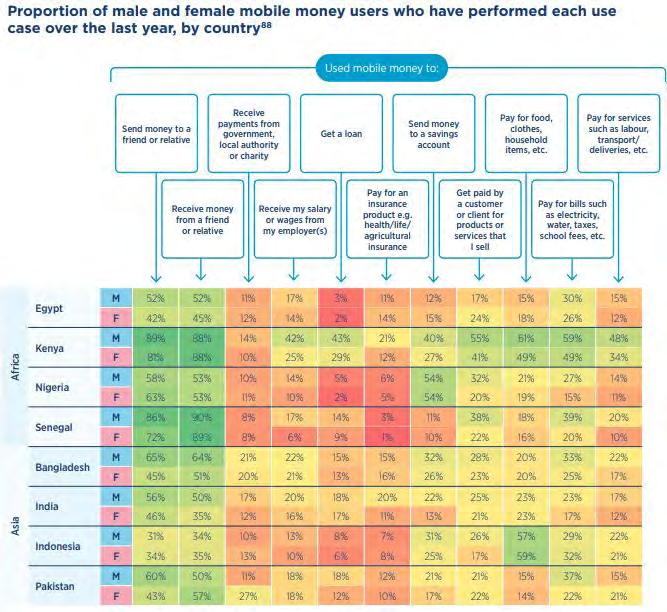

A concerning development that was highlighted in the GSMA report was the staggering gender gap in Mobile money adoption.

Source: GSMA

As per the report, “In Pakistan for instance, 76 percent of men and 51 percent of women own a mobile phone, 77 percent of men and 70 percent of women have heard of at least one national brand of mobile money, but only 19 percent of men and six per cent of women have a mobile money account.”

The figures are representative of the overall gender gap in our society. As per Global Gender Gap Report 2021 by the World Economic Forum, Pakistan ranks 153 out of 156 countries when benchmarked against the criteria of Economic Participation and Opportunity, Educational Attainment, Health and Survival, and Political Empowerment.

The benefits of servicing this gap are not restricted to just the profitability of the service providers but it can also bring in disproportionate benefits to the women using mobile money as due to societal norms their access to conventional financial services is already restricted compared to men.

Regulatory framework

The regulatory body overseeing mobile money is State Bank of Pakistan (SBP). The entities operating in the segment are licensed under the branchless banking regulation or the EMI regulation issued in 2019. The EMI regulations was the first one to permit complete digital operations but the services allowed to be offered are limited. As per the Mobile Money Regulatory Index 2021, “The regulation restricts EMI to neither pay interest/returns to customers nor offers anything that adds to the monetary value of e-money, leading to some restrictions on how the interest may be utilised.”

The solution to this has already been introduced by the SBP through the introduction of Licensing and Regulatory Framework for Digital Banks. However, there are some inherent limitations in this framework also.

Sardar Abubakr, Chief Finance and Strategy officer of Mobilink Bank/Jazzcash, while talking to Profit stated, ‘ As of now, the opportunity to operate at a larger scale is limited under digital banking licence. The minimum capital to deposit multiple is something that would need to be looked upon as under given limits maximum deposit that can be raised is well below the deposits already held by Jazzcash.” Amidst all the developments, Pakistan is progressing well in the sector as the market opens up for new service providers and solutions. An evidence of the improved performance and initiative from the regulator is the country being amongst the top ten in the “positive rating movement list” of Mobile Money Regulatory Index 2021 by GSMA. n