INNOVATING WITH INTENT

An insight into the news and trends shaping the region with perceptive commentary and analysis

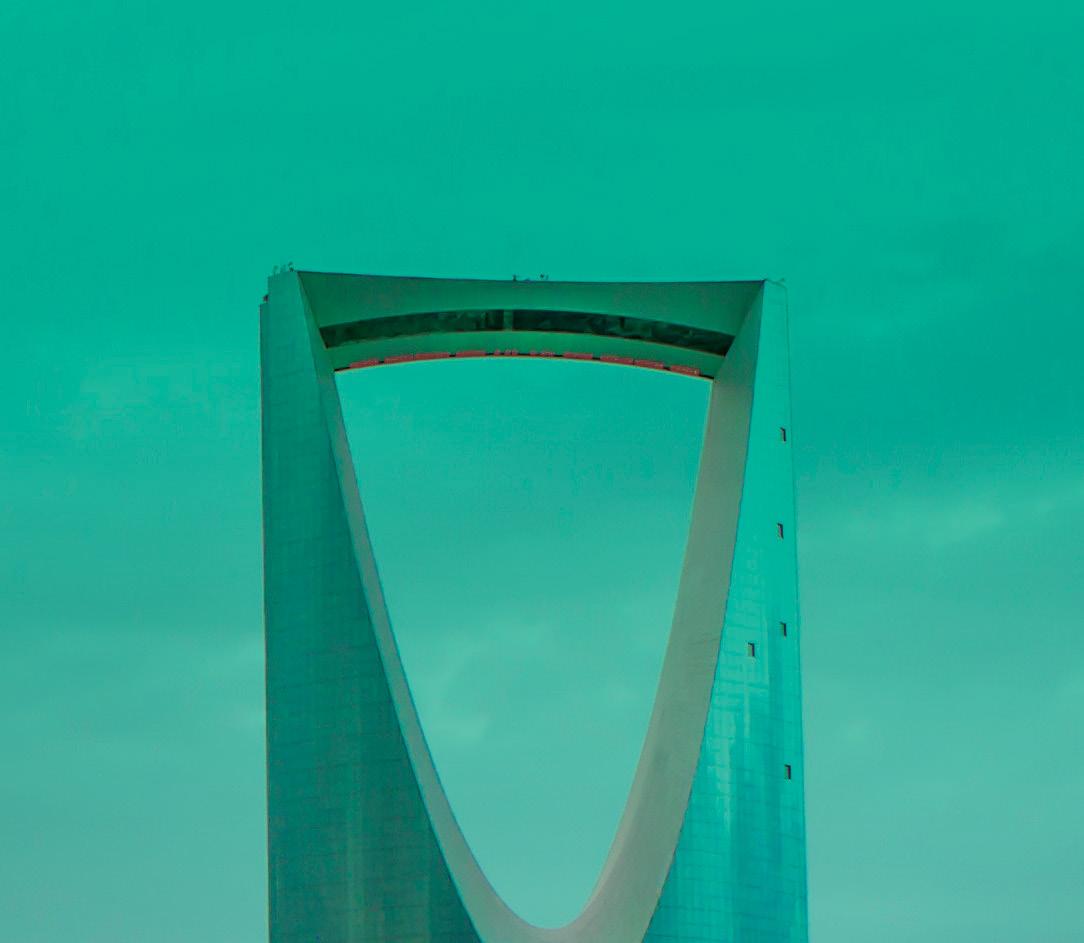

Mastercard EEMEA president Dimitrios Dosis shares how the company is leveraging technology, diversification and strategic partnerships to serve communities across the region Pic courtesy:

Rapid rebound: We showcase the developments and trends boosting the tremendous recovery of the regional and global tourism sector in recent months

Editor-in-chief Obaid Humaid Al Tayer

Managing partner and group editor Ian Fairservice

Chief commercial officer Anthony Milne anthony@motivate.ae

Editor Neesha Salian neesha.salian@motivate.ae

Tech editor Divsha Bhat divsha.bhat@motivate.ae

Senior feature writer Kudakwashe Muzoriwa

Kudakwashe.Muzoriwa@motivate.ae

Senior art director Olga Petroff olga.petroff@motivate.ae

Senior art director Freddie N. Colinares freddie@motivate.ae

Cover: Freddie N Colinares

Interviews with entrepreneurs and insights from experts on how the regional SME ecosystem is evolving

General manager – production S Sunil Kumar

Production manager Binu Purandaran

Production supervisor Venita Pinto

Digital sales director Gurjeet Kaur Gurjeet.Kaur@motivate.ae

Group sales manager Mansi Khatwani Mansi.Khatwani@motivate.ae

Senior sales manager Sangeetha J S

Sangeetha.js@motivate.ae

Group marketing manager Joelle AlBeaino joelle.albeaino@motivate.ae

“We are a country founded on ambition. We are a country that has not stopped since December 2, 1971. It will not stop. It will not turn around. It will not set small goals for itself.”

SheikhMohammed bin Rashid Al Maktoum, Vice

Presidentand Prime Minister of the UAE and Ruler of Dubai Why conservation is key? Rob Yordi of SeaWorld Research & Rescue explains p.60 Luxury central: How Harrods continues to deliver a deluxe shopping experience p.64 Beauty and the beast: The new McLaren Artura unleashed p.66

Cuétara’s family business is Switzerland-based snack company Cuétara Foods, which makes 25 brands of cookies, biscuits and crackers sold all over the world. For Cuétara, who was CEO for the Americas at the time, that moment was a turning point. “I was like, ‘I want to blame everybody else for this,” he says. “But I’m not an innocent party here. I’m part of the problem.’”

Most bags for potato chips and other crispy snacks are made with three layers of polymer materials: a moisture barrier on the inside, low-density polyethylene in the middle and an outer layer of thermoplastic resin. From an environmental standpoint, polymers – like all plastics – have two marks against them: They’re made from petroleum, and they’ll never decompose.

Today, according to the UN Environment Programme, humans produce about 400 million tonnes of plastic waste every year. Half of that is single-use plastic, like potato chip bags, that ends up in landfills or in waterways, where it breaks down into microplastics that are consumed by aquatic life, and eventually by people. At the behest of consumers and under the shadow of potential regulation, snack companies are now looking for a way to break that cycle with alternative packaging materials.

Cuétara swam into his cookie bag in 2015, setting off a four-year quest to find a different packaging material that didn’t rely on fossil fuels. In 2019, Cuétara and Dr Russ Petrie, an orthopedic surgeon in California, founded Okeanos, which uses calcium carbonate to create bags for snacks, rice, coffee and salt, as well as wraps for flowers.

Florencio Cuétara is the kind of person who crosses the street to tell people to pick up their litter. One day, Cuétara, an avid diver, was swimming in the Mediterranean when he came across a plastic cookie bag. “This bag hits me in the face as I’m swimming. And I’m cursing whoever put it in there, as if it’s somebody else’s fault,” Cuétara says. “Then I realised that the bag was one of my bags – with my last name on it.”

Calcium carbonate, a mineral naturally found in stone or rocks, has been used as a filler in packaging before, but only in small percentages. Cuétara and Petrie developed a technology they called “Made from Stone” that is up to 70 per cent calcium

carbonate; the rest is made of resin. The company’s bags are both flexible and light – they float on water – and the technology is now used by manufacturers in 15 countries including Brazil, India, Canada, the Philippines and the US.

For Sean Mason and Mark Green, co-founders of British crisps company Two Farmers, it took five years to find a packaging material that would both biodegrade and keep their chips crunchy. When it came to identifying an alternative material, though, Mason and Green were stumped. First, they considered cardboard boxes. “We suddenly realised that we would still have to put a plastic bag inside to keep it fresh,” Mason says. “So we were effectively just overpackaging; packaging for packaging’s sake.” Next they looked at tins. “Too expensive and probably too much waste for a small 40-gramme packet.” Finally, they came across eucalyptus cellulose films in their raw state, and started talking to the producers about their potential for crisps bags. The duo found a laminator, which helped them figure out how to add plant-based glues and inks for printing. After producing the film, they sent it off to TŪV Austria – a third-party certifier that verifies whether packaging is compostable – to have it tested for compostability and eco-toxicity. Following some trial and error, their material passed muster, and in 2019 Two Farmers officially launched its gourmet potato chips in 100 per cent compostable packaging made from eucalyptus cellulose. Mason says his company’s bags take 30 to 36 weeks to decompose in home composting systems, or 11 weeks in an industrial composter.

In the world of US potato chips, for example, FritoLay, a division of PepsiCo began its own foray into alternative packaging over a decade ago, with the 2009 debut of a 100 per cent compostable bag for SunChips. The company has a goal of making all its packaging 100 per cent recyclable, compostable, biodegradable or re-usable by 2025. In 2021, it debuted

IN THE EU, ALMOST 38 PER CENT OF PLASTIC WAS RECYCLED IN 2020

a bag made of 85 per cent polylactic acid – typically composed of corn starch – for two of its Off the Eaten Path veggie chips.

The Off the Eaten Path bag is industrially compostable, which means it can be put into city compost systems. The bags can also be sent back via a free shipping label to New Jersey-based TerraCycle, which partners with Frito-Lay on the venture.

Companies that aren’t moving towards plastic-free packaging yet may be forced to in the future, as regulators start to step in. Last year, the European Union (EU) proposed new rules that would require companies selling products in EU countries to make their packaging easier to reuse, recycle or compost. The rules would also limit unnecessary empty space in packaging, part of an overall goal to to reduce packaging waste by 5 per cent by 2030, compared to 2018 levels. If effective, the EU could set a standard for other nations to follow. But the hurdles remain enormous, and snack bags are just one piece of a much bigger problem. Most developing countries don’t have recycling or composting facilities, and in the nations that do, those systems are often broken or dysfunctional. The Environmental Protection Agency estimates a US plastic recycling rate of just below 9 per cent, while Beyond Plastics, a project out of Bennington College, pegs it at an even bleaker 5 per cent to 6 per cent.

In the EU, almost 38 per cent of plastic was recycled in 2020, and regulations imposed in 2021 halted the sale of the 10 most common plastics to wash up on European beaches, including bottle caps and straws. But addressing plastic packaging writ large will require changes at every part of its life cycle: from raw materials to duration of use to the nature of disposal. Those hurdles are part of why Cuétara says Made from Stone bags are catching on: Packaging manufacturers can keep using their existing equipment, and calcium carbonate is naturally abundant with relatively stable pricing.

“THIS BAG HITS ME IN THE FACE AS I’M SWIMMING. AND I’M CURSING WHOEVER PUT IT IN THERE, AS IF IT’S SOMEBODY ELSE’S FAULT,” CUÉTARA SAYS. “THEN I REALISED THAT THE BAG WAS ONE OF MY BAGS – WITH MY LAST NAME ON IT”

TODAY, ACCORDING TO THE UN ENVIRONMENT PROGRAMME, HUMANS PRODUCE ABOUT 400 MILLION TONNES OF PLASTIC WASTE EVERY YEAR . HALF OF THAT IS SINGLE-USE PLASTIC, LIKE POTATO CHIP BAGS, WHICH ENDS UP IN LANDFILLS OR IN WATERWAYS

Global awareness of the dangers posed by climate change has probably never been greater than today. The impact from a heating planet is being felt around the world. According to a report by NGO Christian Aid, the top ten most impactful extreme weather events in 2022 cost more than $168bn in damages combined.

Against this backdrop, political willingness to implement policies that reduce greenhouse gas emissions, and thereby limit global warming is growing. But even as companies around the world are setting targets to reduce their carbon footprint and align themselves to climate targets, the path to net zero is not without risk. Indeed, few companies are looking closely at how the mounting pressures to decarbonise are leading to costs and reputational risks for companies in sectors where emissions are hard to abate.

Within the financial community, this is referred to as transition risk. At the same time, the growing impact from extreme weather events will gradually lead to higher economic costs, reinforcing the need to invest in climate adaptation strategies. Although “loss and damage” financing was part of the official COP27 agenda for the first time, most companies do not yet consider how these so-called physical risks will affect them.

For UAE-based companies in our dataset, climate physical risks are projected to increase, on average, only mildly over the course of the century.

Edo Schets, head of climate for Core Product Sustainable Finance Solutions, Bloomberg LP

In 2030, UAE-based companies will face a 58 per cent chance of being affected by climate physical risks. Individual companies could face much higher risks, however, depending on their geographical footprint throughout the world.

For some UAE based companies, the chance of being affected by climate physical risks in 2030 is as high as 80 per cent. Savvy investors will want to be hedged against both transition risk and physical risk, while maintaining good investment returns. To do this well, investors need to address three fundamental challenges.

The first challenge is to understand how companies are exposed to climate risk. To determine a company’s exposure to climate-related risks investors need non-financial data, unlike for traditional types of financial risk. For transition risk, for example, key factors to take into account include a company’s carbon footprint and its transition plans. Such data is not traditionally reported by companies, and to help investors plug that gap vendors have developed models to estimate emissions, and solutions to understand whether companies are on track to achieve net zero targets.

Another challenge to consider is how to derive the potential impact from climate risk. As climate change is unprecedented, forward-looking data and models are needed to capture the future financial impacts from climate risk and give plausible predictions of how climate policies, energy technologies and the physical environment could evolve.

Finally, there is the question of how to incorporate climate risk assessments into investment decisions. Given that climate risk assessments rely on non-traditional datasets and models, questions arise around how to use the insights from such assessments in actual investment decisions. For example, how should longer term climate risks be factored into shorter term investment strategies? How should different future scenarios be weighted so as to allow for probabilistic impact metrics, such as a climate value-at-risk?

In light of these challenges, the task of incorporating climate financial risk in investment decisions can feel overwhelming. This is where climate risk data and tools need to be integrated into investment decision-making processes. To make strategic climate-informed decisions, it is crucial to understand how company performance could be impacted across a range of scenarios.

However, thanks to increasingly reliable data and insightful analytics, climate risk management is set to become business as usual.

To determine a company’s exposure to climate-related risks investors need non-financial data, unlike for traditional types of financial risk

To achieve the goal of the Paris Agreement of limiting global warming to an increase in temperature of 1.5°C above pre-industrial levels, the substitution of fossil fuels with renewable energy is beyond crucial. However, renewable electricity alone will not be su cient to meet the energy needs of hard-to-electrify industries such as steel, cement, aviation, and shipping. And this is where low-carbon hydrogen and its derivatives such as ammonia, methanol, and kerosene (so-called power-to-X) will play a critical role. Together, these fuels must provide 10 to 12 per cent of global energy consumption if we are to reach net zero by 2050.

Hydrogen is a relatively well-established industry today, with more than 90 million tonnes produced almost exclusively from unabated fossil fuels (i.e. grey hydrogen) and consumed in a few key sectors such as ammonia and methanol production and refining.

Low-carbon hydrogen (green and blue hydrogen), is, however, a much more nascent industry. According to BCG’s analysis of the future need for low-carbon fuels, 350 million tonnes per year of low-carbon hydrogen and its derivatives will be required by 2050 to limit global warming to 2°C, rising to 540 million tonnes per year in a 1.5° scenario.

Low-carbon hydrogen will first need to replace grey hydrogen where it is currently used and then be targeted at select additional use cases (For e.g. steel, aviation, shipping and long-term storage). By 2050, the low-carbon hydrogen market could represent a value of $600bn to $1.1tn, according to BCG estimates.

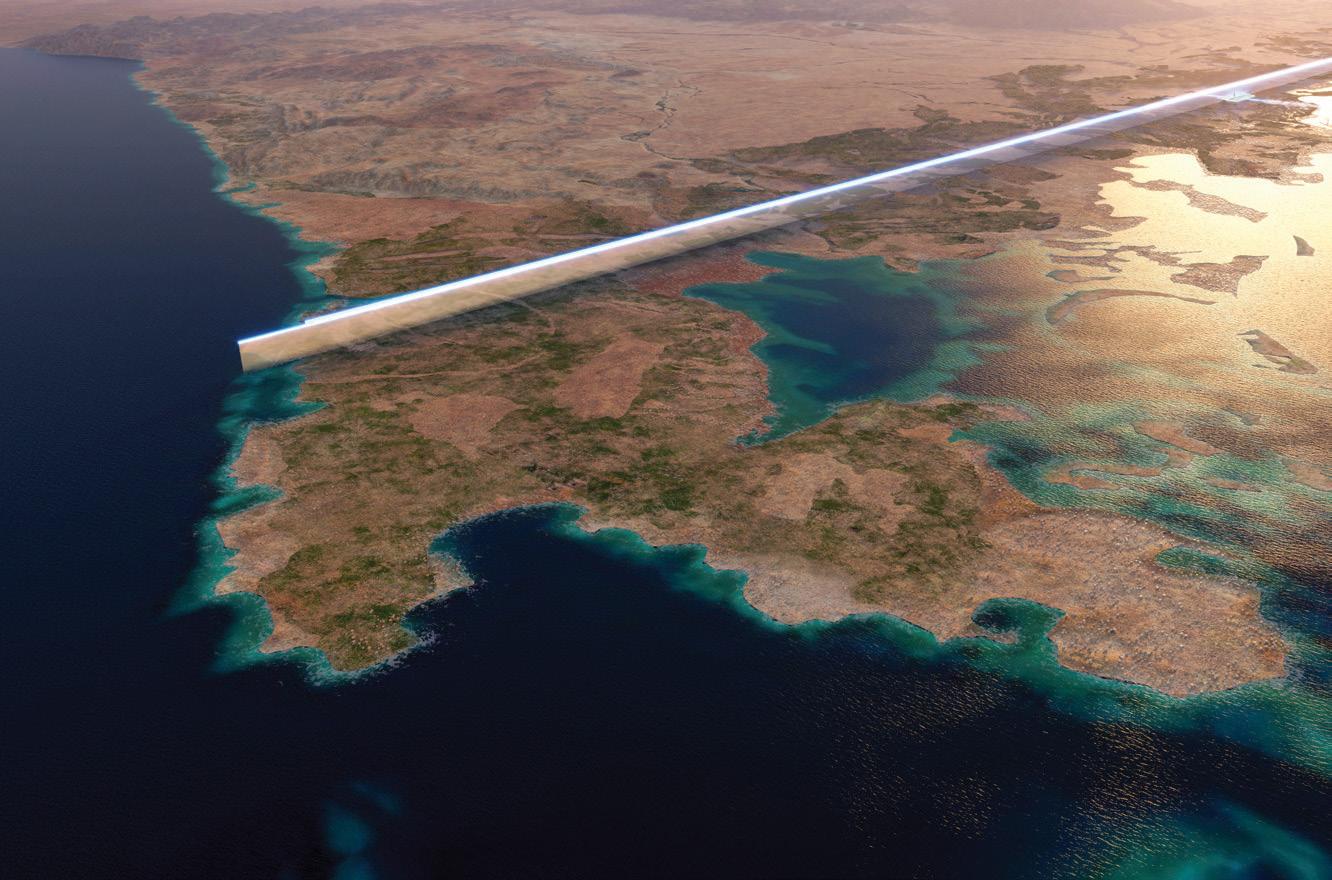

There are currently over 900 low-carbon hydrogen projects in the global pipeline of which the majority are green hydrogen projects. The Middle East, in particular, has demonstrated high ambitions to undertake large-scale developments for low-carbon hydrogen.

The UAE so far aims to produce 100 gigawatts (GW) of renewables and 1 Mpta of green hydrogen by 2030. Saudi Arabia just recently announced that it aims to become the largest global exporter of lowcarbon hydrogen and is investing $266bn in a clean energy plan. And, Oman is currently running an auction process to award large-scale green hydrogen projects to developers, intending to meet its production target of 1 Mtpa of green hydrogen by 2030.

But the Middle East is not alone in the race to capture global market share. Other countries can also produce low-carbon hydrogen competitively and at scale, in particular Chile, South Africa, Namibia, Morocco and Australia.

The recent US Inflation Reduction Act (IRA), which includes $369bn of funding for climate and energy over the next decade and builds on more than $110bn of funding from the Infrastructure Investment and Jobs Act passed in late 2021, is expected to have profound and lasting impacts across the global energy systems. The IRA, with its production tax credit of up to $3/kg of hydrogen, improves the competitiveness of US-produced hydrogen in a step-change.

Although the pipeline of low-carbon hydrogen

projects is expanding fast, only less than five per cent of projects are under construction or have reached a final investment decision.

While clear opportunities are ahead, some challenges lie in the pace of development of the hydrogen industry. Combined and coordinated action is thus required across stakeholders to de-risk projects and enable the development of the low-carbon hydrogen industry. Specifically:

Governments and regulators: They will need to translate their ambitions/strategies into supportive and stable policies and regulations (combining both incentives and mandates) and also cooperate to define certification/standards, notably for emissions intensity of hydrogen production.

Lenders and developers: Until customers make purchase commitments, including agreements to opt for premium low-carbon hydrogen, lenders and developers will need new instruments to support the development of large-scale low-carbon hydrogen projects.

Producers: They will need to engage in bringing together all the required capabilities along the value chain through partnerships as well as engage potential off-takers early on.

Technology providers: Companies must develop and deploy new technologies to reduce production costs and increase electrolyser efficiency and capacity.

Infrastructure providers: Companies will need to develop the required infrastructure to be able to transport and store hydrogen and its derivatives. Many elements of the future hydrogen infrastructure use technologies readily available but long-distance transportation will require further technology development.

To conclude, low-carbon fuels, including low-carbon hydrogen and its derivatives, will play a critical role in the decarbonisation of our economies. Their use will however need to be targeted at select use cases where renewable electricity will not be sufficient. The next decade will be crucial to the development of the low-carbon hydrogen sector.

Infrastructure investors are well aware of the high returns earned by those that invested early in new technologies, such as renewables, and are as such keen on investing in low-carbon hydrogen projects. However, the development of the hydrogen industry will require coordinated efforts from all stakeholders, including governments, developers, technology providers, and infrastructure providers.

“INFRASTRUCTURE INVESTORS ARE WELL AWARE OF THE HIGH RETURNS EARNED BY THOSE THAT INVESTED EARLY IN NEW TECHNOLOGIES, SUCH AS RENEWABLES, AND ARE AS SUCH KEEN ON INVESTING IN LOW-CARBON HYDROGEN PROJECTS”

Asset tokenisation can have a dramatic effect on the carbon market because it ensures transparency, both in terms of credit provenance and price, among other benefits

Asset tokenisation has emerged as one of the best use cases for Web3 technologies. It enables physical assets, such as bonds, real estate and gold, to be represented on-chain, taking advantage of a number of benefits offered by blockchains and smart contracts. Tokenised assets facilitate trade, enable fractionalisation, increase liquidity, reduce fraud risk and provide unprecedented transparency.

Consider the real estate market. Traditionally known as an illiquid market in which properties take significant time and money to trade, representing property deeds on-chain can bring the kind of efficiency needed to make buying and selling as quick as transferring a token. At the same time, property owners will be able to unlock the liquidity of the property by using it as collateral for non-discriminatory on-chain borrowing. And that’s not even to mention the potential of fractionalisation.

Any physical asset can benefit from tokenisation. Climate assets, such as carbon credits, are a strong candidate because they are currently seen as inaccessible and are not even considered an asset class. With no centralised solutions in sight and the environment very much in crisis, asset tokenisation may offer the kind of hope we need to change the way we think about and act towards the climate.

Carbon credits were originally conceived as a way of incentivising good climate behaviour. Companies that beat government emissions targets could earn credits and sell them for a profit. While that market – known as the compliance market – is still in operation, a voluntary market has emerged in which companies seek to voluntarily offset their carbon emissions by purchasing carbon credits generated primarily by certified reforestation and preservation projects. The

issue is that the voluntary carbon market (VCM) is known for being opaque, inefficient and exclusive. There is no industry-accepted way to price credits, for example, and brokers exert disproportionate control over the entire process. This has, in some cases, led to fraudulent activity where credits are sold twice. It’s for these reasons that carbon credits have yet to become their own asset class and remain inaccessible to most people.

Asset tokenisation can have a dramatic effect on the carbon market because it ensures transparency, both in terms of credit provenance and price, and provides the market infrastructure to facilitate the sale and immediate retirement of credits.

A more transparent, efficient and inclusive market means greater participation across the spectrum, from organisations and individuals looking to offset their emissions to projects focused on reforestation and preservation. This then becomes the foundation for mass adoption and makes the tokenised carbon credit the primary asset of the regeneration finance (or ReFi) movement.

A good example is the carbon offset option provided by some airlines. Without intimate knowledge of carbon credit methodologies, it is near impossible to determine the provenance, vintage (the year that the credit was generated) and overall quality of the offsets on offer.

Airlines selling tokenised carbon credits, on the contrary, can demonstrate complete transparency with respect to the credits. Users can then rest assured that the offsets they are buying are the result of legitimate climate initiatives.

Carbon credits may have the greatest need of tokenisation, but they are not the only climate asset that can be tokenised. Renewable energy credits from solar or hydroelectric sources, for example, provide great incentives for small-scale projects, but suffer from the same market opacity and illiquidity as carbon credits.

We are also seeing assets such as unexploited land be tokenised as non-fungible tokens (NFTs) as a way of raising capital for preservation. NFT purchasers earn easement rights for a period of time as well as the “avoidance” carbon credits produced by the land. This is a win-win-win for the landowner, purchaser and the environment.

Other candidates are the reforestation and preservation projects themselves. Traditionally seen as accessible only to institutional investors, tokenisation of their equity and/or carbon credit rights could provide a revenue-generating investment vehicle for retail investors looking to support climate initiatives.

With the support of like-minded investors and governments, we are seeing a wide range of Web3 climate solutions aimed specifically at corporations. At the top of the list are on-chain credit registries. Corporations looking to offset their carbon emissions or fund reforestation and preservation projects can purchase tokenised credits without needing to approach a broker or project directly.

On the flip side, corporations eligible to claim carbon credits can take advantage of the same registries to tokenise and sell them on the open market without the need for an intermediary. Or, in cases where capital is needed to spin up a climate impact project, corporations can turn to on-chain funding solutions such as decentralised autonomous organisations.

We know that this year will be a big one for Web3 climate impact, especially with the UAE announcing 2023 as the ‘Year of Sustainability’ and Dubai hosting COP28 in November. We strongly believe that COP28 will be the biggest and most action-oriented gathering to date, with stakeholders from across the globe coming together to focus on climate impact. This is our opportunity to progress collectively towards our net zero ambitions.

But work has to start today. On one side, we need solutions that lower the barriers to access and incentivise climate impact.

On the other, corporations need to step up and inspire the next generation of climate warriors by making demonstrable impact and supporting climate initiatives.

Climate asset tokenisation is a core component of both. It’s an indelible part of the foundation that innovative minds can leverage in our shared quest to confront the environmental crisis and start healing the planet.

“AIRLINES SELLING TOKENISED CARBON CREDITS, ON THE CONTRARY, CAN DEMONSTRATE COMPLETE TRANSPARENCY WITH RESPECT TO THE CREDITS.USERS CAN THEN REST ASSURED THAT THE OFFSETS THEY ARE BUYING ARE THE RESULT OF LEGITIMATE CLIMATE INITIATIVES”

THIS YEAR WILL BE A BIG ONE FOR WEB3 CLIMATE IMPACT, ESPECIALLY WITH THE UAE ANNOUNCING 2023 AS THE ‘YEAR OF SUSTAINABILITY’ AND DUBAI HOSTING COP28 IN NOVEMBER

Aholistic approach to workplace design balances smart and sustainable features with employee wellness and productivity. Technological advancements, an everchanging work culture, and a focus on employee well-being are all instrumental in designing offices for the future.

Workplace design is now geared towards spaces that are adaptable, flexible, respectful of nature, and incorporate cutting-edge technology and sustainable practices. With 2023 being declared as the Year of Sustainability in the UAE, the Emirates’ property and real estate sector is committed to working towards earth-friendly targets in the future. The pandemic saw the rapid implementation of innovation across

multiple levels – flexible working and a heavier reliance on technology, for example. Subsequent office design is implementing some of the comforts more usually associated with a home office; for instance, for a more inviting atmosphere.

The prospect of flexible working is being carried on, such as compressed work weeks and tech that reduces in-person meetings across significant distances – all in all contributing towards sustainability, productivity and work-life balance.

I see bioliphic design as an integral feature for sustainable business design. Design elements that make use of natural elements such as greenery, water features, sunshine and natural light are moodboosters. They improve air quality, reduce stress, and save on energy bills. They’re also aesthetically fitting and pair well with sleek interiors. They also seamlessly blend with natural and sustainable materials, such as recycled plastic and bamboo, to create futuristic spaces.

The key to future-forward office design is flexibility. Adjustable workstations customise workspace to fit individual and health needs, reducing the risk of injury and improving productivity. By utilising flexible design methods in workplace design,

FUTURISTIC DESIGN CATERS TO DIVERSE NEEDS, AND MUST BE ESPECIALLY MINDFUL TOWARDS PEOPLE OF DETERMINATION. INCLUSIVE OFFICES INCLUDE ACCESSIBLE AMENITIES, WHEELCHAIR RAMPS, AND FURNITURE OF ADJUSTABLE HEIGHTS

Our view of how and where we work has changed significantly over the last three years. We look at what developers can do to create the perfect working environmentPIC COURTESY: ARADA

organisations can create spaces that are adaptable, sustainable, and supportive of employee wellbeing, leading to improved productivity and a more positive work environment.

Energy-efficient designs and technologies such as solar panels, green roofs, and smart lighting systems save energy and reduce carbon emissions but also provide a futuristic feel to the buildings. Userfriendly smart building systems – from sensors to phone apps to smart ventilation, smart lighting, and sound-masking – enhance efficiency, increase security, and diminish wastage.

Smart air quality sensors and real-time alerts for potential security breaches may help employees feel safe and secure and enhance safety, while increasingly sophisticated automation systems help streamline processes and reduce manual labour.

Collectively, designing for the workplace ought to reduce environmental impact while creating visually appealing and functional spaces that adapt to changing work configurations. Multipurpose spaces can accommodate different activities and work modes. Curved and organic shapes are creative as well as functional in that they create more efficient airflow.

Future-forward interiors should also encourage teamwork and social interaction, such as communal work areas and breakout spaces. Employee comfort is integral for physical and mental health, ranging from ergonomic furniture and adjustable lighting to acoustic solutions to reduce distractions. Employees’ needs are given added respect and consideration in sustainable design for the workplace which ultimately leads to a happier environment.

Key design features to achieve optimal employee

ART WORKS TO INSPIRE OR PROVOKE THOUGHT, OR EVEN START A CONVERSATION

Elie Mrad, chief architectural officer, Arada

ENERGY-EFFICIENT DESIGNS AND TECHNOLOGIES SUCH AS SOLAR PANELS, GREEN ROOFS, AND SMART LIGHTING SYSTEMS SAVE ENERGY AND REDUCE CARBON EMISSIONS BUT ALSO PROVIDE A FUTURISTIC FEEL TO THE BUILDINGS

conditions may include large windows and skylights; ergonomic chairs, adjustable desks, and supportive furniture; acoustic panels or plants, to reduce noise levels – with comfort and enjoyment going hand-inhand with productivity and efficiency.

Futuristic design caters to diverse needs, and must be especially mindful towards people of determination. Inclusive offices include accessible amenities, wheelchair ramps and furniture of adjustable heights. A welcoming and supportive environment heightens employee morale and enhances bodily health. Both furnishings and activity options can support the human body by reducing pain and fatigue. From prayer rooms to yoga or meditation zones and gyms, the workplace can be expanded to become a destination for solace, motivation and self-improvement. When it comes to designing forward-thinking workplaces that simultaneously prioritise wellness, productivity, and sustainability, design configurations are increasingly holistic in their approach, with open plan layouts, ergonomic furniture, areas for communal gatherings, and designated zones that invite collaboration and brainstorming.

Art works to inspire or provoke thought, or even start a conversation, have a place here too. Thoughtful textures and colour palettes that inspire, calming views of nature, leafy indoor plants, and ample natural light are all factors that contribute towards impactful, contemporary design. Public transportation, electric car charge ports and scooters, and an abundance of green, walkable spaces as well as amenities such as childcare facilities, fitness centres and dining options all contribute to convenience, motivation, and ultimately, sustainable productivity.

When it comes to architecture and landscape design for very warm climates, strategic positioning can make a significant impact on lowering temperatures and preventing heat islands. Planting leafy green trees and structuring buildings to take advantage of natural wind tunnels effectively provide shade, breeze and respite from extreme heat.

The way we view our workplaces has changed enormously over the last three years and it’s incumbent on all stakeholders, from employers and developers to regulators and professional groups, to make our working lives as simple, heathy, stress-free and productive as possible.

“FUTURE-FORWARD INTERIORS SHOULD ALSO ENCOURAGE TEAMWORK AND SOCIAL INTERACTION, SUCH AS COMMUNAL WORK AREAS AND BREAKOUT SPACES.

EMPLOYEE COMFORT IS INTEGRAL FOR PHYSICAL AND MENTAL HEALTH, RANGING FROM ERGONOMIC FURNITURE AND ADJUSTABLE LIGHTING TO ACOUSTIC SOLUTIONS TO REDUCE DISTRACTIONS”

Independent directors play a critical role in providing unbiased oversight and challenging the decisions of the management. The SVB board was dominated by insiders who contributed to a lack of effective checks and balances, and a failure to identify and address potential risks faced by the bank.

Risk management is a crucial aspect of governance, especially for financial institutions. SVB’s exposure to high-risk loans and investments, particularly in the untested technology sectors has caused a domino effect. It has been reported that the bank’s risk management practices were inadequate, with insufficient risk assessment, monitoring, and mitigation measures in place. Essentially it is a failure of the board in overseeing the bank’s risk management practices.

The board has the responsibility to ensure that the company’s financial performance is properly monitored and managed. This includes reviewing financial reports, assessing the adequacy of financial controls, and ensuring that the company’s financial practices are in compliance with applicable laws and regulations. In the case of SVB, there have been allegations of financial mismanagement and lack of transparency in financial reporting, which indicates inadequate financial oversight by the board.

Diversity in board composition in terms of gender, ethnicity, age, experience, and expertise is known to enhance effectiveness of decision-making. The SVB board lacked diversity, with a homogenous composition that did not reflect the diversity of its customers, employees and stakeholders. This contributed to a narrow perspective in decision-making and a failure to adequately understand the concerns of stakeholders.

The recent collapse of Silicon Valley Bank (SVB), a prominent bank focused on tech startups, has brought to light the critical role of board governance once again. While SVB was once considered a trailblazer in the banking industry, providing specialised banking services to technology and innovationfocused companies, its downfall has been attributed to poor board governance practices. Poor governance can manifest in various ways, and in the case of SVB, it has been problematic in several areas.

Effective board oversight is critical for ensuring that the management is operating in the best interests of its stakeholders. However, in SVB’s case, the board must take the blame for its weak oversight of operations and risk management practices. It failed to ask tough questions, challenge management’s assumptions, and hold the management accountable for its actions. Overall, it appears that the board had inadequate information and communication. Directors rely on accurate and timely information to make informed decisions. This lack of timely and transparent information may have limited the board’s ability to fully understand the risks faced by the bank and take appropriate actions to mitigate them. There was also inadequate succession planning at SVB, which

How GCC bank boards can gain valuable insights from the recent collapse of the Silicon Valley Bank

is a critical aspect of governance. The board should have ensured that there was a robust plan in place to identify and develop potential successors for key leadership positions, including the CEO and other top executives. These governance failures hold the following important lessons for the boards of Gulf Cooperation Council (GCC) banks:

DON’T COMPROMISE ON RISK MANAGEMENT. SVB’s failure underscores the importance of robust risk management practices. GCC bank boards should ensure that they will not compromise on this. Boards should actively review and assess the risk appetite, risk culture, risk governance and risk management practices. They should also ensure that risk management policies and procedures are regularly updated, and risk-reporting mechanisms are in place to enable effective oversight.

DIVERSIFY, AND AVOID CONCENTRATION RISK. SVB’s over-reliance on a narrow segment of the market contributed to its failure. Bank boards in GCC should oversee that they don’t have excessive concentration risk in terms of customer segments, industries, or geographies. Diversification across different sectors, industries, and customer segments can reduce risks and provide stability. Actively review and assess the portfolio diversification and take steps to mitigate concentration risks.

ENSURE INDEPENDENT BOARD OVERSIGHT. The SVB fiasco highlights the importance of having more independent directors who can provide effective oversight. Ensure that the board has a balanced mix of independent directors with diverse expertise who can exercise independent judgment, challenge management, and provide effective oversight. Encourage them to question management decisions, assess risks objectively and hold management accountable.

BRING TRANSPARENCY IN REPORTING. Prioritise transparency in the operations, financial reporting,

Dr M Muneer, co-founder of the nonprofit Medici Institute

and communication with stakeholders. Boards should ensure that the financial reporting is timely, accurate and transparent, and that risk disclosures are comprehensive and informative.

DRIVE INNOVATION AND DIGITAL TRANSFORMATION. The SVB collapse shows the importance of this in the banking sector. Embrace innovation and digital technologies to enhance customer experience, streamline operations, and improve risk management. Invest in fintech partnerships, develop digital banking channels, leverage data analytics for risk assessment, and explore emerging technologies such as blockchain and artificial intelligence. This will help in staying competitive and agile.

STAY COMPLIANT, NO MATTER WHAT. GCC banks must prioritise compliance with regulatory requirements including anti-money laundering regulations, know-your-customer requirements, and other regulatory frameworks. Robust compliance practices like internal controls, and policies and procedures, are essential to mitigate legal, reputational, and operational risks.

FOCUS ON TALENT AND LEADERSHIP DEVELOPMENT. Boards must ensure attracting, developing, and retaining top talent as a critical governance issue. Skilled leaders can effectively manage risks and drive innovation. Leadership development programmes, succession planning, and talent retention strategies should be in place to cultivate a strong leadership pipeline and to ensure continuity in leadership roles.

SEEK MORE DIVERSITY. Lack of board diversity contributed to SVB’s failure. GCC banks should ensure that they don’t make similar mistakes. Diverse boards bring different perspectives, insights, and experiences to the table, which can help in better decision-making and risk management. Actively promote diversity in the boardroom and management.

“BOARDS MUST ENSURE ATTRACTING, DEVELOPING, AND RETAINING TOP TALENT AS A CRITICAL GOVERNANCE ISSUE. SKILLED LEADERS CAN EFFECTIVELY MANAGE RISKS AND DRIVE INNOVATION”ILLUSTRATION: GETTY IMAGES/LUCIANO LOZANO

Alan O’Neill Managing director of Kara, change consultant and speaker

Alan O’Neill Managing director of Kara, change consultant and speaker

Of all the industries that exist in the marketplace, retail is the one that stands out for me as the one that has experienced probably the most disruptive change in the last 50 years. Whether you see it as a positive change or negative is all to do with your attitude and your willingness to embrace retail “Darwinism”.

From open market stalls to small stores with counters, to open department stores and gigantic malls, the evolution has been relentless. Television shopping channels arrived in the 80s with a very product-focused pushy selling style, and it was followed in the 90s by the big daddy of all disruption, the internet.

There is a lot of confusion and noise around how online shopping is causing a retail apocalypse and the closure of physical retail stores.

For sure, online is eating into overall retail spend and as it becomes more e cient and sophisticated, it will inevitably grow. Some figures were released during the pandemic that suggested that the global spending on retail (not including airlines, and hospitality bookings) was about 12-13 per cent, with experts at that time suggesting that it is unlikely to grow beyond 20 per cent of the overall retail mix.

However, the pandemic has changed much of that. The inevitable spike in online purchasing has advanced the global needle by three to five years. It did of course drop back a ter the pandemic, but

it is still expected that the overall mix will increase from 12-13 per cent, as new migrants to the channel grow to love it.

The bottom line here is that online shopping is growing and it’s a significant part of the strategic mix for retailers. You might wonder why I’m even saying this. Well, it’s because of some recently released data. Here are some of the highlights along with some of my own observations.

Consumers. Since the onset of Covid-19, consumers have embraced online in their droves. There is an obvious spike as you can see above. Small retailers. Quite shockingly, there is still a cohort of small retailers that should, but don’t even have a website. Only 25 per cent of all SME retailers sell online. Given that 82 per cent of online shoppers do so somewhat frequently, this makes those non-adopter businesses lose out. Strangely, 46 per cent of them say online is not their priority. Their relevance in their locality will continue to diminish, jeopardising their and their employees’ livelihoods.

Your online store. As normality returns and consumers feel less loyal to brands, they will once again start comparing sites across the whole global spectrum. Retailers need to use this time right now to further enhance their online shopfronts, their range edit and their descriptions.

International players have a greater choice or ‘endless aisles’ online.

Perhaps you could speak to your main suppliers about getting their support with this. Photography and descriptions too o er you an opportunity to localise your site with language and detail that will inspire your customers to buy. That means that you can no longer just ‘copy and paste’ your suppliers’ catalogues.

ONLY 25 PER CENT OF ALL SME RETAILERS SELL ONLINE. GIVEN THAT 82 PER CENT OF ONLINE SHOPPERS DO SO SOMEWHAT FREQUENTLY, THIS MAKES THOSE NON-ADOPTER BUSINESSES LOSE OUT

Click-and-collect. Businesses that started out as pure-play retailers (i.e., online-only, otherwise called DTCs – direct to consumer) are now opening stores. Why? Two main reasons stand out. They want to build a human rapport with their customers. And experience shows that customers can be influenced to buy more when they come in to store to collect their online purchases.

Returns. Recent research shows that customers buying decisions are hugely influenced by online retailers’ return policies. Use that to your advantage as a local supplier servicing a local customer base where international supply chains can be troublesome.

Data. Omni-channel is the next step beyond multi-channel. Multi-channel means that you

A strategic offering of

shopping experiences can help retailers stay relevant in current times

enable your customers to buy either in-store or online, by telephone or by email. Omni-channel is when you use technology to join up all these channels and offer your customer a seamless experience – where all touchpoints are connected. That and the use of data for personalisation may be a step too far for those with less budget. But don’t let the noise around omni-channel put you off starting with the basics, described before.

While online is likely to grow to 25 per cent of the overall mix, don’t forget that that means 75 per cent of all retail purchases will still be in-store. Because of the noise around online, I feel that many retailers forget this. Please don’t fall into that trap.

“BUSINESSES THAT STARTED OUT AS PURE-PLAY RETAILERS (I.E. ONLINEONLY, OTHERWISE CALLED DTCS – DIRECT TO CONSUMER) ARE NOW OPENING STORES. WHY? TWO MAIN REASONS STAND OUT. THEY WANT TO BUILD A HUMAN RAPPORT WITH THEIR CUSTOMERS. AND EXPERIENCE SHOWS THAT CUSTOMERS CAN BE INFLUENCED TO BUY MORE WHEN THEY COME IN TO STORE TO COLLECT THEIR ONLINE PURCHASES”

You can maximise your efficiency by managing your energy. These daily rituals will help

Our energy levels tend to fluctuate throughout the day. Some of us have high energy levels in the morning; others feel more energised in the evening. If we have a co ee, we feel a burst of energy, but then feel a drop in energy when the e ects of the ca eine wear o .

We all tend to experience a crash in energy levels a ter a heavy lunch, as our stomach starts the di cult task of digesting food. Figuring out when you have the most energy in the day is key to becoming more productive and focused.

Identifying your peak energy period has several catchy titles, one such is Biological Prime Time (or BPT), a phrase coined by Sam Carpenter in his book Work the System. Managing our time, but also managing our energy levels throughout the day ensures we avoid becoming distracted when we grow tired, and we’re able to continue to focus on the tasks at hand.

I o ten keep a time log so I can check in on myself every hour to ensure I’m staying on task, not becoming distracted by the trivial and not procrastinating and

WHAT METHOD AND RULES WILL YOU DEPLOY WHEN YOU WORK? FOR EXAMPLE, WILL YOU SET YOURSELF A TIMER FOR A 30‑MINUTE BURST OF WORK, OR WILL YOU WRITE FOR A COUPLE OF PAGES, OR WILL YOU ENSURE YOU DO NOT BROWSE THE INTERNET FOR THE FIRST HOUR, OR WILL YOU TURN OFF WI FI FROM YOUR LAPTOP SO YOU CAN FOCUS ON THE TASK?

putting off essential work. At the end of the day this allows me to review how I did. The great thing with an hourly time log is that you don’t have to wait till the end of the day to hold yourself accountable. If you’re veering off your desired path, you’ll be able to quickly rectify your position and get back on track.

One study of nearly 1,700 participants showed that keeping a food diary can double a person’s weight loss. The study found that the best predictors of weight loss were how frequently food diaries were kept and how many support sessions the participants attended. Those who kept daily food records lost twice as much weight as those who kept no records. The same effect can be seen when you keep a time log – you manage to reduce the level of distractions and increase your focus and attention. In addition to scheduling your hardest work when you have the most energy, it also makes sense to be organised and not haphazard.

The Pulitzer Prize-winning biographer Robert Caro, as was revealed in a 2009 magazine article, explained how every inch of his New York office was governed by rules. He had rules about where he placed his books (research on his immediate subject was closest), how he stacked his notebooks (new interviews were stacked at the top), what he put on the wall (an outline of the book he was working on), and even

“ONE STUDY OF NEARLY 1,700 PARTICIPANTS SHOWED THAT KEEPING A FOOD DIARY CAN DOUBLE A PERSON’S WEIGHT LOSS . THE STUDY FOUND THAT THE BEST PREDICTORS OF WEIGHT LOSS WERE HOW FREQUENTLY FOOD DIARIES WERE KEPT AND HOW MANY SUPPORT SESSIONS THE PARTICIPANTS ATTENDED”

Rehan Khan, principal consultant for BT and a novelistWHAT WILL YOU SUPPORT YOURSELF WITH? FOR EXAMPLE, A STRONG CUP OF COFFEE OR TEA, OR THE RIGHT LEVEL OF FOOD, OR A SHORT EXERCISE BREAK, EVERY 45 MINUTES

what he wore to the office. Everything had a routine, so that he could bring his full attention to his writing.

“I trained myself to be organised,” he explained as he pointed almost apologetically at his massive writer’s map. “If you’re fumbling around trying to remember what notebook has what quote, you can’t be in the room with the people you’re writing about.”

David Brooks summarises this reality more bluntly: “Great creative minds think like artists but work like accountants.” Caro was not being peculiar. Rather, he knew that success in his work relied on his ability to think deeply, and one way of facilitating this was to remove all distractions from his working environment.

You may not be writing a prize-winning piece, but you will be working on creating value in your organisation and personal life, and why not give yourself the best possible opportunity to excel at it?

Here are some things you might want to think about in terms of your working rituals:

How long are you going to work and where? Location is important and you must spend some time preparing it so that you can perform your best work there.

What method and rules will you deploy when you work? For example, will you set yourself a timer for a 30-minute burst of work, or will you write for a couple of pages, or will you ensure you do not browse the internet for the first hour, or will you turn off Wi-Fi from your laptop so you can focus on the task?

What will you support yourself with? For example, a strong cup of coffee or tea, or the right level of food, or a short exercise break, every 45 minutes.

Whenever I’m at my most productive, I’m usually in a routine where I don’t need to think too hard about where I work, how I will work or what will support my work. I plan all this in advance. I can then use all my energy on my most creative tasks.

The Comprehensive Economic Partnership Agreement (CEPA) between the UAE and Israel entered into e ect on April 1, 2023, the latest step in the two countries burgeoning relations since the Abraham Accords, which heralded greater economic and trade integration nearly three years ago.

Since the historic formation of diplomatic ties in September 2020, top o cials from the UAE and Israel have exchanged visits and signed several bilateral agreements. The two countries’ relationship has evolved swi tly over the years amid increased cooperation in the finance, energy, security, technology and water security sectors. The UAE and Israel seek to advance bilateral non-oil trade

from the $1.3bn recorded in 2021 to $10bn by the end of the decade. The two countries are also expanding their ties beyond bilateral trade.

Speaking to us at the Motivate Media Group o ces, Zaslansky weighed in on the strengthening relationship between the UAE and Israel, trade and economic opportunities between the two countries and the development in priority sectors, including healthcare, agritech, advanced technologies and energy. Here are excerpts from the discussion.

Relations between the UAE and Israel have gone from strength to strength since the signing of the Abraham Accords

almost three years ago. Which are the areas that have benefitted the most because of stronger ties between the two nations?

The establishment of diplomatic ties between Israel and the UAE is creating strategic opportunities in almost every aspect of the non-oil economy from tourism and aviation to finance and technology among others.

The trade figures between the two countries, which smashed expectations in 2022, have been phenomenal even before CEPA came into e ect.

Going forward, tourism will remain the fast-growing and one of the best-performing industries following an agreement to increase daily flights between Israel and UAE, the inauguration of visa-free travel and the opening of kosher restaurants to cater to the growing Jewish population in Dubai and Abu Dhabi. On the cooperation front, there’s growing collaboration between companies and institutions in both countries across all sectors.

What does the opening of the Abrahamic Family House in Abu Dhabi represent to the Jewish community in the UAE and Israel? Why is it key to promoting the message of amity, tolerance and peace?

The Abrahamic Family House opened its doors to visitors on March 1, 2023. The opening of the multi-faith place of worship holds historical significance as the home of the first purpose-built synagogue in the UAE and the first built in the Arab world in nearly a century.

It demonstrates the UAE leadership’s deep commitment to coexistence and tolerance, which are among the leading values of the country and are at the heart of the Abraham Accords.

The multi-faith place of worship has the potential to be something greater: a global centre for pluralism, culture, education and engagement; a centre for interfaith education, research and engagement; a place that creates links between Jewish, Arab and Christian communities in the UAE, across the Arab world and globally. To the Jewish World, the Abrahamic Family House is a place of tolerance and a place where everyone can feel at home.

Tell us about the collaboration and knowledge sharing between leading Israeli and UAE institutions. Give us some examples.

There is growing collaboration between Emirati and Israeli organisations, companies and institutions since the signing of the Abraham Accords in 2020.

KSM Maccabi signed multiple MOUs with di erent leading health entities in the UAE with a joint goal to bring new knowledge to the world. Together with those entities they will expend research in multiple domains such as big data research, genetics and clinical trials and will bridge the entire ecosystem to a much more diverse population

The UAE and Israel are the strongest innovation hubs in the Middle East. Israel has a vibrant tech ecosystem such as the country’s drip agriculture micro-irrigation which bonds well with the UAE’s push to drive development through innovation.

Cooperation between Israeli and Emirati entities is yet to expand into the education sector

and going forward we hope to see more collaboration between universities in basic research, applied research and joint development.

The UAE ratified its CEPA with Israel in March. How will the two countries benefit from the removal of trade tariffs?

Israel and the UAE signed the CEPA into e ect earlier in April, removing tari s on about 96 per cent of goods traded between the countries.

In addition to the removal of tari s, Israeli companies will gain access to government tenders in the UAE, a positive move that will create more industries and areas of cooperation between businesses from the two nations.

Which sectors (in addition to software, diamonds, defence and security) do you expect will benefit from the CEPA?

CEPA also will reassure investors on both sides regarding the stability of their financial transactions, and therefore increase

investments in startups, private equity etc. in various sectors, such as energy, finance, water and healthcare.

There are also opportunities on the logistics front as well and Israeli companies that ship through Dubai benefit from significant cost savings.

The bilateral trade of goods between the UAE and Israel in January this year reached $264.4m compared to $138.9m in January 2022. With this robust rise, how do you envision the volume of trade growing in 2023 and beyond?

The bilateral trade of goods (excluding so tware) between the UAE and Israel for the first two months of the year, rose by 76.5 per cent to $540.6m compared to $306.2m for the same period of 2022. Bilateral nonoil trade between the two countries reached $2.49bn in 2022, up 90 per cent from 2021 figures while re-exports from Israel grew by 71.2 per cent and non-oil exports to Israel surged to 48.6 per cent.

With the CEPA coming into e ect, the value of bilateral trade between the two countries is expected to more than double what has been achieved since the signing of the Abraham Accords. We are eagerly waiting to see half-year statistics in June to examine the impact of the free trade agreement and the trajectory that bilateral trade between the two countries is going forward, with the UAE’s Ministry of Economy projecting that trade will be doubled in the next five years.

In 2022, we forecasted that trade between Israel and the UAE would cross the $2bn threshold but instead, trade eclipsed our projections to close the year at $2.57bn and this trajectory will continue to grow.

Are

challenges

face when trying to establish operations in either of the two countries?

Challenges come with every new relationship. The business culture in the two jurisdictions is di erent, there are di erences in regulations and other related issues that require the attention of the

GOING FORWARD, TOURISM WILL REMAIN THE FAST-GROWING AND ONE OF THE BEST-PERFORMING INDUSTRIES FOLLOWING AN AGREEMENT TO INCREASE DAILY FLIGHTS BETWEEN ISRAEL AND UAE”THE UAE AND ISRAEL SEEK TO ADVANCE BILATERAL NON-OIL TRADE FROM THE $1.3BN RECORDED IN 2021 TO $10BN BY THE END OF THE DECADE

respective governments and relevant institutions. The mutual recognition of driver’s licences in the two countries came into force in March, making it easier for Israelis to come and drive themselves in the UAE – this is just a small example. So, Israeli businesses who open here and conversely, UAE businesses who open in Israel have both shared how helpful people have been on both sides which has led to seamless set up experiences.

Companies and entities are receiving assistance from authorities such as the Dubai International Financial Centre where the Consulate General of Israel in Dubai is located.

One of Israel’s biggest digital payments firms Rapyd opened its doors for business in Dubai in December 2021 and a year later, Israeli chef Eyal Shani brought his North Miznon brand to the UAE. These are the success stories that we are sharing with other companies and startups that are considering expanding into the GCC market.

There are currently 16 daily flights between Israel and the UAE. In your opinion, how has this bolstered tourism and aviation in both countries?

The 2020 Abraham Accords opened up travel and tourism between the UAE and Israel. The latest data from Dubai Tourism shows that the number of visitorsfrom Israel increased by 212 per cent to 85,000 in the first two months of the year.

THE LATEST DATA FROM DUBAI TOURISM SHOWS THAT THE NUMBER OF VISITORS FROM ISRAEL INCREASED BY 212 PER CENT TO 85,000 IN THE FIRST TWO MONTHS OF THE YEAR

Abu Dhabi received a significant number of Israeli tourists during the same period with 9,000 visitors checking into its hotels – the 11th-largest source of visitors to the city and 1,000 behind Saudi Arabia. The flights between Israel and the UAE are always full. Israel is looking forward to welcoming more tourists from the Emirates to Israel.

Oman recently opened its airspace to Israeli airlines in February, how do you see this development benefitting Israel’s aviation sector and economy?

The signing of the Abraham Accords opened the GCC airspace to Israeli carriers, which has reduced flight time for Israeli travellers going to destinations in Asia. First was Saudi Arabia which opened its airspace to all airlines in July 2022 and the historic move by Oman is expected to pave the way for Israeli carriers such as El Al Israel Airlines (El Al), Israir and Arkia to expand deeper into the Southeast Asia market such as Japan.

Beyond shortening current flight times, the opening of Oman’s airspace will potentially allow Israeli airlines such as flag carrier El Al to explore new routes to Australia and restart flights to India from its hub at Ben Gurion International Airport. It will also reduce the cost of doing business for Israeli companies considering expanding in Asian and Oceania markets.

IN 2022, WE FORECASTED THAT TRADE BETWEEN ISRAEL AND THE UAE WOULD CROSS THE $2BN THRESHOLD BUT INSTEAD, TRADE ECLIPSED OUR PROJECTIONS TO CLOSE THE YEAR AT $2.57BN AND THIS TRAJECTORY WILL CONTINUE TO GROW AND IT WORKS”

The UAE has long been known for its businessfriendly policies and tax-free environment. Following the introduction of VAT back in 2018 and corporate tax being rolled out starting in June 2023, UAE businesses and investors are getting used to the new reality – tax is here and it’s here to stay.

While some industries have had exposure to tax at an emirate level, most UAE businesses had to ensure that their accounting and reporting systems are able to capture the necessary data and produce accurate tax returns to enable them to comply with the reporting requirements.

Tax considerations are essential in a transactional context. In jurisdictions with developed tax regimes, tax implications are a priority when contemplating an M&A transaction or corporate restructuring. Not considering tax from the outset can be a costly oversight. M&A transactions involve complex legal and financial arrangements that can span multiple countries and therefore, consequences of efficient tax structuring (or lack of) can reverberate across various jurisdictions. In the UAE, companies will have to consider the tax implications of

their deals, including the impact on their financial statements, cash flows, and tax obligations. UAE corporate tax structuring will have its own challenges, given the difference in treatment between free zone entities and mainland entities, and requirements around tax holidays afforded to free zone companies.

Companies will also need to evaluate the tax treaties that are relevant to their operations and transactions (including double taxation treaties) to ensure that they are able to take advantage of any relief provisions.

For M&A transactions, the tax residency of the target company will be a critical factor in determining the tax implications of share deals. In transactions involving asset acquisitions, the tax liability will be based on the location of the assets. Buyers will need to evaluate the tax status of the target company or target assets, and consider whether any restructuring is required to optimise tax efficiency. This may involve restructuring the target company’s operations, such as moving its intellectual property or other assets to a tax-efficient jurisdiction (this may, in the UAE, be a free zone).

Similarly, restructurings, such as mergers or spin-offs, may trigger tax liabilities under the new regime. Companies must evaluate the tax implications of any restructuring and ensure compliance with the new tax laws. For example, companies may need to restructure their debt or equity to ensure that any tax liability exposure is optimised.

The new corporate tax may also impact company valuations. Potential investors will need to consider the impact of the tax on company’s profits and cash flows, which may affect valuations. This may lead to a decrease in the value of companies that are subject to the corporate tax, particularly if the tax rate is higher than the rates in other jurisdictions.

It is inevitable that at times tax disputes will arise, and companies will need to be prepared to deal with such events and engaging with reputable, competent advisers will be essential. Companies have the right to appeal any decisions made by the tax authorities. The UAE has established a specialised court for tax disputes.

It will be interesting to see how the introduction of the corporate tax in the UAE will impact the country’s economy. The country has been a hub for business and investment in the region, and its tax-free environment has been a key factor in attracting businesses to the country. Investors committed to the region are unlikely to be discouraged by the introduction of this new tax, especially given the favourable rate and the various options for tax optimisation that they will have at their disposal. The government has indicated that the revenue from the corporate tax will be used to fund public services and infrastructure projects in the UAE. This will likely have a positive impact on the country’s economy, as the increased revenue will likely lead to improved infrastructure and services, which may attract further investment and business.

In conclusion, while the new tax regime may add complexity to transactions, it may also provide new opportunities for businesses to optimise their tax strategies and improve their overall financial performance. It will be interesting to see how businesses in the UAE adapt to the new tax regime and how it will shape the future of the country’s economy.

Navigating the complexities of M&A transactions and restructurings in the face of UAE’s corporate tax

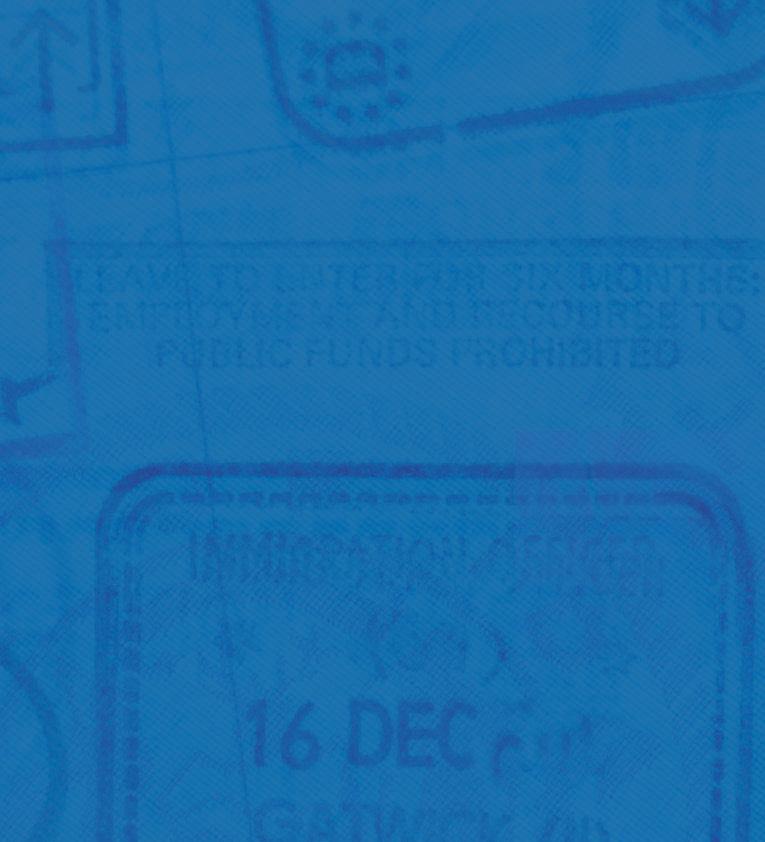

SHOWCASING THE WORLD’S MOST AND LEAST POWERFUL PASSPORTS IN 2023

Just 6 per cent of passports worldwide give their holders visa-free access to more than 70 per cent of the global economy. Only 17 per cent of countries give their passport holders visa-free access to more than four-fifths of the world’s 227 destinations

SINGAPORE

Visa-free score: 193

Visa-free score: 191

Visa-free score: 192

THE US REMAINS ONE OF THE MOST SOUGHT AFTER DESTINATIONS FOR INVESTORS. THE US EB-5 IMMIGRANT INVESTOR PROGRAM OFFERS AN EFFICIENT ROUTE TO PERMANENT RESIDENT STATUS (A GREEN CARD) IN A SHORT PERIOD OF TIME

THE ITALY RESIDENCE BY INVESTMENT PROGRAM ME

INVESTMENT

Minimum investment from EUR250,000 to EUR2M

PROCESSING TIME

Three–four months

As a globally recognised tourist destination with major cities including Milan, Rome, and Venice, Italy offers investors access to a strong, well-connected EU market and the many opportunities available in the region

KEY BENEFITS

The right to live, work, and study in Italy

The UAE leads the region in the index with its passport holders allowed easy access to 178 destinations around the world

16th Ranking in 2023

UNITED ARAB EMIRATES

178 Visa-free destinations

In a highly unpredictable and volatile world, economic mobility and cross-country visa-free access to more stable economies helps investors mitigate risk and secure additional income streams. For investors from countries with poor visa-free access, the global mobility and economic advantages and opportunities associated with acquiring a more powerful passport are indisputable”

Dr Juerg Steffen, CEO of Henley & Partners

111 Visa-free destinations

PASSPORT RANKINGS OF COUNTRIES HOSTING CITIZENSHIP BY INVESTMENT PROGRAMMES St. Kitts and Nevis 26th

56th Ranking in 2023 QATAR

100 Visa-free destinations

57th

Ranking in 2023 Ranking in 2023

53rd TÜRKIYE KUWAIT

97 Visa-free destinations

Antigua and Barbuda 31st St. Lucia 32nd Grenada 33rd Dominica Malta 8th

North Macedonia 45th Türkiye 53rd Jordan 89th 34th

61st Ranking in 2023 BAHRAIN

87 Visa-free destinations

US ANALYSTS ANTICIPATE...

THAT KUWAIT AND QATAR WILL SIGN A VISA-FREE DEAL WITH THE EU THIS YEAR — A MOVE THAT WILL DRAMATICALLY ENHANCE BOTH COUNTRIES’ SCORES, AS THEIR PASSPORT HOLDERS WILL BE GRANTED VISA-FREE ACCESS TO ALL 27 EU MEMBER STATES

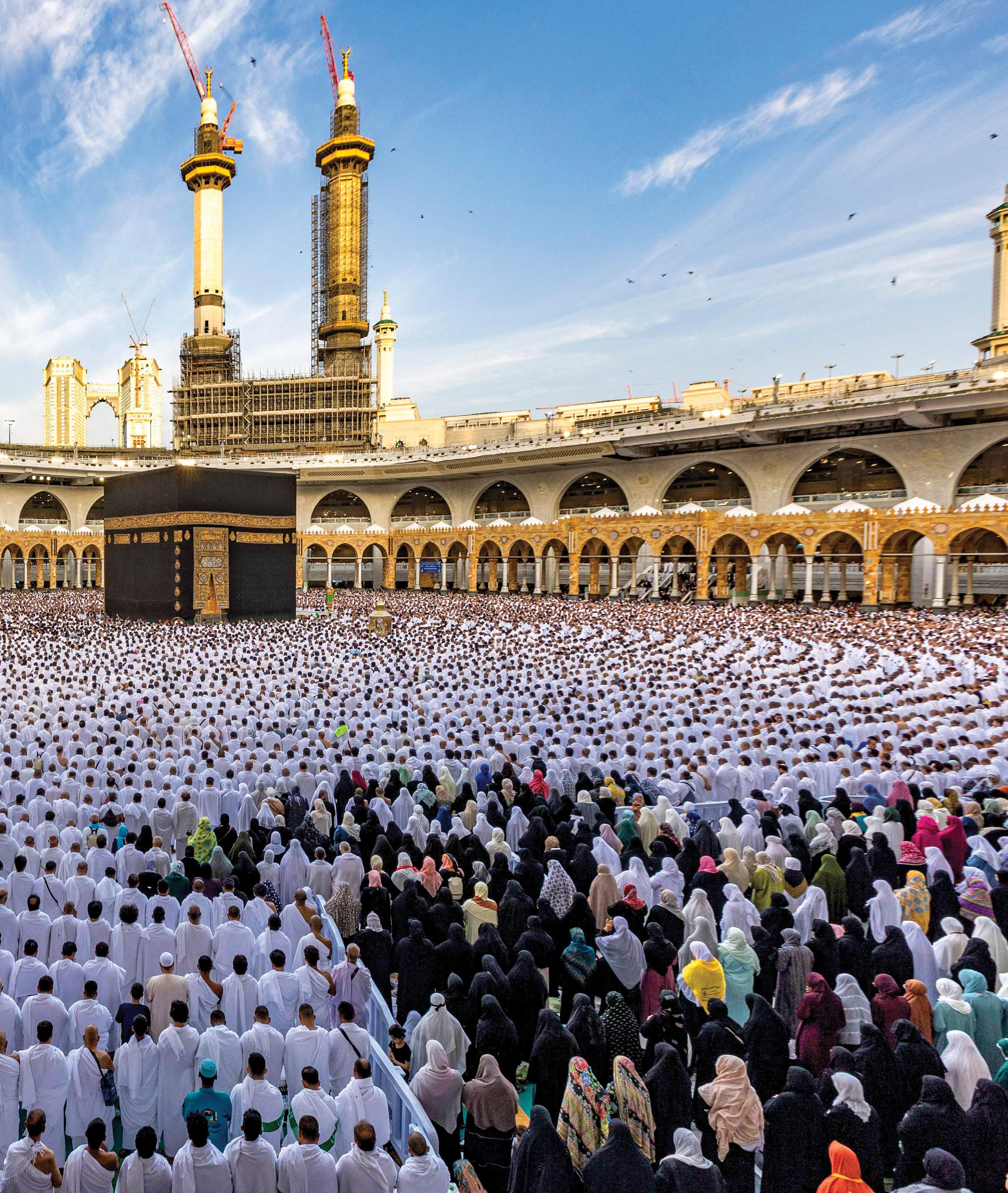

Muslim worshippers offer prayers around the Kaaba, Islam’s holiest shrine, at the Grand Mosque, in Mecca, Saudi Arabia on the first day of Eid al-Fitr, which marked the end of Ramadan and a month-long period of fasting on April 21, 2023.

AS EEMEA PRESIDENT OF MASTERCARD, DIMITRIOS DOSIS LEADS OVER A THIRD OF THE MARKETS WHERE THE TECHNOLOGY COMPANY OPERATES. HERE, DOSIS TALKS TO GULF BUSINESS

ABOUT HOW MASTERCARD IS GROWING THE DIGITAL ECONOMY AND SERVING THE NEEDS OF COMMUNITIES ACROSS ITS MARKETS

WORDS: KUDAKWASHE MUZORIWA

PHOTOS: MARK MATHEW

Leading a region as diverse as Eastern Europe, Middle East and Africa (EEMEA) is a role for someone bold, decisive and interested in how di erences can add value and create advantage for the many, rather than the few. The region is also home to 41 of the world’s 100 fastest-growing economies, so you need a leader who gets things done at speed, without compromising on standards.

Dimitrios Dosis is that person – overseeing 81 of Mastercard’s 210 markets, as president.

The EEMEA region has emerged as a focal point for Mastercard’s global innovation, digital transformation and financial inclusion e orts in recent years. Today, this melting pot serves as a launchpad for deploying strategic partnerships, non-traditional collaborations, and new business models in the payments industry across Mastercard’s extensive global network.

The EEMEA payments industry has demonstrated resilience in 2022, with the economic downturn, high inflation and soaring interest rates altering consumer and business behaviour and, consequently, payments dynamics.

Changes in the payments space are creating new opportunities for service providers in the region to develop new solutions and claim market share. EEMEA is certainly a diverse region, and that very diversity generates some of the most exciting opportunities.

The region is home to a young population, which goes hand-in-hand with an appetite for exploring new innovations and o ten, a high degree of tech savviness. Dosis says the youth segment in the EEMEA region o ers a massive opportunity, not just for Mastercard, but for everyone. “This is where progress can make an impact swi tly. It’s where the momentum starts,” he adds.

“Technology is evolving at a rapid speed, and our region is well on its way to becoming one of the most digitally connected in the world,” says Dosis. Still, the individual markets are quite di erent, and this is where localisation and tailor-made solutions can make the difference. Dosis highlights that pulling standard solutions o a global shelf doesn’t cut it. However, being present in the markets where customers are, listening to pain points, understanding user journeys and being open to co-creating solutions, are essential, he says.

According to Mastercard New Payments Index 2022: Consumers in MENA Embrace Digital Payments report, 85 per cent of people in the MENA have used at least one emerging payment method, 64 per cent increased their use of digital payment methods and 19 per cent used less cash in 2021.

Of course, where there are opportunities there are also challenges. Dosis sees geopolitical tensions, rising nationalism, healthcare concerns, inflation, supply chain issues, and rising climate change worries having widespread implications across the EEMEA region.

The fact remains that there will always be challenges, but Mastercard is leveraging the power of technology to prepare for the challenges while enabling collaboration across the ecosystem to position for mutual growth ahead.

Collaboration and innovation are at the heart of Mastercard’s progress and Dosis says the company places a strategic focus on the importance of partnerships with both private and public sectors, across industries.

These partnerships include Mastercard’s alliance with e& in the UAE. Dosis says the technology group is forging an ambitious digital transformation journey that the payments company will support by integrating digital payment services in a way that adds value and enhances user-friendliness in 16 markets.

According to Dosis, this is where governments can also play an especially important part. “We’ve partnered with governments across the region, sharing our expertise and technology solutions to help digitise their economies and positively impact the welfare of citizens and residents.”

In Jordan, Mastercard joined hands with the Greater Amman Municipality (GAM) and Network International earlier this year to roll out the country’s first transit payment ecosystem. It will enable seamless digital payments across the GAM-operated public transport network, powered by Mastercard’s Payment Gateway Services.

Additionally, Mastercard’s other collaborations in Egypt and Saudi Arabia are great examples of how the payment solutions firm can support the development of country-wide digital ecosystems. Overall, Dosis is seeing encouraging trends across the Middle East that present a significant chance to reimagine how we can use technology and drive partnerships for the greater good.

Dosis stresses that as a trusted partner of governments, the company is collaborating on use cases such as transit, education, infrastructure, wage digitisation, welfare disbursements, bill payments via WhatsApp and the development of interoperable payment systems.

“We have been shi ting from a product-centric to solution-centric organisation. In this process, Mastercard has evolved into a multi-faceted brand innovation partner with a wide range of competencies and capabilities, which are benefitting retailers, travel companies, governments, fintech startups and others,” adds Dosis.

The digital payments space had gained significant traction in the EEMEA region before the shi t to the ‘digital-first’ approach that gained prominence a ter the outbreak of the pandemic three years ago.

According to Dosis on the one hand there is the ongoing acceleration in technology and on the other there’s the fact that customers want choice.

Blockchain technology is democratising finance while data analytics are adding insights that are informing business decisions with greater precision.

“Mastercard’s multi-rail strategy is the way we approach this and the way we make sure we transfer value in new ways beyond a card. We do this by advancing capabilities such as e-commerce, QR codes, account-toaccount transactions, B2B payments, click-to-pay and buy-now-pay-later solutions,” says Dosis.

Cross-border remittances are especially important in the Middle East to keep people connected and communities supported. Today, Mastercard’s cross-border services connect 90 per cent of the world’s population via bank accounts, digital wallets, cards and cash agents.

Mastercard remains committed to leveraging innovative technologies to develop new value propositions that are personalised and contextual, shaping the future of commerce, solving real problems and making people’s lives easier.

Besides their technical benefits, digital payments are key enablers of economic growth and financial inclusion.

“These days, when we talk about the economy, it’s increasingly a reference to the digital economy, as this is where value is being moved. As a result, digital inclusion is necessary for financial inclusion,” asserts Dosis, adding that financial inclusion is critical because it’s an essential step towards financial security.

As a responsible company, Mastercard is intricately aware that technology needs to be directed in the right ways so everyone can benefit from it, not just a few. When it supports financial inclusion, it drives scale and generates shared growth, ultimately leading to financial security for more people. That’s why the company pledged to bring one billion people globally into the digital economy by 2025.

Mastercard has been working to bridge the financial inclusion gap through a broad range of e orts, including partnerships with telecommunications companies, ongoing work on government disbursement solutions, wage digitisation of private sector workers and scaling e orts with mobile network providers via their digital platforms and digital wallets.

Given the importance of small businesses to both economic growth and community welfare, Dosis says the company unveiled its ambitious plan to connect 50 million SMEs to the digital tools and insights that will enable them to grow nearly three years ago. Mastercard’s strategy seeks to benefit 25 million female entrepreneurs.

Small businesses are the backbone of communities and the engine of economies, which is why Mastercard is committed to empowering them with what they need to thrive.

“Bringing this commitment to life happens in many ways. Like our Tap on Phone solution, which transforms a phone into an acceptance device,” says Dosis. “Solutions such as pay-on-demand can place an a ordable mobile device into the hands of those who don’t yet have a way to engage in the digital economy, especially relevant in emerging economies. And in more mature

We've partnered with governments across the region, sharing our expertise and technology solutions to help digitise their economies and positively impact the welfare of citizens and residents"

economies of the Gulf, we focus on co-creating solutions that enable greater financial security for people and small businesses.”

Dosis highlights that it is great to see many countries in the region embracing the innovation that is making all sorts of things possible, including wider inclusion. However, he notes that the critical part that holds everything together is trust.

“It’s a key point on any digital transformation agenda and rightly so, because at the end of the day, you simply can’t do business without trust,” says Dosis.

The proliferation of digital payments and e-commerce over the years has led to increased cybersecurity risk exposure as cybercrime and malicious hacking cases have intensified over the past three years.

Dosis notes that cyberthreats and cyberattacks are real and global geopolitical instability elevates these risks. “It’s essential to be prepared,” he says while applauding GCC countries that have strong cybersecurity defences in place such as Saudi Arabia and the UAE – both of which rank high on the Global Cybersecurity Index.

“At Mastercard we are committed to investing in solutions and forming partnerships that instil trust, securing every transaction and every interaction. We are constantly strengthening our capabilities in artificial intelligence and machine learning to fight fraud and enhance real-time intelligence,” says Dosis.

According to recent estimates, the current worldwide cost of cybercrime is $6tn, accounting for 1 per cent of the global GDP and the estimated cost is set to rise by $4.5tn in the next few years. The use cases for artificial intelligence (AI) and machine learning are everywhere, including fraud prevention. It is predicted that AI will be worth $320bn in the Middle East by 2030. Similarly, innovations in biometrics mean one can now pay with a smile or a wave of a hand in several of Mastercard's

markets. Solutions such as Mastercard Cyber Secure, an AI-powered suite of tools, allow banks to assess the cyber risk across their ecosystem and prevent potential breaches. Partnerships also contribute to a more secure future and Mastercard is collaborating with the Dubai Financial Services Authority’s Threat Intelligence Platform to help boost cyber resilience across the Middle East, Africa and South Asia.

For Dosis, data responsibility is a key component of creating a trusted business environment and Mastercard’s philosophy is simple. “When it comes to your data, you own it, you control it, you should benefit from it and we protect it,” he says adding that companies have a responsibility to act for the greater good as creators and guardians of safe digital networks that increase business confidence and drive trust in digital commerce.

Because cyber-breaches are largely motivated by financial gain, businesses are a major target for attacks, putting them at risk of financial loss, reputational damage and more.