UNDERGROUND THE

NJLICA’S QUARTERLY PUBLICATION

What you need to know about the Corporate Transparency Act, the future of electric vehicles in the construction industry, and cyber strategies.

What you need to know about the Corporate Transparency Act, the future of electric vehicles in the construction industry, and cyber strategies.

We help our clients manage and protect their most valuable assets—their people and their business.

As part of the World Insurance Associates family, we offer our clients top products and services from the best providers that span all of your personal and commercial needs. You will continue to get the white-glove service and personal touch of your local agent. Call or email us today to learn

As president of the Board of Directors, I would like to take this opportunity to share my thoughts on the current political and economic landscape following the recent presidential election, as well as our expectations for New Jersey’s gubernatorial election in 2025.

Election outcomes at the state and federal levels profoundly impact our industry. They influence everything from infrastructure investments and land use regulations to workforce development and environmental policies. With the presidential election behind us, we anticipate policy priorities shifting that could affect funding for infrastructure projects, land improvement initiatives, and environmental conservation efforts. These changes bring opportunities and challenges for contractors like us.

policies that support our work, address our challenges, and promote the growth of our sector.

As members of this association, we must remain engaged and informed to ensure our voices are heard on these critical matters. NJLICA will continue leading efforts to equip our members with the knowledge and resources needed to tackle these challenges.

I encourage all of you to participate in our initiatives, share your perspectives, and stay involved as we collectively work to shape the future of our industry. Your contributions and dedication make us a strong, united voice for land improvement in New Jersey.

NJLICA BOARD OF DIRECTORS

Dennis Mikula, Jr., President Mikula Contracting, Inc.

Mark Krutis, Vice President Tom Krutis Excavating, Inc.

William J. Esposito, Historian Espo's Tree and Crane Service

Frank C. Del Guercio Tilcon NY

Ron Garofalo

DAG Mobile Aggregate Recycling, Inc.

Warren Gonzalez Foley, Inc.

The upcoming gubernatorial race in New Jersey will be pivotal. The next governor’s stance on critical issues such as development incentives, regulatory reform, and public works investment will play a crucial role in shaping the future of our state’s industry. This is why NJLICA has retained a lobbyist to safeguard our industry’s best interests. Our lobbyist works tirelessly to advocate for

Thank you for your unwavering commitment to our work and mission. Together, with a proactive approach and a clear voice in the legislative arena, we can overcome challenges, seize opportunities, and build a thriving future for our industry and our communities.

Wishing everyone a successful year in 2025!

Best Always,

Dennis Mikula, Jr. President, NJLICA

Shelly Hewson Hewson Landscape, Inc.

Frank Horan Groff Tractor Mid Atlantic, LLC

Bob Manis North American Aggregates

Joe Mayers Septic Experts, LLC

John Rothberg L.N. Rothberg & Son

Dave Vander Groef Wantage Excavating Co., Inc.

Buddy Freund, Executive Director

BY FRANK HORAN

The construction industry is standing at the threshold of a transformative shift. While heavy machinery has historically relied on diesel engines to power everything from excavators to bulldozers, the rapid adoption of electric vehicles (EVs) is poised to change the face of construction equipment. With sustainability at the forefront of global initiatives, electrification is no longer just a trend but a strategic imperative for the future of construction.

From reducing carbon footprints to lowering operational costs, the potential benefits of electric vehicles in construction are vast. As the industry moves toward cleaner and more efficient alternatives, here’s a look at why electric-powered machinery is gaining traction and what the future holds.

The construction industry is one of the largest contributors to global carbon emissions. According to the International Energy Agency (IEA), construction equipment accounts for a significant portion of worldwide diesel consumption and related CO2 emissions. As sustainability efforts intensify, construction companies are facing growing pressure to reduce their environmental impact. Governments across the globe are setting ambitious carbon reduction targets, and in response, many regions are tightening emissions regulations for machinery.

This regulatory environment is one of the driving forces behind the growing adoption of electric vehicles and equipment in construction. With the added incentive of potential tax rebates, subsidies, and green building certifications, companies are finding that investing in electric machinery can not only meet regulatory requirements but can also enhance their reputation and appeal to environmentally-conscious clients.

The transition to electric machinery in construction is already underway. Over the past decade, advances in battery technology and electric drivetrains have paved the way for electric-powered construction vehicles that offer performance comparable to their diesel counterparts — but with far fewer emissions. The current portfolio of electric construction equipment includes everything from electric excavators and wheel loaders to compactors, dump trucks, and forklifts.

One of the key benefits of electric equipment is the lower total cost of ownership. While the upfront cost of electric machinery may be higher, it is quickly offset by savings in fuel and maintenance. Electric vehicles have fewer moving parts than their internal combustion engine counterparts, which reduces wear and tear and lowers the need for routine servicing like oil changes and air

filter replacements. Additionally, the cost of electricity is generally lower than diesel fuel, further driving down operational costs.

Electric excavators are one of the most exciting innovations in the field of construction machinery. Historically, excavators have been among the most fuel-hungry machines on construction sites, burning large amounts of diesel to perform heavy digging and lifting tasks. But today, electric versions of these workhorses are offering a cleaner, quieter alternative.

Electric excavators are designed to provide the same powerful performance expected from their diesel equivalents, but with zero emissions and quieter operation. These machines are especially well-suited for urban job sites where noise pollution and air quality are critical concerns. The future of electric excavators is particularly bright, as manufacturers continue to improve battery life and power output, making them suitable for longer work shifts and more demanding tasks.

One of the biggest hurdles to the widespread adoption of electric vehicles in construction is battery technology. While electric vehicles in other industries, such as passenger cars, have benefited from rapid improvements in battery energy density and efficiency, construction equipment operates in more extreme conditions and requires higher levels of power output.

However, advancements in battery technology are already enabling electric construction equipment to achieve longer run times and faster charging capabilities. Batteries are becoming lighter, more efficient, and quicker to charge, which means electric equipment can spend more time on the job and less time tethered to charging stations.

Manufacturers are also exploring fast-charging options and wireless charging systems, which will reduce downtime even further. In the future, we may see “battery swapping” stations, where construction fleets can quickly exchange depleted batteries for fully charged ones, similar to the way refueling stations operate for gasoline or diesel vehicles today.

The urbanization of construction sites, particularly in densely populated areas, presents both challenges and opportunities for electric machinery. Urban construction projects often involve tight spaces and noise-sensitive environments, such as residential neighborhoods or school zones. Diesel-powered machines, known for their loud engines and heavy emissions, are increas-

PHOTO BY FRANK HORAN

ingly being seen as unsustainable in such contexts.

Electric construction equipment is uniquely positioned to address these challenges. With near-silent operation and zero tailpipe emissions, electric machines are ideal for working in locations where noise restrictions are in place or where air quality is a major concern.

Moreover, the compact and agile nature of some electric equipment, like smaller electric skid steers and excavators, makes them ideal for high-density urban projects, including building renovation and infrastructure upgrades in busy city centers.

As battery technology improves and charging infrastructure expands, the focus of many manufacturers is shifting toward hybrid solutions that combine the benefits of both electric and traditional combustion engines. These hybrid systems allow for better power management, longer operational hours, and the flexibility to switch between electric and diesel power depending on the demands of the task.

At the same time, autonomous electric construction vehicles are gaining attention. Automation is already beginning to play a role in improving the efficiency and safety of job sites, and electric vehicles, with their cleaner, more controlled power systems, are likely to play a central role in the evolution of autonomous equipment. Self-driving electric excavators, bulldozers, and even cranes are expected to increase productivity while reducing human error, all while maintaining zero emissions.

While the outlook for electric vehicles in the construction industry is promising, there are several challenges to overcome before electric machinery becomes the standard.

1. High initial costs: While the long-term savings on fuel and maintenance can be substantial, the initial cost of electric construction vehicles is still higher than diesel-powered machines. However, as production scales up and technology improves, these costs are expected to decline.

2. Charging infrastructure: The expansion of charging infrastructure on construction sites is essential to the widespread adoption of electric vehicles. To maximize efficiency, fast-charging stations and convenient charging options need to be available on-site.

3. Battery range and performance: For large-scale projects, ensuring that electric equipment can handle the demands of a full workday without requiring multiple charges is a key challenge. As battery technology continues to evolve, these limitations will likely be addressed.

4. Industry education and training: The transition to electric machinery will require education and training for construction crews. Operators must become familiar with new charging protocols, maintenance requirements, and the different ways in which electric machines behave compared to traditional machinery.

The future of electric vehicles in construction is bright, and the transition to electric-powered machinery is no longer a matter of if, but when. As technology continues to evolve, electric construction equipment will become more powerful, more affordable,

and more widely available. The industry stands on the cusp of a cleaner, more sustainable era, where electric vehicles play a central role in reducing emissions, improving efficiency, and driving down costs.

As the transition to electric machinery continues to gain momentum, companies that embrace these technologies will be better positioned for the future — improving their environmental impact, operational efficiency, and bottom line. The journey to electrification in construction is well underway, and we’re just beginning to see the immense potential that lies ahead.

Frank Horan is a territory manager with GT Mid Atlantic, a proud member of NJLICA and an equipment dealer with 15 locations in New Jersey, Pennsylvania, Delaware, and Maryland. “Your #1 source for everything under construction.”

BY ALADAR G. KOMJATHY

The fall has been a busy time with elections and legislative sessions going on.

On November 5, Vice President Kamala Harris was defeated by now President Elect Donald Trump by 5%, the best result for a GOP presidential candidate in 30 years.

Congressman Andy Kim was elected to the U.S. Senate, defeating Curtis Bashaw by a closer margin than normal. Kim replaces the long-time Sen. Bob Menendez, who was convicted of several counts of various crimes.

New Jersey elected three new members of Congress:

Dr. Herb Conaway, a veteran member of the New Jersey Legislature, was elected to be the Congressman of the Third District, the seat vacated by Congressman Kim.

State Senator Nellie Pou was elected to fill the seat vacated by long time Eighth District Congressman, Bill Pascarell. Newark Councilwoman Monic McIvyer was elected to the seat of the late Congressman Donald Payne Jr. who passed away earlier this year.

2025 Governor’s Race

The primary election is now underway with at least seven Democratic candidates and four Republican candidates planning runs for governor.

My final two years of working as a full-time lobbyist in Washington, D.C. were the first two years of President Trump’s first term in 2017. All three branches of government — the legislative, executive and judicial — quickly learned that it was no longer business as usual. This is what his supporters expected, and he delivered. Corporations had been exposed to this new form of management — disruption — but the halls of Congress had never seen the shake up that came even before President Trump was sworn in.

Now with a resounding victory squarely in his hands, President-elect Trump is again preparing to move quickly in naming his cabinet and starting his term with a series of actions which he campaigned on. The final makeup of the House and Senate has not been determined, but clearly a mandate has been given to Republicans to lead the government. Speaking of leadership, one of the important steps that will be taken when Congress returns to Washington will be to select House and Senate leadership who will work closely with the president to advance his agenda.

NJLICA was honored to have Republican candidate for governor, Jack Ciattarelli, speak with our members at the Annual Beefsteak Dinner in September. His message was well received. Ciattarelli will continue to reach out to NJLICA to hear our membership’s concerns.

Legislative Updates

We continue to monitor various pieces of legislation which affect NJLICA and it’s members:

• S 1397 (Singleton): Requires certain disclosure by providers of Commercial Financing

• S 3817 (Diegnan) & A4967 (Calabrese): Requires NJDEP to implement Advanced Clean Truck regulation no later than Jan. 1, 2027

We also continue to monitor other pieces of business legislation which affect small businesses.

Aladar G. Komjathy & Keen LLC represent NJLICA's interests in Trenton with both the legislative and executive branches of government.

BY NICK YAKSICH

Here are just a few important issues to land improvement contractors I anticipate being front and center in the new Administration and Congress:

Significant tax legislation is required to extend tax provisions in the Tax Cuts and Jobs Act (TCJA) signed into law by then-President Trump nearly five years ago. This must-pass bill will encourage a broad range of tax policies, such as reducing the corporate tax rate, bonus depreciation on capital goods, estate tax reform, extending the cap for state and local tax deduction, and other provisions for both large corporations and small businesses.

It is unlikely that the lame duck Congress will consider the Farm Bill (except a short-term extension of current law) that has expired and is critical to rural America. The change in Senate majority will allow Republicans early next year to restructure the existing

farm programs based on their priorities. The biggest policy issue will be how the funds are authorized between commodity and nutrition programs.

Through the appropriations process and the Inflation Reduction Act, millions of additional federal dollars were pumped into existing and new conservation programs. Much of this funding has been slow to be implemented. Priority emphasis from NRCS has been given to urban agriculture, diversity in hiring, and climate change initiatives. Safe to say these priorities will be dismissed and new priorities will be launched by the administration as part of the Farm Bill and the work of the yet named secretary of agriculture.

It was President Trump in his first term who initiated the largest investment in infrastructure this nation has experienced. President Biden was able to pass the bill through Congress using mostly deficit spending. You can see this investment be put in place all across New Jersey, whether it is road construction, broadband, airport improvements, mass transit upgrades, etc. President Trump’s

team will lead the effort to reauthorize the Infrastructure Bill in the next Congress. The same challenge that stymied President Trump’s success in passing a massive infrastructure bill — how to pay for it — will again challenge Congress and the administration in the reauthorization. Increase in the federal gas tax last occurred in 1992. It won’t happen in the next four years.

A clear message from the business community is that regulations are stifling business growth and opportunities. Across the government, actions will be taken to reduce federal regulations. This will be done through executive order and legislation action. Removing and/or reducing climate change and workplace hiring practices are two areas that will receive early attention by the administration.

The above are just a few top of line issues that come to mind as the swirl of the election slows and the move to governance begins. Stay tuned and buckle up for the ride!

Nick Yaksich serves as the director of government relations for LICA.

If you are an open shop contractor there are many reasons to implement a prevailing wage plan. As a contractor working on 20% or more state/federal government work there are quite a few advantages to company, employee and employer that can help to move your business forward.

• Save on payroll burden; WC, GL, FICA, FUTA, SUTA

• Fringes help pay for company sponsored employee bene ts

• Become more competitive when bidding; Win more bids!

• Employee receives pre-taxed retirement plan

• Compliance is top priority at TLC4 Prevailing Wage, keeping you compliant

• Levels the playing eld between union/open shop companies

New Jersey is one of the few states that impose a transfer inheritance tax. This tax is levied on the right to receive property from a decedent. It applies to both residents of New Jersey and non-residents who own real or tangible personal property located within the state.

Who pays the tax?

The tax is imposed on the beneficiary, not the estate. However, the executor is responsible for paying the tax and filing the necessary returns, unless the decedent’s will directs otherwise. Beneficiaries are classified into distinct categories, and their classification determines whether they will be taxed and at what rate.

1. Class A Beneficiaries: These include spouses, civil union partners, children, grandchildren, great-grandchildren, stepchildren (but not step-grandchildren), parents, and grandparents. Transfers to these individuals are entirely exempt from the inheritance tax.

2. Class C Beneficiaries: Siblings, sons-in-law, and daughters-in-law are included in this class. The first $25,000 transferred is exempt, and the tax rates range from 11% to 16% on the amount in excess of $25,000.

3. Class D Beneficiaries: This class encompasses all other individuals, including nieces, nephews, cousins, and friends. The tax rate for Class D beneficiaries is 15% on amounts up to $700,000 and 16% on amounts above that threshold.

4. Class E Beneficiaries: Charitable organizations, churches, and other tax-exempt entities are considered Class E beneficiaries and are fully exempt from paying any inheritance tax.

The tax is applied to property valued at $500 or more that passes to a beneficiary. This includes real estate, tangible personal property, bank and brokerage accounts, stocks, and bonds. Certain assets, such as life insurance proceeds paid directly to a named beneficiary, are exempt from the tax. However, the tax applies to any assets owned in a revocable trust. Gifts made within three years of death may also be taxed if they are considered to have been made in contemplation of death.

The transfer inheritance tax return must be filed and the tax paid within eight months of the decedent’s death. If the tax is not paid within this period, interest accrues at a rate of 10% per year on any unpaid amount. Executors file the return and pay the tax on behalf of the beneficiaries. The New Jersey Division of RevenueInheritance and Estate Tax Branch examines the return and issues

BY ANNE MARIE ROBBINS

inheritance tax waivers, which release the tax lien on certain assets and allow the assets to be fully collected by the estate or the beneficiaries.

Beneficiaries who fall outside of Class A are most impacted by the inheritance tax. For example, if a decedent leaves a bequest of $100,000 to a niece, the niece will owe $15,000 in inheritance tax. If the same bequest were made to a child of the decedent, no tax would be due.

Step-relatives also present unique challenges. While stepchildren are considered Class A beneficiaries and bequests to them are exempt, step-grandchildren fall under Class D and are subject to the tax.

Several planning strategies can help reduce or avoid the transfer inheritance tax. For instance, using life insurance policies to transfer assets to non-Class A beneficiaries can be an effective way to bypass the tax, as life insurance proceeds are generally exempt. Another approach is creating irrevocable trusts during a grantor’s lifetime, which can provide for the transfer of assets to beneficiaries without incurring inheritance tax.

New Jersey’s transfer inheritance tax continues to be a significant factor in estate planning, especially for individuals who wish to make bequests to beneficiaries outside of their immediate family. Proper planning, including the use of tax-exempt assets, and strategic gift planning, can help minimize its impact. Executors should be mindful of deadlines and filing requirements to avoid penalties, ensuring a smooth transfer of assets to beneficiaries. For further details, consult with an estate planning attorney to tailor a strategy that fits your specific circumstances.

Lindabury, McCormick, Estabrook & Cooper, P.C. provides litigation and transactional counsel to a broad spectrum of clients in the construction industry. Anne Marie Robbins is a partner in the firm’s Wills, Trusts & Estates group. She can be reached at arobbins@lindabury.com.

Pay Transparency Is (Probably) Coming To New Jersey

This article discusses a bill on pay transparency which has passed both houses of the New Jersey legislature and is on the governor’s desk for signature. There is a high likelihood that the governor will sign the bill into law. The law would become effective seven months after the governor signs the bill.

What is pay transparency?

Pay transparency laws generally require employers to post the compensation and benefits attached to a specific position in their job postings. The salary range must be fairly specific and realistic. The requirement appears harmless and places the job applicant in the status of an informed job seeker. These laws, however, effectively permit current employees to learn the going rate for their own or comparable jobs.

Can pay transparency expose employers to liability?

Where pay transparency is required, unless the employer is perfect, that employer should expect requests for salary adjustments (“You are advertising for a job paying $25 an hour, and I make $23 an hour, even though I’ve been working for you for three years, and my performance reviews are always acceptable and above.”) and claims of unequal pay (“You just hired a younger man to fill this job, and pay him more than your older, female employees performing the same work for years.”).

Characteristics protected under New Jersey law include race, creed, color, national origin, nationality, ancestry, age, sex (including pregnancy), familial status, marital/civil union status, religion, domestic partnership status, affectional or sexual orientation, gender identity and expression, genetic information, military service, and mental or physical disability. This means that almost every employee who feels that they are not earning fair wages or wages comparable to new hires can use compensation information required in job postings to advance a claim for discrimination or unequal pay. With that concept In mind, let’s examine the New Jersey Pay Transparency Bill.

What are the core requirements of the New Jersey Pay Transparency Bill?

The key provisions of the bill require employers to place employees on notice of advertised promotional opportunities within their departments. This means that if an employer either internally or externally advertises vacant positions, then the employer must take “reasonable efforts” to notify employees in that department of the opportunity. This requirement would not apply to promotions based on years of service or performance.

The bill also requires that each advertisement for a job or transfer opportunity include the hourly wage rate/salary, or salary range for the position, and must also generally describe the benefits and compensation programs that attach to the job. The employer, however, retains the discretion to increase the salary when it makes the job offer.

Are all employers subject to the proposed law?

The bill would apply to only those employers and labor organi-

BY BRIGETTE N. EAGAN

zations with 10 or more employees over 20 calendar weeks who: 1) do business, 2) have employees, or 3) accept employment applications in New Jersey. Public employers, including the state of New Jersey and the various counties and municipalities throughout New Jersey would also be subject to the law.

Are there any exempted employers under the bill?

If an employer has 10 or more employees, then it would be subject to this proposed law. The bill provides for one small limitation for consulting and temporary help firms; these employers would be exempted from posting salary and benefits for potential jobs and would only have to comply with the transparency requirements for existing, available positions.

What are the statutory penalties For non-compliance?

Violations would carry the penalty of $300 for the first violation and $600 for subsequent violations.

How should New Jersey employers prepare for pay transparency?

As with most sticky situations, prevention is the best remedy. Employers should consider reviewing their staff’s compensation, along with their job duties, responsibilities, workloads, and performance, to determine if staff receive equal pay for equal work. When benchmarking new positions, pay in the local job market should not be the sole consideration. Employers should also think about benchmarking vacant positions against staff’s current compensation to prevent similar unequal pay claims. Finally, employers may want to consider standardized ranges for salary increases, as opposed to a discretionary amount for each employee. Having a set range (for example 3% for an average performance evaluation, 5% for exceptional performance) will help justify salary differentials and also help defend against any unequal pay claims. As we close the year and prepare for performance appraisals and salary adjustments, pay transparency best practices can be integrated into year-end compliance.

For over 30 years, Genova Burns has partnered with companies, businesses, trade associations, and government entities on matters in New Jersey and the greater northeast corridor between New York City and Washington, D.C.

The Federal Motor Carrier Safety Administration (FMCSA) has implemented a new policy where user accounts on the Clearinghouse portal will be automatically deleted after 90 days of inactivity. This action is significant as the FMCSA Clearinghouse is a required database search for anyone hiring a driver covered by the FMCSA for employers, providing vital information about drivers’ Drug and Alcohol Program violations. Therefore, to ensure uninterrupted access to this vital resource, users must ensure the regular activity of their accounts. Losing access to your account might disrupt your operations and compliance with FMCSA regulations. Additionally, account deletions due to inactivity will require users to undergo the entire registration process again, which could lead to potential delays in verifying drivers’ compliance with drug and alcohol regulations.

What does “Activity” mean?

Activity on the FMCSA Clearinghouse portal entails actions such as logging in, conducting queries, reporting violations, or managing consent requests. Merely opening the website or checking your profile will not be considered an activity that resets the 90-day counter. To clarify, even if you’re not running any queries, reporting violations, or managing consent requests, you MUST, at a minimum, log in quarterly to prevent your account from being deleted.

Big Truck Co. has 12 long-term employees and only hires drivers in January each year. They ran their annual queries on March 1 and had no violations to report. Unfortunately, they did NOT log in by May 30, and their account was deleted due to inactivity. They must now re-register their company to stay in compliance.

Rolling Tire Inc. has 10 long-term employees and is not hiring anyone in the near future. They ran their annual queries on March 1 and had no violations to report. They proactively log in every two months to maintain compliance. They logged in on May 1, reset their 90-day timer, and their account is still active and in compliance.

To prevent automatic deletion due to inactivity, there are several steps you can take:

Regular login: Ensure to log into your FMCSA Clearinghouse account at least once every 90 days.

• Conduct queries: Periodic queries about prospective and current drivers not only keep your account active but also help you maintain compliance with FMCSA regulations.

• Report violations: Should any violations occur, report them immediately through your Clearinghouse account.

BY ANTHONY MORREALE

• Manage consent requests: Respond promptly to any consent requests from prospective or current employees.

By carrying out these steps, your account will remain active and safe from deletion, ensuring you continued access to the Clearinghouse’s invaluable resources.

What

Tri-State Safety Solutions, LLC professionals can assist you with your FMCSA Clearinghouse needs, including:

• Reporting certain violations on your behalf.

• Performing queries on your behalf when requested (orders must be placed through our background services; DISA does not conduct queries automatically).

• Assisting in tracking the completion of queries through

• Driver qualification services.

Contact us for more information on FMCSA Clearinghouse Service.

For assistance with your USDOT and OSHA compliance, don’t hesitate to get in touch with Anthony Morreale, co-owner of TriState Safety Solutions, at 732-551-3833, amorreale@tsss-nj.com, or visit our website, www.tsss-nj.com.

MANAGEMENT

As a contractor, embarking on a surety program might seem challenging, but with the right information and guidance, the process becomes straightforward. Understanding the surety’s objectives is essential — they seek to prequalify you to assess your risk profile, as they are essentially investing in your ability to successfully complete construction projects.

The first crucial step in preparing for a surety program is choosing an experienced agent who possesses extensive surety knowledge and has established relationships with multiple markets. Your agent plays a pivotal role; they need to grasp your business operations and your future strategies. Alongside your agent, you’ll compile vital documents such as CPA financial statements, tax returns, job schedules, banking information, personal statements, and a contractor questionnaire for submission to the surety company. While the document list may seem lengthy, these components are key to securing the best conditions for your surety program.

Your agent will utilize the gathered information to craft a detailed summary of your account for submission to the surety company. It’s crucial that your agent thoroughly understands your business and strategic vision. They must have a grasp on your

BY PAUL SIMEON

firm’s strengths and weaknesses because surety companies are attuned to potential risks and areas for improvement within your account presentation. With a focus on achieving a zero-loss ratio, surety firms operate differently from traditional insurers; statistically, only three out of 100 accounts may result in claims, but those claims can significantly impact the portfolio’s profitability. This highlights why it’s vital for your agent to effectively communicate how your firm is addressing and mitigating risk factors to the underwriter, to strengthen your risk profile.

Additionally, surety companies will request a meeting to gain deeper insights into your operations. The more they understand your business, the greater the surety credit they can extend, ultimately increasing your potential for profit — which is the overarching objective for your company.

Should you have any questions or need further assistance, the Surety Practice at World Insurance Associates, LLC is available to help. Reach out to us at SuretyRequest@Worldinsurance.com.

A recent ruling by U.S. District Judge Ada Brown in Texas temporarily halts the Federal Trade Commission’s (FTC) proposed nationwide ban on non-compete agreements. The decision is significant as it prevents the rule from taking effect on its scheduled date, September 4, and raises questions about the FTC’s legal authority to implement such broad regulatory changes.

Judge Brown found that the FTC exceeded its authority by attempting to implement a blanket ban on non-competes, declaring the rule as “arbitrary and capricious.” Instead of addressing specific harmful agreements on a case-by-case basis, the rule was seen as an overreach. However, the decision does not stop the FTC from continuing its enforcement actions against non-compete agreements in individual cases, where harm can be demonstrated.

The current Biden administration has voiced support for banning non-compete agreements, which some argue restrict workers’ ability to seek better employment opportunities. The ruling may prompt further legal challenges, and it is likely that this topic will continue to be contested in the courts and potentially in Congress as well.

Broad ban on non-compete clauses: The rule prohibits employers from entering into or enforcing non-compete agreements with workers. This applies to both existing and new agreements, except those involving senior executives and in connection with the sale of a business.

Definition of worker and employer: The term “worker” is broadly defined to include employees, independent contractors, and unpaid workers. “Employer” includes partnerships, corporations, associations, and other legal entities under FTC jurisdiction.

Senior executive exception: Non-compete clauses with senior executives are allowed, but “senior executive” is narrowly defined as individuals in policy-making positions earning at least $151,164 annually.

De facto non-competes: The rule also targets de facto non-compete clauses, which may include broad non-disclosure or non-solicitation agreements that effectively function as non-compete clauses.

Sale of business exception: Non-compete clauses are permitted in the context of a bona fide sale of a business. This exception does not require the seller to hold a 25% ownership interest in the business

State law interactions: The rule preempts state laws that are in-

BY RICHARD GAYNOR

consistent with it but allows states to enforce laws that provide greater protection to workers.

Legal challenges: The rule is expected to face significant legal challenges, including arguments that the FTC lacks the authority to issue such a rule and that it constitutes an overreach of regulatory power. IF cleared, this law is anticipated to be effective 9/4/24

These proposed changes are designed to increase worker mobility and reduce the use of restrictive covenants that can limit job opportunities and wage growth.

If an employer has an existing non-compete agreement currently in place, this proposed rule requires notification to the employee. Employers must provide clear and conspicuous notice to workers that existing non-compete agreements are void and unenforceable. This notice can be delivered by hand, mail, email, or text.

1. Give clear and prompt notice to your employees: Include broad non-disclosure or non-solicitation agreements if this rule is approved.

2. Employment Practices Liability Insurance (EPLI): Review your EPLI insurance coverage with your insurance advisor for coverage related to employment practices, such as discrimination, harassment, wrongful termination, and other employment-related issues. Non-compete agreement violations, on the other hand, are generally considered a breach of contract matter and fall outside the scope of EPLI coverage.

Insurance coverage can vary based on the specific terms and conditions of an EPLI policy. It’s essential for employers to carefully review their policy documents and consult with their insurance provider to understand the full extent of their coverage. In some cases, an employer might need to seek additional or specialized insurance coverage to protect against non-compete agreement violations and related contractual disputes.

Employment Practices Liability Insurance (EPLI) is designed to protect employers from claims made by employees alleging various forms of wrongful acts in the workplace. Here are some key values and benefits of having EPLI:

1. Protection against legal costs: EPLI covers the costs associated with defending against employment-related lawsuits, including legal fees, court costs, and settlement or judgment expenses.

2. Coverage for various claims: EPLI can provide coverages for a wide range of employment-related claims, such as:

• Wrongful termination

• Discrimination (based on race, gender, age, disability, etc.)

• Sexual harassment

• Retaliation

• Failure to promote

• Breach of employment contract

• Negligent evaluation

• Infliction of emotional distress

3. Risk management: Having EPLI encourages and assists employers to implement proper risk management and human resources practices. Insurers often provide resources, training, and guidelines to help prevent employment-related issues.

4. Peace of mind: Employers can operate with greater confidence knowing they have financial protection against potential lawsuits from employees, former employees, and even job applicants.

5. Compliance with regulations: EPLI helps businesses stay compliant with various employment laws and regulations, as insurers often require adherence to certain standards as a condition of coverage.

6. Financial stability: Without EPLI, a significant employment-related lawsuit could have a devastating financial impact on a company. EPLI helps ensure that a business can withstand such financial shocks.

Overall, EPLI is a crucial component of a comprehensive risk management strategy for businesses of all sizes, helping to safeguard against the unpredictable and often costly nature of employment-related claims.

Richard Gaynor is the president of Middleton & Company Insurance, the insurance advisor for many trade and business associations. The company provides informative, relevant, and cost-effective business insurance protection.

As of Jan. 1, 2024, the Corporate Transparency Act (CTA) went into effect, and it is crucial for your business to understand and comply with its requirements. Non-compliance can result in severe monetary and criminal penalties.

Understanding the requirements and timelines for compliance is essential to avoid penalties. This article will provide you with detailed information on what the CTA entails, the necessary steps for compliance, and the potential consequences of failing to meet these new regulations.

What is it?

The CTA requires private, unregulated companies to report information about beneficial owners — those who own at least 25% of or exercise substantial control over the reporting company — to the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN).

The law closes a loophole in federal corporate regulations that enables criminals to hide their identities using shell companies. It is explicitly designed to combat money laundering, tax fraud, and terrorist activities. However, the legislation affects many American small businesses, including family offices, independent contractors, and limited liability companies (LLCs).

What are the requirements?

All entities formed or registered to do business in the United States will need to do one of the following:

1. Confirm that they qualify for an exemption from the CTA reporting requirements OR

2. Timely submit a beneficial ownership information (BOI) report to the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN).

What is the timeline for compliance for reporting companies?

Existing entities formed before Jan. 1, 2024, have one year, until Dec. 31, 2024, to file their initial BOI report. After the initial BOI report, no annual or quarterly filing is required unless the company undergoes an ownership change, in which case an amendment must be filed in 30 days. New entities created on or after Jan. 1, 2024, must file their initial BOI report within 90 days of formation.

Under the CTA, what is considered a “reporting company?”

A reporting company includes all entities, unless an exemption applies, that are formed or registered to do business in the United States by filing a document with a secretary of state or similar office, this including corporations, LLCs, and LLPs. If an entity is not created by a state filing (such as certain general partnerships and most trusts), that entity is not subject to the CTA.

BY SMOLIN, LUPIN & CO., LLC

What types of entities are exempt from the CTA reporting requirements?

There are 23 listed exemptions. These include:

• Large operating companies with a presence in the United States, having more than 20 full-time U.S. employees and reporting more than five million U.S. dollars in revenue from U.S. sources on a consolidated basis to the Internal Revenue Service in the previous year.

• Nonprofits, political organizations, and certain exempt trusts.

• Regulated enterprises such as public companies, insurance companies, banks, regulated investment companies, and other entities subject to regulatory oversight.

• Subsidiaries wholly owned by exempt entities. If the entity is exempt, no further action is required.

What are the reporting requirements?

Each reporting company will be required to submit a BOI report to FinCEN. E Filing is available on FINCEN’s website. Each BOI

report must disclose required information about the reporting company (name, address, taxpayer identification number) and its “beneficial owners” and “applicants” (full legal names, date of birth, address, and passport or driver’s license number, with a photocopy of such documents).

Who are considered an entity’s “beneficial owners” and “applicants?”

A beneficial owner is any individual who directly or indirectly either:

1. Exercises “substantial control” over the reporting company (such as the CEO, CFO, or other officer) OR

2. Owns or controls at least 25% of ownership interests. Applicants include a maximum of two individuals:

1. The person who directly files the formation or registration document of the reporting company AND

2. The person who was primarily responsible for directing such filing.

However, entities formed before Jan. 1, 2024, will not need to provide information about their applicants.

Every day we hear about another malicious hack where perpetrators are utilizing brute force tactics to attack the construction industry. What makes the construction industry more vulnerable is that a contractor’s office does not end at four walls; it is those four walls plus job sites. And it is very rare that there is only one contractor on a job site at a time, creating another level of complexity when discussing cyber security protocols for the construction industry.

The construction industry must deploy a multi-faceted approach to mitigate against brute force attacks amongst other schemes. Here are some effective strategies:

• Regularly review and update company-wide cyber security protocols.

• Conduct regular cybersecurity training sessions to educate employees about common threats like phishing and social engineering.

• Promote a culture of security awareness, encouraging employees to report suspicious activities.

What are the penalties for non-compliance?

The CTA provides civil ($500 per day for failure to file or filing an incomplete report) and criminal penalties (up to $10,000 and two years imprisonment) for willfully providing false information, failing to provide complete information, or failing to update information.

What about state reporting for BOI?

New York State recently implemented its own BOI reporting regime scheduled to go into effect Jan. 1, 2026. It is similar to the federal statute but it only applies to LLCs organized in the state of New York or authorized to do business in New York.

The Corporate Transparency Act (CTA) represents a significant shift in corporate regulation, aiming to enhance transparency and combat illicit activities. As a business owner, it is imperative to understand the requirements and timelines for compliance to avoid severe penalties.

If you have any questions or need assistance with the CTA and its impact on your business, Smolin is here to help. Please do not hesitate to contact Joe Andolino, tax director; Diane McNulty, member of the firm; or a Smolin professional at (973) 439-7200. We are here to help you navigate these new regulations and ensure your business’s compliance.

BY GRASSI ADVISORS & ACCOUNTANTS

• Categorize data based on sensitivity and prioritize protecting the most valuable information.

• Encrypt sensitive data in transit and at rest to protect it from unauthorized access.

• Implement strict data-sharing protocols on projects to ensure secure communication and data transfer.

• Implement strict access controls to ensure that only authorized personnel have access to sensitive information and systems.

• Use multi-factor authentication (MFA) to add an extra layer of security.

• Use privilege access management to limit access to sensitive data.

• Keep all software, including operating systems and

applications, up to date with the latest security patches.

• Regularly review and update security protocols to address new vulnerabilities.

Network Security

• To protect the network from unauthorized access, implement firewalls, intrusion detection systems (IDS), and intrusion prevention systems (IPS).

• Segment the network to limit the spread of malware and other threats.

Vendor and Supply Chain Security

• Assess the cybersecurity practices of vendors and contractors to ensure they meet your security standards.

• Include cybersecurity requirements in contracts and regularly audit third-party security measures.

Backup and Recovery

• Regularly back up critical data and systems to ensure they can be restored during a cyber incident.

• Test backup and recovery procedures to ensure they work effectively.

Cybersecurity Culture

• Foster a cybersecurity-aware culture across the organization.

•

Encourage employees to report suspicious activities and potential threats.

• Collaborate with cybersecurity experts to enhance systems, firewalls, and access points.

• Conduct thorough risk assessments to identify and mitigate vulnerabilities.

Incident Response Plan

• Develop and maintain a comprehensive incident response plan to quickly address and mitigate the impact of cyber incidents.

• Conduct regular drills and simulations to prepare the team for potential cyberattacks.

• Consider investing in cyber insurance to help mitigate financial losses in a cyberattack.

By implementing these strategies, construction companies can significantly reduce their exposure to cyber risks and enhance their overall cybersecurity posture.

Grassi is a leading provider of advisory, accounting, and tax services to the construction industry.

In our last two articles we discussed what a personal CFO is and the benefits of hiring someone in this role for your business. In this, our final article of the series, we’ll discuss how making the decision to hire a personal CFO is a significant step towards achieving financial clarity and security for both your business and personal life. This final article in our series offers a comprehensive guide to selecting the right personal CFO for your unique situation and outlines the keys to building a successful partnership. Choosing a personal CFO involves more than just veri fying credentials; it requires a deep understanding of your financial goals, personal values, and the kind of relationship you want to have with your financial advisor. With the right match, you can unlock a world of financial potential and peace of mind.

When embarking on the search for a personal CFO, the qualifications and experience of po tential candidates should be your primary concern. Essential credentials might include certifications such as CDFA, CFA, CFP, and AIF which demonstrate a foundational knowledge and commitment to ethical standards in financial

BY MICHAEL J. GUARINO III

planning and investment management. However, beyond these certifications, consider the candidate’s experience in dealing with businesses and individuals of similar scale and complexity to your own. Look for a track record of successfully navigating the type of financial challenges you face and ask for references or case studies that demonstrate their expertise. Understanding their approach to financial planning, risk management, investment strategy, and their familiarity with the latest financial software and tools is also crucial.

Identifying a personal CFO who aligns with your communication style, values, and financial goals is just as important as their technical qualifications. During the selection process, assess their ability to explain complex financial concepts in understandable terms and gauge their willingness to listen and adapt to your needs. A strong rapport and mutual respect form the foundation of a successful partnership. To find candidates, consider seeking recommendations from your professional network, industry associations, or specialized financial recruiting firms. During interviews, ask probing questions to uncover their approach to

financial planning and problem solving, and ensure their philosophy aligns with your own.

Once you’ve selected a personal CFO, establishing a framework for effective collaboration is vital. This includes setting clear expectations for communication frequency, methods, and financial reporting. Agree on regular meeting schedules to review financial performance, discuss new opportunities, and adjust strategies as needed. Transparency is crucial; ensure that your personal CFO has a comprehensive understanding of your financial situation and goals. Encourage them to challenge your assumptions and provide honest, objective advice. The success of this partnership relies on mutual trust, open communication, and a shared commitment to achieving your financial objectives.

To assess the effectiveness of your personal CFO, establish clear, measurable financial goals and benchmarks at the outset of your partnership. These could include specific targets related to savings, investment returns, tax efficiency, or debt reduction. Regularly review these metrics together to evaluate progress and adjust strategies as necessary. The true impact of a personal CFO extends beyond numbers; consider improvements in your understanding of financial strategies, your confidence in financial decision-mak-

ing, and your overall financial well-being.

Choosing and working with a personal CFO is a transformative journey that can lead to profound financial and personal rewards. By carefully selecting a qualified, compatible advisor and fostering a transparent, collaborative relationship, you may achieve your financial goals and secure your and your business’s future. Remember, a personal CFO is more than just a financial advisor; they are a strategic partner dedicated to your success. As you move forward with the insights gained from this series, you’re well-equipped to take this significant step towards financial empowerment and peace of mind.

Michael J. Guarino III has been helping business owners and individuals with succession planning for over 18 years. His firm, Main Street Wealth Management, serves businesses owners, and individuals with Personal CFO Services, financial planning, retirement planning, insurance, investing, and developing exit strategies for business owners nationwide. If you’d like to learn more about how Mike Guarino can help your business, please reach out via email to Mike@mswealth.com or call 973-625-1112 ext. 2 to schedule a complementary and 100% confidential Zoom or phone consultation.

There is a recent development in N.J. prevailing wage law that will require your attention early next year. On November 18, Gov. Phil Murphy signed S2962 into law. This amendment to the Prevailing Wage Act requires employers performing covered prevailing wage work to conduct orientation sessions for employees who will be working on a covered project before they begin their work. In that orientation, employers must identify the applicable prevailing wage classification (e.g. journeyman electrician) and the associated wage rate that will apply to employees’ work. Further, employers must obtain a signed statement from employees attesting to their attendance at the orientation. The orientation requirement takes effect on February 1, 2025.

The New Jersey Department of Labor and Workforce Development (NJDOL) has been tasked with developing a model form for employers to use for this purpose. These statements must be retained for six years, and must be produced in response to a request by NJDOL. Recognize that this will become a regular part of any NJDOL records request/audit. Also note that contractors with collective bargaining relationships do not have to provide the orientation for union-represented employees.

While the orientation requirement is manageable (albeit just another administrative chore), contractors should be prepared for inquiries from employees about the information they now must provide (i.e. classification of work and associated wage rates). In this regard, now is the time to understand where to locate the wage rate determination associated with a project, assuming it hasn’t been provided by the public body or prime/general contractor. In addition, to the extent the full prevailing benefit rate is not paid to employees in their paycheck (because the employer takes credit for certain benefits), employers should be prepared to explain and justify their individual annualization calculations. Finally, this amendment presents an opportunity to review apprentice participation requirements, since any and all prevailing wage classifications contained in a certified payroll report must be supported by participation in an approved United States Department of Labor apprentice program.

NJLICA Apprenticeship Program: Honors its First Graduate

Conor Seguine of Mark E. Seguine Excavating is the first graduate of the NJLICA Apprenticeship Program. Conor received his certificate after completing the two-year Construction Craft Laborer Program. He is now enrolled in the heavy equipment operator course. Conor is pictured with the managing director of the apprenticeship program, Buddy Freund, his instructor Terry Styer, and his classmates in the laborer’s program and operator’s program.

Total Pro Expo is being held on January 28-29, 2025 at the New Jersey Convention and Exposition Center. This two-day conference attracts over 2,000 attendees and 150 vendors including Foley Caterpillar, GT Mid Atlantic, Bobcat, JESCO, Hoffman Equipment, Cherry Valley Tractor, Vermeer North America, Woods Machinery, Coast Cities Truck & Equipment, Ransome Attachments, New Jersey One Call, Jersey Rents, Tri-State Safety Solutions, and Patriot Commercial Vehicle Inspections. Those NJLICA members who paid their annual membership dues prior to October 10 will be sent two complimentary tickets to the conference. Please be on the lookout for your tickets, which will be mailed in early January.

The NJLICA dues year runs from September 1-August 31 of each year. Dues invoices are mailed to every NJLICA member, both NJDOL public works and non-public works contractors, and associate members just after Labor Day. A second dues notice was mailed in November.

NJDOL public works contractors are also required to make an annual contribution to the ERISA Trust Fund. This payment is legislated by the state of New Jersey and is due on the anniversary date of your company joining the Apprenticeship Program. These invoices are mailed a month prior to your anniversary date. Payment is required to remain compliant with the NJDOL and maintain your public works certificate.

Members who are participants in the United Fire Group Insurance Program will receive your renewal invoice in September as well. Payment is required at that time, not on the renewal date of your insurance. Payment is required to maintain your participation in the insurance program.

Please review your mailed and emailed communication to ensure accuracy, correct spelling of contact person, name, business, phone numbers, etc. Please contact Buddy at buddy@govisionstrong.com with any changes.

• Instill your company’s culture and retain workers

• Recruit and develop a diverse and highly skilled workforce

• Improve productivity, profitability, and your bottom line

• Reduce turnover, improve loyalty, and retain top talent

New hires and/or existing employees or Hire an apprentice from the NJLICA Apprenticeship Program How Can Apprenticeship Training Help Your Company?

• Demonstrate investment in your community

District Heights, MD • Waldorf, MD Construction, Forestry

Shrewsbury, MA • Fairfield, NJ • Lumberton, NJ

South Plainfield, NJ • Deer Park, NY • Beacon, NY

Middletown, DE • Baltimore, MD • Frederick, MD • Delmar, MD

Contractor Members

Aggregates NJ, Inc.

Beatrice Gesualdo Livingston, N.J.

Amelia Trucking LLC

Francisco Guaicha Stirling, N.J.

American Custom Fabricators, Inc.

Robert Schinder Bayville, N.J.

Angeles Transportation Corp. Luis Angeles Somerset, N.J.

Arellanos Future Landscaping

Junenal Arellano Howell, N.J.

B Environmental Investigations LLC

Eric Davis Jamesburg, N.J.

Brunswick Site Solutions LLC

Matthew Hagood East Windsor, N.J.

CLS Contracting Corp.

Tejas Patel Secaucus, N.J.

Chutemaster Environmental, Inc.

Craig Berlin Union, N.J.

Conigliaro Trucking LLC

Vincenzo Conigliaro Hazlet, N.J.

NJLICA DUES INVOICES WERE MAILED OUT IN SEPTEMBER. YOUR PROMPT REPLY IS GREATLY APPRECIATED. A REMNIDER THAT THE NJLICA DUES YEAR RUNS FROM SEPTEMBER 1-AUGUST 31. YOUR PAYMENT WILL CARRY YOU THROUGH AUG. 31, 2025.

42 NEW MEMBERS IN THE THIRD QUARTER

Dumac, Inc.

Carlos Duarte Colts Neck, N.J.

ECPM, Inc.

Robert Van Tassell Warren, N.J.

Elite Landscaping & Construction LLC

Rick Landgraber South Plainfield, N.J.

Elliott Glass Co., Inc.

Kevin Elliott Woodland Park, N.J.

G & D Materials & Logistics LLC

Matt Bryant Whiting, N.J.

J & K Toro Trucking LLC

Jonathan Toro Morristown, N.J.

Joey Sosik Landscaping

Joe Sosik Franklinville, N.J.

Journey Enterprises Co.

Carey Italiano Pilesgrove, N.J.

K & S Contractor LLC

Kerran Soman Vineland, N.J.

KVF Contracting LLC

Frederico Magalhaes West Caldwell, N.J.

Karan Sharma Trucking LLC

Karan Sharma Vineland, N.J.

LPM Distributions LLC

Camela Leslie Hillsborough, N.J.

Marie & Son Express LLC

William Jackson III

Millville, N.J.

Maruti Construction LLC

Harshadkumar Patel Jersey City, N.J.

Material Delivery Service LLC

Christopher Jackson Atco, N.J.

Middletown Sprinkler Company, Inc.

Robert Dobson Port Monmouth, N.J.

THE NJLICA BOARD HAS POSITIONS AVAILABLE FOR THE FOLLOWING COMMITTEES: Membership Scholarship

and Live Auction

Meetings

Moving Mountains Contracting

Nathan Boone II Vineland, N.J.

O Penafiel Trucking LLC

Oscar Penafiel Bloomfield, N.J.

PG Environmental Services, Inc.

Carlos Quinonez Hauppauge, N.Y.

Pinx Group, Inc.

Nicole Murray Wrightstown, N.J.

Quality Facility Solutions

Juda Falkowitz Brooklyn, N.Y.

Rioza General Contractor

Gema Mendoza Union City, N.J.

Saga I Landscape & Trucking

Pedro Ausay Wharton, N.J.

Schilke Construction Co., Inc.

Douglas Schilke Hillsborough, N.J.

Sparkle Edge Cleaning Service, Inc.

Charilyn Sloan Bridgewater, N.J.

TMA Contracting LLC

William Matthews Jackson, N.J.

The Resource Management Group LLC

Brian Haney Lumberton, N.J.

TIGRIS Aquatic Services LLC

Krista Michniewicz Mt. Bethel, Pa.

VISION STRONG MANAGEMENT GROUP

Buddy Freund PO Box 166 Succasunna, NJ 07876 973-753-2800 buddy@govisionstrong.com govisionstrong.com

Vision Strong Management Group provides full-service association management services for associations, foundations, societies, and trade organizations. Add your company name to our Patron Directory. Contact NJLICA Executive Director Buddy Freund at 973-630-7600 or buddy@govisionstrong.com.

US Pipelining LLC

Jeremy Bowman Langhorne, Pa.

Associate Members

Auto Action Technologies

Joe Cardinale Kenilworth, N.J.

MV Custom Apparel

Terry Ikey Mt. Laurel, N.J.

Smolin, Lupin, & Co.

Diane McNulty Red Bank, N.J.

Over the past 2 years LICA has implemented a quali ed DOL Apprenticeship program, for Truck Drivers (1 year) Laborers (2 years) and Heavy Equipment Operators (3 years) that we are very proud to o er to our members. Apprentices can help give your company the boost you didn't even know it needed. With an apprentice on hand to take on some of the smaller tasks, it frees up your more experienced sta to concentrate on key areas of work and spend time on other tasks – making your overall business practices more productive. LICA has also built into the program employer and employee incentives.

When enrolling an apprentice(s) in one of the trades listed above, and if you are contributing to the ERISA trust, this will decrease your required contribution to 1/3 of your cost. Example, If you are paying $2000 into the trust you will only be require to contribute $666.

Employers who sponsor apprentices gain skilled workers, reduce employee turnover, and improve productivity. Apprenticeships can also help businesses address any critical or expected shortages of skilled labor at a time when many businesses are reporting that they cannot nd skilled workers to ll jobs.

LICA recognizes that in ation is at a high, food and gas are expensive, just about every aspect of our everyday lives have a hefty price tag. erefore, we wanted to help our apprentices with the following:

Truck Drivers will receive:

• $3000 upon completion of the program, OR CDL class paid for by NJLICA.

• Available to the rst 12 who enroll in the program

Laborers will receive:

• $7,500 for the rst year completed (payment made upon start of second year)

• $7,500 for the second year completed (payment made upon graduation)

• Available to the rst 10 who enroll in the program

Heavy Equipment Operators will receive:

• $7,500 for the rst year completed (payment made upon start of second year)

• $7,500 for the second year completed (payment made upon start of third year)

• $7,500 for the third year completed (payment made upon graduation)

• Available to the rst 14 who enroll in the program

Contact: Tracy Carver: tcarver@tlc4prevailingwage.com Buddy Freund: buddy@govisionstrong.com

The historic Banks Course at Forsgate County Club was the setting for the First Annual NJLICA Golf Classic South. With its sloping greens and 10-foot bunkers, Forsgate served as a challenging host for the 69 golfers who came out on this beautiful September day. The team from Church Auto featuring Ted Bertram, Bob Church, Pete Erndl, and Mark Roberts took home the first championship trophy.

Premier Sponsors

Invitational Sponsors

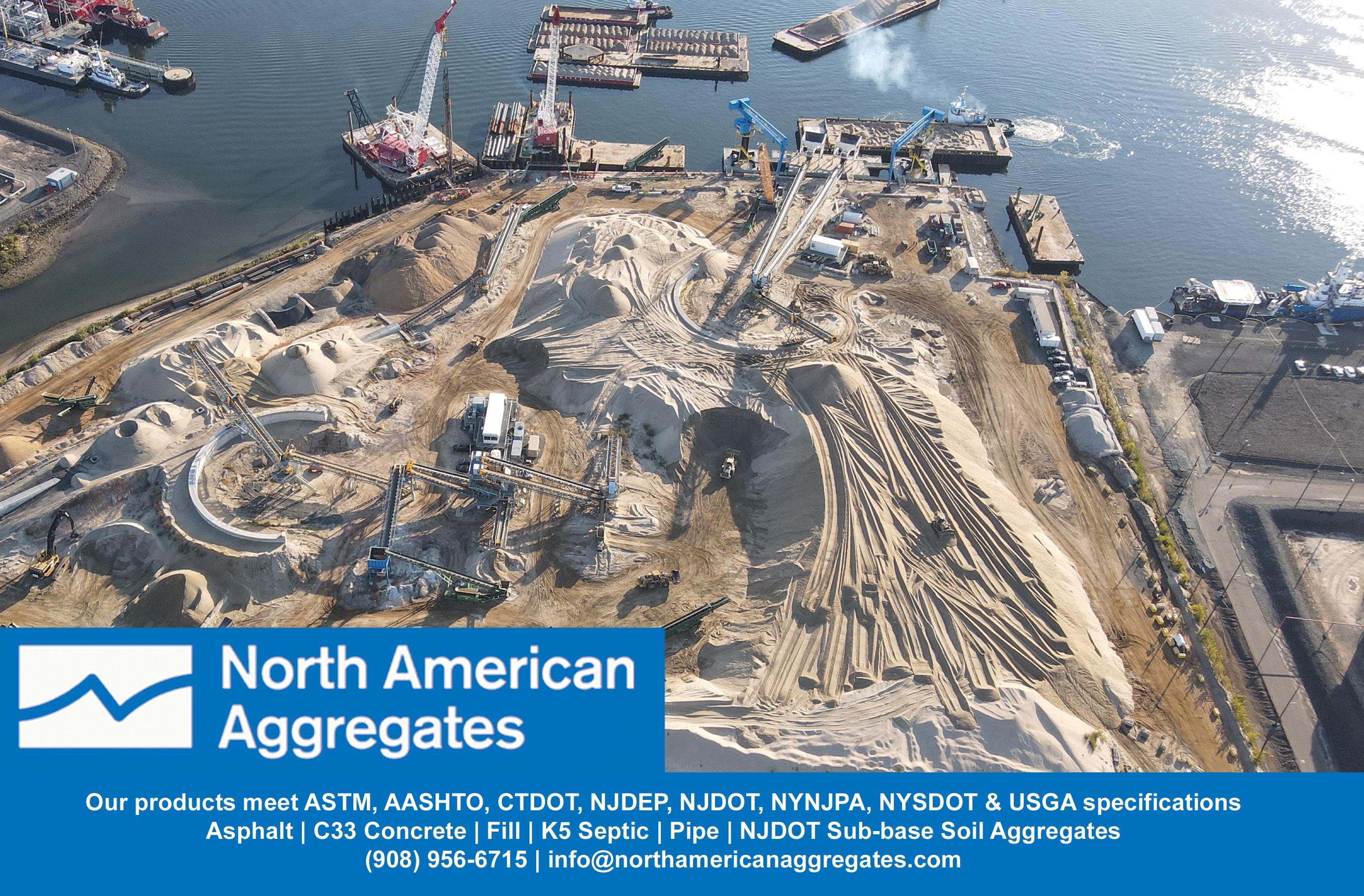

North American Aggregates

Prins Insurance

United Fire Group

Golf Ball Launcher

North American Aggregates

Player Giveaway Sponsor

DeSapio Construction

Dinner Sponsor

Premier Emissions & Safety

Inspections

Beverage Cart Sponsor

J. Kramer Landscaping & Snowplowing

Beverage Station Sponsor

Patriot Sawcutting

Fleet of Carts Sponsor

The True Agency

Registration Sponsors

Haskell Paving

World Insurance Associates

Ball Sponsor

Foley Caterpillar

Putting Green Sponsor

Icon Equipment Distribution

Driving Range Sponsors

Mathis Construction Co.

Tilcon NY

Lunch Sponsors

L.N. Rothberg & Son

The Ireland Construction Group

Closest to the Pin Sponsor

Brent Material Company

Tee and Green Sponsors

Church Auto

Croft Construction

Dave O'Donovan Excavating

Espo's Tree & Crane Service

GT Mid Atlantic

James R. Ientile

Kelly Donahue Contracting

L.N. Rothberg & Son

Middleton & Company

Patrick DiCerbo - Northwestern Mutual

Petrocon

Renda Roads

Stavola Companies

TLC4 Prevailing Wage

Tri-State Safety Solutions

True & Associates - A World Company

Twin Construction

Wantage Excavating

Lehigh Valley Sporting Clays was the site for the Second Annual NJLICA Clay Shoot. Nearly 60 shooters enjoyed a great day on this beautiful course. Caleb Vander Groef of Wantage Excavating took home Top Shooter. The team from Wantage Excavating won first prize in the team competition.

As an ongoing effort to provide more events in the central and southern part of New Jersey, nearly 40 NJLICA members enjoyed the spectacular Laurita Winery in New Egypt at the Fall Dinner Meeting South. Great food and beverages were enjoyed by all. Mike Guarino of Main Street Wealth Management provided an outstanding presentation on maximizing the value of one’s business when transfer of ownership takes place.

You cannot comprehend the magnitude of this spectacular display of antique trucks. The site includes 80,000 square feet of space, seven barns, a working antique train, and beautiful grounds. Attendees were treated to a commemorative presentation of 9/11 by Boy Scout Troup 86 of Lyndhurst, led by Star and Senior Patrol Leader Christiano Garofalo.

Certainty is what we have delivered to the New Jersey Construction industry for over 40 years.

Grassi’s Construction advisors and accountants provide the industry knowledge and guidance that construction professionals need to make confident business decisions.

buddy@govisionstrong.com

Succasunna, NJ 07876