Nordic Fintech Magazine exclusively works together with selected Nordic Community Partners for insights and distribution, giving us unparalleled reach with audiences across the Nordics and Baltics

Thank you to all the fintech heroes contributing to this magazine!

8

Welcome to the Winter Edition of Nordic Fintech Magazine! p. 6 p. 10

Stockholm the Capital of Fintech

12

Fintech on Tour: Europe’s Next Big Act

Fimento’s AI Achieves 97% Accuracy in Credit Onboarding Process Fimento is a financial SaaS solutions provider specialising in credit insights, loans and

€10M EU-Funded LendTech “Mifundo” Reduces Credit Risk by 7X p. 13

14

16

17

18

The Future of Banking is Agentic

Combating Fincrime and Cybercrime in the Age of AI

Maventa Solves 60-year-old E-invoicing Problem

Why your 2025 GTM is FKD

Fraud, Stigma, and Systemic Failure: A Call for Change p. 20

Mambu’s Composable Banking Approach Offers Solution for Nordic Banking Transformations p. 22

23

24

26

25

Mastercard’s Lighthouse Program is a Key Driver of Nordic & Baltic Fintech Innovation

A Core Banking Platform So Revolutionary That You Can Pay for It by the Hourp

Enterprise Estonia: Driving Innovation and Economic Growth

The Wacky World of Quantum and Why This Mind-Bending Concept Could Change Everything

Enterprise Estonia: Driving Innovation and Economic Growth

34

36

37

38

40

42

46

The Growth and Future of Latvia’s Fintech Ecosystem: A New Era of Innovation and Collaboration

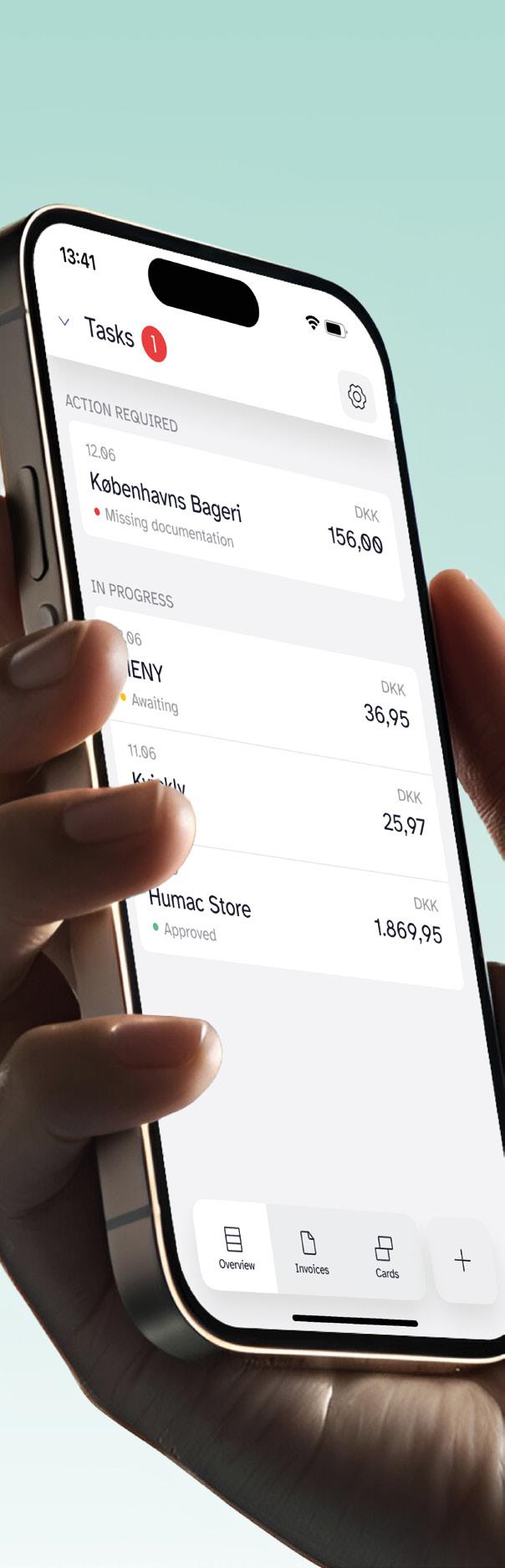

Wolfpack Provides the Missing Layer Between Banking and Accounting

Svea Bank’s BaaS Solution: Transforming Financial Services through Integration

Stop Talking Tech-Start Solving Problems Your Customers Care About

Temenos Launches Enterprise Cross-Border Payments Solution

What’s Next in Blockchain

Quantum Computing: A New Era for Financial Services - Defence and Offence

Shift4: One Integration. One API. Instant Access to Global Payments p. 48

50

Ntroducing Hybrid Payments - On The Verge Of Digital Dominance

55

Asia’s Payment Revolution: How the World’s Fastest-Growing Region is Redefining Payments

Crafting the Baltic Fintech Ecosystem: A Modern-Day Baltic Way

56 Are New WealthTech Tools Truly Democratizing Investment?

“From Compliance to Competitive Edge: Why Europe’s Fintech Future Lies in Purpose, Humanity, and Trust”

58

Fintechs and academics of the world, unite: How collaborating with a fintech scholar can turbocharge your startup

As we step into 2025, the Nordic and Baltic fintech landscapes continue to push the boundaries of the industry with exciting develompents that are setting the tone for 2025.

By Chris Crespo

The industry has matured, becoming a steady source of job creation and investment.

Gone are the days of unmeasured growth; today, we see a stable yet promising phase in the fintech sector. To borrow from Gartner‘s Hype Cycle, Fintech has entered the proverbial “plateau of productivity”. Originally coined to describe the phase where technology matures, proves its value, and gains widespread adoption, in this context, we use it to signify the coming of age of an industry that initially went through a period of unfocused overreach, marked by a “winner-takes-all” mindset. Over time, however, it has shifted from disruption to refinement. In this more recent stage of maturity, fintechs are expanding both within their

home markets and internationally. They are building strong collaborations with other ecosystem players and, in some cases, preparing for IPOs. Klarna is a prime example, highlighting the region’s growing influence in global fintech.

Sweden and specifically Stockholm continues to be the beating heart of Nordic fintech accounting for 42% of the Nordic Fintech Ecosystem. The Swedish market also continues attract the hightest levels of investment. Notably, seven out of the top ten funded fintech firms in 2023 were based in Sweden. There are far too many innovative fintech companies in Sweden to name them all, but a few that stand out include Atlar, simplifying bank-to-bank payments for businesses; Lovable, enabling software development through a chat inter-

face; Anyfin, which helps consumers refinance loans and reduce borrowing costs, and Minna Technologies, which provides subscription management tools for banks and businesses.

But tha’s not all. Finland is setting a precedent in crypto regulations, focusing on fraud prevention and consumer trust, setting the stage for the MiCA regulations which as of the 30th of December has gone into full force. Meanwhile, Norway’s green fintech sector is merging sustainability with finance, supporting platforms that track carbon credits and promote sustainable investments.

Denmark’s fintechs like Lunar and Pleo are continuing their international expansion, capitalizing on Denmark’s reputation for user-friendly financial solutions.

The Baltic fintech ecosystem is flourishing. With it’s highest density of unicorns per capita in the world, the region is attracting record venture capital investments, particularly in payments and compliance. For the first time, the region will have its own dedicated fintech event in 2025, Baltic Fintech Days. The event will highlight the region’s exceptional fintech talent and position it as Europe’s next major fintech hub.

Blockchain is quietly making a comeback with real-world applications that promise to transform financial services. Wealthtech is democratizing investment markets, enabling average people to invest. Compliance is becoming a competitive edge, and fintechs are leveraging academic expertise for growth.

In Lithuania, the fintech ecosystem is booming, making it a magnet for investment and talent. The country’s strategic focus on regulatory clarity and innovation has positioned it as a leading hub in Europe. Additionally, compliance is increasingly being seen as a competitive advantage. Fintechs are not only meeting regulatory demands but turning them into opportunities for differentiation and growth.

Working with academic institutions is emerging as a key strategy for many fintechs. Collaborating with academics provides fintech companies with deep insights and cutting-edge research, enhancing their strategic direction and innovation potential. This untapped resource is proving a secret weapon for fintechs wishing to drive growth and excellence.

We’re thrilled to share these insights and trends with you. Our contributors, including thought leaders and influential voices in fintech, bring you a diverse range of topics from quantum finance to the impact of romance scams.

We hope you find this edition inspiring and opinion shiftig as we take a cold and refreshing plunge into the world of the riveting world of fintech. Enjoy and stay disruptive!

AboutChris Crespo is a corporate storyteller and Head of Content at Nordic Fintech Magazine, where he oversees the creation of narratives that connect industry leaders and celebrate innovation in the Nordics and Baltics.

2025: The Nordics have cemented their position as a global hotspot for financial innovation, with Stockholm emerging as the region’s de facto capital. As the meeting point for Nordic collaboration and business, Stockholm boasts a thriving ecosystem of startups, a supportive community, and a culture deeply rooted in problem-solving. Let’s explore the hard numbers, unique mindset, and vibrant community that make Stockholm the cornerstone of the Nordic fintech ecosystem.

By Love Dager, Lana Brandorne, Anna Claassen

Stockholm’s fintech sector exemplifies growth and innovation. The city hosts over 500 fintech startups, making it one of the densest fintech hubs in Europe. In 2022 alone, Stockholm’s fintechs attracted more than €1.2 billion in venture capital investment, underscoring its appeal to global investors. While global fintech investment experienced a significant decline in recent years, Stockholm remained resilient. In 2024, the city is estimated to have attracted approximately €500-600 million in venture capital investment, reflecting both its continued strength as a fintech hub and the broader economic challenges impacting investment levels worldwide.

Stockholm is also renowned for producing fintech unicorns, including Klarna, Bambora (Ingenico 2015, merged with Worldline 2020), iZettle (acquired by PayPal 2018), and Trustly, positioning

it among Europe’s leading cities for billion-dollar fintech companies. Moreover, the fintech sector has contributed significantly to job creation, employing over 20,000 professionals in the Stockholm region, bolstering both the economy and a skilled workforce.

The Mindset: Solving Challenges Through Entrepreneurship

Sweden’s entrepreneurial mindset is deeply rooted in a unique blend of cultural openness, technological sophistication, and supportive infrastructure. The nation’s start-up ecosystem benefits from readily available funding, robust investor networks, and well-established mentorship channels. Historically, Sweden’s emphasis on universal access to quality education and near-total internet connectivity— about 99% of citizens are online—has cultivated a highly literate, tech-savvy population primed for innovation.

However, while other Nordic countries also boast high levels of connectivity and education, Stockholm distinguishes itself as the financial capital of the Nordics, home to the region’s largest banking and financial sector.

A significant factor in Stockholm’s success is the role of its early fintech successes, which have not only inspired a new generation of entrepreneurs but also significantly contributed to the availability of VC and angel funding. This increased access to capital provides fertile ground for startups to scale and thrive.

At the cultural level, openness is a defining characteristic, encouraging transparency, collaboration, and the free exchange of ideas. Swedish consumers, known as early adopters of digital services, actively nurture entrepreneurial spirit by embracing new technologies. Their acceptance of e-government services, used by over 95% of the

Lana Brandorne, Love Dager and Anna Claassen. Co-Founders of Stockholm Fintech.

to support innovators who drive economic growth and societal progress.

A Thriving Community

If you too want to be a part of the thriving fintech community that Stockholm is, we warmly welcome you to our home at Stockholm Fintech Week 11-12 February 2025. Read more at stockholmfintech week.com.

Anna Claassen, Lana Brandorne and Love Dager Co-Founders of Stockholm Fintech

population, further reflects a national willingness to embrace change.

Sweden’s normalization of risk-taking and its cultural emphasis on innovation have solidified its reputation as a global leader in fostering entrepreneurial problem-solving. This environment continues

Stockholm’s fintech success is not just about numbers—it’s also about the people and the ecosystem they’ve cultivated. The city boasts a vibrant, collaborative network of startups, investors, regulators, and accelerators. Programs such as Sting provide fintech startups with mentorship, funding, and resources to scale rapidly.

Events like Stockholm Fintech Week underline the city’s strong sense of community. This annual gathering brings together over 1,500 attendees, including startups, investors, regulators, and global partners. Stockholm Fintech, a central player in the ecosystem, facilitates year-round events, startup-investor pitch sessions, and international collaborations that amplify the city’s profile as a fintech hub.

The Way Forward

Stockholm’s rise as a fintech capital is no accident. It reflects a deliberate effort to cultivate a supportive ecosys-

tem, driven by innovation and trust. As finance continues to evolve, Stockholm not only keeps pace but sets the standard for what a fintech hub can achieve.

From its robust infrastructure and entrepreneurial mindset to its collaborative community, Stockholm offers a unique blend of opportunity, talent, and inspiration.

Stockholm isn’t just the capital of Sweden—it’s the capital of fintech innovation, shaping the future of finance in Europe and beyond.

Anna Claassen, Lana Brandorne and Love Dager are the co-founders of Stockholm Fintech, the fintech community of Stockholm and Sweden. Each year they organize multiple events, international delegations and investor activities for the Nordic finance and tech sector – all culminating in the Stockholm Fintech Week that each year gathers everyone in one place.

The fintech industry stands at the forefront of a global financial revolution, reshaping traditional banking and payments ecosystems. With rapid advancements in digital technologies and increasing consumer demand for faster, more efficient financial solutions, the sector has become a battleground for innovation.

By Lukas Savickas, Minister of Economy and Innovations of Lithuania

As the U.S. and China dominate the landscape with their tech giants and extensive markets, Europe faces the challenge of carving out its place amidst these global powerhouses.

Europe: A Contender in the Global Fintech Arena

In recent years, Europe has taken significant strides to assert itself in the fintech domain. The European Union has introduced robust regulatory frameworks, such as the PSD2 directive, fostering innovation and competition while ensuring consumer protection. Countries like the UK, Germany, and the Netherlands have long been considered fintech leaders in the region. Yet, the EU’s fragmented financial systems and diverse regulations remain hurdles to creating a unified fintech ecosystem. Despite these challenges, Europe’s focus on sustainable and inclusive growth offers a unique competitive edge. Initiatives supporting green finance, insurtech, and regtech are reshaping the continent’s fintech narrative. However, staying ahead in the race demands continuous innovation, cross-border collaboration, and the ability to attract global talent and investment.

Lithuania: A Gateway to European Fintech

Amidst Europe’s fintech surge, Lithuania has emerged as a formidable player and a gateway for international fintech companies entering the EU. With over 276 fintechs operating locally, the country’s regulatory environment, talent pool, and strategic vision have set it apart as a hub of innovation and opportunity. The sector employs over 7,400 professionals (Invest Lithuania, 2023). These achievements have positioned Lithuania 10th in the Global Fintech Ranking (Findexable, 2021) and as the largest fintech hub in the EU in terms of licensed companies (EUCLID Register, European Banking Authority, 2022). Additionally, Lithuania is recognized as a low-risk jurisdiction, ranking 9th globally, and it claimed 3rd place in the competition to host the EU’s new Anti-Money Laundering Authority (Basel AML Index, 2023).

Lithuania’s achievements are a testament to its ambitious approach. Its regulatory authority, the Bank of Lithuania, is renowned for its progressive initiatives, including the Regulatory Sandbox and the Newcomer Program, which enable companies to test and scale their solutions within a safe and supportive framework.

Cost-Efficiency and Talent: Lithuania offers a highly competitive cost-to-quality ratio. Ranked first globally for digital and technological skills availability, it ensures that fintech firms can access topnotch expertise at competitive costs. Moreover, 43% of fintech leadership roles in Lithuania are held by women, showcasing inclusivity.

• Strategic Location and Accessibility: Positioned as a gateway to the European Economic Area (EEA), Lithuania simplifies market entry for non-EU companies. Global names like Revolut and DriveWealth have chosen Lithuania as their base for EU operations.

Diverse Ecosystem: While payments remain a dominant sub-sector, Lithuania has expanded its fintech portfolio

Lukas Savickas Minister of Economy and Innovations of Lithuania

Regions like the Baltics and Nordics hold immense potential to drive this transformation further.

Lukas Savickas

Minister

of Economy and Innovations of Lithuania

Lithuania’s 2023–2028 Fintech Strategy underscores its commitment to becoming a global leader in financial technology. The strategy focuses on qualitative and quantitative growth, emphasizing the diversification of the fintech ecosystem. Initiatives like the LBChain blockchain platform and AI-driven fraud prevention systems highlight Lithuania’s drive for technological excellence.

to include wealthtech, crowdfunding, insurtech, and regtech. These areas are primed for growth, with initiatives like enhanced financial literacy campaigns and supportive licensing environments leading the way.

Ebis et modis etur? Quia ipiet volupti uribus dolupta nienimo llaborrore expelit ecepresecum velignihil is doloreped maxim illupta tianihitiis nitione stotasperion prore nonse explandam solorem et iniendi gnatem idest reicaboribus is eicae. Que conse nat harchil luptis excestias voloreptatet re aut quam ipienis eum recae dolutem eaqui cuptatem venis eumenist, nite lab inum as

Strengthening Europe’s Global Position Collaboration across borders is key to Europe’s strategy, as seen in its efforts to unify fragmented financial systems and streamline market access. This approach not only reduces barriers for fintech companies but also strengthens the continent’s collective capacity to innovate and attract investment.

The success of leading fintech hubs in the UK, Germany, the Netherlands, Lithuania, and emerging players demonstrates Europe’s potential to be a global contender. By harnessing its diverse markets, strategic initiatives, and skilled workforce, Europe is creating an ecosystem that thrives on technological excellence and inclusivity. In a globalized world, Europe’s ability to compete with dominant markets hinges on continuous innovation, unified policy-making, and the attraction of global talent. With a clear vision and strategic collaboration, Europe is poised to strengthen its position as a

global fintech powerhouse, contributing to a more dynamic and balanced financial landscape.

Moreover, regions like the Baltics and Nordics hold immense potential to drive this transformation further. With their high levels of digital literacy, advanced infrastructure, and entrepreneurial ecosystems, the Baltic and Nordic countries are uniquely positioned to serve as catalysts for innovation. These regions are not only pioneering solutions in payments and blockchain but are also leading the way in sustainable and inclusive fintech development. Their compact size and agility allow them to quickly adopt and implement forward-thinking policies, making them ideal testing grounds for new financial technologies.

So I urge Europe to become a cross-border playground, unifying systems and regulations to foster seamless collaboration and innovation.

Fimento is a financial SaaS solutions provider specialising in credit insights, loans and factoring, and AI technology. The company forms part of Moank Fintech Group, which includes Moank Bank, an early adopter of PSD2.

By R. Paulo Delgado

M’oank began as a consumer lending business. By 2018, Moank recognised that its technology was mature enough to offer to others. The company split into two, giving rise to Fimento, which is the tech arm of Moank Fintech Group. Moank went on to receive a banking license in 2022, while Fimento continued to build out its tech offerings.

In 2023, the company established a significant joint venture with UC—Sweden’s credit reference agency—to provide PSD2 and credit insight services across Sweden and Finland. The company has since expanded its operations to Spain and the Netherlands.

Credit assessment services

Fimento provides banks and financial institutions with AI-powered analysis of customer bank account data to verify income, analyse spending patterns, and detect potential fraud.

“Our income and expenditure AI has reached accuracy levels of up to 97% in categorisation tasks. We use this categorisation during a customer onboarding process to improve the quality of credit checks,” says Torbjörn Sandahl, CEO of Moank Fintech Group.

Fimento offers real-time bank account analysis for credit assessment, including

Torbjörn

Sandahl CEO of Moank Fintech Group

Fimento is open for business in the fields of credit onboarding, factoring, and PSD2 and PSD3 requirements.

Torbjörn Sandahl

CEO

of Moank Fintech Group

a 90-day monitoring option to determine risk. The platform can cross-check company financials against their submitted annual statements to verify accuracy and detect potential discrepancies.

With the customer’s consent, Fimento’s tech can also listen for anomalies such as excessive loans or other suspicious account behaviour to determine risk with a high degree of accuracy.

“We’re constantly improving our AI categorisation so that the credit process can become faster, reducing the need for someone to sit at a desk crunching numbers in an Excel spreadsheet,” says Sandahl.

“Hyperfinance”—groundbreaking factoring technology

Fimento offers a factoring service called Hyperfinance that operates fundamentally differently from traditional bank lending. Instead of going through the immense paperwork of obtaining a fixed credit line—which grows more complex when the company wants to increase that credit line later—Fimento offers a

pay-per-use option.

“Companies simply state how much they think they need and then run as fast as they can,” says Sandahl.

No additional fees are associated with having the credit line.

The service is currently up and running with a factoring company in Sweden.

In all cases, Moank Bank provides the financing while Fimento provides the tech behind it.

Fimento will flex its muscles at Stockholm Fintech Week by demonstrating two live AI-powered systems. The first, called Moa, is a chatbot that answers questions about the Digital Operational

Resilience Act (DORA).

DORA went into force in 2023 and into application on 17 January 2025. Its purpose is to strengthen the IT security of financial institutions.

It’s also 600 pages long with 1,100 lines of requirements, and Moa’s task will be to demonstrate AI’s ability to provide simple, accurate answers based on complex underlying data.

The other AI demo is more personal. Visitors will be able to drop their ID into it and Fimento’s AI will categorise their spending and income for them after they provide consent.

“Fimento is open for business in the fields of credit onboarding, factoring, and PSD2 and PSD3 requirements,” says Sandahl.

Credit data is fragmented across Europe, making it virtually impossible for expats, cross-border commuters, and people wanting a vacation home abroad to access debt. Mifundo, a LendTech based in Estonia, has solved this problem by building a product that consolidates credit and open banking data for banks to access.

By R. Paulo Delgado

Mifundo has already made history by being the first fintech to receive funding from the European Innovation Council (EIC). The company received €10 million from a fund slated for companies of strategic importance to Europe, and with global disruptive potential.

NFM caught up with Kaido Saar, CEO and Founder of Mifundo, to understand more about the fintech:

NFM: How does Mifundo work?

Kaido Saar: Mifundo aggregates and standardizes credit bureau data and open banking information from multiple European countries, delivering it through a single API to banks. This allows banks to access the same level of customer financial information that local banks would have in other countries.

Mifundo’s unique value proposition is our ability to connect cross-border financial histories across EU countries, enabling individuals to access financial services without the barriers created by local credit histories.

It sounds simple, but it’s immensely complex to achieve this, especially in Europe where accessing financial data across borders is both highly regulated and highly complex due to multiple data sources, languages, currencies, and technologies.

How did you overcome the data-sharing challenge?

No data is shared without full customer consent, and we maintain a

record of that consent for compliance purposes. When a bank wants to query a customer’s financial profile, they trigger the request through Mifundo’s platform or API.

How has the response been from the banking sector?

Banks are extremely receptive to the service because they’re shackled without data, and obtaining this data without a service such as Mifundo’s is complex, to say the least.

Given enough accurate data, a bank can explore loan opportunities they otherwise wouldn’t, Most banks don’t know that 15% of loan applications in Europe come from foreigners, likely more for digital banks.

Our product is particularly valuable for banks dealing with foreign customers, as building individual connections with multiple credit bureaus across countries would be impractical and costly for small percentages of their customer base.

Europe doesn’t have uniform credit scoring practices, so we standardize the data, regardless of the source language or currency.

We take care of all the technological and compliance complexities so the bank can focus on the underwriting process.

Tell us about any success stories from using your product.

foreign customer creditworthiness, thus significantly reducing the credit risk associated with those loans.

This allows banks to access the same level of customer financial information that local banks would have in other countries.

Kaido Saar CEO and Founder of Mifundo

One of our clients, a bank in Southern Europe, faced significant challenges with nationals living in Northern Europe, the Nordics, and the UK, who wished to return home and purchase real estate.

The bank lacked proper data on these potential customers, making it difficult to assess their creditworthiness.

By integrating Mifundo’s platform, the bank could instantly determine

Another case was a bank with a BNPL scheme designed to serve international retailers. Mifundo helped increase the conversion rate for retailers.

Every bank is different, and Mifundo accommodates their needs.

What is Mifundo’s immediate goal for 2025?

In the coming year, our top priorities include expanding our network of integrated credit bureaus, securing more bank partnerships, and further refining our platform to support advanced features and AI capabilities.

Behind that desire to expand is our underlying purpose—to empower individuals across Europe with the freedom to move and be trusted, ensuring that their creditworthiness travels with them, no matter where they choose to live.

We are in the midst of the next banking technology revolution. Few visionary banks have started to lay the groundwork for this revolution by adopting MACH architecture (microservices, API-first, Cloud-native and Headless). MACH is key to making banks composable rather than the rigid silos they have today. This in itself is a transformation journey not just a project. However, beyond MACH, the next stage of that journey is already upon us and it is called “Agentic Banking”. This is not about chatbots and using generative AI, it is a fundamental shift towards making the bank much more dynamic and responsive to change right down to an individual customer level!

By Dharmesh Mistry

The transformation to MACH architecture has already demonstrated significant benefits for early adopters, including increased agility, faster time-to-market for new features, and improved scalability. These advantages create the perfect foundation for the next evolutionary step: agentic banking platforms that can truly transform the financial services landscape.

Old Habits

Some banks pride themselves on implementing cutting-edge generative AI solutions, but these often amount to sophisticated point solutions: a GPT model for customer service here, an AI-driven risk assessment tool there. This is the same fragmented approach that has got them to have a disjointed patchwork of disparate systems based on different genres of technology. Whilst it’s good to understand this new technology with a single implementation, letting departments exploit it independently is a mistake. Once banks

understand the full transformative potential of truly integrated AI systems a plan for a more strategic and holistic approach can be created.

This fragmented approach creates several challenges: duplicate data storage, inconsistent customer experiences, increased operational costs, and missed opportunities for cross-functional insights. Moreover, maintaining multiple AI systems across different departments leads to higher technical debt and complexity in system integration. Banks must break free from these traditional patterns to remain competitive in an increasingly digital financial landscape.

Technically in very simplistic terms it is about embedding AI across all the systems in the bank. It is about replacing workflows and business rules/logic with dynamic decisions backed by data. Agentic banking will transcend siloed systems by leveraging API’s to interact directly with source systems rather than having to copy data or

have it manually rekeyed by humans.

Recently in an interview Microsoft CEO Satya Nadella goes further to say that “AI agents are poised to render traditional SaaS applications obsolete”.

The technical architecture required for agentic banking consists of several crucial layers:

1. Data Foundation Layer: A unified data platform that enables real-time access and processing of all banking data, from customer interactions to market information.

2. AI Agent Layer: Specialized agents designed for specific banking functions, each with its own expertise and decision-making capabilities.

3. Orchestration Layer: Sophisticated systems managing agent interactions, ensuring coordinated actions and maintaining operational integrity.

4. Security and Compliance Layer: Embedded controls ensuring all agent actions adhere to

regulatory requirements and security protocols.

Imagine a unified banking platform where intelligent agents collaborate seamlessly:

A risk assessment agent identifies market opportunities and potential threats in real-time Trading agents automatically evaluate and execute opportunities within compliance boundaries

• Portfolio management agents dynamically adjust client positions based on market conditions

Customer communication agents proactively engage clients with personalized insights and recommendations

• Fraud detection agents continuously monitor transactions and adapt to new threat patterns

• Regulatory compliance agents ensure all operations meet current legislative requirements

AI agents are poised to render traditional SaaS applications obsolete.

Satya Nadella CEO at Microsoft

Product recommendation agents create personalized financial solutions based on individual customer needs and behaviour

This orchestrated intelligence operates at scale, transforming how banks serve their customers and manage risk. The platform requires sophisticated orchestration layers managing agent interactions while maintaining strict security protocols and regulatory compliance by design.

In my previous article, “A day in the life of Frank”, I presented a story of a banking customer of the future. In this story much of the characters life was being orchestrated by his bank. This really was just one example of how agentic banking could fundamentally change the role of a bank by allowing it to be more deeply embedded into customer lives.

The potential applications of agentic banking extend far beyond traditional banking services. Consider these scenarios:

• Predictive financial planning that adapts in real-time to life events

About

Dharmesh has 35 years experience in banking technology and innovation. He has both worked inside banks driving vision and innovation as well as outside as a serial entrepreneur, investor and writer.

• Automated investment strategies that respond in real-time to market changes and personal circumstances

• Proactive risk management that anticipates and mitigates potential financial challenges

• Seamless integration with other aspects of customers’ digital lives, from shopping, travel, work or healthcare planning

The transition to agentic banking presents several significant challenges that banks must address:

1. Technical Infrastructure: Building and maintaining the required sophisticated infrastructure while ensuring system reliability and performance.

2. Data Quality and Integration: Ensuring data accuracy and accessibility across all systems while maintaining privacy and security.

3. Regulatory Compliance: Navigating complex regulatory requirements while implementing autonomous AI systems.

4. Change Management: Training staff and adapting organizational structures to work effectively with AI agents.

By now many of you will question whether this is possible, and some will question whether their bank wants this. However, I would ask banks to consider if their competitor(s) decide to move in this direction, what will the fate of banks that don’t move towards agentic banking? Those who embrace this transformation early will gain a significant competitive advantage, as agentic platforms represent more than a technological upgrade - they represent a fundamental reimagining of banking operations for the digital age.

The transition to agentic banking is not just an option but a necessity for financial institutions aiming to remain relevant in an increasingly automated and personalized financial services landscape. The question is no longer whether to make this transition, but how quickly and effectively banks can implement this transformative technology while maintaining the trust and security their customers expect.

The Bank for International Settlements (BIS) Innovation Hub brings central banks together from all over the world to experiment and develop financial technology for central banks, and also to share information and provide education. One key topic of discussion for the last three years has been AI and how this technology changes the landscape from a fincrime perspective.

By R. Paulo Delgado

We caught up with Beju Shah, Head of the Nordic Center at Bank for International Settlements Innovation Hub, for his insights.

NFM: How is technology changing the financial crime landscape?

Shah: Cybercriminals are using cutting-edge technologies faster than regulators or the private sector can keep up with. It’s easier than ever for cybercriminals to adopt technology-enabled services like Money Laundering as a Service and Cybercrime as a Service. Technology and AI are reducing the barrier to entry, allowing bad actors to test multiple options and variations of attack vectors rapidly, and criminals are using AI at scale to automate attacks with increased sophistication.

What are the main challenges in combating these new types of attacks?

Shah: Ultimately, money laundering is an international problem. It’s a borderless payments problem. Tackling the problem successfully requires information sharing and collaborative approaches to analysis

information sharing and collaborative approaches to analysis are ultimately needed.

What have we learned about effective detection?

Shah: At the BIS Nordic Centre, we ran a highly successful proof of concept called Project Aurora, which used AI, ML, privacy-enhancing technologies, and advanced analytics that demonstrated that, by applying these to analysis, the broadest possible view of data could achieve a three-fold increase in detection of money laundering but also a reduction in false positives of up to 80%. We’ve now moved into the second phase of the project.

Are banks using AI and ML to try and combat sophisticated attacks?

Shah: Although unsupervised machine learning, particularly graph neural networks, seems to be the most effective of all the technologies tested so far, a lot of questions surround it, particularly regarding explainability. About 25% of banks are using or trying it and have found it promising. Over 50% are using or trying network analysis, graph analytics, and anomaly detection.

What progress is being made on cross-border data sharing?

Shah: Europe’s incoming Anti-Money Laundering Regulations have provisions for better data sharing in Article 75. The regulation doesn’t solve everything but it’s a stride in the right direction. Technologies like federated learning could help but there’s a lot more non-technology work that needs to be done to move progress forward. At the very least, starting nationally is a major step forward.

How is BIS Innovation Hub helping?

Shah: BIS Innovation Hub’s purpose is to educate, show the art of the possible with the latest technologies, and move conversations forward. Several projects across our global centres are looking at various aspects of this problem.

across institutions and ultimately across borders.

It’s not currently possible for banks to rapidly track and adapt to evolving and complex typologies—the patterns used by money launderers—across borders because of variances in data protection regulations which, while

necessary, prevent banks from sharing data easily.

In a survey we did of about 100 major financial institutions and FinTechs, 72% agreed that a holistic network view of transactions and flows is essential to effectively combat money laundering and fincrime, and 82% agreed that

We must be mindful that no silver bullet exists. The threat actors are sophisticated and some have immense resources.

Leveraging tech and data in new ways to improve the visibility of suspicious networks and increase the criminals’ risk could make it harder for them to profit from such activities, especially by slowing them down sufficiently.

E-invoicing will become mandatory for businesses in Europe in 2030, and as early as 2026 in Belgium.

By R. Paulo Delgado

Many small businesses read “e-invoice” and think of the PDF sent over email. That isn’t an e-invoice.

An e-invoice is a machine-readable invoice format that allows for automated payments.

Believe it or not, the technology has existed since 1965. The first e-invoice ever sent was a shipping manifest sent by telex that same year using a format called EDI (electronic data interchange). We’re still using EDI today to send e-invoices, in addition to other formats.

E-invoices can travel on a variety of networks. The most popular of these networks is PEPPOL, but there are closed operator networks as well.

The EU’s regulation to mandate e-invoicing for all businesses flies into the teeth of multiple systems, standards, networks, and legacy formats. However, Europe can look to the Nordics for guidance, which has been using e-invoicing for over 20 years, especially in Norway, Finland, and Sweden. Also in Finland and the Nordics, a

Heikki Malkamäki

Managing Director at Maventa

company called Maventa provides connections to e-invoicing transmission layers. Maventa’s technology is already integrated into popular ERPs and many people might be using Maventa under the hood without knowing it.

Legacy co-existing with new tech

Despite e-invoicing technology’s 60year history, it is deeply integrated into large corporation payment systems. Getting rid of EDI simply isn’t an option— at least not for now.

Europe has issued the EN 16931 standard as part of its regulatory clampdown but adoption is unlikely to happen quickly for companies using legacy systems.

Individual countries also have proprietary standards for their e-in-

voices. For example, Finland uses the Finvoice 3.0 and TEAPPSXML 3.0 formats, Sweden uses Svefaktura, and Germany uses XRechnung and ZUGFeRD.

“Maventa provides format conversions for all relevant formats, and we’re introducing more as we go,” says Heikki Malkamäki, Managing Director at Maventa. “The regulation doesn’t particularly care what format is used, so long as it’s compliant with the EU invoicing standard.”

Benefits of e-invoicing

The use of e-invoicing can significantly speed up payments.

Lost or forgotten invoices become a thing of the past because invoices are integrated into the ERP directly and arrive almost instantly.

“Many businesses cite poor information flow as the main reason for late customer payments. E-invoicing solves that,” says Malkamäki.

E-invoicing can also reduce fraud.One of Maventa’s value-add services is fraud

detection: It uses AI to analyze incoming and outgoing invoices to find erroneous or potentially fraudulent invoices.

BEC (business email compromise) is a serious threat to businesses of all sizes. It refers to a technique where threat actors send fraudulent invoices over email to the accounts department and demand payment. BEC attacks have been successful against massive companies, including Google and Facebook who paid more than $100 million to fraudsters who used this technique. A Toyota subsidiary lost $37 million in 2019 after a BEC attack.

E-invoicing adds a layer into the invoice lifecycle that makes such attacks far more challenging to execute successfully.

E-invoicing helps companies more easily remain compliant with VAT payments, especially as Europe begins implementing its ViDA (VAT in Digital Age) framework to combat VAT fraud, which introduces new RFI requirements for ERP providers.

Maventa’s 2025 goals

Looking ahead, Maventa is monitoring the rollout of e-invoicing mandates across Europe, evaluating which markets they can effectively serve. To do this, the company has its eyes open for partnerships that create mutual benefits and synergies.

Maventa has 15 years of experience in this market—a major advantage over newcomers. “There’s plenty of learning that occurs in 15 years. Our product is high quality and has an extremely high success rate,” says Malkamäki.

By Ewan Macleod

Your Go To Market (“GTM”) strategy isn’t working. It’s time to reset for 2025. That’s because you’ve underpinned that strategy with lead generation that requires constant spamming of hundreds of emails and LinkedIn messages every single day.

For many bank executives I know, this epidemic of ‘lead generation spam’ is making the LinkedIn messaging feature almost unusable. Work mailboxes are already clogged with spam.

Every day, thousands of automated messages are being thrown into bank executive inboxes from desperate, misguided Fintechs.

If the definition of madness is repeating the same task continually, hoping for

different outcomes, then it’s safe to say that most of the bank-serving Fintech ecosystem descended into madness long ago.

Yet, the nonsense continues. And now, in 2025, it’s AI-enabled. Oh dear.

Yes, all of those spammy LinkedIn and email messages are now pumped through ChatGPT to generate a constant barrage of automated “personalised” outreach messages. This, as far as the Marketing teams are concerned, rep-

resents the pinnacle of lead generation automation. It works very well in some industries, but it’s entirely the wrong focus for any Fintech aiming to sell services to banks.

Spare a thought, dear reader, for the Sales and Business Development teams at these Fintechs (I’ll call them “Biz Dev” ongoing).

Spare a thought for them because they know what needs to be done. They know it’s about relationships. They

My key message is a simple one: Get in the room with your target executives.

Ewan Macleod

Founder, New Era Digital Partners

know they need to reach 1-2 individuals at every bank to begin to drive and develop that institutional relationship. They understand they’re in the business of Enterprise Sales. Unfortunately, nobody else in the company is focused on that.

Everyone else has drunk the Fintech Kool-Aid. Everyone else – from the CEO to the Chief Marketing Officer – is busy obsessing over ‘leads’. More leads. Let’s get more leads. Buy a new lead generation system! Get a premium Zoominfo account! Let’s get a new CRM! Blow more budget on another new website! Let’s do a report, to get leads! Leads! Leads!

As for the Biz Dev team? What are they doing? Why aren’t they converting all these leads we’re sending them, asks the Marketing team.

“We don’t need your irrelevant leads from this week’s nonsense campaign,” replies the Biz Dev team, “We know who to speak with. We need to get in the room with Bryan and Jane from [insert bank name].”

“We gave you their email address and mobile numbers,” replies the Chief Marketing Officer, eyeing the CEO who nods with approval, “It cost us a LOT of money to get those via that contact scraper service.”

The Biz Dev team are backed into the corner.

“Come on, phone them, stop hiding away!” chides the CEO.

The Biz Dev team are privately horrified – but there’s no support. No understanding. No awareness. It’s 2025 and they’re back to bashing phones. But nobody answers the phone anymore. No bank executive ever answers an unknown number. Ever. They did it once, back in 2022 – and they learned, very quickly, never to do that again. Now they let the procurement team manage all that. Likewise, executives have learned to

avoid unsolicited incoming emails and LinkedIn messages. I remember making the mistake of innocently opening a spam email from a vendor (by mistake!) only to receive a barrage of, “Hi, I see you’re interested in our services…” automated emails that continued for weeks.

Many of the executives I know are keen to engage in constructive discussions with Fintech vendors. If it was simple. If it didn’t come with the huge pain of being subjected to constant marketing overload from vendors as a result.

Back to the Fintech CEO. Under pressure from the board and investors, they’re doing their best business Judo and redirecting the pressure at the Biz Dev teams:

“Make more calls!”

“Make more sales!”

“Do more business!”

It doesn’t take much for Biz Dev teams to wilt under such sustained pressure. Zero support. Zero budget. Zero awareness from their colleagues. Just constant pressure.

It’s at this point I am often introduced to Fintech leadership teams by worried investors.

My key message is a simple one: Get in the room with your target executives. It’s a message already familiar to the Biz Dev teams, of course. But it’s quite a difficult one for other management to hear. It’s almost too simple. And it doesn’t come with easily measurable ‘results’ like the existing approaches. It’s difficult to consider, especially when so much focus, effort, energy and budget has been spent doing the total opposite.

I’ve often faced exasperated Chief Marketing Officers, demanding, “Well, what am I supposed to do?”

My response? I turn and point at the Biz Dev director and say, “Put them in the room with the target customer.”

The CMO will often respond by pointing out that, ‘This isn’t their job’.

Ewan is the founder of New Era Digital Partners, offering advisory and strategy consulting to banks and FinTech companies in the Nordics, Europe, UK and the Middle East. He is active on LinkedIn and a regular guest speaker on the topics of FinTech and Digital Transformation in Financial Services.

And they are correct. In many Fintechs, the Marketing function is to obtain lots of ‘qualified’ leads. (‘Qualified’ meaning ‘They work for a bank’).

Go and look at the actual leads being generated. Look at them. I will often insist that the detail is shown on screen whilst we discuss the topic.

“Junior Developer, Anti-money Laundering Team”

What’s this? I ask. That’s not a decision-maker! Besides, we already know who the decision-makers are. Next?

“Graduate Trainee, Compliance.” Next!

This is the actual horror of Fintech Marketing Lead Generation laid bare in 2025.

The Marketing teams still think their job is generating leads. Why? Well, I’d suggest it’s because leads are measurable. No CMO does anything, nowadays, that isn’t measurable, right?

When it comes to Enterprise Technology Sales, business is resolutely done between people. Not companies. Yes, you can sell me a Netflix or Disney subscription through a few banner ads –and you can readily track and measure that sales journey to winning the $12 fee from my card. But you can’t do this with Enterprise sales. You need to get your Biz Dev people into the room with target customers. This is how it’s done.

To do this, you need to radically adjust your approach to marketing, business development and sales. Stop tracking irrelevant lead generation KPIs that feel good but don’t deliver the goods. Start tracking physical meetings generated with target customers.

The Fintech industry is blessed with great Marketing talent – so I find it enormously exciting when Marketing teams are encouraged to focus their intellect, capability and creativity on helping their Biz Dev teams get in the room.

Quickly, ideas come flying. Marketing teams are brilliant at this, once they’re freed from the straitjacket of mass irrelevant lead generation.

Roundtables. Custom events. Breakfast briefings. Podcast interviews. Sideevents at big conferences. Experience days. Customer summits and conferences.

It’s time to unleash your Marketing teams to help them fully support their Biz Dev colleagues.

It’s time for CEOs to radically adjust their approach: Stop focusing on leads. Start focusing on getting your Biz Dev people in the room.

By Cecilie Fjellhøy

In 2024, fraud was finally labelled a societal problem by the Norwegian National Authority for Investigation and Prosecution of Economic and Environmental Crime. Yet, this recognition feels bittersweet. The root cause of our inaction, I believe, is the stigma attached to fraud—a stigma that prevents us from tackling it like we do other crimes.

After going public with my own experience as the whistleblower in the Tinderswindler case, one of Netflix’s most-viewed documentaries, I was intrigued by the public’s response. Instead of focusing on why the criminal was still at large or the flaws that allowed such crimes to happen, the narrative shifted to victim-blaming. Were we, the victims, gold diggers who deserved what happened to us? It was a cruel echo of the kind of questions faced by victims of other crimes, like asking a rape survivor why they were in a certain place or wearing certain clothes.

Fraud is one of the few crimes where victims are openly mocked and told they’re at fault. This attitude shifts responsibility away from the criminals and onto those who suffer. It’s damaging, and it creates an environment where victims are left without support and fraudsters can continue unchecked.

When I woke up from the nightmare of my fraud experience, I naively believed the system would help me recover. Instead, I faced a harsh reality: victims of financial crimes are often left to fend for themselves. In my case, I was left with over nine loans and £200,000 in debt.

The psychological toll was immense. I had fallen into the sunk-cost fallacy— the more I invested in a relationship, the harder it became to accept the truth and escape.

Coming to terms with being a victim

Cecilie Fjellhøy,

Keynote Speaker & activist at LoveSaid

was excruciating. Fraud often isolates its victims. We lie to ourselves, our families, and even financial institutions to sustain the illusion. This isolation leads to self-blame, a sentiment that society, law enforcement, and financial systems readily reinforce.

Adding insult to injury, I was taken to court by four banks for debts I couldn’t

repay. Billion-dollar institutions pointed the finger at me, while my fraudster walked free. This level of systemic failure compounds the trauma and leaves victims feeling utterly abandoned.

Professor Marte Kjørven from the University of Oslo has described the

Fraud is one of the few crimes where victims are openly mocked and told they’re at fault.

Cecilie Fjellhøy Keynote Speaker & activist at LoveSaid

treatment of fraud victims in Norway as the country’s greatest collective economic injustice. I couldn’t agree more. By focusing on blaming victims instead of holding criminals accountable, we’ve created an environment where fraud thrives. Why wouldn’t it? It’s one of the most lucrative crimes, with minimal consequences even for those who are caught.

Fraud is often called a financial crime, reducing its impact to stolen money. This view ignores the devastating human cost. Research has shown parallels between fraud and domestic abuse, including economic abuse, isolation, humiliation, and psychological manipulation. These aren’t just money problems— they’re deeply personal and damaging. Some victims even take their own lives under the weight of their suffering. I’ve been on the receiving end of soul crushing messages from victims themselves not knowing how to continue their lives, or family who’s been left.

As a UX designer with a decade of experience in tech, I once worked to make processes as seamless as possible. But when I became a victim, I saw the dark side of frictionless systems. It took me just two minutes to apply for 10 bank loans and less than two days to secure over £50,000 in unsecured loans. I even warned my fraudster about how frighteningly easy the process was: “No wonder people go bankrupt here.” Two years later, I found myself applying for personal bankruptcy because of those very actions. This ease of access shows a critical flaw in our financial systems. While convenience benefits honest users, it also empowers criminals. Worse, when victims fall prey to these flaws, they’re treated as complicit rather than as casualties of systemic negligence.

The Bigger Picture Fraud isn’t just about stolen money. The funds often fuel larger criminal enterprises, including drug trafficking, human trafficking, and terrorism. Yet, we fail to treat fraud as the serious threat it is. Instead, we allow outdated attitudes and broken systems to let the problem grow.

Fraud’s human cost goes far beyond the financial. Victims lose trust—in people, in institutions, and in themselves. Trust is the glue that holds society

My determination to change how fraud victims are treated—and my deep desire to prevent anyone else from experiencing what I did—led me to co-found LoveSaid with Anna Rowe. LoveSaid is a non-profit organization dedicated to supporting victims of romance fraud and financial abuse and driving meaningful change.

At LoveSaid, we believe one simple truth: no one should have to recover alone. We offer emotional support,

When it’s eroded, everyone feels the effects.

To combat fraud effectively, we need serious change. First, we must stop blaming victims. Recognize that they’ve lost more than money; they’ve lost parts of their lives. Second, we need to use technology for good, not thinking the criminals have won, even though they rapidly change tactics and methods (AI scams and deepfakes). Third, we need

collaboration across industries to share data and ideas.

Finally, let’s make fraud prevention the new customer service. By focusing on security and accountability, we can rebuild trust and create a safer society for everyone.

Fraud can happen to anyone. It’s time we treated it like the serious issue it is— not just as a financial problem, but as a societal one. Together, we can protect those at risk and stop fraud before it destroys more lives.

practical guidance, and vital resources to help survivors rebuild their lives after fraud.

But our mission goes beyond support—it’s about driving systemic change. LoveSaid actively advocates for stronger victim protections, pushing for policy reforms that hold financial institutions and tech companies accountable. We work to close the gaps that fraudsters exploit by collaborating with banks, tech platforms,

and policymakers to build safer online spaces and implement better safeguards. Our work includes providing specialized training, leading workshops, and participating in webinars, conferences, and roundtables.

Our purpose is clear: empower survivors, break the stigma, and fight for real change in how fraud is prevented and addressed. If you want to know more, or support our work please visit lovesaid.org.

The Nordic banking market is renowned for its high level of digital maturity. However, the same maturity has led to a sense of complacency, leading to solutions that struggle to compete with more agile fintechs, says Jorno Levels, Account Executive at Mambu.

By R. Paulo Delgado

NFM caught up with Jorno Levels to discuss Mambu’s focus for the Nordics and its plans for 2025.

NFM: How is technology changing the financial crime landscape?

Jorno Levels: Mambu is the first cloud-native, software-as-a-service (SaaS) core banking platform. We started out in 2011 in Africa. In two years, 100 organizations in 26 countries adopted our engine. Today, our cloud banking platform helps over 260 customers provide lending, deposits, payments, and many other solutions to 114 million end users in over 65 countries.

What makes Mambu’s composable banking model unique?

Our composable banking model ensures complete flexibility, allowing you to integrate best-of-breed solutions around the core and unlock unlimited innovation.

In addition, our “composable bankin-a-box” model simplifies the process by having a single System Integrator (SI)

manage the entire contract. The SI will recommend, integrate, and manage best-of-breed solutions around a core like Mambu, reducing the complexity of managing multiple technology contracts. This approach is created with scale, agility, ease-of-use, and speed in mind and offers more flexibility than an end-to-end (E2E) modular banking model while providing a streamlined, unified experience.

We see this model becoming more and more common, particularly in the

Mambu is positioned at the core of this ecosystem. While we provide the foundational architecture—a composable and configurable core banking platform—we believe that true transformation cannot go without collaboration. Our extensive ecosystem of partners, including fintech technology providers, SIs, and consulting firms, is key to delivering comprehensive solutions.

Mambu’s role in this transformation is to offer a viable and compelling alternative to traditional, often localized, banking solutions in the Nordics. We enable financial institutions to choose a delivery model that fits their needs best. Whether it’s our “composable bank-in-a-box” solution for seamless, managed transformations or our “headless” core banking platform designed for tech-savvy teams seeking flexibility and extensibility, Mambu empowers Nordic financial institutions to innovate, scale, and adapt with ease.

What are Mambu’s priorities for 2025?

A top priority is strengthening our collaboration with Nordic strategic partners. Together, we will continue investing in localizing the Mambu solution and enhancing our offering.

The appointment of Ivneet Kaur as our new Chief Product and Technology Officer will help us achieve that even faster. With over 20 years of expertise in cloud infrastructure, AI, and product/platform engineering, Ivneet will drive Mambu’s technology strategy and innovation.

Speaking of innovation, Mambu’s recent acquisition of Numeral, a payment fintech company, underscores just that. With Numeral we are able to provide even better payment solutions that are seamlessly integrated into Mambu’s cloud banking platform.

Nordics where the demand for localized solutions is high.

What is Mambu’s unique offering for the Nordic ecosystem?

The transformation of the Nordic financial landscape is driven by fintech innovation. And innovation means collaboration. Composable banking is a good example of this; it inherently depends on the integration of multiple fintech offerings via modern APIs.

This translated into a major milestone: the partnership with a leading Swedish retail bank to fully transform and migrate their business onto Mambu. After an extensive evaluation process, the bank concluded that Mambu’s cloud banking platform aligns perfectly with its ambitions, and is compliant across the Nordic market.

Mastercard launched the Lighthouse program in 2018 in the Nordics and Baltics to foster symbiotic growth between banks, fintechs, and Mastercard. The program’s achievements are laudable: The companies that participated in the Mastercard Lighthouse program have raised over €1 billion during or following the program. The winners of the Mastercard Lighthouse program receive an invitation to the Mastercard Global Start Path program to pitch for potential participation.

Lighthouse provides global network access to help startups scale geographically. It involves structured workshops with banks, advisors, experts, and investors,” says Mats Taraldsson, Head of Fintech and Impact Tech Engagement at Mastercard, Northern Europe.

The program has two main tracks:

• Lighthouse FINITIV, the partnership program focused on fintech startups and scale-ups

Lighthouse MASSIV, which is focused on social impact startups that empower sustainability

“Our MASSIV program aligns with the UN’s Sustainable Development Goals, particularly in financial inclusion, making the world more prosperous and secure, and sustainability and environmental initiatives,” says Mats Taraldsson.

Why Mastercard began the Lighthouse program in the Nordics and Baltics Mats Taraldsson describes Mastercard’s mission as one of providing globally

excellent payment solutions and making those payments safe, simple, and secure for consumers, merchants,

businesses, and governments. “Innovation is key for us to accomplish this,” he says.

Mastercard began the Lighthouse program due to the immense innovation and creative solutions happening in the Nordics and Baltics.

Because the region is made up of small geographic zones with different languages, the startups in the area have focused on a global market from the start.

The Baltics, especially, focus on a European market from the start due to each country’s relatively small size.

“There are no signs of innovation slowing down in the Nordic and Baltic regions,” says Taraldsson.

The Nordics and Baltics have a vibrant fintech startup landscape, and Mastercard hopes to help these companies through primarily a partnership approach.

What the program offers Mastercard’s focus is to help companies grow through expert guidance, access to bank networks and expert advisors, and through supporting geographical scaling. In some cases, Mastercard will become a co-creator where the startup’s services might integrate well with Mastercard services. Mastercard may also partner directly, such as in the case of Aiia, a previous year’s participant that Mastercard initially partnered with and then ultimately acquired.

About the Program for start-ups

Mastercard selects 20 participants twice a year to take part in the Fall and Spring Lighthouse program. All participants must be based in or active in the Nordic or Baltic region, and focus on some aspect related to payments.

When selecting participants to the program, Mastercard looks at these factors: Likeliness to succeed with their service or solution • Market interest Potential

The likelihood to succeed is the most important factor in the selection process.

The Lighthouse FINITIV Spring edition runs from March to June, and the Fall edition runs from September to December. Each program consists of three in-person workshops with continuous, remote support. After the first workshop, partners and startups will determine which potential partnerships will be pursued.

Three finalist companies will be invited to the Mastercard Grand Finale event typically held at Latitude 59 in Tallinn for the Spring program and Slush in Helsinki for the Fall program. The program winner will receive an opportunity to pitch at Mastercard’s Start Path Pitch Day.

Additionally, all participants become part of the Mastercard Lighthouse alumni network, which remains active through ongoing communication and meetups.

When Nelson Wootton and Steve Round launched a UK bank for lowincome customers twelve years ago, they ran head-on into the problem that led to the creation of SaaScada’s revolutionary platform. They discovered that nothing on the market could deliver the product or data agility they wanted.

By R. Paulo Delgado

We found the process of buying and deploying core banking really painful,” Wootton says. “Getting the reporting from different systems to understand how customers use the products then takes 6-8 weeks. In the worst-case scenario, the reporting might reveal there’s a problem. Implementing changes then takes another three months and results in a hefty invoice from the provider. Your team then waits the usual eight-week reporting period to know if the problem has been solved.

“So, we’re talking about the better

part of a year to do a single product iteration. In today’s now-now-now world, that’s an aeon,” says Wootton.

Rethinking data architecture

Creating yet another microservices or API-driven core banking solution wasn’t going to solve the underlying issue. Wootten recognized that all existing core banking systems were being hampered by their architecture.

“They use structured data whereas we use completely unstructured data. We then have an event system that reads the unstructured data and builds structured databases for

facilitate lending. All the code thereafter then becomes tightly coupled with the lending code, making it challenging to add code for other banking services that don’t somehow relate to lending.

The result is immense complexity, and a system so tightly intertwined that changing any part of it might have unforeseen ramifications on numerous other parts,

SaaScada tackled this by moving away from the concept of product modules. Instead, they provide a full suite of features within the Product Sequencer, enabling clients to create multi-ledger accounts which may include features and wallets that cross traditional product boundaries. Clients can mix and match features and intertwine without any fear of breaking other parts of the system.

“The ability to change, innovate, and configure your own service, alongside real-time data to tell you what your customers do and don’t do with those products—it’s an incredibly powerful position to be in,” says Wootton.

We’re already

deploying

in hours. By the end of this year, we’ll be deploying in minutes.

Nelson Wootton Co-Founder and CEO, SaaScada

clients,” Wootton says.

By adopting a non-structured approach to data, SaaScada’s core banking system can adapt to the needs of the client. Reading and writing data are two completely uncoupled processes, meaning reporting can scale independently of transaction volume.

Lending is what banks do, but shouldn’t be what the code predominantly does

A bank’s primary business is lending. Historically, this meant that core banking systems initially began with code to

The proof is in the pudding In evidence of its success, Allica Bank, the UK’s fastest-growing fintech ever, according to its website, utilises SaaScada’s core banking technology. Allica Bank was also named the UK’s fastest-growing company in The Sunday Times’ Top 100 for 2024. Allica hit profitability in 2023 and hopes to capture 10% market share in the next five years.

SaaScada has clients in the UK, Switzerland, Mauritius, Zimbabwe and South Africa, and has its eyes set on the Baltics and Eastern Europe. The company is about to start its Series A and is looking to open offices in Singapore and Dubai. Perhaps the most mind-boggling of all its feats is the ability to sell fully-fledged core banking per hour for less than the cost of an average lunch.

“We’re already deploying in a few hours. By the end of this year, we’ll be deploying in minutes. Don’t bother with an RFI or an RFP. Pick a data centre you want it deployed in, and we’ll deploy it,” says Wootton.

Nelson Wootton Co-Founder and CEO, SaaScada

Established in 2000, Enterprise Estonia was formed by merging various governmentcontrolled agencies focused on export, foreign investment, technology, regional development and tourism.

By Tom

Our mission is to promote sustainable economic growth across Estonia by fostering innovation, internationalization and regional development. We aim to empower entrepreneurs and businesses throughout the country, supporting the creation of more successful enterprises and innovative business environments.

Estonia: A Global Trailblazer in Fintech Innovation

Often hailed as the “startup nation,” Estonia has established itself as a hub of innovation and entrepreneurship. In the fintech sector, the country’s small size has proven to be a significant advantage, enabling close-knit networks and collaborations that transcend public and private sector boundaries. Combined with its forward-thinking government policies and advanced digital infrastructure, Estonia is leading the charge in reshaping the fintech landscape.

One of the most exciting trends in fintech is connected commerce, which leverages

personal data to create seamless and personalized buyer journeys, whether online or offline.

Estonia is uniquely positioned to thrive in this space, thanks to its secure and transparent data management systems. Residents can easily authenticate and control data access for merchants and banks, ensuring a balance between privacy and personalization. This approach not only enhances the shopping experience but also fosters trust among consumers, businesses and financial institutions.

Estonia is set to lead in the field of embedded finance, particularly in payments, credit and business administration. By integrating e-money and payment solutions into daily-use apps, such as grocery retail platforms or online stores, the country is simplifying financial transactions and adding convenience to everyday life.

The development of eIDAS 2.0 compliant eID wallets promises to take this transformation even further, enabling businesses to offer highly contextualized financial services tailored to the needs of their customers.

Estonia’s fintech success is underpinned by its advanced digital infrastructure, including the X-Road data exchange

administrative processes are straightforward, making it an ideal environment for setting up financing structures and holding companies.

Estonia’s fintech success is underpinned by its advanced digital infrastructure, including the X-Road data exchange layer and a thriving API economy.

Tom Holgersson Enterprise Estonia (EIS)

layer and a thriving API economy.

These technologies facilitate real-time operations, enabling businesses to streamline legal, compliance and financial processes. The system benefits not only local companies but also e-residents, making Estonia an attractive destination for international entrepreneurs.

The country’s ease of doing business further enhances its appeal. Incorporating a legal entity in Estonia can be accomplished in minutes and the

One of the most pressing challenges in 2025 is navigating the increasingly complex regulatory environment. Enterprise Estonia provides essential support by connecting fintechs with legal and compliance experts, offering tailored guidance and organizing workshops to keep companies informed of the latest developments.

Looking ahead, Enterprise Estonia is poised to accelerate its impact on the fintech ecosystem with priorities designed to foster innovation, drive sustainability and position Estonian companies on the global stage.

Our first milestone is building more unicorns, reinforcing Estonia’s status as a leader in entrepreneurial success. Through export consulting, international matchmaking and participation in global trade events, we help Estonian fintech firms unlock opportunities and establish a competitive presence across borders.

Prompted by the increasing frequency with which I hear the term “quantum” being thrown around as the next big thing, I decided to venture, or at least try to, into the perplexing, confusing, and often just plain weird world of quantum. What I thought would be a straightforward exploration of innovation in technology led me deep into the history of physics and the fundamental understanding of how reality works, long before I could begin to grasp what quantum is and why it’s touted as an exponential revolution.

By Chris Crespo

I’ve written this piece as I would have liked it explained to me, after many hours of reading and researching what this “quantum” thing is all about and why it could potentially upend everything we’ve built so far, at least, technologically. Here’s my account. But first, let’s take a look at the physics of reality.

For centuries, classical physics has been our go-to explanation for how the world works. Newton’s laws, Maxwell’s equations, and Einstein’s general relativity have shaped our understanding of everything from the motion of planets to the behavior of light. It all made perfect sense. That is, until we started looking closer into the atomic and subatomic world.

The early 20th century marked a critical turning point. Discoveries like Planck’s quantum hypothesis and Einstein’s photoelectric effect challenged the classical understanding of physics. They revealed a strange and probabilistic nature to the microscopic world, where particles like electrons, photons, and other subatomic particles, behave in ways that defy the rules of classical physics.Unlike objects in our everyday experience, which have definite properties and predictable behaviors, quantum particles follow the principles of quantum mechanics, where outcomes are inherently probabilistic. At its core, this means that the result of an event or process cannot be predicted with certainty, even if all the initial conditions are known. Instead of a single, definite outcome, there are multiple

possible outcomes, each with a certain probability of occurring.This gave birth to quantum mechanics, a radical new theory that describes how particles like electrons and photons behave in ways that defy classical expectations. Ok this is bit theoretical but stay with me, you’ll see why this is important a few lines ahead. Unlike classical objects, quantum entities can exist in multiple states simultaneously, a phenomenon known as superposition. They can also be entangled, meaning the state of one particle instantaneously influences another, no matter the distance. And this is where things start to get weird as superposition and entanglement are two core principles of quantum mechanics that challenge our traditional understanding of reality.

In classical physics, an object exists in one place at any given time. We all know this, two material objects cannot be in two places at the same time. An apple can’t be both on the table and in the fridge simultaneously. This is how all of us experience material reality. The quantum world is different, particles like electrons or photons can exist in multiple states at once. This is known as superposition. You may want to re-read that last sentence again. Done? Ok it gets wiereder. A particle can be in two different energy states simultaneously until it is measured. I know, it makes no sense, but in quantom physics particles remain in ambiguous states until they are observed. It is then and only then that they it ‘collapse’ into one specific state.

Entanglement is another phenomenon that defies classical intuition. When particles become entangled, their states are interdependent, no matter how far apart they are. Whether they are a few nanometers or billions of light-years away. This phenomenon is often referred to as “non-locality. If you measure the state of one particle, the state of the other is instantly known, defying the classical notion that information cannot travel faster than the speed of light.

These concepts are profoundly counterintuitive. In our macroscopic world, objects have definite positions and states. But in the quantum realm, particles follow a different set of rules that seem almost absurd and illogcial. This shift in understanding is what makes quantum mechanics so revolutionary, and it’s the foundation upon which quantum computing is built, opening doors to unprecedented computational power, but we’ll get into that later on.

So far I’ve described the wacky concepts of superposition and entanglement, if you are anything like me, by now you should be asking yourself - but how?

And how could this even be measured?

Well scientists who study subatmic particles have devised a number of clever experiments. For example, they might shoot tiny particles through a barrier with two slits. Instead of going through one slit

Now, let’s talk about how these mind-bending principles of quantum physics are being used to build amazing quantum computers.

Imagine a regular computer as a super-fast librarian who can only look at one book at a time. Each book represents a piece of information, and the librarian flips through them very quickly. In classical computers, a bit is like a tiny switch that can be either 0 (off) or 1 (on). It’s like reading one story at a time.

But in quantum computing, a quantum bit (qubit), thanks to superposition, can be both 0 and 1 at the same time. This is like reading many stories at once.

Because qubits can be in multiple states simultaneously, a quantum computer can perform many calculations at once, making it incredibly powerful and much faster than regular computers.

Now, let’s bring in entanglement.

or the other like a tiny apple would, the particles act like they’re going through both slits at the same time, creating patterns that show this strange behavior.

Only when they measure or observe the particles do they ‘choose’ a specific path, just like the apple would choose a place when we look at it.