Investments Designed for New Hampshire

NH PDIP has provided New Hampshire’s public entities with investment options since 1993. NH PDIP focuses on safety, liquidity, and earning a competitive yield in order to meet the distinct needs of cities, towns, school districts, and other political subdivisions.

This information is for institutional investor use only, not for further distribution to retail investors, and does not represent an offer to sell or a solicitation of an offer to buy or sell any fund or other security. Investors should consider the Pool’s investment objectives, risks, charges and expenses before investing in the Pool. This and other information about the Pool is available in the Pool’s current Information Statement, which should be read carefully before investing. A copy of the Pool’s Information Statement may be obtained by calling 1-844-464-7347 or is available on the NHPDIP website at www.nhpdip.com. While the Pool seeks to maintain a stable net asset value of $1.00 per share, it is possible to lose money investing in the Pool. An investment in the Pool is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Shares of the Pool are distributed by U.S. Bancorp Investments, Inc., member FINRA (www.finra.org) and SIPC (www.sipc.org). PFM Asset Management is a division of U.S. Bancorp Asset Management, Inc., which serves as administrator and investment adviser to the Pool. U.S. Bancorp Asset Management, Inc. is a direct subsidiary of U.S. Bank N.A. and an indirect subsidiary of U.S. Bancorp. U.S. Bancorp Investments, Inc. is a subsidiary of U.S. Bancorp and affiliate of U.S. Bank N.A.

New Ha mp sh ire Publ ic Deposit Inve st ment Pool

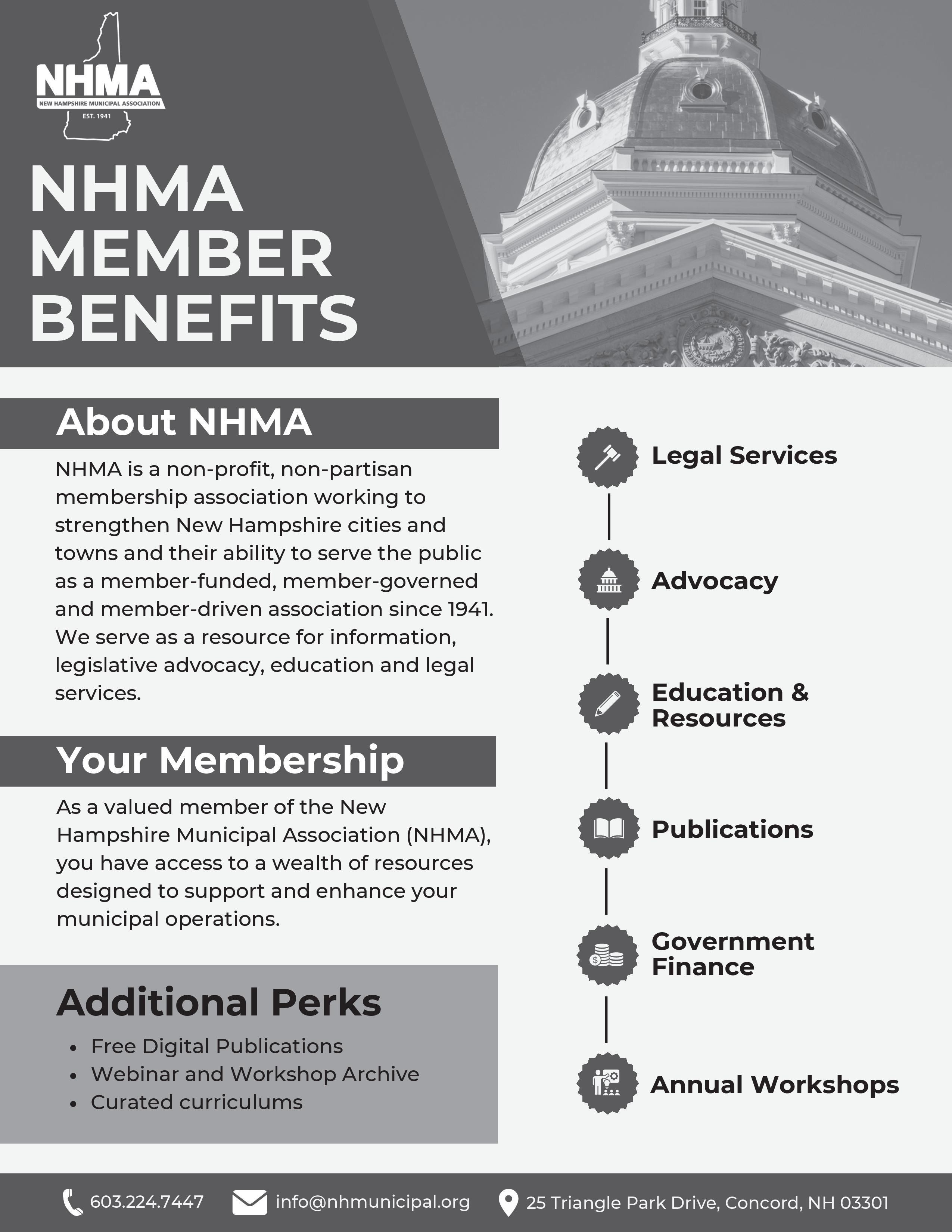

New Hampshire Municipal Association

BOARD OF DIRECTORS

Laura Buono Town Administrator, Hillsborough

David Caron Trustee of Trust Funds, Belmont

Shelagh Connelly Conservation Commission, Holderness

Phil D’Avanza Planning Board, Goffstown

Stephen Fournier Town Manager, Newmarket

Elizabeth FoxImmediate Past Chair Asst. City Manager, HR Director, Keene

Jennifer Kretovic City Councilor, Concord

Dale Girard Mayor, Claremont

Conner MacIver Town Administrator, Barrington

Holly Larsen

Joanne Haight - Secretary Select Board Chair, Sandwich

Dennis Shanahan - Chair Deputy Mayor, Dover

Thomas Seymour Moderator, Hill

Jeanie Forrester - Vice Chair Select Board Member, Meredith

Joseph R. Devine - Treasurer Town Manager, Salem

Judie Milner Town Manager, Meredith

Jim Michaud Chief Assessor, Hudson

David Moore Town Administrator, Stratham

Shaun Mulholland Town Manager, Londonderry

Bonnie Ham Planning Board, Woodstock

Lori Radke Town Councilor, Beford

NHMA A Message from the Executive Director

Margaret M.L.Byrnes

Welcome to the wellness issue! This issue of Town & City features articles from HealthTrust, the largest pooled risk entity offering health and related coverages to local governments in New Hampshire. If you’re like me, after a summer of eating hot dogs and ice cream, a little reminder to take care of our health doesn’t hurt!

Of course, the September/October issue also means NHMA’s Annual Conference is right around the corner. The event takes place at the Downtown Doubletree Hotel in Manchester on November 19-20, and registration opens in September. In addition to our usual two days of educational sessions and jam-packed Exhibit Hall, Wednesday night features a dinner and casino night event. We hope you’ll take a chance and join us for two days of networking, learning, prizes, and fun with NHMA staff and your municipal colleagues from across the state.

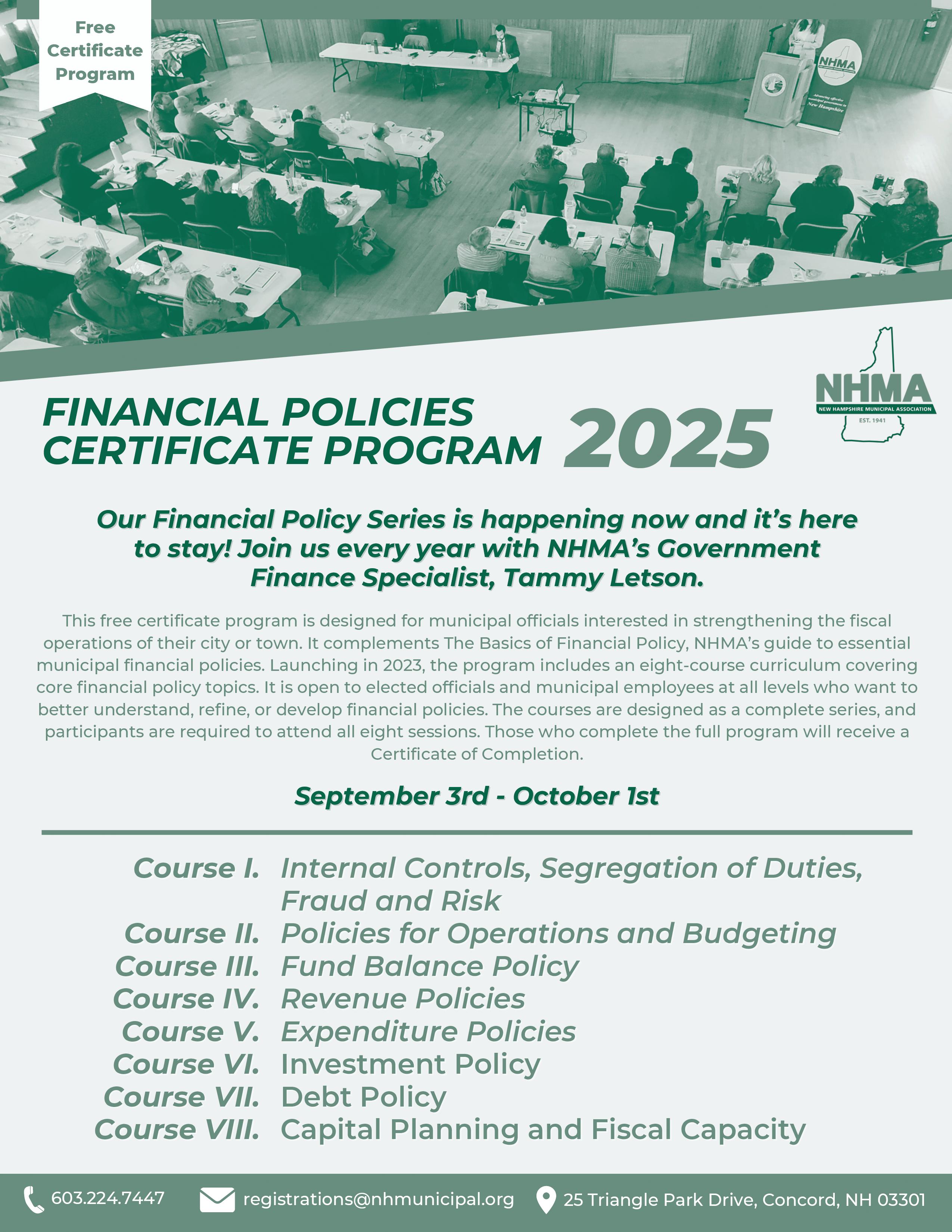

Of course, there are plenty of other educational opportunities for local officials. After the legislative session ended in June, the Legal Services Team drafted several guidance documents on key law changes affecting cities and towns, which can be found on our website here. The fall also features our traditional annual events, Budget & Finance Workshop (two locations) and the Land Use Law Conference. You can check out our 2025 Events At a Glance or visit our Events Calendar to learn more and register. I’m also so pleased that we are hosting our second Finacial Policies Certificate series, which kicks off in September. This educational series, first run in 2023, will now become a regular annual event, presented by NHMA’s new Government Finance Specialist, Tammy Letson. Tammy joined us in May and is available to provide guidance and education on issues related to government finance to our members—a brand new service established in 2025. Give her a call or send her an email with your questions at legalinquiries@ nhmunicipal.org or 603.224.7447.

We hope you had a great summer and look forward to seeing you at an event or talking to you soon, as we top off another great year of serving cities and towns in New Hampshire!

P.S. Remember that I’m available to attend your select board, council, or board of aldermen meeting if you’d like to hear more about NHMA or get an update on legislative activity. Reach out to us anytime at info@nhmunicipal.org for more information.

Warmest regards,

Margaret M.L. Byrnes, NHMA Executive Director

HAPPENINGS

Is something new and exciting happening in your city or town?

We'd love to include it in Town & City! Email us at publications@nhmunicipal.org

Check Out NHMA’s New Government Finance Services Page

We’re excited to introduce our updated Government Finance Services page, highlighting the expanded financial support now available to municipalities through our new Government Finance Specialist, Tammy Letson. Tammy is here to assist with everything from audits and internal controls to accounting, payroll, and more. View the full page for a full list of topics!

www.nhmunicipal.org/government-finance-services

The NHMA team had a great experience at the National League of Cities Conference in Minneapolis, Minnesota!

We connected with municipal leaders from across the country, joined thought-provoking sessions, and shared our newest initiatives aimed at strengthening and supporting communities nationwide. From building relationships with peers to learning about innovative approaches to today’s urban challenges, the event was both inspiring and productive.

NLC: Supreme Court Review for Local Governments: 2024-2025

Recently, legal experts from the Local Government Legal Center (LGLC) engaged in a discussion of the Supreme Court’s important decisions of the term impacting local governments. The Supreme Court heard several monumental cases this Term, including cases related to public safety, the environment, employment law, and nationwide or universal injunctions.

Speakers

Amanda Karras, Executive Director / General Counsel, International Municipal Lawyers Association

Luke McCloud, Partner, Williams & Connolly LLP

John Korzen, Associate Professor of Legal Writing and Director of Appellate Advocacy Clinic, Wake Forest University School of Law

Watch it here: https://www.nlc.org/resource/from-the-event-supreme-court-review-for-localgovernments-2024-2025/

Public Invited to Appeal or Comment on Flood Maps in Belknap County, New Hampshire

Preliminary flood risk information and updated Flood Insurance Rate Maps are available for review by residents and business owners in affected communities in Belknap County, New Hampshire. Residents and business owners are encouraged to review the latest information to learn about local flood risks and potential future flood insurance requirements. The updated maps were produced in coordination with local, state and FEMA officials. Significant community review of the maps has already taken place. Before the maps become final, community stakeholders can raise questions or concerns about the information provided and participate in the 90-day appeal and comment periods.

The 90-day appeal and comment periods will begin on or around July 16, 2025. The affected communities in Belknap County, New Hampshire are listed in the Proposed Flood Hazard Determinations Notice in the Federal Register at the following website: https://www.federalregister. gov/documents/2025/06/12/2025-10700/proposed-flood-hazard-determinations

The Importance of Mental Health

To provide accessibility, many new behavioral health resources are virtual.

Mental health is as important as physical health for overall wellbeing. Good mental health helps us cope with the stresses of life, realize our abilities, learn and work well, and contribute to the community.

Each individual has unique mental health needs that are specific to them and what they are going through. There are many factors that can undermine mental health — genetics, environment, and lifestyle influence — and sometimes there are multiple, linking

causes underlying a mental health illness.

Common mental health conditions include anxiety disorders, attention-deficit/hyperactivity disorder, and depression, to name a few. More serious mental health conditions include schizophrenia, bipolar disorder, and post-traumatic stress disorder. Approximately 221,000 adults in New Hampshire have a mental health condition, according to the New Hampshire chapter of the National Alliance on Mental Illness, and 57,000 adults have a serious mental illness.

If you live in a rural area of New Hampshire and don’t have access to the care you or your family may need, your Anthem health plan offers a range of cost-effective, easy-to-access benefits. Many of these in-network behavioral health programs are available by telephone or virtually by video or chat, providing even more options for individuals.

You may already know about Aspire365, InStride Health, Aware Recovery Care, and LiveHealth Online through HealthTrust communications, and now there are more behavioral health programs with in-network providers and available to HealthTrust medically covered Enrollees and their families. Anthem has put

together the Anthem Behavioral Health Site, a website with all of the behavioral health programs in one place. Here are a few resources you may not know about:

• Vita Health: Suicide intervention program that includes teletherapy and psychiatry services. 1.844.866.8336

• Headway: Virtual mental health clinic that offers easy-to-access therapy and psychiatry services for adults, children, adolescents, and teens. 1.646.941.7645

• Talkspace: Video, text, and phone sessions with a licensed therapist for individuals, teens, couples, and families. 1.888.846.4821

• Equip: Eating disorder treatment delivered at home. 1.855.951.5503

• Charlie Health: Virtual intensive therapy for youth who need a higher level of support. 1.986.206.0414

• Valerahealth: Virtual mental health clinic that offers therapy and psychiatry services for adults, children, adolescents, and teens. 1.646.450.7748

Of course, if virtual isn’t for you, in-person visits at your home or an office or clinic are often available. You can use Anthem’s Find Care tool to locate a care provider or facility near you.

Save the Dates

• NAMIWalks New Hampshire, October 5

• World Mental Health Day, October 10

• National Depression Screening Day, October 10

Top 5 Mental Health Issues

• Anxiety

• Partner relationships

• Stress

• Psychological

• Depression

Top 3 Work/Life Issues

• Financial assistance

• Eldercare

• Moving

— Statistics provided by ComPsych, HealthTrust’s partner in health

Behavior Change Starts with You

Nine steps to help you make behavior change last.

Taylor Bowse

Do you feel stuck? Have you been trying to make a change and just can’t seem to find the motivation?

Changing a behavior can be hard, but it doesn’t have to feel scary or impossible. The decision to start any health-related journey is often the hardest first step. In order to make a change you have to be motivated to make that change and believe in your abilities.

The Stages of Change Model, also called the Transtheoretical Model, explains an individual’s readiness to change their behavior. It describes the process of behavior change as occurring in stages. Individuals can move back and forth through these stages.

Creating new habits — and making these new habits last — can be hard but anyone can make a meaningful change.

Tips to Make Behavior Change Last:

1. Create SMART goals: SMART stands for Specific, Measurable, Attainable, Realistic, Time-based.

2. Set reminders and hold yourself accountable: By setting deadlines and reminders, you can prioritize tasks effectively and ensure everything gets done on time.

3. Journal and write daily activities: Activity logs help you to stay on track and see your progress.

4. Celebrate small successes and reward yourself: Celebrating small wins can boost your mood and improve confidence in your accomplishments, keeping you motivated as you pursue a larger goal.

5. Establish a good routine: All healthy routines should include eating a nutrition-rich diet, exercising, and getting enough sleep, but no two routines will be exactly the same.

6. Create a support system: Healthy relationships mean hanging around with people who want to achieve similar goals or support you in your goals. Every connection you make matters.

7. Reflect: Self-reflection is the ability to witness and evaluate one’s own cognitive, emotional, and behavioral processes. Be in the moment and be realistic with yourself.

8. Continue to grow: Continual progress requires a proactive approach to evaluating your goals. Regular assessments help you identify what’s working and what may need adjustments.

9. Maintain and embrace new habits: The goal is not just short-term success but long-term sustainability. Make adjustments that align with your lifestyle, ensuring your plan remains realistic and enjoyable.

"What do you want to change or what do you hope to change? Is this something you can do on your own or do you need help? There are many questions that can come up when you decide to make a behavior change. Asking yourself these questions is the first step; behavior change truly starts with you."

As a Wellness Advisor and Certified Health Coach, I teach the stages of change as well as walk through them in my own life. I grew up as a student athlete and competed all the way through college. Sports for me was more than just being physically active; it was a huge stress reliever. After college I felt lost and unsure of how or what I would do to get that same enjoyment and stress relief as I got from competing. I did some trial and error, went to the gym, joined groups, and did at-home workouts before I finally found what worked for me.

When I became a mother, I found I needed to adjust my schedule and, at times, give myself grace for doing what I could. Life has ups and downs and so does any health journey — there are setbacks and adjustments that need to be made along the way. As long as you keep moving forward and pushing toward your goals, you can’t lose. Believe in yourself and make a change today!

Taylor Bowse is a Wellness Advisor with HealthTrust and Certified Health Coach. She is passionate about helping others improve their overall well-being.

Getting to the Bottom of Burnout

Emotionally drained, depressed, or burnout? How you can help employees at every stage.

There have been some budget issues, zoning disagreements, and staff changes at the town office. You have an employee who comes into work every day — but they are not really at work. Meeting participation is minimal, group lunches or social opportunities are avoided, and training opportunities are declined. Their comments about the town and their job are increasingly negative and cynical. Is it burnout or is it depression?

Let’s take a look to find out where this employee sits on the stress spectrum.

What is burnout?

People who have burnout feel exhausted, empty, and, as the name states, burned out. (National Library of Medicine)

Exhaustion, cynicism, and inefficiency are the defining features of burnout. (American Psychological Association)

What is depression?

Depression is a common and serious mental disorder that negatively affects how a person feels, thinks, acts, and perceives the world. (American Psychiatric Association)

How are burnout and depression different? With depression, negative thoughts and feelings are about all areas of life — not just work. (National Library of Medicine)

So, in the example above, if that employee is also sad, feels tired all the time, and is not interested in their usual activities outside of work, they could be suffering from depression.

Isn’t burnout just stress?

Burnout is thought to be caused by work-related or other kinds of stress, but it is more than the

usual feelings of being stressed. People are drained, emotionally exhausted, and may even develop physical symptoms like gastrointestinal issues.

What are the types of burnout?

According to Headspace, there are three types:

• Frenetic: Employees who are so committed to their work they don’t focus on their well-being, ending up overworked and exhausted.

• Under-challenged: Employees who were once engaged with their work and lost interest over time, resulting in indifference or apathy.

• Worn-out: Employees who, after a prolonged period of feeling undervalued or poorly managed, are now so disengaged they completely disregard the responsibilities of their job.

Who is at risk for burnout?

Four in five employees feel emotionally drained from their work, which is an early sign of burnout.

(Mental Health America)

Research from Moodle found 66% of American employees are experiencing some sort of burnout in 2025. Nearly 44% of women feel burnout, compared to 35% of their male coworkers. (Fortune)

Why should employers care about burnout?

Burnout can lead to reductions in productivity and increases in absenteeism. It can hurt a team’s ability to collaborate and connect and, in severe cases, can lead to leaves of absence or cause employees to quit.

(World Health Organization)

Burnout takes a toll on an employee’s mind — and body. More than two thirds (77%) of employees say work stress has negatively impacted their physical health. Half of employees reported they have cried because of work issues, and 58% have considered quitting their jobs as a result of their mental health.

(Headspace)

What can employers do to help?

With the rates of mental health issues increasing in the modern workforce, supporting employees’ emotional

well-being has never been more critical. Mental health issues are not just personal issues. They can also impact productivity, satisfaction, absenteeism, and more — all of which can significantly affect an organization. (Personify Health)

Employers, of course, are not going to be able to diagnose employees. But you can offer mental health benefits as part of medical coverage to help employees with depression. Or, you can offer time off from work or suggest a longer vacation to help those with burnout recover from symptoms.

Other workplace strategies include:

• Making work a safe place so employees have increased comfort in discussing mental health at work. Conversation and support may contribute to lower burnout on the job. (National Alliance on Mental Illness)

• Helping employees establish connections at work by providing opportunities to interact or work as a team. It could be something as simple as a fun team-building exercise at the next meeting.

• Taking a look at your organization’s practices to make sure workers have the control, flexibility, and resources to manage workload. Regularly check in with employees, provide flexible working arrangements (if possible), and encourage time off. (World Health Organization)

• Creating a work environment that prioritizes well-being and implementing wellness programs to meet employee needs. Almost half (46%) of employees prioritize well-being benefits over pay increases. (Forbes)

THE BOTTOM OF BURNOUT from page 7

The Grass Is Greener Where You Water It

Positive thinking can improve your mental and physical health. But how do you become a glass half full person?

Krista Bouchard and David Salois

Consider this:

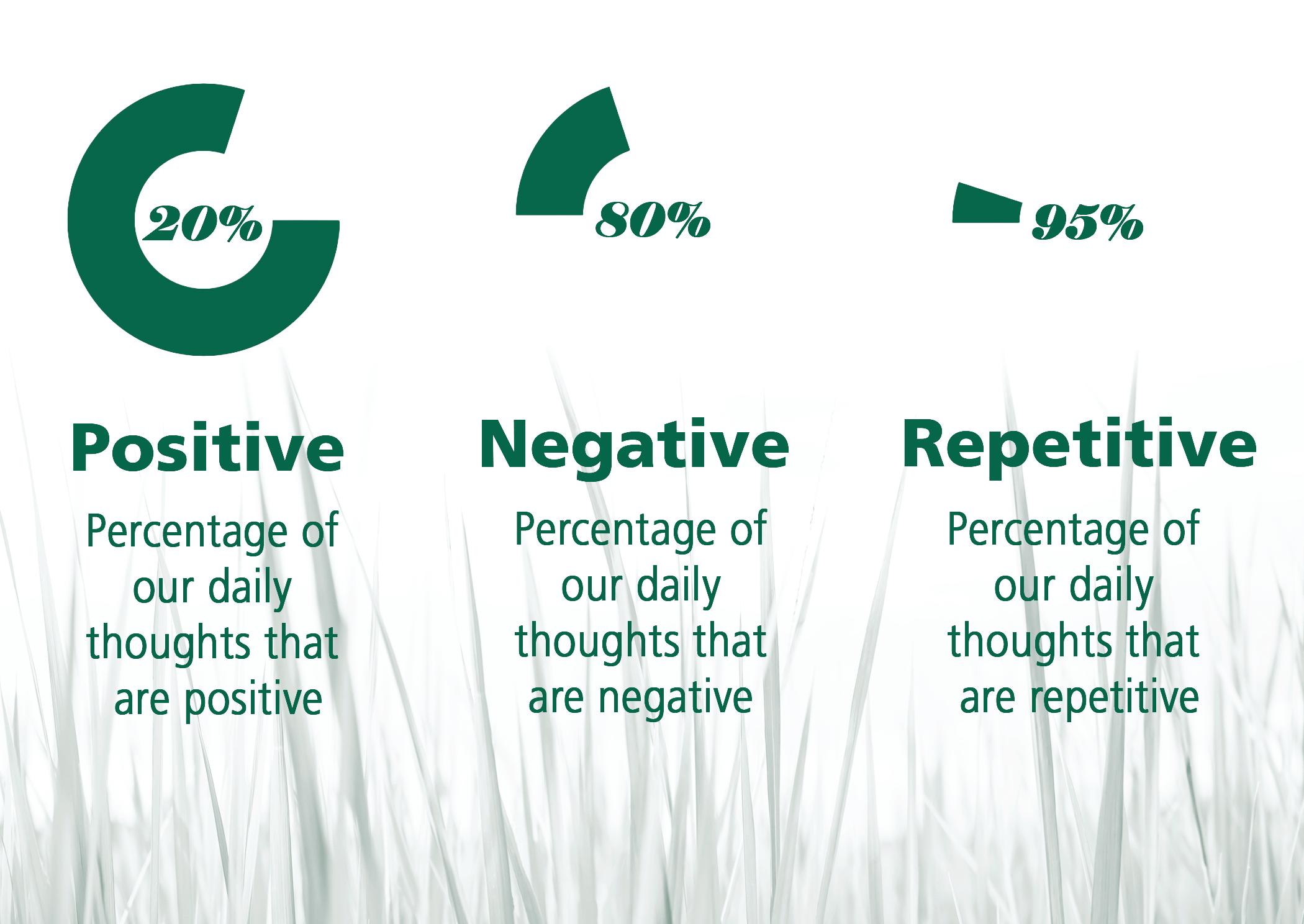

The average adult has about 12,000 to 60,000 thoughts per day. And 80% of them are negative.

We know positive thinking is good for your health. But what is positive thinking? And what are the effects of negative thinking? Find the Silver Lining

Positive thinking means you approach unpleasantness in a positive and productive way. You think the best is going to happen, not the worst. Positive thinking can also be related to looking on the bright side or finding the silver lining. Not everything we do in life will be pleasant but looking at situations in a different light can certainly help you get through those tough times.

Positive thinking often starts with self-talk. Self-talk is the endless stream of unspoken thoughts that run through your head.

Here are some examples of negative vs. positive thinking:

I can’t do anything right. I will try my best. I don’t know anything. I am willing to learn I have always been this way. I am open to change. This is too difficult. It sounds challenging but I will try my best. Bad things always happen to me. Bad things happen but I always find a way. I don’t like anything about myself. I am strong. I am loved. I am valued.

Do you see how changing a negative thought to a positive affirmation can help shift negative thoughts as well as promote self-confidence and well-being? If you find yourself thinking negatively, try countering that thought with a positive statement.

The Disadvantages of Negativity

Negative thinking can have a significant impact on various aspects of your life, including your mental and emotional well-being, physical health, relationships, and overall quality of life. Here are some of the potential effects of negative thinking:

• Physical Health Issues: Chronic stress can lead to a variety of physical health problems, including headaches, muscle tension, digestive issues, and weakened immune system.

• Mental Health Challenges: Persistent stress can take a toll on your mental health, leading to anxiety, depression, or other mood disorders. It can also exacerbate existing mental health conditions.

• Poor Decision Making: When under stress, people often make hasty decisions without carefully considering the consequences.

• Neglecting Self-Care: In the midst of stress, people often neglect self-care activities like exercise, proper nutrition, and relaxation techniques, all of which can help alleviate stress.

• Negative Thought Patterns: Chronic stress can foster negative thinking patterns, such as assuming the worst.

Tapping into the Power of Positive

Think about a time where you faced a difficulty and forged ahead with a positive mindset. We’re guessing you were likely able to adapt to the situation with a lot more grace and resiliency. Or perhaps you were able to think more creatively and be better at problem solving.

That positive thinking can help improve your health as well — stronger immune system, lower risk of depression, and reduced stress levels.

But how do you flip the switch? Here are some techniques to help you focus on the positives.

Visualization. This is a powerful tool to help you to manifest your future. You create a mental vision of where you want to be in the future. Not only is it a way to reprogram your mind, visualization can also help you get through a tough time. Headspace has an article about the benefits of this focused practice.

Meditation. Meditation, or mindfulness, can help you clear your mind and come back to the present moment. This is a helpful tool when you are in a stressful situation. It’s good to take a mindfulness moment, reset, and return with confidence. YouTube is a great place to start if you are looking for guided meditations.

Express Gratitude. Studies show that people who express gratitude are happier individuals. Remind yourself of how truly lucky you are: you woke up today, you are healthy, and you are strong. Make it a practice to write down three reasons you are grateful every morning or evening. Not sure what to write? Calm offers some prompts to get you started.

Audit Your Circle. If you surround yourself with positive people, it is easier to be a positive person. Recognize how you feel when you are with certain people in your life. Do they fill your cup, or drain it? It is important to have a circle of support that provides inspiration, motivation, and encouragement.

Learn from Failure. Rather than seeing failure as a dead end, positive thinkers view it as a stepping stone to success. Use the experience to move forward in a new way.

Encourage Others. Positive thinkers not only focus on their own well-being but also support and encourage others. Think back to your circle of support — how do you make others feel? Do you fill their cups, or drain them?

Look Where You Want to Go

Changing your mindset takes time, but it can be done. Take driving as an example. When you are driving, you look where you want to go. If you turn your head to look at something on the side of the road, you will inevitably head in that direction.

So, by consciously choosing to look in the right direction and staying committed to your goals and values, you can steer your life toward the outcomes you desire.

Remember when you are looking for the negatives, you will find them and, when you look for the positives, you will find those, too. Keep your eyes on the positive.

Krista Bouchard is the Wellness Coordinator at HealthTrust. David Salois is the Benefits Services Manager at HealthTrust.

Contribute to Town & City!

Do you have insights or expertise to share with New Hampshire's municipal community? Town and City invites municipal leaders and industry experts to contribute articles that inform, inspire, and engage readers across the state.

THE GRASS IS GREENER from page 9

Go Ahead — Laugh Out Loud! It’s

Good for You!

Kerry Horne

Laughing is good for you! Not only is laughing fun and contagious, it has actual health benefits. Good, hearty laughter can relieve tension and stress, boost the immune system by reducing stress hormones and increasing activity among immune cells and antibodies, and help reduce the risk of heart attack and stroke by improving blood flow and blood vessel function, according to sources including the Mayo Clinic and Wellness Council of America (WELCOA).

What Happens When You Laugh?

Think of the last time you had a good, long laugh. How did you feel after? Happier? More relaxed? According to the Mayo Clinic, these feelings may result from the beneficial physiological changes that occur when you laugh.

• Laughter increases your intake of oxygen-rich air, stimulates your heart, lungs and muscles, and increases endorphins (natural feel-good chemicals released by your brain).

• A hearty laugh stimulates and then cools down your stress response, and it can increase and then decrease your heart rate and blood pressure. Laughter also decreases stress hormones, such as cortisol and epinephrine, while increasing endorphins, according to WELCOA. The result? A good, relaxed feeling.

• Laughter can also stimulate circulation and aid muscle relaxation, both of which can help reduce some of the physical symptoms of stress.

Can Laughter Have Long-term Effects?

In addition to the short-term benefits of laughter, there is some evidence that laughter may have longterm positive effects, too:

• Improve your immune system. Negative thoughts manifest into chemical reactions that can affect your body by bringing more stress into your system and decreasing your immunity. By contrast, positive thoughts can release neuropeptides that help fight stress and may help you fight off infection.

• Reduce the effects of stress on cardiovascular health. Researchers from the University of Tokyo asked people age 65-plus how often they laughed. The result: people who never laughed had a higher risk for heart disease and stroke than people who laughed daily.

• Relieve pain. Laughter may ease pain by causing the body to produce its own natural painkillers. A 2024 study examining the effects of laughter therapy (using a laughter yoga routine) and spontaneous laughter on cancer patients found participant’s pain levels were cut in half.

• Help you lose weight. Well, you’ll have to laugh for several hours to burn off the calories of a candy bar, but a study on the energy expenditure of genuine laughter by Vanderbilt University found 10 to 15 minutes of laughing can help you burn 10 to 40 calories. In addition, it provides good cardiac, abdominal, and facial muscle conditioning.

• Increase personal satisfaction. Laughter can make it easier to cope with difficult situations and help you connect and bond with others, according to the Mayo Clinic.

• Improve your mood. Laughter may help lessen depression and anxiety, possibly making you feel happier.

• Improve your memory. Cortisol, the stress hormone, can damage hippocampus neurons and impair learning and memory. But a single session of laughter (studies looked at a range of 9 to 60 minutes) may reduce your cortisol level by 37%.

Tips for Laughing More

Try to add a little more laughter into each day! Here are a few ideas to bring laughter into your life.

• Watch a funny movie, your favorite sitcom, or a silly TikTok video.

• Surround yourself with things that make you laugh – such as funny photos, comics, or artwork.

• Try a laughter yoga class, which combines intentional laughter with breathing exercises to promote well-being.

• Spend time with people who make you smile and laugh.

• Make time for fun activities.

• Spend more time with children and pets.

• Learn a good joke and share it with friends and family.

Remember, even when times are tough, laughter can help relieve stress and provide a positive outlet. Go ahead… laugh out loud! You may discover there’s some truth to the adage, “laughter is the best medicine.”

Kerry Horne is the Well-Being Manager at HealthTrust.

Did You Know?

• Children laugh about 400 times a day, but adults on average laugh only about 15 times. (Journal of Hospital Medicine)

• People laugh 30 times more in the company of others than they do alone. (Scientific American)

• Frowning causes more wrinkles than smiling. (Nature Journal of Science)

Stay Informed with our Bill Tracker

Track key legislation affecting New Hampshire municipalities in real time. The New Hampshire Municipal Association (NHMA) advocates for the interests of cities and towns at the New Hampshire General Court and state agencies. With the legislative session running January to June, NHMA tracks state actions that could significantly affect the state's 234 municipalities.

• Real-time updates on legislative activity through FastDemocracy

• Access to bills categorized by legislative topic

• NHMA's stance on key measures

• Optional daily or weekly email updates with new bill actions and upcoming hearings

• No account is required to access FastDemocracy, but members can create one for additional customization

LAUGH

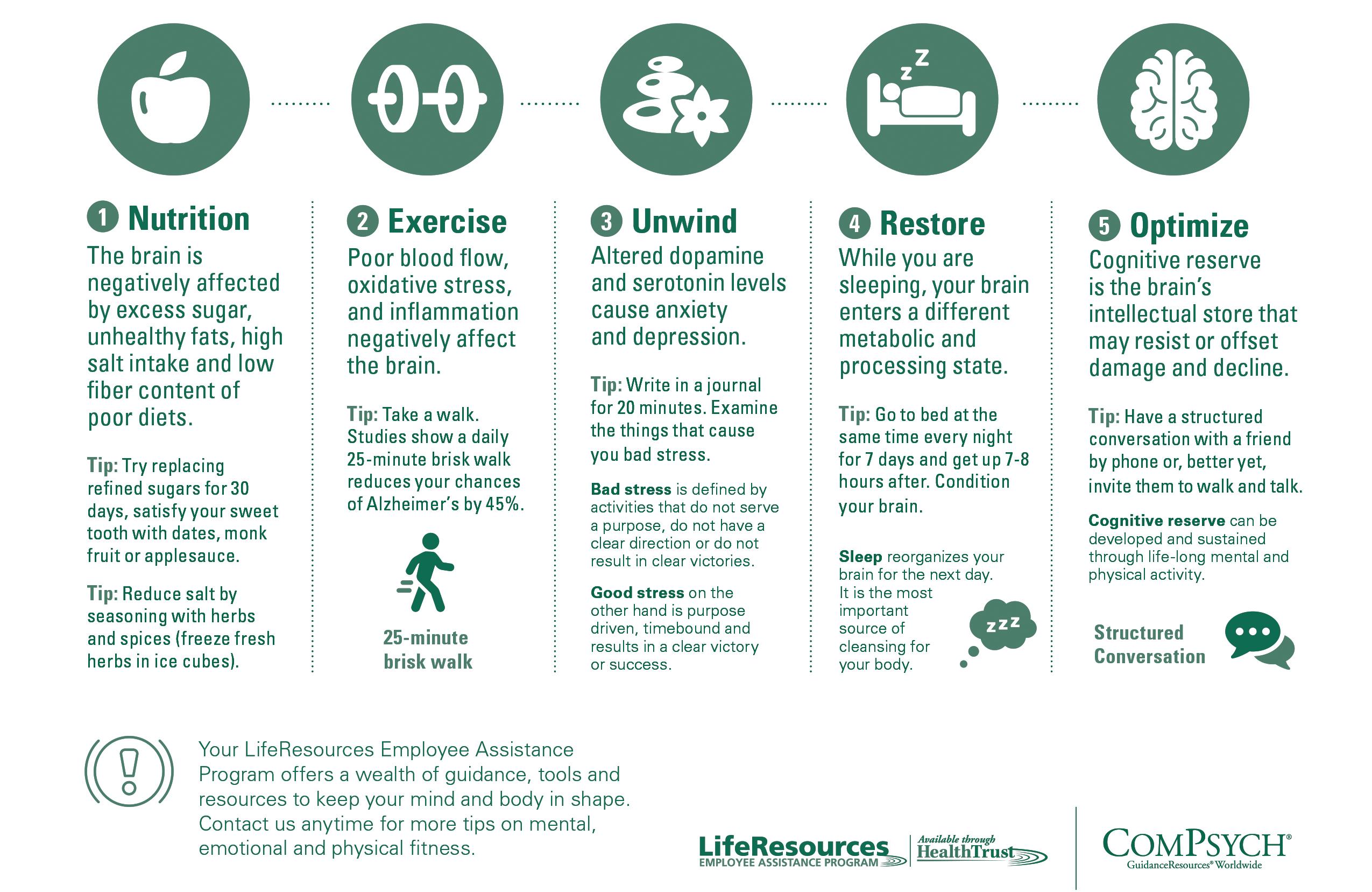

Healthy Habits for a Healthy Brain

A healthy brain is the foundation of a vibrant, fulfilling life, influencing everything from memory and focus to mood and decision-making. Just as our bodies thrive on proper care, our brains benefit from daily habits that support mental clarity, emotional balance, and long-term cognitive function.

By incorporating simple, consistent practices, we can enhance brain health and build resilience against age related decline. Prioritizing these habits not only sharpens our minds today, but also safeguards our mental well-being for the future. Check out the tips below to enhance your brain health today!

Cordell A. Johnston Attorney at Law

Representing towns and cities

P.O. Box 252

Henniker, NH 03242

603-748-4019

cordell@cajohnston.com

Graphic courtesy of ComPsych, provider of LifeResources Employee Assistance Program and a HealthTrust partner

Upcoming Events

SEPTEMBER

Labor Day (NHMA Offices Closed)

Monday, September 1

Financial Policies Certificate Program

September 3 – October 1

25 Triangle Park Drive, Concord, NH 03001

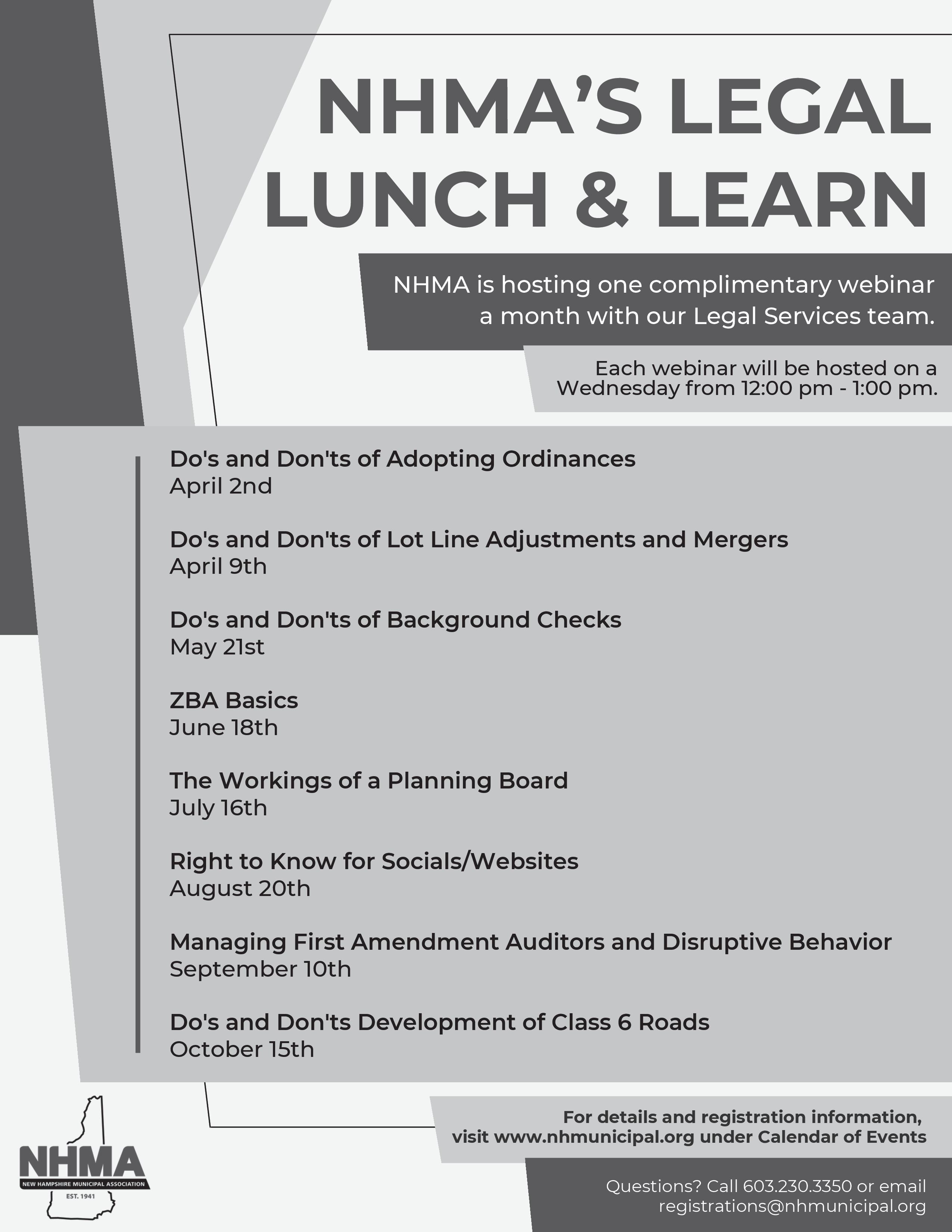

Managing First Amendment Auditors and Disruptive Behavior Webinar

12:00 pm – 1:00pm Wednesday, September 10

For more information or to register for an event, visit our online Calendar of Events at www.nhmunicipal.org. If you have any questions, please contact us at registrations@nhmunicipal.org.

Land Use Law Conference

9:00 am – 3:30pm Saturday, October 4

Southern New Hampshire University, Dining Center Banquet Hall 2500 North River Road Manchester, NH 03106

OCTOBER

Columbus Day (NHMA Offices Closed) Monday, October 13

Budget & Finance Workshop (Manchester)

9:00 am – 4:30pm Thursday, September 11

The Derryfield Restaurant & Conference Center 625 Mammoth Road, Manchester, NH 03104

Budget & Finance Workshop (Littleton)

9:00 am – 4:30pm Thursday, September 25

Littleton Opera House 2 Union Street Littleton, NH 03561

Do's and Don'ts of Development of Class VI Roads Webinar

12:00 pm – 1:00pm Wednesday, October 15

NHMA Board of Directors Meeting

9:30 am – 12:00pm Friday, October 17

25 Triangle Park Drive Concord, NH 03301

For the most up-to-date event and training information, please visit the NHMA website at www.nhmunicipal.org. Event times and dates are subject to change. Thank you.

INTRODUCING:

Tammy Letson

NHMA's New Government Finance Specialist!

NHMA is excited to announce that Tammy Letson has joined NHMA as our new Government Finance Specialist! Tammy is now available to answer government-finance inquiries from NHMA members and will be conducting a variety of educational workshops, including the return of the Financial Policies Certificate series in the fall.

Prior to joining the NHMA team, she held various positions in municipalities including Town Administrator, Finance Director, Tax Collector, Trustee of Trust Funds, and Planning Board Secretary. She was a Municipal Services Advisor for 14 years with an NH accounting firm and worked for 8 years in software support for an NH based company who specializes in local government.

To contact Tammy with your finance inquiries, please use the legalinquiries@nhmunicipal.org email address, or call us at 603.224.7447 and press one. Tammy's typical availability is Monday - Thursday from 9:00 am - 4:30 pm. And stay tuned for upcoming training opportunities!

UP CLOSE AND PERSONAL

Welcome to Up Close and Personal, a regular column in New Hampshire Town and City designed to give readers a closer look at NHMA Board members. This issue features Councilor Lori Radke, Town of Bedford and NHMA Board Member.

What are your duties and responsibilities as a Town Councilor?

I am a member of the Bedford Town Council, currently serving as the chairwoman. The town of Bedford operates under the town council/town manager form of government. Town Councilor responsibilities include the administration of the fiscal, prudential, municipal, and other affairs of the town. The Town Council appoints residents to various Boards and Commissions.

What is your biggest challenge in performing your duties?

The biggest challenge is getting elected every three years. Once you have accomplished that task, the next challenge is working with a group of six other town councilors. As you may know, we don’t always agree, so the challenge is trying to find the middle ground.

How has NHMA helped you to do your job?

Bedford

"Being an elected official makes you an open book. So, I try not to engage in social media; I do my best to treat my colleagues and residents with respect, and I do my best to drive the speed limit!"

NHMA is amazing and a wealth of information. I utilize the resources that NHMA offers to research questions I may have, attend workshops, and stay informed about legislative matters. Being informed helps me become a better town councilor.

Give us an example of a problem you solved or a dilemma you faced and overcame in the line of duty.

Not so much a dilemma as a solution. Bedford is a wonderful community with lots of housing options and business opportunities. What Bedford is lacking is a sufficient amount of open space. My first order of business when I was elected in 2020 was to propose changing the amount of LUCT (land use change tax) from 50% to 100%.

That initiative passed overwhelmingly, and now the town enjoys 100% of LUCT being diverted directly to Conservation, so it has more funds to secure additional open space.

What is the public perception about your job and how does it differ from the reality of your job?

Residents believe the Town Council has the power to make immediate changes. Although that has some truth to it, what they don’t understand is that RSA’s and our town Charter can bind the Town Council.

Tell us a story about an unusual experience you have had while doing your job.

Great question, I just can’t think of anything. I believe that is a good thing.

Lori Radke

Has your public position changed you personally?

Being an elected official makes you an open book. So, I try not to engage in social media; I do my best to treat my colleagues and residents with respect, and I do my best to drive the speed limit! As an elected official, there is nothing worse than having your name in the newspaper when it’s not good news!

Has your job changed the way you look at the role of government?

Yes, being a town councilor has heightened my awareness of what is happening in Concord and how some of their decisions impact municipalities. Although the legislature's decisions in Concord may be good or bad, they will ultimately affect how towns and cities operate. That is why it is crucial to stay informed.

What lessons about human nature have you learned in your municipal role?

There are two sides to every issue, and the truth is somewhere in the middle.

What advice would you give someone who would like to follow in your footsteps into this job?

Learn as much as you can about local government. Begin by volunteering to serve on a board or commission. Work on obtaining certifications or the necessary education to gain

entry. Once you make that leap of faith, go into it with your eyes wide open and always follow your true north.

Do you dislike any aspects of your job? Which ones? Why?

Long meetings. Given our form of government and having an outstanding Town Manager, there is no need for the Town Council to delve into the details of town operations, which can turn a one-hour meeting into a three-hour meeting. Oy vey!

Given the opportunity, what changes would you make to the position?

I like the town manager/town council form of government that Bedford currently has. The only change I would like to see is having the town council approve the operating budget instead of sending it to the residents for approval. Unfortunately, in 2024, the town voted to go from a budgetary town meeting to SB2 to approve the budget. A step backwards, if you ask me.

Is there anything else you would like to discuss regarding your job?

In addition to serving as a town councilor in Bedford, I also serve as a town administrator in Hollis. Some may think this to be a conflict or too much on my plate. I would disagree-- being a town councilor in Bedford has made me a more effective town administrator in Hollis, and I wouldn’t change a thing!

Accessible Voting System Pilot Program Made Permanent

Sarah Burke Cohen, NHMA Legislative Advocate

On June 30, 2025, the pilot program that required municipalities to enter into pilot agreements with the Secretary of State (“SOS”) for the mandatory use of Accessible Voting Systems at local elections was set to expire. Given the success of the program, HB 67, which extends the pilot program to December 31, 2025 and makes the program permanent starting January 1, 2026, was passed by both chambers and signed into law by Governor Ayotte on August 1, 2025.

Accessible Voting Systems (“AVS”) are required to be used at all state and federal elections under the Helping Americans Vote Act. The SOS purchased and maintains AVS for every polling site in the state. AVS are designed to assist voters who are blind, visually impaired, or have other disabilities that make traditional voting methods difficult. AVS provides voters with disabilities with equal access to the election process, including voting privately and independently.

As previously required by the pilot program, HB 67 obligates any city, town, or school district that uses an official ballot system to ensure that each polling place is equipped with at least one accessible voting system during local elections. Municipalities must enter into agreements with the SOS’s office to use the AVS for

local elections. The permanent agreement will again include the requirement that the municipality cover the cost of programming the AVS (for local elections only); store and maintain the AVS in accordance with state issued election security standards; and follow any guidance issued by the NH SOS relative to AVS programming and election-day setup.

The SOS issued a Request for Proposals (RFP) to replace the state’s existing in-person accessible voting system. The SOS has stated that its objective for the RFP is to ensure easy set up for election officials and ease of use for voters. The SOS has also indicated that it will be cognizant of the programming costs when reviewing the responses to the RFP. The SOS has indicated that the new equipment and associated form agreements pursuant to HB 67 will be delivered to municipalities in early 2026.

Although legislation passed both chambers that would have provided an option for municipalities to opt-out of deploying the AVS, it was vetoed by Governor Ayotte on August 1, 2025. In the veto message, Governor Ayotte stated "This legislation (HB 613) impacts people with disabilities and would conflict with federal law that requires accessible voting systems be available at all polling places during federal elections."

100 Years of Service: Clerks' Corner

Sherry Farrell, Londonderry Town Clerk, Executive Board Member

NH Leads in Election Integrity

July 21st Democracy Defense Project New Hampshire joined the New Hampshire City and Town Clerks Association, hosted by Tina Gilford the Derry Town Clerk to discuss New Hampshire Elections and why I always say that New Hampshire Leads the way in ensuring Fair and Transparent Elections. With Secretary David Scanlan as the moderator an open discussion was held with former Congressman John Sununu and our Ambassador to Denmark Richard N. Swett. The goal of this open forum was to continue to build confidence and understanding of the New Hampshire Electoral process.

The New Hampshire Town and City Clerks’ Association Celebrates the NEMCI Class of 2025!

Congratulations to the NEMCI Class of 2025 on completing the immersive in-person educational

experience! We’re especially proud of our two New Hampshire graduates, Elise Smith and Erica Anthony, pictured on the far left.

Cheers to all the dedicated and inspiring New England clerks who completed this incredible milestone!

100th Conference Celebration

Our New Hampshire City and Town Clerk Association will be celebrating their 100 years of service to the state and residents we love at their Annual Conference October 28th - 31st. Beginning in 1925 till 1950 the Conferences were held at Concord City Hall. The City and Town Clerks are busy gathering data from previous conferences to display at our up-coming100th conference. If anyone has anything to share, please contact Sherry Farrell at the Londonderry Town Hall, sfarrell@londonderrynh.gov or if you are interested in being a sponsor for this important event.

Taken July 17, 2025, at Plymouth State University, NH

The State Doth Protest Local Zoning Too Much

Brodie Deshaies, NHMA Legislative Advocate

In 2025, we saw some of the most significant changes to the state’s zoning enabling laws in the last three decades. All the changes made to these laws prevent municipalities from adopting several different types of zoning ordinances, overriding existing voter-adopted ordinances that balance reasonable and responsible development with the rights of new and existing property owners. Additionally, these new mandates impede the key purposes of locally adopted zoning ordinances, including preventing overdevelopment that can overwhelm existing resources and infrastructure, harm others enjoyment of their property or public commons, and prevent large property tax burden shifts caused by unfettered development.

These new mandates were supported by housing advocates and members of the New Hampshire Housing Supply Coalition, such as the New Hampshire Home Builders and Housing Action New Hampshire, who blame local governments for the ongoing housing shortage.

Most of these bills received limited debate or discussion within the House Housing Committee, Senate Commerce Committee, and the Senate’s Subcommittee on Housing. For example, over 5 months of committee hearings, work sessions, and executive sessions, the House Housing Committee spent about 50 hours on 35 bills. We opposed nearly all these bills because they limited local decision making on zoning and land use. The House Housing Committee voted 281-2 in favor of these bills, and placed all of them on the consent calendar, preventing debate or opposing viewpoints from being raised during the process.

When some of these bills were removed from the consent calendar and debated on the House floor, the majority tended to agree with our position, with us winning four of the six floor votes in the House. One vote we narrowly lost 179-170, and we would have won the vote if attendance were slightly different on that day; but “close” only counts in horseshoe and hand grenades.

The Senate did not see the value in local control over zoning this year. Leadership in both parties determined that they would treat land use law as a primarily “commercial” or “business issue” by sending every zoning bill to the Senate Commerce Committee. Zoning is not simply an economic issue; however, it appears the Senate will continue this approach for the time being. The committee referred many of these bills to the Senate Subcommittee on Housing, chaired by the senator who introduced nearly all the anti-

local zoning bills this year in the Senate.

The Senate did not roll call any of the anti-local zoning bills, except for Senate Bill 84 (the mandated minimum lot size bill). All the other zoning mandate bills passed on simple voice votes, with vocal opposition on many from the Senator of District 9. Even with a massive effort in the Senate to kill SB 84, led by us and our members, the bill eventually passed with the Senate President casting the deciding vote. This was despite the Senate postponing the vote on the bill two weeks in a row due to a lack of support and votes to pass the bill—but a floor amendment from the Senator of District 4, unfortunately, broke the gridlock. The House Housing Committee later retained SB 84 with the intent of reviving the effort next year, but only after a massive turnout by our members and key state legislators at the committee hearing. This hearing served as a turning point as well, and we have seen the tides start to turn. We must continue to work hard and keep that momentum going.

Despite the adversity, our members were instrumental in helping get state representatives to act and vote against many of the worst bills. It took a while to get state legislators who agree with us to force floor debates and votes in the House. This was due to the legislative process and strategy of hiding these statewide zoning mandates on the consent calendar—a special docket of recommended action on bills that legislators “consent to” and rarely review. Once the House woke up, they tended to act in support of local decision making and respected the votes on zoning ordinances made by Granite Staters in every town.

We must continue to raise awareness and encourage our state legislators to do the right thing by voting against future statewide zoning mandates or even repealing existing ones. The New Hampshire Municipal Association and our members must work to help more senators see the value in local decision making. Please call or email your senator to express your concerns about the bills that were passed and urge them to take a different approach next year: https:// gc.nh.gov/senate/members/senate_roster.aspx.

The zoning mandates that passed were all signed into law by Governor Ayotte on July 15th. Again, thanks to our members, we embarked on a substantial veto request campaign, hoping the Governor would veto at least a few of the most harmful bills. Our requests and strong urging against these bills could not override the well funded campaign in favor of these mandates.

Here are the most notable statewide zoning mandates Governor Ayotte signed into law with no fanfare, no affordability requirements, or guarantee that this housing will be utilized by existing New Hampshire residents: Just state mandates.

HB 577, mandating that a municipality which adopts a zoning ordinance shall allow accessory dwelling units in all zoning districts that permit single-family dwellings. One accessory dwelling unit (ADU), which may be either attached or detached, shall be allowed as a matter of right, and municipalities may no longer require either a conditional use permit or special exception for an ADU.

Additionally, a plethora of local control provisions were removed from the existing state law. Municipalities may not adopt greater requirements for a septic system for a single-family home with an accessory dwelling unit than is required by the Department of Environmental Services. They can’t have local parking requirements for ADUs beyond what state law allows. They can’t require a familial relationship between the occupants of an accessory dwelling unit and the occupants of a principal dwelling unit or limit an ADU to only one bedroom.

HB 577 also requires municipalities to allow accessory dwelling units to be converted from existing structures, including but not limited to detached garages, regardless of whether such structures violate current dimensional requirements for setbacks or lot coverage. (Effective July 1, 2025).

HB 631 requires municipalities to allow multi-family residential development on commercially zoned land, provided that adequate infrastructure for roads, water and sewerage systems is available to support that development. Municipalities may still restrict residential development in zones where industrial and manufacturing uses are permitted. Nevertheless, municipalities may require that the ground floor space in the commercially zone property may be required to be dedicated in whole or in part to retail or similar uses. (Effective July 1, 2026).

SB 284 prohibits municipal zoning ordinances from requiring more than one residential parking space per unit. This amendment to RSA 674:16 does not affect the power to regulate parking on land uses other than residential uses. (Effective September 13, 2025).

HB 457 prohibits municipal zoning ordinances from restricting the number of occupants of any dwelling unit to less than 2 occupants per bedroom. In addition, any existing zoning ordinance that restricts the number of occupants per bedroom to less than 2 occupants can no longer be enforced by the governing body. Furthermore, municipal zoning ordinances based on the familial or non-familial relationships or marital status, occupation, employment status, or educational status, including but not limited to scholastic enrollment, or academic achievement at any level among shall not be enforced. (Effective September 13, 2025).

SB 281 amends RSA 674:41, by permitting the issuance of building permits on Class VI roads without requiring approval from the governing body. Instead, in order to get a building permit for the erection of a building a Class VI road, the applicant will need only sign and record at the registry of deeds a liability waiver acknowledging: that the municipality will not maintain the road nor provide services to any lot accessible by the road; that the municipality will not be responsible for losses or damages caused by lack of services; and, that the responsibility for such services falls solely on the applicant. Prior to the issuance of the building permit, the applicant shall prove that the lot and any buildings thereon are insurable. (Effective July 1, 2026).

HB 296 amends RSA 674:41, building and subdivision on Class VI and Private Roads, and RSA 676:5, appeals to the Zoning Board of Adjustment. Currently, a building permit for the erection of a building on a Private Road can only be authorized by the local governing body after review and comment by the planning board. This amendment to RSA 674:41, I (d)(1) will allow, as an alternative to going to the planning board for review and comment, the applicant can instead establish that the private road identifies and complies with a policy adopted by the governing body. Therefore, if the governing body adopts a policy for building on private roads, and the applicant complies with that policy, then planning board input is not required.

In addition, this bill modifies the statute governing the time for appealing to the Zoning Board of Adjustment. Currently, RSA 676:5, I states that appeals to the Zoning Board of Adjustment will be taken within a reasonable time as provided by the rules of the board. This amendment changes that appeal period to a standard 30-day period. (Effective September 13, 2025).

Cartoon by Dale Neseman

On top of these zoning mandates and others, the state established a commission to study the New Hampshire Zoning Enabling Act (what is now RSA 674:16-23). The commission created by HB 399 will be studying these provisions of state law and others to determine whether the state should eliminate sections of the enabling laws for local zoning. Specifically, the commission will “Determine if the listed powers are still appropriate and/or applicable today, and if any could be removed or if any not present should be added,” amongst other charges to study. This implies further significant reforms to limit or end local control of zoning will be recommended.

We will be closely monitoring this study commission and asking our members with expertise and experience with local zoning to attend. We don’t want this study commission to become a trojan horse for more statewide zoning mandates.

The New Hampshire Municipal Association is committed to repealing these new zoning mandates, others that currently exist, or amending existing ones to make them less harmful or burdensome to municipalities and residents. We are engaging with key state legislators to get

bills introduced, passed, and on the Governor’s desk. We will continue to keep our members informed throughout the process in the Legislative Bulletin.

Municipalities are not the reason for the state’s housing shortage. The state’s years of limited to no action on funding or incentivizing housing access and infrastructure investments, coupled with decades of downshifting that put pressure on property taxes, plus economic factors outside our control, like interest rates and building and labor costs, are the most significant causes. I am reminded of a line from Hamlet that my father quotes from time-to-time: “The lady doth protest too much, methinks.” Methinks the state doth protest too much without taking real action to address housing. It’s time for the state to take ownership and stop scapegoating municipalities.

In 2025, the state kicked down municipalities and then kicked the can down the road. We’re committed to a very different 2026.

In the meantime, please refer to our legal guidance on these bills and many others: https://www.nhmunicipal.org/ new-laws-guidance.

Municipal Tax Caps – An Overview and Update in Light of Recent Legislation

Stephen C. Buckley, NHMA Legal Services Counsel

Towns and cities (as well as school districts) may adopt limits on spending or tax increases. For a city, or for a town with a town council form of government, the charter may be amended to include a limit on annual increases in the amount raised by taxes in the city or town budget. The limit must include a provision allowing for override of the cap by a supermajority vote as established in the charter. RSA 49-C:12, III; RSA 49-C:33, I(d); RSA 49-D:3, I(e). Amendments effective August 20, 2021 provide that city and town charter exclusions, ordinances and accounting practices that have the effect of an override of a tax cap require a supermajority vote of the legislative body.

In other towns with traditional town meetings or official ballot referendum town meetings (SB 2), and other political subdivisions adopting a budget at an annual meeting of the voters, the voters may adopt a limit on annual increases in the estimated amount of local taxes in the governing body’s or budget committee’s proposed budget.

According to the New Hampshire Department of Revenue Administration, of the 13 cities in New Hampshire, there are 5 which do not mention any “cap” or budget limitation in their charters: Berlin, Claremont, Concord, Keene and Lebanon. The remaining 8 cities use a variety of ways to control spending either through charter provisions that limit budget increases, or through limits on the amount of any increase in the property tax levy or a limit on appropriations: Dover, Franklin, Laconia, Manchester, Nashua, Portsmouth, Rochester and Somersworth. There are 6 towns that have adopted tax caps under RSA 32:5-b: Alstead, Brentwood (adopted in 2025), Litchfield, Middleton, Milton and Nottingham.

Amendments to RSA 32:5-b adopted this year will have a significant impact on towns that have adopted tax caps or will adopt tax caps in the future. These changes do not affect cities.

HB 200

HB 200 eliminates the current ability of town meeting to override an adopted tax cap

and requires any override to be approved by the legislative body (town meeting) by ballot 3/5th vote. Prior to the enactment of HB 200, a tax cap did not limit the amount the voters could actually appropriate at the annual town meeting; it was only a limit on the budget submitted to the voters for consideration. In a traditional town meeting, the voters were allowed to amend the proposed budget up or down in the same way they ordinarily would. In a town using the SB 2 form of town meeting, adoption of a cap did not prevent the voters at the deliberative session from amending one or more warrant articles (or all of them) to increase the amount of a proposed appropriation or the total amount of all proposed appropriations. It is important to note, of course, that in a town with an official budget committee, the ten percent limitation still applied, effectively capping the total amount that may be appropriated.

HB 200

Amended paragraph III of RSA 32:5-b to provide that to override an adopted tax cap the business meeting of a traditional town meeting shall vote by secret ballot to exceed the tax cap, and the vote to override shall be approved by a 3/5 majority. Presumably, the need to a conduct a ballot vote to exceed a tax cap would arise anytime a motion to amend an appropriation warrant article would have the effect of exceeding an adopted tax cap. For a town using the SB 2 form of government, HB 200 provides that if the warrant article for the operating budget results in appropriations exceeding the tax cap and receives less than 3/5 majority in favor, “the adopted operating budget shall be reduced by appropriations already raised to remain compliant with the tax cap under this section." Needless to say, what this provision means by referring to “appropriations already raised” is confusing and open to significant debate. If the proposed operating budget in an SB 2 with a tax cap is amended at the deliberative session to exceed the tax cap, and the operating budget is nevertheless approved by a 3/5 majority, how does this vote affect the votes on subsequent warrant articles also containing appropriations? Must all such

additional warrant article appropriations that were amended at the deliberative session so as to exceed the tax themselves individually or collectively be approved at the ballot session by a 3/5 majority?

This amendment controlling the override of a town tax cap applies to all towns with tax caps adopted prior to the effective date of HB 200. HB 200 is effective as of September 13, 2025.

HB 374

HB 374 was also adopted this year further amending 32:5-b by clarifying how a tax cap using inflation and changes in population or attendance at school districts will be calculated. New definitions on “Attendance,” “Base Amount,” and “Population” are provided along with a clarification that official inflation figures (from either the Bureau of Labor Statistics or American City and County) shall be as of October 1st preceding the date of the budget hearing held under RSA 32:5, I. HB 374 also amended RSA 32:5-c concerning the phrasing of the questions for the adoption of a tax cap specifying the ballot language for a tax cap using a multiplication factor. HB 374 is effective September 13, 2025.

SB 105

Finally, SB 105 has been adopted that introduces new options for Town Budget Caps, RSA 32:5-g and RSA 32:5-h, effective August 23, 2025. A budget cap adopted under this provision would limit a proposed budget so as not to exceed the dollars spent per resident in the prior fiscal year times the current town population plus a fixed percentage, or percent annual increase for inflation from the Bureau of Labor Statistics or American City or County.

This new budget cap option also contains the restriction imposed by HB 200 that any override of a budget cap must be approved by a 3/5 ballot vote in favor by the annual meeting. Furthermore, this legislation also introduces a new limit on the authority of town meeting to amend warrant articles. Any question to adopt a budget cap under RSA 32:5-g shall not be subject to amendment by the legislative body. RSA 32:5-h, V.

State Budget: What’s In It for Municipalities?

Marty Karlon, NHMA Policy & Research Analyst

Despite a challenging state revenue picture, uncertainty over federal funding, and costly legislative priorities (pension changes, school voucher expansion), the $15.9 billion, two-year FY 2026-27 state budget adopted in June maintains most of the hard-won gains in state aid that municipalities achieved in recent years.

Here is a high-level summary of items in the budget impacting municipalities:

Meals and rooms tax:

Various proposals to reduce 30% municipal share of meals and rooms tax were unsuccessful. Revenue from this tax has grown steadily and is projected to increase by $7.5 million in FY 2026 and by another $8 million in FY 2027.

Retirement system:

New Hampshire Retirement System pension benefits for first responders in the system but not vested prior to January 1, 2012, were increased from current levels. The budget included a promise of at least $262 million in state funding through 2034, although only the $42 million to be paid in FY 26-27 is guaranteed. The budget also contained language that the state “shall pay the normal contribution and accrued liability contributions attributable to this act,” which is intended to prevent downshifting the cost of these changes to municipalities. If the state were to renege on its commitment, local retirement costs would skyrocket.

Revenue sharing:

Although it has no current fiscal impact, the budget includes a repeal of municipal revenue sharing under RSA 31-A. Although this provision has been suspended since 2010, keeping the statute alive would have made it easier for a future legislature to revisit it.

SAG Grants:

The budget included $2.5 million per year in funding for State Aid Grants (SAG), which provide 20% to 30% of eligible principal and interest payments for completed municipal infrastructure projects. The funding is still well below the $15 million per year included in the last budget.

Granite advantage:

The state will introduce premiums for these health programs on a flat, per-family member basis. NHMA has concerns that new, out-of-pocket premiums for participants will have an adverse trickle-down impact on local welfare budgets.

Vehicle inspections:

The budget eliminated motor vehicle safety inspections in 2026 and authorizes the state to work with the federal government regarding emissions testing. Because 12 percent of the motor vehicle fee revenue is distributed to municipalities, the Department of Transportation estimates this change would decrease municipal revenue by about $350,000 per year.

Housing Appeals Board (HAB):

The budget includes funding for a modified version of the HAB, which the House wanted to eliminate. Under the new model, the HAB will share resources with the Board of Tax and Land Appeals (BTLA).

Right to Know Ombudsman:

The ombudsman was converted to per-diem position attached to a newly created office of state and public sector labor relations, which led to the resignation of the incumbent ombudsman. The position, when filled, will continue to independently exercise the statutory jurisdiction conferred upon it.

Other:

Despite multiple attempts, no funding was added to the budget for the Housing Champions program, and state funding for regional planning commissions was eliminated.

Overall, municipalities fared well in this budget when compared with other tight budget cycles over the past 20 years. This outcome is due in no small part to the advocacy of our members, who spoke out loudly and clearly when asked. Thank you again for your input, questions, and support throughout the legislative session.

The HR REPORT

Tax Deduction for Overtime Wages

Mark T. Broth

Many local governments have, in recent years, struggled with both the cost of overtime and the difficulty filling overtime shifts. A recent change in federal law may provide some indirect relief to employers by providing employees with a tax deduction for overtime wages.

The federal Fair Labor Standards Act (FLSA) enacted in 1938, established a nationwide minimum wage for employees working for employers engaged in interstate commerce. The FLSA was enacted during the Depression, a period of high unemployment. The overtime provision, which requires most employers to pay 1.5 times an employee’s “regular rate” for hours worked in excess of 40 in a pay week (53 for firefighters, 43 for police), was intended to discourage employers from working the same employees for more than 40 hours and to create work opportunities for the unemployed. The overtime penalty predated the now well-established practice of employer-provided health insurance. In many cases, the cost of providing an employee with health insurance is greater than the cost of overtime wages, so the penalty no longer serves its intended purpose. Cultural changes have also lowered the interest of some employees to work overtime hours. The prohibitive benefit cost of adding additional employees, an aging population, a decline in interest in firefighter and law enforcement careers, and the general decline in interest in overtime has resulted in unfilled shifts and the continuous use of “forced” overtime.

The new tax exemption for overtime wages may encourage some employees to more willingly work

overtime hours. Effective retroactive to January 1, 2025, employees may claim an annual tax deduction of $12,500 ($25,000 if filing jointly) against overtime wages earned in the tax year. The deduction is available to all non-exempt employees (those who employers are legally obligated to pay at overtime rates), although the deduction is reduced for employees earning in excess of $150,000 ($300,000 jointly). It is important to note that the deduction only applies to overtime pay mandated under the FLSA. Contractual overtime, such as overtime for working beyond scheduled work hours in a day or overtime based on an employer’s agreement to treat certain non-work hours (vacation, sick, personal, or holiday hours) as work hours, are not eligible for the tax deduction. While the IRS has not yet issued new recordkeeping rules, it appears that employers will be required to differentiate between statutory and contractual overtime on employee W-2 forms.

We have all the tools to meet your needs.

Drummond Woodsum’s attorneys are experienced at guiding towns, cities, counties and local governments through a variety of issues including:

• Municipal bonds and public finance

• Land use planning, zoning and enforcement

• Ordinance drafting

• Tax abatement

Employers struggling to fill shifts may wish to inform employees of this change in the tax law as a way of encouraging overtime work. At the same time, employers must remain mindful of health and safety considerations that could arise if employees begin working excessive hours.

• General municipal matters

• Municipal employment and labor matters

• Litigation and appeals

We work hard to offer clients the counsel and support they need, precisely when they need it.

This is not a legal document nor is it intended to serve as legal advice or a legal opinion. Drummond Woodsum & MacMahon, P.A. makes no representations that this is a complete or final description or procedure that would ensure legal compliance and does not intend that the reader should rely on it as such.

NEW HAMPSHIRE ASSOCIATION OF REGIONAL PLANNING COMMISSIONS

Transit and Mobility Management Investment

Scott Bogle, RPC; Tim Josephson, UVLSRPC; Jay Minkarah, NRPC; Mike Tardiff, CNHRPC; Sylvia von Aulock and Ben Herbert, SNHPC

Introduction

How would you get where you need to go in New Hampshire if you couldn’t drive? You may be like most Granite State residents and not have to worry about this, but you probably have a neighbor or family member that can't drive or is nearing the age when they'll need to give up their keys. It's a frightening prospect for many, especially older residents, folks with disabilities, and people without means to own a car. Only 34 of 234 communities in the Granite State have regular fixed route public transportation. Where they exist, public bus services play a key role in getting people to work, medical care and other basic life needs; and helping employers access an adequate labor pool. Many other New Hampshire communities are served by nonprofit van services and volunteer driver programs that focus on older adults and people with disabilities but not others in need. Still other towns lack transportation options altogether if you don’t drive or don’t have family or friends nearby to provide rides.

This article provides a glimpse of ways in which transit systems, volunteer programs and other community transportation providers are working together to help expand transportation access across the state, and get New Hampshire residents where they need to go.

Mobility Management Concept

Since 2022 the NH Department of Transportation has funded a statewide network of mobility managers who work to improve the efficiency of existing community transportation services by expanding coordination and awareness of public and nonprofit transportation programs. Around the state this has included establishing a regional call center that books rides for multiple public and nonprofit transit providers; working with nonprofit volunteer driver programs to expand service to new towns, setting up new backstop transportation programs

that offer rides when no other services are available; and developing new information tools to let people know what transportation services exist and facilitate taking transit or carpooling.

TripLink Regional Call Center

The Alliance for Community Transportation (ACT) is the Regional Coordination Council for 38 communities in Strafford, eastern Rockingham and southern Carroll Counties (RCC10). In 2013 ACT partnered with COAST, the Seacoast’s public transit system, to establish the TripLink call center. TripLink handles ride reservations and scheduling for COAST’s ADA paratransit and Route 7 On Demand services, as well as Portsmouth Senior Transportation, Meals on Wheels of Rockingham County, Community Action Program of Strafford County, and the Ready Rides volunteer driver program. An additional service known as Community Rides was established in 2015 to fill gaps when other agencies that schedule through TripLink don’t go to locations or at times that trips are needed.

In 2023 TripLink piloted a Common Application allowing people to call and sign up for rides from all the participating transportation services in the region for which they are eligible. With a single call to TripLink, people can access multiple services, saving them time and creating opportunities to combine trips, thus improving efficiency. Centralizing scheduling also reduces duplication of staff roles across the participating nonprofits. Since 2013 TripLink and its participating agencies have provided over 350,000 trips, and is currently adding an average of 61 new applicants per month through the common application.

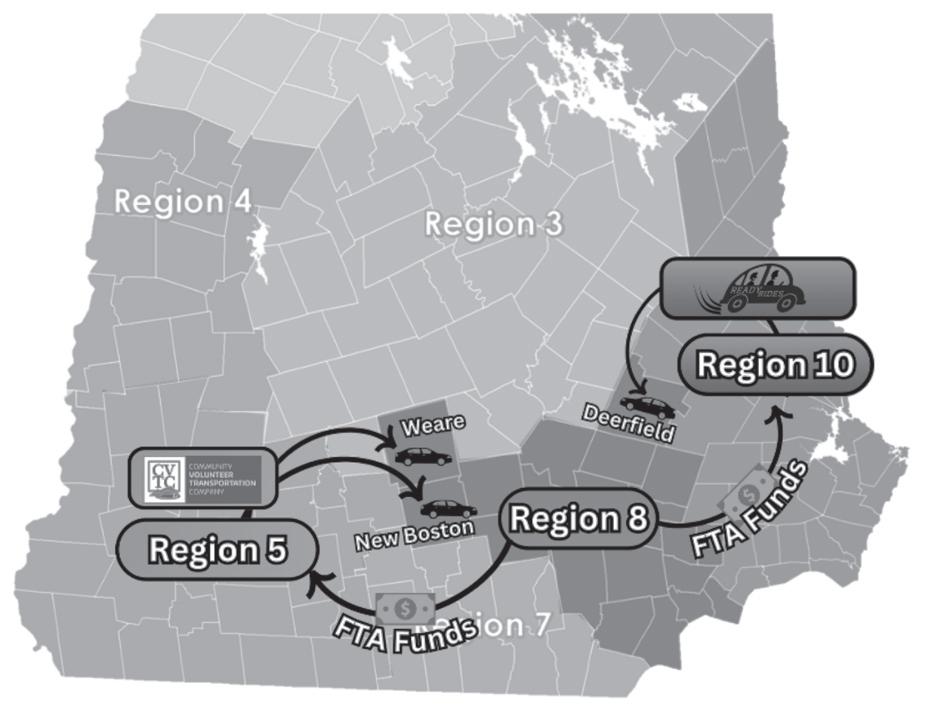

Expanding Volunteer Driver Program Access in Rural Southern New Hampshire

Creating transportation alternatives in rural communities can seem challenging at times. But thanks to coordination among multiple agencies

and stakeholders including two volunteer driver agencies (CVTC and Ready Rides) , three regional planning commissions (RPC, SNHPC, and SWRPC), three Regional Coordination Councils (RCC5, RCC8 and RCC10), several Mobility Managers, Cheshire County, and of course, community champions from Deerfield, New Boston, and Weare, the challenge was met in 2024 for three more communities that now have volunteer driver coverage.

Starting in Deerfield, a group of ambitious citizens formed Age-Friendly Deerfield, whose mission is to implement services and practices which address the challenges of aging in Deerfield. The group was determined to bring transportation to their older residents, starting by building relationships with the regional coordinating councils and a volunteer driver program. The Region 8 RCC and ACT/ Region 10 RCC facilitated a cross-regional agreement whereby Deerfield was picked up as a service community by Ready Rides and the TripLink call center described previously, with funding support through NHDOT. Community champions organized through Age-Friendly Deerfield soon became volunteer drivers, and by neighbor helping neighbor, Deerfield became the first of three rural communities in the past year in the SNHPC region to begin offering a transportation alternative for their residents.

Much of New Hampshire’s coordinated transportation network is sustained by volunteer drivers willing to put in a few hours each month to help a neighbor.

Everyone is encouraged to volunteer on one of New Hampshire’s volunteer driver programs. Drivers are able to choose which rides they would like to do, based on their availability and area preference. Volunteers also receive staff-supported enrollment and orientation, calendar

reminders via email, monthly mileage reimbursement, and loads of appreciation. Visit the NH Alliance for Healthy Aging’s website to learn more about what it is to become a volunteer driver: https://nhaha.info/volunteerdriver-initiative/.

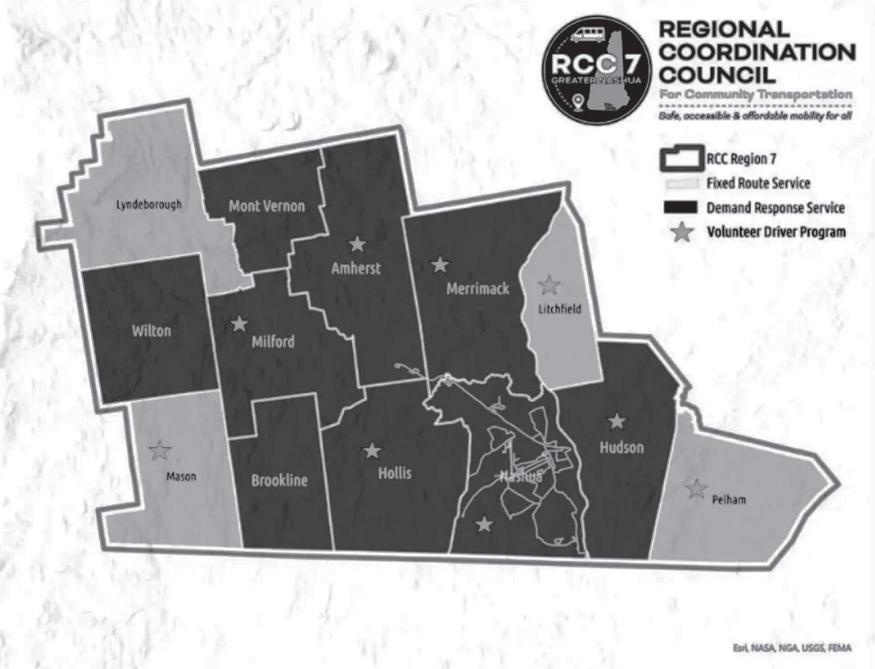

Greater Nashua Community Rides Pilot Program

The Greater Nashua Region provides another example of agencies collaborating to improve transportation access. In 2024 the Nashua Regional Planning Commission (NRPC), the NRPC Foundation, and the Nashua Region Coordinating Council (RCC7), collaborated to establish a Community Rides Pilot Program to help fill gaps in existing community transportation services for elderly, disabled, or otherwise transit-dependent low-income residents of the region. The program, coordinated by NRPC’s Regional Mobility Manager, leverages public and private dollars to fund taxi, Uber, Lyft, and other private transportation services, including wheelchair-assist services, for qualifying individuals to access medical appointments, trips to the grocery store and other needs where no other reasonable alternative exists.

Most communities within the Nashua Region are served by some form of subsidized, demand-response community transportation services for elderly and disabled individuals, though there are significant gaps in service. Nashua Transit System (NTS) paratransit services are generally limited to destinations within the City of Nashua. The Souhegan Valley Transportation Collaborative (SVTC) only provides services within its six member communities as well as to and from Nashua, while NTS contracted services for Hudson and Merrimack provide rides between those communities and Nashua but not to any other communities. None of these services provide rides to key destinations outside the region such as to medical facilities in Boston or Manchester.

Further, none of these services operate on Sundays and only Nashua residents have Saturday or evening service. The Greater Nashua Community Rides Pilot Program is specifically designed to help fill those gaps in service.