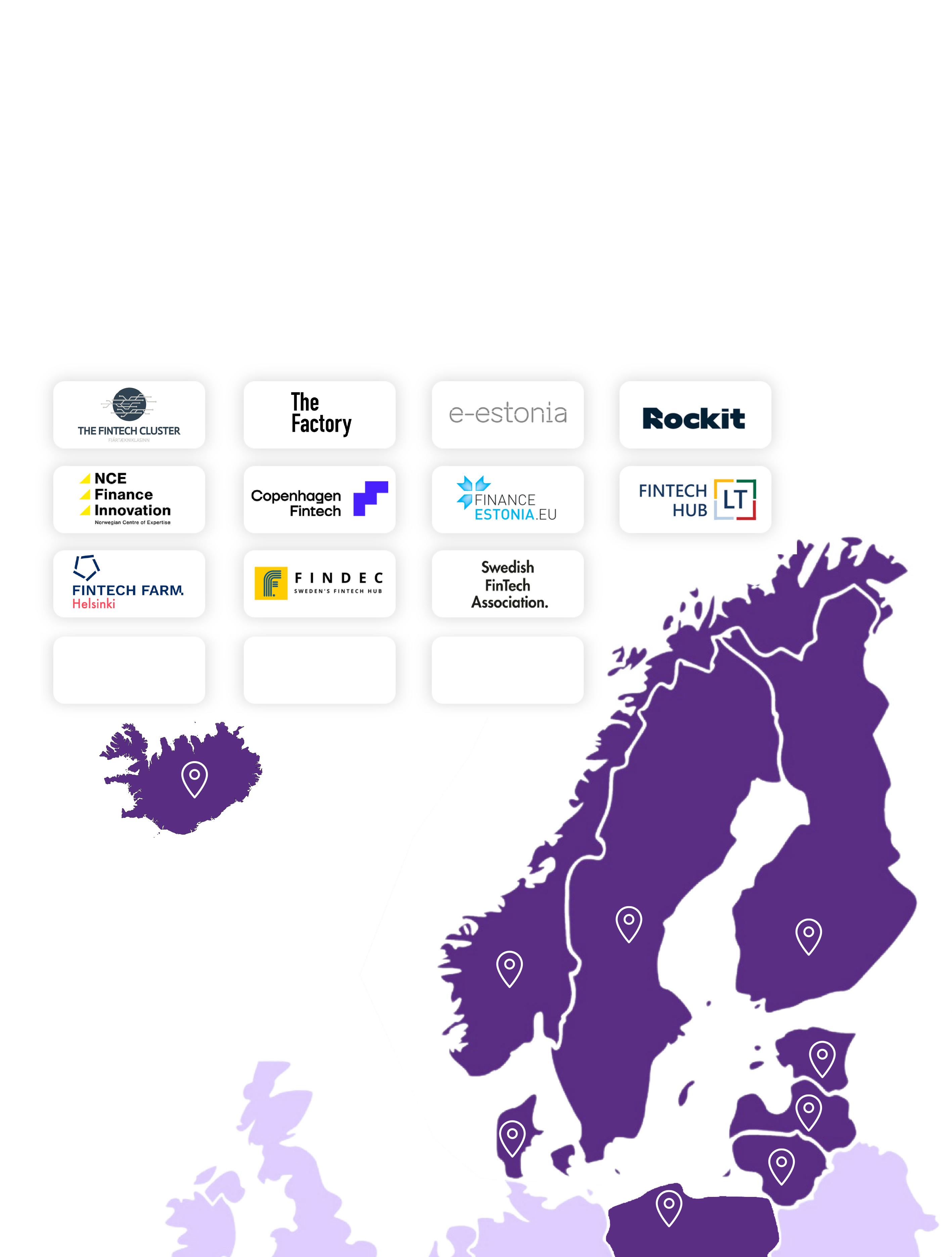

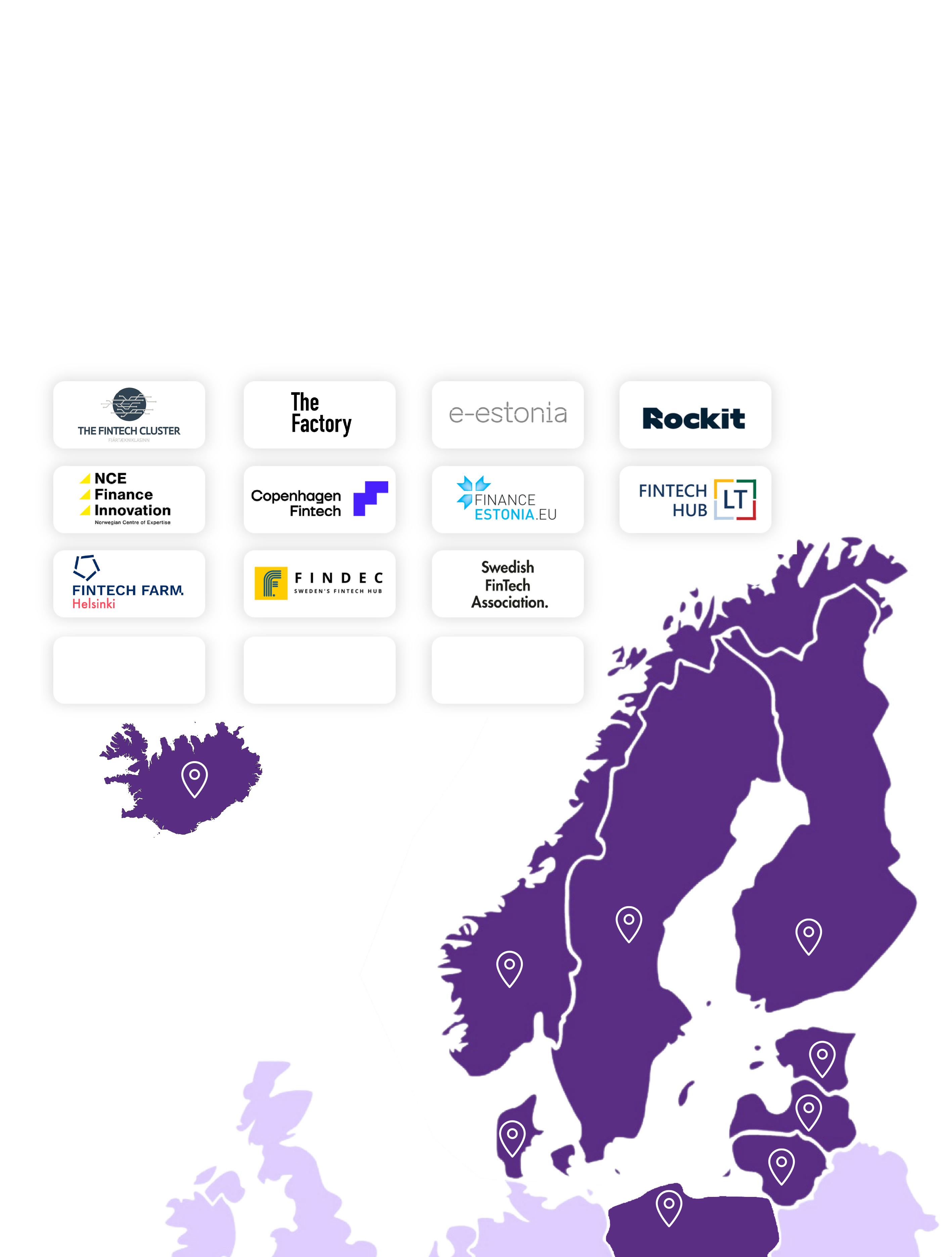

Nordic Fintech Magazine exclusively works together with selected Nordic Community Partners for insights and distribution, giving us unparalleled reach with audiences across the Nordics and Baltics

Thank you to all the fintech heroes contributing to this magazine!

Welcome to the spring Edition of Nordic Fintech Magazine! p. 6-7

8-9

10-11

The Future of Finance Belongs to AI That Can Think and Act

The Growth and Future of Latvia’s Fintech Ecosystem: A New Era of Innovation and Collaboration

How the Baltics are Quietly Changing Global Financial Services

Resilience is Your Next Competitive Edge

Global Wallet AstroPay Opens Copenhagen Hub for European Expansion

Transforming Finance: Payhawk’s Impact on the Baltics and Beyond

Lithuania’s Fintech Ecosystem: A Model of Public-Private Synergy Driving Global Expansion

MAGNETIQ BANK: setting the standard of future B2B banking

ZTL Simplified B2B Payments in the Nordics. Now, It’s Ready to Scale.

Introducing automation in Fintech companies 5 key steps

40

From Startups to Success: Legal Support in the Baltic Fintech Revolution

CRIF Helps Fintechs and Banks Handle Data Overload

How MySQL is Transforming Financial Services

Beyond Quantum Computing: How Quantum Technology is Transforming Financial Services

The Evolution of Core Banking Is Underway

Lithuania’s Fintech Rise and Tribe Payments’ Role

DECTA Launches FinTech Fast-Track for New Acquirers and Issuers

The Customer Experience Problem Financial Institutions Don’t Want to Talk About

Your Data, Evolving with AI Right Now

Fimento Launches Self-Service AI Model for Transaction Categorisation

Why Flexibility, Speed, and Trust Matter More Than Ever in Business Banking

Introducing Hybrid Payments - On The Verge Of Digital Dominance

Stablecoins: The Silent Revolution Transforming Financial Services (And Why They’re Overtaking CBDCs) A Fintech PR Playbook to build credibility and get media coverage

Green Finance Institute Leads Lithuania-Based Fintechs Through the Regulatory Labyrinth

Fintechs to Watch

It started with a simple mission: serve the Nordic markets. That was always the goal for Nordic FinTech Magazine. We wanted to tell the stories of the innovators, the disruptors, the people shaping the future of finance in the region. But what we didn’t expect, what truly surprised us, was how quickly our focus expanded.

By Chris Crespo

The moment we took a closer look at each of the five Nordic markets, we saw something incredible. Each country had its own distinct approach to fintech, its own way of pushing the boundaries of digital finance. That diversity fascinated us. But then came the invitation, an open door to explore the Baltics, and we walked through it.

From that moment, we were hooked.

The Baltics are different. There’s a spirit here, an energy, a drive that’s impossible to ignore. Maybe it’s rooted in history, in the resilience that at the fall of the Soviet Union brought together 2 million people in the Baltic Way, A human chain, showing solidarity in protest against Soviet occupation, spanning the geogrpahies of all three countries. It’s message was deafening: ‘We want to be free, sovereign and independent”. Maybe it’s the deep-seated belief in innovation and ownership. Whatever it is, it’s working. Today, the region is home to a thriving fintech ecosystem with 676 companies employing thousands of talented fintech heroes across the region.

These numbers tell a compelling story. The Baltic fintech sector is growing, creating jobs, and positioning itself as a major player in the global financial sector. It’s not just about the numbers, though. It’s about the impact these companies are making, not only in their home countries but aroudn the world.

Over the past three years, we’ve built strong connections here, and what stands out the most isn’t just the technical expertise, it’s the commitment to making a global impact. There’s a sense of brotherhood and sisterhood in how these economies develop, in how knowledge is shared, and in how different players in these ecosystems, both private and public, uplift one another.

That’s why we’re thrilled to be part of Baltic Fintech Days. Lithuania, Latvia and Estonia, are coming together to:

• Give Baltic fintech companies a stage to showcase their thought leadership.

• Brand the region as Europe’s next major fintech hub. Attract international investors and partners looking for cutting-edge collaborations.

The same spirit of freedom and liberation that surged through the Baltics 35 years ago is now emerging in Ukraine. Just as the Baltic nations turned hard-

Chris Crespo Head of Content at Nordic Fintech Magazine

ship into an opportunity for reinvention, Ukraine is proving that resilience breeds innovation. We had a unique opporutnity to speak to representatives from the Ukrainan Financial Ecosystem to gain an understanding of how war can impact a country’s financial system. During our conversations with six key representatives from the Ukrainian financial sector, including the National Bank of Ukraine, leading commercial banks, international institutions, and fintech pioneers, we learnt firsthand how they are navigating immense challenges. Even under extraordinary pressure, they are maintaining economic stability, adapting financial infrastructure, and pushing forward with innovation. Their efforts highlight the critical role fin-

tech and finance play in sustaining an economy during crisis and laying the groundwork for recovery.These are the stories that need to be told.

And that’s why this issue is so special. In addition, we’re tackling some of the most groundbreaking topics in fintech, not just in the Nordics and the Baltics, but globally. AI has exploded past even the boldest predictions, and we’re featuring insights on how it’s overhauling banking, making processes faster, smarter, and more efficient. We’re also breaking down stablecoins and how they’re reshaping the very concept of money. We continue to explore the fascinating an perplexing world of quantum as the financial landscape is being is being supercharged with innovation

and unprecedented speed.

We also bring insights into the technologies that are transforming everything from how financial services organizations fight fraud to how they streamline operations, reduce waste, boost resilience, and create hyper-personalized customer experiences.

So, as you flip through these pages, we hope this issue sparks curiosity, challenges perspectives, and offers a deeper understanding of the dynamic forces at play in fintech today. Because whether it’s the Nordics, the Baltics, Ukraine or beyond, one thing is clear: the future of fintech is being rewritten, and we are honoured to have a front row seat.

Stay disruptive.

A few years ago, the idea of AI-powered financial advisors, fraud detection systems that operate independently, and hyper-personalized banking experiences felt more like science fiction than reality. Predictions suggested we wouldn’t see real progress in agentic AI until 2030. Yet here we are in 2025, and these AI-driven transformations are happening now, faster and more powerfully than anyone expected.

By Chris Crespo

Alfred Mukudu, Head of Go-to-Market Strategy & Business Development for Financial Services at AWS, has had a front-row seat to this shift.

“I’ve read forecasts where the assumption was we’d start getting to agentic AI around 2030, but already in 2025, we’re finding useful applications,” he says. AWS has been rolling out agent capabilities across industries, not just for developers but for real business and consumer-facing applications.

AI has already made waves in financial services, particularly behind the scenes.

Automation has improved fraud detection, streamlined customer service, and helped firms meet compliance requirements. But there’s a gap. Most AI implementations are passive, waiting for inputs rather than taking initiative.

“The difference with agentic AI,” Mukudu explains, “is that it’s not just answering questions. It’s actually doing things.”

Financial institutions are under pressure. Customers expect seamless, personalized interactions. Regulators demand airtight security and compliance. Fintech challengers are pushing the boundaries of automation.

Traditional AI models, as powerful as they are, still require too much human intervention. That’s where agentic AI changes the game.

It’s about giving financial institutions choice, whether it’s encryption, deployment strategies, or selecting the best large language model for their needs.

Alfred Mukudu Head of Go-to-Market Strategy & Business Development for Financial Services at AWS

Mukudu breaks it down simply:

“Think of agentic AI as an AI system that can independently perform tasks and make decisions. Unlike traditional generative AI, which responds to prompts but lacks the ability to take action, agentic AI can execute workflows autonomously.”

For example, today’s chatbots can tell you how much vacation time you have left. But an agentic AI system? It doesn’t just provide the information. It books your leave, finds flights, and even arranges transportation. This leap from passive AI to proactive automation is where financial services are heading.

One of the most compelling applications of agentic AI is hyper-personalization. Mukudu points to NatWest Bank in the UK as a prime example. “They enabled over two million people to save for the first time just by personalizing messaging at scale,” he says. Instead of sending out generic emails, NatWest uses AI to tailor financial guidance to each customer’s individual behaviors.

“We’re talking about true one-to-one personalization, where ten different customers get ten different messages based on what matters to them.”

To make agentic AI work at scale, Mukudu highlights three key ingredients:

1. Data Infrastructure. “You need access to a knowledge repository, whether it’s standard operating procedures, database access, or clean data,” Mukudu says. Without strong data management, AI agents can’t make informed decisions.

2. Actionable APIs and Microservices. AI has to be able to do more than just analyze data. “Microservices and good APIs are critical so these agents can execute tasks seamlessly,” Mukudu explains.

3. Governance and Upskilling. When AI is making decisions 24/7, you need the right oversight. Mukudu stresses that firms must train

Alfred Mukudu, Head of Go-to-Market Strategy & Business Development for Financial Services at AWS

their teams. “Agents rely on good prompt engineering, so upskilling employees is key to maximizing automation.”

AWS is actively shaping the future of agentic AI in finance. Mukudu describes the company’s approach.

“We’re democratizing access to these technologies. It’s about giving financial institutions choice, whether it’s encryption, deployment strategies, or selecting the best large language model for their needs.”

With platforms like AWS Bedrock (a fully managed service that simplifies building and scaling generative AI applications), a vast selection of compute instances, and purpose-built database services, AWS is ensuring that financial institutions can deploy AI in ways that suit their operational needs. “The ability to choose how you implement AI is going to be super

powerful,” Mukudu emphasizes.

Looking forward, Mukudu is particularly excited about AI’s expansion into edge computing. “With AWS Outposts, Local Zones, and Wavelength, we’re extending cloud capabilities closer to where customers are,” he says. AI running at the edge, on devices, in branches, and within networks, means faster decision-making and more seamless interactions.

Further down the line, emerging technologies like quantum computing and blockchain will push agentic AI even further. Mukudu is confident that these developments will “fundamentally transform how we interact with financial services.”

Agentic AI is no longer just a concept. It is happening now. From automating workflows to delivering hyper-personalized financial experiences, it is already transforming the industry. The firms that embrace it

today will be the leaders of tomorrow. Those who hesitate? They will be playing catch-up.

Mukudu sums it up with a clear message. “Agentic AI is not just about efficiency. It’s about rethinking how financial services interact with people, making every experience smarter, faster, and more personal.”

Amazon Web Services (AWS) is the world’s most comprehensive and broadly adopted cloud, with more than 200 fully featured services available from data centers globally.

Millions of customers—including the fastest-growing startups, largest enterprises, and leading government agencies—are using AWS to lower costs, increase security, become more agile, and innovate faster.

Latvia’s fintech ecosystem stands at the cusp of a transformative moment. The past year has been a crucial one for both the FinTech Latvia Association and the broader Latvian fintech sector. As we celebrate the launch of the third annual Fintech Pulse report (please check it online here: fla.lv/pulse2024), I am proud to reflect on our many achievements and the exciting developments on the horizon.

By Tina Luse, Managing Director of the FinTech Latvia Association

With the momentum we’ve built, Latvia is not only cementing its position as a fintech hub but is also spearheading initiatives that are paving the way for a dynamic future of innovation, collaboration, and growth.

One of the most significant milestones this year has been the dramatic growth in our membership. The number of members within the FinTech Latvia Association has doubled, reflecting the expanding scope and diversity of Latvia’s fintech sector. We have welcomed new members from across the financial technology spectrum: established digital lending platforms, prestigious law firms serving fintechs, and market leaders in business lending, crowdfunding, RegTech, and even a fully fintech-oriented bank. This growing diversity is a

testament to Latvia’s rising status as an integrated fintech destination. This rapid expansion underscores the increasing importance of Latvia as a hub for financial technology and innovation. More importantly, it highlights the value of our mission: to foster financial inclusion, democratize access to investment opportunities, and enhance financing options across various financial verticals. With this influx of new members, we are accelerating the development of a robust ecosystem capable of driving significant change both locally and globally.

A particularly noteworthy development within our growing membership is the collaboration among investment platforms within the Association. At the end of this year, these platforms came together to sign a memorandum aimed at shaping the future of regulated fintech. The memorandum calls for the unification of platforms to

create a more secure and transparent regulatory environment for alternative investment markets. The objective is to foster collaboration between fintech businesses, improve investor protection, and promote regulatory certainty. By working together, these platforms aim to advocate for responsible regulation that benefits both the industry and the wider public, ensuring that the sector continues to thrive and evolve in line with European standards.

This initiative aligns perfectly with our core mission at FinTech Latvia—ensuring that Latvia not only remains at the forefront of innovation but also leads the way in setting a global example of a well-regulated, transparent, and inclusive fintech landscape. Through this memorandum and similar efforts, we are confident that Latvia will continue to attract both investors and entrepreneurs, fostering an environment of trust and collaboration.

As a region, we are stronger together.

Tina Luse

Director

The importance of a strong regulatory environment cannot be overstated. This year, Latvia took significant steps forward with the successful passage of the national law for the MiCA (Markets in Crypto-Assets) regulation, a crucial milestone for the country’s fintech landscape. With this regulatory framework in place, Latvijas Banka—the Central Bank of Latvia—is now empowered to welcome new market participants with aspirations for pan-European expansion in the crypto space. Moreover, it has already been offering free pre-licensing consultations since mid-2024.

Latvia’s regulatory clarity and openness are increasingly being recognized as key factors that make the country an attractive location for fintech businesses. As I’ve repeatedly heard from companies,

“Working with Latvijas Banka feels like working with another fintech— just from the public sector.”

In addition to MiCA, Latvijas Banka continues to provide unparalleled support to fintech innovators through initiatives such as pre-licensing consultations, innovation sandboxes, and capped supervision fees for crypto service providers. These efforts ensure that companies entering the EU market can do so with ease and clarity, making Latvia a safe, competitive, and accessible jurisdiction for fintech entrepreneurs.

Among the most significant developments past year was the groundwork being laid for non-bank payment providers to gain access to the SEPA (Single Euro Payments Area) payment system via the Central Bank, which at the moment is already fully operational. This move signals Latvia’s commitment to ensuring that fintech companies have the tools and infrastructure they need to operate on an international scale.

In line with our growth, we have also deepened our international collaborations. For several years now, we have been proud members of the European Digital Finance Association (EDFA).

Since January 2021, Tīna leads the Fintech Latvia Association. The aim of the Association is to unite the providers of financial services of the non-banking sector based on financial technologies in order to ensure the representation and implementation of their interests at the national and international level, promoting sustainable development and growth of the Latvian financial sector.

This prestigious platform allows us to represent Latvia’s fintech interests on a pan-European stage, further amplifying our voice within the European Union and beyond. I am especially impressed about the ECSP crowdfunding platform working group operational under the umbrella of EDFA.

With our regional partners, we are also focused on how to enhance the visibility of the Baltics as a key player in the global fintech scene. A prime example of this regional collaboration is the Baltic Fintech Days — a unique event that will bring together the fintech ecosystems of Latvia, Estonia, and Lithuania. This event reflects our shared vision of creating a sustainable, competitive, and dynamic environment for financial technology in the region. By uniting the expertise and resources of all three countries, the Baltic Fintech Days will showcase innovations emerging from our ecosystems,

foster cross-border collaboration, and highlight the value of regional cooperation in advancing the fintech industry.

The Baltic Fintech Days will serve as a platform for thought leadership, knowledge-sharing, and business development across the Baltics and beyond. As a region, we are stronger together, and this event will highlight the collective potential of the Baltics as a global fintech powerhouse. Our goal is not only to showcase the fintech innovations emerging from our countries but also to provide a platform for startups, investors, and regulators to collaborate, exchange ideas, and shape the future of fintech in Europe. With a dynamic regulatory environment, a highly skilled workforce, and strong political support, the Baltics are quickly becoming one of the most sought-after regions for fintech entrepreneurs. See you in Vilnius on 2nd and 3rd of April, 2025!

Looking ahead, we recognize the importance of restoring Latvia’s reputation as a safe and competitive jurisdiction for financial services. This year, our ecosystem has been preparing for the upcoming Moneyval assessment, which evaluates anti-money laundering (AML) and counter-terrorism financing measures. This process ensures that Latvia remains a trusted environment for both investors and fintech companies, fostering sustainable growth and reinforcing our commitment to maintaining the highest standards of regulatory compliance.

But our ambitions don’t end there. With the guidance and leadership of Latvijas Banka and the support of the Prime Minister, we are actively shaping the next phase of Latvia’s fintech development strategy. Our vision is clear: to build a robust, sustainable, and inclusive fintech ecosystem that attracts talent, fosters innovation, and provides ample opportunities for all stakeholders.

We invite new players—whether they are entrepreneurs, investors, or innovators—to join us on this exciting journey. Together, we can build a future where Latvia not only thrives as a fintech hub but also serves as a model for other nations striving to create dynamic and sustainable financial ecosystems.

Join us, and you could be the next success story in this thriving community!

A decade ago, if you had asked most people to name the world’s leading hubs for fintech innovation, you would have heard answers like Silicon Valley, London, or Singapore. But today, there’s another name that’s impossible to ignore: the Baltics. Lithuania, Latvia, and Estonia have quietly built one of the most vibrant fintech ecosystems in the world, revolutionizing the way payments work.

By Chris Crespo

Juha Sillanpää, Group Country Manager, Finland and Baltics at Visa, sees the region as a “hotbed of payments innovation” and an example for the rest of the world. So what makes the Baltics so special? And what can other markets learn from this rising fintech force?

Why the Baltics Stand Out Walk into a café in Vilnius, and you’ll likely find people tapping their phones to pay without thinking twice. Digital payments are second nature here, thanks to a highly educated and tech-savvy population. This has created the perfect environment for fintech solutions to take off at lightning speed.

But it’s not just about the people, it’s also about policy. “The Baltics have created a unique environment where fintech startups thrive,” says Juha. The Baltics have a regulatory system that actively encourages innovation. Instead of stifling fintech startups with bureaucracy, governments and central banks

have taken a forward-thinking approach, making it easier for companies to test, refine, and scale new payment solutions.

And let’s talk about the startups. The Baltics have become a launchpad for globally recognized fintechs. With government-backed incubators, an influx of venture capital, and a strong talent pool, the region’s fintech ecosystem is booming. Companies are scaling fast, setting trends that the rest of the world is watching closely.

Lessons from Baltic Innovation

Imagine sending money to a friend and having it land in their account instantly. That’s already a reality in the Baltics. Real-time payments are the norm, setting a high standard for markets still struggling with slow bank transfers.

Then there’s Estonia’s e-residency program, which has completely changed the way business is done. Entrepreneurs from anywhere in the world can establish and run a company digitally, with secure online transactions

backed by a robust digital identity system. This approach is shaping the future of global business operations.

The Baltics have fully embraced blockchain technology, using it for everything from financial transactions to secure digital contracts, driving transparency and efficiency.

Unlike other regions where regulation can feel like a roadblock, the Baltics use regulatory sandboxes to their advantage. These controlled environments allow fintechs to test their products in real-world conditions while ensuring compliance. It’s a win-win for both innovation and consumer protection.

“Innovation thrives in environments where businesses can test, learn, and iterate quickly. The Baltics have nailed this approach,” says Juha.

New Players: Threat or Opportunity?

“With fintechs popping up left and right, you might expect Visa to see them as competition. But that’s not the case” affirms Juha. Many of these newcomers

Juha Sillanpää

Group Country Manager, Finland and Baltics at Visa

bring fresh perspectives, contributing to the overall evolution of payments. In fact, many of them end up becoming valuable partners, enhancing Visa’s services and improving the payment experience for everyone.

“Of course, competition is real. But rather than resisting change, Visa embraces it” he adds. The pressure from new entrants keeps everyone on their toes, driving continuous innovation and better solutions for businesses and consumers alike.

“At Visa, we don’t see fintechs as threats. We see them as partners who can help drive the industry forward,” says Juha.

Visa has a history of engaging with fintech startups, understanding that fostering innovation helps drive industry progress. By providing funding, expertise, and access to a global network, Visa ensures that the most promising ideas don’t just stay ideas, but that they become reality.

“Think of Visa as the backbone of fintech innovation” says Juha. Its suite of APIs makes it easy for startups to integrate payment processing, fraud prevention, and other critical services, allowing them to focus on what they do best, innovating.

Scaling globally is a major challenge for startups, but Visa removes that barrier with its vast infrastructure, enabling fintechs to expand beyond their home markets and reach customers worldwide with seamless payment options. At the same time, navigating regulations can be complex, but Visa’s deep expertise in security and compliance helps startups stay ahead of regulatory requirements while protecting them from fraud and cyber threats. “Our role extends beyond payments, focusing on enabling innovation,” says Juha.

And for those just getting started, Visa’s Fintech Fast Track Program offers crucial support to startups looking to navigate the complexities of scaling and regulation. It provides funding, mentorship, and strategic partnerships, helping fintechs accelerate their growth and bring their solutions to market faster.

As payments speed up, so do fraud risks, requiring constant innovation to stay ahead of cybercriminals. Visa employs over 1 000 full time cybersecurity specialists globally and operates 3 Cybersecurity Fusion Centres on three

Innovation thrives in environments where businesses can test, learn, and iterate quickly. The Baltics have nailed this approach.

Juha Sillanpää

Group Country Manager, Finland and Baltics at Visa

different continents to ensure that the network operates every day of the year.

Just over the past five years, Visa has invested over €11 billion in technology, including to reduce fraud and to enhance network security.

“Last year, Visa proactively prevented an estimated EUR 39 billion in global fraud, contributing to our network’s fraud rates being among the lowest rates of any payment method. However, I strongly and personally believe that in order to successfully combat fraud, we need ensure that we as an industry collaborate closely to stay ahead of the cybercriminals,” Juha Sillanpää adds.

At the same time, financial inclusion remains a challenge, with millions still lacking access to digital payments. Ensuring fintech solutions reach underserved communities is essential for broader economic participation.

Cross-border transactions add another layer of complexity, as different financial networks don’t always integrate smoothly, creating friction in global payments. Meanwhile, the rise of digital currencies raises questions about how they fit into traditional finance while maintaining security and regulatory compliance. “The goal is not just faster payments but also smarter, safer, and more inclusive payments,” says Juha.

The Baltics have proven that size doesn’t matter when it comes to innovation. This small but mighty region is setting global benchmarks in payments, and companies like Visa are ensuring that the momentum doesn’t slow down. “The payments industry is evolving at lightning speed. The Baltics are at the forefront, and Visa is proud to be part of that journey,” says Juha.

In an era of digital banking and instant transactions, resilience in financial services has become a boardroom priority. Having launched full fintech infrastructures for financial services firms, I’ve seen first-hand how even minor disruptions erode customer trust and invite regulatory scrutiny.

By Ian Kalla, Head of Fintech at FinanceEstonia and Commercial Lead at XYB

The past year’s disruptions have hammered home a clear lesson: robust infrastructure and operational endurance are now essential for competitive advantage. In a market that prizes reliability, resilience is emerging as the next big differentiator.

Recent high-profile outages have exposed glaring resilience issues even in major banks. In early 2025, a third-party service failure left thousands of Capital One customers unable to access accounts or receive direct deposits. Over two dozen other financial institutions relying on this provider were affected. The same week, Barclays suffered a “technical glitch” that knocked out customers’ access to accounts for nearly 24 hours. The timing could not have been worse – it hit on January payday, leaving some people unable to pay bills or withdraw wages. In October 2024, a Bank of America outage saw online balances suddenly drop to $0 due to a widespread systems outage. Panicked account holders flooded support lines until the issue was resolved, illustrating how quickly a technical hiccup can escalate into a consumer confidence crisis.

These incidents highlight common failure points: IT glitches, third-party dependencies, and operational missteps. The impacts – frozen transactions, reputational damage, and regulatory scrutiny – demonstrate the industry’s growing systemic risks. Reliance on a handful of critical IT providers means a single failure can ripple across institutions, raising concerns about financial stability. In other words, a single outage at a key tech partner – or a botched software update – can quickly become everyone’s problem. The wake-up call from these outages is loud and clear, and it has accelerated efforts to fortify operational resilience across the sector.

The Digital Operational Resilience Act (DORA), in effect since January 2025, aims to standardise resilience requirements across the financial sector. Covering banks, insurers, and investment firms, DORA enforces stricter ICT risk management, incident reporting, and resilience testing. This means banks and insurers now need to prove they can prevent, respond to, and recover from disruptions in a systematic way – no more ad-hoc fire-fighting or hoping vendors never fail. One of the biggest shifts under DORA

is how it elevates the treatment of third-party tech partners. Financial firms now must ensure that their software vendors, cloud providers, and other ICT suppliers adhere to the same high resilience standards. Importantly, DORA introduces an oversight framework whereby if a tech provider is deemed “critical” to the financial system, it can be directly supervised by EU regulators. This is a game-changer: major cloud and core banking service providers could find themselves under regulatory watch to ensure they don’t become single points of failure. In sum, DORA is forcing a culture change: operational resilience is moving from box-ticking compliance to a strategic priority

Ian

Kalla, Head of Fintech at FinanceEstonia and Commercial Lead at XYB

that’s jointly owned by financial institutions and their tech partners.

The Role of Fintech Enablers

The next generation of financial services will be defined not only by the features and rates on offer, but by the trust that comes from consistent uptime and crisis-proof operations.

Fintech enablers play a critical role in brewing resilience into their offerings. Next-generation banking platforms are increasingly built with failover capabilities, automated resilience testing, and modular architectures that allow financial institutions to recover rapidly from disruptions. For example, cloud-native core banking platforms now offer real-time redundancy, ensuring continuous service in case of outages. This minimises downtime risks compared to legacy infrastructure. Similarly, embedded resilience features

– such as automated incident reporting and built-in compliance tracking – help financial institutions meet regulatory requirements seamlessly.

Beyond raw infrastructure strength, fintech enablers are uniquely positioned to introduce resilience-oriented value propositions. For instance in XYB, we’ve positioned the platform as a way for banks to modernise their core systems with no risk and zero downtime. The component-based design lets banks upgrade piece by piece, rather than via risky “big bang” migrations. This approach directly addresses one historical cause of outages – the complexity of legacy cores – by enabling both component optionality as well as progressive

modernisation. Apart from that, we believe there’s plenty of room for further innovation around resiliency.

Collaboration for a Robust Financial Ecosystem

At the FinanceEstonia DORA seminar on January 17, industry leaders from legal, audit, banking, and technology sectors discussed how financial institutions can work with service providers to implement resilience-first strategies. The consensus? Resilience in financial services is a team sport. No single bank or provider can ensure stability alone – it requires coordination across the entire ecosystem.

Financial institutions must work closely with their technology vendors, cloud platforms, and fintech partners to identify single points of failure and design them out. This means jointly mapping out dependencies, sharing incident data, and coordinating on contingency plans. Likewise, fintech and tech providers need to proactively support their clients’ resilience goals –whether by adapting products to meet new compliance requirements or by participating in industry-wide drills and information-sharing schemes. When a critical outage hits, a well-coordinated response between a bank and its vendors can make the difference between a brief hiccup and a prolonged crisis.

As we look ahead, it’s clear that resilience is becoming an essential pillar of digital finance’s value proposition. Regulators have set the direction with DORA and similar rules, but it’s up to the industry to turn compliance into creativity. The next generation of financial services will be defined not only by the features and rates on offer, but by the trust that comes from consistent uptime and crisis-proof operations. Far from being a hindrance, the new resilience regime can become a driver of innovation.

Forward-looking firms see DORA not just as a compliance headache, but as an opportunity to streamline risk management and upgrade aging systems for the digital age. By embracing collaboration – banks working hand-in-hand with fintech enablers – we can build a financial ecosystem that doesn’t just survive disruptions but thrives through them. In that sense, resilience is more than a defensive strategy; it’s the new competitive edge that will separate the leaders from the laggards in the financial services arena.

In 2020, AstroPay was only a checkout solution - a button on a web page that allowed you to pay for items. Since bringing on new CEO Marc Sacal - whose extensive financial background includes co-founding Arcus, a payments company that raised over $20 million in VC funding before being acquired by Mastercard, as well as experience at Goldman Sachs—AstroPay has grown into a global wallet with millions of users worldwide.

By R. Paulo Delgado

The company’s vision is to make cross-border finance as easy as possible, with a particular focus on digital nomads and freelancers who work internationally.

“Our ultimate goal is to build a global bank where access to financial services isn’t limited by the currency you use or where you live. The world is becoming increasingly digital, and we’re ensuring banking keeps up,” says Sacal.

Copenhagen will be AstroPay’s European base Sacal strategically set his sights on Denmark, and specifically Copenhagen, for AstroPay’s European base because of the zone’s “global-first” approach and its ability to attract global talent.

“I lived in Copenhagen for a year, and the international community there is remarkable. Denmark’s compact size drives organic integration of people from all over the world, giving it an inherently global mindset and making it an ideal base for AstroPay,” he says.

When the World Bank ran its renowned Doing Business Report, Denmark consistently ranked as the

The future of banking must be global-first, real-time, and currencyagnostic, ensuring that work, travel, and finance move seamlessly across borders. AstroPay is building that future.

top easiest country to do business in, snatching the number one spot for nine consecutive years. The country is known for its highly innovative environment and strong infrastructure.

Investments in fintech are booming in Denmark, with Q1 2024 attracting more investments into fintech than the entirety of 2023. Despite the risk-averse attitude experienced globally in 2023 for fintech investment, Denmark still outperformed its two neighbours. Fin-

tech investment into Denmark in 2023 made up a total of 37.5% of all fintech investments in the Nordics for that year.

The number of people working in fintech experienced 6X growth between 2015 and 2022, making fintech even larger than the insurance industry.

During Sacal’s time in Copenhagen, he grew impressed by the combination of strong work ethic and international culture in the city. Denmark’s central positioning is also favorable, attracting the best talent from the Baltics, Northern Europe, and Scandinavia.

The Institute for Management Development (IMD), an independent academic institution from Switzerland, prepares a global talent ranking report each year. The report looks at Talent Competitiveness between 67 countries, based on 31 indicators and three categories. The categories include how much the country invests in talent development, how much appeal it has for overseas talent, and the degree of availability it has for competencies in the talent pool.

In its 2024 report, IMD ranked Denmark number five globally, beating Germany, the USA, and the EU average by far.

AstroPay also chose Denmark due

to its regulatory clarity and speed-tomarket advantages, which will help ensure compliance while quickly expanding financial services responsibly. The company has secured an EMI license in Denmark, enabling it to offer key financial services under strict regulatory oversight.

The EMI license allows AstroPay to operate within a well-defined framework, ensuring transparency and consumer protection. For services beyond the EMI’s scope, AstroPay will collaborate with licensed banking-as-a-service providers, maintaining full adherence to European financial regulation.

Sacal was also impressed by what he calls Denmark’s “design thinking” and how products in the region focus on usability and seamless integration. “The place we intend on winning is in AstroPay’s design features, and how beautiful and seamless the app is,” he says.

The statement is reminiscent of Steve Jobs’s approach, whose relentless search for beautiful design and excellent user experience has often been cited as the driving force behind the iPhone’s success - and Apple’s turnaround from a struggling company into the global empire it is today.

The problem with global banking today

The global workforce is undergoing a transformation, says Sacal, with digital work untethering people from traditional financial systems. Today, 28% of the global workforce is remote, up from just 12% a decade ago, and 1.5 billion people are freelancers, half of whom work with clients across borders.

This shift is fueling an explosion in demand for borderless financial services. Meanwhile, 18% of global GDP is now digital, reflecting a world where people increasingly earn, spend, and move money online.

“However, financial infrastructure remains outdated - global payments are slow, costly, and riddled with friction. The future of banking must be global-first, real-time, and currency-agnostic, ensuring that work, travel, and finance move seamlessly across borders. AstroPay is building that future,” says Sacal.

AstroPay’s global wallet allows users to send money to each other easily and rapidly in more than 10 currencies. The company offers personal and business solutions, facilitating payments through payment

links, QR codes, and wallet-to-wallet payments. It also supports a variety of local payment methods, and merchants can accept AstroPay directly on their websites.

Plenty of room for new players

AstroPay’s entrance into a market with several dominant players such as Revolut and Wise is bold. However, Sacal believes that plenty of room exists for new entrants. “The total addressable market of this space is huge. It’s like saying that Barclays and HSBC can’t co-exist. That’s impossible,” he says.

AstroPay also brings a unique focus - the digital nomad and international freelancer. Every aspect of its design and experience aims to address this segment of users more heavily than any other player.

“We’re focusing a lot on our ideal customer profile, the digital nomad. These are usually content creators or freelancers working abroad,” Sacal says.

He describes an example of a content creator streaming live on a platform who then puts up an AstroPay QR code to accept payments, allowing people to pay

in their own currency while the creator receives it in their currency.

“Our go-to-market strategy, focus, and design is very much focused towards that user profile,” he says.

partnerships

AstroPay is actively seeking new partners in three distinct categories: Banking, merchants, and enablers.

The banking partners will allow AstroPay to provide further banking services, such as IBAN accounts.

Merchants who sign up for AstroPay would be able to accept payments from AstroPay users, which Sacal says is much cheaper than card payments and other wallets like PayPal.

Under the enablers category fall any partners interested in creating something of mutual value. For example, AstroPay recently partnered with payroll and HR giant Deel so that Deel can pay contractors and employees using AstroPay.

“We did a soft launch in Denmark and we are now ready to start building for Europe. Once we have the partnerships in place, we’ll start the marketing machine in Europe,” he says.

Business finances are messy. Scattered employee spending, manual data entry, and managing cross-border payments can bury finance teams in paperwork and complexities. Even worse, without real-time oversight, small issues like untracked expenses or unexpected exchange rate fees can snowball into massive outlays.

By R. Paulo Delgado

Payhawk solves these issues by providing spend management solutions in a unified platform that helps companies manage their spending easily.

We spoke with Saulius Žlabys, VP Payments and Country Manager at Payhawk Lithuania, about their solution, customer challenges, and future plans.

Tell us more about your company.

Payhawk was founded in 2018 with a clear mission: to simplify and streamline business finance through innovative spend management solutions. We’ve grown from a small startup to a fintech unicorn serving businesses across Europe, the UK, and the US. Our focus is on providing an all-in-one financial solution that combines corporate cards, expense management, and accounts payable automation–essentially streamlining financial operations and payments under one roof.

What unique value does your company bring to the fintech industry?

First, our deep finance knowledge enables us to build solutions that address real-world challenges, not just

technological possibilities. Second, our ERP integrations—built meticulously from the start—create seamless data flow between financial systems that legacy solutions simply can’t match. Third, our rapid innovation cycle allows us to consistently outpace competitors with new capabilities that solve emerging customer needs. Looking ahead, we’re evolving from spend management to comprehensive finance enablement with AI agents that automate manual financial processes.

What are the biggest challenges your clients currently face, and how do you address them?

Our clients face three critical challenges: First, the lack of real-time visibility into company-wide spending. Second, disconnected financial systems create reconciliation nightmares with receipts, transactions, and approvals scattered across platforms.

Third, physical card management remains surprisingly manual in many organizations. Payhawk addresses these through a unified platform offering real-time spend visibility, AI-enabled workflows that manage the

The Baltic region is emerging as a European fintech powerhouse, with Lithuania, Estonia, and Latvia leveraging supportive regulations and digital-first mindsets. We’re seeing some key shifts: widespread AI adoption in financial services, the rise of embedded finance, and accelerating open banking innovation. In this regard, Payhawk is focused on collaborating with organizations like Unicorns Lithuania to share our unicorn experience while helping local companies implement advanced financial management tools.

Can you share a specific customer success story?

DECATHLON Bulgaria’s expansion from one store to twelve locations created significant expense management challenges. After implementing Payhawk, their accounting department now saves two full working days per month on expense processing. They’ve reduced emergency payment requests by equipping managers with corporate cards with preset monthly limits.

How do you ensure you stay ahead in a rapidly evolving fintech market?

entire financial ecosystem—from transaction capturing and document processing to policy enforcement and master data management—and integrated card issuance that eliminates shared office cabinet cards.

How do you see the fintech landscape changing in the Baltic region?

Our approach to innovation is what we call ‘pragmatic innovation’—we balance breakthrough technology with practical impact for finance teams. This starts with deep customer understanding. We maintain this through quarterly hackathons where even junior developers can pitch ideas directly to our CTO. We invest heavily in AI not as a marketing gimmick but to solve genuine finance challenges.

How did a small country with fewer than 3 million people transform into one of Europe’s most dynamic fintech hubs? Was it a stroke of luck, or was it a carefully crafted strategy?

Ten years ago, Lithuania’s fintech scene was almost non-existent, with fewer than 50 companies in the sector.

Back then, Lithuania was not seen as a fintech destination, and global players rarely considered it for expansion. So, what changed? Today that landscape has transformed, with nearly 280 fintech companies now operating in Lithuania and serving approximately 10% of the EU market, attracting international players and investors to its thriving ecosystem.

This transformation was the outcome of a bold national strategy that prioritized fintech as a core driver of economic development. At the center of this strategy was the clear understanding that Lithuania had the potential to create a digital-first, innovation-driven financial sector, and making it a reality required both speed and decisive action.

By aligning regulatory openness, government support, and entrepreneurial ambition, Lithuania converted fintech into a key pillar of its national economic growth plan, ensuring that it wasn’t just an emerging industry but a core pillar of its financial sector.

With the Bank of Lithuania orchestrating the efforts, Lithuania introduced an accessible and fast-track licensing process, setting a strong foundation for fintech businesses to operate across Europe. This regulatory foresight, combined with state-backed innovation programs, provided fintechs with the

tools to launch, scale, and expand internationally. At ROCKIT, we’ve played a key role in this evolution, fostering collaboration between startups, investors, and institutions to create a dynamic and globally competitive fintech hub.

Public and Private Sectors Driving Innovation Together

What makes Lithuania stand out? It’s the fact that the public and private sectors never looked like separate worlds. Since 2016, when fintech started booming here, it became evident that these two, traditionally distinct areas could work as one well-synchronized team. This partnership is fast, agile, and adaptable, just like a high-growth startup but with a serious financial jurisdiction’s long-term strategy and regulatory foresight.

The Bank of Lithuania, together with the Ministry of Finance, created one of the most progressive and business-friendly regulatory environments in Europe. Agencies like Invest Lithuania and Innovation Agency Lithuania actively attract fintech players, while the Memorandum of Understanding on National Fintech Guidelines for 2023-2028 ensures a clear, open, and stable regulatory framework for businesses to thrive.

Homegrown Success Powering

Global Expansion

Lithuania is attracting fintech talent. It is also securing major international

investments. A perfect example is TransferGo, which in 2024 secured a $10 million investment from Taiwania Capital Management. Backed by Taiwan’s National Development Fund, this funding will accelerate TransferGo’s expansion and further enhance real-time cross-border payments. The deal highlights Lithuania’s reputation as a global fintech magnet.

At the same time, major global players like Revolut, Payhawk, Paystrax, Shift4, Tribe Payments, Curve, SumUp, and Railsr have established operations in Lithuania, drawn by its strong regulatory framework and fintech-friendly infrastructure. Meanwhile, homegrown champions like Ondato, SME Bank, TransferGo, AMLYZE, Vinted, Heavy Finance, ConnectPay and Paysera continue to scale, proving that local startups can grow into global powerhouses with the right support.

Expanding Across Asia and the U.S. Lithuania’s fintech ambitions extend beyond Europe. Recognizing the importance of expanding into the world’s biggest financial markets, the country has strengthened partnerships in both Asia and the United States.

In March 2024, Lithuania officially entered Silicon Valley with the launch of InnoHub - an initiative by Innovation Agency Lithuania. This hub is designed to connect Lithuanian fintech startups with U.S. investors, accelerators, and leading financial institutions, paving the way for deeper collaborations and cross-border expansion.

Meanwhile, South Korean fintechs, especially crypto companies, are increasingly choosing Lithuania as their EU base. Thanks to its precise regulatory alignment with MiCA (Markets in Crypto-Assets Regulation), Lithuania is fast becoming a go-to destination

for blockchain and digital asset firms. Companies like Wavebridge and Dafin Labs are already setting up shop here, leveraging Lithuania’s innovation-driven yet compliance-focused approach.

Balancing Innovation and Regulation for Growth

A key reason why fintech thrives in Lithuania is its ability to balance security with business-friendliness. In many markets, compliance is often seen as a challenge, but Lithuania has turned regulatory excellence into a competitive advantage.

Institutions like the Bank of Lithuania, Financial Crime Investigation Service (FNTT), the Ministry of Finance, the Centre of Excellence in Anti-Money Laundering (AML Center), and Fintech Hub LT ensure that Lithuania remains one of the safest and most transparent jurisdictions for fintech operations. This focus on security has attracted leading fintech players, reinforcing Lithuania’s position as one of the most trusted fintech destinations in the EU.

For fintech companies looking to scale, disrupt, and conquer global markets, Lithuania is the place to be.

About Kamile Sulcaite is the Head of Strategic Partnerships at ROCKIT, fostering collaborations across the Baltic fintech ecosystem, uniting innovators, industry leaders, and policymakers to drive growth.

setting the standard of future B2B banking

Magnetiq Bank is redefining the landscape of B2B banking, particularly within the FinTech and e-commerce industries. The bank’s mission is to become the first choice for FinTech payment institutions, serving as a strong partner and bridging the gap between regulators and FinTech companies. Built on the belief that banking should be simple, accessible, and efficient, Magnetiq Bank embraces the latest digital trends to provide a seamless and user-friendly experience.

By Jesper Henriksen

This transformation was initiated in December 2023 following the acquisition by Latvia’s leading investment bank, Signet Bank AS, which became the sole shareholder and parent company of AS Magnetiq Bank. In June 2024, Magnetiq Bank became the first bank to join the Fintech Latvia Association, reinforcing its role in the FinTech

industry. Just a few months later, in October 2024, Magnetiq Bank made history as the first Latvian bank to join Fintech Hub LT, demonstrating its dedication to innovation and collaboration in the FinTech sector.

”Magnetiq Bank was established to address the increasing demand for financial products and services tailored to FinTech, e-commerce businesses,

and the advancement of financial innovations. Our goal is to provide best-in-class service to our clients who require technologically advanced and visionary payment and banking solutions to help their business solidify and grow,” explains Jakub Więcław, chairman of the board at Magnetiq Bank and a seasoned financial and banking technology professional with more than

Więcław Chairman of the board at Magnetiq Bank

15 years of experience in driving FinTech innovation and strategic business growth in Europe.

This shift underscores the bank’s commitment to fostering financial innovations and enhancing the availability of digital products in the banking sector.

Magnetiq Bank distinguishes itself by offering a comprehensive suite of services designed to meet the unique needs of its clientele, including delivering knowledge and fostering relationships to navigate regulatory challenges effectively.

Other areas would be Banking as a Service (BaaS), which empowers Electronic Money Institutions (EMIs), Small Payment Institutions (SPIs), Peerto-Peer (P2P) lending platforms, and Crypto-Asset Service Providers (CASPs) by providing access to licensed banking infrastructure. This allows these businesses to launch, manage, and scale their products more effectively.

Furthermore, Magnetiq Bank delivers secure and efficient payment solutions specifically tailored for e-commerce merchants and payment service providers. These solutions facilitate transactions in over 100 currencies, enabling global reach and enhancing operational efficiency. Finally, to ensure the safety of client funds and build trust, Magnetiq Bank provides segregated accounts, keeping these funds separate and protected in accordance with regulatory requirements.

“At Magnetiq Bank, we recognize the critical importance of time-to-market in the FinTech industry. That’s why we’ve streamlined our onboarding process, enabling clients to move from the initial meeting to a signed agreement in just one to two months—far faster than the 5-7 month industry average in the Baltics. Our deep expertise ensures a seamless and efficient experience,” says Jakub Więcław.

To further ensure a seamless experience, Magnetiq Bank offers an almost DIY product through APIs, allowing clients to connect with minimal assistance from the bank. While customisation is available, the primary focus is on simple integration, enabling faster deployment than competitors. Companies leveraging Magnetiq Bank infrastructure can

We recognize the critical importance of time-tomarket in the FinTech industry. That’s why we’ve streamlined our onboarding process, enabling clients to move from the initial meeting to a signed agreement in just one to two months.

Jakub Więcław

access payment systems and introduce embedded financial services, positioning themselves at the forefront of future banking trends.

The new direction within banking is finding its way around the globe, where companies from Starbucks to Uber and Shopify are embrasing the possibilities. The market has in international media been estimated to grow at a rate of 29 pct. annually for the next 5 to 7 years.

The bank envisions a future where large corporations will be even more prone to enhance customer loyalty through embedded banking and credit card services. For instance, via integration of

Magnetiq Bank, a Latvian bank, is dedicated to meeting the unique needs of FinTech, startups, and e-commerce service providers. We offer banking infrastructure, segregated accounts, and payment solutions to support your business growth. Our goal is to foster the development of the startup and e-commerce sector by leveraging innovative technologies and providing exceptional customer service. As a part of the Signet Bank group, our sole shareholder is Signet Bank AS – the leading investment bank in Latvia, which is committed to financing local entrepreneurs and attracting investments for their businesses.

payment cards into mobile applications, leveraging their financial capabilities through Magnetiq Bank infrastructure. This approach allows companies to offer banking services without directly managing the associated complexities, positioning Magnetiq Bank as a pivotal partner in such initiatives.

Unlike traditional banking models, Magnetiq Bank proactively monitors e-commerce transactions in real time. This approach enables the bank to act as a partner rather than merely a service provider, as it plans to offer quick loans and working capital based on live transaction data. This daily monitoring ensures financial solidity and will provide clients with timely support to fuel their growth.

”At Magnetiq Bank, we believe in constant evolution. We’re driven by continuous development, combining innovative and efficient financial solutions with cutting-edge technology. Our goal? To unlock new potential and growth for our clients. That’s our commitment to modernizing financial services,” Jakub Więcław, summarizes.

Magnetiq Bank has outlined ambitious plans to expand its services within Poland and the Baltic regions over the next 12 months, with aspirations to penetrate other European markets subsequently. The bank’s focus on quality, regulatory compliance, and a comprehensive service portfolio positions it well to attract significant players in the FinTech industry.

Despite the relatively small population of approximately 6 million in the Baltics, the region’s FinTech sector is burgeoning, and Magnetiq Bank is poised to support and capitalize on this growth.

“It is hardly an exaggeration to claim that Magnetiq Bank is setting a new standard in future banking by aligning its services with the evolving needs of FinTech and e-commerce businesses. Through innovative solutions, rapid onboarding, and a client-centric approach, the bank is not only addressing current market demands but also anticipating future trends in the financial industry. As it expands its footprint across Europe, Magnetiq Bank is poised to become a leading partner for businesses seeking advanced and reliable banking solutions,” concludes Jakub Więcław.

Six and a half years ago, the founders of ZTL recognised that B2B payment solutions were broken. Whereas consumer payments had advanced tremendously, the same couldn’t be said for payments in businesses.

By R. Paulo Delgado

We decided to rebuild payments from the ground up, and our focus has been the same ever since we began,” says Andreas Bjerke, CEO and Co-Founder of ZTL, a payments facilitator focusing on B2B payments in the Nordics.

The company’s slogan—“Make payments your business”—is both literal and figurative. It refers to how system owners who want to embed a payment solution can take over the full B2B payment cycle, instead of depending on legacy banking methods and infrastructure.

The problem with traditional B2B payment systems

Traditionally, system owners like ERPs have been mere redistributors of bank payment services. Companies must subscribe to bilateral and costly remittance agreements with banks that follow a time-consuming onboarding process.

“In some cases, companies must even send information by physical mail,” says Bjerke.

Once the company receives its remittance agreement, it’s locked into that bank’s pricing structure, including the complex schedule of fees which, for the most part, are opaque and expensive.

Until ZTL came along, banks faced little competition in this space, unless it was from other banks. Open Banking and PSD2 made it possible for a company like ZTL to fill in the gap created by legacy systems.

One API for all B2B payments

ZTL offers a toolkit of APIs that removes the complexity of B2B payments. Companies no longer need complicated

remittance agreements with their banks and can get up and running in minutes. Although a cost-saving factor exists, the greater appeal is the immense reduction of complexity, errors, and wasted time.

Additionally, system providers such as ERPs or accountants can start offering their own embedded payment offerings. As a regulated financial institution, ZTL has a fully-fledged KYC/ AML solution in place, which alone represents a massive barrier to entry for anyone wanting to handle business payments directly.

Transparent and competitive pricing

ZTL also offers highly competitive rates, especially in cross-currency payments, which rival banking rates by far. “You need a PhD these days to understand bank fees. There’s no transparency on your bank statement. At the bottom, it says, ‘Bank costs,’ and you have to especially go to the bank to get any breakdown of those costs,” says Bjerke.

On the contrary, ZTL’s pricing is transparent, and it’s possible to see the exact financial implications of any transactions down to the last cent.

One especially groundbreaking

Andreas Bjerke CEO and Co-Founder of ZTL

Legacy technology causes bottlenecks, so we went cloud-native from the start.

Andreas Bjerke CEO and Co-Founder of ZTL

offering is ZTL’s forex rate lock-in for invoices with a forward maturity date. No pre-funding or cash collateral is required to secure a rate for a future-dated payment. The payer simply accepts the forecasted rate, and ZTL will honour it. ZTL then executes the payment at this rate with zero fees and only adds a tiny markup on the rate itself, which yet remains highly competitive.

Built to scale from the beginning

ZTL is fully operational in Sweden, Denmark, and Norway. The company built its technology from scratch as a fully cloud-native solution, meaning it’s ready to scale.

“Legacy technology causes bottlenecks, so we went cloud-native from the start. The typical modus operandi for a bank if they have a problem, such as an AML issue, is to recruit a hundred more people. That doesn’t solve the problem.

You need technology,” says Bjerke. The company has focused heavily on stability and excellence in its product for the last 6.5 years. By building a cloud-native infrastructure, ZTL remains agile and able to handle high transaction volumes without significant increases in overhead.

In the immediate future, ZTL is focused on ensuring a strong foundation in the Nordics. Beyond that, the company is looking at possible opportunities in the data market, considering the immense volume of transactions it handles and the potential insight that data could bring.

“It’s very rewarding to be where we are now, where everything is working. We don’t spend a lot of time building new things on the platform. It’s now all about optimizing, calibrating, and making sure it runs even more smoothly and scalably,” Bjerke says.

Automation of infrastructure, software delivery and security is crucial for the Fintech industry to enable faster innovation and higher operational reliability. But how is the best way to do this when dealing with complex systems, large volumes of sensitive data and rigorous compliance requirements?

By Iver

Automation plays an important role in minimizing the risk of human error in an environment where regulations and security requirements are strict.

Niclas Karlsson, VP Bank & Fintech at Iver, has gathered some important steps to get started with automation as a Fintech company.

Evaluate current infrastructure and workflows

1 Start by conducting a thorough review of the current infrastructure, software delivery process and

security strategy. Identify repetitive manual processes and other bottlenecks that can be automated, and analyze how security is managed at different levels, from code to network.

Implement Infrastructure as Code (IaC)

2 To automate infrastructure, you should implement an Infrastructure as Code (IaC) system. Using specific tools, infrastructure can be described in code form, making it easy to create, manage and scale infrastructure automatically. It also ensures that

Karlsson VP Bank & Fintech at Iver

all environments, development, test and production, are consistent and properly documented.

Introduce CI/CD pipelines for automated software delivery

3 The next step is to automate the software delivery process by implementing Continuous Integration/ Continuous Delivery (CI/CD). Here, there are specific tools you can use to integrate, test and deploy new code automatically. Automated tests, including unit tests, integration tests and security tests, should be part of the pipeline to minimize risks.

Integrate security throughout the development process (DevSecOps)

4 By following DevSecOps principles, security can be built into every stage of software development and delivery. Use automated code review and security testing tools as part of the CI/CD workflow. Automated scans of both code and infrastructure should be performed to detect vulnerabilities early in the development cycle.

Ensure continuous improvement and adaptation

5 Automation is an ongoing process. It is important to continuously evaluate and improve automation strategies. Regular review of tools, processes and security measures is necessary to adjust and optimize workflows based on technological advances and regulatory changes.

About

Iver is a leading Nordic full-service provider of cloud-based IT services with cutting-edge expertise in operations, cybersecurity, cloud and innovation. Iver helps Fintech companies to effectively get started with automation. The strategy is customized based on specific business needs and the industry’s strict regulations to ensure that processes are scalable, reliable and secure.

My writing this year has centered on the unprecedented acceleration of innovation, particularly in technological capacity—processing power, storage, and bandwidth. Futurist Brian Wang recently declared that we are “on the event horizon of the singularity” and that “we will get 4060 years progress in about 6 years.” His analysis (www.nextbigfuture. com/2025/02/on-the-event-horizon-of-the-singularity.html) offers compelling calculations supporting this projection.

By Dharmesh Mistry

However, as I’ve often emphasized, understanding the past provides crucial context for the future. I believe it’s essential to examine why progress is accelerating at such a remarkable rate—and why even Wang’s bold predictions might underestimate what we’ll achieve before 2030, especially in financial services.

The printing press in the 1440s revolutionized information storage and dissemination. Before Gutenberg, knowledge was constrained by laborious manual copying onto scrolls and parchment. Mass production of books dramatically expanded literacy, creating a broader foundation for innovation by enabling more minds to build upon

existing knowledge. For early banking, this meant the standardization of accounting principles and the wider dissemination of financial concepts that had previously been guild secrets.

The industrial revolution brought transformative transportation technologies—steam engines, railways, automobiles, and eventually aircraft. These innovations enabled the physical movement of both ideas (through books and publications) and innovators themselves. For banking, this era saw the birth of modern financial institutions capable of operating across continents. Branch banking expanded, international wire transfers became possible, and the foundations of a truly global financial system emerged

as bankers could physically travel between financial centers.

The emergence of silicon processors in the 1960s, followed by the internet, fundamentally changed our relationship with information. Physical distance ceased to be a barrier to collaboration as we gained the ability to process and share information globally. The banking sector was among the earliest adopters of this digital revolution— from the first ATMs and electronic payment systems to sophisticated trading algorithms. Core banking systems digitized customer accounts and transactions, while market data became available in real-time rather than with daily delays.

The proliferation of fiber optics, mobile broadband, and smartphones has connected billions of individuals worldwide, creating a truly global collaborative network. For banking, this transformation has been profound— mobile banking has reached remote villages where physical branches never existed, creating financial inclusion on an unprecedented scale. Real-time payments and cross-border transfers that once took days now complete in seconds. The COVID-19 pandemic accelerated digital adoption in banking by years, demonstrating how connectivity could dramatically transform consumer behavior and service delivery models.

We stand at the threshold of an intelligence revolution. Today’s AI systems, primarily housed in centralized data centers, mirror the mainframe computing paradigm of decades past. Yet AI capabilities are rapidly dispersing into banking applications—from credit

scoring and fraud detection to personalized financial advice and automated customer service. These systems can analyze patterns in financial data that human analysts might never detect, identifying both risks and opportunities with unprecedented precision. Banking, fundamentally an information business, is being reimagined through this intelligence lens.

Perhaps the most profound transformation underway is the reinvention of money itself through distributed ledger technology. Throughout history, money has evolved from physical commodities to paper representations to digital entries in centralized databases. Now, we’re witnessing the emergence of truly digital native assets built on blockchain technology.

This evolution represents more than a technological shift—it’s a fundamental reimagining of financial infrastructure. Traditional banking relies on centralized ledgers with trusted intermediaries

We no longer live in a world where financial innovation depends on the occasional breakthrough product or service.

Dharmesh Mistry

reconciling transactions. Distributed ledgers create consensus through cryptographic protocols, potentially eliminating the need for many traditional banking functions while dramatically reducing settlement times and costs.

Central Bank Digital Currencies (CBDCs) are accelerating this transformation, with major economies developing sovereign digital currencies that combine the programmability of cryptocurrencies with the stability of fiat money. Meanwhile, decentralized

finance (DeFi) protocols are recreating core banking functions—lending, borrowing, trading, insurance—without traditional intermediaries.

For banks, this presents both existential threats and extraordinary opportunities. Those that adapt quickly could become infrastructure providers for this new financial ecosystem, securing their relevance in a radically different landscape. Those that resist may find their core value propositions systematically unbundled by more agile competitors and protocols.

After decades of Moore’s Law, the doubling of computational power produces exponential leaps that dwarf the incremental increases of previous eras. In banking, we’ve moved from batch processing of transactions to real-time settlement, from quarterly financial reviews to continuous monitoring, from statistical models updated monthly to machine learning systems that adapt in real-time.

This acceleration affects every

banking domain—payments, lending, investing, risk management, and customer experience. More significantly, financial technology is converging with advances in other fields: biometrics enabling seamless authentication, quantum computing threatening current encryption while enabling new risk models, and augmented reality creating immersive financial interfaces.

Given this compounding acceleration, I question whether Wang’s dramatic predictions are actually too conservative for banking. We may witness the transformation of financial services within this decade more profound than all the changes of the previous century combined.

In recent decades, banking technology has often resembled a game of leapfrog—institutions that missed leadership in one innovation cycle (like early internet banking) could overtake competitors in the next (mobile banking), benefiting from hindsight. Most forward-thinking banks

have responded by investing in agility through modular architecture, API-driven services, and cross-functional teams.

However, the current pace of change demands more than agility alone.

Banks must develop “technological antifragility”—the capacity to actually benefit from disruption rather than merely survive it. This means we need:

1. Continuous Innovation Labs: Establishing permanent innovation teams with the freedom to experiment without immediate ROI pressures

2. Ecosystems Rather Than Products: Building platforms that external developers can build upon, extending capabilities beyond internal resources driving continuous innovation

3. Adaptive Regulation Partnerships: Working proactively with regulators to develop frameworks that protect consumers while enabling innovation

5. Data as Core Asset: Moving beyond data as a byproduct to data as a strategic resource that appreciates rather than depreciates with use (moving beyond software IP)

Traditional banking horizon planning— often structured in 3-5 year strategic cycles—must evolve into a continuous approach that integrates innovations in real-time. Financial institutions can no longer wait for established technology roadmaps to unfold predictably.

The New Banking Paradigm

We no longer live in a world where financial innovation depends on the occasional breakthrough product or service. Technology itself can now perform much of the cognitive heavy lifting that previously required rare human insight. The primary limitations facing banking today are not computational or technical—they are limitations of imagination, organizational culture, and collective will to harness these accelerating capabilities.

4. Talent Transformation: Reimagining workforce development to create continuous learning cultures that keep pace with technological evolution

Banking faces a profound choice: retreat to core functions protected by regulation, or embrace this technological acceleration to create financial services that are more inclusive, efficient, personalized, and embedded in daily life than anything previously possible. Those that choose the latter path may help create a financial ecosystem that truly serves all participants in ways we’re only beginning to imagine.

The financial sector must recognize that we’re not merely experiencing faster change—we’re experiencing a fundamental transformation in how money, value, and trust operate in a digitally accelerated world.

AboutDharmesh has 35 years experience in banking technology and innovation. He has both worked inside banks driving vision and innovation as well as outside as a serial entrepreneur, investor and writer.

ConnectPay is a licensed EMI in Lithuania whose purpose is embodied in its name— connecting anything payment-related for its customers, in any way possible.

By ConnectPay

We’ve essentially built in-house tech for every service that an EMI is allowed to offer, and we help our customers connect those up in whatever way suits them best,” says Marius Galdikas, CEO of ConnectPay.

The Lithuanian fintech focuses on embedded finance for businesses in various sectors, including other fintechs. It offers solutions for loyalty programs, crowdfunding, and even sports clubs— pretty much any entity that hopes to integrate some form of payment into its app or website. Solutions might include accounts with multi-currency support,

card issuing (including loyalty cards or fan cards), acquiring, or open banking.

“ConnectPay closes the payment loop, thus significantly reducing costs of inter-ecosystem transactions for that entity,” says Galdikas.

Payments as components

ConnectPay operates through a lens of “payments as components”—modular, scalable functionalities that can be seamlessly integrated into an app or platform as the business grows.

“We want to turn payments into an actual commodity, making any transaction frictionless, whether it’s between a mer-

chant and a customer, or an investor and a borrower,” says Galdikas. ConectPay achieves this by creating tech that “just works,” and which basically any entity can use inside its platform.