December2025

As 2025 winds down, it’s the perfect time to pause, reflect, and set yourself up for success in the year ahead. This is your moment to celebrate the wins, learn from the challenges, and take a breath before diving into new opportunities Ending the year strong isn’t just about accomplishments it’s about mindset, focus, and positioning yourself for growth in 2026. At Milwaukee REIA, we ’ re here to help you do just that. Whether it’s connecting with experienced investors, learning new strategies, or finding the support you need to take your next step, our community and resources are designed to help you finish the year on a high note and start the next one with confidence, clarity, and momentum.

The market is shifting and if you ’ ve been feeling it, you ’ re not imagining things. This month, we ’ re bringing in two powerhouse local experts to break it all down in a way you won’t find online This is a two-part deep dive into Milwaukee’s real estate landscape:

Our first speaker will walk you through the real data behind 2025. Not national trends. Not broad headlines. Actual Milwaukee numbers, movement, and patterns plus the hidden market signals that tell us why the year shook out the way it did

You’ll learn:

Which neighborhoods shifted the most

What the data says about investor behavior

Where expectations didn’t match reality

And what 2025’s surprises mean for your strategy today If you want clarity instead of guesswork, this is where it starts.

Our second speaker will take you into the future the early indicators, the emerging opportunities, the risks, and the moves smart investors are preparing for now

You’ll walk away knowing:

What’s likely changing in 2026

How to adjust your buying, selling, and holding strategies

Where the biggest opportunities may open up

What to expect from inventory, demand, and competition

We’re in a moment of uncertainty and in a market like this, the winning edge isn’t just information it’s local information It’s who you know, what you understand, and how quickly you can adapt If you want to stay ahead in 2026, you’ll want to be in this room.

Dave Graf | 920-203-6087 | dave@gsifoundations com

Jodi Graf | 414-395-5478 | jgraf@premierpointrealty.com

Taylor Rens | 414-296-6225 | taylor rens@zrlaywers com John Newland | 414-852-0921 jnewland@terranova-realestate.com

Dan Farsht | 262-208-4708 | info@reiahardmoney com 414-276-7378 | membership@aasew org

Welcome to One Media – your trusted partner in high-quality real estate media. We specialize in capturing stunning visuals that elevate your property listings and help you make a lasting impression Whether you're a real estate agent, property developer, or investor, we offer professional photography and videography services designed to showcase your property in the best light.

Let us help you create a powerful visual story that attracts buyers/renters and gets your property noticed Reach out today to book a session!

Niko Vang 262-444-5823

hello@onemediawi.com

Brew City Property Services is a full-service property maintenance provider dedicated to helping real estate investors protect and enhance their assets. We specialize in comprehensive property solutions designed to streamline operations and maximize efficiency We are equipped to service day-to-day call-in's but we are also structured to handle tenant requests directly. With a commitment to quality service, reliability, and hassle-free property management, we take the stress out of maintenance so landlords can focus on growing their investment portfolios

Reehanah Al-Othman

Nhia Chang

Max Fiascone

Jesus Madrigal-Chavez

Missy Olsen

Sharlene Paalisbo Amit Ray Kar Vang

BY: VICTORIA COWARD, CPM, NAAEI FACULTY VIA REALESTATEINVESTINGTODAY.COM

Today, well over half of U.S. households between 66% and 75% own a pet. Let’s break that down in the context of rental housing With approximately 44 5 million renter-occupied housing units in the country, and assuming 70% of these households have pets, that translates to more than 31 million pet-owning renter households. Among those, the average pet ownership per household is 1 6 dogs or 1 8 cats Using the more conservative estimate of 1 6 pets per household, we ’ re looking at nearly 50 million pets living in U.S. rental housing.

Despite these staggering numbers, many renters and advocates like the Humane Society report ongoing challenges in finding truly pet-friendly housing. This disconnect can result in heartbreaking outcomes: pets being surrendered to shelters and renters struggling to find stable, fulfilling housing.

The question becomes: why, with such a large market of pet-owning renters, does this disconnect persist?

While the housing industry frequently labels itself as “pet-friendly,” renters often encounter only limited tolerance. As one Apartments.com spokesperson shared, “Nearly all pet owners surveyed said pet policies play a major role in their decision of where to live ”

This is where pet policy management and property marketing intersect Communities that proactively promote their pet-friendly policies are not only seen as more attractive by renters they also experience higher conversion rates and longer retention. The same Apartments com spokesperson noted, “Pets are a deal-breaker for many, and apartment buildings with more flexible pet policies will be the ones to attract this growing group of pet-owning renters and possibly keep them for a longer period of time.”

To craft or refine your pet policies, it’s important to go beyond a generic “pet-friendly” label. Consider including the following components:

Pet Restrictions: Will there be breed or weight restrictions? If so, how will they be defined and justified?

Pet Allowances: How many pets are allowed per unit? What types (dogs, cats, birds, etc.) will be welcomed?

Rental Readiness: Move beyond blanket restrictions Tools like PetScreening’s FIDO Score, which evaluates over 35 data points, offer a more holistic view of a pet’s rental readiness

Vaccination Requirements: How will vaccination records be submitted and managed?

Pet Fees and Charges: Will you charge pet deposits, monthly pet rent, or one-time fees? How will these charges be structured?

Renter Responsibilities: What expectations will you set regarding pet waste cleanup, noise control, or supervision?

Pet Agreement: How will you document expectations and ensure ongoing compliance?

Pet Insurance: While renter’s insurance is common, consider requiring pet liability coverage, particularly for dog bites, which cost U S insurers $882 million in 2021

As you build your policies, weigh both risk exposure and the opportunity to strengthen resident satisfaction. Arbitrary breed and weight restrictions often fail to account for the actual behavior or history of a pet. When used, they should be combined with readiness assessments and pet owner accountability to form a fair and effective approach.

Recognize the broader value of pets in your communities:

97% of pet owners consider their pets family

Pets foster connection, helping reduce loneliness and build a sense of belonging

The physical and mental health benefits of pet ownership are well-documented and valuable in today’s multifamily communities.

For years, the rental housing industry has sought to better understand renter demographics. Today, the message is clear: more than 66% of renters have pets, and nearly all of them consider those pets family

By embracing this reality and implementing thoughtful, relevant pet policies, communities can attract more loyal residents, boost retention, and enhance the overall living experience Ultimately, it’s not just about allowing pets it’s about welcoming the entire household.

Let’s meet today’s renters where they are. Let’s create communities that foster both individual fulfillment and long-lasting resident relationships with tails wagging every step of the way.

Victoria Cowart, CPM, NAAEI Faculty, and the Director Education & Outreach for PetScreening For more information, please visit PetScreening com

BY: BRAD BECKETT VIA REALESTATEINVESTINGTODAY.COM

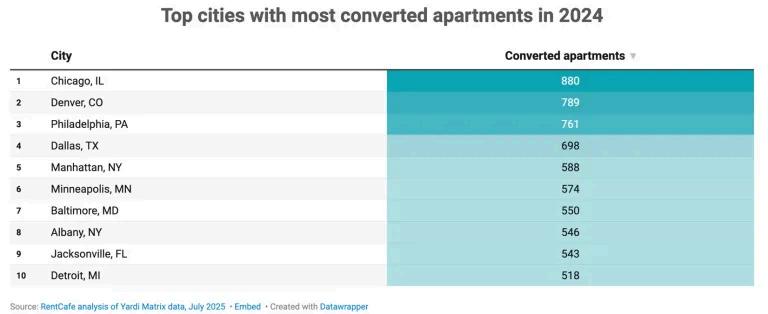

A recent report from RentCafe says the wave of adaptive reuse projects is accelerating at a record pace with Hotels taking the top category for adaptive reuse projects last year. Overall, the number of apartments resulting from converted buildings was close to 25k in 2024 That number is 50% more than the units delivered in 2023 and double from 2022 Some key takeaways:

Close to 25k apartments were completed in 2024 from adaptive reuse projects across the U S Office conversions accounted for nearly one quarter of all new units.

Hotels were, once again, the top category for adaptive reuse projects in 2024. A record-breaking 180k apartments are now in various stages of development across the nation

Ballpoint Marketing is a leading provider of direct mail for real estate investors, agents, insurance companies, and nonprofits. It’s what we use in our business to send out mailers, and we have seen GREAT success with these handwritten letters.

CLICK HERE TO SIGN UP AND USE CODE: ERIC5

SAVE UP TO 40% ON COPIES WITH OFFICE DEPOT BUSINESS

With inflation on the rise, there is no better time than now to open your Office Depot (ODP) Business Solutions account. We have negotiated incredible pricing on the solution categories your business uses most Check out the benefits below

Savings Benefits:

Up to 55% off on office supplies

Up to 55% off on cleaning & breakroom items

Free next-day shipping on order for $50 or more

40% off black and white copies

25% off color copies

CLICK HERE TO SIGN UP

BY: BRAD BECKETT, REALESTATEINVESTINGTODAY COM

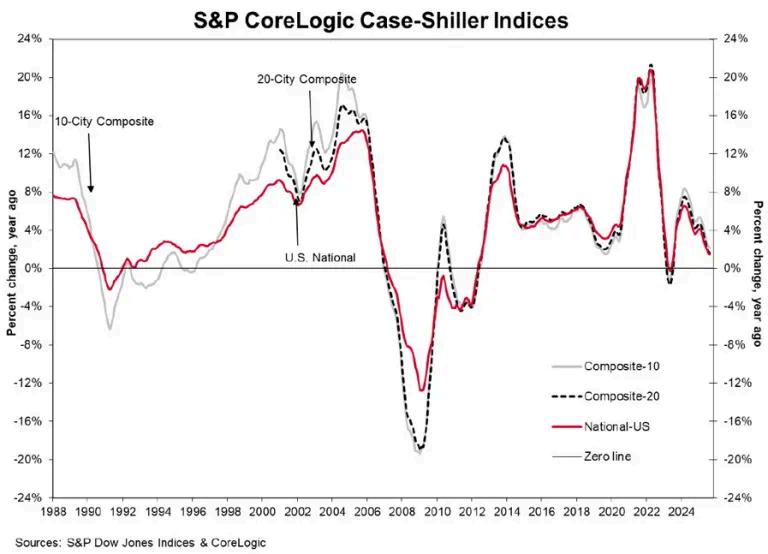

The latest S&P Cotality Case-Shiller U.S. National Home Price NSA Index has reported a 1.5% annual increase for August, 2025. Their 10-City Composite posted 1.8% increase year-over-year and their 20-City Composite posted a 2 3% year-over-year increase They say U S home prices are continuing to slow:

“Mortgage rates remaining above 6.5% continue to weigh on buyer demand, even during what should be the busy summer season The combination of high financing costs and prices that remain near record highs has limited transaction activity Markets that experienced the sharpest pandemic-era gains are now seeing the largest corrections, while more affordable metros with stable local economies are holding up better” Said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices