Taking Control of Your Money

Written for real people with real lives. Whether you’re just starting out, trying to catch up, or planning your next big step your path to financial peace starts here One habit, one choice, one step at a time

Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it. – Albert Einstein

If the last few years have taught us anything, it’s that having control over your money brings peace of mind Whether it’s soaring grocery prices, an unexpected hospital visit, or a sudden job change life has a way of throwing surprises. And when money is tight, those surprises hit even harderBut here’s the good news: you don’t need to be a finance expert to get your money on track. Over the years, as a publisher working closely with everyday people students, families, professionals, retirees I’ve seen how small, consistent habits can transform financial lives. Here’s the biggest myth in money management: that there’s one “right” way to do it But the truth is, your financial journey should fit you your values, your lifestyle, your goals So why not begin now? Change just one thing this week Start tracking your spending, open a savings account, cancel that unused subscription whatever your first step is, take it.

Because when you take care of your money, it starts taking care of you

Practical Steps to Get Started:

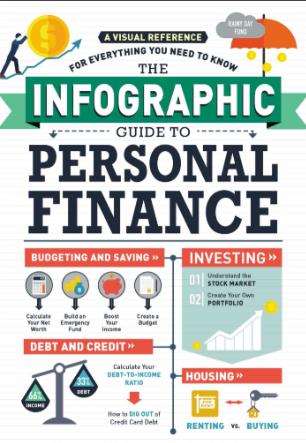

1. Create a Budget That Fits Your Life

A budget is your financial roadmap not a restriction, but a plan Start by tracking your spending for a month Then try the 50/30/20 rule: 50% for needs (bills, rent, groceries), 30% for wants (entertainment, dining out), 20% for savings and debt repayment

��You don’t have to get it perfect. Awareness is the first win

2. Start an Emergency Fund

Life happens. A job loss, a car repair, or a sudden vet bill can throw things off track Having 3–6 months’ worth of expenses saved in a separate account gives you breathing room

��Begin with what you can Even setting aside $10 or $20 each week adds up over time

3. Trim the Extras, Keep the Joy

Look at where your money’s going Still paying for subscriptions you don’t use? Ordering out more than you realized? Cutting back doesn’t mean cutting fun it just means being intentional Keep what brings joy, skip the rest

4. Tackle High-Interest Debt First

Debt can feel overwhelming especially when interest keeps growing Focus on your highest-interest balances first (avalanche method) or start with your smallest debts for quick wins (snowball method). Both work choose the one that keeps you motivated.

5. Invest Early, Even in Small Amounts

You don’t need a big paycheck to start investing. Even $10 a month in a low-fee index fund can grow over time Tools like Acorns, Fidelity, or your bank’s investment platform make it easy to get started

��The sooner you start, the more you benefit from compound interest your money making money while you sleep

6 Set Real, Personal Goals

What are you working toward? A down payment? Debt-free living? Early retirement? Get clear on your short- and long-term goals Write them down, revisit them often, and let them guide your money choices

As someone who’s shared stories from all walks of life, I can tell you this with confidence: progress is what matters, not perfection. Every smart choice no matter how small adds up

�� Here’s a powerful truth: you have more control than you think Personal finance isn’t just for the wealthy or investment-savvy It’s for anyone who wants to sleep better at night, make confident decisions, and build a better future no matter where they’re starting from