Six Inescapable Trends Stretching the Boundaries of Limitless Payments p. 30-33 From Open Banking to Open Finance: The top 10 Lessons for Seamless Transition Executing Digital Banking Transformation with Fintech Partnerships

Six Inescapable Trends Stretching the Boundaries of Limitless Payments p. 30-33 From Open Banking to Open Finance: The top 10 Lessons for Seamless Transition Executing Digital Banking Transformation with Fintech Partnerships

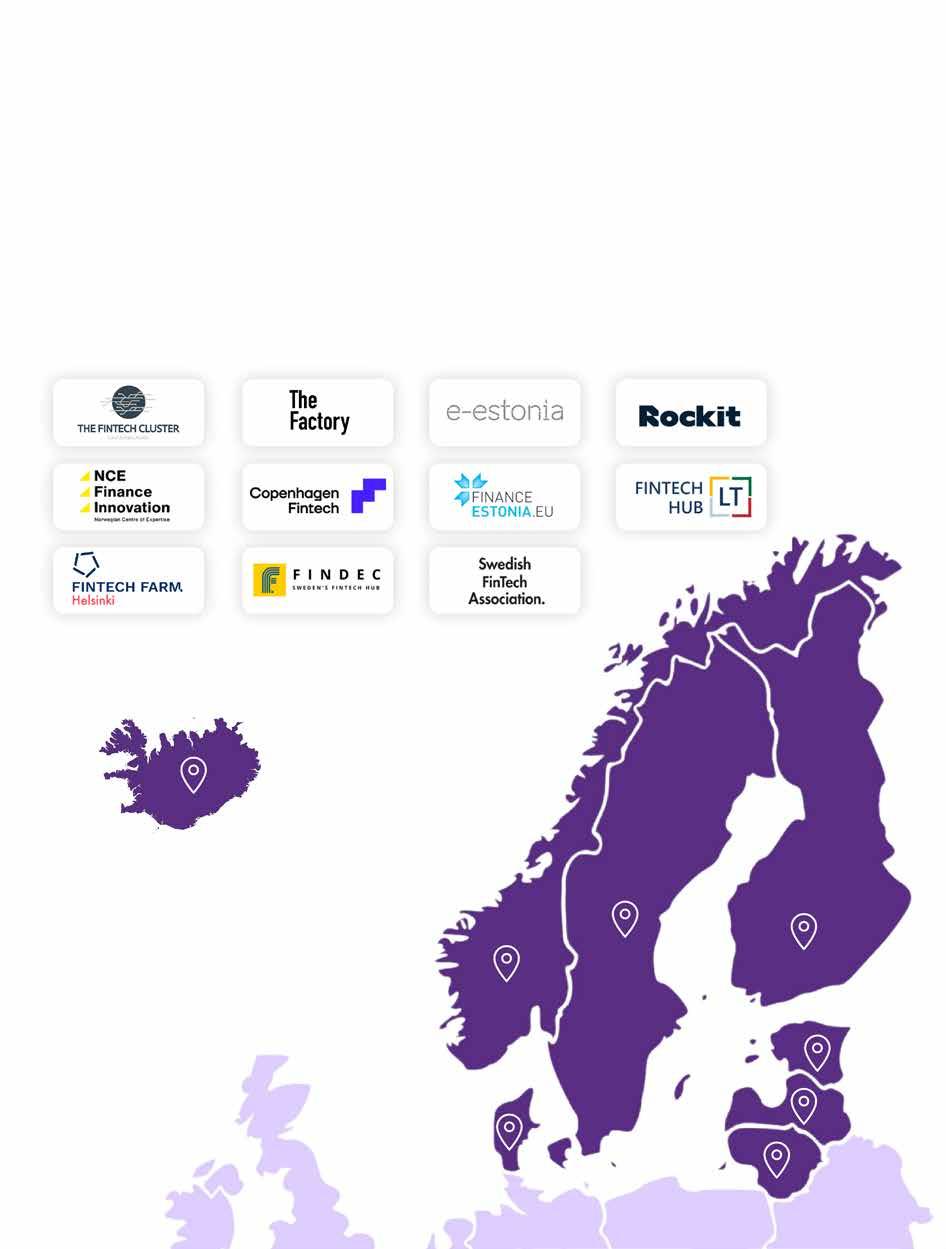

Nordic Fintech Magazine exclusively works together with selected Nordic Community Partners for insights and distribution, giving us unparalleled reach with audiences across the Nordics and Baltics

Thank you to all the Fintech heroes contributing to this magazine!

In the first quarter of 2024, Nordic Fintech Magazine embarked on an extensive journey across the Nordics and Baltics to take a plunge right into the pulsating heart of financial innovation. In our quest, we have travelled near and far to places like Lithuania, Norway, Denmark, and Stockholm, where in line with our mission of unlocking transformational ideas, we continue to tap into, and expose some spectacular thought leadership from this innovation rich region. With over 2200 Fintechs sculpting the financial services landscape, the Nordics and Baltics remain a force to be reckoned with in the race for influence in the global Fintech stage.

Throughout our activities in this first quarter, we've engaged with thought leaders and visionaries that are not just able to think bold, but to also think beyond. These interactions fill us with excitement, optimism, and a profound sense of admiration for the ingenuity and resolve with which Nordic and Baltic Fintech entrepreneurs are orchestrating transformative shifts in the industry.

In this issue we’ll cover trends that have captured our attention for their potential and their gravitas as pillars of the ecosystem. We start off by looking at the emergence of identity services and trust. The deep-seated trust in government, systems, and institutions lies close to the heart of our region. This trust made way for the widespread adoption of digital identities, enabling access to a vast array of services, from public sector offerings to financial transactions. We will explore the foundational role digital identity plays in Fintech and the accelerating effect that trust based services can have in the development of novel financial solutions.

Shifting our focus to payments, we witness an evolution spurred by the recent Instant SEPA regulation, marking a stride towards instant payment solutions across Europe. This change, coupled with the advancements in open banking and account-to-account payments, and regulatory shifts like PSR and PSD3 hint towards a more

interconnected future financial ecosystem. Embedded finance further exemplifies this integration, advancing how financial services are seamlessly incorporated into various customer journeys. This phenomenon is not confined to traditional financial companies, but spans across diverse sectors like retail, travel, and healthcare, showcasing the ever-expanding link between financial services and adjacent industries.

Our region's dynamism in Fintech is also evidenced by the vibrancy of industry events, from the exhilarating Fintech Day in Lithuania to the largescale Stockholm Fintech Week and upcoming cutting-edge Norway Fintech Festival, the region is alight with conferences. These gatherings are not just networking opportunities but also fertile grounds for sharing ideas and expanding collaborations that fuel the sector's growth. And Nordic Fintech Magazine, has been and will continue to be there at the center of the action to cut through the noise and bring you front row access to the sharpest thinking in the industry.

An intriguing narrative that we’ve stumble upon as we try to understand the forces shaping Fintech in 2024 is the rise of financial services innovations emerging from unconventional quarters, notably retail. We observe developments that are responses to unmet needs in integrated solutions encompassing data management, artificial intelligence, and payment systems, revealing a trend of self-driven innovation among non-traditional financial players.

The pace of change in our ecosystem is relentless, with AI playing a transformative role in both the backend and frontend of financial services. Up to 46% of new code is now generated by AI, resulting in a 55% increase in overall developer productivity and highlighting a significant shift towards automation in software development. The integration of generative AI is to revolutionize the sector, streamlining foundational processes and unleashing potential for new value propositions, business models, and problem-solving methodologies.

While we embrace the rapid pace of innovation, we also value the careful consideration needed for its practical application and broader acceptance. Indeed, novelty brings excitement and the potential to transform longstanding practices. However, we understand that in our industry, successful innovation has always depended on the resilience and reliability of a robust infrastructure. This infrastructure, having served over 33 million people across our regions for years, is secure, sturdy, and dependable. It forms the essential backbone that supports the mission to

Chris Crespo Chief Editor & Head of Content at Nordic Fintech Magazine

Chris Crespo Chief Editor & Head of Content at Nordic Fintech Magazine

make financial services more accessible, convenient, and adaptable. This ensures that finance not only fulfills its fundamental purpose but also extends its reach to offer improved, more accessible services for everyone. In this issue, we celebrate both the visionaries who introduce new possibilities and the dedicated individuals who have built and maintained the necessary foundations that enable these advancements.

In a recent discussion with Thomas Jul, CEO of Inpay, we explored the challenges faced by international organisations when moving money across borders. We talk about the operational and regulatory complexities that arise when transferring funds across jurisdictions and the impact these can have on business operational efficiency and costs.

By Chris Crespo

By Chris Crespo

Global commerce hinges on the ability to transfer money efficiently and securely to suppliers, customers, and partners. Regional international payments in areas like the EU have benefited enormously from the common regulatory frameworks and infrastructure that enable transactions to happen quickly and with full traceability. Yet, businesses worldwide struggle with a variety of obstacles in crossborder payments beyond regional jurisdictions. “Transferring money from Germany to Spain can be done as an Instant SEPA payment, but moving money from Germany to Bangladesh can take weeks” says Thomas Jul, CEO of Danish headquartered payment frontrunner Inpay. These challenges originate from varying regulations, complex compliance demands, and disparate technologies. In less developed regions, transactions can become hampered by inefficient banking infrastructure and opaque financial processes, leading to delays and uncertainty. This problem is particularly acute in sectors where time-sensitive operations are common. To circumvent these all-too-

common problems, Inpay has devised a “smart routing” approach that allows it to transfer money across jurisdictions with unique precision and efficiency. Reflecting on the significance of this innovation, Jul states, "smart routing is a strategic asset that combines technology, network and compliance allowing us navigate the diverse landscape of global payments with speed and reliability.” Opening new corridors across the world requires a thorough understanding of local regulations and the local financial landscape. “Smart routing is the backbone of our operation, through which we fine tune each transaction to meet the specific needs and regulations of its destination” Jul adds.

Under Jul’s strategic guidance, Inpay has carved a specialist niche in the often-crowded world of crossborder payments. The company distinguishes itself through a dual-focus approach, combining technological innovation with a deep commitment to customer relationship building. “We don't believe that a transaction is transactional, we think it's the start of a partnership.” Jul asserts. By transforming transactions into the foundation of sustainable

business relationships, Inpay has managed to stand out in the highly competitive marketplace of financial services, building trust and loyalty among its customers.

Delivering against bespoke customer needs

Inpay’s growth can in many ways be attributed to its laser-focused belief that any successful payments provider needs to absolutely understand and solve the specific problems of the sectors it serves. Sector-specialism has therefore become baked into the way it operates.

‘’Our product and commercial teams aren’t split by the product they are selling’’, states Jul ‘’…but by the sector they are serving. This is critical in making sure we provide our customers with the expertise needed to solve their very specific pain points.’’

This belief in the power of specialised service can work regionally too. As Jul states ‘’We knew that our banking customers in the Middle-East had a very different set of demands to those in Europe. For a start, we know that to service that market as well as we could,

we absolutely needed feet on the ground, and we absolutely needed face-to-face contact. So that’s what we did, with a local presence established in Dubai specifically to cater to this.’’

This customer-driven approach can also be seen in the way Inpay understands and addresses complexities in the shipping and NGO sectors, where a set of very specific needs exist. The company's swift, transparent, and secure payment solutions mitigate the adverse effects of delayed transactions in the shipping industry, where timing is often directly linked to significant operational and financial outcomes.

"A container ship can't wait outside harbour for three weeks” stresses Jul, as he explains how delays in cross border payments have significant repercussions in efficiency, costs, and supply chains.

NGOs also encounter distinct financial challenges in cross-border payments, including high standards of accountability, the need for comprehensive documentation, and the demand for secure, transparent transactions. Inpay's response to these challenges is comprehensive, offering services that provide the necessary speed, transparency, and security.

Inpay's foundation is deeply rooted

in addressing complex payment scenarios. Originating from the founder's challenge of donating to Myanmar during a crisis, Inpay was born out of the necessity to navigate the intricacies of international money transfers, particularly in situations where traditional banking fails. This origin story highlights a key focus on 'complex corridors', that demand more than standard transaction processes due to regulatory, logistical, or compliance complexities.

“Inpay excels in these complex cases by starting with a clear understanding of the customer's needs and the specific challenges they face." Jul explains. In the case of NGOs like the Red Cross, which struggle to transfer funds to remote or restricted regions, Inpay connects the dots while addressing the deep causes of the problem. This involves rigorous compliance checks, including KYC processes, and innovative solutions like creating a whitelist of approved recipients to ensure funds are delivered securely and transparently.

Inpay's approach is to strategically develop its network to tackle such complex scenarios head-on. By prioritizing hard-to-solve cases, Inpay has positioned itself as a partner capable of providing bespoke solutions that standard payment processors might not offer. This customer-centric approach, coupled

with Inpay's technological capability, enables it to open new corridors demonstrating its commitment to solving what may seem 'unsolvable'.

Inpay sets itself apart with exceptional completion rates for transactions, a crucial metric for measuring the efficiency and reliability of payment platforms. Jul highlights that, unlike many in the industry where completion rates often falter, Inpay consistently achieves over 99% completion each month. This industry leading performance is particularly impressive considering the complex nature of transactions it specialised on, which traditionally have a higher likelihood of failure.

One of Inpay's standout features is the implementation of the 'four eyes principle,' which allows customers to mandate a dual-approval process for transactions, reinforcing security and oversight. This principle, akin to two-factor authentication in digital security, ensures that every financial transaction is subject to thorough verification, enhancing the accountability and transparency that companies require. “Partnerships are significantly strengthened with the introduction of the 'four eyes principle', a meticulous process that necessitates dual approval for every payment for customers that want it."

Jul explains.

This initiative by Inpay is especially pivotal in the context of organisations with operations in regions where traditional banking and payment systems are either inadequate or entirely absent. Here, the challenges are not just logistical but deeply linked to regulatory compliance and the imperative need for transparency.

Moreover, Inpay’s commitment to speed in transaction processing does not compromise its dedication to security and detailed financial oversight. This balance ensures that organisations that need to move money across borders, meet their operational demands swiftly without sacrificing the integrity

of their financial transactions. By addressing the unique needs of organisations operating in challenging environments, Inpay empowers them to manage transactions with an unprecedented level of confidence and precision, enabling them to focus on their core mission.

“Inpay heavily relies on partnerships to navigate the complex global payments landscape”, Jul emphasizes. The company partners with a variety of entities, including traditional banks, PSPs, and regional/global license holders, to enhance its network's reach and efficiency. These partnerships are crucial for maintaining high completion rates and for Inpay's ability to deliver funds seamlessly and at speed across borders. “By working closely with partners who possess complementary capabilities and licenses, Inpay ensures compliance, safety, and transparency in its transactions." Jul adds. This collaborative approach not only expands Inpay's operational capabilities but also reinforces its commitment to solving the challenges of international payments.

Inpay, under Jul's leadership, is actively redefining the standards of cross-border financial transactions. By prioritizing customer relationships, leveraging technological advancements, and nurturing strategic partnerships, Inpay is not only solving present-day challenges but also shaping the future of global commerce and finance. “Looking into the future, the old world of SWIFT with many links on each payment chain will be replaced with networks of partnerships that work together to deliver money globally as quickly, safely transparently as you would expect in a local transaction” Jul concludes.

As the financial industry evolves from Open Banking to Open Finance, the journey is fraught with technological, regulatory, and strategic challenges. However, this transition offers unprecedented opportunities for innovation and growth. Drawing from my experience with Nordea Open Banking, here are ten invaluable lessons that can illuminate the path to successful Open Finance implementation.

Open Finance ushers in a technological revolution, moving from batch processing to real-time data access. This leap forward enables the creation of innovative products and solutions, transforming how we think about financial services.

Imagine offering products that leverage real-time financial data, enhancing customer experiences and operational efficiency.

Setting clear objectives is crucial. Begin by outlining your commercial goals and regulatory requirements under the Financial Data Act (FiDA). Integrating these aspects from the start ensures that your strategy remains flexible and robust against evolving regulations, preventing the need for a complete overhaul down the line.

Inspiration for Open Finance can be found beyond the banking sector. Initially, we looked towards tech giants like Oracle and Microsoft. Today, innovators like Nordea, BBVA, and Deutsche Bank provide valuable blueprints for API marketplaces. Examining their successes and approaches can offer insights into creating a competitive Open Finance ecosystem.

The importance of management‘s understanding and support cannot be overstated. Early and ongoing education ensures long-term commitment, enabling informed decision-making and resource allocation. This foundational support is key to navigating the complexities of Open Finance implementation.

An internal evangelization strategy is essential to spread knowledge and enthusiasm about Open Finance across departments. Collaboration between various expertise areas can lead to groundbreaking solutions, ensuring that the initiative‘s benefits are fully leveraged.

Given that the implementation journey can span years, recognizing milestones is vital to maintaining motivation. Acknowledging achievements helps sustain engagement and enthusiasm, crucial for navigating the long-term challenges of Open Finance adoption.

The regulatory landscape and market demands are ever-changing. An agile approach to your implementation plan allows for timely adjustments, ensuring your projects remain relevant and compliant. This flexibility is crucial for staying aligned with both regulatory expectations and user needs.

Listening to users from the outset guides product development in a direction that meets market needs while avoiding regulatory pitfalls. Early and continuous engagement with users is instrumental in refining your offerings and ensuring they resonate with your target audience.

"Don‘t just build it and they will come.“ A comprehensive launch strategy is necessary to capture early market interest and valuable feedback. This involves a mix of community management, customer support, and targeted marketing efforts to ensure your product reaches its intended audience effectively.

From the MVP stage, consider who your product is for and how it can meet their needs. This proactive approach allows you to begin commercialization efforts early, targeting users who will benefit most from your initial offerings and setting the stage for broader adoption as your product matures.

In conclusion, transitioning from Open Banking to Open Finance is not just about compliance or technological upgrades; it‘s about reimagining the future of financial services. By applying these lessons, we can navigate the complexities of Open Finance, creating products that are not only compliant but also highly valued by customers. The journey ahead is promising, and with a strategic approach, we can unlock the full potential of Open Finance for businesses and consumers alike.

Mantvydas Štareika is the CEO of CapitalBox, a leading fintech lender for small- and medium-sized enterprises (SMEs) throughout Europe. Headquartered in Finland, the pure fintech company has offices in Sweden, Denmark, the Netherlands, and Lithuania. CapitalBox’s financing solutions are flexible and accessible, and provided by mixing lending tools to make financing both secure and responsible. In this interview, Mantvydas chats about his journey to CapitalBox CEO, how SME lending is being upended by fintech, and where the industry is heading.

Interview with Mantvydas Štareika, CEO of CapitalBox

What is CapitalBox, and where do you fit into it?

Essentially we provide SMEs with loans that meet them exactly where they are in their financing journey, and with the amount of capital they require to not just stay afloat but grow. We’re able to dispense loans within a matter of hours, accept more diverse criteria as collateral, and provide more personalised attention to our clients.

SMEs are often overlooked by traditional banking institutions because of the element of risk involved. These banks are often weary of giving SMEs the capital they need, and that’s led to an enormous SME funding gap in Europe. That gap amounts to roughly 400 billion euro in the E.U. alone. To say there’s a market for alt lending to serve this is putting it lightly, and that’s exactly what CapitalBox is doing.

What was your professional journey prior to CapitalBox?

It was an interesting one, to be sure. My educational background happens to be in law. I entered fintech in 2007 when I joined Coface, eventually

working my way up to CEO. Coface provides credit insurance to businesses, and it was a crash course in credit lending and crisis management via the recession and banking crisis of the late 2000s and early 2010s. As CEO I focused on consolidating and relaunching entire divisions to optimise the company from top to bottom.

I integrated AI and data information systems. I later joined SME Bank as a board member and as CEO, and that was my springboard into CapitalBox in January 2023.

So you’re a little past the one year mark. What have you accomplished in that time? How has the company changed during your tenure thus far?

Hitting the one year mark is a crucial milestone for any executive. You’ve had time to try out certain things and let ideas percolate, but it’s still, relatively speaking, early days. I’m very proud of the expansion efforts I’ve spearheaded in the last year, including launching a new branch in Denmark with a team of Danish market experts. We’ve done some recruiting

and expanded our C-suite. On top of that, we’ve also introduced collateral loans ranging from €500,000 to €3,000,000. Finding a way to offer collateral lending was a major priority from the moment I arrived, and to see it implemented and chugging along at the one-year mark is a big accomplishment for me personally and for the company at large.

Tell us more about this emphasis on collateral lending, and where that fits into the underfunding gap you described.

Everything we do, as far as I see it, is about addressing this underfunding gap, including collateral lending. Closing that gap is the overarching goal. SMEs make up 99 percent of European companies, so no matter how you slice it, SMEs are indispensable to the European economy. The natural next question is, of course, why is the backbone of the European economy underfunded 400 billion euros? Our initial approach with CapitalBox focused on digital sales and small loans for working capital.

We've since realized the need to offer larger investment loans securely, which led us straight to the introduction of collateral lending. Collateral lending creates the security necessary for us to scale and offer more to businesses. As I mentioned before, there’s a bit of risk aversion when it comes to traditional banks lending to SMEs. Even when these institutions do dispense loans, it is often at lower amounts. SMEs tend not to have an overwhelming amount of collateral assets compared to, say, a major corporation. The loan amounts that collateral lending makes possible are the loan amounts necessary for growth. By expanding the criteria around collateral lending and actually dispensing these loans, we’re addressing the lending gap in a real way.

CapitalBox is characterised as a pure fintech lender. Where does this approach fit into your specific application and lending process?

Being a pure fintech company, we’re faster, more efficient, and more accurate than we could be if we weren’t. The funny thing is that initially we positioned ourselves as a lender rather than as a tech company. That has started to shift, particularly since we acquired Omniveta in March.

This acquisition reflects our ongoing expansion into invoice financing in a tech-savvy, SME-friendly way. More broadly, we have an API-based model, and we’ve embraced AI and machine learning. Loan applications are reviewed by a sophisticated AI-powered system first, and in most cases can be approved and thus dispensed in a matter of minutes. SMEs have shorter financial runways and need cash fast, so speed is crucial. With all our loans, we use machine learning to evaluate account metrics beyond a simple credit score and include criteria such as social reach. We also offer revenue-based financing for ecommerce businesses that requires sophisticated technology. Essentially a business collects the loan every day, and the exposure jumps up and down based on its turnover. By doing so we address the incredibly specific and mutable needs of a given company, and that happens through being a pure fintech company ourselves.

How do you balance the AI integration with customers feeling supported by real people on your side?

That’s a question we’re always asking ourselves. We don’t want to be a faceless machine to our SMEs. Every-

Mantvydas Štareika, CEO of CapitalBoxAs a leading European fintech lender for small- and medium-sized enterprises, CapitalBox provides timely, trusted, and tailored alternative funding solutions to businesses that form the backbone of the European innovation economy. Founded in 2015 as part of Multitude Group’s growth platform, the pure fintech lender provides fully automated online business loans up to €2 million that can be delivered in minutes following a successful application. CapitalBox’s unique business risk assessment methodology, ability to deliver capital quickly, and emphasis on personalized service make financing newly feasible for underserved businesses across the continent. Headquartered in Finland, the lender has offices in Sweden, Denmark, the Netherlands, and Lithuania, with plans to expand into more countries in the near future.

To find out more, visit capitalbox.com

one wants and likes our fully digital onboarding and experience, but that doesn’t mean we’re off the hook with human interactions. WIth more complicated loans, particularly collateral loans, we’re very deliberate with interacting directly with applicants. And at every step of the process we make it very easy for applicants to say, ‘Let me talk with a real person,’ no matter how simple or complex the loan.

Where do you see the digital finance industry heading in the near future?

Personalisation is already essential and only getting more important. We’re moving from an era of personalisation being focused on needs to personalisation being focused on preferences, thus creating a more satisfying customer experience. Fraud detection is getting better thanks to AI, which I find promising. Open banking, which is the process that allows customers to share their financial data with third-party providers, is increasingly in popularity, which is driving development of new services in the sector. A high tide raises all boats. It bodes well for the entire sector.

Mantvydas Štareika, CEO

Combining well-honed entrepreneurial instincts with proven legal acumen, Mantvydas Štareika is an international business and financial services expert with extensive experience in sales, marketing, international mergers, and growth and strategy drive. Prior to joining CapitalBox in December 2022, Mantvydas served as CEO and head of the supervisory board at SME Bank, the first neobank in Lithuania. While there he spearheaded financial licensing efforts across the Baltics and Finland, and the company now holds licenses to operate in ten European countries. He held multiple senior roles at Coface, eventually leading the Baltic States division as CEO. Mantvydas holds a master’s in business administration from the Stockholm School of Economics. He lives in Vilnius, Lithuania, with his family.

Enable Banking, a Finland-based fintech providing open banking API connectivity for over 2,500 European banks, has just concluded a partnership with CapitalBox, a leading provider of growth finance for SMEs. The partnership will bring robust and thoroughly-tested open banking capabilities into the B2B lending space.

By Paulo DelgadoOpen banking is now mature enough to operate in the B2B lending sector,” says Sarah Häger, Chief Commercial Officer at Enable Banking, and a veteran of open banking who worked with Nordea Bank to set up its open banking capabilities for seven years before moving to the fintech.

“The trend has changed,” Häger tells NFM. “Open banking for B2B is here now. Businesses in the lending space don’t need to wait two or three years to make use of it.”

Why business open banking solutions lagged behind consumer ones

Several factors converged to delay open banking solutions for corporate accounts, including a lack of standardised regulations, ambiguities in PSD2 itself, technological hindrances, and market pressure.

No standardised regulations

Although we sometimes loosely use the word “regulation” when referring to PSD2—the Revised Payment Services Directive that entered into force in 2016—it’s really a directive, meaning that individual European countries must decide how to implement it as a law (regulation) on a national level. This approach led to a widely varied approach to open banking in each European state, and none of it has been driven by clearcut regulatory standards. The term “open banking” isn’t even used anywhere inside the PSD2 text.

Instead, PSD2 led to a market-driven approach of making banking more open, and each country and bank implemented open banking in its own way—or didn’t implement it at all until enough pressure mounted.

Different APIs

APIs—application programming interfaces—are the industry standard for obtaining information from any closed system, whether that system is a bank’s internal system or a weather service so you can access the weather on your phone.

An API provides standardised programmatic calls that incorporate security, are well-documented, and follow industry best-practices.

However, APIs must be individually programmed by the company offering them, such as the bank or financial institution that holds a customer’s account. It requires resources to create easy-to-use, well-documented, available, and robust APIs.

Additionally, the lack of regulatory standardisation means that one bank’s APIs will typically follow a different

Open banking is now mature enough to operate in the B2B lending sector.

Sarah Häger, Chief Commercial Officer at Enable Banking.

format than another’s. For a third party to access each bank through its API, it must individually write programming code for that specific bank. Considering that Europe has thousands of banks, that’s a lot of APIs to write code for.

The lack of APIs coupled with their complexity has slowed both corporate and consumer adoption of open banking. However, the consumer side moved faster because of market pressure.

Before APIs, TPPs (third-party providers) offered scraping solutions

Even before PSD2, open-like banking services relied on screen scraping instead of API access to perform actions on consumer accounts.

Screen scraping is a clunky, error-prone, and often frustrating process. However, before banks had any API infrastructure in place to access consumer data, screen scraping remained the only way to achieve open

banking after PSD2, in many cases.

“One of the reasons for slower adoption in the B2B lending space is that it wasn’t possible to scrape corporate accounts in the same way you could scrape consumer accounts,” Häger tells NFM.

PSD2 left the door open to omit corporate accounts

Another reason banks didn’t rush to create corporate account APIs was because of an ambiguity in the first version of PSD2 which made it appear that access should be provided only for consumer accounts. The PSD2 amendment of 2021 corrected this ambiguity, closing the door on any hesitations from banks to implement corporate account access APIs.

Meanwhile, a growing number of open banking use cases continued to appear since 2019 for consumer lending.

“Market influence from large players such as Klarna, Trustly, and Tink added to the pressure because these players focused on consumer access, not on corporate access,” says Häger.

In fact, demand was so high for consumer solutions that banks were struggling with providing access to these accounts, leaving them few resources to dedicate to corporate access as well.

The good news is that the consumer pressure eventually spilled over into the corporate world. Just as the iPhone changed what consumers expect from their mobile devices and spilled over into business use cases, ultimately changing an entire sector, so did greater consumer access to open banking start influencing B2B.

Today, corporations are demanding open banking from their banks because of their experiences using it on their personal bank accounts.

Two key elements are driving the push for open banking in the corporate space, Häger tells NFM:

1. Banks have recognized that open banking is a significant driver of indirect revenue, increasing CLV (customer lifetime value).

2.Corporations are now demanding open banking solutions.

In keeping with the market-driven as-

pect that has informed European open banking since PSD2, banking departments are now themselves clamouring for better APIs.

Corporate customers are asking banks for API access, and more and more TPPs are starting to operate in the corporate space.

This combination of factors has tilted the scale in favour of corporate open banking.

Enable Banking and CapitalBox partnership

Enable Banking provides developers with a single API connector to access the APIs of over 2,500 banks. Instead of writing individual code for each of those banks, a company can partner with Enable Banking and offer open banking features 2,500X faster—literally.

That’s precisely what CapitalBox did.

To answer the call for a B2B lending solution that works as seamlessly as retail lending, Enable Banking teamed up with CapitalBox to provide business lending services powered by open banking. Companies availing themselves of CapitalBox’s services will now be able to apply for growth finance using far simplified processes that they’ve become familiar with in the consumer space, making the loan process easier—and much faster.

CapitalBox already has a streamlined lending process in place, fully incorporating KYC/AML, and offering a completely digital experience for applicants. The Enable Banking partnership adds an additional level of sophistication through open banking to that process.

"Through our partnership with Enable Banking, we're not just revolutionizing B2B lending; we're democratizing access to growth finance for SMEs. This collaboration signifies a pivotal moment in reshaping the landscape of business lending. By integrating CapitalBox's streamlined lending process with Enable Banking's cutting-edge open banking capabilities, we are empowering businesses to seize opportunities with unparalleled speed and ease. This alliance exemplifies our commitment to driving financial inclusion and fostering sustainable growth in the market." -

Anne Trampedach, Denmark Country Manager.

The advent of digital IDs, which offer a robust solution for verifying consumers' legitimacy, is meeting the challenge of establishing trustworthy online interactions and securing financial services head-on. Digital IDs can streamline user access while upholding critical security protocols, addressing the crucial need for uncomplicated, protected digital financial engagements.

By Jakob Frier

In today's era of online transactions and purely digital interactions, establishing trust is crucial when engaging in business or accessing various services. The question then arises: how do we verify the authenticity of the other party or even confirm their human identity?

Identity is a complex concept encompassing physical traits, demographic details, social attributes, preferences, and beliefs. From something as official as your passport number to something as personal as your

preferred grocery store, each detail contributes to the distinctiveness of your identity.

Our digital identities comprise a collection of unique, inherent data, distinguishing us as individual users from everyone else.

But how significant is this in the digital realm?

“Knowing who is accessing the services and, at the same time, the user knowing that it is the right and authentic service provider is essential for any type of business and even for

services that may not have a direct monetary value,” says Jukka Yliuntinen, Head of Digital Payment Solutions at Giesecke+Devrient (G+D).

In the fintech industry, where services are connected to financial assets and delivered through digital platforms, it's essential to possess a digital identity system that is not only strong and safe but also user-friendly.

“Digital identity may not be considered a service of its own, but it is an extremely important enabler for fintech innovation and services, and with the

growing volume of fraud and increasing awareness of data privacy, the role of digital identity will be even more important,” Yliuntinen says.

Identity forms the foundation of any digital system. Organisations must understand at least a facet of customers' identity, if not a precise identification of who they are.

“A digital ID system simplifies user interactions and makes it simpler for users to choose alternatives, as well as providing a way for individuals to prove who they are to any organisation, not only financials,” says John Erik Setsaas, Director of Innovation in the Financial Crime Prevention unit at Tietoevry Banking.

Financial service providers face stringent Anti-Money Laundering (AML) obligations, extending to numerous other services. Generally, the repetitive process of registering for new services and supplying detailed information each time has become a tiresome task for many of us.

“A consistent UX, both for signing up, signing in, and signing documents across services, is part of improving the user journey,” Setsaas.

John Erik Setsaas, Director of Innovation in the Financial Crime Prevention unit at Tietoevry Banking.When the Digital ID concept is well designed and executed, it provides customer satisfaction, and, in the best case, it can be an even differentiator. Users are more prone than ever to easy-to-use services with the least friction.

“Consumers are more prone than ever to easy-to-use services with the least friction. When KYC with onboarding is done fluently, for example, enabled from your home using a digital channel and then applying the created digital identity with biometrics, you are on par with customer expectations,” Yliuntinen says.

Yet, this ease of use must uphold the essential security measures, as financial services, including fintech offerings, are obligated to safeguard financial assets. Should there be any weaknesses in digital identity management, the repercussions could be drastic, leading to severe outcomes from identity theft.

“Therefore, good customer experience needs to be balanced with security and some ‘positive friction’, for example, in terms of having an additional step in the payment acceptance process can be useful,” Yliuntinen adds.

Digital IDs can be set up in various forms, and within financial services, they need to offer strong reliability for everyone involved. Using usernames and passwords may not be the best way, as poorly implemented digital IDs result in loss of business, a bad reputation, and unhappy customers.

The financial service sector has typically well-implemented security, including KYC processes that result in a strong digital identity.

“For the fintech sector, digital onboarding is quite commonplace already. When thoroughly designed and implemented, it provides a digital identity that can be used securely for any further services, whether payment transactions or logins to services,” Yliuntinen says.

National eIDs, which facilitate entry to accounts and can be used to secure credit cards or loans, are becoming a prime target for fraudsters.

“The greater the value obtainable via a single eID, the more enticing it becomes for those intent on committing fraud,” Setsaas explains.

According to him, BankID is frequently targeted by scams, such as imposters claiming to be from banks or law enforcement, tricking victims into transferring money to "safe" accounts, using BankID for fraudulent confirmations, and leading to the loss of funds.

“Despite violating terms and conditions, over 20% of individuals admit sharing their BankID details. Since people often aren't careful with their PINs and passwords, it could be easy to use their information to take out a loan pretending to be them,” Setsaas says.

To avoid fraudsters, Tietoevry has introduced a 'live presence' feature that requires people to verify their identity with a facial scan for sensitive transactions. This scan is matched against a securely stored reference image. Relying on a mobile device's biometrics isn't secure because the data collection is outside their supervision.

Digital services, including Digital IDs, are evolving to offer better accessibility

for diverse customers and democratise financial services, such as the visually impaired, who may use voice commands instead of traditional graphical interfaces.

By incorporating such inclusive features, Digital ID supports secure remote access and simpler digital onboarding and improves the overall user experience for all customers.

“The leading enablement is user movement. We see many related services using this to improve their services, such as becoming a verified user on an online marketplace,” Setsaas says.

Digital identity solutions and technologies can provide limitless opportunities and room for innovations.

“Having digital identification that provides digital signing capability makes it easy to perform such tasks by simply providing your fingerprint or any other authenticator. Another area where further innovation can occur is when the basic digital identity (such as name, address, and age) can be added with new attributes, such as one’s creditworthiness or other financial status,” Yliuntinen explains.

While most digital ID solutions can be easily incorporated into business operations, the pay-per-transaction cost may pose a financial challenge. Additionally, the digital ID provider's ability to track login times could be a concern, depending on the level of trust involved.

Consequently, many fintechs opt to independently verify identities using technology that scans official documents like passports or driver's licenses and employs selfie-based liveness detection for robust user verification.

“Even though the user experience is somewhat worse than using a digital ID, it is not a big showstopper for signing up new users. Future authentications will be done within the fintech app, typically using local biometrics for convenience. Many neo-banks are good examples of this. This also works for any nationality of identity document, if it has NFC, making it a global solution, and no need to integrate with many digital IDs,” Setsaas says.

Jukka Yliuntinen, Head of Digital Payment Solutions at Giesecke+Devrient (G+D).

Setting up a Digital ID system is a multifaceted endeavour that involves technical challenges, establishing relationships, managing risks, and negotiating liabilities with different stakeholders. It is crucial to ensure a robust foundation by strongly verifying the user or entity from the outset.

“This is why, e.g., governmental-level identities, whether physical or digital, require one-time face-to-face meetings where identity can be proven and used in different channels afterwards. Beyond the solid KYC process, it is important that digital identity is secure, especially in the financial sector, as your brand is very much about trust,” Yliuntinen says.

Most financial sector organisations have developed digital identification solutions, which usually apply only to this single service provider.

National digital identity schemes are gaining momentum and are already well established in many countries, providing an excellent opportunity for

fintech and other actors to use such common infrastructure.

“This enables cost savings on digital identity infrastructure and larger reach as digital identity is acknowledged in multiple businesses and public and private sectors,” says Yliuntinen, and points to the self-sovereign identity (SSI) concept where identity holder can self-manage what type of identity information will be shared in different environments is very much preferred model and gradually being applied.

“To fully benefit from SSI and make it a reality, the whole ecosystem must be applied. Beyond the financial service sector and public authorities, multiple other activities are ongoing in the field of digital identity, spanning from big techs to payment schemes, and fintechs may need to consider which of these initiatives will provide the best value for them in terms of cost, reach, security, and user experience,” Yliuntinen concludes.

The Nordic and Baltic regions continue to establish themselves as major hubs for fintech development, distinguished by an advanced digital ecosystem, high mobile penetration, and a profound trust in public institutions. These elements have catalyzed rapid advancements in financial services that have progressed at different speeds across the region but with a consistent upward trajectory.

In this article we take a look at the Fintech scenes of three fast developming Nordic and Baltic ecosystems: Lithuania, Norway and Latvia.

By Chris Crespo

Despite a recent slowdown in sectoral growth and a contraction in investment pace, the fintech landscape in the region remains robust and dynamic. Fintech investment globaly decreased by a steep 48% in 2023 compared to the previous year. The trend was also reflected across the Nordic and Baltic region in 2023. The current investment climate, more selective yet strategic, prioritizes fintechs with proven growth and profitability potential. We see this in ecosystemst like Lithuania, which saw a stark decline in the total amount of fintech funding, from €67.9 million in 2022 to only €5.5 million in 2023. Despite this significant shift, the Lithuanian fintech ecosystem remains vibrant with many companies still primarily funding their operations through revenue.

Norway has seen a smilar trend in the decline of fintech investment. In 2023 it reported a decrease of 29% in the total number of deals compared to the previous year, while avilable funding has also suffered a significant loss estimated to be 78% lower than

the year before. This shift shows a cooling down of investment previously seen across the region but also indicates the Nordic and Baltic markets are entering a new stage of maturity, honing in on sustainable and impactful financial solutions. With evident discernment in capital allocation and a strong focus on sectors like blockchain, data analytics, artificial intelligence, climate fintech, payments and regtech, the region continues to justify its position of global influence in the Fintech arena.

With over 2,500 fintech entities spread across the Nordic and Baltic markets, the region is a fertile ground for innovation, collaboration, and cross-border partnerships. We continue to see great growth ambitions across the region. A great example can be seen in the Latvian Fintech ecosystem where the Fintech sector constitutes 25% of the 600 startups seen across industries, a significant portion of the startup ecosystem. Latvia has recently undertaken a significant reform of its financial sector, setting a precedent in Europe for the

extent of its ambition. This transformation has enhanced the knowledge and expertise among industry stakeholders, regulators, and consultants beyond the European average. With the fintech sector rapidly advancing and diversifying in terms of business models and associated regulatory challenges, Latvia is now positioned to lead in demonstrating effective risk management practices and fostering the development of innovative financial solutions. The number of Fintechs in this market continues to increase annualy supported by government initiatives like visas, tax incentives and a friendly, open, and accessible regulator.

Norway is another great example, having grown from less than 30 fintech startups in 2016 to over 180 by 2023, the expansion of the Norwegian Fintech scene, indicates a robust development of the sector. The country has been actively working to increase the number of fintech companies within its borders through various initiatives including a Regulatory Sandbox that allows companies to test their

Bergen Harbour, Norwayfinancial innovations in a controlled environment under the suppervision of financial regulators, innovation clusters like NCE Finance Innovation in Bergen which bring together startups, established companies and academic institutions to collaborate on financial technology projects and investment in technology and infrastructure.

Aside from fueling its home grown market, Lithuania has also gone to great lengths to attract foreing Fintechs by offering a supportive regulatory environment, a fast and efficient licensing process, and supportive government policies. Lithuania has successfully attracted notable fintech companies, including Revolut, Shift4 and Google Payment, leveraging its favorable regulatory environment and supportive government policies. These companies chose Lithuania for its efficient licensing process, proactive fintech promotion, and strategic location in the EU market, enhancing Lithuania's reputation as a vibrant fintech hub.

These ecosystems are not only critical in the creation of jobs but are also magnets for international talent, essential for the ongoing development and diversification of fintech services. Several countries within the region report challenges in atracting the necessary talent to continue to fuel their sector growth, and this is not because of a shortage of technical talent emerging from their local higher education institutions, but because of a rapid surge in demand that surpasses locally available supply.

Latvia, for example, is investing in specialized education programs and initiatives like the Baltic Centre of Excellence in Financial Services, aiming to bridge the knowledge gap and foster industry growth. Latvia is actively working to attract fintech talent through supportive government policies such as startup visas for foreign founders and friendly stock options policies. These measures, coupled with efforts to create a favorable regulatory environment, aim to boost

the growth of the Fintech sector and make Latvia an appealing destination for international Fintech professionals and companies.

Norway is also fostering its fintech workforce by capitalizing on its highly digitalized banking and public sector, and leveraging advancements in technologies like AI, machine learning, and blockchain. The country's educational and training programs are evolving to meet the sector's demands, ensuring a skilled pool of professionals ready to innovate in the fintech landscape. This strategic focus on workforce development helps maintain Norway's competitive edge in the fast-growing fintech industry.

Lithuania's fintech sector is also known for its strong talent and employment growth. The countrys robust ecosystem with over 270 fintech companies, employs more than 7,400 people. The government's proactive approach in facilitating a favorable environment for fintech startups has been crucial in attracting international talent and strengthening the local employment market in this field. The country has established itself as a fintech-friendly hub with initiatives like the "Startup Visa" program, which eases the immigration process for non-EU entrepreneurs, and a commitment to digital innovation. These measures, along with a collaborative ecosystem that encourages investment and development, make Lithuania an attractive location for fintech professionals and companies globally.

The rise in blockchain and cryptocurrency-focused companies signifies an innovative leap in transactions and financial solutions and the willingness from the sector to explore more foundational changes that challenge not only what services should be provided but also how. Data, too, has taken center stage, with companies leveraging it to gain actionable insights, developing solutions that ensure data privacy, and empowering user control. A trend, quite unique to the region is the rise of Regulatory technology

(regtech) as a regional competitive advantage, driven by the EU’s rigorous regulatory landscape. The regulatory environment, particularly with frameworks like MICA, the AI Act, and the evolving PSD directives, has not only fueled innovation but has also built investor confidence and market stability. Latvia can be seen taking the lead in this trend as it continues to foster innovation while ensuring high compliance standards, particularly after its financial sector overhaul and focus

on creating a business-friendly regulatory environment to attract new players and facilitate market entry.

The Nordic and Baltic fintech sectors excel in crafting regtech solutions that align with legislative requirements, enhancing operational efficiencies associated with compliance that free up time and resources for companies to focus on core innovation.

Across the board, climate fintech is gaining prominence, reflecting the region's commitment to integrating

environmental sustainability into financial services. This alignment with green finance principles not only addresses global climate challenges but also reinforces the regions’ leadership in sustainable financial innovation. The gradual shift from competition to cooperation among fintechs and financial institutions signifies a mature understanding of market dynamics, focusing on collective strength and customer-centric solutions.The success of collaborations between large financial institutions and agile fintechs are testament to the region's forward-thinking approach. These partnerships not only speed up market entry but also infuse the sector with fresh, innovative capabilities.

Nordic and Baltic fintechs are enhancing their partnership capabilities to extend their global reach and enhance their market offerings. By collaborating with diverse stakeholders, these fintechs are not only expanding their operational footprint but also enriching their value propositions. This strategic approach leverages regional strengths in technology and innovation, positioning these entities as the keyholders to the gates to a thriving european fintech space led from the Northern parts of Europe.

Examples include Norwegian fintech companies, like Vipps, Signicat, and others, that have significantly marked their presence internationally. For instance, Vipps has successfully merged with Denmark's MobilePay, creating a major Nordic payment service provider with over 11 million users. This is a part of broader trends where Norwegian fintechs are not only thriving domestically but are also actively engaging in cross-border collaborations and expanding their market reach globally, benefiting from Norway's digitally advanced ecosystem and supportive investment climate.

Lithuanian fintechs continue to expand their footprint across Europe serving now over 27,000 million europeans

It is exciting to witness first hand how

the Nordic and Baltic fintech landscape rapid growth is influencing the broader European financial ecosystem. The region continues to solidify its status in the global fintech arena, driving strategic alliances, securing significant investments, and leveraging technology for financial inclusivity and environmental responsibility.

Furthermore the unique public-private partnerships that continue to propel many of these ecosystems forward, provide valuable lessons in collaboration and innovation-driven development. The masterful orchestration between regulators, central banks and the fintech ecosystems of the Nordics and Baltcs, serve as exemplary models for global financial services evolution. Their ability to leverage regulatory frameworks for market advantage, coupled with a relentless pursuit of transformative solutions, positions these regions at the forefront of the financial industry’s revolution.

Unity across the region makes for a strong case for combinatorial collaboration, where players are increasingly becoming adept at finding their sweet spot and augmenting their visions with the help of regional partners and collaborators. Of course each ecosystem remains independent from each other, maintaining their unique identity. But unlike other regions that compete for investment, talent and customers, the Nordics and Baltics have found common ground in their ambition, their values and their relentless pursuit for simplicity, elegance, functionality and quality. Diverse in nature, cutlure and focus, Nordic and Baltic ecosystems thrive in the understanding that through collaboration, the size of the pie can increase for all.

On 8 January 2025, every bank in Europe that offers SEPA transfers must be reachable through instant payments at no additional cost to customers, according to new EU regulations.

By Paulo DelgadoThe new instant payment regulation provides various challenges for banks, even for those already offering instant payments. Also, ambiguities in the regulations leave much to interpretation, putting banks on unsteady ground regarding their compliance.

One company that knows how to answer these questions and provide actionable solutions is Hamburg-based PPI AG, a publicly listed consulting and software company that’s been serving the financial sector for over 30 years.

PPI offers a comprehensive Instant Payments Readiness Check that establishes a bank’s potential weaknesses and provides a roadmap to address them before the compliance cutoff date.

NFM caught up with Thomas Riedel, Leading Product-Manager at PPI, to delve in-depth into the topic.

The benefits of instant payments extend to companies, retail customers, and even EU-wide economic factors.

Some of these benefits include:

n The European Payment Initiative (EPI) uses SEPA Instant Payments and hopes to offer an alternative for US-dominated card payments in Europe.

n Companies could pay employees on the last calendar day of the month instead of the last business day.

n ●Together with SEPA Request-ToPay—a scheme that allows payees to request payment initiations across a wide range of physical and online use cases—instant payments offer a fast, reliable, and secure alternative to direct debits without the risk of refunds.

For those banks who don’t yet offer instant payments, the challenges are:

n 24/7 availability for all services, not only instant payments, including balance checks and sanction-screening services.

n Response-time for these services should ideally be a few hundred milliseconds, even during peak load times.

n Tight implementation schedule.

The rule comes into force on 8 April 2024, and the grace period for implementation ends on 8 January 2025.

For banks already offering instant payments, further challenges include:

n Customers must be allowed to define the maximum amount that can be sent through instant payments.

n The orderer of an instant payment must receive a final response regarding the payment within 10 seconds. When the clock starts ticking for these 10 seconds is still open to interpretation, as is what the orderer must do if it doesn’t receive this confirmation on time.

n Instant payment verifications must occur instantly and run 24/7. How banks will achieve this is unclear. One option is that banks must provide APIs to a central data centre that manages all customer and account data securely, which is a massive undertaking.

One of the largest challenges for both types of banks is the expected throughput because the regulation enforces that instant payments must cost the same as traditional SEPA transfers. PPI expects an enormous increase in load, forcing banks to reevaluate their existing instant payments solution to ensure it can handle the additional traffic with zero downtime.

The regulation itself isn’t without its flaws, putting banks in a precarious position regarding compliance—one of the primary reasons to bring on a consultancy service such as PPI’s Instant Payments Readiness Check.

The first of the blindspots is the 10-second limit we discussed above. “The main issue is that the regulation contradicts the current version of the EPC rulebook for instant payments,” says Riedel. “Adjustments must be

made to the rulebook to cope with the regulation, but those won’t be available immediately, forcing banks into yet another tightly scheduled implementation project.”

Sanction screening is another sticky topic. It’s clear that every bank within the EEA must check customers against the EU sanction list on a daily basis. Following this procedure prevents the necessity of a transaction-based sanction screening—at least if banks also check their customers against other sanction lists like OFAC, and the transaction is processed completely within the EEA.

However, the open question is what to do if at least one of the parties lies outside the EEA.

One silver lining is that instant payments are as standardised as classical SEPA credit transfers, Riedel says, reducing any individual per-bank requirements

“The individual requirements of banks for processing instant payments are quite small, especially if compared to the much more complex processing of cross-border payments,” he says. “Since many regulations apply EEA-wide, the majority of regulatory needs are already covered by the standard product.”

Drawing on 30 years of experience as a financial consulting and software company, experts from PPI analyse the bank’s ecosystem to identify all systems, areas, and interfaces affected by instant payments. PPI’s experts then provide an overview of potential issues, presenting solutions to tackle them.

“With detailed knowledge of the instant payment regulation, our experts estimate the effort and timelines for the proposed solutions and offer target-oriented decision memos to enable the bank to reach instant payment readiness in time, quality, and budget,” says Riedel. PPI’s tech innovations to expedite transitions for banks starting from scratch

In addition to consulting, PPI offers multiple tech tools and frameworks to make the transition process as smooth as possible. The PPI system is easily customisable and already configured with standardised interfaces for:

n Bulk and single-payment initiations.

n Balance checks.

n Booking.

n Clearing communication.

n Customer status reports.

n Beneficiary notifications

n Master data.

n Directory imports.

n And others.

If a bank can’t implement the standard interfaces on time, PPI can adapt the formats to the bank’s liking, using PPI’s parser and writer framework.

PPI’s software offerings facilitate compliance and enhance operational efficiency

PPI has successfully stress-tested its systems to run 24/7 without downtime, even during changes in message formats. Whenever a final confirmation doesn’t arrive on time, PPI’s software can still process payments completely without any manual interaction because it uses an automated investigation and finalisation procedure.

“The software also offers automatic enrichment of payments to comply with EU regulations on money transfers, and it ensures that every message is delivered. This is especially relevant when informing customers of incoming funds,” says Riedel.

As for payee verification, PPI offers a central service with standardised request interfaces, allowing any of the bank’s systems to query it easily.

Multilingual support and offices across Europe

PPI has offices in Germany, Norway, Switzerland, France, and Italy, allowing the company to interact with its customers on a personal level.

“The ability to support customers locally is an advantage,” says Riedel. “It removes language barriers and provides expertise on national specialties.”

PPI’s software’s graphical user interface has also been translated into English, German, French, and Italian.

Agency banking is also known as “indirect access” or “sponsored banking”. It refers to when an FI or payment service provider (PSP) has a contractual agreement with a direct participant in a clearing system.

By Paulo DelgadoThe process for getting direct access is incredibly involved, requiring liquidity, a healthy dose of governance paperwork and verifications, and an account with one or more central banks.

In addition to the access itself, you also need the technological ability to process transaction messages, encrypt them securely, perform validations, and so on.

Some FIs might have the liquidity and central bank accounts in place for clearing and settlement, but lack the tech and infrastructure for the messaging. Others might have the tech but lack the liquidity. Because Banking Circle is also a licensed bank, it can provide both liquidity and the technical solution, eliminating the need for multiple vendors.

“Banking Circle can slot in at any level of the bank’s needs,” Boel says. “Banks can send us an end-of-day file with transactions, or we can check for new transactions every fifteen minutes, or they can connect to one of our webhooks for instant messaging. If they don’t have the liquidity, we can provide it. The only thing they need is

their own licence.”

Key benefits of the service include:

n Faster payments: Indirect participants can use their own issued accounts, using their own Bank Identifier Codes (BICs) and International Bank Account Numbers (IBANs) to send and receive payments.

n Full payment transparency:

Using their own BIC and IBANs for payments presents the FI or PSP as the ordering party and their customer as the sender.

n Aligned to European Parliament regulation: Providing instant payment options to send and receive payments for consumers and businesses within the SEPA zone.

Given the choice between an instant payment and a payment that takes three days, it’s logical to assume that consumers will choose the instant payment. Experts expect an enormous increase in SCT Inst transaction volume once the grace period is over, and banks must be prepared for that load.

“Banking Circle significantly reduces the barrier to entry for banks,” says

Boel. “We’ve tested our payments system on our own bank accounts across payment zones for almost three years, and the solution is mature and robust.”

Only two major networks serve the European SCT Inst infrastructure directly—one provided by Swift and the other by Italian company SIA, which merged with Nexi Group in 2020.

Banking Circle built its access directly onto Nexi/SIA's network, bypassing any third-party gateways, allowing it to provide extremely competitive rates.

“We've built our gateways as close to the source as possible, which gives us more control over the value chain so we can keep the cost as low as possible,” says Boel.

Instant payments across the Nordic countries pose unique challenges. One attempt to standardise and implement them in 2017—called P27—showed initial promise but eventually fell short of a rapidly changing ecosystem and regulatory landscape.

Michael Boel Head of Clearing and Product Execution at Banking Circle

Michael Boel Head of Clearing and Product Execution at Banking Circle

Unlike Eurozone payments that all occur in a single currency, payments between Nordic countries trigger a forex event, adding a level of complexity that ultimately prevents such transactions from occurring instantly.

However, the Swedish central bank’s RIX-INST settlement service offers two different models for settlement—the Standard Settlement Model(STM) and the Single Instructing Party Settlement Model (SIP Model).

“Banking Circle has fully implemented the necessary testing and compatibility for RTGS (Real-Time Gross Settlement) and the STM,” Boel tells NFM. “As soon as Swedish banks start demanding the service, we’re ready to offer indirect banking there, too.”

Similar to European banks, Swedish banks currently have a choice whether to implement instant payments or not. However, as of November 2024, that choice becomes mandated for participants, already participating in the Getswish/SIP settlement models. Hence the adherence and usage for instant payment will grow in Sweden.

In Denmark, Banking Circle is the frontrunner testing partner for Den-

mark’s central bank, and the company has passed all necessary functional implementation tests to enter Europe’s instant payment scheme in April 2025. Although Sweden and Denmark’s implementations are national ones, customers that use Banking Circle’s Agency Banking service will be able to offer instant-like payments across borders, regardless of the currencies involved. The reason they can do this is because Banking Circle handles the liquidity, forex events, and settlements in the back-end, providing a seamless experience on the user end. From the user’s perspective, their transfer happens instantly.

Access to Instant Payments from Eurozone to GBP—and Soon Also USD

Banking Circle is already well-established in the UK, and is one of only 11 institutions with direct access to the UK’s banking infrastructure, which officially supports indirect access.

Using a single API or the banking sector’s familiar SWIFT messaging format, banks using Banking Circle can offer instant payments between EUR and GBP accounts.

We've built our gateways as close to the source as possible, which gives us more control over the value chain so we can keep the cost as low as possible.

Michael Boel, Head of Clearing and Product Execution at Banking Circle

Eurozone regulated FIs and PSPs are eligible for EUR indirect participation. UK regulated FIs and PSPs are eligible for both GBP and EUR indirect participation. Sort code issuance through Banking Circle is available within the GBP FPS (Faster Payments Service) scheme.

Additionally, Banking Circle has also obtained a licence in the US and is working towards onboarding with the Federal Reserve in order to implement FedNow payments—the US’s instant

payment scheme—which will open up the USD market for Banking Circle clients.

Banking Circle’s Agency Banking service means that Banking Circle takes care of all the complexities and back-end services. Banking Circle’s customers don’t need to invest in any new infrastructure to gain access to these new markets.

Innovation in payments is ramping up, we are swiftly moving from “scratching the surface” of innovation towards the fearless exploration of new solutions, business models, technologies and unlikely collaborations to solve legacy challenges. In a recent exclusive gathering of the top voices in payments in Copenhagen, speakers and participants engaged in insight rich conversations that presented varied perspectives from within and beyond the industry. We look at some of the messages framing the conversation around payments and that will continue to do so in the months and possibly years to come.

By Chris CrespoJust Pause for a moment and take a breath! - That's how many of us feel when faced with the overwhelming pace of change in financial technology. And nowhere is this change more palpable than in Payments. Almost every quarter, we witness new players, cutting-edge trends, and inventive applications of technology bringing down traditional barriers in the payment sector. These advancements are facilitating entry for non-traditional banking and financial entities while streamlining processes that have long been cumbersome and inefficient.

Despite the significant strides made, the consensus is that we have merely begun to scratch the surface. While local payment systems have achieved remarkable levels of speed, convenience, and seamlessness, cross-ju -

risdictional transactions remain hampered with challenges, including disparate infrastructures, banking systems, and regulatory landscapes. Nevertheless, pioneers in the fintech arena are dedicated to transforming the payment experience, making it universally accessible and straightforward.

In early April, Copenhagen hosted Fintensity, the first of a series of intimate and exclusive events by Nordic Fintech Magazine, aimed at gathering the mos prominent voices in financial innovation, to discuss at length the trends, challenges and innovations that are upending discrete parts of the value chain. The first edition of Fintensity, gathered 130 influential voices in the payments sector from the Nordics and Baltics. Banks, Payment-Service-Providres, retailers, regulators,

NGOs and entrepreneurs, gathered to explore the frontier of payment solutions, including cross-border and instant payments, as well as the evolving landscapes of open banking and Web3 technologies.

Attendees were treated to insights from industry household names like Microsoft, Visa, Mastercard, BankAxept, Mobilepay, Inpay and others. These presentations revealed current trends and future directions in the payment space. The event wasn't just about listening, though; it was a chance for attendees to engage, share ideas, gain actionable know how and foster connections that could drive the future of financial technology. Amongst the many themes discussed, several megatrends framed the conversations that took place throughout the day. The

following are but a few that created and enduring impression in the selective group of participants.

Artificial Intelligene continues to make inroads. As in most conversations these days, Generative Artificial intelligence (Gen AI) could not go amiss. The technology is notably reshaping the financial industry, with frontrunners like Microsoft at the head showcasing how Gen AI can be used across the entire value chain for both front and back office fucntions. Gen AI is streamlining operations, enhancing customer experiences, and enabling the development of new products. With 46% of new code being written by AI and a notable increase in developer productivity, the collaboration between human creativity and AI's capabilities is a driving force for future innovation. Furthermore, the adoption of AI in financial crime prevention, through tools like Lucinity, underscores the growing reliance on technology to mitigate risks and improve efficiency, but also to transform business operations and address financial and operational challenges.

Open Banking delivers change. The evolution of payment methods has seen a shift from traditional modes to more user-friendly, digital alternatives. Innovations in this space, such as Apple Pay and peer instant payments, reflect a broader trend towards inte -

grating technology to enhance the transaction experience. Discussions around solutions like Klarna Checkout and the potential of open banking signal a continued effort to refine payment systems, making them not just functional but also engaging for users.

3

Person to person transfers go Nordic. Vipps MobilePay's success story in the Nordics, with millions of users and widespread retail adoption, showcases the potential of fintech to create comprehensive and user-centric payment solutions. Its easy to use service has become a unifying platform, bridging generational gaps and providing a suite of services like person-to-person transfers with chat functionality, collective fund boxes, gift cards, and expense sharing. Their approach to integrating person-to-person transfers, collective funding, and payment services within a single platform is indicative of the sector's move towards cross-Nordic transactions, bill payments, and the vision of a singular, comprehensive wallet for all financial activities.

4

urgency to improve the movement of money across borders, is spotlighting the need for better solutions for international money transfers. The need for repeatable, effortless international transactions and the ability to distribute money to hard to access corridors in remote jurisdictions are the focus of companies like Inpay and Visa who, tasked with improving cross border payments, have developed strong value propositions that utilize their widespread network and robust partner ecosystems to improve speed, security and transparency making cross border payments as simple as local ones.

5

Innovation from Beyond. A surprising trend is emerging where innovation in payment solutions is increasingly originating from beyond the traditional boundaries of financial services. Collaborations and partnerships between unlikely players, such as retail giants and their competitors, are fostering a new wave of payment technologies. These developments are primarily driven by the need to circumvent high transaction fees and to meet specific customer requirements that conventional payment providers fail to address. For instance, major retailers are now engineering their own payment systems to facilitate seamless in-store experiences, integrating payment with advanced identification solutions. This not only caters to the operational needs of 1 2

Cross border payments gain momentum. The shift towards digital, evidenced by the staggering amount of B2B payments, is driving significant changes in how businesses and consumers interact financially. This trends combined with the strong regulatory push for instant SEPA payments across the EU and the rising