10 minute read

Pull over, the economy’s check engine lights are on

What does the hiking of the interest rate mean in the larger scheme of things?

By Ariba Shahid

Advertisement

There are two kinds of people. The first are the stable ones. As soon as they see the ‘check engine’ light on their cars turn on, they pull over and call a mechanic. At most, they will take the risk of taking their car to the mechanic themselves. The other kind of people are the chaotic ones. These are the ones that not only ignore their check engine light as if it means nothing, but when the car engine starts rumbling and making scary noises they turn up their stereo to drown out the noise and ignore the problem. Of course, eventually the car will break down and the mechanic’s job (and cost) will be doubled.

The economy is often analogised as a car. The question is, how are we handling our check engine light?

The emergency monetary policy committee (MPC) meeting hiking policy rates by 250 basis points on Thursday, more than 12 days ahead of the scheduled MPC meeting was a blaring check engine light if there ever was one. In an emergency meeting, the State Bank of Pakistan announced a 250 bps policy rate hike bringing the policy rate to 12.25%.

In the last scheduled Monetary Policy Committee (MPC) meeting, the SBP stated that it was “prepared to meet earlier than the next scheduled MPC meeting in late April, if necessary, to take any needed timely and calibrated action to safeguard external and price stability.”

The MPC meeting for April is scheduled on Tuesday April 19, 2022. Analysts expect the policy rates to rise in the upcoming MPC meeting as well. This increases forward-looking real interest rates (defined as the policy rate less expected inflation) to mildly positive territory.

Why couldn’t the SBP wait?

To TLDR is to get ahead of the markets. The markets were ahead of the SBP and the SBP, despite calling this a proactive measure, was behind.

In fact, primary market participants felt that the move to hike policy rates was not proactive, nor swift enough to be called reactive. In fact, the market behavior kept poking at the SBP to do something, until the SBP called in this emergency meeting. The MPC is calling the decision to hike policy rates through an emergency meeting as a “strong and proactive policy response.”

“The SBP should have ideally hiked the policy rates in the last MPC meeting to set the tone. They adopted the wait and see approach which resulted in markets getting ahead,”

explains Dr Sajid Amin Javed, Research Fellow and founding head of Policy Solutions Lab at Sustainable Development Policy Institute (SDPI) Pakistan

On Wednesday, the Market Treasury Bill (MTB) auction hinted towards a need for a policy rate hike as cut off yields rose significantly. The 3 month cut off yield increased by 80bps to 12.8%, 6 month cut off yields by 75% to 13.25%, 12 month cut off yield rose by 60bps to 13.3%. This is important to note as the average spread between the 3 month, 6 month and 12 month MTBs and policy rate used to be 0.61%, 1.04%, and 1.3% respectively but have climbed to 3.05%, 3.50%, and 3.55%.

“The markets are pricing in aggressive rate hikes in April and hence we see the sharp 80bps increase in the Tbill cut off yields,” explains Sayem Zulfiqar, Visiting Faculty at the Institute of Business Administration.

The SBP received bids of Rs911 billion, however was able to raise Rs680 billion against the target of Rs600 billion. The bid cover ratio clocked in at 1.34x. The highest participation came in the 3 month tenure MTBs as the market is anticipating higher policy rates in the foreseeable future.

Therefore, the decision to hike policy rates by 250 bps and restart the tightening cycle is not only done in light of macroeconomic developments but also keeping into account the financial markets and the signals it was setting. In normal situations, the SBP guides the market, not the other way round.

“Had the SBP hiked the policy rates gradually over a period of time, the transition to a tightening cycle might have been smoother. However, it is now expected that the SBP will have to be faster with the hikes which could weigh down on the economy,” Javed adds.

Does this fix all our economic woes?

The SBP explained that the reason for the home is because the outlook for inflation had deteriorated and risks to external stability had risen. The inflation forecasts have been revised upwards to slightly above 11% in FY22 by the SBP. The SBP believes that inflation will moderate in FY23.

While the inflation witnessed in Pakistan is primarily cost push inflation driven by rising international commodity prices which are beyond the control of Pakistan, this move is an attempt to mop up liquidity and any demand driven inflation there is.

“Externally, futures markets suggest that global commodity prices, including oil, are likely to remain elevated for longer and the Federal Reserve is likely to increase interest rates more quickly than previously anticipated, likely leading to a sharper tightening of global financial conditions,” reads the Monetary Policy Statement (MPS).

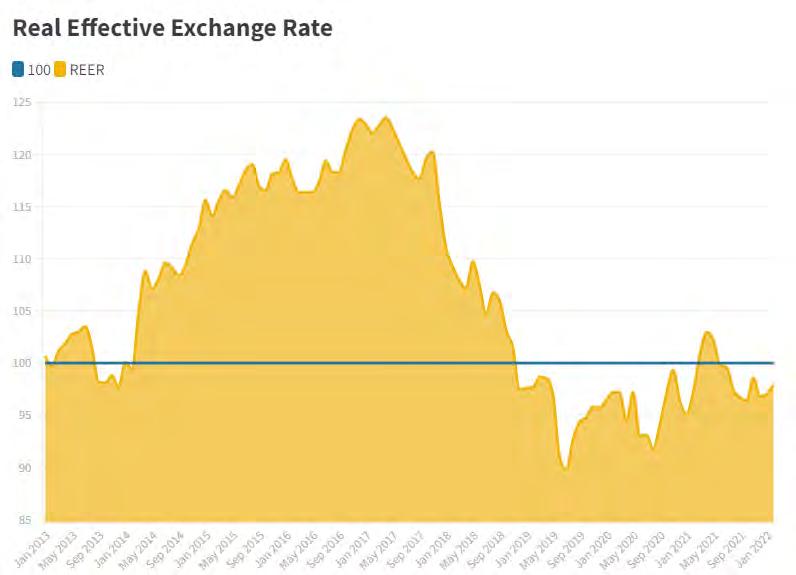

The MPC also commented on the impact of political uncertainty on the economic climate of Pakistan “heightened domestic political uncertainty contributed to a 5% depreciation in the rupee and a sharp rise in domestic secondary market yields as well as Pakistan’s Eurobond yields and CDS spreads since the last MPC meeting,”

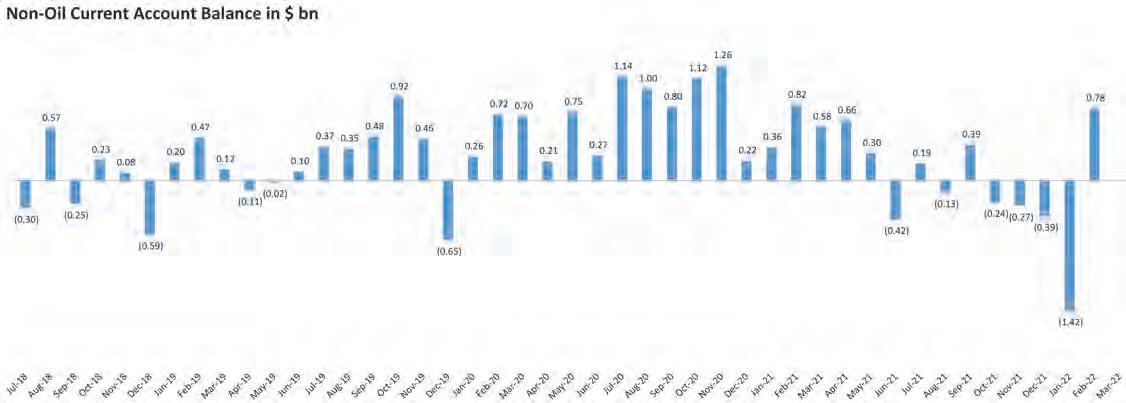

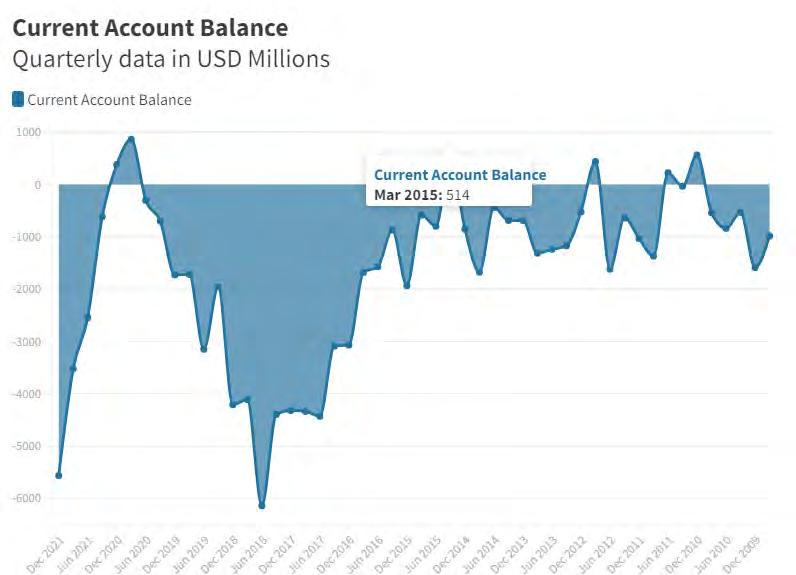

However, what should be an immediate cause of concern is the declining reserves and the swelling current account deficit which is inadequately met by the import cover.

Reservations on the reserves as the rupee nosedives

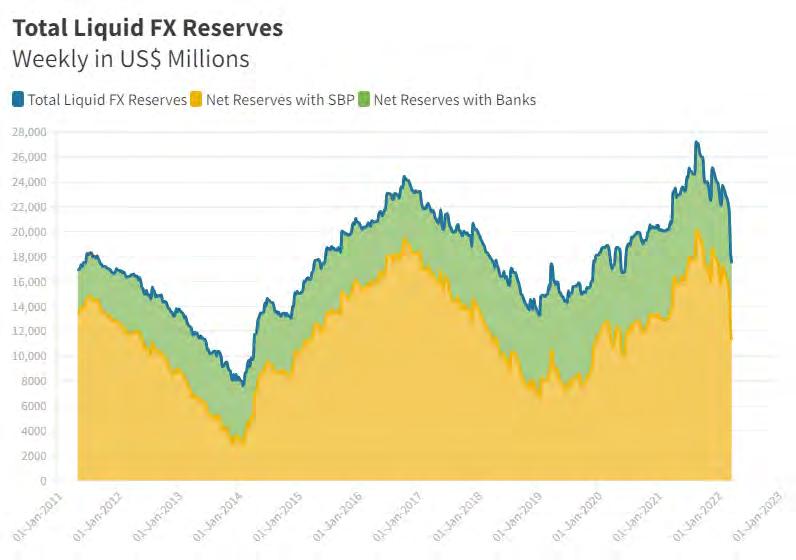

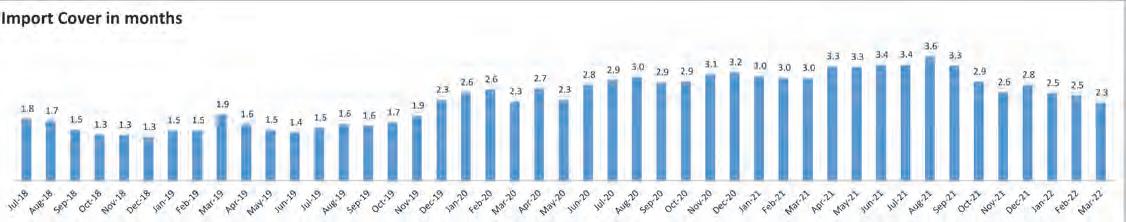

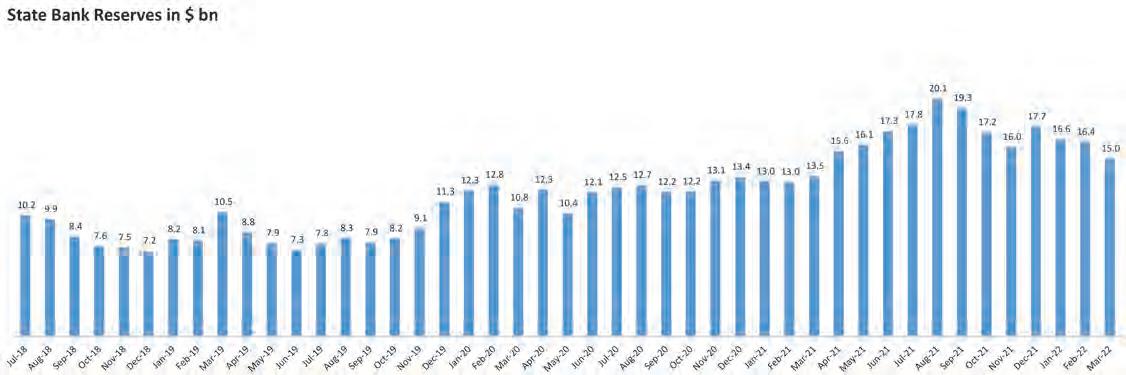

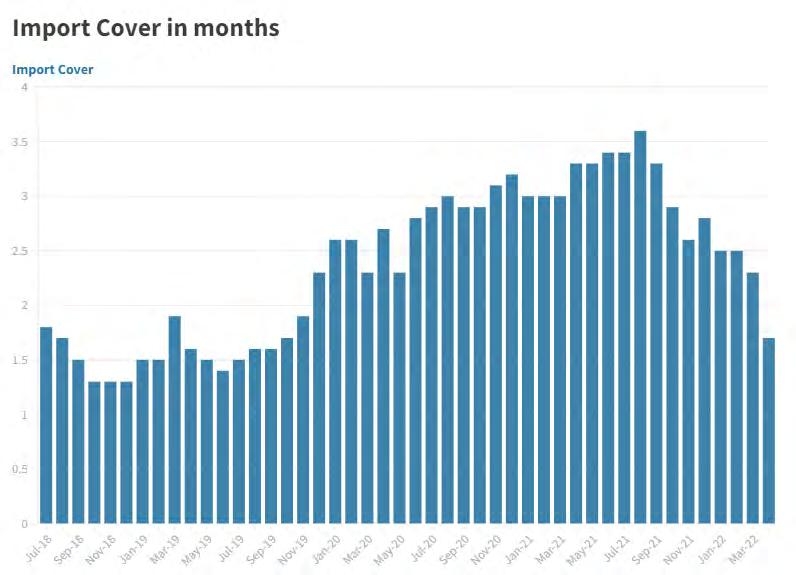

The total liquid foreign reserves held by the country stood at $17,476.9 million as of April 1, 2022, the lowest level since June 2020. During the week ended in April 1, 2022, SBP reserves decreased by $728 million to $11,319.2 million, largely due to debt repayment and government payment pertaining to settlement of an arbitration award related to a mining project. Total reserves are down by $1,078 million. A breakdown of this shows that SBP reserves stand at $11.3 billion, and are down by $728 million. Bank reserves are down by $350 million, clocking in at $6.2 billion. The total liquid FX reserves have declined $1.078 billion over last week which is equivalent to a 5.8% decline week on week. The import cover has declined from 1.82 months to 1.71 months based on average imports of the last 12 months.

At this point it is important to note that while Pakistan has been at a worse position before, it is the trend that is alarming.

“The rupee had been depreciating because the import bill had risen and reserves had been depleting. However, if you look back, we’ve been in such a situation before where reserves were at this level, and the import cover was low too,” explains Javed. He adds, “There are three basic reasons for declining reserves. The first is the foreign obligations Pakistan has met over the past few months. The volume of imports has grown, and the unit price of imports as a result of a rise in international markets has also added pressure.” However, despite the economic reasons, behavior theory also comes into play as panic sentiments rise.

“The reason for the recent behavior [in the rupee weakening] could primarily be because of the political uncertainty and the outlook of the economic situation. Moreover, another reason is outflows in portfolio investment, particularly in Naya Pakistan Certificates (NPC). There is also a panic factor in the market especially considering the future of the IMF program.,” says Javed.

Javed, however, feels that the solution to these economic woes, however, would have been easier had there been stability on the

political front. He opines, “At a time when we’re faced with such issues on the economic front, the one thing we needed was a stable government to deal with it.”

The very fact that the rupee recovered 1.89% day on day closing at Rs 184.86 following the supreme court’s judgment shows that political uncertainty played a factor.

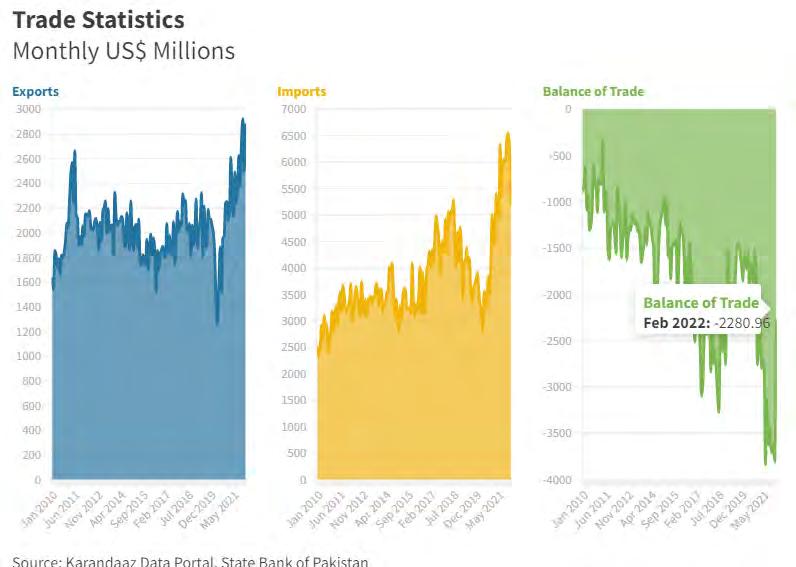

Moreover, the import bill of the country does not seem to be coming down any time soon, at least until global commodity prices cool down, especially petrol and palm oil.

A slowed down future

The Asian Development Bank (ADB) on Wednesday (prior to the surprise MPC) forecast Pakistan’s economic growth rate to slow down to 4 per cent this year from 5.6pc in FY21 owing to tighter fiscal and monetary policies and Russia-Ukraine war fallout.

“Pakistan’s growth is forecast moderating to 4pc in 2022 on weaker domestic demand from monetary tightening and fiscal consolidation before picking up to 4.5 in 2023”, the ADB said. Pakistan has a GDP growth rate target of 4.8pc for the current fiscal year.

It is important to note that the ADB forecast is based on the revival of the IMF programme in January for fiscal and monetary tightening. This is before the finance package announced by Prime Minister Imran Khan which was the opposite of fiscal tightening. “slower growth in the current fiscal year reflects the government reactivating its stabilisation programme under the International Monetary Fund (IMF) Extended Fund Facility to narrow the current account deficit, raise international reserves, and cut inflation,” said the ADB.

Will our imported economic turmoil ever end?

Keeping in mind, Pakistan’s reliance on imported fuel, despite the SBP’s forecasts, one cant be sure as to when inflation will recede. “International commodity prices have jumped to the highest levels since 2011, primarily due to the Ukraine conflict but also due to record quantitative easing measures by the global central banks. For e.g. oil prices have jumped 91% since Dec 2021 and currently trading above $ 100 bbl. This is putting enormous pressure on our import bill, which has jumped by 50% (JulMar) and led to sharper drawdown of the SBP FX reserves,” says Zulfiqar.

Zulfiqar adds, “In the last month, the political crisis has severely compromised the authorities ability to respond to the crisis. Political instability has led to delay in disbursement of credit from IMF and other international development agencies. Cost of borrowing from international bond markets has increased sharply, with Moodys warning off a rating downgrade. As a result, plans to launch Eurobond / Sukuks have been shelved. Fiscal measures to curb import bill including new import taxes and reduction in subsidies cannot be taken until a new government takes office.”

However, in order to suppress the import bill and the overheating of the economy, the SBP has hiked the markup rate by 250 bps for financing under Export Finance Scheme (EFS) bringing it to 5.5%. Despite the increased markup rate for EFS, the banks’ spread for corporate borrowers and SMEs remains unchanged at 1% and 2% respectively. It is important to note that the revision in rates will not be applicable on financing under rupee based discounting facility of EFS which suggests that this may be a way to curb FX outflow in light of declining reserves and the PKR depreciation.

Moreover, the SBP has also imposed a 100 percent cash margin on 177 items in a bid to curb their imports. “These items are mostly finished goods including luxury items and exclude raw materials,” the SBP said in a monetary policy statement. The SBP is using this as a means to curb imports, bring down the CAD, save reserves, and stop the depreciation of the rupee, despite stressing that the non-oil current account balance has continued to improve. What this means is, the breaks are being pulled, and you’re going to feel it. n