ECN vs. STP: Your Trading Journey, Your Choice

Navigating the world of Forex can be complex, and one of the most crucial decisions you'll make is choosing the right broker Understanding how brokers execute your trades is key to maximizing your potential Let's dive into two popular execution models: ECN and STP Both offer significant advantages over traditional "dealing desk" models, providing direct market access and greater transparency But they do so with subtle differences that can impact your trading experience

�� ECN: The Pure Market Connection

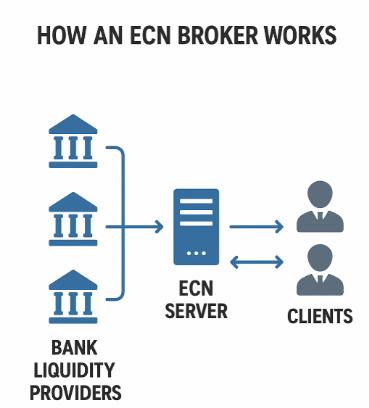

Imagine a bustling marketplace where everyone sees the same prices and interacts directly That's the essence of an ECN (Electronic Communication Network) broker.

● Direct Access, Deep Liquidity: ECN brokers connect you directly to a vast network of liquidity providers such as major banks, financial institutions, and even other traders

● True Market Spreads, Transparent Costs: You'll typically encounter raw, razor-thin spreads, often starting from 0 0 pips Instead, ECN brokers operate on a transparent, commission-based model

● No Dealing Desk Intervention, Lightning-Fast Execution: Your trades are automatically routed and executed, eliminating any potential for re-quotes or manual intervention This translates to incredibly fast execution speeds, crucial for capitalizing on fleeting market opportunities.

● Market Depth Transparency: Many ECN brokers offer a "Depth of Market" (DOM) view, allowing you to see the liquidity available at different price levels This provides valuable insight into market sentiment and available volume.

● Ideal for Precision Trading: The tight spreads, rapid execution, and direct market access make ECN environments highly appealing for strategies that demand precision, such as scalping or high-frequency trading.

For example,

Coinexx positions itself as a strong contender for the "best ECN forex account" due to several key features that align with the advantages of ECN (Electronic Communication Network) trading

KEY FEATURES:

1 Direct ECN Access & Deep Liquidity: Coinexx claims to connect you directly to a network of tier-1 banks and liquidity providers. They market this as delivering deep and institutional-level liquidity.

2 Raw Spreads from 0 0 pips with Commission Transparency: They advertise true ECN pricing, starting from 0.0 pips, with a fixed commission of around $2 per 100k traded

3 No Dealing Desk and Fast ECN Execution: Coinexx uses a non-dealing-desk model, automatically routing orders without manual intervention, ideal for high-frequency or scalping strategies

4. Flexible Stop/Limit Orders: Traders can use any stop-loss, take-profit, or pending orders without broker-imposed limits or restrictions

5 Full MT4/MT5 Platform with ECN Benefits: They provide MT4 and MT5 across desktop, web, and mobile, with support for EAs, scalping, and "Depth of Market" via MT5’s tools and aggregated liquidity feed

6. Fully Crypto Funded: All deposits/withdrawals are in cryptocurrency only. Coinexx offers USDT, USDC, and other cryptocurrencies such as BTC, LTC, ETH, BCH, and DOGE

7. Low Minimum Deposit and Instant Withdrawal: The minimum deposit is only $10. Also, the deposits and withdrawals are processed instantly in real time, which makes the process smooth and hassle-free

��STP: The Efficient Bridge to Liquidity

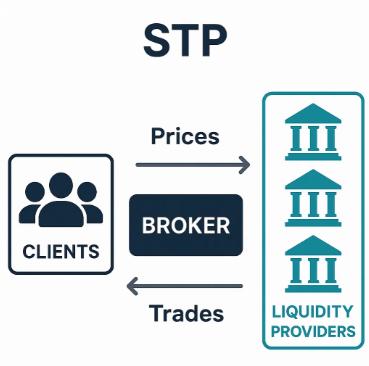

Think of a super-efficient express lane to the liquidity pool STP (Straight Through Processing) brokers provide a seamless, automated pathway for your trades.

● Automated Routing: STP brokers automatically route your orders to their network of liquidity providers. There's no dealing desk involved, ensuring swift and un-interfered execution.

● Competitive Spreads: While not always as razor-thin as raw ECN spreads, STP brokers generally offer very competitive and often variable spreads, free from manual manipulation

● Flexible Profit Model: STP brokers can profit through a small markup on the spread received from liquidity providers, or by charging a commission, or a combination of both

● Fast Execution: Just like ECN, STP minimizes requotes and delays, providing quick order fulfillment.

● Simplicity and Accessibility: STP models can be a great entry point for traders seeking direct market access without the complexities of navigating raw ECN feeds and commission structures

● Good for Various Trading Styles: The balanced approach of STP makes it suitable for a wide range of traders, from day traders to swing traders

For example - Pepperstone

I’ve used Pepperstone’s STP account, and it consistently routes trades straight to tier-1 banks with no dealing desk interference Execution is smooth, and fill rates are very high The Razor account offers ultra-tight spreads (from 0 0 pips) with a small commission well suited for scalping They also operate as an ECN broker as well

✅ Key Takeaways for Smart Traders

● Transparency is paramount

● Execution Speed Matters

● Cost Structure

Ultimately, the best execution model aligns with your trading goals For those who prioritize raw spreads, direct market access, and lightning-fast execution, an ECN account with a broker that truly delivers on these promises can be a significant advantage