UNDERGROUND THE

Learn how to grow your business with a personal CFO, maximize land improvement projects, and why you need cyber insurance.

NJLICA’S QUARTERLY PUBLICATION

SPRING 2024

AAs the president of the NJLICA Board of Directors, I am honored to address you on a matter of great importance for the future of our industry — the cultivation of the next generation of land improvement contractors.

Our industry is based on sustainable development, innovation, and land stewardship principles. It plays a major role in shaping the landscapes of tomor row. However, to ensure continued success and advancement of our field, we must actively engage in fostering the talents and passions of the next generation.

shape the future trajectory of NJLICA and the entire land improvement industry.

Investing in the growth and development of the upcoming generation is necessary to ensure the future of our industry, and to fulfill our obligation to responsible land management and environmental stewardship. By providing guidance and mentorship, we can instill the principles of sustainability, integrity, and excellence in those who will shape the landscapes of tomorrow.

I invite you to actively participate in NJLICA by promoting and supporting initiatives to nurture young professionals in the land improvement industry. We can empower emerging leaders through mentorship programs, educational outreach, or apprenticeship opportunities. There are countless ways to do so.

By participating in our organization, you will enrich your professional journey and contribute to the growth of our community. Your unique perspectives, talents, and contributions are invaluable assets that have the power to

Please join me in embracing this noble cause and making a meaningful difference in the lives of young professionals in our industry. Together, let us establish a culture of learning, collaboration, and innovation that will propel our industry to new heights of success and sustainability.

Thank you for your unwavering dedication to our shared vision as a member of NJLICA. Together, we will build a brighter future for the land improvement industry and leave behind a legacy that will endure for generations.

Best always,

Dennis Mikula, Jr. President, NJLICA

NJLICA BOARD OF DIRECTORS

Dennis Mikula, Jr., President Mikula Contracting, Inc.

Mark Krutis, Vice President Tom Krutis Excavating, Inc.

William J. Esposito, Historian Espo's Tree and Crane Service

Frank C. Del Guercio Tilcon NY

Ron Garofalo

DAG Mobile Aggregate Recycling, Inc.

Warren Gonzalez Foley, Inc.

Shelly Hewson Hewson Landscape, Inc.

Frank Horan Groff Tractor Mid Atlantic, LLC

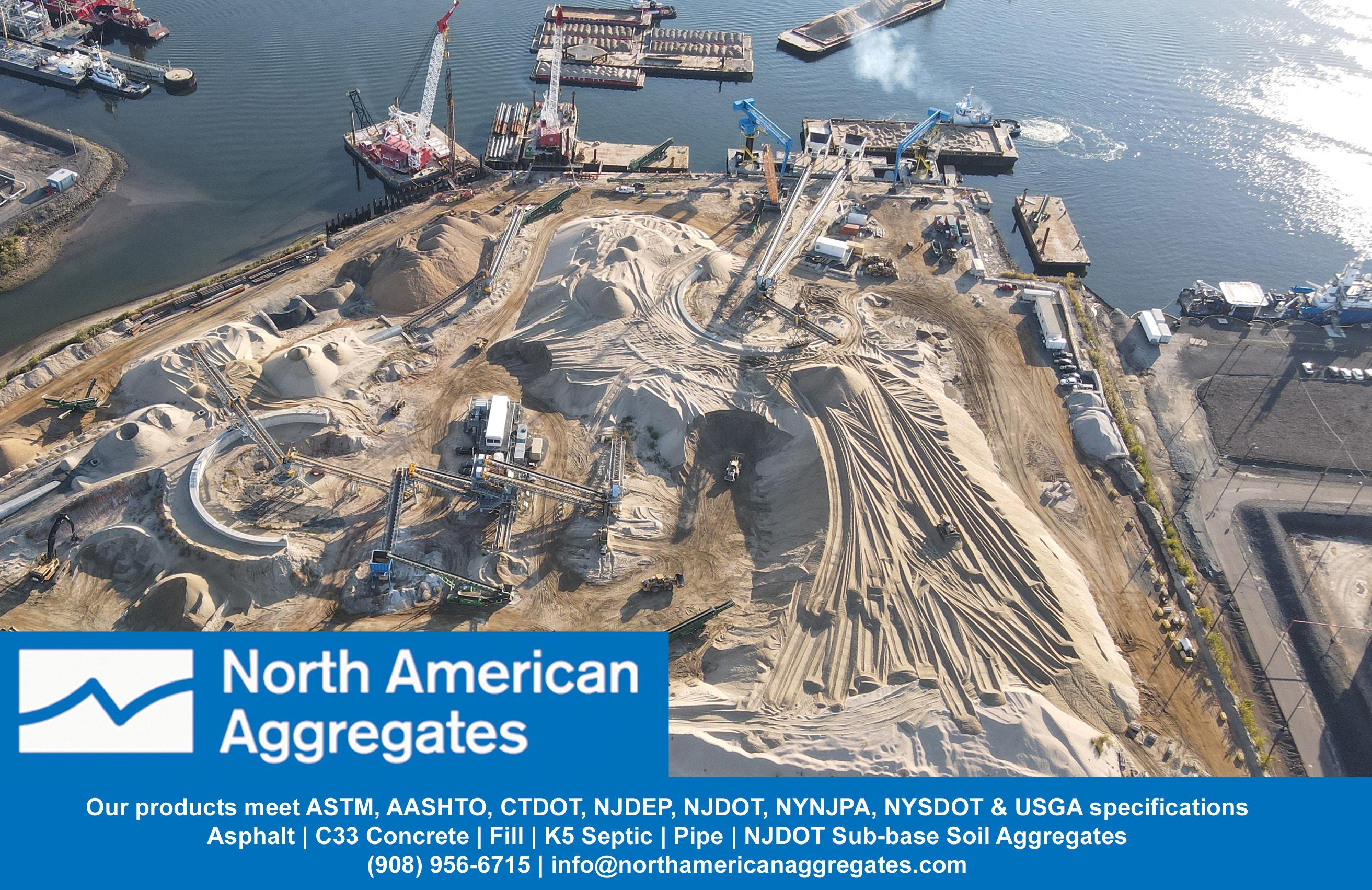

Bob Manis North American Aggregates

Joe Mayers

Septic Experts, LLC

John Rothberg

L.N. Rothberg & Son

Dave Vander Groef Wantage Excavating Co., Inc.

Buddy Freund, Executive Director

4 SPRING 2024 LETTERS

SPRING 2024 5 CONTENTS FIELD GUIDE Legislative News 8 Safety Perspectives 10 Money Talks 10 Equipment Manual 12 Legally Speaking 13 Risk Management 14 FEATURES NJLICA News 20 DISPATCHES New Members 26 Member Benefit 30 Event Recap 31 Upcoming Events 34 Contact Information 38 Advertiser’s Index 38

COVER PHOTO BY BERMIX STUDIO, UNSPLASH; PHOTO PAGE 5 BY TUNGSTEN RISING, UNSPLASH

Large Resources. Local Relationships.

SPRING 2024 7 6 Leigh Street Clinton, NJ 08809 325 North Avenue East Westfield, NJ 07090 Call or email us today to learn more about our offerings. rschielke@trueassoc.com 908-379-2359 We help our clients manage and protect their most valuable assets—their people and their business. As part of the World Insurance Associates family, we offer our clients top products and services from the best providers that span all of your personal and commercial needs. You will continue to get the white-glove service and personal touch of your local True agent. • Personal Insurance • Commercial Insurance • Surety & Bonding • Employee Benefits • Financial & Retirement Planning • Human Capital Management Solutions

INVESTING IN NEW JERSEY'S HIGHWAYS

Anyone who drives on New Jersey’s and the nation’s highways recognizes the vast amount of resources that is being invested to build and maintain our roads and bridges. Three years ago, the president signed a historic federal infrastructure bill, so while Congress now battles over other domestic and international funding, contractors are busy working on America’s roads and bridges.

New Jersey Infrastructure Investment & Jobs Act (IIJA)

The 2021 federal infrastructure law provides New Jersey with $8.14 billion to improve its roadway and bridge infrastructure network. The third installment of that five-year commitment is expected to be $1.44 billion in FY 2024, which began October 1, 2023. Of that total, $1.17 billion in formula funds need to be committed by the end of FY 2024 to new or ongoing projects.

• New Jersey has obligated funds for new projects in FY 2024 and also repurposed federal-aid dollars from pre vious years. It is not uncommon for states to repurpose more funds than they commit in the beginning of the fis cal year.

• This has supported 17 new project commitments in FY 2024.

• In FY 2024, the state has received $106.29 million in federal-aid reimbursements for ongoing work.

• The U.S. Department of Transportation has announced nine IIJA discretionary project grants in New Jersey, val ued at $120.2 million.

On average, federal funds support 32 percent of state capital spending in New Jersey for highway construction, right of way purchases, and planning and design work. IIJA funds complement investments made at the state and local level, and the totality gen erates business activity and economic efficiencies across all sectors of the economy.

BY NICK YAKSICH

BY NICK YAKSICH

and from the state each year. But, conditions on the system are deteriorating, as the need for transportation improvements far outpaces the amount of state and federal funding available.

• The design, construction, and maintenance of transportation infrastructure in New Jersey supports approximately 115,000 full-time jobs across all sectors of the state economy. Approximately 1.7 million full-time jobs in New Jersey in key industries like tourism, retail sales, agriculture, and manufacturing are completely dependent on the state’s transportation network.

• A total of 57 percent of New Jersey’s major roads are in poor or mediocre condition. Driving on deteriorated roads costs New Jersey motorists $4.6 billion a year —

New Jersey Infrastructure Needs Still Outweigh the Investment

Despite this historic investment, according to the Road Information Program (TRIP), New Jersey still has significant highway and bridge needs.

• Roads and highways are the backbone of our economy, allowing New Jersey motorists to travel 77.4 billion miles annually and moving a significant portion of the $973 billion worth of commodities shipped to

8 SPRING 2024 LEGISLATIVE NEWS

CASE CE O ers a range of Light and Heavy Construction Equipment Backhoes, Wheel Loaders, Excavators, Dozers, Skid Steer Loaders, Compact Track Loaders EQUIPMENT SALES • RENTALS • PARTS • SERVICE www.GTMidAtlantic.com Vineland, NJ 856-697-1414 Freehold, NJ 732-780-4600 Totowa, NJ 973-785-4900

Your #1 Source for Everything Under Construction

or $715 per driver — in the form of additional repairs, accelerated vehicle depreciation, and increased fuel consumption and tire wear.

• A total of 7 percent of New Jersey’s bridges are rated in poor/structurally deficient condition, meaning there is significant deterioration to the major components of the bridge. A total of 55 percent of the state’s bridges are at least 50 years old, an age when many bridges require significant rehabilitation or replacement.

Motor Vehicle Traffic Fatalities Declined in 2023

This investment is also leading to safer roads. From 2018 through 2022, 3,117 people died on New Jersey’s highways, an average of 623 annual fatalities. New Jersey’s traffic fatality rate of 0.93 fatalities per 100 million vehicle miles of travel is lower than the national average of 1.35.

Nationally, early projections from the National Highway Traffic Safety Administration (NHTSA) indicate that motor

vehicle traffic fatalities declined by 3.6 percent in 2023 versus 2022. The agency said it estimates 40,990 people died in motor vehicle traffic crashes in 2023, compared to the 42,514 fatalities that occurred in 2022.

NHTSA added in a statement that the fourth quarter of 2023 represents the seventh consecutive quarterly decline in fatalities, a decline that began in the second quarter of 2022.

Keep the Focus on Investment and Its Benefits

New Jersey federal and state elected officials should be proud of the investment they have committed to build and maintain the state’s roads and bridges. However, while conditions and safety of the system are improved, the industry needs to continue to advocate for continued investment to meet the significant needs that have been identified.

Nick Yaksich serves as the director of Government Affairs for LICA.

2024 SPRING LEGISLATIVE REPORT

The 2024-25 session of the New Jersey Legislature was sworn into office on January 10, 2024. The year begins with significant turnover in both houses of the legislature. Notable retirements include State Senator/former Governor Richard J. Codey (50 years) and longtime Transportation Committee Chair Nick Sacco. In the assembly, Assemblymen Tom Giblin and Joe Egan retired after serving several terms in the lower house. These legislators were very much involved in the transportation and infrastructure side of their respective houses.

The first three months of the year brought the following activity by the governor and legislature. Both Senate President Nick Scutari and Assembly Speaker Craig Coughlan were reelected by their colleagues to serve as the leaders of their respective houses. Both Senator Anthony Bucco Jr. and Assemblyman John DiMaio were reelected leaders of the minority parties.

The legislature has enacted the Transportation Trust Act A-4011 (Calabrese) and S 2931 (Sarlo/Scutari). Highlights of the legislation include:

• Establish a five-year program beginning July 1, 2024 and ending June 30, 2029 to ensure a steady stream of revenue to support statewide transportation projects

• Authorize roughly $10.37 billion in appropriations for the state’s Transportation Capitol programs from FY 2025 to FY 2029. An estimated $2.3 billion will be allocated for state aid to counties and municipalities for transportation projects.

• Establish an annual electric vehicle fee of $250 per year, which increases $10 per year in the remaining four years, and will ensure that all motorists share in the responsibility to maintain roads,

BY ALADAR G. KOMJATHY

Both bills passed with bipartisan support. The governor has signed the legislation into law and will come into effect July 1, 2024.

The legislature has also enacted a series of affordable housing laws and the governor signed these measures into law.

The legislature begins its annual hearings on the governor’s FY 2025 proposed budget. Budget hearings will take place in the months of April and May. The budget must be enacted by June 30, 2024.

Aladar G. Komjathy and Kean LCC represent NJLICA’s interests in Trenton with both the legislative and executive branches of government.

SPRING 2024 9 PHOTO PAGE 8 BY JOSHUA SUKOFF, UNSPLASH

FMCSA WARNS OF EMAIL PHISHING SCAM

An email is being sent to registered motor carriers by someone pretending to be FMCSA and notifying the recipient that they must schedule a safety audit. The link to request the safety audit has what appears to be a SAFER URL and mirrors FMCSA’s MCS-150, but includes fields to enter a PIN number, EIN number, and social security number.

Phishing emails masquerade as from reputable companies or entities to get the recipient to reveal personal information, such as passwords and credit card numbers. In this case, some of the requested information is not only sensitive personal information that could be used for purposes such as identity theft, but this information would also allow the unauthorized party to gain access to your FMCSA account.

The agency says the email containing the link is very convincing as coming from FMCSA.

FMCSA explains that communications relating to safety audits will typically come directly from an FMCSA-dedicated mailbox or from the state entity that has been assigned the responsibility

MONEY TALKS

BY ANTHONY MORREALE

BY ANTHONY MORREALE

to conduct the safety audit. While these emails typically end in a “.gov”, FMCSA recommends that you verify any potentially suspicious email or communication with the appropriate agency or contact your FMCSA Division Office directly to clarify.

The Federal Trade Commission has some advice on how to recognize phishing scams.

If you suspect your company has been the victim of fraud or identity theft, we recommend using the official website of the Federal Trade Commission (FTC) dedicated to reporting fraud cases at: https://reportfraud.ftc.gov/#/.

If you need assistance with your registration, please get in touch with FMCSA by calling 1-800-832-5660.

For assistance with your USDOT and OSHA compliance, don’t hesitate to get in touch with Anthony Morreale, co-owner of TriState Safety Solutions, at 732-551-3833, amorreale@tsss-nj.com, our visit our website, www.tsss-nj.com.

UNLOCKING BUSINESS GROWTH WITH A PERSONAL CFO

In my last article, I discussed the importance of having a succession plan for your business. In this three-part series, I’ll discuss the benefits of hiring your own personal CFO, how they can assist in your business growth, and help you gain clarity on how your business is doing and where it’s heading.

In the rapidly evolving landscape of modern business, owners and entrepreneurs find themselves facing an increasingly complex array of financial challenges. From managing day-today operations to planning for long-term growth, the financial decisions made today can have a profound impact on the future viability and success of a business. It’s within this challenging environment that the concept of a personal CFO has emerged as a beacon of guidance and strategic financial management. Unlike traditional financial roles that may only skim the surface of a business’s financial health, a personal CFO offers a deep dive into the

BY MICHAEL J. GUARINO III

financial intricacies of both the business and its owner. This first article introduces business owners to the pivotal role of a personal CFO, outlining how this dedicated financial partner can navigate the complexities of modern financial management to secure both immediate stability and long-term prosperity.

Part 1: Understanding the Role of a Personal CFO for Business Owners

The role of the CFO has traditionally been seen as a cornerstone of large, corporate entities — a figurehead tasked with overseeing the financial operations, risk management, and financial planning of a multilayered organization. However, as the business world has evolved, so too has the role of the CFO, transitioning into a more dynamic and essential component of even the smallest business teams. This evolution reflects a broader shift in the

10 SPRING 2024

SAFETY PERSPECTIVES PHOTO PAGE 10 BY POP & ZEBRA, UNSPLASH; PHOTO PAGE 11 BY DMITRY DEMIDKO, UNSPLASH

economic landscape, where financial agility, strategic planning, and personal investment have become just as critical for small to medium-sized enterprises (SMEs) as for larger corporations.

The advent of the personal CFO marks a significant milestone in this evolution, tailored to meet the unique needs of entrepreneurs and business owners. This role diverges from traditional financial advisory services by offering a more holistic and integrated approach to managing a business owner’s complete financial picture — encompassing both personal and business finances. In essence, the personal CFO serves as a strategic partner, guiding business owners through the complexities of financial decision-making, and ensuring that every financial action aligns with both immediate needs and long-term goals.

What Does a Personal CFO Do?

A personal CFO transcends the boundaries of traditional financial roles by merging the strategic oversight of a corporate CFO with the personalized touch of a financial advisor. This role is comprehensive, encompassing a wide range of responsibilities designed to stabilize and grow both the business and the personal wealth of the owner. At its core, a personal CFO focuses on five key areas:

1. Financial and Estate Planning and Strategy: Developing long-term financial plans that align with the business owner’s personal and professional objectives. This includes retirement planning, estate planning checklists and recommendations, and setting up college funds for children, all tailored to the specific goals and risks appetite of the individual.

CFO crafts a portfolio that balances risk and reward according to the owner’s financial goals and risk tolerance.

4. Tax Planning and Compliance: Navigating the everchanging tax landscape to minimize liabilities and maximize compliance, ensuring that both the business and the individual take full advantage of available taxsaving strategies.

5. Risk Management: Identifying potential financial risks to both the business and the owner’s personal finances, and developing strategies to mitigate these risks. This includes insurance planning, business continuity planning that we discussed in our last article, and personal asset protection.

By covering these critical areas, a personal CFO provides a level of oversight and strategic planning that goes beyond what traditional financial advisors offer. They become an integral part of the business owner’s decision-making process, ensuring that every financial decision is made with a comprehensive understanding of its implications on both the immediate and long-term future.

2. Cash Flow Management: Implementing strategies to optimize the business’s cash flow, ensuring that the business can cover its operational costs while also identifying opportunities for reducing expenses and enhancing revenue streams.

3. Investment Management: Guiding the business owner through the complex world of investments, a personal

Michael J. Guarino III has been helping business owners and individuals with succession planning for over 18 years. His firm, Main Street Wealth Management, serves businesses owners and individuals with CFO services, financial planning, retirement planning, insurance, investing, and developing exit strategies for business owners nationwide. If you’d like to learn more about how Mike Guarino can help your business, please reach out via email to Mike@mswealth.com or call 973-625-1112 ext. 2 to schedule a complementary and 100 percent confidential Zoom or phone consultation.

SPRING 2024 11

MAXIMIZING LAND IMPROVEMENT PROJECTS: A GUIDE FOR CONTRACTORS

As a land improvement contractor, your success depends on your ability to transform undeveloped land into functional and aesthetically pleasing spaces. Whether you’re working on large-scale developments or smaller residential projects, having access to the right construction equipment is crucial. At GT Mid Atlantic, we understand the challenges you face and aim to provide insights to help you optimize your operations.

Selecting the Right Equipment

Choosing the appropriate machinery is the cornerstone of any successful land improvement project. Consider factors such as the size of the site, the nature of the terrain, and the specific tasks required. For instance, excavators are essential for tasks such as digging trenches and clearing debris, while dozers excel at grading and leveling uneven terrain. GT Mid Atlantic offers a wide range of equipment options to suit your needs, along with expert advice to help you make informed decisions.

Embracing Technology

In recent years, technological advancements have revolutionized the construction industry. From GPS-guided systems to telematics, incorporating these innovations into your workflow can enhance efficiency and accuracy. GPS technology, for example, enables precise grading and earthmoving, reducing the need for manual labor and minimizing errors. Telematics systems provide valuable insights into equipment performance, allowing for proactive maintenance and cost savings. By staying up to date with the latest developments, you can stay ahead of the competition and deliver superior results.

Prioritizing Safety

Safety should always be a top priority on any job site. Operating heavy machinery poses inherent risks, but adherence to strict safety protocols can mitigate these dangers. Ensure that all workers receive comprehensive training on equipment operation and safety procedures. Encourage a culture of vigilance and accountability, where team members look out for one another and report any hazards promptly. GT Mid Atlantic is committed to promoting safety awareness and offers resources such as training programs and safety guidelines to support your efforts.

BY FRANK HORAN

BY FRANK HORAN

Investing in Quality Equipment

While cost considerations are important, investing in high-quality equipment can yield substantial long-term benefits. Reliable machinery not only enhances productivity but also reduces downtime and maintenance expenses. Partnering with a reputable dealership that offers top-tier brands and comprehensive support services can provide peace of mind and maximize your return on investment. GT Mid Atlantic stands behind the products we sell, providing ongoing maintenance, repairs, and parts support to keep your operations running smoothly.

In the competitive landscape of land improvement contracting, success hinges on a combination of expertise, technology, and quality equipment. By partnering with a trusted dealership that understands your unique needs, you can gain a competitive edge and achieve superior results. At GT Mid Atlantic, we are committed to supporting contractors like you with top-of-theline equipment, innovative solutions, and unparalleled service. Together, we can turn your land improvement projects into showcases of excellence. Contact us today to learn more about how we can help you succeed.

Frank Horan is a territory manager with GT Mid Atlantic, a proud member of NJLICA and an equipment dealer with 15 locations in New Jersey, Pennsylvania, Delaware, and Maryland. “Your #1source for everything under construction.”

PHOTO BY FRANK HORAN

12 SPRING 2024

EQUIPMENT

Jennifer Roselle, Esq.

Jennifer Roselle, Esq.

Patrick W. McGovern, Esq.

Patrick W. McGovern, Esq.

LEGALLY SPEAKING

NOW MORE THAN EVER

THE SECURE ACT ELIMINATED STRETCH IRAS. NOW WHAT?

The SECURE Act (Setting Every Community Up for Retirement Enhancement Act), which was enacted in December 2019, eliminated the stretch IRA — a feature of an inherited IRA account that allowed the beneficiary to stretch out required minimum distributions (RMDs) over his or her lifetime, thereby deferring a significant amount of income taxes on the RMDs. Now, beneficiaries must withdraw the entire account over the 10-year period following the owner’s death. Doing so will significantly accelerate the income tax due with respect to the account.

Perhaps you are thinking: this is a piece of legislation coming from Washington — there’s got to be a loophole, right? The answer is: maybe. Here are a few planning ideas to consider in light of the SECURE Act:

Increase the number of designated beneficiaries

If an IRA account is divided among five beneficiaries instead of two, for example, the amount that each beneficiary receives, and

BY ELIZABETH CANDIDO PETITE

therefore must pay tax on, is less. Of course, this works best in large families where there are more people who may be named as beneficiaries.

Designate beneficiaries who are in a lower tax bracket

If you have one child who is wealthy and another child who is not, you could designate the less wealthy child as the beneficiary of your IRA account and the wealthier one as the beneficiary of another asset. The income tax liability may be less burdensome to your child who is less well-off and in a lower tax bracket. But beware: this type of estate planning requires frequent review if your goal is to ensure that your children are treated equally. If you spend down your brokerage account during your lifetime but don’t touch the IRA, for example, then what seemed like an equal distribution when you enacted the plan will be very unequal when it is implemented after death.

SPRING 2024 13 GENOVA BURNS LLC • WWW.GENOVABURNS.COM NEWARK • NEW YORK

JERSEY CITY PHILADELPHIA • BASKING

•

RIDGE

AT LAW

ATTORNEYS

Take advantage of a Roth conversion during your lifetime

If you are in a lower tax bracket than your designated beneficiaries, you could convert your traditional IRA into a Roth IRA. Doing so will have an immediate income tax consequence to you, but will greatly benefit your beneficiaries because distributions from a Roth IRA are not taxable.

Designate “eligible beneficiaries” who can still continue to stretch RMDs

The SECURE Act allows “eligible beneficiaries” to stretch RMDs over their lifetimes. These include spouses, minor children, and chronically ill or disabled persons. But beware, the 10-year rule comes into play once minor children become adults, and an RMD in the hands of a disabled beneficiary could jeopardize eligi bility for government benefits.

Spend down IRAs, save other assets

For example, consider using your RMDs to make charitable contributions during your lifetime rather than making donations from other assets; the maximum amount allowed per year is $100,000.

Utilize charitable remainder trusts

Leaving your retirement accounts to a charitable remainder unitrust (CRUT) or charitable remainder annuity trust (CRAT) allows your relatives or friends, as the income beneficiaries of the trust, to receive distributions from the trust that the trustee

RISK MANAGEMENT

withdraws from the IRA over the course of their lifetimes (or a specified time period), instead of taking the IRA distributions over the 10-year period required under the SECURE Act. Whatever is left upon their death (or at the end of the specified term of years) must pass to charity, so this approach works best if you are already charitably inclined.

Planning opportunities may also exist for the beneficiaries of an inherited IRA under the SECURE Act. Notably, the law does not require equal distributions over the 10-year period, but only that the entire account be withdrawn during that time. This means a beneficiary could withdraw the entire account in one year to pay for a large expense, such as a home renovation project or college tuition (just remember that the distribution is taxable), or spread it out over some or all 10 of the years to likewise spread out the income tax liability.

We recommend that you talk to your estate planning attorney, accountant or financial planner about whether any of these planning ideas regarding retirement accounts may benefit you and your family.

Elizabeth Candido Petite is a partner at Lindabury, McCormick, Estabrook & Cooper, P.C. She can be reached at epetite@lindabury.com.

N.J. MOTOR VEHICLE LAW REQUIRING $1.5 MILLION MINIMUM LIMIT OF LIABILITY

NJ Senate Bill S2841 was just passed and is now the Law for all Commercial Motor Vehicles. Effective July 1, 2024, New Jersey has raised the MINIMUM auto liability insurance limits to $1,500,000 for all commercial vehicles with a gross vehicle weight (GVW) of over 26,000 pounds. Commercial vehicles with a GVW of between 10,001 to 26,000 pounds are required to have a MINIMUM auto liability insurance limit of $500,000 for bodily injury and property damage.

This bill was passed to address the severity and frequency of auto accident claims. The cost of settling auto accident claims have greatly increased over the past several years, and in many cases, exceed the limits of insurance coverage purchased by commercial company owners.

As we were expecting, the increased severity and frequency of auto related claims has also greatly increased commercial auto insurance premiums. Everyone has seen their commercial auto insurance premiums increase for the past couple of years because of this. The severity of these claims have also leaked into the excess/

BY RICHARD GAYNOR

umbrella policies limits. Consequently, we are also experiencing a dramatic increase in the cost of excess/umbrella policies. Many insurance companies who write excess liability/ umbrella insurance are limiting the amount of coverage that they are willing to offer. We are seeing $1 million, $2 million, and $5 million caps on umbrella coverage being offered.

If you are one of the more fortunate businesses with few claims, you should see less of a premium increase. We recommend speaking with your insurance agent in advance of July 1, 2024 to make sure you are insured properly with the increased bodily injury and property damage liability limit requirement and as cost effectively as possible.

Richard Gaynor is the president of Middleton & Company Insurance, the insurance advisor for many trade and business associations. The company provides informative, relevant, and cost-effective business insurance protection.

14 SPRING 2024

TINGEY LAW FIRM , UNSPLASH

PHOTO BY

WHAT IS ALL THE FUSS ABOUT CYBER INSURANCE?

What is cyber? According to CISO Global’s Chief Technology Officer Jerald Dawkins, the word “cybernetics” came into use in the 1940s to describe a field of study that encompassed “control systems and communications between people and machines.” As time moved along, the word cyber jumped from a noun to an adjective. Now there is cyber everything. How about cyberspace or cybercrime? There is cyber-defense and cyber-ops. These sound like clandestine operations performed by cybernauts!

Why does cyber keep popping up? We read about cyberattacks against our government’s computers or attacks against big business. We hear that we are vulnerable to cyberattack against the electrical grid, which, if shut down, would be a big problem. How about the cyberattack on Colonial Pipelines’ computers that shut it down? If we think about it, cyberattacks are real and they are a threat.

If you own a computer you are susceptible to an attack. We hear about big and noteworthy attacks, but attacks against all sizes of companies occur every day. Our computers were compromised a few years ago. We thought we would be under the radar with only four computers back then, but we tried opening our PDF files one morning and found them all locked by some unknown hacker. We could get our files back if we paid a ransom. You cannot trace

BY MICHAEL PUGACZEWSKI AND TOMMY SALU

these hackers, and they could be located anywhere in the world. We were lucky. The hacker must have been impatient, and we were able to go back a few days to our tapes and upload the files before they had been locked. Some hackers will wait months to spring the trap with thousands of irretrievable files at stake.

Direct attacks are not the only problems we face. Last week, we received a call from a client whose computer operations were shut down. His system is in the cloud and controlled by his computer tech. The problem was his computer tech’s computers were hit by hackers looking for a ransom. The hackers shut the tech’s computer system down, affecting all his clients. This lasted two days until the problem was resolved.

So how do you protect your company’s computer system from attacks that could come from anywhere or from anyone, even trusted advisors? There are cybersecurity computer techs who can collaborate with you to provide internal protection for your system to prevent cyberattacks from being successful. This would involve firewalls, changing passwords, and using random passwords. Involve your employees and make them aware of the threat. Have a policy on cybersecurity and review its procedures with everyone in the company. Make cyber security everyone’s responsibility!

SPRING 2024 15

If you accept credit cards, your company should be PCI (Payment Card Industry) compliant. There is a PCI Security Standards Council that sets security standards for businesses that accept credit card payments. If the credit card information is stored on the computer or the information transmitted to another computer, there are security standards that you should meet. These standards are not enforced by law, but keep in mind regulatory requirements become more stringent each year.

If you use a payment service provider (PSP) to process your credit card transactions, they usually take on some of your responsibilities as required by the PCI standards. Your company should still be PCI compliant, and you should read your service contract carefully to learn what you are receiving from the PSP. For example, if there is a breach you might find there is some money for breach response, which would involve costs to notify the credit card holders about the breach. The average breach cost used to be $8.00 per card, but with inflation, it is more likely $15.00 per card. Multiply this number by the number of credit card users in your database. This can be an enormous number. If there is a credit card breach, then the credit cards will have to be replaced. There are estimates that banks will charge $5.00 to $10.00 to replace each card, and the bank will want to be reimbursed.

reputational harm. There is also e-crime coverage for funds transfer fraud, service fraud, and hardware replacement with a reward sub-limit.

Evaluate each available coverage and its applicability to your individual company needs. Question your cyber insurance professional to be sure you understand the cyber terminology, which can be confusing. Select cyber coverage and dollar limits that you are comfortable with after considering your ultimate loss exposure. Buy the cyber policy. Rest easy!

Michael Pugaczewski is a client advisor and contributor. Tommy Salu is a corporate placement advisor at World Insurance Associates, a national insurance broker that provides insurance products and services to construction, commercial and industrial companies.

Cyber threats are rising and there is an uptick in the severity of claims. Artificial intelligence will also have a negative impact, as the thieves are learning how to use it to their advantage. Replication of your usual safe and secure vendors’ websites will be impossible to detect. Is it your bank’s website or have you landed somewhere that looks like your bank’s website?

The threats seem endless, from viruses to ransomware, malware, spam, and phishing. Password attacks, Trojan horses, spyware, and worms are common. Do not forget the business email compromise hacker looking to receive a check for a fake service or product. You do everything possible to eliminate these threats, but what happens if you are hit? Where do you go? You go to your computer tech and try to mitigate the loss. Then you submit a claim to your cyber insurance policy insurance company. Here you will find additional help to survive the attack.

Work with a cyber insurance professional to explain and guide you through the available coverages. There are third party coverages that provide payment for individuals and businesses outside of the company who have been damaged. There is first party coverage to provide relief to your company for digital asset restoration, breach response, business interruption, dependent business interruption, cyber extortion (ransomware) and

16 SPRING 2024

LOIC LERAY , UNSPLASH

PHOTO BY

CATERINA SUPPLY INC. SALES OFFICE WAREHOUSE AND YARD 1271 Glassboro Road Williamstown, New Jersey 08094 CELEBRATING 94 YEARS OF SUCCESS www.brentmaterial.com WBE Certified (NJ, DE, NY/NJ Port Authority, NYC, NY State, DASNY) WBENC, WOSB, SBE Certified (NJ) SALES OFFICE 325 Columbia Turnpike, Suite 308 Florham Park, New Jersey 07932 TEL: (973) 325-3030 FAX: (973) 325-7360 7:30 A.M. - 5:00 P.M. Monday - Friday EMERGENCY HOURS BY REQUEST WAREHOUSE AND YARD 308 North 14th Street Kenilworth, New Jersey 07033 TEL: (908) 686-3832 7:30 A.M. - 4:30 P.M. Monday - Friday EMERGENCY HOURS BY REQUEST • WATER WORKS • • STORM DRAINAGE • • SANITARY SEWER • • EROSION CONTROL • www.caterinasupply.com SUCCESS THROUGH SERVICE SINCE 1927 7:00 A.M. - 5:00 P.M. Monday - Friday EMERGENCY HOURS BY REQUEST TEL: (856) 728-0171 FAX: (856) 728-8275 CELEBRATING 37 YEARS OF SUCCESS NJ Certified WBE/SBE, DE Certified WBE/SBF, PA Certified SDB-W/SBF

Types of Transitional Duties in Return-to-Work Programs

When an employee experiences an occupational illness or injury, their eventual return to the workplace can create considerable challenges, putting significant stress on both the individual and their employer Nevertheless , return-towork (RTW) programs can help alleviate these concerns by supporting staff as they reintegrate into the workforce. These programs may entail having an injured employee return to work with shortened hours, lighter workloads or different tasks (also known as transitional duties) as they continue to recover from their occupational ailment.

RTW programs offer several benefits, allowing employers to keep their workers’ compensation costs under control and giving injured employees the opportunity to resume working even when they aren’t ready to take on their original job duties. In turn, such programs can allow employers to limit staff turnover, maintain productivity, boost morale and reduce litigation risks, all while helping injured employees retain their job skills, uphold workplace connections, minimize financial challenges and keep a healthier mindset during the recovery process.

In order for RTW programs to be successful, it’s important for employers to determine appropriate types of transitional duties for injured employees. After all, employees’

capabilities will vary based on their particular occupational ailments and associated recovery needs. If injured employees are assigned inadequate duties whether overly demanding or potentially demeaning they will be less likely to experience the full benefits of RTW programs.

In general, transitional duties can be divided into two main categories: alternative and modified This article provides more information on different types of transitional duties and highlights situations where these tasks are most suitable

A Alternative Duties

This category pertains to an injured employee being temporarily placed into an existing position within their organization, albeit one that’s less physically demanding than their original role. Examples of alternative duties include the following:

• C Clerical tasks This may entail answering phone calls and emails, filling out workplace documentation, making copies, addressing letters and packages, ordering inventory and sorting supplies.

• S Safety ta sks Such responsibilities may involve training new workers, updating safety resources and records to ensure compliance with applicable requirements (e.g., OSHA standards), conducting job site inspections and analyses, and acting as a spotter while other workers perform more high-risk tasks.

• M Ma intenance task s This may entail performing light housekeeping tasks, inspecting workplace vehicles and equipment for possible issues, and repairing damaged parts as needed.

This Work Comp Insights is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2024 Zywave, Inc. All rights reserved. Prins Insurance, Inc - Your Workers’ Compensation Partner

Alternative duties generally make the most sense for employees whose original roles involved more strenuous activities and manual labor (e.g., heavy lifting and material handling). Thus, these workers are better suited to office work and administrative tasks during recovery.

M Modified Dutie s

This category refers to an injured employee resuming their original job role, only with certain elements of the position removed or otherwise adjusted to comply with the worker’s current physical limitations.

For example, a warehouse employee recovering from an occupational back strain or shoulder sprain may be permitted to perform the majority of their job duties (e.g., taking inventory and moving boxes) but with slight alterations to specific tasks (e.g., only lifting boxes under 30 pounds or reaching for inventory at eye level).

On the other hand , this category may simply involve an injured employee returning to their original position but with a shortened workday For instance, a manufacturing employee recovering from a minor occupational hand injury may work four-hour shifts on the production line instead of their usual eight -hour shifts until their hand is fully healed.

In some cases, an injured employee may be able to supplement their modified duties with alternative duties to complete a full workday. In the previous example, the manufacturing employee could work four hours on the production line and then complete administrative tasks for the remainder of the workday to fulfill an entire shift.

Modified duties are often most fitting for employees with occupational ailments that limit their ability to handle the physical demands of a full workday or those who could be more prone to reinjury if they overexert themselves.

C Conclusion

RTW programs are an essential component of any workplace, providing various benefits for both employers and employees. By identifying appropriate transitional duties within these programs and assigning injured workers personalized and purposeful tasks, employers can minimize the fallout from occupational ailments and cultivate a supportive work environment for their staff.

Contact us today for additional workers’ compensation resources.

| Types of Transitional Duties in Return-to-Work Programs

NJLICA TRUCK SHOW

20 SPRING 2024 NJLICA NEWS

Dane Casamento, Over the Edge Excavating, Best Pickup Truck

Over the Edge Excavating

Jeff Neary, J.A. Neary Excavating, Best Service Truck

J.A. Neary Excavating

Jeff Bailey, Haskell Paving, Best Dump Truck

Haskell Paving

Dan Swayze & Son, Best in Show

Dan Swayze & Son

Scheideler Excavating

V.A. Spatz & Sons

V.A. Spatz & Sons

Dan Swayze & Son

Dan Swayze & Son

J.A. Neary Excavating

Over the Edge Excavating

NJLICA Dues and ERISA Trust Clarification

The NJLICA dues year runs from September 1-August 31 of each year. Dues invoices are mailed to every NJLICA member, both NJDOL public works and non-public works contractors, and associate members just after Labor Day. It is greatly appreciated if you pay your annual dues at that time.

NJDOL public works contractors are also required to make an annual contribution to the ERISA Trust Fund. This payment is legislated by the state of New Jersey and is due on the anniversary date of your company joining the Apprenticeship Program. These invoices are mailed a month prior to your anniversary date. Payment is required in order to remain compliant with the NJDOL and maintain your public works certificate.

Members that are participants in the United Fire Group Insurance Program will receive your renewal invoice in September as well. Payment is required at that time, not on the renewal date of your insurance. Payment is required to maintain your participation in the insurance program.

Incentives Being Offered to Employers and Employees of NJLICA Apprenticeship Program

Beginning with the September classes, employers placing an employee in the NJLICA Apprenticeship Program will see their ERISA Trust contribution reduced by two-thirds. For example, a $2,000 ERISA Trust contribution will be reduced to $666.

In addition, apprentices in the NJLICA Apprenticeship Program for craft laborers and heavy equipment operators will be given a cash bonus at the completion of each year of their involvement in the program. Those cash incentives can reach $15,000 for laborers and $22,500 heavy equipment operators.

Lastly, truck driver heavy apprentices will have the cost of their CDL class completely reimbursed upon completion of the program.

Please see page 29 for more information.

Interested in Being More Involved?

NJLICA continues to look for motivated people to assume committee positions within the association. With an ever-increasing membership and an expanded event calendar, there are a variety of committees (scholarship, events, membership, legislative, communication, etc.) to get involved with.

More Golf, Anyone?

The NJLICA Golf Classic has grown each year and has reached capacity. With that in mind, NJLICA will host two golf classics in 2024. Monday, August 19 marks the 36th Annual NJLICA Golf Classic, North at Black Oak Golf Course. Tuesday, September 17 will be the First Annual Golf Classic, South at the historical Banks Course at Forsgate Club in Monroe Township.

89 cents a day!

Please take a close look at the Member Benefits on page 30. For a mere $0.89 a day, you have access to the monthly Employment Law Webinar Series, quarterly Prevailing Wage educational webinars, and the LICA Safety Portal, a library of 800 safety videos. We are now developing a financial series of webinars designed to help your business.

SPRING 2024 21

Aaron Excavating

Aaron Excavating V.A. Spatz & Sons

George Vetter Landscaping

The ZW100-6 Hitachi wheel loader is perfect for a wide range of applications and job sites. In addition, it’s smooth and efficient to operate, and offers increased productivity and greater fuel efficiency.

We’re more than just your vendor. We’re your partner. We help you get the job done productively and predictably.

At Highway Equipment, we are SOLUTION PARTNERS. We help you find the right equipment and features, like the Hitachi ZW100-6, to get YOUR job done productively and predictably.

Your time is valuable. Your uptime is critical. Our proactive parts, services, and data experts are here to keep you running.

Heavy Equipment should be fun. With us, it is. We’re always on the lookout for ways to reduce friction and avoid complexity.

22 SPRING 2024 615 STATE ROUTE 33, MILLSTONE TWP, NJ 08535 | HIGHWAY-EQUIPMENT.COM 732.446.7600

SOLUTION PARTNERS URGENT ABOUT UPTIME JOY TO WORK WITH

HITACHI ZW100-6 WHEEL LOADER

URGENT ABOUT UPTIME SINCE 1933

FOR MORE INFORMATION VISIT US AT

24 SPRING 2024

CONTRACTOR INSURANCE

We can help you assess your risks and provide a rate plan comparison to find the best coverages and prices available in the market. We do the work for you so you can focus on your business.

BASIC & SPECIALIZED COVERAGES

• General liability

• Workers’ compensation

• Commercial auto and trucking

• Commercial umbrella

• Commercial property

• Inland marine (equipment)

• Equipment breakdown

• Pollution liability

• Employee benefits/health insurance

• Payroll and HR solutions

INSURANCE EXPERTISE

• Expert consultation and personal customer service

• Competitive rates and plan comparisons

• Consolidation between carriers

• Continuity of coverage

• Dedicated inhouse claims team

• Claim and premium dispute facilitation

WORLD INSURANCE ASSOCIATES

100 Wood Avenue South, Iselin, NJ 08830

732-380-0900 • yourteam@worldinsurance.com

YOUR BUSINESS, YOUR UNIQUE PROGRAM

We tailor your insurance plan to meet your specific needs:

• Highway, street and bridge

• GC, carpentry, roofing

• Plumbing, electrical, HVAC

• Drywall, plastering, painting

• Demolition, excavation, masonry

“World combined all of my insurance with one company, increased my protection, and saved me 35% on Auto, 55% on General Liability, and 25% on Workers’ Comp. Plus, their service team responds quickly and accurately to our requests. I highly recommend them to all contractors.”

Ruben Colonia, President Colony Fence Co., White Plains, NY

SPRING 2024 25

LARGE RESOURCES. LOCAL RELATIONSHIPS. WWW.WORLDINSURANCE.COM

NEW MEMBERS

THE NJLICA DUES YEAR RUNS FROM SEPT. 1-AUG. 31 OF EACH YEAR. THE 2024-25 DUES INVOICE WILL BE MAILED TO YOU JUST AFTER LABOR DAY. YOUR CONTINUED SUPPORT IS APPRECIATED.

GROWING BIGGER AND STRONGER

Contractor Members

EVERY DAY

ALNA Construction Corp.

Salvatore Albanese Secaucus, N.J.

Advanced Forestry Solutions LLC

Colin McLaughlin Port Norris, N.J.

Ali Al Trucking LLC

Alexander Robinson Bridgeton, N.J.

Anthem Construction LLC

Nick Vitcusky Newton, N.J.

B.E. Hassett Millwrights, Inc.

Ben Hassett Harrods Creek, Ky.

Bryan Drilling Co.

Kevin Wertman Netcong, N.J.

C. Imbriacco Tandem Dump Truck Services

Chris Imbriacco Edison, N.J.

CS Construction Improvement Systems LLC

Sergio Da Costa South River, N.J.

DEE-EN Electrical Contracting, Inc.

Dominick Livia Linden, N.J.

DLS Contracting, Inc.

Donato Salvatoriello Fairfield, N.J.

DNJ Transport LLC

Jose Lopez Elizabeth, N.J.

58 NEW MEMBERS IN THE FIRST QUARTER

DVS Trucking Company, Inc.

Dean Severino Rutherford, N.J.

E & E Graphics Sign Source LLC

Oscar Escobar Cranford, N.J.

E. Thomas Trucking LLC

Eric Thomas Vineland, N.J.

Eagle Contracting LLC

Joanne Vickery-DiTore Cherry Hill, N.J.

Eastside Bulk Transport LLC

James Hoffman

Lake Hopatcong, N.J.

Elegant Lawns & Landscaping, Inc.

Lauren Rabinowitz Inwood, N.Y.

Elemental Concepts, Inc.

Thomas Bubryckie Hackettstown, N.J.

Garrison’s Tree Service LLC

Jeffrey Garrison Newfield, N.J.

Gotthold Contractors LLC

Onan Barrera Ridgefield, N.J.

H & W Trucking LLC

Wesley Sanches Freehold, N.J.

J & L Industries LLC

Julian Gonzalez-Vanegas Elizabeth, N.J.

J & P Grupo, Inc.

Pedro Rodrigues Elizabeth, N.J.

J.P. Williams, Inc.

Cheryl Williams Toms River, N.J.

JGM Excavating LLC

Jonas Mieres Parsippany, N.J.

JTS Construction LLC

Justin Stewart Glassboro, N.J.

Ken’s Marine Service, Inc.

Raymond Huckemeyer Bayonne, N.J.

Lakewood Group Corp.

Michelle Frassetti Marlboro, N.J.

Lefty’s Trucking LLC

Lamont Woodson Hammonton, N.J.

GET INVOLVED

THE NJLICA BOARD HAS POSITIONS AVAILABLE FOR THE FOLLOWING COMMITTEES:

and Live Auction

26 SPRING 2024

Silent

Member

Member

Monthly

Events: State

Golf Classic Beefsteak Dinner Holiday Awards Dinner

Membership Scholarship Legislative Communications and Marketing

Programming and Social

Networking/Education

Meetings

Conference

LJI Transport LLC

Ellis Miller Browns Mills, N.J.

Lombardo Excavating, Inc.

Jonathan Lombardo Newton, N.J.

Lourenco Contracting Co., Inc.

Mauro Lourenco Hazlet, N.J.

M & L United Truck Lines LLC

Mark Barsoum Clifton, N.J.

M & N Restoration LLC

Nevena Olcan Totowa, N.J.

M. Walley Construction

Martin Walley Linwood, N.J.

Mainline Fuel Service, Inc.

Wanda Vargas Bridgeton, N.J.

Mauro Material Solutions LLC

Sal Mauro Keasbey, N.J.

McCullough Tree Experts LLC

Sue Ellen Donahue Sussex, N.J.

Metropolitan Trucking Group LLC

Gennaro Fusella Morristown, N.J.

Mount Materials LLC

David Smith Berlin, N.J.

NextGen Services Group

Aaron Taschek Marlton, N.J.

North East Group

James Funfgeld Yaphank, N.Y.

Paramount Facility Management Solutions

Robert Sena Branchburg, N.J.

Pedowitz Machinery Movers of NJ

Craig Levine, Jr. Lebanon, N.J.

Pineland Construction

Frank Edwardi

Sea Isle City, N.J.

Pineland Recycling LLC

Frank Edwardi

Sea Isle City, N.J.

R. Guzman Transport LLC

Mirian Manchego Manalapan, N.J.

S & B Property Maintenance, Inc.

Adolfo Salazar Prospect Park, N.J.

Sand Castle Excavation LLC

Joseph Andrzejczak Villas, N.J.

Service Master by DRS

Tariq Bour Cranford, N.J.

Subsurface Technologies, Inc.

Chris Catania Rock Tavern, N.Y.

Tony Casale, Inc.

Bill Andrews Yonkers, N.Y.

TTL Services LLC

Lesley Dominguez Ridgewood, N.J.

Valiant Contracting LLC

Thomas Juskus Lake Hopatcong, N.J.

Victor Dos Santos

Victor Dos Santos Clark, N.J.

XII Wheels Contracting LLC

Nathan Boone Millville, N.J.

Youngs Water & Sewer, Inc.

Kimberly Young Howell, N.J.

Associate Members

Citizens

Dragana Jovanovic Jersey City, N.J.

VISION STRONG MANAGEMENT GROUP

Buddy Freund PO Box 166 Succasunna, NJ 07876 973-753-2800

buddy@govisionstrong.com govisionstrong.com

Vision Strong Management Group provides full-service association management services for associations, foundations, societies, and trade organizations. Add your company name to our Patron Directory. Contact NJLICA Executive Director Buddy Freund at 973-630-7600 or buddy@govisionstrong.com.

SPRING 2024 27 PATRONS

• Instill your company’s culture and retain workers

• Recruit and develop a diverse and highly skilled workforce

• Improve productivity, profitability, and your bottom line

• Reduce turnover, improve loyalty, and retain top talent

• Demonstrate investment in your community

28 SPRING 2024 NJLICA • PO Box 166 • Succasunna, NJ 07876 • www.NJLICA.org NJLICA is looking for LABORER, OPERATOR, & TRUCK DRIVER APPRENTICES New

NJLICA

hires and/or existing employees or Hire an apprentice from the

Apprenticeship Program How Can Apprenticeship Training Help Your Company?

This Education Has Two Facets: On The Job Training and Classroom Instruction Your Apprentice will Learn and Produce Better Quality Work, Moving You Forward at No Additional Cost to the Employer! For Questions Or To Enroll Your Apprentice Today Simply Contact: Buddy Freund, Executive Director At Buddy@govisionstrong.com 973-630-7600

Over the past 2 years LICA has implemented a quali ed DOL Apprenticeship program, for Truck Drivers (1 year) Laborers (2 years) and Heavy Equipment Operators (3 years) that we are very proud to o er to our members. Apprentices can help give your company the boost you didn't even know it needed. With an apprentice on hand to take on some of the smaller tasks, it frees up your more experienced sta to concentrate on key areas of work and spend time on other tasks – making your overall business practices more productive. LICA has also built into the program employer and employee incentives.

When enrolling an apprentice(s) in one of the trades listed above, and if you are contributing to the ERISA trust, this will decrease your required contribution to 1/3 of your cost. Example, If you are paying $2000 into the trust you will only be require to contribute $666.

Employers who sponsor apprentices gain skilled workers, reduce employee turnover, and improve productivity. Apprenticeships can also help businesses address any critical or expected shortages of skilled labor at a time when many businesses are reporting that they cannot nd skilled workers to ll jobs.

LICA recognizes that in ation is at a high, food and gas are expensive, just about every aspect of our everyday lives have a hefty price tag. erefore, we wanted to help our apprentices with the following:

Truck Drivers will receive:

• $3000 upon completion of the program, OR CDL class paid for by NJLICA.

• Available to the rst 12 who enroll in the program

Laborers will receive:

• $7,500 for the rst year completed (payment made upon start of second year)

• $7,500 for the second year completed (payment made upon graduation)

• Available to the rst 10 who enroll in the program

Heavy Equipment Operators will receive:

• $7,500 for the rst year completed (payment made upon start of second year)

• $7,500 for the second year completed (payment made upon start of third year)

• $7,500 for the third year completed (payment made upon graduation)

• Available to the rst 14 who enroll in the program

Contact: Tracy Carver: tcarver@tlc4prevailingwage.com Buddy Freund: buddy@govisionstrong.com

SPRING 2024 29

30 SPRING 2024 • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • NJLICA

A bigger bang for your buck •

MEMBER BENEFITS

2024 TOTAL PRO EXPO

Total Pro Expo 2024 attracted over 2,000 attendees to this industry two-day event. NJLICA provided a business education track that included OSHA 10 training, CPR and Stop the Bleed certification, a New Jersey state trooper roadside inspection, classes on how to develop a safety program, best practices for construction equipment maintenance, reading and understanding grading plans, and new technology in construction. Mark your calendars for Total Pro Expo 2025, January 29-30.

Scheideler Excavating Co. EVENTS

NJLICA Spring Dinner Meetings Make a Big Hit!

Director of Business Development for Renova Environmental Company, Jack Lennox, accepts the NJLICA Safety Recognition Award from NLICA President, Dennis Mikula, Jr.

The Spring Dinner Meeting, North was held at Foley Caterpillar in Piscataway. Sixty attendees were treated to a great meal and a presentation on digital solutions for equipment management, parts ordering, and rental fleet management provided by the staff at Foley Caterpillar.

The Spring Dinner Meeting, South was held at The Cabin in Freehold. Tony Salati of Fleetwatcher gave the 60 in attendance great insight into the management and utility of operational data in real time and the ROI requirements of Telematics. Todd Ressler of Sitework Estimating Consultants provided the group great insight into saving money on sitework estimating.

Certainty is what we have delivered to the New Jersey Construction industry for over 40 years.

Grassi’s Construction advisors and accountants provide the industry knowledge and guidance that construction professionals need to make confident business decisions.

Advisory | Tax | Audit

Carl Oliveri, CPA, CCIFP, CFE, MBA Partner, Construction Practice Leader grassicpas.com/construction

You’ve worked hard to construct a reliable business that takes pride in excellent workmanship. That matters.

UFG Insurance knows the importance of protecting the reputation you’ve built.

As the carrier of choice, we’re proud to offer members of the New Jersey Chapter of LICA a special opportunity to participate in our trusted state LICA insurance program.

Receive products and services tailored to unique industry needs, including comprehensive risk control.

Exceptional customer service that doesn’t end when a contract is signed.

HARD WORK. RELIABILITY. PRIDE.

It’s what matters.

CEDAR RAPIDS, IA Find a UFG agent today at ufginsurance.com. © 2022 United Fire & Casualty Company. All rights reserved.

34 SPRING 2024

EMPLOYMENT LAW WEBINAR SERIES

SPRING 2024 35 35 WINTER 2024

ALL WEBINARS FREE FOR NJLICA MEMBERS PREVAILING WAGE WEBINARS

NJLIC A SAVE THE DATES! Buddy Freund, Executive Director 973-630-7600 | buddy@govisionstrong.org www.njlica.org 36th Annual Golf Classic - North MONDAY, AUGUST 19TH, 2024 Black Oak Golf Club | Long Valley, NJ 1st Annual Golf Classic - South TUESDAY, SEPTEMBER 17TH, 2024 Forsgate Country Club | Monroe Twp, NJ PLAY ONE... EITHER ONE! PLAY BOTH! SPONSOR ONE... EITHER ONE! SPONSOR BOTH! Registration and Sponsor information to follow.

Construction, Forestry

Experts in Road Building & Minerals

Walk Behind Loaders & Trenchers

Land Surveying

Multi-Tip Dump Trucks

Low Boy & Easy Loader Trailers

Locations

Road Maintenance

Shrewsbury, MA • Fairfield, NJ • Lumberton, NJ

South Plainfield, NJ • Deer Park, NY • Beacon, NY

Middletown, DE • Baltimore, MD • Frederick, MD • Delmar, MD

District Heights, MD • Waldorf, MD

SPRING 2024 37

Asphalt Pavers & Sweepers

Hydraulic Hammers & Compactors

38 SPRING 2024 AD INDEX M. Adams & Associates: 25 a Division of World NJLICA 28 North American Aggregates 15 Power Patch 16 Precision Hydraulic & Oil 23 Prins Insurance 33 Scheideler Excavating 31 Tilcon inside front TLC4 Prevailing Wage back cover Tri-State Safety Solutions 9 True & Associates: 7 a World Company

are

content. Promote your business by sponsoring an ad, or send us articles and

published in a future issue of The Underground. For more information on how you can be featured,

Buddy Freund NJLICA Executive Director 973-630-7600 buddy@govisionstrong.com CONTACT US HEY, YOU! WRITE TO US! Have a story idea? SEND IT! Got a great photo? SEND IT! Have some feedback for us? SEND IT! COMPANY PAGE NUMBER Brent Material Company 17 Bucket Supply & inside back Equipment Parts Cut Wright 3 DAG Onsite Crushing 24 Genova Burns 13 Grassi Advisors & 32 Accountants GT Mid Atlantic 8 Highway Equipment 22 JESCO 37 Lindabury, McCormick, 6 Estabrook & Cooper, P.C.

We

on the lookout for

photographs to be

contact:

NJLICA

NJLICA

PO Box 166

Succasunna, NJ 07876

If you are an open shop contractor there are many reasons to implement a prevailing wage plan. As a contractor working on 20% or more state/federal government work there are quite a few advantages to company, employee and employer that can help to move your business forward.

• Save on payroll burden; WC, GL, FICA, FUTA, SUTA

• Fringes help pay for company sponsored employee bene ts

• Become more competitive when bidding; Win more bids!

• Employee receives pre-taxed retirement plan

• Compliance is top priority at TLC4 Prevailing Wage, keeping you compliant

• Levels the playing eld between union/open shop companies

BY NICK YAKSICH

BY NICK YAKSICH

BY ANTHONY MORREALE

BY ANTHONY MORREALE

BY FRANK HORAN

BY FRANK HORAN

Jennifer Roselle, Esq.

Jennifer Roselle, Esq.

Patrick W. McGovern, Esq.

Patrick W. McGovern, Esq.

NJLICA

NJLICA