Investments Designed for New Hampshire

NH PDIP has provided New Hampshire’s public entities with investment options since 1993. NH PDIP focuses on safety, liquidity, and earning a competitive yield in order to meet the distinct needs of cities, towns, school districts, and other political subdivisions.

This information is for institutional investor use only, not for further distribution to retail investors, and does not represent an offer to sell or a solicitation of an offer to buy or sell any fund or other security. Investors should consider the Pool’s investment objectives, risks, charges and expenses before investing in the Pool. This and other information about the Pool is available in the Pool’s current Information Statement, which should be read carefully before investing. A copy of the Pool’s Information Statement may be obtained by calling 1-844-464-7347 or is available on the NHPDIP website at www.nhpdip.com. While the Pool seeks to maintain a stable net asset value of $1.00 per share, it is possible to lose money investing in the Pool. An investment in the Pool is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Shares of the Pool are distributed by U.S. Bancorp Investments, Inc., member FINRA (www.finra.org) and SIPC (www.sipc.org). PFM Asset Management is a division of U.S. Bancorp Asset Management, Inc., which serves as administrator and investment adviser to the Pool. U.S. Bancorp Asset Management, Inc. is a direct subsidiary of U.S. Bank N.A. and an indirect subsidiary of U.S. Bancorp. U.S. Bancorp Investments, Inc. is a subsidiary of U.S. Bancorp and affiliate of U.S. Bank N.A.

New Ha mp sh ire Publ ic Deposit Inve st ment Pool

Margaret M.L. Byrnes, Executive

Stephen C. Buckley, Senior Legal Services

Jonathan Cowal, Legal Services Counsel

C. Christine Johnston, Legal Services Counsel

Sarah Burke Cohen, Legislative Advocate

Brodie Deshaies, Legislative Advocate

Marty Karlon, Policy & Research Analyst

Tammy Letson, Government Finance Specialist

Judith Pellowe, Business Administrator

Ashley Methot, Event Coordinator

Pam Valley, Administrative Assistant

New Hampshire Municipal Association

BOARD OF DIRECTORS

Laura Buono Town Administrator, Hillsborough

David Caron Trustee of Trust Funds, Belmont

Shelagh Connelly Conservation Commission, Holderness

Phil D’Avanza Planning Board, Goffstown

Stephen Fournier Town Manager, Newmarket

Elizabeth FoxImmediate Past Chair Asst. City Manager, HR Director, Keene

Jennifer Kretovic City Councilor, Concord

Dale Girard Mayor, Claremont

Conner MacIver Town Administrator, Barrington

Holly Larsen

Joanne Haight - Secretary Select Board Chair, Sandwich

Dennis Shanahan - Chair Deputy Mayor, Dover

Thomas Seymour Moderator, Hill

Jeanie Forrester - Vice Chair Select Board Member, Meredith

Joseph R. Devine - Treasurer Town Manager, Salem

Judie Milner Town Manager, Meredith

Jim Michaud Chief Assessor, Hudson

David Moore City Manager, Somersworth

Shaun Mulholland Town Manager, Londonderry

Bonnie Ham Planning Board, Woodstock

Lori Radke Town Councilor, Beford

NHMA A Message from the Executive Director Margaret M.L.Byrnes

The end of the year is upon us! At NHMA, that means two big things: getting ready for the next legislative session and hosting our annual conference.

The Annual Conference will take place on Wednesday November 19 and Thursday November 20 at the Downtown Doubletree Hotel in Manchester. If you haven’t registered yet...time is running out! Registration closes on November 4, so if you are planning to attend, we encourage you to register ASAP. (Of course, walk ins are welcome!) I hope to see you there.

As always, our annual conference features two jam packed days of training for local officials, as well as time for networking and even some fun! Members can choose from over 50 educational sessions and explore the Exhibit Hall with over 100 vendors, games, and prizes. Feel like the pressure is getting to you? Learn how to respond to challenges with humor during keynote speaker Jan McInnis’ “Bouncing Back: Handling Setbacks Like a Comedian” on Wednesday morning. Wednesday evening will also feature a cocktail hour reception, followed by a casino night themed dinner and entertainment event. So, roll the dice and come spend a couple of days with old and new friends at the annual conference—we think it’s a win-win!

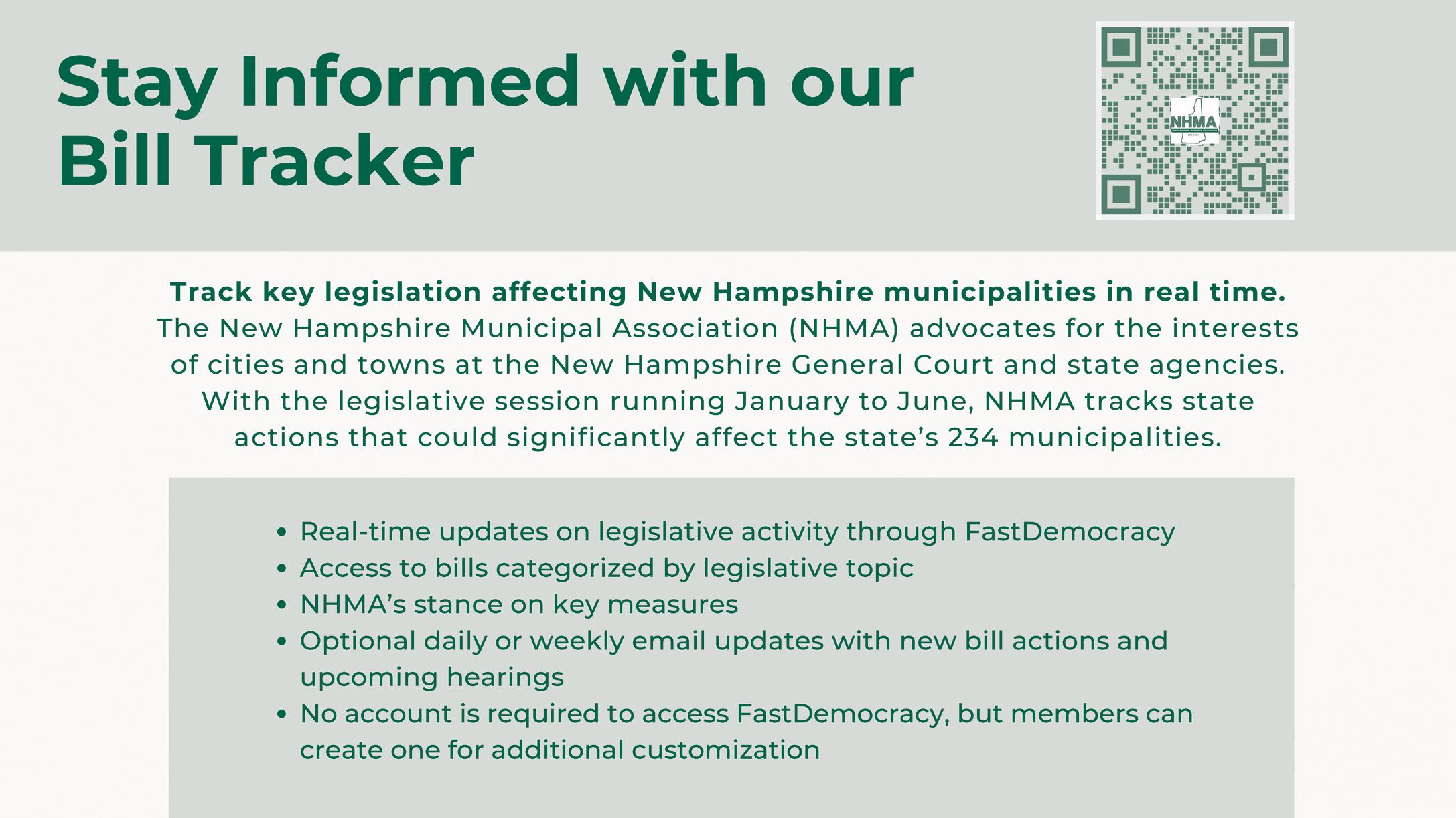

But it can’t be all fun and games: The 2026 legislative session is already shaping up to be a busy one. Although there was much talk of legislators filing fewer bills in 2026, there are already nearly 1,100 legislative service requests (LSRs). Although some will be withdrawn, there are certainly more to come, too. Two public LSRs are focused on restricting NHMA’s ability to advocate for our members, while numerous other titles suggest new mandates and restrictions on local government decision-making and autonomy. So although we will have to play a fair amount of defense representing our members, I’m pleased to say that the NHMA Advocacy Team worked with numerous legislators over the summer to file a variety of bills that would enhance and benefit cities and towns, including bills to repeal and fix the most detrimental statewide zoning mandates passed last year. We will be calling on our members to enhance our advocacy by speaking to your own legislators, testifying at public hearings, writing op-eds, and any other activity that raises the voice of local governments, and the people they represent, over other special interests.

Finally, I want to welcome our newest staff member, Christine Fillmore Johnston, who joined the NHMA team last month. Christine comes to us with years of municipal law experience, most recently at the law firm DrummondWoodsum, but the beginning of her municipal law career actually tracks back to her days at NHMA! Jonathan Cowal and Christine Fillmore Johnston now both serve as Legal Services Counsel, and Senior Legal Services Counsel, Stephen Buckley, will retire at the end of the year, capping off a 40-year legal career and over 10 years at NHMA. Congratulations Steve and welcome (back) Christine!

Warmest regards,

Margaret M.L. Byrnes, NHMA Executive Director

HAPPENINGS

Is something new and exciting happening in your city or town?

We'd love to include it in Town & City! Email us at publications@nhmunicipal.org

Check Out

NHMA’s New

Government Finance Services Page

We’re excited to introduce our updated Government Finance Services page, highlighting the expanded financial support now available to municipalities through our new Government Finance Specialist, Tammy Letson. Tammy is here to assist with everything from audits and internal controls to accounting, payroll, and more. View the full page for a full list of topics! www.nhmunicipal.org/government-finance-services

Introducing Christine Johnston!

We’re excited to reintroduce Christine, NHMA’s newest Legal Services Counsel!

Christine (Fillmore) Johnston returned to NHMA in October, 2025 and provides legal services to NHMA’s member municipalities, including legal advice, training programs, and educational publications. She finds it immensely rewarding to work with municipal officials – who are often volunteers – to fulfill their duties and serve their communities. She has worked both in private practice (most recently as a shareholder with Drummond Woodsum) and with NHMA, exclusively representing municipalities for more than two decades in all aspects of municipal law. She is also the current co-author of the four municipal volumes of the NH Practice legal treatise series. Christine received her B.A. from Tufts University and her J.D. from Boston College Law School.

Please join us in giving Christine a warm welcome to the NHMA team!

Important Date Calendars 2026!

NHMA’s 2026 Important Date Calendars are now available for download and iCal synchronization on the NHMA website. Updated each summer by NHMA Senior Legal Services Counsel and Legal Services Counsel, these publications help municipalities stay on top of key deadlines and events.

Both the PDF calendars and the iCal links can be found under the Resources tab in the dropdown menu of our website.

NHMA Has Issued Guidance on New 2025 Laws

NHMA has posted guidance documents for municipal officials regarding various new changes in the law. The guidance documents are available on the News Laws Guidance page of our website.

Check out NHMA’s Final Legislative Bulletin for a roundup of 2025 changes to state laws impacting municipalities.

Specific questions about the application of these and other statutes may be directed to NHMA Legal Services at legalinquiries@nhmunicipal.org or 603-224-7447.

DOJ/SOS Election Law Guidance

The legislature made a significant amount of election law changes this past session. The Secretary of State and the Attorney General have put together a memorandum to provide guidance to moderators, supervisors of the checklist, town and city clerks and governing body members to help election officials understand these changes.

Court Update

By Stephen C. Buckley, Senior Legal Services Counsel and Jonathan Cowal, Legal Services Counse

Now available online:

AUGUST 2025

The Attorney Client Privilege is Not Subject to a Balancing Test Under the Right-to-Know Law; Employee Settlement Payments Shall Provide Copies of Original Financial Records under RSA 91-A:4, I-a., Keene Publishing Corp. v. Fall Mountain Regional School District, New Hampshire Supreme Court 2025 N.H. 35 08/12/2025

Veterans’ Disability Benefits Constitute Income that Must be Counted when Determining Eligibility for Elderly Property Tax Exemptions, and This is Not Contrary to Federal Law, Appeal of Girard Conti, New Hampshire Supreme Court Case No. 2024-0330

08/14/2025

Legal Standing Requires Close Physical Proximity and Probable Direct Injury to the Aggrieved Party’s Property by the Land Use Project Approved by a Land Use Board, Big Step, LLC v Concord; Cameron v. Concord*, New Hampshire Supreme Court Case Nos. 2024-0410 and 2024-0571

8/14/2025

A Street Shown on an Approved Plan is Deemed a Dedicated Street and Can be Accepted as a Public Highway by a Town or City at Any Time, Taylor Community v. City of Laconia, New Hampshire Supreme Court Case No. 2024-0393 08/27/2025

For the most up-to-date court summaries, please visit the NHMA website at www.nhmunicipal.org/court-updates. Thank you.

Municipal Budgeting: Tackling the Unexpected

Stephen C. Buckley, Senior Legal Services Counsel

Once the budget and other appropriations have been voted on, what is their legal effect? RSA 32:8 provides that no town, village district or school district official can spend any money for any purpose in excess of the amount appropriated by the legislative body for that purpose, or for any purpose for which no appropriation has been made.

Furthermore, annual appropriations are just that; they are appropriations that provide for identified expenditures for that fiscal year. All appropriations lapse at the end of the fiscal year and any unexpended portion cannot be expended without further appropriation, or unless of the exceptions to the lapse rule applies as stated in RSA 32:7.

This past year several municipalities faced demands for significant expenditures that were not anticipated and were decidedly unexpected. Some ambulance services were threatening to close their doors unless the town they served agreed to provide significant additional funding above and beyond what had been budgeted for that year. Here are some options for addressing unexpected expenditures that might bust the budget:

Contingency Fund:

To be prepared for an unexpected expenditure that arises during the year towns may establish a contingency fund by separate warrant article. The fund may be used by the governing body (select board, school board, village district commissioners) during the year to meet the cost of unanticipated expenses that may arise during that year. The amount of the fund may not exceed one percent of the amount appropriated by the town during the preceding year, excluding capital expenditures and debt service. A detailed report of all expenditures from the contingency fund must be made each year by the select board and published in the annual report. RSA 31:98-a; RSA 32:11, V. School Districts can also be authorized to establish a contingency fund under RSA 198:4-b.

Line-Item Transfers:

If changes arise during the year that make it necessary to spend more than the amount appropriated for a specific purpose, the governing body may transfer to that appropriation any unexpended balance remaining in some other appropriation, provided:

• The total amount spent shall not exceed the total amount appropriated at the town or district meeting.

• Records shall be kept by the governing body, such that the budget committee, if any, or any citizen may ascertain the purposes of appropriations to which, and from which, amounts have been transferred.

• A statement comparing all appropriations and expenditures shall be deemed adequate for this purpose so long as every

expenditure has been properly authorized and properly classified and entered and any expenditures exceeding the original annual meeting legislative appropriations are offset by unexpended balances remaining in other appropriations.

• Any amount appropriated at the meeting under a special warrant article, or to a capital reserve fund pursuant to RSA 35:5, may be used only for the purpose specified in that article and shall not be transferred.

Emergency Expenditures:

Using RSA 32:11 either the Commissioner of the NH Department of Revenue or the Commissioner of Education can approve an expenditure that would exceed the total amount appropriated at the annual meeting, or for a purpose where no appropriation had been made, where “an unusual circumstance” arises during the year:

• The municipality shall apply to the DRA or Education Department prior to making the expenditure (although an expenditure caused by a sudden or unexpected emergency could justify an after the fact application).

• No such authority shall be granted until a majority of the budget committee, if any, has approved the application in writing. If there is no budget committee, the governing body shall hold a public hearing on the request, with notice as provided in RSA 91-A:2.

• Neither the DRA Commissioner nor Education Commissioner can approve such an expenditure unless the governing body designates the source of revenue to be used. This requires that there be sufficient municipal fund balance to support the expenditure. Neither commissioner shall have the authority to increase the town or district's tax rate in order to fund such an expenditure.

• When applying to the Education Commissioner the school board shall send a copy of such application to the DRA.

Special Town Meeting Permission:

There are two options to consider under RSA 31:5 (towns & village districts) or RSA 197:3 (school districts) to get permission to raise and appropriate funds to address an unexpected expenditure:

Special Meeting with Minimum Voter Attendance:

A special meeting of the legislative body (town or district meeting) can be held by the municipality to increase or reduce an appropriation previously approved at the annual meeting but only if 1/2 of the number of legal voters are in attendance. The checklist used at the meeting just preceding the special meeting is used to determine whether voter attendance satisfies this 50% requirement, and all voting

at the special meeting shall be by ballot. This requirement would not apply to money to be raised for the public defense or any military purpose in time of war or to money to be raised for the purpose of financing broadband infrastructure bonds under RSA 33:3-g.

Special Meeting with Superior Court Approval: Since satisfying the 50% voter attendance requirement could be extremely difficult, in case an emergency arises during the year requiring an immediate expenditure of money, the select board, district commissioners or school board may petition the superior court for permission to hold a special meeting which, if granted, shall give the special meeting the same authority as an annual town or district meeting.

"Emergency" is defined as “a sudden or unexpected situation or occurrence, or combination of occurrences, of a serious and urgent nature, that demands prompt, or immediate action, including an immediate expenditure of money. This definition, however, does not establish a requirement that an emergency involves a crisis in every set of circumstances.”

To demonstrate that an emergency exists the petition to the Superior Court must address the following factors:

(1) The severity of the harm to be avoided.

(2) The urgency of the petitioner's need.

(3) Whether the claimed emergency was foreseeable or avoidable.

(4) Whether the appropriation could have been made at the annual meeting.

(5) Whether there are alternative remedies not requiring an appropriation.

On or before the date of filing the petition with the Superior Court, the select board or district commissioners shall forward a copy of the petition and the warrant article or articles, by certified mail, to the commissioner of the department of revenue administration. The petition to the superior court shall include a certification that the commissioner of the department of revenue administration has been notified pursuant to this paragraph.

For School Districts, ten days prior to petitioning the Superior Court, the school board shall notify, by certified mail, the commissioner of the department of revenue administration that an emergency exists by providing the commissioner with a copy of the explanation of the emergency, the warrant article or articles and the petition to be submitted to the superior court. The petition to the superior court shall include a certification that the commissioner of the department of revenue administration has been notified pursuant to this paragraph.

For both towns and districts the governing bodies are required to post notice of their vote to petition the Superior Court within 24 hours after taking the vote and a minimum of 10 days prior to filing the petition with the court. Notice of the court date for any evidentiary hearing on the petition shall also be posted within 24 hours after receiving notice of the court date from the court. Such notices shall be posted at the office of the governing body and at 2 or more other conspicuous places in the town or district, and in the next available edition of a local newspaper with a wide circulation in the town or district.

Revenue sharing, we hardly knew ye

“In consideration of the removal of certain classes of property from taxation, which would otherwise have the effect of reducing the tax base of cities and towns of the state, it is hereby declared to be the policy of the state to return a certain portion of the general revenues of the state to the cities and towns for their unrestricted use…”

If you aren’t a regular reader of the obituary page, you may have missed the passing of a longtime financial supporter of local government who had been in rough shape for years.

RSA 31-A: Return of Revenue to Cities and Towns, more commonly known as revenue sharing, ceased to exist in New Hampshire law on July 1, 2025, when House Bill 2, the budget trailer bill signed by the governor, took effect.

In 1969, reform in how the state taxed businesses led to the implementation of the Business Profits Tax (BPT), which eliminated many antiquated taxes more reflective of the agricultural economy of the past. These taxes, however, were assessed and collected by municipalities and were part of the property tax base for municipalities, school districts, and counties. Revenue sharing was intended to help replace lost local income.

When RSA 31-A was enacted in 1970, it included a provision to increase revenue sharing by 10% annually. In testimony, then New Hampshire Attorney General Warren Rudman addressed concerns that future legislators may choose not to honor this commitment. “It seems quite doubtful to me that once this bill is passed that any legislator would go back on its pledge to return revenue to cities and towns that originally belonged to those cities and towns,” he stated, without irony. “And I might also add, in passing, that I could hardly see a Governor signing a bill which would deprive cities and towns of the revenue which they once had.”

– Chapter 5, Laws of 1970

Despite assurances, the 10% provision was short-lived and was reduced to 5% the following year, with further reductions in subsequent years.

This is not to say RSA 31-A wasn’t a lifeline for municipalities and school districts for decades. In 1999, total revenue sharing amounted to $47 million (the equivalent of $91 million in 2025 dollars).

In 2000, revenue sharing allocated to school districts was eliminated, with the money diverted to fund the state’s adequate education obligations. This left $25 million annually for general revenue sharing with municipalities and counties, a figure that remained constant through fiscal year 2009. However, since 2010, initially motivated by the impacts of the Great Recession, revenue sharing was suspended in every state budget, resulting in an annual loss of $25 million for municipalities and counties—a total of $400 million from fiscal years 2010 to 2025. It’s worth emphasizing again that this wasn’t a handout from the state—this was revenue cities and once had before their property tax base was reduced by law.

The story of a 55-year-old statute that never fully lived up to its promise is a sobering reminder that when we think of “State Law,” we must always remember that it is an impermanent thing, subject to the whims of our elected legislators.

Some previous NHMA content on the history of revenue sharing was used in this article.

MAKE LEMONADE.

A Fresh Start with FRESH SOLUTIONS.

A NEW GOVERNMENT BANKING SOLUTION WITH LOCAL CARE THAT KEEPS YOU THRIVING.

As a new government banking partner in your community, know that we are invested in the success of our municipalities, and o er the latest in municipal financing options, and a comprehensive list of resources. Our Municipal Lending Team is right here in your community, with the knowledge, flexibility and accessibility you need to reliably run your day-to-day operations.

OUR FLEXIBLE GOVERNMENT BANKING SOLUTIONS INCLUDE:

A Local Municipal Lending Team—o ering local knowledge, flexibility and customer care when you need it

Municipal Depository Accounts—to include Insured Cash Sweep service which provides FDIC insurance coverage

Electronic Banking—convenience of banking from anywhere, any time

Cash Management Services—which includes Positive Pay and ACH filtering

Remote Deposit Capture—allowing flexibility of depositing checks from the convenience of your o ce

Debit Mastercard Business Card—increased purchasing flexibility to better manage cash flow and recordkeeping

CONTACT OUR TEAM TO GET STARTED

Tech Insights

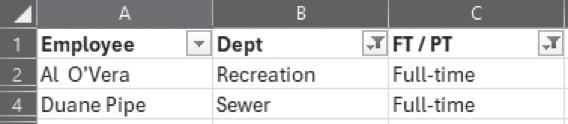

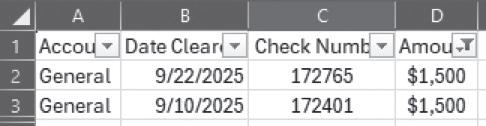

Filtering data on an Excel Spreadsheet

Tammy Letson, Government Finance Specialist

Isn’t it frustrating when you look at a spreadsheet trying to find specific information but there is so much data that it is impossible to see what you want? Maybe you have a list of employees in alphabetical order, but you only need to see the full-time recreational and sewer employees. How about a list of cleared checks from the bank statement and you cannot find the one the bank has the wrong check number on? I am happy to share that Excel has a feature that makes it easy to find what you are looking for.

Filters can hide or display rows containing certain items in columns. To do this, highlight an area or full columns of your spreadsheet you wish to search. On the Home tab in the Editing section click on Sort & Filter then Filter. Drop down arrows appear in the top row of the section you highlighted. Clicking on any of the drop-down arrows shows you, in alpha-numeric order, all the items below that dropdown arrow. In my example below I am going to choose the down arrow after FT/PT. The options given show that you can sort the section based on this column, sort or filter by color filled cells, or select only certain data within the cell. To see only the full-time employees, uncheck select all, check fulltime, and click OK.

What is then displayed are only the full-time employees. Next you can choose the down arrow in Dept. Because you need to see the recreation and sewer employees, you simply need to uncheck the admin option. If you have blank rows you want to hide, you can uncheck blanks as well. What is remaining is now only your full-time water and sewer employees. Notice the drop-down arrow changes to a funnel shape on the columns you filtered data from. This is a visual indicator that these are columns with selections that are limiting your data. Also notice that your row numbers are not sequential. This is an indicator that there is data that is not being shown as it does not match your filters.

In the scenario of not finding a check by its number, you can set up filters and choose the filter for the amount column. Unselect all items, scroll down to the amount that matches your check, then click okay. The remaining data will be all the checks that are in that list that match the amount.

Our extensive Training Archive is a fantastic benefit available exclusively to NHMA members. Behind the member wall on our website, you'll find a wealth of recorded trainings, all accessible at no additional cost. These sessions are an invaluable resource for your ongoing learning and professional development.

This is just one of the many perks of being an NHMA member. Don't miss out–explore the Training Archive today and make the most of all your training membership benefits!

Upcoming Events

NOVEMBER

Veterans Day (NHMA Offices Closed)

Tuesday, November 11

Annual Conference & Exhibition

Wednesday, November 19 –Thursday, November 20

The DoubleTree by Hilton Manchester Downtown Hotel, 700 Elm Street, Manchester, NH 03101

Thanksgiving Day (NHMA Offices Closed) Thursday, November 27

Day after Thanksgiving Day (NHMA Offices Closed) Friday, November 28

For more information or to register for an event, visit our online Calendar of Events at www.nhmunicipal.org. If you have any questions, please contact us at nhmaregistrations@nhmunicipal.org.

DECEMBER

NHMA Board of Directors Meeting

9:30 am – 12:00pm Friday, December 19 25 Triangle Park Drive, Concord, NH 03301

Christmas Day (NHMA Offices Closed) Thursday, December 25

For the most up-to-date event and training information, please visit the NHMA website at www.nhmunicipal.org. Event times and dates are subject to change. Thank you.

INTRODUCING:

Tammy Letson

NHMA's New Government Finance Specialist!

NHMA is excited to announce that Tammy Letson has joined NHMA as our new Government Finance Specialist! Tammy is now available to answer government-finance inquiries from NHMA members and will be conducting a variety of educational workshops, including the return of the Financial Policies Certificate series in the fall.

Prior to joining the NHMA team, she held various positions in municipalities including Town Administrator, Finance Director, Tax Collector, Trustee of Trust Funds, and Planning Board Secretary. She was a Municipal Services Advisor for 14 years with an NH accounting firm and worked for 8 years in software support for an NH based company who specializes in local government.

To contact Tammy with your finance inquiries, please use the legalinquiries@nhmunicipal.org email address, or call us at 603.224.7447 and press one. Tammy's typical availability will be Monday - Thursday from 9:00 am - 4:30 pm. And stay tuned for upcoming training opportunities!

NEW HAMPSHIRE ASSOCIATION OF REGIONAL PLANNING COMMISSIONS

NHARPC: Resources for Volunteer Planners

Courtney Bowler (NCC), Noah Hodgetts (NHBEA/OPD), Todd Horner (SWRPC), Brendan McDowell (NHBEA/OPD) Sylvia von Aulock (SNHPC)

Whether you are new as a volunteer planner on a local land use board or you are a seasoned volunteer, every now and then, it’s likely you are looking for resources. Thanks to the internet, countless excellent resources are at your fingertips. Still, many volunteer planners enjoy in-person training opportunities, workshops and listening sessions, as well as a variety of hardcopy reference materials and maps. The following article outlines state and regional resources and provides a variety of resources for four of the current hot topics in the planning world.

State Resources for New and Existing Board Members:

The New Hampshire Department of Business and Economic Affairs (BEA) (https://www. nheconomy.com) through the Office of Planning and Development (OPD) offers many services to state, regional and local officials and interested New Hampshire residents relating to planning, zoning, and land use.

A great place for new and seasoned planning board members to start or refresh their knowledge on state statutes is OPD’s Planning Board Handbook (https://www.nheconomy.com/ office-of-planning-and-development/resources/ planning-board-handbook). The handbook is designed to serve as a guide to the organization, powers, duties and procedures of planning boards in New Hampshire. OPD has also drafted a similar handbook for Zoning Boards of Adjustment (ZBA) members to understand the rules that govern these roles (https://www.nheconomy. com/getmedia/80b7bb45-2a29-4ac8-b3d26437d5f06102/2024-ZBA-Handbook-FINAL. pdf). It serves as a guide in clarifying the board's rules, responsibilities, and quasi-judicial power. Both the Planning and Zoning Board handbooks are updated annually with legislative changes.

The latest BEA Planning tool is the Fiscal Analysis of Housing Calculator (https://www.nheconomy.

com/office-of-planning-and-development/fiscalhousing-calculator). The calculator was created to assist municipalities and others in analyzing the effects of single-family, middle density, and multifamily housing development in making informed policy decisions.

OPD also hosts a Monthly Webinar Series, “Planning Lunches at Noon” (PLAN), every third Thursday from 12-1 pm, on a relevant or timely planning and zoning topic (https://www.nheconomy.com/office-of-planning-and-development/ what-we-do/municipal-and-regional-planningassistance/osi-planning-and-zoning-training/ monthly-webinar-series). These lunch and learns are free to anyone and conducted live with a presentation and a Q&A session. All webinars are recorded and posted on OPD's YouTube Channel (https://www.youtube.com/@nhstateplanning/ videos) where they can be easily accessed at any time for future reference. Additionally, for over thirty years, OPD has put on a Spring Planning and Zoning Conference (https://www.nheconomy.com/office-of-planning-and-development/ what-we-do/municipal-and-regional-planningassistance/osi-planning-and-zoning-conferences) which educates planning board and zoning board members on their essential duties as board members and how the boards on which they serve are supposed to operate.

OPD publishes a Zoning Amendment Calendar(https://www.nheconomy.com/office-

Fiscal Analysis of Housing showing the possible impact of a 40-unit market rate multifamily development in Concord.

EXPERIENCED SELLERS OF TAX DEEDED PROPERTY FOR over 40 YEARS!

of-planning-and-development/what-we-offer/zoningamendment-calendars) every August, which outlines the dates by which zoning amendments need to be proposed and go to public hearing in towns. OPD also publishes a summation of changes in planning and zoning laws in September of every year (https://www.nheconomy.com/ office-of-planning-and-development/resources/planningand-zoning-legislation). There is also a resource page that provides links to other local and state planning, zoning, and land use subjects (https://www.nheconomy.com/ office-of-planning-and-development/resources/planningtopics) and links to planning and zoning related chapters for easy reference (https://www.nheconomy.com/officeof-planning-and-development/resources/selected-landuse-regulation).

How Regional Planning Commissions Can Help:

Regional Planning Commissions (RPCs) offer volunteer planners a support network that they can tap into to learn about new planning topics, consult with planning professionals, and connect with valuable resources. RPCs are public, non-profit organizations authorized by NH RSA 36, formed by municipalities on a voluntary basis. There are nine RPCs across the state. Their mission is to advise and support municipalities within their region on planning and public policy issues, including land use, transportation, housing, economic development and more. To learn about the RPC in your area, visit: https://www.nharpc.org/

Each Planning Commission assists their member communities through a variety of educational opportunities. The Southwest Region Planning Commission (SWRPC) has been facilitating Citizen

Planner Round Tables in which towns can learn from one another. (https://www.swrpc.org/citizen-plannerroundtables/) Over the last year, SWRPC staff have invited volunteer planning board members to discuss shared challenges, build a mutual support network, and to dig into specific planning topics together.

The RPCs also create interactive tools such as story maps to provide examples of positive planning work as well as resources to help keep planners up to speed with evolving policies and best practices. A recent example is Strafford Regional Planning Commission’s 2025 Legislative Toolkit (https://straffordrpcnh. gov/2025/08/18/srpc-publishes-2025-nh-legislativetoolkit/), which summarizes changes in state law that impact local planning issues. The Commissions also provide tailored technical assistance to volunteer land use boards. This year, utilizing the State’s Housing Opportunity Program funding, Rockingham Planning Commission assisted the Town of Hampton in developing and adopting an inclusionary housing ordinance, representing another step in addressing housing challenges and shortages in New Hampshire.

Hot Planning Topics in New Hampshire:

Although it was difficult to narrow our focus for this section on hot topic areas, the authors decided to include two uplifting planning areas and two more serious and difficult challenges. For the former, we felt that the love of New Hampshire’s farms and the ever-growing popularity and use of the state’s rail trails were great fits. For the latter, the mounting challenges related to the state’s housing shortage and the difficulty of dealing with contamination of forever chemicals such as PFAS were also good fits.

Excerpt from 2026 Zoning Amendment Calendar – Traditional March Town Meeting zoomed into November-February.

Nate Bernitz of UNH Extension discusses volunteer planner recruitment and retention at citizen planner roundtable in Harrisville, NH. VOLUNTEER PLANNERS from page 18

Agritourism: New Hampshire loves its farms and many them have become destinations for familyfriendly events, especially during their harvest season. Farms and agriculture need the support of communities on many levels and there are several excellent ways planners and volunteer board members can support their local farms. First, ensure your master plan encourages and supports their local agriculture and farms. Second, create an Agriculture Commission, as

demonstrated in the Town of Lee, whose mission is to "recognize, educate, promote, protect and encourage agriculture and agricultural resources throughout the Town”. Third, educate yourself on agritourism through several channels such as UNH and the NH Food Alliance. Finally, ensure that agricultural uses have flexible zoning allowances. Check out these resources for all these strategies.

Agritourism Resources:

• The NH Food Alliance: https://www. nhfoodalliance.org/agritourism

• The National Agricultural Law Center: https:// nationalaglawcenter.org/overview/agritourism

• UNH Extension also has excellent resources such as this series of videos entitled, “Can Agritourism add to your bottom line?”: https://extension.unh. edu/resource/cultivating-farm-experiences-canagritourism-add-your-bottom-line

• Agricultural Commission, Lee, NH: https:// www.leenh.org/agricultural-commission

Rail Trails:

Rail trails are booming in New Hampshire, and their growing popularity reflects a broader shift toward

outdoor recreation and community connectivity. These trails offer safe, scenic, and accessible spaces that support healthy lifestyles, connect people, and contribute to local economies. With over 380 miles of rail trails crisscrossing the state, they are well established and increasingly central to community planning.

To support their continued development, volunteer planners can draw on resources such as:

• NH Rail Trails Coalition (https://nhrtc.org/) for technical assistance and advocacy,

• Recreational Trail Program (https://www. nhstateparks.org/find-parks-trails/find-trailsmaps-clubs/grants/recreational-trails-program) (RTP) for project funding (though federal support beyond 2026 is uncertain), and

• UNH Extension’s DIRT Initiative (https://www. nhstateparks.org/find-parks-trails/find-trailsmaps-clubs/grants/recreational-trails-program) for collaboration and capacity building.

As Chuck Redfern stated in a NH Business Magazine article by Judi Currie in 2022, “Rails are popular with a wide range of outdoor enthusiasts because they are user-friendly,” capturing the broad appeal of these vital public assets (https://www.businessnhmagazine.com/ article/popularity-of-nhrsquos-rail-trails-on-the-rise).

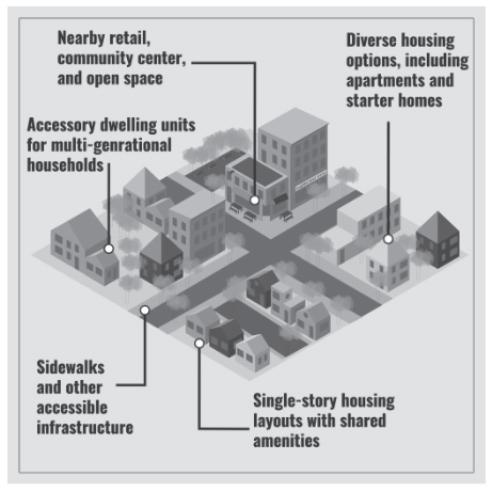

Housing Resources:

Housing has become a critical concern across New Hampshire as communities grapple with shortages, affordability challenges, and changes in housing needs as shifts in the state’s demographics continue. Volunteer planners play a pivotal role in addressing these issues by adopting innovative local strategies and leveraging state-led tools tailored for diverse community contexts. The New Hampshire Housing Toolbox (https://nhhousingtoolbox.org/) offers 20 planning and zoning strategies, like accessory dwelling units, cluster housing, and adaptive reuse, that municipalities can implement to encourage housing production. Meanwhile, Housing Opportunity

Picture from DeMeritt Hill Farm Agritourism in action

Planning (HOP) grants (https://www.nhhfa.org/wpcontent/uploads/2025/02/nhh_case_study_2025. pdf) and Community Housing Navigator programs under InvestNH (https://www.nhhopgrants.org/) have funded regulatory audits, zoning updates, and facilitated engagement in over 98 small and mid-sized communities to date. Additional support comes from RPC Housing Snapshot Profiles produced by regional planning commissions using US Census data which provides recent data on demographics, housing stock, and local housing needs helping communities plan decisions and assess gaps. While not all regions have published snapshot profiles, all nine RPCs have developed Regional Housing Needs Assessment (RHNAs) that provide comprehensive data and policy recommendations to address housing needs at the regional scale (http://nharpc.org/rhna).

Explore Data Snapshots by Region:

• Strafford RPC: https://straffordrpcnh.gov/ communities/

• Southwest RPC: https://www.swrpc.org/ resources/data/community-snapshots/

• Central NH RPC: https://cnhrpc.org/gisdata/2010-census-data/

• North County Council: https://data-resourcehub-2-nccouncil.hub.arcgis.com/pages/datasnapshots

• Southern NH RPC: https://www.snhpc.org/ community-economic-development/land-usehousing/pages/housing-needs-assessment

These resources empower volunteer planners to move from identifying housing challenges to implementing effective, context-specific solutions.

Groundwater Protection/PFAS:

PFAS (per- and polyfluoroalkyl substances) have emerged as a pressing groundwater concern for New Hampshire communities. These chemicals – often called “forever chemicals” – do not break down easily and have been detected in water supplies across the state. This is alarming because even extremely low concentrations of PFAS in drinking water (in the parts-per-trillion range) can pose health risks. Long-term exposure to PFAS has been linked to issues like elevated cholesterol, thyroid disorders, and even certain cancers, making it crucial to keep them out of public water.

Fortunately, resources are available to help towns navigate PFAS and groundwater protection. The NHDES PFAS Response website is a key hub for upto-date information, mapping of contamination, and guidance on state response efforts. The NHDES Local Source Water Protection Grant Program (https://www. des.nh.gov/climate-and-sustainability/conservationmitigation-and-restoration/source-water-protection/ swp-grants) offers funding to municipalities for projects that protect drinking water sources (such as wellhead protection plans or ordinances). Local officials can also refer to the NH Department of Health and Human Services’ PFAS information for guidance on health risks and community outreach. In addition, the NHDES Model Groundwater Protection Ordinance (https://www.des.nh.gov/sites/g/files/ehbemt341/ files/documents/wd-24-02.pdf) provides towns with a regulatory roadmap for protecting water resources from PFAS and other contaminants. By staying informed and taking advantage of these resources, New Hampshire towns and cities can be proactive in keeping their groundwater – and residents – safe from PFAS.

These examples represent a thin slice of how the State and RPCs can assist volunteer planners. For a more in-depth discussion on the topic, consider attending the New Hampshire Municipal Association’s Annual Conference on November 19th and 20th (https://www. nhmunicipal.org/nhmas-84th-annual-conference-andexhibition). The authors will be participating on a panel (11/20 at 1:30) to share additional ways they support volunteer planners across the state.

NH Housing Toolbox example of age-friendly housing alternatives.

VOLUNTEER PLANNERS from page 21

Avitar Associates of New England Inc

Bank of New Hampshire

Bar Harbor Bank & Trust

Ben Schaffer Recreation

Bonnette, Page & Stone Corp.

Cartographic Associates, Inc., dba CAI Technologies

CGI Business Solutions

CheckmateHCM

Cordell A. Johnston, Attorney at Law

Donahue, Tucker & Ciandella, PLLC

Dirigo Risk Management Solutions

Doucet Survey, LLC

Drummond Woodsum

Eagle Network Solutions

Freedom Energy Logistics

Guardian Energy Management Solutions

H.L. Turner Group Inc.

HealthTrust, Inc.

HEB Engineers

JSJ Auctions, LLC

MHEC

Municipal Resources, Inc.

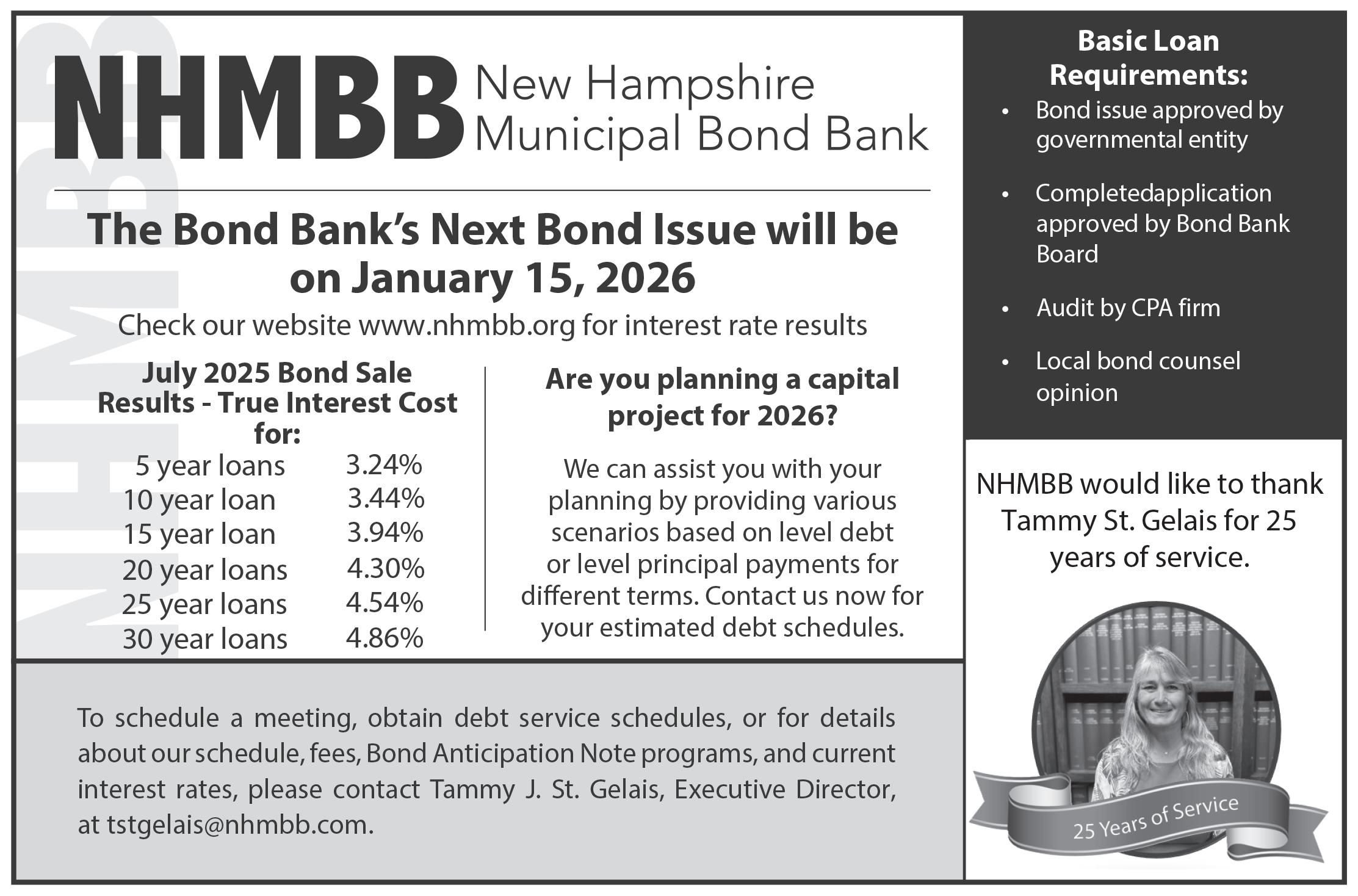

NH Municipal Bond Bank

Nessit

NH PDIP/PFM Asset Management LLC

NH Tax Deed & Property Auctions

Primex

RMON Networks, Inc.

Sawdey Solutions Services, Inc.

Three Bearding Fiduciary Advisors, Inc.

TD Bank

Umbral Technologies

Upton & Hatfield, LLP

VHB

Vision Government Solutions, Inc.

TIlluminating Efficiency: A Guide to EnergyEfficient Commercial Lighting

NHSaves® Utility Partners

here are plenty of reasons to invest in energy-efficient lighting for your business: Safety. Functionality. Ambience. Plus, perhaps everyone’s favorite— a noticeable positive impact on your bottom line.

Delve into the world of energy-efficient commercial lighting solutions. From sleek LEDs to smart lighting systems, these options light up your workspace while minimizing your environmental footprint. Discover the advantages of embracing LED technology, from cost savings to enhanced aesthetics and beyond.

LED lighting technology consumes significantly less electricity when compared to traditional incandescent or fluorescent lighting. In fact, LED light bulbs consume at least 75% less energy than incandescent bulbs and last up to 25 times longer. So why are they so efficient? The answer lies in the fact that 95% of energy used in LED bulbs is converted into light. This means only 5% is being lost to heat, whereas in an incandescent bulb that uses heat to create light, about 90% of energy is being wasted as heat. Plus, various incentives are available, from $3 all the way up to $215, based on the type of LED lighting you purchase.

Another great benefit is that many energy-efficient lighting systems come equipped with smart controls. This means that you can customize lighting levels and set schedules for different times of the day when more or less light may be needed. So, whether you own a restaurant and want to set the mood with your lighting, a retail store

where bright light can positively impact sales, a school where proper lighting can affect test scores or a museum where lighting needs to be just right to maintain works of art, you can have it all when you make the switch to LED lighting with a smart-control system. Even better? You can upgrade your current lighting system with a lighting retrofit incentive.

Ultimately, investing in LED lighting is, simply put, a smart business move. Though the date of the invention of the first-ever LED light bulb is up for debate, their rise in popularity didn’t come about until the early 2000s. And though there were barriers to entry to begin with (higher quality = higher cost), the same is not true of today’s LEDs. While the upfront cost is slightly higher (think: $5–$7 per bulb vs. $2–$3 per bulb), when you consider the fact that LEDs last up to 25 times longer, the investment more than pays for itself. Plus, as technology continues to advance, energy-efficient lighting is likely to become even more efficient and affordable. By investing in these technologies now, businesses like yours can position themselves to benefit from future innovations.

Whether you’re ready to make the investment now or are just looking into your options, your NHSaves® utility partners have resources to help you get started. Choose from three different ways to save with LEDs or check out LED lighting rebate options for municipalities.

Learn more at NHSaves.com/lighting

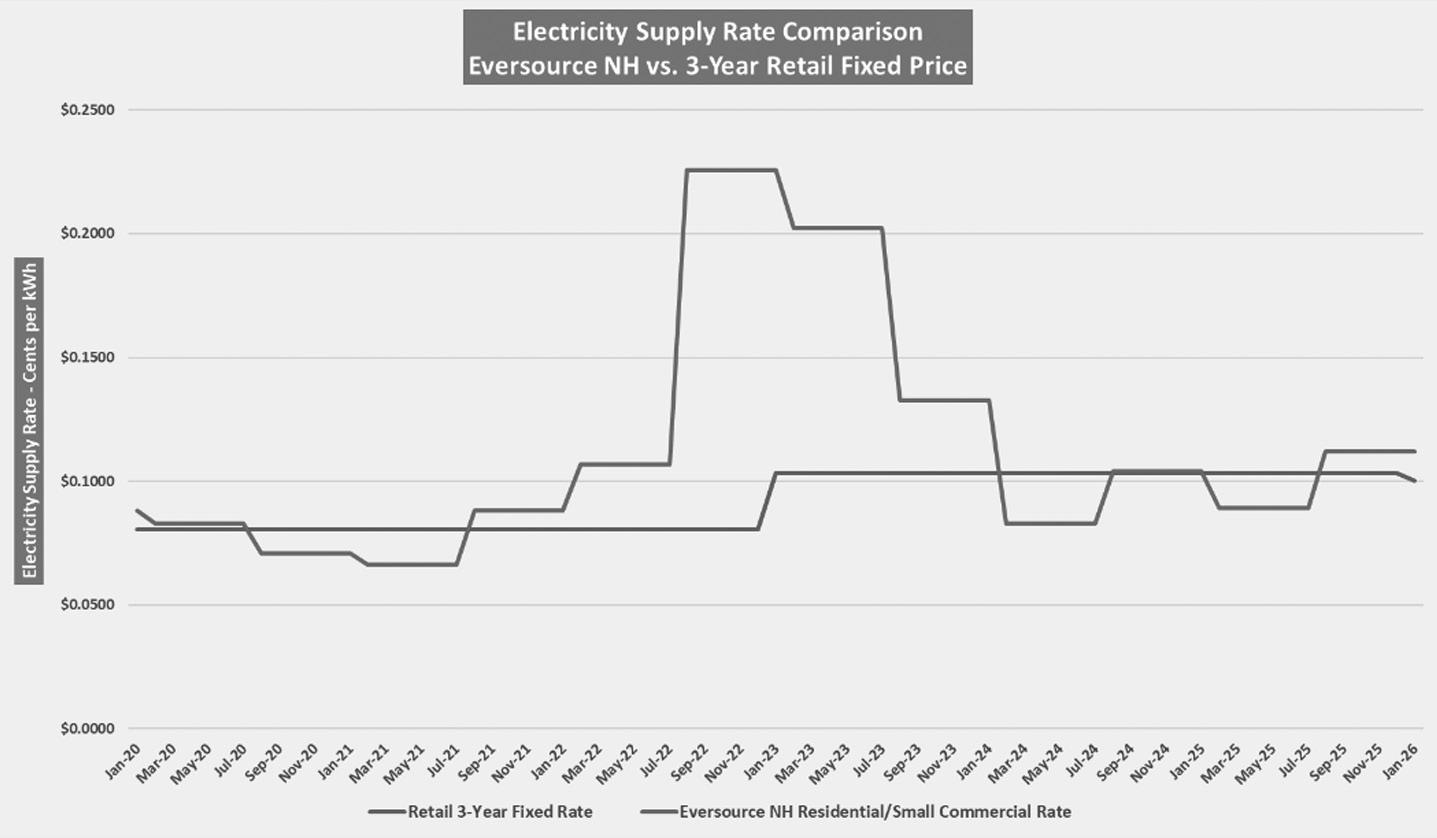

Beyond the Six-Month Cycle: Why Longer-Term CCA Contracts Can Deliver More for New Hampshire Communities

Bart Fromuth, CEO, Freedom Energy Logistics

Community Choice Aggregation (CCA) has emerged as a powerful tool for New Hampshire municipalities to take control of their energy futures. With over 40 active towns participating through the Community Power Coalition of New Hampshire, Standard Power, Colonial Power Group or Freedom Energy Logistics, the landscape is growing—but so is the need for strategic evolution.

One area ripe for reconsideration is contract duration. Most CCAs in New Hampshire follow the utility’s cadence of six-month supply contracts. This approach was originally designed to ensure rates stayed below utility default service, a cautious strategy that worked for a time. But since January 2025, many, if not all, of the communities on this cycle have seen this strategy backfire with rates well above default service.

This article is not intended to dissuade use of short-term contracts; they have their utility. It is about encouraging towns to think differently, more strategically, about how they use and optimize their CCA programs to deliver longterm value and stability to their residents.

The Problem with Short-Term Thinking

Electricity markets are volatile. From 2021 to 2022 New England went from historic lows to historic highs in under 18 months. Prices can swing dramatically due to weather, fuel supply disruptions, and global energy policy shifts. For ratepayers, especially seniors and low-to-moderate income households, these fluctuations can be difficult to absorb.

Short-term contracts, while flexible, often miss opportunities to lock in favorable rates. They also expose communities to the same volatility as utility default service and traditional residential third-party supply. When prices spike, everyone feels it. There is no cushion, no fallback.

Longer-term contracts, on the other hand, offer budget certainty. They smooth out the bumps and allow towns to plan with confidence. And when appropriately timed, they can deliver savings and stability—a rare combination in today’s energy landscape

Hampton and Salem Lead the Way

Take Hampton, for example. Their first CCA contract was an 18-month term at just over 9 cents per kWh, currently the lowest aggregation rate in New Hampshire. They were conservative on duration, as many towns are with their first contract. But seeing the benefits, they have now locked in a three-year agreement at 11 cents per kWh.

With natural gas trading around $3 per dekatherm (dth), a key driver of electricity prices in New England, this is more than likely to be an excellent entry point. Hampton’s residents will enjoy three years of price certainty at a time when volatility is the norm.

Salem, one of the fastest-growing communities in the state, followed suit this Fall with a two-year agreement, also around 11 cents per kWh. With Liberty Utilities’ rates climbing to 12.4 cents and potentially higher in February, Salem can now market its energy program as a quality-oflife benefit: great neighborhoods, good shopping, excellent restaurants—and stable, affordable energy rates!

Massachusetts: A Model of Long-Term Success? In this case, YES.

While we do not often look to our neighbors to the south for examples of what we should do, Massachusetts has over 150 active aggregations, and the majority opt for longerterm contracts between 1 and 3 years. The results speak for themselves.

A 2023 survey by UMass Amherst1 found that 79%

1 https://www.umass.edu/news/article/new-umass-amherst-study-finds-community-choice-energy-aggregation-programs-have

of Massachusetts CCAs achieved savings versus utility default service. While savings were the top priority, 60% of respondents cited price stability as a key motivation for launching their programs.

This is a stark contrast to New Hampshire, where only a small fraction of CCAs have gone beyond six-month terms. Is it any surprise then the NH’s savings track record is also in stark contrast to Massachusetts? If price stability is a core goal, then longer durations should be part of the strategy, and the savings will likely follow.

Why Now Is a Good Time to ‘Go Long’

Looking at the current futures market, the case for longerterm contracts is compelling:

• Electricity futures for 2026 have dropped from 6.8 cents to 6.4 cents per kWh.2

• 2027 and 2028 futures are even lower, at 5.3 and 4.9 cents, respectively.3

• Natural gas futures, which heavily influence electricity prices, have declined from $4.47 to $3.85 per dth.4

• Storage levels are healthy, sitting between the five-year average and maximum.5

• ISO New England predicts annual electricity consumption will increase by 11% over the next decade, if we do not keep up with generation this burden will manifest in higher prices.6

This suggests a favorable buying environment. Locking in now could protect communities from future spikes driven by geopolitical tensions, weather events, or supply constraints.

Longer-term contracts do not mean towns lose flexibility. The beauty of CCA is that it allows for strategic migration between the default offer and the aggregation. What manufacturer would not love to have the option to come and go from a long-term energy contract without penalty? If the market shifts, rate payers can adjust. But having a stable base rate gives them leverage—and options.

In short, CCAs should be used not just for savings, but for budget certainty. That is the real value. And it is especially important for vulnerable populations who cannot afford surprises in their utility bills.

New Hampshire’s CCA movement is still in the early stage. There’s room to learn, adapt, and improve. One of the most impactful changes towns can make is to rethink contract duration. Longer terms can deliver the dual benefits of savings and stability, helping communities' weather the ups and downs of an unpredictable energy market.

Whether you are a town just launching your CCA or one looking to renew, consider the long game. Your residents will thank you.

2 https://felpower.com/new-england-spot-market-futures-electricity-and-natural-gas-price-summary/

3 https://felpower.com/new-england-spot-market-futures-electricity-and-natural-gas-price-summary/

4 https://felpower.com/new-england-spot-market-futures-electricity-and-natural-gas-price-summary/

5 https://felpower.com/new-england-spot-market-futures-electricity-and-natural-gas-price-summary/

6 https://www.utilitydive.com/news/iso-new-england-prepares-11-percent-rise-annual-electricity-consumption/747422/

The State of Local Land Use Regulations in New Hampshire – 2024 Update

Alvina Snegach, Assistant Planner and Noah Hodgetts, Principal Planner

NH Department of Business and Economic Affairs (BEA), Office of Planning and Development

August

2025

2024 Summary

This article highlights the results of the 2024 Municipal Land Use Regulation Survey. In 2024, out of 227 jurisdictions that have zoning, 170 adopted zoning amendments (75 percent), the vast majority of which were adopted by ballot at Town Meeting.

Many of these zoning amendments affect the regulation of new housing construction. With funding from the InvestNH Housing Opportunity Planning (HOP) grant program, a record number of communities adopted innovative planning and zoning approaches to increase housing opportunities, while others tightened their housing regulations.

While the survey does not measure intent, housing-related zoning amendments appear to be driven by three factors:

• the state’s growing housing shortage

• state statute changes adopted by the legislature in 20212023

• pending legislation affecting the regulation of new housing construction

Of particular note, in 2024, 15 communities amended their Accessory Dwelling Unit (ADU) ordinances to allow detached ADUs. A total of 129 municipalities now allow detached ADUs, or a little over half of all jurisdictions. A new question on the survey discovered seven municipalities that allow detached ADUs also allow a second ADU on a lot. Two communities added a definition for workforce housing or adopted a workforce housing ordinance; 15 communities added a definition for short-term rentals or adopted short-term rental regulations; and one community adopted RSA 79-E, which provides property tax relief to encourage investment in rehabilitation of underutilized buildings in downtowns and town centers.

Errol became the latest municipality to adopt zoning in 2024, increasing the total number of jurisdictions with zoning authority in New Hampshire to 227. This includes 216 municipalities, nine village districts, the Coos County Planning Board, which has zoning authority over 23 unincorporated places in the North Country, and the Pease Development Authority, which has zoning authority over the

Pease International Tradeport in Newington and Portsmouth. Accessory Dwelling Units

Since RSA 674:71-73 took effect in 2017, 211 jurisdictions have adopted a provision in their zoning ordinance regulating ADUs. The statute requires communities that have adopted a zoning ordinance to allow ADUs in all zoning districts that permit single-family dwellings by right, by conditional use permit or special exception. If a zoning ordinance does not have provisions pertaining to ADUs, then one ADU is permitted by right to any lot with a single-family dwelling that conforms to the municipal zoning.

Of the 211 jurisdictions with an ADU ordinance, 179 require the principal dwelling unit or the ADU to be owneroccupied. About half of the jurisdictions that regulate ADUs permit them by right, while the balance requires a discretionary approval via a conditional use permit or special exception.

Municipalities adding flexibility to their ADU ordinances in 2024 include:

• Voting to allow detached ADUs: Bethlehem, Boscawen, Bow, Colebrook, East Kingston, Franconia, Gilsum, Greenland, Hillsborough, Lancaster, Lyndeborough, Northwood, Roxbury, South Hampton, and Sunapee.

• Allowing ADUs by right: Chester, Conway, Canterbury, Goffstown, Holderness, Laconia, and Plymouth (previously required a conditional use permit or special exception)

• Allowing two ADUs: Conway, Dover, Enfield, Greenfield, New Ipswich, Sugar Hill, and Wilmot

• Increasing maximum allowed square footage of an ADU, or expanded permitted locations: Francestown, Hancock, Laconia, Lebanon, Lyndeborough, Rindge, Swanzey, and Wilton

• Fitzwilliam changed from allowing detached ADUs by special exception to allowing them by conditional use permit, while Harrisville did the opposite.

Workforce Housing and Age-Restricted Housing

Among New Hampshire’s 234 municipalities, 85 have a workforce housing ordinance and 32 have a workforce housing multi-family overlay district.

In 2024, Gilford and Hampton adopted a Workforce Housing Ordinance, while Chester adopted a Fair Market Rental/Workforce Ordinance.

The majority of the communities adopting workforce housing ordinances are in southern New Hampshire, the Seacoast, the Mount Washington Valley, and the Upper Valley, where housing-cost pressures are greatest. Rural communities, facing a growing workforce and housing shortage, have also considered adoption of workforce housing ordinances.

There are 52 communities that have an inclusionary zoning clause in their workforce housing ordinance, which provides a density bonus or other incentive in exchange for a property owner renting or selling a percentage of units (usually between 10 - 20 percent) below market rate. Some communities also expanded their workforce housing ordinances and overlay districts to increase workforce housing opportunities.

Another 79 communities have age-restricted housing regulations, some of which offer incentives to developers providing housing for persons over the ages of 55 or 62. Following a statute change that took effect July 1, 2024, which requires any incentives for age-restricted housing also be applicable to workforce housing, some communities have adopted amendments to either expand or limit these regulations.

Lowering Regulatory Barriers to Housing Development

Several communities adopted zoning changes intended to lower regulatory barriers to developing housing and allow a diverse range of housing types including:

• Bethlehem now allows the conversion of existing singlefamily residences and structures used for non-residential purposes to multi-family housing in several districts. It also allows residential above first floor commercial in the Commercial District I.

• Boscawen adopted a Planned Unit Development (PUD) ordinance and redefined its Mill Redevelopment Zoning District to allow more diverse housing types and increase allowed densities.

• Claremont added Cottage Developments as an allowed use by Conditional Use Permit (CUP) to several districts and added conversion of existing single-family residences to duplexes or multi-family housing by CUP.

• Exeter expanded the Mixed-Use Neighborhood District (MUND) outside of downtown to include the C2 Highway Commercial district and provided incentives including a density bonus to create a mix of housing units (including 10% affordable units).

• Farmington increased the maximum density for duplexes

and multi-family housing and added density bonuses for properties connected to water and sewer. It now allows duplexes, in addition to single family homes, on a rear lot that has been subdivided out of a parcel otherwise lacking sufficient frontage to be subdivided, in all residential districts except the Agricultural Residential District.

• Hinsdale reduced the minimum lot size from 2 acres to 1 acre in the Rural Agricultural District and now allow residential uses in the Commercial Industrial District.

• Jaffrey now allows multi-family housing in the General Business and General Business A District where water and sewer is available and added a density bonus for workforce housing and senior housing. Jaffrey allows developers of workforce or senior housing to exceed the 8 units per building limit if it makes the project economically viable.

• Keene adopted a Cottage Court Overlay District, which allows for innovative site design and clustering of smaller residential units at a higher density within the tract than would be allowed by the underlying zoning district by CUP.

• Newbury removed its minimum square footage requirement for single-family homes.

• Portsmouth created the Gateway Neighborhood Overlay District for the purpose of creating additional housing opportunities in certain neighborhoods. It will also allow for higher density housing.

• Sandwich allowed duplexes in all residential districts.

• Waterville Valley added a PUD ordinance by CUP to allow more one- and two-bedroom homes up to 1,200 sq. ft. than are allowed in a conventional subdivision. Waterville Valley also decreased setbacks in the Village District.

• Wilton created a Downtown Residential Overlay District that lowers the minimum lot size in the downtown area served by sewer and water from a half-acre to one-third of an acre. Existing dwellings within the overlay district may be converted to duplexes or multi-family dwellings.

A review of zoning amendment ballot results shows that other communities adopted zoning amendments more restrictive for housing development, or failed to pass housingfriendly zoning changes:

• Bedford set a minimum lot size of 1.5 acres for detached ADUs.

• Peterborough rejected the rezoning of the Family District to General Residential, removal of owner-occupancy and parking requirements for ADUs, and removal of parking minimums.

• Housing-friendly zoning changes failed in New London, Sutton, and Sullivan

Mixed-Use Zoning

While separation of residential and commercial uses remains the dominant zoning trend throughout the state, 149 communities have at least one mixed-use zoning district, usually in their downtown or village center. These allow for residential, commercial, and retail uses to be located either near each other or within the same structure.

• Bethlehem now allows dwelling units above first-floor businesses in the Commercial I District and added a definition of mixed use.

• Boscawen amended the Mill Redevelopment District to allow a mix of uses including housing.

• Bow updated its Bow Mills Mixed Used District ordinance to give the Planning Board additional flexibility to consider innovative developments in the district and allow buildings up to 4-stories including multi-unit residential.

• Campton now allows mixed uses in the Commercial Zoning District.

• Canterbury voted to allow limited residential uses in the Commercial District.

• Sanbornton amended the requirements in the Commercial Zoning District, increasing the number of permitted uses and allowing for mixed-use development.

Cluster Developments

Currently, 180 jurisdictions allow cluster developments, also called open space or conservations subdivisions, an innovative land use control authorized under RSA 674:21,I(f), where homes are spaced closer than in a traditional subdivision in exchange for permanently protecting a percentage of open space. Many of these communities provide a density bonus for developments that conserve more than the minimum required amount of open space. In 2024, several communities updated their cluster development ordinances:

• Bethlehem and Colebrook added a density bonus for cluster developments to encourage construction of homes less than 1,200 square feet.

• Boscawen added density bonuses for cluster developments and now requires a mandatory Homeowners Association with private roads to encourage flexibility with road standards for developers.

• Canterbury adopted a new cluster neighborhood ordinance to allow farmhouse style developments which complement the existing neighborhood character at higher densities than would otherwise be allowed.

Short-Term Rentals

With the popularity of short-term rentals in the state’s tourism regions, including the Mount Washington Valley, the Lakes Region, and the Seacoast, 15 communities added definitions for short-term rentals or adopted short-term rental regulations, increasing the number of communities that regulate short-term rentals to 64 in 2024. A new trend is that seven of the 15 communities adopting short-term rental regulations are located outside of tourism regions in response to an increasing number of year-round housing units converted to short-term rentals.

The 15 communities that adopted short-term rental regulations in 2024 are: Allenstown, Bethlehem, Brookline, Carroll, Colebrook, Fitzwilliam, Hampton Falls, Jefferson, Lancaster, Lyndeborough, Marlow, New Castle, Ossipee, Springfield and Sugar Hill.

Several other communities made changes to their existing short-term rental regulations:

• Barnstead adopted Short-Term Rental Regulations in addition to its Short-Term Rental definition in its zoning ordinance.

• Canterbury and Easton amended their existing ShortTerm Rental Regulations.

• Jackson voted to limit the use of an Accessory Apartment (also known as an Accessory Dwelling Unit) as a ShortTerm Rental.

• New Castle added Short-Term Rentals to a list of prohibited uses in the R-1 and Mixed-Use Districts.

• Sunapee amended its Short-Term Rental Ordinance to confirm that accessory structures are allowed to be used as short-term rentals and to limit the amount of time a short-term rental with an owner not in residence may be operated to 120 days during a 12-month period.

79-E Community Revitalization Tax Relief Incentive

The Community Revitalization Tax Relief Incentive Program (79-E), which encourages rehabilitation of underutilized buildings in downtowns, town, and village centers through the provision of local property tax relief, is an increasingly popular economic development tool used by municipalities. To date, 68 communities have adopted 79-E.

Conway became the first community in the state to adopt a 79-E Housing Opportunity Zone in 2024 and now offers property tax relief for the construction of new affordable housing to be taxed at the predevelopment assessed value for a maximum of 10 years, or a maximum of 14 years for projects involving the preservation of historic structures.

Impact Fees and Growth Management Ordinances

There are 83 communities in New Hampshire that levy impact fees for schools, fire and police, and/or other municipal infrastructure; 22 communities have growth management ordinances limiting the number of permits that can be issued annually for new housing to a percentage of the municipality’s existing number of housing units.

In 2024, Barnstead extended its Growth Management Ordinance sunset date by five years to April 2029.

Solar Energy Ordinances

In 2024, eight communities adopted definitions for solar arrays or a solar ordinance, bringing the number of communities with solar energy regulations to 81. Some communities regulate solar arrays in their zoning ordinance, while others regulate them in their site plan review regulations. As the size and complexity of solar arrays has grown in recent years, communities have adopted increasingly comprehensive solar ordinances which address everything from lot coverage and buffers to decommissioning.

Conclusion

Rounding out the 2024 survey:

• A total of 163 jurisdictions have performance-based standards, a flexible alternative to traditional use-based zoning, which typically regulates site standards and intensity of use.

• Eight communities have a form-based code for some or all their community, which regulates the character and physical form of an area rather than specific uses.

• Aside from use-based zoning, the most prevalent planning and development technique used by communities is the regulation of signs; 217 out of 227 zoning jurisdictions have some form of sign ordinance regulating type, size, lighting, and content.

• Since 2020, 85 communities have adopted master plan updates, including 18 that updated at least one chapter of their Master Plan in 2024, with an increasing number adopting master plan chapters deviating from the master plan chapters detailed in RSA 674:2. Emerging master plan topics include broadband, community health, arts, resiliency, and age-friendliness.

The results of the 2024 Municipal Land Use Regulation Survey including an interactive map are available at https:// www.nheconomy.com/office-of-planning-and-development/ what-we-do/municipal-and-regional-planning-assistance/ municipal-land-use-regulation-annual-survey

For additional information or questions e-mail planning@ livefree.nh.gov.

The HR REPORT

You Can't Ignore What You Already Know

Attorney Mark T. Broth

In a recent decision, the New Hampshire federal district court reaffirmed that once an employer has actual notice of an employee’s disability, it must afford that employee the rights and protections of the Americans with Disabilities Act (ADA). The court made clear that an employer is on notice when a supervisory employee has knowledge of the disability, even if that supervisor gained knowledge of the employee’s disability prior to being promoted to a supervisory position.

This case arose in the context of a fire department but could just as easily have occurred in any municipal department. Two co-workers developed a workplace friendship. One of the co-workers disclosed to the other that he had been diagnosed with PTSD. Like other emotional health issues, PTSD can qualify as a disability under the ADA. The employee explained the symptoms of PTSD to his co-worker and described the type of situations that could trigger those symptoms, specifically unexpected criticism of his work performance or perceived threats to his job security. The employee shared that a key to avoiding PTSD reactions was effective communication with supervisors and that difficulties in communications with the then Fire Chief was problematic. The employee further explained that he was allowed time to attend therapy sessions.

The employee with the PTSD diagnosis moved on to another fire department. After his former coworker was promoted to Fire Chief, the employee returned to his original department to work under the new chief. The new Fire Chief developed concerns about several aspects of the employee’s performance, including his driving skills, workplace communications, and unexcused absences from meetings. One or more meetings were held to discuss these performance concerns. Ultimately, the Fire Chief prepared a performance improvement plan

(PIP), which he presented to the employee without prior notice. The Fire Chief proceeded to read the PIP aloud, ignoring the employee’s request that he be given time to read the PIP himself. The employee, visibly upset, excused himself from the meeting. This resulted in a disciplinary suspension and referral for a fitness for duty examination.

The court noted that the Fire Chief was aware of the employee’s PTSD diagnosis from the time that he and the employee were co-workers. That actual knowledge of a disabling condition did not disappear when he was promoted to Chief. Despite the Chief’s actual knowledge, it appears that there was no discussion of whether the disability could be contributing to the performance concerns. Further, despite actual knowledge of the type of conduct that could trigger a PTSD episode, the Chief presented the PIP in a manner that was likely to cause an adverse reaction.

Supervisors should be reminded that if they are aware that an employee may have a disability, even if such knowledge was obtained before they became a supervisor, they should seek guidance to assure that the employer is complying with the ADA. In this case, the employer might have sought information from the employee’s health provider regarding possible job accommodations and avoided those behaviors that were likely to trigger a PTSD reaction. This does not mean that an employer must accept substandard performance of essential job functions but it must explore reasonable accommodations that might help the employee to succeed.

Drummond

•

• Land use planning, zoning and enforcement

• Ordinance drafting

• Tax abatement

• General municipal matters

• Municipal employment and labor matters

• Litigation and appeals We work hard to offer clients the counsel and support they need, precisely when they need it.

This is not a legal document nor is it intended to serve as legal advice or a legal opinion. Drummond Woodsum & MacMahon, P.A. makes no representations that this is a complete or final description or procedure that would ensure legal compliance and does not intend that the reader should rely on it as such.

Our Financial Policies Series has officially wrapped up for this year. Thank you to everyone who joined us! We invite you to participate again next year for another round of timely, practical guidance on municipal financial management.

Our Financial Policies Series has officially wrapped up for this year. Thank you to everyone who joined us! We invite you to participate again next year for another round of timely, practical guidance on municipal financial management.

New surcharge on solid waste in New Hampshire to take effect in January

William Skipworth, NH Bulletin

Originally published in the NH Bulletin. Reprinted with permission.

Starting Jan. 1, New Hampshire will place a $3.50 per ton surcharge on all solid waste taken at any of the state’s six active landfills or its waste-to-energy facility.

The surcharge was included in the state budget signed into law in June. The state plans to use the revenue to fund salaries for waste management officials at the Department of Environmental Services and to support grant projects focused on improving waste disposal infrastructure across the state. This type of surcharge is common in other states, including neighboring Vermont and Massachusetts.

The fee will be paid by municipalities, businesses, and other institutions, but New Hampshire towns and cities will receive a 100% quarterly rebate.

Roughly 1.9 million tons of trash were disposed of in New Hampshire in 2022, according to the most recent data available from the New Hampshire Department of Environmental Services. At $3.50 per ton, 1.9 million tons would’ve generated roughly $6.7 million had the surcharge been in effect at the time, though some of that would’ve been rebated to towns and cities.

Of the 1.9 million tons in 2022, roughly 1.1 million tons — about 58% — came from municipalities, though it’s unclear from the data how many of those municipalities were in New Hampshire and how many were out-of-state. But almost half of the total (both municipal and nonmunicipal) — or roughly 820,000 tons — came from outof-state sources, mostly nearby states with more restrictive waste regulations. The large amount of out-of-state trash being dumped in New Hampshire has been a focus of those advocating for changes in the state’s landfill system.

Reagan Bissonnette, an expert on solid waste issues, said that’s why the rebate applies only to in-state municipalities.

“If the state simply wanted to stop waste from coming into the state from out of state, they wouldn’t be able to simply say ‘no trash can come here from Vermont or Maine or Massachusetts,’” she said. “That would actually violate the Commerce Clause of the Constitution. So this disposal fee is designed in such a way that the burden will primarily be on anyone from out of state who’s disposing waste in New Hampshire, and any business sources or institutions that are disposing of waste in New Hampshire. So municipalities are really the ones most benefiting here.”

Solid Waste Disposal Surcharge

Source: https://www.des.nh.gov/waste/solid-waste/ disposal-surcharge

The recently passed 2026-2027 state budget requires that, starting January 1, 2026, customers who dispose of solid waste at a permitted New Hampshire solid waste landfill, waste-to-energy-facility or incinerator pay a disposal surcharge of $3.50 per ton of solid waste. These disposal facilities will be responsible for collecting the surcharge from customers and submitting the surcharge to NHDES, along with information detailing the types and amounts of solid waste they receive for disposal, on a quarterly basis.

The law does not exempt municipalities or solid waste districts from paying the disposal surcharge.

As customers, municipalities will be able to request quarterly reimbursement of these surcharge payments after submitting invoices and proof of payment.

These state budget provisions will be integrated into RSA 149-R, the Solid Waste Management Fund statute, and NHDES is currently drafting rules to implement the program. To view the new law, go to page 63 in the PDF version online.

For any questions, please contact Leah McKenna at leah.l.mckenna@des.nh.gov.

In the coming months, this webpage will include resources for both disposal facilities and municipalities. Please check back often for updates.

Disposal facilities

Materials used as cover at landfills are not subject to the disposal surcharge.

Check back for more information specific to disposal facilities.

Municipalities

Wastewater sludge is subject to the disposal surcharge. Check back for more information specific to municipalities.

Bissonnette is a member of the state’s Solid Waste Working Group, which was created by the state Legislature to advise DES, and is the executive director of NH Recycles, a nonprofit created by New Hampshire municipalities that helps communities develop and improve recycling systems. She sees the fee as a positive.