OECD work in support of industrial decarbonisation

For further information: www.oecd.org

For further information: www.oecd.org

Industrial decarbonisation is a cornerstone to realising net-zero emission targets. Effective decarbonisation pathways require swift and bold action from both industry actors and governments across countries. The OECD provides data-driven and fact-based analyses and policy advice to support governments and industry in this essential journey to net zero.

Examples of our work include:

• Granular data on the magnitude of industrial decarbonisation challenges across value chains

• In-depth analysis of industrial decarbonisation challenges at regional level

• Data on policy measures put in place to address these challenges

• Insights on how green industrial policy approaches can support decarbonisation, notably through science, technology and innovation

• Made-to-measure policy frameworks to assist countries in effectively addressing decarbonisation challenges

• Measurement and tracking of industrial subsidies in key industrial sectors

• Identification of enabling conditions and financing instruments to improve competitiveness of low-carbon industrial technologies, both for OECD and non-OECD countries

• Assessment of skills needs to enable the green transition

• Assessment of carbon footprint methodologies and analysis of firm-level emissions, with an emphasis on small- and medium-sized enterprises (SMEs)

• Multilateral platforms for policy dialogue and joint action on industrial decarbonisation

Decarbonising industry is an essential part of reaching the objectives of the Paris Agreement. Collectively, manufacturing industries account for as COSmuch as 40% of total global carbon dioxide (CO2) emissions or around 16 gigatonnes (Gt) annually (see Figure 1). Industrial decarbonisation involves the transition of energy-intensive industry sectors such as steel, cement, chemicals, and shipbuilding from their current high levels of emissions to a pathway aligned with net zero by around this mid-century.

This is far from the current reality: emissions from the global steel industry alone account for 7%-9% of total global CO2 emissions. Policymakers are increasingly aware that without accelerating the decarbonisation of industry, the Paris Agreement targets will not be met.

To provide governments and policymakers with evidence, data and analysis, the OECD has undertaken a variety of activities in the field of industrial decarbonisation which are described in this brochure. Contributing to improving data availability to support a better understanding of industrial decarbonisation, define objectives and measure progress is one key area of OECD work (see Box 1).

Process emissions, 2.6 Gt (16%)

Indirect

emissions, 6.9 Gt

Source: Estimated based on OECD/IEA (2023)

Note: Direct emissions from the combustion of fossil fuels accounted for around 40% of the total industrial emissions (6.5 Gt). An additional 2.6 Gt of process emissions came from the production of ammonia, cement, iron and steel, and aluminium (scope 1) (as defined by the Greenhouse Gas Protocol). Finally, another 40% came from indirect emissions in electricity and district heat generation that were subsequently consumed by the industry (6.9 Gt) (scope 2). These exclude emissions from industrial product use (e.g. release of carbon from solvent use) and waste treatment (e.g. release of the carbon stored when plastics are combusted at the end of their lifetime) as well as other indirect emissions considered scope 3.

The OECD plays a central role in ensuring availability of high-quality and comparable data to monitor and measure progress towards climate targets. The Climate Action Dashboard features key indicators that help the assessment of country progress towards climate objectives and provide snapshots of climate action at country level. It is one of four components of the OECD International Programme for Action on Climate (IPAC), along with the Annual Climate Action Monitor. Covering over 50 countries, IPAC aims to support countries in their path towards net zero and contribute to building a more resilient economy by 2050. Furthermore, the OECD also provides regional statistics on industrial emissions.

The OECD Inter-Country Input-Output (ICIO) database, when combined with statistics on CO2 emissions from fossil fuel combustion and other industry statistics, can be used to estimate demand-based CO2 emissions as a complement to regularly reported production-based emissions. The OECD maintains and updates a collection of indicators related to carbon emissions embodied in international trade that allow the final demand for embodied carbon emitted anywhere in the world along global production chains to be determined. Industry carbon footprints can also be estimated.

For example, comparing CO2 emissions from the production of basic metals around the world with estimates of the geographical distribution of these emissions embodied in final demand reveals that China and India are net exporters of emissions from basic metals (e.g. steel, aluminium), while OECD countries as a whole are net importers of emissions (see Figure 2).

In various sectors such as steel production, the OECD provides a dashboard to monitor progress on industrial decarbonisation efforts.

The OECD also contributes to data availability on industrial decarbonisation policies, for instance through the Policy Instruments for the Environment Database (PINE), the EC-OECD STIP Compass on science, technology and innovation policies and the Subsidy Platform

Industries face a variety of challenges in advancing industrial decarbonisation. Putting industry’s CO2 emissions on a pathway aligned with net zero requires a significant scaling-up of low-carbon technology deployment and related investments. Most of the needed technologies are at demonstration phase or early stages of commercialisation, and many of them are capitalintensive. Further, the execution risk and the costs associated with net-zero transition may reduce profits for companies. OECD analysis shows that these challenges are exacerbated by limited access to finance or skills and a lack of enabling conditions including an investmentfriendly business environment.

Uncertainty and/or fragmentation in policy efforts and regulatory regimes can also be a significant barrier to decarbonisation. Making progress on common standards and definitions, for instance on low-emission steel, can reduce uncertainty and fragmentation. Creating clarity and confidence in markets is essential for attracting the investments needed to commercialise and expand lowcarbon industrial technologies.

Science, technology, and innovation will be the backbone for achieving climate change mitigation targets in the industry sector. While moving forward in industrial decarbonisation certainly requires making better use of existing technologies across industries and countries, moving the technology frontier will be crucial in implementing the long-term 2050 strategies defined within the Paris Agreement.

OECD analysis shows that science, technology, innovation (STI) and industrial policies focusing on developing and deploying low-carbon technologies will be decisive in achieving carbon neutrality. Yet the current level of innovation is insufficient to meet the challenge due to a policy emphasis on deployment rather than research and development (R&D) support. The share of patents focusing on green technology in total patenting has not grown between 2011 and 2019 (the latest available year); public spending on research, development, and deployment (RD&D) for energy efficiency, renewables, nuclear energy, and other lowcarbon technologies represent less than 0.5% of gross

domestic product (GDP), down from a peak of 0.1% of GDP in 1980 (Figure 3).

After a period of strong growth between 2006 and 2012, the share of patents in climate-related mitigation and adaptation (CCMA) technologies has declined recently (see Figure 3). This is mostly due to higher growth in patenting in other technologies. By contrast, the proportion of trademarks covering climate-related goods and services has grown markedly over the last two decades, a positive sign of success in technology diffusion and deployment. Recent trends suggest that governments need to pay greater attention to bring technologies currently at the research and development stage towards the demonstration or prototype stage to make it to market by 2030.

The 2023 OECD Science, Technology and Innovation Outlook concludes that governments must be more ambitious and act with greater urgency in their STI policies to support climate objectives. They need to design policy portfolios that enable transformative innovation and new markets to emerge, challenge existing fossil fuel-based systems, and create opportunities for low-carbon technologies to break through. More investment and greater directionality in research and innovation activities are needed, for example through mission-oriented innovation policies (coordinated packages of policy and regulatory measures specifically tailored to mobilise innovation to address well-defined societal objectives in a defined timeframe), to help direct and shorten the innovation cycle for lowcarbon technologies.

OECD analysis also highlights the importance of fostering wider use of best available techniques (BAT) for industrial decarbonisation. Further work assesses how value chain approaches can be incorporated into BAT definitions and related environmental regulatory and policy concepts to ensure that such improvements benefit an industry’s entire value chain.

The OECD also works on emerging technologies to allow for industry-scale development of carbon capture and utilisation (CCU), next to carbon capture and storage (CCS). There are clear paths to the deployment of innovative technologies for CCU in construction, chemistry and biotechnology, all aided by digitalisation, which would benefit from a policy environment that safeguards a level playing field with other technologies and resource needs.

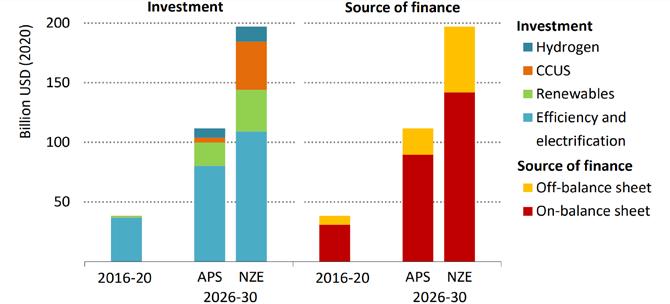

The global annual clean energy investment in the industry sector stood at less than USD 50 billion between 2016 and 2020 on average. By 2030, investments need to quadruple to reach nearly USD 200 billion per year (see Figure 4b). A majority of these investments will need to happen in emerging and developing economies. There are two sides to this problem: there is a limited supply of public finance for industry decarbonisation, and there is a lack of tailored instruments to de-risk projects for mobilising private capital.

Financing risks and challenges for industry decarbonisation stem from the high upfront costs of most low-carbon technologies, a majority of which remain at the early stages of commercialisation (see Figure 4a). Additionally, access to capital is limited and expensive, reflecting financial, regulatory, political and technological risks.

The OECD Framework for industry’s net-zero transition collaborates with emerging and developing economies to demonstrate how private capital can be mobilised through innovative financing reinforced

by enabling conditions for investments to overcome barriers and minimise overall risks. This framework has been developed as part of the Sustainable Infrastructure Programme in Asia (SIPA) that aims to help align the strategies, policy frameworks and infrastructure investments in Central and Southeast Asian countries with a net-zero, resilient pathway. Indeed, aligning infrastructure and equipment investments with climate change mitigation goals and decarbonisation pathways, and ensuring consistency with sustainable finance taxonomies is critical for industry decarbonisation. SIPA assists governments in building capabilities in Central and Southeast Asia that use tools and indicators measuring these and streamlining those objectives.

This framework for industry’s net-zero transition is implemented for several industrial sectors in countries (Egypt, Indonesia, South Africa and Thailand) by the Clean Energy Finance and Investment Mobilisation (CEFIM) programme, which aims to strengthen domestic enabling conditions to attract finance and investment in renewables, energy efficiency and decarbonisation of industry in emerging economies.

Mitigation measures

Maturity of measures

Measure

CCUS

Energy efficiency

Other fuel shifts

Electrification

Other renewables

Bioenergy

Hydrogen

Material efficiency

Maturity

Prototype

Demonstration

Market uptake

Mature

A pilot study for Norway shows that only 15% of the total investments during the period 2010-2017 were consistent with a 2oC scenario. Further work explores metrics to track climate action and targets in the private sector and drive existing finance towards climatealigned activities. Industrial sectors are typically seen as transition sectors by financial institutions. Hence, their climate performance is often assessed based on the ambitiousness of their targets according to OECD analysis

Access to resources: the example of clean hydrogen

The availability of clean hydrogen (including renewable hydrogen derived from renewable power via the electrolysis process and low-carbon hydrogen based on natural gas where CO2 emissions are captured for utilisation and storage) and its derivatives is a critical condition for successful industrial decarbonisation in sectors that need heat in their production processes. The OECD supports countries in developing effective strategies to accomplish this (see Box 2).

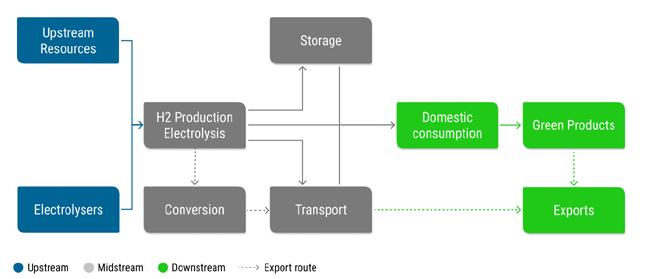

Improving the availability of clean hydrogen is widely seen as a crosscutting energy vector of the industrial decarbonisation agenda both in OECD member countries and in emerging and developing economies. OECD studies have examined the current development of hydrogen technology in the industry sector and the policies enacted to support its deployment across countries. Further OECD work presents a value chain approach to identify priority areas for developing national hydrogen strategies, focusing on emerging and developing economies. The work highlights success factors for renewable hydrogen projects based on eight case studies covering applications in industrial, transport and power generation sectors (see Figure 5).

Source:

Source:

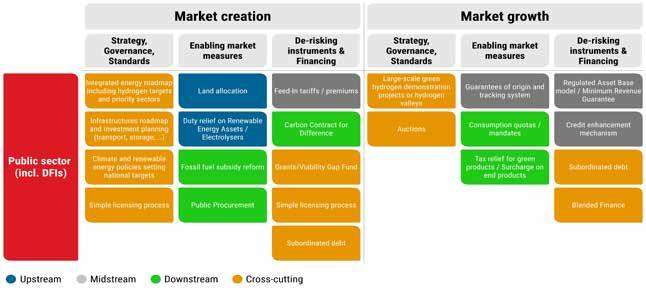

The CEFIM programme updates this work with more case studies and with a specific focus on emerging and developing economies. The OECD also investigates the role of financing clean hydrogen with the World Bank Hydrogen for Development Partnership (H4D). In that context, the OECD highlights the importance of de-risking to reduce the cost of capital, which is a major factor in hydrogen’s cost competitiveness. Facilitation of international trade in clean hydrogen through certification stands out as an important element of this (see Figure 6).

Further work on regulatory aspects of fostering clean hydrogen availability will take place in the near future, in particular on the role of the precautionary principle in hydrogen-related decision-making. Infrastructure investments are critical for ensuring renewable hydrogen availability.

Through its Production Transformation Policy Reviews (PTPRs), the OECD Development Centre supports countries on how to leverage the momentum for renewables, including clean hydrogen, to strengthen their industrial and innovation capabilities. PTPRs have been implemented or are in the process of implementation in Bangladesh, Chile, Colombia, Dominican Republic, Egypt, Togo and Shenzhen, China. The OECD Environmental Performance Reviews (EPRs) and Green Growth Policy Reviews provide independent assessments of countries’ progress towards their environmental policy objectives. Some recent and forthcoming reviews include a focus on industrial decarbonisation, hydrogen and related infrastructure investment (e.g. Chile, Costa Rica, Egypt, Germany, Norway). The SIPA supports countries in Central and Southeast Asia transition towards energy, transport and industry systems including in hydrogen.

An important component of the industrial decarbonisation agenda is to improve resource efficiency through circularity. The OECD’s Resource Productivity and Circular Economy programme provides policy guidance on resource efficiency and the transition to a circular economy. It aims to identify and quantify the impact of resource-efficient circular economy policies to guide a range of stakeholders in OECD member countries and emerging market economies through quantitative and qualitative analysis. This circular perspective has been used in various industrial sectors, for instance in shipbuilding. Upcoming work will focus for instance on the functioning of steel scrap markets.

Furthermore, the OECD’s global environment-economy modelling analyses demonstrate that the transition to a resource-efficient and circular economy (RECE) can bring significant environmental gains while enabling decoupling of economic growth and material use. The analyses provide governments with a better understanding of synergies and trade-offs in the

transition to RE-CE as well as their broader economic implications. One particular modelling assessment assesses the impact of a global adoption of policy packages such as primary material taxes and recycling subsidies. It suggests that scale, efficiency and traderelated effects could account for 10% to 40% reduction in materials use by 2040 compared to a business-asusual scenario, depending on the type of material.

Identifying the linkages between domesticallyimplemented circular economy policies and international trade, OECD work also shows that international trade can enhance opportunities for circularity by strengthening secondary markets securing cross-border reverse supply chains such as recycling waste and scrap into secondary raw materials, and extending product life by promoting direct reuse, repair, refurbishment and remanufacturing

Access to critical raw materials constitutes another important resource-related aspect of industrial decarbonisation. The OECD Global Material Resources Outlook to 2060 presents global projections of materials use and their environmental consequences, providing a quantitative outlook to 2060 at the global, sectoral and regional levels for 61 different materials (biomass resources, fossil fuels, metals and non-metallic minerals). It explains the economic drivers determining the decoupling of economic growth and materials use, and assesses how the projected shifts in sectoral and regional economic activity influence the use of different materials.

A recent policy paper on raw materials critical for the green transition shows that achieving net zero CO2 emissions will require a significant scaling up of production and international trade of several raw materials critical for renewable energy technologies. The paper provides a joint assessment of data on production, international trade, and export restrictions on such critical raw materials from the OECD’s Inventory of Export Restrictions on Industrial Raw Materials covering the period 2009-2020. It presents data on production and trade concentrations, sheds early light on the impact of export restrictions, and discusses possible directions of further work in this area. The evidence presented suggests that export restrictions may be affecting availability and prices of these materials in international markets.

OECD countries have been increasingly exposed to the use of export restrictions for critical raw materials. The OECD has also conducted work on critical raw materials at country level, such as in the Production Transformation Policy Review of Chile, and at sectoral level, such as the Global Steel Supply Chain Observatory

Through its work on due diligence for responsible supply chains, the OECD assists industries in making their supply chain strategies more responsible, for instance for minerals of relevance for industrial decarbonisation. A recent briefing note shows for instance how responsible sourcing can help address disruption factors and geopolitical risks in the supply

of transition minerals (i.e. minerals like cobalt, lithium and rare earth metals that are necessary for the energy and digital transitions). Furthermore, the Handbook for Environmental Due Diligence in Mining Supply Chains describes why risk-based environmental due diligence for companies in global value chains are important, what adverse environmental effects may occur, and how environmental aspects can be taken into account with step-by-step implementation of the 6-stage OECD due diligence framework.

The green transition is changing jobs, skills, and local economies. This is a topic reflected in a variety of OECD work. Jobs and skills in the context of the net-zero transition is an issue that is discussed in various OECD Economic Surveys. The latest Economic Survey on Germany for instance shows that the transition to net zero will require reallocation of labour across sectors and firms and risks increasing inequalities. Workers displaced in high carbon intensity sectors tend to suffer more lasting and significant losses (see Figure 7).

An OECD working paper and report shows that between 2019 and 2030, employment is estimated to decrease by 3% for blue-collar and farm workers in the Fit for 55 policy package implementation in the EU (compared to a decrease of 2% in a scenario in which the policy was not implemented) but increase by 4.5% for other occupations. The most demanded skills relate to interpersonal communication and the use of digital technologies, whereas demand for traditional tools and technologies declines.

Adjustments in demand for jobs and skills often have a strong regional dimension, because energy-intensive industries are typically concentrated in certain regions (see section on regions). At the same time, successful decarbonisation has different implications for sectors

and occupations. The anticipation of such distributional implications is of paramount importance for the design of skills policies that support the reallocation of workers from shrinking sectors into expanding sectors. An example of such analysis of distributional impact is a recent study on effects of carbon prices in Lithuania Industrial decarbonisation poses new challenges but also opportunities, both of which will differ across places within countries. The OECD has explored the impact of green transition on gender and socioeconomic inequalities by identifying the characteristics of workers in those jobs. OECD has also explored how labour and social policies can contribute to a just transition

Furthermore, the next Employment Outlook in 2024 will focus on the green transition and the labour market.

The challenges facing industrial decarbonisation are global, but circumstances across countries and industries differ significantly. The transition affects various existing industry sectors but also the broader economy as industry feeds into many other sectors and activities.

In a recent report for the 2023 Japanese G7 Presidency, the OECD highlighted how differences in assets, inputs used, business environments and innovation efforts make for heterogeneous decarbonisation pathways in the global steel sector. For instance, manufacturing processes for crude steel production differ widely depending on the quantity and quality of the required steel products, the availability and cost of energy and raw materials (including steel scrap), and the needs of

downstream steel-consuming industries. Globally, blast furnace-basic oxygen furnace (BF-BOF) route accounted for nearly three-quarters of the total steel production. The remainder came from the electric arc furnace (EAF) route (27%) that used primarily scrap steel. This category also includes iron and steel produced through the direct reduced iron (DRI)–EAF route that accounted for around 5.6% of total steel production in 2020.

The BF-BOF route dominates global steel production and benefits from economies of scale and continuous technology improvement. As Figure 8 shows, the country whose steel production has the highest share of BF-BOF route is China, while Italy has the highest share of EAF use. Globally, production of one tonne of steel emitted on average 1.83 tonnes CO2. The best conventional BF-BOF emits around 1.7 tonnes CO2 per tonne of steel. Coal and coke use for iron production account for the largest share of these emissions. By comparison, a DRI-EAF route that uses green hydrogen produced from renewable power would virtually eliminate up to 95% of these emissions.

These differences underline that effective industrial decarbonisation requires a tailored approach. The Inclusive Forum on Carbon Mitigation Approaches (IFCMA) is the OECD’s flagship initiative to help optimise the global impact of emissions reduction efforts around the world through better data, information sharing, evidence-based mutual learning, and inclusive multilateral dialogue (see Figure 9).

• Develop and apply a standardised typology to enable systematic stocktake of mitigation and mitigationrelevant policies of IFCMA countries in a single database

• Map policies to their emissions base to identify the share of greenhouse gas emissions they cover

• Complement and support the work undertaken under the UNFCCC / Paris Agreement with improved comparibility of policies

By taking stock of different carbon mitigation approaches, mapping policies to the emissions they cover, and estimating their comparative emissions reductions, the IFCMA is enhancing understanding of the comparative impact of the full spectrum of carbon mitigation approaches deployed around the world.

• Develop and apply a consistent methodological approach to estimate the effects of policy instruments and policy packages on greenhouse gas emissions

• Work with country experts to couple country -specific sectoral models with economy -wide models to develop robust estimates

• Undertake a comprehensive and systematic review of ex-post empirical evidence on the effects of mitigation policies on emissions

The IFCMA is also exploring methodologies for computing sector- and product-level carbon intensity metrics and the challenges faced by firms that seek to calculate them, and will report on these efforts in 2024. The development and use of sector- and product-level carbon intensity metrics can play an important role in supporting the transition to net zero, particularly for the industry sector. They can help policymakers design, implement, and evaluate cost-effective mitigation policies, and can provide crucial information to steer firms and consumer decisions towards low-carbon products. Making strides in this direction will support the development of a global market for low-carbon goods. Finally, accurate and timely carbon intensity metrics are key to assessing carbon leakage risks and informing internationally coordinated solutions to reduce and manage such risks.

The various OECD insights on industrial decarbonisation are used in targeted projects to assist countries in strengthening their policy approach.

Examples include:

Exploring methodologies for computing carbon intensity of goods and sectors

• Survey methodologies using sector, installation, and product -level data

• Review challengesfaced by firms in collecting and verifying supply chain data

• Explore issues related to data variability ; and

• Consider the role of governments in supporting measurement and use of carbon intensity metrics , whlist minimising trade frictions and disproportionate costs for firms.

• the Production Transformation Policy Reviews with India, Chile and Egypt

• the assessment of policies for carbon-neutral industries in the Netherlands with further cooperation with Slovenia

• the cooperation within EFFECT with Trinidad and Tobago

• Environmental Performance Reviews

• cooperation with Indonesia, South Africa, Thailand and Egypt as part of the Framework for Industry’s net-zero Transition

• cooperation with Mongolia in SIPA

OECD Country Economic Surveys regularly assess the specific challenges countries face in decarbonising economies, including in the industry sector, and provide policy recommendations considering more general macroeconomic and socio-economic developments. The variety of OECD and non-OECD countries at the table in industrial decarbonisation cooperation makes this a truly global partnership.

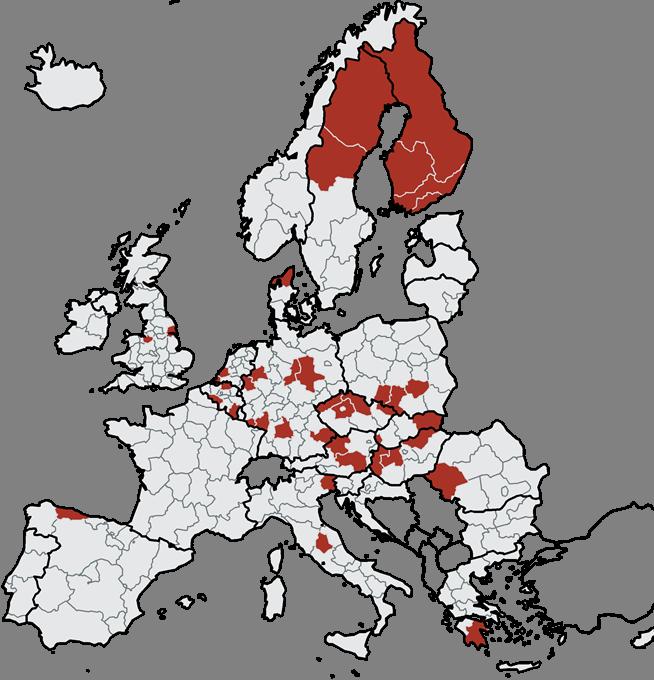

Industrial decarbonisation is not just a challenge for national policymakers. Because energy-intensive industries are often concentrated in certain regions, effective and inclusive transitions have an important regional dimension.

The OECD study Regional Industrial Transitions to Climate Neutrality explores the implications of the net-zero transition for key manufacturing sectors, where the challenge is particularly big and implies new forms of production (including new energy carriers

and new materials, requiring more investments), new infrastructure, and new skills. These industrial activities are typically regionally concentrated. In that context, the OECD identified the European regions most exposed to these transformations, both for managing the challenges and for exploiting opportunities (see Figure 10). These exposed regions will have to decarbonise production assets while at the same time capitalising on opportunities to ensure a just transition for their workers, for example, through reskilling. As the study shows, many of these regions are socio-economically weak. Supporting them in addressing these challenges is therefore key for a just transition and avoiding a geography of discontent.

Steel

The OECD has a longstanding focus on steel. Environmental performance of the steel sector has been in the limelight for quite some time, but has gained in importance in recent years. The iron and steel sector accounts for 7% of energy-related global CO2 emissions from the production of 1.8 Gt finished steel products (2021). The sector ranks as one of the highest emitting industry sectors by accounting for around 30% of all industrial CO2 emissions. With such a large carbon footprint, decarbonising the steel sector is key to achieving climate goals.

Baowu

ArcelorMittal

Ansteel

Nippon Steel

Shagang

POSCO

Jianlong HBIS

Shougang

Tata Steel

Nucor JFE

SAIL Cleveland Cliffs JSW

NLMK

IMIDRO

US Steel

Techint

Thyssenkrupp MMK

Erdemir Group

Liberty

BlueScope

Following on from the study on the Heterogeneity of Steel Decarbonisation Pathways mentioned above, current work focuses on decarbonisation strategies at firm level. This includes looking at barriers firms encounter and policies to address these, work on the circular economy steel scrap markets and trade in a decarbonisation context, as well as how hydrogen could reshape the global steel value chain. Hydrogen-based

OECD analysis shows that the steel industry is increasingly rising up to this challenge, with the number of net-zero pledges growing. Indeed, more than 90% of global steelmaking capacity and crude steel production are in countries that have announced a net-zero target. While these net-zero pledges are not directed to the steel sector alone (but to the whole economy), it is clear that such targets imply a fundamental shift in steel production modes (and industrial production in general) to bring it onto a netzero pathway. Echoing this, almost all regional steel champions have set targets for decarbonisation (Figure 11). Overall, at the end of 2021, companies with net-zero targets accounted for 30% of global steel production.

DRI production has received increasing attention as an enabler for renewable energy use and a CO2 emission mitigation. It is critical that hydrogen production does not emit CO2 to ensure that its use in blast furnaces or direct reduction plants leads to emission reductions. Using renewable electricity to produce hydrogen via electrolysis can lead to up to 95% less CO2 emissions than the coal and coke based conventional BF-BOF

process. In such cases, access to low-cost renewable power besides cheap electrolysers is critical for the competitiveness of hydrogen-based steel production (see Figure 12).

A topic of increasing interest is the nexus of steel capacity developments (excess capacity is once again rising) and decarbonisation. OECD analysis shows the importance of addressing the capacity and decarbonisation challenges in conjunction. Steelmaking capacity is expected to increase to 2,500 Mt by the end of 2023, marking the 5th consecutive year of growth, and outpacing the latest projections for steel demand. The capacity increase of 56 Mt in 2023 translates into the

highest annual volume increase in global capacity in a decade. For purposes of comparison, the global increase this year alone is roughly equivalent to the existing level of capacity of a major steel-producing economy, for example that of Brazil or Germany. Global steelmaking capacity is projected to increase significantly over the next three years (2024-2026), with 46 Mt of capacity additions underway and an additional 103.5 Mt in the planning stage. Most of the new capacity increases, especially in Asia, involve BF/BOF plants with relatively high emissions.

The production, conversion and waste management of plastics generate about 4% of total global greenhouse gas (GHG) emissions. The climate mitigation and plastic pollution policy domains have synergies because climate change and plastic policies influence plastics’ lifecycle GHG emissions through different channels. High ambition for both goals means tackling both issues

globally.

Building on its Global Plastics Outlook to 2060, the OECD work explores the interlinkages between climate change and plastic pollution and the policy solutions to address these two challenges simultaneously.

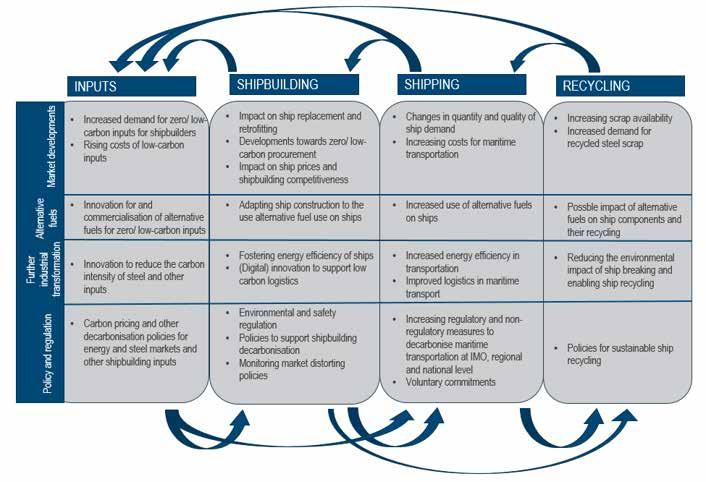

The shipping industry is responsible for approximately 3% of GHG emissions. A net-zero pathway requires the maritime sector to decarbonise by improving vessel designs, retrofitting energy saving technologies (ESTs) and accelerating the uptake of alternative fuels. Within the maritime value chain, the shipbuilding industry is responsible for an important share of the sector’s carbon footprint, and it is essential for designing and constructing efficient and less emission-intensive ships.

on shipbuilding shows, it is essential to assess GHG emissions and the environmental impact of ships throughout their entire lifecycle, and demonstrate how shipbuilding can help mitigate this. A lifecycle analysis of maritime industries can provide insights into the areas that contribute the most to emissions, and identify potential areas for improvement or bottlenecks in decarbonisation efforts.

Current OECD work on shipbuilding includes the mapping of maritime decarbonisation policies, analysis of marine technologies that help support the green and digital transition, and the development of a ship replacement model that allows for assessing how environmental regulation will affect demand for ships.

The role of SMEs

Many associate industrial decarbonisation with large-scale industrial production. Indeed, given the importance of scale, large entities play a central role in energy-intensive industries, although differences exist across sectors. However, OECD work shows that while entrepreneurs can help find the solutions needed for successful industrial decarbonisation, small and medium enterprises (SMEs) also have a significant footprint. OECD analysis helps tackle the lack of data and information around SMEs in environmental and climate analysis and policy.

For example, OECD analysis shows that in the manufacturing sector, SMEs (i.e., companies with less than 250 employees) account for between 30% and 38% of GHG emissions at the EU level (see Figure 13), while in the business sector as a whole (which includes services), SMEs generate between 37% and 41% of GHG emissions at the EU level.

OECD work also shows that SMEs in energy-intensive sectors and elsewhere lag behind larger enterprises across a wide range of environmental actions, hindered by lack of information and awareness, regulatory hurdles, limited access to knowledge

networks and innovation assets, skills gaps and financing constraints. Similarly, OECD analysis shows that SMEs have been heavily impacted by the recent energy crisis caused by Russia’s war in Ukraine, with many governments in OECD countries having progressively expanded liquidity support to help SMEs deal with the increased cost of energy.

At the same time, innovative SMEs and green entrepreneurs play a central role in green innovation and finding solutions to address climate change, and can play a pioneering role in introducing sustainable business practices and models. A recent OECD study shows how policymakers can help unleash the potential of green entrepreneurship in industrial sectors and elsewhere.

Achieving climate targets demands aligning policy frameworks across diverse areas with the pursuit of the transition to a low-carbon economy. OECD analysis shows that it is crucial to integrate a clear SME and entrepreneurship perspective in climate, environmental and circular economy policies and to mainstream an environmental perspective in broader strategies for SME development and entrepreneurship.

The need for an inclusive and tailor-made approach

A key OECD resource supporting policymakers in industrial decarbonisation is its recent industrial policy framework which includes strong emphasis on industrial decarbonisation policies and has for instance been applied to industrial decarbonisation in the Netherlands. This framework, which is based on a comprehensive overview of empirical analysis in the domain, has also been applied to various sectors (e.g. automotive) and technologies (e.g. hydrogen).

Currently, the framework is being applied to quantify industrial policy measures, with a view to better assess

their impact and effectiveness and provide policy advice on how to improve industrial decarbonisation policy measures. The Quantifying Industrial Strategies (QuIS) project gathers publicly available data and measures industrial strategies across OECD countries through harmonised data on industrial policy expenditures, their composition, their mode of delivery, and the characteristics of their beneficiaries. The results of QuIS show that green policies are on the rise and targeted.

QuIS also allows the comparison of approaches across countries. Figure 15 shows green industrial policies as a share of GDP and illustrates that in many countries most green industrial policies are either targeting the energy sector or are non-sectoral.

Fiscal spending policies adopted in the wake of the COVID-19 pandemic were presented as a unique opportunity to “build back better” and re-ignite the economy while accelerating the transition to a lowcarbon economy. As part of a project supported by the

Breakthrough Energy foundation, the OECD analysed 1166 funding measures announced by 51 countries and the European Union in 2020-21 to support the development and diffusion of low-carbon technologies

The total funding amounted to USD 1.29 trillion, but the industry sector received a mere 4%, with a vast majority (76%) focusing on support for carbon capture use and storage (CCUS) and hydrogen in industrial processes (see Figure 16). Going forward, it might be necessary to increase the share of public support to low-carbon technologies

targeted at the energy-intensive industrial sector, as part of a broader policy mix also including carbon pricing, standards and regulations, public infrastructure provision, public procurement, as well as skills, competition and entrepreneurship policies.

Note: Post-COVID public investments not targeting any sector or technology in particular (USD 8.5 bn) are excluded from this graph.

Source: Aulie, F., et al. (2023), “Did COVID-19 accelerate the green transition?: An international assessment of fiscal spending measures to support low-carbon technologies”, OECD Science, Technology and Industry Policy Papers, No. 151, OECD Publishing, Paris, https://doi.org/10.1787/5b486c18-en

Policy resources not only focus on OECD members, but also on developing and emerging economies. Through its Framework for industry’s net-zero transition: developing financing solutions in emerging and developing economies the OECD provides a stepby-step approach to assist emerging and developing economies in designing solutions for financing. It also aims to improve the enabling conditions that can accelerate industry’s transition across a multitude of hard-to-abate (e.g. steel, cement) and other industry sectors (e.g. industry clusters, small- and mediumenterprises) by looking at specific low-carbon technologies and approaches as well as industry value chains (see Figure 17). Collaboration with the

governments of Egypt (hydrogen for industrial uses and exports), Indonesia (steel and textile), South Africa (steel industry), and Thailand (petrochemicals) are underway in implementing the Framework for various industry sectors in the 2023-2025 period.

Solutions to

Source: OECD (2022)

The OECD is also an important resource for studies on industrial subsidies that are of relevance to decarbonisation, for instance analysing the climate implications of government support in aluminium smelting and steelmaking. OECD work shows that heavy industry and the production of renewable energy

1.

equipment tend to attract relatively more support than other industries (see Figure 18), with aluminium receiving government grants and below-market borrowings of almost 2% of revenues, and lower but significant shares for shipbuilding (0.8%), steel (0.6%) and chemicals (0.4%).

Below-market borrowings (% of revenue, weighted average) Government grants (% of revenue, weighted average)

Note: Data are expressed relative to the sales revenue of the firms covered in the 2021 study over the period 2005-19. The graph above does not include tax concessions since these are less comparable across countries and sectors than other forms of support. Below-market equity returns are not included either since their estimates are less precise and only concern certain specific sectors (e.g. semiconductors and aerospace & defence).

Source: OECD (2023)

OECD work on steel finds that subsidies for environmental purposes have increased fivefold from 2008 to 2016 as a share of total purpose stated, but have been decreasing continuously since then, resulting in an overall 136% increase from 2008 to 2020. Improving our understanding on what is a ‘good subsidy’ (from the perspective of decarbonisation but also in terms of effectiveness and minimal market and trade distortive impact) is a key question for the coming period. Further examples on policy work in industrial decarbonisation include policies to green shipbuilding as well the equitable framework on finance for extractive-based countries in transition (EFFECT) and for regional transitions.

OECD Committees and initiatives play a central role as platforms for dialogue and cooperation on industrial decarbonisation. The IFCMA, for instance, during its first meetings in February 2023, brought together delegations from 104 countries. The OECD Steel Committee brings together delegates from OECD and non-OECD steel producing economies as well as industry representatives and provides a unique platform for discussions on steel decarbonisation.

Similarly, the OECD Policy Dialogue on Global Value Chains, Production Transformation and Development provides a global platform for policy dialogue and knowledge-sharing between countries from Africa, Asia, Europe and the Americas, aiming at improving evidence and at identifying policy guidelines to support production transformation and sustainable and inclusive participation to local, regional and global markets.

The OECD Platform on Financing SMEs for Sustainability provides a forum to advance knowledge sharing, data and analytical work, and policy dialogue on

sustainable finance for SMEs. By bringing together public and private financial institutions, governments, fintech companies, regulators and SME representatives, the platform aims to fill in awareness gaps and develop and share innovative, workable solutions and good practices for finance providers, SMEs and governments.

The OECD and the IEA have also been tasked to provide the Interim Secretariat for the Climate Club, which was established following the Germany G7 Presidency in 2022, and which is expected to provide a further platform for delivering on industrial decarbonisation.

Below please find an exhaustive list of databases, resources, reports and papers referenced in this document.

Databases & resources

OECD International Programme for Action on Climate (IPAC): https://www.oecd.org/climate-change/data

OECD Climate Action Dashboard: https://www.oecd. org/climate-action/ipac/dashboard

OECD Climate Action Monitor: https://www.oecd. org/climate-action/ipac/the-climate-actionmonitor-2022-43730392

OECD Regional Statistics on industrial emissions: https://stats.oecd.org/Index. aspx?DataSetCode=REGION_DEMOGR

OECD Data on Carbon dioxide emissions embodied in international trade: https://www.oecd.org/sti/ind/ carbondioxideemissionsembodiedininternationaltrade. htm

OECD Steel decarbonisation dashboard: https://www. steelforum.org/steel-indicator-decarbonisationdashboard.pdf

OECD Policy Instruments for the Environment Database (PINE): https://oecd-main.shinyapps.io/pinedatabase/

OECD/EC Science, Technology, Innovation Policy compass (STIP): https://stip-pp.oecd.org/stip/

IMF/OECD/World Bank/WTO Subsidy Platform: https:// www.subsidydata.org/en/subsidydata/home

OECD International property statistics and analysis: https://www.oecd.org/sti/inno/intellectual-propertystatistics-and-analysis.htm

OECD Best Available Techniques (BAT) to Prevent and Control Industrial Pollution: https://www.oecd.org/ chemicalsafety/risk-management/best-availabletechniques.htm#Activity6

OECD Sustainable Infrastructure Programme in Asia: https://www.oecd.org/site/sipa/

OECD Clean Energy Finance and Investment Mobilisation: https://www.oecd.org/cefim/

OECD/World Bank HYDROGEN FOR DEVELOPMENT PARTNERSHIP (H4D): https://www.esmap.org/ Hydrogen_for_Development_Partnership_H4D

OECD Production Transformation Policy Reviews (PTPRs): https://www.oecd.org/dev/productiontransformation-policy-reviews-ptpr.htm

OECD Environment Performance Reviews: https://www. oecd-ilibrary.org/environment/oecd-environmentalperformance-reviews_19900090

OECD Resource Productivity and Waste: https://www. oecd.org/environment/waste/

OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: https://mneguidelines.oecd.org/mining.htm

OECD Handbook on Environmental Due Diligence in Mineral Supply Chains: https://mneguidelines.oecd. org/duediligence/dd-minerals-handbook.htm

OECD Economic Surveys: https://www.oecd.org/ economy/surveys

OECD Inclusive Forum on Climate Mitigation Approaches: https://www.oecd.org/climate-change/ inclusive-forum-on-carbon-mitigation-approaches

OECD Environmental Performance in the Steel Sector: https://www.oecd.org/sti/ind/steel-environmentenergy-efficiency.htm

OECD Steelmaking Capacity: https://www.oecd.org/ industry/steelcapacity.htm

OECD Shipbuilding: https://www.oecd.org/sti/ind/ shipbuilding.htm

OECD Implementation Toolkit The OECD Recommendation on SME and Entrepreneurship Policies: https://www.oecd.org/cfe/smes/implementationtoolkit-for-the-oecd-recommendation-on-sme-andentrepreneurship-policy.pdf

OECD Quantifying Industrial Strategies (QUIS): https:// www.oecd.org/industry/industrial-policy-andstrategies/quantifying-industrial-strategies/

OECD Platform on Financing SMEs for Sustainability: https://www.oecd.org/cfe/smes/financing-smessustainability.htm

OECD Policy Dialogue on Global Value Chains, Production Transformation and Development: https:// www.oecd.org/dev/global-value-chains.htm

Climate Club: https://climate-club.org/

Reports & papers

Anderson, B., et al. (2021), “Policies for a climate-neutral industry: Lessons from the Netherlands”, OECD Science, Technology and Industry Policy Papers, No. 108, OECD Publishing, Paris, https://doi.org/10.1787/a3a1f953-en

Aulie, F., et al. (2023), “Did COVID-19 accelerate the green transition?: An international assessment of fiscal spending measures to support low-carbon technologies”, OECD Science, Technology and Industry Policy Papers, No. 151, OECD Publishing, Paris, https://doi. org/10.1787/5b486c18-en

Borgonovi, F., et al. (2023), “The effects of the EU Fit for 55 package on labour markets and the demand for skills”, OECD Social, Employment and Migration Working Papers, No. 297, OECD Publishing, Paris, https://doi. org/10.1787/6c16baac-en

Cammeraat, E., A. Dechezleprêtre and G. Lalanne (2022), “Innovation and industrial policies for green hydrogen”, OECD Science, Technology and Industry Policy Papers, No. 125, OECD Publishing, Paris, https://doi.org/10.1787/ f0bb5d8c-en

Cervantes, M., et al. (2023), “Driving low-carbon innovations for climate neutrality”, OECD Science,

Technology and Industry Policy Papers, No. 143, OECD Publishing, Paris, https://doi.org/10.1787/8e6ae16b-en

Cordonnier, J. and D. Saygin (2022), “Green hydrogen opportunities for emerging and developing economies: Identifying success factors for market development and building enabling conditions”, OECD Environment Working Papers, No. 205, OECD Publishing, Paris, https:// doi.org/10.1787/53ad9f22-en

Criscuolo, C., et al. (2022), “An industrial policy framework for OECD countries: Old debates, new perspectives”, OECD Science, Technology and Industry Policy Papers, No. 127, OECD Publishing, Paris, https:// doi.org/10.1787/0002217c-en

Dellink, R. (2020), “The consequences of a more resource efficient and circular economy for international trade patterns: A modelling assessment”, OECD Environment Working Papers, No. 165, OECD Publishing, Paris, https:// doi.org/10.1787/fa01b672-en

Dechezleprêtre, A., et al. (2023), “How the green and digital transitions are reshaping the automotive ecosystem”, OECD Science, Technology and Industry Policy Papers, No. 144, OECD Publishing, Paris, https:// doi.org/10.1787/f1874cab-en

Dobrinevski, A. and R. Jachnik (2020), “Exploring options to measure the climate consistency of real economy investments: The manufacturing industries of Norway”, OECD Environment Working Papers, No. 159, OECD Publishing, Paris, https://doi.org/10.1787/1012bd81-en

Garsous, G., D. Smith and D. Bourny (2023), “The climate implications of government support in aluminium smelting and steelmaking: An Empirical Analysis”, OECD Trade Policy Papers, No. 276, OECD Publishing, Paris, https://doi.org/10.1787/178ed034-en

Gourdon, K. (2019), “Ship recycling: An overview”, OECD Science, Technology and Industry Policy Papers, No. 68, OECD Publishing, Paris, https://doi. org/10.1787/397de00c-en

IMF, OECD et al. (2022), Subsidies, Trade, and International Cooperation, Éditions OCDE, Paris, https:// doi.org/10.1787/a4f01ddb-en

Immervoll, H., et al. (2023), “Who pays for higher carbon prices?: Illustration for Lithuania and a research agenda”, OECD Social, Employment and Migration Working Papers, No. 283, OECD Publishing, Paris, https:// doi.org/10.1787/8f16f3d8-en

Keese, M. and L. Marcolin (2023), “Labour and social policies for the green transition: A conceptual framework”, OECD Social, Employment and Migration Working Papers, No. 295, OECD Publishing, Paris, https:// doi.org/10.1787/028ffbeb-en

Kowalski, P. and C. Legendre (2023), “Raw materials critical for the green transition: Production, international trade and export restrictions”, OECD Trade Policy Papers, No. 269, OECD Publishing, Paris, https://doi.org/10.1787/ c6bb598b-en

Livingstone, L., et al. (2022), “Synergies and trade-offs in the transition to a resource-efficient and circular economy”, OECD Environment Policy Papers, No. 34, OECD Publishing, Paris, https://doi.org/10.1787/ e8bb5c6e-en

Marchese, M. and Medus, J. (2023), Assessing greenhouse gas emissions and energy consumption in SMEs. Towards a pilot dashboard of SME greening and green entrepreneurship indicators, OECD Publishing Paris, forthcoming.

Mercier, F. et L. Giua (2023), « Subsidies to the steel industry: Insights from the OECD data collection », OECD Science, Technology and Industry Policy Papers, n° 147, Éditions OCDE, Paris, https://doi.org/10.1787/06e7c89ben

Noels, J. and R. Jachnik (2022), “Assessing the climate consistency of finance: Taking stock of methodologies and their links to climate mitigation policy objectives”, OECD Environment Working Papers, No. 200, OECD Publishing, Paris, https://doi.org/10.1787/d12005e7-en

OECD (2023), Job Creation and Local Economic Development 2023: Bridging the Great Green Divide, OECD Publishing, Paris, https://doi. org/10.1787/21db61c1-en

OECD (2023), OECD Science, Technology and Innovation Outlook 2023: Enabling Transitions in Times of Disruption, OECD Publishing, Paris, https://doi. org/10.1787/0b55736e-en

OECD (2023), The Heterogeneity of Steel Decarbonisation Pathways, OECD Publishing, Paris, https://doi. org/10.1787/fab00709-en

OECD (2023), Regional Industrial Transitions to Climate Neutrality, OECD Regional Development Studies, OECD Publishing, Paris, https://doi.org/10.1787/35247cc7-en

OECD (2023), Assessing and Anticipating Skills for the Green Transition: Unlocking Talent for a Sustainable Future, Getting Skills Right, OECD Publishing, Paris, https://doi.org/10.1787/28fa0bb5-en

OECD (2023), “SME policy responses to the 2022/2023 energy crisis: Policy highlights and country experiences”, OECD SME and Entrepreneurship Papers, No. 43, OECD Publishing, Paris, https://doi.org/10.1787/80012fbd-en.

OECD (2023), OECD Skills Outlook 2023: Skills for a Resilient Green and Digital Transition, OECD Publishing, Paris, https://doi.org/10.1787/27452f29-en

OECD (2023), “Government support in industrial sectors: A synthesis report”, OECD Trade Policy Papers, No. 270, OECD Publishing, Paris, https://doi. org/10.1787/1d28d299-en

OECD (2022), “Framework for industry’s net-zero transition: Developing financing solutions in emerging and developing economies”, OECD Environment Policy Papers, No. 32, OECD Publishing, Paris, https://doi. org/10.1787/0c5e2bac-en

OECD (2022), Equitable Framework and Finance for Extractive-based Countries in Transition (EFFECT), OECD Development Policy Tools, OECD Publishing, Paris, https://doi.org/10.1787/7871c0ad-en

OECD (2022) ASSESSING STEEL DECARBONISATION PROGRESS READY FOR THE DECADE OF DELIVERY?

https://www.oecd.org/industry/ind/assessing-steeldecarbonisation-progress.pdf

OECD (2022), “Financing SMEs for sustainability: Drivers, Constraints and Policies”, OECD SME and Entrepreneurship Papers, No. 35, OECD Publishing, Paris, https://doi.org/10.1787/a5e94d92-en

OECD (2022), Policies to Support Green Entrepreneurship: Building a Hub for Green Entrepreneurship in Denmark, OECD Studies on SMEs and Entrepreneurship, OECD Publishing, Paris, https://doi.org/10.1787/e92b1946-en

OECD (2022), Global Plastics Outlook: Policy Scenarios to 2060, OECD Publishing, Paris, https://doi.org/10.1787/ aa1edf33-en

OECD (2021), Policies for a Carbon-Neutral Industry in the Netherlands, OECD Publishing, Paris, https://doi. org/10.1787/6813bf38-en

OECD (2021), “No net zero without SMEs: Exploring the key issues for greening SMEs and green entrepreneurship”, OECD SME and Entrepreneurship Papers, No. 30, OECD Publishing, Paris, https://doi. org/10.1787/bab63915-en

OECD (2019), Global Material Resources Outlook to 2060: Economic Drivers and Environmental Consequences, OECD Publishing, Paris, https://doi. org/10.1787/9789264307452-en

OECD (2017) ANALYSIS OF SELECTED MEASURES

PROMOTING THE CONSTRUCTION AND OPERATION OF GREENER SHIPS https://www.oecd.org/industry/ind/ analysis-of-measures-promoting-greener-ships.pdf

Yamaguchi, S. (2021), “International trade and circular economy - Policy alignment”, OECD Trade and Environment Working Papers, No. 2021/02, OECD Publishing, Paris, https://doi.org/10.1787/ae4a2176-en

Yamaguchi, S. (2022), “Securing reverse supply chains for a resource efficient and circular economy”, OECD Trade and Environment Working Papers, No. 2022/02, OECD Publishing, Paris, https://doi.org/10.1787/6ab6bb39-en

https://www.oecd.org industrial.decarbonisation@oecd.org

@OECD_ENV