2025

Forex trading continues to evolve in 2025, driven by new technologies, faster execution platforms, and a more informed global trading community. For beginners and experienced traders alike, having a solid trading strategy is crucial to navigating the highly volatile currency markets

What Are Forex Trading Strategies?

A forex trading strategy is a set of rules or techniques a trader follows to make decisions on when to buy or sell currency pairs These strategies are based on technical analysis, fundamental analysis, or a combination of both The goal is to create a consistent, repeatable approach to increase profitability and minimize risk.

In this article, we’ll explore 5 proven forex trading strategies that have shown reliable performance and are especially effective in 2025's trading environment

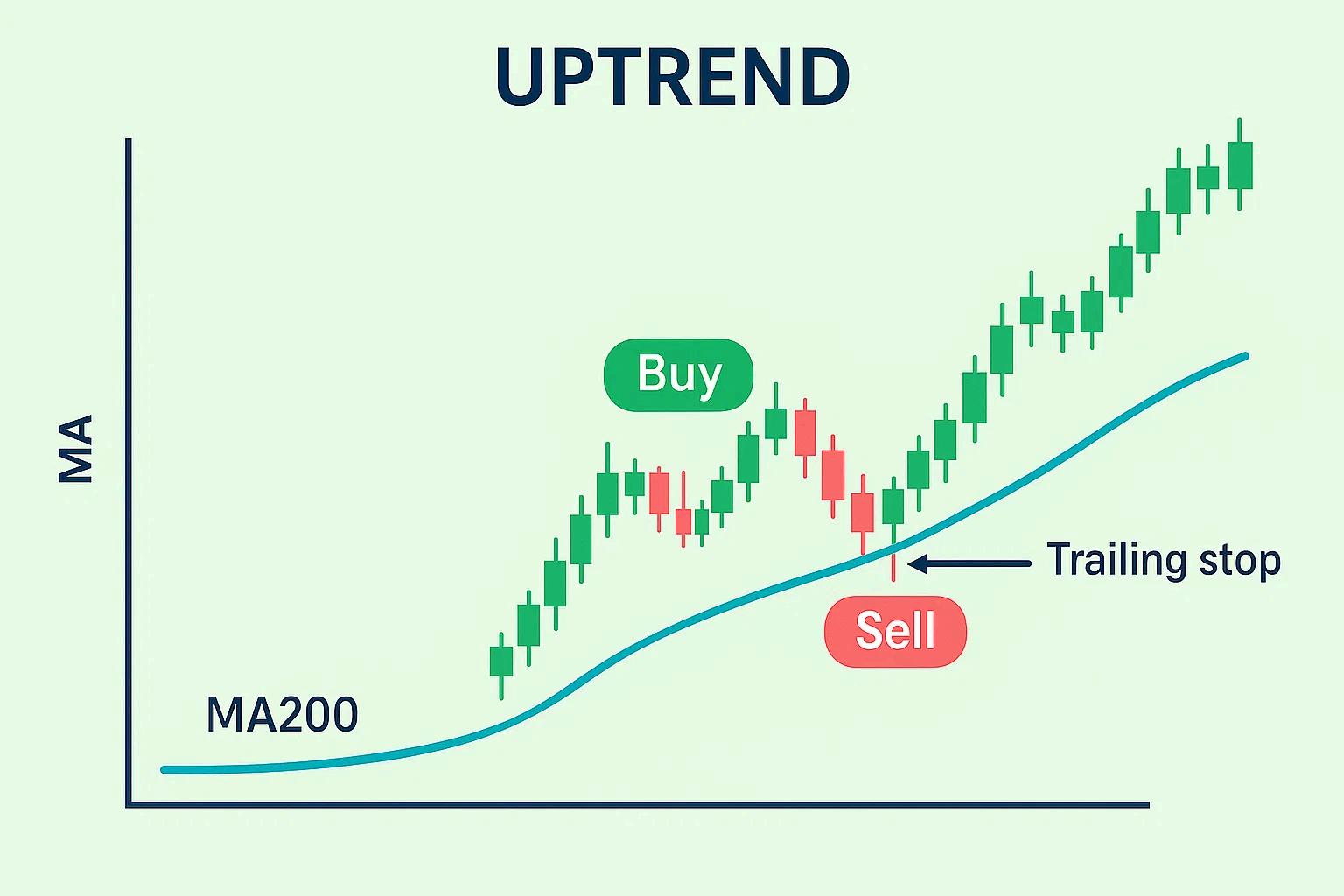

1. Trend-Following Strategy

Best for: Beginners & long-term traders

Tools needed: Moving Averages, MACD, RSI

The trend-following strategy is one of the most popular and beginner-friendly approaches in forex trading It’s based on the principle of "trading with the trend" rather than against it.

How it works:

● Identify the overall trend using tools like the 200-day moving average or MACD

● Enter long (buy) positions during uptrends and short (sell) positions during downtrends.

Use trailing stop-losses to lock in profits while giving the trade room to breathe

This strategy works well in 2025’s trending markets, especially when trading major pairs like EUR/USD and GBP/USD

2. Breakout Trading Strategy

Best for: Volatile market conditions

Tools needed: Support and resistance levels, Volume indicators

Breakout trading involves entering a position when the price breaks above or below a key support or

resistance level The idea is to catch a strong move early

How it works:

● Identify consolidation zones or chart patterns like triangles and rectangles

● Wait for a clear breakout with increased volume confirmation

● Place stop-loss orders just outside the breakout zone to manage risk

This strategy is highly effective during major economic news releases or market openings when volatility is high

3. Scalping Strategy

seconds

How it works:

● Open and close trades within minutes or seconds.

● Use ultra-short timeframes (like 1-minute charts)

Best for: Advanced traders and fast decision-makers

Tools needed: Tick charts, Level 2 data, ECN broker

Scalping is a high-frequency trading strategy that focuses on small price movements, aiming to make multiple trades within a single day, sometimes within

● Requires a low-spread broker like Coinexx and fast execution speeds

While profitable, scalping demands quick reflexes, discipline, and real-time data access making it suitable only for experienced traders

4. Swing Trading Strategy

How it works:

● Analyze medium-term trends on 4-hour or daily charts

● Use tools like Fibonacci retracements to find entry/exit points.

● Combine technical indicators to time trades effectively.

Best for: Part-time traders

Tools needed: Fibonacci retracement, RSI, trendlines

Swing trading is ideal for those who can't monitor charts all day. It involves holding positions for several days to capture “swings” in price.

This approach is perfect for traders balancing other responsibilities but still looking to profit from the forex market.

Best for: Traders who follow economic news

Tools needed: Economic calendar, news feeds, volatility alerts This strategy capitalizes on market-moving economic events, such as interest rate decisions, employment reports, and geopolitical developments

How it works:

● Monitor a reliable economic calendar (e g , Forex Factory)

● Trade shortly before or after major news releases

● Use wide stops or reduced position sizing to manage the volatility

News trading is unpredictable but can yield substantial profits if timed correctly and paired with solid risk management.

✅ Choose the Strategy That Suits You

There’s no “one-size-fits-all” when it comes to forex trading strategies The key is to test different methods, analyze your trading style, and refine your strategy based on real performance. Whether you're trend-following or news trading, success in 2025 depends on discipline, risk control, and ongoing learning

Want to boost your trading even further? Pair these strategies with the right tools, including a reliable ECN broker, real-time charts, and a demo account for testing.