FEATURE: LONG-TERM INVESTING LESSONS FROM 2020

31 December 2020

RAYHAAN JOOSUB Head: Multi-Asset and Asset Allocation, Sentio

Long-term investing lessons during the COVID-19 crisis

T

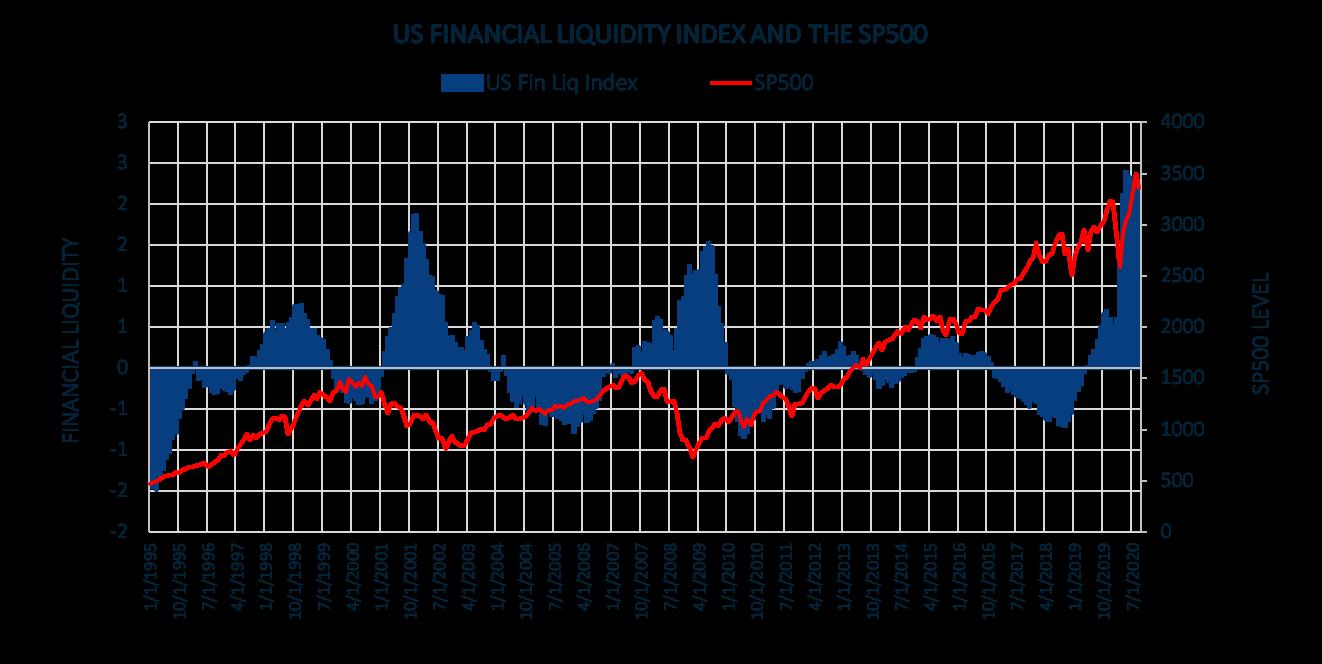

he COVID-19 crisis this year in spectacular fashion, despite the wreaked havoc on global economy being in terrible shape. So, economies and financial clearly one of the lessons is that the markets alike. However, while global equity market leads the economy – economies are still in the grips of but that is only partly true. Liquidity the crisis, financial markets have drives financial markets and central made a remarkable recovery since banks understand the important the lows in March linkages between of this year. So, what financial markets and were the lessons CENTRAL BANKS the real economy. Harsh that we can take lessons were learnt post WERE EXTREMELY the global financial from this amazing QUICK IN development? crisis in 2008 and UNDERSTANDING central banks will now Liquidity and do ‘whatever it takes’ THE GRAVITY OF financial to support financial markets markets in order to THE CRISIS Let us first avoid the ‘second round understand the reasons behind effects’ into the real economy. In the this amazing market rally. For one, graph below, we show the importance central banks were extremely quick of financial liquidity, which tends to in understanding the gravity of the lead equity markets. A clear lesson crisis and therefore reacted quickly here is that once a crisis does ensue, by cutting rates and launching an it’s probably too late to sell. In fact, aggressive QE policy. This liquidity volatility is your friend during a crisis, supported financial markets with and you should rather take advantage credit spreads narrowing and equity of the attractive prices of risk assets to prices rallying off their March lows add to your portfolio.

Sentio_MM_Dec 2020_V2.pdf

C

M

Sentio Capital Management (Pty) Ltd is an authorised FSP.

Source: BCA, Bloomberg

1

2020/11/02

09:32

Source: Sentio Capital Management

Appropriate investment strategy But how do you deal with the large portfolio drawdowns and the volatility that these ‘Black Swan’ events bring about? Well, the first thing you need is an appropriate investment strategy that is well designed to your financial goals in terms of required returns, but also the strategy must be wellsuited to your temperament, as this becomes crucial when markets are falling. If your investment strategy is too aggressive, you will not be able to stomach the losses and invariably cut your losses at the bottom, which will lead to disastrous consequences for your long-term financial goals. This is because the initial market recovery, post a large sell-off, is most often the strongest period for equity markets. Missing out on those periods of market recovery can lead to very sub-par investment returns in the long term. Strategic asset allocation So, what makes a good investment strategy? Broadly, it involves

designing a strategic asset allocation benchmark that is appropriate to your required returns and risk tolerance. This strategic allocation must effectively give you exposure to the risk premiums available in the market to achieve your return objectives, but must also be adequately diversified to provide you protection during troubled times and thus minimise the impact of market drawdowns on your portfolio. The graphic above shows the average returns of assets during normal and crash markets, and shows the benefits of foreign bonds, foreign cash and derivative hedges in order to diversify a South African equity portfolio during troubled times. Designing the strategic asset allocation requires a good mix of return-generating assets and diversifying assets in order to balance your return and risk objectives; and this strategy should be followed in a disciplined manner, irrespective of market conditions. This will force you to buy into weakness and sell into strength – and avoid costly errors like selling at the bottom of markets.

BUY INTO WEAKNESS. SELL INTO STRENGTH.

Y

CM

MY

CY

CMY

K

A majority black-owned asset manager.

WWW.MONEYMARKETING.CO.ZA 23