Balancing prudential regulation and competition policy: FinTech’s impact

Xavier Vives

IESE Business School OECD, December 2025

Xavier Vives

IESE Business School OECD, December 2025

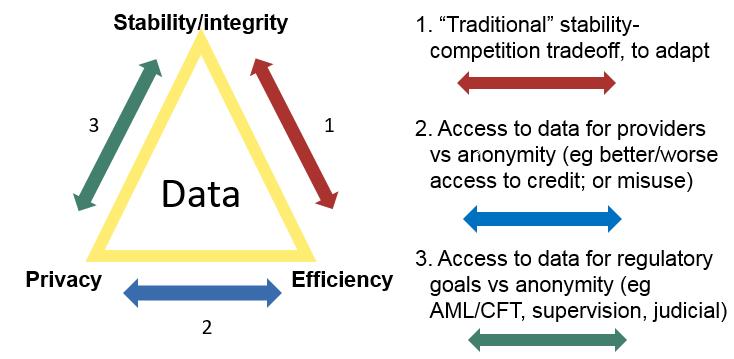

• The promised efficiency benefits of information technology (IT) come together with concerns about stability, inclusion, privacy and welfare implications.

• The evidence of the impact on the concerns is mixed (on defaults, inclusion and the effects of open banking).

• IT presents new policy trade-offs and sharpens existing ones.

Source: Carletti, Claessens, Fatás and Vives (2020)

• If we could eliminate market failure arising from asymmetric information and externalities, we would be better off with more competition.

• Regulation can alleviate the competition-stability trade-off but not eliminate it.

• With better regulation, we can have more competition without endangering stability.

–E.g., risk-based deposit insurance premiums

• Capping deposit rates to limit systemic risk when weak institutions exploit deposit insurance (Spain, Portugal).

• Resolution of failing entities' sale (e.g., HBOS-Lloyds, UBS-CS) may lead to the formation of anticompetitive and TBTF market structures.

• Compliance costs as a barrier to expansion/entry for small banks/new entrants:

– Reduce regulatory burden for small banks, but correlated strategies induce systemic risk e.g., S&Ls, SVB crisis)

• Increased competitive pressure (e.g., open banking) needs enhanced capital.

• Competition policy as a credible tool to check TBTF:

– Competitive distortion based on the advantage of being TBTF.

– Competition Authority may impose structural and conduct measures on TBTF-helped entities. Divergence US-EU

Should regulation aim at a level playing field or favor entrants to promote competition?

What are the implications of fintech entry for financial stability?

Examples:

Price discrimination

Open banking (California CPA, Europe’s GDPR vs PSD2, DMA)

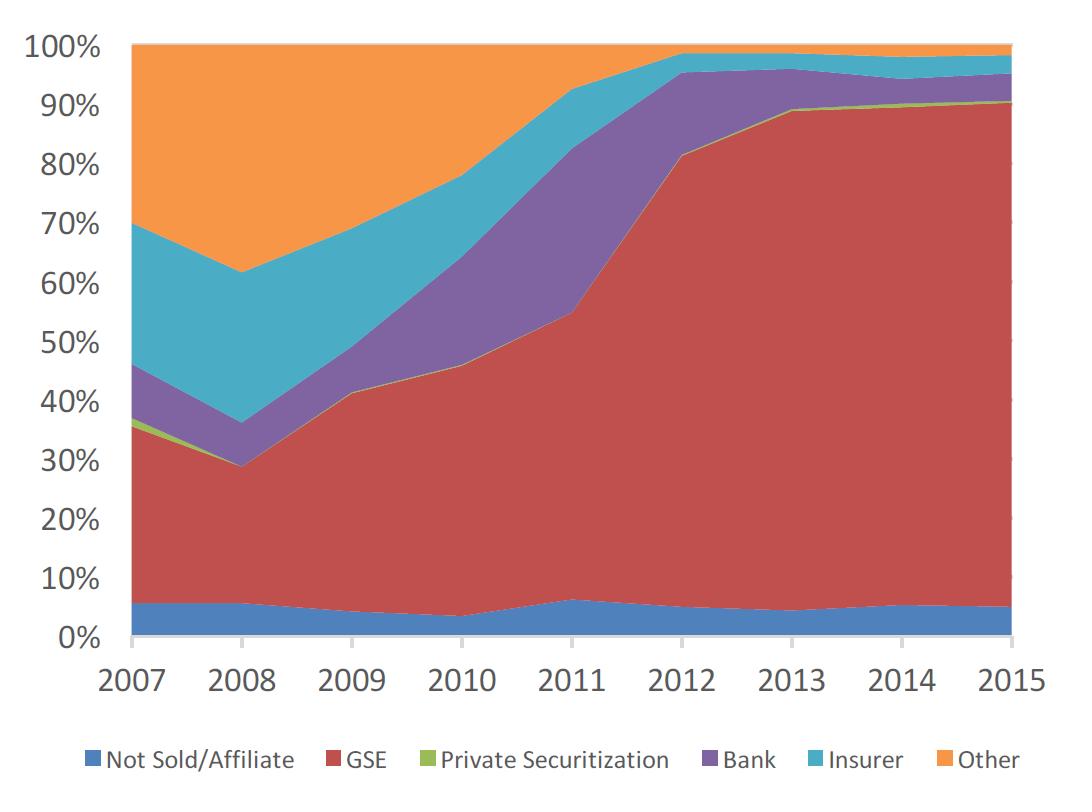

US mortgage market

• Whether IT reduces distance frictions—physical or informational— between intermediaries and borrowers, thereby affecting market differentiation and competition.

• The severity of incentive frictions of the borrowers such as moral hazard.

• Whether lenders can price discriminate and the degree of bank concentration.

• The efficiency gap between fintechs and banks (in terms of monitoring, screening, or convenience).

• The intensity of inter-fintech competition.

• The size of the unbanked population.

• The presence of economies of scope between lending and payment services.

• Explicit and implicit insurance mechanisms.

• Fintechs can price more flexibly (technology and regulation).

• Price discrimination is a competitive weapon that need not be welfare optimal unless it extends the market.

• For welfare, one must balance the incentives of entrepreneurs and intermediaries to exert effort, mitigating moral hazard and encouraging participation by entrepreneurs, while enhancing monitoring or screening by lenders.

– This balance does not typically require price discrimination.

– However, allowing banks to discriminate when fintechs do discriminate improves welfare when there is little inter-fintech competition.

• Asymmetries in the obligations to share customer data between banks and fintechs may create an uneven playing field.

• Data sharing policy that benefits fintechs (e.g., open banking) has to be complemented with an appropriate degree of inter-fintech competition.

• When payment fintechs compete with banks, they do not internalize that depriving banks of payment data may hurt their loan provision, although it may improve the payment service.

• Leveling the playing field (in terms of the ability to price discriminate and access to information) is a good policy if it aims at a degree of competition that induces a division of rents that balances the incentives of different market participants.

• Due to prudential concerns, there are limits to how level the field can be (activity vs entity regulation).

• FinTech will tend to increase contestability in financial services but also raise the tension between the objectives of different regulators:

– the banking regulator worried about financial stability,

– the competition authority worried about customer welfare (in parallel to consumer protection regulation), and

– the data regulator worried about privacy.

• Carletti, E., Claessens, S., Fatás, A. and Vives, X., “The Bank

Business Model in the Post-Covid-19 World”, 2020, CEPR.

• Vives, X. and Z. Ye, “Fintech Entry, Lending Market Competition and Welfare”, Journal of Financial Economics, 2025, 168, 104040.

• Vives, X. and Z. Ye, “Information Technology and Lender Competition”, Journal of Financial Economics, 2025, 163, 103957.

• Vives, X., “FinTech Competition in Lending”, 2025, White Paper, Wharton Initiative on Financial Policy & Regulation.

• Vives, X. “Digital Disruption in Banking”, The Annual Review of Financial Economics, 2019, 11, 243-272.