16 minute read

Despite the pandemic employment rises steadily

The 2020-2021 Labour Force Survey results were released on 31st March. It gives insight into the labour market during Covid-19, demonstrating overall positive developments.

By Zunairah Qureshi

Advertisement

What do you think would have happened to employment in Pakistan in the last few years? An immediate thought would be that the unemployment rate will have been soaring thanks to the Covid-19 pandemic. However, to the contrary, there has been a marked increase in employment despite the pandemic.

Coming after the delayed results of the last 2018-2019 edition of the Labour Force Survey (LFS), the 2020-2021 LFS by Pakistan Bureau of Statistics (PBS) updates the labour market’s situation during the Covid-19 pandemic period.

The survey, which was conducted for the period of June 2020 to July 2021 was, for the first time, carried out on digital tablets through a specialised Android software application.

The survey obtained data from the highest number of sample households in the history of all LFS previously conducted. A total of 99,904 households were surveyed, which is a considerable increase from the 41,184 households that were surveyed for the 2018-2019 LFS.

The LFS reported that labour force participation rates and employment, notably for women, increased between the last and present survey periods. Appropriately, more young people joined the labour force, however, participants from the under 15 age group decreased.

This edition included a section on Sustainable Development Goals (SDGs), reporting performance for each of its indicators. This encompasses a breakdown of data for employment of disabled persons.

It was previously reported by PBS that, ‘Labour Force Survey for 2019-2020 did not take place due to preparations for an extensive survey in 2020-2021.’ This means the newly released LFS results are a much needed and crucial update which may remain relevant for some time.

PBS communicated to Profit that, ‘We are currently focusing our energy and efforts on the upcoming 7th census. At the time of the national census, all other surveys apart from price updates are halted.’ So, it is hard to expect another LFS update anytime soon.

Labour Force Participation

[All comparisons of the 2020-2021 LFS results are against that of the previous 20182019 LFS’ result]

Both the crude and refined activity participation rates increased since 2019. The crude labour force participation rate is 32.3%, meaning that this percentage of Pakistan’s total population is either employed or available for work. The refined rate is 44.9% which means that this percentage of Pakistan’s working-age (10 years and above) population is either employed or available for work.

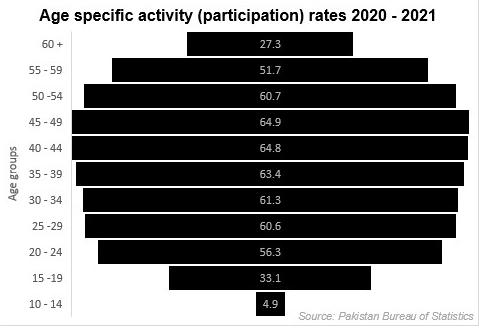

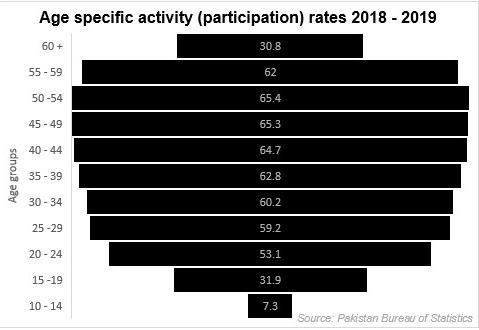

This makes sense as there is a significant increase in participation from the 15 – 44 age groups. In contrast, there is a decline in participation from the 10-14 and 45 and above age groups. The age-specific participation data indicates increasing youth participation in the labour force. A side by side comparison for participation rates from the previous LFS and the new LFS depicts an increasing youth bulge

It is, however, interesting to note the decrease in the number of younger kids in the labour force, who are perhaps increasingly opting for school instead of working. The Labour Force Survey SDG indicator for participation rate of youth in formal and informal education was estimated at 38.2%.

Updated data for the number of school-going kids will be available through the upcoming national census.

In terms of sex, female participation for crude labour force remained the same overall, with increased participation from the age

groups 20 – 44. There was also an increase in female participation rates in the provinces of Khyber Pakhtunkhwa and Sindh.

However, significant increase to the labour force was observed through increased male participation which, for refined rates, went from 67.7 % to 67.9 % while refined female labour force participation rates actually declined from 21.5% to 21.3%.

In total there was an induction of 3.01 million people into the labour force from 2019 to 2021, bringing it to 71.76 million.

(Un)employment

The total number of employed persons increased from 64.03 million to 67.25 million while unemployed persons decreased from 4.71 million to 4.51 million.

The increase in new employment indicates that around 3.22 million jobs were created from June 2019 to June 2021. The circulating figure of ‘5.5 million jobs created by the PTI government’ is likely reporting the total number of jobs created since the start of the present government’s tenure in 2018.

The overall unemployment rate in the country came down to 6.3% from 6.9%. In terms of provinces, unemployment decreased in each province but the greatest decrease was observed in KP, where it went down from 10.3% to 8.8%. Punjab’s rate was estimated at 6.8%, Balochistan at 4.3%, and Sindh at 3.9%

The most notable change in unemployment was the decrease in female unemployment, which significantly declined in both rural and urban areas. Overall female unemployment came down from 10.0% to 8.9% by 2021. Male unemployment rates went from 5.9% to 5.5% in the same period.

However, it’s important to note that while unemployment decreased, underemployment increased from 1.2% to 1.5%. Underemployment is the number of employed persons working less than 35 hours in the reference week, who were available to work for longer hours, expressed as a percentage of all employed persons.

The increase in underemployment rate is an apparent effect of Covid-19 impact on working conditions as many employees switched to remote work and faced salary cuts during ‘smart lockdown’.

As for wages, average monthly wages increase from 21326 to 24028. There was a significant hike in female employees’ wages as it increased by 30.1%. This is much higher than the 11.1% increase in male employees’ wages. This significant development brought the Rs 6711 wage gap between male and female wages down to Rs 4536 by 2021.

This might be in part due to the 1.9% increase of women in managerial positions as reported by the SDG indicator.

Employment by sector

In terms of industrial division, employment in the construction and community/social and personal services sectors has increased, going from 8.0% to 9.5% and 25.5% to 16.0% respectively. Female employment in the services sector significantly increased from 15.1% to 15.8%. On the other hand, there was a decrease in agricultural/forestry/ hunting and fishing during the 2022 to 2021 fiscal year, which went down from 39.2% to 37.4%. Employment in other categories remained the same overall. Skilled agricultural, forestry & fishery workers remained the largest occupational group with 33.2% of all employment – although this was a decrease from the previous estimate of 33.5%. Service and sales workers also went down from 16.0% to 15.6%, while plant/machine operators and assemblers significantly increased from 6.9% to 7.4%. Other occupational groups saw slight changes or remained the same In terms of employment status, the percentage of employers, own account workers, and contributing family members decreased. Employees remained the largest group with a significant increase from 39.8% to 42%. While male employees increased 1.9% from 45.1 to 47.0%, the greater increase was observed in female employees at 3.2%, going from 21.8% to 25.0%.

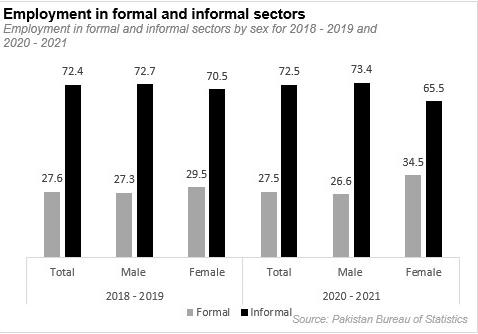

The formal sector saw a marginal decrease in employment while the informal sector saw an increase in employment as it rose to 72.5% in 2021. Female employment significantly decreased in the informal sector while increasing in the formal sector. In comparison, the opposite trend was observed for male employment. n

Pak-Iran barter trade

A fresh notification could mean trade volumes increase by as much as $4 billion

By Ahtasam Ahmad

In the most basic explanations of human civilization provided in social studies textbooks, humankind evolved from an economic system that was based on barter trade all the way to the high-rolling and often confusing world of capital markets today. However, barter trade still has its place in the world today. On the one hand, it exists in more sophisticated forms, such as in the advertising industry, where one company sells its available ad space to another company in exchange for the right to advertise on the second company’s space. However, barter trade also exists in some of its archaic form in the world today. Just recently, the Ministry of Trade issued a notification on 7th April to lay down the procedure for barter trade between Iran and Pakistan. Officials believe that this move will increase the bilateral trade from the existing level of $1 billion to $5 billion. A preferential trade agreement was signed between the two countries back in 2006 but it failed to increase bilateral trade as the US heavily sanctioned the Iranian economy.

The barter trade agreement

The draft working for a trade agreement was shared by the Iranian officials with their Pakistani counterparts at the 8th Joint Trade Committee (JTC) meeting held in Quetta in October 2020. After due deliberation by Pakistani officials including those from; State Bank of Pakistan, Ministry of Commerce and Federal Board of Revenue, a barter trade agreement was drafted that was subsequently tabled and signed between Quetta Chamber of Commerce and Industry (Pakistan) & Zahiddan Chamber of Commerce and Industry (Iran) at the 9th JTC meeting that took place in Tehran in November last year.

On the signing of this agreement, Pakistan’s Commerce Secretary Sualeh Faruqi, expressed his optimism on removal of impediments for trade between the two countries and the possibility to achieve $5 billion bilateral trade by 2023.

Reza Fatemi Amin, Iranian Industry, Mining and Trade Minister, while talking to a private publication stated, “With the measures taken, the existing barriers will be removed within the next three months and the trade processes will be facilitated. Hopefully, the Pakistani government will provide Iranian companies with the same facilities.”

However, analysts were apprehensive about the success of this agreement given that there is an absence of a formal banking channel between the two countries. An official of the Ministry of Commerce, while talking to a private publication commented, “Until the regular banking channel was established for a mode of payment, the target to increase trade to $5bn in the next two years might also remain only on paper.”

The Notification

The ground for barter trade was laid with the agreement back in November, however, procedural complications were yet to be resolved. The recent notification along with the SROs defines the procedures for conducting barter trade between the two countries.

Through SRO 484 and 485, the ministry of commerce made amendments to the Import Policy Order 2020 and Export Policy Order 2020. Prior to this amendment, exports and imports were regulated by Foreign Exchange Regulation of the State Bank of Pakistan. The Export Policy states, “Exports from Pakistan shall be made under the foreign exchange rules, regulations and procedures notified by the State Bank of Pakistan.”However, the notified amendments will permit barter trade by adding the following clauses, “Provided that import/export shall also be allowed under barter trade agreements as approved by the Ministry of Commerce”. The notification also specifies some rules of trade to be followed for barter trade under the agreement. These directions include; special customs code to be introduced for tracking of goods, barter trade cell to be introduced for record keeping and registration purposes, Both chambers to reconcile the trade figures quarterly and net-off outstanding amounts through trade or other means. While a trade dispute mechanism will also be formulated to ensure timely resolution of any trade conflicts. As per the notification, the Quetta Chamber of Commerce will open a Pak rupee bank account and will receive and disburse proceeds of imports and exports on confirmation from the Zahiddan Chamber of Commerce.

Pak-Iran bilateral trade

As per the Observatory of Economic Complexity, Pakistan’s major imports from Iran include Petroleum Gas, Electricity and Refined Petroleum while Pakistan’s export to the country consisted primarily of Rice and other agri products mainly reaching Iran through a transit route like Dubai. The trade with Iran is of great significance for the people living in Balochistan near Iran’s border. Their livelihood is heavily dependent on trade while a major source of food supply in the region is the neighboring country. As of now, there are 959 joint border crossings between Iran and Pakistan but only nine are operational. n

Economy: the timeline ahead

By Mushtaq Khan

These are unprecedented times in Pakistani politics. IK’s April 3rd surprise has been unanimously ruled to be unconstitutional, and the Supreme Court (CN) has reconvened the assemblies and has instructed the Speaker to carry on with the vote of no confidence (VONC) by 10:30 am on April 9th. But as going to press, the assembly session was underway with no sight of voting on the horizon. Just hours before the SC decision, SBP finally acted and hiked interest rates by 250 bps and has increased the scope of cash import margins on all goods that are not raw materials. That the rupee in the interbank market lost Rs 1.84/$ on the same day before SBP acted, has created a narrative that the rupee’s weakness is driven by the political crisis.

This is true and untrue at the same time. Casual correlation (between key economic parameters like the currency and interest rates, and political developments) does not reveal causality, and the timing of SBP’s decisions could be driven more by a political schedule, than the need to manage market sentiments and keep the FX market calm.

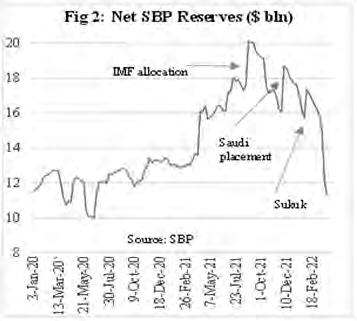

Figure 1 shows the interbank rupee parity in the past seven months, and the underlying current account deficit (CAD). Despite large CADs from October to January 2022, the rupee was remarkably stable, which puts into question SBP’s claim that it is following a market-determined exchange rate. Even before the opposition tabled the vote of no confidence on March 28th, the rupee was already in a deep dive. SBP’s management of the currency defies understanding: the rupee was managed from November to January, with near record high CADs, but after the improvement in February (CAD was only $ 545 mln), the rupee appears to have lost its anchor.

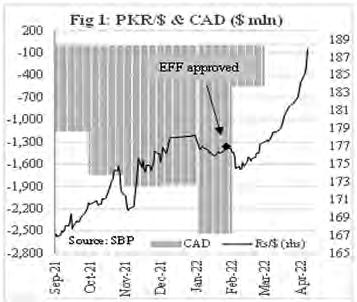

Figure 2 shows the sharp fall in SBP’s reserves in March (reserves fell by 4.9 bln), which could explain the rupee’s weakness in the month. However, it does beg the question about why SBP did not act last month to manage the CAD as it took a heavy toll on its reserves. Could it be that SBP did not want to disturb PTI’s political narrative that IK has the people’s support, and the economy is doing just fine? One must realize that the finance minister and SBP governor had both committed to the IMF that fuel and power tariffs would reflect global prices, and no new amnesty scheme would be launched: IK’s relief package announced on February 28th was a blatant U-turn on these commitments and will have to be reversed if Pakistan wants to re-engage with the IMF. While the finance minister comes with a political agenda (Shaukat Tarin is, after all, a Senator), the SBP governor is supposed to be apolitical.

How will this play out?

After the SC ruling, it is hard to see how the PTI can stop the VONC, even as it tries to create further impediments. PTI is likely to lose the vote of confidence, and the opposition coalition will be asked to select a new prime minister and cabinet. Indications are that Shahbaz Sharif will be the PM while Miftah Ismail is likely to be the new finance minister (FM).

It is understood that the new (PML-N) government wants to contest the next general election as incumbents. Hence, NAB cases against members of the Sharif family will have to be dealt with (and ended), while the use of electronic voting machines (EVMs) will be delayed; furthermore, given PTI’s support from expat Pakistanis, the new government will seek to limit the number of expats who are able to vote in future elections. Finally, some key positions in Punjab and Sind will be changed to help the incumbent government in the next elections.

However, as we have discussed earlier, the new FM will have to prepare for his trip to the WB/IMF Spring Meetings during April 18-23, and will need a plan to restart the EFF. We have heard that a $ 2.2 bln loan from China was repaid in March (which explains the sharp fall in SBP’s reserves in the week ending March 25th), which will only be rolled over if Pakistan is engaged with the IMF. As a signal of intent, the new FM will have to reverse IK’s relief package before he leaves for D.C. This means a sharp increase in retail fuel price and its repercussions on inflation, which (obviously) will be blamed on the short-term policies of the PTI government. The FM may also argue that IK’s relief package was a cynical political play as he knew the PTI government would not survive, so why not let the next government take the blame.

When the relief package is reversed, we can expect positive statements from the IMF and a concerted effort to complete the 7th review of the EFF. This will certainly calm sentiments in the FX market and stabilize the rupee. In view of the exceptional circumstances created by the war in Ukraine, the IMF is likely to endorse the measures recently taken by SBP to reduce imports. The IMF may also provide some leeway on the size of Pakistan’s external deficit and its reserve targets.

Conclusion

In our view, SBP’s last-minute steps to help the external sector are too little, too late. The next government will have to do the heavy lifting to stabilize the economy, and the resulting political pain will have to be accepted if the new government wants to contest the next elections on its terms. Once the political groundwork has been done, the ruling coalition will have to decide the election date. There could be much squabbling on this issue, but that is the nature of politics. The outlook for the next general election will depend on the political campaigns. IK will surely focus on the Western conspiracy against his government and accuse the opposition as complicit in these designs. IK will accuse opposition leaders of corruption and how the US encouraged this as a means of keeping Pakistan’s economy weak and dependent on the IFIs. Since the reform programs started in the late 1980s and have failed to deliver tangible results (and have increased income inequality), IK may find a sympathetic audience, especially from conservatives who are anti-Western. So, while it appears that Pakistan has again dodged the bullet, there is much pain in store. How the political class handle the public anger with looming general elections, remains to be seen. One thing is clear: if the opposition parties win the next elections, Pakistan’s relations with the West will improve and we will be back with the IMF; if PTI manages to gain power, Pakistan will enter uncharted waters. n

The author is an economist who has worked as the Chief Advisor to the State Bank Governor and now runs a private economics consultancy.