Why USD Liquidity Matters in Forex

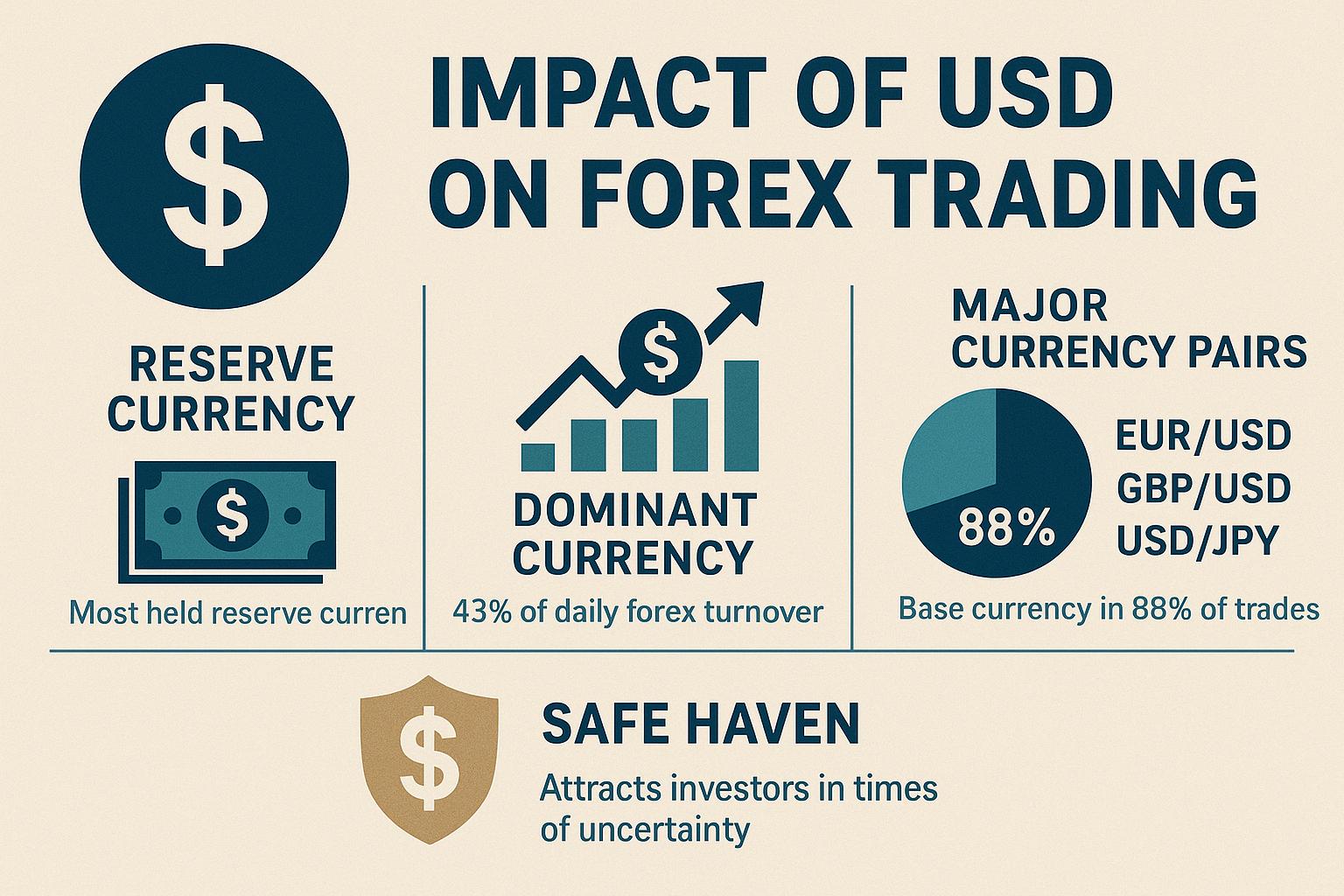

The U.S. dollar (USD) is the backbone of global financial markets, and its liquidity plays a pivotal role in the foreign exchange (Forex) market. As the world's primary reserve currency, the USD is involved in nearly 88% of all Forex transactions, according to the 2022 Bank for International Settlements (BIS) Triennial Survey Its unmatched liquidity shapes market dynamics, influences trading strategies, and impacts economies worldwide This article explores why USD liquidity is critical in Forex and how it affects traders, institutions, and global markets

USD liquidity is crucial for Forex traders due to its impact on trading efficiency and opportunities. It offers tighter spreads (e.g., 0.1-0.3 pips for EUR/USD), lowering costs compared to less liquid pairs Reduced volatility and slippage ensure smoother, more predictable trades, especially for large orders The USD’s liquidity supports diverse trading strategies across various currency pairs, from majors to exotics. Additionally, U.S. economic data like NFP and FED decisions drive trading volume and volatility, creating opportunities for traders to profit from price movements in USD pairs

How does USD liquidity impact the forex market?

Exchange Rate Volatility

● When USD liquidity tightens (e g , when the Fed raises rates or drains USD supply through quantitative tightening), USD strengthens

● This causes other currencies to weaken, sometimes sharply, especially if they rely on USD funding.

Cross-currency funding stress

● Limited USD availability can spike demand for USD swaps and forwards, widening basis spreads

● This can ripple into currency pairs not directly involving USD

Market Depth & Spreads

● Good USD liquidity means tighter bid-ask spreads in major pairs like EUR/USD, USD/JPY, and GBP/USD

● In times of crisis, if USD liquidity dries up, spreads widen and execution becomes more expensive.

Central Bank Intervention

● When global USD liquidity is tight, central banks can coordinate swap lines with the US Federal Reserve to provide USD to their local banks.

● For example, during COVID-19, the Fed reopened swap lines to major central banks to ease USD funding stress

�� How does news impact USD volatility?

Big news = Big moves

The US dollar reacts sharply to economic data, central bank actions, and geopolitical events because the USD sits at the center of global finance.

● Major reports like Non-Farm Payrolls (NFP), CPI inflation, and Fed interest rate decisions often trigger sudden spikes in USD pairs

● Unexpected results can cause huge intraday moves as traders reprice expectations for interest rates, growth, or risk sentiment

How this translates to actual volatility

Wider spreads & faster moves:

News releases cause sudden bursts of volume and algorithmic trading Liquidity can dry up momentarily, widening bid-ask spreads

Short-lived spikes or trend changes:

Some news causes a quick spike that reverses Other times, it sets up a longer-term trend if it changes the Fed’s rate path or market sentiment

Tip for traders:

When trading forex, especially during high-impact USD news like NFP, CPI, or unexpected Fed moves, spreads on major pairs can widen dramatically, eating into your profits Tight spreads can make a big difference to your bottom line https://coinexx com/ is known for offering raw spreads starting from 0.0 pips, so your trading costs stay low even when the market gets volatile

Plus, with ultra-fast execution and deep liquidity, you’re less likely to experience slippage or widened spreads during news spikes This makes Coinexx a solid choice if you want to trade with more control and keep more of your profits.

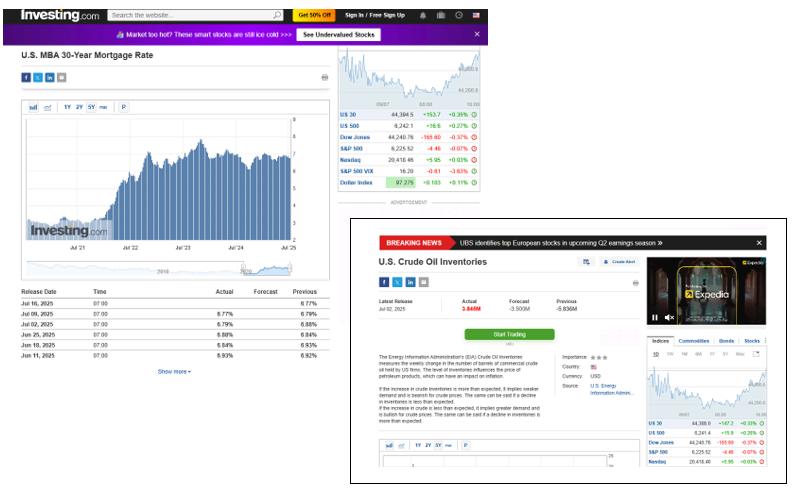

News

https://wwwinvesting com/economic-calendar/mba-30-year-mortgage-rate-1042

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

https://www.investing.com/economic-calendar/10-year-note-auction-571