The Race for Profit

The Nordic region has long been a hotbed for innovation, particularly in financial technology or fintech. However, the ongoing crisis has dramatically shifted the investment landscape, compelling Nordic fintech startups to pivot their strategies and prioritise profitability and sustainable business models to secure funding from venture funds.

p.08

p.18

How Technology is Reshaping the Insurance Industry

p.24

From Woes to Woos: Baltic Fintech’s remarkable journey

p.34

Collaborations Needed to Unleash the Full Potential of AI JUNE 2023

The greatest Fintech event in the Nordics

Join

Nordic Fintech Week 2023 and take part in unlocking the future of finance.

2,000 Attendees |

Nordic Fintech Week opens the doors to a journey like no other. Come face to face with the forces reshaping finance in the Nordics Baltics and Beyond. Featuring our boldest agenda yet, learn how Finance is blending with other industries and how Fintechs and Financial Institutions are embracing Open Finance, WEB3, Decentralisation and Ethical Finance to build the next generation of financial services.

+70 Investors

Open Finance Track

Open Banking has transformed the banking industry, sparked innovation, improved experiences, and reduced costs that benefit customers, and financial institutions alike. The time has come to supercharge Open Banking principles to a new level. Enter Open Finance, the next evolution expanding beyond banking, to unlock a world of possibilities where hird-party providers can access diverse customer data savings, pensions, investments, insurance, mortgages and offer ultra-personalised financial products. Open Finance will redefine our understanding of finance, giving consumers control over their data, transforming financial services for unparalleled convenience.

Join us at Nordic Fintech Week 2023 to explore the boldest ideas in this industry shifting new trend!

Decentralised Finance Track

Welcome to the world where individuals control their data, transactions are secure, and trust is inherent. The emergence of a decentralised alternative financial system that operates on smart contract platforms is upending what we’ve known about finance until now. Decentralisation in Financial Services brings a new range of secure alternatives to traditional finance empowering users with true ownership of assets and platforms but also providing new and exciting services made possible, only now, through decentralisation technologies. Get ready to embrace the limitless potential of DeFi and Web3 and learn what the decentralised future of the industry looks like, only at Nordic Fintech Week 2023.

+100 Speakers | +200 FinTechs

Ethical Finance

Ethical Finance stands out for its commitment to community-focused values. It goes beyond just sustainability and actively uses people’s money to support projects that benefit society, promote local growth, and show international solidarity. In this track we will look at the efforts that financial organisations are going through to make a positive impact in business and society, catering for the needs of those overlooked by traditional financial institutions and meeting the growing demand from savers and investors who want their money used ethically. Join us at Nordic Fintech Week 2023 and find out what the industry is doing to combine doing good while doing well.

The Future of Finance

Join us for an exhilarating track that will take you on a journey through the cutting-edge realms of banking, regulation, insurance, payments, lending, and wealth. From reimagining the way we bank to uncovering the latest regulatory trends, this track is packed with excitement and innovation. Discover how exponential technologies like AI, machine learning and robotics are reshaping the financial landscape and paving the way for a more inclusive and seamless financial ecosystem. Be provoked to see the future of our industry like never before and here directly from those reimagining the global financial ecosystem, right here from the Nordics.

Blended Finance

Brace yourself for the thrilling synergies unfolding at the crossroads of financial services, ecommerce, retail, mobility, travel, and entertainment. As boundaries blur, a new era of extraordinary value propositions emerges, surpassing our wildest dreams. Experience the awe-inspiring collaborations where industries combine their expertise and capabilities to delight customers in new and exciting ways. Witness the birth of groundbreaking innovations that once seemed impossible and get ready to learn how the convergence of finance and various sectors is creating bleeding edge experiences, through the extraordinary fusion of possibilities!

27th & 28th nfweek.com

September

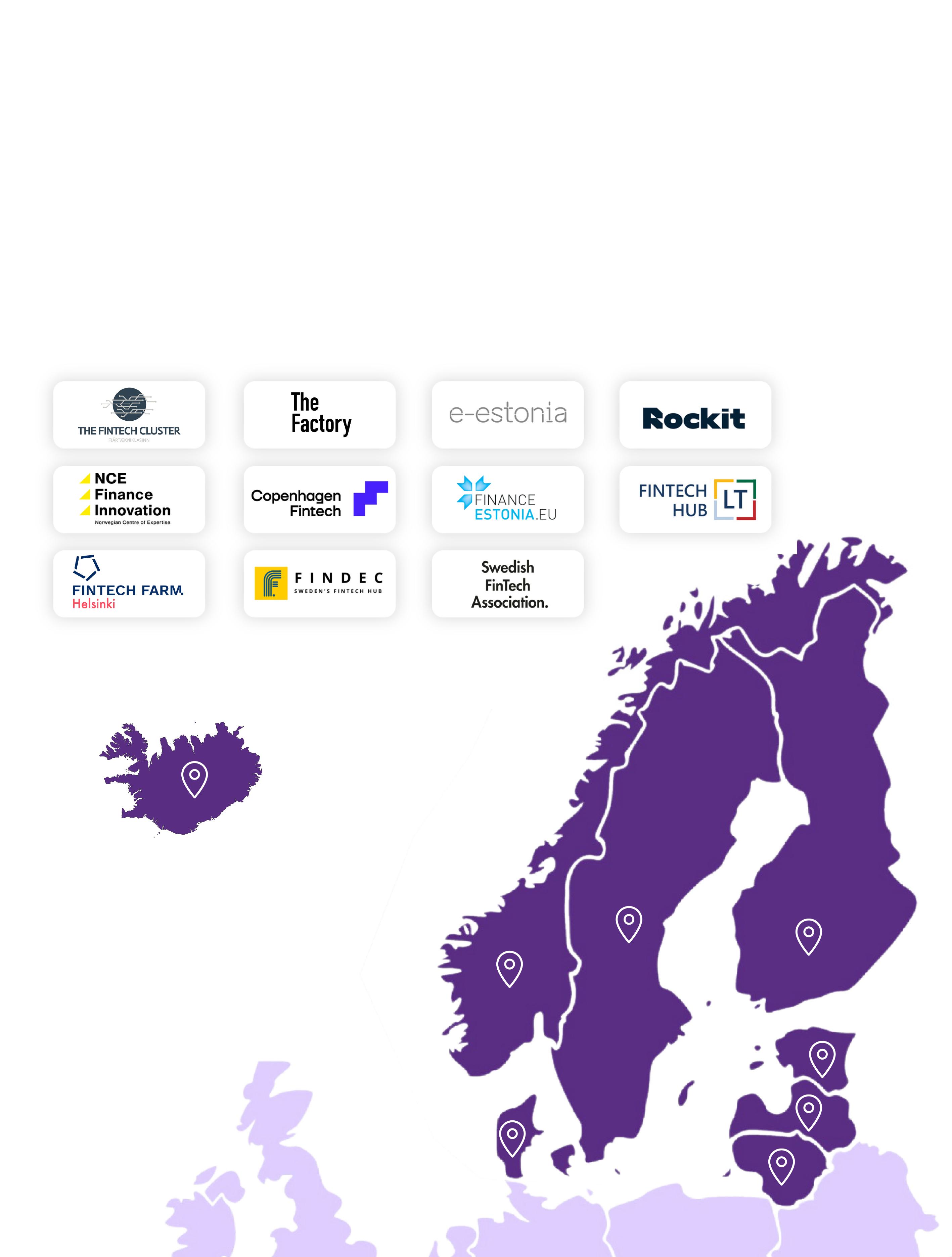

NFM’S NORDIC FINTECH DISTRIBUTION COMMUNITY

Editor in Chief: Chris Crespo

Journalists: Jakob Frier & Paulo Delgado

Layout: Vratislav Pecka

Exclusive partner: Published by Nordic Fintech Magazine Contact: Stian Faber, Head of Partnerships stian@nordicfintechmagazine.com

Fintech Magazine exclusively works together with selected Nordic Community Partners for insights and distribution, giving us unparalleled reach with audiences across the Nordics and Baltics

Nordic

5 Content 06–07 Pioneering a New Era: Unstoppable Forces Reshaping Finance in the Nordics and Baltics The Race for Profit 08–13

Nordic Fintech Ecosystem: Leading the Way Towards a Sustainable Future 14-15

Boldness and Vision. Lithuania’s Unwavering Commitment to Redefine Financial Services in the Baltics and Beyond

Wintermads Brings Curated Quality and Better UX to NFTs

How Technology is Reshaping the Insurance Industry

big transformation journey for insurers? 19

Nordic Insurance

Unique

to Digital Transformation European

Nordic Fintechs: A Radical Shift in Power Dynamics Unleashes a New Era for Payments 22-23 25-29 From Woes

Woos:

Fintech’s remarkable journey

Fighting

Financial Crime

The

16

17

18

Will 2023 form the beginning of the next

20-21

Companies Face

Challenges

and

to

Baltic

30

the Invisible War: The Power of Anti-Money Laundering Technology in the Fight Against

31

34

to

of

Inside the Mind of Financial Criminals 35

Open Banking: Now & a glimpse of the Future

32-33 Busting the super app myth: Why Europe is unlikely to get one-stop-shop apps

Collaborations Needed

Unleash the Full Potential

AI

Pioneering a New Era: Unstoppable Forces Reshaping Finance in the Nordics and Baltics

2023 has kept our team on its toes, as we’ve raced across the fastest growing fintech ecosystems in the Nordics, delivered keynotes, and forged media partnerships. With a nonstop stream of innovation in fintech, insuretech, regtech, and wealthtech, our journalists, content creators, and editor-in-chief have been firing on all cylinders to bring you the boldest thinking from the Nordics and Baltics. In this issue, we reflect on the stories that have stopped us in our tracks, prompting us to rethink and retrace as we make sense of the industry’s rapid evolution.

By Chris Crespo

Looking back at the first half of this year, it’s been a non-stop stream of activity for Nordic Fintech Magazine. We’ve done keynotes and panels at some of the most exciting events in the Baltic countries, and have started partnerships with several of the most visionary organizations in the industry. In this issue we will tell you all about it!

First, let’s talk about Vilnius, the capital of Lithuania. We were lucky enough

to visit twice, once for Fintech Day, masterfully organized by Rockit, and secondly as guest speakers at the Lithuanian Davos conference. The energy and enthusiasm at these events were palpable, and it was clear that something truly special is in the making.

Our trips to Riga, the capital of Latvia, were equally exciting. On our first visit, we had the opportunity to meet some of the most exciting proponents of fintech in the country, from entre-

preneurs to policymakers, who are all working to build a thriving ecosystem for fintech innovation. The second visit was even more exciting, as we were invited as exclusive media partners to ECOM’21, an event unique in its class, bringing together fintech and Ecommerce. There we met with some of the entities and organizations rallying people and policy makers to accelerate the expansion of fintech in the region and to further blurry the boundaries

between fintech and other adjacent industries like ecommerce and mobility. The passion and dedication of these individuals is truly inspiring, and it’s clear that their ambitions and grit is the catalyst driving the growth of fintech in the Baltics.

What’s truly remarkable about these New Nordic countries, as they are often referred to, is that they embody the best attributes of startup companies themselves. They are agile, innovative, fast, ambitious, and extremely talented. Their recent history and the fact that they were reborn in the 90s have given these three nations an unprecedented impetus that is catapulting them into Fintech stardom.

Estonia, for example, has 10 unicorns, or one for every 130,000 people, while Lithuania is the largest fintech hub in Europe by the number of issued licenses and Latvia ranks among the top 10 countries with the highest number of fintechs per capita. This powerful combination of skills, strong focus on STEM, young minds, and collaborative ecosystems is bringing together regulators, academia, central banks, corporates, and entrepreneurs to supercharge the development of their ecosystem. It’s inspiring to say the least, to see how the fintech community in these countries is co-creating an ecosystem that nourishes innovation, growth, and collaboration.

But as we all know, fintech is one of the most regulated industries and with good reason. In this issue we have also continued to explore how practitioners in AML and Financial Crime prevention are waging a war against highly sophisticated criminals who operate at the bleeding edge of technology to find new ways to exploit system loopholes and generate profits from illicit activities. Thankfully, AI, machine learning, and a whole lot of inventiveness are resulting in a flurry of new value propositions coming to market by companies that are emboldening their capabilities with strong technical expertise, knowledge of financial markets, criminology, psychology, and deep knowledge from the trenches in the field, from regulators, controllers, and central bankers. In this issue and as part of our AML and Fincrime Deep Dive we got to

6 Editorial

Chris Crespo Head of Content

speak to subject matter experts from Denmark, France, Latvia, Estonia, Germany and Lithuania, and we’ll bring you some surprising findings from this wrongly overlooked function of financial services, which in our estimation, has got to be one of the most exciting areas in fintech where real life cat and mouse pursuits are waged out every day.

Unfortunately, the conditions in the market are changing. The slowdown in investment, as well as the failure of banks like Silicon Valley Bank, Signature Bank, and Credit Suisse, are creating an increasingly difficult scenario for fintech startups. It’s narrowing the funnel that once provided bountiful fuel for these organizations to realize their value propositions. This new reality means that those companies determined to expand their list of features and functionalities will have to turn on a dime to show profitability. Markets across Europe are prepping themselves for increased activities in mergers and acquisitions and investors are withholding their bets only for those companies who can really show solid plans to profitable growth.

Nevertheless, we are as excited as ever for the future of fintech. The passion, dedication, and hard work of the individuals driving the growth of fintech in the Nordic and Baltic markets is a testament to the fact that innovation and collaboration can overcome any obstacle. And we are certain the current challenges will result in a more mature and stable market, poised to accelerate the emergence of a fairer more reliable and resilient financial system.

With some fabulously inspiring Fintech events and gatherings behind us and with the return of Nordic Fintech Week, in September, we can’t wait to see the new directions the industry is taking as founders and innovators pioneer new tools, technologies, and business models. We’ll be here every step of the way, covering and celebrating the heroes transforming our industry, one innovation at a time. Join us, and if you can, avoid blinking else you may miss the birth of the next amazing thing that changes how you experience finance forever.

7

The Race for Profit

The Nordic region has long been a hotbed for innovation, particularly in financial technology or fintech. However, the ongoing crisis has dramatically shifted the investment landscape, compelling Nordic fintech startups to pivot their strategies and prioritise profitability and sustainable business models to secure funding from venture funds.

By Jakob Frier

By Jakob Frier

Aglobal pandemic, geopolitical uncertainties and a war on the European continent have affected global economies and caused a great threat of economic downturn. That has caused venture capital firms to become more cautious in their investment decisions.

Numbers from Copenhagen Fintech show that investments in fintech have declined since an all-time high in 2021.

“From what we learn from our online series of ‘Nordic Fintech Trends’ with all the Nordic countries represented, we can certainly say that the Nordics follow the global trend. No doubt that 2021 was an outlier, and what we saw in 2022 and are now seeing in 2023 is probably a return to ‘normal’,” says Thomas Krogh Jensen, CEO at Copenhagen Fintech.

He also points to the turmoil that evolved in the US banking sector and the collapse of Silicon Valley Bank have fueled some anxiety among investors and sustained a slowdown in investment activity.

These events also impact the Nordic region. Securing funding has become increasingly competitive today, and investors now emphasise sustainable business models and revenue generation more than chasing growth. This has caused a specific question from investors showing a new trend:

“When it comes to business angels and family offices making seed investments, they all ask, “When can you become profitable?” It has definitely become a priority. It was not a question asked so early, just five years ago. Today, it has come front and centre,” says Søren Nielsen, senior manager at Thursday Consulting.

Nielsen is a seasoned fintech entrepreneur, and today, he advises high-growth startups on subjects like fundraising and scalable commercial models. According to him, companies that cannot control how it becomes profitable will have difficulty raising capital today.

He views the new trend as a backlash to several years of focus on volume and user growth without a clear path to commercialisation from the users on the platform. Many platform-focused companies require a lot bigger investment with bigger risks and, thus bigger

Senior

rewards if they succeed.

“These platform-focused companies can struggle in the current environment because it requires larger ticket sizes and more patience, and they are uncertain about how to make money from it. It is the same both internationally and in Denmark,” Nielsen says.

shares Nielsen’s perspective, which he sees as a healthy sign from the venture funds.

Harder to raise money Tjommi, a B2C fintech startup with Norwegian roots, is currently raising funds with the goal of completing the funding process within the next four to five months.

CEO Henrik Johannessen

“It’s harder to raise money now, but it’s good for the market. Over the last few years, many B2C companies have shown much user growth but haven’t shown the ability to make money on those users. And that’s the core problem in B2C fintech. The industry is stabling down right now. But that also sets requirements to raise the money in terms of showing there’s actually a possibility to make money on it, not just having the user growth,” he says.

9

Søren Nielsen

manager, Thursday Consulting

PHOTO: Sebastian Stigsby Falck, Digital Hub Denmark

He experiences firsthand how demands are higher around monetisation and unit economics. Investors are doing their due diligence thoroughly and are displaying heightened interest in various metrics compared to previous rounds.

The investors are now delving into greater detail during the due diligence process, particularly concerning the cost of acquisition, revenue per user, churn rate, and payback time. These are metrics that the team should know and follow closely.

“Today, only facts mean something. You can forecast as much as you want, but in the end, the numbers here and now only mean something,” Johannessen adds.

By scanning and registering prices across the internet, Tjommi helps con-

sumers automatically claim money back if the price drops after purchase. Johannessen and the team is paying a lot of attention to generating increased revenue for existing users on the platform.

“With the increase of the ARPU (Average Revenue Per User), it’s all about activating users to use the vouchers they get through our system. So every time there’s a refund, the customer gets a voucher, and it’s our job to ensure it is used,” say Johannessen and adds:

“You need to have a solid path to profit. Not saying you need to have everything sorted, but it needs to be a revenue model that shows a path to getting profitable.”

Nielsen also emphasises the need for metrics that show much money a company earns from its existing customer base.

“One of the key metrics currently emphasised is Net Dollar Retention. It also tells how many customers the company loses and how much extra it can sell to existing customers. It is a specific data point that is being asked about,” he concludes.

The need for a fundraising strategy

The changes in the industry indicate that it now requires more time and a greater number of attempts to find success, necessitating the need to encounter and evaluate more opportunities. Founders have to prepare and devise a clear strategy, including a strong narrative, especially on how they plan for scale and a clear path to profitability, according to Krogh Jensen:

“It is more important than ever to think about how the funding journey should look like one or two rounds down the journey. The investors do their due diligence, but so should the startup founders. More important than ever.”

According to Nielsen, many startups must look closely at and reduce their fixed costs. Salary costs are a significant factor, and reducing them is an effective measure. Additionally, many are trying to sell more to existing customers, as acquiring new customers involves more marketing costs. And that still requires some level of funding.

“Throughout the spring, I have seen several companies doing bridging rounds because they suddenly need to change their strategy. These bridging rounds have sometimes been as short as four months to try to get closer to a calmer venture market and closer to profitability at least.”

His observations are that investors most often prioritise companies already in their portfolio. Nielsen often advises startups to do a bridging round now and expects it to take some time before the investors become more risk willing, which could easily be another six months. He also points to public funding as a short-term solution, such as innovation fund grants or Eurostars funding.

At Tjommi, Johannesson has decided to wait five months until closing the round to boost the metrics and be better positioned to raise a round.

“I see a lot of companies fundraising all the time instead of setting a strategy

10

Henrik Johannessen CEO, Tjommi

for it. And if you don’t have a strategy for it, you just end up being a little back and forth everywhere,” he says and adds:

“There are two ways to look at it. Times are harder now. But then you can also look at it differently and take it as an advantage. Tough times mean there’s still money to deploy, but the bar is higher. So how do you stand out?

I think you stand out by week after week, showing the progress, executing during the hard times, and getting the team to focus on the product and the metrics. And if you do that over time, you will have the metrics they seek. So right now, we have decided to just focus on the metrics.”

At Copenhagen Fintech, Krogh Jensen is confident that Nordic fintech

startups are doing their best to navigate and weather the storm:

“It’s not easy if you get stuck ‘in the middle’, so to speak, but I really do think that founders, the executive boards and their investors are doing everything they can and should to recalibrate and adjust. Being agile and adapting to a changing environment is in the DNA of a startup.”

Securing a bargain

Venture funds are telling their portfolio companies to shelter in place for uncertain months, and some have laid off staff. Those startups that don’t have a clear bridge to the other side of that chasm will be looking for buyers.

A Danish proverb says that when the storm blows, some build shelters, and

some build wind turbines. And according to Nielsen, we are somewhat in that situation today:

“The companies that have capital can start buying and investing. There is a golden opportunity to invest and buy talent and these new types of products now.”

Large financial incumbents are capitalising on the uncertainty in the market by seizing the opportunity to snap up struggling startups at a discount at a lower valuation than what they were worth 18 months ago.

“By leveraging the volatile and unpredictable market conditions, these big players in the financial industry can negotiate favourable deals and secure bargains when acquiring these startups,” says Krogh Jensen.

11

Thomas Krogh Jensen CEO, Copenhagen Fintech

PHOTO: Sebastian Stigsby Falck, Digital Hub Denmark

Deal count VC vs CVC year-over-year growth 2012-22

12

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 8% 21% 7% 31% 74% 28% 37% 26% 2%3% 3% 9% 16% 15% 17% 4% 8% 6% 42% 42% -2% -25% 2022 -40% -20% 0% 20% 40% 60% 80% Total CVC Total VC Sources: PitchBook, GCV

The lower valuations of these fintech companies compared to their previous values make them attractive targets for acquisition, enabling the larger companies to expand their portfolio and enhance their competitive position in the industry. This strategy allows the big financial companies to leverage the market uncertainty to their advantage and make strategic investments at a more favourable price point.

A survey from Global Corporate Venturing with numbers from Pitchbook shows that the market turbulence led traditional venture capital investors to reduce their involvement in startup funding deals, while corporate investors demonstrated greater stability. Despite an overall 25 per cent decrease in the number of venture capital funding

rounds compared to the previous year, rounds that involved corporate backing experienced a 2 per cent decline.

The return of venture investment

Today, more money is earned on interest by putting it in a passive account or investing in bonds than in recent years. Consequently, there is less risk-taking capital available. But the venture funds are obligated to invest the money and cannot keep it idle.

“We experienced the same situation during the pandemic when several funds had money but were cautious about investing due to uncertainties. That caused a ketchup effect and a sudden surge in investment activities,” says Nielsen and explains:

“We might be seeing a similar situ-

ation where some venture funds are holding onto the money because the markets are challenging to invest in. But eventually, they need to invest. The question is when.”

While that timing remains uncertain, Johannesson is optimistic about securing a fair valuation:

“The bar is higher. But you need a lot of capital to solve meaningful problems. And the investors know that to go through that long journey, the valuations must be higher on the seed stage because otherwise, the cap table would be unbalanced all the way out. So, if you’re solving a meaningful problem and taking that long journey, it’s about being convinced that you are on that journey and have the profitability.”

13

The Nordic Fintech Ecosystem: Leading the Way Towards a Sustainable Future

By Thomas Krogh Jensen, CEO at Copenhagen Fintech

Opinion

In the realm of financial technology, few regions can rival the prowess and innovation of the Nordic countries (I know I am biased). With a progressive mindset, robust digital infrastructure, and unwavering commitment to sustainability, the Nordic fintech ecosystem has emerged as a shining example of excellence. In this article I will take a deep dive into the strengths of the ecosystem, explore the outlook, and ponder whether the Nordics can maintain the global lead in the face of increasing competition from many other regions around the world.

So let us begin with green finance and sustainability. The Nordics have long been pioneers in sustainable practices, and our fintech industry is no exception. With a strong focus on environmental responsibility, Nordic fintech companies have embraced green finance, fostering the development of innovative solutions that align with the region’s commitment to combating climate change. From carbon offset platforms to sustainable investment tools, the Nordics are at the forefront of leveraging fintech for a greener future.

A robust digital infrastructure. The Nordic countries boast a world-class digital infrastructure, providing a solid foundation for fintech innovation. With high internet penetration rates and advanced telecommunications networks, the region offers a seamless and secure digital ecosystem. This infrastructure allows fintech companies to develop cutting-edge products and services, making the Nordics a hotbed for technological advancements in the financial sector.

Yes, we like to collaborate. In fact, collaboration lies at the heart of the Nordic fintech ecosystem. The region fosters strong partnerships between traditional financial institutions, fintech startups, regulators, and academia. This collaborative approach promotes knowledge sharing, innovation, and the creation of groundbreaking solutions. By working together, Nordic fintech players harness their collective strengths to drive progress and maintain a competitive edge on the global stage.

The Future Outlook

A notable trend is the transition from open banking to open finance. The Nordics have already embraced open banking, which enables secure data sharing between banks and fintech firms, leading to enhanced customer ex-

periences and increased competition for the benefit of the consumer. However, the region is now on the cusp of a new era, where open finance will further expand data access to include insurance, investment, and other industries. This transition will hopefully also position the Nordics as pioneers in shaping the global landscape of open finance. Moreover, the adoption of financial technology is not limited to the traditional banking sector alone. Other industries, ranging from retail, mobility and gaming, are increasingly incorporating fintech solutions into their core offerings.

The advent of Web3 technologies has brought forth a new era of digital transformation, disrupting traditional business models and empowering individuals in ways previously unimaginable. In this context, legacy brands, with their established reputation and loyal customer base, are seeking ways to embrace this decentralized and open landscape. Fintech and Non-Fungible Tokens (NFTs) emerge as powerful tools, enabling these brands to seamlessly transition into the Web3 era while redefining customer engagement, ownership, and monetization.

Staying Ahead of Global Competition

While the global fintech landscape becomes increasingly competitive, the Nordic region has the necessary ingredients to maintain its lead. By building upon their existing strengths, the Nordics can continue to set new benchmarks for innovation and sustainability in fintech. Furthermore, the region’s commitment to regulatory excellence ensures a secure and trustworthy environment for both businesses and consumers. The proactive approach of Nordic regulators in fostering innovation while safeguarding against risks gives the region a competitive advantage over its global counterparts. One crucial aspect contributing to

the Nordic fintech ecosystem’s continued success is the role played by corporate innovation units. They possess a unique advantage: the resources, industry expertise, and customer base of their parent companies. Through partnerships, corporate innovation units can tap into the innovative spirit and agility of fintech startups, integrating their cutting-edge technologies into their core offerings. This collaboration allows traditional players to stay ahead of the curve, meet evolving customer demands, and unlock new revenue streams.

By aligning their interests and goals, both parties can benefit from each other’s strengths. Fintech startups gain access to valuable resources and a wider customer base, while established companies gain fresh perspectives, innovative solutions, and a competitive edge in the rapidly evolving fintech landscape. The success of corporate innovation units and their fintech partnerships in the Nordic region is evident in numerous industry collaborations. From banks partnering with payment service providers to retailers integrating mobile payment solutions, these partnerships have transformed traditional industries, enhancing customer experiences and driving digital transformation.

Conclusion

The Nordic fintech ecosystem is a force to be reckoned with. With a strong emphasis on sustainability, robust digital infrastructure, and a collaborative mindset, the Nordics have carved a niche for themselves in the global fintech landscape. The transition from open banking to open finance, along with the increasing adoption of fintech across various industries, promises a future where the Nordic region will remain at the forefront of financial technology. Consider yourself invited to join us.

Boldness and Vision. Lithuania’s Unwavering Commitment to Redefine Financial Services in the Baltics and Beyond

In the ever-evolving landscape of financial technology, Vaiva Amulė stands as a driving force and visionary leader within the Lithuanian fintech ecosystem. As the Head of Fintech Hub LT, the largest association of licensed fintechs in Lithuania, she has played a pivotal role in spearheading the fintech movement, fostering ongoing dialogues with regulators and key industry players. Recognized as the Fintech Leader of the Year 2023 Vaiva Amule’s relentless commitment to ensuring an adequate balance of regulatory compliance and innovation within the ecosystem has paved the way for a thriving fintech industry. In this exclusive interview, we delve into her insights, exploring the vital role fintechs play in transforming Lithuania, the Baltics, and the wider European financial landscape.

By Chris Crespo

Where do you see Lithuania on the startup journey - are you a startup, scaleup, or a unicorn?

Lithuania’s startup ecosystem has transitioned from the startup to scaleup phase, rapidly gaining recognition in Europe. Despite its small population, Lithuania attracted €295 million in investment in 2022, making it the second-fastest-growing startup ecosystem in Central and Eastern Europe. The ecosystem’s value has increased 17 times since 2017, reaching €9.5 billion. Additionally, 800 startups contributed €297 million to the Lithuanian budget in 2022, a 51% increase from the previous year. With a focus on sustainability and profitability, Lithuania’s startup ecosystem is poised for future success, attracting more investors.

How has the Lithuanian fintech industry evolved in the past few years, and what major trends have emerged?

In recent years, Lithuania’s fintech industry has become an integral part of the country’s economy showing resilience and attracting foreign

investment. The electronic money and payments sector experienced notable growth in 2022, with a 1.6 times increase in licensed activity revenue compared to 2021, serving over 25 million clients. Lithuania currently has seven specialized banks, 87 electronic money institutions, and 51 payment institutions. Fintech companies in the country also secured a record financing of 67.9 million euros in 2021, accounting for 28% of total investments. Active policies, a strong ecosystem, collaboration and a culture of compliance and risk management and collaboration between institutions and the market have all contributed to the growth of our ecosystem.

What are some of the key success stories of Lithuanian fintech companies, and what do you think sets them apart from their competitors?

Lithuania’s fintech ecosystem has gained attention for its global fintech unicorns, including Revolut, SumUp, and NIUM. Alongside them, other Lithuanian fintech companies like ConnectPay, Trans-

ferGo, Paysera, Bankera, and Ondato have achieved remarkable success. These companies prioritize understanding customer needs and developing innovative solutions locally and abroad. They attract top talent globally due to favorable business conditions and government support. Lithuanian fintech companies succeed through innovation, customer focus, regulatory compliance, and strategic partnerships.

What opportunities do you see for collaboration between Lithuanian fintech companies and other players in the global fintech ecosystem?

Collaboration between Lithuanian fintech companies and global players offers opportunities for growth. One opportunity is leveraging expertise from fintech companies in different regions to expand into new markets. Collaboration with traditional financial institutions, such as banks, allows fintech companies to utilize existing infrastructure and customer base while offering innovative solutions. Working with government agencies and regulators fosters the

development of policies that promote innovation, consumer protection, and financial stability. Overall, collaboration within the global fintech ecosystem drives innovation, market expansion, and better customer experiences.

What role do Lithuanian fintech companies play in shaping the future of finance, and what innovations are on the horizon?

Lithuanian fintechs are actively developing innovative products and technologies that combine classical finance with blockchain, in response to new European regulations like eIDAS and MiCA. This includes introducing decentralized finance protocols, promoting digital wallet adoption, and implementing new methods for customer identification.

They are also harnessing the power of artificial intelligence and machine learning to improve lending decisions, and big data analytics to enable personalized investment recommendations. Our fintechs are not only disrupting the local market but markets in Europe and beyond.

How do you see the Lithuanian fintech industry evolving over the next few years, and what are the key drivers of this change?

Our fintech companies are driving advancements in areas like payments, lending, digital identity, and regulatory compliance. They are introducing cutting-edge products and services that enhance convenience, security, and efficiency for both businesses and consumers. Moreover, Lithuania’s fintech ecosystem fosters collaboration between startups, traditional financial institutions, regulators, and other stakeholders, creating a vibrant and dynamic environment that will continue to grow and innovate in the years to come.

16

Wintermads Brings Curated Quality and Better UX to NFTs

By R. Paulo Delgado

Two major barriers for NFT adoption are authenticity and user experience. A new platform out of Sweden attempts to solve both.

Mass adoption of NFTs remains low despite the surge in interest after precedent-setting sales such as Beeple’s First 5000 Days and PAK’s The Merge—selling for nearly $70 million and over $91 million respectively.

But only 7% of the U.S. population are active NFT owners, and only 25% are familiar with NFTs.

Buying an NFT is a byzantine process that can take days for inexperienced users, sometimes requiring multiple calls to “that friend who knows about crypto”, or dozens of Google Searches to understand what a wallet is, what a blockchain is, and what gas fees are.

On the flip side, we have NFT natives—users who are firm believers in NFTs, crypto, and Web3. They’re community-driven and often vocal about projects they consider inauthentic. To them, NFTs and Web3 are philosophical movements more than an investment.

NFT natives insist on quality, and the influx of NFTs into existing marketplaces makes it challenging to find that quality. The rise of natively created NFT marketplaces on different blockchains only adds to the confusion.

NFT authenticity

Porsche bulldozed into the NFT space with overconfidence and learned quickly that Web2 branding means nothing in Web3. The luxury brand sold only 16% of its NFT collection, and suffered enormous backlash from the

Web3 community, which derided the project as a cash grab.

NFTs go far beyond an NFT’s price.

For artists, NFTs also rekindled the hope that they could regain power in a world dominated by technologies that had eroded an artist’s ability to earn a living. NFTs symbolise an opportunity for artists to shine as artists.

That idea remains strong in the NFT community, but with a lack of dedicated curation to let the cream rise, these artists might struggle to gain the recognition they deserve.

Failing to lower barriers to entry for newcomers also contributes to keeping promising artists in obscurity.

UX barriers

And then there’s the UX factor. New users wanting to buy an NFT must navigate a

labyrinth of complexities, including passing the necessary KYC and AML checks to purchase crypto, which is only necessary because the crypto-fiat offramp is considered a currency exchange—a regulated activity.

People visiting a marketplace expect to take out their credit cards and walk away with a product. Years of UX studies aren’t going to be suddenly disproven because “blockchain is such an awesome technology.”

Swedish startup Wintermads solves both problems

Swedish startup Wintermads is on a mission to solve both problems by reducing friction during the purchase process, and providing quality collections of superlative NFTs that have been curated for specific markets.

“Our team has extensive experience in lowering barriers to entry in this space,” Serod Nasrat, CEO of Wintermads, tells NFM, “and we’re dedicated to doing that with Wintermads for both new and experienced users. Buying an NFT should be easy. Users shouldn’t need to go through the superfluous step of buying crypto to do that.”

As a result, Wintermads has implemented an ingenious solution of letting users pay directly with fiat currency for NFTs, something unheard of in other marketplaces. The closest those marketplaces come to achieving this is by letting users buy crypto—not NFTs—with a credit card. Even then, they only do this for a small number of collections.

“We also want to help the incredibly talented pool of NFT creators, and match them with the right audience,” Nasrat says. “Popular collections elsewhere aren’t necessarily popular in the Nordics, so we’ve partnered with regional agencies who know how to communicate with the Nordic audience. Our focus on regional markets is something completely overlooked by the larger NFT marketplaces.”

Every NFT on Wintermads is handpicked from hundreds of collections by an in-house veteran art seller highly familiar with the NFT space.

The company is still in early stages, but might be defining a model that all successful NFT marketplaces will eventually follow.

17

How Technology is Reshaping the Insurance Industry

The insurance industry is undergoing significant changes driven by digitalisation and data. Insurance companies like Tryg are adapting their business models to meet customer expectations in the digital age.

By Jakob Frier

The insurance industry is undergoing significant changes due to advancements in technology, that presents opportunities in new business models and challenges in stricter regulation. As digitalisation and data become increasingly prevalent, insurance companies are adapting their business models to meet the evolving needs and expectations of their customers.

According to Lars Bonde, the COO at Tryg, a Danish insurance company, digitalisation is one of the key factors shaping the insurance industry. As customers increasingly embrace digital channels, insurance companies must adapt and provide convenient, user-friendly experiences. Bonde highlights the importance of serving customers in a digital way to meet their expectations efficiently:

“Customers today demand a digital, seamless and effective case processing and digitalisation provide us with a great opportunity to meet that demand and enhance customer experience,” says Bonde.

By embracing digital channels Tryg can leverage data-driven insights and

optimise internal operations. Tryg is building a new claim system. Bonde explains:

“Over the last five years we have received a growing number of claims year by year. To make sure we can manage the number of claims most efficiently, we want the customers to fill them digitally. When doing so, we can provide the customers with the compensation within a couple of minutes. And going forward, we aim that 80 percent of the claims will be registered digitally,” says Bonde.

Adapting to the Age of Digitalization

The increasing availability of data comes with great opportunities for the insurance companies to better calculate risks and prices on the customers. While Bonde acknowledges a need for open data to be regulated by institutions as the EU he also emphasizes that a company like Tryg is not able to share how they calculate prices since that would force the company to reveal the secret sauce.

However, Tryg is working on finding ways to share data with partners. To embrace the increasing availability of data and enhance collaboration, Tryg

has developed Tryg 360, a comprehensive data organization system. Bonde explains:

not worried about inflation you are making a big mistake” Bonde concludes.

He emphasizes the impact of new regulations as well as the increasing demand for addressing environmental issues, where insurance companies can play a crucial role in addressing environmental concerns and making a positive impact. Bonde acknowledges that while individuals must also consider their daily activities, insurance companies have a unique opportunity to contribute to sustainability efforts.

Lars Bonde COO at Tryg

“Tryg 360 is our new way of organising data so all business units can use it in an effective way. We build the system with open API’s to share data with partners and try to find out which ecosystems we should be a part of and then we build a system where we can control the consent of the customers. So, we know when and with whom we can share data.”

Overcoming Challenges and Embracing Sustainability

Inflation, regulatory changes, and environmental concerns pose challenges to the insurance industry. Lars Bonde highlights the uncertainty surrounding future prices due to inflation, urging insurance companies to closely monitor and adapt their strategies accordingly.

“If you are working in insurance and

“Where we can really make a difference as an insurance company is on the claim side,” Bonde says and continues: “If we can help repair shops to be more sustainable, that would lead to something. When you look at the CO2 saved when we repair windshields instead of replacing them, we save double the amount of what the entire company of Tryg is emitting over a year.”

The approach aligns with their commitment to sustainability and demonstrates their proactive efforts to make a tangible difference. Bonde emphasizes that sustainability initiatives are not only crucial for the environment but also for meeting customer expectations, and Tryg aims to enhance their value proposition and meet customer needs effectively.

“Claims is where we will spend a lot of time in the future, both getting more sustainable and reducing claims expenses, and creating better products for our customers.”

18

Will 2023 form the beginning of the next big transformation journey for insurers?

By Joachim Allerup, Expert Partner, Bain & Company

The Nordic insurance industry has been performing well in the last decade, with significant investment and focus on driving internal digitalization and automation to optimise profits and improve customer experience. However, with the advent of artificial intelligence (AI), there are new opportunities for both automation and new revenue generation, and insurers need to think beyond just the core business. The next wave of transformation and innovation is prime to affect the industry, and insurers must engage with insuretech and other tech companies to strengthen their future position and growth potential.

While the future growth of the Nordic insurance market is expected to remain relatively flat in the coming years, with market forecasts for non-life premiums suggesting a moderate annual growth of ~3-4% until 2026, there are still scale and efficiency gains to be captured from the core business. AI digitalization and automation will remain a strategic focus area for 2023, as the industry continues its path to optimization

However, this alone will not drive significant topline increase or unlock ground breaking differentiation. Insurance companies need to use the new technologies to not only optimize the core business but also think beyond the traditional risk transfer mandate into a more holistic set of services and new arising eco-systems, which will eventually expand their footprint. Typically within home, mobility and health services.

Bain research shows a gap in the market with ~60-80% of Nordic consumers interested in integrated ecosystem services, and see the insurance companies as the natural (and trusted) owners of these. So, whereas most

Nordic insurers have already made decisive attempts at using AI and digitalization for better incremental services, few have started really branching out to new Engine 2 initiatives or started rethinking the core. 2023 seems to be the definitive breakthrough of AI and possibly also blockchain and hence might very well be the final initiator of making insurers go from incrementally optimizing the core to re-defining the core - and beyond. Hence it also offers an opportunity for true differentiation for those who understands how to implement the new technologies with the customer experience in focus and an eye for new eco-system driven revenue streams.

Especially in the long run technologies like AI and blockchain will significantly affect the industry; especially as automation of transactional engagements leaves insurance companies with even less options to differentiate on the core offering - unless they add an additional focus on how AI can be used to deliver innovative customer experiences with new creative marketing efforts, personalized UX, digital membership assistance, new product generation and re-thought claims prevention. The

Joachim Allerup Expert Partner, Bain & Company

speed of change is once again accelerating. Hence, leveraging an efficient, digitalized, optimized and re-thought Engine 1 (core business) to develop Engine 2 (new business) is becoming a pivotal priority for insurance leaders.

In conclusion; The Nordic insurance industry has done well in driving digitalization and automation internally. The next wave of transformation and innovation is poised to affect the industry. Insurers need to focus on partnering with companies that offer value to their customers and use their expertise (and data) to expand their offerings beyond traditional risk transfer products in order to ensure that they are well-positioned for the future.

As a natural starting point, insurers should identify the long-term impact of AI and other technologies and use this to define their “future back” opportunities. To inform this process, insurers must at all times keep abreast of the industry’s ongoing risk assessment and comply with evolving ethical guidelines.

Only with a clear view of the strategic impact of these emerging technologies can companies start the next big transformation journey on the right foot.

19

Opinion

Nordic Insurance Companies Face Unique Challenges to Digital Transformation

The Nordic insurance market is highly unique, running on legacy systems that are challenging to modernise, but serving a highly satisfied user base that isn’t complaining about any lack of change.

By R. Paulo Delgado

The Nordics are one of the most mature insurance markets in the world, operating on mainframes that are largely incompatible with modern systems. But they also have a highly satisfied customer base—customers rarely change providers in their lifetimes. Although customer retention remains high, nothing stands still. Insurance companies in the Nordics will eventually need to upgrade their legacy systems or risk being raided by an aggressive disruptor—but only if that disruptor’s software can handle the complex way that Nordic insurance policies are renewed.

Innovation challenges

The Nordic legacy infrastructure means the Scandinavian countries experience more challenges to innovate than less mature markets.

“Nordic companies have typically handled innovation using middleware solutions,” says Shreyas Vasanthkumar, Managing Director for Europe, the Middle East and Africa (EMEA) at Duck Creek Technologies, a global insurance software company. “But they’ve reached a point where it’s no longer viable to maintain.”

Insurance has traditionally been the laggard in fintech, not only in the Nordics. That’s changing now. Sweden currently leads the way, hosting 60% of the region’s insurtech startups, including mobile insurance company Bima; home insurance provider Hedvig; embedded insurance product Omocom; and several others.

In Denmark, an insurtech called Undo simplifies signing up for car insurance and offers pay-as-you-go travel insurance—you only pay on travel days. Products of this type are highly challenging to launch using the existing infrastructure, Vasanthkumar tells NFM, and sometimes downright impossible. But insurtechs might be just the backstop needed to hold any potential disruptor off until the major insurers can carry out a full-scale digital modernisation.

Insurtech symbiotic relationship

In the banking sector, the symbiotic relationship between incumbents and fintechs is well established. Many of the world’s large banks have embraced ready-made solutions provided by fintechs because it means those banks can innovate faster.

Tryg’s Head of Nordic Innovation Discovery, Line Dalsfort, is eager to establish meaningful partnerships with insurtech startups because it would help the insurance giant embed its insurance products in other apps. Tryg is currently the largest non-life insurer in the Nordics. “You don’t always have to go into your core system to innovate,” she tells NFM. “We have really added value with several insurtech startups.”

Tryg has several partnerships with insurtechs, including one with Undo, where Tryg is the insurer behind the app’s service.

But Dalsfort agrees that the user must ultimately benefit. Where integrations exist, they must be seamless. And if that can’t be achieved, then an infrastructure upgrade might be the way to go.

“We have a responsibility to our customers,” she says. “Even though people are currently happy with us, as shown by customer retention, we have an obligation to ensure they remain happy.”

That means insurance companies must keep their guard up and innovate in-house to avoid overly depending on too many intermediaries that could ultimately push the costs up for the end user.

20

Shreyas Vasanthkumar Managing Director, Europe, the Middle East and Africa (EMEA)

Line Dalsfort Head of Nordic Innovation Discovery, Tryg

40%

In other countries, customers renew policies individually.

Renewing policies in bulk is great for customer retention, but it’s a nightmare from a technical standpoint. Renewing everything at once is highly complex, and finding a software system that deals successfully with that for the private insurance market is difficult.

20%

+50%

“Most insurance systems are architected product-line by product-line,” he says. With multiple products in one basket, you need the capability to renew the entire basket as well as individual products. You need to account for mid-term adjustments, cancellations of individual policies, account for endorsements— written amendments that change the terms of the policy—and other factors.

When in Rome, do as the Romans do. When in the Nordics, sell insurance in bulk.

“At Duck Creek Technologies,” Vasanthkumar says, “we’re lucky that we can handle these packaged products out of the box because our DNA is in commercial and specialty insurance.”

Customer satisfaction makes the Nordic insurance world go round That sense of obligation to the customer is a core principle of the Nordic market.

“The United Kingdom is also a very mature market,” says Vasanthkumar, “in terms of spending and penetration. But the Nordic level of satisfaction with their insurance company is far higher than in the UK. People love their insur-

ers in the Nordics. The situation isn’t the same in the UK.”

This has forced the UK market to innovate far more rapidly than the Nordic one.

“Retention levels in Norway are around 80 or 90 percent,” Vasanthkumar says. “They’re nowhere near that in the UK. Loyalty, or lack thereof, is a big issue in the UK. In stark contrast, it seems to be a non-issue for Nordic insurers, particularly in Norway. The reason is their commitment to quality and the ability to deliver excellent service in return for customer loyalty.”

This high customer satisfaction has directly contributed to the massive profitability of Nordic insurance companies, some of which consistently hit a Combined Ratio of 80-90%, Vasanthkumar says.

Highly complex renewal process

Vasanthkumar tells NFM that the Nordic market maintains its stability mainly because of the way insurance is sold in the Nordics—in bulk.

When a customer renews, the insurer renews the customer’s entire portfolio.

Commercial and specialty insurance operates much more complexly than private insurance. Large commercial insurances have highly complex ratings and policies, and multi-risk policies—policies that cover several risks under one policy.

Technically speaking, dealing with the factors of a multi-risk policy would be the same as dealing with multiple policies in a single basket.

An interesting battlefield

The complexity of renewal might be another reason that no disruptor has successfully entered this field—it’s simply too complex to implement. Or perhaps the right player simply hasn’t seen the opportunity.

In either case, Nordic insurers will have no defence if that player does appear and shows the aggression typical of an upstart newcomer hungry for market share.

“We have an interesting situation in the Nordics,” Vasanthkumar says. “It’s an unusually profitable market that cannot really innovate much because of its legacy systems. Something will happen in the market. Ultimately, a player or two will have the power, finance, eagerness, and aggression to compete harder. And then this market will become an interesting battlefield.”

21

Something will happen in the market. Ultimately, there will be a player or two that will have the power, finance, eagerness, and aggression to compete harder. And then this market will become an interesting battlefield.

Shreyas Vasanthkumar, Managing Director, Europe, the Middle East and Africa (EMEA), Duck Creek Technologies

FACTS

Exclusive first findings from the 2023 Global Consumer Insurance Insights Survey, extracted for the Nordic region.

Nordic policyholders who are aware of embedded insurance. Almost half are not.

Scandinavians who trust embedded insurance because they trust the provider.

Percentage of Scandinavians who are aware of embedded insurance that also trust it.

European and Nordic Fintechs: A Radical Shift in Power Dynamics Unleashes a New Era for Payments

Despite high market penetration, the Nordic region’s payments ecosystem remains fragmented, favouring a handful of dominant players. But this power dynamic is changing.

By R. Paulo Delgado

PYMNTS recently reported that the Nordics have been a “global digital payments frontrunner for decades.” But the relatively small region is also one of the most fragmented, making it challenging for any fintech to gain access to the zone.

A 2022 report by Swedish bank Riksbank revealed that more than 80% of in-store purchases are made with a card or mobile phone in Norway, Sweden, and Denmark. According to Denmark’s official government statistics, card transactions in the Danish zone alone topped $93.5 billion (DKK642 billion) in 2022. And in 2021, Swedes paid a total of $106.3 billion (SEK1,115 billion) by card.

The Nordic payments sector is a promising revenue stream for any

fintech hoping to tap into it—if they can overcome the hurdles.

Nordic payments fragmentation

The fragmentation of this zone comes about because of different currencies, languages, and myriad local card and wallet implementations. In Denmark, for example, the nationally issued Dankort dominated for years due to higher transaction fees for foreign cards.

In Norway, the country’s BankAxept card still dominates the market, even over Visa and Mastercard.

The Swedes love to pay with Swish, while the Danes use MobilePay. In April 2021, 100% of Danes in their 20s, and 99% in their 30s, paid with MobilePay at least once.

To successfully enter the Nordic payments market, a player would need to support each of these different payment methods. Previously, that meant building an in-house solution, and typically teaming up with multiple partners.

But new market entrants—powered by Finaro’s end-to-end white-labelled payments solution that caters to every Nordic region’s payment idiosyncrasies—introduce an interesting shift in power dynamics to the region.

Loss of market share opens the door to new entrants

A changing global ecosystem has resulted in enough loss of market share for major players, so that entrants now stand a chance of competing.

For example, the “pure” Dankort has been incompatible with popular payment systems such as Google Pay and Apple Pay. This has led to the rise of so-called “co-branded” Dankorts, issued in combination with Visa or Mastercard.

“Pure” Dankorts accounted for a mere 1.3% of all card payments in Denmark for Q1 2023. Co-branded Dankorts, however, made up over 65% of card payments for the same time period.

In the past, capturing the Dankort market meant signing up with the only company legally allowed to process Dankort payments. Today, the strategy is completely different: You can just ignore it. The negligible volume of transactions, coupled with more competitive pricing from entrants means that merchants are now finally willing to reject Denmark’s “preferred means of payment”—at least the non-Visa version of it.

The same is true in Norway with its BankAxept card, the most popular debit card in the country. Few of the “pure” BankAxept cards exist anymore. The majority is now co-branded with Visa or Mastercard, making it possible for other payment processors to process them.

“One of our Fintech clients is already disrupting the market in Denmark,” says Ruben Frimand Nielsen, Vice President of Sales and Business Development for the Nordics at Finaro. “Because of superior pricing, and the ability to own the entire relationship, the company could offer payment terminals to merchants for free. This was previously unheard of in Denmark. In light of this major saving, the merchants didn’t care that they couldn’t accept Dankort.”

Finaro is also officially an acquirer for MobilePay, and MobilePay is available though Finaro’s gateway, as well as

FACTS

Only 1.3% of card transactions in Denmark were made with “pure” Dankort in Q1 2023.

Swedes paid over $106.3 billion by card in 2021.

Over 80% of in-store purchases in Norway, Denmark, and Sweden are made with a card or mobile phone.

100% of Danes aged 20 - 29 paid with MobilePay in April 2021, and 99% aged 30 to 39.

almost all major international wallets, including Google Pay, Apple Pay, and WeChat Pay. In total, Finaro offers access to over 250 different payment methods globally.

How Finaro empowers fintechs in the Nordics and beyond Loss of market share hasn’t been enough on its own to radically disrupt the Nordic payments market. But if you add the ability to own the entire payments relationship, and charge more competitive rates to merchants, a lot more opportunities exist for players bold enough to try and take a slice of the market from the giants.

Finaro provides the full gamut of payment services from gateway to processing to acquiring. Because it’s an acquiring bank, it can set its own card transaction fees for partners. The company is also a licensed bank, giving it the power to set its own rates for FX trades, provide lines of credit, loans, or even open up business accounts.

In essence, any fintech wishing to plug into Finaro’s payments solution would own the entire relationship with its merchants and be able to offer the full list of financial services.

“Fintechs are asking themselves, ‘Why are we paying for payment services when we could create our

own?’” says Nielsen. “By partnering with someone that can process those payments, they can immediately compete at an equal level with established players in the Nordics. Companies that already have merchants using their products can take full advantage of the payments infrastructure. For example, a fintechs providing a billing system could add a white-laballed payments solution that they could run on their own terms.

Companies can go all-in with Finaro or use only what they need, such as Finaro’s acquiring service. But every gap can be immediately filled. Additionally, Finaro is currently focusing on long-term partnerships in the Nordics rather than on contracting directly with merchants, thereby greatly reducing the chances of any conflict of interest—something that has historically been a problem in Denmark, says Nielsen.

The benefit for fintechs is Finaro’s global reach: Companies entering Europe or the Nordics using Finaro’s backend would immediately gain access to international markets using the same infrastructure.

“Even many big companies haven’t yet recognized how much control they can take of the payment processing cycle,” says Nielsen. “It could become an entirely new revenue generator for them because everything is streamlined under Finaro’s umbrella.”

Fintechs are asking themselves, ‘Why are we paying for payment services when we could develop our own? By partnering with someone that can process those payments, they can immediately compete at an equal level with established players.

Ruben Frimand Nielsen, Vice President of Sales and Business Development for the Nordics at Finaro

Ruben Frimand Nielsen Vice President of Sales and Business Development for the Nordics, Finaro

From Woes to Woos: Baltic Fintech’s remarkable journey to become a Global Fintech Innovation powerhouse

As the Baltic countries of Lithuania, Estonia and Latvia continue to solidify their position as frontrunners in the global fintech landscape, their success story serves as an inspiration for other nations grappling with the growing pains of fast developing fintech ecosystems. By embracing a renewed determination for regulatory rigor, innovation, and security, these fastrising nations are proving that with the right strategies, a rocky past can be transformed into limitless opportunity, fertile ground for collaboration, investment, technological advancements and economic growth.

By Chris Crespo

Picture this: you’re at a bustling tech conference, surrounded by the brightest minds in the industry, and everyone is talking about the same thing – the Baltic region. This small European region has been making waves in the fintech industry, and it’s not slowing down anytime soon.

Similar to a scaleup that has achieved product-market fit and is experiencing rapid expansion, the Baltic countries of Lithuania, Estonia and Latvia, have established a thriving fintech ecosystem attracting attention from investors and entrepreneurs worldwide. Moreover, the Baltics are well-positioned to continue

their upward trajectory in the fintech industry with a highly skilled workforce, favorable taxation, rigorous regulations, and a strong startup culture.

But that has not always been the case.

All three states have in recent years, been forced to overcome challenges related to compliance and money laundering. Reputations have been bruced, licensens have been suspended and the Baltic states have had to pull themeselves through scandals that have tarnished their aspiring ecosystems. In spite of these challenges the Baltics have demonstrated remarkable resilience and determination to overcome

their past challenges, taking significant measure to overhaul their regulatory and supervisory functions and address these issues head on.

Recognizing the gravity of the situation, the Baltic states have implemented stringent anti-money laundering regulations, signaling their unwavering commitment to combating financial crimes. Moreover, they have actively increased collaboration and cooperation with international law enforcement agencies, demonstrating their proactive approach in tackling the issue at a global level and emerging as formidable players in the fintech arena.

25

Vaiva Amulė Head of Fintech Hub LT

In this article, we explore how the countries in the region are rising above this legacy and evolving into a brighter future as global fintech hubs.

Sustainable growth

Lithuania’s startup ecosystem is no longer in its infancy; it’s in the scaleup phase and growing exponentially. With a population of just 2.8 million, it is not only the most populated Baltic country but also a leading fintech ecosystem with 263 fintech companies registered as of the end of 2022 and the most licensed payment or electronic money institutions in the European Economic Area. Its relatively small size might make it easy to overlook this hidden gem in the European startup scene, but, investors are taking notice, and for good reason.

In 2022, Lithuanian startups attracted 295 million euros in investment. According to Dealroom, Lithuania is the second-fastest-growing startup ecosystem in Central and Eastern Europe, with a value that has steadily increased nearly 17 fold to 9.5 billion Euros, all between 2017 and 2022.

Many Lithuanian startups focus on sustainability and profitability, financing their development from profits rather than relying solely on investments. Half the founders use their funds or shareholders’ contributions, demonstrating a commitment to long-term success. As

Vaiva Amulė, head of Fintech Hub LT, the main Fintech association in Lithuania puts it: “There is a focus on sustainable growth and developing business models that can be scaled.”

So, what does the future hold for Lithuania’s fintech ecosystem?

Strict but progressive regulator

The Lithuanian government has played a significant and proactive role in fostering the growth of the Fintech industry. Among these measures, a notable accomplishment has been the inclusion of fintechs in the Bank of Lithuania’s payment system, CENTROlink, which grants them access to the Single Euro Payments Area (SEPA). In addition, the government has created a Center of Excellence in Anti-Money-Laundering, the first public-private sector partnership in Europe, operating as a separate institution. Currently, the country is actively seeking to attract

26

AMLA, the Anti-Money Laundering Authority of the European Union.

While Lithuania has made significant progress in developing a favorable regulatory environment for fintech, there are still some challenges that need to be addressed. As the Lithuanian fintech industry continues to mature, it will be essential for players to strike a balance between regulatory compliance and growth.

“The Lithuanian regulatory environment for fintech has indeed evolved over time and is now much stricter than before. As the industry grows and matures, regulators have shifted their focus towards ensuring stability and minimizing risks in the financial sector. This has led to more rigorous compliance requirements, which can be challenging for fintech companies to navigate.” Says Amulė.

She continues: “It is crucial to note that these measures are sometimes necessary for the long-term stability of the industry. Ongoing collaboration between fintech companies, regulatory bodies, and traditional financial institutions will be needed to create an environment that fosters innovation while ensuring the safety and stability of the financial system.”

Towards the end of last year, Lithuania implemented significant changes to the laws governing virtual asset service providers (VASPs) in order to enhance risk management and ensure effective prevention of money laundering within the country. Under the new regulations, companies engaged in such activities are required to maintain an initial capital of at least 125,000 euros. As a result of this increased financial requirement, the number of VASPs operating in Lithuania has decreased from approximately 840 to around 300.

In addition to the regulatory environment, Lithuania offers various other advantages to fintech companies. The country has a highly educated workforce, with many people skilled in technology and finance. Lithuania’s cost of living is relatively low compared to Northern European countries, making it an attractive location for startups looking to keep their costs down while scaling and enjoying direct access to the European market and financial system.

“The Lithuanian fintech industry is poised to continue its growth trajectory over the next few years as it solidifies its position as a leading fintech hub in Europe. The key drivers of this change will include a continued focus on innovation, collaboration between institutions and the market, and the ability to adapt to new and upcoming regulations.”

Breaking the waves

Like Lithuania, Estonia is experiencing an expanding fintech boom. Catalysed by an impressive lineup of unicorn founders who upon exiting their organisations have chosen to reinvest capital, and know how in the country, this small nation of only 1.3 million inhabitant has already been the launchpad for 10 unicorns and a line of hopeful “soonicorns” to follow. With the highest density of unicorns per capita in Europe, Estonia has claimed the “unicorn stable” title in the Nordics and Baltics.

With a young and highly digital population, Estonia’s emphasis on STEM (science, technology, engineering and maths), a culture of pragmatism and tight knit startup ecosystem, offers a glimpse into the success of the country’s ascending Fintech scene. But it doesn’t end there.

According to Kaido Saar, chairman of Finance Estonia and co-founder and CEO of Mifundo, a data solution for cross border credit products. One of the strengths of Estonia’s fintech ecosystem today is its regulatory environment, which is known for being both innovative and efficient. Saar explains:

“Estonia is still a small country. Therefore, it is easy to set up the contacts. Moreover, regulatory institutions are ready to meet with fintech companies, if relevant, and provide feedback on licensing if required.”

Openness and accessibility to and from the governmental institutions are essential to the future of Estonian fintech.

“We have actively worked with Estonian governmental institutions to design and build the dedicated Fintech Strategy for Estonia. Hopefully, it will soon be approved by the government and launched later this year,” says Saar when asked about the future of Estonian fintech.

27

But Estonia has experienced growing pains. In 2017, the Danske Bank Estonian branch was embroiled in a major money laundering scandal involving billions of euros, which led to investigations and reforms by the government and financial regulators.

“The Estonian Financial Supervision Authorities stopped the activities in the branch and forced Danske Bank to quit operations in Estonia. The supervisors gained good experience to advise other regulators and Estonian financial companies dealing with related matters,” says Saar.

While the scandal involving a foreign company’s negligence in fulfilling

its regulatory duties brought adverse effects to Estonia’s financial sector reputation, the country has swiftly turned crisis into opportunity, sparkin a surge in demand for companies offering cutting-edge solutions in compliance and anti-money laundering measures.

One standout example is Salv, a leading firm providing innovative services to assist financial institutions in meeting the ever-increasing regulatory requirements and effectively combatting money laundering.

“New business models have also appeared. For example, so-called climate fintechs and carbon credits-related companies have widely popped up on

the market. Like Single.Earth, Arbonics, and Kwota. Also, strong growth is visible in regtech (regulatory technologies red.) and usage of open banking in Estonia,” says Saar.

While the initial scandal may have tarnished Estonia’s financial sector reputation, it has served as a catalyst for positive change, allowing Estonia to emerge stronger and more resilient, solidifying its position as a global leader in innovative financial technologies.

The perfect

testbed

As Estonia is a small country, each newly founded fintech company must be international from the beginning, says Saar.

28

Kaido Saar Chairman of Finance Estonia and co-founder and CEO of Mifundo

“Besides global ambitions, we have a strong knowledge base and supportive startup ecosystem which helps fintech companies to grow. After the successful growth of Estonian unicorns, e.g. Skype, Wise, Veriff, we have seen the collected knowledge and financial resources are widely used for planting new companies in Estonia, hopefully, new unicorns as well,” he adds.

Estonia holds several records for the number of startups and unicorns per capita. According to Invest Estonia, there are more than 1.000 startups and 7,7 unicorns per million per capita.

As Estonia is a small and open country, our fintechs are constantly searching for partnerships with other players in the global ecosystem. Therefore, Estonian fintechs can provide high-level technology and people with the right spirit behind the technology.

“Estonia is a perfect testbed for new technologies due to the size of the country and people’s willingness to consume new solutions. Still, scaling out the global partners are highly essential, but due to the international mindset, Estonian fintechs have the potential to shape the future of the financial industry,” says Saar.

Estonia’s fintech industry is thriving despite the country’s challenges. The industry’s focus on sustainability, transparency, innovation, and a supportive regulatory environment, are key factors driving growth in the sector.

Coping with a crisis

The governmental support to cope and rise from a crisis has also pushed the fintech ecosystem forward in the country in the middle of the Baltic region. As a result, Latvia has been growing and evolving in recent years, thanks to various factors such as the emergence of innovative solutions and the support of government institutions. To understand the current state of the industry and its prospects, we spoke with Ričards Švītiņš, a leading expert from the Investment and Development Agency of Latvia (LIAA).

“The financial crisis in 2008 was a turning point for the Latvian Fintech industry” says Švītiņš,. At that time, alternative financial institutions began to emerge, offering fast, innovative credit solutions. Over time, the industry matured, and new trends, such as blockchain and crypto, emerged.

“We are now at a point where blockchain and crypto industries are seen as a valuable asset and a usable technology solution,” Švītiņš says.

The country implements different European Union strategies to support startups, including those focused on science-intensive and DeepTech business ideas - including in the fintech industry.

“LIAA works with state support programs for companies of different sizes and industries. Although the state does not offer specific support programs for fintech companies, they can apply and benefit from the support programs offered to all startups,” Švītiņš says.

Today, The Innovation Hub and Regulatory Sandbox, provided by the

Latvian Financial and Capital Market Commission (FCMC), offer professional support and consultancy services to all market players on existing and upcoming regulations.

A future crypto stronghold

Despite the Latvian Fintech industry’s success, it still faces numerous challenges, according to Švītiņš. This includes regulatory and licensing processes, company operational work, and anti-money laundering.

“Everyone is up for the task, and there are ongoing collaborations between Latvian Fintech companies and other players in the global Fintech ecosystem. In 2022, Latvia hosted its first-ever