P.04 BEYOND THE LOGO: Inside

Dubai’s branded residence boom

P.06

PROPERTY POWERHOUSE:

Cityscape Global returns to Riyadh in November

P.04 BEYOND THE LOGO: Inside

Dubai’s branded residence boom

P.06

PROPERTY POWERHOUSE:

Cityscape Global returns to Riyadh in November

MSHEIREB PROPERTIES' ALI AL KUWARI ON ITS TRANSFORMATIVE APPROACH TO URBAN LIVING IN QATAR

P.14

UAE DEVELOPERS WEIGH IN ON THE NEXT PHASE OF REAL ESTATE

BACK TO THE ROOTS: HOW MSHEIREB’S MODEL IS REIMAGINING URBAN LIVING

CEO Ali Al Kuwari shares the vision behind its transformative approach to community and connections

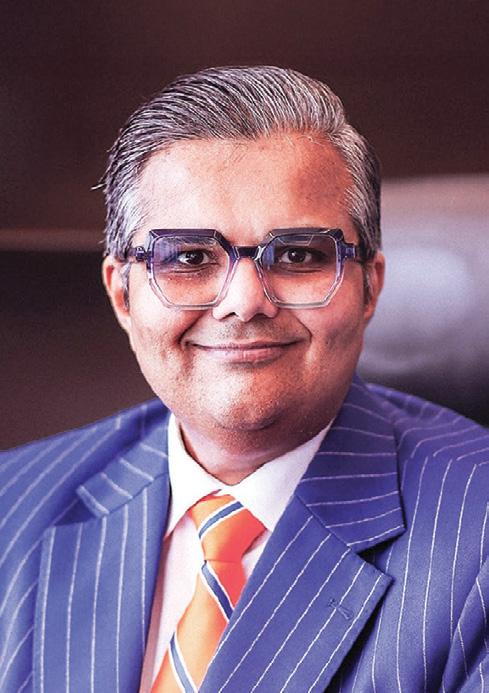

Chairman and CEO Naguib Sawiris shares the story behind Bayn, ORA’s regional vision and global learnings shaping the UAE’s newest waterfront project

HEAD OFFICE: Media One Tower, Dubai Media City, PO Box 2331, Dubai, UAE, Tel: +971 4 427 3000, Fax: +971 4 428 2260, motivate@motivate.ae

DUBAI MEDIA CITY: SD 2-94, 2nd Floor, Building 2, Dubai, UAE, Tel: +971 4 390 3550, Fax: +971 4 390 4845

ABU DHABI: PO Box 43072, UAE, Tel: +971 2 657 3490, Fax: +971 2 677 0124, motivate-adh@motivate.ae

SAUDI ARABIA: Regus Offices No. 455 - 456, 4th Floor, Hamad Tower, King Fahad Road, Al Olaya, Riyadh, Saudi Arabia, Tel: +966 11 834 3595 / +966 11 834 3596, motivate@motivate.ae

LONDON: Acre House, 11/15 William Road, London NW1 3ER, UK, motivateuk@motivate.ae

Follow us on social media: Linkedin: Gulf Business Facebook: GulfBusiness X: @GulfBusiness Instagram: @GulfBusiness

The biggest draw for developers is liquidity — tokenisation unlocks faster access to capital and reduces reliance on institutional buyers. For investors, it offers lower entry points, transparency, and the potential for real-time exits.”

Editor-in-chief Obaid Humaid Al Tayer

Managing partner and group editor Ian Fairservice

Chief commercial officer Anthony Milne anthony@motivate.ae

Publisher Manish Chopra manish.chopra@motivate.ae

Group editor Gareth van Zyl Gareth.Vanzyl@motivate.ae

Editor Neesha Salian neesha.salian@motivate.ae

Deputy editor Rajiv Pillai Rajiv.Pillai@motivate.ae

Reporter Nida Sohail Nida.Sohail@motivate.ae

Senior art director Freddie N Colinares freddie@motivate.ae

General manager – production S Sunil Kumar

Production manager Binu Purandaran

Assistant production manager Venita Pinto

Digital sales director Mario Saaiby mario.saaiby@motivate.ae

Sales manager Hitesh Kumar Hitesh.Kumar@motivate.ae

Cover: Freddie N Colinares

WORDS NIDA SOHAIL

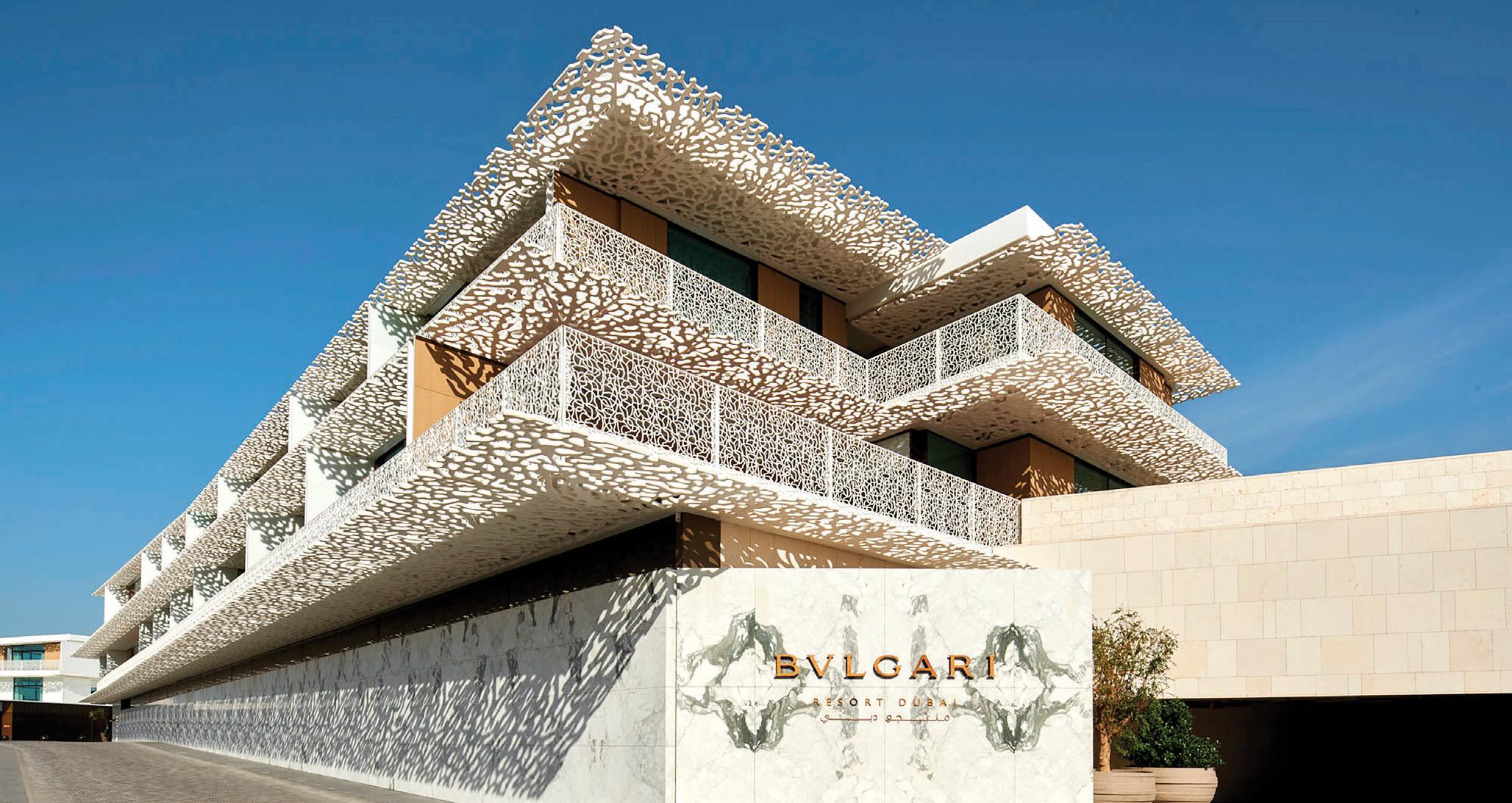

randed residences, luxury homes developed in collaboration with internationally recognised brands, are reshaping the global real estate landscape. Nowhere is this trend more evident than in Dubai, which has emerged as the regional, and arguably global — capital of branded living. The emirate has seen an impressive 160 per cent growth in this sector over the past decade, outpacing global competitors.

BAccording to a new industry report by Betterhomes, Branded Residences: Dubai vs The World, with over 140 branded projects slated for delivery by 2031, Dubai is leading a movement that fuses high-end real estate with global names like Bugatti, Armani, and Six Senses.

Branded residences offer more than just a home, they deliver a lifestyle. Originally tied to luxury hospitality groups such as Four Seasons and Ritz-Carlton, the market has evolved to include a wide array of global brands. Automotive titans like Mercedes-Benz and Bugatti, fashion houses like Armani and Missoni, and hospitality icons such as Cipriani now lend their prestige to real estate projects.

This shift signals a growing appetite for lifestyle-centric living, where buyers not only seek comfort and exclusivity but also

brand identity and curated experiences. Swapnil Pillai, associate director – Research, Savills Middle East, commented: “In a highly competitive residential market, branded residences offer a point of difference. Brands bring design expertise and marketing benefits that help widen the customer base and achieve potential price premiums. Dubai benefits from a healthy mix of projects from global brands along with a sizeable number of projects from domestic players such as Emaar, bringing to the market a range of diverse offerings.”

Globally, the branded residences sector has expanded by 230 per cent over the past decade.

Today, 580 schemes are open and operating, comprising nearly 100,000 units. The

market is forecast to exceed 900 schemes by 2026, almost doubling the current supply. This growth parallels the rise in the number of participating brands, from 69 in 2011 to 133 in 2021.

Dubai’s rise as a global hub for branded residences is no accident. A combination of forward-thinking government policies, investor-friendly regulations, and strategic urban planning has made the city a magnet for high-net-worth individuals (HNWIs). Benefits include 100 per cent foreign ownership, zero income tax, and Golden Visas, all of which enhance Dubai’s global appeal.

“High-net-worth buyers are no longer just looking for property. They’re investing in lifestyle, brand value, and long-term growth. Dubai offers all three, and that’s why it’s outperforming legacy markets like London and Miami,” Christopher Cina, director of Sales at Betterhomes, noted.

Strategic collaborations are central to Dubai’s branded real estate boom. Developers such as Binghatti (Bugatti Residences), Arada (Armani Beach Residences) and Select Group (Six Senses Residences) have partnered with globally recognised luxury brands.

Meanwhile, mega-developers like Emaar, Meraas, and Nakheel have designed entire districts around lifestyle brands, reinforcing Dubai’s leadership in the sector. These partnerships enhance marketability and grant developers access to premium pricing, branding power, and buyer loyalty.

DAMAC Properties, the Middle East’s premier luxury real estate developer, recently unveiled Chelsea Residences by DAMAC at a landmark event hosted at Stamford Bridge, London (in May). This marks the debut of the world’s first Chelsea FC-branded residential project — an innovative lifestyle concept blending the legacies of two globally recognised icons: DAMAC and Chelsea F.C.

Amira Sajwani, MD of Sales & Development at DAMAC, commented: “Chelsea Residences by DAMAC is the epitome of our philosophy to bring global partnerships to life through worldclass design and lifestyle experiences. Our collaboration with Chelsea FC is a first-of-its-kind and offers an unmatched residential opportunity for buyers who value exclusivity and quality. With Dubai’s reputation as a leading global city for luxury real estate, we are confident this project will set new benchmarks for branded residences.”

Dubai continues to stand out as one of the world’s most compelling real estate markets, particularly for British investors. The city

ALSO HIGHLIGHTS DUBAI’S STATUS AS A PREFERRED LIFESTYLE AND INVESTMENT DESTINATION

offers gross rental yields averaging 7 per cent, significantly outperforming comparable global cities such as London and New York. Its investor-friendly environment—including zero property tax, no capital gains tax, and no income tax on rental income — further enhances its appeal. A growing British expatriate community of over 180,000 residents also highlights Dubai’s status as a preferred lifestyle and investment destination, according to a DAMAC group report.

Chelsea Residences by DAMAC has been designed to deliver the ultimate branded living experience. Residents will enjoy a meticulously curated Chelsea FC-inspired lifestyle, featuring exclusive amenities including a rooftop football pitch, Athlete Performance Centre, Chelsea Sports Bar, private cinema, and the vibrant Aquarium Lounge.

Prices start at Dhs2.17m, with one-, two-, and three-bedroom configurations available, making the development especially appealing for London-based investors seeking both lifestyle and capital appreciation.

When benchmarked against international cities like Miami, London, Phuket, and Madrid, Dubai presents a more balanced investment opportunity. For example, while Aston Martin Residences in Miami fetch up to Dhs25,000 per square foot, Dubai’s Bvlgari Residences sell for around Dhs10,500, offering both value and prestige. Meanwhile, Bugatti Residences command a 237 per cent premium, demonstrating that Dubai can rival or even exceed international luxury benchmarks. By contrast, cities like London face high property taxes and complex regulations. Markets such as Spain and Thailand, though exclusive, often lack the liquidity and investor confidence found in Dubai.

WITH $61BN WORTH OF DEALS ANNOUNCED AT ITS LAST EDITION, CITYSCAPE GLOBAL RETURNS TO RIYADH FROM 17–20 NOVEMBER 2025. THE EVENT WILL UNITE GLOBAL LEADERS, INNOVATORS, AND INVESTORS UNDER THE KINGDOM’S VISION 2030 AGENDA

WORDS GARETH VAN ZYL

Cityscape Global 2025 will take place from 17 to 20 November 2025 at the Riyadh Exhibition & Convention Centre in Malham, Riyadh, Saudi Arabia. It will once again bring the world’s most influential names in real estate together, offering unparalleled opportunities for industry professionals to connect, learn, and expand their business horizons. Against a backdrop of evolving regulations, rising sustainability mandates, and giga projects rapidly moving from vision to reality, the event promises insights and partnerships that matter most.

The 2025 edition will give attendees direct access to decision-makers shaping the future of real estate. It will also offer a platform to reconnect with peers, explore high-growth markets, and stay close to the projects defining the sector’s trajectory.

Cityscape Global 2025 is sponsored by the Ministry of Municipalities and Housing and organised in partnership with the Real Estate General Authority (REGA), Vision 2030, and the Housing Program. The event is organised by Tahaluf, an Informa company.

While free passes are still available, Cityscape Global is introducing new Advantage and Elite paid passes this year, designed to enhance the visitor experience with exclusive access, premium networking opportunities, and curated business engagements.

These premium packages provide a series of upgrades to ensure attendees can make the most of their time at the event. Elite Pass holders will enjoy early venue access, premium parking with

shuttle services, and fast-track entry. They will also benefit from entry to invitation-only networking events, access to exclusive business lounges, and an invitation to the official Opening Ceremony. Additionally, they will have entry to premium zones across the venue and access to facilities designed for comfort during long business days.

The Advantage Pass includes many of these perks, offering attendees seamless access to the venue and enhanced networking opportunities.

With only a limited number of premium passes available, the organisers are encouraging early registration to secure these benefits.

This year’s programme features a diverse group of high-profile speakers drawn from government, urban planning, asset management, and architecture.

NOTABLE CONFIRMED NAMES INCLUDE: SALLY CAPP – Former Mayor of Melbourne, speaking at the Future of Living Summit.

ANIL ERDEM – Managing Director, Asset Management at Bentall GreenOak, also at the Future of Living Summit.

RUTH DUSTON OBE – Founder and CEO of Primera Corporation, appearing on the DnA – Developers & Architects Stage.

GORDON ADAMS – Former Head of Planning at the Battersea Power Station Development Company, on the DnA – Developers & Architects Stage.

H.E. MARGARETE SCHRAMBOECK – Former Austrian Minister of Economy and Digital Affairs, featured on the ESTAAD – Stadi ums & Entertainment stage.

MITCHELL SILVER – Former New York City Parks Commissioner, also speaking on the ESTAAD – Stadiums & Entertainment stage.

This combination of global and regional expertise ensures that the event will offer rich perspectives on how real estate, urban design, and infrastructure projects are evolving to meet the demands of the future.

Cityscape Global 2025 will also feature an extensive exhibitor list, bringing together visionary developers and industry‑defin ing innovators. Attendees will have the chance to position their businesses alongside the most influential names in the sector and to connect directly with potential partners, clients, and investors.

Exhibitors will showcase developments, technologies, and ser vices that are shaping the next era of real estate. The exhibition floor will provide a global platform for high‑value opportunities, enabling companies to reach audiences that span multiple mar kets and sectors.

Cityscape Global has long been recognised as a hub for strate gic discussions and cross‑border collaboration in real estate. In 2025, the event’s agenda will address the challenges and oppor tunities presented by an evolving market, including sustainability requirements, smart city technologies, and the integration of new building standards.

$61BN IN REAL ESTATE INVESTMENTS ANNOUNCED

560+ SPEAKERS

444 EXHIBITORS

172,000 ATTENDEES ACROSS FOUR DAYS

Attendees will gain first‑hand exposure to projects at various stages of development — from concept through to delivery — across residential, commercial, mixed‑use, and mega‑scale developments.

The event’s curated networking oppor tunities are designed to foster meaningful connections that can translate into tangible business outcomes. Whether it is through the dedicated business lounges, targeted networking sessions, or informal meetings, Cityscape Global provides the environment for productive engagement.

For industry leaders, policymakers, and innovators, Cityscape Global offers a rare opportunity to meet face‑to‑face with peers and potential collaborators from across the globe. Whether seeking insight into market trends, scouting for investment opportu nities, or exploring strategic partnerships, attendees will find the tools and connections needed to drive their projects forward.

With giga projects continuing to trans form skylines and urban landscapes, Cityscape Global remains a key fixture for anyone involved in real estate devel opment, investment, and planning.

Registration for Cityscape Global 2025 is now open. Free passes are available, but those seeking a premium experience are encour aged to secure Advantage or Elite passes early to ensure access to the full range of benefits.

For more information on the speaker line‑up, exhibitor list, pass options, and venue logistics, visit the event’s official website. Learn more: www.cityscapeglobal.com

IN AN ERA OF MEGAPROJECTS AND TOWERING SKYLINES, QATAR’S MSHEIREB PROPERTIES OFFERS A DISTINCT AND MORE ROOTED ALTERNATIVE, BLENDING TRADITION, SUSTAINABILITY AND INTELLIGENT URBANISM. CEO ALI AL KUWARI SHARES THE VISION BEHIND THIS TRANSFORMATIVE APPROACH TO COMMUNITY AND CONNECTIONS

In a region where architectural ambition is often equated with scale and spectacle, Msheireb Downtown Doha stands as a bold counterpoint: a 31-hectare urban regeneration development grounded in heritage, sustainability and human-centric urbanism.

Msheireb, historically the heart of old Doha, was once a thriving residential and commercial district. Its transformation today pays tribute to this legacy while shaping the future of urban life in Qatar.

Developed by Msheireb Properties, which is backed by Qatar Foundation and Qatar Investment Authority (QIA), the project reflects a national vision for sustainable, culturally rooted urban development.

“This project was never about building the biggest or boldest,” says Ali Al Kuwari, CEO of Msheireb Properties. “It was about building something timeless – something that brings people back to the soul of urban living.”

“The guiding principles for the project,” he adds, “are driven by heritage and culture, innovation, environment, smart city technology, sustainability, mobility and wellbeing.”

At its core is a deep respect for how Qatari communities traditionally lived: close-knit social structures, walkable streets, and human-scale architecture that promotes connection. “From day one, we wanted to bring people back to their roots and rediscover community and togetherness,” Al Kuwari explains.

Pics: Supplied

This ambition was realised after a rigorous three-year collaboration with global academics and urban planners. “We developed a new definition of architectural language that reflects Qatar’s cultural history,” he emphasises.

Among the most distinctive features of Msheireb Downtown Doha is the use of courtyard-style housing – a nod to the traditional Qatari townhouse format. Residential homes are clustered around central courtyards that offer privacy while fostering community.

Barahat Msheireb, the main public square located between the M7 cultural hub and the Mandarin Oriental, extends this approach to the community scale. It takes inspiration from the traditional majlis to create a space for gathering, commerce and exchange.

“We were keen to innovate a distinguished architectural methodology that embodies the depth of Qatar’s cultural heritage,” he adds.

This project was never about building the biggest or boldest. It was about building something timeless — something that brings people back to the soul of urban living.”

One of the biggest challenges, Al Kuwari reminisces, was selecting which elements of Qatar’s rich architectural past should be retained. “We had an abundance of inspiration. The difficulty was in choosing which to feature to strike the right balance between past and present.”

The result: a refined architectural narrative that is not just visually appealing but also socially and culturally coherent.

In fact, Msheireb’s blend of modernity and tradition is now considered as a benchmark for the wider region.

SUSTAINABILITY FROM THE GROUND UP

However, Msheireb Downtown Doha isn’t just about aesthetics. it’s a smart city grounded in sustainable heritage urban design, with all its buildings either Gold or Platinum LEED-certified.

The developer has received numerous prestigious awards, including two Asia Property Awards 2025 for ‘Sustainable Development of the Year’ and ‘Excellence in Smart City Planning’, cementing its prestigious position in human-centered urban development. Msheireb Properties also recently signed a strategic partnership with Cundall, the global consultancy, to decarbonise its entire real estate portfolio in the district. This initiative is the first of its kind at this scale in Qatar for urban regeneration and represents a significant step toward reducing the carbon footprint of one of the country’s most prominent urban developments.

“Sustainability has been the core principle for the city, built from the inside out,” says Al Kuwari. “We’ve ensured the deployment of the latest available technologies and adopted design methodologies that encourage sustainable practices and enhance quality of life.

“Our achievement of the GOLD Smartscore certification for three of our commercial buildings demonstrates our unwavering commitment to innovation, sustainability, and technological integration, where we are the first to achieve this accomplishment in Qatar.”

In the district, buildings are positioned to shade one another, materials are light in colour to reduce solar heat absorption, and facades include heat-isolating glass and thicker walls to reduce energy consumption. It also boasts more than 6,400 rooftop solar panels for energy generation and another 1,400 for hot water.

Water systems also maximise reuse. Rainwater and air conditioning condensation are collected, stored, and reused for irrigation and toilet flushing.

“We built this place to be resilient,” Al Kuwari adds, “and these systems prove that smart design can reduce operational costs while enhancing comfort.”

While sustainability defines the district’s physical form, digital integration powers its daily function.

Msheireb Downtown Doha has established a new standard for innovation in line with Qatar’s vision toward a smart and sustainable future, reaffirming this year its position as the world’s first fully smart and sustainable urban district.

The district’s smart infrastructure features a wide network of over 430 kilometres of fiber optic cables, ensuring high-speed internet. Residents and visitors can access Wi-Fi from more than 5,000 points dispersed across the downtown area.

Additionally, over 650,000 IoT devices monitor and control the smart city community, smart buildings and smart homes. A centralised command and control room, armed with approximately 10,000 surveillance cameras, oversees the district’s safety. The district also has 8,000 smart metres for utility monitoring, and a Tier-2 data centre, guaranteeing data security.

With this robust digital backbone in place, Msheireb Downtown Doha has emerged as a fully operational district that not only houses residents and cultural venues but also continues to attract global businesses and institutions at scale.

MSHEIREB DOWNTOWN DOHA IS BASED ON A COMPREHENSIVE VISION THAT DRAWS ITS PILLARS FROM: HERITAGE AND CULTURE

INNOVATION AND CREATIVITY

ENVIRONMENTAL PROTECTION AND SUSTAINABILITY

SMART CITY TECHNOLOGIES

ADVANCED TECHNOLOGICAL INTEGRATION

SUSTAINABLE MOBILITY

QUALITY OF LIFE AND WELLBEING

“We’re seeing phenomenal growth in new tenants shifting their operations into the district,” shares Al Kuwari.

Global firms such as Google Cloud, Microsoft, Total, and Siemens have all moved in, drawn by the district’s liveable, walkable infrastructure and environmentally responsible planning.

In September, the relocation of Media City Qatar’s headquarters to Msheireb Downtown Doha marked an important milestone in the city’s journey as a centre for creative industries and technological development. October witnessed the Government Communication Office relocating its headquarters to Msheireb Downtown Doha, further enhancing the city’s position as a central hub for media and communications in Qatar.

DOHA BY THE NUMBERS

Simultaneously, Msheireb Downtown Doha welcomed the first regional TikTok studio and a Snapchat office, marking a pivotal milestone in its transformation into a global digital hub. In December, the International Media Office relocated to Msheireb Downtown Doha as the first government media entity to conduct operations from the city.

“We’ve created a neighbourhood where everything is connected – homes, workplaces, and public spaces – all within walking distance,” says Al Kuwari.

There’s the Msheireb Tram, for instance, a free tram system for convenient mobility, connecting different areas within Msheireb Downtown Doha. This system includes a 2-kilometre closed circular track. The district, which has four EV charging stations, also holds the Guinness World Record for the largest underground car park, featuring an impressive 10,017 spaces.

But beyond infrastructure and corporate momentum, what truly sets Msheireb apart is its cultural heartbeat

At the centre of the district’s identity is a deep commitment to preserving and amplifying Qatar’s rich heritage.

The Msheireb Museums, set within four meticulously restored heritage houses, trace the arc of Qatar’s social, political, and economic journey — from the transformative discovery of oil to the often-overlooked legacy of slavery.

“They offer powerful, interactive storytelling,” says Al Kuwari. “And help people gain a deeper understanding of Qatar’s cultural history.”

The efforts to renovate these four heritage houses and transform them into Msheireb Museums have garnered the prestigious “Green Apple” award for beautiful buildings, in recognition of the urban renaissance led by Msheireb Downtown Doha in heritage preservation.

Msheireb Museums have established important partnerships with various ministries and institutions, cementing their position as a vibrant space that stimulates dialogue and drives positive

31-hectare smart city development

6,400+ rooftop solar panels for energy

1,400+ solar panels for hot water

4M+ visitors during FIFA World Cup Qatar 2022

15M+ visitors in 2024

social change, transcending the role of traditional museums and exhibitions.

Far from being static exhibitions, the museums are designed to provoke dialogue, reflection, and connection with the nation’s past. Meanwhile, the Doha Design District gives local and regional designers a global platform. M7, Qatar’s epicentre for innovation and entrepreneurship in fashion, design, and technology, supports emerging Qatari creatives in scaling their ventures. “It’s about cultivating what comes next,” says Al Kuwari.

What sets Msheireb apart is not just this convergence of culture and commerce, but how deliberately it was planned. “Before a single building went up, we spent years thinking about how people want to live,” he adds. “That careful planning is why it works so well today.”

That same long-term thinking is now reflected across Qatar’s broader property

landscape. Qatar’s real estate market is undergoing a post-World Cup transformation.

With the global spotlight still lingering, momentum is shifting towards long-term strategic goals – economic diversification, regulatory reforms, and sustainable urbanisation.

According to Knight Frank’s Qatar Real Estate Market Review –Winter 2024/25, Msheireb Downtown Doha is now one of Doha’s strongest performing office submarkets, alongside West Bay. The report notes sustained demand from government entities and corporates, with modern infrastructure and sustainability credentials helping maintain stable rental values.

Foreign investment is also on the rise. Invest Qatar now ranks real estate as the country’s second most attractive sector for FDI, bolstered by legislative updates that simplify ownership and residency rights and digital tools that streamline property transactions.

“Qatar’s real estate development sector is witnessing accelerated growth,” Al Kuwari notes. “We’re seeing greater emphasis on smart cities, mixed-use communities, and sustainable design – and Msheireb is right at the forefront of these trends.”

But Al Kuwari is clear that the real legacy lies ahead. “Our focus over the next five years is to enrich our cultural offerings, expand our educational programmes, and strengthen our engagement with the local community.”

Currently, Msheireb Downtown Doha is experiencing significant demand for its commercial and residential spaces. Commercial occupancy rates exceed 94 per cent of total spaces, while residential occupancy rates exceed 80 per cent of total capacity, affirming the city’s leadership as a distinguished environment for work and living. These achievements have received international acclaim, with Msheireb Properties being named as one of the most

“WHOEVER IGNORES THE CULTURAL, SOCIAL, AND ENVIRONMENTAL DIMENSIONS IN THEIR VISION HAS MISSED THE TRAIN OF THE FUTURE.”

We were keen to innovate a distinguished architectural methodology that embodies the depth of Qatar’s cultural heritage.”

innovative companies in architecture and design by a leading regional publication.

Meeting these evolving expectations requires more than architectural prowess – it takes institutional commitment. “We collaborate with partners across Qatar Foundation and QIA to achieve these goals,” Al Kuwari says.

The project’s official launch, timed just before the FIFA World Cup Qatar 2022, helped establish it as one of the nation’s premier cultural and touristic districts.

In addition to welcoming more than four million visitors during the FIFA World Cup, Msheireb Downtown Doha received over 15 million visitors last year alone, solidifying its role as one of Qatar’s most visited cultural and commercial districts.

But Al Kuwari is clear that the real legacy lies ahead. “Our focus over the next five years is to enrich our cultural offerings, expand our educational programmes, and strengthen our engagement with the local community.”

By continuing to evolve and adapt, he believes Msheireb can serve as a long-term model for what urban life in the Gulf – and the wider world – can look like.

With regional urbanism at a crossroads, Msheireb Properties’ example is timely. Many cities in the Gulf are now asking urgent questions: How do we build for the future without erasing the past? How do we scale without disconnecting from community?

Msheireb Downtown Doha offers answers. It’s not a vanity project, nor a branding exercise. It’s a living, breathing demonstration of how design, technology, and tradition can co-exist – and in doing so, create value far beyond the balance sheet.

“The world is watching, and expectations are higher than ever,” Al Kuwari concludes. “Whoever ignores the cultural, social, and environmental dimensions in their vision has missed the train of the future.”

Real estate tokenisation is no longer a concept of the future — it’s a fast-unfolding reality, and Dubai is at the forefront. As the emirate pilots regulated models and integrates

blockchain infrastructure into government systems, tokenisation is reshaping ownership, access, and investment. From luxury properties on Palm Jumeirah to institutional-grade smart contracts, this evolution

is creating a more accessible, liquid and tech-enabled marketplace. Below, key voices shaping the property landscape share their perspectives on how tokenisation is transforming the industry.

Tokenisation has the potential to democratise real estate by enabling fractional ownership, making high-value assets accessible to a broader base of investors. It directly addresses two longstanding barriers in the sector: liquidity and transparency.

With the global tokenised real estate market valued at $3.5bn in 2024 and forecasted to reach $19.4bn by 2033, the shift is already well underway. The UAE is taking clear strides in this direction, with active pilots from the Dubai Land Department, the Virtual Assets Regulatory Authority, and the Central Bank. For adoption to accelerate, we need clearer legal frameworks around smart contracts, greater system interoperability, and robust investor education. Hospitality assets and branded residences are proving the most popular for tokenised and fractional ownership, largely thanks to their dependable income potential and strong brand equity.

We are also seeing increased interest in luxury residential units, driven by their asset appreciation and global demand. For developers, tokenisation unlocks new capital channels,

accelerates presales, and improves liquidity. For investors, the appeal lies in lower entry points, diversification, and the ability to trade shares — benefits that traditional real estate often lacks. In Dubai alone, tokenised real estate transactions reached $399m in H1 2025.

We’re piloting smart contracts for escrow handling, rental flows, and milestone-based payments. The primary challenge remains legal enforceability under UAE civil law, which currently views smart contracts as auxiliary agreements. Developers and proptech firms are increasingly collaborating to build tokenised platforms, with joint ventures forming and platforms like Prypco Mint, powered by the XRP Ledger, being integrated into government registries. The biggest misconception is that tokenisation is equivalent to high-risk cryptocurrency trading, when in fact it offers a secure, compliant means of digitising real-world assets. The Gulf, particularly the UAE and Bahrain, is leading this evolution and Dubai’s tokenised real estate market alone could reach $16bn by 2033.

ZEESHAAN SHAH Chairman, One Group and founder of ELEVATE

We’ve seen tokenised real estate gain serious traction across the UK and Europe, driven by a broader wave of innovation powered by AI, blockchain, and advanced proptech platforms. The UAE, with its investor-friendly climate, tech-forward mindset, and appetite for disruption, is a ripe market to take this on. But for tokenisation to move from hype to tangible impact, what’s crucial is the creation of a robust, integrated ecosystem — legal, digital, and financial. Dubai, in particular, has the infrastructure and ambition to not just adopt these technologies, but to lead the region — and possibly the world — in setting the benchmark.

VEER DOSHI MD and CEO, Vincitore Real Estate Development

Over the next decade, tokenisation will unlock unprecedented access, liquidity, and global reach — just as Dubai has pioneered through the DLD–VARA pilot and REES sandbox in 2025. It will energise secondary markets, streamline off-plan financing, and elevate fractional investing from novelty to mainstream— helping Dubai secure a projected $16bn tokenised market by 2033. As a forwardlooking developer, we’re evaluating how these innovations can integrate with our vision of redefining luxury living through architecture, technology, wellness, and financial accessibility.

FOR DEVELOPERS, TOKENISATION PROVIDES ACCESS TO GLOBAL CAPITAL WHILE PRESERVING BRAND EQUITY.”

The UAE is uniquely positioned to lead the global shift to tokenised real estate— especially in the luxury segment, where innovation and trust are critical. But for tokenisation to become mainstream, three pillars must align: regulatory clarity, investor readiness, and seamless tech-legal integration. When smart contracts operate within a trusted framework, tokenised ownership won’t just be possible — it will be inevitable.

For developers, tokenisation provides access to global capital while preserving brand equity. For investors, it offers flexible entry, transparency, and liquidity, redefining real estate as an agile, intelligent asset class aligned with Dubai’s future.

Developer–proptech collaboration is shifting from experimentation to execution. Together, they’re building asset-backed ecosystems merging compliance, liquidity, and user experience.

A common misconception is that tokenisation guarantees fast capital and instant liquidity. But the reality is that it demands greater transparency, legal structure, and discipline.

Dubai isn’t waiting for global frameworks, it’s setting them. With initiatives like VARA’s Rulebook 2.0 and DLD’s regulatory sandbox, the Gulf is fast becoming the global benchmark for tokenised real estate.

IMRAN KHAN

Founder and CEO, PIXL Global | Invespy

In the UAE, we’re building the rails for a smarter property market, and tokenisation is a cornerstone. But proptech isn’t just about the tech — it’s about trust. While the success of the latest initiative by DLD, which sold out in under two minutes, is a powerful signal of what’s possible. Standardisation, cybersecurity, and user experience will be key in driving adoption. This is the future of UAE real estate, and there’s no better place than Dubai to lead it — the city has always had a remarkable ability to embrace and scale gamechanging innovations.

Founder, Pantheon Development

Tokenisation is a seismic shift in the luxury real estate landscape. Over the next five to ten years, this technology will lower investment barriers and enable fractional ownership of high-value assets. By leveraging blockchain’s security and transparency, tokenisation will democratise access to premium properties, attract new classes of investors, and create a more liquid, globally connected market.

We are confident that tokenisation will become mainstream in the UAE, thanks to the region’s forward-thinking regulatory initiatives and robust appetite for technological innovation. Our advanced R&D investments affirm our commitment to supporting and shaping this evolution into a secure, scalable investment ecosystem.

Today, Dubai has become a hotbed for fractional ownership of high-end properties. The Dubai Land Department, in partnership with the Virtual Assets Regulatory Authority and Dubai Future Foundation, launched a regulated

SHABANA FAROOQ

Managing partner and COO, URBAN Properties

Innovation has always been at the heart of the real estate industry, from how we list and market properties to how we close deals and build client relationships. Tokenisation is the next evolution in that journey. We’re constantly seeking smarter, faster, and more transparent ways to connect buyers with the right opportunities — and this technology allows us to do just that. It opens the door to a wider investor pool, fractional ownership models, and quicker transactions. Ultimately, it’s about making real estate more accessible and engaging for today’s digital-first customer. It won’t replace the human element, but it will definitely enhance how we sell, communicate, and deliver value.

tokenisation pilot this year — opening access to premium properties in areas like Palm Jumeirah, Downtown, and Emirates Hills.

According to a 2025 report by Dubai’s Department of Economy and Tourism, tokenised residential assets are forecast to represent Dhs60bn in transactions by 2033, accounting for approximately 7 per cent of the emirate’s real estate market. This growth is being driven by both local and foreign retail investors entering with as little as Dhs 500, gaining exposure to assets previously reserved for the ultra-wealthy.

Commercial and mixed-use properties are also steadily gaining traction in the tokenisation ecosystem. Office buildings, retail strips, and multi-purpose developments are being fractionalised primarily for their predictable rental yields and long-term tenant contracts. Developers are leveraging tokenisation not only as a sales tool, but also as a financing mechanism — avoiding traditional debt structures.

Co-founder of RRS International Development and partner at RRS Capital ManagementProperties

With Dubai leading as the first emirate to regulate real estate tokenisation, we’re entering a new era of property investment. It offers a more accessible, hassle-free way to own and manage real estate — perfect for Gen Z, Gen Alpha and all those who prefer digital, blockchain-enabled solutions. Investors can start from just Dhs2,000 (approx. $545) and still proudly hold real estate while diversifying across other asset classes.

While the concept is still new and comes with a learning curve, the benefits for both sides— greater transparency, global liquidity, and ease of ownership — make it an exciting and strong option, even for cautious investors and those who are traditionally risk averse. As this ecosystem grows we will educate ourselves to invest better.

CAPTAIN PRADEEP SINGH Founder, Karma Developers

AHMED CEO, SmartCrowd

okenisation will democratise real estate by enabling fractional ownership, increasing liquidity, and opening access to global investors. Given the right regulatory framework, we can expect it to evolve from a niche innovation to a mainstream investment vehicle — much like how REITs reshaped real estate decades ago. The UAE is already laying the groundwork, from the Dubai Land Department’s pilot tokenisation project to VARA’s regulatory frameworks. For tokenisation to scale, continued enhancements in regulatory clarity will further accelerate adoption, along with robust secondary markets and greater education among traditional stakeholders. So far, high-value residential and hospitality assets are leading the charge. There’s growing interest in branded residences and lifestyle-led developments for tokenisation, particularly among younger, tech-savvy investors. However, as tokenisation becomes more mainstream than novelty, efficiencies would result in assets with good rental returns having higher trading volumes.

For developers, tokenisation unlocks faster access to capital and broadens the investor base. For investors, it offers lower entry points, enhanced liquidity, and real-time transparency. We are still in the process of evaluating and understanding the advantages and challenges of smart contracts. Globally, one of the key challenges remains the lack of universal legal recognition — many jurisdictions don’t treat them as fully enforceable contracts. Traditional agreements benefit from established legal frameworks, while smart contracts rely solely on code, which can be prone to errors with significant consequences. That said, smart contracts in Dubai’s real estate sector offer significant potential for automation, transparency, and cost efficiency. However, as mentioned, adoption is in early stages and largely concentrated in tech-forward projects.

Widespread implementation will depend on regulatory updates, increased stakeholder awareness, and seamless integration with DLD and other official platforms. The Gulf — and Dubai in particular — is leading the region in embracing tokenisation. Initiatives like the DLD’s Real Estate Evolution Space and VARA’s licensing regime show a clear commitment to innovation with oversight.

In the next five to 10 years, real estate will exist as onchain tokens backed by income-generating assets — programmable, tradable, and transparent. At SmartCrowd, we laid the foundation for this transformation through fractional ownership. Tokenisation builds on that, embedding real estate into blockchain to create digital assets that can be traded in real time, with smart contracts automating governance, compliance, and distribution. Unlike traditional platforms, settlement can now happen in minutes, not months. Dubai is no longer experimenting—it’s implementing. With the Dubai Land Department issuing Tokenisation Certificates and VARA regulating virtual assets, the infrastructure is validated and government-backed. This is not just a tech innovation; it’s an institutional-grade investment channel.

Tokenisation will go mainstream not because it’s trendy, but because it’s better, merging the transparency of blockchain, the flexibility of fintech, and the legal robustness of traditional real estate. That said, education is key. Many still confuse tokenised real estate with crypto speculation. In reality, it’s underpinned by tangible, income-producing assets with regulatory oversight. The idea that it’s unregulated or untested couldn’t be further from the truth — platforms like ours have proven the model works.

Secondary residential properties are currently the most viable asset class due to title clarity, income track record, and regulatory ease. The biggest draw for developers is liquidity — tokenisation unlocks faster access to capital and reduces reliance on institutional buyers. For investors, it offers lower entry points, transparency, and the potential for real-time exits.

What’s needed next is deeper integration with mainstream finance apps, broader institutional participation, and continued regulatory collaboration. The UAE is setting the global playbook for tokenised real estate, and we’re proud to help drive that change from the ground up.

TOKENISATION WILL GO MAINSTREAM NOT BECAUSE IT’S TRENDY, BUT BECAUSE IT’S BETTER.”

As the UAE cements its position as a global innovator in tokenised real estate, the road ahead lies in scaling adoption through education, regulation, and trust. With the right framework, what began as a tech-forward experiment could soon redefine the core of property ownership, investment, and access — not just in Dubai, but worldwide.

ORA DEVELOPERS’ CHAIRMAN AND CEO NAGUIB SAWIRIS SHARES THE STORY BEHIND BAYN, ORA’S REGIONAL VISION AND HOW GLOBAL LEARNINGS ARE SHAPING THE UAE’S NEWEST WATERFRONT PROJECT

ORA Developers has established its new UAE headquarters at One Central in Dubai’s central business district, reinforcing its commitment to regional growth under the leadership of chairman and CEO Naguib Sawiris.

&

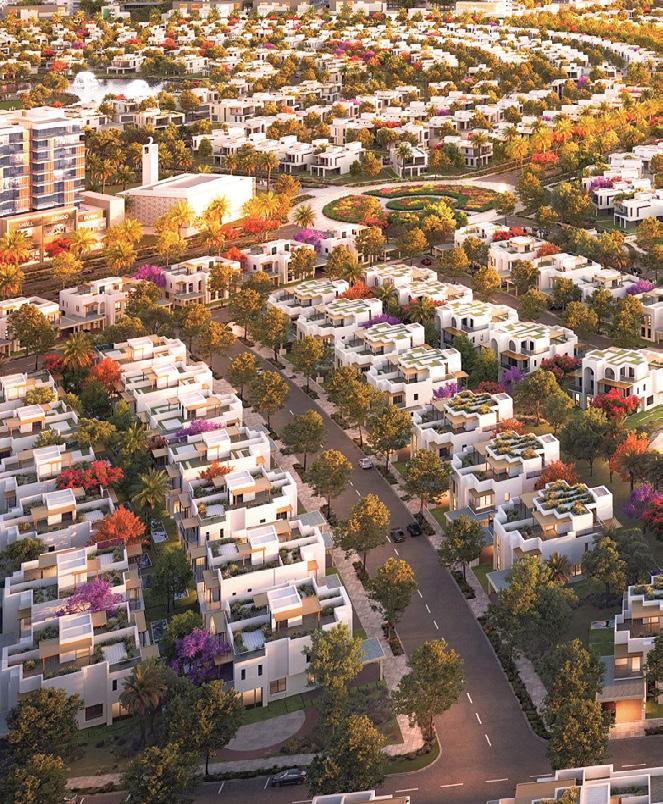

The announcement coincides with the developer’s UAE debut project: Bayn, a 4.8 million sqm beachfront master-planned community in Ghantoot. Featuring 1.2km of natural Arabian Gulf coastline, more than 55 per cent open space, and a 15-minute city philosophy, Bayn aims to redefine coastal living between Dubai and Abu Dhabi.

The developer has also made key appointments and plans to triple its UAE workforce by end-2025, leveraging its international expertise across Egypt, Cyprus, Greece, Pakistan, and the Caribbean to shape Bayn into a world-class lifestyle destination.

In this interview, Naguib Sawiris shares the story behind Bayn, ORA’s regional vision, and how global learnings are shaping the UAE’s newest waterfront project.

Bayn marks ORA Developers’ debut in the UAE. Why did you choose Ghantoot as the location for such a large-scale master-planned community, and what sets Bayn apart from other coastal developments in the region?

Bayn marks ORA Developers’ debut in the UAE, and Ghantoot stood out to us because it offers something increasingly rare: true natural beachfront, direct access to both Dubai and Abu Dhabi, and the ability to shape a destination from the ground up with longterm vision. Strategically located between the UAE’s two hubs, Bayn

sits just 30 minutes from Dubai and 45 minutes from Abu Dhabi and is near the upcoming Al Maktoum International Airport. This location gives it unique access to two major markets, future growth corridors, and tourism hubs like Yas Island and Palm Jebel Ali. But location alone doesn’t define Bayn. Its 1.2km stretch of natural Arabian Gulf beachfront is a rare asset in a region where most coastal developments rely on reclaimed land.

Bayn is built around a 15-minute city philosophy, where daily needs, nature, and leisure are all within easy reach. Over 55 per cent of the masterplan is dedicated to open space, creating room for movement, connection, and wellbeing. We’ve also embedded green infrastructure into every layer of the project. Bayn is built to support clean energy, water-smart systems, and walkable mobility.

Bayn is poised as an ideal first home beach community offering space, privacy, and a deeper sense of connection. From a 108,000 sqm sports club to an integrated beach town and marina, every

NAGUIB SAWIRIS CHAIRMAN AND CEO, ORA DEVELOPERS

detail is crafted to provide a holistic lifestyle. In essence, Bayn redefines what a coastal or beach community can be. It’s where city life meets beach living without compromise.

The first phase of Bayn includes 464 villas and townhouses, with handover expected in 2028. Can you share more about your long-term vision for the development and how you see it evolving over the next decade?

The first phase of Bayn, comprising 464 villas and townhouses across two gated clusters, is just the beginning of a much larger journey. The first phase sets the tone. So, we focus on creating a complete environment, not merely the building. That means prioritising key anchors like education, community spaces, hospitality, greenery alongside the first residential offerings. When people arrive, they need to feel like life can begin immediately.

That early momentum builds trust with buyers, supports value appreciation, and gives the whole development long-term stability. We don’t just launch with floorplans, we launch with a vision that people can experience from the start.

Our long-term vision is to transform Bayn into one of the UAE’s most comprehensive and future-ready beach communities, one that evolves organically while staying rooted in liveability and design excellence. What sets this vision apart is our commitment to building a fully self-sustained destination, not a development that ends at the doorstep, but a lifestyle ecosystem that supports work, leisure, family, and wellbeing within a walkable, human-centric layout.

More than 55 per cent of Bayn’s land is dedicated to open space. How does this reflect ORA’s design philosophy, and what role do sustainability and wellness play in shaping the community experience?

Dedicating over 55 per cent of Bayn’s land to open space is a direct reflection of ORA’s design philosophy: build around people, not just property. For us, open space is not a luxury, it is fundamental to quality of life our residents will enjoy. We believe that true value in real estate comes from how a place makes people feel, move, and connect not just from square footage.

At Bayn, this means expansive parks, waterfront promenades, landscaped walkways, and wellness zones are not afterthoughts, they are central to the masterplan. It’s about enabling a lifestyle where movement and nature are integrated into daily life. The

entire community follows a 15-minute city model, ensuring that every essential, whether it’s a school, a retail hub, or a fitness trail is accessible by foot or bike.

Sustainability measures are embedded at every level. Native greenery supports biodiversity and minimises water use. Building orientation and design maximise natural light and ventilation, reducing cooling demands. Solar-powered energy systems and smart water infrastructure ensure longterm environmental performance.

Wellness, too, is approached holistically. From a 108,000 sqm sports club to car-free zones and active mobility trails, Bayn encourages balance, movement, and mental clarity. In contrast to developments that maximise buildable land at the expense of livability.

ORA Developers has an expanding international footprint, with projects across Egypt, Pakistan, Cyprus, and now the UAE. How does your experience in diverse markets influence your approach to real estate development, and what lessons are you applying to the UAE market?

ORA Developers’ international portfolio spans Egypt, Pakistan, Cyprus, Grenada, Greece, Iraq, and now the UAE — covering over 76 million square meters and owns a portfolio of real estate products worth over $45bn. With a rapidly expanding global portfolio and a reputation built on design excellence and delivery, ORA’s vision is to develop spaces that transcend architecture, delivering lifestyle destinations that are timeless, soulful, and rooted in harmony. With the UAE as its next frontier, ORA offers a promise: to deliver elevated living, grounded in purpose and made to last.

What sets ORA apart is its ability to craft integrated destinations that blend residential, commercial, and hospitality elements into cohesive lifestyle

BAYN SITS JUST 30 MINS FROM DUBAI AND 45 MINS FROM ABU DHABI AND NEAR THE UPCOMING AL MAKTOUM INTERNATIONAL AIRPORT

ecosystems. The group’s hospitality assets include Silversands Grand Anse & Silversands Beach House in Grenada, the Caribbean, an upcoming five-star hotel in Mykonos, in addition to other pipeline under development hospitality projects.

ORA redefines luxury through sensorial, masterfully designed spaces that embody both elegance and emotional value. Through strategic partnerships with governments, global designers, consultants, and premium brands, ORA ensures excellence from blueprint to build. Flagship projects such as ZED and Silversands in Egypt, Ayia Napa Marina in Cyprus, and Eighteen in Pakistan demonstrate the company’s ability to adapt and deliver transformative developments across geographies.

Our strength lies in our ability to tailor globally successful models to fit local needs.

Beyond real estate, you’ve been a prominent investor in telecoms, gold and media. How does Bayn — and your broader investment in v lifestyle developments — align with your personal investment philosophy and your view of regional economic trends? My investment philosophy is deeply rooted in a commitment to creating spaces that genuinely elevate the quality of life. I believe in identifying untapped potential in locations others may overlook, and in enhancing the natural character of the land rather than altering it. Beyond mere structures, we aim to build thriving communities that offer enriching experiences and foster a strong sense of belonging.

As for the economic landscape of the Middle East, particularly here in the UAE, it presents a compelling opportunity for well-conceived lifestyle developments. The region’s increasing affluence, coupled with ambitious government initiatives focused on enhancing city living and attracting global talent, fuels a significant demand for sophisticated residential offerings. People are seeking environments that not only meet their practical needs but also resonate with their aspirations for a high standard of living.

Our investments in this sector are a direct response to this evolving market, aiming to contribute to the region’s growth by creating landmark destinations that set new benchmarks for quality and design. My vision extends beyond mere financial returns. We are driven by the desire to leave a positive and enduring impact on the communities we create, building a legacy

of innovation and excellence that will be associated with our name for generations to come.

As a well-known advocate for private sector leadership in economic development, what role do you believe developments like Bayn can play in contributing to the UAE’s broader economic diversification and Vision 2031?

As a strong advocate for private sector leadership, I believe initiatives like Bayn are pivotal in reducing the UAE’s reliance on oil and driving economic diversification — a cornerstone of Vision 2031’s “Forward Economy” pillar. The non-oil sector already accounts for 74.6 per cent of UAE’s GDP in the first nine months of 2024, showcasing the nation’s successful shift toward a more resilient economy.

The UAE’s Emiratisation programme, which saw over 131,000 citizens join the private sector by 2024, further exemplifies the growing contribution of the private sector to national development. Moreover, private sector investment drives innovation, fuels the introduction of new technologies and supports business models crucial for achieving UAE’s ambition to become a global leader.

With domestic credit to the private sector accounting for 66.59 per cent of GDP in 2022, the UAE’s robust financial ecosystem is ready to support ambitious developments that contribute to the country’s long-term goals.

As a real estate developer, I believe projects like Bayn are crucial to fostering livability and creating sustainable environments central to Vision 2031. Bayn addresses the pressing need for well-designed communities that not only provide high-quality living spaces but also prioritise wellbeing and longterm resilience.

Amid increasing city congestion in the region, Bayn offers a low-density, natureintegrated alternative that aligns with the UAE’s Green Spine initiative and the broader goal of enhancing the quality of life for its residents.

In essence, projects like Bayn are more than just real estate developments. They are vital components of the UAE’s strategy to build sustainable, livable communities and drive forward the nation’s ambitious economic transformation.

FRESH OFF A $500,000 FUNDING ROUND, THE CO-FOUNDERS OF RENTIFY SHARE THEIR VISION FOR SCALING OPERATIONS, BRIDGING GAPS IN THE TRADITIONAL RENTAL PROCESS, AND POSITIONING THE PLATFORM AS THE REGION’S GO-TO RENTAL ECOSYSTEM

T&

he UAE’s rental market is ripe for disruption, and Rentify is making its presence felt with its fintech-driven approach. Co-founders Rajneel Kumar (COO) and Rashed Hareb (CEO) sat down with us to discuss how their AI-powered platform is transforming the leasing experience — from “Rent now, pay later” (RNPL) solutions to predictive analytics and strategic rewards programmes.

Fresh off a $500,000 funding round, they share their vision for scaling operations, bridging gaps in the traditional rental process, and positioning Rentify as the region’s go-to rental ecosystem.

The UAE rental market has a variety of platforms — what makes Rentify stand out, and how do you see yourselves positioning differently from existing competitors?

The UAE rental space is active and evolving, but many platforms still focus primarily on listings or offer limited digital layers over traditional processes. Rentify takes a different approach—we’re a fintech platform built to address the core financial pain points of

the rental experience. Our RNPL model helps tenants pay monthly while landlords receive their rent upfront, easing the cash burden on tenants and providing certainty to landlords. With an integrated rewards programme, we’re building a smarter, more trusted rental ecosystem, one that moves the industry forward.

How does the AI-powered aspect of your platform enhance the user experience for both landlords and tenants? Could you share more about its role in predictive analytics, automated rent collection, and other functionalities?

AI isn’t just a buzzword for us; it’s embedded into how we operate. We use machine learning models to pre-screen tenants, forecast payment risk, and dynamically adapt approval limits. For landlords, AI automates rent collection reminders, tracks portfolio risk, and flags anomalies. For tenants, it means faster approvals and more flexibility. It’s not just smarter — it’s

proactive. We believe that in a few years, the majority of rental underwriting will be AI-driven. We’re just ahead of the curve.

Rentify recently secured $500,000 in funding — what are your key goals with this investment, and how do you plan to use it to scale operations in the UAE and beyond?

The $500,000 was a strategic injection to validate market fit, test underwriting logic, and onboard early units. Our immediate focus is scaling to over 4,000 units, locking in partnerships with real estate groups, and building our credit facility for RNPL. Long-term, our model expands into transaction-based revenues and thirdparty bill payments.

Given the challenges in the region’s traditional rental process, why did you decide to create a tech-first solution? What gaps were you specifically aiming to fill?

The rental experience in the UAE still relies heavily on outdated systems — paper cheques, informal communication, and limited payment flexibility.

We saw an opportunity to modernise this journey. Our platform is designed to streamline access, reduce friction, and foster trust between tenants and landlords. Tenants seek flexibility and transparency; landlords value predictability and lower vacancy rates. We built a tech-first solution that addresses the needs of both, end-toend. Rent is the largest monthly expense for most households — it requires infrastructure that reflects that significance.

Tell us more about your strategic partnerships, such as the Rentify Rewards programme, and how these collaborations are driving business growth.

We’re in talks with major real estate groups, banks and telcos to plug Rentify into broader ecosystems. Our Rentify Rewards

IN FIVE YEARS, RENTIFY WILL BE THE OPERATING SYSTEM FOR

THE REGION. A TENANT SHOULD BE ABLE TO MOVE INTO A PROPERTY, GET PRE-APPROVED, PAY DIGITALLY, EARN REWARDS — ALL WITHIN ONE INTERFACE.”

OUR IMMEDIATE FOCUS IS SCALING TO OVER

4,000 UNITS

programme lets tenants earn points on rent, which they can use for bill payments, lifestyle benefits, or even savings. It’s the first rent-linked rewards programme in the region. Strategic partners help us scale quickly and layer value across multiple verticals.

As the UAE’s rental ecosystem continues to evolve, where do you see Rentify in the next five years, and what major innovations can we expect from your platform?

In five years, Rentify will be the operating system for residential rent in the region. A tenant should be able to move into a property, get pre-approved, pay digitally, earn rewards — all within one interface. For landlords, it means full automation, analytics, and reduced delinquency. We’re building the infrastructure layer, and the possibilities are endless.

What are some of the tangible benefits for tenants and landlords using Rentify, and what are the key areas covered within the UAE?

For tenants: no upfront annual rent, access to credit, and rewards. For landlords: upfront rent payments, lower risk, faster occupancy. We cover all seven emirates and are actively onboarding properties across Dubai, Sharjah, and Abu Dhabi, with strong traction from both institutional landlords and independent owners. It’s a win-win system that eliminates inefficiencies at both ends.

What are some of the trends you are seeing impact the rental market?

We’re seeing a surge in tenant demand for flexibility — monthly payments, digital leases, and faster move-ins. At the same time, landlords are becoming more data-conscious and want performance dashboards, risk assessments, and liquidity options. The era of static, offline renting is ending.

)Business Bay(

)Al Marjan Island(

4