MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS

STRATEGIC APPROACH

PERFORMANCE

STRATEGIC APPROACH

PERFORMANCE

2023 was a decisive year for the Nors Group. Over these twelve months, as we celebrated our 90-year legacy with great enthusiasm, we looked to the future, paving the way for significant achievements in the years to come. This year was driven by the motto "A legacy of future".

2023 was indeed pivotal in shaping Nors' horizon for the upcoming years: we know where we want to be and how to get there. From defining our future vision, anchored in the presentation of the Nors' strategy through 2030, named "Making our future work", to the successful implementation of several strategic internal projects, to expanding our global presence - with the acquisition of two new companies that reinforce the Group’s geographic footprint and its business diversification strategy - every step we took was guided by a shared vision of excellence

and sustained growth. This is and will continue to be, the driving force behind our ambition for the years ahead: with a structural focus on development, efficiency, transformation, People, and sustainability, we are paving a path that can only be expected to be ambitious, innovative, and prosperous.

Thus, it was only natural that we reflected a strong spirit of commitment within the organisation, leading the Group’s economic performance to positive levels. In a year characterised by unpredictable geopolitical scenarios, the unfavorable behaviour of some commodities impacting our business, and constraints arising from macroeconomic contexts and restrictive monetary policies in some of the markets where we operate (particularly in Angola), we achieved remarkable results and, once again, ended this year with a sense of fulfilled duty.

For 2024 We will take the lessons learned and the energy that characterised us to 2024. The challenges ahead are opportunities to innovate, grow, and have a lasting impact on our businesses, clients, and employees. A year of great news awaits us, and above all, with a vast certainty: we will be increasingly united, closer, and more Nors.

Throughout 2023 we have embarked on a journey of ambition in which we have celebrated, with great enthusiasm, our “legacy of future”. Under this motto, we have marked an essential milestone in our journey: the 90 years of Nors Group.

We have materialised this expression on several occasions, always with the premise of uniting our heritage - a part of history and legacy - with the ambition we have set for the future.

Together with all those who have been or are part of this journey, we celebrated 90 years of and incredible history, marked by audacity, growth, and optimism for the future we are building.

This success story would not have been possible without all those who build it with us on a daily basis. Thus, from the early stages, we wanted to celebrate with everyone involved, from current to former employees of the Group, stakeholders, clients, and suppliers.

The engagement and commitment of our People and all those we “invited to our birthday party” was amazing.

Together we spoke with one voice and told our story of ambition and success, highlighting what is still to come!

It was unavoidable for us to dedicate an issue of Nors Magazine to this meaningful celebration.

Thus, we have focused the articles, the interviews, and the news of the 5th edition on the 90 years of stories, sharing, and culture that characterise us.

The year 2023 began with the Kick-Offs in all of our companies and structures through the geographies in which Nors operates, with a transversal and unique message celebrating our 90 years of existence.

At the Annual Meeting which took place in September and gathered the top management of our geographies, this milestone was also one of the inevitable themes of the event.

kick-offs all over the world Centre

A 90-year journey would have been impossible without the right People by our side. Therefore, we made a point to reinforce the culture of appreciation and recognition that we uphold through seniority honours and the We Nors Awards, where we honoured six categories and received 381 applications. Additionally, we awarded a special “90 Years” prize to the “Mãos à Obra” project, carried out by the Nors teams in Angola.

this 90-year history would not have been possible without our People

1.2. business areas

With over 90 years of legacy, the Nors Group is historically associated with its leadership in heavy mobility and construction and agricultural equipment sectors, being the leading partner of the Volvo Group since 1933. Currently, with a more diversified portfolio, Nors also integrates other complementary business units in areas as diverse as recycling systems or the insurance sector, always with the fundamental premise of responding, in a cross-cutting and integrated manner, to the needs of our customers worldwide.

NORS AFTERMARKET

NORS VENTURES

The Nors Mobility segment aggregates a set of solutions capable of responding to our customers' mobility and transportation needs.

From heavy vehicles, such as trucks and buses, to cars, generators and marine and industrial engines, we guarantee a dedicated offer with a global scope. In this business area, we integrate the Auto Sueco, Auto Sueco Automóveis, Galius and KinLai brands.

Auto Sueco started its activity in Portugal with the distribution of Volvo brand products. Today, with decades of history, besides Portugal, it is also present in 5 marketsAngola, Brazil, Botswana, Mozambique and Namibia - with a portfolio of products and services adapted to each geography. Taking a transversal approach, it distributes a diversified range of products, with a focus on Volvo trucks. The offer also encompasses Volvo buses, Volvo Penta marine and industrial engines, Kohler-SDMO generators and Isuzu buses, among others.

Auto Sueco Automóveis is the Nors Group brand that operates in the automotive retail market in Portugal. With six dealerships from the north to the south of the country, it represents a portfolio of brands in the light vehicle seg ment - Volvo, Mazda, Land Rover, Jaguar, and Honda. Ensures a complete response to market needs, combining commercial solutions with the guarantee of a 360º service in the after-sales area.

Galius began its operation in 2015, with the exclusive representation of Renault Trucks in the Portuguese market. Specialised in the commercialization of new and used trucks, it provides a transversal offer to the different transport sectors: distribution, construction, long distance, among others. It also guarantees an agile, integrated and efficient after-sales service, with a distribution and assistance network that includes nine locations throughout the country.

KinLai, founded in 2020, is the official distributor of Dongfeng Trucks in Angola. With a diversified portfolio of trucks, aimed at the medium and high ranges, it also operates in the medium duty segment, as well as in the pick-up and SUV segments.

It also bets on offering special solutions, responding to the Angolan market's most particular needs.

The Nors Off-Road segment includes the Nors Group's construction, industrial and agricultural equipment distribution business.

This business area includes the Agrofito, AgroNew, Auto Maquinaria, Strongco, Nors Centro Oeste and Ascendum brands.

Agrofito has been the official distributor of Case IH in the state of Mato Grosso for 20 years. It sells grain harvesters, tractors, planters, and sprayers and provides technical assistance services for this range of equipment. It has four branches in the municipalities of Rondonópolis, Primavera do Leste, Campo Verde, and Paranatinga.

AgroNew is the official distributor of Case IH Agriculture, the Case New Holland brand for agricultural equipment, in the state of São Paulo. Starting its operation in 2002, AgroNew ensures the supply of the municipalities of Catanduva and Votupuranga and encompasses the distribution of three main products: agricultural tractors, grain harvesters and sugar cane harvesters, the main product sold in this area of operation.

Focused on the premises of quality, safety and performance, Auto Maquinaria started its operation in 2005 with the goal of providing a wide range of construction equipment in the Angolan territory. Providing integrated sales and after sales solutions, Auto Maquinaria is the official distributor for Volvo Construction Equipment in Angola, also representing Groove, Hyster, Epiroc and SDLG products in this market.

Nors Centro Oeste distributes construction equipment from Volvo Construction Equipment in Mato Grosso and Mato Grosso do Sul, Brazil. It represents the Nors operation in Brazil in the construction equipment sector and has facilities in Campo Grande, Dourados, Cuiabá, Sinop, and Juínathe current Nors network in Brazil.

Strongco is the largest dealer of Volvo Construction Equipment construction and infrastructure equipment I n Canada. With operations in 26 branches spread across the provinces of Alberta, Ontario, Quebec, Nova Scotia, New Brunswick, Newfoundland and Labrador and Prince Edward Island. Strongco was acquired by Nors in March 2020.

Ascendum, present in 14 countries, is one of the largest global distributors of Volvo Construction Equipment. Founded in 1959, it sells industrial and construction equipment, providing the respective technical assistance, equipment rental and logistics operations. With a transversal offer, it operates in sectors as diverse as construction and public works, extraction and transformation, handling and logistics, agriculture, energy, among others.

Nors Aftermarket is the Group's business segment that encompasses the distribution and retail of multi-brand parts for cars, trucks and buses.

This business area includes the brands Civiparts, in the heavy vehicle segment, and AS Parts and OneDrive, in the light vehicle segment.

Founded in 1982, Civiparts joined the Nors Group in 2003. Currently present in the Portuguese and Angolan markets, Civiparts specializes in the distribution of multi-brand workshop parts and equipment for the heavy vehicle segment (trucks and buses).

AS Parts starts its operation as a wholesaler in 2006, specializing in the independent distribution of parts, components and bodywork for the light vehicle segment, in Portugal.

With a wide multi-brand offer and having logistics efficiency and agility as its main competitive factors, AS Parts guarantees delivery coverage throughout the national territory, supplying numerous workshops and shops all over the country.

Under the OneDrive brand, the Group operates in the retail market of parts and accessories for light vehicles.

With distribution points in Portugal and Angola, OneDrive provides integrated services for parts identification, quotation, ordering and invoicing, ensuring a fast shipping and delivery service and specialised technical support.

Nors Ventures is the Group's business segment that encompasses complementary businesses and solutions. From insurance mediation to environmental solutions, through the commercialization of construction glass, this business axis has as its main goal to add value to the operation in a transversal logic. Here, we find the brands Sotkon and Amplitude Seguros.

Amplitude Seguros is an insurance and risk management consultancy, operating in different sectors of the economy and directing its offer to the Private and Business segments. Based in Portugal, Amplitude Seguros affirms a global presence through partnership agreements with different brokers, guaranteeing quality service to clients operating internationally, in any geography.

Present in Portugal, Spain, France, Angola and Turkey, Sotkon joined the Nors Group in 2008. Specialized in the development, marketing and distribution of modular systems for recycling and collection of urban waste through underground containers, it has more than 30,000 units installed worldwide.

1.3 big numbers

In the United States, Turkey, Central Europe, Mexico, Spain and Portugal, the Ascendum Group’s contribution is considered 100%, despite this joint venture being accounted for using the equity method.

1.3.1. business big numbers, bigger results

1.3.2. People

Training hours 30 Nationalities

445 men

89 women management positions

534

1.4. governance model

The Governance Model identifies the Group's top management bodies and how they relate to each other. At Nors , the key governance bodies of the corporate model are the Board of Directors and the Executive Board, which has delegated powers for the day-to-day management of the Group. Other corporate governance bodies include the Statutory Auditor, the Remuneration Committee and the Company Secretary.

Nors ' Governance Model reflects the Group's purpose and value proposal, as well as a set of other governance principles that guide the organisation's morphology and its actions with its key stakeholders, of which we highlight:

Nors employees must guide their conduct by principles of honesty, integrity and absolute respect for Human Rights. legal and regulatory compliance

All Group employees must, within the scope of their functions, comply with the law and internal regulatory documentation.

The Group fosters an open, collaborative environment that promotes the sharing of organisational knowledge.

innovation and creativity

Nors promotes and values an environment of constant innovation and creativity, allowing the organisation to evolve and follow the latest market trends in its different areas of activity.

composition, operation and responsibilities by body

The General Meeting is made up of all the shareholders with voting rights in the Group's parent company, Nors , S.A..

remuneration committee

The Remuneration Committee is elected at a General Meeting. Is responsible to define the remuneration of the company’s governing bodies.

By law, supervision of the company is led by a Statutory Auditor, who will be a chartered accountant or a firm of chartered accountants. The Statutory Auditor has the powers that the law attributes to the Audit Committee.

The Group is managed by a Board of Directors elected at a General Meeting. The Board of Directors has the overall power to lead and manage the Group within the scope of the corporate purpose and the powers attributed to it by the Nors , S.A. articles of association.

The Executive Board is responsible for defining and implementing the transversal policies which materialise the strategy approved by the Board of Directors. It is also responsible for the day-to-day management of the Group's portfolio, monitoring the performance of its business areas and operations.

Tomás Jervell

Nascimento

Ana Peneda Member of Nors Executive

Jorge Guimarães

José Jensen Leite de Faria

Júlio Rodrigues Member of Nors Executive

Luís Jervell Non

Tomás Jervell

Group CEO

Francisco Ramos Chief Operating Officer

José Jensen Leite de Faria Chief Corporate Officer

Jorge Guimarães Chief Operating Officer

Júlio Rodrigues Chief Corporate Officer

Peneda Chief People Officer

Rui Miranda Chief Financial Officer

Ana

structure portugal NORSMOBILITY NORSAFTERMARKET NORSVENTURES brazil NORSMOBILITY NORSOFF-ROAD canada NORSOFF-ROAD angola NORSMOBILITY NORSOFF-ROAD NORSAFTERMARKET botswana NORSMOBILITY NORSOFF-ROAD namibia NORSMOBILITY mozambique NORSMOBILITY NORSOFF-ROAD ascendum Portugal , USA , Mexico , Turkey ,

1.4.3. ownership structure

ownership structure

The share capital of Nors , S.A, which is fully subscribed and paid up, is 30 million Euros (30,000,000 shares with a nominal value of 1 (one) Euro).

Nors ’ capital is still held by the two founding families: the Jervell Family and the Jensen Family. On 31 December 2023, the breakdown of the company’s share capital was as follows:

2.1. our strategy for 2030

Throughout 2023, we stabilised and presented the Nors strategy until 2030, based on the motto 'Making our future work'.

This path will necessarily shape our future together and it implies everyone's involvement and participation in this journey from the beginning.

This new strategic cycle resulted from a collaborative exercise carried out over 18 months, involving the participation of People from different areas, sectors, and cultures, with the explicit intention of building an inspiring vision for the future, with the ability to mobilise all the People who make up the Nors universe.

With the assumption of reflecting the ambition to develop a company that is a source of pride for all, perpetuating the enduring legacy that already exists, we aim for a cultural change, ensuring an even more courageous, strong, and inspiring Nors in 2030.

This way, we have divided our actions into five pillars that systematise the Group's organisational commitment to the future: Growth, Efficiency, Transformation, People and Sustainability. Each of these pillars reflects ambitions and objectives that will determine Nors' future, and all of them play a crucial role in achieving the path we propose to pave.

efficiency

We want to grow, build a stronger Nors, and be ready to embrace the future. We know where we want to go and do it in a balanced, profitable, and secure way, emphasising portfolio diversification, strategic geographical expansion, and innovation. We need to focus daily on efficiency and results optimisation, always keeping the customer at the centre of our decisions and prioritising the value of their time.

Growth has played a pivotal role in Nors' success over the past 90 years and will play a fundamental role in building renewed success in its future. We aim to grow sustainably, promoting the development of a circular economy based on trusted partners who share our commitment to the future anchored in a culture of integrity.

NorsThe Nors Group's History over the past years is a tale of sustained growth. It's a journey that, far more than a sprint, resembles a marathon, and we aim to reach its final goal successfully, knowing that we are still at the beginning. In the sector where it operates, the Nors Group is already a truly global player, and we aspire to continue growing in a balanced manner, both in terms of products and geography.

Efficiency should be promoted in everything we do and deliver so that, in the end, we can achieve our ultimate ambition of a high-performance organisation that propels us to the level of differentiation and value addition we aspire to. To do so, we need to have a technological and sophisticated environment associated with our operations and leverage the Group's technological transformation and digitalisation project to underpin the challenges we face and enable customers to recognise our service's evolution, improvement and quality.

Francisco Ramos Group's COO Jorge Guimarães Nors Group's COO Júlio Rodrigues Nors Group's' CCOTransformation is a theme we have discussed extensively throughout the strategy's definition, and it is an essential pillar to achieve our ultimate vision, allowing us to create more value and remain relevant in the future. It seems clear to me that the roadmap we have designed for technological transformation will enable us to make the technological leap we need, but this leap is only relevant if the customer feels it. I am very proud of the customer focus and their presence at the centre of our decisions, which makes all the difference.

José Leite Faria Nors Group's CCO

We aim to be a driving force for transformation and always to remain relevant and adapt to the evolving context in which we live. Digitalisation and investment in innovation will be crucial for us to be prepared to face future challenges.

People are our most important asset; companies are the People who compose them and without our People we cannot embark on the growth and sustainability journey we have envisioned for the future. Hence, this pillar is the cornerstone of our strategy. We want to ensure we have happy and loyal employees eager to be part of Nors.

Ana Peneda Nors Group's CPOBecause we would not exist without People, we place our employees at the centre of our strategy. We aim to inspire, empower, and energise all our employees, promoting a more united Nors with a widespread sense of belonging through a strong and unique organisational culture.

Finally we want to be more sustainable, committed to leaving a better world for future generations through significant investment in sustainability actions and social initiatives within our communities. This is, indeed, the foundation of all the other pillars.

Sustainability appears as the foundation of our strategy, and I believe we genuinely embrace this because we understand that business behaviours that do not fulfill commitments to society, the environment, and future generations, focused solely on internal interests and financial returns, have a bleak future. Conversely, we believe responsible businesses will have a more prosperous future - at Nors, we have a range of initiatives contributing to this.

We want to leave a legacy we can be proud of in all these matters; therefore, these pillars, combined with the foundation of sustainability, are indeed our strategy for 2030. A strategy that seems solid, well-anchored, thoroughly discussed, and very well-constructed. I am delighted with the final result.

Tomás Jervell Nors Group's CEO

As it should be, we want the Strategic Plan created for 2030 to be truly a mission for all. We want our People to be involved and feel like an integral part from the very

In light of the Group's undeniable growth over the past years and considering that one of the strategic objectives for 2030 is to keep growing in a balanced, profitable, and secure manner, it is inevitable that we equip ourselves with the necessary tools to achieve this.

In addition to this factor, we operate in a constantly changing market environment, where we must be able to adapt and transform at an increasingly fast pace. We must ensure that our management models, processes, and systems can cope with the sector's dynamism and sophistication and sustain our competitiveness.

Thus, in 2023, we remain focused on prioritising the various fronts of transformation that we have underway, continuing the projects that foster our versatility and the agility with which we face the future.

Core is the digital and technological transformation programmeme that involves all functional areas of Nors, aiming to achieve a comprehensive model of application architecture and processes, which will provide greater efficiency and added value to the customer.

In 2023, the culmination of two years of hard work by all the teams involved took place with the go-live of Wave II of "Core Originals." This wave covered the operations of Auto Sueco Portugal and Galius, directly or indirectly impacting over 750 employees in Portugal. In this wave, integration with the administrative and financial back office was also reinforced.

To transform the after-sales areas and provide them with tools that sustain the future of Nors companies, Flow represents a new paradigm of Operational Efficiency based on a process improvement and optimisation journey supported by technological transformation. Based on lean methodologies, this programme assumes the adaptation of after-sales operations to the needs of our customers, ensuring service quality improvement and enhancing satisfaction. In 2023, the global implementation process of the Flow programme continued. After its launch in Brazil in 2022 at Auto Sueco São Paulo, the programme started at Auto Sueco Centro Oeste in 2023. Canada also joined the Flow programme map with the implementation kick-off at Strongco.

Through detailed mapping of all phases and touchpoints of the customer journey, and by identifying the gap between the customer experience and expectation at each touchpoint, Follow enables the company to adopt a customer-centric mindset and identify improvement opportunities through a set of initiatives with a defined roadmap. Follow associates this customer-centric process with implementing the Group's CRM tool, supported by the digital and technological transformation programme (Core). Follow will provide a competitive advantage in the market as it continually enhances the experience and ensures excellence at every stage of customer interaction. In 2023, this project was implemented at Auto Sueco São Paulo and Auto Sueco Centro Oeste and initiated at Auto Sueco Angola.

In its context, the Nors Group is exposed to a plurality of risks capable of affecting the pursuit of the defined strategy. To anticipate, identify, prioritise, manage, and monitor the risks that impact the organisation, the Group has implemented a rigorous risk control and management system. The Executive Committee supports these processes, which ensures alignment between the CEOs and the Risk Management team.

In this way, the Head Office of Audit and Risk aims to ensure the effectiveness of established processes and the efficiency and adequacy of internal control mechanisms, risk management, and internal audit, actively participating in the process of creating long-term value in an increasingly regulated and, simultaneously, unpredictable scenario.

The Group's risk control and management system are structured to support achieving the objectives in the Nors' strategic pillars, which embody the 2030 Strategy.

Responsible for ensuring appropriate risk management and internal control systems that promote a risk management culture. Also responsible for defining an adequate risk appetite, considering how the pursuit of the Group's long-term objectives may be affected by the crystallisation of one or more risks.

Responsible for identifying risks, managing the internal control environment, and monitoring potential changes in the risk profile adopted.

Responsible for developing and implementing policies and methodologies for integrated risk management; supporting the first line in coordinating the risk management process and respective control measures. Risk Owner

Perform analysis to ensure an independent level of confidence regarding the functioning of the internal control framework, the risk management system, and governance processes.

1.st line of defense

2.nd line of defense

1.st line of defense

2.nd line of defense

The risk management and control system of Nors Group is based on the principles of ISO (International Organisation for Standardization) 31000 - Risk Management: risk management and control system information and comunication monitoring action plan risk response analysis and evaluation identification goals control environment

The Risk Management process is fully integrated into Nors Group’s processes at all levels:

• It involves the systematic application of policies, procedures, and practices;

• It is an integral part of management and decision-making;

• It is integrated into the organisation’s structure, operations, and processes.

A systematic approach consisting of six steps is adopted for its implementation: identification, analysis, assessment, response, monitoring, and reporting.

This process stimulates active thinking about the risks that impact operations and the respective role to be played.

control environment

Nors Group values building a solid compliance culture and adopting a risk-aware attitude. It clearly defines the roles and responsibilities of critical areas.

In this way, the Group promotes a controlled environment in pursuing its objectives and strategy, implementing various policies and procedures, such as:

• Code of Conduct;

• Anti-corruption Policy;

• Whistleblowing Channel;

• Risk Management Regulation.

People and communication

At Nors, we believe that our People are our most valuable asset and, therefore, our primary concern and the core of everything we do. In this 90-year journey, the commitment to our talent and the promotion of a culture of growth and development have been the centre of our success. We know that it is essential to equip our teams with the right tools and resources to evolve and unleash their full potential and unique skills. We aim to provide everyone with a good work environment and quality of life and ensure that we meet their needs on multiple fronts.

At the same time, we recognise that talent retention is as crucial as talent attraction to continue ensuring our legacy and future's simultaneous construction. Therefore, we strive to create an environment that stimulates and promotes the success of our talent and People through fair and personal development, fostering an inclusive and united culture where employees feel valued, respected, inspired, and motivated.

talent attraction & onboarding

compensation & benefits

talent, learning & development

Nors culture, employee experience & engagement internal communication brand & reputaion corporate & social responsability

Local communities social support

In 2023, we launched Nors [intra]net: a new communication platform that aggregates the Group's information, initiatives, and functionalities impacting Nors.

This channel facilitated communication among our various companies, structures, and geographies, allowing employees to access all the information they need quickly and efficiently.

It becomes simpler to stay informed about everything happening within the Group worldwide, with news being continuously updated. This platform also promotes the culture of unity and sharing that we advocate, representing a space for interaction among everyone, more than just an exclusive space for institutional communication.

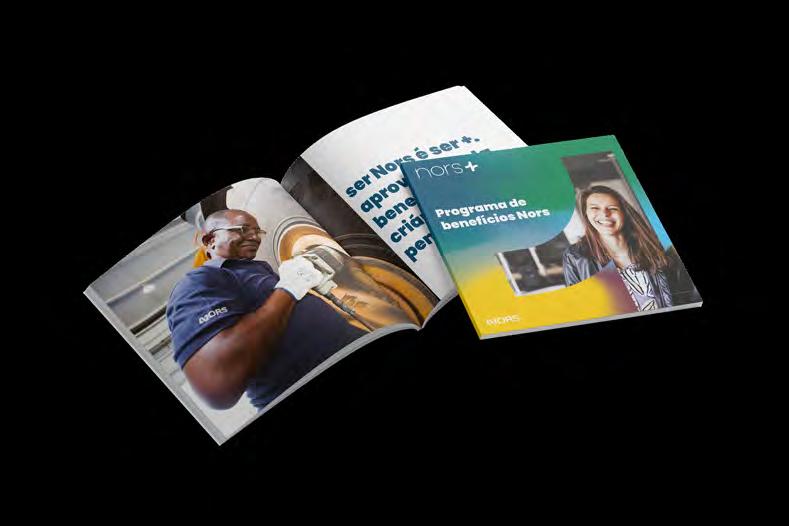

Nors+ is the new benefits programme at Nors that promises to aggregate in one place all the advantages of working within the Group so that all our People have access to a wide range of benefits that facilitate their daily lives. We aim to promote a balance between professional and personal life, offering various benefits in the areas of Education, Health, and Banking, as well as discounts on brands and services. Launched in 2023, this programme is currently available in Portugal and to be implemented in other geographies. It is structured into four main areas: flexible benefits, protocols, discounts, and flexibility.

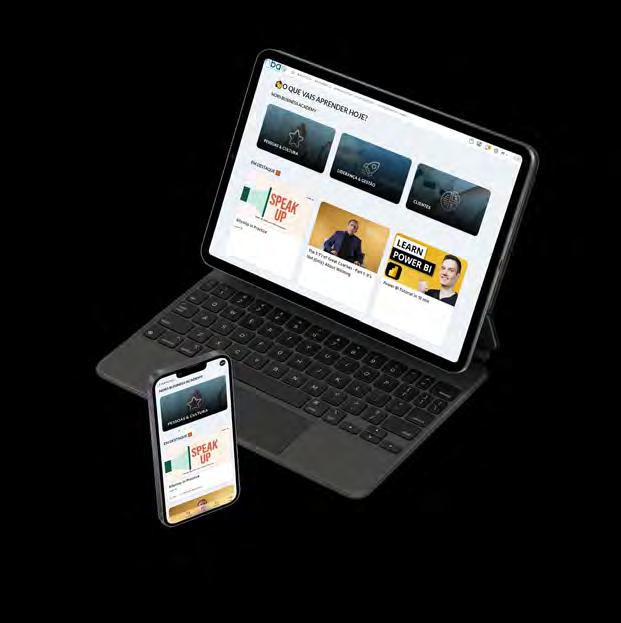

The Nors Business Academy is the Group's corporate academy. This programmeme, spanning all geographies and companies in which Nors operates, aims to educate and develop our People by sharing internal knowledge. In this way, we encourage opportunities for technical, behavioural, and personal development for all employees, making them more comprehensive and fulfilled professionals. The NBA also features a platform and training concept adaptable to different profiles of Nors employees.

Nors Go is the Nors Group's trainee programme to attract, retain, and prepare the organisation's future talent. This programme is designed for recent graduates or those starting their professional experience with diverse backgrounds and skills. Nors GO aims to contribute to the professional growth of trainees by providing mentoring throughout the programme, continuous training, exposure to Nors leadership layers, and the possibility of integration into the Group.

This initiative is based on the strategy of providing the Group with a pipeline of young talent with excellent training and readiness for future challenges. This approach allows for the continuous revitalisation of Nors' structure and a refresh of the skill set, mindset, and preparation for future leadership.

The Nors Flow internship programme, resulting from an update and renaming of a previous initiative aimed at trainees in technical-operational areas, aims to associate operational efficiency with the Flow programme to attract young talent to integrate into Nors' after-sales and thus transform the future of this area.

Currently in its 7th edition, Nors Flow includes a paid internship of 9 months aimed at strengthening skills and providing certified training in areas such as Mechanics, Painting, Metalworking, Bodywork, Reception, or Logistics. Over 170 trainees have passed through Auto Sueco Portugal, Auto Sueco Automóveis, and Galius since 2014, with the programme boasting a retention rate of about 2/3 of the trainees integrated into it through their hiring by Nors companies.

2.5. sustainability

Today, the fast pace at which new needs, solutions and challenges arise requires organisations to have a full, and increasingly proprietary, understanding of the global challenges that impose themselves.

Considering numerous factors, from its position in the value chain to its geographical dispersion, current business models and the opportunities and risks inherent to its spheres of activity, Nors' proposal within the scope of its ESG (Environmental, Social and Governance) strategy aims to mirror a clear purpose regarding the performance of a relevant, integral and transparent role in all the relationships it fosters as an organisation: with employees, customers, partners and all the stakeholders, decision-makers and agents of transformation that orbit around it.

Therefore, in 2023, under the need to systematise, in a more tangible and concrete way, a sustainability approach capable of responding to the positioning and strategic goals of the Group, also under development, a path was started to reformulate the strategic assumption that had been in force since 2019. In this way, the intention is to establish a medium/long-term vision that is capable of increasing the value of our performance, defining commitments, political ambitions and environmental, social and governance performance metrics as criteria for strategic decisions. The presentation of a new strategic direction for the organisation materialised in the “Sustainability Pillar” integrated into the new Strategic Plan with a horizon to 2030.

· the future in the hands of the Goers - group

· local community support - portugal

· "Mãos à Obra" project - angola and southern africa

· local community support - brasil

The universal goals outlined in the United Nations Sustainable Development Goals aim to address environmental, political, and economic challenges by 2030, whose impact is global and cross-cutting. Nors' sustainability agenda is developed under these widely recognised guidelines, seeking to continuously implement concrete and consistent actions to reinforce these priorities.

· well-being and health promotion - portugal

· well-being and health promotion - angola and southern africa

· awareness-raising and health-prevention action - brasil

· "Mãos à Obra" project - angola and southern africa

· "Braço Direito" initiative - angola and southern africa ·

Faced with the destruction caused by the earthquakes that struck Turkey and Syria earlier this year, the Group joined the aid provided by the Anadolu Isuzu Group by donating 10 steel tents worth €5,000.

Group

the future in the hands of the Goers

Demonstrating young entrepreneurship and their concern for the future, the #Goers (trainees of the Nors GO Programme) repurposed damaged or obsolete uniforms from our workshops and, in collaboration with the social reintegration association Betel, commissioned the manual production of tote bags branded with the Nors identity to be distributed at job fairs and other promotional events. To date, 44 uniform pieces have been collected at Auto Sueco Automóveis and 76 pieces at Galius, resulting in 40 tote bags.

Continuing the premise of upcycling the waste we produce in our facilities, the Goers also collected damaged bumpers and fenders from the workshops, which were transformed into flower beds to decorate a renovated Nors building.

Portugal

local community support

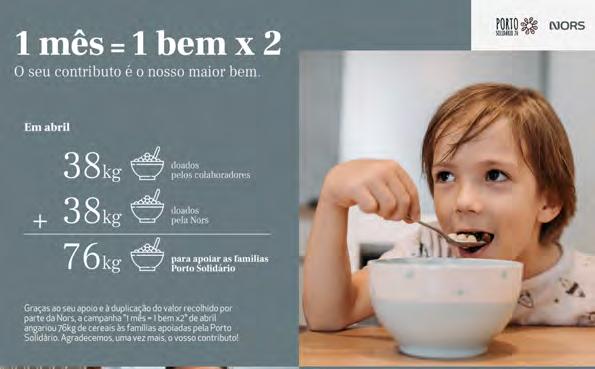

The Nors Group once again partnered with the association Porto Solidário, this time for the "1 month = 1 goods x 2) campaign. This initiative involves collecting food items from employees of some companies within the Group in the Porto area. Every two months, different items are requested, and the Group doubles the quantity of products for every donation gathered by employees.

Additionally, Amplitude Seguros supported Porto Solidário by offering insurance for the vehicle used to distribute food products.

Sotkon also supported the community it serves by collecting clothes, household items, toys, books, games, personal hygiene products, and school supplies, among other things. The company also made a monetary donation, which, combined with the collected goods, was delivered to CAT - Temporary Reception Centre in Praia do Ribatejo, which provides urgent and temporary shelter for vulnerable children and young People aged between 6 and 17.

Furthermore, Norshare in Portugal supported the Santo Tirso Association for Solidarity and Social Action through a solidarity team-building activity held during its Kick-Off event. Additionally, they donated 8 bicycles to an institution supporting children in this locality.

Portugal

well-being and health promotion

Nors promoted the fulfilment of dreams for visually impaired children through the Terra dos Sonhos association, providing 10 blind or severely visually impaired children with the experience of a trip to Disneyland Paris.

The Group also partnered with ALMAZ - a holistic association in the prison environment - to support the "Prison Yoga Project" initiative. The primary purpose of this project is to support inmates with yoga and meditation practices to promote rehabilitation and social reintegration, reduce recidivism, improve mental and physical health, promote social and behavioural transformation, and prevent public safety issues.

During this year, we also highlight the Group's membership in ASM - the Alliance for the Promotion of Mental Health in the Workplace, which aims to place People at the core of organisations and mental health as a top priority.

Additionally, Norshare organised a collection of bottle caps to purchase a wheelchair for children with motor disabilities.

Finally, Auto Sueco Automóveis donated a simulation baby chair to the Gynecology and Obstetrics service at the Centro Hospitalar de Vila Nova de Gaia and Espinho. This bench facilitates the installation of child restraint systems, contributing to the promotion of safe behaviours and proper child transportation. It also provides parents with the opportunity for simulation and training.

Portugal

environmental sustainability and renewable resources

Following the pilot unit in Maia in 2022, photovoltaic panels were installed at the Auto Sueco Portugal facilities in Guimarães and Setúbal. Currently, 579 solar panels have been installed, which have already reduced CO2 emissions by nearly 100 tons. By summer 2024, there is expected to be 885 MWh of photovoltaic production, with a projected selfconsumption rate of 60% to 70%.

Continuing in this subject, Auto Sueco Portugal joined the Route 25 consortium - a project under the National Recovery and Resilience Plan (PRR), led by Capgemini Portugal and involving 28 entities, to advance the agenda of autonomous, intelligent, interoperable, and inclusive mobility.

Finally, with this scope, Galius partnered with students from the Instituto Superior Técnico in Lisbon, providing the facilities, knowledge, and expertise of professionals to design and prepare molds for constructing highly efficient electric vehicles. Once produced, these vehicles have participated in national and international competitions and won numerous national and international awards.

“Mãos

The Local Corporate Centre of Angola & Southern Africa continued its social action plan by promoting the well-known and cherished project "Mãos à Obra" (Hands-on), which was also recognised at the last edition of the We Nors Awards with the Special "90 Years" Prize. This social responsibility project works with the Community of Nossa Terra, alongside the Salesians of Dom Bosco, as it empowers the community school.

As part of this initiative, scholarships were also awarded to 3 young People from underprivileged families, aged between 18 and 22, who are attending high school courses in Automotive Mechatronics and Machines and Engines at the Industrial Polytechnic Institute of Luanda.

In Namibia, this project contributed to improving conditions and safety in the community child centre by installing fencing and renovating the community kitchen.

In Botswana, assistance to disadvantaged children was provided through donations from Auto Sueco Botswana, including school uniforms, shoes, backpacks, writing and learning materials, and hygiene items, to the Tshwaragano primary school in Gaborone.

Learn all about "Mãos à Obra," one of the projects that fill us with pride.

“Braço Direito” in training encouragement

The Nors Group companies in Angola also organised the "Braço Direito" initiative, which offers young trainees from the National Institute of Employment and Professional Training, Nors scholarship holders, and students from the Nossa Terra Community, the opportunity to spend a day alongside our staff. 16 young people had the chance to learn about the daily activities of our staff from several areas, shadow them, and perform some tasks.

well-being and health promotion

The companies of Nors in Angola organised a health fair in the Community Nossa Terra in partnership with the Congregation of the Salesian Fathers of Dom Bosco and the National Youth Council. This initiative aimed to provide healthcare to the community in the areas of general medicine, pediatrics, physiotherapy, and psychology at a time when there was a growing number of diseases and significant healthcare deficits. This activity aimed to combat the spread and progression of clinical conditions. Additionally, the Human Resources Department of Angola and Southern Africa also promoted the 2nd edition of the well-being programme "Toca a Mexer" (Let's Move) in partnership with the OkuHuman consultancy. This initiative, which comprises physical exercise sessions, nutritional counseling, and yoga classes, among many others, is based on the premise that well-being encompasses not only physical health but also mental health and nourished relationships.

Brasil

local community support

Nors Centro Oeste donated used uniforms to make rugs, which are then sold, and the funds raised go towards supporting disadvantaged children in the local parish.

awareness-raising and health-prevention actions

Throughout this year, Nors companies in Brazil have promoted several awareness campaigns on health issues, focusing on raising awareness among employees about certain diseases and encouraging prevention. These campaigns included promoting preventive flu vaccination and providing information about breast cancer associated with "Pink October" and prostate cancer linked to "Blue November."

In the Catanduva region, AgroNew conducted a campaign to collect pull-tabs to support the Cancer Hospital and made a monetary donation to the voluntary association supporting cancer patients and their families in the region.

Finally, AgroNew organised a social gathering with the elderly residents of Asilo São Vicente de Paulo to reduce their isolation and loneliness during Easter.

we are building a better tomorrow with our People

Sustainability is the cornerstone of our strategy for the future, and it was one of the most discussed topics throughout the strategic definition process.

We began by developing a roadmap for a comprehensive strategy, focusing on topics such as decarbonization, our environmental footprint, the social impact we leave behind, and the governance policies that guide us.

Diagnosis: We started by understanding what we were already doing in this field, what we had proposed to do, and what priorities to follow.

We listened to experts and our people: We interviewed over 20 individuals and received responses from over 200 employees through a questionnaire.

Benchmarking: We identified the best practices in the market and industry to determine what was being done exceptionally well.

We facilitated workshops to identify priorities through exercises.

We aligned these results with the strategic vision we were pursuing and achieved our main objective: making sustainability a cross-cutting pillar of Nors, present in various areas, and integrated into the value creation process and our positioning as an organisation.

We conducted a materiality analysis for all regions where Nors operates and the Group as a whole, considering both financial and non-financial aspects.

We calibrated the results and identified eight key action areas for sustainability.

and so we have reached our main goals

We aim to promote sustainable growth.

How? By acting with integrity, embracing circularity, and fostering trusting relationships.

We aim to embrace transformation and innovation for the sake of our planet.

Our goal is to increase sales of zero-emission vehicles and foster strategic partnerships in innovation.

We aim to efficiently promote the reduction of our ecological footprint.

To achieve this, we will focus on reducing our environmental footprint and minimizing waste production.

We aim to have a positive impact on the people we serve

We want to help the communities where we are located by promoting inclusion and diversity.

3.1.main macroeconomic indicators

According to the latest projections for the end of the year, Portuguese GDP is expected to grow by 2.1% in 2023. The context of geopolitical tensions, particularly the ongoing war in Ukraine caused by the Russian invasion, and the conflict in the Middle East between Israel and the Islamist group Hamas, along with restrictive monetary policy, contributed to the slowdown in economic growth.

Following economic stagnation in the second and third quarters of 2023, there was low growth in the fourth quarter. The recent evolution of economic activity was constrained by weakening external demand, inflation experienced during the year (with an average annual HICP variation of 5.3%), and tighter monetary policy, which affected the financing conditions of economic agents.

In 2023, private consumption grew by 1.0%, in a context of real disposable income gains and an increase in the savings rate. Regarding public consumption, it also increased positively by 1.1%.

Despite the growth in private and public consumption, these are expected to lose weight concerning the growth of the Portuguese economy, which should be based on the dynamism of investment and exports, with the improvement of the macroeconomic context.

Export growth was more restrained compared to previous years, due to cooling demand from key trading partners. Goods exports declined in 2023; however, it is expected that in the following years, external demand will recover at a slower pace than the prepandemic period and support higher growth rates in goods exports.

Regarding services, there was significant growth in 2023, as a result of the postpandemic recovery of tourism. Overall, these effects led to an expected growth of 4.3% in export volume.

Meanwhile, import growth in 2023 was 1.3%, with gradually moderate growth expected in the following years.

The labor market maintained a favorable performance in 2023, with an unemployment rate of 6.5%. A rise in the unemployment rate to an average value of 7.2% is projected for 2024-26, which is close to the estimated trend unemployment rate. It is estimated that labor supply will continue to increase due to rising immigration and labor force participation rates compensating for the effects of population aging.

Regarding inflation, there was a reduction throughout 2023, reflecting monetary policy and the impact of reduced production costs on consumer prices.

After reaching 2.6% year-on-year in the last quarter of 2023, inflation is expected to be pushed higher, mainly due to prices of energy goods (an increase in electricity prices is expected at the beginning of the year, and unlike what happened in the first half of 2023, fuel prices are not expected to decrease to the same extent) and food prices (end of zero VAT in January). In 2025, inflation is expected to converge to 2.0%.

In 2024, the Portuguese economy is expected to slow down, with GDP growth around 1.2%, projecting an acceleration to 2.2% in 2025.

Inflation rate in Portugal

In Brazil, GDP grew by 3.1% in 2023, with a forecasted slowdown in growth to 1.7% in 2024, followed by growth of 1.9% in 2025. Agricultural exports drove growth in 2023, but this momentum is expected to fade in the following years, considering the context of lower commodity prices.

Regarding inflation, there was a decreasing trend throughout the year, estimated to be around 4.6% in 2023 and 3.2% in 2024. This allowed the Central Bank to ease monetary policy, resulting in effects such as a reduction in the basic interest rate (SELIC). Due to the expectation of continued inflation decline, it is estimated that the Central Bank of Brazil will continue an expansionary monetary policy, with a further reduction in SELIC to around 9.2% by the end of 2024 and 7.8% by the second half of 2025.

The loosening of monetary policy restored confidence to investors and is expected to boost private investment, improving financial conditions.

In 2023, fiscal policy was expansionary, driven by increased social transfers. New fiscal rules were approved with the aim of adding flexibility, particularly in investments, and improving mediumterm predictability. Additionally, a tax reform was approved in the Chamber of Deputies, aiming to create a unified value-added tax, which will simplify the tax system and boost economic growth.

The labor market has been strengthening, with the unemployment rate around 8.3% in 2023. Job creation is predominantly driven by the services sector.

After a GDP growth of 3.8% in 2022, Canada's GDP growth in 2023 is expected to reach only 1.1%. This slowdown reflects the slowdown in domestic demand, related to increased borrowing costs and reduced exports due to the slowing US economy. The economic outlook for 2024 predicts another timid growth, around 1.4%.

Regarding inflation, the highest value since 1982 was reached in 2022 (6.8%). In 2023, inflation was around 4.0%, heavily impacted by the increase in fuel prices. On the other hand, decreases in underlying inflation have been observed. For 2024, inflation is estimated to be around 3.0%, moving towards reaching 2.0% in the following years. In case of a slowdown in the first half of 2024, there is a possibility of interest rate relief in the second half of 2024, which should support economic growth – however, failure to meet inflation targets for 2024 may jeopardize economic growth forecasts.

In the labor market, the unemployment rate was around 5.5% in 2023, in line with the previous year, where it reached a historic low of 5.3%. Wage growth will be moderate in 2024, remaining in line with inflation. Economic growth is expected to strengthen in 2025, reaching 2.3%. Strong external demand will drive exports and business investment, as well as increase purchasing power.

In Angola, in the year 2023, there was a slowdown in GDP growth, which was around 1.3%, mainly due to the weakening of the oil sector. The decline in oil production and prices resulted in lower oil export revenues. On the other hand, there was positive performance in the non-oil economy, with the diamond and mineral sector contributing the most to this improvement, ending the third quarter with a growth of 41.7% compared to the same period last year.

Between May and June 2023, the Kwanza depreciated by about 40% against the US dollar. This depreciation is related to the decrease in oil revenues and higher external debt service. The end of debt moratoriums put pressure on the country's foreign currency reserves.

Regarding the inflation rate, although it remains high, it has shown a decreasing trend in recent years, standing at around 13.1% in 2023. However, it is estimated that inflation will increase significantly in 2024, reaching 22.3%. This increase in the inflation rate is due to the impact of exchange rate fluctuations on imported foodstuffs.

It is projected that total public debt service will be around 14.3 billion kwanzas, with 5.9 billion corresponding to domestic debt and 8.3 billion kwanzas representing external debt service. This effort in debt service again puts considerable pressure on the Angolan currency in 2024.

For the coming years, despite the significant increase in the inflation rate, prospects for the Angolan economy remain positive, with GDP growth forecasted to be around 3.3%.

Inflation rate in Angola

The economic performance of Namibia has been recovering, with GDP growth in 2023 around 2.8%. This GDP growth was higher than pre-pandemic levels but lower than the growth recorded in 2022, which was around 4.6%. The mining sector has helped Namibia recover from production losses resulting from the pandemic, being the main sector contributing to economic activity. On the other hand, agricultural production contracted due to droughts and floods in 2023, as well as rising fertilizer prices due to the war in Ukraine.

Regarding inflation, it increased sharply in 2022, considering high international oil and food prices, which were around 6.1%. In 2023, the inflation rate was 6.0%, and it is expected to be 4.9% in 2024. The fiscal deficit is expected to decrease, driven by strong mobilization of domestic resources and tax compliance efforts by the Namibian Tax Authority, along with spending rationalization efforts. The current account deficit is expected to decrease due to increased revenues from the mining and tourism sectors.

Regarding the labor market, the employment rate remained below pre-pandemic levels, as labor-intensive manufacturing subsectors created jobs relatively slowly.

Inflation rate in Namibia

The economy of Botswana is heavily dependent on diamond production, representing about 90% of goods exports. In 2023, the decrease in diamond production led to a slowdown in GDP growth to 3.8%. However, the liberalization of the beef sector and the increase in copper and vaccine production contributed positively to the evolution of economic activity. The mining sector is expected to grow in the years 2024 and 2025, as diamond prices and quantities produced are expected to increase.

The performance of the non-mining sector is also expected to improve, driven by government actions to support economic activity. Climate shocks continue to challenge growth prospects, posing a threat to activities in agriculture, mining, and tourism. In 2023, the unemployment rate and level of inequality remain quite high in the country, with the unemployment rate hovering around 25%.

Regarding inflation, it was quite high in 2022, reaching 12.2%. In 2023, inflation decreased, reaching around 5.9%, mainly due to the decrease in international oil prices starting in May and the fact that regulated prices remained unchanged.

Despite the forecasted GDP growth of around 4.1% for 2024, growth prospects remain unstable. This vulnerability is mainly related to the dependence on the mining sector (diamond exports) and high levels of unemployment.

After the impact of the pandemic crisis, Mozambique resumed its growth trajectory, registering GDP growth of 2.4% in 2021 and 4.2% in 2022. In 2023, there was an acceleration in the pace of GDP growth to 7.0%, mainly driven by the production of Liquefied Natural Gas and the extractive and agricultural sectors. In 2024, GDP growth is estimated to be around 5.0%.

Mozambique aims to use the Liquefied Natural Gas sector as a supplier of energy for electrifying the country.

The government is investing in agricultural productivity, which should lead to overall growth in the sub-regions, resulting in increased use of Mozambique's logistical routes.

Despite the good prospects for the country, the main risks identified for consolidating this trajectory are climate shocks, security risks, and pressures on food and fuel prices, which could cause a reduction in medium-term GDP growth.

Regarding inflation, it was lower than initially expected, around 7.4% in 2023, mainly reflecting lower prices of food and fuel.

After GDP growth of 5,8% in 2022 and a closing estimate of around 2,4% in 2023, Spanish economic activity is believed to lose strength throughout 2024, with growth expected to be around 1,5%.

Economic growth in 2023 exceeded expectations, mainly due to the fact that the energy crisis dissipated more quickly than anticipated and the strong momentum of the external sector. For 2024, the impact of rising interest rates is expected to remain significant; however, the economy will continue to have supportive elements that will allow it to keep growing, albeit at a slower pace. Particularly noteworthy is the labor market, which supports confidence and income growth for households, along with the support from European funds.

Regarding the pace of price growth, it is estimated that 2023 closed with an average inflation of 3.5%, which will evolve to 3.9% in 2024. Despite the increase in oil prices between July and September 2023, signs of moderation were observed in both October and November, with a downward trajectory expected in the coming months. However, underlying inflation, which excludes the energy component and unprocessed food products, has remained persistent, with a year-on-year growth of 4.5% in November.

The labor market has shown very positive signs, in line with activity evolution and the assumption of some productivity recovery. The unemployment rate continues to decline, although at a slower pace than in recent years - the unemployment rate in 2023 is estimated to have been 12.1%. The labor market appears robust, reflected in the growth of the active population, as well as the incorporation of immigrants into the workforce.

The year 2022 was marked by a slowdown in GDP growth, reaching 1.9%. In 2023, growth was 2.5%, with an expected slowdown in 2024 and 2025 to around 2.1% and 1.7%, respectively. As a consequence of restrictive monetary policy, a slowdown in private consumption and investment is expected. In 2023, the unemployment rate was 3.6%, with estimates suggesting it will remain stable in 2024 compared to 2023.

Regarding the inflation rate, it was 8.0% in 2022, showing a deceleration in 2023 to 4.1%, with an estimated rate of around 2.8% in 2024. As for underlying inflation, housing market and services inflation are the main highlights.

Oil exports reached record levels in 2023, despite the high effective dollar exchange rate. The trade balance with China improved after exports performed in line with previous years, while imports decreased by 25%.

It is estimated that consumption and investment growth will increase in 2024 and 2025 as inflation decreases and monetary policy becomes more flexible. However, the geopolitical environment continues to present uncertainties and risks, given the high trade tensions with China, the ongoing Russia-Ukraine conflict, and conflicts in the Middle East. Additionally, the presidential elections in 2024 could also have significant impacts on the future macroeconomic context.

In 2023, the Turkish economy again experienced a decline in GDP growth, resulting in a growth rate of 4.0%. It is estimated that in the years 2024 and 2025, growth will continue to slow down, reaching 3.1% and 3.2%, respectively. Investment growth will remain high due to ongoing reconstruction efforts following the earthquakes that struck the country earlier in the year. It is expected that exports will significantly evolve in 2025, driving strong overall growth.

Regarding price developments, inflation reached 72.3% in 2022. Despite decreasing in 2023, inflation remains at high levels, around 52.8%, with an estimated decrease to 47.4% in 2024. Inflation is strongly driven by increasing production costs, strong demand, and the devaluation of the Turkish lira.

The unemployment rate decreased from 10.5% in 2022 to 9.6% in 2023, with an estimate to settle around 10.0% in 2024.

In 2023, the Austrian economy experienced an economic contraction of around 0.4%, and it is expected to grow by 0.6% in 2024. High inflation, rising interest rates, and labor shortages have dampened investment and weakened external demand. Exports account for more than 50% of GDP, making Austria vulnerable to fluctuations in global trade and external demand. Investment is expected to remain moderate due to high financing costs and increasing labor costs.

Inflation in 2023 was 7.7%, with notable increases in energy, restaurants, and hotels. A decrease in inflation is projected for 2024, reaching 3.9%.

Hungary experienced an economic contraction of 0.6% in 2023, with GDP growth projected to reach 2.4% in 2024. The contraction in 2023 is directly linked to a loss of investor confidence, especially in the construction and retail sectors, as well as a decline in private consumption.

In 2023, the inflation rate peaked at 17.5%, but it is estimated to decrease significantly to 4.6% in 2024. The decrease in inflation, driven mainly by

energy and food prices, will allow for a gradual recovery in investment and private consumption.

It's worth noting that the main risks regarding future projections relate to the pace of inflation decline and the outcome of negotiations with the EU regarding the implementation of European funds.

Romania recorded a GDP growth of 1.9% in 2023, showing a decrease from the 4.6% value in 2022. For 2024, the growth is projected to be around 3.0%. Infrastructure projects funded by the EU will continue to positively impact economic activity, with this sector being the main contributor to GDP, while the industrial and agricultural sectors have been losing weight in this indicator.

Exports and imports decreased due to the fall in oil and gas prices. Although the current account deficit has decreased, it still remains high. The unemployment rate in 2023 was 5.7%, above pre-pandemic levels.

Regarding inflation, there is a decreasing trend, as it was around 10.4% in 2023, and it is estimated to reach 5.0% in 2024, with monetary policy expected to remain restrictive in 2024. By the end of 2025, overall inflation will decelerate to 3.5%.

Fonte

Fonte

In the Czech Republic, there was an economic contraction in 2023, around 0.3%. Despite this decline, GDP is expected to grow by 1.6% in 2024. Domestic demand is heavily affected by high inflation and restrictive monetary policy. On the other hand, public investment shows improvements, driven by the final phase of the EU 2014-2020 programme and the use of funds from the Next Generation EU.

Weak domestic demand has led to a reduction in imports, but nevertheless,

significantly in 2023, around 10.7%, and is expected to be around 3.1% in 2024. This decrease in inflation, coupled with an increase in real wages and an unemployment rate below 3%, will have positive effects on private consumption. However, the Czech economy is subject to various uncertainties, such as potential disruptions in energy supply, unexpected increases in raw material prices, and sharp depreciation of the Czech crown.

In 2023, the Croatian market saw GDP growth of 2.5%, and it is projected to stabilize in 2024, around 2.6%.

Growth was driven by the recovery of consumption, as wages and employment increased, boosting real household incomes. Robust tourism activity, partly driven by integration into the Eurozone and Schengen Area, supported demand in labor-intensive services, helping to reduce the unemployment rate. These factors offset the weakening of the

As for the Mexican economy, GDP growth is expected to slow from 3.4% in 2023 to 2.5% in 2024 and 2.0% in 2025. It is estimated that exports will be affected due to the more moderate growth in the United States.

In 2023, consumption proved resilient and investment grew, especially in non-residential construction, supported by public infrastructure projects and investment in machinery and equipment for the relocation of industrial parks near the border with the United States.

industrial sector, which saw decreases in goods exports, affected by higher energy costs and weaker external demand.

Inflation slowed down in 2023, reaching 8.6%, and it is expected to decrease in the years 2024 and 2025, hovering around 4.2% and 2.6%, respectively.

Source International Monetary Fund

OECD: Economic report november 2023

The inflation rate was 5.5% in 2023, showing a decreasing trend for the coming years, translating into a projection of 3.9% in 2024 and 3.2% in 2025. Therefore, monetary policy is expected to remain restrictive, aiming to ensure that inflation decreases gradually and sustainably.

Source International Monetary Fund

OECD: Economic report november 2023

Economic growth in Slovakia in 2023 was 1.1%, and it is estimated to be 1.8% in 2024 and 2.4% in 2025, respectively.

The continuation of a restrictive monetary policy will pressure private investment. However, EU recovery and resilience funds will sustain public investment over the next few years. Projections indicate an increase in exports, in line with external demand, due to fewer disruptions in the supply chain in the short term.

The labor market remains resilient, with an unemployment rate close to pre-pandemic levels. As for inflation, it reached 11.1% in 2023; however, it is estimated to decrease significantly in the coming years to 5.2% in 2024 and 3.4% in 2025.

Source International Monetary Fund OECD: Economic report november 2023

3.2. economic performance

3.2.1. global economic performance

The year 2023 was marked by the consolidation of business volume, with the Nors Group recording a value in line with 2022. We demonstrated, with great success, that the growth strategy pursued in recent years enabled the Group to reach the milestone of 1.5 billion Euros in 2023 - a result that represents a new sales record for the Nors Group. In a context of high macroeconomic and geopolitical challenges, the Group showed resilience and adaptability to market circumstances. These factors were critical in capturing value from all the geographies where the Group operates, ensuring the importance of operational diversification.

We highlight the sales growth in Portugal, which exceeded the previous year by 75.4 million Euros (+21.0%), largely associated with the business portfolio that transitioned from the previous year. In Brazil, despite initial investor skepticism leading to postponed purchase decisions, we saw a maintenance of business volume (+0.3% compared to 2022), favored by the inclusion of Agrofito and Nors Centro Oeste in the operational scope in Brazil. Canada experienced a decrease in business volume of 44.5 million Euros (-11.4%), reflecting the effects of restrictive economic policies.

In Africa, sales decreased by 9.3% (15.5 million Euros), closely related to the impact of activity in Angola. In this geography, the effect of currency devaluation, which occurred in the second half of the year, negatively impacted sales by 14.4 million Euros compared to the same period.

The breakdown of turnover by geography and business area is as follows:

The Group's gross margin, like the business volume, showed a stabilization in growth, increasing from 264.4 million Euros in 2022 to 267.2 million Euros in 2023 - a 1.0% increase primarily driven by the after-sales segment.

The commercial gross margin contributed 118.7 million Euros (-1.4% compared to 2022). Portugal experienced a growth of 35.3%, which was not sufficient to offset the declines seen in other regions, with Brazil and Canada showing the largest variations - -10.2% and -4.1%, respectively.

In the after-sales segment, the excellent performance in gross margin across all markets, except for Angola, contributed 148.0 million Euros – an increase of 5.8 million Euros compared to 2022. Excluding the effects of acquisitions, on a comparable basis, the impact would remain positive at 3.5 million Euros.

In 2023, the consolidated profitability of the gross margin reached 18.1% of the business volume, compared to the 17.9% achieved in 2022, representing a growth of 0.2 percentage points. This was only possible due to the consolidation of selling margins in our operations in 2023, especially in the after-sales activity, capitalizing on the investments made in recent years.

In 2023, the EBITDA amounted to 188.8 million Euros, representing a reduction of only 1.8% compared to the historic result achieved in 2022.

It's worth noting the positive contribution from Portugal (+6.2 million Euros) and Ascendum (via Equity Method) with a growth of 11.0 million Euros, while the remaining geographies reduced their contributions compared to the same period, notably Canada (-9.6 million Euros), Angola (-6.4 million Euros), and Brazil (-5.6 million Euros).

The EBITDA margin presented in 2023 was 12.6%, similar to the 13.0% EBITDA percentage in 2022 – the prudent increase in indirect expenses was offset by the excellent performance of the margin across various Nors businesses and the increased contribution from Ascendum's EM in 2023.

In addition to the evolution of EBITDA, it is important to highlight its geographical dispersion in terms of its origin. In this regard, we demonstrate a healthy distribution of EBITDA, with none of the geographies exceeding 30% of the total Group weight.

breakdown of ebitda by main contributors

The year 2023 was marked, as previously mentioned, by the effects of restrictive monetary policies in most countries where the Group operates, resulting in a significant increase in borrowing costs. Additionally, the normalization of inventory levels (associated with supply chain regularization) and investments in company acquisitions made during the year led to an increase in the Group's average debt. Consequently, we witnessed an increase in net interest expenses, with an impact of 3.0 million Euros.

It is also important to note that the significant depreciation of the Kwanza had a negative impact of 6.4 million Euros compared to the same period last year. Overall, these effects resulted in a worsening of the Group's financial performance.

However, the Group ended the year 2023 with a net profit of 110.0 million Euros, representing 7.3% of the turnover. This result consolidates the Group's position, surpassing the 100 million Euros mark for the second consecutive year.

The consolidated asset in 2023 amounted to 1,157.3 million Euros, representing an increase of 231.9 million Euros (+25.1%) compared to the value recorded at the end of 2022. This significant increase is directly related to the acquisitions made in 2023, which increased the asset by 111.3 million Euros, and the return to normalcy of distribution chains in the markets where Nors operates, resulting in an inventory increase of 87.4 million Euros.

Capital employed continues to be one of the indicators to which Nors pays special attention. Always focused on the careful allocation of resources to the existing businesses in the various geographies. In 2023, we saw the employed capital increase by 59.4% (93.6 million Euros).

This effect was due to the increase in working capital requirements, which grew by 38.8 million Euros, supported by the robust increase in inventories and accounts receivable balance surpassing the accounts payable balance. Consequently, the working capital requirements in days of sales increased from 5 days in 2022 to 15 days in 2023.

Additionally, in the process of allocating the purchase price of the agricultural equipment distribution businesses and construction equipment in the states of Mato Grosso and Mato Grosso do Sul, intangible assets related to supplier relationships were established, with an impact of 43.9 million Euros at the end of the year.

We close the year 2023 with a Net Debt (including Lease Liabilities) of 133,1 million Euros, representing an increase of 82,8% (or 60,3 million Euros) compared to the end of 2022.

It's worth noting that we ended the fiscal year with net bank debt (obtained financingcash and bank deposits - investments available for sale - debt instruments at amortized cost) of 52.0 million Euros, compared to a negative net bank debt position of -7.9 million Euros in 2022. This increase is related to the financial effort associated with the aforementioned effects of inventory normalization and operations acquired in 2023.

The acquisition of Agrofito and the integration of Nors Centro Oeste led to an increase in net debt in the amount of 19.7 million Euros and 11.4 million Euros, respectively - without this effect, net bank debt would amount to 20.9 million Euros, representing an increase of 28.8 million Euros compared to 2022.

debt (with securities) and net cost of financial activity

Nevertheless, the Group's indebtedness in relation to the generated EBITDA remains at very conservative levels, reflecting the effort to maintain a solid balance sheet capable of accommodating any unfavorable market movements.

The equity section increased from 338.3 to 402.8 million Euros, representing an increase of about 19.1%. The main movements in this section are related to the positive contribution from Nors' net income and the dividend distribution. It's worth noting the negative impact of currency devaluation amounting to 4.6 million Euros, mostly associated with the depreciation of the US Dollar against the Euro. The increase in equity was lower than the growth of assets (which grew by +25.1%), resulting in a financial autonomy of 34.8%, compared to 36.6% in 2022.

Regarding profitability ratios, the ROE decreased from 53.7% to 39.1%. This reduction is explained by the slight decrease in net income attributable to the shareholders of Nors Group in the face of a 32.6% increase in shareholder investment - measured by the increase in equity excluding net income.

The ROI also decreased in 2023 compared to the same period (from 36.9% to 27.8%). This performance is explained by the increase in invested capital combined with the reduction in pre-tax income.

Despite this, both ratios remain at highperformance levels - far surpassing the results achieved in periods prior to 2022.

¹ Sales + service provision + work for the company itself

² Earnings before interest, taxes, depreciation and amortisation

³ Costs and revenues associated with financing activities

performance

3.2.2. economic performance by business unit

In Portugal, 2023 was a year marked by the normalization of supply chains, which impacted the heavy and light vehicle market. In this context, the high-range truck market grew by 28%, reaching 4,462 units. Regarding market share, the combined Auto Sueco Portugal and Galius achieved a 31.5% market share - translating to 1,406 registrations compared to 1,202 in the same period.

In Brazil, 2023 was expected to be a highly challenging year, which turned out to be the case. After the market growth seen in 2021 and 2022, which exceeded expectations, 2023 was marked by a slowdown in activity - the high-range truck market in São Paulo and the Midwest region experienced a decline of 25.8% and 12.2%, respectively. This decline originated from some

skepticism among entrepreneurs in the period following the elections and some uncertainty about the economic policy to be pursued by the new government. Throughout the year, activity gained traction, although not enough to recover from the setback in the first months.

In Angola, the year started strong, supported by the closed business portfolio of 2022. However, the second half was marked by a shortage of foreign exchange, leading to the depreciation of the local currency and consequent loss of purchasing power. Nevertheless, the high-range truck market showed an 80% growth compared to the same period, closing the year with 570 registered units (compared to 316 in 2022). Auto Sueco Angola and KinLai presented a combined market share in the official

high-range truck market of 79.9%, up by 5.2 percentage points from the market share in 2022.

In Namibia, Botswana, and Mozambique, 2023 reinforced the ongoing evolution of the markets in which these companies operate. There were growths in Namibia (14.2%) and Mozambique (70.6%), while in Botswana, the market grew by 3.7% compared to 2022. However, Auto Sueco Namibia and Auto Sueco Botswana saw their market share decline, affecting their results. Auto Sueco Mozambique, with the Volvo and Dongfeng brand alliance, solidified its position in the official market, with a market share exceeding 90%.

Auto Sueco Portugal is the exclusive distributor of Volvo trucks and buses, ISUZU buses, and Volvo Penta marine and industrial engines for Portugal. The company is also the exclusive distributor of Kohler power generators for this market.

In 2023, the high-end truck market saw a growth of 28%, totaling 4,462 registered units. Auto Sueco Portugal, the market leader with a 19.4% share (866 registered units), boosted its commercial sales by 12.9% compared to 2022.

After-sales activity decreased by approximately 3.4% compared to the same period, heavily influenced by the results of the last two months of the year - during which the company was in the startup phase of a new business information system.

Auto Sueco Portugal achieved an EBITDA of €17.7 million, representing an improvement of 33.5% compared to 2022. This result comes in a context of careful expense management but also in profitability improvement, with growth in the percentage margin in the commercial area and in the after-sales segment.

Auto Sueco Angola is the official distributor of Volvo trucks, buses and cars in Angola, and is also the representative for Kohler-SDMO generator sets in this country. Taking into account the aforementioned Angolan market context and as shown by the analysis of the indicators, the company's overall results were positive.