New Hampshire Municipal Association

New Hampshire Municipal Association

Margaret M.L.Byrnes

When this issue of Town & City hits the proverbial stands, the legislative session will be over, and (we hope) the new two-year state budget will have been signed into law.

Nearing the end of legislative session always causes me to pause and reflect, this year more than ever. If I had to sum it up, I would say that chaos and confusion teamed up to dominate the first half of 2025 for cities and towns. Changes at the federal level have been fast, frequent, and often unclear, making it difficult for municipalities to react or plan, or even for NHMA to provide timely and accurate information. At the state level, more than 30% of the nearly 1,000 bills filed this session involved some sort of municipal impact—and that number does not include the 200+ page state budget which is full of municipal implications and impacts. Aside from the technical issues and confusing language in many of these bills, attacks on local decision-making have been at the forefront of the session— most notably the zoning mandate movement, touted as a solution to the complex problem of the nationwide housing shortage (in simpler terms, a seller’s market)— while cuts in state aid and downshifting of costs that increase property taxes are met with assertions that municipalities just need to spend less. But when you pull back the curtain, you see a concerted effort to downshift costs and problems onto municipalities, and to blame them when the issues are not actually solved. And round and round we go—as none of this rhetoric is new, and none of this ever resolves statewide (or nationwide) issues, which will require collaborative, thoughtful solutions, coupled with key investments, if the goal really is problem solving rather than problem shifting. On behalf of the NHMA staff, thank you to all the local officials who have helped amplify NHMA’s advocacy this year. Although not everything is going our way, there have been many successes this session for cities and towns. At NHMA’s core is a belief that local governments are stronger together, and every year you prove me right!

But enough of that—it's summer! During the summer, NHMA (mostly) takes a break from live workshops, but don’t forget that our online training archive is open 24/7 when you log into the website. We’re looking forward to seeing many of you in person or online in the fall when our biggest events of the year return, including Budget & Finance, Land Use Law Conference, and Annual Conference. I’m particularly looking forward to the gamble we are taking on this year’s Annual Conference—there's a little clue for you!

We wish you and yours a wonderful summer—with sunny weekends and just enough weekday rain to keep the flowers happy!

And Happy Independence Day!

Warmest regards,

Margaret M.L. Byrnes, NHMA Executive Director

Is something new and exciting happening in your city or town? We'd love to include it in Town & City! Email us at publications@nhmunicipal.org

New Hampshire Recycles, the oldest and largest cooperative-model recycling nonprofit in the US, announced it has changed its name from the Northeast Resource Recovery Association (NRRA) to New Hampshire Recycles (NH Recycles). The new name and logo were shared near the close of the organization’s two-day Recycling Conference & Expo, an event that gathered nearly 300 attendees in Concord, NH for education and networking.

The State of New Hampshire now offers a free one-year subscription to an end-user productivity suite for all State, Municipal, County, City, and K–12 public employees, fully funded by the SLCGP Grant.

Upskilling municipal and K–12 staff allows IT teams to focus on configuration, security, and modernization, while employees work more efficiently with the tools they use every day.

This opportunity is open to eligible employees with supervisor approval and includes training on everyday productivity tools as well as technical certifications. The subscription is fully funded for one year.

Sign up here:

https://forms.office.com/pages/responsepage.aspx?id=6eotmUwcyEKjEFCIr1W6dO4sLzh3nBxJgt6TNEwzSDdUQzdUQ U04TVMxQU1HTzhaTk5aVkJaQUI3Wi4u&route=shorturl

DHS Offer Grants to Increase Number of Trained Firefighters by Making $360 Million Available to Communities

FEMA announced that $360 million are available for the Fiscal Year 2024 Staffing for Adequate Fire and Emergency Response (SAFER) grant program. At the direction of Secretary Noem, SAFER will award these funds directly to fire departments and volunteer firefighter interest organizations across the nation to help them increase or maintain the number of trained firefighters available in their community.

FEMA also announced that applications will be accepted for $36 million available through the FY 2024 Fire Prevention and Safety (FP&S) grant program. These funds help strengthen community fire prevention programs and support scientific research on innovations that improve firefighter safety, health and well-being.

During 2024, there were approximately 4,200 home fire fatalities in the United States, including 61 firefighters. To help keep communities and firefighters safer, FEMA will award SAFER funding directly to fire departments and volunteer firefighter interest organizations to assist in increasing the number of firefighters to help communities meet industry minimum standards and attain 24-hour staffing, provide adequate fire protection from fire and fire-related hazards and fulfill traditional missions of fire departments.

The purpose of the FP&S Grant Program is to award grants directly to fire departments, national, regional, state, local, Tribal Nation and non-profit organizations such as academic (e.g., universities), research foundations, public safety institutes, public health, occupational health and injury prevention institutions for fire prevention programs and to support firefighter health and safety research and development such as clinical studies that address behavioral, social science and cultural research.

The application period for both the FY24 SAFER and FP&S programs will open at 9 a.m. ET on May 23, 2025, and close on July 3, 2025, at 5 p.m. ET.

City of Portsmouth NH Establishes Below Market Rate Housing Trust Fund to Receive and Distribute Funds to Create and Retain Housing

The Portsmouth NH City Council voted to accept the recommendations of the Housing Blue Ribbon Committee and the City Trustees of Trust Funds to establish a Below Market Rate Housing Trust Fund. The Trust will support the City Council’s goal to enhance the supply of housing choices, specifically the supply of below market rate housing options and will be overseen by the Trustees of the Trust Funds.

JULY

Independence Day (NHMA offices closed) Friday, July 4

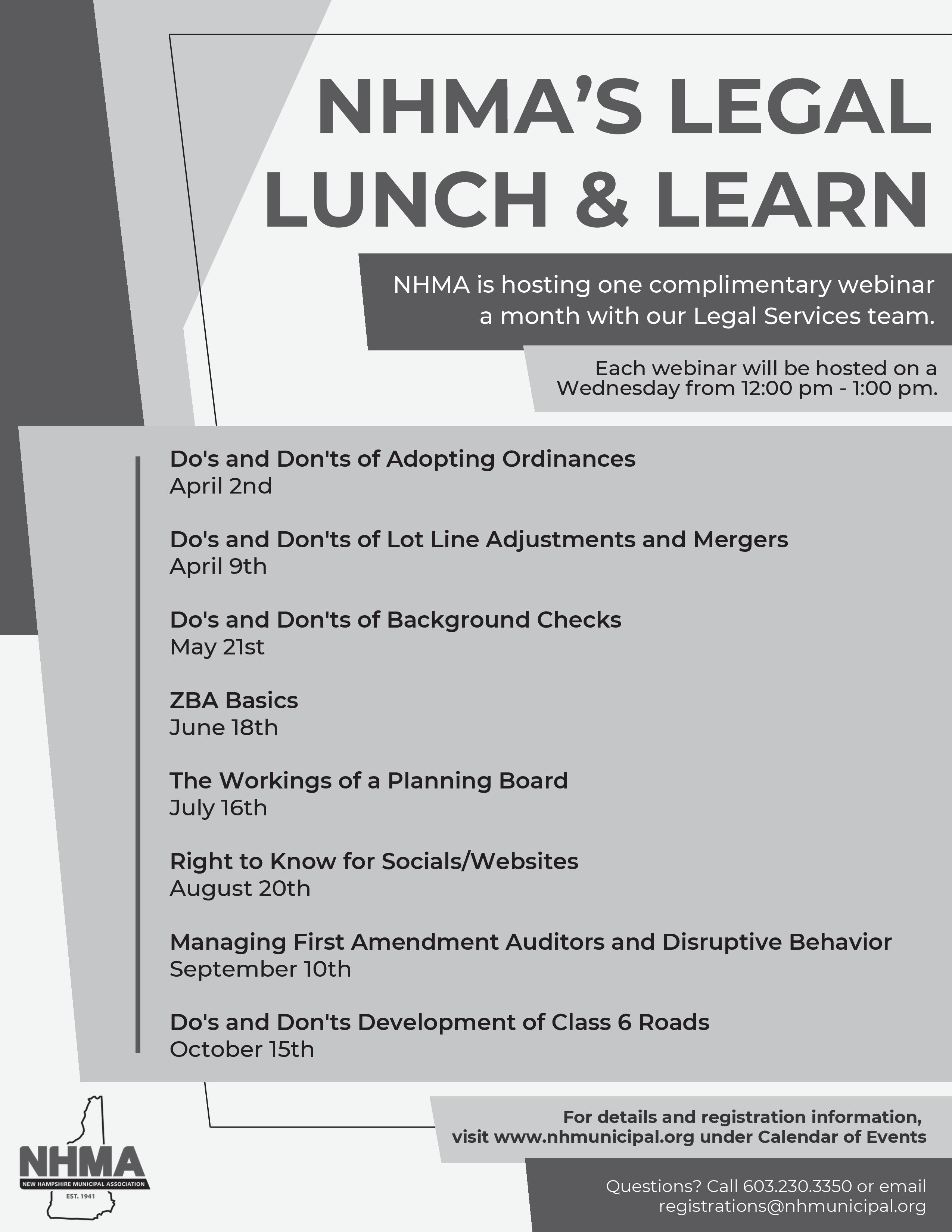

The Workings of a Planning Board Webinar

12:00 pm – 1:00 pm Wednesday, July 16

For more information or to register for an event, visit our online Calendar of Events at www.nhmunicipal.org. If you have any questions, please contact us at registrations@nhmunicipal.org

AUGUST

Right to Know for Socials/Websites Webinar

12:00 pm – 1:00 pm Wednesday, August 20

For the most up-to-date event and training information, please visit the NHMA website at www.nhmunicipal.org. Event times and dates are subject to change. Thank you.

Carolyn Berndt • Stephanie Martinez-Ruckman • Angelina Panettieri

As part of the funding offset for the House Republican “One, Big, Beautiful Bill Act (PDF)” to extend the 2017 tax cuts, the House Energy and Commerce Committee was charged with securing $880 billion in program cuts or revenue generation.

On May 13, the Committee passed the bill along a party line vote, targeting clean energy programs and Medicaid as funding offsets, and the bill passed the House on May 21 in a vote of 215-214. Here is a section-by-section summary of the Energy and Commerce bill (PDF) and a look at the key provisions for local governments.

The bill repeals unobligated funding from several grant programs under the U.S. Environmental Protection Agency (EPA) and U.S. Department of Energy established by the Inflation Reduction Act (IRA). Among the programs for repeal and rescission that local governments are utilizing are:

• Greenhouse Gas Reduction Fund

• Climate Pollution Reduction Grants, which consisted of regional planning and implementation grants.

• Clean Heavy-duty Vehicles

• Clean Ports

• Environmental Justice/Climate Grants, including the Government-to-Government and Community Change grants. Several communities report to NLC that they have received termination notices from EPA regarding these grant programs.

These programs were one-time funding under the IRA. NLC analysis of USAspending data indicates that most local governments that received funding under these programs have obligated awards. However, repealing the authorization for these programs would impact grant implementation and agency oversight and jeopardize the viability of the obligated funds under signed grant agreements.

Additionally, the Greenhouse Gas Reduction Fund is subject to ongoing litigation, which may impact Congress’s ability to recoup funding from this program.

The bill contains $715 billion in healhcare cuts, the majority of which come from Medicaid, which is the largest program providing medical and health-related services to low-income individuals in the United States. While these cuts are estimated to reduce the deficit by at least $715 billion over 10 years, the Congressional Budget Office also estimates that 13.7 million Americans will become uninsured by 2034 as a result of these changes.

Among the changes to the Medicaid program are:

• Mandates that states impose work requirements on able-bodied adults without dependents (80 hours per month).

• Reduced federal spending to states (Federal Medical Assistance Percentage or FMAP) that expanded Medicaid and use their own funds to provide Medicaid coverage to undocumented immigrants.

• Suspension of streamlined eligibility and facilitated enrollment under Medicaid.

Medicaid is a federal-state-local partnership that provides health coverage to approximately 79 million Americans, including children, seniors, people with disabilities and lowincome adults. It covers 38 million children, funds 40% of all births, supports rural hospitals and is the largest payer of long-term care and behavioral health services. Expansion has provided additional federal funding to 41 states, increasing access to care, particularly for those with substance use disorders.

Preserving state flexibility and preventing significant funding cuts are both critical to ensuring Medicaid can be tailored to local priorities. The proposals included in the House bill would severely limit this ability, forcing states to reduce services, restrict eligibility or shift costs to local governments.

The bill includes a provision preempting state, tribal, territorial and local regulations governing artificial intelligence systems for ten years. It includes carve-outs for laws intended to facilitate the deployment of artificial intelligence technologies or to facilitate their use for government functions such as permitting and procurement. Several state governments have considered legislation to govern artificial intelligence models and platforms, although local governments have generally not sought to directly regulate artificial intelligence. It is unclear whether the preemption would limit the ability of local governments to prohibit or limit the use of certain artificial intelligence tools or functions by local government departments.

The “One, Big, Beautiful Bill” now moves to the Senate, where changes are expected.

To learn more about the tax provisions of the House bill and how it would limit local government ability to utilize the IRA direct pay provision for local clean energy projects, read NLC’s summary of the House Ways and Means Committee provisions.

Recently, 175 local elected officials signed onto a letter urging Senate and House leaders to preserve the IRA clean energy tax credits (PDF).

By Stephen C. Buckley, Legal Services Counsel and Jonathan Cowal, Municipal Services Counsel

Now available online:

February 2025

In Order to Reassess the Value of Taxable Property there Must Be a Change in the Market Value; Discovery of an Extreme Underassessment is Insufficient, Merrimack Premium Outlets v. Town of Merrimack, New Hampshire Supreme Court Case No. 2023-0548

02/28/2025

March 2025

A Community of Interest Among Public Employees to Support a Collective Bargaining Unit Requires Commonly Shared Working Conditions, Appeal of Town of Barnstead, New Hampshire Supreme Court 2025 N.H. 14

03/26/2025

Flags Displayed on the City of Nashua Citizen Flag Pole were Government Speech Not Regulated by the First Amendment, Bethany & Stephen Scaer v. City of Nashua, United States District Court, District of New Hampshire Case No. 24-cv-00277

03/28/2025

April 2025

Individuals Have a Significant Privacy Interest in their Interactions with Law Enforcement, Laurie A. Ortolano v. City of Nashua, New Hampshire Supreme Court Case No. 2022-0342

04/02/2025

To Qualify for an Equitable Waiver of Dimensional Requirements a Property Owner Must Have Largely Completed a Structure Built in Reasonable Reliance on a Permit Before a Zoning Violation was Discovered, Garry R. Lane v. City of Dover, New Hampshire Supreme Court Case No. 2023-0629

04/04/2025

My Way Realty Appealed a Superior Court Decision Upholding the Denial of a Special Exception by the Manchester ZBA, My Way Realty, LLC v. City of Manchester*, New Hampshire Supreme Court Case No. 2024-0223

04/14/2025

The Statutory Limited Liability for Municipal Highways and Sidewalks Embraces All Aspects of a Road System, Including Crosswalk Warning Signs and Signals, Raymond Felts v. City of Rochester, New Hampshire Supreme Court 2025 N.H. 16

04/16/2025

May 2025

Voters at a SB 2 Deliberative Session May Amend the Unprescribed Portions of a Warrant Article Whose Language is Otherwise Prescribed by Law, Keith Prive, et al. v. William McFadden, New Boston Select Board, Hillsborough Superior Court – Northern District Docket No. 216-2025-CV-00195

05/09/2025

For the most up-to-date court summaries, please visit the NHMA website at www.nhmunicipal.org/court-updates. Thank you.

By Weston R. Sager, Esq. and Richard D. Sager, Esq., Sager & Smith, PLLC and NH Tax Deed & Property Auctions

Two years ago, we wrote an article for New Hampshire Town & City debunking the top ten myths of tax deeding. In this piece, we address five more common misconceptions about tax deeded properties and other municipal real estate that we have encountered representing New Hampshire municipalities as attorneys and auctioneers.

Myth 1: Municipalities can retain tax deeded properties indefinitely without fear of legal repercussions.

New Hampshire municipalities were once able to keep all proceeds generated from the sale of tax deeded properties that had been held for three years or more. In 2020, however, the New Hampshire Supreme Court held in Polonsky v. Town of Bedford, 173 N.H. 226 (2020) that this was unconstitutional, writing “when the municipality acquires property by tax deed that is worth more than the amount owed, the municipality is required to provide compensation to the former owner.”

Three years later, the United States Supreme Court reached a similar conclusion in Tyler v. Hennepin County, 598 U.S. 631 (2023), holding in relevant part that the government could not “use the toehold of the tax debt to confiscate more property than was due.”

As a result of these decisions, municipalities are now entitled to keep only their back taxes, interest, cost, and penalty, and

presumed to have retroactive application.)

Considering the Polonsky and Tyler cases, municipalities should review their current tax deeded properties—including those held for fewer than three years—and determine whether they ought to be sold or converted into non-tax-deeded municipal real estate. For tax deeded properties the municipality intends to sell, the municipality can offer them via public auction, advertised sealed bid, or another statutorily approved method described in RSA 80:80 (such as hiring a real estate agent). For tax deeded properties the municipality intends to keep, the municipality should convert them into non-tax-deeded municipal properties upon vote of the town meeting or city council pursuant to RSA 80:80, V. Before conversion, the municipality should negotiate the conversion price with and obtain releases from the former owner(s) and lienholder(s) to protect itself from claims that the municipality did not provide sufficient compensation to these parties.

2: The process for selling tax deeded real estate and non-tax-deeded municipal real estate is identical.

The sale of tax deeded properties is governed by RSA 80:58 through RSA 80:91. At a high level, the municipality first approves selling tax deeded properties at town meeting or by ordinance. After such authorization, for each tax

Towns: Sales of non-tax-deeded municipal real estate for towns is governed by RSA 41:14-a. As with tax deeded properties, the town first approves this method of sale by town meeting. For each proposed sale of municipal real estate, the governing body (such as the selectboard or town council) first solicits non-binding, advisory recommendations from (as applicable) the planning board, the conservation commission, the heritage commission, and the historic district commission. Once the governing body receives the above recommendations, it holds two public hearings on the proposed sale at least ten but not more than fourteen days apart. The governing body may then approve the sale no sooner than seven days nor later than fourteen days after the second public hearing.

Cities: A city’s process for selling non-tax-deeded municipal real estate is comparatively straightforward. Pursuant to RSA 47:5, city councils have the power to approve and sell non-tax-deeded, city-owned real estate “whenever the interests or convenience of the city shall require it.”

Note that, if uncertainty exists about whether a certain parcel was acquired by tax deed or another method (which is not uncommon for properties acquired many years ago), a municipality should consider following the procedures of RSA 41:14-a or RSA 47:5 before proceeding with the sale to assure that it satisfies the applicable legal requirements.

Myth 3: All existing liens are extinguished when a property is taken by tax deed.

According to New Hampshire Supreme Court caselaw, a tax deed creates a “new and paramount title to the land in fee simple absolute” and “devest[s] . . . all other liens thereon or titles thereto.” See, e.g., Burke v. Pierro, 159 N.H. 504 (2009); First NH Bank v. Town of Windham, 138 N.H. 319 (1994). Viewed in isolation, this language suggests that all liens are extinguished when a property is taken by tax deed. There are, however, several notable exceptions to this rule:

· First, mortgages could survive a tax deed if the municipality failed to provide notice of an impending tax deed to mortgage lenders as required by RSA 80:89. According to the New Hampshire Supreme Court, such notice to mortgage lenders is necessary pursuant to principles of fundamental fairness and procedural due process. See, e.g., First NH Bank v. Town of Windham, 138 N.H. 319 (1994). Further, even though the statute of limitations for challenging tax deeds contained in RSA 80:39 ostensibly severs a mortgage lender’s recovery ten years after the tax deed was recorded, a mortgage lender could still mount a successful challenge even after this period has elapsed. Cf., e.g., J & N Fieldstone Supply, Inc. v. BHC Dev. Corp., 146 N.H. 500 (2001).

· Second, federal tax liens may survive a tax deed if notice was not provided to the IRS at least twenty-five days before the municipality took the property. See 26 U.S.C. §§ 6323, 7425. Even if such notice was provided, the IRS retains the ability to redeem the property for 120 days after the tax deed was recorded. See 26 U.S.C. § 7425.

· Third, certain other federal liens (such as HUD mortgages) cannot be extinguished by tax deed. According to recently enacted New Hampshire Bar Association Title Examination Standard 9-46, such federal liens will not be terminated unless a “judicial sale” occurs. See also 28 U.S.C. § 2410; Show Me State Premium Homes, LLC v. McDonnell, 74 F.4th 911 (8th Cir. 2023). Because the tax deeding process is not overseen by a court, it is not considered a judicial sale. This means that these federal liens may survive a tax deed even though the municipality provided proper notice to federal lienholders in accordance with RSA Chapter 80.

If a municipality believes that it did not send appropriate notice to mortgage lenders before taking a property by tax deed, or if a tax deeded property appears to have one or more federal liens, it should contact municipal counsel to develop an appropriate strategy before proceeding with the property’s sale or conversion. Fortunately, however, simply because a possible surviving mortgage or other lien is discovered in connection with a tax deeded property does not mean that the property cannot be sold. For certain properties, liens could have expired by operation of law, or the lienholder might be willing to negotiate a discharge and release. Even if a lien on a tax deeded property likely would survive a transfer to a third party, the best option may be to disclose the issue and move forward with the sale—potential purchasers might be willing to assume the risk of negotiating a discharge and release after acquiring a tax deeded property, particularly if the lien amount is modest in relation to the property’s overall value.

Myth 4: If the certified letter notifying a property owner of an impending tax deed is undeliverable, the municipality is not required to perform additional actions before taking the property.

When a municipality sends a certified letter informing a property owner of an impending tax deed, the return receipt (also known as the “green card”) may come back unsigned or otherwise marked as undeliverable. When this occurs, the municipality should undertake additional reasonable efforts to contact the property owner.

In 2006, the United States Supreme Court held that although actual notice of an impending taking of real estate for non-payment of taxes is not required, the government must attempt “notice reasonably calculated, under all the

circumstances, to apprise interested parties.” See Jones v. Flowers, 547 U.S. 220 (2006). This includes actions beyond what is mandated by state statutory law.

Consequently, when certified mail of an impending tax deed is unsigned or undeliverable, a municipality should also attempt to contact the property owner using some combination of the following methods:

· Sending a notice via first-class mail

Mailing a notice that is addressed to “occupant”

· Posting a notice on the property of the impending tax deed

Conducting reasonable attempts to obtain the property owner’s current contact information (e.g., searching social media, running public records searches, and reaching out to the property owner’s known family members and acquaintances)

Providing notice by publication in one or more New Hampshire newspapers. (Note, however, that courts disfavor this method because few people regularly read published legal notices.)

Additionally, if a municipality suspects that the property owner has died, it should try to confirm whether the property owner is still alive, and, if the owner has passed away, the municipality should attempt to identify and contact relatives of the deceased by (among other possible methods):

· Reaching out to known family members and acquaintances of the property owner

Conducting online obituary searches

· Searching social media

Running public records searches

· Searching the registry of deeds for recorded death certificates of the property owner and related information

· Conducting probate record searches

A prudent municipality will contract with legal counsel or a title examiner to complete one or more of the above tasks. Note that the municipality can recover such legal expenses pursuant to RSA 80:88, RSA 80:89, and RSA 80:90, I(d)-(e).

Myth 5: Municipalities are not required to try to achieve market value when selling tax deeded properties themselves.

Many municipalities in New Hampshire continue to sell tax deeded real estate “in-house.” Due to the Polonsky and Tyler decisions described above, however, municipalities now have an obligation to the former owner(s) and lienholder(s) to attempt to achieve market value when selling tax deeded properties. Unless a municipality’s sale method and marketing strategies are sound, it could expose itself to claims from the former owner(s) and lienholder(s) that the municipality failed to generate adequate proceeds.

When selling tax deeded properties, the municipality’s first consideration should be its sale method. Although the municipality may sell properties several different ways pursuant to RSA 80:80, the two most common (and the only two that do not require a special justification by the governing body) are (1) advertised sealed bids and (2) public auctions.

In an advertised sealed bid sale, also known as a “blind auction,” interested purchasers submit confidential bids directly to the municipality. Typically, the municipality will accept the highest bid received. Unlike a public auction, the bidders submitting sealed bids have no knowledge of the other bidders’ identities or their bid amounts. This process may result in higher sale values than a public auction if one bidder overvalues the property or wants to ensure no one else purchases it.

If, however, two or more bidders have roughly equal valuations of a property, a public auction usually will result in higher sale values than an advertised sealed bid sale. In an auction setting, interested purchasers know who is bidding and the bid amounts. This transparency can lead to more robust values because, among other reasons, bidders have a better understanding of the true market for a property. In addition, the collegial yet exciting atmosphere of a public auction, and the competitive nature of open bidding, often leads to higher overall bids.

Regardless of whether a municipality chooses to sell its tax deeded properties by advertised sealed bid or public auction, the municipality must be diligent in marketing the sale. When a municipality fails to advertise widely, fewer bidders likely will participate, and the bids likely will be less competitive. This could expose the municipality to claims from the former owner(s) and lienholder(s) that the amount of excess proceeds generated was unreasonably low. Therefore, when marketing a sale of tax deeded properties, municipalities should consider doing one of the following:

1. Hiring a third-party auction company or marketing firm that will comprehensively advertise the sealed bid sale or public auction on behalf of the municipality, or

2. Advertising the sale extensively by posting announcements on the municipality’s website and in municipal buildings as well as (a) sending notices to property abutters, (b) erecting signage on the properties, (c) purchasing ads in newspapers with local and statewide circulation, (d) uploading listings on real estate websites, (e) posting on social media, and (f)performing other marketing that will alert members of the community, prospective home buyers, and real estate investors. Note that, although these tasks probably will require substantial municipal staff time, advertising costs incurred are generally recoverable from the sale proceeds pursuant to RSA 80:88 and RSA 80:90, I(e).

Disposing of tax deeded properties and surplus municipal real estate can be complex and time-consuming. Nevertheless, given the Polonsky and Tyler decisions, municipalities now have an obligation to sell or convert tax deeded properties and distribute any excess proceeds to the former owner(s) and lienholder(s). Municipalities should also explore selling surplus non-tax-deeded municipal real estate to increase tax revenue and make available properties that could be developed for affordable housing and other beneficial purposes.

When undertaking any sale or conversion of municipal real estate, however, a municipality ought to engage legal counsel at the outset to confirm that it is adhering to the relevant laws and regulations. This will not only help safeguard the municipality from potential future litigation, but also will help ensure that any properties sold will close without issue.

Weston R. Sager and Richard D. Sager are partners at Sager & Smith, PLLC and co-owners of NH Tax Deed & Property Auctions. Both are dual-licensed attorneys and auctioneers with experience in municipal law, real estate law, and auction law. Weston may be reached at weston@sagersmith.com or weston@ nhtaxdeedauctions.com, and Rick may be reached at rick@ sagersmith.com or rick@nhtaxdeedauctions.com

The information contained in this article is not intended as legal advice or as a legal opinion.

There are an estimated 3,600 data centers in the U.S. as of 2025. Of these, at least 600 are hyperscale data centers, which are the most resource intensive and power generative artificial (AI) intelligence development and use. With more data centers being built to meet the growing demand of AI, cloud computing and digital services, local leaders are wondering what data centers mean for economic development and long-term sustainability in their communities.

Data centers are physical sites that host the hardware, such as computer servers and telecommunications equipment, required for on-site or cloud data storage, as well as artificial intelligence (AI) computing.

At NLC’s 2025 Congressional City Conference, the Energy, Environment and Natural Resources (EENR) and Information Technology and Communications (ITC) committees met in a joint session to explore ways in which the use of AI and data centers impact local communities. In the session, elected officials shared several issues they are considering when faced with data center development.

The joint session was the first time NLC members engaged on this topic, and it was clear there is strong interest in continuing the conversation and learning more. The joint session raised both innovative thinking and significant concerns about data centers and the impacts they have on communities.

Below are some of the key takeaways from that discussion:

Local Governments are Balancing Technological and Economic Development with Data Centers’ Externalities and Environmental Impacts

Many communities in the discussion mentioned the positives of data center development, such as tax revenue and temporary jobs from site construction. However, there were concerns about increased water and energy use, greenhouse gas (GHG) emissions and strain on power grids possibly being handed down to ratepayers. They also wanted to know how noise and light pollution

might increase, affecting residents nearby.

Regulatory Frameworks are Evolving to Address AI and Data Centers

Local governments across the U.S. have adopted, or are considering, zoning ordinances to regulate where and how data centers are developed, prioritizing commercial and industrial zones. Water use ordinances can also be enacted but are more impactful if coordinated regionally across jurisdictions. As AI becomes more common in governmental services, regulatory measures could address security vulnerabilities, misinformation risks and ethical concerns such as AI bias and decisionmaking transparency.

Public Education, in Plain Language, is Needed to Communicate AI’s Energy Demands and Environmental Trade-Offs to Constituents

Without greater public awareness, local leaders may struggle to gain support for regulations on AI and data centers. Most people are unaware of the significant energy and water consumption required to power AI and cloud services. This should be communicated in public education campaigns using everyday comparisons that are easy to understand. For example, running a single ChatGPT query can require 10 times the computing power of a Google search.

Regional Coordination Could Help Manage the Rising Infrastructure Burden of Supporting Data Centers and Other Energy-Intensive Industries

Coordinated planning is needed for future power grid expansions, and to ensure fair energy and water distribution between jurisdictions. Where water scarcity is a major issue, regional water-sharing agreements and usage agreements as they pertain to data centers could be a potential solution. Sharing wins, challenges and learnings with each other can help drive thoughtful development, that is both economically and environmentally advantageous.

By Sherry Farrell, Londonderry Town Clerk, Executive Board Member

The Secretary of State’s Department honored Orville B.Fitch—known to all who have had the privilege of working with him as “Bud.”

New Hampshire’s Town and City Clerks and Moderators joined the Secretary of State’s team in celebrating this remarkable man and expressing our heartfelt gratitude for his years of dedicated service.

Bud exemplifies the humble public servant heart, always working diligently behind the scenes. Clerks and Moderators across the state knew they could count on him to be a steady, knowledgeable, and supportive presence. His professionalism, accuracy, and scholar-level understanding of our laws were matched only by his patience and kindness.

Bud will be deeply missed. He holds a special place in our hearts—not just for what he accomplished, but for how he did it.

We wish him a retirement filled with adventure, joy, and the lasting satisfaction of knowing the profound difference he made in the lives and work of so many.

By: Bree Rossiter, Conservation Program Manager, Lake Winnipesaukee Alliance

s cyanobacteria blooms become more frequent in New Hampshire, communities around Lake Winnipesaukee are stepping up—and the Lake Winnipesaukee Alliance (LWA) is helping lead the charge.

The Lake Winnipesaukee Alliance (LWA) is a non-profit organization dedicated to protecting the water quality and natural resources of Lake Winnipesaukee and its watershed now and for the future. Using education and science, we're relentless in our pursuit of the best policies and practices to ensure a healthy, vibrant Lake for residents, business owners, and visitors, today and for generations to come.

Local cyanobacteria committees are forming in towns across the region, empowering volunteers, expanding monitoring, and raising awareness. These efforts align with the state’s Cyanobacteria Plan, which emphasizes education and early detection to reduce health risks.

In 2024, Moultonborough launched its Cyanobacteria Committee through the Conservation Commission. A key project is the Cyanobacteria Watcher Program, which trains residents to spot and report potential blooms. Volunteers from Lake Kanasatka, Lee’s Pond, and Lake Winnipesaukee are now actively contributing, supported by NHDES and LWA. The committee also hosted two public presentations—now available on LWA’s YouTube channel.

Meredith followed in 2025, establishing its own committee and Watcher Program. With members from the town, Windy Waters, the Waukewan Watershed Advisory Committee, and LWA, the group is bringing new energy and coordination to the increasing threat of cyanobacteria.

Meanwhile, Wolfeboro Waters has been actively promoting water quality education and community action since 2019.

Example of a Cyanobacteria Bloom, Cedar Cove Lake Winnipesaukee (2024)

Appointed by the Town of Wolfeboro, the committee addresses a range of water concerns with LWA providing scientific support and regional coordination.

Cyanobacteria blooms threaten more than just lake ecology— they impact recreation, tourism, and our local economy. These grassroots initiatives are boosting detection, speeding up response times, and building a stronger culture of lake stewardship.

Cyanobacteria blooms threaten more than just lake ecology, they impact recreation, tourism, and our local economy. These grassroots initiatives are boosting detection, speeding up response times, and building a stronger culture of lake stewardship. Collaboration between municipal leaders and regional nonprofits has become an essential part of this work. Joanne Haight, Chair of the Select Board in Sandwich, Director of Development and outreach for LWA, and Secretary of the New Hampshire Municipal Association, exemplifies the role of a dedicated lake ally, bringing local knowledge and watershed-wide initiatives across municipal boundaries.

by Stephen C. Buckley, Legal Services Counsel

What form of notice must be provided when local government proposes to undertake certain forms of official action? The statutes that govern the authority of a municipality or local board to take official action will often, but not always, spell out the methods of notice to be afforded to affected individuals and the public at large. In addition to providing notice as dictated by a statute or regulation, the constitutional mandate of due process will require “notice reasonably calculated, under all the circumstances, to apprise interested parties of the pendency of the action and afford them an opportunity to present their objections.” Mullane v. Cent. Hanover Bank & Tr. Co., 339 U.S. 306, 314-15 (1950). As stated by New Hampshire Supreme Court in White v. Wolfeboro, 131 N.H. 1, 551 A.2d 514 (1988), municipalities are advised to take every reasonable step to insure that notice is given to all individuals who risk the loss of some interest or right because of a hearing or other municipal action. Local government must be mindful of the U.S. Supreme Court’s admonition in Mullane, “But when notice is a person’s due, process which is a mere gesture is not due process.”

Personal notice by certified or verified mail is dictated for municipal actions directly affecting the property and personal interests of individuals. Notice of lien for unpaid real estate taxes must be sent by certified or registered mail to the current owner. RSA 80:60. Two years after that notice of lien a notice of impending tax deed must be provided the current owner by certified mail. RSA 80:77. However, due process did not require a municipality to demonstrate actual receipt of notice that was mailed. In Appeal of City of Concord, 161 N.H. 169, 170 (2010) the city placed the bills for a land use change tax in the mail, and nothing in the record indicated that the mail was returned unclaimed or undeliverable. The city’s reliance on the United

States Postal Service was reasonably calculated, under all the circumstances, to apprise interested parties of the amount of the land use change tax that was imposed and afford them an opportunity to present their objections by timely appealing for an abatement. So, when the property owner filed an untimely abatement appeal, the NH Supreme Court disagreed with the BTLA that due process dictated actual notice.

Land use boards are required to give personal notice of proposed decisions affecting interests in land, and failure to do so can deny the legal validity of any actions taken. In Hussey v. Barrington, 135 N.H. 227 (1992), the failure to notify abutters to a proposed gravel excavation that required a variance rendered the decision in the property owner’s favor void. Even where personal notice is not required, public notice may also be deficient and render a zoning amendment approved by vote of town meeting void. In Bedford Residents Group v. Bedford, 130 N.H. 632 (1988) the town planning board posted and published notice in a newspaper that it would be considering “amendments to the zoning ordinance and zoning map,” and that “copies of . . . the proposed amendments to the zoning ordinance and zoning map . . . are on file for public inspection in the Selectmen’s Office.” This description fell short of the statutory requirement in RSA 675:7, II that the notice contain “an adequate statement describing the proposal.” In order to satisfy the constructive notice requirements in RSA 675:7, II it was necessary for the notice to state “the location of the affected property, the nature of the proposed amendments or the identity or boundaries of the property.”

The decision in Bedford Residents Group highlights the necessity of strictly conforming to statutory notice requirements. For instance, RSA 675:7 no longer requires notice of zoning amendments (or the adoption of a master plan, subdivision regulation, site plan review

regulation and historic district regulation) be published in a paper of general circulation in the municipality if notice is provided on the municipality’s website. However, the option of posting public notice on the municipality’s website does require that the notice “appear prominently on the website’s home page, or a link directly to the notice shall appear prominently on the home page.” Thus, that website notice shall stand out from the rest of the surrounding content on the home page and be noticeable.

Under the Right-to-Know Law notice of a public meeting by a public body shall provide the time and place of the meeting, including a nonpublic session, and shall be posted in 2 appropriate places one of which may be the public body’s Internet website at least 24 hours, excluding Sundays and legal holidays, prior to the meeting. This establishes the minimum statutory notice for all public hearings and meetings. Furthermore, even though under RSA 91-A a posted agenda is not required for a public meeting it is recommended the subject of the meeting or hearing always be included in the notice. Elsewhere, the specific subject of a public hearing must be included in

the public notice and absence of those subject details could jeopardize the validity of an enactment.

For instance, under RSA 41:9-a town meeting can delegate to the select board the ability to adopt and amend municipal fees for the issuance of any license or permit which is part of a regulatory program which has been established by vote of the town. Prior to establishing or amending any such fees, the select board shall hold a public hearing, with notice given at least 7 days prior to the hearing, posted in 2 public places, and by publication in a newspaper of general circulation in the town. Most importantly the newspaper and public notice shall include the proposed schedule of fees that are planned to be adopted by the select board.

Where the procedural requirements for adoption of a municipal ordinance or regulation do not call for public hearing and newspaper publication notice to the public at large, but the adopted ordinance would impose significant penalties, a public hearing and publication process preceding adoption of the ordinance is recommended.

For instance, under RSA 41:11, the select board may adopt rules governing use of public ways, traffic devices

Track key legislation affecting New Hampshire municipalities in real time. The New Hampshire Municipal Association (NHMA) advocates for the interests of cities and towns at the New Hampshire General Court and state agencies. With the legislative session running January to June, NHMA tracks state actions that could significantly affect the state's 234 municipalities.

• Real-time updates on legislative activity through FastDemocracy

• Access to bills categorized by legislative topic

• NHMA's stance on key measures

• Optional daily or weekly email updates with new bill actions and upcoming hearings

• No account is required to access FastDemocracy, but members can create one for additional customization

and signals and automobile parking controls. This type of rulemaking dictates a more broad-based public notice and participation process. For such ordinances, a town can generally satisfy the due process requirement by posting notice of the proposed highway regulation in two public places in town and publishing notice in a local newspaper approximately one week prior to any hearing. At a minimum, the contents of the notice should indicate where a copy of the proposed full regulation is available (for example, town clerk’s office) and the location and time of the hearing. Prior to the select board’s vote, the town should conduct a hearing at which the public has a meaningful opportunity to comment on the proposal. After the hearing, any vote to enact the ordinance or regulation should be recorded in the minutes. A copy of the minutes should be filed with the town clerk and in any local ordinance compilation or code book. Notice of the adoption of the regulations should also be published in the newspaper and be available to enforcement officials for use in court to prove the regulation’s existence

SuggeStionS for enSuring proper

1. Read the governing statute for the action to be taken and be sure all required elements for the content of the notice to the public have been satisfied.

2. Where the official municipal action involves the adoption of rules, regulations or an ordinance, plan to hold at least one public hearing that states the subject, time, date and place of the public hearing.

3. If the statute governing the municipal action states a minimum number of days public notice must be provided, both posted and published in a newspaper (or on the town website) the day of posting and/ or publication is excluded from the calculation and the day of the event or public hearing is included. RSA 21:35, I.

4. It is always appropriate (and sometime required) to record notice of final municipal action with the town clerk. For instance, no master plan, or other land use board regulation adopted under RSA 675:6 shall be legal or have any force and effect until copies of it are certified by a majority of the board or commission and filed with the city clerk, town clerk, or clerk for the county commissioners.

5. For municipal ordinances and bylaws that impose civil and legal penalties, notice of adoption should also be published in a newspaper of general circulation in the municipality.

The NH Municipal Association is pleased to announce that we are now accepting session proposals for our 2025 annual conference, to be held on Wednesday, November 19 and Thursday, November 20, 2025 with an end time of 2:45pm. We will be returning to The DoubleTree by Hilton Manchester Downtown Hotel in Manchester, NH for the conference.

The deadline for submitting proposals is close of business on Monday, June 30, 2025. We'll let you know if

your proposal has been accepted no later than August 11, 2025. If your session proposal is accepted, your presentation materials will be due on October 24th, three weeks before the conference.

Submit your proposal via Sched. Once you have reviewed the information on the main Proposal page (linked above), click “Submit Proposal Here!” You will be prompted to create a Sched account or sign in using Google if you have a Gmail address. If you want to create a new Sched account, click “Sign up with

Email,” then enter your email address and create a password.

After logging in, you can enter all of the details about your proposal. If you do not yet know all of your speakers, that is okay. We will follow up for that information if your proposal is approved. However, you must enter at least one speaker's information in order to continue to page 2, where you will provide your session title, description, and select a session track.

Questions? Contact us at conference@ nhmunicipal.org

Do you have insights or expertise to share with New Hampshire's municipal community? Town and City invites municipal leaders and industry experts to contribute articles that inform, inspire, and engage readers across the state.

By Nick Gosling, Customer Experience and Communications Manager, Community Power Coalition of New Hampshire

At recent Town Meetings, eight municipalities—Bedford, Canaan, Dalton, Meredith, Newington, Northumberland, Shelburne, and Sunapee—voted to adopt Community Power programs, continuing a growing trend of local governments assuming greater control over electricity procurement. These affirmative votes bring the number of New Hampshire communities participating in the Community Power Coalition of New Hampshire (CPCNH) to over 60, reflecting broad-based interest in local energy autonomy and ratepayer choice.

Community Power enables cities and towns to pool electricity purchases on behalf of residents and businesses, providing a framework for competitive supply rates, renewable energy investment, and long-term energy planning. Enabled by state law (RSA 53-E), these programs are designed and governed at the local level, offering a new pathway for municipalities to advance fiscal and environmental goals.

“Bedford Community Power is grateful to CPCNH for their assistance and expertise in achieving the approval of over 91% of Bedford voters on March 11,” said Christopher Bandazian, Vice Chair of the Bedford Energy Commission. “We’re now looking forward to offering our ratepayers lower supply rates and greener choices.”

Each of the newly enrolled communities developed and approved local Community Power plans, a process that typically involves public engagement, review by the governing body, and a Town Meeting vote. For many municipalities, the program offers a strategic tool to stabilize energy costs while advancing sustainability goals.

“The onboarding experience was not taken lightly—by the Town, Board of Selectmen, or CPCNH,” said Newington Selectman Brandon Arsenault. “The amount of handholding, explanation, public meeting attendance, documentation, and preparation that CPCNH contributed was beyond our expectations.”

“Our Energy Committee is very pleased with the support at Town Meeting,” added Al Rossetto, Chair of the Northumberland Energy Committee. “We’re all looking forward to lower power rates in the future.”

As electricity costs and volatility continue to challenge municipal budgets, Community Power provides an avenue for towns to collaborate, plan proactively, and support long-term infrastructure improvements. CPCNH members work together to aggregate buying power, develop innovative energy products, and reinvest locally—under a model that centers municipal leadership.

For more information on how your community can explore Community Power, visit www.cpcnh.org.

Representing towns and cities

Cordell A. Johnston Attorney at Law

P.O. Box 252

Henniker, NH 03242

603-748-4019

cordell@cajohnston.com

By Marty Karlon Policy & Research Analyst

s of this writing, the 2025 Legislative session is in its final weeks, and many burning questions — including the state budget — remain unresolved. While we await final outcomes on a host of significant issues impacting municipalities, here is a look back at the session thus far, by the numbers:

731 / 350 The number of House / Senate bills introduced in 2025. This count is on par with historical trends.

81 The number of legislative service requests (LSRs) that were withdrawn before being assigned a bill number. A number of requests are withdrawn every year, often due to redundancy with other proposals or because the language needs more work.

367 The number of bills tracked by the NHMA Advocacy Team. Remember, NHMA provides members access to FastDemocracy, an online bill tracking platform, for efficient, real-time updates to legislative activity of interest to members. Visit our online Bill Tracker page to learn more and feel free to subscribe to weekly or daily updates on subjects and bills of interest.

2 The number of declared independents in the House (there are none in the Senate). Also the number of House vacancies due to resignations.

39 Number of bills related to zoning, planning or housing introduced this session and assigned to the House Housing Committee or its Senate counterpart, the Senate Commerce Committee. A few more bills on these topics were assigned to other committees.

281-2 The combined vote on 16 zoning mandates recommended ought to pass by the House Housing Committee.

95 Number of House or Senate bills dealing with elections or town/school meetings assigned to the respective election committees in each chamber.

190 The number of days between July 1, 2025, and January 6, 2026, when the next legislative session convenes.

Drummond Woodsum’s attorneys are experienced at guiding towns, cities, counties and local governments through a variety of issues, including:

• Municipal bonds and public finance

• Land use planning, zoning and enforcement

• Ordinance drafting

• Tax abatement

• General municipal matters

• Employment law and collective bargaining

• Litigation and appeals

We work hard to offer our clients the counsel and support they need, precisely when they need it.

By Hannah Devoe, Esquire

On March 26, 2025, the New Hampshire Supreme Court reversed a September 2023 decision by the State Public Employee Labor Relations Board (PELRB) and, in doing so, clarified the “community of interest” standard required by RSA 273-A to combine employees within a certified bargaining unit.

Background

NH RSA 273-A governs public employee labor relations in New Hampshire. Relevant to this case, RSA 273-A:8(I) prohibits the PELRB from certifying new bargaining units if such unit would be comprised of less than ten (10) employees who share a community of interest. Per the statute, a community of interest may be exhibited by the following criteria: (a) employees with the same conditions of employment; (b) employees with a history of workable and acceptable collective negotiations; (c) employees in the same historic craft or profession; and/or (d) employees functioning within the same organizational unit. More specifically, PELRB regulations set forth additional factors for consideration such as a common geographic location of the proposed unit, common work rules and personnel practices, common salary and benefit structures, a self-felt community of interest among employees, and more.

Supreme Court Decision – Appeal of Barnstead, 2025 N.H. 14.

In February 2023, AFSCME Council 93 filed a petition with the PELRB to certify a bargaining unit consisting of thirteen (13) employees holding various positions within the Town’s police and fire departments. The Town objected, arguing that the duties of the employees in the proposed bargaining unit “are so dissimilar that they lack the essential community of interest.”. After consideration of written record provided by the parties, the hearing officer concluded that the “employees in the proposed unit have a sufficient community of interest such that it is reasonable for them to negotiate jointly.” See Appeal of Barnstead, p.2. The hearing officer recognized a difference in training requirements, job duties, and standard operating procedures, but concluded a community of interest exists based on the fact that the employees work in public safety and are subject to the Town’s employment terms and conditions. On appeal, the Supreme Court reversed the PELRB decision, holding, in summary, that the PERLB’s analysis had essentially eschewed the “community of interest” standard and instead certified the unit based on the finding that the employees merely worked for the same employer.

Specifically, the Court held that the PELRB’s reliance on geographic proximity and common personnel policies (which could have been used to justify a unit of any of the Town’s employees) was inconsistent with the Court’s preexisting decision in Appeal of Town of Newport (140 N.H. 343 (1995)), which stands for the proposition that “employees with different schedules, duties, responsibilities, and chains of command do not share a community of interest despite having a common employer and common set of generally applicable personnel policies.” The Court further noted that, while both police and fire personnel both provide emergency services and public safety functions to the Town, the duties between the departments differ significantly, and the employees work in different locations and follow different operating procedures.

Accordingly, the Court concluded that the record did not support the PERLB’s finding of a community of interest, and reversed the PERLB’s decision approving the proposed collective bargaining unit.

What does this mean for you? For those towns, cities, and other public employers with longstanding mixed bargaining units who have a history of workable negotiations, it is unlikely that this decision will have

a significant impact. However, this is an important decision for smaller communities who may be seeing union drives seeking to combine employees between departments in order to reach the statute’s ten (10) employees minimum to form a bargaining unit. This decision clarifies for unions and public employers alike that a mere demonstration that all of the employees in a proposed unit share an employer is not sufficient. Instead, the decision returns to a stricter interpretation of the “community of interest” standard, requiring the proposed exclusive representative to make a more thorough showing that the duties, training, schedules, chain of command, etc. of the employees in the proposed unit are sufficiently communal such that it will make sense for the employees in the proposed bargaining unit to negotiate jointly.

attorneys are experienced at guiding towns, cities, counties and local governments through a variety of issues including:

• Municipal bonds and public finance

• Land use planning, zoning and enforcement

• Ordinance drafting

• Tax abatement

• General municipal matters

If you have questions about unionization efforts or the impact of this decision on your community, you are encouraged to reach out to your Town attorney.

• Municipal employment and labor matters

• Litigation and appeals

We work hard to offer clients the counsel and support they need, precisely when they need it.

This is not a legal document nor is it intended to serve as legal advice or a legal opinion. Drummond Woodsum & MacMahon, P.A. makes no representations that this is a complete or final description or procedure that would ensure legal compliance and does not intend that the reader should rely on it as such.

By: Cameron Prolman, Senior Planner, SNHPC; Michelle Moren-Grey, Executive Director, North Country Council; Shanna B. Saunders, Executive Director, Lakes Region Planning Commission

Across New Hampshire, Regional Planning Commissions (RPCs) are working to address the growing need for affordable housing. The Southern New Hampshire Planning Commission (SNHPC), which serves 14 communities in the greater Manchester area, has been focused on helping towns and cities expand housing options. In 2023, the New Hampshire RPCs, including SNHPC, completed Regional Housing Needs Assessments (RHNA) that provided a detailed look at housing demand and availability across the region and outlined practical strategies communities can use to meet both current and future needs.

One of those strategies is finding ways to reuse land that has already been developed. These may be sites that are vacant, underused, or have real or perceived environmental concerns. These are also known as brownfields. Because of uncertainty around contamination, they’re often overlooked for redevelopment. But with the right support and planning, they can offer real opportunities to create new housing, especially in areas where land is limited but infrastructure is already in place.

The SNHPC, like many RPCs in New Hampshire, operates a Brownfields Assessment Program through funding from the U.S. Environmental Protection Agency. The program helps communities take that first step by offering environmental assessments and technical guidance for cleanup and reuse of brownfield sites. The assessments which identify potential contaminates and then identify and characterize potential mitigation strategies are required for future grant funding for redevelopment of

these sites. Whether the goal is to create new housing, support commercial redevelopment, expand public green space, or pursue a mix of community uses, these assessments give property owners and municipalities the information they need to move forward with confidence.

Brownfields programs can also spark housing development more broadly, not just affordable housing but homes of all types. As communities across New Hampshire struggle with a lack of housing supply, these sites present a way to add new units without sprawling into undeveloped land. A great example of this is Cotton Mill Square in Nashua. With support from the Regional Economic Development Center (REDC) and EPA brownfields funding, a historic mill building was cleaned up and transformed into more than 100 new apartments, over half of which are designated as

affordable. The project also enhanced the surrounding neighborhood, connecting it to the Nashua Riverwalk and helping to revitalize a key piece of downtown.

Within the SNHPC region, we are working in collaboration with the City of Manchester on an environmental assessment of Arms Park, a city-owned property along the Merrimack River. Once part of the historic Amoskeag Manufacturing Company campus, the site played a key role in Manchester’s industrial past. Following the decline of the mills in the mid20th century and the demolition of buildings on the site, the parcel was converted into surface parking and has remained in that use for decades. Despite its proximity to downtown and the riverfront, the site has seen little change, even as nearby areas have undergone revitalization. The City’s 2021 Master Plan recognizes the significance of this underutilized property and identifies it as an opportunity to enhance public access, increase parking efficiency, expand open space, and support new development that could include housing. Through its Brownfields Program and in partnership with its Qualified Environmental Professional, Credere Associates, SNHPC is helping assess environmental conditions at the site to support future planning and reuse.

The following roadmap outlines steps municipalities can take to identify and begin transforming brownfield sites into valuable community assets:

• Connect with your Regional Planning Commission weather they have an active brownfields program or not they can assist.

• Conduct a Site Inventory: Identify underutilized, vacant, or potentially contaminated sites in your community.

• Engage Community Stakeholders: Include residents, local organizations, and property owners early to shape a shared vision.

• Explore Funding: Pursue grants, incentives, and public-private partnerships. Become familiar with funding sources such as:

• Regional Planning Commission Brownfields Assessment Programs

• EPA Brownfields Assessment & Cleanup Grants

• NH Department of Environmental Services (NHDES) Brownfields Program

• HUD, CDBG, and low-income housing tax credit programs.

• Inventory and Assess: Identify brownfield sites and assess contamination levels.

Brownfield redevelopment presents an opportunity for municipalities: environmental cleanup and housing solutions. Through planning, community engagement, and leveraging available resources, municipalities can turn underutilized properties into vibrant and thriving neighborhoods.

NHMA is excited to announce that Tammy Letson has joined NHMA as our new Government Finance Specialist! Tammy is now available to answer government-finance inquiries from NHMA members and will be conducting a variety of educational workshops, including the return of the Financial Policies Certificate series in the fall.

Prior to joining the NHMA team, she held various positions in municipalities including Town Administrator, Finance Director, Tax Collector, Trustee of Trust Funds, and Planning Board Secretary. She was a Municipal Services Advisor for 14 years with an NH accounting firm and worked for 8 years in software support for an NH based company who specializes in local government.

To contact Tammy with your finance inquiries, please use the legalinquiries@nhmunicipal.org email address, or call us at 603.224.7447 and press one. Tammy's typical availability is Monday - Thursday from 9:00 am - 4:30 pm. And stay tuned for upcoming training opportunities!

New Hampshire Town and City is the official magazine of the New Hampshire Municipal Association, a nonprofit organization serving cities, towns, village districts, and counties. With a circulation of 2,500, this magazine is the only publication that comprehensively reaches the entire New Hampshire municipal market. Over 1,500 physical copies are distributed across the state, with an additional 1,000 digital versions sent directly to recipients. On average, the publication garners 65,000 impressions annually. Subscribers include mayors, councilors, selectmen, city and town managers, road agents, public works directors, assessors, clerks, and finance directors.

X 2.25

ACCEPTANCE OF ADVERTISING: All advertisements are subject to the approval of the publisher. The publisher reserves the right to place the word "advertisement" with advertising copy which, in the opinion of the publishers, resembles editorial matter. Responsibility for claims and actions based on advertising content is borne by the advertiser.

ISSUANCE AND CLOSING DATES: Published 6 times a year on a bi-monthly production schedule (Jan/Feb, Mar/ Apr, etc.). Closing date for advertising file and payment is 5 weeks prior to the publication month (e.g., the May/June issue deadline for ad file and payment is the last Friday of March).

COMMISSIONS: New Hampshire Municipal Association does not allow for any agency commission.

ADVERTISING MATERIAL: New Hampshire Town and City is printed on 100 lb. paper for the cover and 70 lb. paper for the inside pages by the photo off set process. The binding is saddle stitched. Complete mechanicals should be furnished for all ads requiring a special layout.

This platform enhances visibility for businesses providing valuable products and services to New Hampshire's municipal governments. Get noticed and grow your municipal client base today!

Recognition in our magazine, with over 65,000 annual impressions and 1,500 physical copies per issue.

Rotating features on our homepage, Encouraging members to support our online advertisers.

A one-time business card-sized Promotion in NewsLink, upon Request (approx. 1050 subscribers).

Complimentary digital subscriptions to Town and City magazine and our NewsLink e-newsletter.

Your online presense on NHMA's website will be active from July 1 to June 30. Please note that ads submitted after July will not be prorated. Please ensure your company logo is supplied electronically in the following format: 210 by 85 pixels - TIF, PNG, JPG (high resolution) to info@nhmunicipal.org.

“Our partnership with the Carsey School builds upon one of NHMA’s core principles: enhancing local government through education. We’re excited to offer this new valuable benefit to our members, expanding the educational opportunities available to municipal officials in New Hampshire for the benefit of our communities.”

Margaret Byrnes Executive Director, New Hampshire Municipal Association

carsey.unh.edu

at the University of New Hampshire’s Carsey School of Public Policy

» Our graduate programs offer a special mix of academic rigor and real-life expertise to prepare students for a career with impact in New Hampshire and beyond:

• Master of Public Administration with an Executive MPA option (Online)

• Master in Community Development (Online)

• Master of Global Conflict and Human Security (Online)

• Master in Public Policy (On Campus)

» Take advantage of up to a 20% tuition discount education award for eligible employees, appointed/ elected officials, and affiliate groups of the NHMA.

» Who is eligible? NHMA Member employees, appointed/elected officials, and affiliate groups.

» How much is the Education Award? Eligible applicants will automatically be awarded a 12% tuition discount. Applicants can also apply for up to an additional 8% Education Award by successfully completing NHMA certificate trainings, webinars, and workshops, for a maximum 20% tuition discount award.

Want to better serve your community? Acquire universal skills for sustainable transformation, while engaging in cooperative online learning.

Prepared to enhance human security around the world? This online program will prepare you for a career in humanitarian relief and global development.

Ready to advance your public service career? This online program will give you the edge you need in today’s competitive public service sector.

In this in-person program, gain the skills needed to make a difference and create change in the challenging world of 21st-century policymaking.

Learn from experienced faculty and peers actively engaged in their fields.

Apply what you learn in class to real issues.

Build a professional network that continues beyond graduation.

920 Alumni

12–24 Months to Completion

Retention Rate 825 Community Projects

Skills for Impact. carsey.unh.edu/academics Carsey School of Public Policy 15 Strafford Avenue Durham, NH 03824 (603) 862-2821

By Jonathan Cowal, NHMA Municipal Services Counsel

It can be confusing trying to understand who has the authority to manage town property. These questions can range from managing the actual building or property, to managing the employees who work in those spaces, to managing the behavior of the members of the public allowed to access those spaces. This article will explain some of the tools at the disposal of the municipality for managing public spaces.

Q. Who has the authority to manage town property and town employees?

A. RSA 41:11-a gives authority to the governing body, in most cases the select board or city council, the authority to manage town property. The governing body is also the manager of town employees. However, RSA 41:11a carves out several exceptions. The most notable is the public library. That is governed by the library trustees pursuant to RSA 202-A:6. The library trustees manage library property, as well as library personnel and employees. Town forests, conserved lands, and recreation areas are the other exceptions listed in RSA 41:11-a where there can be a different managing authority.

Q. What are the most common methods used to manage town property and employees?

A. There are three main categories of regulatory authority; ordinances or bylaws which are generally adopted by a vote of town meeting and govern the town as a whole; town policies which are guidelines set by the governing body; and personnel policies which set rules and standards for town employees.

Ordinances, sometimes called bylaws, are rules or regulations that govern the municipality as a whole. These are established, in most cases, by a vote of the legislative body at town meeting, or by city councils, however larger towns may have granted the select board the authority to enact ordinances. Ordinances can regulate activities throughout the entire municipality such as noise or waste disposal or be directed towards the care, protection,

preservation and use of public parks, libraries, etc. They are enforced by officers appointed to enforce local ordinances and through fines.

Town policies are more like guidelines that the governing body sets for managing certain activities, behaviors or use of property. For example, the library trustees could establish an unattended minor policy at the local library to prevent parents from leaving small children alone for extended periods of time. Policies are more guidelines than strictly enforceable bylaws, but they can play an important role in establishing when someone has crossed the line by repeatedly violating the rules. In these instances, it is generally the local police department that helps enforce these policies.

Finally, personnel policies are used to set the rules and expectations for town employees. The terms of these policies are agreed to as part of a person’s employment or position with the municipality and are enforced through the employer/employee relationship.

Q. How can municipalities manage the behavior of the public within public spaces?

A. Members of the public are expected to abide by town ordinances and policies, as well as the criminal code. All of these can work together in managing public use of town property. For example, the town could set a policy that the town hall is closed to the public at 6pm every night. If someone tried to enter the building after closing hours, they would be committing a criminal trespass which could be enforced by the police department.

Obviously, it isn’t always as straightforward as the above example. One area where we have seen town policies come into play is in dealing with 1st Amendment Auditors. A 1st Amendment Auditor is someone who enters a public space, usually recording, and seeks to agitate local officials and town employees. Many municipalities have struggled handling these situations since members of the public are allowed to enter public spaces and are also allowed to record.

However, there are many policies which could be enacted to help handle a situation like this. For example, towns are allowed to establish portions of a public space or building that are marked “employees only” where members of the public are not allowed to freely access. Town employees can be provided with guidance and procedures on how to interact with disruptive individuals through personnel policies to help them know who to report to and how to interact with these individuals. Also, having a policy in place which establishes grounds for removal from a public space if someone becomes belligerent, obtrusive, argumentative, or prevents employees from doing their work can be a useful tool.

Finally, public boards and bodies have the ability to set their own policies or rules of procedure for handling public comment or interactions during public meetings. This can include setting rules for how someone signs up or gets recognized to speak, setting time limits for comments and rules preventing disruptive and out of turn behavior.

Q. Can towns regulate firearms on public property?

A. This is a complicated question because it must be considered under the facts of the specific situation. Generally speaking, if the patron is in lawful possession

of the gun and is not using it in an unlawful manner, then the patron should be allowed to remain on public property with the gun.

While the select board does have the ability to manage town property, this authority is subject to state laws. With regard to guns, RSA 159:26 provides that "[e]xcept as otherwise specifically provided by statute, no ordinance or regulation of a political subdivision may regulate the sale, purchase, ownership, use, possession … or other matter pertaining to firearms, …." However, this is not to say that a patron who is using a gun to intimidate or threaten other patrons or staff must be ignored. Such a patron will likely be in violation of the criminal code as well as a town policy.

It is possible that other members of the public may be disturbed at the mere sight of a weapon and, on those grounds alone, demand that the person be removed. Caution should be used when removing someone from a public space solely on the request of others when the patron in question is not breaking any town policies or state laws regarding gun possession. Of course, town staff who reasonably believe that a patron in possession of a gun is behaving in a threatening or erratic manner should contact their local police for assistance.

Our extensive Training Archive is a fantastic benefit available exclusively to NHMA members. Behind the member wall on our website, you'll find a wealth of recorded trainings, all accessible at no additional cost. These sessions are an invaluable resource for your ongoing learning and professional development.

This is just one of the many perks of being an NHMA member. Don't miss out–explore the Training Archive today and make the most of all your training membership benefits!

Becoming a Sustaining Sponsor positions your business as a patron of New Hampshire's cities and towns, enhancing your brand recognition and trust within the community. By aligning with the mission of the New Hampshire Municipal Association (NHMA), you can choose from tiered options that offer increasing levels of visibility and access. Strengthen your brand's reputation by supporting local government initiatives, and make a strategic investment that elevates your business profile. As a Sustaining Sponsor, you'll gain direct access to NHMA members, ensuring exposure to key decision-makers in local government.

We extend our deepest gratitude to our current Sustaining Sponsors. Your support is invaluable to NHMA and the local

This New Hampshire town was named after Robert Marsham, 2nd Baron __.

It was originally granted in 1761 by Governor Benning Wentworth to settlers from Colchester and East Haddam, Connecticut. Although first settled in 1765, some of the original grantees did not meet the charter’s requirements, so the land was regranted in 1767 to a new group of settlers.

With fertile soil, the town became a thriving farming community. By 1859, the population had reached 1,109. Industries at the time included fifteen sawmills, a large tannery, and a ladder factory. Rail service began on the town’s western side in the early 1850s, provided by the Boston, Concord and Montreal Railroad.

On December 22, 1954, the Automobile License Plate Collectors Association (ALPCA) was founded here. It has since grown into an international organization with members in all 50 states and 19 countries.

The town is also a well-known rock climbing destination. Most climbing areas are located on the south face of Rattlesnake Mountain, part of the White Mountain National Forest. These cliffs are made mostly of schist, with some granite, and range from smooth slabs to steep overhangs and sharp aretes.